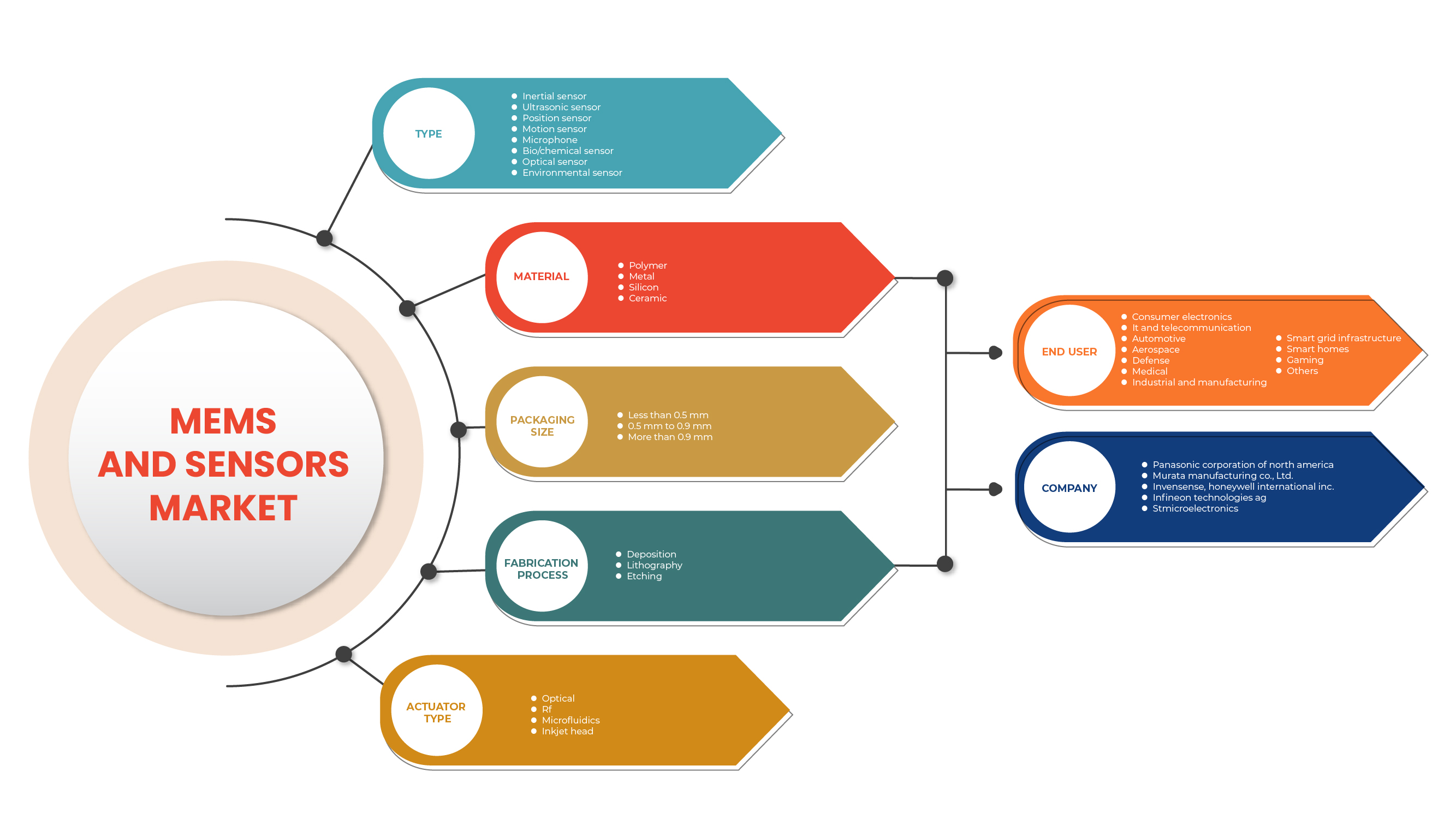

Middle East and Africa MEMS and Sensors Market, By Type (Inertial Sensor, Ultrasonic Sensor, Position Sensor, Motion Sensor, Microphone, Bio/Chemical Sensor, Optical Sensor And Environmental Sensor), Material (Polymer, Metal, Silicon and Ceramic), Packaging Size (Less Than 0.5 MM, 0.5 MM To 0.9 MM, More Than 0.9 MM), Fabrication Process (Deposition, Lithography and Etching), Actuator Type (Optical, RF, Microfluidics and Inkjet Head), End User (Consumer Electronics, IT and Telecommunication, Automotive, Aerospace, Defense, Medical, Industrial and Manufacturing, Smart Grid Infrastructure, Smart Homes, Gaming and Others), Industry Trends and Forecast To 2029.

Market Analysis and Insights

Sensors are devices or machines used to detect the presence of any physical object in the vicinity and send information about the same to the receiving end. The device is mostly used with other electronic devices. Any physical quantity, such as pressure, force, strain, light, and others, can be identified and converted into a desired electrical signal. These are classified as analogue and digital sensors. Others include temperature, ultrasonic, pressure, and proximity sensors. They use less energy and have high performance. Data is collected from the environment using sensors for the internet of things.

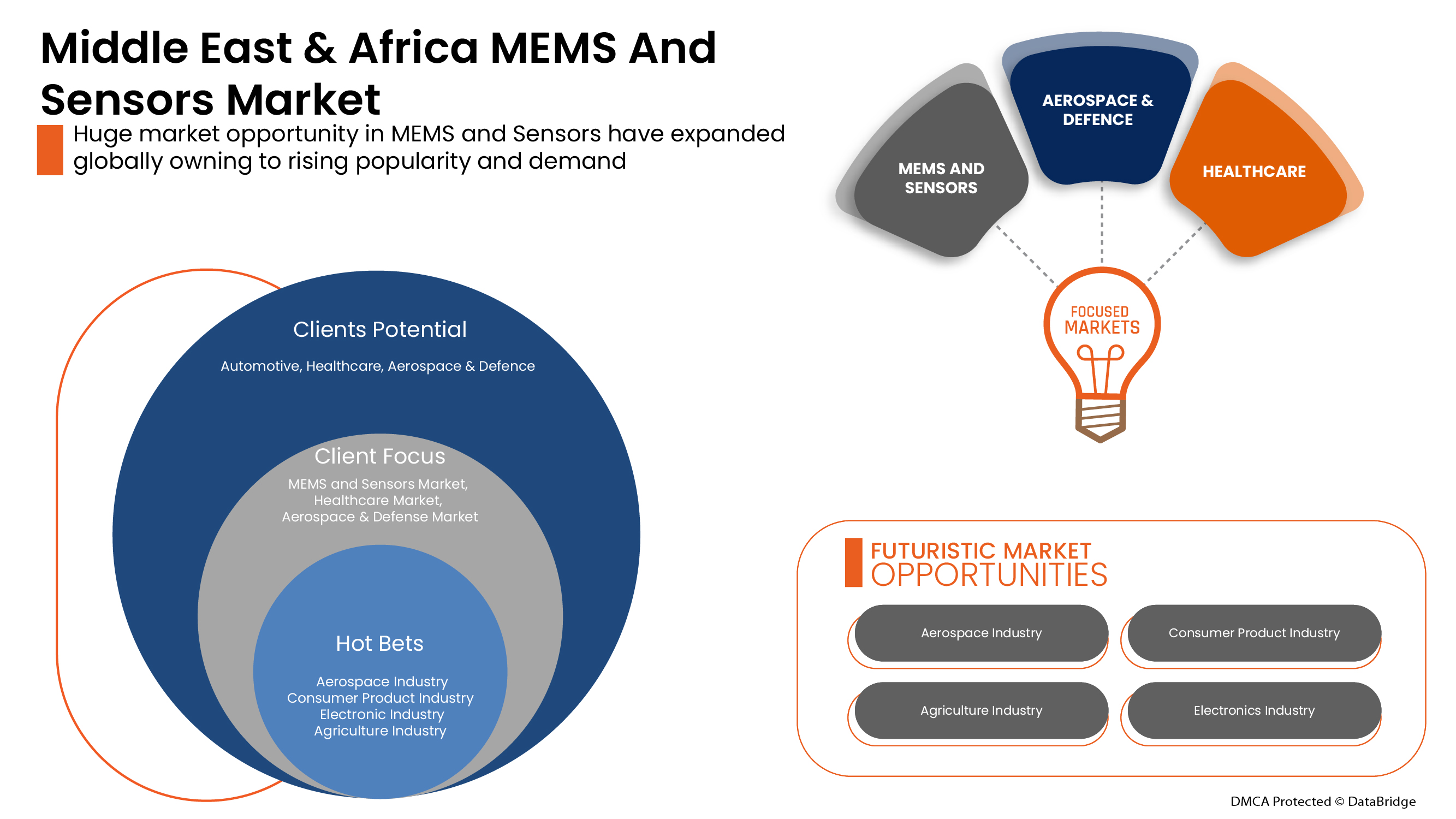

Technological developments in the semiconductor industry have increased the manufacturing of application-based and MEMS technology-based sensors used for various factors such as smart grid infrastructure, smart home appliances, and others. This has been made possible as the population is increasingly inclined toward digital platforms, internet services, and online services for their daily requirements. The growing popularity of IoT-based devices in semiconductors is increasing the demand for smart consumer electronics and wearables. It is expected that the Middle East and Africa MEMS and Sensors market will boom in the future.

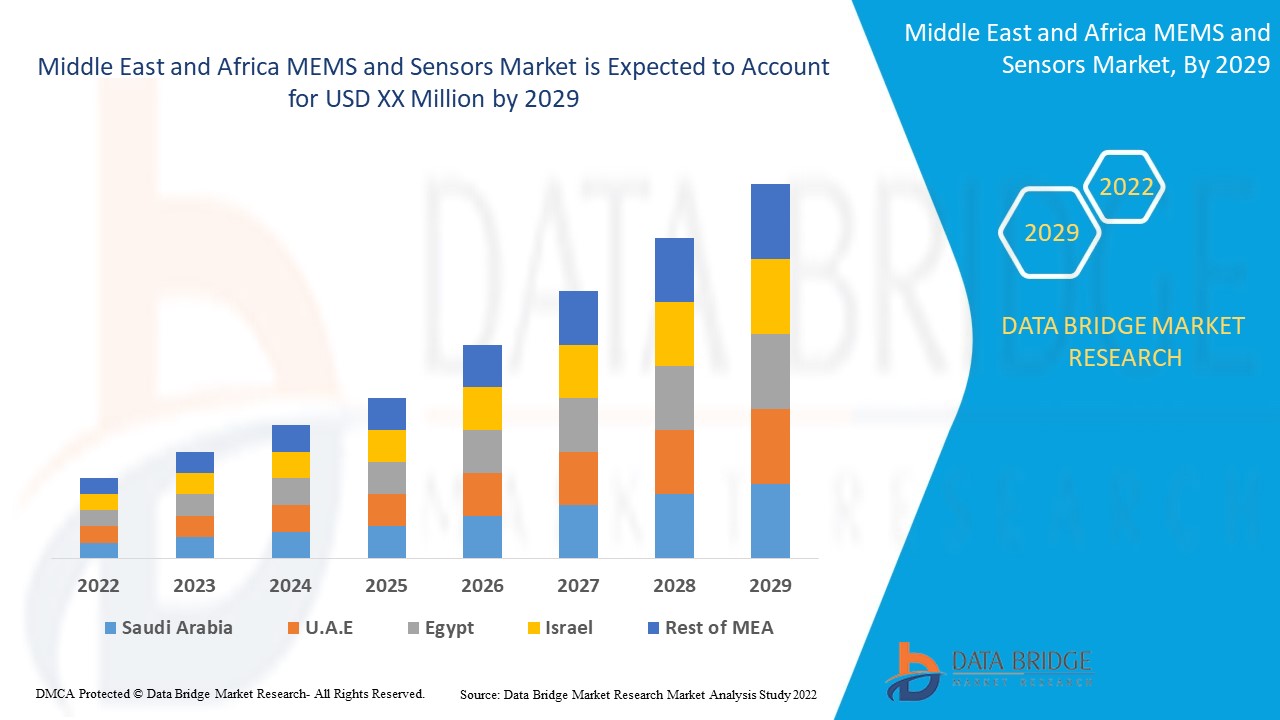

Currently, the importance of MEMS device has grown drastically, and the growth of inertial sensor, ultrasonic sensor, and packaging size based services across Middle East and Africa. In addition, the growing demand for MEMS and sensor in various sectors has fuelled the market boom. Data Bridge Market Research analyses that the Middle East and Africa MEMS and sensors market will grow CAGR of 7.6% during the forecast period of 2022 to 2029.

Market Definition

MEMS는 마이크로 제조 기술을 사용하여 제조된 기계 및 전기 기계 장치와 구조물의 통합 시스템입니다. MEMS 장치는 모든 물리적 또는 화학적 특성을 감지하고 조작하는 3차원 속성으로 구성됩니다. 마이크로 센서, 마이크로 액추에이터 및 기타 마이크로 구조를 사용하는 기본 구성 요소는 단일 실리콘 기판에 제조됩니다. MEMS 장치의 기본 구성 요소에는 한 형태의 에너지를 다른 형태로 변환하는 마이크로 센서 및 마이크로 액추에이터가 포함됩니다. MEMS 장치는 물리적 치수가 1마이크론 미만에서 수 밀리미터까지 다양한 정적 또는 이동식 구성 요소를 가질 수 있습니다.

|

보고서 메트릭 |

세부 |

|

예측 기간 |

2022년부터 2029년까지 |

|

기준 연도 |

2021 |

|

역사적 연도 |

2020 (2019-2014까지 사용자 정의 가능) |

|

양적 단위 |

매출은 천 달러, 가격은 달러로 표시됨 |

|

다루는 세그먼트 |

유형별(관성 센서, 초음파 센서, 위치 센서, 모션 센서, 마이크, 생화학 센서, 광학 센서 및 환경 센서), 재료(폴리머, 금속, 실리콘 및 세라믹), 패키징 크기(0.5mm 미만, 0.5mm~0.9mm, 0.9mm 초과), 제조 공정(증착, 리소그래피 및 에칭), 액추에이터 유형(광학, RF, 마이크로유체 및 잉크젯 헤드), 최종 사용자(소비자 전자 제품, IT 및 통신, 자동차, 항공우주, 방위, 의료, 산업 및 제조, 스마트 그리드 인프라, 스마트 홈, 게임 및 기타) |

|

적용 국가 |

남아프리카, 사우디아라비아, UAE, 이집트, 이스라엘, 중동 및 아프리카의 나머지 지역 |

|

시장 참여자 포함 |

북미 파나소닉 주식회사, 무라타 제조 주식회사, 인벤센스, 허니웰 인터내셔널 주식회사, 인피니언 테크놀로지스 AG, ST마이크로일렉트로닉스, 텍사스 인스트루먼트 주식회사, NXP 반도체, 아날로그 디바이스 주식회사, 로옴 주식회사, 텔레다인 테크놀로지스 주식회사, 로버트 보쉬 주식회사, 센사타 테크놀로지스 주식회사, 덴소 주식회사, 히타치 주식회사, 퀄컴 테크놀로지스 주식회사, 알레그로 마이크로시스템스 주식회사, 메가칩스 주식회사, 비샤이 인터테크놀로지 주식회사 |

중동 및 아프리카 MEMS 및 센서 시장 동향

운전자

- 보안을 위한 자동차 센서에 대한 수요 증가

세계는 기존 차량에서 전기 자동차로 선호도를 꾸준히 전환해 왔습니다. 차량에서 센서와 MEMS 기반 장치는 자동차의 전자 제어 시스템에 필수적인 부분입니다. 하이브리드 전기 자동차 및 플러그인 하이브리드 자동차(PHEV)와 같은 최신 자동차는 차량의 온보드 컴퓨터 시스템과 인터페이스된 다양한 센서에서 제공하는 데이터를 기반으로 수천 가지 결정을 내립니다. 센서는 극한의 온도, 진동 및 환경 오염 물질에 노출되는 혹독하고 거친 조건에서 작동할 수 있으므로 자동차의 보안 목적으로 사용됩니다.

- 가전제품 센서 수요 증가

COVID-19 팬데믹은 2020년 가전제품 시장에 긍정적인 영향을 미쳤습니다. 성장은 집 밖에서의 엔터테인먼트 기회 부족과 재택근무 직원 수 증가로 인해 이루어졌습니다. 가전제품에는 엔터테인먼트부터 레크리에이션, 커뮤니케이션까지 다양한 기기가 포함됩니다.

소비자들은 웨어러블, 음성 인식 스마트 스피커, 비디오 게임 콘솔, 자동차 전자 제품과 같은 새롭고 떠오르는 제품을 빠르게 받아들이고 있습니다. 센서는 소비자 전자 제품에서 모니터링, 측정, 데이터 로깅 및 제어를 위해 광범위하게 사용됩니다. TV 리모컨 시스템과 같은 소비자 전자 제품의 다양한 응용 프로그램은 적외선 센서를 사용하여 장치 관련 설정을 변경합니다.

- (마이크로 전기 기계 시스템) MEMS 자이로스코프 사용 증가

MEMS 자이로스코프는 소비자, 자동차, 산업 및 군사를 포함한 다양한 응용 분야에서 사용되었습니다. MEMS 자이로스코프는 카메라용 광학 이미지 안정화, 데드 레코닝 및 GPS 지원을 포함하여 휴대용 장치에서 흥미로운 응용 프로그램을 가능하게 했습니다. MEMS 기술의 출현은 다양한 응용 프로그램을 위한 소형화, 저비용, 저전력 센서의 개발을 제어했습니다.

최근 몇 년 동안 반도체, 수동소자, 상호연결이 지속적으로 개선되어 고정밀 데이터 수집 및 처리가 가능해졌습니다. MEMS 센서는 175도 이상을 견딜 수 있는 센서에 대한 수요로 인해 널리 받아들여지고 있습니다. MEMS 자이로스코프는 고온 내성, 더 작은 크기, 저렴한 유지 관리로 인해 사용됩니다.

- 방위 및 군사 분야에서 MEMS 센서의 응용 분야 확대

방위 및 군사용 센서는 입증되고 신뢰할 수 있는 기술이 필요합니다. 센서는 모니터링 및 실행을 포함하여 방위 생태계에 솔루션을 제공하기 때문에 기술의 중요한 부분입니다.

드론, 우주선, 미사일, 군용 차량, 선박, 해양 시스템, 위성, 로켓을 포함한 다양한 시스템은 이러한 시스템이 우주에서 데이터를 수집하는 데 사용되기 때문에 센서가 필요합니다. 능동형, 스마트형, 지능형, 카메라형, 적외선형, 나노형 센서와 같은 다양한 유형의 센서는 군사용 애플리케이션에 사용됩니다. 능동형 센서는 고성능 군사용 제어 및 측정 애플리케이션에서 감지 솔루션을 제공합니다.

기회

- 스마트 그리드 인프라에 대한 수요 증가

스마트 그리드 인프라에는 전력선 온도와 기상 조건을 모니터링하는 센서가 필요합니다. 전체 전기 네트워크 인프라에서 전기적 매개변수를 모니터링하는 센서는 스마트 그리드를 보호하고 네트워크의 에너지 효율을 개선하는 데 근본적인 역할을 합니다. 스마트 그리드에는 고전적인 아날로그 전기 기계 릴레이에서 최신 지능형 전자 장치에 이르기까지 전기적 오류를 감지하는 보호 장치가 포함됩니다. 보호 시스템은 스마트 그리드의 전력 품질과 안정성을 유지하는 데 필수적인 역할을 합니다.

스마트 그리드 인프라는 사용 가능한 재생 에너지원의 높은 침투를 특징으로 합니다. 주로 SAIDI(System Average Interruption Duration Index)와 같은 지속 기간 지수나 SAIFI(System Average Interruption Frequency Index)와 같은 빈도 지수에 초점을 맞춥니다.

- 환경 기반 센서의 개발

환경 상태 모니터링을 위한 다재다능한 환경 기반 센서가 전 세계적으로 채택되고 있습니다. 가스, 온도, 연기 센서와 같은 환경 기반 센서의 개발이 증가함에 따라 인공 지능 기반 인터페이스가 생겨 환경 상태를 보호할 수 있게 되었습니다. 산업적 규모에서 이 기술은 화학 물질 방출을 지속적으로 모니터링하는 것과 같은 많은 이점을 제공하며 환경 자원을 보호하기 위해 방출을 줄이는 데 도움이 될 것입니다.

유해한 환경 물질을 모니터링하기 위해 바이오센서와 같은 수많은 환경 기반 센서가 시장에 출시되고 있습니다. 다양한 회사가 환경 기반 센서를 제조하고 개발하기 위한 이니셔티브를 취하고 있습니다.

- MEMS 센서 연구개발 투자 증가

MEMS 센서는 1971년 처음 개발된 이래로 많은 발전을 이루었습니다. 이는 한 쌍의 정전식 판 사이에 매달린 질량으로 구성된 센서를 갖춘 칩 기반 기술입니다. 크기는 크게 줄었지만 효율성은 기하급수적으로 증가했습니다. 그러나 초박형 및 유연한 디스플레이에 대한 수요가 증가함에 따라 여전히 갈 길이 멉니다. 이를 인용하여 주요 기업은 MEMS 센서의 미래 잠재력을 연구하고 이를 현실로 만들기 위해 개발하는 데 많은 비용을 투자하고 있습니다.

MEMS 센서는 극한의 온도에서 사용되고 작동합니다. 주로 충격 및 진동 저항 특성으로 인해 사용됩니다. 따라서 정밀 요소와 같은 많은 한계를 극복하고 측정의 정확도를 높이기 위해 이 기술을 더욱 향상시켜 센서 비용을 줄이기 위한 많은 R&D가 시작되고 있습니다.

Covid-19 중동 및 아프리카 MEMS 및 센서 시장에 미치는 영향

COVID-19 팬데믹은 2020년 가전제품 시장에 긍정적인 영향을 미쳤습니다. 성장은 집 밖에서의 엔터테인먼트 기회 부족과 재택근무 직원 수 증가로 인해 이루어졌습니다. 가전제품에는 엔터테인먼트부터 레크리에이션, 커뮤니케이션까지 다양한 기기가 포함됩니다.

소비자들은 웨어러블, 음성 인식 스마트 스피커, 비디오 게임 콘솔, 자동차 전자 제품과 같은 새롭고 떠오르는 제품을 빠르게 받아들이고 있습니다. 센서는 소비자 전자 제품에서 모니터링, 측정, 데이터 로깅 및 제어를 위해 광범위하게 사용됩니다. TV 리모컨 시스템과 같은 소비자 전자 제품의 다양한 응용 프로그램은 적외선 센서를 사용하여 장치 관련 설정을 변경합니다.

가전제품과 가전제품의 센서에는 압력, 근접, 동작, 온도, 흐름 및 레벨, 음향, 터치, 이미지 센서가 포함됩니다. 또한 센서는 크기가 작아지고 효율성이 몇 배나 증가함에 따라 엄청난 변화를 겪었습니다. 단일 제스처로 집 전체를 제어할 수 있는 연결된 홈이 현실이 되었습니다.

최근 개발

- 2022년 5월, Analog Devices Inc.와 Synopsys는 전력 시스템 설계를 가속화하기 위해 협력했습니다. 이 협력은 DC/DC IC 및 µModule 레귤레이터에 대한 모델 옵션을 제공했습니다. 이 협력은 전자 시스템 혁신을 개발하고 고객의 설계 목표를 달성하는 데 도움이 될 것입니다. 이 협력은 회사가 고객 기반을 늘리는 데 도움이 될 것입니다.

- 2022년 5월, Honeywell International Inc.는 빌딩 내 커뮤니케이션 포트폴리오 확장을 발표했습니다. 이 확장은 회사가 안전 스펙트럼을 개발하고 확장 가능한 솔루션을 제공할 수 있도록 도울 것입니다. 이를 통해 회사는 새로운 고객을 타겟팅하는 데 도움이 될 것입니다.

중동 및 아프리카 MEMS 및 센서 시장 범위

중동 및 아프리카 MEMS 및 센서 시장은 유형, 소재, 패키징 크기, 제조 공정, 액추에이터 유형 및 최종 사용자를 기준으로 세분화됩니다. 이러한 세그먼트 간의 성장은 산업의 빈약한 성장 세그먼트를 분석하고 사용자에게 핵심 시장 응용 프로그램을 식별하기 위한 전략적 결정을 내리는 데 도움이 되는 귀중한 시장 개요와 시장 통찰력을 제공하는 데 도움이 됩니다.

유형별로

- 관성 센서

- 초음파 센서

- 위치 센서

- 모션 센서

- 마이크로폰

- 생물/화학 센서

- 광학 센서

- 환경 센서

MEMS 및 센서 시장은 유형을 기준으로 관성 센서, 초음파 센서, 위치 센서, 모션 센서, 마이크, 생화학 센서, 광 센서, 환경 센서로 구분됩니다.

재료

- 중합체

- 금속

- 규소

- 세라믹

MEMS 및 센서 시장은 재료를 기준으로 폴리머, 금속, 실리콘, 세라믹으로 구분됩니다.

포장 크기

- 0.5mm 미만

- 0.5mm ~ 0.9mm

- 0.9mm 이상

MEMS 및 센서 시장은 패키지 크기를 기준으로 0.5mm 미만, 0.5mm~0.9mm, 0.9mm 이상으로 구분됩니다.

제작 과정

- 침적

- 리소그래피

- 에칭

MEMS 및 센서 시장은 제조 공정을 기준으로 증착, 리소그래피, 에칭으로 구분됩니다.

액추에이터 유형

- 광학

- RF

- 마이크로유체학

- 잉크젯 헤드

액추에이터 유형을 기준으로 MEMS 및 센서 시장은 광학, RF, 마이크로유체 및 잉크젯 헤드로 구분됩니다.

최종 사용자

- 가전제품

- IT 및 통신

- 자동차

- 항공우주

- 방어

- 의료

- 산업 및 제조

- 스마트 그리드 인프라

- 스마트 홈

- 노름

- 기타

최종 사용자를 기준으로 MEMS 및 센서 시장은 가전제품, IT 및 통신, 자동차, 항공우주, 방위, 의료, 산업 및 제조, 스마트 그리드 인프라, 스마트 홈, 게임 및 기타로 구분됩니다.

Middle East and Africa MEMS and Sensors Market Regional Analysis/Insights

The MEMS and sensor market is analysed by type, material, packaging size, fabrication process, actuator type, end user as referenced above.

The countries covered in Middle East and Africa MEMS and sensor market are South Africa, Saudi Arabia, U.A.E., Egypt, Israel, the Rest of the Middle East and Africa.

Saudi Arabia is the dominating country because of technology usage and modernisation.

The country section of the report also provides individual market impacting factors and domestic regulation changes that impact the current and future market trends. Data points such as new sales, replacement sales, country demographics, disease epidemiology, and import-export tariffs are some of the major pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands and the impact of sales channels are considered while providing forecast analysis of the country data.

Competitive Landscape and the Middle East and Africa MEMS and Sensors Market Share Analysis

The MEMS and sensor market competitive landscape provides details of the competitor. Details include company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus on the MEMS and sensor market.

Some of the major players operating in the MEMS and sensors market are Panasonic Corporation of North America, Murata Manufacturing Co., Ltd, InvenSense, Honeywell International Inc., Infineon Technologies AG, STMicroelectronics, Texas Instruments Incorporated, NXP Semiconductors, Analog Devices, Inc., ROHM CO., LTD., Teledyne Technologies Incorporated., Robert Bosch GmbH., Sensata Technologies, Inc., DENSO CORPORATION., Hitachi, Ltd., Qualcomm Technologies, Inc., Allegro MicroSystems, Inc, MegaChips Corporation., Vishay Intertechnology, Inc among others.

SKU-

세계 최초의 시장 정보 클라우드 보고서에 온라인으로 접속하세요

- 대화형 데이터 분석 대시보드

- 높은 성장 잠재력 기회를 위한 회사 분석 대시보드

- 사용자 정의 및 질의를 위한 리서치 분석가 액세스

- 대화형 대시보드를 통한 경쟁자 분석

- 최신 뉴스, 업데이트 및 추세 분석

- 포괄적인 경쟁자 추적을 위한 벤치마크 분석의 힘 활용

목차

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF MIDDLE EAST & AFRICA MEMS AND SENSORS MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELING

2.9 TYPE TIMELINE CURVE

2.1 MARKET APPLICATION COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 REGULATIONS

4.1.1 OVERVIEW

4.1.2 INTERNATIONAL ORGANIZATION FOR STANDARDIZATION (ISO)

4.1.3 OCCUPATIONAL SAFETY & HEALTH ADMINISTRATION (OSHA)

4.1.4 AMERICAN NATIONAL STANDARDS INSTITUTE (ANSI)

4.1.5 UNDERWRITERS LABORATORIES (UL)

4.1.6 UNDERWRITERS LABORATORIES (UL)

4.1.7 EN ISO/IEC 17025

4.1.8 CCC CERTIFICATION

4.2 PORTER'S FIVE FORCE ANALYSIS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 GROWING DEMAND FOR AUTOMOTIVE SENSORS FOR SECURITY

5.1.2 RISING DEMAND FOR SENSORS IN CONSUMER ELECTRONICS

5.1.3 INCREASING USE OF (MICRO-ELECTRO-MECHANICAL-SYSTEM) MEMS GYROSCOPES

5.1.4 GROWING APPLICATIONS OF MEMS SENSORS IN DEFENSE AND MILITARY

5.2 RESTRAINT

5.2.1 LACK OF STANDARDIZED FABRICATION PROCESS OF MEMS (MICRO-ELECTRO-MECHANICAL-SYSTEM)

5.3 OPPORTUNITIES

5.3.1 GROWING DEMAND FOR SMART GRID INFRASTRUCTURE

5.3.2 DEVELOPMENTS IN ENVIRONMENTAL BASED SENSORS

5.3.3 RISE IN INVESTMENTS FOR R&D OF MEMS SENSORS

5.4 CHALLENGES

5.4.1 TECHNICAL CHALLENEGS AND HIGH COST OF END PRODUCTS

5.4.2 TOUCH SENSORS LEAD TO HIGH SENSITIVITY

6 MIDDLE EAST & AFRICA MEMS & SENSORS MARKET, BY TYPE

6.1 OVERVIEW

6.2 MICROPHONE

6.3 MOTION SENSOR

6.3.1 ACTIVE

6.3.1.1 ULTRASONIC SENSOR

6.3.1.2 MICROWAVE SENSOR

6.3.1.3 TOMOGRAPHIC SENSOR

6.3.2 PASSIVE

6.3.2.1 DUAL OR HYBRID TECHNOLOGY

6.3.2.2 INFRARED MOTION SENSOR

6.3.2.3 OTHERS

6.4 OPTICAL SENSOR

6.4.1 AMBIENT LIGHT SENSOR

6.4.2 MICROBOLOMETER

6.4.3 PIR AND THERMOPHILE

6.4.4 OTHERS

6.5 INERTIAL SENSOR

6.5.1 ACCELEROMETER

6.5.1.1 SINGLE AXIS

6.5.1.2 MULTI AXIS

6.5.2 GYROSCOPE

6.5.3 COMBO SENSOR

6.5.4 MAGNETOMETER

6.6 POSITION SENSOR

6.6.1 PROXIMITY SENSORS

6.6.2 LINEAR SENSORS

6.6.3 DISPLACEMENT SENSORS

6.6.4 3D SENSORS

6.6.5 PHOTOELECTRIC SENSORS

6.6.6 ROTARY SENSOR

6.7 ULTRASONIC SENSOR

6.8 ENVIRONMENTAL SENSOR

6.8.1 HUMIDITY SENSORS

6.8.1.1 ABSOLUTE HUMIDITY SENSORS

6.8.1.2 RELATIVE HUMIDITY SENSORS

6.8.1.3 OSCILLATING HYGROMETER

6.8.1.4 OPTICAL HYGROMETER

6.8.1.5 GRAVIMETRIC HYGROMETER

6.8.2 PRESSURE SENSORS

6.8.2.1 GAUGE PRESSURE SENSORS

6.8.2.2 DIFFERENTIAL PRESSURE SENSORS

6.8.2.3 ABSOLUTE PRESSURE SENSORS

6.8.2.4 VACUUM PRESSURE SENSORS

6.8.2.5 SEALED PRESSURE SENSORS

6.8.3 TEMPERATURE SENSORS

6.8.3.1 CONTACT

6.8.3.1.1 THERMOCOUPLES

6.8.3.1.2 BIMETALLIC TEMPERATURE SENSORS

6.8.3.1.3 RESISTIVE TEMPERATURE DETECTORS

6.8.3.1.4 TEMPERATURE SENSORS ICS

6.8.3.1.5 THERMISTORS

6.8.3.2 NON-CONTACT

6.8.3.2.1 FIBER OPTIC TEMPERATURE SENSORS

6.8.3.2.2 INFRARED TEMPERATURE SENSORS

6.8.4 GAS SENSORS

6.8.4.1 OXYGEN

6.8.4.2 CARBON DIOXIDE

6.8.4.3 AMMONIA

6.8.4.4 HYDROGEN

6.8.4.5 HYDROGEN SULFIDE

6.8.4.6 CARBON MONOXIDE

6.8.4.7 METHANE

6.8.4.8 NITROGEN OXIDE

6.8.4.9 CHLORINE

6.8.4.10 HYDROCARBON

6.8.4.11 VOLATILE ORGANIC COMPOUND

6.8.5 OTHERS

6.9 BIO/CHEMICAL SENSOR

6.9.1 ELECTROCHEMICAL

6.9.2 SENSOR PATCH

7 MIDDLE EAST & AFRICA MEMS AND SENSORS MARKET, BY ACTUATOR TYPE

7.1 OVERVIEW

7.2 OPTICAL

7.3 RF

7.3.1 SWITCH

7.3.2 FILTER

7.3.3 OSCILLATOR

7.4 MICROFLUIDICS

7.5 INKJET HEAD

8 MIDDLE EAST & AFRICA MEMS AND SENSORS MARKET, BY PACKAGING SIZE

8.1 OVERVIEW

8.2 LESS THAN 0.5 MM

8.3 0.5 MM TO 0.9 MM

8.4 MORE THAN 0.9 MM

9 MIDDLE EAST & AFRICA MEMS AND SENSORS MARKET, BY FABRICATION PROCESS

9.1 OVERVIEW

9.2 DEPOSITION

9.3 LITHOGRAPHY

9.4 ETCHING

10 MIDDLE EAST & AFRICA MEMS AND SENSORS MARKET, BY MATERIAL

10.1 OVERVIEW

10.2 POLYMER

10.3 METAL

10.4 SILICON

10.5 CERAMIC

11 MIDDLE EAST & AFRICA MEMS & SENSORS MARKET, BY END USER

11.1 OVERVIEW

11.2 CONSUMER ELECTRONICS

11.2.1 BY TYPE

11.2.1.1 SMARTPHONES

11.2.1.2 LAPTOPS

11.2.1.3 TABLETS

11.2.1.4 CAMERAS

11.2.1.5 WEARABLE DEVICES

11.2.1.6 HEADPHONES

11.2.1.7 SMART AUDIO DEVICES

11.2.1.8 TELEVISION

11.2.1.9 INKJET PRINTERS

11.2.1.10 AR/VR

11.2.1.11 OTHERS

11.2.2 BY SENSOR TYPE

11.2.2.1 MICROPHONE

11.2.2.2 MOTION SENSOR

11.2.2.3 OPTICAL SENSOR

11.2.2.4 INERTIAL SENSOR

11.2.2.5 POSITION SENSOR

11.2.2.6 ULTRASONIC SENSOR

11.2.2.7 ENVIRONMENTAL SENSOR

11.2.2.8 BIO/CHEMICAL SENSOR

11.2.2.9 OTHERS

11.3 IT AND TELECOMMUNICATION

11.4 AUTOMOTIVE

11.4.1 BY TYPE

11.4.1.1 VEHICLE COMFORT SYSTEMS

11.4.1.2 AIR CONDITIONING COMPRESSOR

11.4.1.3 BRAKE FORCE AND SUSPENSION CONTROL

11.4.1.4 FUEL AND VAPOUR LEVEL SENSOR

11.4.1.5 ENGINE MANAGEMENT SYSTEM

11.4.1.6 RESTRAINT SYSTEMS

11.4.1.7 TIRE PRESSURE

11.4.1.8 OTHERS

11.4.2 BY SENSOR TYPE

11.4.2.1 MICROPHONE

11.4.2.2 MOTION SENSOR

11.4.2.3 OPTICAL SENSOR

11.4.2.4 INERTIAL SENSOR

11.4.2.5 POSITION SENSOR

11.4.2.6 ULTRASONIC SENSOR

11.4.2.7 ENVIRONMENTAL SENSOR

11.4.2.8 BIO/CHEMICAL SENSOR

11.4.2.9 OTHERS

11.5 GAMING

11.5.1 MICROPHONE

11.5.2 MOTION SENSOR

11.5.3 OPTICAL SENSOR

11.5.4 INERTIAL SENSOR

11.5.5 POSITION SENSOR

11.5.6 ULTRASONIC SENSOR

11.5.7 ENVIRONMENTAL SENSOR

11.5.8 BIO/CHEMICAL SENSOR

11.5.9 OTHERS

11.6 AEROSPACE

11.6.1 MICROPHONE

11.6.2 MOTION SENSOR

11.6.3 OPTICAL SENSOR

11.6.4 INERTIAL SENSOR

11.6.5 POSITION SENSOR

11.6.6 ULTRASONIC SENSOR

11.6.7 ENVIRONMENTAL SENSOR

11.6.8 BIO/CHEMICAL SENSOR

11.6.9 OTHERS

11.7 DEFENSE

11.7.1 BY TYPE

11.7.1.1 AIRCRAFT CONTROL

11.7.1.2 SURVEILLANCE

11.7.1.3 ARMING SYSTEMS

11.7.1.4 EMBEDDED SENSORS

11.7.1.5 MUNITIONS GUIDANCE

11.7.1.6 DATA STORAGE

11.7.2 BY SENSOR TYPE

11.7.2.1 MICROPHONE

11.7.2.2 MOTION SENSOR

11.7.2.3 OPTICAL SENSOR

11.7.2.4 INERTIAL SENSOR

11.7.2.5 POSITION SENSOR

11.7.2.6 ULTRASONIC SENSOR

11.7.2.7 ENVIRONMENTAL SENSOR

11.7.2.8 BIO/CHEMICAL SENSOR

11.7.2.9 OTHERS

11.8 MEDICAL

11.8.1 BY TYPE

11.8.1.1 MONITORING DEVICES

11.8.1.2 SURGICAL DEVICES

11.8.1.3 DIAGNOSTIC DEVICES

11.8.1.4 THERAPEUTIC DEVICES

11.8.1.5 OTHERS

11.8.2 BY SENSOR TYPE

11.8.2.1 MICROPHONE

11.8.2.2 MOTION SENSOR

11.8.2.3 OPTICAL SENSOR

11.8.2.4 INERTIAL SENSOR

11.8.2.5 POSITION SENSOR

11.8.2.6 ULTRASONIC SENSOR

11.8.2.7 ENVIRONMENTAL SENSOR

11.8.2.8 BIO/CHEMICAL SENSOR

11.8.2.9 OTHERS

11.9 INDUSTRIAL AND MANUFACTURING

11.9.1 BY TYPE

11.9.1.1 INDUSTRIAL ROBOTS

11.9.1.2 DRONES

11.9.1.3 OTHERS

11.9.2 BY SENSOR TYPE

11.9.2.1 MICROPHONE

11.9.2.2 MOTION SENSOR

11.9.2.3 OPTICAL SENSOR

11.9.2.4 INERTIAL SENSOR

11.9.2.5 POSITION SENSOR

11.9.2.6 ULTRASONIC SENSOR

11.9.2.7 ENVIRONMENTAL SENSOR

11.9.2.8 BIO/CHEMICAL SENSOR

11.9.2.9 OTHERS

11.1 SMART GRID INFRASTRUCTURE

11.10.1 MICROPHONE

11.10.2 MOTION SENSOR

11.10.3 OPTICAL SENSOR

11.10.4 INERTIAL SENSOR

11.10.5 POSITION SENSOR

11.10.6 ULTRASONIC SENSOR

11.10.7 ENVIRONMENTAL SENSOR

11.10.8 BIO/CHEMICAL SENSOR

11.10.9 OTHERS

11.11 SMART HOMES

11.11.1 MICROPHONE

11.11.2 MOTION SENSOR

11.11.3 OPTICAL SENSOR

11.11.4 INERTIAL SENSOR

11.11.5 POSITION SENSOR

11.11.6 ULTRASONIC SENSOR

11.11.7 ENVIRONMENTAL SENSOR

11.11.8 BIO/CHEMICAL SENSOR

11.11.9 OTHERS

11.12 OTHERS

12 MIDDLE EAST & AFRICA MEMS AND SENSORS MARKET BY GEOGRAPHY

12.1 MIDDLE EAST AND AFRICA

12.1.1 SAUDI ARABIA

12.1.2 SOUTH AFRICA

12.1.3 U.A.E.

12.1.4 ISRAEL

12.1.5 EGYPT

12.1.6 REST OF MIDDLE EAST & AFRICA

13 MIDDLE EAST & AFRICA MEMS AND SENSORS MARKET, COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: MIDDLE EAST & AFRICA

14 SWOT ANALYSIS

15 COMPANY PROFILE

15.1 SENSATA TECHNOLOGIES, INC.

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 COMPANY SHARE ANALYSIS

15.1.4 PRODUCT PORTFOLIO

15.1.5 RECENT DEVELOPMENT

15.2 ROBERT BOSCH GMBH

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 COMPANY SHARE ANALYSIS

15.2.4 PRODUCT PORTFOLIO

15.2.5 RECENT DEVELOPMENT

15.3 DENSO CORPORATION

15.3.1 COMPANY SNAPSHOT

15.3.2 REVENUE ANALYSIS

15.3.3 COMPANY SHARE ANALYSIS

15.3.4 PRODUCT PORTFOLIO

15.3.5 RECENT DEVELOPMENT

15.4 HITACHI, LTD.

15.4.1 COMPANY SNAPSHOT

15.4.2 REVENUE ANALYSIS

15.4.3 COMPANY SHARE ANALYSIS

15.4.4 PRODUCT PORTFOLIO

15.4.5 RECENT DEVELOPMENT

15.5 HONEYWELL INTERNATIONAL INC.

15.5.1 COMPANY SNAPSHOT

15.5.2 REVENUE ANALYSIS

15.5.3 COMPANY SHARE ANALYSIS

15.5.4 PRODUCT PORTFOLIO

15.5.5 RECENT DEVELOPMENTS

15.6 ALLEGRO MICROSYSTEMS, INC.

15.6.1 COMPANY SNAPSHOT

15.6.2 REVENUE ANALYSIS

15.6.3 PRODUCT PORTFOLIO

15.6.4 RECENT DEVELOPMENT

15.7 ANALOG DEVICES, INC.

15.7.1 COMPANY SNAPSHOT

15.7.2 REVENUE ANALYSIS

15.7.3 PRODUCT PORTFOLIO

15.7.4 RECENT DEVELOPMENTS

15.8 HEWLETT PACKARD ENTERPRISE DEVELOPMENT LP

15.8.1 COMPANY SNAPSHOT

15.8.2 REVENUE ANALYSIS

15.8.3 PRODUCT PORTFOLIO

15.8.4 RECENT DEVELOPMENT

15.9 INVENSENSE

15.9.1 COMPANY SNAPSHOT

15.9.2 PRODUCT PORTFOLIO

15.9.3 RECENT DEVELOPMENT

15.1 INFINEON TECHNOLOGIES AG

15.10.1 COMPANY SNAPSHOT

15.10.2 REVENUE ANALYSIS

15.10.3 PRODUCT PORTFOLIO

15.10.4 RECENT DEVELOPMENT

15.11 MURATA MANUFACTURING CO., LTD.

15.11.1 COMPANY SNAPSHOT

15.11.2 REVENUE ANALYSIS

15.11.3 PRODUCT PORTFOLIO

15.11.4 RECENT DEVELOPMENT

15.12 MEGACHIPS CORPORATION

15.12.1 COMPANY SNAPSHOT

15.12.2 REVENUE ANALYSIS

15.12.3 PRODUCT PORTFOLIO

15.12.4 RECENT DEVELOPMENT

15.13 NXP SEMICONDUCTORS

15.13.1 COMPANY SNAPSHOT

15.13.2 REVENUE ANALYSIS

15.13.3 PRODUCT PORTFOLIO

15.13.4 RECENT DEVELOPMENT

15.14 PANASONIC CORPORATION OF NORTH AMERICA

15.14.1 COMPANY SNAPSHOT

15.14.2 REVENUE ANALYSIS

15.14.3 PRODUCT PORTFOLIO

15.14.4 RECENT DEVELOPMENT

15.15 QUALCOMM TECHNOLOGIES, INC.

15.15.1 COMPANY SNAPSHOT

15.15.2 REVENUE ANALYSIS

15.15.3 PRODUCT PORTFOLIO

15.15.4 RECENT DEVELOPMENT

15.16 ROHM CO., LTD.

15.16.1 COMPANY SNAPSHOT

15.16.2 REVENUE ANALYSIS

15.16.3 PRODUCT PORTFOLIO

15.16.4 RECENT DEVELOPMENT

15.17 STMICROELECTRONICS

15.17.1 COMPANY SNAPSHOT

15.17.2 REVENUE ANALYSIS

15.17.3 PRODUCT PORTFOLIO

15.17.4 RECENT DEVELOPMENTS

15.18 TEXAS INSTRUMENTS INCORPORATED

15.18.1 COMPANY SNAPSHOT

15.18.2 REVENUE ANALYSIS

15.18.3 PRODUCT PORTFOLIO

15.18.4 RECENT DEVELOPMENT

15.19 TELEDYNE TECHNOLOGIES INCORPORATED

15.19.1 COMPANY SNAPSHOT

15.19.2 REVENUE ANALYSIS

15.19.3 PRODUCT PORTFOLIO

15.19.4 RECENT DEVELOPMENT

15.2 VISHAY INTERTECHNOLOGY, INC.

15.20.1 COMPANY SNAPSHOT

15.20.2 REVENUE ANALYSIS

15.20.3 PRODUCT PORTFOLIO

15.20.4 RECENT DEVELOPMENT

16 QUESTIONNAIRE

17 RELATED REPORTS

표 목록

TABLE 1 MIDDLE EAST & AFRICA MEMS & SENSORS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 2 MIDDLE EAST & AFRICA MICROPHONE IN MEMS & SENSORS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 3 MIDDLE EAST & AFRICA MOTION SENSORS IN MEMS & SENSORS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 4 MIDDLE EAST & AFRICA MOTION SENSOR IN MEMS & SENSORS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 5 MIDDLE EAST & AFRICA ACTIVE IN MEMS & SENSORS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 6 MIDDLE EAST & AFRICA PASSIVE IN MEMS & SENSORS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 7 MIDDLE EAST & AFRICA OPTICAL SENSOR IN MEMS & SENSORS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 8 MIDDLE EAST & AFRICA OPTICAL SENSOR IN MEMS & SENSORS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 9 MIDDLE EAST & AFRICA INERTIAL SENSOR IN MEMS & SENSORS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 10 MIDDLE EAST & AFRICA INERTIAL SENSOR IN MEMS & SENSORS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 11 MIDDLE EAST & AFRICA ACCELEROMETER IN MEMS & SENSORS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 12 MIDDLE EAST & AFRICA POSITION SENSOR IN MEMS & SENSORS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 13 MIDDLE EAST & AFRICA POSITION SENSOR IN MEMS & SENSORS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 14 MIDDLE EAST & AFRICA ULTRASONIC SENSOR IN MEMS & SENSORS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 15 MIDDLE EAST & AFRICA ENVIRONMENTAL SENSOR IN MEMS & SENSORS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 16 MIDDLE EAST & AFRICA ENVIRONMENTAL SENSOR IN MEMS & SENSORS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 17 MIDDLE EAST & AFRICA HUMIDITY SENSOR IN MEMS & SENSORS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 18 MIDDLE EAST & AFRICA PRESSURE SENSORS IN MEMS & SENSORS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 19 MIDDLE EAST & AFRICA TEMPERATURE SENSOR IN MEMS & SENSORS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 20 MIDDLE EAST & AFRICA CONTACT IN MEMS & SENSORS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 21 MIDDLE EAST & AFRICA NON-CONTACT IN MEMS & SENSORS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 22 MIDDLE EAST & AFRICA GAS SENSOR IN MEMS & SENSORS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 23 MIDDLE EAST & AFRICA BIO/CHEMICAL SENSOR IN MEMS & SENSORS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 24 MIDDLE EAST & AFRICA BIO/CHEMICAL SENSOR IN MEMS & SENSORS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 25 MIDDLE EAST & AFRICA MEMS AND SENSORS MARKET, BY ACTUATOR TYPE, 2020-2029 (USD THOUSAND)

TABLE 26 MIDDLE EAST & AFRICA OPTICAL IN MEMS AND SENSORS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 27 MIDDLE EAST & AFRICA RF IN MEMS AND SENSORS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 28 MIDDLE EAST & AFRICA RF IN MEMS AND SENSORS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 29 MIDDLE EAST & AFRICA MICROFLUIDICS IN MEMS AND SENSORS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 30 MIDDLE EAST & AFRICA INKJET HEAD IN MEMS AND SENSORS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 31 MIDDLE EAST & AFRICA MEMS AND SENSORS MARKET, BY PACKAGING SIZE, 2020-2029 (USD THOUSAND)

TABLE 32 MIDDLE EAST & AFRICA LESS THAN 0.5 MM IN MEMS AND SENSORS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 33 MIDDLE EAST & AFRICA 0.5MM TO 0.9 MM IN MEMS AND SENSORS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 34 MIDDLE EAST & AFRICA MORE THAN 0.9 MM IN MEMS AND SENSORS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 35 MIDDLE EAST & AFRICA MEMS AND SENSORS MARKET, BY FABRICATION PROCESS, 2020-2029 (USD THOUSAND)

TABLE 36 MIDDLE EAST & AFRICA DEPOSITION IN MEMS AND SENSORS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 37 MIDDLE EAST & AFRICA LITHOGRAPHY IN MEMS AND SENSORS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 38 MIDDLE EAST & AFRICA ETCHING IN MEMS AND SENSORS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 39 MIDDLE EAST & AFRICA MEMS AND SENSORS MARKET, BY MATERIAL, 2020-2029 (USD THOUSAND)

TABLE 40 MIDDLE EAST & AFRICA POLYMER IN MEMS AND SENSORS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 41 MIDDLE EAST & AFRICA METAL IN MEMS AND SENSORS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 42 MIDDLE EAST & AFRICA SILICON IN MEMS AND SENSORS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 43 MIDDLE EAST & AFRICA CERAMIC IN MEMS AND SENSORS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 44 MIDDLE EAST & AFRICA MEMS & SENSORS MARKET, BY END USER, 2020-2029 (USD THOUSAND)

TABLE 45 MIDDLE EAST & AFRICA CONSUMER ELECTRONICS IN MEMS & SENSORS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 46 MIDDLE EAST & AFRICA CONSUMER ELECTRONICS IN MEMS & SENSORS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 47 MIDDLE EAST & AFRICA CONSUMER ELECTRONICS IN MEMS & SENSORS MARKET, BY SENSOR TYPE, 2020-2029 (USD THOUSAND)

TABLE 48 MIDDLE EAST & AFRICA IT AND TELECOMMUNICATION IN MEMS & SENSORS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 49 MIDDLE EAST & AFRICA AUTOMOTIVE IN MEMS & SENSORS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 50 MIDDLE EAST & AFRICA AUTOMOTIVE IN MEMS & SENSORS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 51 MIDDLE EAST & AFRICA AUTOMOTIVE IN MEMS & SENSORS MARKET, BY SENSOR TYPE, 2020-2029 (USD THOUSAND)

TABLE 52 MIDDLE EAST & AFRICA GAMING IN MEMS & SENSORS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 53 MIDDLE EAST & AFRICA GAMING IN MEMS & SENSORS MARKET, BY SENSOR TYPE, 2020-2029 (USD THOUSAND)

TABLE 54 MIDDLE EAST & AFRICA AEROSPACE IN MEMS & SENSORS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 55 MIDDLE EAST & AFRICA AEROSPACE IN MEMS & SENSORS MARKET, BY SENSOR TYPE, 2020-2029 (USD THOUSAND)

TABLE 56 MIDDLE EAST & AFRICA DEFENSE IN MEMS & SENSORS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 57 MIDDLE EAST & AFRICA DEFENSE IN MEMS & SENSORS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 58 MIDDLE EAST & AFRICA DEFENSE IN MEMS & SENSORS MARKET, BY SENSOR TYPE, 2020-2029 (USD THOUSAND)

TABLE 59 MIDDLE EAST & AFRICA MEDICAL IN MEMS & SENSORS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 60 MIDDLE EAST & AFRICA MEDICAL IN MEMS & SENSORS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 61 MIDDLE EAST & AFRICA MEDICAL IN MEMS & SENSORS MARKET, BY SENSOR TYPE, 2020-2029 (USD THOUSAND)

TABLE 62 MIDDLE EAST & AFRICA INDUSTRIAL AND MANUFACTURING IN MEMS & SENSORS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 63 MIDDLE EAST & AFRICA INDUSTRIAL AND MANUFACTURING IN MEMS & SENSORS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 64 MIDDLE EAST & AFRICA INDUSTRIAL AND MANUFACTURING IN MEMS & SENSORS MARKET, BY SENSOR TYPE, 2020-2029 (USD THOUSAND)

TABLE 65 MIDDLE EAST & AFRICA SMART GRID INFRASTRUCTURE IN MEMS & SENSORS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 66 MIDDLE EAST & AFRICA SMART GRID INFRASTRUCTURE IN MEMS & SENSORS MARKET, BY SENSOR TYPE, 2020-2029 (USD THOUSAND)

TABLE 67 MIDDLE EAST & AFRICA SMART HOMES IN MEMS & SENSORS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 68 MIDDLE EAST & AFRICA SMART HOMES IN MEMS & SENSORS MARKET, BY SENSOR TYPE, 2020-2029 (USD THOUSAND)

TABLE 69 MIDDLE EAST & AFRICA OTHERS IN MEMS & SENSORS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

그림 목록

FIGURE 1 MIDDLE EAST & AFRICA MEMS AND SENSORS MARKET: SEGMENTATION

FIGURE 2 MIDDLE EAST & AFRICA MEMS AND SENSORS MARKET: DATA TRIANGULATION

FIGURE 3 MIDDLE EAST & AFRICA MEMS AND SENSORS MARKET: DROC ANALYSIS

FIGURE 4 MIDDLE EAST & AFRICA MEMS AND SENSORS MARKET: MIDDLE EAST & AFRICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 MIDDLE EAST & AFRICA MEMS AND SENSORS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 MIDDLE EAST & AFRICA MEMS AND SENSORS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 MIDDLE EAST & AFRICA MEMS AND SENSORS MARKET: DBMR MARKET POSITION GRID

FIGURE 8 MIDDLE EAST & AFRICA MEMS AND SENSORS MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 MIDDLE EAST & AFRICA MEMS AND SENSORS MARKET: APPLICATION COVERAGE GRID

FIGURE 10 MIDDLE EAST & AFRICA MEMS AND SENSORS MARKET: SEGMENTATION

FIGURE 11 DEMAND FOR HIGH DEFINITION CONTENT BY CONSUMERS IS EXPECTED TO DRIVE MIDDLE EAST & AFRICA MEMS AND SENSORS MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 TYPE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF MIDDLE EAST & AFRICA MEMS AND SENSORS MARKET IN 2022 & 2029

FIGURE 13 ASIA-PACIFIC EXPECTED TO DOMINATE, AND IS THE FASTEST-GROWING REGION IN THE MIDDLE EAST & AFRICA MEMS AND SENSORS MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF MIDDLE EAST & AFRICA MEMS AND SENSORS MARKET

FIGURE 15 MIDDLE EAST & AFRICA MEMS & SENSORS MARKET, BY TYPE, 2021

FIGURE 16 MIDDLE EAST & AFRICA MEMS AND SENSORS MARKET, BY ACTUATOR TYPE, 2021

FIGURE 17 MIDDLE EAST & AFRICA MEMS AND SENSORS MARKET, BY PACKAGING SIZE, 2021

FIGURE 18 MIDDLE EAST & AFRICA MEMS AND SENSORS MARKET, BY FABRICATION PROCESS, 2021

FIGURE 19 MIDDLE EAST & AFRICA MEMS AND SENSORS MARKET, BY MATERIAL, 2021

FIGURE 20 MIDDLE EAST & AFRICA MEMS & SENSORS MARKET, BY END USER, 2021

FIGURE 21 MIDDLE EAST & AFRICA MEMS AND SENSORS MARKET: BY COUNTRY (2021)

FIGURE 22 MIDDLE EAST & AFRICA MEMS AND SENSORS MARKET: BY COUNTRY (2021)

FIGURE 23 MIDDLE EAST & AFRICA MEMS AND SENSORS MARKET: BY COUNTRY (2022 & 2029)

FIGURE 24 MIDDLE EAST & AFRICA MEMS AND SENSORS MARKET: BY COUNTRY (2021 & 2029)

FIGURE 25 MIDDLE EAST & AFRICA MEMS AND SENSORS MARKET: BY TYPE (2022-2029)

FIGURE 26 MIDDLE EAST & AFRICA MEMS AND SENSORS MARKET: COMPANY SHARE 2021 (%)

연구 방법론

데이터 수집 및 기준 연도 분석은 대규모 샘플 크기의 데이터 수집 모듈을 사용하여 수행됩니다. 이 단계에는 다양한 소스와 전략을 통해 시장 정보 또는 관련 데이터를 얻는 것이 포함됩니다. 여기에는 과거에 수집한 모든 데이터를 미리 검토하고 계획하는 것이 포함됩니다. 또한 다양한 정보 소스에서 발견되는 정보 불일치를 검토하는 것도 포함됩니다. 시장 데이터는 시장 통계 및 일관된 모델을 사용하여 분석하고 추정합니다. 또한 시장 점유율 분석 및 주요 추세 분석은 시장 보고서의 주요 성공 요인입니다. 자세한 내용은 분석가에게 전화를 요청하거나 문의 사항을 드롭하세요.

DBMR 연구팀에서 사용하는 주요 연구 방법론은 데이터 마이닝, 시장에 대한 데이터 변수의 영향 분석 및 주요(산업 전문가) 검증을 포함하는 데이터 삼각 측량입니다. 데이터 모델에는 공급업체 포지셔닝 그리드, 시장 타임라인 분석, 시장 개요 및 가이드, 회사 포지셔닝 그리드, 특허 분석, 가격 분석, 회사 시장 점유율 분석, 측정 기준, 글로벌 대 지역 및 공급업체 점유율 분석이 포함됩니다. 연구 방법론에 대해 자세히 알아보려면 문의를 통해 업계 전문가에게 문의하세요.

사용자 정의 가능

Data Bridge Market Research는 고급 형성 연구 분야의 선두 주자입니다. 저희는 기존 및 신규 고객에게 목표에 맞는 데이터와 분석을 제공하는 데 자부심을 느낍니다. 보고서는 추가 국가에 대한 시장 이해(국가 목록 요청), 임상 시험 결과 데이터, 문헌 검토, 재생 시장 및 제품 기반 분석을 포함하도록 사용자 정의할 수 있습니다. 기술 기반 분석에서 시장 포트폴리오 전략에 이르기까지 타겟 경쟁업체의 시장 분석을 분석할 수 있습니다. 귀하가 원하는 형식과 데이터 스타일로 필요한 만큼 많은 경쟁자를 추가할 수 있습니다. 저희 분석가 팀은 또한 원시 엑셀 파일 피벗 테이블(팩트북)로 데이터를 제공하거나 보고서에서 사용 가능한 데이터 세트에서 프레젠테이션을 만드는 데 도움을 줄 수 있습니다.