Middle East And Africa Medical Device Testing Market

시장 규모 (USD 10억)

연평균 성장률 :

%

USD

52.26 Million

USD

96.78 Million

2021

2029

USD

52.26 Million

USD

96.78 Million

2021

2029

| 2022 –2029 | |

| USD 52.26 Million | |

| USD 96.78 Million | |

|

|

|

Middle East and Africa MedicalDevice Testing Market, By Service Type (Testing Services, Inspection Service and Certification Services), Testing Type (Physical Testing, Chemical/Biological Testing, Cybersecurity Testing, Microbiology and Sterility Testing and Others), Phase (Preclinical and Clinical), Sourcing Type (In-House and Outsourced), Device Class (Class I, Class II and Class III), Product (Active Implant Medical Device, Active Medical Device, Non-Active Medical Device, In-vitro Diagnostics Medical Device, Ophthalmic Medical Device, Orthopedic and Dental Medical Device, Vascular Medical Device and Others) Industry Trends and Forecast to 2029

Middle East and Africa Medical Device Testing Market Analysis and Insights

Medical device testing is the process of demonstrating that the device is reliably and safely performed in use. In new product development, extensive design validation testing is applied. This includes performance testing, toxicity, chemical analysis, and sometimes human factors or clinical testing. Ongoing quality assurance testing is generally more limited. This usually includes dimensional checks, some functional tests, and packaging verification. Various types of medical testing services are available there in the market, such as inspection and certification services.

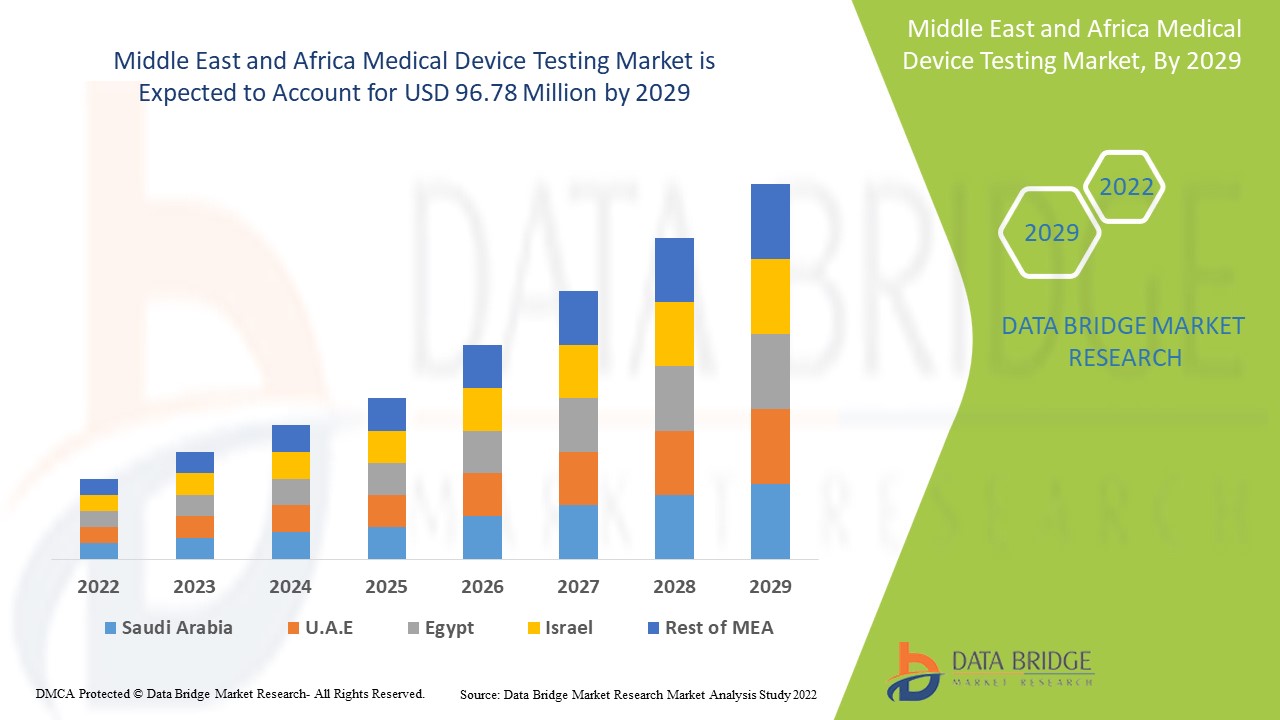

Middle East & Africa medical device testing market is expected to grow in the forecast period of 2022 to 2029. Data Bridge Market Research analyses that the market is growing with a CAGR of 8.5% in the forecast period of 2022 to 2029 and is expected to reach USD 96.78 million by 2029 from USD 52.26 million in 2021.

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Years |

2020 (Customizable to 2019-2014) |

|

Quantitative Units |

Revenue in USD Million, Pricing in USD |

|

Segments Covered |

By Service Type (Testing Services, Inspection Service and Certification Services), Testing Type (Physical Testing, Chemical/Biological Testing, Cybersecurity Testing, Microbiology and Sterility Testing and Others), Phase (Preclinical and Clinical), Sourcing Type (In-House and Outsourced), Device Class (Class I, Class II and Class III), Product (Active Implant Medical Device, Active Medical Device, Non-Active Medical Device, In-vitro Diagnostics Medical Device, Ophthalmic Medical Device, Orthopedic and Dental Medical Device, Vascular Medical Device and Others) |

|

Countries Covered |

South Africa, Saudi Arabia, U.A.E, Egypt, Israel and Rest of Middle East and Africa |

|

Market Players Covered |

Intertek Group plc, SGS SA, Bureau Veritas, TUV SUD, TUV Rheinland, UL LLC, NSF, Eurofins Scientific, Element Materials Technology, Medical Engineering Technologies Ltd., and among others |

Market Definition

의료 기기 테스트는 기기가 사용 중에 안정적이고 안전하게 수행된다는 것을 입증하는 프로세스입니다. 신제품 개발에서는 광범위한 설계 검증 테스트가 적용됩니다. 여기에는 성능 테스트, 독성 및 화학 분석, 때로는 인적 요인 또는 임상 테스트가 포함됩니다. 지속적인 품질 보증 테스트는 일반적으로 더 제한적입니다. 여기에는 일반적으로 치수 검사, 일부 기능 테스트 및 포장 검증이 포함됩니다. 검사 서비스, 인증 서비스 등과 같은 다양한 유형의 의료 테스트 서비스가 시중에 제공됩니다.

의료 기기 테스트 시장 동향

운전자

- 의료기기 검증 및 유효성 확인에 대한 필요성 증가

검증 및 확인 방법은 의료 산업에서 널리 사용되고 있습니다. 일반적으로 검증은 제품이 지정된 요구 사항을 준수하는지 여부를 확인하는 개발 단계인 반면, 검증은 의도된 용도가 충족되었는지, 따라서 사용성 세부 사항이 충족되는지 확인합니다. 의료 기기에 대한 가장 일반적인 검증 및 확인 유형은 설계, 프로세스 및 소프트웨어 검증 및 확인입니다. 의료 기기는 또한 점점 더 작고 설계가 복잡해지고 있으며, 때로는 고급 엔지니어링 플라스틱을 사용합니다. 이로 인해 검증 및 확인(V&V)이 더욱 중요해집니다. 그 결과 반복성이 향상되고 실수가 줄고 재작업 및 재설계가 줄어들고 시장 출시 시간이 빨라지고 경쟁력이 향상되고 생산 비용이 낮아집니다.

- 체외검사 수요 증가

체외 진단(IVD)은 인체에서 채취한 혈액이나 조직과 같은 샘플에 대해 수행되는 검사입니다. 체외 진단은 질병이나 기타 상태를 감지할 수 있으며 질병을 치료, 치료 또는 예방하기 위해 개인의 전반적인 건강을 모니터링하는 데 사용할 수 있습니다. 체외 검사는 HIV 감염, 말라리아, 간염 등과 같은 다양한 질병을 감지하는 데 사용됩니다. 이러한 질병의 유병률은 전 세계적으로 빠르게 증가하고 있으며, 이로 인해 체외 검사 및 다양한 의료 기기에 대한 수요가 증가하고 있습니다.

- 혁신 및 기술의 확대

지난 몇 년 동안 의료 분야의 기술 개발 가속화가 엄청나게 증가했습니다. 의료 기기 기술의 발전은 질병 관리 중에 고통스럽지 않고 복잡하지 않은 치료를 지원합니다. 게다가 의료 기기의 혁신과 업그레이드는 질병 진단의 정확하고 빠른 결과를 돕습니다. 의료 기기의 발명은 질병 치료 중에 기술 기반 치료 도구의 비용 효율성을 제공합니다. 게다가 많은 정부 기관과 의료 기관이 의료 연구 센터를 지원하고 있습니다. 이 지원의 주요 목적은 전 세계적으로 의료 혁신을 강화하는 것입니다. 그 이후로 혁신과 기술 발전이 증가함에 따라 예상 기간 동안 의료 기기 테스트의 성장이 촉진됩니다.

기회

-

의료비 지출 증가

다양한 국가의 사람들의 가처분 소득이 증가함에 따라 전 세계적으로 의료비가 증가했습니다. 게다가 인구 요구 사항을 충족하기 위해 정부 기관과 의료 기관은 의료비 지출을 가속화하여 주도권을 잡고 있습니다. 의료비 지출의 증가는 최근 몇 년 동안 의료 환경에서 의료 기기 테스트 서비스를 개선하는 데 도움이 됩니다.

또한, 주요 시장 참여자들이 취하는 전략적 이니셔티브는 2022~2029년 예측 기간 동안 의료 기기 테스트 시장에 구조적 무결성과 미래 기회를 제공할 것입니다.

제지/도전

- 의료기기 국산화의 장벽

그러나 일부 지역에서는 의료 기기의 현지 개발에 대한 장벽과 의료 기기의 높은 비용이 의료 기기 생산을 방해하여 시장 성장을 저해할 수 있습니다. 또한 의료 기술 산업의 치열한 경쟁과 해외 자격에 대한 긴 리드타임은 시장 개발에 도전적인 요소가 될 수 있습니다.

이 의료 기기 테스트 시장 보고서는 최근의 새로운 개발, 무역 규정, 수출입 분석, 생산 분석, 가치 사슬 최적화, 시장 점유율, 국내 및 지역 시장 참여자의 영향, 새로운 수익 창출처, 시장 규정의 변화, 전략적 시장 성장 분석, 시장 규모, 범주 시장 성장, 응용 분야 틈새 시장 및 지배력, 제품 승인, 제품 출시, 지리적 확장, 시장의 기술 혁신에 대한 분석 기회를 제공합니다. 의료 기기 테스트 시장에 대한 자세한 정보를 얻으려면 Data Bridge Market Research에 연락하여 분석가 브리핑을 받으세요. 저희 팀은 시장 성장을 달성하기 위한 정보에 입각한 시장 결정을 내리는 데 도움을 드립니다.

COVID-19 이후 의료 기기 테스트 시장에 미치는 영향

COVID-19는 시장에 긍정적인 영향을 미쳤습니다. MRI 스캐너, 인공호흡기 등과 같은 의료 기기의 사용이 그 해에 증가했습니다. 따라서 전 세계 인구에서 다양한 기기의 사용이 크게 증가했습니다. 따라서 팬데믹은 이 테스트 시장에 긍정적인 영향을 미쳤습니다.

최근 개발

- 2021년 4월, TUV SUD는 Medtec LIVE에 참가하여 의료 기기 테스트를 위한 원스톱 숍이 될 수 있는 역량을 선보였다고 발표했습니다. 이 서비스에는 전기 및 기능 안전, 사이버 보안 및 소프트웨어, EMC, 생체 적합성 테스트가 포함되었습니다. TUV SUD의 전문가들은 다양한 강연, 라이브 해킹, 엘리베이터 피치를 통해 온라인 무역 박람회 및 컨퍼런스 프로그램에 참여했습니다.

중동 및 아프리카 의료 기기 테스트 시장 범위

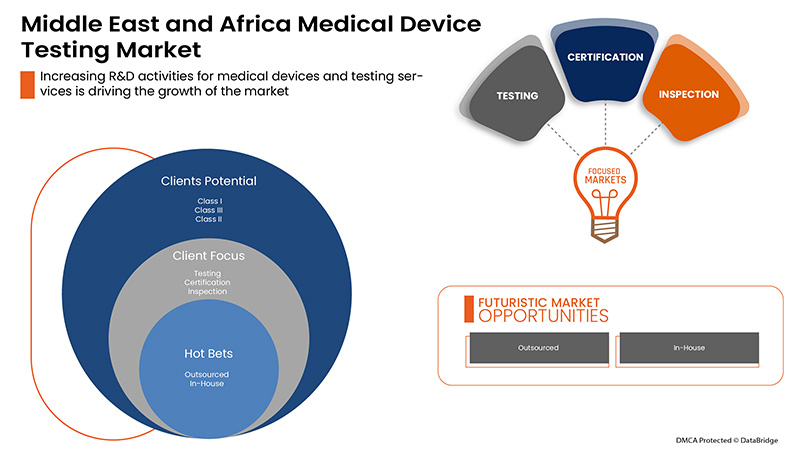

중동 및 아프리카 의료 기기 테스트 시장은 서비스 유형, 테스트 유형, 단계, 소싱 유형, 기기 클래스 및 제품으로 세분화됩니다. 이러한 세그먼트 간의 성장은 산업의 빈약한 성장 세그먼트를 분석하고 사용자에게 핵심 시장 응용 프로그램을 식별하기 위한 전략적 결정을 내릴 수 있는 귀중한 시장 개요와 시장 통찰력을 제공하는 데 도움이 됩니다.

서비스 유형

- 테스트 서비스

- 검사 서비스

- 인증 서비스

서비스 유형을 기준으로 중동 및 아프리카 의료 기기 테스트 시장은 테스트 서비스, 검사 서비스, 인증 서비스로 구분됩니다.

테스트 유형

- 물리적 테스트

- 화학/생물학적 테스트

- 사이버 보안 테스트

- 미생물학 및 무균 테스트

- 기타

테스트 유형을 기준으로 중동 및 아프리카 의료 기기 테스트 시장은 물리적 테스트, 화학/생물학적 테스트, 사이버 보안 테스트, 미생물학 및 무균 테스트 및 기타로 구분됩니다.

단계

- 전임상

- 객관적인

중동 및 아프리카 의료기기 시험 시장은 단계별로 전임상과 임상으로 구분됩니다.

소싱 유형

- 아웃소싱

- 사내에서

소싱 유형을 기준으로 중동 및 아프리카 의료 기기 테스트 시장은 자체 테스트와 아웃소싱으로 구분됩니다.

장치 클래스

- 1학년

- 2학년

- 3학년

중동 및 아프리카 의료기기 테스트 시장은 기기 유형을 기준으로 1등급, 2등급, 3등급으로 구분됩니다.

제품

- 능동 임플란트 의료기기

- 활성 의료 기기

- 비활성 의료 기기

- 체외진단 의료기기

- 안과 의료 기기

- 정형외과 및 치과 의료기기

- 혈관 의료 기기

- 기타

중동 및 아프리카 의료 기기 시험 시장은 제품을 기준으로 활성 임플란트 의료 기기, 활성 의료 기기, 비활성 의료 기기, 체외 진단 의료 기기, 안과 의료 기기, 정형외과 및 치과 의료 기기, 혈관 의료 기기 및 기타로 구분됩니다.

의료 기기 테스트 시장 지역 분석/통찰력

의료 기기 테스트 시장을 분석하고, 위에 참조된 대로 국가, 서비스 유형, 테스트 유형, 단계, 조달 유형, 기기 종류 및 제품별로 시장 규모에 대한 통찰력과 추세를 제공합니다.

중동 및 아프리카 지역에 포함되는 국가는 사우디아라비아, UAE, 이스라엘, 이집트, 남아프리카공화국, 그리고 기타 중동 및 아프리카 국가입니다.

남아프리카 공화국은 시장 점유율과 시장 수익 측면에서 의료 기기 테스트 시장을 지배하고 있으며 예측 기간 동안 지배력을 계속 확대할 것입니다. 이는 이 지역에서 의료 기기를 검증하고 검증해야 할 필요성이 높아지고 있기 때문입니다.

보고서의 국가 섹션은 또한 현재 및 미래 시장 추세에 영향을 미치는 개별 시장 영향 요인과 시장 규정의 변화를 제공합니다. 신규 및 교체 판매, 국가 인구 통계, 질병 역학 및 수출입 관세와 같은 데이터 포인트는 개별 국가의 시장 시나리오를 예측하는 데 사용되는 주요 포인터 중 일부입니다. 또한 글로벌 브랜드의 존재 및 가용성과 국내 및 국내 브랜드와의 치열한 경쟁으로 인해 직면한 과제, 판매 채널의 영향이 국가 데이터에 대한 예측 분석을 제공하는 동안 고려됩니다.

경쟁 환경 및 의료 기기 테스트 시장 점유율 분석

의료 기기 테스트 시장 경쟁 구도는 경쟁업체의 세부 정보를 제공합니다. 포함된 세부 정보는 회사 개요, 회사 재무, 창출된 수익, 시장 잠재력, 연구 개발 투자, 새로운 시장 이니셔티브, 글로벌 입지, 생산 현장 및 시설, 생산 용량, 회사의 강점과 약점, 제품 출시, 제품 폭과 범위, 애플리케이션 우세입니다. 위에 제공된 데이터 포인트는 의료 기기 테스트 시장에 대한 회사의 초점과만 관련이 있습니다.

의료 기기 테스트 시장에서 활동하는 주요 기업으로는 Intertek Group plc, SGS SA, Bureau Veritas, TUV SUD, TUV Rheinland, UL LLC, NSF, Eurofins Scientific, Element Materials Technology, Medical Engineering Technologies Ltd. 등이 있습니다.

연구 방법론

데이터 수집 및 기준 연도 분석은 대규모 샘플 크기의 데이터 수집 모듈을 사용하여 수행됩니다. 시장 데이터는 시장 통계 및 일관된 모델을 사용하여 분석 및 추정됩니다. 또한 시장 점유율 분석 및 주요 추세 분석은 시장 보고서의 주요 성공 요인입니다. DBMR 연구팀에서 사용하는 주요 연구 방법론은 데이터 마이닝, 시장에 대한 데이터 변수의 영향 분석 및 기본(산업 전문가) 검증을 포함하는 데이터 삼각 측량입니다. 이 외에도 데이터 모델에는 공급업체 포지셔닝 그리드, 시장 타임라인 분석, 시장 개요 및 가이드, 회사 포지셔닝 그리드, 회사 시장 점유율 분석, 측정 표준, 중동 및 아프리카 대 지역 및 공급업체 점유율 분석이 포함됩니다. 추가 문의 사항이 있는 경우 분석가 전화를 요청하십시오.

사용자 정의 가능

Data Bridge Market Research는 고급 형성 연구 분야의 선두 주자입니다. 저희는 기존 및 신규 고객에게 목표에 맞는 데이터와 분석을 제공하는 것을 자랑으로 생각합니다. 보고서는 타겟 브랜드의 가격 추세 분석, 추가 국가에 대한 시장 이해(국가 목록 요청), 임상 시험 결과 데이터, 문헌 검토, 재생 시장 및 제품 기반 분석을 포함하도록 사용자 정의할 수 있습니다. 타겟 경쟁업체의 시장 분석은 기술 기반 분석에서 시장 포트폴리오 전략까지 분석할 수 있습니다. 필요한 만큼 많은 경쟁업체를 원하는 형식과 데이터 스타일로 추가할 수 있습니다. 저희 분석가 팀은 또한 원시 Excel 파일 피벗 테이블(팩트북)로 데이터를 제공하거나 보고서에서 사용할 수 있는 데이터 세트에서 프레젠테이션을 만드는 데 도움을 줄 수 있습니다.

SKU-

세계 최초의 시장 정보 클라우드 보고서에 온라인으로 접속하세요

- 대화형 데이터 분석 대시보드

- 높은 성장 잠재력 기회를 위한 회사 분석 대시보드

- 사용자 정의 및 질의를 위한 리서치 분석가 액세스

- 대화형 대시보드를 통한 경쟁자 분석

- 최신 뉴스, 업데이트 및 추세 분석

- 포괄적인 경쟁자 추적을 위한 벤치마크 분석의 힘 활용

목차

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF MIDDLE EAST & AFRICA MEDICAL DEVICE TESTING MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 SERVICE TYPE LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET TESTING TYPE COVERAGE GRID

2.11 VENDOR SHARE ANALYSIS

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTEL ANALYSIS

4.2 PORTER'S FIVE FORCES

5 MIDDLE EAST & AFRICA MEDICAL DEVICE TESTING MARKET: REGULATIONS

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 RISING NEED FOR VERIFICATION VALIDATION OF MEDICAL DEVICES

6.1.2 INCREASING DEMAND FOR IN-VITRO TESTS

6.1.3 ESCALATION IN INNOVATION AND TECHNOLOGIES

6.2 RESTRAINTS

6.2.1 BARRIERS TO THE LOCAL DEVELOPMENT OF MEDICAL DEVICES

6.2.2 HIGH COST OF MEDICAL DEVICES

6.3 OPPORTUNITIES

6.3.1 RISE IN HEALTHCARE EXPENDITURE

6.3.2 DEVELOPMENT IN AI AND IOT IN VARIOUS MEDICAL DEVICES

6.3.3 STRATEGIC INITIATIVES OF KEY PLAYERS

6.4 CHALLENGES

6.4.1 HIGH COMPETITION IN MEDICAL TECHNOLOGY INDUSTRY

6.4.2 LONG LEAD TIME FOR OVERSEAS QUALIFICATION

7 MIDDLE EAST & AFRICA MEDICAL DEVICE TESTING MARKET, BY SERVICE TYPE

7.1 OVERVIEW

7.2 TESTING SERVICES

7.3 INSPECTION SERVICES

7.4 CERTIFICATION SERVICES

8 MIDDLE EAST & AFRICA MEDICAL DEVICE TESTING MARKET, BY TESTING TYPE

8.1 OVERVIEW

8.2 CHEMICAL/BIOLOGICAL TESTING

8.3 MICROBIOLOGY AND STERILITY TESTING

8.3.1 STERILITY TEST & VALIDATION

8.3.2 BIO BURDEN DETERMINATION

8.3.3 ANTIMICROBIAL ACTIVITY TESTING

8.3.4 PYROGEN & ENDOTOXIN TESTING

8.3.5 OTHERS

8.4 PHYSICAL TESTING

8.4.1 ELECTRICAL SAFETY TESTING

8.4.2 FUNCTIONAL SAFETY TESTING

8.4.3 EMC TESTING

8.4.4 ENVIRONMENTAL TESTING

8.4.5 OTHERS

8.5 CYBERSECURITY TESTING

8.6 OTHERS

9 MIDDLE EAST & AFRICA MEDICAL DEVICE TESTING MARKET, BY PHASE

9.1 OVERVIEW

9.2 PRECLINICAL

9.3 CLINICAL

10 MIDDLE EAST & AFRICA MEDICAL DEVICE TESTING MARKET, BY SOURCING TYPE

10.1 OVERVIEW

10.2 OUTSOURCED

10.3 IN-HOUSE

11 MIDDLE EAST & AFRICA MEDICAL DEVICE TESTING MARKET, BY DEVICE CLASS

11.1 OVERVIEW

11.2 CLASS I

11.3 CLASS III

11.4 CLASS II

12 MIDDLE EAST & AFRICA MEDICAL DEVICE TESTING MARKET, BY PRODUCT

12.1 OVERVIEW

12.2 NON-ACTIVE MEDICAL DEVICE

12.3 ORTHOPEDIC AND DENTAL MEDICAL DEVICE

12.4 ACTIVE IMPLANT MEDICAL DEVICE

12.5 VASCULAR MEDICAL DEVICE

12.6 ACTIVE MEDICAL DEVICE

12.7 IN-VITRO DIAGNOSTICS MEDICAL DEVICE

12.8 OPTHALMIC MEDICAL DEVICE

12.9 OTHERS

13 MIDDLE EAST & AFRICA MEDICAL DEVICE TESTING MARKET, BY GEOGRAPHY

13.1 MIDDLE EAST AND AFRICA

13.1.1 SOUTH AFRICA

13.1.2 SAUDI ARABIA

13.1.3 U.A.E

13.1.4 ISRAEL

13.1.5 EGYPT

13.1.6 REST OF MIDDLE EAST AND AFRICA

14 MIDDLE EAST & AFRICA MEDICAL DEVICE TESTING MARKET: COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: MIDDLE EAST & AFRICA

15 SWOT ANALYSIS

16 COMPANY PROFILE

16.1 LABCORP

16.1.1 COMPANY SNAPSHOT

16.1.2 REVENUE ANALYSIS

16.1.3 COMPANY SHARE ANALYSIS

16.1.4 PRODUCT PORTFOLIO

16.1.5 RECENT DEVELOPMENTS

16.2 CHARLES RIVER LABORATORIES.

16.2.1 COMPANY SNAPSHOT

16.2.2 REVENUE ANALYSIS

16.2.3 COMPANY SHARE ANALYSIS

16.2.4 PRODUCT PORTFOLIO

16.2.5 RECENT DEVELOPMENTS

16.3 TUV SUD

16.3.1 COMPANY SNAPSHOT

16.3.2 REVENUE ANALYSIS

16.3.3 COMPANY SHARE ANALYSIS

16.3.4 PRODUCT PORTFOLIO

16.3.5 RECENT DEVELOPMENTS

16.4 WUXI APPTEC

16.4.1 COMPANY SNAPSHOT

16.4.2 REVENUE ANALYSIS

16.4.3 COMPANY SHARE ANALYSIS

16.4.4 PRODUCT PORTFOLIO

16.4.5 RECENT DEVELOPMENTS

16.5 SGS SA

16.5.1 COMPANY SNAPSHOT

16.5.2 REVENUE ANALYSIS

16.5.3 COMPANY SHARE ANALYSIS

16.5.4 PRODUCT PORTFOLIO

16.5.5 RECENT DEVELOPMENTS

16.6 NORTH AMERICAN SCIENCE ASSOCIATES, LLC

16.6.1 COMPANY SNAPSHOT

16.6.2 PRODUCT PORTFOLIO

16.6.3 RECENT DEVELOPMENTS

16.7 HOHENSTEIN

16.7.1 COMPANY SNAPSHOT

16.7.2 PRODUCT PORTFOLIO

16.7.3 RECENT DEVELOPMENTS

16.8 ARBRO PHARMACEUTICALS PRIVATE LIMITED & AURIGA RESEARCH PRIVATE LIMITED

16.8.1 COMPANY SNAPSHOT

16.8.2 PRODUCT PORTFOLIO

16.8.3 RECENT DEVELOPMENTS

16.9 BIOMEDICAL DEVICE LABS

16.9.1 COMPANY SNAPSHOT

16.9.2 PRODUCT PORTFOLIO

16.9.3 RECENT DEVELOPMENTS

16.1 BIONEEDS

16.10.1 COMPANY SNAPSHOT

16.10.2 PRODUCT PORTFOLIO

16.10.3 RECENT DEVELOPMENTS

16.11 BUREAU VERITAS

16.11.1 COMPANY SNAPSHOT

16.11.2 REVENUE ANALYSIS

16.11.3 PRODUCT PORTFOLIO

16.11.4 RECENT DEVELOPMENTS

16.12 CIGNITI

16.12.1 COMPANY SNAPSHOT

16.12.2 REVENUE ANALYSIS

16.12.3 PRODUCT PORTFOLIO

16.12.4 RECENT DEVELOPMENTS

16.13 ELEMENT MATERIALS TECHNOLOGY

16.13.1 COMPANY SNAPSHOT

16.13.2 PRODUCT PORTFOLIO

16.13.3 RECENT DEVELOPMENTS

16.14 ENDOLAB MECHANICAL ENGINEERING GMBH

16.14.1 COMPANY SNAPSHOT

16.14.2 PRODUCT PORTFOLIO

16.14.3 RECENT DEVELOPMENTS

16.15 EUROFINS SCIENTIFIC

16.15.1 COMPANY SNAPSHOT

16.15.2 REVENUE ANALYSIS

16.15.3 PRODUCT PORTFOLIO

16.15.4 RECENT DEVELOPMENTS

16.16 GATEWAY ANALYTICAL.

16.16.1 COMPANY SNAPSHOT

16.16.2 PRODUCT PORTFOLIO

16.16.3 RECENT DEVELOPMENTS

16.17 IMR TEST LABS

16.17.1 COMPANY SNAPSHOT

16.17.2 PRODUCT PORTFOLIO

16.17.3 RECENT DEVELOPMENTS

16.18 INTERTEK GROUP PLC

16.18.1 COMPANY SNAPSHOT

16.18.2 REVENUE ANALYSIS

16.18.3 PRODUCT PORTFOLIO

16.18.4 RECENT DEVELOPMENTS

16.19 ITC ZLIN

16.19.1 COMPANY SNAPSHOT

16.19.2 PRODUCT PORTFOLIO

16.19.3 RECENT DEVELOPMENTS

16.2 MEDICAL ENGINEERING TECHNOLOGIES LTD.

16.20.1 COMPANY SNAPSHOT

16.20.2 PRODUCT PORTFOLIO

16.20.3 RECENT DEVELOPMENTS

16.21 MEDISTRI SA

16.21.1 COMPANY SNAPSHOT

16.21.2 PRODUCT PORTFOLIO

16.21.3 RECENT DEVELOPMENTS

16.22 NELSON LABORATORIES, LLC- A SOTERA HEALTH COMPANY

16.22.1 COMPANY SNAPSHOT

16.22.2 REVENUE ANALYSIS

16.22.3 PRODUCT PORTFOLIO

16.22.4 RECENT DEVELOPMENTS

16.23 NSF.

16.23.1 COMPANY SNAPSHOT

16.23.2 PRODUCT PORTFOLIO

16.23.3 RECENT DEVELOPMENTS

16.24 PACE

16.24.1 COMPANY SNAPSHOT

16.24.2 PRODUCT PORTFOLIO

16.24.3 RECENT DEVELOPMENTS

16.25 Q LABORATORIES

16.25.1 COMPANY SNAPSHOT

16.25.2 PRODUCT PORTFOLIO

16.25.3 RECENT DEVELOPMENTS

16.26 TUV RHEINLAND

16.26.1 COMPANY SNAPSHOT

16.26.2 REVENUE ANALYSIS

16.26.3 PRODUCT PORTFOLIO

16.26.4 RECENT DEVELOPMENTS

16.27 UL LLC

16.27.1 COMPANY SNAPSHOT

16.27.2 PRODUCT PORTFOLIO

16.27.3 RECENT DEVELOPMENTS

17 QUESTIONNAIRE

18 RELATED REPORTS

표 목록

TABLE 1 FDA REGULATIONS BASED ON DEVICES TYPE

TABLE 2 PRICES OF ESSENTIAL MEDICAL DEVICES

TABLE 3 MIDDLE EAST & AFRICA MEDICAL DEVICE TESTING MARKET, BY SERVICE TYPE, 2020-2029 (USD MILLION)

TABLE 4 MIDDLE EAST & AFRICA TESTING SERVICES IN MEDICAL DEVICE TESTING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 5 MIDDLE EAST & AFRICA INSPECTION SERVICES IN MEDICAL DEVICE TESTING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 6 MIDDLE EAST & AFRICA CERTIFICATION SERVICES IN MEDICAL DEVICE TESTING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 7 MIDDLE EAST & AFRICA MEDICAL DEVICE TESTING MARKET, BY TESTING TYPE, 2020-2029 (USD MILLION)

TABLE 8 MIDDLE EAST & AFRICA CHEMICAL/BIOLOGICAL TESTING IN MEDICAL DEVICE TESTING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 9 MIDDLE EAST & AFRICA MICROBIOLOGY AND STERILITY TESTING IN MEDICAL DEVICE TESTING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 10 MIDDLE EAST & AFRICA MICROBIOLOGY AND STERILITY TESTING IN MEDICAL DEVICE TESTING MARKET, BY TESTING TYPE, 2020-2029 (USD MILLION)

TABLE 11 MIDDLE EAST & AFRICA PHYSICAL TESTING IN MEDICAL DEVICE TESTING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 12 MIDDLE EAST & AFRICA PHYSICAL TESTING IN MEDICAL DEVICE TESTING MARKET, BY TESTING TYPE, 2020-2029 (USD MILLION)

TABLE 13 MIDDLE EAST & AFRICA CYBERSECURITY TESTING IN MEDICAL DEVICE TESTING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 14 MIDDLE EAST & AFRICA OTHERS IN MEDICAL DEVICE TESTING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 15 MIDDLE EAST & AFRICA MEDICAL DEVICE TESTING MARKET, BY PHASE, 2020-2029 (USD MILLION)

TABLE 16 MIDDLE EAST & AFRICA PRECLINICAL IN MEDICAL DEVICE TESTING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 17 MIDDLE EAST & AFRICA CLINICAL IN MEDICAL DEVICE TESTING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 18 MIDDLE EAST & AFRICA MEDICAL DEVICE TESTING MARKET, BY SOURCING TYPE, 2020-2029 (USD MILLION)

TABLE 19 MIDDLE EAST & AFRICA OUTSOURCED IN MEDICAL DEVICE TESTING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 20 MIDDLE EAST & AFRICA IN-HOUSE IN MEDICAL DEVICE TESTING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 21 MIDDLE EAST & AFRICA MEDICAL DEVICE TESTING MARKET, BY DEVICE CLASS, 2020-2029 (USD MILLION)

TABLE 22 MIDDLE EAST & AFRICA CLASS I IN MEDICAL DEVICE TESTING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 23 MIDDLE EAST & AFRICA CLASS III IN MEDICAL DEVICE TESTING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 24 MIDDLE EAST & AFRICA CLASS II IN MEDICAL DEVICE TESTING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 25 MIDDLE EAST & AFRICA MEDICAL DEVICE TESTING MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 26 MIDDLE EAST & AFRICA NON-ACTIVE MEDICAL DEVICE IN MEDICAL DEVICE TESTING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 27 MIDDLE EAST & AFRICA ORTHOPEDIC AND DENTAL MEDICAL DEVICE IN MEDICAL DEVICE TESTING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 28 MIDDLE EAST & AFRICA ACTIVE IMPLANT MEDICAL DEVICE IN MEDICAL DEVICE TESTING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 29 MIDDLE EAST & AFRICA VASCULAR MEDICAL DEVICE IN MEDICAL DEVICE TESTING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 30 MIDDLE EAST & AFRICA ACTIVE MEDICAL DEVICE IN MEDICAL DEVICE TESTING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 31 MIDDLE EAST & AFRICA IN-VITRO MEDICAL DEVICE IN MEDICAL DEVICE TESTING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 32 MIDDLE EAST & AFRICA OPTHALMIC MEDICAL DEVICE IN MEDICAL DEVICE TESTING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 33 MIDDLE EAST & AFRICA OTHERS IN MEDICAL DEVICE TESTING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 34 MIDDLE EAST AND AFRICA MEDICAL DEVICE TESTING MARKET, BY REGION, 2019-2029 (USD MILLION)

TABLE 35 MIDDLE EAST AND AFRICA MEDICAL DEVICE TESTING MARKET, BY SERVICE TYPE, 2020-2029 (USD MILLION)

TABLE 36 MIDDLE EAST AND AFRICA MEDICAL DEVICE TESTING MARKET, BY TESTING TYPE, 2020-2029 (USD MILLION)

TABLE 37 MIDDLE EAST AND AFRICA MICROBIOLOGY AND STERILITY TESTING IN MEDICAL DEVICE TESTING MARKET, BY TESTING TYPE, 2020-2029 (USD MILLION)

TABLE 38 MIDDLE EAST AND AFRICA PHYSICAL TESTING IN MEDICAL DEVICE TESTING MARKET, BY TESTING TYPE, 2020-2029 (USD MILLION)

TABLE 39 MIDDLE EAST AND AFRICA MEDICAL DEVICE TESTING MARKET, BY PHASE, 2020-2029 (USD MILLION)

TABLE 40 MIDDLE EAST AND AFRICA MEDICAL DEVICE TESTING MARKET, BY SOURCING TYPE, 2020-2029 (USD MILLION)

TABLE 41 MIDDLE EAST AND AFRICA MEDICAL DEVICE TESTING MARKET, BY DEVICE CLASS, 2020-2029 (USD MILLION)

TABLE 42 MIDDLE EAST AND AFRICA MEDICAL DEVICE TESTING MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 43 SOUTH AFRICA MEDICAL DEVICE TESTING MARKET, BY SERVICE TYPE, 2020-2029 (USD MILLION)

TABLE 44 SOUTH AFRICA MEDICAL DEVICE TESTING MARKET, BY TESTING TYPE, 2020-2029 (USD MILLION)

TABLE 45 SOUTH AFRICA MICROBIOLOGY AND STERILITY TESTING IN MEDICAL DEVICE TESTING MARKET, BY TESTING TYPE, 2020-2029 (USD MILLION)

TABLE 46 SOUTH AFRICA PHYSICAL TESTING IN MEDICAL DEVICE TESTING MARKET, BY TESTING TYPE, 2020-2029 (USD MILLION)

TABLE 47 SOUTH AFRICA MEDICAL DEVICE TESTING MARKET, BY PHASE, 2020-2029 (USD MILLION)

TABLE 48 SOUTH AFRICA MEDICAL DEVICE TESTING MARKET, BY SOURCING TYPE, 2020-2029 (USD MILLION)

TABLE 49 SOUTH AFRICA MEDICAL DEVICE TESTING MARKET, BY DEVICE CLASS, 2020-2029 (USD MILLION)

TABLE 50 SOUTH AFRICA MEDICAL DEVICE TESTING MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 51 SAUDI ARABIA MEDICAL DEVICE TESTING MARKET, BY SERVICE TYPE, 2020-2029 (USD MILLION)

TABLE 52 SAUDI ARABIA MEDICAL DEVICE TESTING MARKET, BY TESTING TYPE, 2020-2029 (USD MILLION)

TABLE 53 SAUDI ARABIA MICROBIOLOGY AND STERILITY TESTING IN MEDICAL DEVICE TESTING MARKET, BY TESTING TYPE, 2020-2029 (USD MILLION)

TABLE 54 SAUDI ARABIA PHYSICAL TESTING IN MEDICAL DEVICE TESTING MARKET, BY TESTING TYPE, 2020-2029 (USD MILLION)

TABLE 55 SAUDI ARABIA MEDICAL DEVICE TESTING MARKET, BY PHASE, 2020-2029 (USD MILLION)

TABLE 56 SAUDI ARABIA MEDICAL DEVICE TESTING MARKET, BY SOURCING TYPE, 2020-2029 (USD MILLION)

TABLE 57 SAUDI ARABIA MEDICAL DEVICE TESTING MARKET, BY DEVICE CLASS, 2020-2029 (USD MILLION)

TABLE 58 SAUDI ARABIA MEDICAL DEVICE TESTING MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 59 U.A.E MEDICAL DEVICE TESTING MARKET, BY SERVICE TYPE, 2020-2029 (USD MILLION)

TABLE 60 U.A.E MEDICAL DEVICE TESTING MARKET, BY TESTING TYPE, 2020-2029 (USD MILLION)

TABLE 61 U.A.E MICROBIOLOGY AND STERILITY TESTING IN MEDICAL DEVICE TESTING MARKET, BY TESTING TYPE, 2020-2029 (USD MILLION)

TABLE 62 U.A.E PHYSICAL TESTING IN MEDICAL DEVICE TESTING MARKET, BY TESTING TYPE, 2020-2029 (USD MILLION)

TABLE 63 U.A.E MEDICAL DEVICE TESTING MARKET, BY PHASE, 2020-2029 (USD MILLION)

TABLE 64 U.A.E MEDICAL DEVICE TESTING MARKET, BY SOURCING TYPE, 2020-2029 (USD MILLION)

TABLE 65 U.A.E MEDICAL DEVICE TESTING MARKET, BY DEVICE CLASS, 2020-2029 (USD MILLION)

TABLE 66 U.A.E MEDICAL DEVICE TESTING MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 67 ISRAEL MEDICAL DEVICE TESTING MARKET, BY SERVICE TYPE, 2020-2029 (USD MILLION)

TABLE 68 ISRAEL MEDICAL DEVICE TESTING MARKET, BY TESTING TYPE, 2020-2029 (USD MILLION)

TABLE 69 ISRAEL MICROBIOLOGY AND STERILITY TESTING IN MEDICAL DEVICE TESTING MARKET, BY TESTING TYPE, 2020-2029 (USD MILLION)

TABLE 70 ISRAEL PHYSICAL TESTING IN MEDICAL DEVICE TESTING MARKET, BY TESTING TYPE, 2020-2029 (USD MILLION)

TABLE 71 ISRAEL MEDICAL DEVICE TESTING MARKET, BY PHASE, 2020-2029 (USD MILLION)

TABLE 72 ISRAEL MEDICAL DEVICE TESTING MARKET, BY SOURCING TYPE, 2020-2029 (USD MILLION)

TABLE 73 ISRAEL MEDICAL DEVICE TESTING MARKET, BY DEVICE CLASS, 2020-2029 (USD MILLION)

TABLE 74 ISRAEL MEDICAL DEVICE TESTING MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 75 EGYPT MEDICAL DEVICE TESTING MARKET, BY SERVICE TYPE, 2020-2029 (USD MILLION)

TABLE 76 EGYPT MEDICAL DEVICE TESTING MARKET, BY TESTING TYPE, 2020-2029 (USD MILLION)

TABLE 77 EGYPT MICROBIOLOGY AND STERILITY TESTING IN MEDICAL DEVICE TESTING MARKET, BY TESTING TYPE, 2020-2029 (USD MILLION)

TABLE 78 EGYPT PHYSICAL TESTING IN MEDICAL DEVICE TESTING MARKET, BY TESTING TYPE, 2020-2029 (USD MILLION)

TABLE 79 EGYPT MEDICAL DEVICE TESTING MARKET, BY PHASE, 2020-2029 (USD MILLION)

TABLE 80 EGYPT MEDICAL DEVICE TESTING MARKET, BY SOURCING TYPE, 2020-2029 (USD MILLION)

TABLE 81 EGYPT MEDICAL DEVICE TESTING MARKET, BY DEVICE CLASS, 2020-2029 (USD MILLION)

TABLE 82 EGYPT MEDICAL DEVICE TESTING MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 83 REST OF MIDDLE EAST AND AFRICA MEDICAL DEVICE TESTING MARKET, BY SERVICE TYPE, 2020-2029 (USD MILLION)

그림 목록

FIGURE 1 MIDDLE EAST & AFRICA MEDICAL DEVICE TESTING MARKET: SEGMENTATION

FIGURE 2 MIDDLE EAST & AFRICA MEDICAL DEVICE TESTING MARKET: DATA TRIANGULATION

FIGURE 3 MIDDLE EAST & AFRICA MEDICAL DEVICE TESTING MARKET: DROC ANALYSIS

FIGURE 4 MIDDLE EAST & AFRICA MEDICAL DEVICE TESTING MARKET: MIDDLE EAST & AFRICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 MIDDLE EAST & AFRICA MEDICAL DEVICE TESTING MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 MIDDLE EAST & AFRICA MEDICAL DEVICE TESTING MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 MIDDLE EAST & AFRICA MEDICAL DEVICE TESTING MARKET: DBMR MARKET POSITION GRID

FIGURE 8 MIDDLE EAST & AFRICA MEDICAL DEVICE TESTING MARKET: MARKET TESTING TYPE COVERAGE GRID

FIGURE 9 MIDDLE EAST & AFRICA MEDICAL DEVICE TESTING MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 MIDDLE EAST & AFRICA MEDICAL DEVICE TESTING MARKET: SEGMENTATION

FIGURE 11 INCREASING DEMAND FOR IN-VITRO TESTS AND DEVELOPMENT IN AI AND IOT IN VARIOUS MEDICAL DEVICES ARE EXPECTED TO DRIVE THE MIDDLE EAST & AFRICA MEDICAL DEVICE TESTING MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 TESTING SERVICES SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE MIDDLE EAST & AFRICA MEDICAL DEVICE TESTING MARKET IN 2022 & 2029

FIGURE 13 NORTH AMERICA IS EXPECTED TO DOMINATE THE MIDDLE EAST & AFRICA MEDICAL DEVICE TESTINGMARKET, AND ASIA-PACIFIC IS EXPECTED TO GROW WITH THE HIGHEST CAGR IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF MIDDLE EAST & AFRICA MEDICAL DEVICE TESTING MARKET

FIGURE 15 MIDDLE EAST & AFRICA MEDICAL DEVICE TESTING MARKET: BY SERVICE TYPE, 2021

FIGURE 16 MIDDLE EAST & AFRICA MEDICAL DEVICE TESTING MARKET: BY SERVICE TYPE, 2022-2029 (USD MILLION)

FIGURE 17 MIDDLE EAST & AFRICA MEDICAL DEVICE TESTING MARKET: BY SERVICE TYPE, CAGR (2022-2029)

FIGURE 18 MIDDLE EAST & AFRICA MEDICAL DEVICE TESTING MARKET: BY SERVICE TYPE, LIFELINE CURVE

FIGURE 19 MIDDLE EAST & AFRICA MEDICAL DEVICE TESTING MARKET: BY TESTING TYPE, 2021

FIGURE 20 MIDDLE EAST & AFRICA MEDICAL DEVICE TESTING MARKET: BY TESTING TYPE, 2022-2029 (USD MILLION)

FIGURE 21 MIDDLE EAST & AFRICA MEDICAL DEVICE TESTING MARKET: BY TESTING TYPE, CAGR (2022-2029)

FIGURE 22 MIDDLE EAST & AFRICA MEDICAL DEVICE TESTING MARKET: BY TESTING TYPE, LIFELINE CURVE

FIGURE 23 MIDDLE EAST & AFRICA MEDICAL DEVICE TESTING MARKET: BY PHASE, 2021

FIGURE 24 MIDDLE EAST & AFRICA MEDICAL DEVICE TESTING MARKET: BY PHASE, 2022-2029 (USD MILLION)

FIGURE 25 MIDDLE EAST & AFRICA MEDICAL DEVICE TESTING MARKET: BY PHASE, CAGR (2022-2029)

FIGURE 26 MIDDLE EAST & AFRICA MEDICAL DEVICE TESTING MARKET: BY PHASE, LIFELINE CURVE

FIGURE 27 MIDDLE EAST & AFRICA MEDICAL DEVICE TESTING MARKET: BY SOURCING TYPE, 2021

FIGURE 28 MIDDLE EAST & AFRICA MEDICAL DEVICE TESTING MARKET: BY SOURCING TYPE, 2022-2029 (USD MILLION)

FIGURE 29 MIDDLE EAST & AFRICA MEDICAL DEVICE TESTING MARKET: BY SOURCING TYPE, CAGR (2022-2029)

FIGURE 30 MIDDLE EAST & AFRICA MEDICAL DEVICE TESTING MARKET: BY SOURCING TYPE, LIFELINE CURVE

FIGURE 31 MIDDLE EAST & AFRICA MEDICAL DEVICE TESTING MARKET: BY DEVICE CLASS, 2021

FIGURE 32 MIDDLE EAST & AFRICA MEDICAL DEVICE TESTING MARKET: BY DEVICE CLASS, 2022-2029 (USD MILLION)

FIGURE 33 MIDDLE EAST & AFRICA MEDICAL DEVICE TESTING MARKET: BY DEVICE CLASS, CAGR (2022-2029)

FIGURE 34 MIDDLE EAST & AFRICA MEDICAL DEVICE TESTING MARKET: BY DEVICE CLASS, LIFELINE CURVE

FIGURE 35 MIDDLE EAST & AFRICA MEDICAL DEVICE TESTING MARKET: BY PRODUCT, 2021

FIGURE 36 MIDDLE EAST & AFRICA MEDICAL DEVICE TESTING MARKET: BY PRODUCT, 2022-2029 (USD MILLION)

FIGURE 37 MIDDLE EAST & AFRICA MEDICAL DEVICE TESTING MARKET: BY PRODUCT, CAGR (2022-2029)

FIGURE 38 MIDDLE EAST & AFRICA MEDICAL DEVICE TESTING MARKET: BY PRODUCT, LIFELINE CURVE

FIGURE 39 MIDDLE EAST AND AFRICA MEDICAL DEVICE TESTING MARKET: SNAPSHOT (2021)

FIGURE 40 MIDDLE EAST AND AFRICA MEDICAL DEVICE TESTING MARKET: BY COUNTRY (2021)

FIGURE 41 MIDDLE EAST AND AFRICA MEDICAL DEVICE TESTING MARKET: BY COUNTRY (2022 & 2029)

FIGURE 42 MIDDLE EAST AND AFRICA MEDICAL DEVICE TESTING MARKET: BY COUNTRY (2021 & 2029)

FIGURE 43 MIDDLE EAST AND AFRICA MEDICAL DEVICE TESTING MARKET: BY SERVICE TYPE (2022-2029)

FIGURE 44 MIDDLE EAST & AFRICA MEDICAL DEVICE TESTING MARKET: COMPANY SHARE 2021 (%)

연구 방법론

데이터 수집 및 기준 연도 분석은 대규모 샘플 크기의 데이터 수집 모듈을 사용하여 수행됩니다. 이 단계에는 다양한 소스와 전략을 통해 시장 정보 또는 관련 데이터를 얻는 것이 포함됩니다. 여기에는 과거에 수집한 모든 데이터를 미리 검토하고 계획하는 것이 포함됩니다. 또한 다양한 정보 소스에서 발견되는 정보 불일치를 검토하는 것도 포함됩니다. 시장 데이터는 시장 통계 및 일관된 모델을 사용하여 분석하고 추정합니다. 또한 시장 점유율 분석 및 주요 추세 분석은 시장 보고서의 주요 성공 요인입니다. 자세한 내용은 분석가에게 전화를 요청하거나 문의 사항을 드롭하세요.

DBMR 연구팀에서 사용하는 주요 연구 방법론은 데이터 마이닝, 시장에 대한 데이터 변수의 영향 분석 및 주요(산업 전문가) 검증을 포함하는 데이터 삼각 측량입니다. 데이터 모델에는 공급업체 포지셔닝 그리드, 시장 타임라인 분석, 시장 개요 및 가이드, 회사 포지셔닝 그리드, 특허 분석, 가격 분석, 회사 시장 점유율 분석, 측정 기준, 글로벌 대 지역 및 공급업체 점유율 분석이 포함됩니다. 연구 방법론에 대해 자세히 알아보려면 문의를 통해 업계 전문가에게 문의하세요.

사용자 정의 가능

Data Bridge Market Research는 고급 형성 연구 분야의 선두 주자입니다. 저희는 기존 및 신규 고객에게 목표에 맞는 데이터와 분석을 제공하는 데 자부심을 느낍니다. 보고서는 추가 국가에 대한 시장 이해(국가 목록 요청), 임상 시험 결과 데이터, 문헌 검토, 재생 시장 및 제품 기반 분석을 포함하도록 사용자 정의할 수 있습니다. 기술 기반 분석에서 시장 포트폴리오 전략에 이르기까지 타겟 경쟁업체의 시장 분석을 분석할 수 있습니다. 귀하가 원하는 형식과 데이터 스타일로 필요한 만큼 많은 경쟁자를 추가할 수 있습니다. 저희 분석가 팀은 또한 원시 엑셀 파일 피벗 테이블(팩트북)로 데이터를 제공하거나 보고서에서 사용 가능한 데이터 세트에서 프레젠테이션을 만드는 데 도움을 줄 수 있습니다.