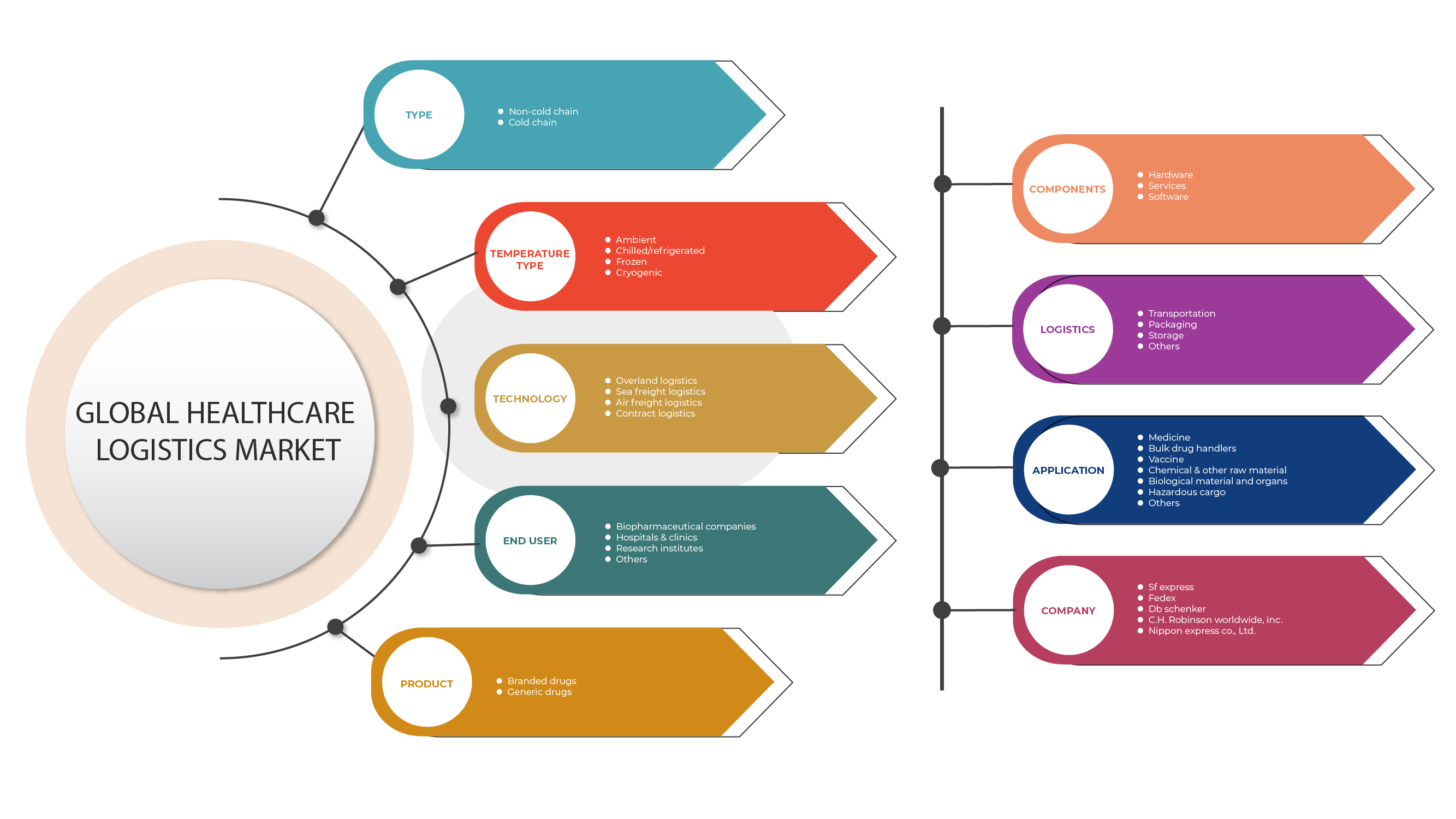

Middle East and Africa Healthcare Logistics Market, By Type (Cold Chain and Non-Cold Chain), Component (Hardware, Software, and Services), Temperature Type (Ambient, Chilled/Refrigerated, Frozen and Cryogenic), Logistics (Transportation, Packaging, Storage, and Others), Logistic Type (Sea Freight Logistics, Air Freight Logistics, Overland Logistics, and Contract Logistics), Application (Medicine, Bulk Drug Handlers, Vaccine, Chemical & Other Raw Material, Biological Material, and Organs, Hazardous Cargo and Others), End User (Biopharmaceutical Companies, Hospitals & Clinics, Research Institutes, and Others) – Industry Trends and Forecast to 2029.

Market Analysis and Size

Logistics is utilized in the healthcare industry to control the manner resources are kept, obtained, and transferred. The effective use of logistics in this business aids in the continual transport of pharmaceuticals, devices, and systems from vendors and providers positioned throughout the country. Hospitals and clinics, in addition to wholesalers of clinical objects and big pharmacy retail chains, make up the healthcare industry.

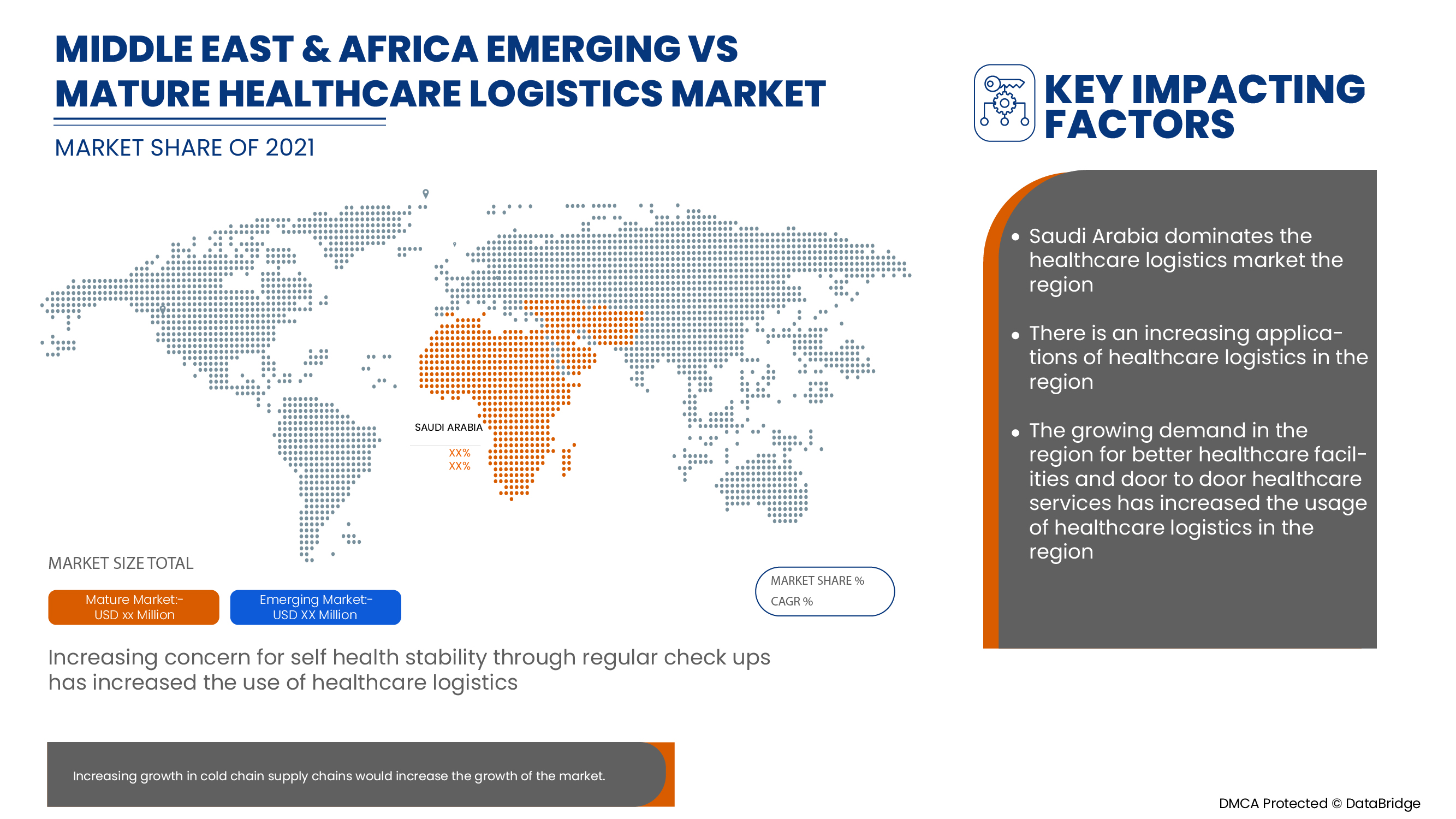

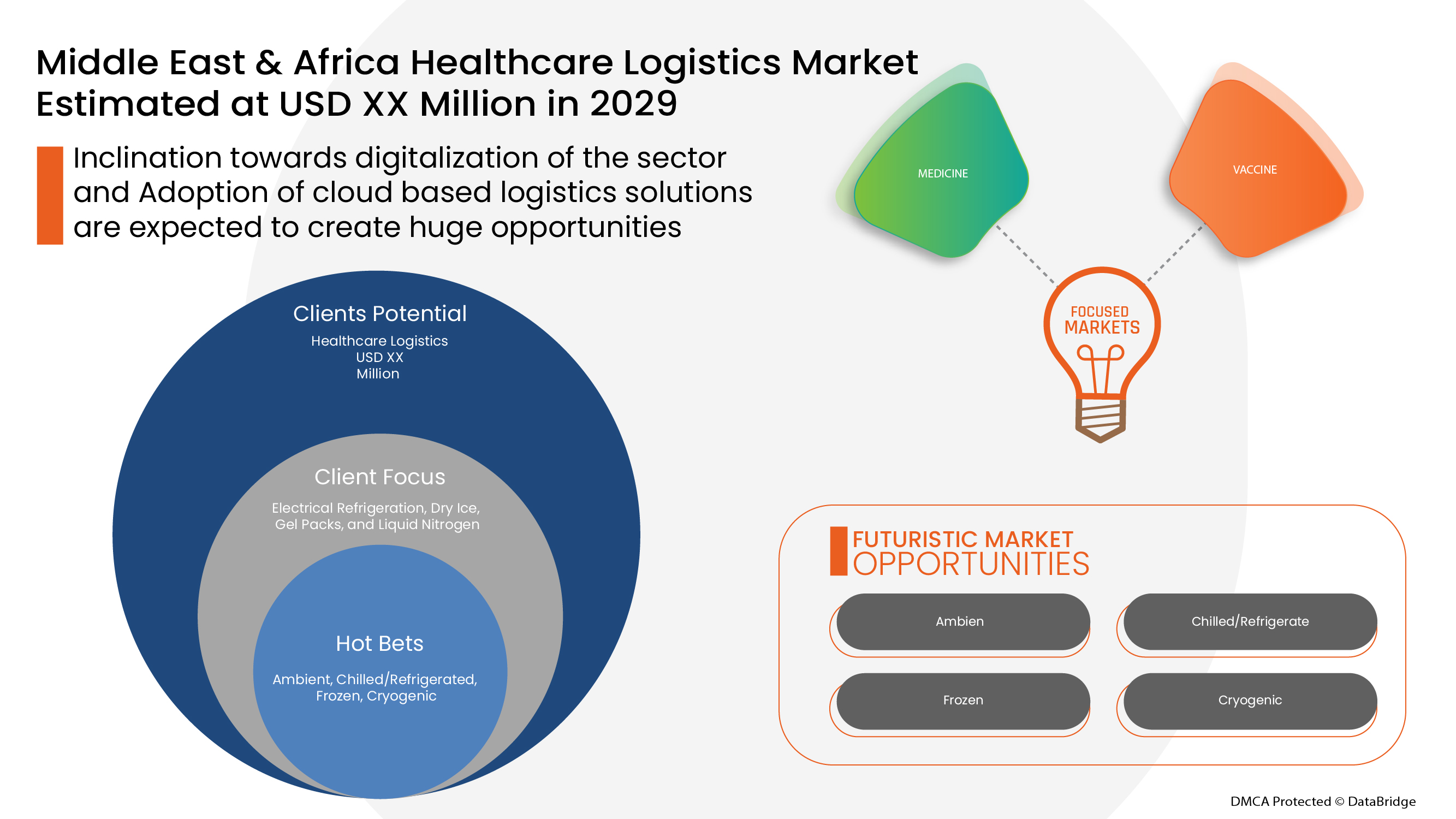

The increased preference for biological pharmaceuticals as well as the growing tendency of businesses to outsource are the main drivers anticipated to drive market growth. Significant numbers of healthcare items need to be shipped over considerable distances through firms these days. These materials are valuable and delicate. The developing market for temperature-sensitive drugs and biological clinical objects, in addition to growing awareness amongst pharmaceutical and logistics companies, is boosting the scope for temperature-controlled healthcare logistics, benefiting the whole healthcare logistics market.

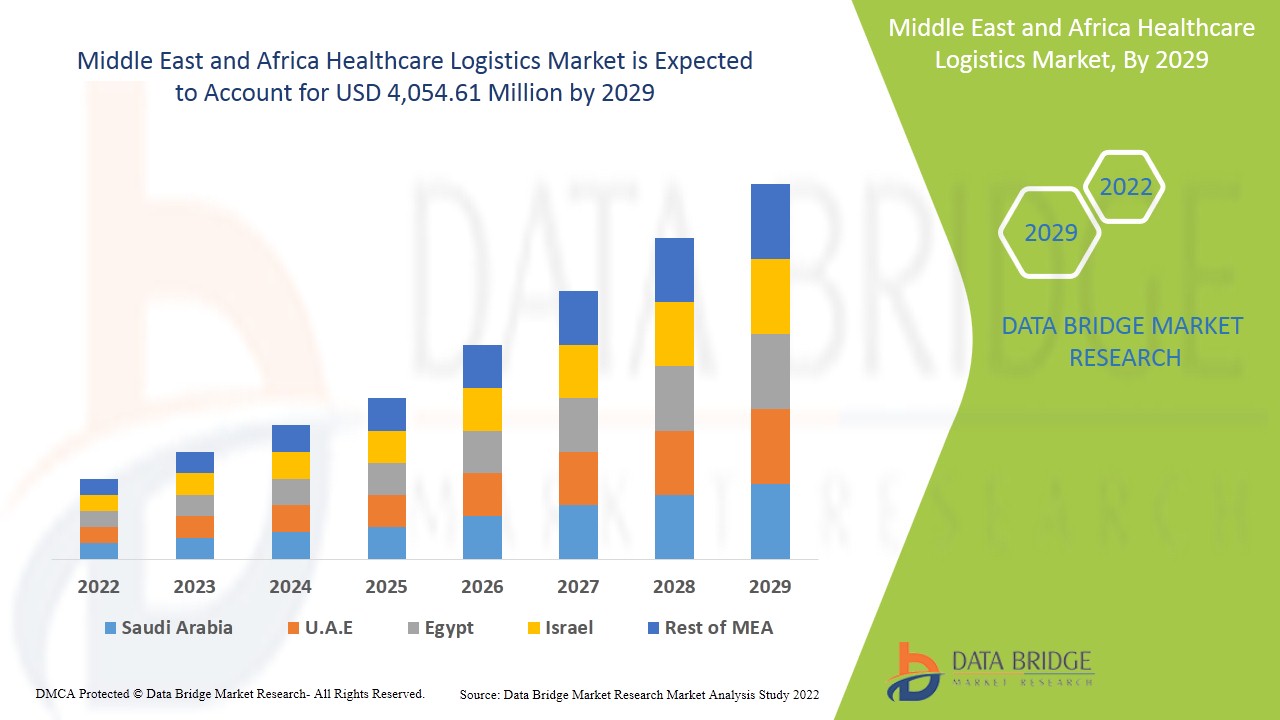

Data Bridge Market Research analyses that the healthcare logistics market is expected to reach the value of USD 4,054.61 million by 2029, at a CAGR of 5.9% during the forecast period. “Non-Cold Chain" accounts for the largest technology segment in the healthcare logistics market non-cold chain as the initial capital cost is low. The healthcare logistics market report also covers pricing analysis, patent analysis, and technological advancements in depth.

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Year |

2020 |

|

Quantitative Units |

Revenue in USD Million, Pricing in USD |

|

Segments Covered |

유형별(냉장 및 비냉장), 구성 요소별(하드웨어, 소프트웨어 및 서비스), 온도 유형별(주변, 냉장/냉동, 냉동 및 극저온), 물류별(운송, 포장, 보관 및 기타), 물류 유형별(해상 운송 물류, 항공 운송 물류, 육로 물류 및 계약 물류), 응용 분야별(의약품, 대량 약물 취급자, 백신, 화학 및 기타 원자재, 생물학적 재료 및 장기, 위험화물 및 기타), 최종 사용자별(생물약학 회사, 병원 및 진료소, 연구소 및 기타) |

|

적용 국가 |

사우디 아라비아, 남아프리카 공화국, UAE, 이스라엘, 이집트 및 중동 및 아프리카의 나머지 중동 및 아프리카 |

|

시장 참여자 포함 |

Agility, CH Robinson, AmerisourceBergen Corporation, Air Canada, CEVA logistics, DB Schenker, Deutsche Post DHL Group, FedEx, Burris Logistics, United Parcel Service of America, Inc., VersaCold Logistics Services, Abbott 등이 있습니다. |

시장 정의

건강 관리에는 감염, 질병, 부상 및 개인의 다양한 신체적, 정신적 장애를 종결, 예상, 치료, 회복 또는 수정하여 건강을 유지 또는 개선하는 것이 포함됩니다. 건강 관리 지원은 연합 건강 분야의 피트니스 전문가를 활용하여 해결됩니다. 치과, 약학, 간호, 청각학, 의학, 시력학, 조산학, 심리학, 작업 및 신체 치료, 그리고 다양한 건강 전문직은 모두 건강 관리에 추가됩니다.

물류는 자원을 획득, 보관, 최종 목적지까지 운송하는 방법을 관리하는 일반적인 절차를 말합니다. 여기에는 잠재적 유통업체와 공급자를 파악하고 효과성과 접근성을 처리하는 것이 포함됩니다. 따라서 의료 물류는 의사, 간호사 및 다양한 의료 전문가를 지원하기 위해 필요한 의료 및 수술 용품, 의약품, 임상 기기 및 장비, 다양한 제품의 물류입니다.

의료 물류 관리(Healthcare Logistic Management)는 도로, 철도, 해상, 항공 등 다양한 운송 수단에 사용됩니다. 도로 경로를 통해 이루어지는 화물 이동은 세그먼트로 불립니다. 단일 세관 문서 프로세스가 필요하기 때문에 가장 일반적인 유형의 운송 수단입니다. 철도 운송 수단은 연료 효율성이 매우 높고 '녹색' 운송 수단이라고 할 수 있습니다. 해상 운송은 벌크 상품의 이동에 사용됩니다. 항공은 가장 빠른 운송 수단이며 의료 물류에서 '적시(JIT)' 재고 보충을 달성하는 데 많이 사용됩니다.

헬스케어 물류 시장 동향

이 섹션에서는 시장 동인, 이점, 기회, 제약 및 과제를 이해하는 것을 다룹니다. 이 모든 내용은 아래와 같이 자세히 논의됩니다.

- 전자상거래 부문의 급속한 성장

전자상거래 또는 전자상거래는 주로 인터넷인 전자 네트워크 또는 온라인 플랫폼을 통해 상품과 서비스를 사고 파는 과정입니다. 최근 Amazon, Flipkart, eBay와 같은 전자상거래 플랫폼의 광범위한 사용은 온라인 상품 매매의 상당한 성장에 기여했습니다. 이는 소비자가 건강 관리 제품을 자유롭게 구매하고 요구 사항에 따라 사용할 수 있는 플랫폼을 제공했습니다.

- 제3자 물류가 제공하는 높은 혜택

제3자 물류는 창고에서 배송까지 운영 물류와 함께 아웃소싱되며, 여기에는 화물 운송, 포장, 주문 이행, 재고 예측, 피킹 및 포장, 창고 및 운송과 같은 공급망에서 여러 서비스를 제공하는 것이 포함됩니다. 제3자 물류는 사업주가 제품 개발, 마케팅 및 판매와 같은 사업의 다른 측면에 더 집중할 수 있도록 돕기 때문에 광범위한 이점을 제공합니다. 따라서 제3자 물류가 제공하는 높은 이점은 글로벌 의료 물류 시장의 성장을 촉진하는 주요 요인으로 작용하고 있습니다.

- 국경 간 무역의 성장 증가

세계화는 기술, 상품 등의 국경 간 무역을 통해 세계 경제, 인구 및 문화가 상호 의존하는 것입니다. 오늘날 대부분의 국가 경제는 다양한 국가 간의 상품 매매에 크게 의존하고 있습니다. 아시아 태평양 지역은 중동 및 아프리카 무역의 주요 참여자였으며 무역 흐름이 많아 물류 서비스 제공업체가 무역 흐름을 보다 편리하고 빠르게 만들어야 한다는 요구가 증가했습니다. 따라서 중동 및 아프리카의 의료 물류 시장 성장을 촉진하고 있습니다.

- 무역로와 관련된 혼잡

도로와 수로에서 교통량과 혼잡이 증가함에 따라 화물 및 운송 서비스 운영자는 안정적인 일정을 유지하는 데 점점 더 어려움을 겪게 됩니다. 이는 공급망과 트럭에 의존하는 사업에 영향을 미치며, 각각 공공 서비스 및 민간 지역 운영자 모두에게 중요성이 커지고 있습니다. 게다가 도로에서 발생한 여러 사고나 해상에서 발생한 유류 유출로 인해 예상치 못한 의료 물류 제약이 발생할 수 있습니다. 최근 COVID-19로 인해 여러 물류 작업이 중단되어 전체 공급망 운영에 심각한 피해가 발생했습니다. 이러한 요인은 중동 및 아프리카 의료 물류 시장의 성장을 크게 제약하는 요인으로 작용합니다.

- 역방향 물류와 관련된 높은 비용

다양한 제조업체와 서비스 제공업체가 제공하는 역방향 물류 서비스와 관련된 비용은 높습니다. 역방향 물류 서비스는 다양한 의료 관련 제품에 대한 수요가 높기 때문에 의료 분야에서 매우 인기가 있습니다. Thomas Publishing Company에 따르면 산업 장비 반품율은 약 4%~8%인 반면 의료 장비는 8%~20%입니다. 반품으로 인해 영향을 받는 총 미국 수익은 5,200만 달러에서 1억 600만 달러 사이로 추산됩니다.

역물류 서비스가 그렇게 비싼 이유는 다양한 요소가 결합되어 서비스 가격을 결정하기 때문입니다.

- 헬스케어 물류의 재고 관리와 관련된 우려

재고 관리란 회사의 제품을 주문, 보관, 판매하고 로그를 유지하는 프로세스입니다. 여기에는 원자재, 구성 요소 및 완제품 관리와 반품 품목의 창고 보관 및 처리가 포함됩니다.

재고는 회사의 가장 귀중한 자산입니다. 재고 관리를 도입하면 생산성을 높이고, 비용을 절감하고, 위험을 완화하고, 고객 만족도를 높이고, 비용을 절감하고, 자산 수익을 극대화할 수 있습니다. 그러나 재고 관리가 헬스케어 물류 서비스 제공자에게는 매우 어렵고 까다로워졌습니다.

- 부문의 디지털화에 대한 성향

디지털 변환은 기업이 디지털 기술을 도입하여 겪는 변화를 말합니다. 운송 및 물류는 최적화, 효율성, 속도 및 타이밍에 극도로 중요성을 두는 것이 필수가 되었습니다. 시장의 변화하는 시나리오와 다가올 새로운 트렌드로 인해 운송 산업이 디지털 변환을 거치는 것이 매우 중요해졌습니다. 의료 물류 회사는 모바일 기기를 사용하여 민첩성을 개선합니다. 게다가 모바일 앱은 고객이 언제든지 반품 배송을 주문, 처리 및 추적할 수 있도록 도와줍니다. 물류 산업의 이러한 디지털 변환이 확대됨에 따라 의료 물류 시장의 성장이 촉진되고 있습니다.

- 반품을 처리할 수 있는 노동력 부족

전반적인 공급망 관리 프로세스에는 방대한 양의 데이터와 수많은 반품을 분석하는 것이 포함됩니다. 전자상거래 부문의 급속한 성장으로 인해 인력은 적절한 시기에 필요한 조치를 취해야 합니다. 제공된 정보는 최적의 결과와 서비스 품질을 제공하기 위해 잘 실행되어야 합니다.

그러나 숙련된 근로자와 직원 교육이 부족하면 제공되는 서비스의 비효율성을 유발하는 여러 가지 오류가 발생할 수 있으며, 이는 의료 물류 부문의 성장에 큰 과제로 작용합니다. 이는 고객 만족이 의료 물류 부문의 전부이기 때문에 큰 좌절이 될 수 있습니다. 의료 물류에서 일하는 근로자는 특정 일련 번호 또는 부품 번호를 식별하는 데 교육을 받아야 합니다. 게다가 근로자는 중앙 기업 자원 계획(ERP) 시스템에 보관된 권한 있는 재고, 보증 정책 및 회계 정보를 알아야 하지만 의료 제품 반품을 처리할 숙련된 근로자를 찾는 것은 어렵습니다.

COVID-19 이후의 헬스케어 물류 시장에 미치는 영향

COVID-19는 거의 모든 국가가 필수품 생산을 다루는 곳을 제외한 모든 생산 시설을 폐쇄하기로 결정하면서 의료 물류 시장에 큰 영향을 미쳤습니다. 정부는 COVID-19의 확산을 막기 위해 비필수품 생산 및 판매 중단, 국제 무역 차단 등 몇 가지 엄격한 조치를 취했습니다. 이 팬데믹 상황에서 거래하는 유일한 사업은 프로세스를 열고 실행할 수 있는 필수 서비스입니다.

헬스케어 물류 시장의 성장은 항공 및 수로를 통한 물류 성장의 증가와 전 세계 전자상거래 부문의 급속한 성장입니다. 그러나 헬스케어 물류의 재고 관리와 관련된 우려와 같은 요인이 시장 성장을 제한하고 있습니다. 팬데믹 상황에서 생산 시설이 폐쇄되면서 시장에 상당한 영향을 미쳤습니다.

제조업체는 COVID-19 이후 회복하기 위해 다양한 전략적 결정을 내리고 있습니다. 업체는 의료 물류에 관련된 기술을 개선하기 위해 여러 연구 개발 활동을 수행하고 있습니다. 이를 통해 회사는 시장에 고급적이고 정확한 컨트롤러를 제공할 것입니다. 또한 정부 기관이 해상 운송 물류, 항공 운송 물류, 육로 물류 및 계약 물류에서 의료 물류를 사용하면서 시장이 성장했습니다.

최근 개발 사항

- 2021년 11월, Agility의 자회사인 National Aviation Services(NAS)는 걸프 지역의 선도적인 독립 유지보수 솔루션 공급업체 중 하나인 Global Jet Technic(GJT)과 파트너십 계약을 체결했습니다. NAS(National Achievement Survey)는 유럽 연합 항공 안전 기관(EASA) 인증에 따라 승인된 포괄적인 라인 유지보수 서비스를 제공합니다. 이 파트너십은 회사의 인지도를 높이는 데 도움이 됩니다.

- 2022년 1월, BDP INTERNATIONAL은 세 개의 주요 사무실이 국제 항공 운송 협회(IATA)의 제약 물류 인증에서 Center of Excellence for Independent Validators(CEIV)를 달성했다고 발표했습니다. BDP의 벨기에 브뤼셀, 이탈리아 밀라노, 뉴욕 JFK 사무실은 운송 과정에서 제약 제품 무결성을 보호하기 위한 최고 수준의 국제적 규정 준수 표준을 보장하는 모든 해당 및 필요한 교육을 성공적으로 완료했습니다. 이러한 발전은 회사의 글로벌 입지를 강화하는 데 도움이 되었습니다.

중동 및 아프리카 의료 물류 시장 범위

헬스케어 물류 시장은 유형, 응용 프로그램, 구성 요소, 온도 유형, 물류, 물류 유형 및 최종 사용자를 기준으로 세분화됩니다. 이러한 세그먼트 간의 성장은 산업의 빈약한 성장 세그먼트를 분석하고 사용자에게 핵심 시장 응용 프로그램을 식별하기 위한 전략적 결정을 내리는 데 도움이 되는 귀중한 시장 개요와 시장 통찰력을 제공하는 데 도움이 됩니다.

유형

- 비냉장 체인

- 콜드 체인

중동 및 아프리카 의료 물류 시장은 기술을 기준으로 비냉장사슬형과 냉장사슬형으로 구분됩니다.

구성 요소

- 하드웨어

- 서비스

- 소프트웨어

구성 요소를 기준으로 중동 및 아프리카 의료 물류 시장은 하드웨어, 소프트웨어, 서비스로 구분됩니다.

온도 유형

- 주변환경

- 냉장/냉장

- 언

- 극저온

중동 및 아프리카 의료 물류 시장은 온도 유형을 기준으로 상온, 냉장/냉장, 냉동 및 극저온으로 구분됩니다.

기호 논리학

- 운송

- 포장

- 저장

- 기타

물류를 기준으로 보면, 중동 및 아프리카 의료 물류 시장은 운송, 포장, 보관 및 기타로 구분됩니다.

물류 유형

- 오버랜드 물류

- 해상 운송 물류

- 항공화물 물류

- 계약 물류

물류 유형을 기준으로 중동 및 아프리카 의료 물류 시장은 해상 운송 물류, 항공 운송 물류, 육로 물류 및 계약 물류로 구분됩니다.

애플리케이션

- 약

- 대량 약물 취급자

- 백신

- 화학 및 기타 원자재

- 생물학적 물질 및 기관

- 위험화물

- 기타

중동 및 아프리카 의료 물류 시장은 응용 분야별로 의약품, 대량 약물 취급업체, 백신, 화학 및 기타 원자재, 생물학적 재료 및 장기, 위험 화물 및 기타로 구분됩니다.

최종 사용자

- 생물제약 회사

- 병원 및 진료소

- 연구 기관

- 기타

중동 및 아프리카 의료 물류 시장은 최종 사용자를 기준으로 생물제약 회사, 병원 및 진료소, 연구 기관 등으로 구분됩니다.

헬스케어 물류 시장 지역 분석/통찰력

위에 언급된 대로, 의료 물류 시장을 분석하고 국가, 유형, 응용 분야, 구성 요소, 온도 유형, 물류, 물류 유형 및 최종 사용자별로 시장 규모에 대한 통찰력과 추세를 제공합니다.

의료 물류 시장 보고서에서 다루는 국가는 사우디아라비아, 남아프리카공화국, UAE, 이스라엘, 이집트, 중동 및 아프리카의 기타 중동 및 아프리카 국가입니다.

사우디 아라비아는 중동 및 아프리카 의료 물류 시장을 장악하고 있으며, 이는 소비자가 의료 제품을 자유롭게 구매하고 필요에 따라 사용할 수 있는 플랫폼 덕분입니다. 또한, 제3자 물류가 소비자에게 제공하는 높은 혜택은 이 지역에서 의료 제품을 자유롭게 구매하고 필요에 따라 사용할 수 있다는 것입니다. 이 지역의 수요는 전방 물류 및 역방향 물류에 대한 수요 증가에 의해 주도될 것으로 예상됩니다.

보고서의 국가 섹션은 또한 현재 및 미래 시장 추세에 영향을 미치는 개별 시장 영향 요인과 시장 규제의 변화를 제공합니다. 다운스트림 및 업스트림 가치 사슬 분석, 기술 추세 및 포터의 5가지 힘 분석, 사례 연구와 같은 데이터 포인트는 개별 국가의 시장 시나리오를 예측하는 데 사용되는 몇 가지 포인터입니다. 또한 중동 및 아프리카 브랜드의 존재 및 가용성과 지역 및 국내 브랜드와의 대규모 또는 희소한 경쟁으로 인해 직면한 과제, 국내 관세 및 무역 경로의 영향은 국가 데이터에 대한 예측 분석을 제공하는 동안 고려됩니다.

경쟁 환경 및 헬스케어 물류 시장 점유율 분석

헬스케어 물류 시장 경쟁 구도는 경쟁자별 세부 정보를 제공합니다. 포함된 세부 정보는 회사 개요, 회사 재무, 창출된 수익, 시장 잠재력, 연구 개발 투자, 새로운 시장 이니셔티브, 중동 및 아프리카 지역, 생산 현장 및 시설, 생산 용량, 회사의 강점과 약점, 제품 출시, 제품 폭과 범위, 애플리케이션 우세입니다. 위에 제공된 데이터 포인트는 헬스케어 물류 시장과 관련된 회사의 초점에만 관련이 있습니다.

의료 물류 시장의 주요 기업으로는 Agility, CH Robinson, AmerisourceBergen Corporation, Air Canada, CEVA logistics, DB Schenker, Deutsche Post DHL Group, FedEx, Burris Logistics, United Parcel Service of America, Inc., VersaCold Logistics Services, Abbott 등이 있습니다.

SKU-

세계 최초의 시장 정보 클라우드 보고서에 온라인으로 접속하세요

- 대화형 데이터 분석 대시보드

- 높은 성장 잠재력 기회를 위한 회사 분석 대시보드

- 사용자 정의 및 질의를 위한 리서치 분석가 액세스

- 대화형 대시보드를 통한 경쟁자 분석

- 최신 뉴스, 업데이트 및 추세 분석

- 포괄적인 경쟁자 추적을 위한 벤치마크 분석의 힘 활용

목차

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF MIDDLE EAST & AFRICA HEALTHCARE LOGISTICS MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELING

2.9 TYPE TIMELINE CURVE

2.1 MARKET APPLICATION COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 REGIONAL SUMMARY

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 RAPID GROWTH IN E-COMMERCE SECTOR

6.1.2 HIGH BENEFITS OFFERED BY THIRD PARTY LOGISTICS

6.1.3 RISING GROWTH IN CROSS BORDER TRADES AND MIDDLE EAST & AFRICAIZATION

6.1.4 INCREASE IN GROWTH OF LOGISTICS THROUGH AIRWAYS AND WATER WAYS

6.2 RESTRAINTS

6.2.1 CONGESTION ASSOCIATED WITH TRADE ROUTES

6.2.2 HIGH COST ASSOCIATED WITH REVERSE LOGISTICS

6.2.3 CONCERNS RELATED TO INVENTORY MANAGEMENT IN HEALTHCARE LOGISTICS

6.3 OPPORTUNITIES

6.3.1 INCLINATION TOWARDS DIGITALIZATION OF THE SECTOR

6.3.2 ADOPTION OF CLOUD BASED LOGISTICS SOLUTIONS

6.3.3 INCREASING GROWTH INVESTMENTS AND EXPANSIONS MADE BY THE MARKET PLAYERS

6.3.4 EMERGENCE OF NEW ADVANCED TECHNOLOGIES

6.4 CHALLENGES

6.4.1 INADEQUATE LABOUR RESOURCES TO HANDLE RETURN

6.4.2 FREQUENT DELAYS IN DELIVERY 0F PRODUCTS DUE TO VARIOUS TECHNICAL FACTORS

7 MIDDLE EAST & AFRICA HEALTHCARE LOGISTICS MARKET, BY TYPE

7.1 OVERVIEW

7.2 NON-COLD CHAIN

7.3 COLD CHAIN

7.3.1 ELECTRICAL REFRIGERATION

7.3.2 DRY ICE

7.3.3 GEL PACKS

7.3.4 LIQUID NITROGEN

7.3.5 OTHERS

8 MIDDLE EAST & AFRICA HEALTHCARE LOGISTICS MARKET, BY COMPONENTS

8.1 OVERVIEW

8.2 HARDWARE

8.2.1 SENSORS & DATA LOGGERS

8.2.2 NETWORKING DEVICES

8.2.3 BARCODE SCANNERS

8.2.4 RFID DEVICES

8.2.5 TELEMATICS & TELEMETRY DEVICES

8.2.6 OTHERS

8.3 SERVICES

8.3.1 DIRECT DISTRIBUTION FOR RETAILERS

8.3.2 AFTER SALES LOGISTICS

8.3.3 REVERSE LOGISTICS

8.3.4 OTHERS

8.4 SOFTWARE

8.4.1 CLOUD BASED

8.4.2 ON-PREMISE

9 MIDDLE EAST & AFRICA HEALTHCARE LOGISTICS MARKET, BY TEMPERATURE TYPE

9.1 OVERVIEW

9.2 AMBIENT

9.3 CHILLED/REFRIGERATED

9.4 FROZEN

9.5 CRYOGENIC

10 MIDDLE EAST & AFRICA HEALTHCARE LOGISTICS MARKET, BY LOGISTICS

10.1 OVERVIEW

10.2 TRANSPORTATION

10.3 PACKAGING

10.4 STORAGE

10.5 OTHERS

11 MIDDLE EAST & AFRICA HEALTHCARE LOGISTICS MARKET, BY LOGISTICS TYPE

11.1 OVERVIEW

11.2 OVERLAND LOGISTICS

11.3 SEA FREIGHT LOGISTICS

11.4 AIR FREIGHT LOGISTICS

11.5 CONTRACT LOGISTICS

12 MIDDLE EAST & AFRICA HEALTHCARE LOGISTICS MARKET, BY PRODUCT

12.1 OVERVIEW

12.2 BRANDED DRUGS

12.3 GENERIC DRUGS

13 MIDDLE EAST & AFRICA HEALTHCARE LOGISTICS MARKET, BY APPLICATION

13.1 OVERVIEW

13.2 MEDICINE

13.2.1 CHEMICAL MEDICINES

13.2.2 SPECIALITY MEDICINES

13.2.2.1 RECOMBINANT THERAPEUTIC PROTEINS

13.2.2.2 REGENERATIVE MEDICINE

13.2.2.2.1 STEM CELL THERAPY

13.2.2.2.2 GENE THERAPY

13.2.2.3 OTHERS

13.2.3 BIO MEDICINES

13.2.4 OTHERS

13.3 BULK DRUG HANDLERS

13.4 VACCINE

13.5 CHEMICAL & OTHER RAW MATERIAL

13.6 BIOLOGICAL MATERIAL AND ORGANS

13.7 HAZARDOUS CARGO

13.8 OTHERS

14 MIDDLE EAST & AFRICA HEALTHCARE LOGISTICS MARKET, BY END USER

14.1 OVERVIEW

14.2 BIOPHARMACEUTICAL COMPANIES

14.3 HOSPITALS & CLINICS

14.4 RESEARCH INSTITUTES

14.5 OTHERS

15 MIDDLE EAST & AFRICA HEALTHCARE LOGISTICS MARKET BY GEOGRAPHY

15.1 MIDDLE EAST & AFRICA

16 MIDDLE EAST & AFRICA HEALTHCARE LOGISTICS MARKET, COMPANY LANDSCAPE

16.1 COMPANY SHARE ANALYSIS: MIDDLE EAST & AFRICA

17 SWOT ANALYSIS

18 COMPANY PROFILE

18.1 SF EXPRESS

18.1.1 COMPANY SNAPSHOT

18.1.2 REVENUE ANALYSIS

18.1.3 COMPANY SHARE ANALYSIS

18.1.4 PRODUCT PORTFOLIO

18.1.5 RECENT DEVELOPMENTS

18.2 FEDEX

18.2.1 COMPANY SNAPSHOT

18.2.2 REVENUE ANALYSIS

18.2.3 COMPANY SHARE ANALYSIS

18.2.4 SERVICE PORTFOLIO

18.2.5 RECENT DEVELOPMENTS

18.3 DB SCHENKER

18.3.1 COMPANY SNAPSHOT

18.3.2 REVENUE ANALYSIS

18.3.3 COMPANY SHARE ANALYSIS

18.3.4 PRODUCT PORTFOLIO

18.3.5 RECENT DEVELOPMENTS

18.4 C.H. ROBINSON WORLDWIDE, INC.

18.4.1 COMPANY SNAPSHOT

18.4.2 REVENUE ANALYSIS

18.4.3 COMPANY SHARE ANALYSIS

18.4.4 SERVICE PORTFOLIO

18.4.5 RECENT DEVELOPMENTS

18.5 NIPPON EXPRESS CO., LTD.

18.5.1 COMPANY SNAPSHOT

18.5.2 REVENUE ANALYSIS

18.5.3 COMPANY SHARE ANALYSIS

18.5.4 PRODUCT PORTFOLIO

18.5.5 RECENT DEVELOPMENTS

18.6 ABBOTT.

18.6.1 COMPANY SNAPSHOT

18.6.2 REVENUE ANALYSIS

18.6.3 PRODUCT PORTFOLIO

18.6.4 RECENT DEVELOPMENTS

18.7 ADALLEN PHARMA

18.7.1 COMPANY SNAPSHOT

18.7.2 PRODUCT PORTFOLIO

18.7.3 RECENT DEVELOPMENTS

18.8 AGILITY

18.8.1 COMPANY SNAPSHOT

18.8.2 REVENUE ANALYSIS

18.8.3 PRODUCT PORTFOLIO

18.8.4 RECENT DEVELOPMENTS

18.9 AGRO MERCHANTS GROUP

18.9.1 COMPANY SNAPSHOT

18.9.2 PRODUCT PORTFOLIO

18.9.3 RECENT DEVELOPMENTS

18.1 AIR CANADA

18.10.1 COMPANY SNAPSHOT

18.10.2 REVENUE ANALYSIS

18.10.3 SERVICE PORTFOLIO

18.10.4 RECENT DEVELOPMENTS

18.11 ALLOGA

18.11.1 COMPANY SNAPSHOT

18.11.2 PRODUCT PORTFOLIO

18.11.3 RECENT DEVELOPMENTS

18.12 AMERISOURCEBERGEN CORPORATION

18.12.1 COMPANY SNAPSHOT

18.12.2 REVENUE ANALYSIS

18.12.3 PRODUCT PORTFOLIO

18.12.4 RECENT DEVELOPMENTS

18.13 BDP INTERNATIONAL

18.13.1 COMPANY SNAPSHOT

18.13.2 PRODUCT PORTFOLIO

18.13.3 RECENT DEVELOPMENTS

18.14 BIOSENSORS INTERNATIONAL GROUP, LTD.

18.14.1 COMPANY SNAPSHOT

18.14.2 PRODUCT PORTFOLIO

18.14.3 RECENT DEVELOPMENTS

18.15 BURRIS LOGISTICS

18.15.1 COMPANY SNAPSHOT

18.15.2 PRODUCT PORTFOLIO

18.15.3 RECENT DEVELOPMENTS

18.16 CAVALIER LOGISTICS MANAGEMENT II, INC.

18.16.1 COMPANY SNAPSHOT

18.16.2 PRODUCT PORTFOLIO

18.16.3 RECENT DEVELOPMENTS

18.17 CEVA LOGISTICS

18.17.1 COMPANY SNAPSHOT

18.17.2 REVENUE ANALYSIS

18.17.3 PRODUCT PORTFOLIO

18.17.4 RECENT DEVELOPMENTS

18.18 CRYOPDP

18.18.1 COMPANY SNAPSHOT

18.18.2 PRODUCT PORTFOLIO

18.18.3 RECENT DEVELOPMENTS

18.19 DEUTSCHE POST AG

18.19.1 COMPANY SNAPSHOT

18.19.2 REVENUE ANALYSIS

18.19.3 PRODUCT PORTFOLIO

18.19.4 RECENT DEVELOPMENTS

18.2 EMERALD FREIGHT

18.20.1 COMPANY SNAPSHOT

18.20.2 PRODUCT PORTFOLIO

18.20.3 RECENT DEVELOPMENTS

18.21 ENTERO HEALTHCARE

18.21.1 COMPANY SNAPSHOT

18.21.2 PRODUCT PORTFOLIO

18.21.3 RECENT DEVELOPMENTS

18.22 INGRAM MICRO SERVICES

18.22.1 COMPANY SNAPSHOT

18.22.2 PRODUCT PORTFOLIO

18.22.3 RECENT DEVELOPMENTS

18.23 KERRY LOGISTICS NETWORK LIMITED

18.23.1 COMPANY SNAPSHOT

18.23.2 REVENUE ANALYSIS

18.23.3 SERVICE PORTFOLIO

18.23.4 RECENT DEVELOPMENTS

18.24 NICHIREI CORPORATION

18.24.1 COMPANY SNAPSHOT

18.24.2 REVENUE ANALYSIS

18.24.3 PRODUCT PORTFOLIO

18.24.4 RECENT DEVELOPMENTS

18.25 OIA MIDDLE EAST & AFRICA

18.25.1 COMPANY SNAPSHOT

18.25.2 PRODUCT PORTFOLIO

18.25.3 RECENT DEVELOPMENTS

18.26 PCI PHARMA SERVICES

18.26.1 COMPANY SNAPSHOT

18.26.2 PRODUCT PORTFOLIO

18.26.3 RECENT DEVELOPMENTS

18.27 PENSKE

18.27.1 COMPANY SNAPSHOT

18.27.2 PRODUCT PORTFOLIO

18.27.3 RECENT DEVELOPMENTS

18.28 TOTAL QUALITY LOGISTICS, LLC

18.28.1 COMPANY SNAPSHOT

18.28.2 PRODUCT PORTFOLIO

18.28.3 RECENT DEVELOPMENTS

18.29 TRANSPLACE

18.29.1 COMPANY SNAPSHOT

18.29.2 PRODUCT PORTFOLIO

18.29.3 RECENT DEVELOPMENTS

18.3 UNITED PARCEL SERVICE OF AMERICA, INC.

18.30.1 COMPANY SNAPSHOT

18.30.2 REVENUE ANALYSIS

18.30.3 SERVICES PORTFOLIO

18.30.4 RECENT DEVELOPMENTS

18.31 VERSACOLD LOGISTICS SERVICES

18.31.1 COMPANY SNAPSHOT

18.31.2 PRODUCT PORTFOLIO

18.31.3 RECENT DEVELOPMENTS

18.32 X2 GROUP

18.32.1 COMPANY SNAPSHOT

18.32.2 PRODUCT PORTFOLIO

18.32.3 RECENT DEVELOPMENTS

18.33 YUSEN LOGISTICS CO., LTD.

18.33.1 COMPANY SNAPSHOT

18.33.2 PRODUCT PORTFOLIO

18.33.3 RECENT DEVELOPMENTS

19 QUESTIONNAIRE

20 RELATED REPORTS

표 목록

TABLE 1 MIDDLE EAST & AFRICA HEALTHCARE LOGISTICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 2 MIDDLE EAST & AFRICA NON-COLD CHAIN IN HEALTHCARE LOGISTICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 3 MIDDLE EAST & AFRICA COLD CHAIN IN HEALTHCARE LOGISTICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 4 MIDDLE EAST & AFRICA COLD CHAIN IN HEALTHCARE LOGISTICS MARKET, BY STORAGE TECHNIQUES, 2020-2029 (USD MILLION)

TABLE 5 MIDDLE EAST & AFRICA HEALTHCARE LOGISTICS MARKET, BY COMPONENTS, 2020-2029 (USD MILLION)

TABLE 6 MIDDLE EAST & AFRICA HARDWARE IN HEALTHCARE LOGISTICS MARKET, BY REGION,2020-2029, (USD MILLION)

TABLE 7 MIDDLE EAST & AFRICA HARDWARE IN HEALTHCARE LOGISTICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 8 MIDDLE EAST & AFRICA SERVICES IN HEALTHCARE LOGISTICS MARKET, BY REGION,2020-2029, (MILLION)

TABLE 9 MIDDLE EAST & AFRICA SERVICES IN HEALTHCARE LOGISTICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 10 MIDDLE EAST & AFRICA SOFTWARE IN HEALTHCARE LOGISTICS MARKET, BY REGION,2020-2029, (USD MILLION)

TABLE 11 MIDDLE EAST & AFRICA SOFTWARE IN HEALTHCARE LOGISTICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 12 MIDDLE EAST & AFRICA HEALTHCARE LOGISTICS MARKET, BY TEMPERATURE TYPE, 2020-2029 (USD MILLION)

TABLE 13 MIDDLE EAST & AFRICA AMBIENT IN HEALTHCARE LOGISTICS MARKET, BY REGION,2020-2029, (USD MILLION)

TABLE 14 MIDDLE EAST & AFRICA CHILLED/REFRIGERATED IN HEALTHCARE LOGISTICS MARKET, BY REGION,2020-2029, (MILLION)

TABLE 15 MIDDLE EAST & AFRICA FROZEN IN HEALTHCARE LOGISTICS MARKET, BY REGION,2020-2029, (MILLION)

TABLE 16 MIDDLE EAST & AFRICA CRYOGENIC IN HEALTHCARE LOGISTICS MARKET, BY REGION,2020-2029, (MILLION)

TABLE 17 MIDDLE EAST & AFRICA HEALTHCARE LOGISTICS MARKET, BY LOGISTICS, 2020-2029 (USD MILLION)

TABLE 18 MIDDLE EAST & AFRICA TRANSPORTATION IN HEALTHCARE LOGISTICS MARKET, BY REGION,2020-2029, (USD MILLION)

TABLE 19 MIDDLE EAST & AFRICA PACKAGING IN HEALTHCARE LOGISTICS MARKET, BY REGION,2020-2029, (MILLION)

TABLE 20 MIDDLE EAST & AFRICA STORAGE IN HEALTHCARE LOGISTICS MARKET, BY REGION,2020-2029, (MILLION)

TABLE 21 MIDDLE EAST & AFRICA OTHERS IN HEALTHCARE LOGISTICS MARKET, BY REGION,2020-2029, (MILLION)

TABLE 22 MIDDLE EAST & AFRICA HEALTHCARE LOGISTICS MARKET, BY LOGISTICS TYPE, 2020-2029 (USD MILLION)

TABLE 23 MIDDLE EAST & AFRICA OVERLAND LOGISTICS IN HEALTHCARE LOGISTICS MARKET, BY REGION,2020-2029, (USD MILLION)

TABLE 24 MIDDLE EAST & AFRICA SEA FREIGHT LOGISTICS IN HEALTHCARE LOGISTICS MARKET, BY REGION,2020-2029, (MILLION)

TABLE 25 MIDDLE EAST & AFRICA AIR FREIGHT LOGISTICS IN HEALTHCARE LOGISTICS MARKET, BY REGION,2020-2029, (USD MILLION)

TABLE 26 MIDDLE EAST & AFRICA CONTRACT LOGISTICS IN HEALTHCARE LOGISTICS MARKET, BY REGION,2020-2029, (USD MILLION)

TABLE 27 MIDDLE EAST & AFRICA HEALTHCARE LOGISTICS MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 28 MIDDLE EAST & AFRICA BRANDED DRUGS IN HEALTHCARE LOGISTICS MARKET, BY REGION,2020-2029, (USD MILLION)

TABLE 29 MIDDLE EAST & AFRICA GENERIC DRUGS IN HEALTHCARE LOGISTICS MARKET, BY REGION,2020-2029, (MILLION)

TABLE 30 MIDDLE EAST & AFRICA HEALTHCARE LOGISTICS MARKET, BY APPLICATION, 2020-2029 (USD

TABLE 31 MIDDLE EAST & AFRICA MEDICINE IN HEALTHCARE LOGISTICS MARKET, BY REGION,2020-2029, (USD MILLION)

TABLE 32 MIDDLE EAST & AFRICA MEDICINE IN HEALTHCARE LOGISTICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 33 MIDDLE EAST & AFRICA SPECIALITY MEDICINES IN HEALTHCARE LOGISTICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 34 MIDDLE EAST & AFRICA REGENERATIVE MEDICINE IN HEALTHCARE LOGISTICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 35 MIDDLE EAST & AFRICA BULK DRUG HANDLERS IN HEALTHCARE LOGISTICS MARKET, BY REGION,2020-2029, (MILLION)

TABLE 36 MIDDLE EAST & AFRICA VACCINE IN HEALTHCARE LOGISTICS MARKET, BY REGION,2020-2029, (USD MILLION)

TABLE 37 MIDDLE EAST & AFRICA CHEMICAL & OTHER RAW MATERIAL IN HEALTHCARE LOGISTICS MARKET, BY REGION,2020-2029, (MILLION)

TABLE 38 MIDDLE EAST & AFRICA BIOLOGICAL MATERIAL AND ORGANS IN HEALTHCARE LOGISTICS MARKET, BY REGION,2020-2029, (USD MILLION)

TABLE 39 MIDDLE EAST & AFRICA HAZARDOUS CARGO IN HEALTHCARE LOGISTICS MARKET, BY REGION,2020-2029, (MILLION)

TABLE 40 MIDDLE EAST & AFRICA OTHERS IN HEALTHCARE LOGISTICS MARKET, BY REGION,2020-2029, (MILLION)

TABLE 41 MIDDLE EAST & AFRICA HEALTHCARE LOGISTICS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 42 MIDDLE EAST & AFRICA BIOPHARMACEUTICAL COMPANIES IN HEALTHCARE LOGISTICS MARKET, BY REGION,2020-2029, (USD MILLION)

TABLE 43 MIDDLE EAST & AFRICA HOSPITAL & CLINICS IN HEALTHCARE LOGISTICS MARKET, BY REGION,2020-2029, (MILLION)

TABLE 44 MIDDLE EAST & AFRICA RESEARCH INSTITUTES IN HEALTHCARE LOGISTICS MARKET, BY REGION,2020-2029, (USD MILLION)

TABLE 45 MIDDLE EAST & AFRICA OTHERS IN HEALTHCARE LOGISTICS MARKET, BY REGION,2020-2029, (MILLION)

그림 목록

FIGURE 1 MIDDLE EAST & AFRICA HEALTHCARE LOGISTICS MARKET: SEGMENTATION

FIGURE 2 MIDDLE EAST & AFRICA HEALTHCARE LOGISTICS MARKET: DATA TRIANGULATION

FIGURE 3 MIDDLE EAST & AFRICA HEALTHCARE LOGISTICS MARKET: DROC ANALYSIS

FIGURE 4 MIDDLE EAST & AFRICA HEALTHCARE LOGISTICS MARKET: MIDDLE EAST & AFRICA VS. REGIONAL MARKET ANALYSIS

FIGURE 5 MIDDLE EAST & AFRICA HEALTHCARE LOGISTICS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 MIDDLE EAST & AFRICA HEALTHCARE LOGISTICS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 MIDDLE EAST & AFRICA HEALTHCARE LOGISTICS MARKET: DBMR MARKET POSITION GRID

FIGURE 8 MIDDLE EAST & AFRICA HEALTHCARE LOGISTICS MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 MIDDLE EAST & AFRICA HEALTHCARE LOGISTICS MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 10 MIDDLE EAST & AFRICA HEALTHCARE LOGISTICS MARKET: SEGMENTATION

FIGURE 11 INCREASING GROWTH IN MIDDLE EAST & AFRICAIZATION LEADING TO HIGH FREIGHT TRANSPORTATION IS EXPECTED TO DRIVE MIDDLE EAST & AFRICA HEALTHCARE LOGISTICS MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 NON-COLD CTYPE IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF MIDDLE EAST & AFRICA HEALTHCARE LOGISTICS MARKET IN 2022 & 2029

FIGURE 13 NORTH AMERICA IS EXPECTED TO DOMINATE AND IS THE FASTEST GROWING REGION IN THE MIDDLE EAST & AFRICA HEALTHCARE LOGISTICS MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 14 DRIVERS, RESTRAINT, OPPORTUNITIES AND CHALLENGE OF MIDDLE EAST & AFRICA HEALTHCARE LOGISTICS MARKET

FIGURE 15 ECONOMIES BY SIZE OF MERCHANDISE TRADE, 2020

FIGURE 16 TONNAGE LOADED AND UNLOADED, 2019 (BILLIONS OF TONS)

FIGURE 17 CONTAINER PORT TRAFFIC BY REGIONS

FIGURE 18 MIDDLE EAST & AFRICA HEALTHCARE LOGISTICS MARKET: BY TYPE, 2021

FIGURE 19 MIDDLE EAST & AFRICA HEALTHCARE LOGISTICS MARKET: BY COMPONENTS, 2021

FIGURE 20 MIDDLE EAST & AFRICA HEALTHCARE LOGISTICS MARKET: BY TEMPERATURE TYPE, 2021

FIGURE 21 MIDDLE EAST & AFRICA HEALTHCARE LOGISTICS MARKET: BY LOGISTICS, 2021

FIGURE 22 MIDDLE EAST & AFRICA HEALTHCARE LOGISTICS MARKET: BY LOGISTICS TYPE, 2021

FIGURE 23 MIDDLE EAST & AFRICA HEALTHCARE LOGISTICS MARKET: BY PRODUCT, 2021

FIGURE 24 MIDDLE EAST & AFRICA HEALTHCARE LOGISTICS MARKET: BY APPLICATION, 2021

FIGURE 25 MIDDLE EAST & AFRICA HEALTHCARE LOGISTICS MARKET: BY END USER, 2021

FIGURE 26 MIDDLE EAST AND AFRICA HEALTHCARE LOGISTICS MARKET: SNAPSHOT (2021)

FIGURE 27 MIDDLE EAST AND AFRICA HEALTHCARE LOGISTICS MARKET: BY COUNTRY (2021)

FIGURE 28 MIDDLE EAST AND AFRICA HEALTHCARE LOGISTICS MARKET: BY COUNTRY (2022 & 2029)

FIGURE 29 MIDDLE EAST AND AFRICA HEALTHCARE LOGISTICS MARKET: BY COUNTRY (2021 & 2029)

FIGURE 30 MIDDLE EAST AND AFRICA HEALTHCARE LOGISTICS MARKET: BY TYPE (2022-2029)

FIGURE 31 MIDDLE EAST & AFRICA HEALTHCARE LOGISTICS MARKET: COMPANY SHARE 2021 (%)

연구 방법론

데이터 수집 및 기준 연도 분석은 대규모 샘플 크기의 데이터 수집 모듈을 사용하여 수행됩니다. 이 단계에는 다양한 소스와 전략을 통해 시장 정보 또는 관련 데이터를 얻는 것이 포함됩니다. 여기에는 과거에 수집한 모든 데이터를 미리 검토하고 계획하는 것이 포함됩니다. 또한 다양한 정보 소스에서 발견되는 정보 불일치를 검토하는 것도 포함됩니다. 시장 데이터는 시장 통계 및 일관된 모델을 사용하여 분석하고 추정합니다. 또한 시장 점유율 분석 및 주요 추세 분석은 시장 보고서의 주요 성공 요인입니다. 자세한 내용은 분석가에게 전화를 요청하거나 문의 사항을 드롭하세요.

DBMR 연구팀에서 사용하는 주요 연구 방법론은 데이터 마이닝, 시장에 대한 데이터 변수의 영향 분석 및 주요(산업 전문가) 검증을 포함하는 데이터 삼각 측량입니다. 데이터 모델에는 공급업체 포지셔닝 그리드, 시장 타임라인 분석, 시장 개요 및 가이드, 회사 포지셔닝 그리드, 특허 분석, 가격 분석, 회사 시장 점유율 분석, 측정 기준, 글로벌 대 지역 및 공급업체 점유율 분석이 포함됩니다. 연구 방법론에 대해 자세히 알아보려면 문의를 통해 업계 전문가에게 문의하세요.

사용자 정의 가능

Data Bridge Market Research는 고급 형성 연구 분야의 선두 주자입니다. 저희는 기존 및 신규 고객에게 목표에 맞는 데이터와 분석을 제공하는 데 자부심을 느낍니다. 보고서는 추가 국가에 대한 시장 이해(국가 목록 요청), 임상 시험 결과 데이터, 문헌 검토, 재생 시장 및 제품 기반 분석을 포함하도록 사용자 정의할 수 있습니다. 기술 기반 분석에서 시장 포트폴리오 전략에 이르기까지 타겟 경쟁업체의 시장 분석을 분석할 수 있습니다. 귀하가 원하는 형식과 데이터 스타일로 필요한 만큼 많은 경쟁자를 추가할 수 있습니다. 저희 분석가 팀은 또한 원시 엑셀 파일 피벗 테이블(팩트북)로 데이터를 제공하거나 보고서에서 사용 가능한 데이터 세트에서 프레젠테이션을 만드는 데 도움을 줄 수 있습니다.