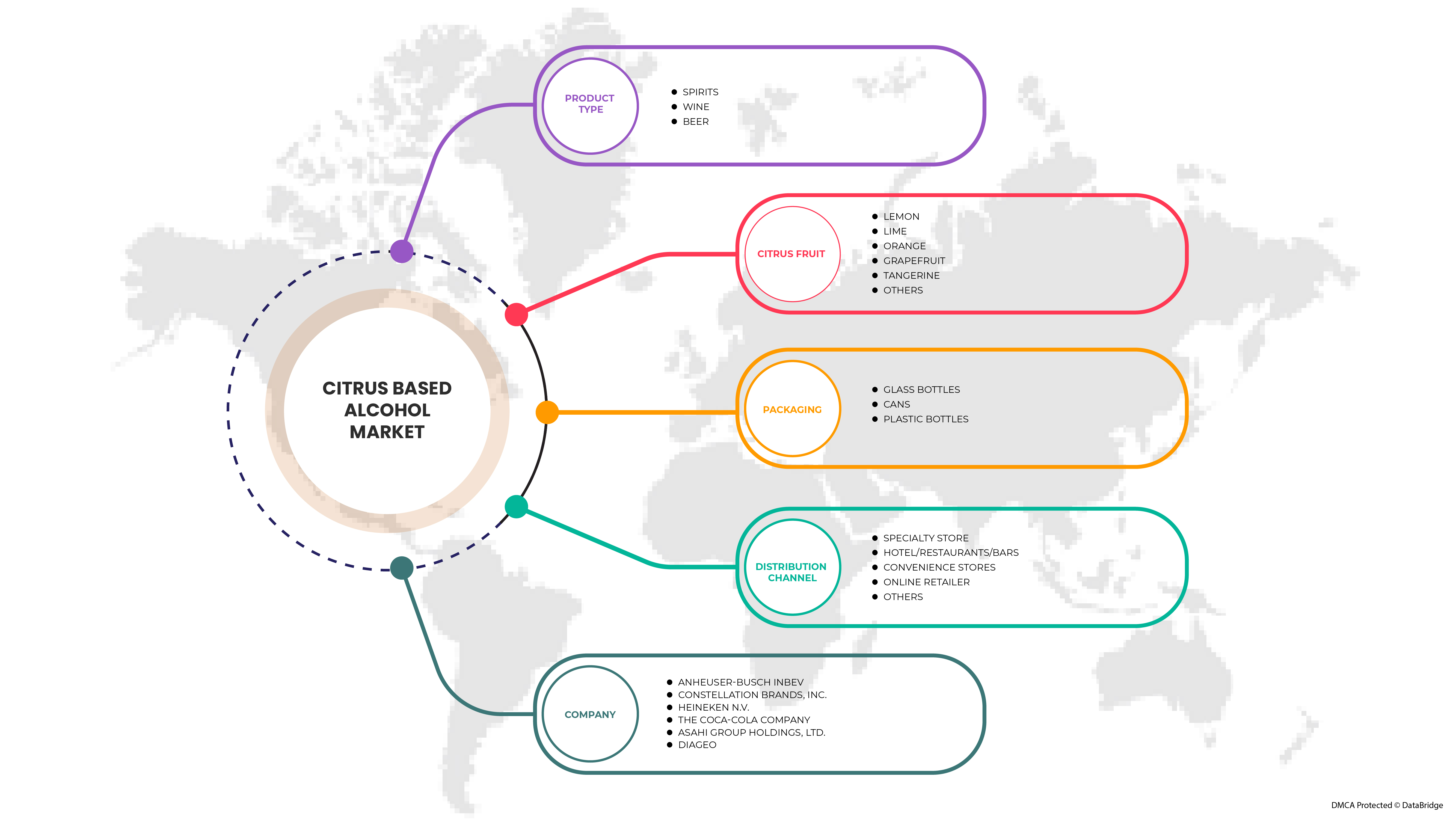

Middle East and Africa Citrus Based Alcohol Market By Product Type (Spirits, Wine, and Beer), Citrus Fruit (Lemon, Lime, Orange, Grapefruit, Tangerine, and Others), Packaging (Glass Bottles, Cans, and Plastic Bottles), Distribution Channel (Specialty Stores, Hotel/Restaurants/Bars, Convenience Stores, Online Retailers, and Others), IndustryTrends and forecast to 2029.

Middle East and Africa Citrus Based Alcohol Market Analysis and Insights

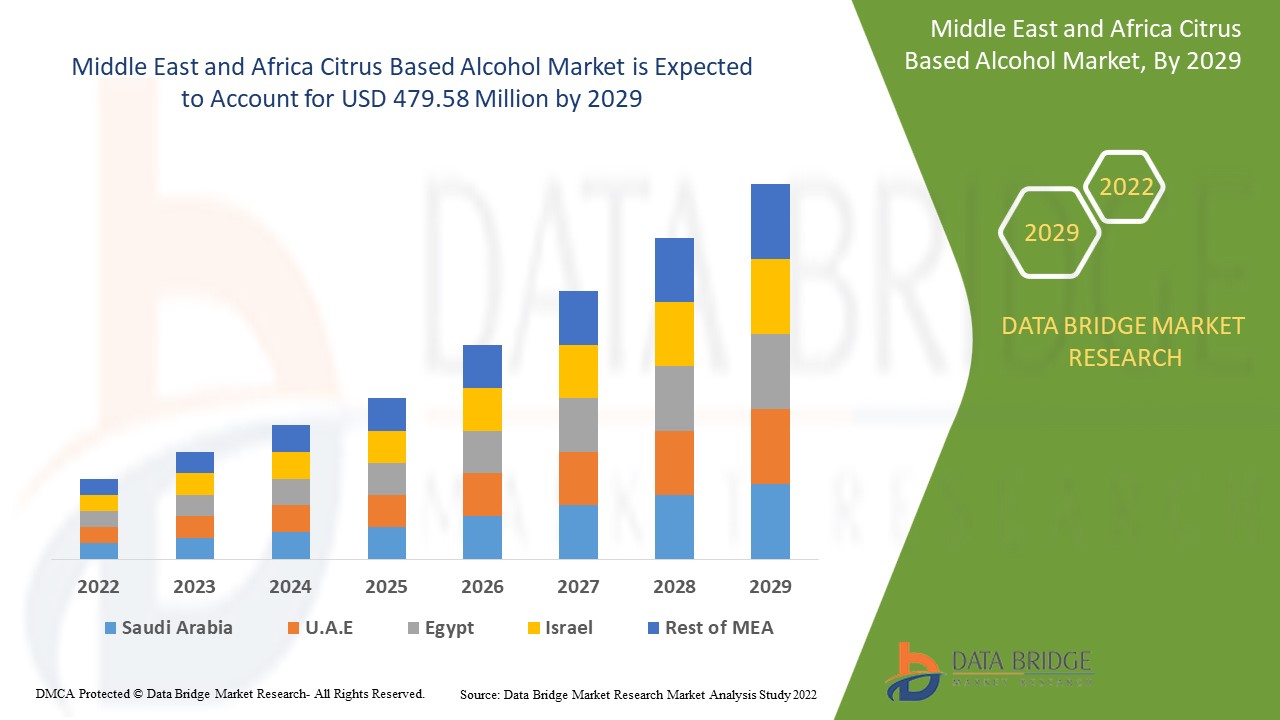

The citrus based alcohol market is expected to gain significant growth in the forecast period of 2022 to 2029. Data Bridge Market Research analyses that the market is growing with a CAGR of 3.7% in the forecast period of 2022 to 2029 and is expected to reach USD 479.58 million by 2029. The major factor driving the growth of the citrus based alcohol market is the growing trend of craft spirits and the adoption of cost-effective ingredients.

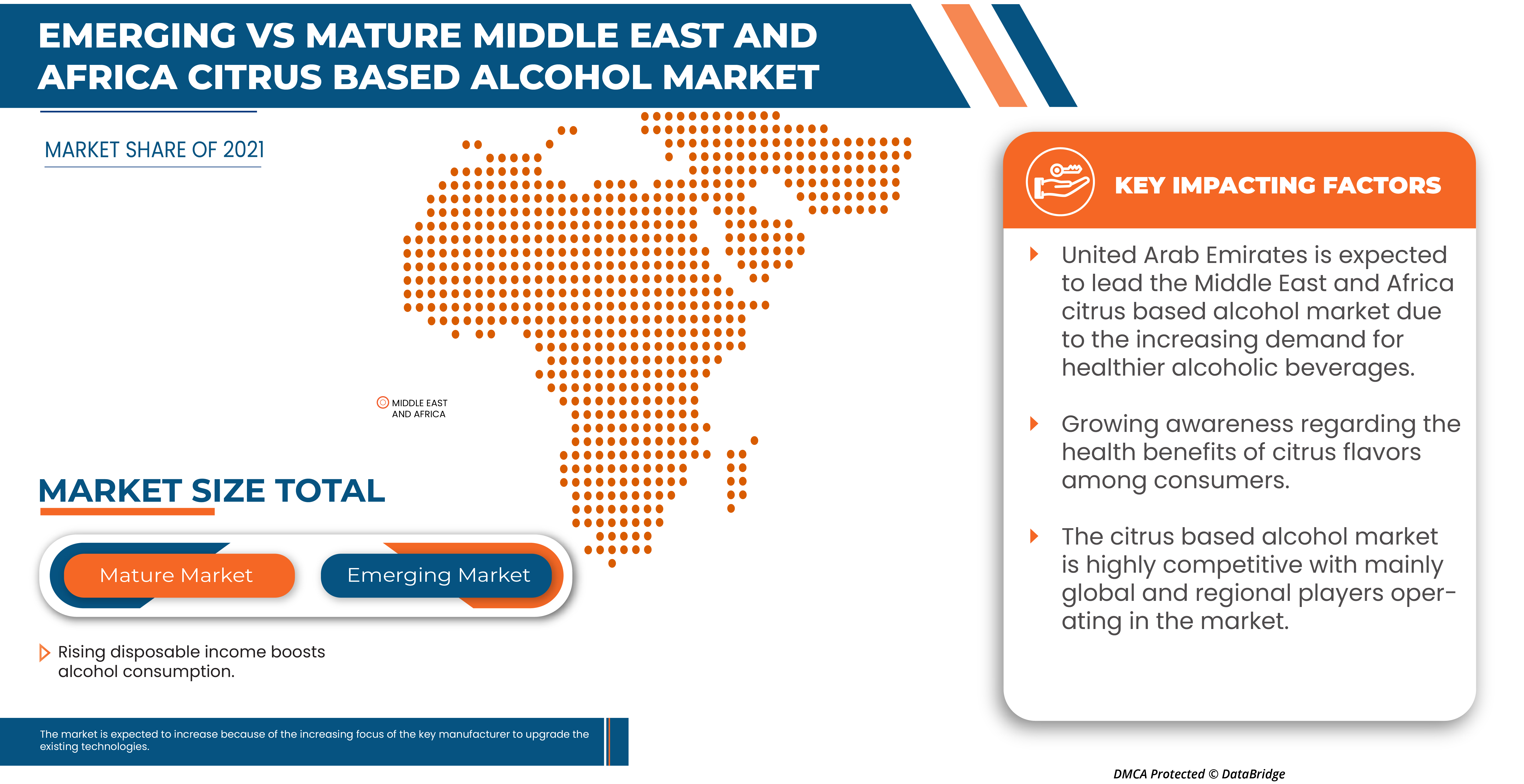

The increasing demand and popularity of craft spirits and the adoption of cost-effective ingredients is an important driver for the Middle East and Africa citrus based alcohol market. Rising disposable income boosts alcohol consumption, and growing awareness regarding the health benefits of citrus flavors among consumers are expected to propel the growth of the Middle East and Africa citrus based alcohol market.

The citrus based alcohol market report provides details of market share, new developments, and the impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, products approvals, strategic decisions, product launches, geographic expansions, and technological innovations in the market. To understand the analysis and the market scenario contact us for an analyst brief, our team will help you create a revenue impact solution to achieve your desired goal.

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Years |

2020 (Customizable to 2019 - 2014) |

|

Quantitative Units |

Revenue in USD Million |

|

Segments Covered |

By Product Type (Spirits, Wine, and Beer), Citrus Fruit (Lemon, Lime, Orange, Grapefruit, Tangerine, and Others), Packaging (Glass Bottles, Cans, and Plastic Bottles), Distribution Channel (Specialty Stores, Hotel/Restaurants/Bars, Convenience Stores, Online Retailers, and Others). |

|

Countries Covered |

Saudi Arabia, United Arab Emirates, South Africa, Kuwait, and Rest of the Middle East and Africa. |

|

Market Players Covered |

Anheuser-Busch InBev, Constellation Brands, Inc., Heineken N.V., The Coca-Cola Company, ASAHI GROUP HOLDINGS, LTD., Anheuser-Busch Companies, LLC., The BOSTON BEER COMPANY, Diageo, Beam Suntory, Inc., Radico Khaitan Ltd., EDRINGTON, SUNTORY HOLDINGS LIMITED, Accolade Wines Limited., WILLIAM GRANT & SONS, Carlsberg Breweries A/S, Halewood Artisanal Spirits, Pernod Ricard, UNITED BREWERIES LTD., Brown-Forman, KALS Distilleries Private Limited, Bacardi Limited |

Market Definition

The citrus based alcohols are produced mainly from citrus fruits such as lemon, lime, grapefruits, and orange. Due to its flavor and strong acidity, citrus has become an integral part of alcoholic drinks, including beer and spirits such as wine, rum, and gin, and is used to provide balance in cocktails. Likewise, citrus alcohol is used as a base and flavor-additive in alcohol production. The citrus based alcohol beverages inherit the nutritional profile of the citrus fruits from which they are produced, such as lemon, lime, orange, grapefruit, tangerine and others. Citrus fruits are rich in vitamin C which is a powerful antioxidant that protects cells from free radical damage, and play an important role in preventing conditions such as diabetes, cancer, neurological disease.

Craft spirits are majorly developed by using the fruit’s flavors infusion. The innovation that stems from craft spirits is otherwise unparalleled in the drinks industry. Craft products are viewed as more creative, nimble, and niche by the consumer with so much variety and artistry. This increasing growth of craft spirits helps the growth of citrus-based alcohol by incorporating citrus in their distillery products. In addition to the citrus fruits, the spirit is infused with various spices including cinnamon, vanilla, ginger, pepper, and others to improve the taste and aroma. This adoption of the ingredients and citrus fruits is both healthier and more cost-effective for the production of spirits.

Citrus Based Alcohol Market Dynamics

Drivers

- Growing trend of craft spirits and the adoption of cost-effective ingredients

As the drinks industry continues to expand and develop, the rise of craft spirits, among craft beers and ciders, cannot be ignored. From rum to gin, 'there's plenty in the way of craft spirits, both online and in-store – all of which embody something different. So much so that many prefer craft spirits to more traditionally commercial brands, which is also likely down to the consumer trend of buying locally from smaller distilleries and breweries. The rapid demand for premium quality craft spirits owing to changing cultural attitudes of the young and affluent population is a major contributor to the growth of the craft spirits market worldwide. Craft spirit consumers prefer products made using natural or organic flavors while small-scale distillers differentiate themselves with clean labels authentic handpicked ingredients such as spring water and non-GMO grains and unique flavor combinations. The most popular craft rum is spiced rum, infused with various spices including cinnamon, ginger, vanilla, nutmeg, and pepper. This adoption of the ingredients is healthier and cost-effective for the production of craft spirits.

- Rising disposable income boosts alcohol consumption

But nowadays alcohol became more affordable in the majority of countries, because of the rising disposable income of the people. The change in real income was greater than the change in the relative price of alcohol. This shows that the growth in real income was the main driver of affordability. The growth of alcohol is large for the age sector between 18 to 80. Especially amongst the youth. The increasing employment and rising disposable income coupled with the decreasing unemployment rates are driving the demand for alcohol. In the modern world, everywhere people need alcohol to enjoy their days and night for their vacations, party, and also leisure time. Increasing IT sectors and people trying to become more social among colleagues. This socialization mostly needs alcohol. In order to ease this, alcohol is not only available in liquor shops or stores, high-end hotels, and restaurants are keen to bring craft spirit into their portfolio.

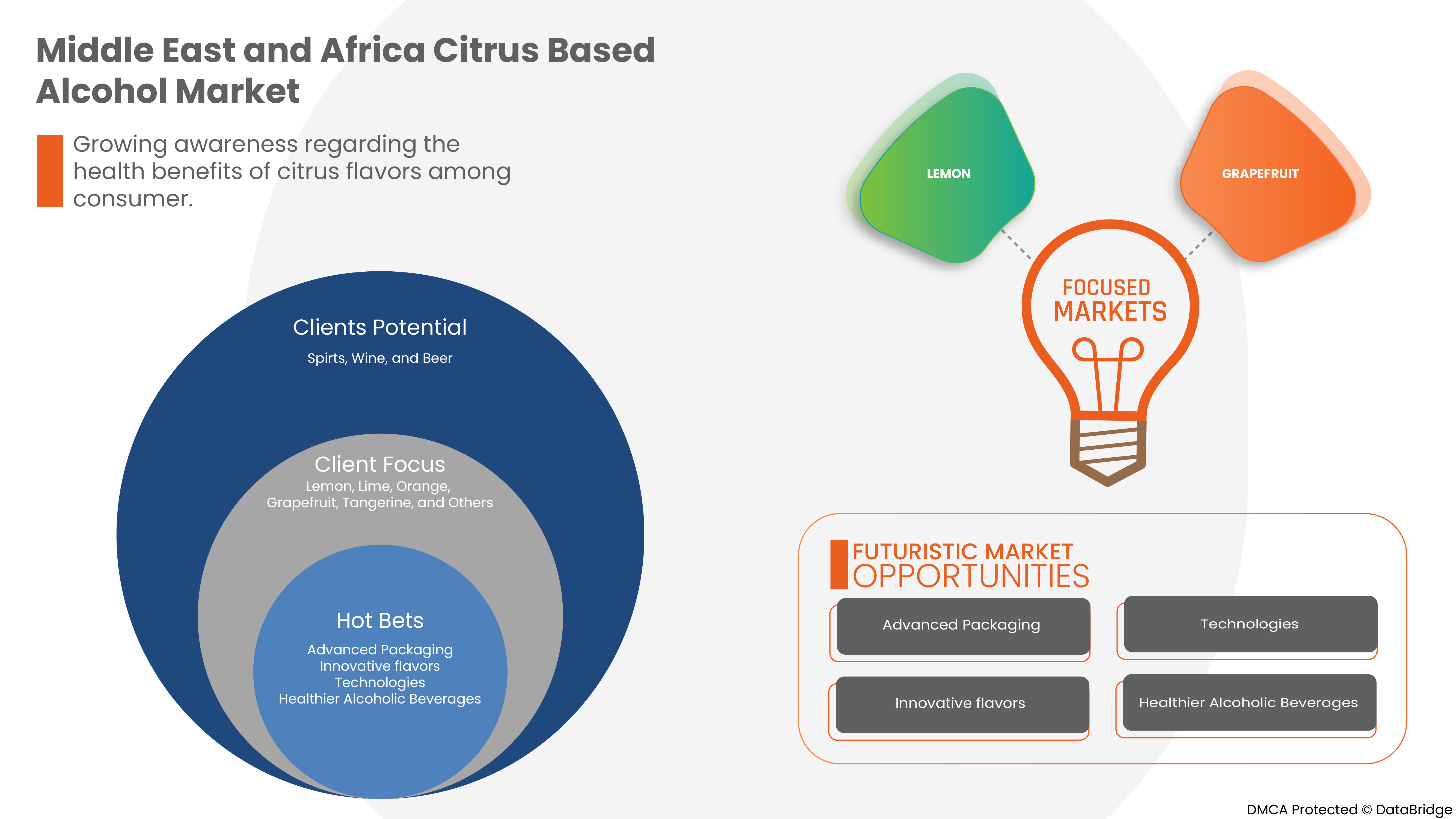

- Growing awareness regarding the health benefits of citrus flavors among consumer

Citrus-flavored alcohol drinks are becoming increasingly popular among most people worldwide because of their multiple health benefits and taste-enhancing ability. Citrus fruits, such as lemons and oranges, are high in vitamin C, a powerful antioxidant protecting cells from free radical damage. Bone production, connective tissue healing, and gum health all require mainly vitamin C which one gets from citrus-flavored drinks. Vitamin C found in citrus also aids in the prevention of wrinkles, dry skin from aging, and sun damage. Moreover, it also catalyzes the production of collagen, which is vital for skin health.

Opportunities

- Soaring demand for innovative alcohol flavors

There are many ways to upgrade a pure alcoholic beverage using fruit flavors. Citrus oils are widely used for beverage flavoring. This fruit belongs to Rutaceae family and consists of about 140 tribes and 1300 species, such as: green Lemon, grapefruit, oranges, yellow Lemon, mandarins, pomelo, bergamot and citron. Citrus oils are stored in leaves, peels, and juice. Terpenes, sesquiterpenes, aldehydes, alcohols, esters, and sterols are among the many chemicals found in these excellent essential oils. They are also known as hydrocarbon mixtures, oxygen-containing chemicals, and non-volatile residue compounds. Citrus flavors are popular in drinks, particularly wheat beer. One of the wheat beer fermentation products are esters which give the fruit taste and aroma to the beer itself, so it perfectly fits with citrus flavors and almost hides the flavor and aroma provided by hops. The most popular beer cocktails are mixed with citrus fruits such as lemon, orange juice, or flavorings.

- Increasing focus of the key manufacturer to upgrade the existing technologies

The alcoholic beverage market is in a rapid transition with the expanding consumption of the citrus based alcoholic drinks. The production technique of citrus fermented alcoholic drinks such as citrus wine and citrus brandy belong to the citrus deep processing field uses citrus fruit as raw material, and adopts the following steps: pressing juice, centrifuging, standing still and clarifying, regulating sugar-acid ratio, and low-temp. Primary fermentation, post-fermentation, filtering and ageing, blending, freezing and filtering, ultra-high temperature flash-pasteurization, and thermal filling to obtain the citrus fermented wine; and then making the dry type citrus fermented wine undergo the processes of distillation, making-up, filtering, aging, blending, freezing and filtering to obtain the invented citrus brandy. Said citrus brandy is clear and transparent, possesses citrus fragrance and natural color, and tastes rich and palate full. And also, other existing technologies are available for manufacturing the citrus-based alcoholic drinks.

Restraints/Challenges

- Price volatility in citrus fruits

Citrus fruits or raw materials prices are playing a major in the citrus based alcohol market because of the use of the citrus fruits flavoring in alcohol, considerably healthier and tastiest beverages are produced and sold in the market. The rise in consumption of alcohol around the globe increases the consumption of citrus based alcohol drinks, too, because of their natural fruit-flavored mix of citrus fruits. The basic main raw material for the production citrus based alcohol is citrus fruits. Citrus fruits include oranges, lemons, limes, and grapefruits. Despite the fact that these citrus fruits are widely available in the market, the inflation rate of several countries, climatic conditions, import and export laws and duties, volatility of petroleum product prices used for transport, and other factors have a significant impact and cause the price fluctuations.

- Strict rules aimed at limiting alcohol consumption

The major strict policies used to reduce the consumption of alcohol includes several 'countries' use of taxation to target alcohol prices such as Unitary tax, specific (volumetric) tax, and other all alcohol excise taxes. In addition to these taxes, some governments have become increasingly interested in minimum unit pricing (MUP). MUP is a policy tool that sets a mandatory floor price per unit of alcohol or standard drink, targeting cheap alcoholic beverages. Several countries including Canada, implemented MUP. Alcohol availability can be restricted to affect intake, limiting the opportunity for people to purchase and consume alcohol. For instance, In Tamil Nadu, India, the operating time of alcohol stores are from 12 PM to 10 PM.

- Growing concerns about the harmful effects of artificial flavors on health

The artificial flavors do not have any nutritional value. They do not add to health benefits through essential vitamins and minerals. They pose harmful effects on human health. The main effects of high consumption of flavored alcoholic drinks are high cancer risk and others like high blood pressure, heart disease, stroke, liver disease, weakening of the immune system, and others.

- A high prevalence of alcohol use disorder (AUD)

The causes of alcohol use disorder appear to be a combination of genetics, early childhood events, and attempts to relieve emotional pain. People are more likely to develop alcohol use disorder if they consume alcohol often, in large amounts or begin drinking early in life, have suffered through trauma, such as physical or sexual abuse, have a family history of alcohol use disorder, have mental health issues, such as grief, anxiety, depression, eating disorders and post-traumatic stress disorder. Have had stomach bypass surgery for weight issues.

- Availability of substitutes for citrus

There are many alternatives to fresh citrus juice to balance out our cocktails, and they come in the form of naturally occurring acids. The one 'you're likely to know of is citric acid. Still, there are several others: malic acid (found in apples, apricots, peaches), tartaric acid (grapes, bananas), and lactic acid (dairy products), to name a few. In addition, vinegars, mollases and verjuice can provide different kinds of acidity and sourness than citrus and powdered acids. Using an incredibly small percentage of acid makes it possible to stabilise syrups and juices, which have a natural degradation of flavor, and vastly increase their shelf life.

Recent Development

- In October 2021, According to Craft Spirits, SunDaze, the citrus ready-to-drink canned cocktails, announced its launch in Southern California at PinkDot and Total Wine locations across Los Angeles County and nationwide (where legal) via direct-to-consumer shipping online. This launch will intensify the company’s operations in the Middle East and Africa market.

- In July 2022, According to the Spirits Business, UK-based Shakespeare Distillery launched a Citrus Vodka as part of its limited edition Distillery Special range. This Citrus Vodka has strong flavors of fresh oranges and lemons that are hand-peeled at the Distillery.

Citrus Based Alcohol Market Scope

The citrus based alcohol market is categorized based on product type, citrus fruit, packaging, and distribution channel. The growth amongst these segments will help you analyze major growth segments in the industries and provide the users with a valuable market overview and market insights to make strategic decisions to identify core market applications.

Product Type

- Spirits

- Wine

- Beer

On the basis of product type, the citrus based alcohol market is classified into three segments namely beer, wine, spirits. .

Citrus Fruit

- Lemon

- Lime

- Orange

- Grapefruit

- Tangerine

- Others

On the basis of citrus fruit, the citrus based alcohol market is classified into six segments namely lemon, lime, orange, grapefruit, tangerine, and others.

Packaging

- Glass bottles

- Cans

- Plastic bottles

On the basis of packaging, the citrus based alcohol market is classified into three segments namely glass bottles, cans, and plastic bottles.

Distribution Channel

- Specialty stores

- Hotel/Restaurants/Bars

- Convenience stores

- Online Retailer

- Others

On the basis of distribution channel, the citrus based alcohol market is classified into five segments namely specialty stores, hotel/restaurants/bars, convenience stores, online retailers, and others.

Citrus Based Alcohol Market Regional Analysis/Insights

The citrus based alcohol market is segmented on the basis of product type, citrus fruit, packaging, and distribution channel.

The countries in the citrus based alcohol market are the Saudi Arabia, United Arab Emirates, South Africa, Kuwait and Rest of the Middle East and Africa.

UAE is dominating the Middle East and Africa citrus based alcohol market in terms of market share and market revenue because of the growing trend of craft spirits and the adoption of cost-effective ingredients.

The country section of the report also provides individual market-impacting factors and changes in market regulation that impact the current and future trends of the market. Data points downstream and upstream value chain analysis, technical trends, porter's five forces analysis, and case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of Middle East and Africa brands and their challenges faced due to large or scarce competition from local and domestic brands, the impact of domestic tariffs, and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Citrus Based Alcohol Market Share Analysis

The citrus based alcohol market competitive landscape provides details by competitors. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, production sites and facilities, company strengths and weaknesses, product launch, product trials pipelines, product approvals, patents, product width and breadth, application dominance, technology lifeline curve. The above data points provided are only related to the companies’ focus related to the citrus based alcohol market.

Some of the major market players operating in the market are Anheuser-Busch InBev, Constellation Brands, Inc., Heineken N.V., The Coca-Cola Company, ASAHI GROUP HOLDINGS, LTD., Anheuser-Bush Companies, LLC., The BOSTON BEER COMPANY, Diageo, Beam Suntory, Inc., Radico Khaitan Ltd., EDRINGTON, SUNTORY HOLDINGS LIMITED., Accolade Wines Limited., WILLIAM GRANT & SONS, Carlsberg Breweries A/S, Halewood Artisanal Spirits, Pernod Ricard, UNITED BREWERIES LTD., Brown-Forman, KALS Distilleries Private Limited, Bacardi Limited and amongst others.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The market data is analyzed and estimated using market statistical and coherent models. In addition, market share analysis and key trend analysis are the major success factors in the market report. The key research methodology used by the DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market, and primary (industry expert) validation. Apart from this, data models include Vendor Positioning grids, Market Time Line Analysis, Market Overview and Guide, Company Positioning grids, Company Market Share Analysis, Standards of Measurement, MEA Vs Regional, and Vendor Share Analysis. Please request an analyst call in case of further inquiry.

SKU-

세계 최초의 시장 정보 클라우드 보고서에 온라인으로 접속하세요

- 대화형 데이터 분석 대시보드

- 높은 성장 잠재력 기회를 위한 회사 분석 대시보드

- 사용자 정의 및 질의를 위한 리서치 분석가 액세스

- 대화형 대시보드를 통한 경쟁자 분석

- 최신 뉴스, 업데이트 및 추세 분석

- 포괄적인 경쟁자 추적을 위한 벤치마크 분석의 힘 활용

목차

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF MIDDLE EAST & AFRICA CITRUS BASED ALCOHOL MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 TYPE LIFE LINE CURVE

2.7 MULTIVARIATE MODELING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 DBMR MARKET CHALLENGE MATRIX

2.11 DBMR VENDOR SHARE ANALYSIS

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 FACTORS INFLUENCING PURCHASING DECISION OF END USERS

4.2 GROWTH STRATEGIES OF THE KEY MARKET PLAYERS

4.3 IMPACT OF THE ECONOMY ON MARKET

4.3.1 IMPACT ON PRICE

4.3.2 IMPACT ON SUPPLY CHAIN

4.3.3 IMPACT ON SHIPMENT

4.3.4 IMPACT ON COMPANY’S STRATEGIC DECISIONS

4.4 INDUSTRY TRENDS AND FUTURE PERSPECTIVE

4.5 TECHNOLOGICAL ADVANCEMENT

4.6 FOB & B2B PRICES – MIDDLE EAST & AFRICA CITRUS BASED ALCOHOL MARKET

4.7 B2B PRICES – MIDDLE EAST & AFRICA CITRUS BASED ALCOHOL MARKET

4.8 VALUE CHAIN ANALYSIS:

4.9 SUPPLY CHAIN ANALYSIS

4.9.1 RAW MATERIAL PROCUREMENT

4.9.2 MANUFACTURING AND PACKING

4.9.3 MARKETING AND DISTRIBUTION

4.9.4 END USERS

5 REGULATORY FRAMEWORK AND GUIDELINES

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 GROWING TREND OF CRAFT SPIRITS AND THE ADOPTION OF COST-EFFECTIVE INGREDIENTS

6.1.2 RISING DISPOSABLE INCOME BOOSTS ALCOHOL CONSUMPTION

6.1.3 GROWING AWARENESS REGARDING THE HEALTH BENEFITS OF CITRUS FLAVORS AMONG CONSUMERS

6.2 RESTRAINTS

6.2.1 PRICE VOLATILITY IN CITRUS FRUITS

6.2.2 STRICT RULES AIMED AT LIMITING ALCOHOL CONSUMPTION

6.2.3 GROWING CONCERNS ABOUT THE HARMFUL EFFECTS OF ARTIFICIAL FLAVORS ON HEALTH

6.3 OPPORTUNITIES

6.3.1 SOARING DEMAND FOR INNOVATIVE ALCOHOL FLAVORS

6.3.2 INCREASING FOCUS OF THE KEY MANUFACTURER TO UPGRADE THE EXISTING TECHNOLOGIES

6.4 CHALLENGES

6.4.1 A HIGH PREVALENCE OF ALCOHOL USE DISORDER (AUD)

6.4.2 AVAILABILITY OF SUBSTITUTES FOR CITRUS

7 MIDDLE EAST & AFRICA CITRUS BASED ALCOHOL MARKET, BY PRODUCT TYPE

7.1 OVERVIEW

7.2 SPIRITS

7.2.1 DISTILLED SPIRITS

7.2.1.1 VODKA

7.2.1.2 WHISKEY

7.2.1.3 RUM

7.2.1.3.1 LIGHT RUM

7.2.1.3.2 GOLD RUM

7.2.1.3.3 DARK RUM

7.2.1.3.4 OVER-PROOF RUM

7.2.1.3.5 SPICED RUM

7.2.1.3.6 CACHACA

7.2.1.3.7 FLAVORED RUM

7.2.1.4 TEQUILA

7.2.1.4.1 BLANCO

7.2.1.4.2 REPOSADO

7.2.1.4.3 ANEJO

7.2.1.4.4 EXTRA-ANEJO

7.2.1.5 BRANDY

7.2.1.5.1 COGNAC

7.2.1.5.2 ARMAGNAC

7.2.1.5.3 SPANISH BRANDY

7.2.1.5.4 AMERICAN BRANDY

7.2.1.5.5 GRAPPA

7.2.1.5.6 EAU-DE-VIE

7.2.1.5.7 FLAVORED BRANDY

7.2.1.6 GIN

7.2.1.6.1 LONDON DRY GIN

7.2.1.6.2 PLYMOUTH GIN

7.2.1.6.3 OLD TOM GIN

7.2.1.6.4 GENEVER

7.2.1.6.5 NEW AMERICAN

7.2.2 NON-DISTILLED SPIRITS

7.3 WINE

7.3.1 RED WINE

7.3.1.1 CABERNET SAUVIGNON

7.3.1.2 PINOT NOIR

7.3.1.3 ZINFANDEL

7.3.1.4 SYRAH

7.3.2 WHITE WINE

7.3.2.1 CHARDONNAY

7.3.2.2 RIESLING

7.3.2.3 PINOT GRIS

7.3.2.4 SAUVIGNON BLANC

7.3.3 ROSE WINE

7.3.4 SPARKLING WINE

7.3.5 DESSERT WINE

7.4 BEER

7.4.1 ALE

7.4.1.1 BROWN ALE

7.4.1.2 PALE ALE

7.4.1.3 INDIA PALE ALE

7.4.1.4 SOUR ALE

7.4.2 LAGER

7.4.3 PORTER

7.4.4 STOUT

7.4.5 WHEAT

7.4.6 PILSNER

8 MIDDLE EAST & AFRICA CITRUS BASED ALCOHOL MARKET, BY CITRUS FRUIT

8.1 OVERVIEW

8.2 LEMON

8.3 LIME

8.4 ORANGE

8.5 GRAPEFRUIT

8.6 TANGERINE

8.7 OTHERS

9 MIDDLE EAST & AFRICA CITRUS BASED ALCOHOL MARKET, BY PACKAGING

9.1 OVERVIEW

9.2 GLASS BOTTLES

9.3 CANS

9.4 PLASTIC BOTTLES

10 MIDDLE EAST & AFRICA CITRUS BASED ALCOHOL MARKET, BY DISTRIBUTION CHANNEL

10.1 OVERVIEW

10.2 SPECIALTY STORES

10.3 HOTEL/RESTAURANTS/BARS

10.4 CONVENIENCE STORES

10.5 ONLINE RETAILERS

10.6 OTHERS

11 MIDDLE EAST & AFRICA CITRUS BASED ALCOHOL MARKET, BY REGION

11.1 MIDDLE EAST & AFRICA

11.1.1 UNITED ARAB EMIRATES

11.1.2 SOUTH AFRICA

11.1.3 SAUDI ARABIA

11.1.4 KUWAIT

11.1.5 REST OF MIDDLE EAST AND AFRICA

12 MIDDLE EAST & AFRICA CITRUS BASED ALCOHOL MARKET, COMPANY LANDSCAPE

12.1 COMPANY SHARE ANALYSIS: MIDDLE EAST & AFRICA

12.2 MERGERS & ACQUISITIONS

12.3 EXPANSIONS

12.4 NEW PRODUCT DEVELOPMENTS

12.5 AGREEMENTS

12.6 PARTNERSHIPS

13 SWOT ANALYSIS

14 COMPANY PROFILES

14.1 ANHEUSER-BUSCH INBEV

14.1.1 COMPANY SNAPSHOT

14.1.2 REVENUE ANALYSIS

14.1.3 COMPANY SHARE ANALYSIS

14.1.4 PRODUCT PORTFOLIO

14.1.5 RECENT DEVELOPMENT

14.2 CONSTELLATION BRANDS, INC.

14.2.1 COMPANY SNAPSHOT

14.2.2 REVENUE ANALYSIS

14.2.3 COMPANY SHARE ANALYSIS

14.2.4 PRODUCT PORTFOLIO

14.2.5 RECENT DEVELOPMENT

14.3 HEINEKEN N.V.

14.3.1 COMPANY SNAPSHOT

14.3.2 REVENUE ANALYSIS

14.3.3 COMPANY SHARE ANALYSIS

14.3.4 PRODUCT PORTFOLIO

14.3.5 RECENT DEVELOPMENT

14.4 THE COCA-COLA COMPANY

14.4.1 COMPANY SNAPSHOT

14.4.2 REVENUE ANALYSIS

14.4.3 COMPANY SHARE ANALYSIS

14.4.4 PRODUCT PORTFOLIO

14.4.5 RECENT DEVELOPMENT

14.5 ASHAHI GROUP HOLDINGS, LTD

14.5.1 COMPANY SNAPSHOT

14.5.2 REVENUE ANALYSIS

14.5.3 COMPANY SHARE ANALYSIS

14.5.4 PRODUCT PORTFOLIO

14.5.5 RECENT DEVELOPMENTS

14.6 ANHEUSER-BUSCH COMPANIES, LLC.

14.6.1 COMPANY SNAPSHOT

14.6.2 PRODUCT PORTFOLIO

14.6.3 RECENT DEVELOPMENT

14.7 THE BOSTON BEER COMPANY

14.7.1 COMPANY SNAPSHOT

14.7.2 REVENUE ANALYSIS

14.7.3 PRODUCT PORTFOLIO

14.7.4 RECENT DEVELOPMENTS

14.8 DIAGEO

14.8.1 COMPANY SNAPSHOT

14.8.2 REVENUE ANALYSIS

14.8.3 PRODUCT PORTFOLIO

14.8.4 RECENT DEVELOPMENT

14.9 BEAM SUNTORY INC.

14.9.1 COMPANY SNAPSHOT

14.9.2 PRODUCT PORTFOLIO

14.9.3 RECENT DEVELOPMENTS

14.1 ACCOLADE WINES LIMITED.

14.10.1 COMPANY SNAPSHOT

14.10.2 PRODUCT PORTFOLIO

14.10.3 RECENT DEVELOPMENT

14.11 BACARDI LIMITED

14.11.1 COMPANY SNAPSHOT

14.11.2 PRODUCT PORTFOLIO

14.11.3 RECENT DEVELOPMENT

14.12 BROWN-FORMAN

14.12.1 COMPANY SNAPSHOT

14.12.2 REVENUE ANALYSIS

14.12.3 PRODUCT PORTFOLIO

14.12.4 RECENT DEVELOPMENTS

14.13 CARLSBERG BREWERIES A/S

14.13.1 COMPANY SNAPSHOT

14.13.2 REVENUE ANALYSIS

14.13.3 PRODUCT PORTFOLIO

14.13.4 RECENT DEVELOPMENT

14.14 EDRINGTON

14.14.1 COMPANY SNAPSHOT

14.14.2 REVENUE ANALYSIS

14.14.3 PRODUCT PORTFOLIO

14.14.4 RECENT DEVELOPMENT

14.15 HALEWOOD ARTISANAL SPIRITS

14.15.1 COMPANY SNAPSHOT

14.15.2 PRODUCT PORTFOLIO

14.15.3 RECENT DEVELOPMENT

14.16 KALS DISTILLERIES PRIVATE LIMITED.

14.16.1 COMPANY SNAPSHOT

14.16.2 PRODUCT PORTFOLIO

14.16.3 RECENT DEVELOPMENT

14.17 PERNOD RICARD

14.17.1 COMPANY SNAPSHOT

14.17.2 REVENUE ANALYSIS

14.17.3 PRODUCT PORTFOLIO

14.17.4 RECENT DEVELOPMENTS

14.18 RADICO KHAITAN LTD.

14.18.1 COMPANY SNAPSHOT

14.18.2 REVENUE ANALYSIS

14.18.3 PRODUCT PORTFOLIO

14.18.4 RECENT DEVELOPMENT

14.19 SUNTORY HOLDINGS LIMITED

14.19.1 COMPANY SNAPSHOT

14.19.2 REVENUE ANALYSIS

14.19.3 PRODUCT PORTFOLIO

14.19.4 RECENT DEVELOPMENT

14.2 UNITED BREWERIES LTD.

14.20.1 COMPANY SNAPSHOT

14.20.2 REVENUE ANALYSIS

14.20.3 PRODUCT PORTFOLIO

14.20.4 RECENT DEVELOPMENT

14.21 WILLIAM GRANT & SONS

14.21.1 COMPANY SNAPSHOT

14.21.2 PRODUCT PORTFOLIO

14.21.3 RECENT DEVELOPMENT

15 QUESTIONNAIRE

16 RELATED REPORTS

표 목록

TABLE 1 MIDDLE EAST & AFRICA CITRUS BASED ALCOHOL MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 2 MIDDLE EAST & AFRICA CITRUS BASED ALCOHOL MARKET, BY PRODUCT TYPE, 2020-2029 (MILLION LITRES)

TABLE 3 MIDDLE EAST & AFRICA SPIRITS IN CITRUS BASED ALCOHOL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 4 MIDDLE EAST & AFRICA SPIRITS IN CITRUS BASED ALCOHOL MARKET, BY REGION, 2020-2029 (MILLION LITRES)

TABLE 5 MIDDLE EAST & AFRICA SPIRITS IN CITRUS BASED ALCOHOL MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 6 MIDDLE EAST & AFRICA DISTILLED SPIRITS IN CITRUS BASED ALCOHOL MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 7 MIDDLE EAST & AFRICA RUM IN CITRUS BASED ALCOHOL MARKET, BY STYLE, 2020-2029 (USD MILLION)

TABLE 8 MIDDLE EAST & AFRICA TEQUILA IN CITRUS BASED ALCOHOL MARKET, BY STYLE, 2020-2029 (USD MILLION)

TABLE 9 MIDDLE EAST & AFRICA BRANDY IN CITRUS BASED ALCOHOL MARKET, BY STYLE, 2020-2029 (USD MILLION)

TABLE 10 MIDDLE EAST & AFRICA GIN IN CITRUS BASED ALCOHOL MARKET, BY STYLE, 2020-2029 (USD MILLION)

TABLE 11 MIDDLE EAST & AFRICA WINE IN CITRUS BASED ALCOHOL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 12 MIDDLE EAST & AFRICA WINE IN CITRUS BASED ALCOHOL MARKET, BY REGION, 2020-2029 (MILLION LITRES)

TABLE 13 MIDDLE EAST & AFRICA WINE IN CITRUS BASED ALCOHOL MARKET, BY WINEMAKING TECHNIQUE, 2020-2029 (USD MILLION)

TABLE 14 MIDDLE EAST & AFRICA RED WINE IN CITRUS BASED ALCOHOL MARKET, BY VARIETY, 2020-2029 (USD MILLION)

TABLE 15 MIDDLE EAST & AFRICA WHITE WINE IN CITRUS BASED ALCOHOL MARKET, BY VARIETY, 2020-2029 (USD MILLION)

TABLE 16 MIDDLE EAST & AFRICA BEER IN CITRUS BASED ALCOHOL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 17 MIDDLE EAST & AFRICA BEER IN CITRUS BASED ALCOHOL MARKET, BY REGION, 2020-2029 (MILLION LITRES)

TABLE 18 MIDDLE EAST & AFRICA BEER IN CITRUS BASED ALCOHOL MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 19 MIDDLE EAST & AFRICA ALE IN CITRUS BASED ALCOHOL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 20 MIDDLE EAST & AFRICA CITRUS BASED ALCOHOL MARKET, BY CITRUS FRUIT, 2020-2029 (USD MILLION)

TABLE 21 MIDDLE EAST & AFRICA LEMON IN CITRUS BASED ALCOHOL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 22 MIDDLE EAST & AFRICA LIME IN CITRUS BASED ALCOHOL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 23 MIDDLE EAST & AFRICA ORANGE IN CITRUS BASED ALCOHOL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 24 MIDDLE EAST & AFRICA GRAPEFRUIT IN CITRUS BASED ALCOHOL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 25 MIDDLE EAST & AFRICA TANGERINE IN CITRUS BASED ALCOHOL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 26 MIDDLE EAST & AFRICA OTHERS IN CITRUS BASED ALCOHOL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 27 MIDDLE EAST & AFRICA CITRUS BASED ALCOHOL MARKET, BY PACKAGING, 2020-2029 (USD MILLION)

TABLE 28 MIDDLE EAST & AFRICA GLASS BOTTLES IN CITRUS BASED ALCOHOL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 29 MIDDLE EAST & AFRICA CANS IN CITRUS BASED ALCOHOL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 30 MIDDLE EAST & AFRICA PLASTIC BOTTLES IN CITRUS BASED ALCOHOL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 31 MIDDLE EAST & AFRICA CITRUS BASED ALCOHOL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 32 MIDDLE EAST & AFRICA SPECIALTY STORES RANGE IN CITRUS BASED ALCOHOL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 33 MIDDLE EAST & AFRICA HOTEL/RESTAURANTS/BARS IN CITRUS BASED ALCOHOL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 34 MIDDLE EAST & AFRICA CONVENIENCE STORES IN CITRUS BASED ALCOHOL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 35 MIDDLE EAST & AFRICA ONLINE RETAILERS IN CITRUS BASED ALCOHOL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 36 MIDDLE EAST & AFRICA OTHERS IN CITRUS BASED ALCOHOL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 37 MIDDLE EAST & AFRICA CITRUS BASED ALCOHOL MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 38 MIDDLE EAST & AFRICA CITRUS BASED ALCOHOL MARKET, BY COUNTRY, 2020-2029 (MILLION LITRES)

TABLE 39 MIDDLE EAST & AFRICA CITRUS BASED ALCOHOL MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 40 MIDDLE EAST & AFRICA CITRUS BASED ALCOHOL MARKET, BY PRODUCT TYPE, 2020-2029 (MILLION LITRES)

TABLE 41 MIDDLE EAST & AFRICA SPIRITS IN CITRUS BASED ALCOHOL MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 42 MIDDLE EAST & AFRICA DISTILLED SPIRITS IN CITRUS BASED ALCOHOL MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 43 MIDDLE EAST & AFRICA RUM IN CITRUS BASED ALCOHOL MARKET, BY STYLE, 2020-2029 (USD MILLION)

TABLE 44 MIDDLE EAST & AFRICA TEQUILA IN CITRUS BASED ALCOHOL MARKET, BY STYLE, 2020-2029 (USD MILLION)

TABLE 45 MIDDLE EAST & AFRICA BRANDY IN CITRUS BASED ALCOHOL MARKET, BY STYLE, 2020-2029 (USD MILLION)

TABLE 46 MIDDLE EAST & AFRICA GIN IN CITRUS BASED ALCOHOL MARKET, BY STYLE, 2020-2029 (USD MILLION)

TABLE 47 MIDDLE EAST & AFRICA WINE IN CITRUS BASED ALCOHOL MARKET, BY WINEMAKING TECHNIQUE, 2020-2029 (USD MILLION)

TABLE 48 MIDDLE EAST & AFRICA RED WINE IN CITRUS BASED ALCOHOL MARKET, BY VARIETY, 2020-2029 (USD MILLION)

TABLE 49 MIDDLE EAST & AFRICA WHITE WINE IN CITRUS BASED ALCOHOL MARKET, BY VARIETY, 2020-2029 (USD MILLION)

TABLE 50 MIDDLE EAST & AFRICA BEER IN CITRUS BASED ALCOHOL MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 51 MIDDLE EAST & AFRICA ALE IN CITRUS BASED ALCOHOL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 52 MIDDLE EAST & AFRICA CITRUS BASED ALCOHOL MARKET, BY CITRUS FRUIT, 2020-2029 (USD MILLION)

TABLE 53 MIDDLE EAST & AFRICA CITRUS BASED ALCOHOL MARKET, BY PACKAGING, 2020-2029 (USD MILLION)

TABLE 54 MIDDLE EAST & AFRICA CITRUS BASED ALCOHOL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 55 UNITED ARAB EMIRATES CITRUS BASED ALCOHOL MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 56 UNITED ARAB EMIRATES CITRUS BASED ALCOHOL MARKET, BY PRODUCT TYPE, 2020-2029 (MILLION LITRES)

TABLE 57 UNITED ARAB EMIRATES SPIRITS IN CITRUS BASED ALCOHOL MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 58 UNITED ARAB EMIRATES DISTILLED SPIRITS IN CITRUS BASED ALCOHOL MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 59 UNITED ARAB EMIRATES RUM IN CITRUS BASED ALCOHOL MARKET, BY STYLE, 2020-2029 (USD MILLION)

TABLE 60 UNITED ARAB EMIRATES TEQUILA IN CITRUS BASED ALCOHOL MARKET, BY STYLE, 2020-2029 (USD MILLION)

TABLE 61 UNITED ARAB EMIRATES BRANDY IN CITRUS BASED ALCOHOL MARKET, BY STYLE, 2020-2029 (USD MILLION)

TABLE 62 UNITED ARAB EMIRATES GIN IN CITRUS BASED ALCOHOL MARKET, BY STYLE, 2020-2029 (USD MILLION)

TABLE 63 UNITED ARAB EMIRATES WINE IN CITRUS BASED ALCOHOL MARKET, BY WINEMAKING TECHNIQUE, 2020-2029 (USD MILLION)

TABLE 64 UNITED ARAB EMIRATES RED WINE IN CITRUS BASED ALCOHOL MARKET, BY VARIETY, 2020-2029 (USD MILLION)

TABLE 65 UNITED ARAB EMIRATES WHITE WINE IN CITRUS BASED ALCOHOL MARKET, BY VARIETY, 2020-2029 (USD MILLION)

TABLE 66 UNITED ARAB EMIRATES BEER IN CITRUS BASED ALCOHOL MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 67 UNITED ARAB EMIRATES ALE IN CITRUS BASED ALCOHOL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 68 UNITED ARAB EMIRATES CITRUS BASED ALCOHOL MARKET, BY CITRUS FRUIT, 2020-2029 (USD MILLION)

TABLE 69 UNITED ARAB EMIRATES CITRUS BASED ALCOHOL MARKET, BY PACKAGING, 2020-2029 (USD MILLION)

TABLE 70 UNITED ARAB EMIRATES CITRUS BASED ALCOHOL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 71 SOUTH AFRICA CITRUS BASED ALCOHOL MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 72 SOUTH AFRICA CITRUS BASED ALCOHOL MARKET, BY PRODUCT TYPE, 2020-2029 (MILLION LITRES)

TABLE 73 SOUTH AFRICA SPIRITS IN CITRUS BASED ALCOHOL MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 74 SOUTH AFRICA DISTILLED SPIRITS IN CITRUS BASED ALCOHOL MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 75 SOUTH AFRICA RUM IN CITRUS BASED ALCOHOL MARKET, BY STYLE, 2020-2029 (USD MILLION)

TABLE 76 SOUTH AFRICA TEQUILA IN CITRUS BASED ALCOHOL MARKET, BY STYLE, 2020-2029 (USD MILLION)

TABLE 77 SOUTH AFRICA BRANDY IN CITRUS BASED ALCOHOL MARKET, BY STYLE, 2020-2029 (USD MILLION)

TABLE 78 SOUTH AFRICA GIN IN CITRUS BASED ALCOHOL MARKET, BY STYLE, 2020-2029 (USD MILLION)

TABLE 79 SOUTH AFRICA WINE IN CITRUS BASED ALCOHOL MARKET, BY WINEMAKING TECHNIQUE, 2020-2029 (USD MILLION)

TABLE 80 SOUTH AFRICA RED WINE IN CITRUS BASED ALCOHOL MARKET, BY VARIETY, 2020-2029 (USD MILLION)

TABLE 81 SOUTH AFRICA WHITE WINE IN CITRUS BASED ALCOHOL MARKET, BY VARIETY, 2020-2029 (USD MILLION)

TABLE 82 SOUTH AFRICA BEER IN CITRUS BASED ALCOHOL MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 83 SOUTH AFRICA ALE IN CITRUS BASED ALCOHOL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 84 SOUTH AFRICA CITRUS BASED ALCOHOL MARKET, BY CITRUS FRUIT, 2020-2029 (USD MILLION)

TABLE 85 SOUTH AFRICA CITRUS BASED ALCOHOL MARKET, BY PACKAGING, 2020-2029 (USD MILLION)

TABLE 86 SOUTH AFRICA CITRUS BASED ALCOHOL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 87 SAUDI ARABIA CITRUS BASED ALCOHOL MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 88 SAUDI ARABIA CITRUS BASED ALCOHOL MARKET, BY PRODUCT TYPE, 2020-2029 (MILLION LITRES)

TABLE 89 SAUDI ARABIA SPIRITS IN CITRUS BASED ALCOHOL MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 90 SAUDI ARABIA DISTILLED SPIRITS IN CITRUS BASED ALCOHOL MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 91 SAUDI ARABIA RUM IN CITRUS BASED ALCOHOL MARKET, BY STYLE, 2020-2029 (USD MILLION)

TABLE 92 SAUDI ARABIA TEQUILA IN CITRUS BASED ALCOHOL MARKET, BY STYLE, 2020-2029 (USD MILLION)

TABLE 93 SAUDI ARABIA BRANDY IN CITRUS BASED ALCOHOL MARKET, BY STYLE, 2020-2029 (USD MILLION)

TABLE 94 SAUDI ARABIA GIN IN CITRUS BASED ALCOHOL MARKET, BY STYLE, 2020-2029 (USD MILLION)

TABLE 95 SAUDI ARABIA WINE IN CITRUS BASED ALCOHOL MARKET, BY WINEMAKING TECHNIQUE, 2020-2029 (USD MILLION)

TABLE 96 SAUDI ARABIA RED WINE IN CITRUS BASED ALCOHOL MARKET, BY VARIETY, 2020-2029 (USD MILLION)

TABLE 97 SAUDI ARABIA WHITE WINE IN CITRUS BASED ALCOHOL MARKET, BY VARIETY, 2020-2029 (USD MILLION)

TABLE 98 SAUDI ARABIA BEER IN CITRUS BASED ALCOHOL MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 99 SAUDI ARABIA ALE IN CITRUS BASED ALCOHOL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 100 SAUDI ARABIA CITRUS BASED ALCOHOL MARKET, BY CITRUS FRUIT, 2020-2029 (USD MILLION)

TABLE 101 SAUDI ARABIA CITRUS BASED ALCOHOL MARKET, BY PACKAGING, 2020-2029 (USD MILLION)

TABLE 102 SAUDI ARABIA CITRUS BASED ALCOHOL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 103 KUWAIT CITRUS BASED ALCOHOL MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 104 KUWAIT CITRUS BASED ALCOHOL MARKET, BY PRODUCT TYPE, 2020-2029 (MILLION LITRES)

TABLE 105 KUWAIT SPIRITS IN CITRUS BASED ALCOHOL MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 106 KUWAIT DISTILLED SPIRITS IN CITRUS BASED ALCOHOL MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 107 KUWAIT RUM IN CITRUS BASED ALCOHOL MARKET, BY STYLE, 2020-2029 (USD MILLION)

TABLE 108 KUWAIT TEQUILA IN CITRUS BASED ALCOHOL MARKET, BY STYLE, 2020-2029 (USD MILLION)

TABLE 109 KUWAIT BRANDY IN CITRUS BASED ALCOHOL MARKET, BY STYLE, 2020-2029 (USD MILLION)

TABLE 110 KUWAIT GIN IN CITRUS BASED ALCOHOL MARKET, BY STYLE, 2020-2029 (USD MILLION)

TABLE 111 KUWAIT WINE IN CITRUS BASED ALCOHOL MARKET, BY WINEMAKING TECHNIQUE, 2020-2029 (USD MILLION)

TABLE 112 KUWAIT RED WINE IN CITRUS BASED ALCOHOL MARKET, BY VARIETY, 2020-2029 (USD MILLION)

TABLE 113 KUWAIT WHITE WINE IN CITRUS BASED ALCOHOL MARKET, BY VARIETY, 2020-2029 (USD MILLION)

TABLE 114 KUWAIT BEER IN CITRUS BASED ALCOHOL MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 115 KUWAIT ALE IN CITRUS BASED ALCOHOL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 116 KUWAIT CITRUS BASED ALCOHOL MARKET, BY CITRUS FRUIT, 2020-2029 (USD MILLION)

TABLE 117 KUWAIT CITRUS BASED ALCOHOL MARKET, BY PACKAGING, 2020-2029 (USD MILLION)

TABLE 118 KUWAIT CITRUS BASED ALCOHOL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 119 REST OF MIDDLE EAST AND AFRICA CITRUS BASED ALCOHOL MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 120 REST OF MIDDLE EAST AND AFRICA CITRUS BASED ALCOHOL MARKET, BY PRODUCT TYPE, 2020-2029 (MILLION LITRES)

그림 목록

FIGURE 1 MIDDLE EAST & AFRICA CITRUS BASED ALCOHOL MARKET

FIGURE 2 MIDDLE EAST & AFRICA CITRUS BASED ALCOHOL MARKET: DATA TRIANGULATION

FIGURE 3 MIDDLE EAST & AFRICA CITRUS BASED ALCOHOL MARKET: DROC ANALYSIS

FIGURE 4 MIDDLE EAST & AFRICA CITRUS BASED ALCOHOL MARKET: MIDDLE EAST & AFRICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 MIDDLE EAST & AFRICA CITRUS BASED ALCOHOL MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 MIDDLE EAST & AFRICA CITRUS BASED ALCOHOL MARKET: THE TYPE LIFE LINE CURVE

FIGURE 7 MIDDLE EAST & AFRICA CITRUS BASED ALCOHOL MARKET: MULTIVARIATE MODELLING

FIGURE 8 MIDDLE EAST & AFRICA CITRUS BASED ALCOHOL MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 MIDDLE EAST & AFRICA CITRUS BASED ALCOHOL MARKET: DBMR MARKET POSITION GRID

FIGURE 10 MIDDLE EAST & AFRICA CITRUS BASED ALCOHOL MARKET: THE MARKET CHALLENGE MATRIX

FIGURE 11 MIDDLE EAST & AFRICA CITRUS BASED ALCOHOL MARKET: VENDOR SHARE ANALYSIS

FIGURE 12 MIDDLE EAST & AFRICA CITRUS BASED ALCOHOL MARKET: SEGMENTATION

FIGURE 13 GROWING TREND OF CRAFT SPIRITS AND THE ADOPTION OF COST-EFFECTIVE INGREDIENTS IS EXPECTED TO DRIVE MIDDLE EAST & AFRICA CITRUS BASED ALCOHOL MARKET IN THE FORECAST PERIOD

FIGURE 14 SPIRITS SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE MIDDLE EAST & AFRICA CITRUS BASED ALCOHOL MARKET IN 2022 & 2029

FIGURE 15 SUPPLY CHAIN ANALYSIS – MIDDLE EAST & AFRICA CITRUS BASED ALCOHOL MARKET

FIGURE 16 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF MIDDLE EAST & AFRICA CITRUS BASED ALCOHOL MARKET

FIGURE 17 MIDDLE EAST & AFRICA CITRUS BASED ALCOHOL MARKET: BY PRODUCT TYPE, 2021

FIGURE 18 MIDDLE EAST & AFRICA CITRUS BASED ALCOHOL MARKET: BY CITRUS FRUIT, 2021

FIGURE 19 MIDDLE EAST & AFRICA CITRUS BASED ALCOHOL MARKET: BY PACKAGING, 2021

FIGURE 20 MIDDLE EAST & AFRICA CITRUS BASED ALCOHOL MARKET: BY DISTRIBUTION CHANNEL, 2021

FIGURE 21 MIDDLE EAST & AFRICA CITRUS BASED ALCOHOL MARKET: SNAPSHOT (2021)

FIGURE 22 MIDDLE EAST & AFRICA CITRUS BASED ALCOHOL MARKET: BY COUNTRY (2021)

FIGURE 23 MIDDLE EAST & AFRICA CITRUS BASED ALCOHOL MARKET: BY COUNTRY (2022 & 2029)

FIGURE 24 MIDDLE EAST & AFRICA CITRUS BASED ALCOHOL MARKET: BY COUNTRY (2021 & 2029)

FIGURE 25 MIDDLE EAST & AFRICA CITRUS BASED ALCOHOL MARKET: BY PRODUCT TYPE (2022-2029)

FIGURE 26 MIDDLE EAST & AFRICA CITRUS BASED ALCOHOL MARKET: COMPANY SHARE 2021 (%)

연구 방법론

데이터 수집 및 기준 연도 분석은 대규모 샘플 크기의 데이터 수집 모듈을 사용하여 수행됩니다. 이 단계에는 다양한 소스와 전략을 통해 시장 정보 또는 관련 데이터를 얻는 것이 포함됩니다. 여기에는 과거에 수집한 모든 데이터를 미리 검토하고 계획하는 것이 포함됩니다. 또한 다양한 정보 소스에서 발견되는 정보 불일치를 검토하는 것도 포함됩니다. 시장 데이터는 시장 통계 및 일관된 모델을 사용하여 분석하고 추정합니다. 또한 시장 점유율 분석 및 주요 추세 분석은 시장 보고서의 주요 성공 요인입니다. 자세한 내용은 분석가에게 전화를 요청하거나 문의 사항을 드롭하세요.

DBMR 연구팀에서 사용하는 주요 연구 방법론은 데이터 마이닝, 시장에 대한 데이터 변수의 영향 분석 및 주요(산업 전문가) 검증을 포함하는 데이터 삼각 측량입니다. 데이터 모델에는 공급업체 포지셔닝 그리드, 시장 타임라인 분석, 시장 개요 및 가이드, 회사 포지셔닝 그리드, 특허 분석, 가격 분석, 회사 시장 점유율 분석, 측정 기준, 글로벌 대 지역 및 공급업체 점유율 분석이 포함됩니다. 연구 방법론에 대해 자세히 알아보려면 문의를 통해 업계 전문가에게 문의하세요.

사용자 정의 가능

Data Bridge Market Research는 고급 형성 연구 분야의 선두 주자입니다. 저희는 기존 및 신규 고객에게 목표에 맞는 데이터와 분석을 제공하는 데 자부심을 느낍니다. 보고서는 추가 국가에 대한 시장 이해(국가 목록 요청), 임상 시험 결과 데이터, 문헌 검토, 재생 시장 및 제품 기반 분석을 포함하도록 사용자 정의할 수 있습니다. 기술 기반 분석에서 시장 포트폴리오 전략에 이르기까지 타겟 경쟁업체의 시장 분석을 분석할 수 있습니다. 귀하가 원하는 형식과 데이터 스타일로 필요한 만큼 많은 경쟁자를 추가할 수 있습니다. 저희 분석가 팀은 또한 원시 엑셀 파일 피벗 테이블(팩트북)로 데이터를 제공하거나 보고서에서 사용 가능한 데이터 세트에서 프레젠테이션을 만드는 데 도움을 줄 수 있습니다.