중동 및 아프리카 칸나비디올(CBD) 시장, 출처(대마 및 마리화나), 등급(식품 등급 및 치료 등급), 특성(유기 및 무기), 응용 분야(팅크제, 식품, 음료, 제약, 국소, 건강 보충제 및 기타), 제품 유형(CBD 오일, CBD 농축물, CBD 분리물 및 기타) - 업계 동향 및 2029년까지의 예측.

중동 및 아프리카 Cannabidiol(CBD) 시장 분석 및 통찰력

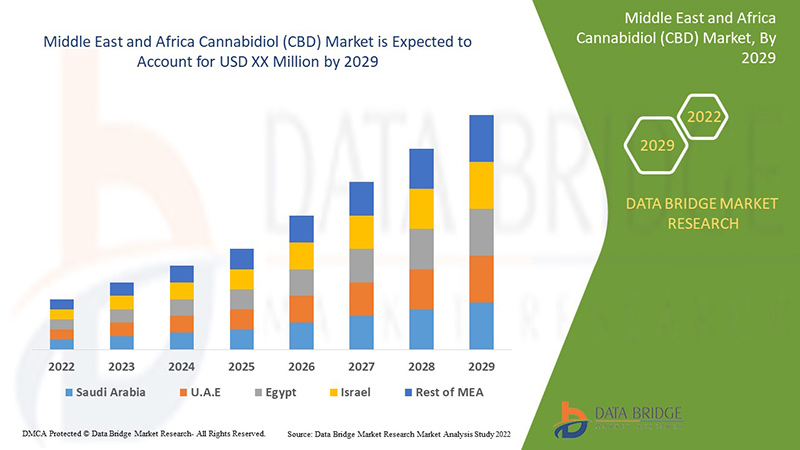

중동 및 아프리카 카나비디올(CBD) 시장은 2022년에서 2029년의 예측 기간 동안 시장 성장을 이룰 것으로 예상됩니다. Data Bridge Market Research는 시장이 2022년에서 2029년의 예측 기간 동안 22.7%의 CAGR로 성장하고 있다고 분석합니다. 카나비디올(CBD) 약물 치료의 기술적 발전, 의료 분야의 증가는 예측 기간 동안 중동 및 아프리카 카나비디올(CBD) 시장 성장을 견인하는 또 다른 요인입니다.

그러나 시중에 판매되는 CBD 오일과 위조 및 합성 제품과 관련된 부작용은 시장 성장을 제한할 것입니다. 주요 시장 참여자의 파트너십 및 인수와 같은 전략적 제휴 채택은 중동 및 아프리카 카나비디올(CBD) 시장 성장의 기회로 작용합니다.

|

보고서 메트릭 |

세부 |

|

예측 기간 |

2022년부터 2029년까지 |

|

기준 연도 |

2021 |

|

역사적 연도 |

2020 (2019-2014로 사용자 정의 가능) |

|

양적 단위 |

수익은 백만 달러, 가격은 미화로 표시됨 |

|

다루는 세그먼트 |

출처(대마 및 마리화나), 등급(식품 등급 및 치료 등급), 자연(유기 및 무기), 응용 분야(팅크제, 식품, 음료, 제약, 국소, 식이 보충제 및 기타), 제품 유형(CBD 오일, CBD 농축물, CBD 분리물 및 기타) |

|

적용 국가 |

UAE, 이스라엘, 남아프리카 및 기타 중동 지역 |

|

시장 참여자 포함 |

중동 및 아프리카 칸나비디올(CBD) 시장의 주요 기업으로는 CV Sciences, Inc., VIVO Cannabis Inc., Gaia Herbs Hemp, Phoena Holdings Inc., Medical Marijuana, Inc., The Cronos Group, CHARLOTTE'S WEB, HEXO Corp., Aurora Cannabis, Canopy Growth Corporation, Jazz Pharmaceuticals, Inc., Tilray, Curaleaf, KAZMIRA, Freedom Leaf, Inc., Koi CBD, Groff North America Hemplex, Joy Organics, Elixinol Wellness Limited, Isodiol International Inc., Healthy Food Ingredients, LLC, NuLeaf Naturals, LLC, Diamond CBD, Medterra CBD, ENDOCA, Green Roads 등이 있습니다. |

카나비디올(CBD) 시장 정의

카나비디올(CBD)은 대마초 sativa 식물에서 발견되는 화학 화합물이며, 일반적으로 대마에서 추출되는데, 대마는 자연적으로 높은 카나비디올(CBD) 함량 때문입니다. 불안과 발작을 치료하고 통증을 줄이는 데 여러 가지 이점이 있습니다. 치유 특성으로 인해 건강과 웰빙 목적으로 CBD에 대한 수요가 높은데, 이것이 시장을 주도하는 주요 요인입니다. 모든 카나비노이드 중에서 카나비디올은 정신 활성 효과가 없기 때문에 치료적 이유로 가장 널리 사용됩니다. 많은 의료 응용 분야에서 카나비디올 오일은 불안 및 우울증 치료, 스트레스 해소, 당뇨병 예방, 통증 완화, 암 증상 완화 및 염증과 같은 데 사용됩니다. 질병을 치료하기 위해 CBD 기반 제품을 점점 더 많이 채택함에 따라 중동 및 아프리카 시장은 예측 기간 동안 수익성 있는 속도로 성장할 것으로 예상됩니다. 카나비디올 오일은 여드름과 주름을 치료하는 스킨케어 제품을 만드는 데 점점 더 많이 사용되고 있습니다. 예를 들어 Sephora는 최근에 매장에 카나비디올 또는 CBD 스킨케어 라인을 출시했습니다. 마찬가지로 Ulta Beauty는 카나비디올 기반 제품 라인을 출시할 계획입니다. 여러 새로운 회사도 카나비디올이 주입된 화장품 시장에 진출하고 있습니다.

게다가, 다양한 국가의 정부와 카나비노이드 시장의 주요 기업들은 연구 개발 활동에 투자하고 있습니다. CBD는 여러 임상 시험에서 간질을 포함한 다양한 신경계 질환에 효과적인 치료법이라고 합니다.

시장 동향

운전자

- 건강과 피트니스 분야에서 CBD에 대한 수요 증가

건강과 피트니스에 대한 소비자들의 인식이 높아지면서 CBD 시장은 급속한 성장을 목격하게 될 것입니다. 의료용 대마의 합법화와 함께 소비자의 가처분 소득이 증가하면서 이 부문에서 카나비디올 수요에 긍정적인 영향을 미칠 것으로 예상됩니다.

또한 CBD 제품은 불안/스트레스, 수면/불면증, 만성 통증, 편두통, 피부 관리, 발작, 관절 통증 및 염증, 신경계 질환 등 다양한 문제를 완화하는 데 사용됩니다. 만성 통증 치료는 CBD를 사용할 때 제공되는 추가 혜택으로 인해 많은 인기를 얻었습니다. 최근 몇 년 동안 광범위한 의료 응용 및 통증 완화 치료로 인해 카나비디올(CBD) 제품에 대한 수요가 증가하고 있습니다. CBD는 신체의 다양한 생물학적 과정에 작용하여 만성 통증을 줄이는 데 도움이 됩니다. 또한 CBD는 항산화, 항염 및 진통 특성을 가지고 있습니다. 따라서 CBD 제품은 만성 통증을 겪는 사람들이 경험하는 불안을 줄입니다. 따라서 만성 통증 치료에 CBD에 대한 수요가 증가함에 따라 시장이 성장하고 있습니다. 또한 피트니스 활동 중에 발생할 수 있는 통증을 피하면서 사람들이 건강과 피트니스 루틴을 유지하는 데 도움이 됩니다.

- CBD 제품에 대한 정부 승인 및 규정 개선

엄격한 정부 규제가 있으며 CBD 기반 제품은 현지 및 국제 시장에서 판매 및 공급되기 전에 엄격한 승인이 필요하여 시장 성장이 제한되었습니다. 그러나 시간이 지남에 따라 이러한 제한이 완화되었고 정제된 CBD 제품에 대한 수용이 증가하고 다양한 용도로 마리화나 및 마리화나 유래 제품이 합법화되는 추세가 증가했습니다. 이는 시장의 성장과 수요를 촉진할 것입니다.

게다가 전 세계적으로 CBD 제품을 생산하는 주요 제조업체가 생겨나면서 미국 식품의약국(FDA), 유럽 연합 등의 정부 및 규제 기관에서는 CBD 및 CBD 기반 제품에 대한 제한을 완화하게 되었습니다.

제지

-

CBD 제품의 높은 비용

CBD는 통증, 염증, 수면 문제로 어려움을 겪는 사람들에게 인기 있고 전체적인 선택입니다. CBD는 연구와 개발이 덜 된 신제품이고 최근에 규제 및 승인을 받았기 때문에 CBD 가격은 변동될 수 있습니다. 대마 생산은 2018년에 합법화되어 CBD 제품 가격에 영향을 미쳤습니다. 그 결과 다양한 CBD 제품의 가격이 다소 상승했습니다.

게다가 많은 농부들이 CBD 제품을 만드는 데 사용되는 대마를 재배하고 판매하는 방향으로 전환하고 있지만, 이 제품의 인기가 높아졌음에도 불구하고, 이 제품은 고유한 농업적 과제를 안고 있습니다. 첫째, 새로운 작물로 전환하면 새로운 비용이 발생합니다. 대마를 수확하는 가장 효율적인 방법은 콤바인 수확기를 사용하는 것입니다. 그러나 딸기와 같이 콤바인이 필요 없는 작물을 재배한 적이 있는 농부들은 바로 콤바인을 살 여유가 없습니다. 따라서 대마 수확을 도울 사람을 고용해야 하며, 이는 원자재가 비싸지면서 전체 제품 가격을 상승시킵니다.

또한 대마는 재배하는 데 더 많은 시간과 노동력이 필요하고 농부는 재배되는 작물을 면밀히 검사해야 합니다. 게다가 수확한 후에는 카나비디올을 추출하는 것이 어렵고 비용이 많이 드는 과정입니다. CBD의 가공업체와 추출업체는 에탄올이나 초임계 이산화탄소(CO2 추출)를 사용해야 합니다. 추출 및 정제 과정에는 특수 기계가 필요하고 시간이 오래 걸리기 때문에 CBD 비용이 올라갑니다. 따라서 이러한 모든 요소가 CBD 제품의 비용으로 합쳐져 다른 제품보다 훨씬 더 비싸지고 시장 수요를 제한할 가능성이 큽니다.

기회

-

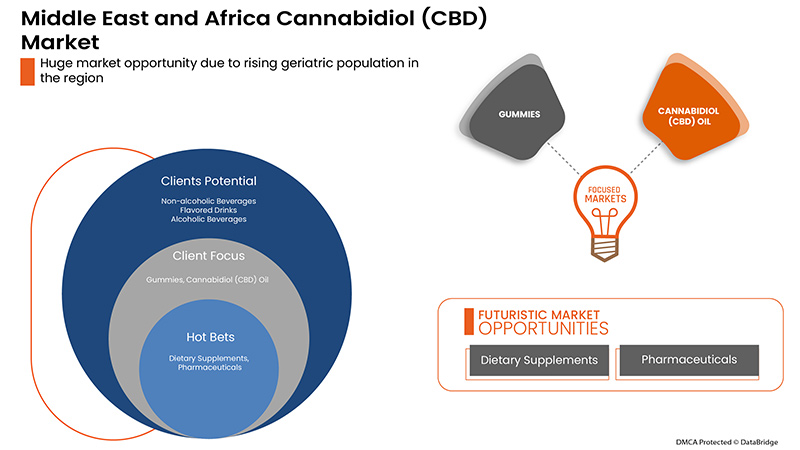

새로운 CBD 기반 제품 개발에 대한 투자 증가

시장에서 혁신적이고 세련된 제품을 제공하는 추세가 증가함에 따라 제조업체는 새로운 CBD 기반 제품을 생산하기 위한 연구 개발에 많은 비용을 지출하고 있습니다. 오일, 팅크제, 농축액, 캡슐, 노예와 같은 국소 용액, 립밤, 로션, 구운 식품, 커피, 초콜릿, 껌, 사탕과 같은 식용품은 수요가 많은 CBD 제품 중 일부입니다.

증가하는 수요로 인해 특정 건강 상태에 대한 CBD의 영향을 연구하기 위한 시험의 수가 증가했으며, 이는 향후 몇 년 동안 수요 증가에 대한 기회를 제공하는 새로운 제품을 개발할 것으로 예상됩니다. 게다가 많은 회사가 대량으로 CBD 오일을 조달하고 CBD가 주입된 제품을 제조합니다. 또한 Rite Aid, CVS Health, Walgreens Boots Alliance와 같은 수많은 건강 및 웰빙 리테일러가 CBD 기반 제품을 제공하고 있습니다.

게다가, 규제가 완화되고 대마초 제품의 승인이 늦어지면서, 기업들은 제품 개발에 막대한 금액을 투자하고 원자재 생산을 업그레이드하고 있으며, 이는 또한 시장에서 급증하는 수요를 충족시키는 동시에 비용을 절감하는 데 도움이 될 것입니다. 시장의 주요 제조업체가 내린 다양한 전략적 결정과 함께 새로운 제품 개발과 증가하는 연구 개발 활동은 중동 및 아프리카 CBD 시장의 성장에 수익성 있는 기회를 제공할 것입니다.

도전

- CBD 오일과 관련된 부작용

카나비디올은 불안, 발작, 신경학적 문제, 암 관련 메스꺼움, 만성 통증 등 다양한 질병을 치료하는 능력으로 잘 알려져 있습니다. 그러나 다양한 의학적 질병에 유용하기 때문에 여러 기관에서 수행한 다양한 연구와 조사에 따르면 CBD 기반 의약품도 부정적인 영향을 미칠 수 있음이 밝혀졌습니다.

소비자들이 일반적으로 경험하는 부작용으로는 입안 건조, 졸음, 저혈압, 현기증이 있습니다. CBD는 또한 신체의 쿠마딘(혈액 응고 방지제) 수치를 높이는 것으로 알려져 있으며, 이는 다른 약물과 상호 작용하여 부정적인 부작용을 일으킬 수 있습니다. 이러한 요인은 치료 목적으로 CBD를 미래에 채택하는 것을 방해할 수 있습니다.

게다가 우려되는 또 다른 원인은 CBD 오일과 같은 제품에서 CBD의 순도와 복용량이 신뢰할 수 없다는 것입니다. 고농도의 CBD 오일은 소비자의 건강에 해로운 영향을 미칠 수도 있습니다. 어떤 경우에는 CBD 오일을 과도하게 사용하면 간 효소가 증가할 수도 있는데, 이는 간 염증의 지표입니다. 시토크롬 P450(CYP450)은 신체가 일부 약물을 분해하는 데 사용하는 효소입니다. CBD 오일은 CYP450을 차단할 수 있습니다. 즉, 이러한 약물과 함께 CBD 오일을 복용하면 필요 이상으로 효과가 강해지거나 전혀 효과가 없을 수 있습니다.

또한 CBD와 허브 성분의 혼합물을 함유한 식이 보충제는 모든 사람에게 안전하지 않을 수 있습니다. 많은 허브가 일반적으로 처방되는 약물과 상호 작용할 가능성이 있기 때문입니다. 이러한 모든 부작용은 사람마다 다를 수 있으며, 일부에게는 사소한 부작용이 다른 사람에게는 심각할 수 있습니다. 이는 중동 및 아프리카 CBD 시장에서 CBD 제품에 대한 수요가 증가하는 데 도전이 될 수 있습니다.

COVID-19 이후 중동 및 아프리카 카나비디올(CBD) 시장에 미치는 영향

COVID-19로 인해 예방 조치를 위해 의료 전문가와 일반 대중 모두에서 의료용품에 대한 수요가 크게 증가했습니다. 이러한 품목의 제조업체는 시장에 개인 보호 장비를 안정적으로 공급함으로써 의료용품에 대한 수요 증가를 이용할 기회가 있습니다. COVID-19는 중동 및 아프리카 칸나비디올(CBD) 시장에 큰 영향을 미칠 것으로 예상됩니다.

중동 및 아프리카 카나비디올(CBD) 시장 범위 및 시장 규모

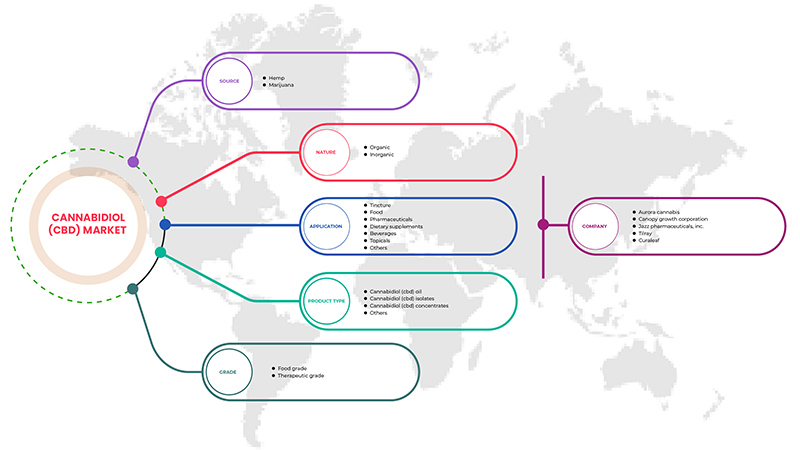

중동 및 아프리카 카나비디올(CBD) 시장은 출처, 등급, 용도, 제품 유형, 특성을 기준으로 세분화됩니다. 세그먼트 간 성장은 틈새 성장 포켓과 시장에 접근하고 핵심 응용 분야와 타겟 시장의 차이점을 파악하기 위한 전략을 분석하는 데 도움이 됩니다.

출처별

- 마

- 삼

중동 및 아프리카 칸나비디올(CBD) 시장은 원산지를 기준으로 대마와 마리화나로 구분됩니다.

제품 유형별

- CBD 오일

- CBD 분리물

- CBD 농축물

- 기타

제품 유형을 기준으로 중동 및 아프리카 카나비디올(CBD) 시장은 CBD 오일, CBD 농축물, CBD 분리물 및 기타로 구분됩니다.

본성적으로

- 본질적인

- 무기질

중동 및 아프리카의 카나비디올(CBD) 시장은 자연적으로 유기적, 무기적 방식으로 구분됩니다.

학년별

- 식품 등급

- 치료 등급

중동 및 아프리카 칸나비디올(CBD) 시장은 등급을 기준으로 식품 등급과 치료 등급으로 구분됩니다.

응용 프로그램별

- 팅크

- 음식

- 음료수

- 제약

- 국소용

- 식이 보충제

- 기타

중동 및 아프리카 칸나비디올(CBD) 시장은 응용 분야를 기준으로 팅크제, 식품, 음료, 의약품, 국소 치료제, 건강 보충제 및 기타로 구분됩니다.

중동 및 아프리카 칸나비디올(CBD) 시장 국가 수준 분석

카나비디올(CBD) 시장을 분석하고, 시장 규모 정보를 출처, 등급, 응용 분야, 제품 유형, 특성별로 제공합니다.

카나비디올(CBD) 시장 보고서에서 다루는 국가는 UAE, 이스라엘, 남아프리카공화국 및 기타 중동 국가입니다.

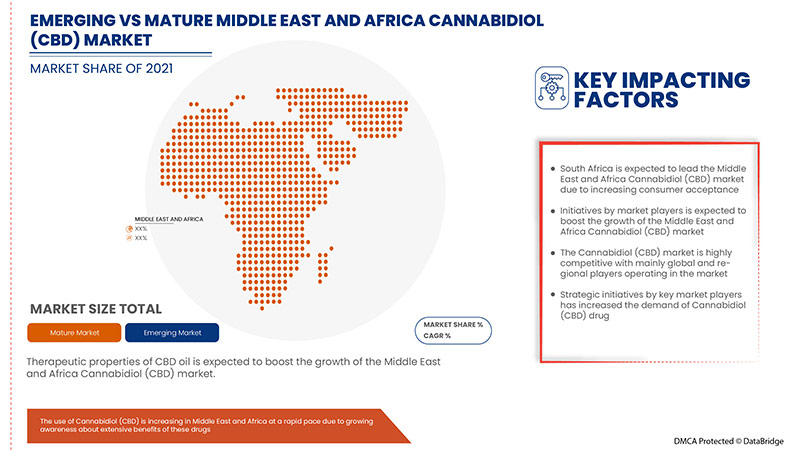

2022년 남아프리카 공화국은 GDP가 높은 가장 큰 소비자 시장을 따라 주요 시장 참여자가 존재하기 때문에 우위를 점하고 있습니다. 남아프리카 공화국은 약물 치료의 기술 발전으로 인해 성장할 것으로 예상됩니다.

보고서의 국가 섹션은 또한 개별 시장 영향 요인과 국내 시장의 현재 및 미래 트렌드에 영향을 미치는 규제 변화를 제공합니다. 신규 판매, 교체 판매, 국가 인구 통계, 규제 조치 및 수출입 관세와 같은 데이터 포인트는 개별 국가의 시장 시나리오를 예측하는 데 사용되는 주요 포인터 중 일부입니다. 또한 중동 및 아프리카 브랜드의 존재 및 가용성과 지역 및 국내 브랜드와의 대규모 또는 희소한 경쟁으로 인해 직면한 과제, 판매 채널의 영향은 국가 데이터에 대한 예측 분석을 제공하는 동안 고려됩니다.

카나비디올(CBD) 시장은 또한 모든 국가의 의료 산업 성장에 대한 자세한 시장 분석을 제공합니다. 게다가, 의료 서비스와 치료, 규제 시나리오의 영향, 카나비디올(CBD) 시장과 관련된 추세 매개변수에 대한 자세한 정보를 제공합니다.

경쟁 환경 및 중동 및 아프리카 Cannabidiol(CBD) 시장 점유율 분석

중동 및 아프리카 카나비디올(CBD) 시장 경쟁 구도는 경쟁자별 세부 정보를 제공합니다. 회사 개요, 회사 재무, 창출된 수익, 시장 잠재력, 연구 개발 투자, 새로운 시장 이니셔티브, 생산 현장 및 시설, 회사의 강점과 약점, 제품 출시, 제품 시험 파이프라인, 제품 승인, 특허, 제품 폭 및 호흡, 응용 프로그램 우세, 기술 수명선 곡선이 포함됩니다. 위에 제공된 데이터 포인트는 카나비디올(CBD) 제품과 관련된 회사의 초점에만 관련됩니다.

카나비디올(CBD) 시장에서 거래하는 주요 기업으로는 CV Sciences, Inc., VIVO Cannabis Inc., Gaia Herbs Hemp, Phoena Holdings Inc., Medical Marijuana, Inc., The Cronos Group, CHARLOTTE'S WEB, HEXO Corp., Aurora Cannabis, Canopy Growth Corporation, Jazz Pharmaceuticals, Inc., Tilray, Curaleaf, KAZMIRA, Freedom Leaf, Inc., Koi CBD, Groff North America Hemplex, Joy Organics, Elixinol Wellness Limited, Isodiol International Inc., Healthy Food Ingredients, LLC, NuLeaf Naturals, LLC, Diamond CBD, Medterra CBD, ENDOCA, Green Roads 등이 있습니다.

합병, 인수 및 주요 시장 참여자 간의 계약과 같은 전략적 제휴를 통해 카나비디올(CBD) 제품의 성장이 더욱 가속화될 것으로 예상됩니다.

예를 들어,

- 2022년 5월, Canopy Growth Corporation과 캘리포니아에 본사를 둔 고품질 대마초 추출물 생산업체이자 클린 베이프 기술의 선구자인 Lemurian, Inc.는 Canopy Growth가 전액 출자 자회사를 통해 미국에서 THC에 대한 연방 허가가 나거나 Canopy Growth가 선택하는 시기에 Jetty의 유통 주식의 최대 100%를 인수할 권리를 제공하는 확정적 계약을 체결했다고 발표했습니다. 이를 통해 회사는 시장에서 사업을 확장할 수 있었습니다.

SKU-

세계 최초의 시장 정보 클라우드 보고서에 온라인으로 접속하세요

- 대화형 데이터 분석 대시보드

- 높은 성장 잠재력 기회를 위한 회사 분석 대시보드

- 사용자 정의 및 질의를 위한 리서치 분석가 액세스

- 대화형 대시보드를 통한 경쟁자 분석

- 최신 뉴스, 업데이트 및 추세 분석

- 포괄적인 경쟁자 추적을 위한 벤치마크 분석의 힘 활용

목차

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF MIDDLE EAST & AFRICA CANNABIDIOL (CBD) MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 MULTIVARIATE MODELLING

2.7 MARKET APPLICATION COVERAGE GRID

2.8 SOURCE LIFELINE CURVE

2.9 DBMR MARKET POSITION GRID

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHT

4.1 BENCHMARKING ANALYSIS

4.2 CBD PRODUCTS, INCLUDING CANNABINOIDS (IN %)

4.3 CBD RAW MATERIAL DEVELOPMENT TREND

4.3.1 MORE CONTROLLED CBD LEVELS:

4.3.2 CBD AND GENETICS:

4.3.3 ADVANCEMENTS MADE IN EXTRACTION:

4.3.4 NANOTECHNOLOGY

4.3.5 CONCLUSION

4.4 COMPANY POSITIONING GRID

4.4.1 MIDDLE EAST & AFRICA CANNABIDIOL (CBD) MARKET: COMPANY LANDSCAPE

4.4.1.1 COMPANY SHARE ANALYSIS: MIDDLE EAST & AFRICA

4.4.1.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

4.4.1.3 COMPANY SHARE ANALYSIS: EUROPE

4.4.1.4 COMPANY SHARE ANALYSIS: SOUTH AMERICA

4.4.2 COMPANY’S CURRENT VENDORS

4.5 OVERALL VOLUME (KILO TONS) & QUANTITY OF COMPLETED TRANSACTIONS: MIDDLE EAST & AFRICA CANNABIDIOL (CBD) MARKET

4.6 LIST OF COUNTRIES THAT LEGALIZED CANNABIDIOL (CBD)

4.7 REGULATION COVERAGE

4.8 IMPORT & EXPORT REGULATION

4.8.1 IMPORT REGULATIONS

4.8.2 EXPORT REGULATIONS

4.9 IMPORT STANDARDS

4.1 GOVERNMENT POLICIES

4.11 QUALIFICATION/CERTIFICATION REQUIRED

4.12 MIDDLE EAST & AFRICA CANNABIDIOL (CBD) MARKET: PRICING ANALYSIS & DEAL PRICING

4.13 RAW MATERIAL EXTRACTOR POSITIONING GRID

4.13.1 KEY EXTRACTION

4.13.2 LINE CAPABILITY

4.14 TECHNOLOGICAL ADVANCEMENTS:

4.15 VENDOR/ DISTRIBUTOR SHARE ANALYSIS

4.16 VENDOR/DISTRIBUTOR KEY BUYERS

5 CLIMATE CHANGE SCENARIO: MIDDLE EAST & AFRICA CANNABIDIOL (CBD) MARKET

5.1 ENVIRONMENT CONCERNS-

5.2 INDUSTRY RESPONSE-

5.3 GOVERNMENT INITIATIVES

5.4 ANALYST RECOMMENDATIONS

6 SUPPLY CHAIN OF THE MIDDLE EAST & AFRICA CANNABIDIOL (CBD) MARKET

6.1 LOGISTIC COST SCENARIO

6.2 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

7 MARKET OVERVIEW

7.1 DRIVERS

7.1.1 INCREASE IN DEMAND FOR CBD IN HEALTH & FITNESS

7.1.2 IMPROVING GOVERNMENT APPROVALS AND REGULATIONS FOR CBD PRODUCTS

7.1.3 THERAPEUTIC PROPERTIES OF CBD OIL

7.1.4 CONSUMERS' SHIFT TOWARDS LEGALLY PURCHASING CANNABIS FOR MEDICAL AS WELL AS RECREATIONAL USE

7.2 RESTRAINTS

7.2.1 HIGH COST OF CBD PRODUCTS

7.2.2 AVAILABILITY OF COUNTERFEIT AND SYNTHETIC PRODUCTS IN THE MARKET

7.3 OPPORTUNITIES

7.3.1 INCREASING INVESTMENTS IN THE DEVELOPMENT OF NEW CBD BASED PRODUCTS

7.3.2 GROWING MEDICAL APPLICATIONS OF CBD

7.4 CHALLENGES

7.4.1 SIDE EFFECTS ASSOCIATED WITH CBD OIL

7.4.2 BARRIERS IN TERMS OF MARKETING OF CBD

8 MIDDLE EAST & AFRICA CANNABIDIOL (CBD) MARKET, BY SOURCE

8.1 OVERVIEW

8.2 HEMP

8.3 MARIJUANA

9 MIDDLE EAST & AFRICA CANNABIDIOL (CBD) MARKET, BY PRODUCT TYPE

9.1 OVERVIEW

9.2 CANNABIDIOL (CBD) OIL

9.2.1 CARBON DIOXIDE EXTRACTION

9.2.2 STEAM DISTILLATION

9.2.3 SOLVENT EXTRACTION

9.2.4 OTHERS

9.3 CANNABIDIOL (CBD) ISOLATES

9.4 CANNABIDIOL (CBD) CONCENTRATES

9.5 OTHERS

10 MIDDLE EAST & AFRICA CANNABIDIOL (CBD) MARKET, BY NATURE

10.1 OVERVIEW

10.2 ORGANIC

10.3 INORGANIC

11 MIDDLE EAST & AFRICA CANNABIDIOL (CBD) MARKET, BY GRADE

11.1 OVERVIEW

11.2 FOOD GRADE

11.3 THERAPEUTIC GRADE

12 MIDDLE EAST & AFRICA CANNABIDIOL (CBD) MARKET, BY APPLICATION

12.1 OVERVIEW

12.2 TINCTURE

12.3 FOOD

12.3.1 CHOCOLATE & CONFECTIONERY

12.3.1.1 CANDY

12.3.1.2 CHOCOLATE

12.3.1.3 CHEWS

12.3.1.4 GUMMIES

12.3.1.5 OTHERS

12.3.2 HONEY

12.3.3 DAIRY BASED EDIBLE

12.3.3.1 MILK

12.3.3.2 ICE CREAM

12.3.3.3 OTHERS

12.3.4 SAUCES AND SEASONINGS

12.3.5 BAKERY EDIBLE

12.3.5.1 COOKIES AND BISCUITS

12.3.5.2 BROWNIES

12.3.5.3 OTHERS

12.3.6 OTHERS

12.3.7 PHARMACEUTICALS

12.3.7.1 DRAVET SYNDROME

12.3.7.2 MULTIPLE SCLEROSIS DRUG APPLICATIONS

12.3.7.3 NEUROLOGICAL DRUG APPLICATIONS

12.3.7.4 CANCER DRUG APPLICATIONS

12.3.7.5 OTHERS

12.3.8 DIETARY SUPPLEMENTS

12.3.8.1 CAPSULES

12.3.8.2 GUMMIES

12.3.8.3 OTHERS

12.3.9 BEVERAGES

12.3.9.1 NON-ALCOHOLIC BEVERAGES

12.3.9.1.1 ENERGY DRINKS

12.3.9.1.2 SOFT DRINKS

12.3.9.1.3 RTD COFFEE

12.3.9.1.4 TEA

12.3.9.1.5 SPARKLING WATER

12.3.9.1.6 OTHERS

12.3.9.2 FLAVORED DRINKS

12.3.9.2.1 ORANGE

12.3.9.2.2 LEMON

12.3.9.2.3 BERRIES

12.3.9.2.4 COCONUT

12.3.9.2.5 OTHERS

12.3.9.3 ALCOHOLIC BEVERAGES

12.3.9.3.1 BEER

12.3.9.3.2 WINE

12.3.9.3.3 OTHERS

12.3.9.4 OTHERS

12.3.10 TOPICAL

12.3.10.1 LOTION

12.3.10.2 SALVE

12.3.10.3 LIP BALM

12.3.10.4 OTHERS

12.3.11 OTHERS

12.3.11.1 VAPES

12.3.11.2 CIGARETTES

12.3.11.3 SPA AND RECREATION

13 MIDDLE EAST & AFRICA CANNABIDIOL (CBD) MARKET, BY REGION

13.1 MIDDLE EAST AND AFRICA

13.1.1 SOUTH AFRICA

13.1.2 U.A.E

13.1.3 ISRAEL

13.1.4 REST OF MIDDLE EAST AND AFRICA

14 SWOT ANALYSIS

15 COMPANY PROFILE

15.1 CURALEAF

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 COMPANY SHARE ANALYSIS

15.1.4 PRODUCT PORTFOLIO

15.1.5 RECENT DEVELOPMENTS

15.2 TILRAY

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 COMPANY SHARE ANALYSIS

15.2.4 PRODUCT PORTFOLIO

15.2.5 RECENT DEVELOPMENTS

15.3 JAZZ PHARMACEUTICALS, INC.

15.3.1 COMPANY SNAPSHOT

15.3.2 REVENUE ANALYSIS

15.3.3 COMPANY SHARE ANALYSIS

15.3.4 PRODUCT PORTFOLIO

15.3.5 RECENT DEVELOPMENT

15.4 CANOPY GROWTH CORPORATION

15.4.1 COMPANY SNAPSHOT

15.4.2 REVENUE ANALYSIS

15.4.3 COMPANY SHARE ANALYSIS

15.4.4 PRODUCT PORTFOLIO

15.4.5 RECENT DEVELOPMENTS

15.5 AURORA CANNABIS.

15.5.1 COMPANY SNAPSHOT

15.5.2 REVENUE ANALYSIS

15.5.3 COMPANY SHARE ANALYSIS

15.5.4 PRODUCT PORTFOLIO

15.5.5 RECENT DEVELOPMENTS

15.6 CHARLOTTE’S WEB.

15.6.1 COMPANY SNAPSHOT

15.6.2 REVENUE ANALYSIS

15.6.3 PRODUCT PORTFOLIO

15.6.4 RECENT DEVELOPMENTS

15.7 CV SCIENCES, INC.

15.7.1 COMPANY SNAPSHOT

15.7.2 REVENUE ANALYSIS

15.7.3 PRODUCT PORTFOLIO

15.7.4 RECENT DEVELOPMENTS

15.8 DIAMOND CBD.

15.8.1 COMPANY SNAPSHOT

15.8.2 PRODUCT PORTFOLIO

15.8.3 RECENT DEVELOPMENTS

15.9 ELIXINOL WELLNESS LIMITED

15.9.1 COMPANY SNAPSHOT

15.9.2 REVENUE ANALYSIS

15.9.3 PRODUCT PORTFOLIO

15.9.4 RECENT DEVELOPMENTS

15.1 ENDOCA.

15.10.1 COMPANY SNAPSHOT

15.10.2 PRODUCT PORTFOLIO

15.10.3 RECENT DEVELOPMENT

15.11 FREEDOM LEAF, INC

15.11.1 COMPANY SNAPSHOT

15.11.2 PRODUCT PORTFOLIO

15.11.3 RECENT DEVELOPMENTS

15.12 GAIA HERBS HEMP

15.12.1 COMPANY SNAPSHOT

15.12.2 PRODUCT PORTFOLIO

15.12.3 RECENT DEVELOPMENT

15.13 GREEN ROADS.

15.13.1 COMPANY SNAPSHOT

15.13.2 PRODUCT PORTFOLIO

15.13.3 RECENT DEVELOPMENT

15.14 GROFF NORTH AMERICA HEMPLEX

15.14.1 COMPANY SNAPSHOT

15.14.2 PRODUCT PORTFOLIO

15.14.3 RECENT DEVELOPMENT

15.15 HEXO CORP.

15.15.1 COMPANY SNAPSHOT

15.15.2 REVENUE ANALYSIS

15.15.3 PRODUCT PORTFOLIO

15.15.4 RECENT DEVELOPMENTS

15.16 HEALTHY FOOD INGREDIENTS, LLC.

15.16.1 COMPANY SNAPSHOT

15.16.2 PRODUCT PORTFOLIO

15.16.3 RECENT DEVELOPMENT

15.17 ISODIOL INTERNATIONAL INC

15.17.1 COMPANY SNAPSHOT

15.17.2 PRODUCT PORTFOLIO

15.17.3 RECENT DEVELOPMENTS

15.18 JOY ORGANICS

15.18.1 COMPANY SNAPSHOT

15.18.2 PRODUCT PORTFOLIO

15.18.3 RECENT DEVELOPMENTS

15.19 KAZMIRA

15.19.1 COMPANY SNAPSHOT

15.19.2 PRODUCT PORTFOLIO

15.19.3 RECENT DEVELOPMENTS

15.2 KOI CBD

15.20.1 COMPANY SNAPSHOT

15.20.2 PRODUCT PORTFOLIO

15.20.3 RECENT DEVELOPMENTS

15.21 MEDICAL MARIJUANA, INC.

15.21.1 COMPANY SNAPSHOT

15.21.2 EVENUE ANALYSIS

15.21.3 PRODUCT PORTFOLIO

15.21.4 RECENT DEVELOPMENTS

15.22 MEDTERRA CBD

15.22.1 COMPANY SNAPSHOT

15.22.2 PRODUCT PORTFOLIO

15.22.3 RECENT DEVELOPMENTS

15.23 NULEAF NATURALS, LLC

15.23.1 COMPANY SNAPSHOT

15.23.2 PRODUCT PORTFOLIO

15.23.3 RECENT DEVELOPMENTS

15.24 PHOENA HOLDINGS INC.

15.24.1 COMPANY SNAPSHOT

15.24.2 PRODUCT PORTFOLIO

15.24.3 RECENT DEVELOPMENTS

15.25 THE CRONOS GROUP

15.25.1 COMPANY SNAPSHOT

15.25.2 REVENUE ANALYSIS

15.25.3 PRODUCT PORTFOLIO

15.25.4 RECENT DEVELOPMENTS

15.26 VIVO CANNABIS INC.

15.26.1 COMPANY SNAPSHOT

15.26.2 REVENUE ANALYSIS

15.26.3 PRODUCT PORTFOLIO

15.26.4 RECENT DEVELOPMENTS

16 QUESTIONNAIRE

17 RELATED REPORTS

표 목록

TABLE 1 BENCHMARK ANALYSIS

TABLE 2 AVERAGE VOLUME TREND FOR MIDDLE EAST & AFRICA CANNABIDIOL (CBD) MARKET (KILO TONS)

TABLE 3 THE FOLLOWING ARE THE PRICES OF PRODUCTS OFFERED BY THE COMPANIES:

TABLE 4 MIDDLE EAST & AFRICA CANNABIDIOL (CBD) MARKET, BY SOURCE, 2020-2029 (USD MILLION)

TABLE 5 MIDDLE EAST & AFRICA HEMP IN CANNABIDIOL (CBD) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 6 MIDDLE EAST & AFRICA MARIJUANA IN CANNABIDIOL (CBD) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 7 MIDDLE EAST & AFRICA CANNABIDIOL (CBD) MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 8 MIDDLE EAST & AFRICA CANNABIDIOL (CBD) OIL IN CANNABIDIOL (CBD) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 9 MIDDLE EAST & AFRICA CANNABIDIOL (CBD) OIL IN CANNABIDIOL (CBD) MARKET, BY EXTRACTION METHOD, 2020-2029 (USD MILLION)

TABLE 10 MIDDLE EAST & AFRICA CANNABIDIOL (CBD) ISOLATES IN CANNABIDIOL (CBD) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 11 MIDDLE EAST & AFRICA CANNABIDIOL (CBD) CONCETRATES IN CANNABIDIOL (CBD) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 12 MIDDLE EAST & AFRICA OTHERS IN CANNABIDIOL (CBD) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 13 MIDDLE EAST & AFRICA CANNABIDIOL (CBD) MARKET, BY NATURE, 2020-2029 (USD MILLION)

TABLE 14 MIDDLE EAST & AFRICA ORGANIC IN CANNABIDIOL (CBD) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 15 MIDDLE EAST & AFRICA INORGANIC IN CANNABIDIOL (CBD) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 16 MIDDLE EAST & AFRICA CANNABIDIOL (CBD) MARKET, BY GRADE, 2020-2029 (USD MILLION)

TABLE 17 MIDDLE EAST & AFRICA FOOD GRADE IN CANNABIDIOL (CBD) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 18 MIDDLE EAST & AFRICA THERAPEUTIC GRADE IN CANNABIDIOL (CBD) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 19 MIDDLE EAST & AFRICA CANNABIDIOL (CBD) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 20 MIDDLE EAST & AFRICA TINCTURE IN CANNABIDIOL (CBD) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 21 MIDDLE EAST & AFRICA FOOD IN CANNABIDIOL (CBD) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 22 MIDDLE EAST & AFRICA FOOD IN CANNABIDIOL (CBD) MARKET, BY EXTRACTION METHOD, 2020-2029 (USD MILLION)

TABLE 23 MIDDLE EAST & AFRICA CHOCOLATE & CONFECTIONERY IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 24 MIDDLE EAST & AFRICA DAIRY BASED EDIBLE IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 25 MIDDLE EAST & AFRICA BAKERY EDIBLE IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 26 MIDDLE EAST & AFRICA PHARMACEUTICALS IN CANNABIDIOL (CBD) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 27 MIDDLE EAST & AFRICA PHARMACEUTICAL IN CANNABIDIOL (CBD) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 28 MIDDLE EAST & AFRICA DIETARY SUPPLEMENTS IN CANNABIDIOL (CBD) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 29 MIDDLE EAST & AFRICA DIETARY SUPPLEMENTS IN CANNABIDIOL (CBD) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 30 MIDDLE EAST & AFRICA BEVERAGES IN CANNABIDIOL (CBD) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 31 MIDDLE EAST & AFRICA BEVERAGES IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 32 MIDDLE EAST & AFRICA NON-ALCOHOLIC BEVERAGES IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 33 MIDDLE EAST & AFRICA FLAVORED DRINKS IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 34 MIDDLE EAST & AFRICA ALCOHOLIC BEVERAGE IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 35 MIDDLE EAST & AFRICA TOPICAL IN CANNABIDIOL (CBD) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 36 MIDDLE EAST & AFRICA TOPICAL IN CANNABIDIOL (CBD) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 37 MIDDLE EAST & AFRICA OTHERS IN CANNABIDIOL (CBD) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 38 MIDDLE EAST & AFRICA OTHERS IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 39 MIDDLE EAST AND AFRICA CANNABIDIOL (CBD) MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 40 MIDDLE EAST AND AFRICA CANNABIDIOL (CBD) MARKET, BY SOURCE, 2020-2029 (USD MILLION)

TABLE 41 MIDDLE EAST AND AFRICA CANNABIDIOL (CBD) MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 42 MIDDLE EAST AND AFRICA CANNABIDIOL (CBD) OIL IN CANNABIDIOL (CBD) MARKET, BY EXTRACTION METHOD, 2020-2029 (USD MILLION)

TABLE 43 MIDDLE EAST AND AFRICA CANNABIDIOL (CBD) MARKET, BY NATURE, 2020-2029 (USD MILLION)

TABLE 44 MIDDLE EAST AND AFRICA CANNABIDIOL (CBD) MARKET, BY GRADE, 2020-2029 (USD MILLION)

TABLE 45 MIDDLE EAST AND AFRICA CANNABIDIOL (CBD) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 46 MIDDLE EAST AND AFRICA FOOD IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 47 MIDDLE EAST AND AFRICA CHOCOLATE & CONFECTIONERY IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 48 MIDDLE EAST AND AFRICA BAKERY EDIBLE IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 49 MIDDLE EAST AND AFRICA DAIRY BASED EDIBLE IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 50 MIDDLE EAST AND AFRICA BEVERAGES IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 51 MIDDLE EAST AND AFRICA ALCOHOLIC BEVERAGE IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 52 MIDDLE EAST AND AFRICA NON-ALCOHOLIC BEVERAGES IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 53 MIDDLE EAST AND AFRICA FLAVORED DRINKS IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 54 MIDDLE EAST AND AFRICA PHARMACEUTICAL IN CANNABIDIOL (CBD) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 55 MIDDLE EAST AND AFRICA TOPICAL IN CANNABIDIOL (CBD) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 56 MIDDLE EAST AND AFRICA DIETARY SUPPLEMENTS IN CANNABIDIOL (CBD) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 57 MIDDLE EAST AND AFRICA OTHERS IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 58 SOUTH AFRICA CANNABIDIOL (CBD) MARKET, BY SOURCE, 2020-2029 (USD MILLION)

TABLE 59 SOUTH AFRICA CANNABIDIOL (CBD) MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 60 SOUTH AFRICA CANNABIDIOL (CBD) OIL IN CANNABIDIOL (CBD) MARKET, BY EXTRACTION METHOD, 2020-2029 (USD MILLION)

TABLE 61 SOUTH AFRICA CANNABIDIOL (CBD) MARKET, BY NATURE, 2020-2029 (USD MILLION)

TABLE 62 SOUTH AFRICA CANNABIDIOL (CBD) MARKET, BY GRADE, 2020-2029 (USD MILLION)

TABLE 63 SOUTH AFRICA CANNABIDIOL (CBD) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 64 SOUTH AFRICA FOOD IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 65 SOUTH AFRICA CHOCOLATE & CONFECTIONERY IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 66 SOUTH AFRICA BAKERY EDIBLE IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 67 SOUTH AFRICA DAIRY BASED EDIBLE IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 68 SOUTH AFRICA BEVERAGES IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 69 SOUTH AFRICA ALCOHOLIC BEVERAGE IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 70 SOUTH AFRICA NON-ALCOHOLIC BEVERAGES IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 71 SOUTH AFRICA FLAVORED DRINKS IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 72 SOUTH AFRICA PHARMACEUTICAL IN CANNABIDIOL (CBD) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 73 SOUTH AFRICA TOPICAL IN CANNABIDIOL (CBD) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 74 SOUTH AFRICA DIETARY SUPPLEMENTS IN CANNABIDIOL (CBD) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 75 SOUTH AFRICA OTHERS IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 76 U.A.E CANNABIDIOL (CBD) MARKET, BY SOURCE, 2020-2029 (USD MILLION)

TABLE 77 U.A.E CANNABIDIOL (CBD) MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 78 U.A.E CANNABIDIOL (CBD) OIL IN CANNABIDIOL (CBD) MARKET, BY EXTRACTION METHOD, 2020-2029 (USD MILLION)

TABLE 79 U.A.E CANNABIDIOL (CBD) MARKET, BY NATURE, 2020-2029 (USD MILLION)

TABLE 80 U.A.E CANNABIDIOL (CBD) MARKET, BY GRADE, 2020-2029 (USD MILLION)

TABLE 81 U.A.E CANNABIDIOL (CBD) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 82 U.A.E FOOD IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 83 U.A.E CHOCOLATE & CONFECTIONERY IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 84 U.A.E BAKERY EDIBLE IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 85 U.A.E DAIRY BASED EDIBLE IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 86 U.A.E BEVERAGES IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 87 U.A.E ALCOHOLIC BEVERAGE IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 88 U.A.E NON-ALCOHOLIC BEVERAGES IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 89 U.A.E FLAVORED DRINKS IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 90 U.A.E PHARMACEUTICAL IN CANNABIDIOL (CBD) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 91 U.A.E TOPICAL IN CANNABIDIOL (CBD) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 92 U.A.E DIETARY SUPPLEMENTS IN CANNABIDIOL (CBD) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 93 U.A.E OTHERS IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 94 ISRAEL CANNABIDIOL (CBD) MARKET, BY SOURCE, 2020-2029 (USD MILLION)

TABLE 95 ISRAEL CANNABIDIOL (CBD) MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 96 ISRAEL CANNABIDIOL (CBD) OIL IN CANNABIDIOL (CBD) MARKET, BY EXTRACTION METHOD, 2020-2029 (USD MILLION)

TABLE 97 ISRAEL CANNABIDIOL (CBD) MARKET, BY NATURE, 2020-2029 (USD MILLION)

TABLE 98 ISRAEL CANNABIDIOL (CBD) MARKET, BY GRADE, 2020-2029 (USD MILLION)

TABLE 99 ISRAEL CANNABIDIOL (CBD) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 100 ISRAEL FOOD IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 101 ISRAEL CHOCOLATE & CONFECTIONERY IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 102 ISRAEL BAKERY EDIBLE IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 103 ISRAEL DAIRY BASED EDIBLE IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 104 ISRAEL BEVERAGES IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 105 ISRAEL ALCOHOLIC BEVERAGE IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 106 ISRAEL NON-ALCOHOLIC BEVERAGES IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 107 ISRAEL FLAVORED DRINKS IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 108 ISRAEL PHARMACEUTICAL IN CANNABIDIOL (CBD) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 109 ISRAEL TOPICAL IN CANNABIDIOL (CBD) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 110 ISRAEL DIETARY SUPPLEMENTS IN CANNABIDIOL (CBD) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 111 ISRAEL OTHERS IN CANNABIDIOL (CBD) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 112 REST OF MIDDLE EAST AND AFRICA CANNABIDIOL (CBD) MARKET, BY SOURCE, 2020-2029 (USD MILLION)

그림 목록

FIGURE 1 MIDDLE EAST & AFRICA CANNABIDIOL (CBD) MARKET: SEGMENTATION

FIGURE 2 MIDDLE EAST & AFRICA CANNABIDIOL (CBD) MARKET: DATA TRIANGULATION

FIGURE 3 MIDDLE EAST & AFRICA CANNABIDIOL (CBD) MARKET: DROC ANALYSIS

FIGURE 4 MIDDLE EAST & AFRICA CANNABIDIOL (CBD) MARKET: REGIONAL VS COUNTRY MARKET ANALYSIS

FIGURE 5 MIDDLE EAST & AFRICA CANNABIDIOL (CBD) MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 MIDDLE EAST & AFRICA CANNABIDIOL (CBD) MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 MIDDLE EAST & AFRICA CANNABIDIOL (CBD) MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 8 MIDDLE EAST & AFRICA CANNABIDIOL (CBD) MARKET: DBMR MARKET POSITION GRID

FIGURE 9 MIDDLE EAST & AFRICA CANNABIDIOL (CBD) MARKET: SEGMENTATION

FIGURE 10 NORTH AMERICA IS ANTICIPATED TO DOMINATE THE MIDDLE EAST & AFRICA CANNABIDIOL (CBD) MARKET AND IS ESTIMATED TO BE GROWING WITH THE HIGHEST CAGR IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 11 THE INCREASING DEMAND FOR CANNABIDIOL (CBD) DUE TO ITS HEALING PROPERTIES AND HEALTH AND WELLNESS PURPOSES IS HIGH, WHICH IS THE MAJOR FACTOR DRIVING THE MARKET IS EXPECTED TO DRIVE THE MIDDLE EAST & AFRICA CANNABIDIOL (CBD) MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 HEMP IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE MIDDLE EAST & AFRICA CANNABIDIOL (CBD) MARKET IN 2022 & 2029

FIGURE 13 MIDDLE EAST & AFRICA CANNABIDIOL (CBD) MARKET: COMPANY SHARE 2021 (%)

FIGURE 14 NORTH AMERICA CANNABIDIOL (CBD) MARKET: COMPANY SHARE 2021 (%)

FIGURE 15 EUROPE CANNABIDIOL (CBD) MARKET: COMPANY SHARE 2021 (%)

FIGURE 16 SOUTH AMERICA CANNABIDIOL (CBD) MARKET: COMPANY SHARE 2021 (%)

FIGURE 17 MIDDLE EAST & AFRICA CANNABIDIOL (CBD) MARKET: VENDOR/ DISTRIBUTOR SHARE ANALYSIS (%)

FIGURE 18 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE MIDDLE EAST & AFRICA CANNABIDIOL (CBD) MARKET

FIGURE 19 MIDDLE EAST & AFRICA CANNABIDIOL (CBD) MARKET: BY SOURCE, 2021

FIGURE 20 MIDDLE EAST & AFRICA CANNABIDIOL (CBD) MARKET: BY SOURCE, 2022-2029 (USD MILLION)

FIGURE 21 MIDDLE EAST & AFRICA CANNABIDIOL (CBD) MARKET: BY SOURCE, CAGR (2022-2029)

FIGURE 22 MIDDLE EAST & AFRICA CANNABIDIOL (CBD) MARKET: BY SOURCE, LIFELINE CURVE

FIGURE 23 MIDDLE EAST & AFRICA CANNABIDIOL (CBD) MARKET: BY PRODUCT TYPE, 2021

FIGURE 24 MIDDLE EAST & AFRICA CANNABIDIOL (CBD) MARKET: BY PRODUCT TYPE, 2022-2029 (USD MILLION)

FIGURE 25 MIDDLE EAST & AFRICA CANNABIDIOL (CBD) MARKET: BY PRODUCT TYPE, CAGR (2022-2029)

FIGURE 26 MIDDLE EAST & AFRICA CANNABIDIOL (CBD) MARKET: BY PRODUCT TYPE, LIFELINE CURVE

FIGURE 27 MIDDLE EAST & AFRICA CANNABIDIOL (CBD) MARKET: BY NATURE, 2021

FIGURE 28 MIDDLE EAST & AFRICA CANNABIDIOL (CBD) MARKET: BY NATURE, 2022-2029 (USD MILLION)

FIGURE 29 MIDDLE EAST & AFRICA CANNABIDIOL (CBD) MARKET: BY NATURE, CAGR (2022-2029)

FIGURE 30 MIDDLE EAST & AFRICA CANNABIDIOL (CBD) MARKET: BY NATURE, LIFELINE CURVE

FIGURE 31 MIDDLE EAST & AFRICA CANNABIDIOL (CBD) MARKET: BY GRADE, 2021

FIGURE 32 MIDDLE EAST & AFRICA CANNABIDIOL (CBD) MARKET: BY GRADE, 2022-2029 (USD MILLION)

FIGURE 33 MIDDLE EAST & AFRICA CANNABIDIOL (CBD) MARKET: BY GRADE, CAGR (2022-2029)

FIGURE 34 MIDDLE EAST & AFRICA CANNABIDIOL (CBD) MARKET: BY GRADE, LIFELINE CURVE

FIGURE 35 MIDDLE EAST & AFRICA CANNABIDIOL (CBD) MARKET: BY APPLICATION, 2021

FIGURE 36 MIDDLE EAST & AFRICA CANNABIDIOL (CBD) MARKET: BY APPLICATION, 2022-2029 (USD MILLION)

FIGURE 37 MIDDLE EAST & AFRICA CANNABIDIOL (CBD) MARKET: BY APPLICATION, CAGR (2022-2029)

FIGURE 38 MIDDLE EAST & AFRICA CANNABIDIOL (CBD) MARKET: BY APPLICATION, LIFELINE CURVE

FIGURE 39 MIDDLE EAST AND AFRICA CANNABIDIOL (CBD) MARKET: SNAPSHOT (2021)

FIGURE 40 MIDDLE EAST AND AFRICA CANNABIDIOL (CBD) MARKET: BY COUNTRY (2021)

FIGURE 41 MIDDLE EAST AND AFRICA CANNABIDIOL (CBD) MARKET: BY COUNTRY (2022 & 2029)

FIGURE 42 MIDDLE EAST AND AFRICA CANNABIDIOL (CBD) MARKET: BY COUNTRY (2021 & 2029)

FIGURE 43 MIDDLE EAST AND AFRICA CANNABIDIOL (CBD) MARKET: BY SOURCE (2022-2029)

연구 방법론

데이터 수집 및 기준 연도 분석은 대규모 샘플 크기의 데이터 수집 모듈을 사용하여 수행됩니다. 이 단계에는 다양한 소스와 전략을 통해 시장 정보 또는 관련 데이터를 얻는 것이 포함됩니다. 여기에는 과거에 수집한 모든 데이터를 미리 검토하고 계획하는 것이 포함됩니다. 또한 다양한 정보 소스에서 발견되는 정보 불일치를 검토하는 것도 포함됩니다. 시장 데이터는 시장 통계 및 일관된 모델을 사용하여 분석하고 추정합니다. 또한 시장 점유율 분석 및 주요 추세 분석은 시장 보고서의 주요 성공 요인입니다. 자세한 내용은 분석가에게 전화를 요청하거나 문의 사항을 드롭하세요.

DBMR 연구팀에서 사용하는 주요 연구 방법론은 데이터 마이닝, 시장에 대한 데이터 변수의 영향 분석 및 주요(산업 전문가) 검증을 포함하는 데이터 삼각 측량입니다. 데이터 모델에는 공급업체 포지셔닝 그리드, 시장 타임라인 분석, 시장 개요 및 가이드, 회사 포지셔닝 그리드, 특허 분석, 가격 분석, 회사 시장 점유율 분석, 측정 기준, 글로벌 대 지역 및 공급업체 점유율 분석이 포함됩니다. 연구 방법론에 대해 자세히 알아보려면 문의를 통해 업계 전문가에게 문의하세요.

사용자 정의 가능

Data Bridge Market Research는 고급 형성 연구 분야의 선두 주자입니다. 저희는 기존 및 신규 고객에게 목표에 맞는 데이터와 분석을 제공하는 데 자부심을 느낍니다. 보고서는 추가 국가에 대한 시장 이해(국가 목록 요청), 임상 시험 결과 데이터, 문헌 검토, 재생 시장 및 제품 기반 분석을 포함하도록 사용자 정의할 수 있습니다. 기술 기반 분석에서 시장 포트폴리오 전략에 이르기까지 타겟 경쟁업체의 시장 분석을 분석할 수 있습니다. 귀하가 원하는 형식과 데이터 스타일로 필요한 만큼 많은 경쟁자를 추가할 수 있습니다. 저희 분석가 팀은 또한 원시 엑셀 파일 피벗 테이블(팩트북)로 데이터를 제공하거나 보고서에서 사용 가능한 데이터 세트에서 프레젠테이션을 만드는 데 도움을 줄 수 있습니다.