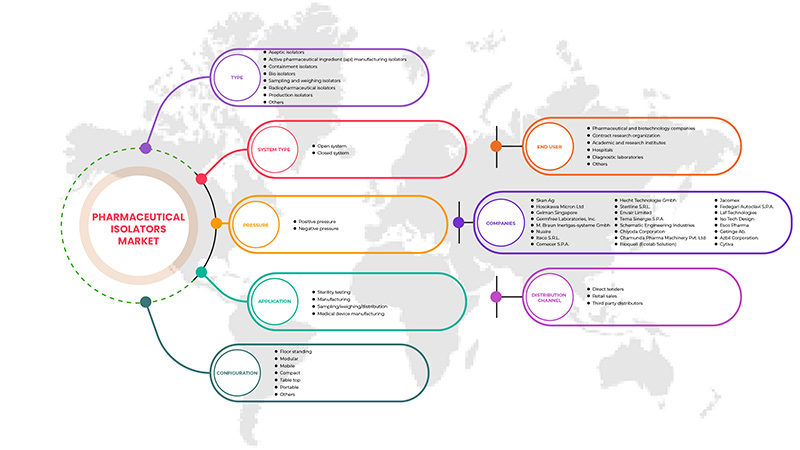

중동 및 아프리카 제약용 분리기 시장, 유형별(무균 분리기, 격리 분리기, 생물학적 분리기, 샘플링 및 계량 분리기, 활성 제약 성분(API) 제조 분리기, 방사성 의약품 분리기, 생산 분리기, 기타), 시스템 유형(폐쇄형 시스템, 개방형 시스템), 압력(양압, 음압), 구성(바닥형, 모듈형, 모바일형, 콤팩트형, 테이블탑형, 휴대용, 기타), 응용 분야(멸균 테스트, 제조, 샘플링/계량/유통, 의료 기기 제조), 최종 사용자(병원, 진단 실험실, 학술 및 연구 기관, 제약 및 생명 공학 회사, 계약 연구 기관, 기타), 유통 채널(직접 입찰, 소매 판매, 제3자 유통업체) 산업 동향 및 2029년까지의 예측.

중동 및 아프리카 제약용 분리기 시장 분석 및 통찰력

제약용 분리기는 제약 산업에서 오염 없는 장벽 시스템으로 사용됩니다. 미생물 검사, 세포 치료 처리, 첨단 제약(ATMP) 제조, 멸균 주사 제품의 계량, 포장 및 유통은 제약용 분리기의 몇 가지 응용 분야일 뿐입니다. 제약용 분리기의 사용은 개발도상국과 선진국에서 제약 시장의 지속적인 성장과 혁신적인 치료법을 생산하기 위한 R&D 지출 증가로 인해 촉진되었습니다. 첨단 의료용 절연체와 제약 산업의 요구 사항으로 인해 주요 제조업체는 의료용 절연체 산업을 성장시켰습니다. 유해 화합물의 사용 증가, 비준수 비용 증가, 연구실 증가는 예측 기간 동안 제약용 분리기 시장을 주도하는 중요한 요인입니다.

그러나 대부분의 전문가들은 규제 기관이 더 이상 제약용 절연체 개발과 같은 획기적인 발전을 방해할 수 없다는 데 동의하지 않습니다.

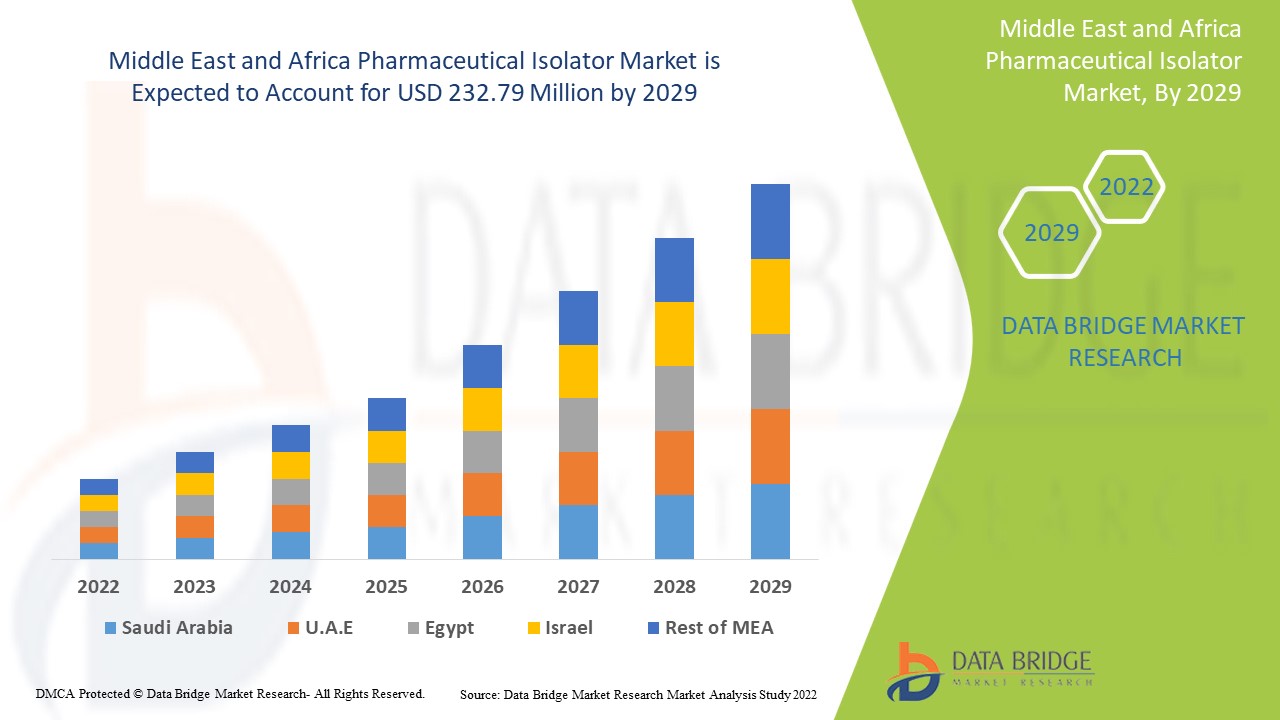

Data Bridge Market Research는 중동 및 아프리카 제약 아이솔레이터 시장이 2029년까지 2억 3,279만 달러에 도달할 것으로 예상되며, 예측 기간 동안 CAGR은 12.0%라고 분석했습니다. 유형은 제약 아이솔레이터 중동 및 아프리카의 빠른 수요로 인해 시장에서 가장 큰 유형 세그먼트를 차지합니다. 이 시장 보고서는 또한 가격 분석, 특허 분석 및 심층적인 기술 발전을 다룹니다.

|

보고서 메트릭 |

세부 |

|

예측 기간 |

2022년부터 2029년까지 |

|

기준 연도 |

2021 |

|

역사적 연도 |

2020 (2019-2014까지 사용자 정의 가능) |

|

양적 단위 |

매출은 백만 달러, 볼륨은 단위, 가격은 달러로 표시 |

|

다루는 세그먼트 |

유형별(무균 격리기, 격리 격리기, 생물학적 격리기, 샘플링 및 계량 격리기, 활성 제약 성분(API) 제조 격리기, 방사성 의약품 격리기, 생산 격리기, 기타), 시스템 유형(폐쇄형 시스템, 개방형 시스템), 압력(양압, 음압), 구성(바닥형, 모듈형, 이동식, 소형, 테이블 상단형, 휴대용, 기타), 응용 분야( 멸균 테스트 , 제조, 샘플링/계량/유통, 의료 기기 제조), 최종 사용자(병원, 진단 실험실, 학술 및 연구 기관, 제약 및 생명 공학 회사, 계약 연구 기관, 기타), 유통 채널(직접 입찰, 소매 판매, 제3자 유통업체). |

|

적용 국가 |

미국, 캐나다, 멕시코, 독일, 프랑스, 영국, 이탈리아, 스페인, 러시아, 터키, 벨기에, 네덜란드, 스위스 및 유럽의 나머지 지역, 중국, 일본, 인도, 한국, 싱가포르, 태국, 말레이시아, 호주, 필리핀, 인도네시아 및 아시아 태평양의 나머지 지역, 남아프리카, 사우디 아라비아, UAE, 이집트, 이스라엘 및 중동과 아프리카의 나머지 지역, 브라질, 아르헨티나 및 남미의 나머지 지역. |

|

시장 참여자 포함 |

Getinge, SKAN AG, Hosokawa micron ltd, Gelman Singapore, Azbil Corporation, Germfree Laboratories, Inc., M. Braun Inertgas-Systeme Gmbh, Nuaire, Iteco SRL, Comecer SPA, Hecht Technologie Gmbh, Steriline SRL, Envair Limited, Tema Sinergie SPA, Schematic Engineering Industries, Chiyoda Corporation, Chamunda Pharma Machinery Pvt. Ltd, Bioquell (Ecolab Solution), Jacomex, Fedegari Autoclavi SpA, LAF Technologies, ISO Tech Design, Cytiva, Esco Pharma 등이 있습니다. |

중동 및 아프리카 제약용 분리기 시장 정의

격리 개념은 작업자로부터 공정을 보호하고 작업자를 공정으로부터 보호하는 동시에 환경을 보호합니다. 격리의 핵심은 최소한의 노출입니다. 화합물에 대해 설정된 위험 수준 아래로 노출 범위를 제어함으로써 작업자와 환경이 적절하게 보호됩니다. 따라서 제품이 보호되고 따라서 주요 규제 문제가 해결됩니다. 제약 격리기는 무균 충전 및 독성 공정을 위해 제약 환경에서 사용되는 밀폐된 박테리아 인클로저입니다. 제품을 어깨 높이의 장갑을 한쪽 벽에 얹어 취급, 보관 또는 포장하는 완벽하게 무균인 주요 격리기로 만들어집니다. 제약 격리기는 제약 공정의 제어 및 격리를 가능하게 합니다. 제약 격리기의 작동에 필요한 조건은 무균 환경이며 생존 가능한 미생물이 없습니다. 제약 격리기는 생산 구역과 무균 환경이 별도의 위치에 배치되도록 합니다. 제약 산업 격리기는 무균 환경에서 제약 산업을 위한 클린룸과 비교할 때 비용 효율적이고 효율적입니다. 격리기 및 제한된 접근 장벽에 필요한 다양한 표준 인증 표준에 맞춰 미생물 및 약물 생산 공정 중에 통제된 분위기를 조성합니다. 제품, 작업자 및 환경을 동시에 보호합니다.

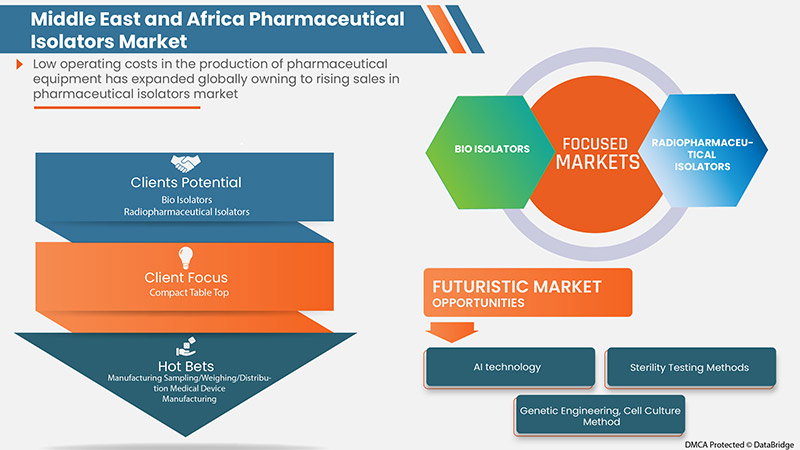

제약 분리기의 풍부한 응용 분야는 생산 및 제어 목적에 따라 다양합니다. 고체 반고체 또는 분말 제약 약물을 취급, 운반 또는 포장하고, 용액 및 주입액을 취급 및 보관하는 동안 사용됩니다. 제약 분리기는 무균 테스트, 조직 또는 생물학적 생산 시스템 또는 병원성 샘플의 무균 취급 등에 적용됩니다. 약물 및 제약 제품의 생산 및 제어에 사용할 수 있습니다. 제약 및 생명 공학 산업 전반에 걸친 분리기 수요 급증, 낮은 운영 비용, 제약 제품 생산 시 무균 조건의 높은 유지 관리 및 생물 제약 산업의 수요 증가는 예측 기간 동안 시장 성장을 주도할 것으로 예상되는 요인입니다.

또한, 시장 참여자들의 전략적 이니셔티브, 제약 아이솔레이터의 기술적 진보, 높은 살균성 보장 및 의료 인프라에 대한 투자 증가. 이러한 요소들은 제약 아이솔레이터 시장 수요를 증가시킵니다.

중동 및 아프리카 제약 아이솔레이터 시장 동향

이 섹션에서는 시장 동인, 이점, 기회, 제약 및 과제를 이해하는 것을 다룹니다. 이 모든 내용은 아래에서 자세히 설명합니다.

운전자

급성장하는 제약 산업에서 제약용 분리기에 대한 수요 증가

제약용 아이솔레이터는 제약용 시술이나 활동을 작업자와 인접한 환경으로부터 분리하는 분리 장치입니다. 다음과 같은 다양한 목적으로 사용됩니다.

- 어떤 활동이나 절차를 위한 분류된 무균 환경을 제공하고 작업자와 인접 환경에서 발생하는 미생물 및 비미생물 오염으로부터 보호하는 것을 제품 보호라고 합니다.

- 다른 제품 및 절차에 의해 생성된 오염으로부터 보호하는 제품, 또한 동시에 또는 이전 작업 중에. 이를 방법에서 생성된 오염 또는 교차 오염에 대한 보호라고 합니다.

제조 단위에서 오염 문제가 증가함에 따라 분리기가 필요하게 되었고, 이로 인해 오염과 오염 제거에 도움이 되는 제약 분리기에 대한 수요가 증가하고 있습니다.

- 제약용 분리기의 낮은 운영 비용

내부적으로 적격한 통제된 환경을 포함하는 일정 수준의 누출 방지로 밀봉된 인클로저는 주변 조건과 함께 변형되어 격리기 적용이 제약품 생산에 의한 R&D에서 실험실 사용, 특히 미생물 품질 관리를 위해 도달합니다. 반면 제약품 무균 생산은 무균 생산을 위한 거의 완전히 입자가 없고 세균이 없는 환경인 매우 높은 청결 기준을 가지고 있습니다.

제약 산업의 성장과 제품 범위 확대로 인해 점점 더 많은 제조업체와 공급업체가 클린룸 기술의 최신 추가 기술에 대한 투자를 고려해야 합니다.

제약 약물의 무균 처리가 정부 규정을 충족하는 GMP(Good Manufacturing Practices)에 포함되어야 하는 주요 요소입니다. 클린룸 기술로 무균 상태를 유지하는 데 드는 높은 비용은 제약 아이솔레이터보다 약 62% 더 높아 제조업체가 아이솔레이터 기술을 습득하도록 전환하고 제약 제품의 전체 제조 비용을 제한합니다.

제지

- 엄격한 정부 규제

제약용 활성 약제 성분(API)과 중간체(예: 생물학적, 방사성 약제학적, 제약학적) 및 임상 시험용 약물 생산에 사용되는 것은 식품의약품규정의 C부 1A조 및 2조에 따라 규제됩니다.

- 식품의약품규정 제1A부 C편에서는 API 시설 허가(EL)를 발급하기 전에 GMP(적정 제조 관리 기준) 준수가 요구되고 이를 입증해야 하는 활동을 설명합니다.

- 식품의약품규정 제2부 C편에서는 API 및 API 중간체의 GMP 요건을 정의하고 있으며, 본 지침서에서는 이에 대한 해석을 제시합니다.

정부의 엄격한 규제로 인해 API(활성 약제성분)에 대한 GMP(우수 제조 관리 기준) 가이드라인(GUI-0104)을 생산하기 위해 따라야 하며, 이는 시장 성장률을 제한합니다.

기회

-

시장 참여자들의 전략적 이니셔티브

제약 아이솔레이터 시장의 성장은 전략적 사업 아이디어에 대한 필요성을 증가시킵니다. 여기에는 파트너십, 사업 확장 및 기타 개발이 포함됩니다. 제약품에 대한 수요 증가는 부형제에 대한 수요를 크게 증가시키고 있으며 이러한 수요에 대처하기 위해 회사는 다른 전략적 이니셔티브와 함께 새로운 제조 시설을 건설하고 있습니다.

제품 출시, 계약 및 주요 시장 참여자의 사업 확장과 같은 이러한 전략적 이니셔티브는 약제학적 분리기 시장 성장을 촉진할 것이며 중동 및 아프리카 의료용 디스플레이 시장에 기회가 될 것으로 예상됩니다.

도전

숙련된 전문성 부족

숙련된 전문성의 부족은 한 곳에서 회복과 성장의 속도에 도전할 것입니다. 종종 한 곳에서 실업한 사람들은 다른 곳에서는 부족한 기술을 가지고 있습니다. 게다가 이 분야의 급속한 기술 발전은 전문성의 부족으로 이어집니다.

제약 아이솔레이터를 취급하는 동안 숙련된 전문가가 부족한 것은 제약 아이솔레이터를 선택하고 개발하는 동안 큰 과제를 안겨줍니다. Phys.org 2003의 데이터는 의료용 디스플레이 산업이 아시아 태평양 지역에서 제약 아이솔레이터에 대한 수요 증가와 LED 및 LCD 디스플레이에 사용되는 마이크로칩의 심각한 부족으로 인해 인력 부족에 직면해 있으며, 이로 인해 LCD 생산의 가격 리드 타임이 증가한다고 언급합니다.

기술 수요가 너무 높기 때문에 기술 전문 인력을 유지하고 관리하는 것이 과제로 나타났습니다. 게다가 기술 발전은 숙련된 전문가에 대한 수요 증가로 이어지는 또 다른 측면입니다. 신경과 의사는 지원적 치료의 필요성과 센터에서 충족되지 않은 장벽이 상당하다고 보고하며, 소수만이 스스로를 지원적 치료를 유능하게 제공한다고 평가합니다. 치매 치료를 위한 신경과 의사와 전문가 교육과 이용 가능한 지원적 치료 리소스 조달이 시급히 필요합니다. 훈련되고 경험이 풍부한 전문가의 부족과 지속적인 기술 격차는 취업 가능성과 양질의 일자리에 대한 접근성을 제한합니다. 따라서 적절한 기술을 갖춘 전문가의 가용성이 시장 성장에 도전할 것으로 예상됩니다.

COVID-19 이후 중동 및 아프리카 제약용 분리기 시장에 미치는 영향

COVID-19 팬데믹은 세계에서 가장 심각한 위협이 되었습니다. 전 세계의 많은 매장과 사업체에 엄청난 피해를 입혔습니다. 반면에 팬데믹은 제약 및 바이오제약 회사가 새로운 코로나바이러스에 대한 새로운 백신을 개발하기 위해 연구 개발 활동을 확대할 수 있는 많은 기회를 제공했습니다. 회사들은 COVID-19 바이러스의 확산을 막기 위해 임상 시험을 실시하고 있습니다. 바이오제약 기관에 제약 절연체를 공급하는 회사는 임상 시험의 수가 증가함에 따라 더 많은 기회를 갖게 됩니다.

Manufacturers are making various strategic decisions to bounce back post-COVID-19. The players are conducting multiple R&D activities and product launch and strategic partnerships to improve the technology and test results involved in the pharmaceutical medical display market.

Recent Developments

- In June 2022, the company announced a partnership with Medical Supply Company (MSC) to market and service Jacomex equipment to the pharmaceutical and pharmaceutical industries in Ireland. MSC has many years of recognized expertise in the market with field teams closest to customers and company’s commercial team currently working abroad had the pleasure of welcoming Cian Murphy and finalizing the agreement between Jacomex and MSC. The beginning of a long and fruitful collaboration. This has helped the company to expand their business.

- In January 2022, Clario partnered with XingImaging, a radiopharmaceutical production and positron emission tomography (PET) acquisition company, to deliver PET imaging clinical trials for testing novel therapeutics in China. The partnership offers to share the joint resources and neuroscience experts of Clario and XingImaging to expedite the startup of clinical trials and drug discovery in China.

Middle East & Africa Pharmaceutical isolator market Scope

Middle East & Africa pharmaceutical isolator market is segmented into type, pressure, application, configuration, system type, end user and distribution channel. The growth among segments helps you analyze niche pockets of growth and strategies to approach the market and determine your core application areas and the difference in your target markets.

MIDDLE EAST & AFRICA PHARMACEUTICAL ISOLATOR MARKET, BY TYPE

- ASEPTIC ISOLATORS

- CONTAINMENT ISOLATORS

- BIO ISOLATORS

- SAMPLING AND WEIGHING ISOLATORS

- ACTIVE PHARMACEUTICAL INGREDIENT (API) MANUFACTURING ISOLATORS

- RADIOPHARMACEUTICAL ISOLATORS

- PRODUCTION ISOLATORS

- OTHERS

On the basis of type, the Middle East & Africa pharmaceutical isolator market is segmented into aseptic isolators, containment isolators, bio isolators, sampling and weighing isolators, active pharmaceutical ingredient (API) manufacturing isolators, radiopharmaceutical isolators, production isolators, others.

MIDDLE EAST & AFRICA PHARMACEUTICAL ISOLATOR MARKET, BY SYSTEM TYPE

- CLOSED SYSTEM

- OPEN SYSTEM

On the basis of system type, the Middle East & Africa pharmaceutical isolator market is segmented into closed system, open system.

MIDDLE EAST & AFRICA PHARMACEUTICAL ISOLATOR MARKET, BY PRESSURE

- POSITIVE PRESSURE

- NEGATIVE PRESSURE

On the basis of pressure, the Middle East & Africa pharmaceutical isolator market is segmented into positive pressure and negative pressure.

MIDDLE EAST & AFRICA PHARMACEUTICAL ISOLATOR MARKET, BY CONFIGURATION

- FLOOR STANDING

- MODULAR

- MOBILE

- COMPACT

- TABLE TOP

- PORTABLE

- OTHERS

On the basis of configuration, the Middle East & Africa pharmaceutical isolator market is segmented into floor standing, modular, mobile, compact, table top, portable, others.

MIDDLE EAST & AFRICA PHARMACEUTICAL ISOLATOR MARKET, BY APPLICATION

- STERILITY TESTING

- MANUFACTURING

- SAMPLING/ WEIGHING/ DISTRIBUTION

- MEDICAL DEVICE MANUFACTURING

- OTHERS

On the basis of application, the Middle East & Africa pharmaceutical isolator market is segmented into sterility testing, manufacturing, sampling/ weighing/ distribution, medical device manufacturing, others.

MIDDLE EAST & AFRICA PHARMACEUTICAL ISOLATOR MARKET, BY END USER

- HOSPITALS

- DIAGNOSTIC LABORATORIES

- ACADEMIC AND RESEARCH INSTITUTES

- PHARMACEUTICAL AND BIOTECHNOLOGY COMPANIES

- CONTRACT RESEARCH ORGANIZATIONS

- OTHERS

On the basis of end user, the Middle East & Africa pharmaceutical isolator market is segmented into hospitals, diagnostic laboratories, academic and research institutes, pharmaceutical and biotechnology companies, contract research organizations, others.

MIDDLE EAST & AFRICA PHARMACEUTICAL ISOLATOR MARKET, BY DISTRIBUTION CHANNEL

- DIRECT TENDER

- RETAIL SALES

- THIRD PARTY DISTRIBUTORS

On the basis of distribution channel, the Middle East & Africa pharmaceutical isolator market is segmented into direct tender, retail sales, third party distributors.

Middle East & Africa Pharmaceutical Isolator Market Regional Analysis/Insights

The Middle East & Africa pharmaceutical isolator market is analyzed and market size information is provided type, pressure, application, configuration, system type, end user and distribution channel.

The countries covered in this market report South Africa, Saudi Arabia, UAE, Egypt, Israel and rest of the Middle East and Africa.

In 2022, South Africa is dominating due to technological advancements in the pharmaceutical isolator and increases in the future of robotics technology in the pharmaceutical isolator industry

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impact the current and future trends of the market. Data points such as new sales, replacement sales, country demographics, regulatory acts, and import-export tariffs are some of the major pointers used to forecast the market scenario for individual countries. Also, presence and availability of Middle East & Africa brands and their challenges faced due to large or scarce competition from local and domestic brands, and impact of sales channels are considered while providing forecast analysis of the country data.

Competitive Landscape and Middle East & Africa Pharmaceutical Isolator Market Share Analysis

중동 및 아프리카 제약 아이솔레이터 시장 경쟁 구도는 경쟁자별 세부 정보를 제공합니다. 포함된 세부 정보에는 회사 개요, 회사 재무, 창출된 수익, 시장 잠재력, R&D 투자, 새로운 시장 이니셔티브, 생산 현장 및 시설, 회사의 강점과 약점, 제품 출시, 제품 시험 파이프라인, 제품 승인, 특허, 제품 폭 및 호흡, 응용 프로그램 우세, 기술 수명선 곡선이 있습니다. 위에 제공된 데이터 포인트는 중동 및 아프리카 제약 아이솔레이터 시장에 대한 회사의 초점과만 관련이 있습니다.

중동 및 아프리카 제약용 분리기 시장에서 활동하는 주요 기업으로는 Getinge, SKAN AG, Hosokawa micron ltd, Gelman Singapore, Azbil Corporation, Germfree Laboratories, Inc., M. Braun Inertgas-Systeme Gmbh, Nuaire, Iteco SRL, Comecer SPA, Hecht Technologie Gmbh, Steriline SRL, Envair Limited, Tema Sinergie SPA, Schematic Engineering Industries, Chiyoda Corporation, Chamunda Pharma Machinery Pvt. Ltd, Bioquell (Ecolab Solution), Jacomex, Fedegari Autoclavi SpA, LAF Technologies, ISO Tech Design, Cytiva, Esco Pharma 등이 있습니다.

연구 방법론: 중동 및 아프리카 제약 아이솔레이터 시장

데이터 수집 및 기준 연도 분석은 대규모 샘플 크기의 데이터 수집 모듈을 사용하여 수행됩니다. 시장 데이터는 시장 통계 및 일관된 모델을 사용하여 분석 및 추정됩니다. 또한 시장 점유율 분석 및 주요 추세 분석은 시장 보고서의 주요 성공 요인입니다. DBMR 연구팀에서 사용하는 주요 연구 방법론은 데이터 마이닝, 시장에 대한 데이터 변수의 영향 분석 및 기본(산업 전문가) 검증을 포함하는 데이터 삼각 측량입니다. 이 외에도 데이터 모델에는 공급업체 포지셔닝 그리드, 시장 타임라인 분석, 시장 개요 및 가이드, 회사 포지셔닝 그리드, 회사 시장 점유율 분석, 측정 표준, 중동 및 아프리카 대 지역, 공급업체 점유율 분석이 포함됩니다. 추가 문의 사항이 있는 경우 분석가 전화를 요청하십시오.

SKU-

세계 최초의 시장 정보 클라우드 보고서에 온라인으로 접속하세요

- 대화형 데이터 분석 대시보드

- 높은 성장 잠재력 기회를 위한 회사 분석 대시보드

- 사용자 정의 및 질의를 위한 리서치 분석가 액세스

- 대화형 대시보드를 통한 경쟁자 분석

- 최신 뉴스, 업데이트 및 추세 분석

- 포괄적인 경쟁자 추적을 위한 벤치마크 분석의 힘 활용

목차

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE MIDDLE EAST & AFRICA PHARMACEUTICAL ISOLATOR MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 MULTIVARIATE MODELLING

2.7 MARKET APPLICATION COVERAGE GRID

2.8 SOURCE LIFELINE CURVE

2.9 DBMR MARKET POSITION GRID

2.1 VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHT

4.1 PESTEL ANALYSIS

4.2 PORTER’S FIVE FORCES

4.3 INDUSTRIAL INSIGHTS:

5 MIDDLE EAST & AFRICA PHARMACEUTICAL ISOLATORS MARKET: REGULATIONS

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 GROWING DEMAND FOR THE PHARMACEUTICAL ISOLATORS ACROSS BOOMING PHARMACEUTICAL

6.1.2 LOW OPERATIONAL COST OF PHARMACEUTICAL ISOLATORS

6.1.3 HIGH MAINTENANCE OF ASEPTIC CONDITIONS IN THE PRODUCTION OF PHARMACEUTICAL PRODUCTS

6.1.4 LOW OPERATING COST OF PHARMACEUTICAL ISOLATORS & GROWING DEMAND IN THE BIOPHARMACEUTICAL INDUSTRY

6.2 RESTRAINTS

6.2.1 STRINGENT GOVERNMENTAL REGULATIONS

6.2.2 HIGH COST OF INSTALLATION & LIMITED ADOPTION OF RABS

6.3 OPPORTUNITIES

6.3.1 STRATEGIC INITIATIVES BY MARKET PLAYERS

6.3.2 TECHNOLOGICAL ADVANCEMENTS IN PHARMACEUTICAL ISOLATORS

6.3.3 HIGH STERILITY ASSURANCE

6.4 CHALLENGES

6.4.1 LACK OF SKILLED EXPERTISE

6.4.2 ENGINEERING CHALLENGES FACED WHILE DESIGNING THE PHARMACEUTICAL ISOLATORS

7 MIDDLE EAST & AFRICA PHARMACEUTICAL ISOLATOR MARKET, BY TYPE

7.1 OVERVIEW

7.2 ASEPTIC ISOLATOR

7.3 ACTIVE PHARMACEUTICAL INGREDIENT (API) MANUFACTURING ISOLATORS

7.4 CONTAINMENT ISOLATORS

7.5 BIO ISOLATORS

7.6 SAMPLING AND WEIGHING ISOLATORS

7.7 RADIOPHARMACEUTICAL ISOLATORS

7.8 PRODUCTION ISOLATORS

7.9 OTHERS

8 MIDDLE EAST & AFRICA PHARMACEUTICAL ISOLATOR MARKET, BY SYSTEM TYPE

8.1 OVERVIEW

8.2 OPEN SYSTEM

8.3 CLOSED SYSTEM

9 MIDDLE EAST & AFRICA PHARMACEUTICAL ISOLATOR MARKET, BY PRESSURE

9.1 OVERVIEW

9.2 POSITIVE PRESSURE

9.3 NEGATIVE PRESSURE

10 MIDDLE EAST & AFRICA PHARMACEUTICAL ISOLATOR MARKET, BY CONFIGURATION

10.1 OVERVIEW

10.2 FLOOR STANDING

10.3 MODULAR

10.4 MOBILE

10.5 COMPACT

10.6 TABLE TOP

10.7 PORTABLE

10.8 OTHERS

11 MIDDLE EAST & AFRICA PHARMACEUTICAL ISOLATOR MARKET, BY APPLICATION

11.1 OVERVIEW

11.2 STERILITY TESTING

11.3 MANUFACTURING

11.4 SAMPLING/WEIGHING/DISTRIBUTION

11.5 MEDICAL DEVICE MANUFACTURING

12 MIDDLE EAST & AFRICA PHARMACEUTICAL ISOLATOR MARKET, BY DISTRIBUTION CHANNEL

12.1 OVERVIEW

12.2 DIRECT TENDER

12.3 RETAIL SALES

12.4 THIRD PARTY DISTRIBUTORS

13 MIDDLE EAST & AFRICA PHARMACEUTICAL ISOLATOR MARKET, BY END USER

13.1 OVERVIEW

13.2 PHARMACEUTICAL AND BIOTECHNOLOGY COMPANIES

13.2.1 STERILE FILTERING

13.2.2 AMPULE FILLING

13.2.3 SYRINGE FILLING

13.2.4 SAMPLING

13.2.5 SAMPLE TESTING

13.2.6 STERILITY TESTING

13.2.7 PACKAGING

13.2.8 OTHERS

13.3 CONTRACT RESEARCH ORGANIZATION

13.3.1 STERILE FILTERING

13.3.2 AMPULE FILLING

13.3.3 SYRINGE FILLING

13.3.4 SAMPLING

13.3.5 SAMPLE TESTING

13.3.6 STERILITY TESTING

13.3.7 PACKAGING

13.3.8 OTHERS

13.4 ACADEMIC AND RESEARCH INSTITUTES

13.4.1 STERILE FILTERING

13.4.2 AMPULE FILLING

13.4.3 SYRINGE FILLING

13.4.4 SAMPLING

13.4.5 SAMPLE TESTING

13.4.6 STERILITY TESTING

13.4.7 PACKAGING

13.4.8 OTHERS

13.5 HOSPITALS

13.5.1 STERILE FILTERING

13.5.2 AMPULE FILLING

13.5.3 SYRINGE FILLING

13.5.4 SAMPLING

13.5.5 SAMPLE TESTING

13.5.6 STERILITY TESTING

13.5.7 PACKAGING

13.5.8 OTHERS

13.6 DIAGNOSTIC LABORATORIES

13.6.1 STERILE FILTERING

13.6.2 AMPULE FILLING

13.6.3 SYRINGE FILLING

13.6.4 SAMPLING

13.6.5 SAMPLE TESTING

13.6.6 STERILITY TESTING

13.6.7 PACKAGING

13.6.8 OTHERS

13.7 OTHERS

14 MIDDLE EAST & AFRICA PHARMACEUTICAL ISOLATOR MARKET, BY REGION

14.1 MIDDLE EAST & AFRICA

14.1.1 SOUTH AFRICA

14.1.2 SAUDI ARABIA

14.1.3 U.A.E

14.1.4 EGYPT

14.1.5 ISRAEL

14.1.6 REST OF MIDDLE EAST AND AFRICA

15 MIDDLE EAST & AFRICA PHARMACEUTICAL ISOLATORS MARKET: COMPANY LANDSCAPE

15.1 COMPANY SHARE ANALYSIS: MIDDLE EAST & AFRICA

16 SWOT ANALYSIS

17 COMPANY PROFILE

17.1 GETINGE AB

17.1.1 COMPANY SNAPSHOT

17.1.2 REVENUE ANALYSIS

17.1.3 COMPANY SHARE ANALYSIS

17.1.4 PRODUCT PORTFOLIO

17.1.5 RECENT DEVELOPMENT

17.2 CYTIVA (A SUBSIDIARY OF DANAHER CORPORATION)

17.2.1 COMPANY SNAPSHOT

17.2.2 REVENUE ANALYSIS

17.2.3 COMPANY SHARE ANALYSIS

17.2.4 PRODUCT PORTFOLIO

17.2.5 RECENT DEVELOPMENT

17.3 AZBIL CORPORATION

17.3.1 COMPANY SNAPSHOT

17.3.2 REVENUE ANALYSIS

17.3.3 COMPANY SHARE ANALYSIS

17.3.4 PRODUCT PORTFOLIO

17.3.5 RECENT DEVELOPMENTS

17.4 CHIYODA CORPORATION

17.4.1 COMPANY SNAPSHOT

17.4.2 REVENUE ANALYSIS

17.4.3 COMPANY SHARE ANALYSIS

17.4.4 PRODUCT PORTFOLIO

17.4.5 RECENT DEVELOPMENT

17.5 HOSOKAWA MICRON LTD

17.5.1 COMPANY SNAPSHOT

17.5.2 COMPANY SHARE ANALYSIS

17.5.3 PRODUCT PORTFOLIO

17.5.4 RECENT DEVELOPMENTS

17.6 BIOQUELL, AN ECOLAB SOLUTION (A SUBSIDIARY OF ECOLAB)

17.6.1 COMPANY SNAPSHOT

17.6.2 REVENUE ANALYSIS

17.6.3 PRODUCT PORTFOLIO

17.6.4 RECENT DEVELOPMENT

17.7 CHAMUNDA PHARMA MACHNIERY

17.7.1 COMPANY SNAPSHOT

17.7.2 PRODUCT PORTFOLIO

17.7.3 RECENT DEVELOPMENTS

17.8 COMECER S.P.A. (A SUBSIDIARY OF ATS AUTOMATION TOOLS) (2021)

17.8.1 COMPANY SNAPSHOT

17.8.2 REVENUE ANALYSIS

17.8.3 PRODUCT PORTFOLIO

17.8.4 RECENT DEVELOPMENT

17.9 ENVAIR TECHNOLOGY

17.9.1 COMPANY SNAPSHOT

17.9.2 PRODUCT PORTFOLIO

17.9.3 RECENT DEVELOPMENTS

17.1 ESCO MICRO PTE. LTD

17.10.1 COMPANY SNAPSHOT

17.10.2 PRODUCT PORTFOLIO

17.10.3 RECENT DEVELOPMENT

17.11 FEDEGARI AUTOCLAVI S.P.A

17.11.1 COMPANY SNAPSHOT

17.11.2 PRODUCT PORTFOLIO

17.11.3 RECENT DEVELOPMENTS

17.12 GERMFREE LABORATORIES, INC.

17.12.1 COMPANY SNAPSHOT

17.12.2 PRODUCT PORTFOLIO

17.12.3 RECENT DEVELOPMENT

17.13 GELMAN SINGAPORE

17.13.1 COMPANY SNAPSHOT

17.13.2 PRODUCT PORTFOLIO

17.13.3 RECENT DEVELOPMENTS

17.14 HECT TECHNOLOGIE GMBH (2021)

17.14.1 COMPANY SNAPSHOT

17.14.2 PRODUCT PORTFOLIO

17.14.3 RECENT DEVELOPMENT

17.15 ISO TECH DESIGN

17.15.1 COMPANY SNAPSHOT

17.15.2 PRODUCT PORTFOLIO

17.15.3 RECENT DEVELOPMENTS

17.16 ITECO SRL

17.16.1 COMPANY SNAPSHOT

17.16.2 PRODUCT PORTFOLIO

17.16.3 RECENT DEVELOPMENT

17.17 JACOMEX

17.17.1 COMPANY SNAPSHOT

17.17.2 PRODUCT PORTFOLIO

17.17.3 RECENT DEVELOPMENT

17.18 LAF TECHNOLOGIES

17.18.1 COMPANY SNAPSHOT

17.18.2 PRODUCT PORTFOLIO

17.18.3 RECENT DEVELOPMENTS

17.19 MBRAUN.(2021)

17.19.1 COMPANY SNAPSHOT

17.19.2 PRODUCT PORTFOLIO

17.19.3 RECENT DEVELOPMENT

17.2 NUAIRE (A SUBSIDIARY OF GENUIT GROUP PLC)

17.20.1 COMPANY SNAPSHOT

17.20.2 REVENUE ANALYSIS

17.20.3 PRODUCT PORTFOLIO

17.20.4 RECENT DEVELOPMENTS

17.21 STERILINE (2021)

17.21.1 COMPANY SNAPSHOT

17.21.2 PRODUCT PORTFOLIO

17.21.3 RECENT DEVELOPMENTS

17.22 SCHEMATIC ENGINEERING INDUSTRY

17.22.1 COMPANY SNAPSHOT

17.22.2 PRODUCT PORTFOLIO

17.22.3 RECENT DEVELOPMENTS

17.23 SKAN AG

17.23.1 COMPANY SNAPSHOT

17.23.2 REVENUE ANALYSIS

17.23.3 PRODUCT PORTFOLIO

17.23.4 RECENT DEVELOPMENT

17.24 TEMA SINERGIE S.P.A

17.24.1 COMPANY SNAPSHOT

17.24.2 PRODUCT PORTFOLIO

17.24.3 RECENT DEVELOPMENTS

18 QUESTIONNAIRE

19 RELATED REPORTS

표 목록

TABLE 1 OPERATING COSTS FOR ASEPTIC PRODUCTION UNDER RABS OR ISOLATOR

TABLE 2 APPLICATION OF GUI-0104 TO API MANUFACTURING

TABLE 3 MIDDLE EAST & AFRICA PHARMACEUTICAL ISOLATOR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 4 MIDDLE EAST & AFRICA ASEPTIC ISOLATOR IN PHARMACEUTICAL ISOLATOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 5 MIDDLE EAST & AFRICA ACTIVE PHARMACEUTICAL INGREDIENT (API) MANUFACTURING ISOLATORS IN PHARMACEUTICAL ISOLATOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 6 MIDDLE EAST & AFRICA CONTAINMENT ISOLATORS IN PHARMACEUTICAL ISOLATOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 7 MIDDLE EAST & AFRICA BIO ISOLATORS IN PHARMACEUTICAL ISOLATOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 8 MIDDLE EAST & AFRICA SAMPLING AND WEIGHING ISOLATORS IN PHARMACEUTICAL ISOLATOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 9 MIDDLE EAST & AFRICA RADIOPHARMACEUTICAL ISOLATORS IN PHARMACEUTICAL ISOLATOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 10 MIDDLE EAST & AFRICA PRODUCTION ISOLATORS IN PHARMACEUTICAL ISOLATOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 11 MIDDLE EAST & AFRICA OTHERS IN PHARMACEUTICAL ISOLATOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 12 MIDDLE EAST & AFRICA PHARMACEUTICAL ISOLATOR MARKET, BY SYSTEM TYPE, 2020-2029 (USD MILLION)

TABLE 13 MIDDLE EAST & AFRICA OPEN SYSTEM IN PHARMACEUTICAL ISOLATOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 14 MIDDLE EAST & AFRICA CLOSED SYSTEM IN PHARMACEUTICAL ISOLATOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 15 MIDDLE EAST & AFRICA PHARMACEUTICAL ISOLATOR MARKET, BY PRESSURE, 2020-2029 (USD MILLION)

TABLE 16 MIDDLE EAST & AFRICA POSITIVE PRESSURE IN PHARMACEUTICAL ISOLATOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 17 MIDDLE EAST & AFRICA NEGATIVE PRESSURE IN PHARMACEUTICAL ISOLATOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 18 MIDDLE EAST & AFRICA PHARMACEUTICAL ISOLATOR MARKET, BY CONFIGURATION, 2020-2029 (USD MILLION)

TABLE 19 MIDDLE EAST & AFRICA FLOOR STANDING IN PHARMACEUTICAL ISOLATOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 20 MIDDLE EAST & AFRICA MODULAR IN PHARMACEUTICAL ISOLATOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 21 MIDDLE EAST & AFRICA MOBILE IN PHARMACEUTICAL ISOLATOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 22 MIDDLE EAST & AFRICA COMPACT IN PHARMACEUTICAL ISOLATOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 23 MIDDLE EAST & AFRICA TABLE TOP IN PHARMACEUTICAL ISOLATOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 24 MIDDLE EAST & AFRICA PORTABLE IN PHARMACEUTICAL ISOLATOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 25 MIDDLE EAST & AFRICA OTHERS IN PHARMACEUTICAL ISOLATOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 26 MIDDLE EAST & AFRICA PHARMACEUTICAL ISOLATOR MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 27 MIDDLE EAST & AFRICA STERILITY TESTING IN PHARMACEUTICAL ISOLATOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 28 MIDDLE EAST & AFRICA MANUFACTURING IN PHARMACEUTICAL ISOLATOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 29 MIDDLE EAST & AFRICA SAMPLING/WEIGHING/DISTRIBUTION IN PHARMACEUTICAL ISOLATOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 30 MIDDLE EAST & AFRICA MEDICAL DEVICE MANUFACTURING IN PHARMACEUTICAL ISOLATOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 31 MIDDLE EAST & AFRICA PHARMACEUTICAL ISOLATOR MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 32 MIDDLE EAST & AFRICA DIRECT TENDER IN PHARMACEUTICAL ISOLATOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 33 MIDDLE EAST & AFRICA RETAIL SALES INPHARMACEUTICAL ISOLATOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 34 MIDDLE EAST & AFRICA THIRD PARTY DISTRIBUTORS IN PHARMACEUTICAL ISOLATOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 35 MIDDLE EAST & AFRICA PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 36 MIDDLE EAST & AFRICA PHARMACEUTICAL AND BIOTECHNOLOGICAL COMPANIES IN PHARMACEUTICAL ISOLATOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 37 MIDDLE EAST & AFRICA PHARMACEUTICAL AND BIOTECHNOLOGY COMPANIES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 38 MIDDLE EAST & AFRICA CONTRACT RESEARCH ORGANIZATIONS IN PHARMACEUTICAL ISOLATOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 39 MIDDLE EAST & AFRICA CONTRACT RESEARCH ORGANIZATIONS IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 40 MIDDLE EAST & AFRICA ACADEMIC AND RESEARCH INSTITUTES IN PHARMACEUTICAL ISOLATOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 41 MIDDLE EAST & AFRICA ACADEMIC RESEARCH & INSTITUTES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 42 MIDDLE EAST & AFRICA HOSPITALS IN PHARMACEUTICAL ISOLATOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 43 MIDDLE EAST & AFRICA HOSPITALS IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 44 MIDDLE EAST & AFRICA DIAGNOSTIC LABARATORIES IN PHARMACEUTICAL ISOLATOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 45 MIDDLE EAST & AFRICA DIAGNOSTICS LABORATORIES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 46 MIDDLE EAST & AFRICA OTHERS IN PHARMACEUTICAL ISOLATOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 47 MIDDLE EAST AND AFRICA PHARMACEUTICAL ISOLATOR MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 48 MIDDLE EAST AND AFRICA PHARMACEUTICAL ISOLATOR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 49 MIDDLE EAST AND AFRICA PHARMACEUTICAL ISOLATOR MARKET, BY SYSTEM TYPE, 2020-2029 (USD MILLION)

TABLE 50 MIDDLE EAST AND AFRICA PHARMACEUTICAL ISOLATOR MARKET, BY PRESSURE, 2020-2029 (USD MILLION)

TABLE 51 MIDDLE EAST AND AFRICA PHARMACEUTICAL ISOLATOR MARKET, BY CONFIGURATION, 2020-2029 (USD MILLION)

TABLE 52 MIDDLE EAST AND AFRICA PHARMACEUTICAL ISOLATOR MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 53 MIDDLE EAST AND AFRICA PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 54 MIDDLE EAST AND AFRICA PHARMACEUTICAL AND BIOTECHNOLOGY COMPANIES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 55 MIDDLE EAST AND AFRICA CONTRACT RESEARCH ORGANIZATIONS IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 56 MIDDLE EAST AND AFRICA ACADEMIC RESEARCH & INSTITUTES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 57 MIDDLE EAST AND AFRICA HOSPITALS LABORATORIES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 58 MIDDLE EAST AND AFRICA DIAGNOSTICS IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 59 MIDDLE EAST AND AFRICA PHARMACEUTICAL ISOLATOR MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 60 SOUTH AFRICA PHARMACEUTICAL ISOLATOR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 61 SOUTH AFRICA PHARMACEUTICAL ISOLATOR MARKET, BY SYSTEM TYPE, 2020-2029 (USD MILLION)

TABLE 62 SOUTH AFRICA PHARMACEUTICAL ISOLATOR MARKET, BY PRESSURE, 2020-2029 (USD MILLION)

TABLE 63 SOUTH AFRICA PHARMACEUTICAL ISOLATOR MARKET, BY CONFIGURATION, 2020-2029 (USD MILLION)

TABLE 64 SOUTH AFRICA PHARMACEUTICAL ISOLATOR MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 65 SOUTH AFRICA PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 66 SOUTH AFRICA PHARMACEUTICAL AND BIOTECHNOLOGY COMPANIES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 67 SOUTH AFRICA CONTRACT RESEARCH ORGANIZATIONS IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 68 SOUTH AFRICA ACADEMIC RESEARCH & INSTITUTES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 69 SOUTH AFRICA HOSPITALS LABORATORIES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 70 SOUTH AFRICA DIAGNOSTICS IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 71 SOUTH AFRICA PHARMACEUTICAL ISOLATOR MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 72 SAUDI ARABIA PHARMACEUTICAL ISOLATOR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 73 SAUDI ARABIA PHARMACEUTICAL ISOLATOR MARKET, BY SYSTEM TYPE, 2020-2029 (USD MILLION)

TABLE 74 SAUDI ARABIA PHARMACEUTICAL ISOLATOR MARKET, BY PRESSURE, 2020-2029 (USD MILLION)

TABLE 75 SAUDI ARABIA PHARMACEUTICAL ISOLATOR MARKET, BY CONFIGURATION, 2020-2029 (USD MILLION)

TABLE 76 SAUDI ARABIA PHARMACEUTICAL ISOLATOR MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 77 SAUDI ARABIA PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 78 SAUDI ARABIA PHARMACEUTICAL AND BIOTECHNOLOGY COMPANIES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 79 SAUDI ARABIA CONTRACT RESEARCH ORGANIZATIONS IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 80 SAUDI ARABIA ACADEMIC RESEARCH & INSTITUTES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 81 SAUDI ARABIA HOSPITALS LABORATORIES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 82 SAUDI ARABIA DIAGNOSTICS IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 83 SAUDI ARABIA PHARMACEUTICAL ISOLATOR MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 84 UAE PHARMACEUTICAL ISOLATOR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 85 UAE PHARMACEUTICAL ISOLATOR MARKET, BY SYSTEM TYPE, 2020-2029 (USD MILLION)

TABLE 86 UAE PHARMACEUTICAL ISOLATOR MARKET, BY PRESSURE, 2020-2029 (USD MILLION)

TABLE 87 UAE PHARMACEUTICAL ISOLATOR MARKET, BY CONFIGURATION, 2020-2029 (USD MILLION)

TABLE 88 UAE PHARMACEUTICAL ISOLATOR MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 89 UAE PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 90 UAE PHARMACEUTICAL AND BIOTECHNOLOGY COMPANIES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 91 UAE CONTRACT RESEARCH ORGANIZATIONS IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 92 UAE ACADEMIC RESEARCH & INSTITUTES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 93 UAE HOSPITALS LABORATORIES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 94 UAE DIAGNOSTICS IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 95 UAE PHARMACEUTICAL ISOLATOR MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 96 EGYPT PHARMACEUTICAL ISOLATOR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 97 EGYPT PHARMACEUTICAL ISOLATOR MARKET, BY SYSTEM TYPE, 2020-2029 (USD MILLION)

TABLE 98 EGYPT PHARMACEUTICAL ISOLATOR MARKET, BY PRESSURE, 2020-2029 (USD MILLION)

TABLE 99 EGYPT PHARMACEUTICAL ISOLATOR MARKET, BY CONFIGURATION, 2020-2029 (USD MILLION)

TABLE 100 EGYPT PHARMACEUTICAL ISOLATOR MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 101 EGYPT PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 102 EGYPT PHARMACEUTICAL AND BIOTECHNOLOGY COMPANIES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 103 EGYPT CONTRACT RESEARCH ORGANIZATIONS IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 104 EGYPT ACADEMIC RESEARCH & INSTITUTES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 105 EGYPT HOSPITALS LABORATORIES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 106 EGYPT DIAGNOSTICS IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 107 EGYPT PHARMACEUTICAL ISOLATOR MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 108 ISRAEL PHARMACEUTICAL ISOLATOR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 109 ISRAEL PHARMACEUTICAL ISOLATOR MARKET, BY SYSTEM TYPE, 2020-2029 (USD MILLION)

TABLE 110 ISRAEL PHARMACEUTICAL ISOLATOR MARKET, BY PRESSURE, 2020-2029 (USD MILLION)

TABLE 111 ISRAEL PHARMACEUTICAL ISOLATOR MARKET, BY CONFIGURATION, 2020-2029 (USD MILLION)

TABLE 112 ISRAEL PHARMACEUTICAL ISOLATOR MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 113 ISRAEL PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 114 ISRAEL PHARMACEUTICAL AND BIOTECHNOLOGY COMPANIES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 115 ISRAEL CONTRACT RESEARCH ORGANIZATIONS IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 116 ISRAEL ACADEMIC RESEARCH & INSTITUTES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 117 ISRAEL HOSPITALS LABORATORIES IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 118 ISRAEL DIAGNOSTICS IN PHARMACEUTICAL ISOLATOR MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 119 ISRAEL PHARMACEUTICAL ISOLATOR MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 120 REST OF MIDDLE EAST AND AFRICA PHARMACEUTICAL ISOLATOR MARKET, BY TYPE, 2020-2029 (USD MILLION)

그림 목록

FIGURE 1 MIDDLE EAST & AFRICA PHARMACEUTICAL ISOLATOR MARKET: SEGMENTATION

FIGURE 2 MIDDLE EAST & AFRICA PHARMACEUTICAL ISOLATOR MARKET: DATA TRIANGULATION

FIGURE 3 MIDDLE EAST & AFRICA PHARMACEUTICAL ISOLATOR MARKET: DROC ANALYSIS

FIGURE 4 MIDDLE EAST & AFRICA PHARMACEUTICAL ISOLATOR MARKET: REGIONAL VS COUNTRY MARKET ANALYSIS

FIGURE 5 MIDDLE EAST & AFRICA PHARMACEUTICAL ISOLATOR MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 MIDDLE EAST & AFRICA PHARMACEUTICAL ISOLATOR MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 MIDDLE EAST & AFRICA PHARMACEUTICAL ISOLATOR MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 8 MIDDLE EAST & AFRICA PHARMACEUTICAL ISOLATOR MARKET: DBMR MARKET POSITION GRID

FIGURE 9 MIDDLE EAST & AFRICA PHARMACEUTICAL ISOLATOR MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 MIDDLE EAST & AFRICA PHARMACEUTICAL ISOLATOR MARKET: SEGMENTATION

FIGURE 11 INCREASING USE OF PHARMACEUTICAL ISOLATORS IS EXPECTED TO DRIVE THE MIDDLE EAST & AFRICA PHARMACEUTICAL ISOLATOR MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 ASEPTIC ISOLATORS IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE MIDDLE EAST & AFRICA PHARMACEUTICAL ISOLATOR MARKET IN 2022 & 2029

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE MIDDLE EAST & AFRICA PHARMACEUTICAL ISOLATOR MARKET

FIGURE 14 MIDDLE EAST & AFRICA PHARMACEUTICAL ISOLATOR MARKET: BY TYPE, 2021

FIGURE 15 MIDDLE EAST & AFRICA PHARMACEUTICAL ISOLATOR MARKET: BY TYPE, 2022-2029 (USD MILLION)

FIGURE 16 MIDDLE EAST & AFRICA PHARMACEUTICAL ISOLATOR MARKET: BY TYPE, CAGR (2022-2029)

FIGURE 17 MIDDLE EAST & AFRICA PHARMACEUTICAL ISOLATOR MARKET: BY TYPE, LIFELINE CURVE

FIGURE 18 MIDDLE EAST & AFRICA PHARMACEUTICAL ISOLATOR MARKET: BY SYSTEM TYPE, 2021

FIGURE 19 MIDDLE EAST & AFRICA PHARMACEUTICAL ISOLATOR MARKET: BY SYSTEM TYPE, 2022-2029 (USD MILLION)

FIGURE 20 MIDDLE EAST & AFRICA PHARMACEUTICAL ISOLATOR MARKET: BY SYSTEM TYPE, CAGR (2022-2029)

FIGURE 21 MIDDLE EAST & AFRICA PHARMACEUTICAL ISOLATOR MARKET: BY SYSTEM TYPE, LIFELINE CURVE

FIGURE 22 MIDDLE EAST & AFRICA PHARMACEUTICAL ISOLATOR MARKET: BY PRESSURE, 2021

FIGURE 23 MIDDLE EAST & AFRICA PHARMACEUTICAL ISOLATOR MARKET: BY PRESSURE, 2022-2029 (USD MILLION)

FIGURE 24 MIDDLE EAST & AFRICA PHARMACEUTICAL ISOLATOR MARKET: BY PRESSURE, CAGR (2022-2029)

FIGURE 25 MIDDLE EAST & AFRICA PHARMACEUTICAL ISOLATOR MARKET: BY PRESSURE, LIFELINE CURVE

FIGURE 26 MIDDLE EAST & AFRICA PHARMACEUTICAL ISOLATOR MARKET: BY CONFIGURATION, 2021

FIGURE 27 MIDDLE EAST & AFRICA PHARMACEUTICAL ISOLATOR MARKET: BY CONFIGURATION, 2022-2029 (USD MILLION)

FIGURE 28 MIDDLE EAST & AFRICA PHARMACEUTICAL ISOLATOR MARKET: BY CONFIGURATION, CAGR (2022-2029)

FIGURE 29 MIDDLE EAST & AFRICA PHARMACEUTICAL ISOLATOR MARKET: BY CONFIGURATION, LIFELINE CURVE

FIGURE 30 MIDDLE EAST & AFRICA PHARMACEUTICAL ISOLATOR MARKET: BY APPLICATION, 2021

FIGURE 31 MIDDLE EAST & AFRICAPHARMACEUTICAL ISOLATOR MARKET: BY APPLICATION, 2022-2029 (USD MILLION)

FIGURE 32 MIDDLE EAST & AFRICA PHARMACEUTICAL ISOLATOR MARKET: BY APPLICATION, CAGR (2022-2029)

FIGURE 33 MIDDLE EAST & AFRICA PHARMACEUTICAL ISOLATOR MARKET: BY APPLICATION, LIFELINE CURVE

FIGURE 34 MIDDLE EAST & AFRICA PHARMACEUTICAL ISOLATOR MARKET: BY DISTRIBUTION CHANNEL, 2021

FIGURE 35 MIDDLE EAST & AFRICAPHARMACEUTICAL ISOLATOR MARKET: BY DISTRIBUTION CHANNEL, 2022-2029 (USD MILLION)

FIGURE 36 MIDDLE EAST & AFRICAPHARMACEUTICAL ISOLATOR MARKET: BY DISTRIBUTION CHANNEL, CAGR (2022-2029)

FIGURE 37 MIDDLE EAST & AFRICAPHARMACEUTICAL ISOLATOR MARKET: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 38 MIDDLE EAST & AFRICA PHARMACEUTICAL ISOLATOR MARKET : BY END USER, 2021

FIGURE 39 MIDDLE EAST & AFRICA PHARMACEUTICAL ISOLATOR MARKET : BY END USER, 2022-2029 (USD MILLION)

FIGURE 40 MIDDLE EAST & AFRICA PHARMACEUTICAL ISOLATOR MARKET : BY END USER, CAGR (2022-2029)

FIGURE 41 MIDDLE EAST & AFRICA PHARMACEUTICAL ISOLATOR MARKET : BY END USER, LIFELINE CURVE

FIGURE 42 MIDDLE EAST & AFRICA PHARMACEUTICAL ISOLATOR MARKET: SNAPSHOT (2021)

FIGURE 43 MIDDLE EAST & AFRICA PHARMACEUTICAL ISOLATOR MARKET: BY COUNTRY (2021)

FIGURE 44 MIDDLE EAST & AFRICA PHARMACEUTICAL ISOLATOR MARKET: BY COUNTRY (2022 & 2029)

FIGURE 45 MIDDLE EAST & AFRICA PHARMACEUTICAL ISOLATOR MARKET: BY COUNTRY (2021 & 2029)

FIGURE 46 MIDDLE EAST & AFRICA PHARMACEUTICAL ISOLATOR MARKET: TYPE (2022-2029)

FIGURE 47 MIDDLE EAST & AFRICA PHARMACEUTICAL ISOLATORS MARKET: COMPANY SHARE 2021 (%)

연구 방법론

데이터 수집 및 기준 연도 분석은 대규모 샘플 크기의 데이터 수집 모듈을 사용하여 수행됩니다. 이 단계에는 다양한 소스와 전략을 통해 시장 정보 또는 관련 데이터를 얻는 것이 포함됩니다. 여기에는 과거에 수집한 모든 데이터를 미리 검토하고 계획하는 것이 포함됩니다. 또한 다양한 정보 소스에서 발견되는 정보 불일치를 검토하는 것도 포함됩니다. 시장 데이터는 시장 통계 및 일관된 모델을 사용하여 분석하고 추정합니다. 또한 시장 점유율 분석 및 주요 추세 분석은 시장 보고서의 주요 성공 요인입니다. 자세한 내용은 분석가에게 전화를 요청하거나 문의 사항을 드롭하세요.

DBMR 연구팀에서 사용하는 주요 연구 방법론은 데이터 마이닝, 시장에 대한 데이터 변수의 영향 분석 및 주요(산업 전문가) 검증을 포함하는 데이터 삼각 측량입니다. 데이터 모델에는 공급업체 포지셔닝 그리드, 시장 타임라인 분석, 시장 개요 및 가이드, 회사 포지셔닝 그리드, 특허 분석, 가격 분석, 회사 시장 점유율 분석, 측정 기준, 글로벌 대 지역 및 공급업체 점유율 분석이 포함됩니다. 연구 방법론에 대해 자세히 알아보려면 문의를 통해 업계 전문가에게 문의하세요.

사용자 정의 가능

Data Bridge Market Research는 고급 형성 연구 분야의 선두 주자입니다. 저희는 기존 및 신규 고객에게 목표에 맞는 데이터와 분석을 제공하는 데 자부심을 느낍니다. 보고서는 추가 국가에 대한 시장 이해(국가 목록 요청), 임상 시험 결과 데이터, 문헌 검토, 재생 시장 및 제품 기반 분석을 포함하도록 사용자 정의할 수 있습니다. 기술 기반 분석에서 시장 포트폴리오 전략에 이르기까지 타겟 경쟁업체의 시장 분석을 분석할 수 있습니다. 귀하가 원하는 형식과 데이터 스타일로 필요한 만큼 많은 경쟁자를 추가할 수 있습니다. 저희 분석가 팀은 또한 원시 엑셀 파일 피벗 테이블(팩트북)로 데이터를 제공하거나 보고서에서 사용 가능한 데이터 세트에서 프레젠테이션을 만드는 데 도움을 줄 수 있습니다.