일본 전자상거래 포장 시장, 제품별(상자, 보호 포장, 보안 봉투, 테이프 및 라벨, 패킷, 버블 랩 , 기타), 재료(유리, 종이, 목재, 플라스틱, 금속, 기타), 인쇄 기술(플렉소 인쇄, 디지털 인쇄, 리소 라미네이트 인쇄, 오프셋 리소그래피, 디지털 인쇄, 기타), 응용 분야(전자 및 소비재, 의류 및 액세서리, 화장품, 가정 관리 및 개인 관리, 식품 및 음료, 가구, 자동차 부품, 의료, 레크리에이션 제품, 기타), 최종 사용자(전통적인 전자상거래 소매업체, 제3자 및 물류 회사, 오프라인 소매업체, 특수 소매업체, 기타) 산업 동향 및 2029년까지의 예측

시장 분석 및 규모

패키징은 회사가 전자상거래 제품을 활용할 수 있는 플랫폼을 개발했습니다. 이 회사는 또한 크거나 작은 골판지에 명확하게 인쇄하는 수단을 확립했습니다. 이를 통해 평판 인쇄 라벨을 인쇄할 필요가 없고 시간과 비용을 절약할 수 있습니다. 친환경적이며 서비스에 따르면 보드에 직접 인쇄하면 재활용할 수 있습니다. 이 주문 및 유통 시스템을 통해 점점 더 많은 사용자와 템플릿을 쉽게 변경할 수 있으며 전자상거래 패키징의 타사 광고에서 큰 잠재력을 발휘할 수 있습니다. 물건이 더 호화롭게 배송될수록 외관이 더 놀랍습니다. 이는 보호를 보장하고 도난을 방지하기 위해 패키지의 가치에 대한 힌트를 제공하지 않기 위해 달성됩니다. 이러한 경우 패키지 내부에 여전히 아름답게 쓰여진 그래픽이 있습니다. 패키지를 열 경우에만 공개됩니다.

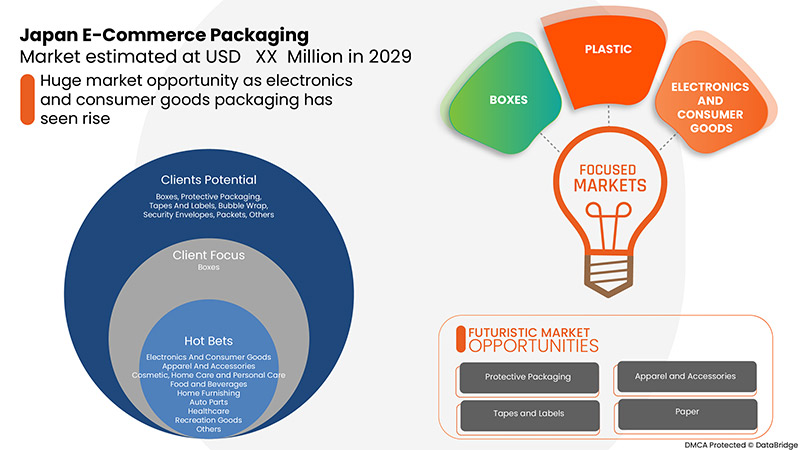

편의성과 스마트 패키징의 인기 증가로 인해 온라인으로 쇼핑 선호도가 바뀌는 것은 시장에서 전자상거래 패키징 수요를 증가시킬 것으로 예상되는 요인 중 일부입니다. Data Bridge Market Research는 전자상거래 패키징 시장이 예측 기간 동안 16.0%의 CAGR로 2029년까지 13,396.98백만 달러에 도달할 것으로 분석합니다. "상자"는 전자상거래 패키징 수요 증가로 인해 해당 시장에서 가장 눈에 띄는 제품 세그먼트를 차지합니다. Data Bridge Market Research 팀이 큐레이팅한 시장 보고서에는 심층적인 전문가 분석, 수입/수출 분석, 가격 분석, 생산 소비 분석 및 기후 사슬 시나리오가 포함되어 있습니다.

|

보고서 메트릭 |

세부 |

|

예측 기간 |

2022년부터 2029년까지 |

|

기준 연도 |

2021 |

|

역사적 연도 |

2020 (2019-2014까지 사용자 정의 가능) |

|

양적 단위 |

매출(백만 달러), 볼륨(백만 단위) |

|

다루는 세그먼트 |

제품별(상자, 보호 포장, 보안 봉투, 테이프 및 라벨, 패킷, 버블 랩, 기타), 재료(유리, 종이, 목재, 플라스틱, 금속, 기타), 인쇄 기술(플렉소 인쇄, 디지털 인쇄, 리소 라미네이트 인쇄, 오프셋 리소그래피, 디지털 인쇄, 기타), 응용 분야(전자 및 소비재, 의류 및 액세서리, 화장품, 가정 관리 및 개인 관리, 식품 및 음료, 가구, 자동차 부품, 의료, 레크리에이션 제품, 기타), 최종 사용자(전통적인 전자 상거래 소매업체, 제3자 및 물류 회사, 오프라인 소매업체, 특수 소매업체, 기타) |

|

국가 커버 |

일본 |

|

시장 참여자 포함 |

International Paper(테네시, 미국), NIPPON PAPER INDUSTRIES CO., LTD.(도쿄, 일본), Mondi(애들스톤, 영국), Amcor Plc(취리히, 스위스), Sealed Air(노스캐롤라이나, 미국), Rengo Co., Ltd.(오사카, 일본), AptarGroup, Inc.(일리노이, 미국), WestRock Company(조지아, 미국), Yamakoh, Co., Ltd.(교토, 일본), CHUOH PACK INDUSTRY CO., LTD.(혼슈, 일본), Holmen Iggesund(이게순드, 스웨덴) 등이 있습니다. |

시장 정의

전자상거래 포장은 브랜딩의 필수적인 부분입니다. 특정 브랜드와 처음 접촉하는 고객은 종종 온라인 쇼핑을 할 때 배달된 패키지를 만집니다. 이는 회사가 좋은 영향을 미치고 브랜드 이미지를 강화하거나 망칠 수 있는 드문 기회입니다. 깨지거나 품질이 좋지 않은 포장으로 인해 프리미엄 포장은 고객의 충성도를 높일 수 있습니다. 최근 제3자 온라인 리테일러가 자사 제품에 광고를 냄으로써 더욱 강화되었습니다. 업계 전문가들은 다른 리테일 매장과 유통업체가 이 모델을 채택할 것으로 예상합니다. 포장은 수익을 늘리고 혁신적인 형태의 크로스 브랜딩과 마케팅을 통합할 것입니다.

규제 프레임워크

일본의 포장 및 라벨링 규정 - 세관 서비스는 포장 및 라벨링 의 품질에 대해 매우 까다롭습니다 . 올바른 포장, 표시 및 라벨링은 일본에서 원활한 통관을 위해 중요합니다. 일반적으로 대부분의 수입 제품에 대한 라벨링은 통관 단계에서 필요하지 않고 판매 시점에서 필요합니다. 결과적으로 일본 수입업체가 통관을 마친 후 수입 제품에 라벨을 붙이는 것이 일반적입니다. 일본에서는 밀짚으로 포장하는 것이 금지되어 있습니다.

COVID-19는 전자상거래 포장 시장에 최소한의 영향을 미쳤습니다.

COVID-19 팬데믹으로 인해 바이러스 확산을 막기 위해 전 세계 여러 지역에서 갑작스럽게 봉쇄가 이루어졌고, 이로 인해 공장, 상점 등이 빠르게 문을 닫았습니다. 수요와 공급이 급격히 감소하고 여행 금지령이 내려지면서 전 세계적으로 비필수 제품 시장이 침체되었습니다. 이 팬데믹은 수요 감소, 공장 직원 부족, 여행 금지령으로 원자재가 부족해져 전자상거래 포장 제품 생산이 중단되면서 경제에 상당한 부정적 영향을 미쳤습니다. 그러나 봉쇄가 완화되고 일본에서 백신 접종이 진행되면서 워크플로가 늘어나기 시작하여 시장 참여자들이 다시 일어설 수 있었습니다. 경제 성장과 신생 기업 증가에 대한 정부 규제와 지원으로 인해 예측 기간 동안 일본의 전자상거래 포장 시장 가치가 급등할 것으로 예상됩니다. 전자상거래 포장에 대한 수요는 온라인 쇼핑이 증가하면서 팬데믹 동안 증가했지만 공급망 중단으로 인해 어느 정도 성장이 방해받았습니다.

전자상거래 포장 시장의 시장 역학은 다음과 같습니다.

전자상거래 포장 시장의 동인/기회

- 편의성으로 인해 온라인 쇼핑 선호도 변화

편의성은 전자상거래의 초석이며 지난 몇 년 동안 온라인 쇼핑이 부상한 주요 이유입니다. 온라인 쇼핑은 구매를 위해 선택한 돈의 방법을 제공하며, 적절한 경우 편리한 프로세스를 사용하여 품목을 수령할 수도 있습니다.

- 전자제품용 2차 포장 및 보호 포장 수요 증가

전자상거래가 기존 유통망에서 분산된 고객망으로 전환됨에 따라 다양한 기준을 충족하기 위한 직접 이행을 제공하는 현대적인 이니셔티브 시스템이 만들어지고 있습니다. 이러한 변환이 더 잘 이해됨에 따라 대응 전략 개발이 개선될 것입니다. 의도치 않은 영향을 피하는 것이 여전히 필수적입니다. 이를 위해 공급망을 둘러싼 커뮤니케이션과 조정이 중요합니다. 업계는 협력하여 이 기회를 활용하여 개발 초기부터 지속 가능성을 공급망에 통합할 수 있습니다.

- 스마트 패키징의 인기 증가

소비자는 도구를 사용하지 않고도 쉽게 열 수 있는 지능형 개봉 및 패키지를 기대합니다. 찢어진 스트립이 선호되며 패키지는 개봉되어야 합니다. 상품은 잘 전달되어야 하며, 특히 누군가가 특별히 패키지를 포장했다는 인상을 전달하는 개인적인 터치가 있어야 합니다. 제품은 과도한 충전재나 공간 없이 완벽하게 도착해야 하며, 잘 보호되어야 합니다. 이는 소비자가 제품과 포장과 관련하여 지속 가능한 솔루션을 찾고 있기 때문에 특히 중요합니다.

- 코로나19 팬데믹으로 식료품 쇼핑 의존도 전자상거래로 높아져

세계가 COVID-19 위기에서 본 적이 없는 것과는 달리, 국가, 기관 및 기업 리더들은 전례 없는 불확실성 수준으로 어려운 선택에 직면해 있습니다. 단기적으로는 방향성이 중요하며, 위기가 더 명확해지고 사회적, 경제적 질서가 지속적으로 형성될 것입니다. 최근의 많은 재난의 경우 미래가 상황이 되었습니다. 우리가 일하고, 배우고, 쇼핑하고, 기술을 사용함에 따라 사회 트렌드가 빠르게 변화하고 있습니다. 이러한 발전은 위기 이전에 이미 형성되었지만, 우리는 새로운 정상 위기에 기여하는 에스컬레이션을 봅니다. 단기적인 반응이 살아가는 데 중요하지만, 승자는 장기적으로 차지될 것입니다.

전자상거래 포장 시장이 직면한 제약/과제

- 전자상거래 회사의 포장 비용 증가로 인해 최종 수익이 감소했습니다.

소비자는 영향을 훨씬 더 잘 알게 되고, 회사에서 운영의 영향을 상쇄하기 위해 무엇을 하려는지에 대한 결정을 내리고 싶어합니다. 그러나 이를 위해 평균 포장 가격 상승의 원인과 상쇄할 수 있는 다양한 측면을 고려해야 합니다. 사용 가능한 부가가치 서비스를 활용하고, 포장 기능을 더 어렵게 만들고, 최적의 품질을 보장하고, 수용 가능한 부가가치 서비스를 활용하는 것이 중요합니다.

- 비용 대비 이익 비율은 제조업체의 관심사입니다.

기업은 인터넷 전자 서비스(e-서비스)를 사용하여 고객을 유치하고, 비즈니스 정보를 공유하고, 비즈니스 링크를 유지하고, 비즈니스 거래를 수행합니다. e-서비스 사용의 초기 단계에서는 조직이 기업 및 사회적 영향에 대한 사실과 인식이 없습니다. 기업은 또한 수년간의 e-서비스 경험을 통해 유사한 전문 지식을 습득했습니다. e-서비스를 채택하는 이점에 비해 서비스를 온라인으로 이전하는 비용을 평가하고 e-서비스를 혁신적으로 활용하여 e-서비스가 고객과 기업 관계에 미치는 영향을 파악하는 것이 시급히 필요합니다.

최근 개발 사항

- 2022년 3월, Rengo Co., Ltd.는 일본 인쇄 산업 연합이 후원하는 제61회 일본 포장 대회(2022JPC)에서 2개 부문에서 3개 상을 수상했습니다. 이 성과는 회사가 세계적인 인정을 받는 데 도움이 될 것입니다.

- 2022년 4월, Amcor Rigid Packaging(ARP)과 Danone은 Villavicencio 워터 브랜드를 위해 100% 재활용 가능한 병을 출시했습니다. 이 병은 100% 재활용 소재로 만들어졌으며 기존 병에 비해 탄소 발자국이 21% 감소했습니다. 이 개발은 혁신적인 제품을 찾는 새로운 고객을 유치할 것입니다.

일본 전자상거래 포장 시장 범위

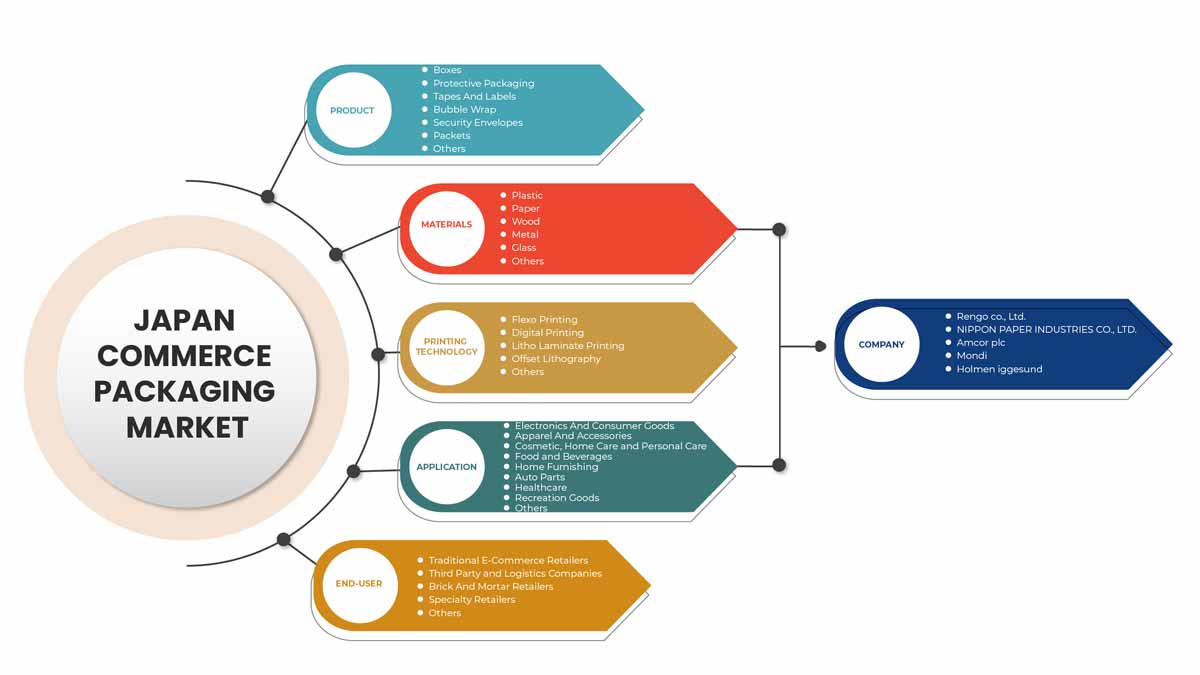

전자상거래 포장 시장은 제품, 소재, 인쇄 기술, 응용 분야 및 최종 사용자를 기준으로 세분화됩니다. 이러한 세그먼트 간의 성장은 산업의 빈약한 성장 세그먼트를 분석하고 사용자에게 핵심 시장 응용 분야를 식별하기 위한 전략적 결정을 내리는 데 도움이 되는 귀중한 시장 개요와 시장 통찰력을 제공하는 데 도움이 됩니다.

제품

- 상자

- 보호 포장

- 테이프와 라벨

- 버블랩

- 보안 봉투

- 패킷

- 기타

일본 전자상거래 포장 시장은 제품을 기준으로 상자, 보호 포장, 보안 봉투, 테이프 및 라벨, 패킷, 버블랩, 기타로 구분됩니다.

재료

- 플라스틱

- 종이

- 목재

- 금속

- 유리

일본 전자상거래 포장 시장은 재료를 기준으로 유리, 종이, 목재, 플라스틱, 금속 등으로 구분됩니다.

인쇄 기술

- 플렉소 인쇄

- 디지털 인쇄

- 리소 라미네이트 인쇄

- 오프셋 리소그래피

- 기타

일본의 전자상거래 포장 시장은 인쇄 기술을 기준으로 플렉소 인쇄, 디지털 인쇄, 리소 라미네이트 인쇄, 오프셋 인쇄, 디지털 인쇄 및 기타로 구분됩니다.

애플리케이션

- 전자제품 및 소비재

- 의류 및 액세서리

- 화장품, 홈 케어 및 개인 케어

- 음식과 음료

- 가구

- 자동차 부품

- 헬스케어

- 레크리에이션 용품

- 기타

일본 전자상거래 포장 시장은 응용 분야별로 전자 제품 및 소비재, 의류 및 액세서리, 화장품, 가정용품 및 개인 관리용품, 식품 및 음료, 가정용품, 자동차 부품, 건강 관리, 레크리에이션 용품 등으로 구분됩니다.

최종 사용자

- 전통적인 전자상거래 소매업체

- 제3자 및 물류 회사

- 벽돌과 모터 소매업체

- 전문 소매업체

- 기타

최종 사용자를 기준으로 볼 때, 일본의 전자상거래 포장 시장은 기존 전자상거래 소매업체, 제3자 및 물류 회사, 오프라인 소매업체, 전문 소매업체 및 기타로 구분됩니다.

경쟁 환경 및 전자 상거래 포장 시장 점유율 분석

전자상거래 포장 시장 경쟁 구도는 경쟁자별 세부 정보를 제공합니다. 포함된 세부 정보는 회사 개요, 회사 재무, 창출된 수익, 시장 잠재력, 연구 개발 투자, 새로운 시장 이니셔티브, 글로벌 입지, 생산 현장 및 시설, 생산 용량, 회사의 강점과 약점, 제품 출시, 제품 폭과 범위, 응용 분야 우세입니다. 위에 제공된 데이터 포인트는 전자상거래 포장 시장과 관련된 회사의 초점에만 관련이 있습니다.

일본 전자상거래 포장 시장에 참여하는 주요 시장 주체로는 International Paper, NIPPON PAPER INDUSTRIES CO., LTD., Mondi, Amcor Plc, Sealed Air, Rengo Co., Ltd., AptarGroup, Inc., WestRock Company, Yamakoh, Co., Ltd., CHUOH PACK INDUSTRY CO., LTD., Holmen Iggesund 등이 있습니다.

SKU-

세계 최초의 시장 정보 클라우드 보고서에 온라인으로 접속하세요

- 대화형 데이터 분석 대시보드

- 높은 성장 잠재력 기회를 위한 회사 분석 대시보드

- 사용자 정의 및 질의를 위한 리서치 분석가 액세스

- 대화형 대시보드를 통한 경쟁자 분석

- 최신 뉴스, 업데이트 및 추세 분석

- 포괄적인 경쟁자 추적을 위한 벤치마크 분석의 힘 활용

목차

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF JAPAN E-COMMERCE PACKAGING MARKET

1.4 LIMITATION

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 PRODUCT LIFE LINE CURVE

2.7 MULTIVARIATE MODELLING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 VENDOR SHARE ANALYSIS

2.12 DBMR MARKET CHALLENGE MATRIX

2.13 IMPORT-EXPORT DATA

2.14 SECONDARY SOURCES

2.15 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 SHIFTING SHOPPING PREFERENCE TOWARDS ONLINE DUE TO CONVENIENCE

5.1.2 RISING DEMAND FOR SECONDARY PACKAGING AND PROTECTIVE PACKAGING FOR ELECTRONIC GOODS

5.1.3 GROWING POPULARITY OF SMART PACKAGING

5.1.4 COVID-19 PANDEMIC INCREASED DEPENDENCY OF GROCERY SHOPPING TO E-COMMERCE

5.2 RESTRAINTS

5.2.1 GOVERNMENT RULES AND REGULATIONS REGARDING PACKAGING

5.2.2 INCREASING PACKAGING COST FOR E-COMMERCE COMPANIES REDUCED THEIR BOTTOM LINE

5.2.3 COST-TO-BENEFIT RATIO IS A CONCERN FOR MANUFACTURERS

5.3 OPPORTUNITY

5.3.1 GROWING DEMAND FOR SUSTAINABLE PACKAGING SOLUTIONS

5.4 CHALLENGES

5.4.1 GREATER TECHNOLOGICAL UNDERSTANDING THAN REQUIRED FOR OTHER PACKAGING FORMS

5.4.2 FLUCTUATIONS IN THE RAW MATERIAL PRICES

6 JAPAN E-COMMERCE PACKAGING MARKET, BY PRODUCT

6.1 OVERVIEW

6.2 BOXES

6.2.1 CORRUGATED BOXES

6.2.1.1 REGULAR SLOTTED CONTAINERS

6.2.1.2 ROLL END CORRUGATED BOXES

6.2.1.3 OTHERS CORRUGATED BOXES

6.2.2 SET-UP BOXES

6.3 PROTECTIVE PACKAGING

6.4 TAPES AND LABELS

6.5 BUBBLE WRAP

6.6 SECURITY ENVELOPES

6.7 PACKETS

6.8 OTHERS

7 JAPAN E-COMMERCE PACKAGING MARKET, BY PRINTING TECHNOLOGY

7.1 OVERVIEW

7.2 FLEXO PRINTING

7.3 DIGITAL PRINTING

7.4 LITHO LAMINATE PRINTING

7.5 OFFSET LITHOGRAPHY

7.6 OTHERS

8 JAPAN E-COMMERCE PACKAGING MARKET, BY MATERIALS

8.1 OVERVIEW

8.2 PLASTIC

8.2.1 POLYETHYLENE (PE)

8.2.1.1 LOW DENSITY POLYETHYLENE (LDPE)

8.2.1.2 HIGH DENSITY POLYETHYLENE (HDPE)

8.2.1.3 LINEAR LOW DENSITY POLYETHYLENE (LLDPE)

8.2.1.4 OTHERS

8.2.2 POLYPROPYLENE (PP)

8.2.3 POLYETHYLENE TEREPHTHALATE (PET)

8.2.4 POLYVINYL CHLORIDE (PVC)

8.2.5 POLYCARBONATE (PC)

8.2.6 POLYSTYRENE (PS)

8.2.7 OTHERS

8.3 PAPER

8.3.1 PAPER BAGS

8.3.2 CORRUGATED BOARD

8.3.3 PAPER CARTONS

8.3.4 KRAFT PAPER

8.3.5 GREASEPROOF PAPER

8.3.6 OTHERS

8.4 WOOD

8.5 METAL

8.5.1 ALUMINUM

8.5.2 STEEL

8.5.3 OTHERS

8.6 GLASS

8.7 OTHERS

9 JAPAN E-COMMERCE PACKAGING MARKET, BY APPLICATION

9.1 OVERVIEW

9.2 ELECTRONICS AND CONSUMER GOODS

9.2.1 WEARABLE TECHNOLOGY

9.2.2 COMPUTER AND ACCESSORIES

9.2.3 MEDIA PLAYERS

9.2.4 MOBILE PHONES

9.2.5 CAMERAS AND PHOTOGRAPHY

9.2.6 CAR AND VEHICLE ELECTRONICS

9.2.7 HOME AUDIO

9.2.8 OTHERS

9.3 APPAREL AND ACCESSORIES

9.3.1 APPAREL AND ACCESSORIES, BY APPLICATION

9.3.1.1 CLOTHING

9.3.1.2 SHOES

9.3.1.3 HANDBAG AND CLUTCHES

9.3.1.4 WATCHES

9.3.1.5 JEWELLERY

9.3.1.6 OTHERS

9.3.2 APPAREL AND ACCESSORIES, BY GENDER

9.3.2.1 MEN

9.3.2.2 WOMEN

9.3.2.3 KIDS

9.4 COSMETIC, HOME CARE AND PERSONAL CARE

9.4.1 SKIN CARE

9.4.2 BATH AND SHOWER

9.4.3 HAIR CARE AND STYLING

9.4.4 TOILET CLEANERS

9.4.5 DISHWASHING

9.4.6 FOOT CARE

9.4.7 HAND CARE

9.4.8 OTHERS

9.5 FOOD AND BEVERAGES

9.5.1 EXTRUDED SNACKS

9.5.2 FRUITS AND VEGETABLES

9.5.3 FROZEN FOOD

9.5.4 PROCESSED FOODS

9.5.5 BAKERY PRODUCTS

9.5.6 BABY FOODS

9.5.7 DAIRY PRODUCTS

9.5.8 JUICES

9.5.9 BOTTLED WATER

9.5.10 OTHERS

9.6 HOME FURNISHING

9.6.1 BED SHEETS

9.6.2 BEDDING SETS

9.6.3 KITCHEN APRONS

9.6.4 BLANKETS

9.6.5 FABRIC

9.6.6 CARPETS

9.6.7 OTHERS

9.7 AUTO PARTS

9.7.1 INTERIOR MIRRORS

9.7.2 DOOR PROTECTION

9.7.3 VEHICLE TOOLS

9.7.4 MOTORBIKE FILTERS

9.7.5 CAR STYLING BODY FITTINGS

9.7.6 SIDE MIRROR AND ACCESSORIES

9.7.7 OTHERS

9.8 HEALTHCARE

9.9 RECREATION GOODS

9.1 OTHERS

10 JAPAN E-COMMERCE PACKAGING MARKET, BY END USER

10.1 OVERVIEW

10.2 TRADITIONAL E-COMMERCE RETAILERS

10.2.1 BOXES

10.2.2 PROTECTIVE PACKAGING

10.2.3 TAPES AND LABELS

10.2.4 BUBBLE WRAP

10.2.5 SECURITY ENVELOPES

10.2.6 PACKETS

10.2.7 OTHERS

10.3 THIRD PARTY AND LOGISTICS COMPANIES

10.3.1 BOXES

10.3.2 PROTECTIVE PACKAGING

10.3.3 TAPES AND LABELS

10.3.4 BUBBLE WRAP

10.3.5 SECURITY ENVELOPES

10.3.6 PACKETS

10.3.7 OTHERS

10.4 BRICK AND MORTAR RETAILERS

10.4.1 BOXES

10.4.2 PROTECTIVE PACKAGING

10.4.3 TAPES AND LABELS

10.4.4 BUBBLE WRAP

10.4.5 SECURITY ENVELOPES

10.4.6 PACKETS

10.4.7 OTHERS

10.5 SPECIALTY RETAILERS

10.5.1 BOXES

10.5.2 PROTECTIVE PACKAGING

10.5.3 TAPES AND LABELS

10.5.4 BUBBLE WRAP

10.5.5 SECURITY ENVELOPES

10.5.6 PACKETS

10.5.7 OTHERS

10.6 OTHERS

10.6.1 BOXES

10.6.2 PROTECTIVE PACKAGING

10.6.3 TAPES AND LABELS

10.6.4 BUBBLE WRAP

10.6.5 SECURITY ENVELOPES

10.6.6 PACKETS

10.6.7 OTHERS

11 JAPAN E-COMMERCE PACKAGING MARKET, BY COUNTRY

11.1 JAPAN

12 JAPAN E-COMMERCE PACKAGING MARKET: COMPANY LANDSCAPE

12.1 COMPANY SHARE ANALYSIS: JAPAN

12.1.1 AGREEMENTS

12.1.2 PRODUCT LAUNCHES

12.1.3 PARTNERSHIP

13 SWOT ANALYSIS

14 COMPANY PROFILE

14.1 RENGO CO., LTD.

14.1.1 COMPANY SNAPSHOT

14.1.2 REVENUE ANALYSIS

14.1.3 PRODUCT PORTFOLIO

14.1.4 RECENT UPDATE

14.2 NIPPON PAPER INDUSTRIES CO., LTD.

14.2.1 COMPANY SNAPSHOT

14.2.2 REVENUE ANALYSIS

14.2.3 PRODUCT PORTFOLIO

14.2.4 RECENT UPDATE

14.3 AMCOR PLC

14.3.1 COMPANY SNAPSHOT

14.3.2 REVENUE ANALYSIS

14.3.3 PRODUCT PORTFOLIO

14.3.4 RECENT UPDATES

14.4 MONDI

14.4.1 COMPANY SNAPSHOT

14.4.2 REVENUE ANALYSIS

14.4.3 PRODUCT PORTFOLIO

14.4.4 RECENT UPDATES

14.5 HOLMEN IGGESUND

14.5.1 COMPANY SNAPSHOT

14.5.2 PRODUCT PORTFOLIO

14.5.3 RECENT UPDATES

14.6 CHUOH PACK INDUSTRY CO., LTD.

14.6.1 COMPANY SNAPSHOT

14.6.2 PRODUCT PORTFOLIO

14.6.3 RECENT UPDATE

14.7 APTARGROUP, INC.

14.7.1 COMPANY SNAPSHOT

14.7.2 REVENUE ANALYSIS

14.7.3 PRODUCT PORTFOLIO

14.7.4 RECENT UPDATE

14.8 INTERNATIONAL PAPER

14.8.1 COMPANY SNAPSHOT

14.8.2 REVENUE ANALYSIS

14.8.3 PRODUCT PORTFOLIO

14.8.4 RECENT UPDATE

14.9 SEALED AIR

14.9.1 COMPANY SNAPSHOT

14.9.2 REVENUE ANALYSIS

14.9.3 PRODUCT PORTFOLIO

14.9.4 RECENT UPDATE

14.1 WESTROCK COMPANY

14.10.1 COMPANY SNAPSHOT

14.10.2 REVENUE ANALYSIS

14.10.3 PRODUCT PORTFOLIO

14.10.4 RECENT UPDATES

14.11 YAMAKOH, CO., LTD.

14.11.1 COMPANY SNAPSHOT

14.11.2 PRODUCT PORTFOLIO

14.11.3 RECENT UPDATE

15 QUESTIONNAIRE

16 RELATED REPORTS

표 목록

TABLE 1 IMPORT DATA OF BOXES, CASES, CRATES AND SIMILAR ARTICLES FOR THE CONVEYANCE OR PACKAGING OF GOODS, OF PLASTICS; HS CODE - 392310 (USD THOUSAND)

TABLE 2 EXPORT DATA OF BOXES, CASES, CRATES AND SIMILAR ARTICLES FOR THE CONVEYANCE OR PACKAGING OF GOODS, OF PLASTICS; HS CODE - 392310 (USD THOUSAND)

TABLE 3 JAPAN E-COMMERCE PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 4 JAPAN E-COMMERCE PACKAGING MARKET, BY PRODUCT, 2020-2029 (MILLION UNITS)

TABLE 5 JAPAN E-COMMERCE PACKAGING MARKET, BY PRODUCT, 2020-2029 (MILLION METER SQUARE)

TABLE 6 JAPAN BOXES IN E-COMMERCE PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 7 JAPAN CORRUGATED BOXES IN E-COMMERCE PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 8 JAPAN E-COMMERCE PACKAGING MARKET, BY PRINTING TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 9 JAPAN E-COMMERCE PACKAGING MARKET, BY MATERIALS, 2020-2029 (USD MILLION)

TABLE 10 JAPAN PLASTIC IN E-COMMERCE PACKAGING MARKET, BY MATERIALS, 2020-2029 (USD MILLION)

TABLE 11 JAPAN POLYETHYLENE (PE) IN E-COMMERCE PACKAGING MARKET, BY MATERIALS, 2020-2029 (USD MILLION)

TABLE 12 JAPAN PAPER IN E-COMMERCE PACKAGING MARKET, BY MATERIALS, 2020-2029 (USD MILLION)

TABLE 13 JAPAN METAL IN E-COMMERCE PACKAGING MARKET, BY MATERIALS, 2020-2029 (USD MILLION)

TABLE 14 JAPAN E-COMMERCE PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 15 JAPAN ELECTRONICS AND CONSUMER GOODS IN E-COMMERCE PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 16 JAPAN APPAREL AND ACCESSORIES IN E-COMMERCE PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 17 JAPAN APPAREL AND ACCESSORIES COMPANIES IN E-COMMERCE PACKAGING MARKET, BY GENDER, 2020-2029 (USD MILLION)

TABLE 18 JAPAN COSMETIC, HOME CARE AND PERSONAL CARE IN E-COMMERCE PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 19 JAPAN FOOD AND BEVERAGES IN E-COMMERCE PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 20 JAPAN HOME FURNISHING IN E-COMMERCE PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 21 JAPAN AUTO PARTS IN E-COMMERCE PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 22 JAPAN E-COMMERCE PACKAGING MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 23 JAPAN TRADITIONAL E-COMMERCE RETAILERS IN E-COMMERCE PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 24 JAPAN THIRD PARTY AND LOGISTICS COMPANIES IN E-COMMERCE PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 25 JAPAN BRICK AND MORTAR RETAILERS IN E-COMMERCE PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 26 JAPAN SPECIALTY RETAILERS IN E-COMMERCE PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 27 JAPAN OTHERS IN E-COMMERCE PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 28 JAPAN E-COMMERCE PACKAGING MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 29 JAPAN E-COMMERCE PACKAGING MARKET, BY COUNTRY, 2020-2029 (MILLION UNITS)

TABLE 30 JAPAN E-COMMERCE PACKAGING MARKET, BY COUNTRY, 2020-2029 (MILLION METER SQUARE)

TABLE 31 JAPAN E-COMMERCE PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 32 JAPAN E-COMMERCE PACKAGING MARKET, BY PRODUCT, 2020-2029 (MILLION UNITS)

TABLE 33 JAPAN E-COMMERCE PACKAGING MARKET, BY PRODUCT, 2020-2029 (MILLION METER SQUARE)

TABLE 34 JAPAN BOXES IN E-COMMERCE PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 35 JAPAN CORRUGATED BOXES IN E-COMMERCE PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 36 JAPAN E-COMMERCE PACKAGING MARKET, BY MATERIALS, 2020-2029 (USD MILLION)

TABLE 37 JAPAN PAPER IN E-COMMERCE PACKAGING MARKET, BY MATERIALS, 2020-2029 (USD MILLION)

TABLE 38 JAPAN PLASTIC IN E-COMMERCE PACKAGING MARKET, BY MATERIALS, 2020-2029 (USD MILLION)

TABLE 39 JAPAN POLYETHYLENE (PE) IN E-COMMERCE PACKAGING MARKET, BY MATERIALS, 2020-2029 (USD MILLION)

TABLE 40 JAPAN METAL IN E-COMMERCE PACKAGING MARKET, BY MATERIALS, 2020-2029 (USD MILLION)

TABLE 41 JAPAN E-COMMERCE PACKAGING MARKET, BY PRINTING TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 42 JAPAN E-COMMERCE PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 43 JAPAN ELECTRONICS AND CONSUMER GOODS IN E-COMMERCE PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 44 JAPAN APPAREL AND ACCESSORIES IN E-COMMERCE PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 45 JAPAN APPAREL AND ACCESSORIES IN E-COMMERCE PACKAGING MARKET, BY GENDER, 2020-2029 (USD MILLION)

TABLE 46 JAPAN HOME FURNISHING IN IN E-COMMERCE PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 47 JAPAN AUTO PARTS IN E-COMMERCE PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 48 JAPAN FOOD AND BEVERAGES IN E-COMMERCE PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 49 JAPAN COSMETIC, HOME CARE AND PERSONAL CARE IN E-COMMERCE PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 50 JAPAN E-COMMERCE PACKAGING MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 51 JAPAN TRADITIONAL E-COMMERCE RETAILERS IN E-COMMERCE PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 52 JAPAN THIRD PARTY AND LOGISTICS COMPANIES IN E-COMMERCE PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 53 JAPAN BRICK AND MOTOR RETAILERS IN E-COMMERCE PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 54 JAPAN SPECIALTY RETAILERS IN E-COMMERCE PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 55 JAPAN OTHERS IN E-COMMERCE PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

그림 목록

FIGURE 1 JAPAN E-COMMERCE PACKAGING MARKET: SEGMENTATION

FIGURE 2 JAPAN E-COMMERCE PACKAGING MARKET: DATA TRIANGULATION

FIGURE 3 JAPAN E-COMMERCE PACKAGING MARKET: DROC ANALYSIS

FIGURE 4 JAPAN E-COMMERCE PACKAGING MARKET: COUNTRY VS REGIONAL MARKET ANALYSIS

FIGURE 5 JAPAN E-COMMERCE PACKAGING MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 JAPAN E-COMMERCE PACKAGING MARKET: PRODUCT LIFE LINE CURVE

FIGURE 7 JAPAN E-COMMERCE PACKAGING MARKET: MULTIVARIATE MODELLING

FIGURE 8 JAPAN E-COMMERCE PACKAGING MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 JAPAN E-COMMERCE PACKAGING MARKET: DBMR MARKET POSITION GRID

FIGURE 10 JAPAN E-COMMERCE PACKAGING MARKET: APPLICATION COVERAGE GRID

FIGURE 11 JAPAN E-COMMERCE PACKAGING MARKET: VENDOR SHARE ANALYSIS

FIGURE 12 JAPAN E-COMMERCE PACKAGING MARKET: CHALLENGE MATRIX

FIGURE 13 JAPAN E-COMMERCE PACKAGING MARKET: SEGMENTATION

FIGURE 14 SHIFTING SHOPPING PREFERENCE TOWARDS ONLINE DUE TO CONVENIENCE IS EXPECTED TO DRIVE THE JAPAN E-COMMERCE PACKAGING MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 15 BOXES SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE JAPAN E-COMMERCE PACKAGING MARKET IN 2022 & 2029

FIGURE 16 DRIVERS, RESTRAINTS, OPPORTUNITY, AND CHALLENGES OF JAPANE-COMMERCE PACKAGING MARKET

FIGURE 17 JAPAN E-COMMERCE PACKAGING MARKET: BY PRODUCT, 2021

FIGURE 18 JAPAN E-COMMERCE PACKAGING MARKET: BY PRINTING TECHNOLOGY, 2021

FIGURE 19 JAPAN E-COMMERCE PACKAGING MARKET: BY MATERIALS, 2021

FIGURE 20 JAPAN E-COMMERCE PACKAGING MARKET: BY APPLICATION, 2021

FIGURE 21 JAPAN E-COMMERCE PACKAGING MARKET: BY END USER, 2021

FIGURE 22 JAPAN E-COMMERCE PACKAGING MARKET: COMPANY SHARE 2021 (%)

연구 방법론

데이터 수집 및 기준 연도 분석은 대규모 샘플 크기의 데이터 수집 모듈을 사용하여 수행됩니다. 이 단계에는 다양한 소스와 전략을 통해 시장 정보 또는 관련 데이터를 얻는 것이 포함됩니다. 여기에는 과거에 수집한 모든 데이터를 미리 검토하고 계획하는 것이 포함됩니다. 또한 다양한 정보 소스에서 발견되는 정보 불일치를 검토하는 것도 포함됩니다. 시장 데이터는 시장 통계 및 일관된 모델을 사용하여 분석하고 추정합니다. 또한 시장 점유율 분석 및 주요 추세 분석은 시장 보고서의 주요 성공 요인입니다. 자세한 내용은 분석가에게 전화를 요청하거나 문의 사항을 드롭하세요.

DBMR 연구팀에서 사용하는 주요 연구 방법론은 데이터 마이닝, 시장에 대한 데이터 변수의 영향 분석 및 주요(산업 전문가) 검증을 포함하는 데이터 삼각 측량입니다. 데이터 모델에는 공급업체 포지셔닝 그리드, 시장 타임라인 분석, 시장 개요 및 가이드, 회사 포지셔닝 그리드, 특허 분석, 가격 분석, 회사 시장 점유율 분석, 측정 기준, 글로벌 대 지역 및 공급업체 점유율 분석이 포함됩니다. 연구 방법론에 대해 자세히 알아보려면 문의를 통해 업계 전문가에게 문의하세요.

사용자 정의 가능

Data Bridge Market Research는 고급 형성 연구 분야의 선두 주자입니다. 저희는 기존 및 신규 고객에게 목표에 맞는 데이터와 분석을 제공하는 데 자부심을 느낍니다. 보고서는 추가 국가에 대한 시장 이해(국가 목록 요청), 임상 시험 결과 데이터, 문헌 검토, 재생 시장 및 제품 기반 분석을 포함하도록 사용자 정의할 수 있습니다. 기술 기반 분석에서 시장 포트폴리오 전략에 이르기까지 타겟 경쟁업체의 시장 분석을 분석할 수 있습니다. 귀하가 원하는 형식과 데이터 스타일로 필요한 만큼 많은 경쟁자를 추가할 수 있습니다. 저희 분석가 팀은 또한 원시 엑셀 파일 피벗 테이블(팩트북)로 데이터를 제공하거나 보고서에서 사용 가능한 데이터 세트에서 프레젠테이션을 만드는 데 도움을 줄 수 있습니다.