Global Rapid Acting Insulin Market

시장 규모 (USD 10억)

연평균 성장률 :

%

USD

4.66 Billion

USD

9.31 Billion

2024

2032

USD

4.66 Billion

USD

9.31 Billion

2024

2032

| 2025 –2032 | |

| USD 4.66 Billion | |

| USD 9.31 Billion | |

|

|

|

|

Global Rapid-Acting Insulin Market Segmentation, By Product Type (Insulin Aspart, Insulin Lispro, Insulin Glulisine, Other Rapid-Acting Insulins), Treatment Type (Monotherapy, Combination Therapy), Age Group (Pediatric, Adult, Geriatric), Mode of Administration (Subcutaneous Injection, Intravenous Injection, Inhalable Insulin), End User (Diabetic Patients (Type 1 and Type 2), Hospitals, Clinics, Home Care Settings), Distribution Channel (Hospitals & Clinics, Retail Pharmacies, Online Pharmacies, Others) – Industry Trends and Forecast to 2032

Rapid-Acting Insulin Market Analysis

The global rapid-acting insulin market is heavily influenced by the growing prevalence of diabetes worldwide. As of recent estimates, over 537 million adults are living with diabetes globally, a number projected to rise to 700 million by 2045. This increase is driving the demand for insulin products, particularly rapid-acting insulins, which are essential for achieving optimal blood sugar control in patients with Type 1 and Type 2 diabetes. Rapid-acting insulins, such as Insulin Lispro, Insulin Aspart, and Insulin Glulisine, are favored for their quick onset and ability to manage post-meal blood sugar spikes. These products are vital in personalized diabetes management, especially with the growing adoption of insulin pumps and pen injectors, which provide more accurate dosing and ease of use. Additionally, the rise in awareness about diabetes complications, such as cardiovascular diseases and kidney damage, further emphasizes the importance of efficient insulin therapy. However, challenges like the high cost of insulin and disparities in healthcare access, particularly in low-income regions, remain significant barriers to broader adoption.

Rapid-Acting Insulin Market Size

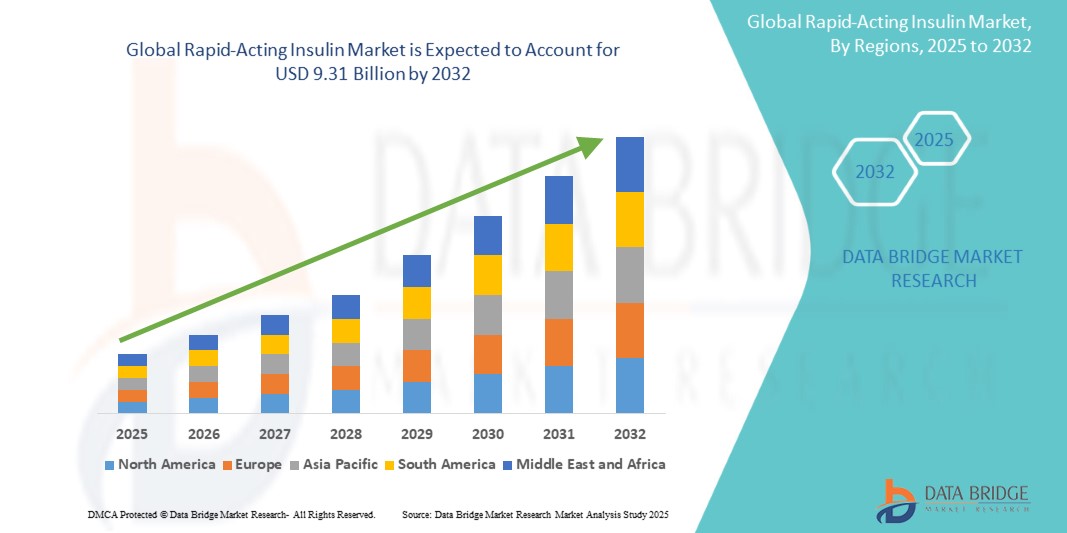

Global rapid-acting insulin market size was valued at USD 4.66 billion in 2024 and is projected to reach USD 9.31 billion by 2032, with a CAGR of 8.60% during the forecast period of 2025 to 2032. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework.

Rapid-Acting Insulin Market Trends

“Rising Focus on Preventive Diabetes Care”

The focus on preventive diabetes care is becoming a significant trend in the healthcare sector. As the prevalence of diabetes continues to rise globally, healthcare systems are increasingly prioritizing the prevention and early detection of the disease. This includes the expansion of screening programs that help identify individuals at risk of developing diabetes before symptoms appear. Additionally, there is a growing emphasis on promoting lifestyle changes, such as healthier diets, increased physical activity, and weight management, to prevent the onset of Type 2 diabetes. These measures aim to reduce the need for insulin therapies in the long term by addressing the root causes of the disease early, thus shifting the focus from treatment to prevention. As more individuals manage their risk factors proactively, there is less reliance on medications like insulin, reflecting a broader trend towards holistic and preventative healthcare solutions.

Report Scope and Rapid-Acting Insulin Market Segmentation

|

Attributes |

Rapid-Acting Insulin Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

U.S., Canada, Mexico, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific, Saudi Arabia, U.A.E., South Africa, Egypt, Israel, Rest of Middle East and Africa, Brazil, Argentina, Rest of South America |

|

Key Market Players |

Novo Nordisk A/S (Denmark), Eli Lilly and Company (U.S.), Sanofi (France), Boehringer Ingelheim International GmbH (Germany), Bristol-Myers Squibb Company (U.S.), MannKind Corporation (U.S.), Merck & Co., Inc. (U.S.), F. Hoffmann-La Roche AG (Switzerland), Bayer AG (Germany), AbbVie Inc. (U.S.), Amgen Inc. (U.S.), Biocon Ltd. (India), Tandem Diabetes Care, Inc. (U.S.), Sandoz International GmbH (Germany), Lannett Company, Inc. (U.S.), Hikma Pharmaceuticals PLC (U.K.), Fresenius Kabi AG (Germany), Viatris Inc. (U.S.), and Teva Pharmaceutical Industries Ltd. (Israel), among others. |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Rapid-Acting Insulin Market Definition

Rapid-acting insulin is a type of insulin that starts to work quickly to lower blood sugar levels after a meal. It is designed to mimic the natural insulin response to food, acting within 10 to 30 minutes after injection, reaching its peak effect within 1 to 3 hours, and continuing to work for approximately 3 to 5 hours. Rapid-acting insulin is typically used in individuals with diabetes to control blood sugar levels during or after meals and is often administered via insulin pens, syringes, or pumps. Common examples include Insulin Lispro, Insulin Aspart, and Insulin Glulisine.

Rapid-Acting Insulin Market Dynamics

Drivers

- Rising Prevalence of Diabetes

The escalating prevalence of diabetes worldwide, particularly Type 1 and Type 2 diabetes, has significantly increased the demand for effective glycemic control solutions, including rapid-acting insulin. As lifestyles shift towards reduced physical activity and high-calorie diets, diabetes has become a growing global health concern. According to the International Diabetes Federation, the number of adults with diabetes is projected to rise to over 640 million by 2040. Rapid-acting insulin addresses the immediate need for postprandial glucose management, offering faster onset and shorter duration compared to traditional insulin. This enables patients to better manage blood sugar levels while enjoying greater flexibility in meal planning. Additionally, awareness campaigns and enhanced diagnostic capabilities are identifying more cases early, leading to increased adoption of rapid-acting insulin among newly diagnosed patients.

The rising global diabetes burden underscores the critical role of rapid-acting insulin in improving patient outcomes, driving growth in the global market.

- Technological Advancements in Insulin Delivery

Innovations in insulin delivery systems have transformed diabetes management, significantly enhancing the adoption of rapid-acting insulin. Devices like insulin pens, pumps, and patch pumps offer precise and customizable dosing, making it easier for patients to manage their blood glucose levels efficiently. These technologies improve user convenience, reduce injection-related discomfort, and eliminate the complexities of traditional syringes, leading to higher patient adherence. Furthermore, advancements such as smart insulin pumps integrated with continuous glucose monitors (CGMs) provide real-time feedback and automated insulin adjustments, enhancing glycemic control. These systems are especially beneficial for individuals requiring rapid-acting insulin for postprandial glucose management, offering a seamless and user-friendly experience. Increased availability of such devices in both developed and developing markets, coupled with rising awareness among diabetic patients, is fueling market growth.

The integration of advanced insulin delivery technologies is a key driver of the global rapid-acting insulin market, improving patient outcomes and promoting wider adoption.

Opportunities

- Increasing Collaborations and Partnerships

Strategic collaborations between pharmaceutical companies, healthcare providers, and technology firms present a significant opportunity to drive innovation and market growth in the rapid-acting insulin segment. By pooling resources and expertise, these partnerships can accelerate the development of advanced insulin formulations, improve delivery technologies, and streamline regulatory processes. Collaborative efforts also enable better integration of rapid-acting insulin with digital health solutions, such as smart insulin pens and mobile apps, enhancing patient adherence and outcomes. Additionally, partnerships with governments and non-governmental organizations can expand market access through subsidies, awareness campaigns, and improved healthcare infrastructure in underserved regions. Joint ventures focused on biosimilar insulin production can reduce costs, making rapid-acting insulin more affordable and accessible to a broader patient base.

For instance,

In August 2024, Abbott has partnered with Medtronic to develop an integrated continuous glucose monitoring (CGM) system that uses Abbott's FreeStyle Libre technology, which will work with Medtronic's automated insulin delivery (AID) and smart insulin pen systems. This collaboration enables automatic insulin adjustments and enhances both companies' diabetes management solutions. This partnership reflects the growing trend of collaborations in the healthcare industry, presenting an opportunity for both companies to expand their market reach and offer more comprehensive diabetes care solutions.

Collaborative strategies between key stakeholders are essential for driving innovation, improving accessibility, and enhancing market penetration, making partnerships a crucial growth opportunity in the global rapid-acting insulin market.

- Increased Government and NGO Initiatives

Supportive initiatives by governments and non-governmental organizations (NGOs) play a pivotal role in expanding the global rapid-acting insulin market, particularly in underserved regions. Policies aimed at subsidizing insulin costs and improving healthcare infrastructure make these life-saving treatments more accessible to low-income populations. Governments across emerging economies are launching programs to increase diabetes awareness, early diagnosis, and effective management, fostering higher adoption of rapid-acting insulin. NGOs and global organizations, such as the World Health Organization (WHO) and International Diabetes Federation (IDF), actively collaborate with industry players to address the growing diabetes burden through outreach programs and resource allocation. These initiatives also promote the availability of affordable biosimilar insulin, further boosting accessibility in resource-limited settings. Combined, these efforts enhance patient awareness and accessibility, creating a favorable environment for market expansion.

Government and NGO initiatives provide a robust framework for improving affordability and accessibility of rapid-acting insulin, driving its market growth globally.

Restraints/Challenges

- High Cost of Rapid-Acting Insulin

The high cost of rapid-acting insulin is a major restraint, limiting its accessibility and affordability, particularly in low- and middle-income countries. These insulin formulations are significantly more expensive than traditional options due to advanced manufacturing processes, rigorous research and development requirements, and sophisticated delivery mechanisms. For many patients in developing regions, out-of-pocket expenses remain a challenge, as healthcare systems often lack comprehensive insurance coverage or subsidies. Even in developed countries, uninsured or underinsured patients face financial difficulties, resulting in lower adoption rates. This cost barrier not only limits patient access but also affects overall market penetration, particularly in price-sensitive markets. However, initiatives such as the introduction of biosimilar insulin and pricing reforms could help alleviate this issue over time, though widespread implementation remains a challenge.

The high cost of rapid-acting insulin continues to hinder market growth by restricting accessibility, particularly in underserved regions, necessitating cost-reduction strategies to drive broader adoption.

- Regulatory and Reimbursement Issues

A major challenge for the Global Rapid-Acting Insulin Market is navigating the complex regulatory and reimbursement environment, which vary significantly across regions. Regulatory authorities impose stringent safety, efficacy, and quality standards, which often lead to delays in the approval process for new insulin formulations and delivery devices. This not only slows the market entry of innovative products but also limits the speed of technological advancements. Moreover, inconsistent reimbursement policies further complicate market growth, as many countries have limited or fragmented insurance coverage for advanced insulin therapies. In some regions, insurance companies may prioritize lower-cost insulin alternatives over newer, more expensive rapid-acting options. This disparity in reimbursement makes it challenging for patients to afford cutting-edge therapies, thereby slowing widespread adoption. The regulatory delays and reimbursement limitations can discourage manufacturers from investing in new solutions, hindering market expansion.

Regulatory hurdles and inconsistent reimbursement policies represent significant challenges to the rapid-acting insulin market, limiting access and hindering growth opportunities.

Rapid-Acting Insulin Market Scope

The market is segmented on the basis of product type, treatment type, age group, mode of administration, end user, and distribution channel. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Product Type

- Insulin Aspart

- Insulin Lispro

- Insulin Glulisine

- Other Rapid-Acting Insulins

Treatment Type

- Monotherapy

- Combination Therapy

Age Group

- Pediatric

- Adult

- Geriatric

Mode of Administration

- Subcutaneous Injection

- Intravenous Injection

- Inhalable Insulin

End User

- Diabetic Patients (Type 1 and Type 2)

- Hospitals

- Clinics

- Home Care Settings

Distribution Channel

- Hospitals & Clinics

- Retail Pharmacies

- Online Pharmacies

- Others

Rapid-Acting Insulin Market Regional Analysis

The market is analyzed and market size insights and trends are provided by country, product type, treatment type, age group, mode of administration, end user, and distribution channel as referenced above.

The countries covered in the market are U.S., Canada, Mexico, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, rest of Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, rest of Asia-Pacific, Saudi Arabia, U.A.E., South Africa, Egypt, Israel, rest of Middle East and Africa, Brazil, Argentina, and rest of South America.

North America is expected to dominate the market due to the high prevalence of diabetes, advanced healthcare infrastructure, and strong reimbursement policies that facilitate access to innovative insulin therapies. Additionally, the presence of key market players and continuous advancements in insulin delivery technologies further contribute to the region's dominance.

Asia-Pacific is expected to be the fastest growing due to the rising prevalence of diabetes, particularly in countries such as China and India, coupled with increasing healthcare investments. Additionally, improving access to insulin therapies and growing awareness about diabetes management are driving market expansion in this region.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Rapid-Acting Insulin Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

Rapid-Acting Insulin Market Leaders Operating in the Market Are:

- Novo Nordisk A/S (Denmark)

- Eli Lilly and Company (U.S.)

- Sanofi (France)

- Boehringer Ingelheim International GmbH (Germany)

- Bristol-Myers Squibb Company (U.S.)

- MannKind Corporation (U.S.)

- Merck & Co., Inc. (U.S.)

- F. Hoffmann-La Roche AG (Switzerland)

- Bayer AG (Germany)

- AbbVie Inc. (U.S.)

- Amgen Inc. (U.S.)

- Biocon Ltd. (India)

- Tandem Diabetes Care, Inc. (U.S.)

- Sandoz International GmbH (Germany)

- Lannett Company, Inc. (U.S.)

- Hikma Pharmaceuticals PLC (U.K.)

- Fresenius Kabi AG (Germany)

- Viatris Inc. (U.S.)

- Teva Pharmaceutical Industries Ltd. (Israel)

Latest Developments in Rapid-Acting Insulin Market

- In December 2024, Cipla has received regulatory approval from the CDSCO to exclusively distribute and market Afrezza (insulin human) Inhalation Powder in India. This approval will enhance Cipla's diabetes portfolio and expand its presence in the rapidly growing diabetes care market in India

- In August 2024, Abbott has partnered with Medtronic to develop an integrated continuous glucose monitoring (CGM) system using Abbott's FreeStyle Libre technology, which will connect with Medtronic's automated insulin delivery (AID) and smart insulin pen systems. This collaboration will enable automatic insulin adjustments to maintain glucose levels, with the CGM sensor developed by Abbott and sold by Medtronic. This partnership will enhance both companies' product offerings and expand their market reach in diabetes management

- In July 2024, Amylyx Pharmaceuticals has acquired avexitide from Eiger BioPharmaceuticals, a drug previously studied for treating hyperinsulinemic hypoglycemia. This acquisition will strengthen Amylyx's pipeline and expand its focus on innovative therapies for metabolic disorders

- In May 2024, Arecor Therapeutics has partnered with Medtronic to develop a novel, high-concentration, thermostable insulin for Medtronic's next-generation implantable pump. This collaboration will enable both companies to enhance their diabetes treatment offerings and strengthen their positions in the growing insulin delivery market

- In June 2020, the FDA has approved Eli Lilly's Lyumjev (insulin lispro-aabc injection) for improving glycemic control in adults with type 1 and type 2 diabetes. This approval will strengthen Lilly's position in the rapid-acting insulin market and expand its product portfolio in diabetes care

SKU-

세계 최초의 시장 정보 클라우드 보고서에 온라인으로 접속하세요

- 대화형 데이터 분석 대시보드

- 높은 성장 잠재력 기회를 위한 회사 분석 대시보드

- 사용자 정의 및 질의를 위한 리서치 분석가 액세스

- 대화형 대시보드를 통한 경쟁자 분석

- 최신 뉴스, 업데이트 및 추세 분석

- 포괄적인 경쟁자 추적을 위한 벤치마크 분석의 힘 활용

연구 방법론

데이터 수집 및 기준 연도 분석은 대규모 샘플 크기의 데이터 수집 모듈을 사용하여 수행됩니다. 이 단계에는 다양한 소스와 전략을 통해 시장 정보 또는 관련 데이터를 얻는 것이 포함됩니다. 여기에는 과거에 수집한 모든 데이터를 미리 검토하고 계획하는 것이 포함됩니다. 또한 다양한 정보 소스에서 발견되는 정보 불일치를 검토하는 것도 포함됩니다. 시장 데이터는 시장 통계 및 일관된 모델을 사용하여 분석하고 추정합니다. 또한 시장 점유율 분석 및 주요 추세 분석은 시장 보고서의 주요 성공 요인입니다. 자세한 내용은 분석가에게 전화를 요청하거나 문의 사항을 드롭하세요.

DBMR 연구팀에서 사용하는 주요 연구 방법론은 데이터 마이닝, 시장에 대한 데이터 변수의 영향 분석 및 주요(산업 전문가) 검증을 포함하는 데이터 삼각 측량입니다. 데이터 모델에는 공급업체 포지셔닝 그리드, 시장 타임라인 분석, 시장 개요 및 가이드, 회사 포지셔닝 그리드, 특허 분석, 가격 분석, 회사 시장 점유율 분석, 측정 기준, 글로벌 대 지역 및 공급업체 점유율 분석이 포함됩니다. 연구 방법론에 대해 자세히 알아보려면 문의를 통해 업계 전문가에게 문의하세요.

사용자 정의 가능

Data Bridge Market Research는 고급 형성 연구 분야의 선두 주자입니다. 저희는 기존 및 신규 고객에게 목표에 맞는 데이터와 분석을 제공하는 데 자부심을 느낍니다. 보고서는 추가 국가에 대한 시장 이해(국가 목록 요청), 임상 시험 결과 데이터, 문헌 검토, 재생 시장 및 제품 기반 분석을 포함하도록 사용자 정의할 수 있습니다. 기술 기반 분석에서 시장 포트폴리오 전략에 이르기까지 타겟 경쟁업체의 시장 분석을 분석할 수 있습니다. 귀하가 원하는 형식과 데이터 스타일로 필요한 만큼 많은 경쟁자를 추가할 수 있습니다. 저희 분석가 팀은 또한 원시 엑셀 파일 피벗 테이블(팩트북)로 데이터를 제공하거나 보고서에서 사용 가능한 데이터 세트에서 프레젠테이션을 만드는 데 도움을 줄 수 있습니다.