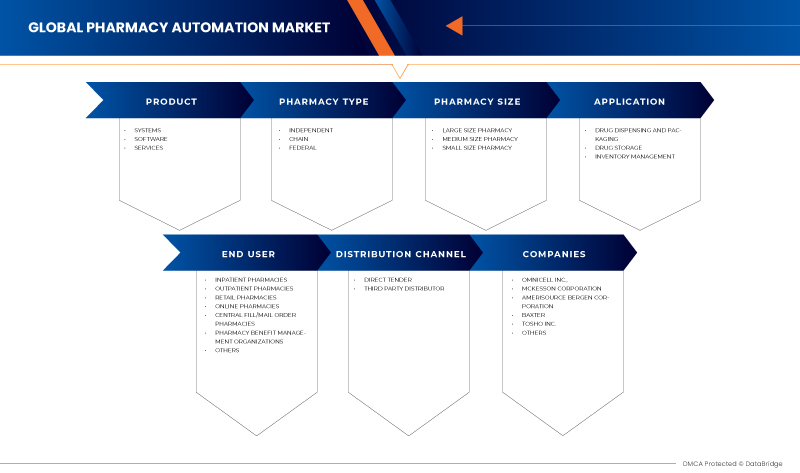

글로벌 약국 자동화 시장, 제품별(시스템, 소프트웨어 및 서비스), 약국 유형(독립형, 체인형 및 연방형), 약국 규모(대형 약국, 중형 약국 및 소형 약국), 응용 분야(약물 분배 및 포장, 약물 보관 및 재고 관리), 최종 사용자(입원 약국, 외래 약국, 소매 약국, 온라인 약국, 중앙 충전/우편 주문 약국, 약국 혜택 관리 기관 및 기타), 유통 채널(직접 입찰 및 제3자 유통업체) - 업계 동향 및 2030년까지의 예측.

약국 자동화 시장 분석 및 통찰력

의료 약물 오류로 인한 사고 및 사망의 증가는 일반 의료 분야에 엄청난 압력을 가하고 있습니다. 의료 전문가와 약사 모두 이러한 빈번한 의료적 오작동을 피하기 위해 보다 효과적이고 정확한 솔루션을 찾고 있습니다. 또한 환자, 방문객 및 각자의 안전 요구 사항이 증가함에 따라 약물 전달 시스템은 날이 갈수록 더욱 복잡해지고 있습니다. 이 심각한 문제를 해결하기 위해 약국 자동화 시스템과 같은 첨단 기술이 이제 가장 강력한 도구로 부상하고 있습니다. 이러한 도구의 목표는 의료 처방 오류를 줄이고 환자 안전을 극대화하는 것입니다. 따라서 이러한 약국 자동화 시스템을 구현하면 의료 서비스 제공자와 약사가 손실을 최소화하고 품질과 생산성을 개선하는 데 도움이 됩니다.

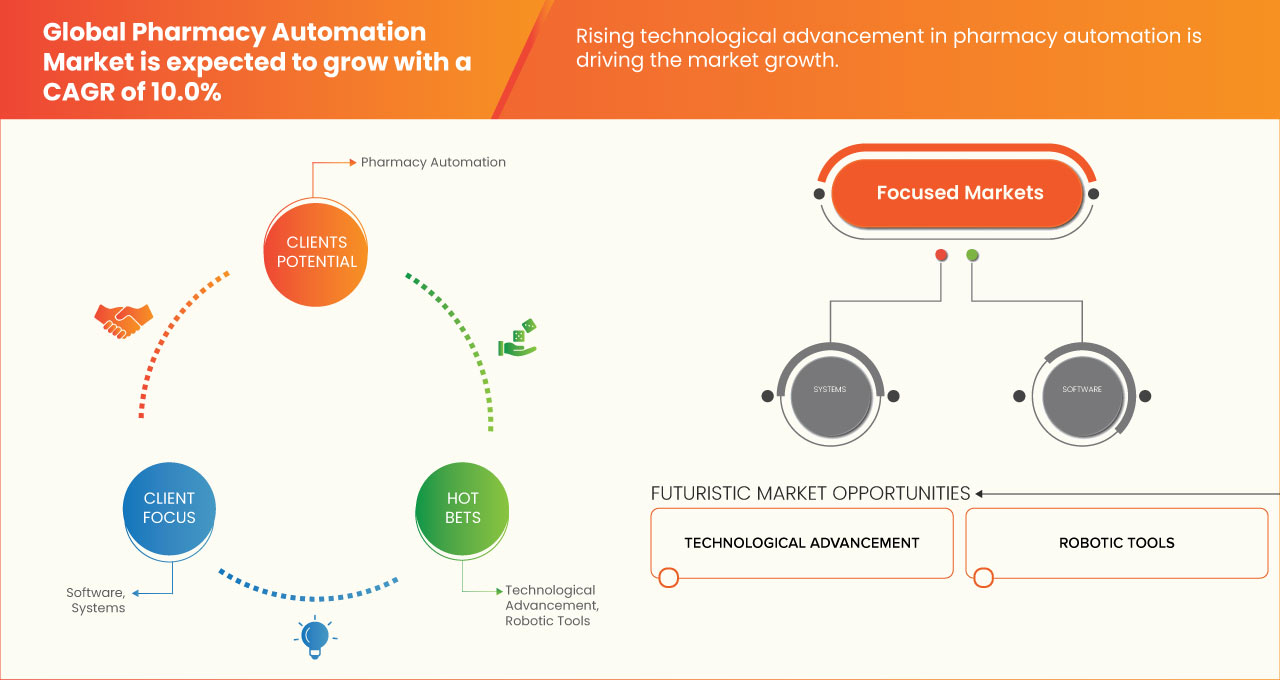

또한, 기술 혁신의 구현과 개선된 약국 자동화 시스템을 갖춘 자동화 시스템의 발전은 더 높은 성공률과 처방약의 조제, 분배, 보관 및 라벨링을 위한 혁신적 제품에 대한 수요가 더 높은 장치의 새로운 응용 분야로 이어지고 예측 기간 동안 시장 성장을 주도하고 있습니다. 그러나 높은 비용으로 인해 약국 자동화 시스템을 구현하는 데 주저하는 것과 같은 요인이 도입을 제한할 것으로 예상되며, 이는 시장 성장을 억제할 것으로 예상됩니다.

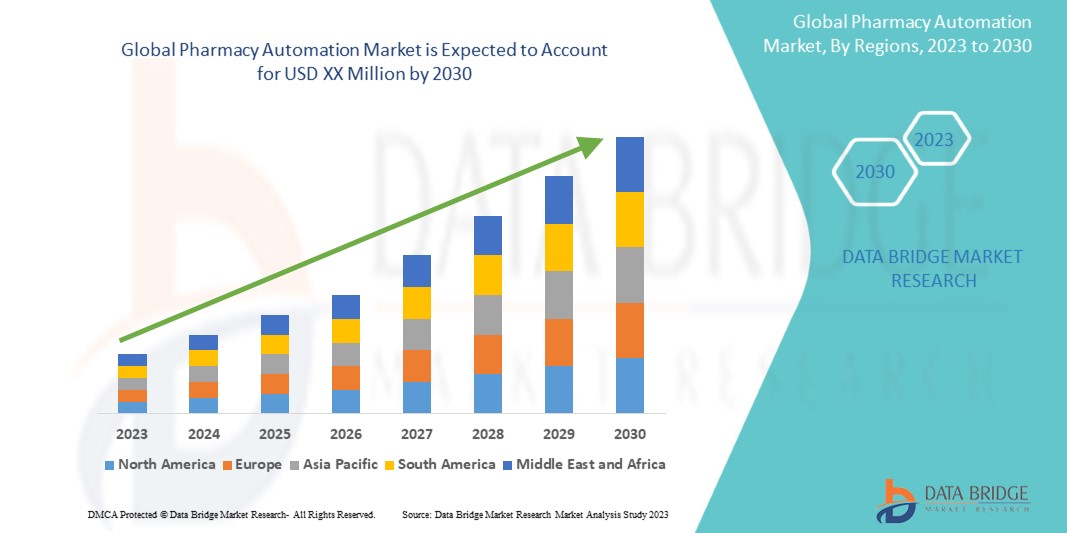

글로벌 약국 자동화 시장은 지원적이며 약물 분배 오류를 줄이고 환자 안전을 개선하는 것을 목표로 합니다. Data Bridge Market Research는 글로벌 약국 자동화 시장이 2023년에서 2030년까지의 예측 기간 동안 10.0%의 CAGR로 성장할 것이라고 분석합니다.

|

보고서 메트릭 |

세부 |

|

예측 기간 |

2023년부터 2030년까지 |

|

기준 연도 |

2022 |

|

역사적 해 |

2021 (2015-2020까지 사용자 정의 가능) |

|

양적 단위 |

수익은 백만 달러이고 가격은 미화입니다. |

|

다루는 세그먼트 |

제품(시스템, 소프트웨어 및 서비스), 약국 유형(독립, 체인 및 연방), 약국 규모(대형 약국, 중형 약국 및 소형 약국), 애플리케이션(약물 분배 및 포장, 약물 보관 및 재고 관리), 최종 사용자(입원 약국, 외래 약국, 소매 약국, 온라인 약국, 중앙 충전/우편 주문 약국, 약국 혜택 관리 기관 및 기타), 유통 채널(직접 입찰 및 제3자 유통업체) |

|

적용 국가 |

미국, 캐나다, 멕시코, 독일, 프랑스, 이탈리아, 영국, 스페인, 네덜란드, 러시아, 스위스, 터키, 벨기에, 유럽의 나머지 지역, 일본, 중국, 인도, 한국, 호주, 싱가포르, 말레이시아, 태국, 인도네시아, 필리핀, 아시아 태평양의 나머지 지역, 브라질, 아르헨티나, 남미의 나머지 지역, 사우디 아라비아, 남아프리카, UAE, 이스라엘, 이집트, 중동 및 아프리카의 나머지 지역 |

|

시장 참여자 포함 |

ARxIUM, OMNICELL INC., Cerner Corporation, Capsa Healthcare, ScriptPro LLC, RxSafe, LLC., MedAvail Technologies, Inc., Asteres Inc., InterLink AI, Inc., BD, Baxter, Fullscript, McKesson Corporation, Innovation Associates, AmerisourceBergen Corporation, UNIVERSAL LOGISTICS HOLDINGS, INC, Takazono Corporation, TOSHO Inc., Willach Group, BIQHS, Synergy Medical, Yuyama, APD Algoritmos Procesos y Diseños SA, JVM Europe BV, Genesis Automation LTD, myPak Solutions Pty Ltd., Demodeks Pharmacy Shelving, Deenova Srl, KUKA AG, KLS Pharma Robotics GmbH 등 |

시장 정의

약국 자동화는 병원 약국이나 소매 약국에서 편리하게 약을 배달하고 유통할 수 있기 때문에 현대 의료에서 중요한 역할을 합니다. 약국 자동화는 약물 오류를 줄이는 데 도움이 됩니다. 약물 정보 누락, 환자 정보 누락, 제형 분배, 처방 오류, 치료 추적 및 수동 프로세스 중에 발생할 수 있는 기타 오류와 같은 오류를 방지합니다. 가장 일반적인 오류 유형 중 하나는 잘못된 라벨 정보 및 지침입니다. 의료 시설과 서비스를 개선하고 환자 안전을 보장하려면 처방 오류를 줄이는 것이 중요하므로 약국 자동화 시스템은 보관, 재고, 사용 및 검색 오류를 제거하는 데 매우 중요한 방식으로 사용됩니다. 약국 자동화를 사용하는 것은 매우 수용 가능하고 약국의 효율성과 정확성을 높이는 데 유익합니다. 또한 약물 오류를 방지해야 할 필요성과 전 세계적으로 증가하는 노령 인구는 예측 기간 동안 시장 성장을 촉진할 가능성이 높습니다.

글로벌 약국 자동화 시장 역학

이 섹션에서는 시장 동인, 이점, 기회, 제약 및 과제를 이해하는 것을 다룹니다. 이 모든 내용은 아래에서 자세히 설명합니다.

운전자

- 약물 오류 최소화에 대한 필요성 증가

의료 오류는 여러 국가에서 사망의 주요 원인이며, 전 세계적으로 입원이 증가하고 있습니다. 약물 오류는 약리학적 및 약제학적 환자 치료 사슬의 오류를 포함하는 다양한 유형이 있습니다. 처방 오류, 분배 오류, 투여 오류, 필사 오류, 처방 오류 및 '전체 설정' 오류입니다.

약물 실수는 의사와 약사 간의 주문 조정 부족, 약국의 부적절한 보관 관행, 동일한 라벨 사용으로 인한 오해 등 다양한 변수로 인해 발생할 수 있습니다.

분배 오류에는 잘못된 복용량, 약물, 복용량 유형, 잘못된 양 또는 불충분하거나, 잘못되거나, 부적절한 라벨링과 같이 처방 순서에서 벗어난 모든 이상 또는 편차가 포함됩니다. 분배 전 약물의 오도되거나 불충분한 사용 지침, 부적절한 계획, 포장 또는 보관도 약물 오류로 간주됩니다.

하루에 250개의 처방전을 처리하는 약국에서 하루에 4건의 오류가 발생하는데, 이는 전국에서 매년 처리되는 30억 개의 처방전 중 약 5,150만 개의 오류가 발생한다는 의미입니다.

- 의약품 수요 증가

암, 당뇨병, 비만, 천식 등 만성 질환의 급증으로 인해 전 세계적으로 의약품 에 대한 수요가 증가하고 있습니다. 이러한 질병을 앓고 있는 사람들은 의사가 처방한 약물 중 하나에 의존합니다.

또한, 더 나은 의료 시설의 가용성으로 인해 전 세계적으로 노령 인구가 증가하고 있습니다. 특정 질병에 맞춰 효과적이고 새로운 약물을 출시하는 연구 개발이 증가함에 따라 의약품에 대한 수요가 급증하고 있습니다.

게다가, COVID-19의 출현으로 인해 전 세계적으로 비타민 C 정제, 하이드록시클로로퀸을 포함한 다양한 약물에 대한 수요도 늘어났으며 , 이로 인해 의약품 수요가 크게 증가했습니다.

기회

- 약국 내 업무 효율성 증대 필요성

모든 약국은 처방전을 정확하고 효율적으로 작성하고, 환자에게 고품질 치료를 제공하며, 근로자가 직무 만족도가 높고 소비자가 만족하는 지속 가능한 사업 모델을 유지하는 것을 포함한 동일한 목표를 추구합니다.

전반적인 병원 전략과 우선순위에 맞춰 약국 활동의 효과성을 개선하여 환자 중심의 고품질 치료를 제공하고자 많은 병원과 약국 리더들이 약국 자동화 시스템을 도입하기 시작했습니다.

향상된 워크플로우와 약국 자동화 소프트웨어 및 시스템의 도입은 잠재적으로 약국의 효율성을 높였습니다. 따라서 약국 내 업무 효율성을 높여야 할 필요성은 시장 성장의 기회로 작용합니다.

제지

- 높은 자본 투자

약국 자동화 시스템은 수동 시스템에 비해 비용이 더 많이 듭니다. 평균 약국 자동화 시스템의 가격은 59,198.45달러에서 시작하지만, 더 이국적인 버전의 경우 최대 591,984.50달러까지 올라갈 수 있습니다.

약국 자동화 시스템 구현에 필요한 자본 투자가 상당히 높기 때문에 개발도상국의 병원과 약국은 물론 전 세계의 소규모 약국에서 이러한 시스템을 도입하기 어렵습니다. 따라서 높은 자본 투자는 약국 자동화 시스템 도입률 감소로 이어집니다. 따라서 시장 성장에 제약으로 작용합니다.

도전

- 엄격한 규제 절차

병원과 약국은 국가의 약물 공급망에서 중요한 역할을 해야 합니다. 대중에게 약물을 배포하는 것입니다. 약물 분배 관행을 규제하는 여러 규정(주 및 연방) 중에는 일반 대중과 업계 종사자 모두의 보호 및 보안과 관련된 3가지 중요한 법률이 있습니다.

이러한 법률은 약물 공급망 보호, 통제 물질 규제 및 안전, 제약품 유해 폐기물 관리에 적용되며 FDA, DEA, EPA에서 시행합니다.

따라서 자동화된 제약 시스템 제조업체는 다양한 규정을 준수해야 합니다. 이러한 규정 준수를 유지하는 것은 지루한 작업이며 제품 출시를 지연시킬 수 있습니다. 따라서 규제 절차의 엄격성은 시장 성장에 도전으로 작용합니다.

최근 개발 사항

- 2023년 1월, AmerisourceBergen Corporation은 PharmaLex Holding GmbH 인수 완료를 발표했습니다. PharmaLex 인수는 AmerisourceBergen Corporation의 전문 서비스 및 제약 제조업체 서비스 역량의 글로벌 플랫폼에서 리더십을 강화하여 성장 전략을 강화합니다.

- 2022년 2월, Baxter는 CVE(Common Vulnerability and Exposures) 프로그램에서 CVE 번호 지정 기관이 될 수 있는 승인을 받았다고 발표했습니다.

글로벌 약국 자동화 시장

글로벌 약국 자동화 시장은 제품, 약국 유형, 약국 규모, 응용 분야, 최종 사용자 및 유통 채널을 기준으로 6개의 주요 세그먼트로 구분됩니다.

제품

- 시스템

- 소프트웨어

- 서비스

제품을 기준으로 시장은 시스템, 소프트웨어, 서비스로 구분됩니다 .

약국 유형

- 독립적인

- 체인

- 연방

약국 유형을 기준으로 시장은 독립형, 체인형, 연방형으로 구분됩니다.

약국 규모

- 대형 약국

- 중간 크기 약국

- 소규모 약국

약국 규모에 따라 시장은 대형 약국, 중형 약국, 소형 약국으로 구분됩니다.

애플리케이션

- 약물 분배 및 포장

- 약물 보관

- 재고 관리

시장은 응용 분야를 기준으로 약물 분배 및 포장, 약물 보관, 재고 관리로 구분됩니다.

최종 사용자

- 입원환자 약국

- 외래 약국

- 소매 약국

- 온라인 약국

- 중앙 채우기/우편 주문 약국

- PHARMACY BENEFIT MANAGEMENT ORGANIZATIONS

- OTHERS

On the basis of end user, the market is segmented into inpatient pharmacies, outpatient pharmacies, retail pharmacies, online pharmacies, central fill/mail order pharmacies, pharmacy benefit management organizations, and others.

DISTRIBUTION CHANNEL

- DIRECT TENDER

- THIRD PARTY DISTRIBUTOR

On the basis of distribution channel, the market is segmented into direct tender and third party distributor.

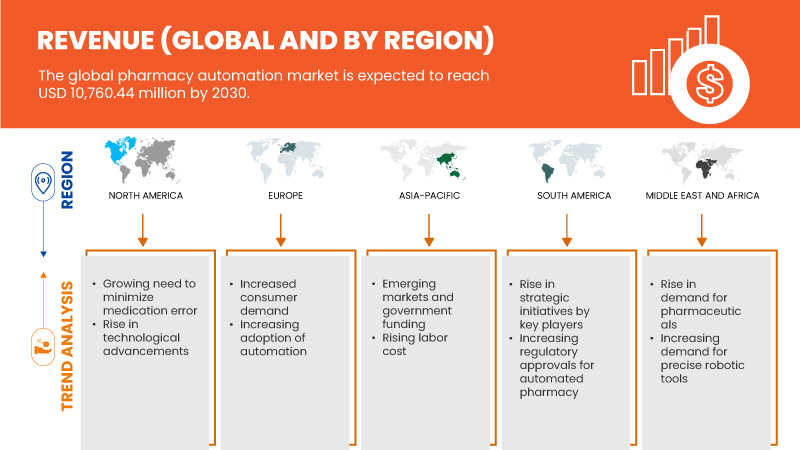

Global Pharmacy Automation Market Regional Analysis/Insights

The global pharmacy automation market is segmented into six notable segments based on product, pharmacy type, pharmacy size, application, end user, and distribution channel.

The countries covered in this market report are U.S., Canada, Mexico, Germany, France, Italy, U.K., Spain, Netherlands, Russia, Switzerland, Turkey, Belgium, rest of Europe, Japan, China, India, South Korea, Australia, Singapore, Malaysia, Thailand, Indonesia, Philippines, rest of Asia-Pacific, Brazil, Argentina, rest of South America, Saudi Arabia, South Africa, U.A.E., Israel, Egypt, and rest of Middle East and Africa.

Asia-Pacific is dominating the market due to the increasing investment in R&D, which is expected to boost market growth. In 2023, China is expected to dominate the Asia-Pacific region due to the growing need to minimize medication errors and the rising demand for pharmaceuticals. The U.S. is expected to dominate the North America region due to the strong presence of key players such as OMNICELL, INC., McKesson Corporation, and AmerisourceBergen Corporation. Germany is expected to dominate the Europe region due to increasing awareness regarding the advantages of pharmacy automation systems over manual methods.

The country section of the report also provides individual market-impacting factors and changes in regulation in the market domestically that impact the current and future trends of the market. Data points such as new sales, replacement sales, country demographics, regulatory acts, and import-export tariffs are some of the major pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, and the impact of sales channels are considered while providing forecast analysis of the country data.

Competitive Landscape and Global Pharmacy Automation Market Share Analysis

The global pharmacy automation market competitive landscape provides details of competitors. Details included are company overview, company financials, revenue generated, market potential, investment in R&D, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, and application dominance. The above data points provided are only related to the companies' focus on the market.

글로벌 약국 자동화 시장에서 활동하는 주요 기업으로는 ARxIUM, OMNICELL INC., Cerner Corporation, Capsa Healthcare, ScriptPro LLC, RxSafe, LLC., MedAvail Technologies, Inc., Asteres Inc., InterLink AI, Inc., BD, Baxter, Fullscript, McKesson Corporation, Innovation Associates, AmerisourceBergen Corporation, UNIVERSAL LOGISTICS HOLDINGS, INC, Takazono Corporation, TOSHO Inc., Willach Group, BIQHS 등이 있습니다.

SKU-

세계 최초의 시장 정보 클라우드 보고서에 온라인으로 접속하세요

- 대화형 데이터 분석 대시보드

- 높은 성장 잠재력 기회를 위한 회사 분석 대시보드

- 사용자 정의 및 질의를 위한 리서치 분석가 액세스

- 대화형 대시보드를 통한 경쟁자 분석

- 최신 뉴스, 업데이트 및 추세 분석

- 포괄적인 경쟁자 추적을 위한 벤치마크 분석의 힘 활용

목차

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL PHARMACY AUTOMATION MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 MULTIVARIATE MODELLING

2.7 MARKET APPLICATION COVERAGE GRID

2.8 PRODUCT LIFELINE CURVE

2.9 DBMR MARKET POSITION GRID

2.1 VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 GLOBAL PHARMACY AUTOMATION MARKET: REGULATIONS

4.1 EXISTING STATE LAWS AND REGULATIONS FOR THE USE OF AUTOMATED DISPENSING SYSTEMS (ADS) IN THE U.S.

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 GROWING NEED TO MINIMIZE MEDICATION ERRORS

5.1.2 RISING DEMAND FOR PHARMACEUTICALS

5.1.3 RISING LABOR COST

5.1.4 ADVANTAGES OF PHARMACY AUTOMATION SYSTEMS OVER MANUAL METHODS

5.1.5 TECHNOLOGICAL ADVANCEMENTS AND PRECISE ROBOTIC TOOLS

5.2 RESTRAINTS

5.2.1 RELUCTANCE AMONG THE HEALTHCARE ORGANIZATIONS TO ADOPT PHARMACY AUTOMATION SYSTEMS

5.2.2 HIGH CAPITAL INVESTMENT

5.2.3 INTEROPERABILITY PROBLEMS IN PHARMACY AUTOMATION

5.3 OPPORTUNITIES

5.3.1 NEED FOR INCREASING THE EFFICIENCY OF WORK WITHIN THE PHARMACIES

5.3.2 RISING HEALTHCARE EXPENDITURE IN EMERGING NATIONS

5.3.3 STRATEGIC INITIATIVES OF KEY MARKET PLAYERS

5.4 CHALLENGES

5.4.1 STRINGENCY OF REGULATORY PROCEDURES

5.4.2 SKILLED WORK-FORCE CHALLENGES

5.4.3 LIMITATIONS OF PHARMACY AUTOMATION SYSTEMS

6 GLOBAL PHARMACY AUTOMATION MARKET, BY PRODUCT

6.1 OVERVIEW

6.2 SYSTEMS

6.3 SOFTWARE

6.4 SERVICES

7 GLOBAL PHARMACY AUTOMATION MARKET, BY PHARMACY TYPE

7.1 OVERVIEW

7.2 INDEPENDENT

7.3 CHAIN

7.4 FEDERAL

8 GLOBAL PHARMACY AUTOMATION MARKET, BY PHARMACY SIZE

8.1 OVERVIEW

8.2 LARGE SIZE PHARMACY

8.3 MEDIUM SIZE PHARMACY

8.4 SMALL SIZE PHARMACY

9 GLOBAL PHARMACY AUTOMATION MARKET, BY APPLICATION

9.1 OVERVIEW

9.2 DRUG DISPENSING AND PACKAGING

9.3 DRUG STORAGE

9.4 INVENTORY MANAGEMENT

10 GLOBAL PHARMACY AUTOMATION MARKET, BY END USER

10.1 OVERVIEW

10.2 INPATIENT PHARMACIES

10.3 OUTPATIENT PHARMACIES

10.4 RETAIL PHARMACIES

10.5 ONLINE PHARMACIES

10.6 CENTRAL FILL/MAIL ORDER PHARMACIES

10.7 PHARMACY BENEFIT MANAGEMENT ORGANIZATIONS

10.8 OTHERS

11 GLOBAL PHARMACY AUTOMATION MARKET, BY DISTRIBUTION CHANNEL

11.1 OVERVIEW

11.2 DIRECT TENDER

11.3 THIRD PARTY DISTRIBUTOR

12 GLOBAL PHARMACY AUTOMATION MARKET, BY REGION

12.1 OVERVIEW

12.2 NORTH AMERICA

12.2.1 U.S.

12.2.2 CANADA

12.2.3 MEXICO

12.3 EUROPE

12.3.1 GERMANY

12.3.2 FRANCE

12.3.3 ITALY

12.3.4 U.K.

12.3.5 SPAIN

12.3.6 SWITZERLAND

12.3.7 RUSSIA

12.3.8 NETHERLANDS

12.3.9 BELGIUM

12.3.10 TURKEY

12.3.11 REST OF EUROPE

12.4 ASIA-PACIFIC

12.4.1 JAPAN

12.4.2 CHINA

12.4.3 AUSTRALIA

12.4.4 SOUTH KOREA

12.4.5 INDIA

12.4.6 SINGAPORE

12.4.7 THAILAND

12.4.8 INDONESIA

12.4.9 MALAYSIA

12.4.10 PHILIPPINES

12.4.11 REST OF ASIA-PACIFIC

12.5 SOUTH AMERICA

12.5.1 BRAZIL

12.5.2 ARGENTINA

12.5.3 REST OF SOUTH AMERICA

12.6 MIDDLE EAST & AFRICA

12.6.1 SAUDI ARABIA

12.6.2 SOUTH AFRICA

12.6.3 U.A.E.

12.6.4 ISRAEL

12.6.5 EGYPT

12.6.6 REST OF MIDDLE EAST & AFRICA

13 GLOBAL PHARMACY AUTOMATION MARKET, COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: GLOBAL

13.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

13.3 COMPANY SHARE ANALYSIS: EUROPE

13.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

14 SWOT ANALYSIS

15 COMPANY PROFILE

15.1 OMNICELL, INC.

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 COMPANY SHARE ANALYSIS

15.1.4 PRODUCT PORTFOLIO

15.1.5 RECENT DEVELOPMENTS

15.2 MCKESSON CORPORATION

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 COMPANY SHARE ANALYSIS

15.2.4 PRODUCT PORTFOLIO

15.2.5 RECENT DEVELOPMENTS

15.3 AMERISOURCEBERGEN CORPORATION

15.3.1 COMPANY SNAPSHOT

15.3.2 REVENUE ANALYSIS

15.3.3 COMPANY SHARE ANALYSIS

15.3.4 PRODUCT PORTFOLIO

15.3.5 RECENT DEVELOPMENTS

15.4 BAXTER

15.4.1 COMPANY SNAPSHOT

15.4.2 REVENUE ANALYSIS

15.4.3 COMPANY SHARE ANALYSIS

15.4.4 PRODUCT PORTFOLIO

15.4.5 RECENT DEVELOPMENTS

15.5 TOSHO CO., INC.

15.5.1 COMPANY SNAPSHOT

15.5.2 COMPANY SHARE ANALYSIS

15.5.3 PRODUCT PORTFOLIO

15.5.4 RECENT DEVELOPMENTS

15.6 APD ALGORITMOS PROCESOS Y DISEÑOS S.A.

15.6.1 COMPANY SNAPSHOT

15.6.2 PRODUCT PORTFOLIO

15.6.3 RECENT DEVELOPMENTS

15.7 ASTERES INC.

15.7.1 COMPANY SNAPSHOT

15.7.2 PRODUCT PORTFOLIO

15.7.3 RECENT DEVELOPMENTS

15.8 ARXIUM

15.8.1 COMPANY SNAPSHOT

15.8.2 PRODUCT PORTFOLIO

15.8.3 RECENT DEVELOPMENTS

15.9 BD

15.9.1 COMPANY SNAPSHOT

15.9.2 REVENUE ANALYSIS

15.9.3 COMPANY SHARE ANALYSIS

15.9.4 PRODUCT PORTFOLIO

15.9.5 RECENT DEVELOPMENTS

15.1 BIQHS

15.10.1 COMPANY SNAPSHOT

15.10.2 PRODUCT PORTFOLIO

15.10.3 RECENT DEVELOPMENTS

15.11 CAPSA HEALTHCARE

15.11.1 COMPANY SNAPSHOT

15.11.2 PRODUCT PORTFOLIO

15.11.3 RECENT DEVELOPMENTS

15.12 CERNER CORPORATION

15.12.1 COMPANY SNAPSHOT

15.12.2 REVENUE ANALYSIS

15.12.3 PRODUCT PORTFOLIO

15.12.4 RECENT DEVELOPMENTS

15.13 DEENOVA S.R.L.

15.13.1 COMPANY SNAPSHOT

15.13.2 PRODUCT PORTFOLIO

15.13.3 RECENT DEVELOPMENTS

15.14 DEMODEKS PHARMACY SHELVING

15.14.1 COMPANY SNAPSHOT

15.14.2 PRODUCT PORTFOLIO

15.14.3 RECENT DEVELOPMENTS

15.15 FULLSCRIPT

15.15.1 COMPANY SNAPSHOT

15.15.2 PRODUCT PORTFOLIO

15.15.3 RECENT DEVELOPMENTS

15.16 GENESIS AUTOMATION LTD

15.16.1 COMPANY SNAPSHOT

15.16.2 PRODUCT PORTFOLIO

15.16.3 RECENT DEVELOPMENTS

15.17 IA

15.17.1 COMPANY SNAPSHOT

15.17.2 PRODUCT PORTFOLIO

15.17.3 RECENT DEVELOPMENTS

15.18 INTERLINK AI, INC

15.18.1 COMPANY SNAPSHOT

15.18.2 PRODUCT PORTFOLIO

15.18.3 RECENT DEVELOPMENTS

15.19 JVM EUROPE BV

15.19.1 COMPANY SNAPSHOT

15.19.2 PRODUCT PORTFOLIO

15.19.3 RECENT DEVELOPMENTS

15.2 KLS PHARMA ROBOTICS GMBH

15.20.1 COMPANY SNAPSHOT

15.20.2 PRODUCT PORTFOLIO

15.20.3 RECENT DEVELOPMENTS

15.21 KUKA AG

15.21.1 COMPANY SNAPSHOT

15.21.2 REVENUE ANALYSIS

15.21.3 COMPANY SHARE ANALYSIS

15.21.4 PRODUCT PORTFOLIO

15.21.5 RECENT DEVELOPMENTS

15.22 MEDAVAIL TECHNOLOGIES, INC.

15.22.1 COMPANY SNAPSHOT

15.22.2 PRODUCT PORTFOLIO

15.22.3 RECENT DEVELOPMENTS

15.23 MYPAK SOLUTIONS PTY LTD.

15.23.1 COMPANY SNAPSHOT

15.23.2 PRODUCT PORTFOLIO

15.23.3 RECENT DEVELOPMENTS

15.24 RXSAFE, LLC.

15.24.1 COMPANY SNAPSHOT

15.24.2 PRODUCT PORTFOLIO

15.24.3 RECENT DEVELOPMENTS

15.25 SCRIPTPRO LLC

15.25.1 COMPANY SNAPSHOT

15.25.2 COMPANY SHARE ANALYSIS

15.26.3 PRODUCT PORTFOLIO

15.26.4 RECENT DEVELOPMENTS

15.27 SYNERGY MEDICAL

15.27.1 COMPANY SNAPSHOT

15.27.2 PRODUCT PORTFOLIO

15.27.3 RECENT DEVELOPMENTS

15.28 TAKAZONO CORPORATION

15.28.1 COMPANY SNAPSHOT

15.28.2 PRODUCT PORTFOLIO

15.28.3 RECENT DEVELOPMENTS

15.29 UNIVERSAL LOGISTICS HOLDINGS, INC.

15.29.1 COMPANY SNAPSHOT

15.29.2 REVENUE ANALYSIS

15.29.3 PRODUCT PORTFOLIO

15.29.4 RECENT DEVELOPMENTS

15.3 WILLACH GROUP

15.30.1 COMPANY SNAPSHOT

15.30.2 PRODUCT PORTFOLIO

15.30.3 RECENT DEVELOPMENTS

15.31 YUYAMA

15.31.1 COMPANY SNAPSHOT

15.31.2 PRODUCT PORTFOLIO

15.31.3 RECENT DEVELOPMENTS

16 QUESTIONNAIRE

17 RELATED REPORTS

그림 목록

FIGURE 1 GLOBAL PHARMACY AUTOMATION MARKET: SEGMENTATION

FIGURE 2 GLOBAL PHARMACY AUTOMATION MARKET: DATA TRIANGULATION

FIGURE 3 GLOBAL PHARMACY AUTOMATION MARKET: DROC ANALYSIS

FIGURE 4 GLOBAL PHARMACY AUTOMATION MARKET: GLOBAL VS REGIONAL MARKET ANALYSIS

FIGURE 5 GLOBAL PHARMACY AUTOMATION MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 GLOBAL PHARMACY AUTOMATION MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 GLOBAL PHARMACY AUTOMATION MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 8 GLOBAL PHARMACY AUTOMATION MARKET: DBMR MARKET POSITION GRID

FIGURE 9 GLOBAL PHARMACY AUTOMATION MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 GLOBAL PHARMACY AUTOMATION MARKET: SEGMENTATION

FIGURE 11 NORTH AMERICA IS ANTICIPATED TO DOMINATE THE GLOBAL PHARMACY AUTOMATION MARKET AND ASIA-PACIFIC IS ESTIMATED TO BE GROWING WITH THE HIGHEST CAGR IN THE FORECAST PERIOD OF 2023 TO 2030

FIGURE 12 GROWING NEED TO MINIMIZE MEDICATION ERRORS IS EXPECTED TO DRIVE THE GLOBAL PHARMACY AUTOMATION MARKET IN THE FORECAST PERIOD OF 2023 TO 2030

FIGURE 13 SYSTEMS SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE GLOBAL PHARMACY AUTOMATION MARKET IN 2023 AND 2030

FIGURE 14 ASIA-PACIFIC IS THE FASTEST GROWING REGION FOR PHARMACY AUTOMATION MANUFACTURERS IN THE FORECAST PERIOD OF 2023 TO 2030

FIGURE 15 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF GLOBAL PHARMACY AUTOMATION MARKET

FIGURE 16 GLOBAL PHARMACY AUTOMATION MARKET: BY PRODUCT, 2022

FIGURE 17 GLOBAL PHARMACY AUTOMATION MARKET: BY PRODUCT, 2023-2030 (USD

FIGURE 18 GLOBAL PHARMACY AUTOMATION MARKET: BY PRODUCT, CAGR (2023-2030)

FIGURE 19 GLOBAL PHARMACY AUTOMATION MARKET: BY PRODUCT, LIFELINE CURVE

FIGURE 20 GLOBAL PHARMACY AUTOMATION MARKET: BY PHARMACY TYPE, 2022

FIGURE 21 GLOBAL PHARMACY AUTOMATION MARKET: BY PHARMACY TYPE, 2023-2030 (USD MILLION)

FIGURE 22 GLOBAL PHARMACY AUTOMATION MARKET: BY PHARMACY TYPE, CAGR (2023-2030)

FIGURE 23 GLOBAL PHARMACY AUTOMATION MARKET: BY PHARMACY TYPE, LIFELINE CURVE

FIGURE 24 GLOBAL PHARMACY AUTOMATION MARKET: BY PHARMACY SIZE, 2022

FIGURE 25 GLOBAL PHARMACY AUTOMATION MARKET: BY PHARMACY SIZE, 2023-2030 (USD MILLION)

FIGURE 26 GLOBAL PHARMACY AUTOMATION MARKET: BY PHARMACY SIZE, CAGR (2023-2030)

FIGURE 27 GLOBAL PHARMACY AUTOMATION MARKET: BY PHARMACY SIZE, LIFELINE CURVE

FIGURE 28 GLOBAL PHARMACY AUTOMATION MARKET: BY APPLICATION, 2022

FIGURE 29 GLOBAL PHARMACY AUTOMATION MARKET: BY APPLICATION, 2023-2030 (USD MILLION)

FIGURE 30 GLOBAL PHARMACY AUTOMATION MARKET: BY APPLICATION, CAGR (2023-2030)

FIGURE 31 GLOBAL PHARMACY AUTOMATION MARKET: BY APPLICATION, LIFELINE CURVE

FIGURE 32 GLOBAL PHARMACY AUTOMATION MARKET: BY END USER, 2022

FIGURE 33 GLOBAL PHARMACY AUTOMATION MARKET: BY END USER, 2023-2030 (USD MILLION)

FIGURE 34 GLOBAL PHARMACY AUTOMATION MARKET: BY END USER, CAGR (2023-2030)

FIGURE 35 GLOBAL PHARMACY AUTOMATION MARKET: BY END USER, LIFELINE CURVE

FIGURE 36 GLOBAL PHARMACY AUTOMATION MARKET: BY DISTRIBUTION CHANNEL, 2022

FIGURE 37 GLOBAL PHARMACY AUTOMATION MARKET: BY DISTRIBUTION CHANNEL, 2023-2030 (USD MILLION)

FIGURE 38 GLOBAL PHARMACY AUTOMATION MARKET: BY DISTRIBUTION CHANNEL, CAGR (2023-2030)

FIGURE 39 GLOBAL PHARMACY AUTOMATION MARKET: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 40 GLOBAL PHARMACY AUTOMATION MARKET: SNAPSHOT (2022)

FIGURE 41 GLOBAL PHARMACY AUTOMATION MARKET: BY REGION (2022)

FIGURE 42 GLOBAL PHARMACY AUTOMATION MARKET: BY REGION (2023 & 2030)

FIGURE 43 GLOBAL PHARMACY AUTOMATION MARKET: BY REGION (2022 & 2030)

FIGURE 44 GLOBAL PHARMACY AUTOMATION MARKET: BY PRODUCT (2023-2030)

FIGURE 45 NORTH AMERICA PHARMACY AUTOMATION MARKET: SNAPSHOT (2022)

FIGURE 46 NORTH AMERICA PHARMACY AUTOMATION MARKET: BY COUNTRY (2022)

FIGURE 47 NORTH AMERICA PHARMACY AUTOMATION MARKET: BY COUNTRY (2023 & 2030)

FIGURE 48 NORTH AMERICA PHARMACY AUTOMATION MARKET: BY COUNTRY (2022 & 2030)

FIGURE 49 NORTH AMERICA PHARMACY AUTOMATION MARKET: BY PRODUCT (2023-2030)

FIGURE 50 EUROPE PHARMACY AUTOMATION MARKET: SNAPSHOT (2022)

FIGURE 51 EUROPE PHARMACY AUTOMATION MARKET: BY COUNTRY (2022)

FIGURE 52 EUROPE PHARMACY AUTOMATION MARKET: BY COUNTRY (2023 & 2030)

FIGURE 53 EUROPE PHARMACY AUTOMATION MARKET: BY COUNTRY (2022 & 2030)

FIGURE 54 EUROPE PHARMACY AUTOMATION MARKET: BY PRODUCT (2023-2030)

FIGURE 55 ASIA-PACIFIC PHARMACY AUTOMATION MARKET: SNAPSHOT (2022)

FIGURE 56 ASIA-PACIFIC PHARMACY AUTOMATION MARKET: BY COUNTRY (2022)

FIGURE 57 ASIA-PACIFIC PHARMACY AUTOMATION MARKET: BY COUNTRY (2023 & 2030)

FIGURE 58 ASIA-PACIFIC PHARMACY AUTOMATION MARKET: BY COUNTRY (2022 & 2030)

FIGURE 59 ASIA-PACIFIC PHARMACY AUTOMATION MARKET: BY PRODUCT (2023-2030)

FIGURE 60 SOUTH AMERICA PHARMACY AUTOMATION MARKET: SNAPSHOT (2022)

FIGURE 61 SOUTH AMERICA PHARMACY AUTOMATION MARKET: BY COUNTRY (2022)

FIGURE 62 SOUTH AMERICA PHARMACY AUTOMATION MARKET: BY COUNTRY (2023 & 2030)

FIGURE 63 SOUTH AMERICA PHARMACY AUTOMATION MARKET: BY COUNTRY (2022 & 2030)

FIGURE 64 SOUTH AMERICA PHARMACY AUTOMATION MARKET: BY PRODUCT (2023-2030)

FIGURE 65 MIDDLE EAST & AFRICA PHARMACY AUTOMATION MARKET: SNAPSHOT (2022)

FIGURE 66 MIDDLE EAST & AFRICA PHARMACY AUTOMATION MARKET: BY COUNTRY (2022)

FIGURE 67 MIDDLE EAST & AFRICA PHARMACY AUTOMATION MARKET: BY COUNTRY (2023 & 2030)

FIGURE 68 MIDDLE EAST & AFRICA PHARMACY AUTOMATION MARKET: BY COUNTRY (2022 & 2030)

FIGURE 69 MIDDLE EAST & AFRICA PHARMACY AUTOMATION MARKET: BY PRODUCT (2023-2030)

FIGURE 70 GLOBAL PHARMACY AUTOMATION MARKET: COMPANY SHARE 2022 (%)

FIGURE 71 NORTH AMERICA PHARMACY AUTOMATION MARKET: COMPANY SHARE 2022 (%)

FIGURE 72 EUROPE PHARMACY AUTOMATION MARKET: COMPANY SHARE 2022 (%)

FIGURE 73 ASIA-PACIFIC PHARMACY AUTOMATION MARKET: COMPANY SHARE 2022 (%)

연구 방법론

데이터 수집 및 기준 연도 분석은 대규모 샘플 크기의 데이터 수집 모듈을 사용하여 수행됩니다. 이 단계에는 다양한 소스와 전략을 통해 시장 정보 또는 관련 데이터를 얻는 것이 포함됩니다. 여기에는 과거에 수집한 모든 데이터를 미리 검토하고 계획하는 것이 포함됩니다. 또한 다양한 정보 소스에서 발견되는 정보 불일치를 검토하는 것도 포함됩니다. 시장 데이터는 시장 통계 및 일관된 모델을 사용하여 분석하고 추정합니다. 또한 시장 점유율 분석 및 주요 추세 분석은 시장 보고서의 주요 성공 요인입니다. 자세한 내용은 분석가에게 전화를 요청하거나 문의 사항을 드롭하세요.

DBMR 연구팀에서 사용하는 주요 연구 방법론은 데이터 마이닝, 시장에 대한 데이터 변수의 영향 분석 및 주요(산업 전문가) 검증을 포함하는 데이터 삼각 측량입니다. 데이터 모델에는 공급업체 포지셔닝 그리드, 시장 타임라인 분석, 시장 개요 및 가이드, 회사 포지셔닝 그리드, 특허 분석, 가격 분석, 회사 시장 점유율 분석, 측정 기준, 글로벌 대 지역 및 공급업체 점유율 분석이 포함됩니다. 연구 방법론에 대해 자세히 알아보려면 문의를 통해 업계 전문가에게 문의하세요.

사용자 정의 가능

Data Bridge Market Research는 고급 형성 연구 분야의 선두 주자입니다. 저희는 기존 및 신규 고객에게 목표에 맞는 데이터와 분석을 제공하는 데 자부심을 느낍니다. 보고서는 추가 국가에 대한 시장 이해(국가 목록 요청), 임상 시험 결과 데이터, 문헌 검토, 재생 시장 및 제품 기반 분석을 포함하도록 사용자 정의할 수 있습니다. 기술 기반 분석에서 시장 포트폴리오 전략에 이르기까지 타겟 경쟁업체의 시장 분석을 분석할 수 있습니다. 귀하가 원하는 형식과 데이터 스타일로 필요한 만큼 많은 경쟁자를 추가할 수 있습니다. 저희 분석가 팀은 또한 원시 엑셀 파일 피벗 테이블(팩트북)로 데이터를 제공하거나 보고서에서 사용 가능한 데이터 세트에서 프레젠테이션을 만드는 데 도움을 줄 수 있습니다.