가축을 위한 글로벌 해충 구제 시장, 구제 방법(화학적, 생물학적, 기계적, 소프트웨어 및 서비스, 기타), 적용 모드(스프레이, 분말, 펠릿, 함정, 미끼, 기타), 해충 유형(곤충, 설치류, 새, 야생 동물, 파충류, 거미류, 흰개미, 연체 동물, 기타), 최종 용도(소 농장, 가금류 농장, 돼지 농장, 양 농장, 말 농장, 염소 농장, 주거/가정용, 기타) - 업계 동향 및 2030년까지의 예측.

가축 시장 분석 및 규모에 대한 해충 관리

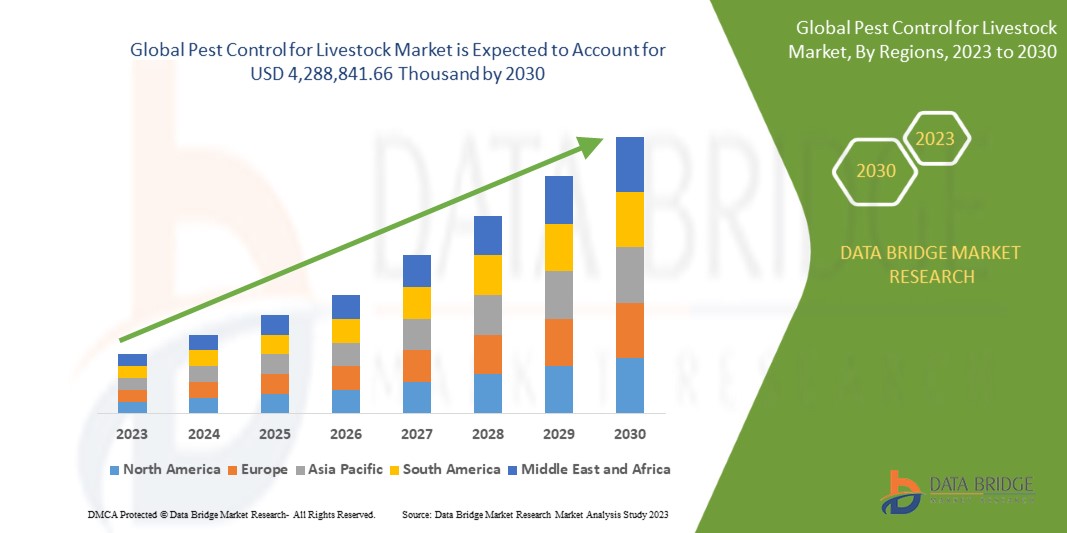

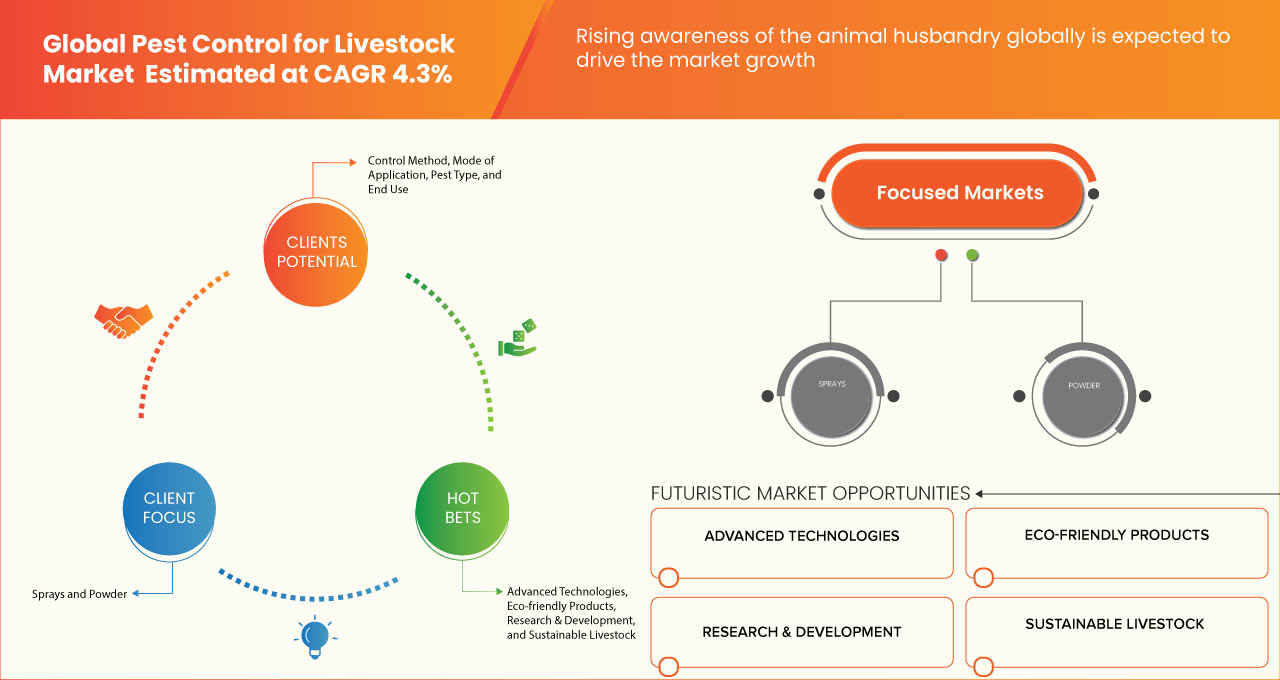

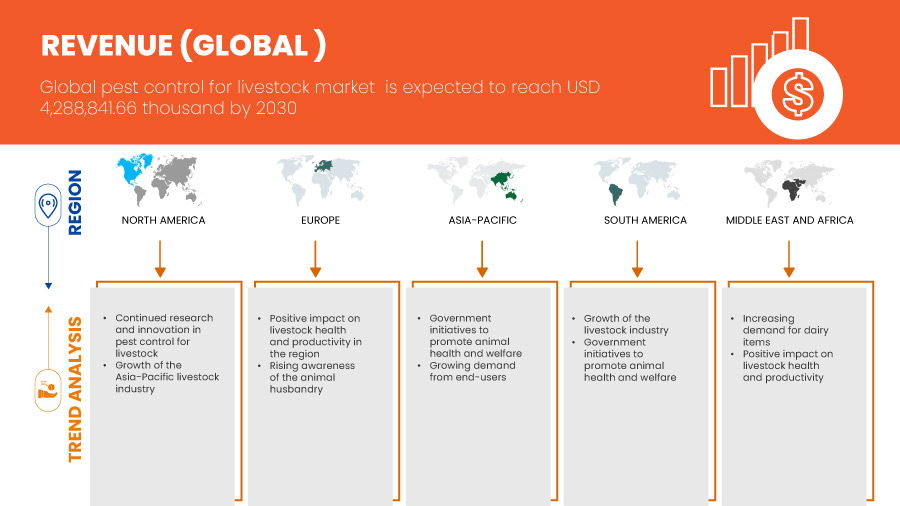

가축을 위한 글로벌 해충 관리 시장은 2023년부터 2030년까지의 예측 기간 동안 상당히 성장할 것으로 예상됩니다. Data Bridge Market Research는 시장이 2023년부터 2030년까지의 예측 기간 동안 4.3%의 CAGR로 성장하고 있으며 2030년까지 4,288,841.66천 달러에 도달할 것으로 예상된다고 분석했습니다. 전 세계적으로 축산업에 대한 인식이 높아지면서 가축을 위한 글로벌 해충 관리 시장이 주요 원동력이 되었습니다.

가축을 위한 글로벌 해충 방제 시장 보고서는 시장 점유율, 새로운 개발, 국내 및 지역 시장 참여자의 영향에 대한 세부 정보를 제공하고, 새로운 수익 창출처, 시장 규정의 변화, 제품 승인, 전략적 의사 결정, 제품 출시, 지리적 확장 및 시장의 기술 혁신 측면에서 기회를 분석합니다. 분석과 시장 시나리오를 이해하려면 당사에 연락하여 분석가 브리핑을 받으세요. 당사 팀은 원하는 목표를 달성하기 위한 수익 영향 솔루션을 만드는 데 도움을 드립니다.

|

보고서 메트릭 |

세부 |

|

예측 기간 |

2023년부터 2030년까지 |

|

기준 연도 |

2022 |

|

역사적 연도 |

2021 (2020-2015까지 사용자 정의 가능) |

|

양적 단위 |

수익 (USD 천) |

|

다루는 세그먼트 |

제어 방법( 화학 , 생물학, 기계, 소프트웨어 및 서비스 및 기타), 적용 모드(스프레이, 분말, 펠릿, 함정, 미끼 및 기타), 판매 모드(곤충, 설치류, 새, 야생 동물, 파충류, 거미류, 흰개미, 연체 동물 및 기타), 해충 유형(곤충, 설치류, 새, 야생 동물, 파충류, 거미류, 흰개미, 연체 동물 및 기타), 최종 사용(가축 농장, 가금류 농장, 돼지 농장, 양 농장, 말 농장, 염소 농장, 주거/가정 및 기타) |

|

적용 국가 |

미국, 캐나다, 멕시코, 프랑스, 독일, 영국, 이탈리아, 스페인, 러시아, 터키, 네덜란드, 벨기에, 스위스, 스웨덴, 핀란드, 노르웨이, 덴마크, 유럽 기타 지역, 중국, 인도, 인도네시아, 베트남, 태국, 일본, 말레이시아, 필리핀, 한국, 싱가포르, 호주, 뉴질랜드, 대만, 홍콩, 아시아 태평양 기타 지역, 브라질, 아르헨티나, 남미 기타 지역, 남아프리카, 이집트, 사우디 아라비아, UAE, 이스라엘, 쿠웨이트, 오만, 카타르, 바레인, 중동 및 아프리카 기타 지역 |

|

시장 참여자 포함 |

Elanco, BASF SE, Central Garden & Pet Company., Neogen Corporation, Purina Animal Nutrition LLC, McLaughlin Gormley King Company, Vetoquinol, Control Solutions, Inc.(ADAMA 그룹 회원), FMC Corporation, LANXESS, Bell Labs., Y-TEX, Inc. 및 Pyranha |

시장 정의

가축 해충 방제는 소, 양, 염소, 돼지, 가금류 및 기타 가축과 같은 가축의 건강, 복지 및 생산성에 부정적인 영향을 미칠 수 있는 다양한 해충 및 기생충을 관리하고 완화하는 것을 말합니다. 이러한 해충 및 기생충에는 곤충, 진드기, 진드기, 벌레 및 가축 산업에서 질병, 불편함 및 경제적 손실을 일으킬 수 있는 기타 유기체가 포함될 수 있습니다. 가축 해충 방제의 주요 목표는 해충 및 기생충의 영향을 관리하고 완화하여 동물 건강을 보호하고, 복지를 향상시키고, 생산성을 최적화하는 것입니다.

가축 시장 역학을 위한 글로벌 해충 관리

이 섹션에서는 시장 동인, 기회, 과제 및 제약을 이해하는 것을 다룹니다. 이 모든 내용은 아래에서 자세히 설명합니다.

운전자

- 전 세계적으로 동물 사육에 대한 인식이 높아지다

육류, 우유 및 가축에서 파생된 기타 상품에 대한 수요 증가와 축산은 전 세계 농업 시스템의 중요한 부분입니다. 파리 침입은 동물에게 심각한 건강 위험을 초래하여 질병과 생산성 감소로 이어집니다. 전 세계 축산 분야에서 일하는 전문가들 사이에서 효율적인 해충 방제의 중요성에 대한 인식이 높아지고 있습니다. 글로벌 해충 방제 산업은 이러한 인식 증가에 의해 주도되고 있으며, 특히 소와 말과 같은 가축의 파리 관련 문제를 해결하는 데 중점을 두고 있습니다.

전 세계의 축산 전문가들 사이에서 가축 농장의 효과적인 해충 관리, 특히 소와 말의 파리 침입에 대한 인식이 높아지고 있는 것은 글로벌 해충 관리 산업의 중요한 원동력입니다. 이 접근 방식은 동물 복지와 생산을 개선하는 것 외에도 축산 부문 내에서 경제적 발전과 혁신을 촉진합니다. 전 세계 축산 기술의 지속 가능성과 도덕적 책임은 전 세계 인구와 가축에서 파생된 제품에 대한 수요가 확대됨에 따라 효과적인 해충 관리에 크게 의존합니다. 따라서 전 세계적으로 축산에 대한 인식이 높아지면서 시장 성장이 촉진될 것으로 예상됩니다.

- 동물 건강과 복지 증진을 위한 정부 이니셔티브

전 세계 정부들은 가축 부문에서 동물 건강과 복지의 중요성을 분석하고 있습니다. 이는 가축의 복지를 보호하기 위해 해충 관리 관행을 개선하는 것을 목표로 하는 일련의 이니셔티브로 이어졌습니다.

효과적인 해충 관리를 통해 동물 건강과 복지를 증진하는 것을 목표로 하는 정부 이니셔티브는 글로벌 해충 관리 시장의 성장에 중추적인 역할을 하고 있으며, 특히 소와 말의 파리 침입을 해결하는 데 중요한 역할을 하고 있습니다. 이러한 이니셔티브는 동물의 복지를 보호할 뿐만 아니라 가축 부문의 경제 성장, 기술 발전 및 지속 가능성에 기여합니다. 효과적인 해충 관리가 전 세계 정부가 동물 건강과 식품 안전을 계속 우선시함에 따라 책임감 있고 지속 가능한 가축 농업 관행의 초석으로 남아 있습니다. 따라서 동물 건강과 복지를 증진하는 것을 목표로 하는 정부 이니셔티브가 시장 성장을 촉진할 것으로 예상됩니다.

기회

- 환경적으로 지속 가능한 해충 관리 접근 방식에 대한 인식 증가

세계 가축 산업은 해충, 특히 파리를 통제하는 데 있어 점점 더 큰 어려움에 직면해 있으며, 이는 동물의 복지와 생산성에 부정적인 영향을 미칠 수 있습니다. 기존의 해충 관리 방법은 종종 화학 살충제를 사용하는 것을 포함하며, 이는 환경 및 건강에 영향을 미칠 수 있습니다. 그러나 환경적으로 지속 가능한 해충 관리 접근 방식에 대한 열의가 증가함에 따라 가축의 파리에 대한 세계 해충 관리 시장에서 상당한 기회가 생겨나고 있습니다.

환경적으로 지속 가능한 해충 관리 방법에 대한 열의가 증가함에 따라 가축 파리에 대한 글로벌 해충 관리 시장에 상당한 기회가 제공됩니다. 화학 살충제에 대한 의존도를 줄이고 친환경 해충 관리 방법을 촉진하는 혁신적인 솔루션이 환경 영향에 대한 인식이 높아지고 지속 가능한 농업 관행에 대한 수요가 증가함에 따라 두각을 나타내고 있습니다. 가축 산업의 제조업체와 이해 관계자는 이 기회를 활용하여 산업과 환경을 의식하는 소비자의 요구를 충족하는 동시에 가축의 웰빙과 생산성을 보장하기 위해 지속 가능한 해충 관리 솔루션의 연구 개발에 투자해야 합니다. 결론적으로 환경적으로 지속 가능한 해충 관리 방법에 대한 인식이 높아지면 가축을 위한 글로벌 해충 관리 시장에 대한 시장 잠재력이 제공됩니다.

제약/도전

- 파리의 저항성과 기존 방제 방법에 대한 적응성

가축 관리 분야의 해충 파리 방제는 전 세계 농부와 가축 생산자에게 끊임없는 투쟁입니다. 파리는 동물을 불편하게 만드는 것 외에도 질병을 퍼뜨리고 가축 생산성을 낮출 수 있기 때문에 심각한 건강 문제를 일으킵니다. 화학적, 생물학적, 물리적 처리를 포함한 다양한 해충 관리 전략이 이 문제를 해결하기 위해 개발되었습니다. 그러나 파리의 기존 방제 조치에 대한 엄청난 저항성과 적응성은 가축의 파리에 대한 글로벌 해충 방제 시장에서 주요 장애물입니다.

제조업체와 가축 생산자는 통합 해충 관리 전략을 채택하고 가축의 건강과 복지, 산업의 지속 가능성을 보장하기 위한 신기술을 탐색하여 이러한 과제에 적응해야 합니다. 따라서 제조업체의 기존 제어 방법에 대한 파리의 저항성과 적응성은 예측 기간 동안 시장 성장에 도전할 것으로 예상됩니다.

- 화학 살충제와 관련된 환경 문제

가축을 위한 글로벌 해충 방제 시장, 특히 파리 침입 관리 시장은 화학 살충제와 관련된 환경적 우려가 증가함에 따라 상당한 어려움에 직면해 있습니다. 이러한 우려는 이러한 살충제의 인정된 생태적 영향에 의해 발생합니다. 파리와 다른 해충을 퇴치하는 데 사용되는 많은 기존 살충제에는 유익한 곤충 , 수생 생물, 심지어 야생 동물과 같은 비대상 종에 해를 끼칠 수 있는 환경에 지속될 수 있는 독성 화학 물질이 포함되어 있습니다.

결론적으로, 화학 살충제와 관련된 환경적 우려는 가축 시장의 글로벌 해충 방제, 특히 파리 침입 관리에 상당한 과제를 안겨줍니다. 이러한 과제에는 생태적 영향, 식품 안전, 살충제 내성, 토양 및 수질 오염, 규정 준수가 포함됩니다. 이러한 우려를 해결하려면 지속 가능하고 환경 친화적인 해충 방제 관행으로 전환해야 하며, 이는 업계에 과제와 기회를 모두 제공합니다. 따라서 화학 살충제와 관련된 환경적 우려는 시장 성장에 도전이 될 것으로 예상됩니다.

최근 개발 사항

- 2023년 6월, ClariFly Larvicide의 생산자인 Central Garden & Pet Company는 세계 최대의 돼지고기 중심 무역 박람회인 아이오와주 데모인의 아이오와주 박람회장에서 6월 7~9일에 열린 World Pork Expo를 방문했습니다. 그들은 최신 ClariFly Larvicide 소식과 발전 사항, IPM 관리 및 전문가가 제안한 파리 제어를 강조하여 돼지 사업이 수익을 최적화하도록 지원했습니다. 이를 통해 회사는 다양한 소비자 그룹에 제품을 전시할 수 있었습니다.

- 2023년 3월, Cyzmic Synergized는 Control Solutions, Inc.의 신제품입니다. Cyzmic Synergized의 피레트로이드 살충제 람다-시할로트린과 시너지스트 피페로닐 부톡사이드(PBO)는 가축 및 가금류 건물 안팎에서 딱정벌레, 파리 및 기타 해충을 방제하는 데 사용됩니다. 이를 통해 이 조직은 제품 제공을 강화하고 고유한 해충 방제 솔루션을 개발하는 데 도움이 될 것입니다.

가축 시장 범위를 위한 글로벌 해충 관리

가축을 위한 글로벌 해충 방제 시장은 방제 방법, 적용 모드, 해충 유형 및 최종 용도에 따라 분류됩니다. 이러한 세그먼트 간의 성장은 산업의 주요 성장 세그먼트를 분석하고 사용자에게 핵심 시장 응용 프로그램을 식별하기 위한 전략적 결정을 내릴 수 있는 귀중한 시장 개요와 시장 통찰력을 제공하는 데 도움이 됩니다.

제어 방법

- 화학적인

- 생물학적

- 기계적

- 소프트웨어 및 서비스

- 기타

시장은 통제 방법을 기준으로 화학, 생물, 기계, 소프트웨어 및 서비스, 기타로 구분됩니다.

적용 모드

- 스프레이

- 가루

- 펠렛

- 트랩

- 미끼

- 기타

적용 방식을 기준으로 시장은 스프레이, 분말, 펠릿, 트랩, 미끼 및 기타로 구분됩니다.

해충 유형

- 곤충

- 설치류

- 조류

- 야생 생물

- 파충류

- 거미강

- 흰개미

- 연체동물

- 기타

해충 유형을 기준으로 시장은 곤충, 설치류, 새, 야생 동물, 파충류, 거미, 흰개미, 연체동물 및 기타로 구분됩니다.

최종 사용

- 가금류 농장

- 가축 농장

- 양 농장

- 염소 농장

- 말 농장

- 돼지 농장

- 주거용 / 가정용

- 기타

최종 용도를 기준으로 시장은 가금류 농장, 소 농장, 양 농장, 염소 농장, 말 농장, 돼지 농장, 주거/가정용 및 기타로 구분됩니다.

가축 시장을 위한 글로벌 해충 관리 지역 분석/통찰력

가축을 위한 글로벌 해충 관리 시장은 관리 방법, 적용 모드, 해충 유형, 최종 용도를 기준으로 세분화됩니다.

글로벌 가축 해충 구제 시장의 국가는 미국, 캐나다, 멕시코, 독일, 영국, 이탈리아, 스페인, 러시아, 터키, 네덜란드, 벨기에, 스위스, 스웨덴, 핀란드, 노르웨이, 덴마크, 기타 유럽, 중국, 인도, 인도네시아, 베트남, 태국, 일본, 말레이시아, 필리핀, 한국, 싱가포르, 호주, 뉴질랜드, 대만, 홍콩, 기타 아시아 태평양, 브라질, 아르헨티나, 기타 남미, 남아프리카, 이집트, 사우디 아라비아, UAE, 이스라엘, 쿠웨이트, 오만, 카타르, 바레인, 기타 중동 및 아프리카입니다.

아시아 태평양 지역은 가축 개체 수가 많고 해충에 대한 우려가 커져 세계 가축 해충 방제 시장을 주도할 것으로 예상됩니다. 중국은 방대한 가축 개체 수, 다양한 농업 관행, 정부 지원, 시장 혁신으로 인해 아시아 태평양 지역에서 주도권을 잡을 것으로 예상됩니다. 미국은 선진 농업 관행, 상당한 가축 개체 수, 혁신적인 해충 관리 솔루션으로 인해 북미 지역에서 주도권을 잡을 것으로 예상됩니다. 프랑스는 강력한 농업 전통, 연구 역량, 효과적인 해충 관리 전략으로 인해 유럽 지역에서 주도권을 잡을 것으로 예상됩니다.

보고서의 국가 섹션은 또한 현재 및 미래 시장 추세에 영향을 미치는 개별 시장 영향 요인과 시장 규제의 변화를 제공합니다. 데이터 포인트 하류 및 상류 가치 사슬 분석, 기술 추세 포터의 5가지 힘 분석 및 사례 연구는 개별 국가의 시장 시나리오를 예측하는 데 사용되는 몇 가지 포인터입니다. 또한 글로벌 브랜드의 존재 및 가용성과 지역 및 국내 브랜드와의 대규모 또는 희소한 경쟁으로 인해 직면한 과제, 국내 관세의 영향 및 무역 경로가 국가 데이터의 예측 분석을 제공하는 동안 고려됩니다.

경쟁 환경 및 가축 시장을 위한 글로벌 해충 관리 시장 점유율 분석

가축을 위한 글로벌 해충 방제 시장 경쟁 구도는 경쟁자에 대한 세부 정보를 제공합니다. 포함된 세부 정보에는 회사 개요, 회사 재무, 창출된 수익, 시장 잠재력, 연구 개발 투자, 새로운 시장 이니셔티브, 생산 현장 및 시설, 회사의 강점과 약점, 제품 출시, 제품 시험 파이프라인, 제품 승인, 특허, 제품 폭과 넓이, 최종 사용 우세, 기술 수명선 곡선이 있습니다. 위에 제공된 데이터 포인트는 시장과 관련된 회사의 초점에만 관련이 있습니다.

시장에서 활동하는 주요 기업으로는 Elanco, BASF SE, Central Garden & Pet Company, Neogen Corporation, Purina Animal Nutrition LLC, McLaughlin Gormley King Company, Vetoquinol, Control Solutions, Inc. (ADAMA 그룹 회원), FMC Corporation, LANXESS, Bell Labs., Y-TEX, Inc., Pyranha 등이 있습니다.

SKU-

세계 최초의 시장 정보 클라우드 보고서에 온라인으로 접속하세요

- 대화형 데이터 분석 대시보드

- 높은 성장 잠재력 기회를 위한 회사 분석 대시보드

- 사용자 정의 및 질의를 위한 리서치 분석가 액세스

- 대화형 대시보드를 통한 경쟁자 분석

- 최신 뉴스, 업데이트 및 추세 분석

- 포괄적인 경쟁자 추적을 위한 벤치마크 분석의 힘 활용

목차

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE GLOBAL PEST CONTROL FOR LIVESTOCK MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.8 DBMR MARKET POSITION GRID

2.9 MARKET END USE COVERAGE GRID

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 RISING AWARENESS OF THE ANIMAL HUSBANDRY GLOBALLY

5.1.2 GOVERNMENT INITIATIVES TO PROMOTE ANIMAL HEALTH AND WELFARE

5.1.3 INCREASING DEMAND FOR DAIRY ITEMS

5.2 RESTRAINTS

5.2.1 RESISTANCE OF FLIES AND ADAPTABILITY TO CONVENTIONAL CONTROL METHODS

5.2.2 HIGH MAINTENANCE COST ASSOCIATED WITH PEST CONTROL

5.3 OPPORTUNITIES

5.3.1 INCREASING AWARENESS TOWARDS ENVIRONMENTALLY SUSTAINABLE PEST CONTROL APPROACHES

5.3.2 NEW INNOVATION ADVANCEMENT IN PEST CONTROL

5.4 CHALLENGES

5.4.1 ENVIRONMENTAL CONCERNS ASSOCIATED WITH CHEMICAL PESTICIDES

5.4.2 CREATION AND ADOPTION OF ENVIRONMENT-FRIENDLY PEST CONTROL SOLUTIONS

6 GLOBAL PEST CONTROL FOR LIVESTOCK MARKET BY REGION

6.1 GLOBAL

6.2 EUROPE

6.3 NORTH AMERICA

6.4 SOUTH AMERICA

6.5 ASIA-PACIFIC

6.6 MIDDLE EAST AND AFRICA

7 GLOBAL PEST CONTROL FOR LIVESTOCK MARKET: COMPANY LANDSCAPE

7.1 COMPANY SHARE ANALYSIS: GLOBAL

7.2 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

7.3 COMPANY SHARE ANALYSIS: NORTH AMERICA

7.4 COMPANY SHARE ANALYSIS: EUROPE

7.5 EXPANSION

7.6 EVENT

7.7 ACQUISITION

7.8 PRODUCT LAUNCH

7.9 PARTNERSHIP

8 SWOT

9 COMPANY PROFILES

9.1 ELANCO

9.1.1 COMPANY SNAPSHOT

9.1.2 REVENUE ANALYSIS

9.1.3 PRODUCT PORTFOLIO

9.1.4 RECENT DEVELOPMENT

9.2 BASF SE

9.2.1 COMPANY SNAPSHOT

9.2.2 REVENUE ANALYSIS

9.2.3 PRODUCT PORTFOLIO

9.2.4 RECENT DEVELOPMENT

9.3 FMC CORPORATION

9.3.1 COMPANY SNAPSHOT

9.3.2 REVENUE ANALYSIS

9.3.3 PRODUCT PORTFOLIO

9.3.4 RECENT DEVELOPMENT

9.4 CENTRAL GARDEN & PET COMPANY.

9.4.1 COMPANY SNAPSHOT

9.4.2 REVENUE ANALYSIS

9.4.3 PRODUCT PORTFOLIO

9.4.4 RECENT DEVELOPMENT

9.5 LANXESS

9.5.1 COMPANY SNAPSHOT

9.5.2 REVENUE ANALYSIS

9.5.3 PRODUCT PORTFOLIO

9.5.4 RECENT DEVELOPMENT

9.6 BELL LABS.

9.6.1 COMPANY SNAPSHOT

9.6.2 PRODUCT PORTFOLIO

9.6.3 RECENT DEVELOPMENT

9.7 CONTROL SOLUTIONS, INC. (A MEMBER OF THE ADAMA GROUP)

9.7.1 COMPANY SNAPSHOT

9.7.2 PRODUCT PORTFOLIO

9.7.3 RECENT DEVELOPMENTS

9.8 MCLAUGHLIN GORMLEY KING COMPANY

9.8.1 COMPANY SNAPSHOT

9.8.2 PRODUCT PORTFOLIO

9.8.3 RECENT DEVELOPMENTS

9.9 NEOGEN CORPORATION

9.9.1 COMPANY SNAPSHOT

9.9.2 REVENUE ANALYSIS

9.9.3 PRODUCT PORTFOLIO

9.9.4 RECENT DEVELOPMENTS

9.1 PURINA ANIMAL NUTRITION LLC

9.10.1 COMPANY SNAPSHOT

9.10.2 PRODUCT PORTFOLIO

9.10.3 RECENT DEVELOPMENT

9.11 PYRANHA

9.11.1 COMPANY SNAPSHOT

9.11.2 PRODUCT PORTFOLIO

9.11.3 RECENT DEVELOPMENT

9.12 VETOQUINOL

9.12.1 COMPANY SNAPSHOT

9.12.2 REVENUE ANALYSIS

9.12.3 PRODUCT PORTFOLIO

9.12.4 RECENT DEVELOPMENT

9.13 Y-TEX, INC.

9.13.1 COMPANY SNAPSHOT

9.13.2 PRODUCT PORTFOLIO

9.13.3 RECENT DEVELOPMENT

10 QUESTIONNAIRE

11 RELATED REPORTS

그림 목록

FIGURE 1 GLOBAL PEST CONTROL FOR LIVESTOCK MARKET: SEGMENTATION

FIGURE 2 GLOBAL PEST CONTROL FOR LIVESTOCK MARKET: DATA TRIANGULATION

FIGURE 3 GLOBAL PEST CONTROL FOR LIVESTOCK MARKET: DROC ANALYSIS

FIGURE 4 GLOBAL PEST CONTROL FOR LIVESTOCK MARKET: GLOBAL VS REGIONAL MARKET ANALYSIS

FIGURE 5 GLOBAL PEST CONTROL FOR LIVESTOCK MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 GLOBAL PEST CONTROL FOR LIVESTOCK MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 GLOBAL PEST CONTROL FOR LIVESTOCK MARKET: DBMR MARKET POSITION GRID

FIGURE 8 GLOBAL PEST CONTROL FOR LIVESTOCK MARKET: MARKET END USE COVERAGE GRID

FIGURE 9 GLOBAL PEST CONTROL FOR LIVESTOCK MARKET: SEGMENTATION

FIGURE 10 ASIA PACIFIC IS EXPECTED TO DOMINATE THE GLOBAL PEST CONTROL FOR LIVESTOCK MARKET WITH THE HIGHEST CAGR IN THE FORECAST PERIOD

FIGURE 11 RISING AWARENESS REGARDING ANIMAL HUSBANDRY GLOBALLY IS DRIVING THE GROWTH OF THE GLOBAL PEST CONTROL FOR LIVESTOCK MARKET IN THE FORECAST PERIOD

FIGURE 12 THE CHEMICAL SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE GLOBAL PEST CONTROL FOR LIVESTOCK MARKET IN 2023 AND 2030

FIGURE 13 ASIA PACIFIC IS THE FASTEST-GROWING MARKET FOR GLOBAL PEST CONTROL FOR LIVESTOCK MARKET IN THE FORECAST PERIOD

FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE GLOBAL PEST CONTROL FOR LIVESTOCK MARKET

FIGURE 15 GLOBAL PEST CONTROL FOR LIVESTOCK MARKET: BY SNAPSHOT (2022)

FIGURE 16 EUROPE PEST CONTROL FOR LIVESTOCK MARKET: BY SNAPSHOT (2022)

FIGURE 17 NORTH AMERICA PEST CONTROL FOR LIVESTOCK MARKET: BY SNAPSHOT (2022)

FIGURE 18 SOUTH AMERICA PEST CONTROL FOR LIVESTOCK MARKET: BY SNAPSHOT (2022)

FIGURE 19 ASIA-PACIFIC PEST CONTROL FOR LIVESTOCK MARKET: BY SNAPSHOT (2022)

FIGURE 20 MIDDLE EAST AND AFRICA PEST CONTROL FOR LIVESTOCK MARKET: BY SNAPSHOT (2022)

FIGURE 21 GLOBAL PEST CONTROL FOR LIVESTOCK MARKET: COMPANY SHARE 2022 (%)

FIGURE 22 ASIA-PACIFC PEST CONTROL FOR LIVESTOCK MARKET: COMPANY SHARE 2022 (%)

FIGURE 23 NORTH AMERICA PEST CONTROL FOR LIVESTOCK MARKET: COMPANY SHARE 2022 (%)

FIGURE 24 EUROPE PEST CONTROL FOR LIVESTOCK MARKET: COMPANY SHARE 2022 (%)

연구 방법론

데이터 수집 및 기준 연도 분석은 대규모 샘플 크기의 데이터 수집 모듈을 사용하여 수행됩니다. 이 단계에는 다양한 소스와 전략을 통해 시장 정보 또는 관련 데이터를 얻는 것이 포함됩니다. 여기에는 과거에 수집한 모든 데이터를 미리 검토하고 계획하는 것이 포함됩니다. 또한 다양한 정보 소스에서 발견되는 정보 불일치를 검토하는 것도 포함됩니다. 시장 데이터는 시장 통계 및 일관된 모델을 사용하여 분석하고 추정합니다. 또한 시장 점유율 분석 및 주요 추세 분석은 시장 보고서의 주요 성공 요인입니다. 자세한 내용은 분석가에게 전화를 요청하거나 문의 사항을 드롭하세요.

DBMR 연구팀에서 사용하는 주요 연구 방법론은 데이터 마이닝, 시장에 대한 데이터 변수의 영향 분석 및 주요(산업 전문가) 검증을 포함하는 데이터 삼각 측량입니다. 데이터 모델에는 공급업체 포지셔닝 그리드, 시장 타임라인 분석, 시장 개요 및 가이드, 회사 포지셔닝 그리드, 특허 분석, 가격 분석, 회사 시장 점유율 분석, 측정 기준, 글로벌 대 지역 및 공급업체 점유율 분석이 포함됩니다. 연구 방법론에 대해 자세히 알아보려면 문의를 통해 업계 전문가에게 문의하세요.

사용자 정의 가능

Data Bridge Market Research는 고급 형성 연구 분야의 선두 주자입니다. 저희는 기존 및 신규 고객에게 목표에 맞는 데이터와 분석을 제공하는 데 자부심을 느낍니다. 보고서는 추가 국가에 대한 시장 이해(국가 목록 요청), 임상 시험 결과 데이터, 문헌 검토, 재생 시장 및 제품 기반 분석을 포함하도록 사용자 정의할 수 있습니다. 기술 기반 분석에서 시장 포트폴리오 전략에 이르기까지 타겟 경쟁업체의 시장 분석을 분석할 수 있습니다. 귀하가 원하는 형식과 데이터 스타일로 필요한 만큼 많은 경쟁자를 추가할 수 있습니다. 저희 분석가 팀은 또한 원시 엑셀 파일 피벗 테이블(팩트북)로 데이터를 제공하거나 보고서에서 사용 가능한 데이터 세트에서 프레젠테이션을 만드는 데 도움을 줄 수 있습니다.