Global Performance Additives Market

시장 규모 (USD 10억)

연평균 성장률 :

%

USD

2.28 Billion

USD

4.24 Billion

2024

2032

USD

2.28 Billion

USD

4.24 Billion

2024

2032

| 2025 –2032 | |

| USD 2.28 Billion | |

| USD 4.24 Billion | |

|

|

|

|

Global Performance Additives Market Segmentation, Type (Plastic Additives, Rubber Additives, Ink Additives, Pigment Additives, Paints and Coating Additives, Fuel Additives and Others), End Use (Packaging, Household Goods, Construction, Automotive, Industrial, Wood and Furniture and Others), - Industry Trends and Forecast to 2032

Performance Additives Market Size

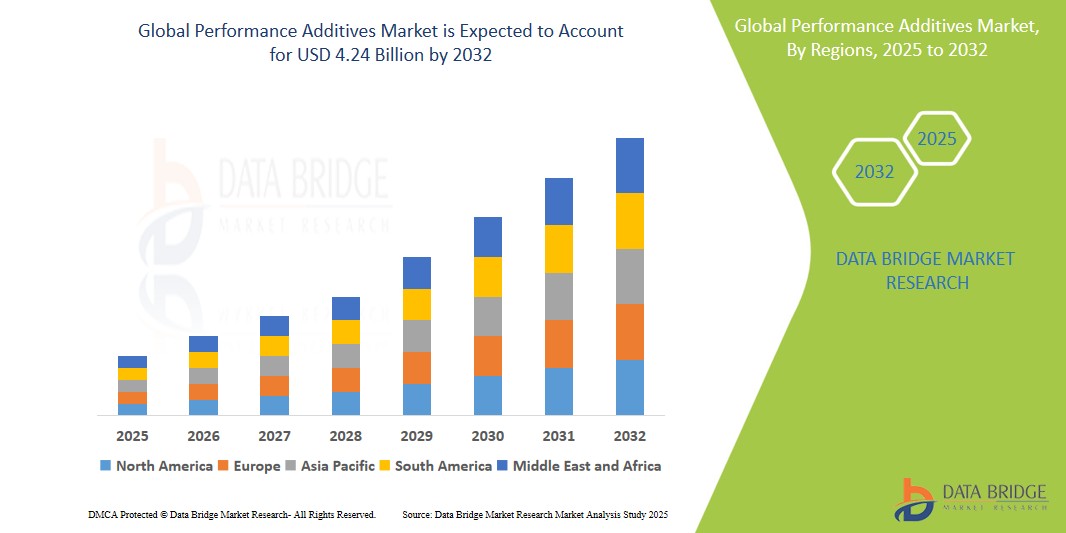

- The global Performance Additives market size was valued atUSD 2.28 billion in 2024 and is expected to reachUSD 4.24 billion by 2032, at aCAGR of 8.03%during the forecast period

- This growth is driven by factors such as the Growth and expansion in the packaging industry have led to the rise in demand for performance additives as they offer enhanced features such as durability, processability, and appearance of the final output

Performance Additives Market Analysis

- Performance Additives are specialized chemicals added to materials like plastics, coatings, adhesives, and lubricants to enhance properties such as durability, flexibility, UV resistance, and processing efficiency. They are critical in industries such as automotive, construction, packaging, and electronics.

- The demand for these additives is significantly driven by increasing performance requirements in end-use applications, stricter environmental regulations, and innovations in polymer and material science.

- North America is expected to dominate the Performance Additives market due to a strong presence of end-user industries, high investment in R&D, and adoption of sustainable and high-performance materials.

- Asia-Pacific is projected to be the fastest-growing region in the Performance Additives market during the forecast period due to rapid industrialization, growth in automotive and construction sectors, and shifting manufacturing bases to countries like China and India.

- The Plastics segment is expected to dominate the market with a significant share (estimated at over 50%) owing to its widespread use across automotive, consumer goods, and packaging applications, where additives like antioxidants, UV stabilizers, and processing aids improve material performance and longevity.

Report Scope and Performance Additives Market Segmentation

|

Attributes |

Performance Additives Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Performance Additives Market Trends

“Growing Adoption of High-Performance Additives for Lightweight and Durable Materials”

- One prominent trend in the performance additives market is the increasing use of high-performance additives to enable the development of lightweight, durable, and multifunctional materials, particularly in automotive, aerospace, and packaging industries.

- These additives improve thermal stability, mechanical strength, and chemical resistance, meeting the evolving demands for high-performance materials that also support fuel efficiency and sustainability goals..

- For instance, the automotive industry is increasingly incorporating advanced plastic additives—like impact modifiers and UV stabilizers—to replace heavier metal components, helping to reduce vehicle weight and enhance energy efficiency without compromising safety.

- These trend is accelerating innovation in material design, supporting regulatory compliance (such as CO₂ emission norms), and expanding the application scope for performance additives across multiple high-growth sectors.

Performance Additives Market Dynamics

Driver

“Increasing Demand for High-Performance Materials in Key Industries”

- The growing need for advanced, high-performance materials in industries such as automotive, aerospace, and construction is significantly driving the demand for performance additives.

- As industries strive to meet stricter environmental regulations and performance standards, performance additives are crucial for improving material properties like durability, heat resistance, and chemical stability.

- The growing focus on lightweight materials and energy efficiency in sectors like automotive is pushing the adoption of advanced additives that enhance material performance while reducing overall weight

For instance,

- In December 2024, according to a report by Grand View Research, the global automotive lightweight materials market is expected to grow by over 10% annually, with performance additives playing a critical role in enabling material weight reduction without compromising on strength or safety.

• As a result, the demand for performance additives is rising, driven by the need for high-performance materials to meet evolving industry needs.

Opportunity

“Innovations in Eco-friendly and Bio-based Additives”

- The increasing consumer and regulatory focus on sustainability presents significant opportunities for performance additives companies to develop eco-friendly and bio-based solutions.

- Companies are exploring natural additives that reduce environmental impact while maintaining high material performance standards, which is particularly attractive in industries like packaging and automotive, where there is pressure to reduce carbon footprints.

- As demand for sustainable materials rises, bio-based performance additives are poised to play a key role in helping industries transition to greener alternatives without sacrificing performance.

For instance,

- In January 2025, the global bio-based polymer market is expected to reach USD 7 billion, with bio-based performance additives driving this growth by offering sustainable alternatives that do not compromise on performance.

- The development of bio-based additives could open new market opportunities in industries seeking to reduce environmental impact, offering a significant growth avenue for manufacturers in the performance additives market.

Restraint/Challenge

“Volatility in Raw Material Prices Impacting Production Costs”

- The volatility in raw material prices, including petroleum-based chemicals and natural minerals used in performance additives, is a significant challenge for the market.

- These fluctuations in material costs can lead to unpredictable production expenses, which in turn affect the pricing strategies of performance additives manufacturers.

- Smaller manufacturers or those in price-sensitive markets may struggle to maintain competitiveness due to these price pressures, potentially limiting growth in certain regions.

For instance,

- In November 2024, according to a report by the International Energy Agency (IEA), the price of key raw materials like polyethylene and polypropylene experienced significant fluctuations due to disruptions in supply chains and rising global energy costs.

- As a result, raw material price volatility remains a key constraint, making it difficult for companies to manage costs and maintain steady supply chains.

Performance Additives Market Scope

The market is segmented on the basis, Type, End Use,

|

Segmentation |

Sub-Segmentation |

|

By Type |

Plastic additives

Rubber additives

Ink additives

Paints and coating additives

Fuel additives

|

|

By End User |

|

In 2025, the Plastic additives is projected to dominate the market with a largest share in application segment

The Plastic additivessegment is expected to dominate the Performance Additives market with the largest share of 56.22% in 2025 due to This dominance is driven by the high demand for precision and performance in plastic materials, which are critical across multiple industries, particularly automotive, packaging, and construction..

The packaging is expected to account for the largest share during the forecast period in End User market

In 2025, the packaging segment is expected to dominate the market with the largest market share of 51.31% due to growing need for better quality, longer shelf life, and sustainability in packaging solutions. Additives in packaging materials, such as slip agents, anti-blocking agents, and plasticizers, play a vital role in improving the performance and functionality of packaging films, bottles, and containers..

Performance Additives Market Regional Analysis

“North America Holds the Largest Share in the Performance Additives Market”

- North America dominates the Performance Additives market, driven by advanced infrastructure, high adoption of innovative technologies, and a strong presence of leading manufacturers and suppliers.

- The U.S. holds a significant share due to increased demand for high-performance materials in sectors such as automotive, packaging, and construction, along with the continuous advancement in manufacturing processes and product quality.

- The presence of well-established regulations and standards, along with high investment in R&D by key industry players, further strengthens the market in this region.

- Additionally, the demand for sustainability and eco-friendly solutions is contributing to the rapid adoption of bio-based and environmentally friendly performance additives across industries.

“Asia-Pacific is Projected to Register the Highest CAGR in the Performance Additives Market”

- Asia-Pacific is expected to experience the highest growth rate in the Performance Additives market, driven by rapid industrialization, expansion of the automotive sector, and increasing consumer demand for high-quality, durable materials.

- Countries like China, India, and Japan are emerging as key markets due to their growing populations and increased focus on developing manufacturing capabilities for advanced materials.

- China is a critical market for performance additives, driven by its role as a global manufacturing hub for automotive, electronics, and packaging industries. The country’s growing middle class and demand for high-quality consumer goods are also fueling market expansion.

- India, with its rapidly growing automotive and construction industries, is seeing significant investments in performance additives to meet the rising demand for lightweight, durable materials. Furthermore, the government's focus on infrastructure development is expected to drive the demand for performance-enhanced materials in the construction sector.

- Japan remains a strong player in the region, particularly in the automotive and electronics industries, where precision and material durability are key. The country’s high adoption of cutting-edge technologies and strict quality standards contributes to the demand for advanced performance additives.

Performance Additives Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- BASF SE, Akzo Nobel N.V., Solvay, Evonik Industries AG, LANXESS, Arkema, Dow, Honeywell International Inc., Clariant, ALTANA AG, Huntsman International LLC., Eastman Chemical Company, Momentive, Avient Corporation, K-TECH (INDIA) LIMITED., Dynea AS, DAIKIN INDUSTRIES, Ltd., BYK-Chemie GmbH, Mitsubishi Chemical Corporation and Total

Latest Developments in Global Performance Additives Market

- In January 2025, BASF announced the commercial launch of a new series of bio-based performance additives for the automotive and packaging industries. These additives are designed to improve the performance and sustainability of polymer materials, offering enhanced UV stability, heat resistance, and impact strength while meeting stringent environmental regulations. The new additives are derived from renewable resources, reducing the carbon footprint of end products and supporting the global push towards more sustainable manufacturing.

- In December 2024, Clariant unveiled a new range of performance additives for the construction industry, focusing on enhancing the durability and weather resistance of building materials. The innovative additives improve the longevity of materials like concrete and coatings, providing better protection against UV degradation, moisture, and temperature extremes. This development is expected to drive market growth in the construction sector, where durability and sustainability are key concerns.

- In November 2024, Dow announced a breakthrough in the development of high-performance plastic additives that significantly reduce energy consumption during the manufacturing process. By enhancing the processing efficiency of polymers, these additives help manufacturers achieve faster production cycles while lowering energy costs, making them ideal for applications in packaging and consumer goods. The additives also offer improved barrier properties, enhancing the shelf life and performance of packaging materials.

- In October 2024, Evonik launched a new range of performance additives specifically designed for the electronics industry. These additives are aimed at improving the conductivity, stability, and thermal management of electronic components, which is crucial as devices continue to get smaller and more powerful. The new products address the growing demand for high-performance materials that can withstand the increasing heat and stress of modern electronic devices.

SKU-

세계 최초의 시장 정보 클라우드 보고서에 온라인으로 접속하세요

- 대화형 데이터 분석 대시보드

- 높은 성장 잠재력 기회를 위한 회사 분석 대시보드

- 사용자 정의 및 질의를 위한 리서치 분석가 액세스

- 대화형 대시보드를 통한 경쟁자 분석

- 최신 뉴스, 업데이트 및 추세 분석

- 포괄적인 경쟁자 추적을 위한 벤치마크 분석의 힘 활용

연구 방법론

데이터 수집 및 기준 연도 분석은 대규모 샘플 크기의 데이터 수집 모듈을 사용하여 수행됩니다. 이 단계에는 다양한 소스와 전략을 통해 시장 정보 또는 관련 데이터를 얻는 것이 포함됩니다. 여기에는 과거에 수집한 모든 데이터를 미리 검토하고 계획하는 것이 포함됩니다. 또한 다양한 정보 소스에서 발견되는 정보 불일치를 검토하는 것도 포함됩니다. 시장 데이터는 시장 통계 및 일관된 모델을 사용하여 분석하고 추정합니다. 또한 시장 점유율 분석 및 주요 추세 분석은 시장 보고서의 주요 성공 요인입니다. 자세한 내용은 분석가에게 전화를 요청하거나 문의 사항을 드롭하세요.

DBMR 연구팀에서 사용하는 주요 연구 방법론은 데이터 마이닝, 시장에 대한 데이터 변수의 영향 분석 및 주요(산업 전문가) 검증을 포함하는 데이터 삼각 측량입니다. 데이터 모델에는 공급업체 포지셔닝 그리드, 시장 타임라인 분석, 시장 개요 및 가이드, 회사 포지셔닝 그리드, 특허 분석, 가격 분석, 회사 시장 점유율 분석, 측정 기준, 글로벌 대 지역 및 공급업체 점유율 분석이 포함됩니다. 연구 방법론에 대해 자세히 알아보려면 문의를 통해 업계 전문가에게 문의하세요.

사용자 정의 가능

Data Bridge Market Research는 고급 형성 연구 분야의 선두 주자입니다. 저희는 기존 및 신규 고객에게 목표에 맞는 데이터와 분석을 제공하는 데 자부심을 느낍니다. 보고서는 추가 국가에 대한 시장 이해(국가 목록 요청), 임상 시험 결과 데이터, 문헌 검토, 재생 시장 및 제품 기반 분석을 포함하도록 사용자 정의할 수 있습니다. 기술 기반 분석에서 시장 포트폴리오 전략에 이르기까지 타겟 경쟁업체의 시장 분석을 분석할 수 있습니다. 귀하가 원하는 형식과 데이터 스타일로 필요한 만큼 많은 경쟁자를 추가할 수 있습니다. 저희 분석가 팀은 또한 원시 엑셀 파일 피벗 테이블(팩트북)로 데이터를 제공하거나 보고서에서 사용 가능한 데이터 세트에서 프레젠테이션을 만드는 데 도움을 줄 수 있습니다.