글로벌 차세대 패키징 시장, 유형별(활성 패키징 , 지능형 패키징 및 개량된 분위기 패키징), 기능(습기 제어, 온도 표시기, 유통기한 감지, 제품 추적 및 기타), 기술(스캐빈저 및 서셉터 RFID 태그, QR 코드, NFC 태그, 코딩 및 표시, 센서 및 출력 장치 및 기타), 재료(플라스틱, 종이, 골판지 및 기타), 응용 분야(식품, 음료, 개인 관리, 의료, 물류 및 공급망, 가전 제품 및 기타), 국가(미국, 캐나다, 멕시코, 독일, 영국, 이탈리아, 프랑스, 스페인, 러시아, 스위스, 터키, 벨기에, 네덜란드, 룩셈부르크 및 기타 유럽, 일본, 중국, 한국, 인도, 싱가포르, 태국, 인도네시아, 말레이시아, 필리핀, 호주 및 뉴질랜드 및 기타 아시아 태평양, 브라질, 아르헨티나 및 기타 남미, 남아프리카, 사우디 아라비아, UAE, 이집트, 이스라엘 및 기타 중동 및 아프리카) 산업 동향 및 2029년까지의 예측

시장 분석 및 통찰력 : 글로벌 차세대 패키징 시장

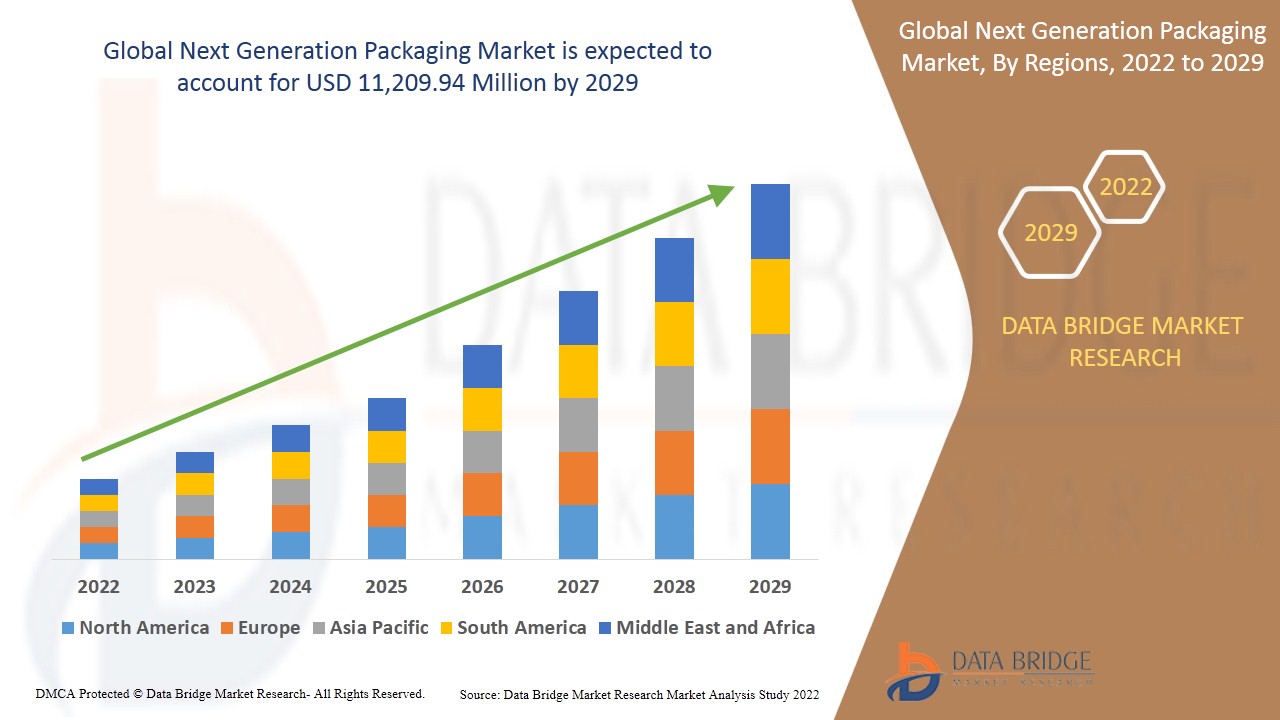

글로벌 차세대 패키징 시장은 2022년부터 2029년까지의 예측 기간 동안 상당한 성장을 이룰 것으로 예상됩니다. Data Bridge Market Research는 시장이 2022년부터 2029년까지의 예측 기간 동안 6.5%의 CAGR로 성장하고 있으며 2029년까지 11,209.94백만 달러에 도달할 것으로 예상된다고 분석합니다.

식품 낭비를 피하기 위한 지능형 포장에 대한 수요 증가로 인해 차세대 포장 제품 사용이 가속화되고 있으며, 이는 시장 성장을 견인할 것으로 예상됩니다. 그러나 연구 개발 활동과 관련된 높은 비용이 시장 성장을 제한할 것으로 예상됩니다. 최근 추세는 공공 및 민간 식품 산업에 대한 투자가 계속 증가함에 따라 차세대 포장에 대한 수요가 증가하고 있음을 나타냅니다. 시장 성장을 견인하는 요인은 일반 대중의 건강 인식 증가와 포장 분야의 지속적인 기술 발전입니다. 세계화의 급속한 성장과 다양한 국가 및 지역에서 식품 및 음료에 대한 의무가 증가함에 따라 글로벌 차세대 포장 시장은 향후 몇 년 동안 증가 추세를 보일 것입니다. 그러나 글로벌 차세대 포장의 높은 포장 비용은 시장 성장을 제한할 것입니다.

다양한 회사들이 시장 점유율을 높이기 위해 연구 시설과 새로운 제품을 출시하기 위한 계약을 맺는 등 전략적 결정을 내리고 있습니다. 그 결과, 차세대 포장 시장은 빠른 속도로 성장하고 있습니다. 반면, 최근의 혁신과 신제품 출시는 시장에 새로운 기회를 창출하고 있습니다. 그러나 대체 제품의 쉬운 가용성은 글로벌 차세대 포장 시장에 과제로 작용하고 있습니다.

글로벌 차세대 패키징 시장 보고서는 시장 점유율, 새로운 개발 및 제품 파이프라인 분석, 국내 및 지역 시장 참여자의 영향, 새로운 수익 창출, 시장 규정의 변화, 제품 승인, 전략적 의사 결정, 제품 출시, 지리적 확장 및 시장의 기술 혁신 측면에서의 분석 기회에 대한 세부 정보를 제공합니다. 분석 및 시장 시나리오를 이해하려면 분석가 브리핑을 위해 저희에게 연락하세요. 저희 팀은 원하는 목표를 달성하기 위한 수익 영향 솔루션을 만드는 데 도움을 드릴 것입니다.

글로벌 차세대 패키징 시장 범위 및 시장 규모

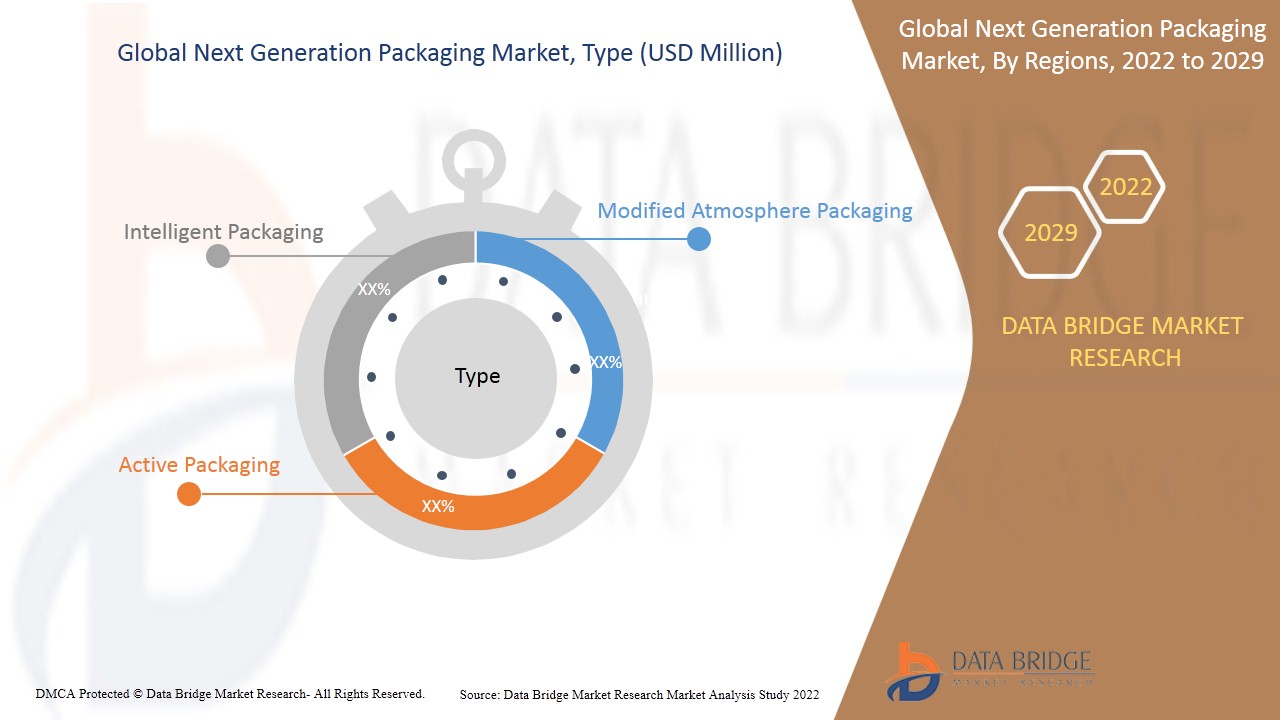

글로벌 차세대 패키징 시장은 유형, 기능, 기술, 소재 및 응용 분야에 따라 5개 세그먼트로 구분됩니다. 세그먼트 간 성장은 틈새 성장 포켓과 시장에 접근하고 핵심 응용 분야와 타겟 시장의 차이점을 파악하기 위한 전략을 분석하는 데 도움이 됩니다.

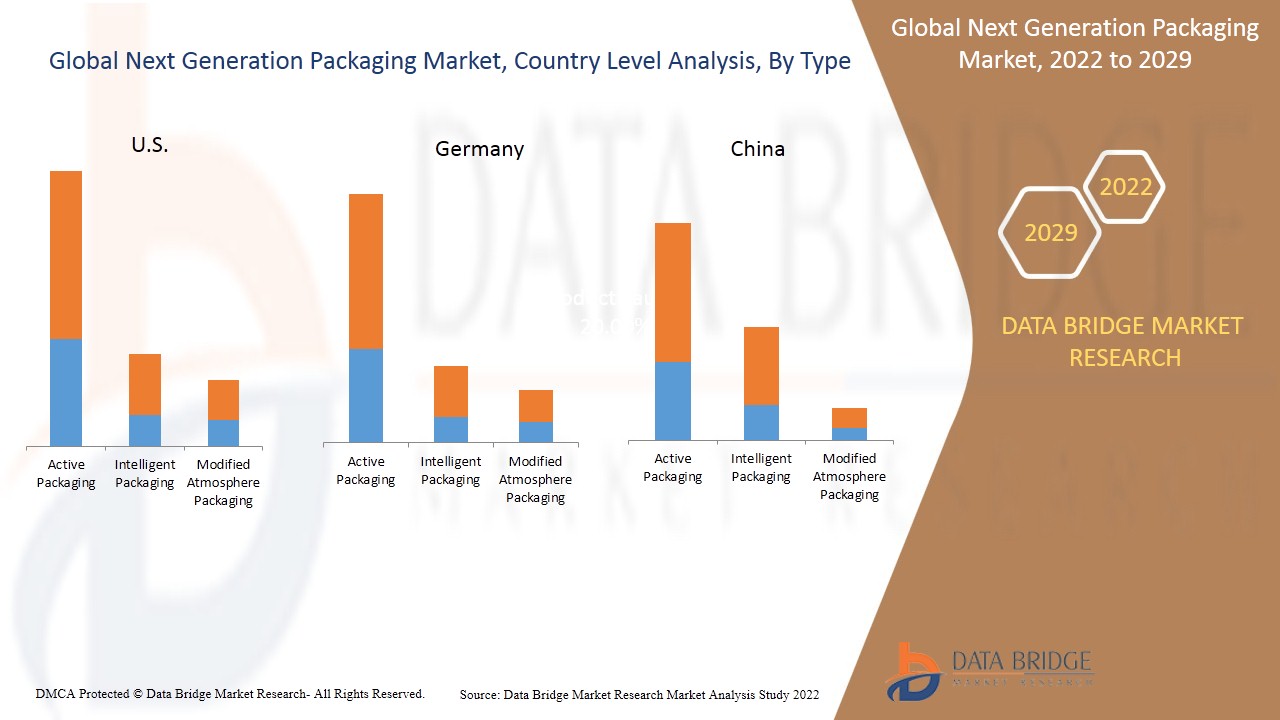

- 유형을 기준으로 글로벌 차세대 포장 시장은 액티브 포장, 지능형 포장, 개량된 대기 포장으로 세분화됩니다. 2022년에는 액티브 포장 세그먼트가 생산량이 많고 액티브 포장의 사용 편의성이 높아 시장을 지배할 것으로 예상됩니다.

- 기능을 기준으로, 글로벌 차세대 포장 시장은 습도 제어, 온도 표시기, 유통기한 감지, 제품 추적 등으로 세분화됩니다. 2022년에는 습도 제어 부문이 제품의 유통기한을 연장하는 데 가장 많이 요구되는 포장 기능이므로 시장을 지배할 것으로 예상됩니다.

- 기술에 따라 글로벌 차세대 패키징 시장은 스캐빈저와 서셉터, RFID 태그, QR 코드, NFC 태그, 코딩 및 마킹, 센서 및 출력 장치 등으로 세분화됩니다. 2022년에는 스캐빈저와 서셉터 부문이 소비자에게 제품에 대한 쉬운 접근성을 제공하기 때문에 시장을 지배할 것으로 예상됩니다.

- 글로벌 차세대 포장 시장은 소재 기준으로 플라스틱, 종이, 골판지 등으로 세분화됩니다. 2022년에는 소비자들이 저렴한 가격으로 제품 포장의 크기에 큰 관심을 보이기 때문에 플라스틱 부문이 시장을 지배할 것으로 예상됩니다.

- 응용 프로그램을 기준으로, 글로벌 차세대 포장 시장은 식품, 음료, 개인 관리, 의료, 물류 및 공급망, 가전제품 및 기타로 세분화됩니다. 2022년에는 바쁜 라이프스타일로 인해 전 세계적으로 포장 식품에 대한 수요가 증가함에 따라 식품 부문이 시장을 지배할 것으로 예상됩니다.

글로벌 차세대 포장 시장은 분산되어 있으며 주요 업체는 신제품 출시, 확장, 계약, 합작 투자, 파트너십, 인수 등 다양한 전략을 사용하여 시장에서 입지를 확대해 왔습니다.

북미는 국가별로 미국, 캐나다, 멕시코로 구분됩니다. 2022년에는 미국이 북미 차세대 포장 시장을 주도할 것입니다. 이는 식품 및 음료 산업에서 이 시장의 적용이 확대되기 때문입니다.

차세대 패키징 시장 국가 수준 분석

글로벌 차세대 포장 시장을 분석하고, 유형, 기능, 기술, 재료 및 응용 분야를 기반으로 시장 규모 정보를 제공합니다.

주요 산업계가 차세대 포장재로 활용할 수 있는 식품 및 음료 제품 개발에 주력하고 있기 때문에 아시아 태평양 지역이 2022년부터 2029년까지 가장 유망한 성장률을 기록하며 성장할 것으로 예상됩니다.

보고서의 국가 섹션은 또한 개별 시장 영향 요인과 국내 시장의 현재 및 미래 트렌드에 영향을 미치는 규제 변화를 제공합니다. 신규 판매, 교체 판매, 국가 인구 통계, 규제 조치 및 수출입 관세와 같은 데이터 포인트는 개별 국가의 시장 시나리오를 예측하는 데 사용되는 주요 포인터 중 일부입니다. 또한 글로벌 브랜드의 존재 및 가용성과 지역 및 국내 브랜드와의 대규모 또는 희소한 경쟁으로 인해 직면한 과제, 판매 채널의 영향은 국가 데이터에 대한 예측 분석을 제공하는 동안 고려됩니다.

미국은 식품 분야에서 활성 포장에 대한 수요가 증가하면서 북미 시장을 장악했습니다.

식품 안전과 품질에 대한 인식이 높아짐에 따라 독일에서는 차세대 포장에 대한 수요가 증가했습니다.

식품 매개 질병의 위험이 증가함에 따라 중국의 식품 안전성이 더욱 높아졌고, 이로 인해 가스는 중국의 포장 시장이 성장하는 데 도움이 되었습니다.

차세대 패키징에 대한 수요 증가

글로벌 차세대 포장 시장은 또한 모든 국가에 대한 자세한 시장 분석을 제공합니다. 산업 성장, 매출, 구성 요소 매출, 차세대 포장의 기술 개발 영향, 규제 시나리오의 변화와 시장 지원. 이 데이터는 2019년부터 2029년까지의 과거 기간에 대해 제공됩니다.

경쟁 환경 및 차세대 패키징 시장 점유율 분석

글로벌 차세대 포장 시장 경쟁 구도는 경쟁자별 세부 정보를 제공합니다. 포함된 세부 정보는 회사 개요, 회사 재무, 창출된 수익, 시장 잠재력, 연구 개발 투자, 새로운 시장 이니셔티브, 글로벌 입지, 생산 현장 및 시설, 회사의 강점과 약점, 제품 출시, 제품 시험 파이프라인, 제품 승인, 특허, 제품 폭과 폭, 응용 분야 우세, 기술 수명선 곡선입니다. 위에 제공된 데이터 포인트는 글로벌 차세대 포장 시장과 관련된 회사의 초점에만 관련이 있습니다.

글로벌 차세대 패키징 시장의 주요 기업으로는 Amcor plc, Sealed Air, Klöckner Pentaplast, MicrobeGuard Corporation, TOPPAN INC., BALL CORPORATION, DuPont de Nemours, Inc., RR Donnelley & Sons Company, Vesta, Amerplast Ltd., MITSUBISHI GAS CHEMICAL, Graham Packaging Company, Active Packaging, American Thermal Instruments, AVERY DENNISON CORPORATION, Temptime Corporation, Cortec Packaging, SAES Getters SpA 등이 있습니다.

또한 전 세계 기업들이 다양한 제품 개발을 시작하면서 차세대 포장 시장 성장도 가속화되고 있습니다.

예를 들어,

- 2017년 DuPont는 중국에서 새로운 Tyvek 40L을 출시했으며, 전 세계적으로 공급할 계획입니다. DuPont Protection Solutions는 의료용 포장재용 Tyvek의 새로운 종류인 DuPont Tyvek 40L을 출시하여 가볍고 위험성이 낮은 장치를 보호하기 위한 비용 효율적인 옵션을 제공합니다.

파트너십, 합작 투자 및 기타 전략은 적용 범위와 존재감을 확대하여 회사 시장 점유율을 높입니다. 또한 조직이 확장된 크기 범위를 통해 차세대 패키징에 대한 제안을 개선하는 데도 도움이 됩니다.

SKU-

세계 최초의 시장 정보 클라우드 보고서에 온라인으로 접속하세요

- 대화형 데이터 분석 대시보드

- 높은 성장 잠재력 기회를 위한 회사 분석 대시보드

- 사용자 정의 및 질의를 위한 리서치 분석가 액세스

- 대화형 대시보드를 통한 경쟁자 분석

- 최신 뉴스, 업데이트 및 추세 분석

- 포괄적인 경쟁자 추적을 위한 벤치마크 분석의 힘 활용

목차

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL NEXT GENERATION PACKAGING MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 SOURCE LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 GLOBAL NEXT GENERATION PACKAGING MARKET: APPLICATION COVERAGE GRID

2.11 VENDOR SHARE ANALYSIS

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 INDUSTRIAL INSIGHTS: GLOBAL NEXT GENERATION PACKAGING MARKET

5.1 DEVELOPMENT OF ADVANCED SMART PACKAGING PRODUCT

5.2 TEMPERATURE BALANCING SMART PACKAGING:

5.3 SMART PACKAGING TO IMPROVE CONSUMER SAFETY:

5.4 CONCLUSION:

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 GROWING DEMAND FOR INTELLIGENT PACKAGING TO AVOID FOOD WASTAGE

6.1.2 INCREASING DISPOSABLE INCOME OF CONSUMERS

6.1.3 INCREASING CASES OF FOOD CONTAMINATION

6.1.4 INCREASE IN THE CONSUMPTION OF PACKAGED PRODUCTS

6.1.5 INCREASING HEALTH AWARENESS AMONG CONSUMERS

6.2 RESTRAINTS

6.2.1 COSTS ASSOCIATED WITH RESEARCH AND DEVELOPMENT ACTIVITIES

6.2.2 HIGH COMPETITION AMONG MARKET PLAYERS

6.3 OPPORTUNITIES

6.3.1 RECENT INNOVATIONS AND NEW PRODUCT LAUNCHES

6.3.2 GROWING ALCOHOLIC AND NON-ALCOHOLIC INDUSTRY WITH ACTIVE AND INTELLIGENT PACKAGING

6.4 CHALLENGES

6.4.1 AVAILABILITY OF ALTERNATIVES IN THE MARKET

6.4.2 SUPPLY CHAIN DISRUPTION DUE TO COVID-19

7 IMPACT OF COVID-19 ON THE GLOBAL NEXT GENERATION PACKAGING MARKET

7.1 AWARENESS ABOUT FOOD SAFETY AND QUALITY INCREASED DUE TO THE COVID-19 PANDEMIC

7.2 COVID-19 IMPACT ON DEMAND & SUPPLY CHAIN OF NEXT GENERATION PACKAGING

7.3 IMPACT ON PRICE

7.4 INITIATIVES TAKEN BY MANUFACTURERS

7.5 CONCLUSION

8 GLOBAL NEXT GENERATION PACKAGING MARKET, BY TYPE

8.1 OVERVIEW

8.2 ACTIVE PACKAGING

8.2.1 GAS SCAVENGERS/EMITTERS

8.2.2 MICROWAVE SUSCEPTORS

8.2.3 OTHERS

8.3 INTELLIGENT PACKAGING

8.4 MODIFIED ATMOSPHERE PACKAGING

9 GLOBAL NEXT GENERATION PACKAGING MARKET, BY FUNCTION

9.1 OVERVIEW

9.2 MOISTURE CONTROL

9.3 TEMPERATURE INDICATORS

9.4 PRODUCT TRACKING

9.5 SHELF LIFE SENSING

9.6 OTHERS

10 GLOBAL NEXT GENERATION PACKAGING MARKET, BY TECHNOLOGY

10.1 OVERVIEW

10.2 SCAVENGERS AND SUSCEPTORS

10.3 RFID TAGS

10.4 NFC TAGS

10.5 QR CODES

10.6 SENSORS & OUTPUT DEVICES

10.7 CODING & MARKINGS

10.8 OTHERS

11 GLOBAL NEXT GENERATION PACKAGING MARKET, BY MATERIAL

11.1 OVERVIEW

11.2 PLASTIC

11.3 PAPER

11.4 CORRUGATED BOARD

11.5 OTHERS

12 GLOBAL NEXT GENERATION PACKAGING MARKET, BY APPLICATION

12.1 OVERVIEW

12.2 FOOD

12.2.1 PACKAGED FOOD

12.2.2 PROCESSED FOOD

12.2.2.1 CHILLED

12.2.2.2 DRIED

12.2.3 MEAT & POULTRY

12.2.4 DAIRY

12.2.5 BAKERY & CONFECTIONERY

12.2.6 FRUITS & VEGETABLES

12.2.7 FROZEN FOOD

12.2.8 OTHERS

12.3 BEVERAGES

12.3.1 NON- ALCOHOLIC

12.3.2 ALCOHOLIC

12.4 PERSONAL CARE

12.5 HEALTH CARE

12.6 LOGISTICS & SUPPLY CHAIN

12.7 CONSUMER ELECTRONICS

12.8 OTHERS

13 GLOBAL NEXT GENERATION PACKAGING MARKET, BY REGION

13.1 OVERVIEW

13.2 ASIA-PACIFIC

13.2.1 JAPAN

13.2.2 CHINA

13.2.3 AUSTRALIA & NEW ZEALAND

13.2.4 SOUTH KOREA

13.2.5 INDIA

13.2.6 INDONESIA

13.2.7 PHILIPPINES

13.2.8 THAILAND

13.2.9 MALAYSIA

13.2.10 SINGAPORE

13.2.11 REST OF ASIA-PACIFIC

13.3 NORTH AMERICA

13.3.1 U.S.

13.3.2 CANADA

13.3.3 MEXICO

13.4 EUROPE

13.4.1 GERMANY

13.4.2 FRANCE

13.4.3 U.K.

13.4.4 ITALY

13.4.5 SPAIN

13.4.6 RUSSIA

13.4.7 BELGIUM

13.4.8 NETHERLANDS

13.4.9 SWITZERLAND

13.4.10 TURKEY

13.4.11 LUXEMBURG

13.4.12 REST OF EUROPE

13.5 MIDDLE EAST AND AFRICA

13.5.1 SOUTH AFRICA

13.5.2 SAUDI ARABIA

13.5.3 U.A.E.

13.5.4 EGYPT

13.5.5 ISRAEL

13.5.6 REST OF MIDDLE EAST & AFRICA

13.6 SOUTH AMERICA

13.6.1 BRAZIL

13.6.2 ARGENTINA

13.6.3 REST OF SOUTH AMERICA

14 COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: GLOBAL

14.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

14.3 COMPANY SHARE ANALYSIS: EUROPE

14.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

15 SWOT ANALYSIS

16 COMPANY PROFILE

16.1 AVERY DENNISON CORPORATION

16.1.1 COMPANY SNAPSHOT

16.1.2 REVENUE ANALYSIS

16.1.3 COMPANY SHARE ANALYSIS

16.1.4 PRODUCT PORTFOLIO

16.1.5 RECENT DEVELOPMENT

16.2 DUPONT

16.2.1 COMPANY SNAPSHOT

16.2.2 REVENUE ANALYSIS

16.2.3 COMPANY SHARE ANALYSIS

16.2.4 PRODUCT PORTFOLIO

16.2.5 RECENT DEVELOPMENTS

16.3 BALL CORPORATION

16.3.1 COMPANY SNAPSHOT

16.3.2 REVENUE ANALYSIS

16.3.3 COMPANY SHARE ANALYSIS

16.3.4 PRODUCT PORTFOLIO

16.3.5 RECENT DEVELOPMENT

16.4 GRAHAM PACKAGING COMPANY

16.4.1 COMPANY SNAPSHOT

16.4.2 COMPANY SHARE ANALYSIS

16.4.3 PRODUCT PORTFOLIO

16.4.4 RECENT DEVELOPMENT

16.5 R.R. DONNELLEY & SONS COMPANY

16.5.1 COMPANY SNAPSHOT

16.5.2 REVENUE ANALYSIS

16.5.3 COMPANY SHARE ANALYSIS

16.5.4 PRODUCT PORTFOLIO

16.5.5 RECENT DEVELOPMENTS

16.6 ACTIVE PACKAGING

16.6.1 COMPANY SANPSHOT

16.6.2 PRODUCT PORTFOLIO

16.6.3 RECENT DEVELOPMENT

16.7 AMCOR PLC

16.7.1 COMPANY SNAPSHOT

16.7.2 REVENUE ANALYSIS

16.7.3 PRODUCT PORTFOLIO

16.7.4 RECENT DEVELOPMENTS

16.8 AMERPLAST

16.8.1 COMPANY SNAPSHOT

16.8.2 PRODUCT PORTFOLIO

16.8.3 RECENT DEVELOPMENT

16.9 AMERICAN THERMAL INSTRUMENTS

16.9.1 COMPANY SANPSHOT

16.9.2 PRODUCT PORTFOLIO

16.9.3 RECENT DEVELOPMENTS

16.1 CORTEC PACKAGING

16.10.1 COMPANY SNAPSHOT

16.10.2 PRODUCT PORTFOLIO

16.10.3 RECENT DEVELOPMENT

16.11 KLÖCKNER PENTAPLAST

16.11.1 COMPANY SNAPSHOT

16.11.2 PRODUCT PORTFOLIO

16.11.3 RECENT DEVELOPMENTS

16.12 MICROBEGUARD CORPORATION

16.12.1 COMPANY SNAPSHOT

16.12.2 PRODUCT PORTFOLIO

16.12.3 RECENT DEVELOPMENT

16.13 MITSUBISHI GAS CHEMICAL COMPANY, INC.

16.13.1 COMPANY SNAPSHOT

16.13.2 REVENUE ANALYSIS

16.13.3 PRODUCT PORTFOLIO

16.13.4 RECENT DEVELOPMENTS

16.14 SAES GETTERS S.P.A.

16.14.1 COMPANY SANPSHOT

16.14.2 PRODUCT PORTFOLIO

16.14.3 RECENT DEVELOPMENT

16.15 SEALED AIR

16.15.1 COMPANY SNAPSHOT

16.15.2 REVENUE ANALYSIS

16.15.3 PRODUCT PORTFOLIO

16.15.4 RECENT DEVELOPMENT

16.16 TEMPTIME CORPORATION.

16.16.1 COMPANY SANPSHOT

16.16.2 PRODUCT PORTFOLIO

16.16.3 RECENT DEVELOPMENTS

16.17 TOPPAN INC.

16.17.1 COMPANY SNAPSHOT

16.17.2 PRODUCT PORTFOLIO

16.17.3 RECENT DEVELOPMENT

16.18 VESTA

16.18.1 COMPANY SNAPSHOT

16.18.2 PRODUCT PORTFOLIO

16.18.3 RECENT DEVELOPMENT

17 QUESTIONNAIRE

18 RELATED REPORTS

표 목록

TABLE 1 GLOBAL NEXT GENERATION PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 2 GLOBAL ACTIVE PACKAGING IN NEXT GENERATION PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 3 GLOBAL ACTIVE PACKAGING IN NEXT GENERATION PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 4 GLOBAL INTELLIGENT PACKAGING IN NEXT GENERATION PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 5 GLOBAL MODIFIED ATMOSPHERE PACKAGING IN NEXT GENERATION PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 6 GLOBAL NEXT GENERATION PACKAGING MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 7 GLOBAL MOISTURE CONTROL IN NEXT GENERATION PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 8 GLOBAL TEMPERATURE INDICATORS IN NEXT GENERATION PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 9 GLOBAL PRODUCT TRACKING IN NEXT GENERATION PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 10 GLOBAL SHELF LIFE SENSING IN NEXT GENERATION PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 11 GLOBAL OTHERS IN NEXT GENERATION PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 12 GLOBAL NEXT GENERATION PACKAGING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 13 GLOBAL SCAVENGERS AND SUSCEPTORS IN NEXT GENERATION PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 14 GLOBAL RFID TAGS IN NEXT GENERATION PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 15 GLOBAL NFC TAGS IN NEXT GENERATION PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 16 GLOBAL QR CODES IN NEXT GENERATION PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 17 GLOBAL SENSORS & OUTPUT DEVICES IN NEXT GENERATION PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 18 GLOBAL CODING & MARKINGS IN NEXT GENERATION PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 19 GLOBAL OTHERS IN NEXT GENERATION PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 20 GLOBAL NEXT GENERATION PACKAGING MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 21 GLOBAL PLASTIC IN NEXT GENERATION PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 22 GLOBAL PAPER IN NEXT GENERATION PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 23 GLOBAL CORRUGATED BOARD IN NEXT GENERATION PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 24 GLOBAL OTHERS IN NEXT GENERATION PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 25 GLOBAL NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 26 GLOBAL FOOD IN NEXT GENERATION PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 27 GLOBAL FOOD IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 28 GLOBAL PROCESSED FOOD IN NEXT GENERATION PACKAGING MARKET, BY APPLICTION, 2020-2029 (USD MILLION)

TABLE 29 GLOBAL BEVERAGES IN NEXT GENERATION PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 30 GLOBAL BEVERAGES IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 31 GLOBAL PERSONAL CARE IN NEXT GENERATION PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 32 GLOBAL HEALTHCARE IN NEXT GENERATION PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 33 GLOBAL LOGISTICS & SUPPLY CHAIN IN NEXT GENERATION PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 34 GLOBAL CONSUMER ELECTRONICS IN NEXT GENERATION PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 35 GLOBAL OTHERS IN NEXT GENERATION PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 36 GLOBAL NEXT GENERATION PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 37 ASIA-PACIFIC NEXT GENERATION PACKAGING MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 38 ASIA-PACIFIC NEXT GENERATION PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 39 ASIA-PACIFIC ACTIVE PACKAGING IN NEXT GENERATION PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 40 ASIA-PACIFIC NEXT GENERATION PACKAGING MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 41 ASIA-PACIFIC NEXT GENERATION PACKAGING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 42 ASIA-PACIFIC NEXT GENERATION PACKAGING MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 43 ASIA-PACIFIC NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 44 ASIA-PACIFIC FOOD IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 45 ASIA-PACIFIC PROCESSED FOOD IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 46 ASIA-PACIFIC BEVERAGES IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 47 JAPAN NEXT GENERATION PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 48 JAPAN ACTIVE PACKAGING IN NEXT GENERATION PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 49 JAPAN NEXT GENERATION PACKAGING MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 50 JAPAN NEXT GENERATION PACKAGING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 51 JAPAN NEXT GENERATION PACKAGING MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 52 JAPAN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 53 JAPAN FOOD IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 54 JAPAN PROCESSED FOOD IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 55 JAPAN BEVERAGES IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 56 CHINA NEXT GENERATION PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 57 CHINA ACTIVE PACKAGING IN NEXT GENERATION PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 58 CHINA NEXT GENERATION PACKAGING MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 59 CHINA NEXT GENERATION PACKAGING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 60 CHINA NEXT GENERATION PACKAGING MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 61 CHINA NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 62 CHINA FOOD IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 63 CHINA PROCESSED FOOD IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 64 CHINA BEVERAGES IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 65 AUSTRALIA & NEW ZEALAND NEXT GENERATION PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 66 AUSTRALIA & NEW ZEALAND ACTIVE PACKAGING IN NEXT GENERATION PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 67 AUSTRALIA & NEW ZEALAND NEXT GENERATION PACKAGING MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 68 AUSTRALIA & NEW ZEALAND NEXT GENERATION PACKAGING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 69 AUSTRALIA & NEW ZEALAND NEXT GENERATION PACKAGING MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 70 AUSTRALIA & NEW ZEALAND NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 71 AUSTRALIA & NEW ZEALAND FOOD IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 72 AUSTRALIA & NEW ZEALAND PROCESSED FOOD IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 73 AUSTRALIA & NEW ZEALAND BEVERAGES IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 74 SOUTH KOREA NEXT GENERATION PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 75 SOUTH KOREA ACTIVE PACKAGING IN NEXT GENERATION PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 76 SOUTH KOREA NEXT GENERATION PACKAGING MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 77 SOUTH KOREA NEXT GENERATION PACKAGING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 78 SOUTH KOREA NEXT GENERATION PACKAGING MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 79 SOUTH KOREA NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 80 SOUTH KOREA FOOD IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 81 SOUTH KOREA PROCESSED FOOD IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 82 SOUTH KOREA BEVERAGES IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 83 INDIA NEXT GENERATION PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 84 INDIA ACTIVE PACKAGING IN NEXT GENERATION PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 85 INDIA NEXT GENERATION PACKAGING MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 86 INDIA NEXT GENERATION PACKAGING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 87 INDIA NEXT GENERATION PACKAGING MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 88 INDIA NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 89 INDIA FOOD IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 90 INDIA PROCESSED FOOD IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 91 INDIA BEVERAGES IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 92 INDONESIA NEXT GENERATION PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 93 INDONESIA ACTIVE PACKAGING IN NEXT GENERATION PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 94 INDONESIA NEXT GENERATION PACKAGING MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 95 INDONESIA NEXT GENERATION PACKAGING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 96 INDONESIA NEXT GENERATION PACKAGING MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 97 INDONESIA NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 98 INDONESIA FOOD IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 99 INDONESIA PROCESSED FOOD IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 100 INDONESIA BEVERAGES IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 101 PHILIPPINES NEXT GENERATION PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 102 PHILIPPINES ACTIVE PACKAGING IN NEXT GENERATION PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 103 PHILIPPINES NEXT GENERATION PACKAGING MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 104 PHILIPPINES NEXT GENERATION PACKAGING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 105 PHILIPPINES NEXT GENERATION PACKAGING MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 106 PHILIPPINES NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 107 PHILIPPINES FOOD IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 108 PHILIPPINES PROCESSED FOOD IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 109 PHILIPPINES BEVERAGES IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 110 THAILAND NEXT GENERATION PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 111 THAILAND ACTIVE PACKAGING IN NEXT GENERATION PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 112 THAILAND NEXT GENERATION PACKAGING MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 113 THAILAND NEXT GENERATION PACKAGING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 114 THAILAND NEXT GENERATION PACKAGING MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 115 THAILAND NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 116 THAILAND FOOD IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 117 THAILAND PROCESSED FOOD IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 118 THAILAND BEVERAGES IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 119 MALAYSIA NEXT GENERATION PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 120 MALAYSIA ACTIVE PACKAGING IN NEXT GENERATION PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 121 MALAYSIA NEXT GENERATION PACKAGING MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 122 MALAYSIA NEXT GENERATION PACKAGING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 123 MALAYSIA NEXT GENERATION PACKAGING MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 124 MALAYSIA NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 125 MALAYSIA FOOD IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 126 MALAYSIA PROCESSED FOOD IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 127 MALAYSIA BEVERAGES IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 128 SINGAPORE NEXT GENERATION PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 129 SINGAPORE ACTIVE PACKAGING IN NEXT GENERATION PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 130 SINGAPORE NEXT GENERATION PACKAGING MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 131 SINGAPORE NEXT GENERATION PACKAGING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 132 SINGAPORE NEXT GENERATION PACKAGING MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 133 SINGAPORE NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 134 SINGAPORE FOOD IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 135 SINGAPORE PROCESSED FOOD IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 136 SINGAPORE BEVERAGES IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 137 REST OF ASIA-PACIFIC NEXT GENERATION PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 138 NORTH AMERICA NEXT GENERATION PACKAGING MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 139 NORTH AMERICA NEXT GENERATION PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 140 NORTH AMERICA ACTIVE PACKAGING IN NEXT GENERATION PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 141 NORTH AMERICA NEXT GENERATION PACKAGING MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 142 NORTH AMERICA NEXT GENERATION PACKAGING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 143 NORTH AMERICA NEXT GENERATION PACKAGING MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 144 NORTH AMERICA NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 145 NORTH AMERICA FOOD IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 146 NORTH AMERICA PROCESSED FOOD IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 147 NORTH AMERICA BEVERAGES IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 148 U.S. NEXT GENERATION PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 149 U.S. ACTIVE PACKAGING IN NEXT GENERATION PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 150 U.S. NEXT GENERATION PACKAGING MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 151 U.S. NEXT GENERATION PACKAGING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 152 U.S. NEXT GENERATION PACKAGING MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 153 U.S. NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 154 U.S. FOOD IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 155 U.S. PROCESSED FOOD IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 156 U.S. BEVERAGES IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 157 CANADA NEXT GENERATION PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 158 CANADA ACTIVE PACKAGING IN NEXT GENERATION PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 159 CANADA NEXT GENERATION PACKAGING MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 160 CANADA NEXT GENERATION PACKAGING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 161 CANADA NEXT GENERATION PACKAGING MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 162 CANADA NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 163 CANADA FOOD IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 164 CANADA PROCESSED FOOD IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 165 CANADA BEVERAGES IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 166 MEXICO NEXT GENERATION PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 167 MEXICO ACTIVE PACKAGING IN NEXT GENERATION PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 168 MEXICO NEXT GENERATION PACKAGING MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 169 MEXICO NEXT GENERATION PACKAGING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 170 MEXICO NEXT GENERATION PACKAGING MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 171 MEXICO NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 172 MEXICO FOOD IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 173 MEXICO PROCESSED FOOD IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 174 MEXICO BEVERAGES IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 175 EUROPE NEXT GENERATION PACKAGING MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 176 EUROPE NEXT GENERATION PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 177 EUROPE ACTIVE PACKAGING IN NEXT GENERATION PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 178 EUROPE NEXT GENERATION PACKAGING MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 179 EUROPE NEXT GENERATION PACKAGING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 180 EUROPE NEXT GENERATION PACKAGING MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 181 EUROPE NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 182 EUROPE FOOD IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 183 EUROPE PROCESSED FOOD IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 184 EUROPE BEVERAGES IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 185 GERMANY NEXT GENERATION PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 186 GERMANY ACTIVE PACKAGING IN NEXT GENERATION PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 187 GERMANY NEXT GENERATION PACKAGING MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 188 GERMANY NEXT GENERATION PACKAGING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 189 GERMANY NEXT GENERATION PACKAGING MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 190 GERMANY NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 191 GERMANY FOOD IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 192 GERMANY PROCESSED FOOD IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 193 GERMANY BEVERAGES IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 194 FRANCE NEXT GENERATION PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 195 FRANCE ACTIVE PACKAGING IN NEXT GENERATION PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 196 FRANCE NEXT GENERATION PACKAGING MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 197 FRANCE NEXT GENERATION PACKAGING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 198 FRANCE NEXT GENERATION PACKAGING MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 199 FRANCE NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 200 FRANCE FOOD IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 201 FRANCE PROCESSED FOOD IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 202 FRANCE BEVERAGES IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 203 U.K. NEXT GENERATION PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 204 U.K. ACTIVE PACKAGING IN NEXT GENERATION PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 205 U.K. NEXT GENERATION PACKAGING MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 206 U.K. NEXT GENERATION PACKAGING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 207 U.K. NEXT GENERATION PACKAGING MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 208 U.K. NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 209 U.K. FOOD IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 210 U.K. PROCESSED FOOD IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 211 U.K. BEVERAGES IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 212 ITALY NEXT GENERATION PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 213 ITALY ACTIVE PACKAGING IN NEXT GENERATION PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 214 ITALY NEXT GENERATION PACKAGING MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 215 ITALY NEXT GENERATION PACKAGING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 216 ITALY NEXT GENERATION PACKAGING MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 217 ITALY NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 218 ITALY FOOD IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 219 ITALY PROCESSED FOOD IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 220 ITALY BEVERAGES IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 221 SPAIN NEXT GENERATION PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 222 SPAIN ACTIVE PACKAGING IN NEXT GENERATION PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 223 SPAIN NEXT GENERATION PACKAGING MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 224 SPAIN NEXT GENERATION PACKAGING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 225 SPAIN NEXT GENERATION PACKAGING MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 226 SPAIN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 227 SPAIN FOOD IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 228 SPAIN PROCESSED FOOD IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 229 SPAIN BEVERAGES IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 230 RUSSIA NEXT GENERATION PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 231 RUSSIA ACTIVE PACKAGING IN NEXT GENERATION PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 232 RUSSIA NEXT GENERATION PACKAGING MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 233 RUSSIA NEXT GENERATION PACKAGING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 234 RUSSIA NEXT GENERATION PACKAGING MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 235 RUSSIA NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 236 RUSSIA FOOD IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 237 RUSSIA PROCESSED FOOD IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 238 RUSSIA BEVERAGES IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 239 BELGIUM NEXT GENERATION PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 240 BELGIUM ACTIVE PACKAGING IN NEXT GENERATION PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 241 BELGIUM NEXT GENERATION PACKAGING MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 242 BELGIUM NEXT GENERATION PACKAGING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 243 BELGIUM NEXT GENERATION PACKAGING MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 244 BELGIUM NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 245 BELGIUM FOOD IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 246 BELGIUM PROCESSED FOOD IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 247 BELGIUM BEVERAGES IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 248 NETHERLANDS NEXT GENERATION PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 249 NETHERLANDS ACTIVE PACKAGING IN NEXT GENERATION PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 250 NETHERLANDS NEXT GENERATION PACKAGING MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 251 NETHERLANDS NEXT GENERATION PACKAGING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 252 NETHERLANDS NEXT GENERATION PACKAGING MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 253 NETHERLANDS NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 254 NETHERLANDS FOOD IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 255 NETHERLANDS PROCESSED FOOD IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 256 NETHERLANDS BEVERAGES IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 257 SWITZERLAND NEXT GENERATION PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 258 SWITZERLAND ACTIVE PACKAGING IN NEXT GENERATION PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 259 SWITZERLAND NEXT GENERATION PACKAGING MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 260 SWITZERLAND NEXT GENERATION PACKAGING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 261 SWITZERLAND NEXT GENERATION PACKAGING MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 262 SWITZERLAND NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 263 SWITZERLAND FOOD IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 264 SWITZERLAND PROCESSED FOOD IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 265 SWITZERLAND BEVERAGES IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 266 TURKEY NEXT GENERATION PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 267 TURKEY ACTIVE PACKAGING IN NEXT GENERATION PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 268 TURKEY NEXT GENERATION PACKAGING MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 269 TURKEY NEXT GENERATION PACKAGING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 270 TURKEY NEXT GENERATION PACKAGING MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 271 TURKEY NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 272 TURKEY FOOD IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 273 TURKEY PROCESSED FOOD IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 274 TURKEY BEVERAGES IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 275 LUXEMBURG NEXT GENERATION PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 276 LUXEMBURG ACTIVE PACKAGING IN NEXT GENERATION PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 277 LUXEMBURG NEXT GENERATION PACKAGING MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 278 LUXEMBURG NEXT GENERATION PACKAGING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 279 LUXEMBURG NEXT GENERATION PACKAGING MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 280 LUXEMBURG NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 281 LUXEMBURG FOOD IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 282 LUXEMBURG PROCESSED FOOD IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 283 LUXEMBURG BEVERAGES IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 284 REST OF EUROPE NEXT GENERATION PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 285 MIDDLE EAST AND AFRICA NEXT GENERATION PACKAGING MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 286 MIDDLE EAST AND AFRICA NEXT GENERATION PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 287 MIDDLE EAST AND AFRICA ACTIVE PACKAGING IN NEXT GENERATION PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 288 MIDDLE EAST AND AFRICA NEXT GENERATION PACKAGING MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 289 MIDDLE EAST AND AFRICA NEXT GENERATION PACKAGING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 290 MIDDLE EAST AND AFRICA NEXT GENERATION PACKAGING MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 291 MIDDLE EAST AND AFRICA NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 292 MIDDLE EAST AND AFRICA FOOD IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 293 MIDDLE EAST AND AFRICA PROCESSED FOOD IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 294 MIDDLE EAST AND AFRICA BEVERAGES IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 295 SOUTH AFRICA NEXT GENERATION PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 296 SOUTH AFRICA ACTIVE PACKAGING IN NEXT GENERATION PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 297 SOUTH AFRICA NEXT GENERATION PACKAGING MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 298 SOUTH AFRICA NEXT GENERATION PACKAGING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 299 SOUTH AFRICA NEXT GENERATION PACKAGING MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 300 SOUTH AFRICA NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 301 SOUTH AFRICA FOOD IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 302 SOUTH AFRICA PROCESSED FOOD IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 303 SOUTH AFRICA BEVERAGES IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 304 SAUDI ARABIA NEXT GENERATION PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 305 SAUDI ARABIA ACTIVE PACKAGING IN NEXT GENERATION PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 306 SAUDI ARABIA NEXT GENERATION PACKAGING MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 307 SAUDI ARABIA NEXT GENERATION PACKAGING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 308 SAUDI ARABIA NEXT GENERATION PACKAGING MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 309 SAUDI ARABIA NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 310 SAUDI ARABIA FOOD IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 311 SAUDI ARABIA PROCESSED FOOD IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 312 SAUDI ARABIA BEVERAGES IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 313 U.A.E. NEXT GENERATION PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 314 U.A.E. ACTIVE PACKAGING IN NEXT GENERATION PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 315 U.A.E. NEXT GENERATION PACKAGING MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 316 U.A.E. NEXT GENERATION PACKAGING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 317 U.A.E. NEXT GENERATION PACKAGING MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 318 U.A.E. NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 319 U.A.E. FOOD IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 320 U.A.E. PROCESSED FOOD IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 321 U.A.E. BEVERAGES IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 322 EGYPT NEXT GENERATION PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 323 EGYPT ACTIVE PACKAGING IN NEXT GENERATION PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 324 EGYPT NEXT GENERATION PACKAGING MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 325 EGYPT NEXT GENERATION PACKAGING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 326 EGYPT NEXT GENERATION PACKAGING MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 327 EGYPT NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 328 EGYPT FOOD IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 329 EGYPT PROCESSED FOOD IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 330 EGYPT BEVERAGES IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 331 ISRAEL NEXT GENERATION PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 332 ISRAEL ACTIVE PACKAGING IN NEXT GENERATION PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 333 ISRAEL NEXT GENERATION PACKAGING MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 334 ISRAEL NEXT GENERATION PACKAGING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 335 ISRAEL NEXT GENERATION PACKAGING MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 336 ISRAEL NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 337 ISRAEL FOOD IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 338 ISRAEL PROCESSED FOOD IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 339 ISRAEL BEVERAGES IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 340 REST OF MIDDLE EAST & AFRICA NEXT GENERATION PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 341 SOUTH AMERICA NEXT GENERATION PACKAGING MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 342 SOUTH AMERICA NEXT GENERATION PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 343 SOUTH AMERICA ACTIVE PACKAGING IN NEXT GENERATION PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 344 SOUTH AMERICA NEXT GENERATION PACKAGING MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 345 SOUTH AMERICA NEXT GENERATION PACKAGING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 346 SOUTH AMERICA NEXT GENERATION PACKAGING MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 347 SOUTH AMERICA NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 348 SOUTH AMERICA FOOD IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 349 SOUTH AMERICA PROCESSED FOOD IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 350 SOUTH AMERICA BEVERAGES IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 351 BRAZIL NEXT GENERATION PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 352 BRAZIL ACTIVE PACKAGING IN NEXT GENERATION PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 353 BRAZIL NEXT GENERATION PACKAGING MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 354 BRAZIL NEXT GENERATION PACKAGING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 355 BRAZIL NEXT GENERATION PACKAGING MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 356 BRAZIL NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 357 BRAZIL FOOD IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 358 BRAZIL PROCESSED FOOD IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 359 BRAZIL BEVERAGES IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 360 ARGENTINA NEXT GENERATION PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 361 ARGENTINA ACTIVE PACKAGING IN NEXT GENERATION PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 362 ARGENTINA NEXT GENERATION PACKAGING MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 363 ARGENTINA NEXT GENERATION PACKAGING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 364 ARGENTINA NEXT GENERATION PACKAGING MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 365 ARGENTINA NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 366 ARGENTINA FOOD IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 367 ARGENTINA PROCESSED FOOD IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 368 ARGENTINA BEVERAGES IN NEXT GENERATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 369 REST OF SOUTH AMERICA NEXT GENERATION PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

그림 목록

FIGURE 1 GLOBAL NEXT GENERATION PACKAGING MARKET: SEGMENTATION

FIGURE 2 GLOBAL NEXT GENERATION PACKAGING MARKET: DATA TRIANGULATION

FIGURE 3 GLOBAL NEXT GENERATION PACKAGING MARKET: DROC ANALYSIS

FIGURE 4 GLOBAL NEXT GENERATION PACKAGING MARKET: GLOBAL VS REGIONAL MARKET ANALYSIS

FIGURE 5 GLOBAL NEXT GENERATION PACKAGING MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 GLOBAL NEXT GENERATION PACKAGING MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 GLOBAL NEXT GENERATION PACKAGING MARKET: DBMR MARKET POSITION GRID

FIGURE 8 GLOBAL NEXT GENERATION PACKAGING MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 GLOBAL NEXT GENERATION PACKAGING MARKET: SEGMENTATION

FIGURE 10 ASIA-PACIFIC IS EXPECTED TO DOMINATE GLOBAL NEXT GENERATION PACKAGING MARKET AND IS EXPECTED TO GROW WITH HIGHEST CAGR IN FORECAST PERIOD OF 2022 TO 2029

FIGURE 11 AN INCREASE IN CONSUMPTION OF BEVERAGES AND HEALTH AWARENESS AMONG CONSUMERS IS EXPECTED TO DRIVE GLOBAL NEXT GENERATION PACKAGING MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 PACKAGING TYPE SEGMENT IS EXPECTED TO ACCOUNT FOR LARGEST SHARE OF GLOBAL NEXT GENERATION PACKAGING MARKET IN 2022 & 2029

FIGURE 13 ASIA-PACIFIC IS THE FASTEST-GROWING MARKET FOR NEXT GENERATION PACKAGING MANUFACTURERS IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 14 DRIVERS, RESTRINTS, OPPORTUNITIES AND CHALLENGES OF GLOBAL NEXT GENERATION PACKAGING MARKET

FIGURE 15 GLOBAL NEXT GENERATION PACKAGING MARKET, BY TYPE, 2021

FIGURE 16 GLOBAL NEXT GENERATION PACKAGING MARKET, BY FUNCTION, 2021

FIGURE 17 GLOBAL NEXT GENERATION PACKAGING MARKET, BY TECHNOLOGY, 2021

FIGURE 18 GLOBAL NEXT GENERATION PACKAGING MARKET, BY MATERIAL, 2021

FIGURE 19 GLOBAL NEXT GENERATION MARKET, BY APPLICATION, 2021

FIGURE 20 GLOBAL NEXT GENERATION PACKAGING MARKET: SNAPSHOT (2021)

FIGURE 21 GLOBAL NEXT GENERATION PACKAGING MARKET: BY REGION (2021)

FIGURE 22 GLOBAL NEXT GENERATION PACKAGING MARKET: BY REGION (2022 & 2029)

FIGURE 23 GLOBAL NEXT GENERATION PACKAGING MARKET: BY REGION (2021 & 2029)

FIGURE 24 GLOBAL NEXT GENERATION PACKAGING MARKET: BY TYPE (2022-2029)

FIGURE 25 ASIA-PACIFIC NEXT GENERATION PACKAGING MARKET: SNAPSHOT (2021)

FIGURE 26 ASIA-PACIFIC NEXT GENERATION PACKAGING MARKET: BY COUNTRY (2021)

FIGURE 27 ASIA-PACIFIC NEXT GENERATION PACKAGING MARKET: BY COUNTRY (2022 & 2029)

FIGURE 28 ASIA-PACIFIC NEXT GENERATION PACKAGING MARKET: BY COUNTRY (2021 & 2029)

FIGURE 29 ASIA-PACIFIC NEXT GENERATION PACKAGING MARKET: BY TYPE (2022 & 2029)

FIGURE 30 NORTH AMERICA NEXT GENERATION PACKAGING MARKET: SNAPSHOT (2021)

FIGURE 31 NORTH AMERICA NEXT GENERATION PACKAGING MARKET: BY COUNTRY (2021)

FIGURE 32 NORTH AMERICA NEXT GENERATION PACKAGING MARKET: BY COUNTRY (2022 & 2029)

FIGURE 33 NORTH AMERICA NEXT GENERATION PACKAGING MARKET: BY COUNTRY (2022 & 2029)

FIGURE 34 NORTH AMERICA NEXT GENERATION PACKAGING MARKET: BY TYPE (2022 & 2029)

FIGURE 35 EUROPE NEXT GENERATION PACKAGING MARKET: SNAPSHOT (2021)

FIGURE 36 EUROPE NEXT GENERATION PACKAGING MARKET: BY COUNTRY (2021)

FIGURE 37 EUROPE NEXT GENERATION PACKAGING MARKET: BY COUNTRY (2022 & 2029)

FIGURE 38 EUROPE NEXT GENERATION PACKAGING MARKET: BY COUNTRY (2021 & 2029)

FIGURE 39 EUROPE NEXT GENERATION PACKAGING MARKET: BY TYPE (2022 & 2029)

FIGURE 40 MIDDLE EAST AND AFRICA NEXT GENERATION PACKAGING MARKET: SNAPSHOT (2021)

FIGURE 41 MIDDLE EAST AND AFRICA NEXT GENERATION PACKAGING MARKET: BY COUNTRY (2021)

FIGURE 42 MIDDLE EAST AND AFRICA NEXT GENERATION PACKAGING MARKET: BY COUNTRY (2022 & 2029)

FIGURE 43 MIDDLE EAST AND AFRICA NEXT GENERATION PACKAGING MARKET: BY COUNTRY (2021 & 2029)

FIGURE 44 MIDDLE EAST AND AFRICA NEXT GENERATION PACKAGING MARKET: BY TYPE (2022 & 2029)

FIGURE 45 SOUTH AMERICA NEXT GENERATION PACKAGING MARKET: SNAPSHOT (2021)

FIGURE 46 SOUTH AMERICA NEXT GENERATION PACKAGING MARKET: BY COUNTRY (2021)

FIGURE 47 SOUTH AMERICA NEXT GENERATION PACKAGING MARKET: BY COUNTRY (2022 & 2029)

FIGURE 48 SOUTH AMERICA NEXT GENERATION PACKAGING MARKET: BY COUNTRY (2021 & 2029)

FIGURE 49 SOUTH AMERICA NEXT GENERATION PACKAGING MARKET: BY TYPE (2022 & 2029)

FIGURE 50 GLOBAL NEXT GENERATION PACKAGING MARKET: COMPANY SHARE 2021 (%)

FIGURE 51 NORTH AMERICA NEXT GENERATION PACKAGING MARKET: COMPANY SHARE 2021 (%)

FIGURE 52 EUROPE NEXT GENERATION PACKAGING MARKET: COMPANY SHARE 2021 (%)

FIGURE 53 ASIA-PACIFIC NEXT GENERATION PACKAGING MARKET: COMPANY SHARE 2021 (%)

연구 방법론

데이터 수집 및 기준 연도 분석은 대규모 샘플 크기의 데이터 수집 모듈을 사용하여 수행됩니다. 이 단계에는 다양한 소스와 전략을 통해 시장 정보 또는 관련 데이터를 얻는 것이 포함됩니다. 여기에는 과거에 수집한 모든 데이터를 미리 검토하고 계획하는 것이 포함됩니다. 또한 다양한 정보 소스에서 발견되는 정보 불일치를 검토하는 것도 포함됩니다. 시장 데이터는 시장 통계 및 일관된 모델을 사용하여 분석하고 추정합니다. 또한 시장 점유율 분석 및 주요 추세 분석은 시장 보고서의 주요 성공 요인입니다. 자세한 내용은 분석가에게 전화를 요청하거나 문의 사항을 드롭하세요.

DBMR 연구팀에서 사용하는 주요 연구 방법론은 데이터 마이닝, 시장에 대한 데이터 변수의 영향 분석 및 주요(산업 전문가) 검증을 포함하는 데이터 삼각 측량입니다. 데이터 모델에는 공급업체 포지셔닝 그리드, 시장 타임라인 분석, 시장 개요 및 가이드, 회사 포지셔닝 그리드, 특허 분석, 가격 분석, 회사 시장 점유율 분석, 측정 기준, 글로벌 대 지역 및 공급업체 점유율 분석이 포함됩니다. 연구 방법론에 대해 자세히 알아보려면 문의를 통해 업계 전문가에게 문의하세요.

사용자 정의 가능

Data Bridge Market Research는 고급 형성 연구 분야의 선두 주자입니다. 저희는 기존 및 신규 고객에게 목표에 맞는 데이터와 분석을 제공하는 데 자부심을 느낍니다. 보고서는 추가 국가에 대한 시장 이해(국가 목록 요청), 임상 시험 결과 데이터, 문헌 검토, 재생 시장 및 제품 기반 분석을 포함하도록 사용자 정의할 수 있습니다. 기술 기반 분석에서 시장 포트폴리오 전략에 이르기까지 타겟 경쟁업체의 시장 분석을 분석할 수 있습니다. 귀하가 원하는 형식과 데이터 스타일로 필요한 만큼 많은 경쟁자를 추가할 수 있습니다. 저희 분석가 팀은 또한 원시 엑셀 파일 피벗 테이블(팩트북)로 데이터를 제공하거나 보고서에서 사용 가능한 데이터 세트에서 프레젠테이션을 만드는 데 도움을 줄 수 있습니다.