글로벌 레벨 및 유량 센서 시장, 유형(유량 센서 및 레벨 센서), 기술(비접촉 레벨 및 유량 센서 및 접촉 레벨 및 유량 센서), 응용 매체(고체, 액체 및 가스), 최종 사용자(산업 제조, 석유 및 가스, 화학 , 소비재, 자동차, 에너지 및 전력, 정부 및 국방, 폐수, 의료 및 기타) - 산업 동향 및 2030년까지의 예측.

레벨 및 유량 센서 시장 분석 및 규모

글로벌 레벨 및 유량 센서 시장은 산업 시설 및 운영에 맞게 조정된 전력 솔루션 제공을 담당하는 경제 내 부문을 말합니다. 이 시장은 제조 공장, 공장, 창고 및 기타 산업 현장의 특정 요구 사항을 충족하기 위해 발전, 분배 및 제어에 중점을 둔 광범위한 제품과 서비스를 포함합니다. 시장의 핵심 구성 요소에는 가스터빈 , 디젤 발전기 및 재생 에너지원과 같은 발전 장비, 변압기 및 스위치기어와 같은 전력 분배 시스템, 전력 제어 및 모니터링 장비, 모터 제어 센터 및 프로그래밍 가능 논리 컨트롤러, 배터리와 같은 에너지 저장 솔루션이 포함됩니다. 또한 이 시장에는 글로벌 레벨 및 유량 센서 시스템과 관련된 설치, 유지 관리 및 프로젝트 관리 서비스가 포함됩니다. 이 시장에 영향을 미치는 요인에는 산업 성장, 에너지 정책, 기술 발전 및 환경적 지속 가능성 문제가 포함됩니다.

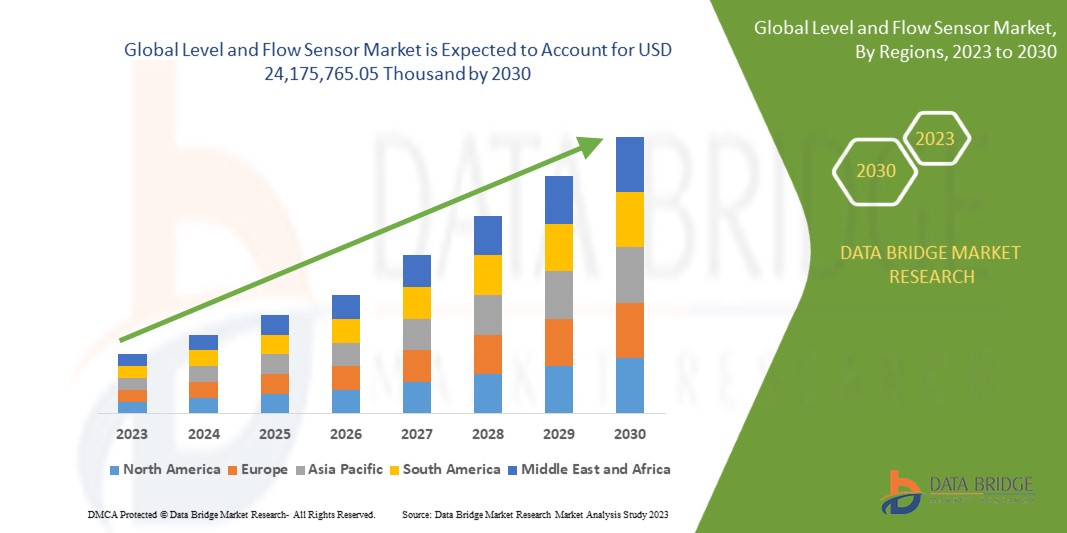

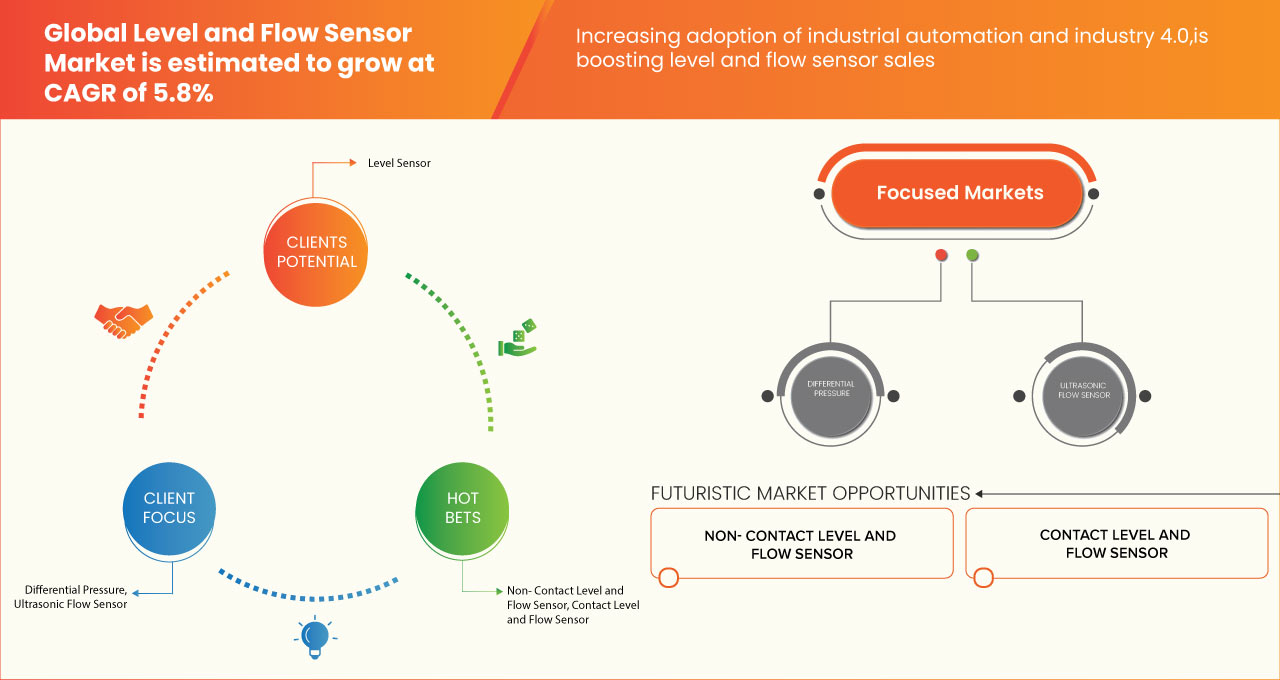

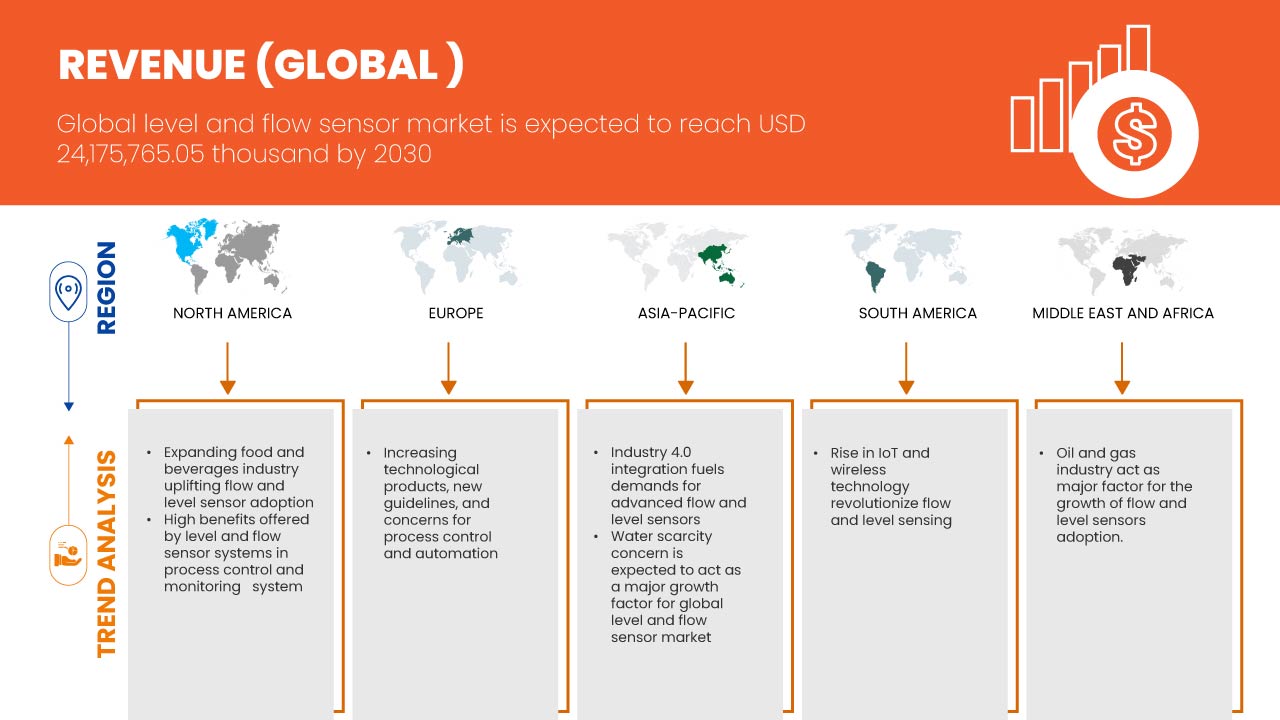

Data Bridge Market Research는 글로벌 레벨 및 유량 센서 시장이 2023년에서 2030년까지의 예측 기간 동안 5.8%의 CAGR로 성장할 것으로 예상되며 2030년까지 24,175,765.05천 달러에 도달할 것으로 예상된다고 분석했습니다. 레벨 및 유량 센서 시장 보고서는 또한 가격 분석, 특허 분석 및 심층적인 기술 발전을 다룹니다.

|

보고서 메트릭 |

세부 |

|

예측 기간 |

2023년부터 2030년까지 |

|

기준 연도 |

2022 |

|

역사적 연도 |

2021 (2015-2020까지 사용자 정의 가능) |

|

양적 단위 |

수익 (USD 천) |

|

다루는 세그먼트 |

유형(유량 센서 및 레벨 센서), 기술(비접촉 레벨 및 유량 센서 및 접촉 레벨 및 유량 센서), 응용 매체(고체, 액체 및 가스), 최종 사용자(산업 제조, 석유 및 가스, 화학, 소비재, 자동차, 에너지 및 전력, 정부 및 국방, 폐수, 의료 및 기타) |

|

적용 국가 |

미국, 캐나다, 멕시코, 독일, 영국, 프랑스, 이탈리아, 스페인, 러시아, 폴란드, 네덜란드, 벨기에, 스위스, 덴마크, 핀란드, 스웨덴, 노르웨이, 터키, 유럽의 나머지 지역, 중국, 일본, 한국, 인도, 대만, 호주, 태국, 인도네시아, 말레이시아, 싱가포르, 뉴질랜드, 필리핀, 베트남, 아시아 태평양의 나머지 지역, 브라질, 아르헨티나, 그리고 남미의 나머지 지역, 사우디 아라비아, UAE, 남아프리카, 쿠웨이트, 카타르, 이집트, 이스라엘, 오만, 바레인, 그리고 중동과 아프리카의 나머지 지역 |

|

시장 참여자 포함 |

TE Connectivity, Temposonics(Amphenol Corporation의 자회사), AMETEK Inc., Emerson Electric Co., KEYENCE CORPORATION, ABB, Fortive, SICK AG, OMRON Corporation, Azbil Corporation, Honeywell International Inc., Endress+Hauser Group Services AG, SSI Technologies, LLC, Balluff Automation India Pvt. Ltd, KROHNE, Siemens, Schneider Electric, Omega Engineering inc., Yokogawa Electric Corporation, ifm electronic GmbH, Baumer, Nanjing AH Electronic Science & Technology Co., Ltd., UWT GmbH, NOHKEN INC., FAFNIR GmbH, Sapcon Instruments Pvt Ltd, Anderson-Negele, Senix 초음파 거리 및 초음파 레벨 센서, GF Piping Systems, Fuelics PC, Aplus Finetek Sensor, Inc(Finetek CO, LTD.의 자회사), Pulsar Measurement 및 Flowline 등 |

시장 정의

글로벌 레벨 및 유량 센서 시장은 다양한 산업, 상업 및 주거용 애플리케이션에서 유체 레벨과 유량을 측정하고 모니터링하도록 설계된 장치의 집합적 수요, 공급 및 거래입니다. 이러한 센서는 시스템, 프로세스 및 장비 내에서 액체와 가스를 효율적이고 정확하게 관리하는 데 중요한 역할을 합니다. 이 시장은 제조, 화학 처리, 수질 및 폐수 관리, 에너지 등과 같은 산업에 맞춰 광범위한 센서 유형, 기술 및 애플리케이션을 포함합니다.

글로벌 레벨 및 유량 센서 시장 동향

이 섹션에서는 시장 동인, 이점, 기회, 제약 및 과제를 이해하는 것을 다룹니다. 이 모든 내용은 아래에서 자세히 설명합니다.

운전자

- 산업 자동화 및 Industry 4.0 채택 증가

제조, 화학, 제약과 같은 분야에서 산업 자동화를 점점 더 많이 도입함에 따라 정확하고 신뢰할 수 있는 센서에 대한 수요가 높아졌습니다. 레벨 및 유량 센서는 실시간 데이터를 제공하여 산업이 프로세스를 최적화하고 수동 개입을 줄이며 전반적인 생산성을 향상시키는 데 도움이 됩니다.

- 석유 및 가스 산업에서의 레벨 및 유량 센서의 광범위한 응용 분야

유량 센서는 제조에서 액체와 가스의 흐름을 측정하는 데 사용됩니다. 이 정보는 생산 공정을 제어하고 제품이 사양에 맞게 제조되도록 하는 데 사용됩니다. 자동화는 제조, 에너지, 운송과 같은 다양한 산업에서 점점 더 많이 사용되고 있습니다. 유량 센서는 자동화 시스템에서 유체의 흐름을 측정하고 기계 및 장비의 작동을 제어하는 데 사용됩니다.

기회

- 다양한 산업에서 정확성에 대한 요구 증가

다양한 산업에서 정확성에 대한 요구가 커지면서 글로벌 레벨 및 유량 센서 시장에 기회가 생겨나고 있습니다. 유량 센서 제조업체는 이러한 산업의 까다로운 요구 사항을 충족하기 위해 새롭고 혁신적인 기술을 개발하고 있습니다. 결과적으로 글로벌 레벨 및 유량 센서 시장은 앞으로 몇 년 동안 크게 성장할 것으로 예상됩니다.

제지/도전

- 레벨 및 유량 센서의 높은 초기 비용

제조, 수처리 , 석유 및 가스 와 같이 레벨 및 유량 센서에 의존하는 많은 산업 및 애플리케이션은 종종 비용에 민감합니다. 높은 초기 비용으로 인해 잠재 고객이 이러한 센서를 채택하지 않을 수 있으며, 특히 많은 수의 센서가 필요한 경우 더욱 그렇습니다.

최근 개발 사항

- 2023년 5월, 무라타 제조 주식회사는 온보드 충전기, 인버터, 배터리 관리 시스템, 무선 전력 전송과 같은 전기 자동차(EV) 애플리케이션을 위해 설계된 고급 수지 성형 기능을 갖춘 EVA 시리즈 다층 세라믹 커패시터(MLCC)를 출시했습니다. 이러한 안전 인증 Y2 등급 MLCC는 305VAC/1500VDC 전압 정격, 10mm 크리피지 거리, 0.1nF~4.7nF 범위의 커패시턴스 값을 특징으로 하며, 최신 자동차 시스템의 소형화를 유지하면서 800V 파워트레인으로의 마이그레이션 요구 사항을 충족합니다. 수지 성형을 사용하면 이러한 소형 구성 요소가 확장된 크리피지와 소형화를 모두 달성하여 고전압의 EV 파워트레인에서 장기적인 신뢰성을 보장합니다.

- 2023년 3월, Delta Electronics, Inc.는 타이베이 국제 공작 기계 쇼(TIMTOS) 미래 제조 포럼에서 자율 주행 로봇(AMR)을 위한 산업용 전원 공급 장치와 무선 충전 솔루션을 선보였습니다. 그들은 산업용 전원 요구 사항을 위한 로우 프로파일 패널 마운트 전원 공급 장치 PMT2 시리즈와 초슬림 DIN 레일 유형 LYTE II 시리즈를 선보였습니다. 또한 Delta는 AMR 및 AGV용 M∞Vair 1kW 무선 충전 시스템을 출시하여 스마트 팩토리 운영과 효율적인 솔루션에 대한 노력을 강조했습니다.

- 2022년 8월, UWT Gmbh는 Siemens로부터 권위 있는 "공급업체 성과상"을 수상했습니다. 이는 전년도에 보여준 탁월한 협업과 탁월한 성과를 인정받은 것이며, 이는 두 회사 간의 강력한 파트너십을 반영합니다.

- 2021년 4월, Temposonics는 공식적으로 존경받는 Amphenol Corporation의 일부가 되었습니다. 세계 최대의 상호 연결 제품 제조업체 중 하나로 유명한 Amphenol은 최첨단 전기, 전자 및 광섬유 커넥터, 상호 연결 시스템 등을 전문으로 합니다.

- 요코가와 전기(Yokogawa Electric Corporation)는 2020년 7월 새로운 압력 및 온도 센서를 출시하여 자사의 무선 산업용 IoT(IIoT) 솔루션인 스시 센서(Sushi Sensor)를 확장한다고 발표했습니다.

글로벌 레벨 및 유량 센서 시장 범위

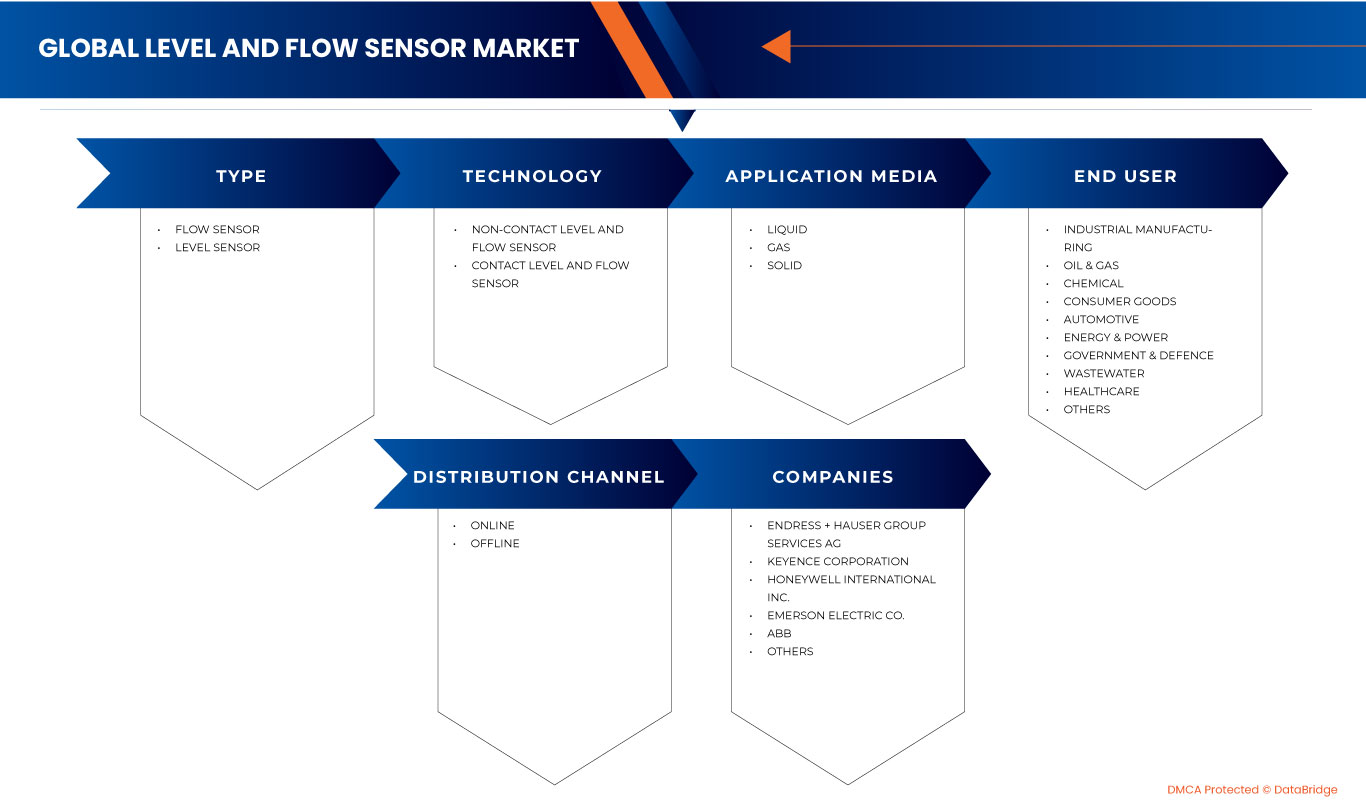

글로벌 레벨 및 유량 센서 시장은 유형, 기술, 애플리케이션 미디어, 최종 사용자 및 유통 채널을 기준으로 세분화됩니다. 이러한 세그먼트 간의 성장은 산업의 빈약한 성장 세그먼트를 분석하고 사용자에게 핵심 시장 애플리케이션을 식별하기 위한 전략적 결정을 내리는 데 도움이 되는 귀중한 시장 개요와 시장 통찰력을 제공하는 데 도움이 됩니다.

유형

- 유량 센서

- 레벨 센서

글로벌 레벨 및 유량 센서 시장은 유형을 기준으로 유량 센서와 레벨 센서로 구분됩니다.

기술

- 비접촉 레벨 및 유량 센서

- 접촉 레벨 및 유량 센서

기술을 기준으로 글로벌 레벨 및 유량 센서 시장은 비접촉 레벨 및 유량 센서와 접촉 레벨 및 유량 센서로 구분됩니다.

응용 프로그램 미디어

- 단단한

- 액체

- 가스

글로벌 레벨 및 유량 센서 시장은 응용 매체를 기준으로 고체, 액체, 기체로 구분됩니다.

최종 사용자

- 산업 제조

- 석유 및 가스

- 화학적인

- 소비재

- 자동차

- 에너지 & 파워

- 정부 및 국방

- 폐수

- 헬스케어

- 기타

최종 사용자를 기준으로 글로벌 레벨 및 유량 센서 시장은 산업 제조, 석유 및 가스, 화학, 소비재, 자동차, 에너지 및 전력, 정부 및 국방, 폐수, 의료 및 기타로 구분됩니다.

유통 채널

- 오프라인

- 온라인

글로벌 레벨 및 유량 센서 시장은 유통 채널을 기준으로 오프라인과 온라인으로 구분됩니다.

글로벌 레벨 및 유량 센서 시장 지역 분석/통찰력

글로벌 레벨 및 유량 센서 시장을 분석하고, 위에 언급된 대로 지역, 유형, 기술, 응용 매체, 최종 사용자 및 유통 채널별로 시장 규모에 대한 통찰력과 추세를 제공합니다.

글로벌 레벨 및 유량 센서 시장 보고서에서 다루는 국가는 미국, 캐나다, 멕시코, 독일, 영국, 프랑스, 이탈리아, 스페인, 러시아, 폴란드, 네덜란드, 벨기에, 스위스, 덴마크, 핀란드, 스웨덴, 노르웨이, 터키, 유럽의 다른 지역, 중국, 일본, 한국, 인도, 대만, 호주, 태국, 인도네시아, 말레이시아, 싱가포르, 뉴질랜드, 필리핀, 베트남, 아시아 태평양의 다른 지역, 브라질, 아르헨티나, 남미의 다른 지역, 사우디 아라비아, UAE, 남아프리카 공화국, 쿠웨이트, 카타르, 이집트, 이스라엘, 오만, 바레인, 그리고 중동 및 아프리카의 다른 지역입니다.

아시아 태평양 지역은 이 지역의 주요 시장에서 많은 제품 출시와 소비자 인식 증가로 인해 글로벌 레벨 및 유량 센서 시장을 지배할 것으로 예상됩니다. 아시아 태평양 지역에서 중국은 제조 및 기술의 글로벌 허브로 빠르게 성장하면서 이 지역을 지배할 것으로 예상됩니다. 북미에서는 세계에서 가장 크고 가장 발전된 경제 중 하나를 보유한 미국이 지배할 것으로 예상됩니다. 유럽에서는 강력한 엔지니어링 전통과 숙련된 노동력으로 유명한 독일이 지배할 것으로 예상됩니다.

보고서의 국가 섹션은 또한 현재 및 미래 시장 추세에 영향을 미치는 개별 시장 영향 요인과 시장 규제의 변화를 제공합니다. 다운스트림 및 업스트림 가치 사슬 분석, 기술 추세 및 포터의 5가지 힘 분석, 사례 연구와 같은 데이터 포인트는 개별 국가의 시장 시나리오를 예측하는 데 사용되는 몇 가지 포인터입니다. 또한 글로벌 브랜드의 존재 및 가용성과 지역 및 국내 브랜드와의 대규모 또는 희소한 경쟁으로 인해 직면한 과제, 국내 관세 및 무역 경로의 영향은 국가 데이터에 대한 예측 분석을 제공하는 동안 고려됩니다.

경쟁 환경 및 글로벌 레벨 및 유량 센서 시장 점유율 분석

글로벌 레벨 및 유량 센서 시장 경쟁 구도는 경쟁자에 대한 세부 정보를 제공합니다. 포함된 세부 정보는 회사 개요, 회사 재무, 창출된 수익, 시장 잠재력, 연구 개발 투자, 새로운 시장 이니셔티브, 글로벌 입지, 생산 현장 및 시설, 생산 용량, 회사의 강점과 약점, 제품 출시, 제품 폭과 범위, 애플리케이션 우세입니다. 제공된 위의 데이터 포인트는 시장과 관련된 회사의 초점에만 관련이 있습니다.

글로벌 레벨 및 유량 센서 시장의 주요 기업으로는 TE Connectivity, Temposonics(Amphenol Corporation의 자회사), AMETEK Inc., Emerson Electric Co., KEYENCE CORPORATION, ABB, Fortive, SICK AG, OMRON Corporation, Azbil Corporation, Honeywell International Inc., Endress+Hauser Group Services AG, SSI Technologies, LLC, Balluff Automation India Pvt. 등이 있습니다. Ltd, KROHNE, Siemens, Schneider Electric, Omega Engineering inc., Yokogawa Electric Corporation, ifm electronic GmbH, Baumer, Nanjing AH Electronic Science & Technology Co., Ltd., UWT GmbH, NOHKEN INC., FAFNIR GmbH, Sapcon Instruments Pvt Ltd, Anderson-Negele, Senix 초음파 거리 및 초음파 레벨 센서, GF Piping Systems, Fuelics PC, Aplus Finetek Sensor, Inc(Finetek CO, LTD.의 자회사), Pulsar Measurement and Flowline 등이 있습니다.

SKU-

세계 최초의 시장 정보 클라우드 보고서에 온라인으로 접속하세요

- 대화형 데이터 분석 대시보드

- 높은 성장 잠재력 기회를 위한 회사 분석 대시보드

- 사용자 정의 및 질의를 위한 리서치 분석가 액세스

- 대화형 대시보드를 통한 경쟁자 분석

- 최신 뉴스, 업데이트 및 추세 분석

- 포괄적인 경쟁자 추적을 위한 벤치마크 분석의 힘 활용

목차

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE GLOBAL LEVEL AND FLOW SENSOR MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 YEARS CONSIDERED FOR THE STUDY

2.3 GEOGRAPHIC SCOPE

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MARKET END-USER COVERAGE GRID

2.9 MULTIVARIATE MODELLING

2.1 TYPE TIMELINE CURVE

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 UPCOMING PROJECTS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 INCREASING ADOPTION OF INDUSTRIAL AUTOMATION AND INDUSTRY 4.0

5.1.2 CONTINUOUS ADVANCEMENTS IN SENSOR TECHNOLOGY

5.1.3 RISING AWARENESS OF SAFETY IN PROCESS CONTROL

5.1.4 WIDE APPLICATIONS OF LEVEL AND FLOW SENSORS IN THE OIL AND GAS INDUSTRY

5.2 RESTRAINTS

5.2.1 HIGH INITIAL COST OF LEVEL AND FLOW SENSORS

5.2.2 STRICT REGULATORY COMPLIANCES RELATED TO SENSOR TECHNOLOGY

5.3 OPPORTUNITIES

5.3.1 INCREASING COLLABORATION AND PARTNERSHIPS AMONG MARKET PLAYERS

5.3.2 GROWING NEED FOR ACCURACY IN VARIOUS INDUSTRIES

5.3.3 EMERGING TECHNOLOGIES, SUCH AS IIOT, ASSET MANAGEMENT, AND ADVANCED DIAGNOSTICS

5.4 CHALLENGES

5.4.1 REQUIREMENT OF TIMELY CALIBRATION AND MAINTENANCE

5.4.2 LESS AVAILABILITY OF SKILLED LABOR

5.4.3 TECHNICAL LIMITATIONS RELATED TO LEVEL AND FLOW SENSORS

6 GLOBAL LEVEL AND FLOW SENSOR MARKET, BY TYPE

6.1 OVERVIEW

6.2 FLOW SENSOR

6.2.1 DIFFERENTIAL PRESSURE

6.2.2 ULTRASONIC FLOW SENSOR

6.2.3 MAGNETIC INDUCTION FLOW SENSOR

6.2.4 VORTEX FLOW SENSOR

6.2.5 THERMAL FLOW SENSOR

6.2.6 TURBINE FLOW SENSOR

6.2.7 CURIOUS SENSOR

6.2.8 POSITIVE DISPLACEMENT FLOW SENSOR

6.2.9 OTHERS

6.3 LEVEL SENSOR

6.3.1 ULTRASONIC LEVEL SENSOR

6.3.2 CAPACITANCE LEVEL SENSOR

6.3.3 OPTICAL LEVEL SENSOR

6.3.4 CONDUCTIVITY OR RESISTANCE LEVEL SENSOR

6.3.5 VIBRATING OR TUNING FORK LEVEL SENSOR

6.3.6 FLOAT LEVEL SENSOR

6.3.7 OTHERS

7 GLOBAL LEVEL AND FLOW SENSOR MARKET, BY TECHNOLOGY

7.1 OVERVIEW

7.2 NON- CONTACT LEVEL AND FLOW SENSOR

7.3 CONTACT LEVEL AND FLOW SENSOR

8 GLOBAL LEVEL AND FLOW SENSOR MARKET, BY APPLICATION MEDIA

8.1 OVERVIEW

8.2 LIQUID

8.3 GAS

8.4 SOLID

9 GLOBAL LEVEL AND FLOW SENSOR MARKET, BY END USER

9.1 OVERVIEW

9.2 INDUSTRIAL MANUFACTURING

9.2.1 FLOW SENSOR

9.2.2 LEVEL SENSOR

9.3 OIL & GAS

9.3.1 FLOW SENSOR

9.3.2 LEVEL SENSOR

9.4 CHEMICAL

9.4.1 FLOW SENSOR

9.4.2 LEVEL SENSOR

9.5 CONSUMER GOODS

9.5.1 FLOW SENSOR

9.5.2 LEVEL SENSOR

9.6 AUTOMOTIVE

9.6.1 FLOW SENSOR

9.6.2 LEVEL SENSOR

9.7 ENERGY & POWER

9.7.1 FLOW SENSOR

9.7.2 LEVEL SENSOR

9.8 GOVERNMENT & DEFENSE

9.8.1 FLOW SENSOR

9.8.2 LEVEL SENSOR

9.9 WASTEWATER

9.9.1 FLOW SENSOR

9.9.2 LEVEL SENSOR

9.1 HEALTHCARE

9.10.1 FLOW SENSOR

9.10.2 LEVEL SENSOR

9.11 OTHERS

9.11.1 FLOW SENSOR

9.11.2 LEVEL SENSOR

10 GLOBAL LEVEL AND FLOW SENSOR MARKET, BY DISTRIBUTION CHANNEL

10.1 OVERVIEW

10.2 OFFLINE

10.2.1 SPECIALITY STORES

10.2.2 RETAIL STORES

10.2.3 OTHERS

10.3 ONLINE

10.3.1 COMPANY WEBSITE

10.3.2 THIRD PARTY E-COMMERCE WEBSITE

11 GLOBAL LEVEL AND FLOW SENSOR MARKET, BY REGION

11.1 OVERVIEW

11.2 NORTH AMERICA

11.2.1 U.S.

11.2.2 CANADA

11.2.3 MEXICO

11.3 EUROPE

11.3.1 GERMANY

11.3.2 U.K.

11.3.3 FRANCE

11.3.4 ITALY

11.3.5 SPAIN

11.3.6 RUSSIA

11.3.7 POLAND

11.3.8 NETHERLANDS

11.3.9 BELGIUM

11.3.10 SWITZERLAND

11.3.11 DENMARK

11.3.12 FINLAND

11.3.13 SWEDEN

11.3.14 NORWAY

11.3.15 TURKEY

11.3.16 REST OF EUROPE

11.4 ASIA-PACIFIC

11.4.1 CHINA

11.4.2 JAPAN

11.4.3 SOUTH KOREA

11.4.4 INDIA

11.4.5 TAIWAN

11.4.6 AUSTRALIA

11.4.7 THAILAND

11.4.8 INDONESIA

11.4.9 MALAYSIA

11.4.10 SINGAPORE

11.4.11 NEWZEALAND

11.4.12 PHILIPPINES

11.4.13 VIETNAM

11.4.14 REST OF ASIA-PACIFIC

11.5 MIDDLE EAST AND AFRICA

11.5.1 SAUDI ARABIA

11.5.2 U.A.E.

11.5.3 SOUTH AFRICA

11.5.4 KUWAIT

11.5.5 QATAR

11.5.6 EGYPT

11.5.7 ISRAEL

11.5.8 OMAN

11.5.9 BAHRAIN

11.5.10 REST OF MIDDLE EAST AND AFRICA

11.6 SOUTH AMERICA

11.6.1 BRAZIL

11.6.2 ARGENTINA

11.6.3 REST OF SOUTH AMERICA

12 GLOBAL LEVEL AND FLOW SENSOR MARKET: COMPANY LANDSCAPE

12.1 COMPANY SHARE ANALYSIS: GLOBAL FLOW SENSOR MARKET

12.2 COMPANY SHARE ANALYSIS: GLOBAL LEVEL SENSOR MARKET

12.3 COMPANY SHARE ANALYSIS: NORTH AMERICA FLOW SENSOR MARKET

12.4 COMPANY SHARE ANALYSIS: NORTH AMERICA LEVEL SENSOR MARKET

12.5 COMPANY SHARE ANALYSIS: EUROPE FLOW SENSOR MARKET

12.6 COMPANY SHARE ANALYSIS: EUROPE LEVEL SENSOR MARKET

12.7 COMPANY SHARE ANALYSIS: ASIA-PACIFIC FLOW SENSOR MARKET

12.8 COMPANY SHARE ANALYSIS: ASIA-PACIFIC LEVEL SENSOR MARKET

13 SWOT ANALYSIS

14 COMPANY PROFILE

14.1 ENDRESS + HAUSER GROUP SERVICES AG

14.1.1 COMPANY SNAPSHOT

14.1.2 COMPANY SHARE ANALYSIS

14.1.3 PRODUCT PORTFOLIO

14.1.4 RECENT DEVELOPMENTS

14.2 KEYENCE CORPORATION

14.2.1 COMPANY SNAPSHOT

14.2.2 REVENUE ANALYSIS

14.2.3 COMPANY SHARE ANALYSIS

14.2.4 PRODUCT PORTFOLIO

14.2.5 RECENT DEVELOPMENT

14.3 HONEYWELL INTERNATIONAL INC.

14.3.1 COMPANY SNAPSHOT

14.3.2 REVENUE ANALYSIS

14.3.3 COMPANY SHARE ANALYSIS

14.3.4 PRODUCT PORTFOLIO

14.3.5 RECENT DEVELOPMENT

14.4 EMERSON ELECTRIC CO.

14.4.1 COMPANY SNAPSHOT

14.4.2 REVENUE ANALYSIS

14.4.3 PRODUCT PORTFOLIO

14.4.4 RECENT DEVELOPMENT

14.5 ABB

14.5.1 COMPANY SNAPSHOT

14.5.2 REVENUE ANALYSIS

14.5.3 PRODUCT PORTFOLIO

14.5.4 RECENT DEVELOPMENTS

14.6 AMETEK INC.

14.6.1 COMPANY SNAPSHOT

14.6.2 REVENUE ANALYSIS

14.6.3 PRODUCT PORTFOLIO

14.6.4 RECENT DEVELOPMENT

14.7 ANDERSON-NEGELE

14.7.1 COMPANY SNAPSHOT

14.7.2 PRODUCT PORTFOLIO

14.7.3 RECENT DEVELOPMENTS

14.8 APLUS FINETEK SENSOR, INC

14.8.1 COMPANY SNAPSHOT

14.8.2 PRODUCT PORTFOLIO

14.8.3 RECENT DEVELOPMENT

14.9 AZBIL CORPORATION

14.9.1 COMPANY SNAPSHOT

14.9.2 REVENUE ANALYSIS

14.9.3 PRODUCT PORTFOLIO

14.9.4 RECENT DEVELOPMENTS

14.1 BALLUFF AUTOMATION INDIA PVT. LTD.

14.10.1 COMPANY SNAPSHOT

14.10.2 PRODUCT PORTFOLIO

14.10.3 RECENT DEVELOPMENTS

14.11 BAUMER

14.11.1 COMPANY SNAPSHOT

14.11.2 PRODUCT PORTFOLIO

14.11.3 RECENT DEVELOPMENTS

14.12 FAFNIR GMBH

14.12.1 COMPANY SNAPSHOT

14.12.2 PRODUCT PORTFOLIO

14.12.3 RECENT DEVELOPMENTS

14.13 FLOWLINE

14.13.1 COMPANY SNAPSHOT

14.13.2 PRODUCT PORTFOLIO

14.13.3 RECENT DEVELOPMENTS

14.14 FORTIVE

14.14.1 COMPANY SNAPSHOT

14.14.2 REVENUE ANALYSIS

14.14.3 PRODUCT PORTFOLIO

14.14.4 RECENT DEVELOPMENTS

14.15 FUELICS PC

14.15.1 COMPANY SNAPSHOT

14.15.2 PRODUCT PORTFOLIO

14.15.3 RECENT DEVELOPMENTS

14.16 GF PIPING SYSTEMS

14.16.1 COMPANY SNAPSHOT

14.16.2 PRODUCT PORTFOLIO

14.16.3 RECENT DEVELOPMENTS

14.17 IFM ELECTRONIC GMBH

14.17.1 COMPANY SNAPSHOT

14.17.2 PRODUCT PORTFOLIO

14.17.3 RECENT DEVELOPMENTS

14.18 KROHNE

14.18.1 COMPANY SNAPSHOT

14.18.2 PRODUCT PORTFOLIO

14.18.3 RECENT DEVELOPMENTS

14.19 NANJING AH ELECTRONIC SCIENCE & TECHNOLOGY CO., LTD.

14.19.1 COMPANY SNAPSHOT

14.19.2 PRODUCT PORTFOLIO

14.19.3 RECENT DEVELOPMENT

14.2 NOHKEN INC.

14.20.1 COMPANY SNAPSHOT

14.20.2 PRODUCT PORTFOLIO

14.20.3 RECENT DEVELOPMENTS

14.21 OMEGA ENGINEERING, INC.

14.21.1 COMPANY SNAPSHOT

14.21.2 PRODUCT PORTFOLIO

14.21.3 RECENT DEVELOPMENTS

14.22 OMRON CORPORATION

14.22.1 COMPANY SNAPSHOT

14.22.2 REVENUE ANALYSIS

14.22.3 PRODUCT PORTFOLIO

14.22.4 RECENT DEVELOPMENT

14.23 PULSAR MEASUREMENT

14.23.1 COMPANY SNAPSHOT

14.23.2 PRODUCT PORTFOLIO

14.23.3 RECENT DEVELOPMENTS

14.24 SAPCON INSTRUMENTS PVT LTD

14.24.1 COMPANY SNAPSHOT

14.24.2 PRODUCT PORTFOLIO

14.24.3 RECENT DEVELOPMENTS

14.25 SCHNEIDER ELECTRIC

14.25.1 COMPANY SNAPSHOT

14.25.2 REVENUE ANALYSIS

14.25.3 PRODUCT PORTFOLIO

14.25.4 RECENT DEVELOPMENTS

14.26 SENIX ULTRASONIC DISTANCE AND ULTRASONIC LEVEL SENSORS

14.26.1 COMPANY SNAPSHOT

14.26.2 PRODUCT PORTFOLIO

14.26.3 RECENT DEVELOPMENTS

14.27 SICK AG

14.27.1 COMPANY SNAPSHOT

14.27.2 PRODUCT PORTFOLIO

14.27.3 RECENT DEVELOPMENTS

14.28 SIEMENS (2022)

14.28.1 COMPANY SNAPSHOT

14.28.2 REVENUE ANALYSIS

14.28.3 PRODUCT PORTFOLIO

14.28.4 RECENT DEVELOPMENTS

14.29 SSI TECHNOLOGIESM, LLC

14.29.1 COMPANY SNAPSHOT

14.29.2 PRODUCT PORTFOLIO

14.29.3 RECENT DEVELOPMENTS

14.3 TE CONNECTIVITY

14.30.1 COMPANY SNAPSHOT

14.30.2 REVENUE ANALYSIS

14.30.3 PRODUCT PORTFOLIO

14.30.4 RECENT DEVELOPMENTS

14.31 TEMPOSONICS (A SUBSIDIARITY OF AMPHENOL CORPORATION)

14.31.1 COMPANY SNAPSHOT

14.31.2 PRODUCT PORTFOLIO

14.31.3 RECENT DEVELOPMENTS

14.32 UWT GMBH

14.32.1 COMPANY SNAPSHOT

14.32.2 PRODUCT PORTFOLIO

14.32.3 RECENT DEVELOPMENTS

14.33 YOKOGAWA ELECTRIC CORPORATION

14.33.1 COMPANY SNAPSHOT

14.33.2 REVENUE ANALYSIS

14.33.3 PRODUCT PORTFOLIO

14.33.4 RECENT DEVELOPMENTS

15 QUESTIONNAIRE

16 RELATED REPORTS

표 목록

TABLE 1 OPTICAL MEASUREMENT SYSTEMS AND COST ASSOCIATED (USD)

TABLE 2 GLOBAL LEVEL AND FLOW SENSOR MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 3 GLOBAL FLOW SENSOR IN LEVEL AND FLOW SENSOR MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 4 GLOBAL FLOW SENSOR IN LEVEL AND FLOW SENSOR MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 5 GLOBAL LEVEL SENSOR IN LEVEL AND FLOW SENSOR MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 6 GLOBAL LEVEL SENSOR IN LEVEL AND FLOW SENSOR MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 7 GLOBAL LEVEL AND FLOW SENSOR MARKET, BY TECHNOLOGY, 2021-2030 (USD THOUSAND)

TABLE 8 GLOBAL NON-CONTACT LEVEL AND FLOW SENSOR IN LEVEL AND FLOW SENSOR MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 9 GLOBAL CONTACT LEVEL AND FLOW SENSOR IN LEVEL AND FLOW SENSOR MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 10 GLOBAL LEVEL AND FLOW SENSOR MARKET, BY APPLICATION MEDIA, 2021-2030 (USD THOUSAND)

TABLE 11 GLOBAL LIQUID IN LEVEL AND FLOW SENSOR MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 12 GLOBAL GAS IN LEVEL AND FLOW SENSOR MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 13 GLOBAL SOLID IN LEVEL AND FLOW SENSOR MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 14 GLOBAL LEVEL AND FLOW SENSOR MARKET, BY END USER, 2021-2030 (USD THOUSAND)

TABLE 15 GLOBAL INDUSTRIAL MANUFACTURING IN LEVEL AND FLOW SENSOR MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 16 GLOBAL INDUSTRIAL MANUFACTURING IN LEVEL AND FLOW SENSOR MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 17 GLOBAL OIL & GAS IN LEVEL AND FLOW SENSOR MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 18 GLOBAL OIL & GAS IN LEVEL AND FLOW SENSOR MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 19 GLOBAL CHEMICAL IN LEVEL AND FLOW SENSOR MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 20 GLOBAL CHEMICAL IN LEVEL AND FLOW SENSOR MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 21 GLOBAL CONSUMER GOODS IN LEVEL AND FLOW SENSOR MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 22 GLOBAL CONSUMER GOODS IN LEVEL AND FLOW SENSOR MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 23 GLOBAL AUTOMOTIVE IN LEVEL AND FLOW SENSOR MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 24 GLOBAL AUTOMOTIVE IN LEVEL AND FLOW SENSOR MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 25 GLOBAL ENERGY & POWER IN LEVEL AND FLOW SENSOR MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 26 GLOBAL ENERGY & POWER IN LEVEL AND FLOW SENSOR MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 27 GLOBAL GOVERNMENT & DEFENSE IN LEVEL AND FLOW SENSOR MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 28 GLOBAL GOVERNMENT & DEFENSE IN LEVEL AND FLOW SENSOR MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 29 GLOBAL WASTEWATER IN LEVEL AND FLOW SENSOR MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 30 GLOBAL WASTEWATER IN LEVEL AND FLOW SENSOR MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 31 GLOBAL HEALTHCARE IN LEVEL AND FLOW SENSOR MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 32 GLOBAL HEALTHCARE IN LEVEL AND FLOW SENSOR MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 33 GLOBAL OTHERS IN LEVEL AND FLOW SENSOR MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 34 GLOBAL OTHERS IN LEVEL AND FLOW SENSOR MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 35 GLOBAL LEVEL AND FLOW SENSOR MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 36 GLOBAL OFFLINE IN LEVEL AND FLOW SENSOR MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 37 GLOBAL OFFLINE IN LEVEL AND FLOW SENSOR MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 38 GLOBAL ONLINE IN LEVEL AND FLOW SENSOR MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 39 GLOBAL ONLINE IN LEVEL AND FLOW SENSOR MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 40 MARKET SHARE OF TOP 15 COMPANIES IN GLOBAL FLOW AND LEVEL SENSOR MARKET

TABLE 41 MARKET SHARE OF TOP 15 COMPANIES IN NORTH AMERICA FLOW AND LEVEL SENSOR MARKET

TABLE 42 MARKET SHARE OF TOP 15 COMPANIES IN EUROPE FLOW AND LEVEL SENSOR MARKET

TABLE 43 MARKET SHARE OF TOP 15 COMPANIES IN ASIA-PACIFIC FLOW AND LEVEL SENSORS MARKET

그림 목록

FIGURE 1 GLOBAL LEVEL AND FLOW SENSOR MARKET: SEGMENTATION

FIGURE 2 GLOBAL LEVEL AND FLOW SENSOR MARKET: DATA TRIANGULATION

FIGURE 3 GLOBAL LEVEL AND FLOW SENSOR MARKET: DROC ANALYSIS

FIGURE 4 GLOBAL LEVEL AND FLOW SENSOR MARKET: GLOBAL VS REGIONAL MARKET ANALYSIS

FIGURE 5 GLOBAL LEVEL AND FLOW SENSOR MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 GLOBAL LEVEL AND FLOW SENSOR MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 GLOBAL LEVEL AND FLOW SENSOR MARKET: DBMR MARKET POSITION GRID

FIGURE 8 GLOBAL LEVEL SENSOR MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 GLOBAL FLOW SENSOR MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 GLOBAL LEVEL AND FLOW SENSOR MARKET: MARKET END-USER COVERAGE GRID

FIGURE 11 GLOBAL LEVEL AND FLOW SENSOR MARKET: MULTIVARIATE MODELLING

FIGURE 12 GLOBAL LEVEL AND FLOW SENSOR MARKET: TYPE TIMELINE CURVE

FIGURE 13 GLOBAL LEVEL AND FLOW SENSOR MARKET: SEGMENTATION

FIGURE 14 THE INCREASING ADOPTION OF INDUSTRIAL AUTOMATION AND INDUSTRY 4.0 IS EXPECTED TO BE KEY DRIVERS FOR THE GLOBAL LEVEL AND FLOW SENSOR MARKET IN THE FORECAST PERIOD OF 2023 TO 2030

FIGURE 15 FLOW SENSOR IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF GLOBAL LEVEL AND FLOW SENSOR MARKET IN 2023 TO 2030

FIGURE 16 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE GLOBAL LEVEL AND FLOW SENSOR MARKET

FIGURE 17 INCREASING AUTOMATION IN INDIA (IN %)

FIGURE 18 ADVANCEMENTS IN SENSOR TECHNOLOGY

FIGURE 19 VARIOUS STRATEGIC INITIATIVES

FIGURE 20 GROWING NEED FOR ACCURACY IN VARIOUS INDUSTRIES

FIGURE 21 TOP IOT CATEGORIES BASED ON 2020 MARKET SHARE

FIGURE 22 GLOBAL LEVEL AND FLOW SENSOR MARKET: BY TYPE, 2022

FIGURE 23 GLOBAL LEVEL AND FLOW SENSOR MARKET: BY TECHNOLOGY, 2022

FIGURE 24 GLOBAL LEVEL AND FLOW SENSOR MARKET: BY APPLICATION MEDIA, 2022

FIGURE 25 GLOBAL LEVEL AND FLOW SENSOR MARKET: BY END USER, 2022

FIGURE 26 GLOBAL LEVEL AND FLOW SENSOR MARKET: BY DISTRIBUTION CHANNEL, 2022

FIGURE 27 GOBAL LEVEL AND FLOW SENSOR MARKET: SNAPSHOT (2022)

FIGURE 28 GLOBAL FLOW SENSOR MARKET: COMPANY SHARE 2022 (%)

FIGURE 29 GLOBAL LEVEL SENSOR MARKET: COMPANY SHARE 2022 (%)

FIGURE 30 NORTH AMERICA FLOW SENSOR MARKET: COMPANY SHARE 2022 (%)

FIGURE 31 NORTH AMERICA LEVEL SENSOR MARKET: COMPANY SHARE 2022 (%)

FIGURE 32 EUROPE FLOW SENSOR MARKET: COMPANY SHARE 2022 (%)

FIGURE 33 EUROPE LEVEL SENSOR MARKET: COMPANY SHARE 2022 (%)

FIGURE 34 ASIA-PACIFIC FLOW SENSOR MARKET: COMPANY SHARE 2022 (%)

FIGURE 35 ASIA-PACIFIC LEVEL SENSOR MARKET: COMPANY SHARE 2022 (%)

연구 방법론

데이터 수집 및 기준 연도 분석은 대규모 샘플 크기의 데이터 수집 모듈을 사용하여 수행됩니다. 이 단계에는 다양한 소스와 전략을 통해 시장 정보 또는 관련 데이터를 얻는 것이 포함됩니다. 여기에는 과거에 수집한 모든 데이터를 미리 검토하고 계획하는 것이 포함됩니다. 또한 다양한 정보 소스에서 발견되는 정보 불일치를 검토하는 것도 포함됩니다. 시장 데이터는 시장 통계 및 일관된 모델을 사용하여 분석하고 추정합니다. 또한 시장 점유율 분석 및 주요 추세 분석은 시장 보고서의 주요 성공 요인입니다. 자세한 내용은 분석가에게 전화를 요청하거나 문의 사항을 드롭하세요.

DBMR 연구팀에서 사용하는 주요 연구 방법론은 데이터 마이닝, 시장에 대한 데이터 변수의 영향 분석 및 주요(산업 전문가) 검증을 포함하는 데이터 삼각 측량입니다. 데이터 모델에는 공급업체 포지셔닝 그리드, 시장 타임라인 분석, 시장 개요 및 가이드, 회사 포지셔닝 그리드, 특허 분석, 가격 분석, 회사 시장 점유율 분석, 측정 기준, 글로벌 대 지역 및 공급업체 점유율 분석이 포함됩니다. 연구 방법론에 대해 자세히 알아보려면 문의를 통해 업계 전문가에게 문의하세요.

사용자 정의 가능

Data Bridge Market Research는 고급 형성 연구 분야의 선두 주자입니다. 저희는 기존 및 신규 고객에게 목표에 맞는 데이터와 분석을 제공하는 데 자부심을 느낍니다. 보고서는 추가 국가에 대한 시장 이해(국가 목록 요청), 임상 시험 결과 데이터, 문헌 검토, 재생 시장 및 제품 기반 분석을 포함하도록 사용자 정의할 수 있습니다. 기술 기반 분석에서 시장 포트폴리오 전략에 이르기까지 타겟 경쟁업체의 시장 분석을 분석할 수 있습니다. 귀하가 원하는 형식과 데이터 스타일로 필요한 만큼 많은 경쟁자를 추가할 수 있습니다. 저희 분석가 팀은 또한 원시 엑셀 파일 피벗 테이블(팩트북)로 데이터를 제공하거나 보고서에서 사용 가능한 데이터 세트에서 프레젠테이션을 만드는 데 도움을 줄 수 있습니다.