Global Industrial Metrology Market

시장 규모 (USD 10억)

연평균 성장률 :

%

USD

11.76 Billion

USD

19.19 Billion

2024

2032

USD

11.76 Billion

USD

19.19 Billion

2024

2032

| 2025 –2032 | |

| USD 11.76 Billion | |

| USD 19.19 Billion | |

|

|

|

|

글로벌 산업 계측 시장 세분화, 제공(하드웨어, 소프트웨어 및 서비스), 장비(CMM, ODS, X선 및 CT), 애플리케이션(품질 관리 및 검사, 역엔지니어링, 매핑 및 모델링 및 기타), 최종 사용자(자동차, 제조, 항공우주 및 방위, 반도체 및 기타) - 2031년까지의 산업 동향 및 예측

산업계량학 시장 분석

글로벌 산업 계측 시장은 고정밀 측정 솔루션에 대한 수요 증가에 의해 크게 주도되고 있습니다. 산업이 효율성과 정확성을 향상하고자 하면서 3D 스캐닝 및 레이저 측정 시스템과 같은 고급 계측 기술이 정밀한 구성품 생산을 보장하기 위해 채택되고 있습니다. 또한 자동차, 항공우주 및 전자 제품을 포함한 다양한 분야에서 품질 관리에 대한 수요가 증가함에 따라 이 시장이 더욱 활성화되고 있습니다. 엄격한 규제 요건과 국제 품질 표준 준수의 필요성으로 인해 제조업체는 신뢰할 수 있는 측정 시스템에 투자해야 합니다. 품질 보증에 대한 이러한 집중은 결함과 생산 비용을 최소화할 뿐만 아니라 제품 신뢰성과 고객 만족도를 높여 시장의 성장 궤적을 공고히 합니다.

산업계량학 시장 규모

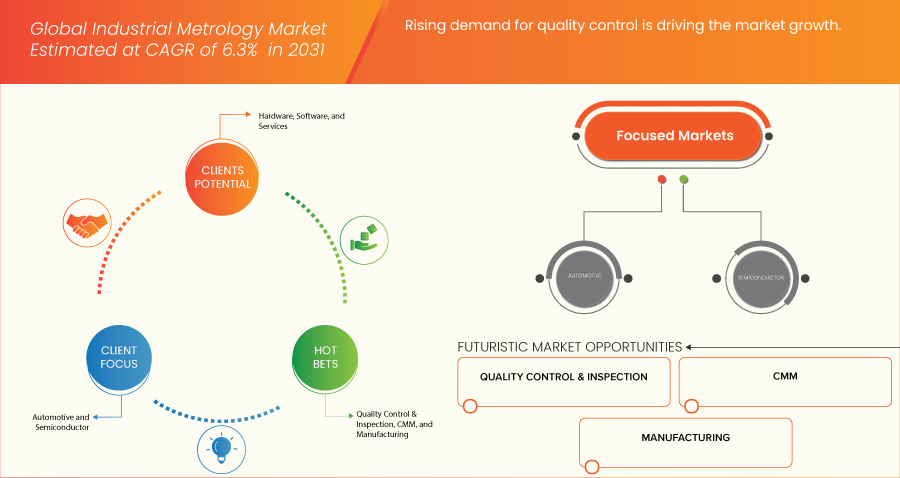

글로벌 산업 계측 시장은 2023년 112억 3천만 달러에서 2031년 180억 5천만 달러 규모로 성장할 것으로 예상되며, 2024년에서 2031년까지 예측 기간 동안 연평균 성장률 6.3%로 성장할 것으로 예상됩니다. Data Bridge Market Research 팀이 큐레이팅한 시장 보고서에는 시장 가치, 성장률, 시장 세그먼트, 지리적 범위, 시장 참여자, 시장 시나리오와 같은 시장 통찰력 외에도 심층적인 전문가 분석, 수입/수출 분석, 가격 분석, 생산 소비 분석, PESTLE 분석이 포함되어 있습니다.

산업 계측 시장 동향

"엄격한 규제 요구 사항 및 표준 준수"

다양한 산업에 걸친 엄격한 규제 요건은 글로벌 산업 계측 시장에 상당한 기회를 제공합니다. 항공우주, 자동차, 제약과 같은 산업은 측정 프로세스의 정확성과 신뢰성을 규정하는 엄격한 표준에 의해 관리됩니다. 이러한 규정이 진화하고 더욱 엄격해짐에 따라 제조업체는 규정 준수를 보장하고 불이행과 관련된 벌금을 피하기 위해 고급 계측 솔루션에 투자해야 합니다.

또한 ISO 9001 및 AS9100과 같은 국제 표준을 준수하려면 생산 프로세스 전반에 걸쳐 일관된 품질 검사가 필요합니다. 정확한 측정 및 문서화를 용이하게 하는 계측 도구는 이러한 표준을 충족하는 데 필수적입니다. 이러한 규정 준수에 대한 필요성은 정교한 측정 시스템에 대한 수요를 촉진하여 제조업체가 복잡한 규제 환경을 탐색하는 데 도움이 되는 계측 솔루션 공급업체에 대한 시장이 성장하고 있습니다. 이러한 추세는 시장 수요를 증가시킬 뿐만 아니라 규제 산업에서 정밀 측정의 중요성을 강조합니다.

보고 범위 및 산업 계측 시장 세분화

|

속성 |

산업 계측학 주요 시장 통찰력 |

|

다루는 세그먼트 |

|

|

적용 국가 |

미국, 캐나다, 멕시코, 독일, 영국, 프랑스, 이탈리아, 스페인, 러시아, 터키, 네덜란드, 노르웨이, 핀란드, 덴마크, 스웨덴, 폴란드, 스위스, 벨기에, 유럽의 나머지 지역, 중국, 일본, 인도, 한국, 호주, 뉴질랜드, 인도네시아, 태국, 말레이시아, 싱가포르, 필리핀, 대만, 베트남, 아시아 태평양의 나머지 지역, 브라질, 아르헨티나, 남미의 나머지 지역, UAE, 사우디 아라비아, 남아프리카, 이집트, 이스라엘, 바레인, 오만, 카타르, 쿠웨이트, 그리고 중동 및 아프리카의 나머지 지역 |

|

주요 시장 참여자 |

Bruker(미국), Baker Hughes Company(미국), Hexagon AB(스웨덴), KEYENCE CORPORATION(일본), Applied Materials, Inc.(미국), SGS Société Générale de Surveillance(스위스), FARO(미국), TriMet(미국), Intertek Group plc(영국), CREAFORM(캐나다), Automated Precision Inc(API)(미국), CyberOptics Corporation(미국), Cairnhill(싱가포르), Metrologic Group(프랑스), ATT Metrology Solutions(미국) 등이 있습니다. |

|

시장 기회 |

|

|

부가가치 데이터 정보 세트 |

Data Bridge 시장 조사팀이 큐레이팅한 시장 보고서에는 시장 가치, 성장률, 시장 세분화, 지리적 범위, 시장 참여자, 시장 시나리오와 같은 시장 통찰력 외에도 심층적인 전문가 분석, 수입/수출 분석, 가격 분석, 생산 소비 분석 및 PESTLE 분석이 포함되어 있습니다. |

산업계량학 시장 정의

글로벌 산업 계측 시장은 산업 공정에서 정밀성과 정확성을 보장하도록 설계된 측정 및 검사 기술의 개발, 제조 및 활용을 포괄합니다. 이 시장에는 좌표 측정기(CMM), 광학 및 레이저 측정 시스템, 데이터 분석 및 품질 관리 소프트웨어와 같은 광범위한 장비 및 솔루션이 포함됩니다. 산업 계측은 자동차, 항공우주, 전자, 의료를 포함한 다양한 분야에서 제조업체가 높은 품질 표준을 유지하고 오류를 줄이며 생산성을 향상할 수 있도록 함으로써 중요한 역할을 합니다. 산업이 자동화 및 첨단 제조 기술을 점점 더 많이 도입함에 따라 엄격한 품질 규정을 준수하고 운영 효율성을 추구해야 하는 필요성에 따라 정밀 측정 솔루션에 대한 수요가 증가할 것으로 예상됩니다. 이 시장은 지속적인 기술 발전과 확장되는 응용 분야 환경이 특징이며, 전반적인 성장과 진화에 기여합니다.

산업계량학 시장 동향

운전자

- 고정밀 측정 솔루션에 대한 수요 증가

산업 환경은 항공우주, 자동차, 전자를 포함한 다양한 부문에서 고정밀 측정 솔루션에 대한 필요성이 점점 더 커지고 있습니다. 제품이 더욱 정교해지고 허용 오차가 좁아짐에 따라 제조업체는 구성 요소가 엄격한 사양을 충족하는지 확인하기 위해 고급 계측 도구에 의존해야 합니다. 고정밀 측정은 품질 보증뿐만 아니라 규정 준수에도 필수적이므로 제품의 안전성과 신뢰성을 유지하려는 산업의 최우선 과제입니다.

예를 들어,

- 2024년 10월, ZEISS는 다양한 산업에서 정밀 기술에 대한 수요가 증가하는 것을 해결하는 획기적인 3D X선 현미경 시스템인 ZEISS VersaXRM 730을 출시했습니다. 이 혁신적인 시스템은 향상된 분해능과 더 빠른 처리량을 제공하여 제조업체가 구성 요소의 효율적인 스캐닝과 정밀한 품질 관리를 수행할 수 있도록 합니다. 수상 경력에 빛나는 ZEN navx 소프트웨어와 빠른 이미징을 위한 FAST 모드와 같은 기능을 갖춘 VersaXRM 730은 생산성을 크게 개선하여 자동차, 항공우주 및 의료 기기와 같은 분야에서 고정밀 측정 솔루션에 대한 증가하는 수요를 지원합니다.

품질 관리에 대한 수요 증가

품질 관리가 제조의 협상 불가 측면이 되었으며, 글로벌 산업 계측 시장에 상당한 영향을 미치고 있습니다. 소비자가 고품질 제품을 기대하고 규제 기관의 감시가 강화됨에 따라 제조업체는 엄격한 품질 관리 조치를 구현해야 합니다. 고급 계측 솔루션은 생산 프로세스 전반에 걸쳐 제품 품질을 모니터링하고 보장하는 데 필요한 기능을 제공하여 결함 가능성을 줄이고 산업 표준을 준수합니다.

예를 들어,

E-Zine Media에 따르면 2024년 10월, 증강 현실(AR)의 통합은 첨단 제조의 품질 관리 프로세스를 크게 변화시켰습니다. AR은 디지털 정보를 물리적 구성 요소에 중첩함으로써 실시간 데이터 시각화를 가능하게 하고 검사의 정밀도를 향상시켰습니다. 이 기술은 운영을 간소화하고, 정확도를 개선하며, 현장 운영자와 원격 전문가 간의 협업을 용이하게 했습니다.

기회

- 계측학 솔루션의 맞춤화

다양한 산업의 고유한 요구를 충족하도록 계측 솔루션을 사용자 정의할 수 있는 능력은 글로벌 산업 계측 시장에서 귀중한 기회를 제공합니다. 자동차, 전자, 의료 기기를 포함한 다양한 부문에는 표준 솔루션이 적절히 해결하지 못할 수 있는 특정 측정 요구 사항이 있습니다. 맞춤형 계측 시스템을 제공함으로써 회사는 고객의 다양한 요구를 더 잘 충족시켜 고객 만족도와 충성도를 높일 수 있습니다.

예를 들어,

2023년 8월, Bowers Group은 Virtue Aerospace에 검사 속도를 92%까지 가속화하는 맞춤형 측정 솔루션을 성공적으로 지원했습니다. 맞춤형 시스템은 Virtue Aerospace가 항공 연료 펌프 임펠러에 대한 엄격한 규정 준수 요구 사항을 충족하는 데 도움이 되었습니다. 품질 및 환경 관리자인 Ian Smith는 시스템의 사용 편의성과 워크플로우의 상당한 개선을 칭찬했습니다.

- 디지털 트윈 기술의 채택 증가

제조 공정에서 디지털 트윈 기술의 채택이 증가함에 따라 산업 계측 시장에 상당한 기회가 제공됩니다. 디지털 트윈은 물리적 자산의 가상 복제본을 생성하여 제조업체가 실시간으로 운영을 시뮬레이션, 분석 및 최적화할 수 있도록 합니다. 정확한 계측 데이터는 효과적인 디지털 트윈을 개발하고 유지하는 데 필수적입니다. 가상 모델이 물리적 자산의 실제 조건과 성능을 반영하도록 보장하기 때문입니다.

예를 들어,

지멘스 백서에 따르면 디지털 트윈 기술을 통해 제조업체는 물리적 자산의 가상 복제본을 개발하여 운영 시뮬레이션을 개선할 수 있었습니다. 정확한 계측 데이터는 이러한 디지털 모델이 실제 조건을 정확하게 반영하도록 하는 데 필수적임이 입증되었습니다. 이는 글로벌 산업 계측 시장에서 디지털 트윈 기술의 채택을 증가시킵니다.

제약/도전

- 초기 투자 비용이 높으면 시장 성장이 방해된다

고급 계측 솔루션에 필요한 높은 초기 투자는 글로벌 산업 계측 시장에 상당한 제약을 가합니다. 레이저 스캐너, 좌표 측정기 (CMM), 자동 검사 기술과 같은 정교한 측정 시스템은 종종 엄청난 비용이 수반되며, 특히 중소기업(SME)의 경우 더욱 그렇습니다. 이러한 회사는 이러한 자본 지출에 예산을 할당하는 데 어려움을 겪을 수 있으며, 이로 인해 필수적인 계측 도구의 도입이 지연될 수 있습니다.

예를 들어,

2024년 6월, 이 기사는 고급 계측 솔루션에 필요한 높은 초기 투자가 산업용 계측 시장에 상당한 제약을 가하고 있다고 강조했습니다. 많은 중소기업(SME)이 예산 제약에 직면하여 필수 측정 기술의 도입이 지연되고 있습니다. 또한, 유지 관리 및 소프트웨어 업데이트에 대한 지속적인 비용으로 인해 투자 능력이 더욱 복잡해져 시장 성장 잠재력이 제한됩니다.

이 시장 보고서는 최근의 새로운 개발, 무역 규정, 수출입 분석, 생산 분석, 가치 사슬 최적화, 시장 점유율, 국내 및 지역 시장 참여자의 영향, 새로운 수익 창출처, 시장 규정의 변화, 전략적 시장 성장 분석, 시장 규모, 범주 시장 성장, 응용 분야 틈새 시장 및 지배력, 제품 승인, 제품 출시, 지리적 확장, 시장의 기술 혁신에 대한 분석 기회를 제공합니다. 시장에 대한 자세한 정보를 얻으려면 Data Bridge Market Research에 연락하여 분석가 브리핑을 받으세요. 저희 팀은 시장 성장을 달성하기 위한 정보에 입각한 시장 결정을 내리는 데 도움을 드립니다.

산업 계측 시장 범위

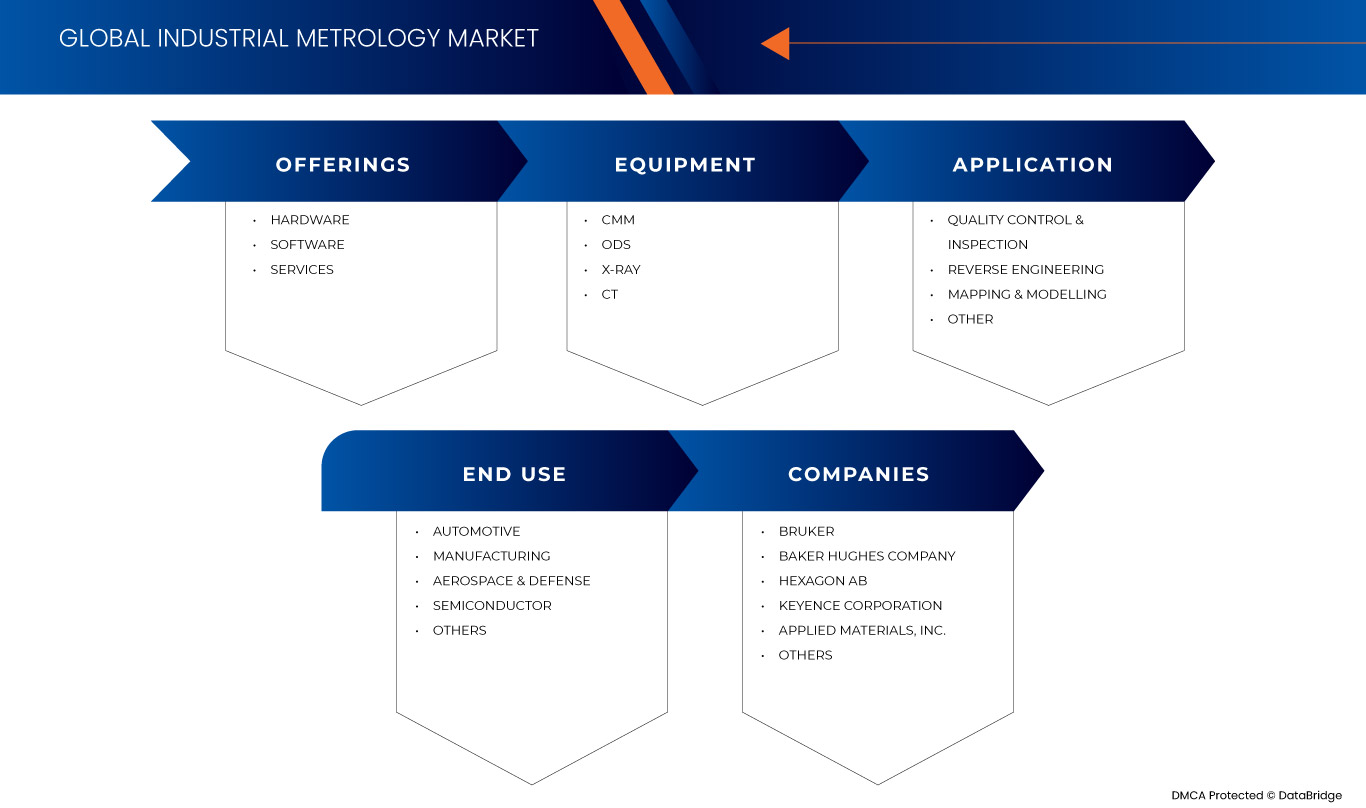

시장은 제공, 장비, 애플리케이션 및 최종 사용자를 기준으로 하는 네 가지 주요 세그먼트로 세분화됩니다. 이러한 세그먼트 간의 성장은 산업의 빈약한 성장 세그먼트를 분석하고 사용자에게 핵심 시장 애플리케이션을 식별하기 위한 전략적 결정을 내리는 데 도움이 되는 귀중한 시장 개요와 시장 통찰력을 제공하는 데 도움이 됩니다.

헌금

- 하드웨어

- 소프트웨어

- 서비스

장비

- CMM

- 오디세이

- 엑스레이

- 코네티컷

애플리케이션

- 품질 관리 및 검사

- 역엔지니어링

- 매핑 및 모델링

- 다른

최종 사용자

- 자동차

- 조작

- 항공우주 및 방위

- 반도체

- 기타

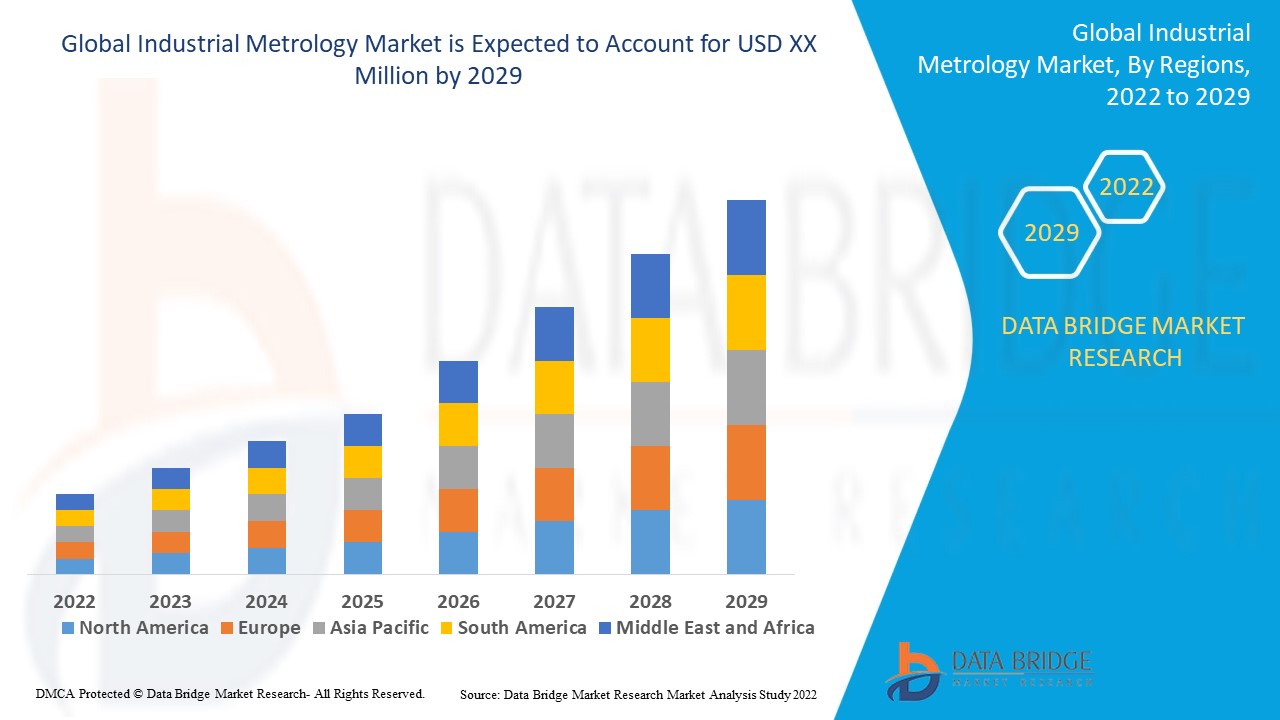

산업 계측 시장 지역 분석

글로벌 산업 계측 시장은 제공, 장비, 애플리케이션 및 최종 사용자를 기준으로 4개의 주요 세그먼트로 구분됩니다.

산업 계측 시장 보고서에서 다루는 국가는 미국, 캐나다, 멕시코, 독일, 영국, 프랑스, 이탈리아, 스페인, 러시아, 터키, 네덜란드, 노르웨이, 핀란드, 덴마크, 스웨덴, 폴란드, 스위스, 벨기에, 기타 유럽, 중국, 일본, 인도, 한국, 호주, 뉴질랜드, 인도네시아, 태국, 말레이시아, 싱가포르, 필리핀, 대만, 베트남, 기타 아시아 태평양, 브라질, 아르헨티나, 기타 남미, UAE, 사우디 아라비아, 남아프리카, 이집트, 이스라엘, 바레인, 오만, 카타르, 쿠웨이트, 기타 중동 및 아프리카입니다.

북미 지역은 첨단 제조 역량, 기술에 대한 적극적인 투자, 품질 관리에 대한 집중, 주요 업계 참여자의 존재 덕분에 글로벌 산업용 계측 시장을 장악하고 있습니다.

Asia-Pacific region is expected to be the fastest-growing region due to the presence of key manufacturers further solidifies the region's market leadership and stringent regulatory standards drive demand for precise measurement solutions across various sectors.

The country section of the report also provides individual Market impacting factors and changes in Market regulation that impact the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the Market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Industrial Metrology Market Share

Global industrial metrology market competitive landscape provides details of the competitor. Details included are company overview, company financials, revenue generated, Market potential, investment in research and development, new Market initiatives, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to global industrial metrology market.

Industrial Metrology Market Leaders Operating in the Market are:

- Bruker (U.S.)

- Baker Hughes Company (U.S.)

- Hexagon AB (Sweden)

- KEYENCE CORPORATION (Japan)

- Applied Materials, Inc. (U.S.)

- SGS Société Générale de Surveillance (Switzerland)

- FARO (U.S.)

- TriMet (U.S.)

- Intertek Group plc (U.K.)

- CREAFORM (Canada)

- Automated Precision Inc (API) (U.S.)

- CyberOptics Corporation (U.S.)

- Cairnhill (Singapore)

- Metrologic Group (France)

- ATT Metrology Solutions (U.S.)

Latest Developments in Industrial Metrology Market

- In July 2024, Professors Andrew Webb and Bernhard Blumich received the Richard R. Ernst Prize at EUROMAR 2024, recognizing their significant contributions to NMR and magnetic resonance research, advancing scientific understanding in these fields

- In February 2021, Baker Hughes Company has acquired ARMS Reliability to bolster its Asset Performance Management (APM) portfolio, advancing its digital solutions across industries such as mining, power, and utilities. This acquisition enhances Baker Hughes’ industrial asset management capabilities by integrating ARMS Reliability’s solutions into its Bently Nevada platform, providing more precise asset monitoring and lifecycle management, and supporting the company’s commitment to improving productivity in Industrial Metrology

- 2024년 9월, Hexagon AB는 대규모 제조에서 품질 검사 지연을 줄이기 위한 새로운 기술을 도입했습니다. Leica Absolute Tracker ATS800은 레이저 추적과 레이더 기능을 결합하여 제조업체가 멀리서 자세한 특징을 측정하고 엄격한 조립 허용 오차를 충족할 수 있도록 했습니다. 이 시스템은 항공우주 및 자동차 분야의 병목 현상을 최소화하여 생산성을 개선했습니다. 이 출시는 Hexagon AB의 시장 지위를 강화하여 핵심 산업 요구 사항을 해결하고 자동화된 검사 기능을 향상하려는 노력을 보여주었습니다.

- 2023년 3월, KEYENCE CORPORATION은 광학, 레이저, 터치 프로브 측정을 하나의 유닛으로 결합한 고정밀 LM-X 멀티센서 측정 시스템을 출시했습니다. 이 시스템은 시간 소모적인 위치 지정 없이 쉽고 고정밀 측정을 가능하게 하여 사용자가 신뢰할 수 있는 검사 보고서를 효율적이고 정확하게 얻을 수 있도록 합니다.

- 2022년 6월, Applied Materials, Inc.는 Picosun Oy를 인수하여 Picosun의 원자층 증착 기술로 ICAPS 그룹의 역량을 강화한다고 발표했습니다. 이러한 움직임은 다양한 시장에서 증가하는 특수 반도체 수요를 해결하기 위한 것이었습니다.

SKU-

세계 최초의 시장 정보 클라우드 보고서에 온라인으로 접속하세요

- 대화형 데이터 분석 대시보드

- 높은 성장 잠재력 기회를 위한 회사 분석 대시보드

- 사용자 정의 및 질의를 위한 리서치 분석가 액세스

- 대화형 대시보드를 통한 경쟁자 분석

- 최신 뉴스, 업데이트 및 추세 분석

- 포괄적인 경쟁자 추적을 위한 벤치마크 분석의 힘 활용

연구 방법론

데이터 수집 및 기준 연도 분석은 대규모 샘플 크기의 데이터 수집 모듈을 사용하여 수행됩니다. 이 단계에는 다양한 소스와 전략을 통해 시장 정보 또는 관련 데이터를 얻는 것이 포함됩니다. 여기에는 과거에 수집한 모든 데이터를 미리 검토하고 계획하는 것이 포함됩니다. 또한 다양한 정보 소스에서 발견되는 정보 불일치를 검토하는 것도 포함됩니다. 시장 데이터는 시장 통계 및 일관된 모델을 사용하여 분석하고 추정합니다. 또한 시장 점유율 분석 및 주요 추세 분석은 시장 보고서의 주요 성공 요인입니다. 자세한 내용은 분석가에게 전화를 요청하거나 문의 사항을 드롭하세요.

DBMR 연구팀에서 사용하는 주요 연구 방법론은 데이터 마이닝, 시장에 대한 데이터 변수의 영향 분석 및 주요(산업 전문가) 검증을 포함하는 데이터 삼각 측량입니다. 데이터 모델에는 공급업체 포지셔닝 그리드, 시장 타임라인 분석, 시장 개요 및 가이드, 회사 포지셔닝 그리드, 특허 분석, 가격 분석, 회사 시장 점유율 분석, 측정 기준, 글로벌 대 지역 및 공급업체 점유율 분석이 포함됩니다. 연구 방법론에 대해 자세히 알아보려면 문의를 통해 업계 전문가에게 문의하세요.

사용자 정의 가능

Data Bridge Market Research는 고급 형성 연구 분야의 선두 주자입니다. 저희는 기존 및 신규 고객에게 목표에 맞는 데이터와 분석을 제공하는 데 자부심을 느낍니다. 보고서는 추가 국가에 대한 시장 이해(국가 목록 요청), 임상 시험 결과 데이터, 문헌 검토, 재생 시장 및 제품 기반 분석을 포함하도록 사용자 정의할 수 있습니다. 기술 기반 분석에서 시장 포트폴리오 전략에 이르기까지 타겟 경쟁업체의 시장 분석을 분석할 수 있습니다. 귀하가 원하는 형식과 데이터 스타일로 필요한 만큼 많은 경쟁자를 추가할 수 있습니다. 저희 분석가 팀은 또한 원시 엑셀 파일 피벗 테이블(팩트북)로 데이터를 제공하거나 보고서에서 사용 가능한 데이터 세트에서 프레젠테이션을 만드는 데 도움을 줄 수 있습니다.