Global Endpoint Detection Response Market

시장 규모 (USD 10억)

연평균 성장률 :

%

USD

4.22 Billion

USD

23.83 Billion

2024

2032

USD

4.22 Billion

USD

23.83 Billion

2024

2032

| 2025 –2032 | |

| USD 4.22 Billion | |

| USD 23.83 Billion | |

|

|

|

|

솔루션(소프트웨어 및 서비스), 엔드포인트 장치(네트워크 장치 및 서버, 모바일 장치, POS(판매 시점 관리) 장치 및 기타), 배포(클라우드 기반 및 온프레미스), 기업 규모(중소기업 및 대기업), 수직(은행, 금융 서비스 및 보험(BFSI), 의료 및 생명 과학, 정부 및 국방, 소매 및 전자 상거래, IT 및 통신, 에너지 및 유틸리티, 제조 및 기타)별 글로벌 엔드포인트 탐지 및 대응 시장 세분화 - 산업 동향 및 2032년까지의 예측

엔드포인트 탐지 및 대응 시장 규모

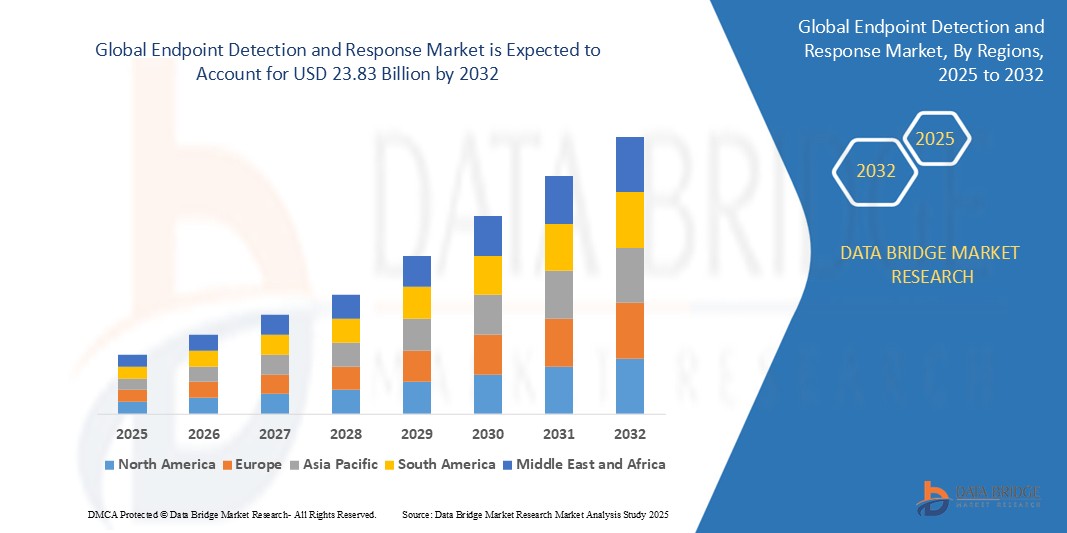

- 글로벌 엔드포인트 감지 및 대응 시장 규모는 2024년에 42억 2천만 달러 로 평가되었으며, 예측 기간 동안 24.16%의 CAGR 로 2032년까지 238억 3천만 달러에 도달할 것으로 예상됩니다 .

- 이러한 성장은 사이버 위협의 빈도 증가, 원격 작업의 증가, 규제 준수 요구 사항 증가와 같은 요인에 의해 촉진됩니다.

엔드포인트 탐지 및 대응 시장 분석

- 엔드포인트 탐지 및 대응(EDR)은 엔드포인트 기기를 지속적으로 모니터링하여 잠재적 위협을 실시간으로 탐지, 조사 및 대응하는 사이버 보안 솔루션을 의미합니다. 위협 인텔리전스, 행동 분석, 자동 대응 기능을 통합하여 데스크톱, 노트북, 모바일 기기, 서버 등 다양한 기기에서 진화하는 사이버 공격으로부터 시스템을 보호합니다.

- EDR 시장은 정교한 사이버 위협의 급증, 원격 및 하이브리드 작업 모델 채택 증가, 데이터 보호에 대한 규제 압력 증가, 클라우드 채택의 급속한 증가, 다양한 엔드포인트에서 실시간 위협 탐지 및 완화에 대한 기업의 집중 증가로 인해 강력한 성장을 경험하고 있습니다.

- 북미는 산업 전반에 걸친 초기 기술 도입과 강력한 사이버 보안 솔루션 공급업체의 존재감으로 인해 32.9%의 점유율로 엔드포인트 탐지 및 대응 시장을 지배할 것으로 예상됩니다.

- 아시아 태평양 지역은 빠른 디지털 전환과 다양한 부문에 걸친 사이버 보안 위험에 대한 인식 증가로 인해 예측 기간 동안 엔드포인트 탐지 및 대응 시장에서 가장 빠르게 성장하는 지역이 될 것으로 예상됩니다.

- 소프트웨어 부문은 실시간 위협 탐지, 조사 및 자동 대응 기능을 제공하는 확장 가능한 클라우드 기반 EDR 솔루션에 대한 수요 증가로 65%의 시장 점유율을 기록하며 시장을 장악할 것으로 예상됩니다. 이러한 변화는 사이버 공격의 정교화와 다양한 엔드포인트에 걸쳐 민첩하고 쉽게 구축할 수 있는 보안 도구에 대한 필요성 증가에 기인합니다.

보고서 범위 및 엔드포인트 탐지 및 대응 시장 세분화

|

속성 |

엔드포인트 감지 및 대응 주요 시장 통찰력 |

|

다루는 세그먼트 |

|

|

포함 국가 |

북아메리카

유럽

아시아 태평양

중동 및 아프리카

남아메리카

|

|

주요 시장 참여자 |

|

|

시장 기회 |

|

|

부가가치 데이터 정보 세트 |

Data Bridge Market Research 팀이 큐레이팅한 시장 보고서에는 시장 가치, 성장률, 시장 부문, 지리적 범위, 시장 참여자, 시장 시나리오와 같은 시장 통찰력 외에도 심층적인 전문가 분석, 수입/수출 분석, 가격 분석, 생산 소비 분석, 유봉 분석이 포함되어 있습니다. |

엔드포인트 탐지 및 대응 시장 동향

“클라우드 기반 솔루션 도입 증가”

- 글로벌 엔드포인트 탐지 및 대응 시장의 두드러진 추세 중 하나는 클라우드 기반 솔루션의 채택이 증가하고 있다는 것입니다.

- 이러한 추세는 확장 가능하고 비용 효율적인 사이버 보안 도구 에 대한 필요성 증가 , 원격 근무자 증가, 분산 환경 전반의 중앙 집중식 위협 모니터링 수요 증가

로 인해 발생합니다.

- 예를 들어 CrowdStrike, Microsoft, SentinelOne과 같은 선도적인 공급업체는 글로벌 엔드포인트에서 실시간 분석, 자동화된 위협 탐지 및 신속한 사고 대응을 가능하게 하는 클라우드 기반 EDR 플랫폼을 제공합니다.

- 클라우드 기반 배포는 통합이 더 쉽고 인프라 비용이 절감되며 접근성이 향상되어 대기업과 중소기업 모두에게 점점 더 인기를 얻고 있습니다.

- 디지털 전환이 가속화되고 조직이 민첩성과 회복성을 우선시함에 따라 클라우드 기반 EDR 솔루션이 시장의 미래 성장 궤적을 형성하는 데 중심적인 역할을 할 것으로 예상됩니다.

엔드포인트 탐지 및 대응 시장 동향

운전사

“관리형 보안 서비스 제공업체(MSSP)의 증가”

- 관리형 보안 서비스 제공업체(MSSP)의 증가는 기업들이 복잡한 사이버 보안 문제를 처리하기 위해 비용 효율적인 전문가 중심 솔루션을 모색함에 따라 엔드포인트 탐지 및 대응(EDR) 시장 성장을 견인하는 주요 요인입니다.

- 이러한 변화는 특히 사내 사이버 보안 팀이 부족하고 지속적인 위협 모니터링 및 대응 역량이 필요한 중소기업에서 두드러지게 나타납니다.

- 사이버 공격이 점점 더 빈번해지고 정교해짐에 따라 기업들은 실시간 보호, 더 빠른 사고 대응 및 규정 준수를 위해 EDR 기능을 MSSP에 아웃소싱하는 경우가 점점 늘어나고 있습니다.

- 서비스 제공업체는 진화하는 기업 요구 사항을 충족하기 위해 고급 분석, AI 기반 위협 탐지 및 클라우드 기반 EDR 플랫폼을 통해 서비스를 강화하고 있습니다.

- MSSP에 대한 의존도가 높아짐에 따라 의료, 금융, 제조 등 산업 전반에 걸쳐 EDR 솔루션의 범위가 확대되고 있습니다.

예를 들어,

- Secureworks는 행동 분석 및 실시간 탐지 기능을 갖춘 관리형 EDR을 제공합니다. AT&T Cybersecurity는 향상된 위협 대응을 위해 통합 보안 관리 플랫폼과 EDR을 통합합니다.

- IBM Security는 X-Force Threat Management 서비스의 일부로 관리형 EDR을 제공하여 기업이 글로벌 엔드포인트에서 고급 위협을 탐지할 수 있도록 지원합니다.

- 기업이 운영 효율성과 위협 회복력을 우선시함에 따라 MSSP 주도 EDR 솔루션에 대한 수요는 2032년까지 시장 성장을 견인하는 핵심 동력이 될 것으로 예상됩니다.

기회

“보안 도구와의 통합”

- 더욱 광범위한 보안 도구와의 통합은 엔드포인트 탐지 및 대응(EDR) 시장에 중요한 기회를 제공하며, 향상된 위협 가시성, 더 빠른 사고 대응, 보다 응집력 있는 사이버 보안 운영을 가능하게 합니다.

- EDR 공급업체는 다양한 보안 환경에서 원활한 데이터 공유, 자동화된 워크플로 및 중앙화된 위협 관리를 제공하기 위해 SIEM, SOAR 및 XDR 플랫폼과 점점 더 긴밀히 협력하고 있습니다.

- 이 기회는 경보 피로를 줄이고, 수정을 간소화하고, 기업 보안 팀 전체에서 더 빠른 의사 결정을 가능하게 하는 통합 사이버 보안 솔루션에 대한 증가하는 수요를 지원합니다.

예를 들어,

- CrowdStrike Falcon은 Splunk 및 IBM QRadar와 같은 SIEM 도구와 통합되어 보안 계층 전반에 걸쳐 실시간 엔드포인트 원격 측정 및 상황별 위협 통찰력을 제공합니다.

- Microsoft Defender for Endpoint는 Azure Sentinel 및 Microsoft 365 Defender와 함께 작동하여 미리 구성된 플레이북을 사용하여 자동 감지 및 대응을 지원합니다.

- 조직이 통합되고 확장 가능한 보안 아키텍처를 우선시함에 따라 기존 도구와의 통합이 2032년까지 EDR 솔루션 도입과 장기 시장 확장을 촉진하는 핵심 요소가 될 것으로 예상됩니다.

제지/도전

"높은 구현 비용"

- 고급 소프트웨어, 숙련된 인력, 기존 IT 인프라와의 통합 비용이 상당한 재정적 장벽을 만들어내기 때문에 높은 구현 비용은 엔드포인트 탐지 및 대응(EDR) 시장에 큰 과제를 안겨줍니다.

- 이러한 비용은 복잡한 EDR 배포를 관리할 전담 사이버 보안 예산과 사내 전문 지식이 부족한 중소기업(SME)에게는 특히 부담스럽습니다.

- 이러한 과제는 지속적인 업데이트, 시스템 튜닝, 보안 분석가 교육의 필요성으로 인해 더욱 복잡해지며 이로 인해 총 소유 비용이 더욱 증가하고 더 광범위한 도입이 제한됩니다.

예를 들어,

- CrowdStrike, Palo Alto Networks, VMware Carbon Black과 같은 공급업체의 엔터프라이즈급 EDR 플랫폼은 종종 사전 라이선스 비용, 연간 구독, 통합 및 모니터링 서비스에 대한 추가 지출이 필요합니다.

- 더 저렴한 가격 모델이나 간소화된 배포 옵션이 없다면 높은 구현 비용으로 인해 예산이 제한된 산업과 개발 시장에서의 도입이 방해를 받을 수 있으며, 이는 2032년까지 EDR 시장의 전반적인 성장을 둔화시킬 가능성이 있습니다.

엔드포인트 탐지 및 대응 시장 범위

시장은 솔루션, 엔드포인트 장치, 배포, 기업 규모 및 수직 유형을 기준으로 세분화됩니다.

|

분할 |

하위 세분화 |

|

솔루션별 |

|

|

엔드포인트 장치별 |

|

|

배치별 |

|

|

기업 규모별

|

|

|

수직별 |

|

2025년에는 소프트웨어가 솔루션 부문에서 가장 큰 점유율을 차지하며 시장을 지배할 것으로 예상됩니다.

소프트웨어 부문은 실시간 위협 탐지, 조사 및 자동 대응 기능을 제공하는 확장 가능한 클라우드 기반 EDR 솔루션에 대한 수요 증가로 인해 2025년 엔드포인트 탐지 및 대응 시장에서 65%의 최대 점유율을 기록하며 시장을 장악할 것으로 예상됩니다. 이러한 변화는 사이버 공격의 정교화와 다양한 엔드포인트에 걸쳐 민첩하고 쉽게 구축할 수 있는 보안 도구에 대한 필요성 증가에 기인합니다.

클라우드 기반은 예측 기간 동안 배포 세그먼트에서 가장 큰 점유율을 차지할 것으로 예상됩니다.

2025년에는 클라우드 기반 부문이 비용 효율성, 구축 용이성, 그리고 지리적으로 분산된 엔드포인트 전반에 걸쳐 실시간 위협 인텔리전스와 중앙 집중식 관리 기능을 제공하여 55.3%의 최대 시장 점유율을 기록하며 시장을 장악할 것으로 예상됩니다. 원격 근무 및 하이브리드 환경의 도입 증가는 유연하고 확장 가능한 클라우드 기반 EDR 솔루션에 대한 수요를 더욱 가속화합니다.

엔드포인트 탐지 및 대응 시장 지역 분석

“북미는 엔드포인트 탐지 및 대응 시장에서 가장 큰 점유율을 차지합니다.”

- 북미는 산업 전반에 걸친 조기 기술 도입과 강력한 사이버 보안 솔루션 공급업체의 존재감에 힘입어 32.9%의 점유율로 엔드포인트 탐지 및 대응 시장을 장악하고 있습니다.

- 미국은 중소기업(SME)의 높은 채택률, 사이버 보안 인프라에 대한 상당한 투자, 데이터 보호에 중점을 둔 사전 규제 환경으로 인해 상당한 점유율을 보유하고 있습니다.

- 시장 성장은 광범위한 연구 개발 활동, 공공-민간 파트너십, 잘 구축된 관리형 보안 서비스 제공업체 생태계에 의해 더욱 뒷받침됩니다.

- 지속적인 혁신, 증가하는 사이버 위협, 고급 엔드포인트 보호에 대한 강력한 기업 수요로 인해 북미는 2032년까지 글로벌 EDR 시장에서 선두 자리를 유지할 것으로 예상됩니다.

"아시아 태평양 지역은 엔드포인트 탐지 및 대응 시장에서 가장 높은 CAGR을 기록할 것으로 예상됩니다."

- 아시아 태평양 지역은 다양한 부문에서 급속한 디지털 전환과 사이버 보안 위험에 대한 인식 증가로 인해 엔드포인트 탐지 및 대응 시장 에서 가장 높은 성장률을 보일 것으로 예상됩니다 .

- 중국은 디지털 보안 분야에서 정부 주도의 이니셔티브, 클라우드 인프라 확장, 위협 탐지 기술에 대한 기업 지출 증가로 인해 상당한 점유율을 확보했습니다.

- 인터넷 보급률 증가, 모바일 및 IoT 기기 도입 증가, 기업 및 정부 기관을 표적으로 삼는 사이버 공격 급증으로 지역적 추진력이 더욱 강화되었습니다.

- 확장 가능한 차세대 보안 솔루션에 대한 수요가 확대됨에 따라 아시아 태평양 지역은 2032년까지 글로벌 엔드포인트 탐지 및 대응 시장에서 가장 빠르게 성장하는 지역이 될 것으로 예상됩니다.

엔드포인트 탐지 및 대응 시장 점유율

시장 경쟁 구도는 경쟁사별 세부 정보를 제공합니다. 여기에는 회사 개요, 회사 재무 상태, 매출 창출, 시장 잠재력, 연구 개발 투자, 신규 시장 진출, 글로벌 입지, 생산 시설 및 설비, 생산 능력, 회사의 강점과 약점, 제품 출시, 제품 종류 및 범위, 응용 분야별 우위 등이 포함됩니다. 위에 제공된 데이터는 해당 회사의 시장 집중도와 관련된 데이터입니다.

시장에서 활동하는 주요 시장 리더는 다음과 같습니다.

- 시스코 시스템즈(Cisco Systems, Inc. ) (미국)

- 브로드컴 (미국)

- 벨든 주식회사(미국)

- 소포스(영국)

- F-Secure(핀란드)

- McAfee, LLC (미국)

- 트렌드마이크로 주식회사(일본)

- NortonLifeLock Inc.(미국)

- 시만텍 주식회사(미국)

- VMware, Inc.(미국)

- 크라우드스트라이크 (미국)

- 팔로알토 네트웍스 (미국)

- 포스포인트(미국)

- InfraRed Integrated Systems Ltd(영국)

- 디지털 가디언(미국)

- 사이버리즌(미국)

- 오픈 텍스트 코퍼레이션(캐나다)

- FireEye, Inc.(미국)

- RSA Security LLC(미국)

- 인텔 코퍼레이션(미국)

Latest Developments in Global Endpoint Detection and Response Market

- In October 2023, HarfangLab, a French cybersecurity firm specializing in endpoint detection and response, secured EUR 25 million in Series A funding. This investment will facilitate the company’s expansion in Europe, enabling it to enhance its capabilities in identifying and neutralizing cyberattacks. HarfangLab’s growth reflects the increasing demand for robust cybersecurity solutions in a rapidly evolving threat landscape

- In August 2023, Fortinet was recognized as the Google Cloud Technology Partner of the Year for Security, particularly for its FortiEDR solution. This accolade acknowledges Fortinet’s effectiveness in real-time breach identification and prevention, which is crucial for organizational resilience against cyber threats. The recognition strengthens Fortinet’s reputation and also supports its future growth in the security market through enhanced integration capabilities

- In October 2022, SyncDog, Inc. partnered with 3Eye Technologies to enhance its mobility and cloud strategy, focusing on a more secure solution for mobile device usage. Their Secure Systems Workspace aims to address the complexities of enabling employee access on mobile platforms. This collaboration seeks to bolster sales targets by offering enterprises and government agencies a scalable and secure environment for mobile operations

- In July 2022, Raytheon Intelligence & Space teamed up with CrowdStrike to bolster its managed detection and response (MDR) services. By integrating CrowdStrike’s advanced endpoint security technologies, the collaboration aims to enhance threat detection and response capabilities. This partnership highlights the importance of combining resources to provide comprehensive security solutions, positioning Raytheon as a stronger contender in the cybersecurity landscape

- In June 2021, Cisco acquired Kenna Security, Inc. to enhance its endpoint security capabilities significantly. This strategic acquisition aims to consolidate Cisco's security portfolio, creating a comprehensive endpoint security framework. By integrating Kenna's technologies, Cisco seeks to offer more robust solutions against cyber threats, strengthening its position as a leader in the cybersecurity industry while improving overall organizational protection

SKU-

세계 최초의 시장 정보 클라우드 보고서에 온라인으로 접속하세요

- 대화형 데이터 분석 대시보드

- 높은 성장 잠재력 기회를 위한 회사 분석 대시보드

- 사용자 정의 및 질의를 위한 리서치 분석가 액세스

- 대화형 대시보드를 통한 경쟁자 분석

- 최신 뉴스, 업데이트 및 추세 분석

- 포괄적인 경쟁자 추적을 위한 벤치마크 분석의 힘 활용

연구 방법론

데이터 수집 및 기준 연도 분석은 대규모 샘플 크기의 데이터 수집 모듈을 사용하여 수행됩니다. 이 단계에는 다양한 소스와 전략을 통해 시장 정보 또는 관련 데이터를 얻는 것이 포함됩니다. 여기에는 과거에 수집한 모든 데이터를 미리 검토하고 계획하는 것이 포함됩니다. 또한 다양한 정보 소스에서 발견되는 정보 불일치를 검토하는 것도 포함됩니다. 시장 데이터는 시장 통계 및 일관된 모델을 사용하여 분석하고 추정합니다. 또한 시장 점유율 분석 및 주요 추세 분석은 시장 보고서의 주요 성공 요인입니다. 자세한 내용은 분석가에게 전화를 요청하거나 문의 사항을 드롭하세요.

DBMR 연구팀에서 사용하는 주요 연구 방법론은 데이터 마이닝, 시장에 대한 데이터 변수의 영향 분석 및 주요(산업 전문가) 검증을 포함하는 데이터 삼각 측량입니다. 데이터 모델에는 공급업체 포지셔닝 그리드, 시장 타임라인 분석, 시장 개요 및 가이드, 회사 포지셔닝 그리드, 특허 분석, 가격 분석, 회사 시장 점유율 분석, 측정 기준, 글로벌 대 지역 및 공급업체 점유율 분석이 포함됩니다. 연구 방법론에 대해 자세히 알아보려면 문의를 통해 업계 전문가에게 문의하세요.

사용자 정의 가능

Data Bridge Market Research는 고급 형성 연구 분야의 선두 주자입니다. 저희는 기존 및 신규 고객에게 목표에 맞는 데이터와 분석을 제공하는 데 자부심을 느낍니다. 보고서는 추가 국가에 대한 시장 이해(국가 목록 요청), 임상 시험 결과 데이터, 문헌 검토, 재생 시장 및 제품 기반 분석을 포함하도록 사용자 정의할 수 있습니다. 기술 기반 분석에서 시장 포트폴리오 전략에 이르기까지 타겟 경쟁업체의 시장 분석을 분석할 수 있습니다. 귀하가 원하는 형식과 데이터 스타일로 필요한 만큼 많은 경쟁자를 추가할 수 있습니다. 저희 분석가 팀은 또한 원시 엑셀 파일 피벗 테이블(팩트북)로 데이터를 제공하거나 보고서에서 사용 가능한 데이터 세트에서 프레젠테이션을 만드는 데 도움을 줄 수 있습니다.