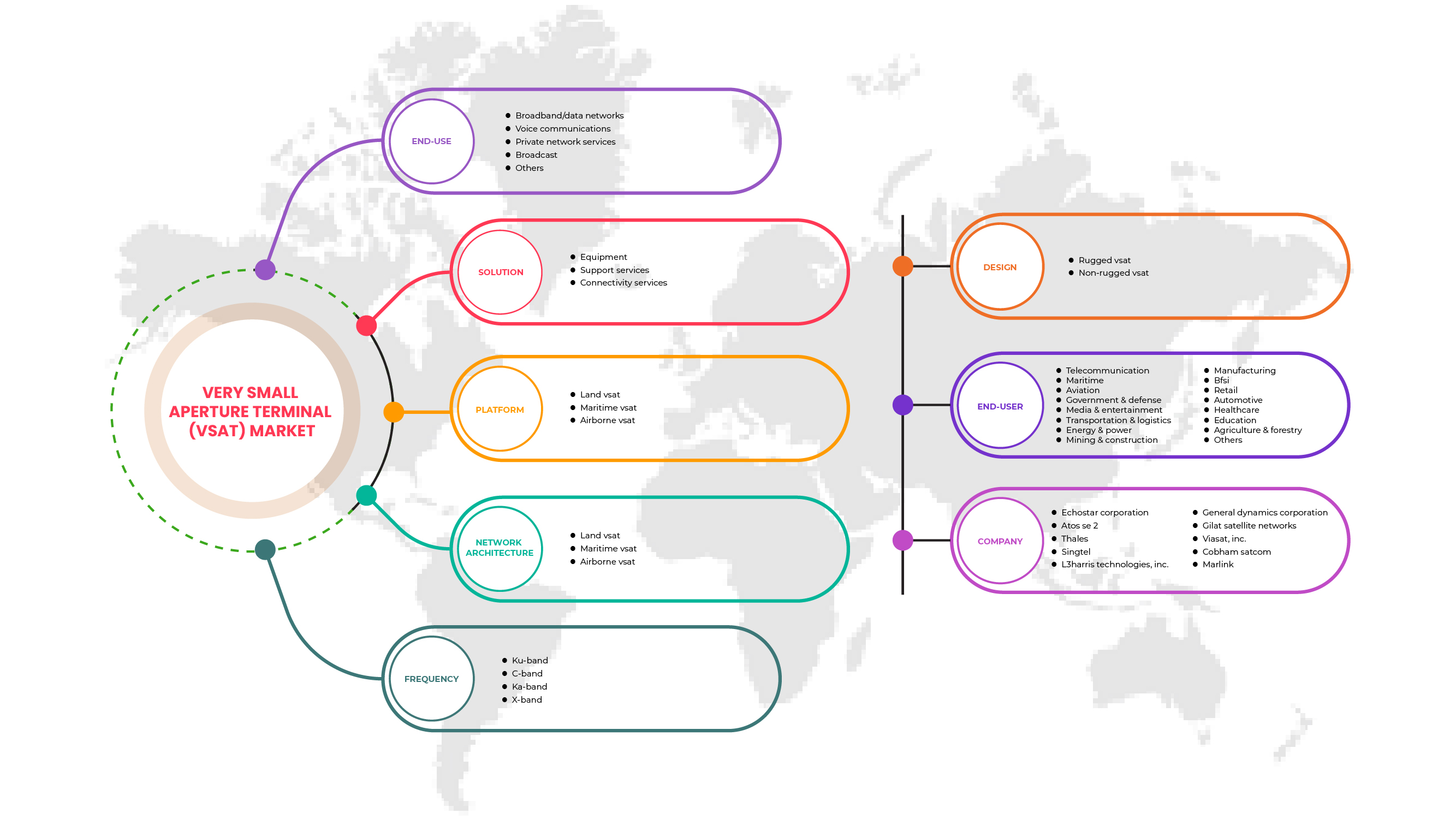

유럽 초소형 개구부 단말(VSAT) 시장, 솔루션(장비, 지원 서비스, 연결 서비스), 플랫폼(육상 VSAT, 해상 VSAT, 공중 VSAT), 주파수(Ku-대역, C-대역, Ka-대역, X-대역), 네트워크 아키텍처(스타 토폴로지, 메시 토폴로지, 하이브리드 토폴로지, 지점 간 링크), 설계(견고한 VSAT 및 비견고한 VSAT), 수직(통신, 해상, 항공, 정부 및 국방, 미디어 및 엔터테인먼트, 운송 및 물류, 에너지 및 전력, 광산 및 건설, 제조, BFSI, 소매, 자동차, 운송 및 물류, 의료, 교육, 농업 및 임업 및 기타), 최종 사용(광대역/데이터 네트워크, 음성 통신, 개인 네트워크 서비스, 방송 및 기타) - 산업 동향 및 2029년까지의 예측.

유럽 초소형 개구단말기(VSAT) 시장 분석 및 규모

위성 용량의 엄청난 성장으로 인해 가격이 상당히 하락하여 매우 작은 개구 단말기(VSAT)가 처음으로 많은 산업과 지역에서 실행 가능한 솔루션이 되었습니다. 또한 해상, 석유 및 가스, 항공 등의 산업에서 VSAT 기술 채택이 증가했습니다. 이러한 시스템은 또한 원격 위치에 있는 의료 애플리케이션, 데이터베이스, 비디오 및 전화 사용자 간에 필요한 연결을 제공하고 원격 및 모바일 사이트와의 통신을 허용합니다.

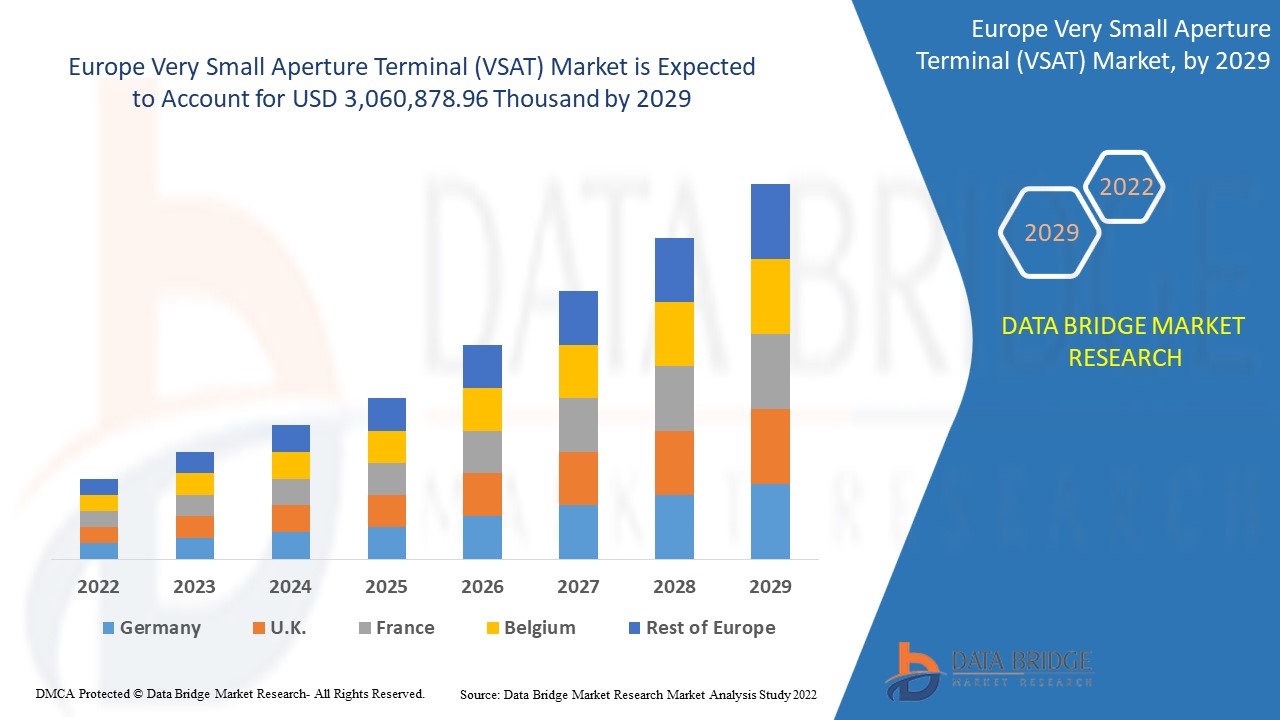

Data Bridge Market Research는 유럽 초소형 개구부 단말(VSAT) 시장이 2029년까지 3,060,878.96천 달러에 도달할 것으로 예상하고 있으며, 예측 기간 동안 CAGR은 8.9%입니다. 초소형 개구부 단말(VSAT) 시장 보고서는 또한 가격 분석, 특허 분석 및 기술 발전에 대한 심층적인 내용을 다룹니다.

|

보고서 메트릭 |

세부 |

|

예측 기간 |

2022년부터 2029년까지 |

|

기준 연도 |

2021 |

|

역사적 연도 |

2020 (2019-2014로 사용자 정의 가능) |

|

양적 단위 |

매출은 천 달러, 가격은 달러로 표시됨 |

|

다루는 세그먼트 |

솔루션별(장비, 지원 서비스, 연결 서비스), 플랫폼별(육상 VSAT, 해상 VSAT, 공중 VSAT), 주파수별(Ku-Band, C-Band, Ka-Band, X-Band), 네트워크 아키텍처별(스타 토폴로지, 메시 토폴로지, 하이브리드 토폴로지, 지점 간 링크), 설계별(견고한 VSAT 및 비견고한 VSAT), 수직별(통신, 해상, 항공, 정부 및 국방, 미디어 및 엔터테인먼트, 운송 및 물류, 에너지 및 전력, 광산 및 건설, 제조, BFSI, 소매, 자동차, 운송 및 물류, 의료, 교육, 농업 및 임업 및 기타), 최종 사용별(광대역/데이터 네트워크, 음성 통신, 개인 네트워크 서비스, 방송 및 기타) |

|

적용 국가 |

독일, 프랑스, 영국, 네덜란드, 스위스, 벨기에, 러시아, 이탈리아, 스페인, 터키, 스웨덴, 유럽의 나머지 지역 |

|

시장 참여자 포함 |

싱텔, 마를링크, 투라야 텔레커뮤니케이션 컴퍼니, 스피드캐스트, NSSLEurope, ST 엔지니어링, 아토스 SE 2, 이리듐 커뮤니케이션스, 에코스타 코퍼레이션, 오빗 커뮤니케이션스 시스템스, 울트라, 니신보 홀딩스, 제너럴 다이내믹스 코퍼레이션, 허니웰 인터내셔널, 코브햄 샛콤, 탈레스, 길라트 위성 네트워크, L3해리스 테크놀로지스, 주식회사, 비아샛, 주식회사, KVH 인더스트리스, 주식회사, CPI 인터내셔널, 글로벌 인바콤 |

시장 정의

양방향 위성 통신 시스템은 VSAT 또는 Very Small Aperture Terminal이라고 합니다. 이 시스템의 접시는 일반적으로 지름이 3.8m 미만입니다. VSAT 시스템의 효율성은 날씨에 부정적인 영향을 받을 수 있습니다 . 또한 일반적으로 사용되는 VSAT 네트워크에는 별형, 메시형 또는 하이브리드형의 세 가지 토폴로지가 있습니다. 따라서 VSAT 시스템은 원격 위치에 있는 의료 애플리케이션, 데이터베이스 , 비디오 및 전화 사용자 간에 필요한 연결을 제공하고 원격 및 모바일 사이트와의 통신을 허용합니다.

유럽 초소구경 단말(VSAT) 시장 동향

이 섹션에서는 시장 동인, 이점, 기회, 제약 및 과제를 이해하는 것을 다룹니다. 이 모든 내용은 아래와 같이 자세히 논의됩니다.

운전자

- 해양 IoT 애플리케이션을 위한 보안 통신에 대한 수요 증가

VSAT 기술은 해양 산업의 주요 거래가 되었습니다. 이 기술은 일반적으로 농촌 지역과 혹독한 환경에서 인터넷, 데이터 및 전화 통신을 위한 양방향 위성 통신에 사용됩니다. 최근 몇 년 동안 해양 IoT 생태계에서 점진적인 변화가 있었습니다. 이 생태계는 다양한 소프트웨어와 통합된 하드웨어인 다양한 표준 전자 부품으로 제공됩니다. 위성을 통한 IoT 서비스를 통해 기업은 가장 저렴한 방식으로 자산의 데이터에 액세스할 수 있습니다. 따라서 바다에 있는 선박은 멀리 떨어져 있고 선박 및 기타 개별 엔티티는 더 큰 IoT 네트워크의 일부로 디지털 시스템을 채택하고 있습니다. 선박/함대에서 IoT 장치와 센서 시스템을 사용하면 이러한 기술을 사용하여 경쟁 우위를 확보하는 데 도움이 되며 회사는 보다 효과적인 운영 및 의사 결정을 위해 데이터의 모든 잠재력을 활용할 수 있습니다.

- 석유 및 가스 산업에서 VSAT 기술 도입 증가

오늘날, 석유 및 가스 부문은 다양한 디지털 혁신으로 인해 엄청난 변화를 겪고 있습니다. 안전, 보안, 새로운 석유 지역 탐사, 굴착 장치와 본사 간의 가시성 증가와 같은 여러 가지 요구 사항이 있으며, 운영 비용을 통제하는 동시에 가능합니다. 따라서 굴착 장치 운영자는 지속적으로 더 빠른 결정을 내리고 운영을 보다 효율적으로 운영하라는 압력을 받고 있습니다. 또한, 석유 및 가스 산업은 육상 기반 통신을 사용하는 것이 실용적이거나 신뢰할 수 없는 원격 온쇼어 및 오프쇼어 환경에서 운영됩니다. 따라서 많은 회사가 VSAT 기술을 구현하기 시작하여 굴착 장치 운영자가 신속하고 정보에 입각한 결정을 내릴 수 있게 되었으며, 이를 통해 운영 비용을 낮추고 생산성을 높이며 위치에 관계없이 승무원에게 보다 안전한 작업 조건을 제공할 수 있습니다.

기회

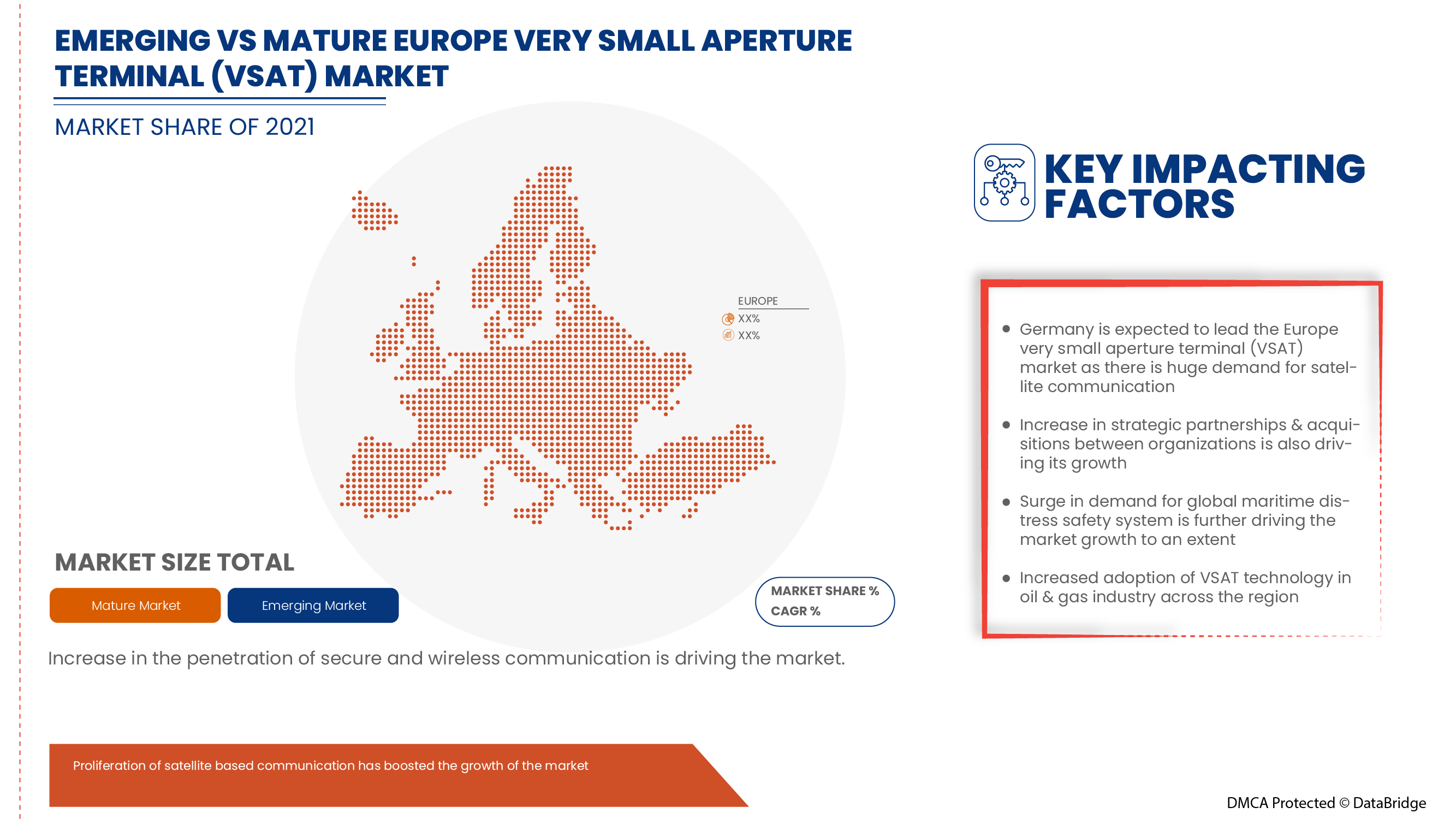

- 다양한 조직 간의 전략적 파트너십 및 인수 증가

프로젝트 조정 및 투자는 초소형 개구단말(VSAT) 부문에서 지속적인 개선을 달성하는 데 필수적입니다. 이로 인해 정부와 기타 민간 기관은 파트너십과 인수를 통해 노력하고 있으며, 이를 통해 산업의 성장을 가속화하고 있습니다. 이를 통해 기관의 인지도와 이익을 구축하고, 이를 통해 산업에서 새로운 발명을 위한 범위를 창출하는 데 도움이 됩니다. 또한 파트너십을 통해 회사는 보다 안전하고 신뢰할 수 있는 초소형 개구단말(VSAT) 서비스와 솔루션을 제공하기 위해 첨단 기술에 더 많이 투자할 수 있습니다. 나아가 이를 통해 두 회사 모두 경쟁 시장에서 인정을 받고 어느 정도 수익을 창출하는 데 도움이 됩니다.

제약/도전

- 증가하는 사이버 보안 우려와 데이터 침해

사이버범죄/해킹 및 사이버보안 문제는 모든 부문에서 팬데믹 동안 600% 증가했습니다. 네트워크 또는 소프트웨어 보안의 결함은 해커가 시스템 내에서 허가되지 않은 작업을 수행하는 데 악용하는 약점입니다.

Safety at Sea와 BIMCO가 최근 발표한 Maritime Cybersecurity Survey 보고서에 따르면, 2020년 2월 이전 12개월 동안 조직의 31%가 사이버 공격의 희생자가 되었으며, 이는 2019년 대비 9% 증가한 수치입니다. Naval Dome의 북미 운영 책임자인 Robert Rizika가 발표한 또 다른 보고서에 따르면, 해운 산업의 운영 기술(OT)에 대한 사이버 공격이 2017년 50%에서 2018년 120%, 2019년 310%로 900% 증가했다고 합니다.

- 악천후 시 초소형 개구단말(vsat) 네트워크의 안정성과 관련된 문제

우주 날씨는 전파를 반사, 굴절 또는 흡수하는 전리층 교란을 일으킬 수 있기 때문에 지구와 위성 간의 무선 통신을 방해합니다. 위성 신호는 공중에서 먼 거리를 이동해야 하기 때문에 농촌 사용자를 위한 위성 인터넷 서비스는 심각한 기상 조건에 취약할 수 있습니다. 바람은 무선 신호에 거의 영향을 미치지 않지만 위성 접시와 같은 장비를 흔들거나 진동시키거나 심지어 이동시킬 수 있습니다. 지연과 비 페이드는 위성의 신호 전송 용량에 영향을 미치는 두 가지 특정 요소입니다. 비와 대기 수분은 비 페이드의 주요 원인이며, 이는 더 높은 Ku 및 Ka 대역 주파수에서 위성 신호를 약화시키거나 저하시킬 수 있습니다.

COVID-19 이후 유럽 초소구경 단말(VSAT) 시장에 미치는 영향

COVID-19는 봉쇄 규정과 제조 시설 폐쇄로 인해 VSAT(초소형 개구 단말기) 시장에 부정적인 영향을 미쳤습니다.

COVID-19 팬데믹은 매우 작은 개구 단말기(VSAT) 시장에 어느 정도 부정적인 영향을 미쳤습니다. 그러나 전 세계적으로 유럽 해상 비상 안전 시스템에 대한 수요가 급증하면서 팬데믹 이후 시장이 성장하는 데 도움이 되었습니다. 또한 COVID-19 이후 시장이 개방된 후 성장이 높았으며 군사 및 방위 부문에서 위성 기반 통신의 확산이 증가함에 따라 이 부문에서 상당한 성장이 있을 것으로 예상됩니다.

솔루션 제공업체는 COVID-19 이후 회복하기 위해 다양한 전략적 결정을 내리고 있습니다. 업체들은 초소형 개구부 단말(VSAT)에 관련된 기술을 개선하기 위해 여러 연구 개발 활동을 진행하고 있습니다. 이를 통해 회사는 시장에 첨단 기술을 선보일 것입니다. 또한 자동화 기술 사용을 위한 정부 이니셔티브로 인해 시장이 성장했습니다.

최근 개발 사항

- 2022년 4월, 제너럴 다이내믹스는 보잉에 1000개의 Tr-밴드를 공급하여 상업용 및 군용 항공기에 라인 피팅 설치를 위한 계약을 발표했습니다. 이 계약은 회사가 매출 성장을 가속화하고 회사의 시장 지위를 강화하는 데 도움이 될 것입니다.

- 2021년 4월 NSSL Europe는 DDK Positioning과의 파트너십을 통해 유럽 항법 위성 시스템(GNSS)을 강화한다고 발표했습니다. 이 파트너십은 회사가 광범위한 제품을 제공하고 시장 지위를 강화하기 위해 해양 제품 포트폴리오를 확대하는 데 도움이 될 것입니다.

유럽 초소구경단말기(VSAT) 시장 범위

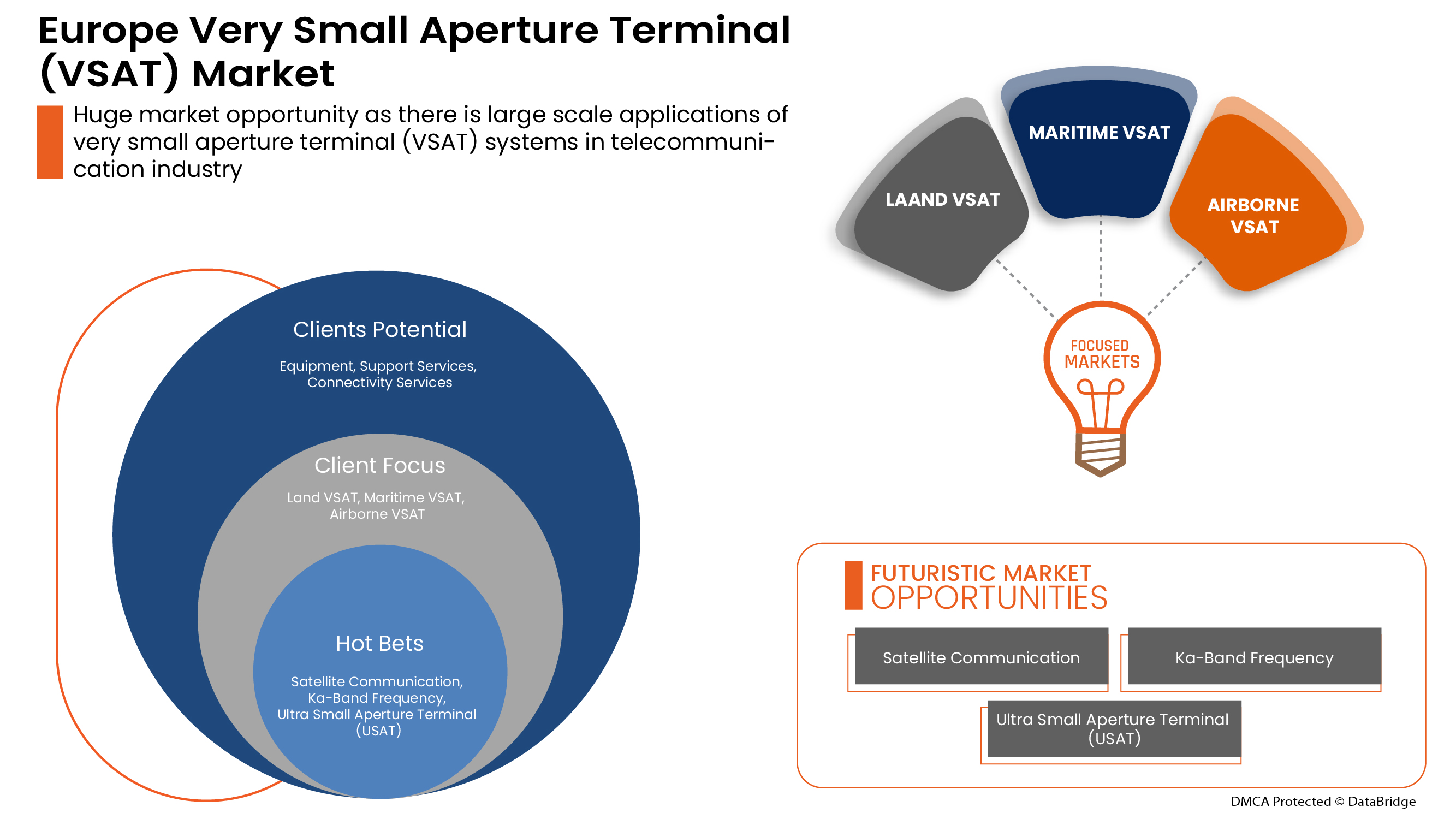

유럽 초소형 개구부 단말(VSAT) 시장은 솔루션, 플랫폼, 주파수, 네트워크 아키텍처, 설계, 수직 및 최종 용도에 따라 세분화됩니다. 이러한 세그먼트 간의 성장은 산업의 빈약한 성장 세그먼트를 분석하고 사용자에게 핵심 시장 애플리케이션을 식별하기 위한 전략적 결정을 내리는 데 도움이 되는 귀중한 시장 개요와 시장 통찰력을 제공하는 데 도움이 됩니다.

해결책

- 장비

- 지원 서비스

- 연결 서비스

유럽 초소형 개구 단말기(VSAT) 시장은 솔루션을 기준으로 장비, 지원 서비스, 연결 서비스로 구분됩니다.

플랫폼

- 육상 VSAT

- 해상 VSAT

- 공중 VSAT

유럽 초소형 개구부 단말(VSAT) 시장은 플랫폼을 기준으로 육상 VSAT, 해상 VSAT, 공중 VSAT로 구분됩니다.

빈도

- 쿠 밴드

- C-밴드

- 카 밴드

- X 밴드

주파수를 기준으로 유럽 초소형 개구 단말기(VSAT) 시장은 Ku 대역, C 대역, Ka 대역, X 대역으로 구분됩니다.

네트워크 아키텍처

- 별의 위상

- 메시 토폴로지

- 하이브리드 토폴로지

- 지점 간 링크

네트워크 아키텍처를 기준으로, 유럽 초소형 개구부 단말(VSAT) 시장은 스타 토폴로지, 메시 토폴로지, 하이브리드 토폴로지 및 지점 간 링크로 구분됩니다.

설계

- 견고한 VSAT

- 비견고형 VSAT

설계를 기준으로, 유럽 초소형 개구부 단말(VSAT) 시장은 견고한 VSAT, 견고하지 않은 VSAT로 구분됩니다.

수직의

- 통신

- 해상

- 비행

- 정부 및 국방

- 미디어 & 엔터테인먼트

- 운송 및 물류

- 에너지 & 파워

- 광업 및 건설

- 조작

- 증권거래위원회

- 소매

- 자동차

- 운송 및 물류

- 헬스케어

- 교육

- 농업 및 임업

- 기타

유럽 초소형 개구부 단말(VSAT) 시장은 수직적으로 통신, 해상, 항공, 정부 및 방위, 미디어 및 엔터테인먼트, 운송 및 물류, 에너지 및 전력, 광업 및 건설, 제조, BFSI, 소매, 자동차, 운송 및 물류, 의료, 교육, 농업 및 임업, 기타로 세분화됩니다.

최종 사용

- 광대역/데이터 네트워크

- 음성 통신

- 개인 네트워크 서비스

- 방송

- 기타

최종 용도를 기준으로 유럽 초소형 개구부 단말(VSAT) 시장은 광대역/데이터 네트워크, 음성 통신, 개인 네트워크 서비스, 방송 및 기타로 구분됩니다.

유럽 초소구경단말기(VSAT) 시장 지역 분석/통찰력

위에 언급된 대로, 유럽 초소형 개구 단자(VSAT) 시장을 분석하고, 국가별, 재료 유형, 제조 공정 및 최종 사용 산업별로 시장 규모에 대한 통찰력과 추세를 제공합니다.

유럽 초소형 개구 단자(VSAT) 시장 보고서에서 다루는 국가는 독일, 프랑스, 영국, 네덜란드, 스위스, 벨기에, 러시아, 이탈리아, 스페인, 터키, 스웨덴, 기타 유럽 국가입니다.

독일은 해상 및 항공 IoT 애플리케이션에 대한 안전한 통신에 대한 수요가 증가하면서 유럽에서 우위를 점하고 있습니다.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points like downstream and upstream value chain analysis, technical trends, porter's five forces analysis, and case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of Europe brands and their challenges faced due to large or scarce competition from local and domestic brands, the impact of domestic tariffs, and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Europe Very Small Aperture Terminal (VSAT) Market Share Analysis

Europe very small aperture terminal (VSAT) market competitive landscape provides details of the competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, Europe presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to the very small aperture terminal (VSAT) market.

Some of the major players operating in the Europe very small aperture terminal (VSAT) market are Singtel, Marlink, Thuraya Telecommunications Company, Speedcast, NSSLEurope, ST Engineering, Atos SE 2, Iridium Communications Inc., EchoStar Corporation, Orbit Communications Systems Ltd., Ultra, Nisshinbo Holdings Inc., General Dynamics Corporation, Honeywell International Inc., Cobham Satcom, Thales, GILAT SATELLITE NETWORKS, L3Harris Technologies, Inc., Viasat, Inc., KVH Industries, Inc., CPI International Inc., Global Invacom

SKU-

세계 최초의 시장 정보 클라우드 보고서에 온라인으로 접속하세요

- 대화형 데이터 분석 대시보드

- 높은 성장 잠재력 기회를 위한 회사 분석 대시보드

- 사용자 정의 및 질의를 위한 리서치 분석가 액세스

- 대화형 대시보드를 통한 경쟁자 분석

- 최신 뉴스, 업데이트 및 추세 분석

- 포괄적인 경쟁자 추적을 위한 벤치마크 분석의 힘 활용

목차

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF EUROPE VERY SMALL APERTURE TERMINAL (VSAT) MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELING

2.9 SOLUTION TIMELINE CURVE

2.1 MARKET CHALLENGE MATRIX

2.11 MARKET PLATFORM COVERAGE GRID

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER'S FIVE FORCES MODEL

4.2 TECHNOLOGY ANALYSIS

4.3 USE CASES

4.3.1 RELIABLE VSAT CONNECTIVITY IMPROVES OPERATIONAL STABILITY FOR SUN ENTERPRISES

4.3.2 CUSTOMER WINS MAJOR OIL AND GAS CONTRACT USING WINEGARD'S SECRET WEAPON

4.3.3 VIZOCOM'S SATELLITE SOLUTION PROVIDES THE DEPARTMENT OF DEFENSE EDUCATION ACTIVITY (DODEA) WITH INTERNET CONNECTIVITY TO PUERTO RICO AFTER HURRICANE MARIA IN 2017

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 GROWING DEMAND FOR SECURE COMMUNICATION FOR MARITIME IOT APPLICATIONS

5.1.2 INCREASED ADOPTION OF VSAT TECHNOLOGY IN THE OIL AND GAS INDUSTRY

5.1.3 PROLIFERATION OF SATELLITE-BASED COMMUNICATION IN THE MILITARY AND DEFENSE SECTOR

5.2 RESTRAINTS

5.2.1 RISING CYBER SECURITY CONCERNS AND DATA BREACHES

5.2.2 ISSUES RELATED TO DATA LATENCY IN VSAT TECHNOLOGY

5.3 OPPORTUNITIES

5.3.1 SURGE IN DEMAND FOR EUROPE MARITIME DISTRESS SAFETY SYSTEM

5.3.2 INCREASING STRATEGIC PARTNERSHIP AND ACQUISITION AMONG VARIOUS ORGANIZATIONS

5.3.3 ADVENT OF VSAT SERVICE PROVIDERS IN VARIOUS ENTERPRISE SECTORS

5.4 CHALLENGES

5.4.1 HIGHER HARDWARE AND INSTALLATION COSTS OF VSAT SYSTEMS

5.4.2 ISSUES RELATED TO RELIABILITY OF VSAT NETWORK DURING BAD WEATHER

5.4.3 HIGHER CHANCES OF INTERFERENCE IN VERY SMALL APERTURE TERMINAL (VSAT) NETWORKS

6 EUROPE VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY SOLUTION

6.1 OVERVIEW

6.2 EQUIPMENT

6.2.1 OUT-DOOR UNITS

6.2.1.1 ANTENNAS

6.2.1.2 RF FREQUENCY CONVERTERS

6.2.1.3 AMPLIFIERS

6.2.1.4 DIPLEXERS

6.2.1.5 OTHERS

6.2.2 IN-DOOR UNITS

6.2.2.1 SATELLITE MODEM

6.2.2.2 SATELLITE ROUTER

6.2.3 MOUNTS

6.2.4 ANTENNA CONTROL UNITS

6.2.5 OTHERS

6.2.6 SUPPORT SERVICES

6.2.6.1 PROFESSIONAL SERVICES

6.2.6.1.1 MAINTENANCE & SUPPORT SERVICES

6.2.6.1.2 ENGINEERING & CONSULTATION

6.2.6.1.3 TRAINING

6.2.6.2 MANAGED SERVICES

6.2.6.2.1 INSTALLATION & SETUP

6.2.6.2.2 NETWORK DESIGN & OPTIMIZATION

6.2.6.2.3 NETWORK OPERATIONS

6.3 CONNECTIVITY SERVICES

7 EUROPE VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY PLATFORM

7.1 OVERVIEW

7.2 LAND VSAT

7.2.1 FIXED

7.2.1.1 EARTH STATION

7.2.1.2 COMMERCIAL BUILDINGS

7.2.1.3 COMMAND & CONTROL CENTERS

7.2.2 ON-THE-MOVE

7.2.2.1 COMMERCIAL VEHICLES

7.2.2.2 MILITARY VEHICLES

7.2.2.3 TRAINS

7.2.2.4 EMERGENCY VEHICLES

7.2.2.5 UNMANNED GROUND VEHICLES

7.2.3 PORTABLE/MANPACKS

7.3 MARITIME VSAT

7.3.1 COMMERCIAL SHIP

7.3.2 MILITARY SHIP

7.3.3 UNMANNED MARINE SHIP

7.4 AIRBORNE VSAT

7.4.1 COMMERCIAL AIRCRAFT

7.4.2 MILITARY AIRCRAFT

7.4.3 UNMANNED MARINE SHIP

8 EUROPE VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY NETWORK ARCHITECTURE

8.1 OVERVIEW

8.2 STAR TOPOLOGY

8.3 MESH TOPOLOGY

8.4 HYBRID TOPOLOGY

8.5 POINT-TO-POINT LINKS

9 EUROPE VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY FREQUENCY

9.1 OVERVIEW

9.2 KU-BAND

9.3 C-BAND

9.4 KA-BAND

9.5 X-BAND

10 EUROPE VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY DESIGN

10.1 OVERVIEW

10.2 RUGGED VSAT

10.3 NON- RUGGED VSAT

11 EUROPE VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY VERTICAL

11.1 OVERVIEW

11.2 TELECOMMUNICATION

11.2.1 EQUIPMENT

11.2.2 SUPPORT SERVICES

11.2.3 CONNECTIVITY SERVICES

11.3 MARITIME

11.3.1 EQUIPMENT

11.3.2 SUPPORT SERVICES

11.3.3 CONNECTIVITY SERVICES

11.4 AVIATION

11.4.1 EQUIPMENT

11.4.2 SUPPORT SERVICES

11.4.3 CONNECTIVITY SERVICES

11.5 GOVERNMENT & DEFENSE

11.5.1 EQUIPMENT

11.5.2 SUPPORT SERVICES

11.5.3 CONNECTIVITY SERVICES

11.6 MEDIA & ENTERTAINMENT

11.6.1 EQUIPMENT

11.6.2 SUPPORT SERVICES

11.6.3 CONNECTIVITY SERVICES

11.7 TRANSPORTATION & LOGISTICS

11.7.1 EQUIPMENT

11.7.2 SUPPORT SERVICES

11.7.3 CONNECTIVITY SERVICES

11.8 ENERGY & POWER

11.9 MINING & CONSTRUCTION

11.9.1 EQUIPMENT

11.9.2 SUPPORT SERVICES

11.9.3 CONNECTIVITY SERVICES

11.1 MANUFACTURING

11.10.1 EQUIPMENT

11.10.2 SUPPORT SERVICES

11.10.3 CONNECTIVITY SERVICES

11.11 BFSI

11.12 RETAIL

11.12.1 EQUIPMENT

11.12.2 SUPPORT SERVICES

11.12.3 CONNECTIVITY SERVICES

11.13 AUTOMOTIVE

11.13.1 EQUIPMENT

11.13.2 SUPPORT SERVICES

11.13.3 CONNECTIVITY SERVICES

11.14 HEALTHCARE

11.15 EDUCATION

11.16 AGRICULTURE & FORESTRY

11.16.1 EQUIPMENT

11.16.2 SUPPORT SERVICES

11.16.3 CONNECTIVITY SERVICES

11.17 OTHERS

12 EUROPE VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY END-USE

12.1 OVERVIEW

12.2 BROADBAND/DATA NETWORKS

12.3 VOICE COMMUNICATIONS

12.4 PRIVATE NETWORK SERVICES

12.5 BROADCAST

12.6 OTHERS

13 EUROPE VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY REGION

13.1 EUROPE

13.1.1 GERMANY

13.1.2 U.K.

13.1.3 FRANCE

13.1.4 SPAIN

13.1.5 ITALY

13.1.6 RUSSIA

13.1.7 NETHERLANDS

13.1.8 SWITZERLAND

13.1.9 SWEDEN

13.1.10 BELGIUM

13.1.11 TURKEY

13.1.12 REST OF EUROPE

14 EUROPE VERY SMALL APERTURE TERMINAL (VSAT) MARKET: COMPANY LANDSCAPE

15 SWOT ANLYSIS

16 COMPAMY PROFILE

16.1 ECHOSTAR CORPORATION

16.1.1 COMPANY SNAPSHOT

16.1.2 REVENUE ANALYSIS

16.1.3 COMPANY SHARE ANALYSIS

16.1.4 PRODUCT PORTFOLIO

16.1.5 RECENT DEVELOPMENT

16.2 ATOS SE

16.2.1 COMPANY SNAPSHOT

16.2.2 REVENUE ANALYSIS

16.2.3 COMPANY SHARE ANALYSIS

16.2.4 PRODUCTS PORTFOLIO

16.2.5 RECENT DEVELOPMENTS

16.3 THALES

16.3.1 COMPANY SNAPSHOT

16.3.2 REVENUE ANALYSIS

16.3.3 COMPANY SHARE ANALYSIS

16.3.4 PRODUCT PORTFOLIO

16.3.5 RECENT DEVELOPMENT

16.4 SINGTEL

16.4.1 COMPANY SNAPSHOT

16.4.2 REVENUE ANALYSIS

16.4.3 COMPANY SHARE ANALYSIS

16.4.4 PRODUCT PORTFOLIO

16.4.5 RECENT DEVELOPMENT

16.5 L3HARRIS TECHNOLOGIES, INC

16.5.1 COMPANY SNAPSHOT

16.5.2 REVENUE ANALYSIS

16.5.3 COMPANY SHARE ANALYSIS

16.5.4 PRODUCT PORTFOLIO

16.5.5 RECENT DEVELOPMENTS

16.6 GENERAL DYNAMICS CORPORATION

16.6.1 COMPANY SNAPSHOT

16.6.2 REVENUE ANALYSIS

16.6.3 PRODUCT PORTFOLIO

16.6.4 RECENT DEVELOPMENTS

16.7 GILAT SATELLITE NETWORKS

16.7.1 COMPANY SNAPSHOT

16.7.2 REVENUE ANALYSIS

16.7.3 PRODUCT PORTFOLIO

16.7.4 RECENT DEVELOPMENTS

16.8 C-COM SATELLITE SYSTEMS INC.

16.8.1 COMPANY SNAPSHOT

16.8.2 REVENUE ANALYSIS

16.8.3 PRODUCT PORTFOLIO

16.8.4 RECENT DEVELOPMENTS

16.9 COBHAM SATCOM

16.9.1 COMPANY SNAPSHOT

16.9.2 PRODUCT PORTFOLIO

16.9.3 RECENT DEVELOPMENTS

16.1 CPI INTERNATIONAL INC.

16.10.1 COMPANY SNAPSHOT

16.10.2 PRODUCT PORTFOLIO

16.10.3 RECENT DEVELOPMENT

16.11 EUROPE INVACOM

16.11.1 COMPANY SNAPSHOT

16.11.2 REVENUE ANALYSIS

16.11.3 SERVICES PORTFOLIO

16.11.4 RECENT DEVELOPMENT

16.12 HONEYWELL INTERNATIONAL INC.

16.12.1 COMPANY SNAPSHOT

16.12.2 REVENUE ANALYSIS

16.12.3 PRODUCT PORTFOLIO

16.12.4 RECENT DEVELOPMENTS

16.13 IRIDIUM COMMUNICATIONS INC.

16.13.1 COMPANY SNAPSHOT

16.13.2 REVENUE ANALYSIS

16.13.3 SERVICE PORTFOLIO

16.13.4 RECENT DEVELOPMENT

16.14 KVH INDUSTRIES, INC.

16.14.1 COMPANY SNAPSHOT

16.14.2 REVENUE ANALYSIS

16.14.3 SOLUTION PORTFOLIO

16.14.4 RECENT DEVELOPMENT

16.15 MARLINK

16.15.1 COMPANY SNAPSHOT

16.15.2 SOLUTION PORTFOLIO

16.15.3 RECENT DEVELOPMENTS

16.16 NISSHINBO HOLDINGS INC.

16.16.1 COMPANY SNAPSHOT

16.16.2 REVENUE ANALYSIS

16.16.3 PRODUCT PORTFOLIO

16.16.4 RECENT DEVELOPMENTS

16.17 NSSL EUROPE

16.17.1 COMPANY SNAPSHOT

16.17.2 PRODUCT PORTFOLIO

16.17.3 RECENT DEVELOPMENT

16.18 ORBIT COMMUNICATIONS SYSTEMS LTD.

16.18.1 COMPANY SNAPSHOT

16.18.2 REVENUE ANALYSIS

16.18.3 PRODUCT PORTFOLIO

16.18.4 RECENT DEVELOPMENTS

16.19 SPEEDCAST

16.19.1 COMPANY SNAPSHOT

16.19.2 SOLUTION PORTFOLIO

16.19.3 RECENT DEVELOPMENTS

16.2 ST ENGINEERING

16.20.1 COMPANY SNAPSHOT

16.20.2 REVENUE ANALYSIS

16.20.3 PRODUCT PORTFOLIO

16.20.4 RECENT DEVELOPMENT

16.21 THURAYA TELECOMMUNICATIONS COMPANY

16.21.1 COMPANY SNAPSHOT

16.21.2 SERVICE PORTFOLIO

16.21.3 RECENT DEVELOPMENT

16.22 ULTRA

16.22.1 COMPANY SNAPSHOT

16.22.2 REVENUE ANALYSIS

16.22.3 PRODUCT PORTFOLIO

16.22.4 RECENT DEVELOPMENTS

16.23 VIASAT, INC.

16.23.1 COMPANY SNAPSHOT

16.23.2 REVENUE ANALYSIS

16.23.3 PRODUCT PORTFOLIO

16.23.4 RECENT DEVELOPMENTS

16.24 VIZOCOM COMPANY

16.24.1 COMPANY SNAPSHOT

16.24.2 SOLUTION PORTFOLIO

16.24.3 RECENT DEVELOPMENT

16.25 X2NSAT

16.25.1 COMPANY SNAPSHOT

16.25.2 SERVICE PORTFOLIO

16.25.3 RECENT DEVELOPMENT

17 QUESTIONNAIRE

18 RELATED REPORTS

표 목록

TABLE 1 CYBER-ATTACKS ON VESSELS/MARITIME INDUSTRY

TABLE 2 TYPICAL HARDWARE AND INSTALLATION COSTS

TABLE 3 EUROPE VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY SOLUTION, 2020-2029 (USD THOUSAND)

TABLE 4 EUROPE EQUIPMENT IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 5 EUROPE EQUIPMENT IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 6 EUROPE OUT-DOOR UNITS IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 7 EUROPE IN-DOOR UNITS IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 8 EUROPE SUPPORT SERVICES IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 9 EUROPE SUPPORT SERVICES IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 10 EUROPE PROFESSIONAL SERVICES IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 11 EUROPE MANAGED SERVICES IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 12 EUROPE CONNECTIVITY SERVICES IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 13 EUROPE VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY PLATFORM, 2020-2029 (USD THOUSAND)

TABLE 14 EUROPE LAND VSAT IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 15 EUROPE LAND VSAT IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 16 EUROPE FIXED IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 17 EUROPE ON-THE-MOVE IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 18 EUROPE MARITIME VSAT IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 19 EUROPE MARITIME VSAT IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 20 EUROPE AIRBORNE VSAT IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 21 EUROPE AIRBORNE VSAT IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 22 EUROPE VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY NETWORK ARCHITECTURE, 2020-2029 (USD THOUSAND)

TABLE 23 EUROPE STAR TOPOLOGY IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 24 EUROPE MESH TOPOLOGY IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 25 EUROPE HYBRID TOPOLOGY IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 26 EUROPE POINT-TO-POINT LINKS IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 27 EUROPE VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY FREQUENCY, 2020-2029 (USD THOUSAND)

TABLE 28 EUROPE KU-BAND IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 29 EUROPE C-BAND IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 30 EUROPE KA-BAND IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 31 EUROPE X-BAND IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 32 EUROPE VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY DESIGN, 2020-2029 (USD THOUSAND)

TABLE 33 EUROPE RUGGED VSAT IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 34 EUROPE NON- RUGGED VSAT IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 35 EUROPE VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY VERTICAL, 2020-2029 (USD THOUSAND)

TABLE 36 EUROPE TELECOMMUNICATION IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 37 EUROPE TELECOMMUNICATION IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY SOLUTION, 2020-2029 (USD THOUSAND)

TABLE 38 EUROPE MARITIME IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 39 EUROPE MARITIME IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY SOLUTION, 2020-2029 (USD THOUSAND)

TABLE 40 EUROPE AVIATION IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 41 EUROPE AVIATION IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY SOLUTION, 2020-2029 (USD THOUSAND)

TABLE 42 EUROPE GOVERNMENT & DEFENSE IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 43 EUROPE GOVERNMENT & DEFENSE IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY SOLUTION, 2020-2029 (USD THOUSAND)

TABLE 44 EUROPE MEDIA & ENTERTAINMENT IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 45 EUROPE MEDIA & ENTERTAINMENT IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY SOLUTION, 2020-2029 (USD THOUSAND)

TABLE 46 EUROPE TRANSPORTATION & LOGISTICS IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 47 EUROPE TRANSPORTATION & LOGISTICS IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY SOLUTION, 2020-2029 (USD THOUSAND)

TABLE 48 EUROPE ENERGY & POWER IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 49 EUROPE MINING & CONSTRUCTION IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 50 EUROPE MINING & CONSTRUCTION IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY SOLUTION, 2020-2029 (USD THOUSAND)

TABLE 51 EUROPE MANUFACTURING IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 52 EUROPE MANUFACTURING IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY SOLUTION, 2020-2029 (USD THOUSAND)

TABLE 53 EUROPE BFSI IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 54 EUROPE RETAIL IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 55 EUROPE RETAIL IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY SOLUTION, 2020-2029 (USD THOUSAND)

TABLE 56 EUROPE AUTOMOTIVE IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 57 EUROPE AUTOMOTIVE IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY SOLUTION, 2020-2029 (USD THOUSAND)

TABLE 58 EUROPE HEALTHCARE IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 59 EUROPE EDUCATION IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 60 EUROPE AGRICULTURE & FORESTRY IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 61 EUROPE AGRICULTURE & FORESTRY IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY SOLUTION, 2020-2029 (USD THOUSAND)

TABLE 62 EUROPE OTHERS IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 63 EUROPE VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY END-USE, 2020-2029 (USD THOUSAND)

TABLE 64 EUROPE BROADBAND/DATA NETWORKS IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 65 EUROPE VOICE COMMUNICATIONS NETWORKS IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 66 EUROPE PRIVATE NETWORK SERVICES NETWORKS IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 67 EUROPE BROADCAST IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 68 EUROPE OTHERS IN VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 69 EUROPE VERY SMALL APERTURE TERMINAL (VSAT) MARKET, BY COUNTRY, 2020-2029 (USD THOUSAND)

그림 목록

FIGURE 1 EUROPE VERY SMALL APERTURE TERMINAL (VSAT) MARKET: SEGMENTATION

FIGURE 2 EUROPE VERY SMALL APERTURE TERMINAL (VSAT) MARKET: DATA TRIANGULATION

FIGURE 3 EUROPE VERY SMALL APERTURE TERMINAL (VSAT) MARKET: DROC ANALYSIS

FIGURE 4 EUROPE VERY SMALL APERTURE TERMINAL (VSAT) MARKET: EUROPE VS REGIONAL MARKET ANALYSIS

FIGURE 5 EUROPE VERY SMALL APERTURE TERMINAL (VSAT) MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 EUROPE VERY SMALL APERTURE TERMINAL (VSAT) MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 EUROPE VERY SMALL APERTURE TERMINAL (VSAT) MARKET: DBMR MARKET POSITION GRID

FIGURE 8 EUROPE VERY SMALL APERTURE TERMINAL (VSAT) MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 EUROPE VERY SMALL APERTURE TERMINAL (VSAT) MARKET: MARKET PLATFORM COVERAGE GRID

FIGURE 10 EUROPE VERY SMALL APERTURE TERMINAL (VSAT) MARKET: SEGMENTATION

FIGURE 11 NORTH AMERICA IS EXPECTED TO DOMINATE WHEREAS ASIA-PACIFIC IS THE FASTEST-GROWING REGION IN THE EUROPE VERY SMALL APERTURE TERMINAL (VSAT) MARKET IN THE FORECAST PERIOD

FIGURE 12 ASIA-PACIFIC IS THE FASTEST GROWING MARKET FOR EUROPE VERY SMALL APERTURE TERMINAL MANUFACTURERS IN THE FORECAST PERIOD

FIGURE 13 PROLIFERATION OF SATELLITE-BASED COMMUNICATION IN THE MILITARY AND DEFENSE SECTOR IS EXPECTED TO DRIVE THE EUROPE VERY SMALL APERTURE TERMINAL (VSAT) MARKET IN THE FORECAST PERIOD 2022 TO 2029

FIGURE 14 EQUIPMENT SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE EUROPE VERY SMALL APERTURE TERMINAL (VSAT) MARKET IN 2022 & 2029

FIGURE 15 IMPACT OF VARIOUS SATELLITE TECHNOLOGY TRENDS AND INNOVATIONS IN 2022

FIGURE 16 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE EUROPE VERY SMALL APERTURE TERMINAL (VSAT) MARKET

FIGURE 17 REGIONAL MARKET SHARE IN SERVICE ENTERPRISE FOR THE YEAR 2016

FIGURE 18 EUROPE SHIPPING LOSSES BY THE NUMBER OF VESSELS OVER THE YEARS

FIGURE 19 EUROPE VERY SMALL APERTURE TERMINAL (VSAT) MARKET, SOLUTION, 2021

FIGURE 20 EUROPE VERY SMALL APERTURE TERMINAL (VSAT) MARKET, PLATFORM, 2021 (USD THOUSAND)

FIGURE 21 EUROPE VERY SMALL APERTURE TERMINAL (VSAT) MARKET, NETWORK ARCHITECTURE, 2021 (USD THOUSAND)

FIGURE 22 EUROPE VERY SMALL APERTURE TERMINAL (VSAT) MARKET, FREQUENCY, 2021 (USD THOUSAND)

FIGURE 23 EUROPE VERY SMALL APERTURE TERMINAL (VSAT) MARKET, DESIGN, 2021 (USD THOUSAND)

FIGURE 24 EUROPE VERY SMALL APERTURE TERMINAL (VSAT) MARKET, VERTICAL, 2021

FIGURE 25 EUROPE VERY SMALL APERTURE TERMINAL (VSAT) MARKET, END-USE, 2021 (USD THOUSAND)

FIGURE 26 EUROPE VERY SMALL APERTURE TERMINAL (VSAT) MARKET: SNAPSHOT (2021)

FIGURE 27 EUROPE VERY SMALL APERTURE TERMINAL (VSAT) MARKET: BY COUNTRY (2021)

FIGURE 28 EUROPE VERY SMALL APERTURE TERMINAL (VSAT) MARKET: BY COUNTRY (2022 & 2029)

FIGURE 29 EUROPE VERY SMALL APERTURE TERMINAL (VSAT) MARKET: BY COUNTRY (2021 & 2029)

FIGURE 30 EUROPE VERY SMALL APERTURE TERMINAL (VSAT) MARKET: BY SOLUTION (2022-2029)

FIGURE 31 EUROPE VERY SMALL APERTURE TERMINAL (VSAT) MARKET: COMPANY SHARE 2021 (%)

연구 방법론

데이터 수집 및 기준 연도 분석은 대규모 샘플 크기의 데이터 수집 모듈을 사용하여 수행됩니다. 이 단계에는 다양한 소스와 전략을 통해 시장 정보 또는 관련 데이터를 얻는 것이 포함됩니다. 여기에는 과거에 수집한 모든 데이터를 미리 검토하고 계획하는 것이 포함됩니다. 또한 다양한 정보 소스에서 발견되는 정보 불일치를 검토하는 것도 포함됩니다. 시장 데이터는 시장 통계 및 일관된 모델을 사용하여 분석하고 추정합니다. 또한 시장 점유율 분석 및 주요 추세 분석은 시장 보고서의 주요 성공 요인입니다. 자세한 내용은 분석가에게 전화를 요청하거나 문의 사항을 드롭하세요.

DBMR 연구팀에서 사용하는 주요 연구 방법론은 데이터 마이닝, 시장에 대한 데이터 변수의 영향 분석 및 주요(산업 전문가) 검증을 포함하는 데이터 삼각 측량입니다. 데이터 모델에는 공급업체 포지셔닝 그리드, 시장 타임라인 분석, 시장 개요 및 가이드, 회사 포지셔닝 그리드, 특허 분석, 가격 분석, 회사 시장 점유율 분석, 측정 기준, 글로벌 대 지역 및 공급업체 점유율 분석이 포함됩니다. 연구 방법론에 대해 자세히 알아보려면 문의를 통해 업계 전문가에게 문의하세요.

사용자 정의 가능

Data Bridge Market Research는 고급 형성 연구 분야의 선두 주자입니다. 저희는 기존 및 신규 고객에게 목표에 맞는 데이터와 분석을 제공하는 데 자부심을 느낍니다. 보고서는 추가 국가에 대한 시장 이해(국가 목록 요청), 임상 시험 결과 데이터, 문헌 검토, 재생 시장 및 제품 기반 분석을 포함하도록 사용자 정의할 수 있습니다. 기술 기반 분석에서 시장 포트폴리오 전략에 이르기까지 타겟 경쟁업체의 시장 분석을 분석할 수 있습니다. 귀하가 원하는 형식과 데이터 스타일로 필요한 만큼 많은 경쟁자를 추가할 수 있습니다. 저희 분석가 팀은 또한 원시 엑셀 파일 피벗 테이블(팩트북)로 데이터를 제공하거나 보고서에서 사용 가능한 데이터 세트에서 프레젠테이션을 만드는 데 도움을 줄 수 있습니다.