유럽 차세대 시퀀싱(NGS) 시장, 제품별(장비, 소모품 및 서비스), 응용 분야별(진단, 바이오마커 발견, 정밀 의학 , 신약 발견, 농업 및 동물 연구 및 기타), 최종 사용자별(제약 및 생명 공학 회사, 연구 센터 및 학계 및 정부 기관, 병원 및 진료소), 국가별(독일, 영국, 이탈리아, 프랑스, 스페인, 스위스, 러시아, 터키, 벨기에, 네덜란드 및 기타 유럽 국가) 산업 동향 및 2029년까지의 예측.

시장 분석 및 통찰력 : 유럽 차세대 시퀀싱(NGS) 시장

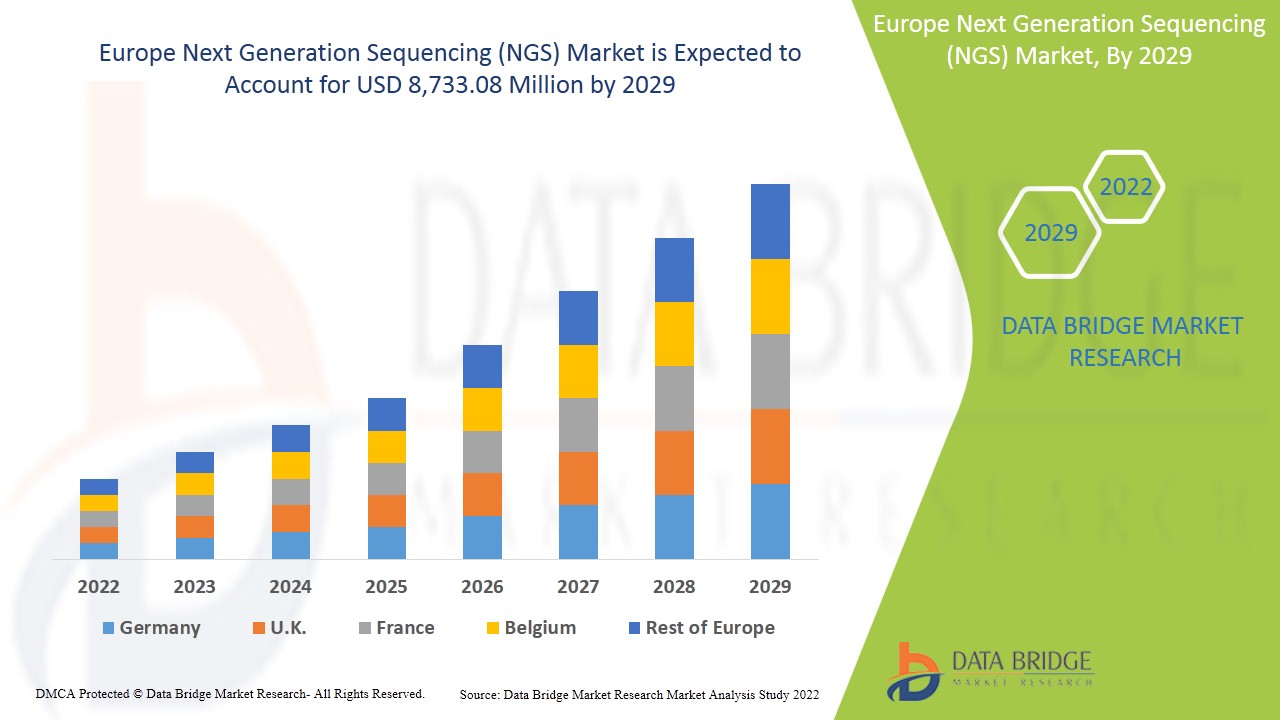

유럽 차세대 시퀀싱(NGS) 시장은 2022년부터 2029년까지의 예측 기간 동안 시장 성장을 이룰 것으로 예상됩니다. Data Bridge Market Research는 시장이 2022년부터 2029년까지의 예측 기간 동안 15.7%의 CAGR로 성장하고 있으며 2029년까지 8,733.08백만 달러에 도달할 것으로 예상된다고 분석했습니다. 차세대 시퀀싱에 대한 연구 활동의 증가는 차세대 시퀀싱(NGS) 시장 성장을 촉진하는 요인으로 작용합니다.

"차세대" 시퀀싱(NGS)으로 가장 널리 알려진 고처리량 시퀀싱은 수많은 기술적, 기능적 개발로 인해 이제 일상적인 임상 실무에 통합되었지만, 초기 프로토콜은 임상 병리학의 일반적인 워크플로 외부에서 수집된 샘플, 표준 포르말린 고정, 파라핀 포매 표본에 의존했으며, 이는 NGS의 시작 재료로 보다 정기적으로 사용될 수 있습니다. 또한 NGS 데이터의 분석 및 해석과 지식 기반을 위한 프로토콜이 수집되어 임상의가 환자 치료 지점에서 게놈 정보에 대해 보다 쉽게 조치를 취할 수 있습니다. 만성 질환 진단에 사용되는 차세대 시퀀싱의 광범위한 제품이 존재하여 의료 시설의 요구를 충족시키고 있습니다. 증가된 기술 발전으로 인해 시장에서 고효율 차세대 시퀀싱(NGS)이 개발되고 있습니다.

차세대 시퀀싱(NGS) 시장 성장을 견인하는 주요 요인은 약물 개발에 있어서 차세대 시퀀싱을 활용하는 것과 주요 기업이 제공하는 폭넓은 포트폴리오입니다. 차세대 시퀀싱(NGS) 시장 성장을 방해하는 요인으로는 차세대 시퀀싱 제품의 높은 비용과 제품 리콜이 있습니다.

차세대 시퀀싱(NGS) 시장 보고서는 시장 점유율, 새로운 개발 및 제품 파이프라인 분석, 국내 및 지역 시장 참여자의 영향, 새로운 수익 창출, 시장 규정의 변화, 제품 승인, 전략적 의사 결정, 제품 출시, 지리적 확장 및 시장의 기술 혁신 측면에서의 분석 기회에 대한 세부 정보를 제공합니다. 분석 및 차세대 시퀀싱(NGS) 시장 시나리오를 이해하려면 Data Bridge Market Research에 연락하여 분석가 브리핑을 요청하세요. 당사 팀은 원하는 목표를 달성하기 위한 수익 영향 솔루션을 만드는 데 도움을 드립니다.

차세대 시퀀싱(NGS) 시장 범위 및 시장 규모

차세대 시퀀싱(NGS) 시장은 제품, 애플리케이션 및 최종 사용자를 기준으로 세분화됩니다. 세그먼트 간의 성장은 틈새 성장 포켓과 시장에 접근하고 핵심 애플리케이션 영역과 타겟 시장의 차이점을 파악하기 위한 전략을 분석하는 데 도움이 됩니다.

- 제품 기준으로 유럽 차세대 시퀀싱(NGS) 시장은 장비, 소모품, 서비스로 세분화됩니다. 2022년에는 장비 부문이 유럽 국가에 제공되는 광범위한 장비 포트폴리오의 존재로 인해 유럽 차세대 시퀀싱(NGS) 시장을 지배할 것으로 예상되며, 이는 수익에 기여하는 주요 부문이기도 합니다.

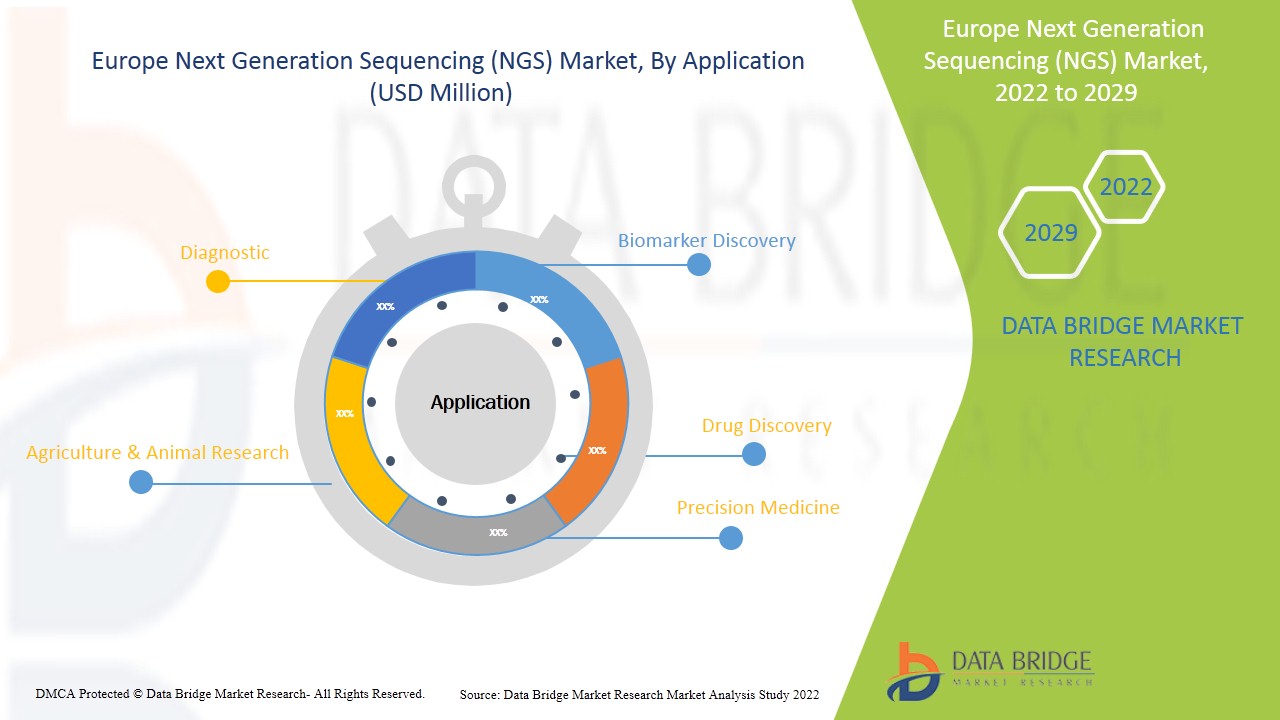

- 응용 프로그램을 기준으로, 유럽 차세대 시퀀싱(NGS) 시장은 진단, 약물 발견, 바이오마커 발견, 정밀 의학, 농업 및 동물 연구로 세분화됩니다. 2022년에는 임상 실험실과 연구실에서 다양한 질병의 일상적인 진단에 NGS를 사용하고 있기 때문에 진단 부문이 유럽 차세대 시퀀싱(NGS) 시장을 지배할 것으로 예상됩니다. 정확한 검사 결과를 제공하고 우수한 치료 체계를 제공할 수 있는 잠재력이 있기 때문입니다.

- 최종 사용자를 기준으로 유럽 차세대 시퀀싱(NGS) 시장은 병원 및 진료소, 연구 센터, 학술 및 정부 기관, 제약 및 생명공학 회사로 세분화됩니다. 2022년에는 연구 센터와 학술 및 정부 기관이 유럽 차세대 시퀀싱(NGS) 시장을 지배할 것으로 예상되는데, 유럽 국가들은 제약 회사와 협력하여 NGS에 끊임없이 노력하고 있는 선진 연구 기관을 보유하고 있는 것으로 알려져 있기 때문입니다.

차세대 시퀀싱(NGS) 시장 국가 수준 분석

차세대 시퀀싱(NGS) 시장을 분석하고, 위에 참조된 국가, 제품, 응용 분야 및 최종 사용자별로 시장 규모 정보를 제공합니다.

차세대 시퀀싱(NGS) 시장 보고서에서 다루는 국가는 영국, 독일, 프랑스, 스페인, 이탈리아, 네덜란드, 스위스, 러시아, 터키, 오스트리아, 아일랜드 및 기타 유럽 국가입니다.

유럽 지역 내 독일의 연구 센터와 학술 및 정부 기관 부문은 기초 단계의 연구가 수행되는 이러한 센터에서 NGS 사용이 증가함에 따라 2022년부터 2029년까지 가장 높은 성장률을 기록하며 성장할 것으로 예상됩니다.

보고서의 국가 섹션은 또한 개별 시장 영향 요인과 국내 시장의 현재 및 미래 트렌드에 영향을 미치는 규제 변화를 제공합니다. 신규 판매, 교체 판매, 국가 인구 통계, 규제 조치 및 수출입 관세와 같은 데이터 포인트는 개별 국가의 시장 시나리오를 예측하는 데 사용되는 주요 포인터 중 일부입니다. 또한 유럽 브랜드의 존재 및 가용성과 지역 및 국내 브랜드와의 대규모 또는 희소한 경쟁으로 인해 직면한 과제, 판매 채널의 영향은 국가 데이터에 대한 예측 분석을 제공하는 동안 고려됩니다.

차세대 시퀀싱(NGS) 치료에 대한 인식을 높이기 위한 주요 시장 참여자들의 전략적 활동이 확대되면서 차세대 시퀀싱(NGS) 시장이 성장하고 있습니다.

차세대 시퀀싱(NGS) 시장은 또한 특정 시장에서 모든 국가별 성장에 대한 자세한 시장 분석을 제공합니다. 또한 시장 참여자의 전략과 지리적 입지에 대한 자세한 정보를 제공합니다. 이 데이터는 2011년부터 2020년까지의 과거 기간에 대해 제공됩니다.

경쟁 환경 및 차세대 시퀀싱(NGS) 시장 점유율 분석

차세대 시퀀싱(NGS) 시장 경쟁 구도는 경쟁자별 세부 정보를 제공합니다. 포함된 세부 정보에는 회사 개요, 회사 재무, 창출된 수익, 시장 잠재력, 연구 개발 투자, 새로운 시장 이니셔티브, 생산 현장 및 시설, 회사의 강점과 약점, 제품 출시, 제품 시험 파이프라인, 제품 승인, 특허, 제품 폭과 폭, 응용 분야 우세, 기술 수명선 곡선이 있습니다. 제공된 위의 데이터 포인트는 차세대 시퀀싱(NGS) 시장을 유도하는 것과 관련된 회사의 초점에만 관련이 있습니다.

차세대 시퀀싱(NGS)을 다루는 주요 기업으로는 Agilent Technologies, Inc., ThermoFisher Scientific, Inc., QIAGEN, Illumina, Inc., Bio-Rad Laboratories, Inc., BGI(BGI Group의 자회사), Oxford Nanopore Technologies plc 등이 있습니다. DBMR 분석가는 경쟁 우위를 이해하고 각 경쟁사에 대한 경쟁 분석을 별도로 제공합니다.

전 세계 여러 회사에서 많은 계약과 협정을 체결하면서 차세대 시퀀싱(NGS) 시장도 가속화되고 있습니다.

예를 들어,

- 2021년 2월, Thermo Fisher Scientific Inc.는 연례 CMO Leadership Awards에서 6개의 상을 수상했다고 발표했습니다. Life Science Leader와 Outsourced Pharma가 수여하는 이 상은 바이오제약 및 바이오테크 회사에서 평가한 최고의 계약 제조 파트너를 인정합니다. 이 인정은 유럽 시장에서 회사의 입지를 강화하고 향후 몇 년 동안 회사의 성장을 급증시킬 것으로 예상됩니다.

협력, 제품 출시, 사업 확장, 수상 및 인정, 합작 투자 및 시장 참여자의 기타 전략을 통해 차세대 시퀀싱(NGS) 시장에서 회사의 입지를 강화하고 조직의 수익 성장에도 도움이 됩니다.

SKU-

세계 최초의 시장 정보 클라우드 보고서에 온라인으로 접속하세요

- 대화형 데이터 분석 대시보드

- 높은 성장 잠재력 기회를 위한 회사 분석 대시보드

- 사용자 정의 및 질의를 위한 리서치 분석가 액세스

- 대화형 대시보드를 통한 경쟁자 분석

- 최신 뉴스, 업데이트 및 추세 분석

- 포괄적인 경쟁자 추적을 위한 벤치마크 분석의 힘 활용

목차

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF EUROPE NEXT GENERATION SEQUENCING (NGS) MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 MULTIVARIATE MODELLING

2.7 MARKET APPLICATION COVERAGE GRID

2.8 PRODUCT TYPE LIFELINE CURVE

2.9 DBMR MARKET POSITION GRID

2.1 VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

3.1 PESTEL'S ANALYSIS

3.2 PORTER'S FIVE FORCES MODEL

4 REGULATIONS OF EUROPE NEXT GENERATION SEQUENCING (NGS) MARKET

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 DECREASE IN THE COST OF GENETIC SEQUENCING PER BASE

5.1.2 INCREASE IN THE ADOPTION OF GENOME-FOCUSED PHARMACOLOGY

5.1.3 WIDE PRODUCT PORTFOLIO OFFERED BY MAJOR PLAYER

5.1.4 USE OF NEXT GENERATION SEQUENCING IN DRUG DEVELOPMENT

5.1.5 INCREASED TREND TOWARDS PERSONALIZED MEDICATION

5.2 RESTRAINTS

5.2.1 HIGH COST OF INSTRUMENT

5.2.2 DIFFICULTY IN CLINICAL NGS DATA ANALYSIS

5.2.3 CYBER SECURITY CONCERN IN GENOMICS

5.3 OPPORTUNITIES

5.3.1 STRATEGIC INITIATIVES BY THE KEY MARKET PLAYER

5.3.2 PRODUCT APPROVAL IN RECENT YEARS

5.3.3 ADVANCEMENT IN NGS TECHNOLOGY

5.4 CHALLENGES

5.4.1 LACK OF SKILLED PROFESSIONALS TO PERFORM NGS

5.4.2 CHALLENGES FOR IMPLEMENTING NGS IN THE CLINICAL LAB

6 IMPACT OF COVID-19 ON EUROPE NEXT GENERATION SEQUENCING (NGS) HEALTHCARE INDUSTRY

6.1 IMPACT ON PRICE

6.2 IMPACT ON DEMAND

6.3 IMPACT ON SUPPLY CHAIN

6.4 KEY INITIATIVES BY MARKET PLAYERS DURING COVID-19

6.5 CONCLUSION

7 EUROPE NEXT GENERATION SEQUENCING (NGS) MARKET, BY PRODUCT

7.1 OVERVIEW

7.2 INSTRUMENTS

7.2.1 HISEQ SERIES

7.2.2 MISEQ SERIES

7.2.3 ION TORRENT

7.2.4 PACBIO RS II

7.2.5 SEQUEL SYSTEM

7.2.6 SOLID

7.2.7 OTHERS

7.3 CONSUMABLE

7.3.1 LIBRARY PREPARATION & TARGET ENRICHMENT

7.3.2 SAMPLE PREPARATION CONSUMABLES

7.3.3 OTHERS

7.4 SERVICES

7.4.1 SEQUENCING SERVICES

7.4.2 DATA MANAGEMENT

8 EUROPE NEXT GENERATION SEQUENCING (NGS) MARKET, BY APPLICATION

8.1 OVERVIEW

8.2 DIAGNOSTICS

8.3 BIOMARKER DISCOVERY

8.4 PRECISION MEDICINE

8.5 DRUG DISCOVERY

8.6 AGRICULTURE & ANIMAL RESEARCH

9 EUROPE NEXT GENERATION SEQUENCING (NGS) MARKET, BY END USER

9.1 OVERVIEW

9.2 PHARMACEUTICAL AND BIOTECHNOLOGY COMPANIES

9.3 RESEARCH CENTERS & ACADEMIC AND GOVERNMENT INSTITUTES

9.4 HOSPITAL & CLINICS

10 EUROPE NEXT GENERATION SEQUENCING (NGS) MARKET, BY REGION

10.1 EUROPE

10.1.1 GERMANY

10.1.2 FRANCE

10.1.3 U.K.

10.1.4 ITALY

10.1.5 RUSSIA

10.1.6 SPAIN

10.1.7 SWITZERLAND

10.1.8 NETHERLANDS

10.1.9 BELGIUM

10.1.10 TURKEY

10.1.11 REST OF EUROPE

11 EUROPE NEXT GENERATION SEQUENCING (NGS) MARKET: COMPANY LANDSCAPE

11.1 COMPANY SHARE ANALYSIS: EUROPE

12 COMPANY PROFILING

12.1 ILLUMINA, INC.

12.1.1 COMPANY SNAPSHOT

12.1.2 REVENUE ANALYSIS

12.1.3 COMPANY SHARE ANALYSIS

12.1.4 SWOT ANALYSIS

12.1.5 PRODUCT PORTFOLIO

12.1.6 RECENT DEVELOPMENTS

12.2 BGI (A SUBSIDIAIRY OF BGI GROUP) (2021)

12.2.1 COMPANY SNAPSHOT

12.2.2 REVENUE ANALYSIS

12.2.3 COMPANY SHARE ANALYSIS

12.2.4 SWOT ANALYSIS

12.2.5 PRODUCT PORTFOLIO

12.2.6 RECENT DEVELOPMENT

12.3 THERMO FISHER SCIENTIFIC INC.

12.3.1 COMPANY SNAPSHOT

12.3.2 REVENUE ANALYSIS

12.3.3 COMPANY SHARE ANALYSIS

12.3.4 SWOT ANALYSIS

12.3.5 PRODUCT PORTFOLIO

12.3.6 RECENT DEVELOPMENTS

12.4 QIAGEN

12.4.1 COMPANY SNAPSHOT

12.4.2 REVENUE ANALYSIS

12.4.3 COMPANY SHARE ANALYSIS

12.4.4 SWOT ANALYSIS

12.4.5 PRODUCT PORTFOLIO

12.4.6 RECENT DEVELOPMENTS

12.5 AGILENT TECHNOLOGIES, INC.

12.5.1 COMPANY SNAPSHOT

12.5.2 REVENUE ANALYSIS

12.5.3 COMPANY SHARE ANALYSIS

12.5.4 SWOT ANALYSIS

12.5.5 PRODUCT PORTFOLIO

12.5.6 RECENT DEVELOPMENT

12.6 OXFORD NANOPORE TECHNOLOGIES

12.6.1 COMPANY SNAPSHOT

12.6.2 PRODUCT PORTFOLIO

12.6.3 RECENT DEVELOPMENTS

12.7 BIO-RAD LABORATORIES, INC.

12.7.1 COMPANY SNAPSHOT

12.7.2 REVENUE ANALYSIS

12.7.3 PRODUCT PORTFOLIO

12.7.4 RECENT DEVELOPMENTS

12.8X GENOMICS

12.8.1 COMPANY SNAPSHOT

12.8.2 REVENUE ANALYSIS

12.8.3 PRODUCT PORTFOLIO

12.8.4 RECENT DEVELOPMENTS

12.9 BIOMÉRIEUX SA

12.9.1 COMPANY SNAPSHOT

12.9.2 REVENUE ANALYSIS

12.9.3 PRODUCT PORTFOLIO

12.9.4 RECENT DEVELOPMENT

12.1 DNASTAR

12.10.1 COMPANY SNAPSHOT

12.10.2 PRODUCT PORTFOLIO

12.10.3 RECENT DEVELOPMENT

12.11 GENEIOUS

12.11.1 COMPANY SNAPSHOT

12.11.2 PRODUCT PORTFOLIO

12.11.3 RECENT DEVELOPMENTS

12.12 GENEWIZ, FROM AZENTA LIFE SCIENCES

12.12.1 COMPANY SNAPSHOT

12.12.2 REVENUE ANALYSIS

12.12.3 PRODUCT PORTFOLIO

12.12.4 RECENT DEVELOPMENTS

12.13 HAMILTON COMPANY

12.13.1 COMPANY SNAPSHOT

12.13.2 PRODUCT PORTFOLIO

12.13.3 RECENT DEVELOPMENT

12.14 MACROGEN, INC.

12.14.1 COMPANY SNAPSHOT

12.14.2 REVENUE ANALYSIS

12.14.3 PRODUCT PORTFOLIO

12.14.4 RECENT DEVELOPMENT

12.15 NEW ENGLAND BIOLABS

12.15.1 COMPANY SNAPSHOT

12.15.2 PRODUCT PORTFOLIO

12.15.3 RECENT DEVELOPMENT

12.16 PACIFIC BIOSCIENCES OF CALIFORNIA, INC.

12.16.1 COMPANY SNAPSHOT

12.16.2 REVENUE ANALYSIS

12.16.3 PRODUCT PORTFOLIO

12.16.4 RECENT DEVELOPMENTS

12.17 PARTEK, INCORPORATED

12.17.1 COMPANY SNAPSHOT

12.17.2 PRODUCT PORTFOLIO

12.17.3 RECENT DEVELOPMENT

12.18 PERKIN ELMER INC. (2021)

12.18.1 COMPANY SNAPSHOT

12.18.2 REVENUE ANALYSIS

12.18.3 PRODUCT PORTFOLIO

12.18.4 RECENT DEVELOPMENTS

12.19 ROCHE SEQUENCING (A SUBSIDIARY OF F. HOFFMANN-LA ROCHE LTD)

12.19.1 COMPANY SNAPSHOT

12.19.2 REVENUE ANALYSIS (PARENT COMPANY)

12.19.3 PRODUCT PORTFOLIO

12.19.4 RECENT DEVELOPMENTS

12.2 TAKARA BIO INC.

12.20.1 COMPANY SNAPSHOT

12.20.2 REVENUE ANALYSIS

12.20.3 PRODUCT PORTFOLIO

12.20.4 RECENT DEVELOPMENTS

13 QUESTIONNAIRE

14 RELATED REPORTS

표 목록

TABLE 1 NEXT GENERATION SEQUENCING COST PER SAMPLE

TABLE 2 EUROPE NEXT GENERATION SEQUENCING (NGS) MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 3 EUROPE INSTRUMENTS IN NEXT GENERATION SEQUENCING (NGS) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 4 EUROPE INSTRUMENTS IN NEXT GENERATION SEQUENCING (NGS) MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 5 EUROPE CONSUMABLES IN NEXT GENERATION SEQUENCING (NGS) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 6 EUROPE CONSUMABLES IN NEXT GENERATION SEQUENCING (NGS) MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 7 EUROPE SERVICES IN NEXT GENERATION SEQUENCING (NGS) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 8 EUROPE SERVICES IN NEXT GENERATION SEQUENCING (NGS) MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 9 EUROPE NEXT GENERATION SEQUENCING (NGS) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 10 EUROPE DIAGNOSTICS IN NEXT GENERATION SEQUENCING (NGS) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 11 EUROPE BIOMARKER DISCOVERY IN NEXT GENERATION SEQUENCING (NGS) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 12 EUROPE PRECISION MEDICINE IN NEXT GENERATION SEQUENCING (NGS) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 13 EUROPE DRUG DISCOVERY IN NEXT GENERATION SEQUENCING (NGS) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 14 EUROPE AGRICULTURE & ANIMAL RESEARCH IN NEXT GENERATION SEQUENCING (NGS) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 15 EUROPE NEXT GENERATION SEQUENCING (NGS) MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 16 EUROPE PHARMACEUTICAL AND BIOTECHNOLOGY COMPANIES IN NEXT GENERATION SEQUENCING (NGS) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 17 EUROPE RESEARCH CENTERS & ACADEMIC AND GOVERNMENT INSTITUTES IN NEXT GENERATION SEQUENCING (NGS) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 18 EUROPE HOSPITAL & CLINICS IN NEXT GENERATION SEQUENCING (NGS) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 19 EUROPE NEXT GENERATION SEQUENCING (NGS) MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 20 EUROPE NEXT GENERATION SEQUENCING (NGS) MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 21 EUROPE INSTRUMENTS IN NEXT GENERATION SEQUENCING (NGS) MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 22 EUROPE CONSUMABLES IN NEXT GENERATION SEQUENCING (NGS) MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 23 EUROPE SERVICES IN NEXT GENERATION SEQUENCING (NGS) MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 24 EUROPE NEXT GENERATION SEQUENCING (NGS) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 25 EUROPE NEXT GENERATION SEQUENCING (NGS) MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 26 GERMANY NEXT GENERATION SEQUENCING (NGS) MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 27 GERMANY INSTRUMENTS IN NEXT GENERATION SEQUENCING (NGS) MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 28 GERMANY CONSUMABLES IN NEXT GENERATION SEQUENCING (NGS) MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 29 GERMANY SERVICES IN NEXT GENERATION SEQUENCING (NGS) MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 30 GERMANY NEXT GENERATION SEQUENCING (NGS) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 31 GERMANY NEXT GENERATION SEQUENCING (NGS) MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 32 FRANCE NEXT GENERATION SEQUENCING (NGS) MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 33 FRANCE INSTRUMENTS IN NEXT GENERATION SEQUENCING (NGS) MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 34 FRANCE CONSUMABLES IN NEXT GENERATION SEQUENCING (NGS) MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 35 FRANCE SERVICES IN NEXT GENERATION SEQUENCING (NGS) MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 36 FRANCE NEXT GENERATION SEQUENCING (NGS) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 37 FRANCE NEXT GENERATION SEQUENCING (NGS) MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 38 U.K. NEXT GENERATION SEQUENCING (NGS) MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 39 U.K. INSTRUMENTS IN NEXT GENERATION SEQUENCING (NGS) MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 40 U.K. CONSUMABLES IN NEXT GENERATION SEQUENCING (NGS) MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 41 U.K. SERVICES IN NEXT GENERATION SEQUENCING (NGS) MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 42 U.K. NEXT GENERATION SEQUENCING (NGS) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 43 U.K. NEXT GENERATION SEQUENCING (NGS) MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 44 ITALY NEXT GENERATION SEQUENCING (NGS) MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 45 ITALY INSTRUMENTS IN NEXT GENERATION SEQUENCING (NGS) MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 46 ITALY CONSUMABLES IN NEXT GENERATION SEQUENCING (NGS) MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 47 ITALY SERVICES IN NEXT GENERATION SEQUENCING (NGS) MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 48 ITALY NEXT GENERATION SEQUENCING (NGS) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 49 ITALY NEXT GENERATION SEQUENCING (NGS) MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 50 RUSSIA NEXT GENERATION SEQUENCING (NGS) MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 51 RUSSIA INSTRUMENTS IN NEXT GENERATION SEQUENCING (NGS) MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 52 RUSSIA CONSUMABLES IN NEXT GENERATION SEQUENCING (NGS) MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 53 RUSSIA SERVICES IN NEXT GENERATION SEQUENCING (NGS) MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 54 RUSSIA NEXT GENERATION SEQUENCING (NGS) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 55 RUSSIA NEXT GENERATION SEQUENCING (NGS) MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 56 SPAIN NEXT GENERATION SEQUENCING (NGS) MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 57 SPAINSTRUMENTS IN NEXT GENERATION SEQUENCING (NGS) MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 58 SPAIN CONSUMABLES IN NEXT GENERATION SEQUENCING (NGS) MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 59 SPAIN SERVICES IN NEXT GENERATION SEQUENCING (NGS) MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 60 SPAIN NEXT GENERATION SEQUENCING (NGS) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 61 SPAIN NEXT GENERATION SEQUENCING (NGS) MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 62 SWITZERLAND NEXT GENERATION SEQUENCING (NGS) MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 63 SWITZERLAND INSTRUMENTS IN NEXT GENERATION SEQUENCING (NGS) MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 64 SWITZERLAND CONSUMABLES IN NEXT GENERATION SEQUENCING (NGS) MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 65 SWITZERLAND SERVICES IN NEXT GENERATION SEQUENCING (NGS) MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 66 SWITZERLAND NEXT GENERATION SEQUENCING (NGS) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 67 SWITZERLAND NEXT GENERATION SEQUENCING (NGS) MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 68 NETHERLANDS NEXT GENERATION SEQUENCING (NGS) MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 69 NETHERLANDS INSTRUMENTS IN NEXT GENERATION SEQUENCING (NGS) MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 70 NETHERLANDS CONSUMABLES IN NEXT GENERATION SEQUENCING (NGS) MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 71 NETHERLANDS SERVICES IN NEXT GENERATION SEQUENCING (NGS) MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 72 NETHERLANDS NEXT GENERATION SEQUENCING (NGS) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 73 NETHERLANDS NEXT GENERATION SEQUENCING (NGS) MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 74 BELGIUM NEXT GENERATION SEQUENCING (NGS) MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 75 BELGIUM INSTRUMENTS IN NEXT GENERATION SEQUENCING (NGS) MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 76 BELGIUM CONSUMABLES IN NEXT GENERATION SEQUENCING (NGS) MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 77 BELGIUM SERVICES IN NEXT GENERATION SEQUENCING (NGS) MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 78 BELGIUM NEXT GENERATION SEQUENCING (NGS) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 79 BRLGIUM NEXT GENERATION SEQUENCING (NGS) MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 80 TURKEY NEXT GENERATION SEQUENCING (NGS) MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 81 TURKEY INSTRUMENTS IN NEXT GENERATION SEQUENCING (NGS) MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 82 TURKEY CONSUMABLES IN NEXT GENERATION SEQUENCING (NGS) MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 83 TURKEY SERVICES IN NEXT GENERATION SEQUENCING (NGS) MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 84 TURKEY NEXT GENERATION SEQUENCING (NGS) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 85 TURKEY NEXT GENERATION SEQUENCING (NGS) MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 86 REST OF EUROPE NEXT GENERATION SEQUENCING (NGS) MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

그림 목록

FIGURE 1 EUROPE NEXT GENERATION SEQUENCING (NGS) MARKET: SEGMENTATION

FIGURE 2 EUROPE NEXT GENERATION SEQUENCING (NGS) MARKET: DATA TRIANGULATION

FIGURE 3 EUROPE NEXT GENERATION SEQUENCING (NGS) MARKET: DROC ANALYSIS

FIGURE 4 EUROPE NEXT GENERATION SEQUENCING (NGS) MARKET: REGIONAL VS COUNTRY MARKET ANALYSIS

FIGURE 5 EUROPE NEXT GENERATION SEQUENCING (NGS) MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 EUROPE NEXT GENERATION SEQUENCING (NGS) MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 EUROPE NEXT GENERATION SEQUENCING (NGS) MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 8 EUROPE NEXT GENERATION SEQUENCING (NGS) MARKET: DBMR MARKET POSITION GRID

FIGURE 9 EUROPE NEXT GENERATION SEQUENCING (NGS) MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 EUROPE NEXT GENERATION SEQUENCING (NGS) MARKET: SEGMENTATION

FIGURE 11 WISE PORTFOLIO OFFERED BY MAJOR PLAYERS AND USE OF NEXT GENERATION SEQUENCING IN DRUG DEVELOPMENT IS EXPECTED TO DRIVE THE EUROPE NEXT GENERATION SEQUENCING (NGS) MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 INSTRUMENT SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE EUROPE NEXT GENERATION SEQUENCING (NGS) MARKET IN 2021 & 2029

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF EUROPE NEXT GENERATION SEQUENCING (NGS) MARKET

FIGURE 14 DECREASE IN COST OF PER BASE SEQUENCING

FIGURE 15 USE OF NSG IN DRUG DEVELOPMENT

FIGURE 16 REVENUE OF THE COMPANY AGILENT TECHNOLOGIES, INC.

FIGURE 17 EUROPE NEXT GENERATION SEQUENCING (NGS) MARKET: BY PRODUCT, 2021

FIGURE 18 EUROPE NEXT GENERATION SEQUENCING (NGS) MARKET: BY PRODUCT, 2020-2029 (USD MILLION)

FIGURE 19 EUROPE NEXT GENERATION SEQUENCING (NGS) MARKET: BY PRODUCT, CAGR (2022-2029)

FIGURE 20 EUROPE NEXT GENERATION SEQUENCING (NGS) MARKET: BY PRODUCT, LIFELINE CURVE

FIGURE 21 EUROPE NEXT GENERATION SEQUENCING (NGS) MARKET: BY APPLICATION, 2021

FIGURE 22 EUROPE NEXT GENERATION SEQUENCING (NGS) MARKET: BY APPLICATION, 2020-2029 (USD MILLION)

FIGURE 23 EUROPE NEXT GENERATION SEQUENCING (NGS) MARKET: BY APPLICATION, CAGR (2022-2029)

FIGURE 24 EUROPE NEXT GENERATION SEQUENCING (NGS) MARKET: BY APPLICATION, LIFELINE CURVE

FIGURE 25 EUROPE NEXT GENERATION SEQUENCING (NGS) MARKET: BY END USER, 2021

FIGURE 26 EUROPE NEXT GENERATION SEQUENCING (NGS) MARKET: BY END USER, 2020-2029 (USD MILLION)

FIGURE 27 EUROPE NEXT GENERATION SEQUENCING (NGS) MARKET: BY END USER, CAGR (2022-2029)

FIGURE 28 EUROPE NEXT GENERATION SEQUENCING (NGS) MARKET: BY END USER, LIFELINE CURVE

FIGURE 29 EUROPE NEXT GENERATION SEQUENCING (NGS) MARKET: SNAPSHOT (2021)

FIGURE 30 EUROPE NEXT GENERATION SEQUENCING (NGS) MARKET: BY COUNTRY (2021)

FIGURE 31 EUROPE NEXT GENERATION SEQUENCING (NGS) MARKET: BY COUNTRY (2022 & 2029)

FIGURE 32 EUROPE NEXT GENERATION SEQUENCING (NGS) MARKET: BY COUNTRY (2021 & 2029)

FIGURE 33 EUROPE NEXT GENERATION SEQUENCING (NGS) MARKET: BY PRODUCT (2022-2029)

FIGURE 34 EUROPE NEXT GENERATION SEQUENCING (NGS) MARKET: COMPANY SHARE 2021 (%)

연구 방법론

데이터 수집 및 기준 연도 분석은 대규모 샘플 크기의 데이터 수집 모듈을 사용하여 수행됩니다. 이 단계에는 다양한 소스와 전략을 통해 시장 정보 또는 관련 데이터를 얻는 것이 포함됩니다. 여기에는 과거에 수집한 모든 데이터를 미리 검토하고 계획하는 것이 포함됩니다. 또한 다양한 정보 소스에서 발견되는 정보 불일치를 검토하는 것도 포함됩니다. 시장 데이터는 시장 통계 및 일관된 모델을 사용하여 분석하고 추정합니다. 또한 시장 점유율 분석 및 주요 추세 분석은 시장 보고서의 주요 성공 요인입니다. 자세한 내용은 분석가에게 전화를 요청하거나 문의 사항을 드롭하세요.

DBMR 연구팀에서 사용하는 주요 연구 방법론은 데이터 마이닝, 시장에 대한 데이터 변수의 영향 분석 및 주요(산업 전문가) 검증을 포함하는 데이터 삼각 측량입니다. 데이터 모델에는 공급업체 포지셔닝 그리드, 시장 타임라인 분석, 시장 개요 및 가이드, 회사 포지셔닝 그리드, 특허 분석, 가격 분석, 회사 시장 점유율 분석, 측정 기준, 글로벌 대 지역 및 공급업체 점유율 분석이 포함됩니다. 연구 방법론에 대해 자세히 알아보려면 문의를 통해 업계 전문가에게 문의하세요.

사용자 정의 가능

Data Bridge Market Research는 고급 형성 연구 분야의 선두 주자입니다. 저희는 기존 및 신규 고객에게 목표에 맞는 데이터와 분석을 제공하는 데 자부심을 느낍니다. 보고서는 추가 국가에 대한 시장 이해(국가 목록 요청), 임상 시험 결과 데이터, 문헌 검토, 재생 시장 및 제품 기반 분석을 포함하도록 사용자 정의할 수 있습니다. 기술 기반 분석에서 시장 포트폴리오 전략에 이르기까지 타겟 경쟁업체의 시장 분석을 분석할 수 있습니다. 귀하가 원하는 형식과 데이터 스타일로 필요한 만큼 많은 경쟁자를 추가할 수 있습니다. 저희 분석가 팀은 또한 원시 엑셀 파일 피벗 테이블(팩트북)로 데이터를 제공하거나 보고서에서 사용 가능한 데이터 세트에서 프레젠테이션을 만드는 데 도움을 줄 수 있습니다.