유럽 건강 및 웰빙 식품 시장, 유형별(기능성 식품, 강화 및 건강한 베이커리 제품, 건강 간식, BFY 식품, 음료, 초콜릿 및 기타), 칼로리 함량(무칼로리, 저칼로리 및 감소 칼로리), 본질(비GMO 및 GMO), 지방 함량(무지방, 저지방 및 감소 지방), 범주(일반 및 유기농), 무첨가 범주(글루텐 무첨가, 유제품 무첨가, 대두 무첨가, 견과류 무첨가, 락토오스 무첨가, 인공 향료 무첨가, 인공 색소 무첨가 및 기타) 및 유통 채널(매장형 소매업체 및 무매장 소매업체), 업계 동향 및 2029년까지의 예측.

시장 분석 및 통찰력

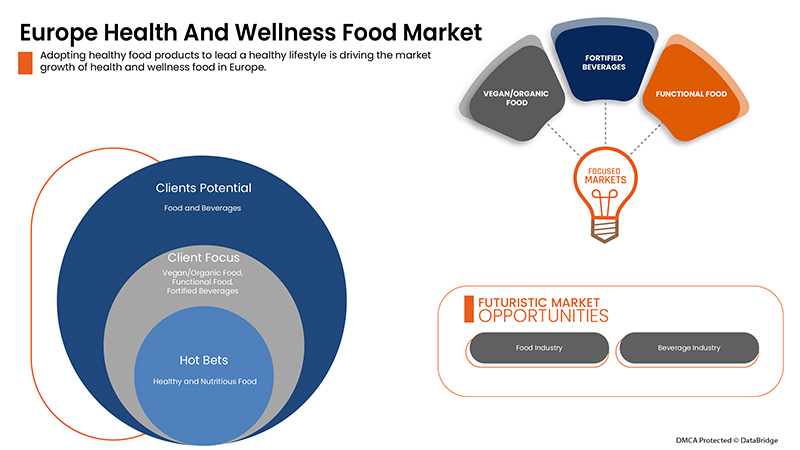

글로벌 건강 및 웰빙 식품 시장은 포장 식품 산업보다 더 빠르게 성장하고 있습니다. 이는 고객 취향이 보다 자연스럽고 기능적인 제품으로 전환되어 균형 잡힌 식단에 대한 보다 전체적인 접근 방식을 채택하고 있기 때문입니다. 식습관을 바꾸고 균형 잡힌 영양 식단과 활동적인 라이프스타일을 받아들이는 개인이 늘어나는 것은 건강 및 웰빙 식품 산업의 성장을 견인하는 주요 요소입니다. 전 세계 사람들은 건강한 식단, 운동, 규칙적인 신체 활동의 가치를 깨닫고 있으며, 이는 시장 성장에 필수적입니다. 그러나 건강 및 웰빙 식품의 높은 가격과 높은 유지 관리 비용이 시장 성장을 방해할 수 있습니다.

무기 제품보다 천연 재료로 만든 유기농 식품의 소비가 증가함에 따라 글로벌 건강 및 웰빙 식품 시장에 새로운 기회가 열릴 것입니다. 반면, 시장 참여자 간의 치열한 경쟁은 시장 성장에 도전이 될 수 있습니다.

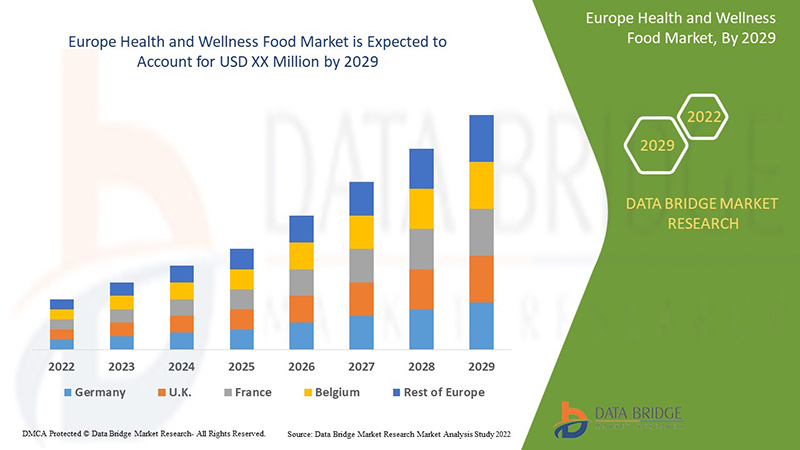

Data Bridge Market Research에 따르면 유럽 건강 및 웰빙 식품 시장은 2022년부터 2029년까지의 예측 기간 동안 연평균 성장률 9.0%로 성장할 것으로 분석됩니다.

|

보고서 메트릭 |

세부 |

|

예측 기간 |

2022년부터 2029년까지 |

|

기준 연도 |

2021 |

|

역사적 해 |

2020 (2019-2015까지 사용자 정의 가능) |

|

양적 단위 |

수익 (USD) 10억 |

|

다루는 세그먼트 |

유형별(기능성 식품, 강화 및 건강 베이커리 제품, 건강 간식 , BFY 식품, 음료, 초콜릿 및 기타), 칼로리 함량(무칼로리, 저칼로리 및 감소 칼로리), 자연별(비GMO 및 GMO), 지방 함량(무지방, 저지방 및 감소 지방), 범주별(일반 및 유기농), 무첨가 범주(글루텐 무첨가, 유제품 무첨가, 대두 무첨가, 견과류 무첨가, 락토오스 무첨가, 인공 향료 무첨가, 인공 색소 무첨가 및 기타) 및 유통 채널별(매장형 소매업체 및 비매장형 소매업체) |

|

적용 지역 |

스페인, 이탈리아, 프랑스, 독일, 영국, 스위스, 네덜란드, 벨기에, 러시아, 터키 및 기타 유럽 국가 |

|

시장 참여자 포함 |

Maspex, PepsiCo, General Mills Inc., Mars, Incorporated, Nestlé, Danone, Abbott, Huel Inc., GSK Group of Companies, Clif Bar & Company, Yoplait USA, Inc., Chobani, LLC., SO DELICIOUS DAIRY FREE, The Simply Good Foods Company, Mondelez International, Kellogg Co., The Quaker Oats Company, Yakult Honsha Co., Ltd., LIBERTÉ |

시장 정의

음식, 건강, 웰빙은 모두 서로 연결되어 있습니다. 우리가 섭취하는 음식과 그 출처는 우리의 건강과 체력에 영향을 미칩니다. 웰빙은 우리가 일상 생활에 통합하는 균형 잡힌 음식에서 비롯됩니다. 건강은 더 나은 음식을 먹는 것뿐만 아니라 긴장과 스트레스를 줄이고 규칙적으로 운동하는 것입니다. 음식, 건강, 웰빙 음식은 기능적 요소나 가공 과정을 수정하여 질병의 위험이나 치료를 줄이고 신체적 또는 정신적 성과를 개선하는 데 도움이 될 수 있습니다.

유럽 건강 및 웰빙 식품 시장 동향

운전자

- 건강식품에 대한 지출 증가

소비자의 가처분 소득이 증가했고, 가계는 저축하거나 음식에 쓸 돈이 더 많아졌고, 이는 자연스럽게 건강한 식품 소비의 증가로 이어졌으며, 글로벌 건강 및 웰빙 식품 시장에 대한 수요를 창출했습니다. 따라서 소비자의 가처분 소득이 증가하면 건강한 삶을 살기 위해 더 많은 영양 음료를 구매할 수 있어 시장 성장이 촉진되었습니다. 나아가 건강하고 영양이 풍부한 식품에 대한 지출이 증가하면서 사람들이 건강을 유지하는 데 도움이 되는 식품에 대한 수요가 증가했습니다.

따라서 가처분소득의 증가로 인해 소비자들은 건강을 유지하기 위해 영양 음료와 같은 건강식품에 더 많은 돈을 지출하는 것으로 보이며, 이는 유럽 건강 및 웰빙 식품 시장의 성장을 촉진할 것으로 예상됩니다.

- 클린 라벨 식품에 대한 수요 증가

클린 라벨 식품은 가장 자연스럽고 가공이 덜한 재료를 포함합니다. 소비자들은 더 건강한 라이프스타일을 위해 건강하고 위생적인 식품 옵션을 선택하고 있으며, 따라서 건강 및 웰빙 식품에 대한 수요가 증가하고 있습니다. 소비자들은 특정 라이프스타일을 지속하기 위해 방부제나 첨가물이 없는 깨끗하고 라벨이 붙은 식품을 선호하고 있습니다. 또한 클린 라벨 제품을 사용하여 지속 가능한 환경을 촉진하는 것에 대한 인식이 시장 성장을 촉진하고 있습니다. 클린 라벨 식품에 대한 수요가 증가함에 따라 건강 및 웰빙 제조업체는 더 많은 제품을 출시할 수 있으며, 이는 시장 성장에 기여합니다.

따라서 소비자에게 고품질의 제품을 제공하고 클린 라벨 및 건강식품에 대한 증가하는 요구를 충족시키기 위해 클린 라벨 안전 제품을 확보하는 제조업체가 점점 늘어나면서 유럽 건강 및 웰빙 식품 시장이 성장할 것으로 예상됩니다.

기회

-

밀레니얼 세대의 식습관과 라이프스타일 변화

밀레니얼 세대의 변화하는 식습관은 의식적인 탐닉에 더 기울어져 있습니다. 즉, 외식과 올바른 식사에 탐닉하고 싶어하지만, 무엇을 먹는지 주의하고 철저히 고려한 후 장소를 선택하고 싶어합니다. 밀레니얼 세대는 신선하고 건강한 음식에 기꺼이 비용을 지불합니다. 그들은 다양한 문화권의 음식과 맛을 좋아하고 식사 서비스와 스무디 배달과 같은 유통 채널에 참여합니다. 따라서 밀레니얼 세대의 변화하는 식습관은 유럽 건강 및 웰빙 식품 시장에 기회를 만듭니다.

따라서 이러한 변화하는 식생활 선호도는 영양 식품 및 음료 시장에 기회를 만들어내고 있으며, 제조업체는 밀레니얼 세대의 요구를 충족시키려고 노력하고 있습니다. 이는 유럽 건강 및 웰빙 식품 시장 성장에 충분한 기회를 만들어낼 것으로 예상됩니다.

제약/도전

- 건강한 음식과 음료에 대한 사람들의 인식 부족과 회의적 태도

영양 식품 및 음료의 건강상의 이점과 영양가에 대한 인식이 제한적이거나 부족하면 제품에 대한 회의주의가 생깁니다. 소비자는 식품 및 음료의 오염과 변질 증가로 인해 영양 음료를 섭취하는 데 주저합니다. 따라서 궁극적으로 이는 부작용을 피하기 위해 식품이나 음료를 구매하기 전에 두 번 생각하는 소비자 사이에 회의주의를 불러일으킵니다. 이는 시장 성장에 있어 핵심적인 도전 요소입니다. 식품 및 음료의 영양 라벨에 대한 이해 부족은 소비자 사이에 혼란을 일으킵니다. 영양 라벨은 오해의 소지가 있을 수 있으며, 어떤 경우에는 거짓 주장이어서 소비자가 적절한 건강한 식품 및 음료를 선택하는 데 주저하게 만듭니다.

그러나 제조업체들은 영양가와 건강성이 높은 음료의 가치를 높이고 제품의 영양가를 명확하게 표시하려고 노력하고 있습니다.

따라서 일부 소비자들 사이에서 건강과 웰빙 제품의 영양 성분과 건강상의 이점에 대한 회의적인 시각과 인식 부족이 커지면서 시장 성장이 방해받을 수도 있습니다.

COVID-19 이후 유럽 건강 및 웰빙 식품 시장에 미치는 영향

COVID-19 팬데믹은 글로벌 건강 및 웰빙 식품 시장에 상당한 영향을 미쳤습니다. COVID-19가 장기간 지속되면서 공급망이 중단되면서 영향을 받았고, 소비자에게 식품을 공급하기 어려워져 처음에는 식품 수요가 감소했습니다. 그러나 COVID 이후에는 건강에 해로운 음식의 부작용에 대한 인식이 높아지고 건강을 유지하려는 욕구가 커지면서 건강 및 웰빙 식품에 대한 수요가 크게 증가했습니다. 소비자들은 건강 문제를 피하기 위해 식물성, 비건, 영양 식품 및 음료와 같은 가장 영양가 있는 제품을 섭취하려고 노력하고 있습니다.

따라서 건강한 식습관을 갖는 추세가 시장에 상당한 영향을 미쳐 향후 몇 년 안에 시장이 급속한 성장을 이룰 것으로 예상됩니다.

최근 개발 사항

- 2022년 5월, 오레오는 미국에서 글루텐 프리 오레오의 새로운 제품군을 출시하고, 중국에서는 오레오 제로, 브라질에서는 락타 인텐스, 호주에서는 초콜릿 제품인 카라밀크를 출시합니다. 이러한 제품은 건강과 웰빙이 회사의 혁신의 초점이 되고 있기 때문에 건강을 의식하는 소비자를 위한 새로운 제형에서 비롯됩니다.

유럽 건강 및 웰빙 식품 시장 범위

유럽 건강 및 웰빙 식품 시장은 유형, 칼로리 함량, 본질, 지방 함량, 범주, 범주에서 자유로움, 유통 채널에 따라 세분화됩니다. 이러한 세그먼트 간의 성장은 산업의 주요 성장 세그먼트를 분석하고 사용자에게 핵심 시장 응용 프로그램을 식별하기 위한 전략적 결정을 내릴 수 있는 귀중한 시장 개요와 시장 통찰력을 제공하는 데 도움이 됩니다.

유형

- 기능성 식품

- 강화되고 건강한 베이커리 제품

- 건강한 간식

- BFY푸드

- 음료수

- 초콜릿

- 기타

유럽 건강 및 웰빙 식품 시장은 유형별로 기능성 식품, 강화 및 건강식품, 베이커리 제품, 건강 간식, BFY 식품, 음료, 초콜릿 및 기타로 구분됩니다.

칼로리 함량

- 칼로리 없음

- 칼로리가 낮음

- 칼로리 감소

칼로리 함량을 기준으로 유럽 건강 및 웰빙 식품 시장은 무칼로리, 저칼로리, 칼로리 감소로 구분됩니다.

자연

- 비GMO

- 유전자 변형

본질적으로 유럽 건강 및 웰빙 식품 시장은 비GMO와 GMO로 구분됩니다.

지방 함량

- 지방 없음

- 저지방,

- 저지방

유럽 건강 및 웰빙 식품 시장은 지방 함량을 기준으로 무지방, 저지방, 감소지방으로 구분됩니다.

범주

- 전통적인

- 본질적인

유럽 건강 및 웰빙 식품 시장은 범주별로 기존 식품과 유기농 식품으로 구분됩니다.

카테고리에서 무료

- 글루텐 프리

- 유제품 불포함

- 대두 무첨가

- 견과류 없음

- 락토오스 무첨가

- 인공 향료 없음

- 인공색소 무첨가

- 기타

유럽 건강 및 웰빙 식품 시장은 무첨가 카테고리별로 글루텐 무첨가, 유제품 무첨가, 대두 무첨가, 견과류 무첨가, 락토오스 무첨가, 인공 향료 무첨가, 인공 색소 무첨가 등으로 구분됩니다.

유통 채널

- 매장형 소매업체

- 무매장 소매업체

유럽 건강 및 웰빙 식품 시장은 유통 채널별로 매장 기반 소매업체와 무매장 소매업체로 구분됩니다.

유럽 건강 및 웰빙 식품 시장 지역 분석/통찰력

위에 참조된 내용을 토대로 유럽 건강 및 웰빙 식품 시장을 분석하고, 시장 규모에 대한 통찰력과 추세를 제공합니다.

유럽 건강 및 웰빙 식품 시장 보고서에서 다루는 국가는 스페인, 이탈리아, 프랑스, 독일, 영국, 스위스, 네덜란드, 벨기에, 러시아, 터키와 기타 유럽 국가입니다.

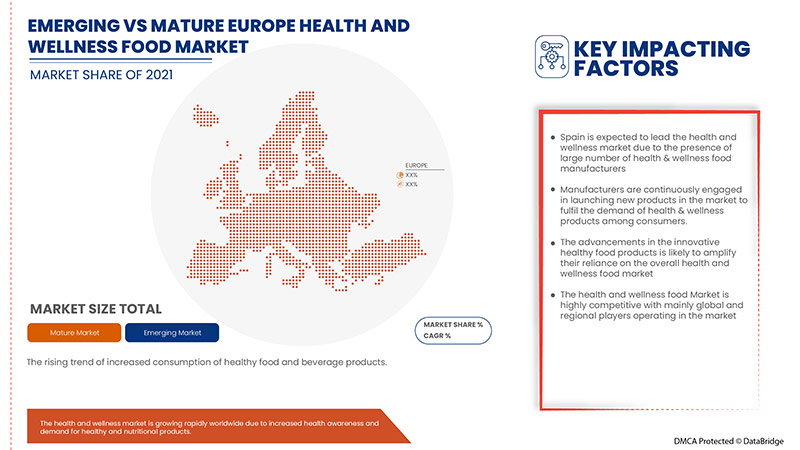

스페인은 시장 점유율과 수익 측면에서 유럽 건강 및 웰빙 식품 시장을 지배할 것으로 예상됩니다. 건강 식품 및 음료 소비 증가 추세와 기능성 식품에 대한 소비자 수요 증가로 인해 예측 기간 동안 지배력을 유지할 것으로 예상됩니다.

보고서의 지역 섹션은 또한 현재 및 미래 시장 추세에 영향을 미치는 개별 시장 영향 요인과 시장 규정의 변화를 제공합니다. 신규 및 교체 판매, 국가 인구 통계, 질병 역학 및 수출입 관세와 같은 데이터 포인트는 개별 국가의 시장 시나리오를 예측하는 데 사용되는 주요 포인터 중 일부입니다. 또한 글로벌 브랜드의 존재 및 가용성과 국내 및 국내 브랜드와의 치열한 경쟁으로 인해 직면한 과제, 판매 채널의 영향이 국가 데이터에 대한 예측 분석을 제공하는 동안 고려됩니다.

경쟁 환경 및 유럽 건강 및 웰빙 식품 시장 점유율 분석

유럽 건강 및 웰빙 식품 시장 경쟁 구도는 경쟁업체를 자세히 설명합니다. 자세한 내용에는 회사 개요, 회사 재무, 창출된 수익, 시장 잠재력, 연구 개발 투자, 새로운 시장 이니셔티브, 글로벌 입지, 생산 현장 및 시설, 생산 용량, 회사의 강점과 약점, 제품 출시, 제품 폭과 범위, 응용 분야 우위가 포함됩니다. 위의 데이터 포인트는 유럽 건강 및 웰빙 식품 시장에 대한 회사의 초점과만 관련이 있습니다.

유럽 건강 및 웰빙 식품 시장의 주요 기업으로는 Maspex, PepsiCo, General Mills Inc., Mars, Incorporated, Nestlé, Danone, Abbott, Huel Inc., GSK Group of Companies, Clif Bar & Company, Yoplait USA, Inc., Chobani, LLC., SO DELICIOUS DAIRY FREE, The Simply Good Foods Company, Mondelez International, Kellogg Co., The Quaker Oats Company, Yakult Honsha Co., Ltd., LIBERTÉ 등이 있습니다.

SKU-

세계 최초의 시장 정보 클라우드 보고서에 온라인으로 접속하세요

- 대화형 데이터 분석 대시보드

- 높은 성장 잠재력 기회를 위한 회사 분석 대시보드

- 사용자 정의 및 질의를 위한 리서치 분석가 액세스

- 대화형 대시보드를 통한 경쟁자 분석

- 최신 뉴스, 업데이트 및 추세 분석

- 포괄적인 경쟁자 추적을 위한 벤치마크 분석의 힘 활용

목차

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF EUROPE HEALTH AND WELLNESS FOOD MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 TYPE LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 BRAND COMPARATIVE ANALYSIS

4.2 CONSUMER DISPOSABLE INCOME DYNAMICS

4.3 CONSUMER LEVEL TRENDS OF EUROPE HEALTH AND WELLNESS FOOD MARKET

4.3.1 OVERVIEW

4.3.2 HIGH NUTRITIONAL VALUE

4.3.3 PLANT-BASED AND ORGANIC PRODUCTS

4.3.4 ON-THE-GO FOOD PRODUCTS

4.3.5 HEALTHY SNACKING

4.4 FACTORS INFLUENCING PURCHASE DECISION

4.4.1 GROWING CONSUMERS' INTEREST IN PLANT-BASED DIETS

4.4.2 DEMAND FOR FREE-FROM FOODS PRODUCTS

4.4.3 HEALTHY AND SUSTAINABLE FOOD AVAILABILITY

4.4.4 PRICING OF HEALTH AND WELLNESS FOOD

4.5 INDUSTRY TRENDS AND FUTURE PERSPECTIVE OF EUROPE HEALTH AND WELLNESS FOOD MARKET

4.5.1 MANUFACTURERS LAUNCHING NATURAL INGREDIENT-BASED FOOD PRODUCTS

4.5.2 GROWING PRODUCTION OF A WIDE RANGE OF HEALTH AND WELLNESS FOOD BY MANUFACTURERS

4.5.3 MANUFACTURERS FOCUSING ON THE DEVELOPMENT OF NUTRACEUTICAL FOOD PRODUCTS

4.6 LIST OF KEY SOURCES OF MARKET INSIGHTS

4.7 MEETING CONSUMER REQUIREMENTS

4.8 NEW PRODUCT LAUNCH STRATEGY

4.8.1 NUMBER OF PRODUCT LAUNCHES

4.8.1.1 LINE EXTENSION

4.8.1.2 NEW PACKAGING

4.8.1.3 RELAUNCHED

4.8.1.4 NEW FORMULATION

4.9 PRIVATE LABEL VS BRAND LABEL

4.1 PROMOTIONAL ACTIVITIES

4.11 REGULATIONS, CERTIFICATION, AND LABELLING CLAIMS

4.11.1 REGULATIONS

4.11.2 LABELING AND CLAIM

4.11.3 CERTIFICATIONS

4.11.3.1 BRC FOOD SAFETY CERTIFICATION

4.11.3.2 AGMARK CERTIFICATION

4.11.3.3 PLANT AND PLANT PRODUCTS

4.12 SHOPPING BEHAVIOR AND DYNAMICS

4.12.1 RECOMMENDATIONS FROM FAMILY AND FRIENDS-

4.12.2 RESEARCH

4.12.3 IMPULSIVE

4.12.4 ADVERTISEMENT:

4.12.4.1 TELEVISION ADVERTISEMENT

4.12.4.2 ONLINE ADVERTISEMENT

4.12.4.3 IN-STORE ADVERTISEMENT

4.12.4.4 OUTDOOR ADVERTISEMENT

4.12.5 CONCLUSION

4.13 SUPPLY CHAIN ANALYSIS

4.13.1 RAW MATERIAL PROCUREMENT

4.13.2 MANUFACTURING PROCESS

4.13.3 MARKETING AND DISTRIBUTION

4.13.4 END USERS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 RISING DEMAND FOR PROTEIN-BASED NUTRITIONAL AND HEALTHY FOOD & BEVERAGES

5.1.2 INCREASING DISPOSABLE INCOME AND GROWING EXPENDITURE ON HEALTHY FOOD PRODUCTS

5.1.3 INCREASING DEMAND FOR VEGAN/PLANT-BASED HEALTHY FOOD

5.1.4 GROWING DEMAND FOR CLEAN LABEL FOOD

5.2 RESTRAINTS

5.2.1 INCREASING REGULATION ON FORTIFIED FOOD & BEVERAGES

5.2.2 HIGHER PRICES OF HEALTHY NUTRITIONAL FOOD & BEVERAGES

5.3 OPPORTUNITIES

5.3.1 INCREASE IN NUMBER OF LAUNCHES OF HEALTH AND WELLNESS FOOD & BEVERAGE PRODUCTS

5.3.2 CHANGE IN EATING HABITS AND LIFESTYLE OF MILLENNIALS

5.3.3 GROWING DEMAND FOR NON-ALCOHOLIC DRINKS THAT PROVIDE HEALTH BENEFITS

5.4 CHALLENGES

5.4.1 DISRUPTED SUPPLY CHAIN DUE TO COVID-19

5.4.2 LACK OF AWARENESS AMONG PEOPLE AND SKEPTICISM TOWARDS HEALTHY FOOD & BEVERAGES

6 POST-COVID IMPACT ON THE EUROPE HEALTH AND WELLNESS FOOD MARKET

6.1 AFTERMATH OF COVID-19

6.2 IMPACT ON DEMAND AND SUPPLY CHAIN

6.3 IMPACT ON PRICE

6.4 CONCLUSION

7 EUROPE HEALTH AND WELLNESS FOOD MARKET, BY TYPE

7.1 OVERVIEW

7.2 FUNCTIONAL FOOD

7.2.1 FUNCTIONAL FOOD, BY TYPE

7.2.1.1 BREAKFAST CEREAL PRODUCTS

7.2.1.1.1 BREAKFAST CEREAL FLAKES

7.2.1.1.2 BREAKFAST OATMEAL

7.2.1.1.3 BREAKFAST CEREAL PORRIDGE

7.2.1.1.4 BREAKFAST COOKIES

7.2.1.1.5 OTHERS

7.2.1.2 YOGURTS

7.2.1.2.1 YOGURT, BY TYPE

7.2.1.2.1.1 REGULAR YOGURTS

7.2.1.2.1.2 CONCENTRATED YOGURT

7.2.1.2.1.3 PROBIOTIC YOGURT

7.2.1.2.1.4 SET YOGURT

7.2.1.2.1.5 BIO LIVE YOGURT

7.2.1.2.1.6 STIRRED YOGURT

7.2.1.2.1.7 OTHERS

7.2.1.2.2 YOGURT, BY CATEGORY

7.2.1.2.2.1 FROZEN YOGURT

7.2.1.2.2.2 DRINKABLE YOGURT

7.2.1.2.2.3 SPOONABLE YOGURT

7.2.1.2.2.4 OTHERS

7.2.1.2.3 YOGURT, BY FLAVOR

7.2.1.2.3.1 PLAIN

7.2.1.2.3.2 FLAVORED

7.2.1.2.3.2.1 STRAWBERRY

7.2.1.2.3.2.2 VANILLA

7.2.1.2.3.2.3 BLUEBERRY

7.2.1.2.3.2.4 PEACH

7.2.1.2.3.2.5 BANANA

7.2.1.2.3.2.6 BLACKBERRY

7.2.1.2.3.2.7 CHERRY

7.2.1.2.3.2.8 BUTTERSCOTCH

7.2.1.2.3.2.9 CARAMEL

7.2.1.2.3.2.10 POMEGRANATE

7.2.1.2.3.2.11 CHOCOLATES

7.2.1.2.3.2.12 NUTS

7.2.1.2.3.2.13 COCONUT

7.2.1.2.3.2.14 ORCHARD CHERRY

7.2.1.2.3.2.15 COTTON CANDY

7.2.1.2.3.2.16 HONEY

7.2.1.2.3.2.17 MOCHA

7.2.1.2.3.2.18 AMARETTO

7.2.1.2.3.2.19 PUMPKIN

7.2.1.2.3.2.20 PEPPERMINT

7.2.1.2.3.2.21 OTHERS

7.2.1.3 NUTRITION BARS

7.2.1.3.1 NUTRITION BARS, BY TYPE

7.2.1.3.1.1 CEREALS BARS

7.2.1.3.1.1.1 GRANOLA BARS

7.2.1.3.1.1.2 OAT BARS

7.2.1.3.1.1.3 RICE BARS

7.2.1.3.1.1.4 MIXED CEREAL BARS

7.2.1.3.1.1.5 OTHERS

7.2.1.3.1.2 ENERGY BARS

7.2.1.3.1.2.1 PLANT-BASED PROTEIN BARS

7.2.1.3.1.2.2 ANIMAL-BASED PROTEIN BARS

7.2.1.3.1.2.2.1 WHEY PROTEIN BARS

7.2.1.3.1.2.2.2 CASEIN PROTEIN BARS

7.2.1.3.1.2.2.2.1 FIBER BARS

7.2.1.3.1.2.2.2.2 PROBIOTIC BARS

7.2.1.3.1.2.2.2.3 OMEGA-3 BARS

7.2.1.3.1.2.2.2.4 AMINO ACID BARS

7.2.1.3.1.2.2.2.5 OTHERS

7.2.1.3.1.3 FRUIT BARS

7.2.1.3.1.3.1 BANANA

7.2.1.3.1.3.2 APPLES

7.2.1.3.1.3.3 ORANGES

7.2.1.3.1.3.4 BERRIES

7.2.1.3.1.3.5 CHERRY

7.2.1.3.1.3.6 AVOCADO

7.2.1.3.1.3.7 OTHERS

7.2.1.3.1.4 NUT BARS

7.2.1.3.1.4.1 ALMOND

7.2.1.3.1.4.2 PEANUT

7.2.1.3.1.4.3 HAZELNUTS

7.2.1.3.1.4.4 CASHEW

7.2.1.3.1.4.5 DATES

7.2.1.3.1.4.6 OTHERS

7.2.1.3.1.5 OTHERS

7.2.1.3.2 NUTRITION BARS, BY CATEGORY

7.2.1.3.3 REGULAR

7.2.1.3.4 PRE WORK OUT BARS

7.2.1.3.5 MEAL REPLACEMENT BAR

7.2.1.3.6 POST WORK OUT BARS

7.2.1.3.7 YOGA BARS

7.2.1.3.8 OTHERS

7.2.2 FUNCTIONAL FOODS, BY CATEGORY

7.2.2.1 CONVENTIONAL

7.2.2.2 ORGANIC

7.2.3 FUNCTIONAL FOODS, BY CALORIE CONTENT

7.2.3.1 LOW CALORIES

7.2.3.2 REDUCED CALORIE

7.2.3.3 NO CALORIES

7.3 HEALTHY SNACKS

7.3.1 HEALTHY SNACKS, BY PRODUCT TYPE

7.3.1.1 VEGGIE SNACKS

7.3.1.2 MULTIGRAIN WAFERS, CRACKERS & CHIPS

7.3.1.3 TRAIL MIXES

7.3.1.4 DRY BERRIES SNACKS

7.3.1.5 OTHERS

7.3.2 HEALTHY SNACKS, BY CATEGORY

7.3.2.1 CONVENTIONAL

7.3.2.2 ORGANIC

7.3.3 HEALTHY SNACKS, BY CALORIE CONTENT

7.3.3.1 LOW CALORIES

7.3.3.2 REDUCED CALORIE

7.3.3.3 NO CALORIES

7.4 BEVERAGES

7.4.1 BEVERAGES, BY TYPE

7.4.1.1 FORTIFIED COFFEE

7.4.1.2 BFY BEVERAGES

7.4.1.2.1 HEALTHY SMOOTHIES

7.4.1.2.2 DIET SODA

7.4.1.2.3 PLANT-BASED MILK

7.4.1.2.3.1 PLANT-BASED MILK, BY TYPE

7.4.1.2.3.1.1 ALMOND MILK

7.4.1.2.3.1.2 SOY MILK

7.4.1.2.3.1.3 COCONUT MILK

7.4.1.2.3.1.4 OAT MILK

7.4.1.2.3.1.5 CASHEW MILK

7.4.1.2.3.1.6 OTHERS

7.4.1.2.4 PLANT-BASED MILK, BY FORMULATION

7.4.1.2.4.1.1 SWEETENED

7.4.1.2.4.1.2 UNSWEETENED

7.4.1.2.5 FLAVORED WATER

7.4.1.3 ENERGY DRINKS

7.4.1.4 KOMBUCHA DRINKS

7.4.1.5 HERBAL TEA

7.4.1.5.1 MIXED HERB

7.4.1.5.2 YERBA MATE

7.4.1.5.3 OOLONG

7.4.1.5.4 CHAMOMILE

7.4.1.5.5 MATCHA

7.4.1.5.6 MINT

7.4.1.5.7 ROSEMARY

7.4.1.5.8 PEPPERMINT

7.4.1.5.9 CONVENTIONAL TEA LEAVES

7.4.1.5.10 SINGLE HERB

7.4.1.5.11 CINNAMON

7.4.1.5.12 THYME

7.4.1.5.13 ROSE HIP

7.4.1.5.14 ECHINACEA

7.4.1.5.15 BUBBLE

7.4.1.5.16 OTHERS

7.4.1.6 FRUIT TEA

7.4.1.6.1 SINGLE FRUIT TEA

7.4.1.6.2 PEACH

7.4.1.6.3 ORANGE

7.4.1.6.4 POMEGRANATE

7.4.1.6.5 MANGO

7.4.1.6.6 STRAWBERRY

7.4.1.6.7 APPLE TEA

7.4.1.6.8 PINEAPPLE

7.4.1.6.9 KIWI

7.4.1.6.10 RASPBERRY

7.4.1.6.11 CRANBERRY

7.4.1.6.12 BLUEBERRY

7.4.1.6.13 GOJI BERRY

7.4.1.6.14 PASSION FRUIT

7.4.1.6.15 OTHERS

7.4.1.6.16 MIX FRUIT TEA

7.4.2 BEVERAGES, BY CATEGORY

7.4.2.1 CONVENTIONAL

7.4.2.2 ORGANIC

7.4.3 BEVERAGES, BY CALORIE CONTENT

7.4.3.1 LOW CALORIES

7.4.3.2 REDUCED CALORIES

7.4.3.3 NO CALORIES

7.5 FORTIFIED & HEALTHY BAKERY PRODUCTS

7.5.1 FORTIFIED & HEALTHY BAKERY PRODUCTS, BY TYPE

7.5.1.1 BREAD & ROLLS

7.5.1.2 BISCUIT & COOKIES

7.5.1.3 PANCAKES & OTHER BAKERY MIXES

7.5.1.4 CAKES & PASTRIES

7.5.1.5 TORTILLA

7.5.1.6 CUPCAKES & MUFFINS

7.5.2 FORTIFIED & HEALTHY BAKERY PRODUCTS, BY CATEGORY

7.5.2.1 CONVENTIONAL

7.5.2.2 ORGANIC

7.5.3 FORTIFIED & HEALTHY BAKERY PRODUCTS, BY CALORIE CONTENT

7.5.3.1 LOW CALORIES

7.5.3.2 REDUCED CALORIE

7.5.3.3 NO CALORIES

7.6 BFY FOODS

7.6.1 BFY FOODS, BY TYPE

7.6.1.1 HEALTHY PIZZA & PASTA

7.6.1.2 HEALTHY CRISPS

7.6.1.3 HEALTHY CRISPS, BY TYPE

7.6.1.3.1 PROTEIN CRISPS

7.6.1.3.2 VEGGIES CRISPS

7.6.1.3.3 GREEN BEANS CRISPS

7.6.1.3.4 MIX VEGGIE CRISPS

7.6.1.3.5 BEETS CRISPS

7.6.1.3.6 CAULIFLOWER CRISPS

7.6.1.3.7 OTHERS

7.6.1.3.8 HEALTHY CRISPS, BY FLAVOR

7.6.1.3.9 BARBECUE

7.6.1.3.10 CHEESE

7.6.1.3.11 SEA SALT

7.6.1.3.12 SWEET CHILLI

7.6.1.3.13 BUFFALO WING

7.6.1.3.14 SWEET & SALT

7.6.1.3.15 OTHERS

7.6.1.4 SOUPS

7.6.1.5 SPREADS

7.6.1.6 SAUCES, MAYONNAISE & DRESSINGS

7.6.1.7 OTHERS

7.6.2 BFY FOODS, BY CATEGORY

7.6.2.1 CONVENTIONAL

7.6.2.2 ORGANIC

7.6.3 BFY FOODS, BY CALORIE CONTENT

7.6.3.1 LOW CALORIES

7.6.3.2 REDUCED CALORIES

7.6.3.3 NO CALORIES

7.7 CHOCOLATE

7.7.1 CHOCOLATES, BY TYPE

7.7.1.1 DARK CHOCOLATE BARS

7.7.1.2 NUT INFUSED CHOCOLATES

7.7.1.3 FRUIT & NUT INFUSED CHOCOLATE BRITTLES

7.7.1.4 FORTIFIED CHOCOLATE BARS

7.7.1.5 OTHERS

7.7.2 CHOCOLATES, BY FORMULATION

7.7.2.1 SWEET

7.7.2.2 SEMI-SWEET

7.7.2.3 SUGAR FREE

7.7.3 CHOCOLATES, BY CATEGORY

7.7.3.1 CONVENTIONAL

7.7.3.2 ORGANIC

7.7.4 CHOCOLATES, BY CALORIE CONTENT

7.7.4.1 LOW CALORIES

7.7.4.2 REDUCED CALORIE

7.7.4.3 NO CALORIES

7.8 OTHERS

8 EUROPE HEALTH AND WELLNESS FOOD MARKET, BY CALORIE CONTENT

8.1 OVERVIEW

8.2 LOW CALORIES

8.3 REDUCED CALORIES

8.4 NO CALORIES

9 EUROPE HEALTH AND WELLNESS FOOD MARKET, BY NATURE

9.1 OVERVIEW

9.2 NON-GMO

9.3 GMO

10 EUROPE HEALTH AND WELLNESS FOOD MARKET, BY FAT CONTENT

10.1 OVERVIEW

10.2 NO FAT

10.3 LOW FAT

10.4 REDUCED FAT

11 EUROPE HEALTH AND WELLNESS FOOD MARKET, BY CATEGORY

11.1 OVERVIEW

11.2 ORGANIC

11.3 CONVENTIONAL

12 EUROPE HEALTH AND WELLNESS FOOD MARKET, BY FREE FROM CATEGORY

12.1 OVERVIEW

12.2 GLUTEN FREE

12.3 DAIRY FREE

12.4 SOY FREE

12.5 NUT FREE

12.6 LACTOSE FREE

12.7 ARTIFICIAL FLAVOR FREE

12.8 ARTIFICIAL COLOR FREE

12.9 OTHERS

13 EUROPE HEALTH AND WELLNESS FOOD MARKET, BY DISTRIBUTION CHANNEL

13.1 OVERVIEW

13.2 STORE BASED RETAILERS

13.2.1 SUPERMARKET/HYPERMARKET

13.2.2 CONVENIENCE STORES

13.2.3 SPECIALTY STORES

13.2.4 GROCERY STORES

13.2.5 OTHERS

13.3 NON-STORE RETAILERS

13.3.1 COMPANY WEBSITES

13.3.2 ONLINE

14 EUROPE HEALTH AND WELLNESS FOOD MARKET, BY REGION

14.1 EUROPE

14.1.1 SPAIN

14.1.2 ITALY

14.1.3 FRANCE

14.1.4 GERMANY

14.1.5 U.K.

14.1.6 SWITZERLAND

14.1.7 NETHERLANDS

14.1.8 BELGIUM

14.1.9 RUSSIA

14.1.10 TURKEY

14.1.11 REST OF EUROPE

15 EUROPE HEALTH AND WELLNESS FOOD MARKET: COMPANY LANDSCAPE

15.1 COMPANY SHARE ANALYSIS: EUROPE

16 SWOT ANALYSIS

17 COMPANY PROFILE

17.1 PEPSICO

17.1.1 COMPANY SNAPSHOT

17.1.2 REVENUE ANALYSIS

17.1.3 COMPANY SHARE ANALYSIS

17.1.4 PRODUCT PORTFOLIO

17.1.5 RECENT DEVELOPMENTS

17.2 DANONE

17.2.1 COMPANY SNAPSHOT

17.2.2 REVENUE ANALYSIS

17.2.3 COMPANY SHARE ANALYSIS

17.2.4 PRODUCT PORTFOLIO

17.2.5 RECENT DEVELOPMENT

17.3 NESTLÉ

17.3.1 COMPANY SNAPSHOT

17.3.2 REVENUE ANALYSIS

17.3.3 COMPANY SHARE ANALYSIS

17.3.4 PRODUCT PORTFOLIO

17.3.5 RECENT DEVELOPMENT

17.4 ABBOTT

17.4.1 COMPANY SNAPSHOT

17.4.2 REVENUE ANALYSIS

17.4.3 COMPANY SHARE ANALYSIS

17.4.4 PRODUCT PORTFOLIO

17.4.5 RECENT DEVELOPMENTS

17.5 GENERAL MILLS INC.

17.5.1 COMPANY SNAPSHOT

17.5.2 REVENUE ANALYSIS

17.5.3 COMPANY SHARE ANALYSIS

17.5.4 PRODUCT PORTFOLIO

17.5.5 RECENT DEVELOPMENT

17.6 YAKULT HONSHA CO., LTD.

17.6.1 COMPANY SNAPSHOT

17.6.2 REVENUE ANALYSIS

17.6.3 PRODUCT PORTFOLIO

17.6.4 RECENT DEVELOPMENTS

17.7 GSK GROUP OF COMPANIES

17.7.1 COMPANY SNAPSHOT

17.7.2 REVENUE ANALYSIS

17.7.3 PRODUCT PORTFOLIO

17.7.4 RECENT DEVELOPMENT

17.8 SIMPLY GOOD FOODS USA, INC.

17.8.1 COMPANY SNAPSHOT

17.8.2 PRODUCT PORTFOLIO

17.8.3 RECENT DEVELOPMENTS

17.9 ALTER ECO

17.9.1 COMPANY SNAPSHOT

17.9.2 PRODUCT PORTFOLIO

17.9.3 RECENT DEVELOPMENTS

17.1 BARREL. SITE BY BARREL

17.10.1 COMPANY SNAPSHOT

17.10.2 PRODUCT PORTFOLIO

17.10.3 RECENT DEVELOPMENT

17.11 CHOBANI, LLC.

17.11.1 COMPANY SNAPSHOT

17.11.2 PRODUCT PORTFOLIO

17.11.3 RECENT DEVELOPMENT

17.12 CLIF BAR & COMPANY

17.12.1 COMPANY SNAPSHOT

17.12.2 PRODUCT PORTFOLIO

17.12.3 RECENT DEVELOPMENTS

17.13 ENJOY LIFE

17.13.1 COMPANY SNAPSHOT

17.13.2 PRODUCT PORTFOLIO

17.13.3 RECENT DEVELOPMENTS

17.14 FORAGER PROJECT

17.14.1 COMPANY SNAPSHOT

17.14.2 PRODUCT PORTFOLIO

17.14.3 RECENT DEVELOPMENTS

17.15 GREEN VALLEY DAIRIE

17.15.1 COMPANY SNAPSHOT

17.15.2 PRODUCT PORTFOLIO

17.15.3 RECENT DEVELOPMENTS

17.16 HUEL INC.

17.16.1 COMPANY SNAPSHOT

17.16.2 PRODUCT PORTFOLIO

17.16.3 RECENT DEVELOPMENT

17.17 KASHI

17.17.1 COMPANY SNAPSHOT

17.17.2 PRODUCT PORTFOLIO

17.17.3 RECENT DEVELOPMENTS

17.18 KELLOGG CO.

17.18.1 COMPANY SNAPSHOT

17.18.2 REVENUE ANALYSIS

17.18.3 PRODUCT PORTFOLIO

17.18.4 RECENT DEVELOPMENT

17.19 KITE HILL

17.19.1 COMPANY SNAPSHOT

17.19.2 PRODUCT PORTFOLIO

17.19.3 RECENT DEVELOPMENTS

17.2 LAKE CHAMPLAIN CHOCOLATES

17.20.1 COMPANY SNAPSHOT

17.20.2 PRODUCT PORTFOLIO

17.20.3 RECENT DEVELOPMENTS

17.21 LAVVA

17.21.1 COMPANY SNAPSHOT

17.21.2 PRODUCT PORTFOLIO

17.21.3 RECENT DEVELOPMENTS

17.22 LIBERTE

17.22.1 COMPANY SNAPSHOT

17.22.2 PRODUCT PORTFOLIO

17.22.3 RECENT DEVELOPMENTS

17.23 MARS, INCORPORATED

17.23.1 COMPANY SNAPSHOT

17.23.2 PRODUCT PORTFOLIO

17.23.3 RECENT DEVELOPMENT

17.24 MASPEX GROUP

17.24.1 COMPANY SNAPSHOT

17.24.2 PRODUCT PORTFOLIO

17.24.3 RECENT DEVELOPMENTS

17.25 MONDELĒZ INTERNATIONAL.

17.25.1 COMPANY SNAPSHOT

17.25.2 REVENUE ANALYSIS

17.25.3 PRODUCT PORTFOLIO

17.25.4 RECENT DEVELOPMENT

17.26 SO DELICIOUS DAIRY FREE

17.26.1 COMPANY SNAPSHOT

17.26.2 PRODUCT PORTFOLIO

17.26.3 RECENT DEVELOPMENTS

17.27 STONYFIELD FARM, INC.

17.27.1 COMPANY SNAPSHOT

17.27.2 PRODUCT PORTFOLIO

17.27.3 RECENT DEVELOPMENTS

17.28 THE QUAKER OATS COMPANY

17.28.1 COMPANY SNAPSHOT

17.28.2 PRODUCT PORTFOLIO

17.28.3 RECENT DEVELOPMENTS

17.29 THE SIMPLY GOOD FOODS COMPANY

17.29.1 COMPANY SNAPSHOT

17.29.2 REVENUE ANALYSIS

17.29.3 PRODUCT PORTFOLIO

17.29.4 RECENT DEVELOPMENTS

17.3 YOPLAIT USA, INC.

17.30.1 COMPANY SNAPSHOT

17.30.2 PRODUCT PORTFOLIO

17.30.3 RECENT DEVELOPMENTS

18 QUESTIONNAIRE:

19 RELATED REPORTS

그림 목록

FIGURE 1 EUROPE HEALTH AND WELLNESS FOOD MARKET: SEGMENTATION

FIGURE 2 EUROPE HEALTH AND WELLNESS FOOD MARKET: DATA TRIANGULATION

FIGURE 3 EUROPE HEALTH AND WELLNESS FOOD MARKET: DROC ANALYSIS

FIGURE 4 EUROPE HEALTH AND WELLNESS FOOD MARKET: EUROPE VS REGIONAL MARKET ANALYSIS

FIGURE 5 EUROPE HEALTH AND WELLNESS FOOD MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 EUROPE HEALTH AND WELLNESS FOOD MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 EUROPE HEALTH AND WELLNESS FOOD MARKET: DBMR MARKET POSITION GRID

FIGURE 8 EUROPE HEALTH AND WELLNESS FOOD MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 EUROPE HEALTH AND WELLNESS FOOD MARKET: SEGMENTATION

FIGURE 10 NORTH AMERICA IS EXPECTED TO DOMINATE THE EUROPE HEALTH AND WELLNESS FOOD MARKET AND GROW WITH THE HIGHEST CAGR IN THE FORECAST PERIOD

FIGURE 11 RISING DEMAND FOR PROTEIN-BASED NUTRITIONAL AND HEALTHY FOOD & BEVERAGES IS EXPECTED TO DRIVE THE EUROPE HEALTH AND WELLNESS FOOD MARKET IN THE FORECAST PERIOD 2022 TO 2029

FIGURE 12 TYPE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE EUROPE HEALTH AND WELLNESS FOOD MARKET IN 2022 & 2029

FIGURE 13 SUPPLY CHAIN ANALYSIS

FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE EUROPE HEALTH AND WELLNESS FOOD MARKET

FIGURE 15 EUROPE HEALTH AND WELLNESS FOOD MARKET: BY TYPE, 2021

FIGURE 16 EUROPE HEALTH AND WELLNESS FOOD MARKET: BY CALORIE CONTENT, 2021

FIGURE 17 EUROPE HEALTH AND WELLNESS FOOD MARKET: BY NATURE, 2021

FIGURE 18 EUROPE GMO CROP REVENUE (2018)

FIGURE 19 EUROPE HEALTH AND WELLNESS FOOD MARKET: BY FAT CONTENT, 2021

FIGURE 20 EUROPE HEALTH AND WELLNESS FOOD MARKET: BY CATEGORY, 2021

FIGURE 21 EUROPE HEALTH AND WELLNESS FOOD MARKET: BY FREE FROM CATEGORY, 2021

FIGURE 22 EUROPE HEALTH AND WELLNESS FOOD MARKET: BY DISTRIBUTION CHANNEL, 2021

FIGURE 23 EUROPE HEALTH AND WELLNESS FOOD MARKET: SNAPSHOT (2021)

FIGURE 24 EUROPE HEALTH AND WELLNESS FOOD MARKET: BY COUNTRY (2021)

FIGURE 25 EUROPE HEALTH AND WELLNESS FOOD MARKET: BY COUNTRY (2022 & 2029)

FIGURE 26 EUROPE HEALTH AND WELLNESS FOOD MARKET: BY COUNTRY (2021 & 2029)

FIGURE 27 EUROPE HEALTH AND WELLNESS FOOD MARKET: BY TYPE (2022 & 2029)

FIGURE 28 EUROPE HEALTH AND WELLNESS FOOD MARKET: COMPANY SHARE 2021 (%)

연구 방법론

데이터 수집 및 기준 연도 분석은 대규모 샘플 크기의 데이터 수집 모듈을 사용하여 수행됩니다. 이 단계에는 다양한 소스와 전략을 통해 시장 정보 또는 관련 데이터를 얻는 것이 포함됩니다. 여기에는 과거에 수집한 모든 데이터를 미리 검토하고 계획하는 것이 포함됩니다. 또한 다양한 정보 소스에서 발견되는 정보 불일치를 검토하는 것도 포함됩니다. 시장 데이터는 시장 통계 및 일관된 모델을 사용하여 분석하고 추정합니다. 또한 시장 점유율 분석 및 주요 추세 분석은 시장 보고서의 주요 성공 요인입니다. 자세한 내용은 분석가에게 전화를 요청하거나 문의 사항을 드롭하세요.

DBMR 연구팀에서 사용하는 주요 연구 방법론은 데이터 마이닝, 시장에 대한 데이터 변수의 영향 분석 및 주요(산업 전문가) 검증을 포함하는 데이터 삼각 측량입니다. 데이터 모델에는 공급업체 포지셔닝 그리드, 시장 타임라인 분석, 시장 개요 및 가이드, 회사 포지셔닝 그리드, 특허 분석, 가격 분석, 회사 시장 점유율 분석, 측정 기준, 글로벌 대 지역 및 공급업체 점유율 분석이 포함됩니다. 연구 방법론에 대해 자세히 알아보려면 문의를 통해 업계 전문가에게 문의하세요.

사용자 정의 가능

Data Bridge Market Research는 고급 형성 연구 분야의 선두 주자입니다. 저희는 기존 및 신규 고객에게 목표에 맞는 데이터와 분석을 제공하는 데 자부심을 느낍니다. 보고서는 추가 국가에 대한 시장 이해(국가 목록 요청), 임상 시험 결과 데이터, 문헌 검토, 재생 시장 및 제품 기반 분석을 포함하도록 사용자 정의할 수 있습니다. 기술 기반 분석에서 시장 포트폴리오 전략에 이르기까지 타겟 경쟁업체의 시장 분석을 분석할 수 있습니다. 귀하가 원하는 형식과 데이터 스타일로 필요한 만큼 많은 경쟁자를 추가할 수 있습니다. 저희 분석가 팀은 또한 원시 엑셀 파일 피벗 테이블(팩트북)로 데이터를 제공하거나 보고서에서 사용 가능한 데이터 세트에서 프레젠테이션을 만드는 데 도움을 줄 수 있습니다.