Europe Handheld Spectrum Analyzer Market, By Product Type (Swept-Tuned Spectrum Analyzer, Vector Signal Spectrum Analyzer and Real-Time Spectrum Analyzer), Frequency Type (Less Than 6 GHZ, 6 GHZ – 18 GHZ and More Than 18 GHZ), Size (Less Than 1 KG and More Than 1 KG), Power Source (Battery, Line and Others), Network Technology (Wired and Wireless), End Use (Automotive & Transportation, Aerospace & Defense, IT & Telecommunication, Medical & Healthcare, Semiconductors & Electronics, Industrial & Energy, Educational Institutes, Government Sector, and others),Country (Germany, Italy, U.K., France, Spain, Netherlands, Belgium, Switzerland, Turkey, Russia, Hungary, Lithuania, Austria, Ireland, Norway, Poland, Rest of Europe) Industry Trends and Forecast to 2028.

Market Analysis and Insights: Europe Handheld Spectrum Analyzer Market

Market Analysis and Insights: Europe Handheld Spectrum Analyzer Market

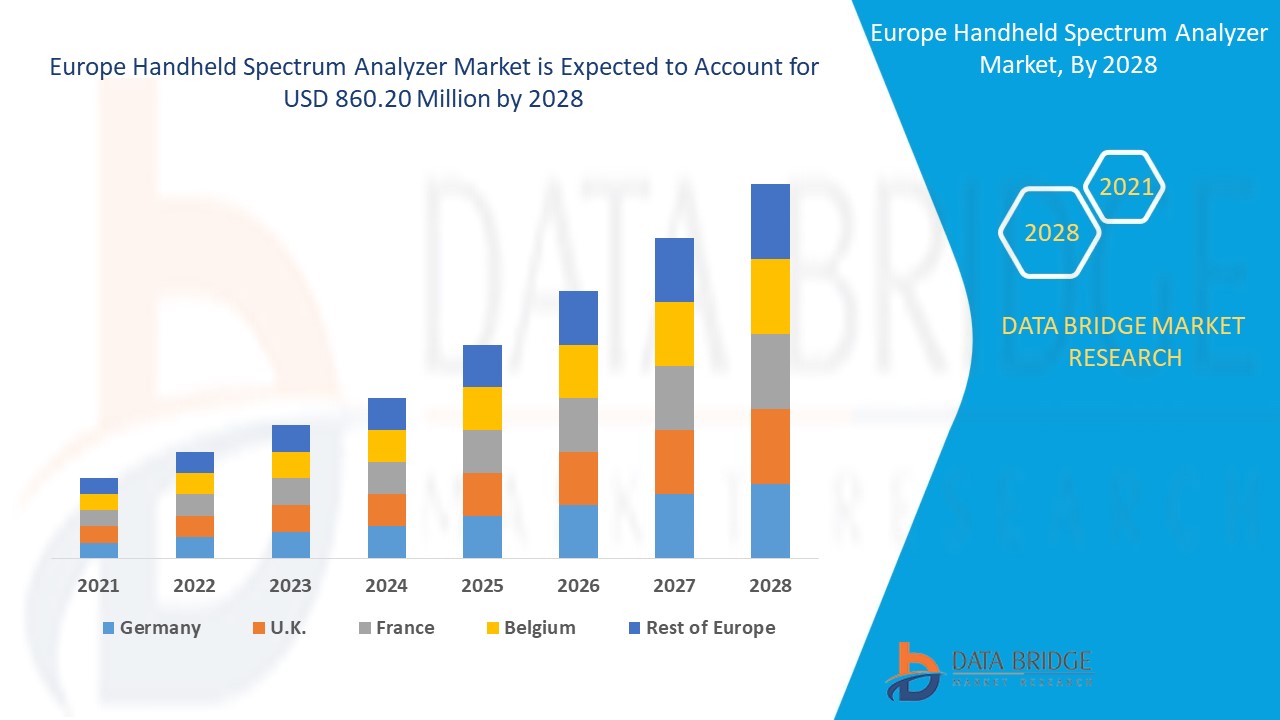

The handheld spectrum analyzer market is expected to gain market growth in the forecast period of 2021 to 2028. Data Bridge Market Research analyses that the market is growing with a CAGR of 9.1% in the forecast period of 2021 to 2028 and expected to reach USD 860.20 million by 2028.

A spectrum analyzer is a test device that measures and plots signal power (amplitude) over a selected frequency range. A handheld spectrum analyzer is self-evident, controlled, and used all while being held in the palm of your hand. Handheld spectrum analyzers limit weight and space. This type of device might be used when the precision or scope of measurements required is low. Spectrum analyzers are commonly used to determine the accuracy of a wireless transmitter. They are used to measure the magnitude of signal input vs frequency for a given spectrum range. A handheld spectrum analyzer is also used to determine the accuracy of a wireless transmitter by comparing the frequencies and bandwidths of an output signal to a received input signal. Typical uses of handheld spectrum analyzers include wireless communication interference tracking and signal location in the field. Regardless of the application, there will always be a trade-off between size and precision. It is up to the user to decide how much accuracy, storage, and processing capability is required for the task at hand. Spectrum Analyzers can be classified into 3 basic categories about their architecture – Swept Spectrum Analyzers (SA), Vector Signal Analyzers (VSA), and Real-time Spectrum Analyzers (RSA). Handheld spectrum analyzers provide excellent flexibility in the field for locating, identifying, recording, and solving communication system problems.

The growth of the market has been highly boosted by the increasing adoption of portable and hand-held spectrum analyzers for measurement across various sectors. Increasing utilization of wireless technology across various sectors is boosting the growth of the handheld spectrum analyzer market. The handheld spectrum analyzer has various limitations which act as a major restraint factor for the global handheld spectrum analyzer market.

This handheld spectrum analyzer market report provides details of market share, new developments, and product pipeline analysis, impact of domestic and localised market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, product approvals, strategic decisions, product launches, geographic expansions, and technological innovations in the market. To understand the analysis and the market scenario contact us for an Analyst Brief, our team will help you create a revenue impact solution to achieve your desired goal.

Handheld Spectrum Analyzer Market Scope and Market Size

Handheld Spectrum Analyzer Market Scope and Market Size

The handheld spectrum analyzer market is segmented on the basis of the product type, frequency type, size, power source, network technology and end use. The growth among segments helps you analyse niche pockets of growth and strategies to approach the market and determine your core application areas and the difference in your target markets.

- On the basis of product type, the handheld spectrum analyzer market has been segmented into swept-tuned spectrum analyzer, vector signal spectrum analyzer and real-time spectrum analyzer. In 2021, a swept-tuned spectrum analyzer is expected to dominate the global handheld spectrum analyzer market, due to a strong preference for mobile spectrum analyzers, mainly for industrial applications, and is considered as a general-purpose tool for frequency measurements, and capability to make a wide variety of measurements.

- On the basis of frequency type, the handheld spectrum analyzer market has been segmented into less than 6 GHZ, 6 GHZ – 18 GHZ and more than 18 GHZ. In 2021, 6 GHZ-18 GHZ is expected to dominate the global handheld spectrum analyzer market due to the wide availability of handheld spectrum analyzers with less than a frequency of 20 GHZ.

- On the basis of size, the handheld spectrum analyzer market has been segmented into less than 1 KG and more than 1 KG. In 2021, more than 1 KG is expected to dominate the global handheld spectrum analyzer market, due to the wide availability of handheld spectrum analyzer (HSA) having size more than 1 KG and approximate weight of HSA is around 3 KG (including batteries).

- On the basis of power source, the handheld spectrum analyzer market has been segmented into battery, line and others. In 2021, the battery segment is expected to dominate the global handheld spectrum analyzer market, due to benefits offered by battery-operated HSA, such as reduced noise, cost savings, ease to use, less vibration, and others. Moreover, they also provide instantaneous capabilities, with versatile display capabilities.

- On the basis of network technology, the handheld spectrum analyzer market has been segmented into wired and wireless. In 2021, the wireless segment is expected to dominate the global handheld spectrum analyzer market, due to surging demand for wireless handheld spectrum analyzers for 5G testing, the rapid growth of wireless data, the expansion of network technologies, and integration of multi-tasking capabilities.

- On the basis of end use, the handheld spectrum analyzer market has been segmented into automotive & transportation, aerospace & defense, IT & telecommunication, medical & healthcare, semiconductors & electronics, industrial & energy, educational institutes, government sector and others. In 2021, semiconductors & electronics are expected to dominate the global handheld spectrum analyzer market, mainly because of factors such as the wide use of handheld spectrum analyzers in the industry, surging growth of semiconductor and electronics globally, and ongoing research and development about advanced products.

Handheld Spectrum Analyzer Market Country Level Analysis

The handheld spectrum analyzer market is analysed and market size information is provided by country, product type, frequency type, size, power source, network technology and end use.

The regions covered in Europe handheld spectrum analyzer market report are Germany, Italy, U.K., France, Spain, Netherlands, Belgium, Switzerland, Turkey, Russia, Hungary, Lithuania, Austria, Ireland, Norway, Poland, Rest of Europe.

Germany dominates the Europe handheld spectrum analyzer market due to increasing research and development activities along with prevalence of majority of manufacturers.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points such as new sales, replacement sales, country demographics, regulatory acts and import-export tariffs are some of the major pointers used to forecast the market scenario for individual countries. Also, presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of sales channels are considered while providing forecast analysis of the country data.

Expanding demand for high bandwidth communication

The handheld spectrum analyzer market also provides you with detailed market analysis for every country growth in industry with sales, components sales, impact of technological development in handheld spectrum analyzer and changes in regulatory scenarios with their support for the handheld spectrum analyzer market. The data is available for historic period 2019.

Competitive Landscape and Handheld Spectrum Analyzer Market Share Analysis

The handheld spectrum analyzer market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, Global presence, production sites and facilities, company strengths and weaknesses, product launch, product trials pipelines, product approvals, patents, product width and breadth, application dominance, technology lifeline curve. The above data points provided are only related to the companies’ focus related to Europe handheld spectrum analyzer market.

The major players covered in the report are SAF Tehnika, VIAVI Solutions Inc., Transcom Instruments Co., Ltd., Bird., Keysight Technologies, Aim and Thurlby Thandar Instruments, Aaronia AG, EXFO Inc., PCTEL, Inc., Signal Hound, GSAS Micro Systems Private Limited, Anritsu, MICRONIX, ADVANTEST CORPORATION, B&K Precision Corporation, LP Technologies, AVCOM, Rohde & Schwarz, TEKTRONIX, INC. (A Subsidiary of Fortive), Meratronik, Research Electronics International (A Subsidiary of HEICO Corporation), Deviser Instruments, Incorporated., Saluki Technology, Narda Safety Test Solutions GmbH (A Subsidiary of L3Harris Technologies, Inc.), GAO Tek & GAO Group Inc., OWON Technology Inc., Ceyear Technologies Co.,Ltd, Crystal Instruments, VeEX Inc. and New Ridge Technologies, LLC (A Subsidiary of Luna Innovations Incorporated) among others. DBMR analysts understand competitive strengths and provide competitive analysis for each competitor separately.

Many product developments are also initiated by the companies worldwide which are also accelerating the growth of handheld spectrum analyzer market.

For instance,

- In March 2021, SAF Tehnika broadened their spectrum compact offerings of ultra-portable handheld microwave spectrum analyzers with the launch of a model which supports 6 GHz – 20 GHz frequency range. This new spectrum compact is suitable for telecommunications professionals, mobile carriers, Internet service providers (ISPs) and contractors responsible for regulatory and compliance, drone applications, and satellite operations. This will help the company to enhance their operations in the market.

- In February 2019, Anritsu announced launch of handheld spectrum analyser named as field Master Pro MS2090A. This newly launched handheld spectrum analyser delivers the highest continuous frequency coverage up to 54 GHz and also supports real-time spectrum analysis bandwidth up to a range of 100 MHz which addresses current and emerging applications of industries. This has helped the company to enhance their offerings and to grow in the market.

Partnership, joint ventures and other strategies enhances the company market share with increased coverage and presence. It also provides the benefit for organisation to improve their offering for handheld spectrum analyzer through expanded range of size.

SKU-

세계 최초의 시장 정보 클라우드 보고서에 온라인으로 접속하세요

- 대화형 데이터 분석 대시보드

- 높은 성장 잠재력 기회를 위한 회사 분석 대시보드

- 사용자 정의 및 질의를 위한 리서치 분석가 액세스

- 대화형 대시보드를 통한 경쟁자 분석

- 최신 뉴스, 업데이트 및 추세 분석

- 포괄적인 경쟁자 추적을 위한 벤치마크 분석의 힘 활용

목차

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA HANDHELD SPECTRUM ANALYZER MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELING

2.9 PRODUCT TYPE TIMELINE CURVE

2.1 MARKET APPLICATION COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 INCREASING ADOPTION OF PORTABLE AND HANDHELD SPECTRUM ANALYZERS FOR MEASUREMENT ACROSS VARIOUS SECTORS

5.1.2 INCREASING UTILIZATION OF WIRELESS TECHNOLOGY ACROSS VARIOUS SECTORS

5.1.3 EXPANDING DEMAND FOR HIGH BANDWIDTH COMMUNICATION

5.1.4 GROWING NEED FOR REAL-TIME ANALYSIS

5.1.5 INCREASED MOBILITY AND EASE OF USE OF HANDLED SPECTRUM ANALYZER

5.2 RESTRAINTS

5.2.1 LACK OF TECHNICAL KNOWLEDGE

5.2.2 LIMITATIONS OF SPECTRUM ANALYZERS

5.3 OPPORTUNITIES

5.3.1 INTRODUCTION TO 5G NETWORK

5.3.2 RAPID INDUSTRIALIZATION AND AUTOMATION WORLDWIDE

5.3.3 SIGNIFICANT GROWTH IN THE ELECTRONICS INDUSTRY

5.3.4 INCREASING EMPHASIS ON RESEARCH AND DEVELOPMENT ACTIVITIES

5.3.5 GROWING INCLINATION TOWARDS DIGITALIZATION

5.4 CHALLENGES

5.4.1 CONTROLLING THE NOISE FLOOR OF THE SPECTRUM ANALYZING SYSTEM

5.4.2 MEASUREMENT OF LOW-LEVEL SIGNALS WITH A SPECTRUM ANALYZER

6 IMPACT OF COVID-19 ON THE NORTH AMERICA HANDHELD SPECTRUM ANALYZER MARKET

6.1 ANALYSIS ON IMPACT OF COVID-19 ON THE MARKET

6.2 AFTERMATH OF COVID-19 AND GOVERNMENT INITIATIVE TO BOOST THE MARKET

6.3 STRATEGIC DECISIONS FOR MANUFACTURERS AFTER COVID-19 TO GAIN COMPETITIVE MARKET SHARE

6.4 IMPACT ON PRICE

6.5 IMPACT ON DEMAND AND SUPPLY CHAIN

6.6 CONCLUSION

7 NORTH AMERICA HANDHELD SPECTRUM ANALYZER MARKET, BY PRODUCT TYPE

7.1 OVERVIEW

7.2 SWEPT-TUNED SPECTRUM ANALYZER

7.2.1 TUNED-FILTER ANALYZER

7.2.2 SUPER HETERODYNE ANALYZER

7.3 VECTOR SIGNAL SPECTRUM ANALYZER

7.4 REAL-TIME SPECTRUM ANALYZER

7.4.1 FAST FOURIER ANALYZER

7.4.2 PARALLEL FILTER ANALYZER

8 NORTH AMERICA HANDHELD SPECTRUM ANALYZER MARKET, BY FREQUENCY TYPE

8.1 OVERVIEW

8.2 6 GHZ – 18 GHZ

8.3 LESS THAN 6 GHZ

8.4 MORE THAN 18 GHZ

9 NORTH AMERICA HANDHELD SPECTRUM ANALYZER MARKET, BY SIZE

9.1 OVERVIEW

9.2 LESS THAN 1 KG

9.3 MORE THAN 1 KG

10 NORTH AMERICA HANDHELD SPECTRUM ANALYZER MARKET, BY POWER SOURCE

10.1 OVERVIEW

10.2 BATTERY

10.3 LINE

10.4 OTHERS

11 NORTH AMERICA HANDHELD SPECTRUM ANALYZER MARKET, BY NETWORK TECHNOLOGY

11.1 OVERVIEW

11.2 WIRED

11.3 WIRELESS

12 NORTH AMERICA HANDHELD SPECTRUM ANALYZER MARKET, BY END USE

12.1 OVERVIEW

12.2 SEMICONDUCTORS & ELECTRONICS

12.2.1 SWEPT-TUNED SPECTRUM ANALYZER

12.2.2 VECTOR SIGNAL SPECTRUM ANALYZER

12.2.3 REAL-TIME SPECTRUM ANALYZER

12.3 AUTOMOTIVE & TRANSPORTATION

12.3.1 SWEPT-TUNED SPECTRUM ANALYZER

12.3.2 VECTOR SIGNAL SPECTRUM ANALYZER

12.3.3 REAL-TIME SPECTRUM ANALYZER

12.4 AEROSPACE & DEFENSE

12.4.1 SWEPT-TUNED SPECTRUM ANALYZER

12.4.2 VECTOR SIGNAL SPECTRUM ANALYZER

12.4.3 REAL-TIME SPECTRUM ANALYZER

12.5 IT & TELECOMMUNICATION

12.5.1 SWEPT-TUNED SPECTRUM ANALYZER

12.5.2 VECTOR SIGNAL SPECTRUM ANALYZER

12.5.3 REAL-TIME SPECTRUM ANALYZER

12.6 MEDICAL & HEALTHCARE

12.6.1 SWEPT-TUNED SPECTRUM ANALYZER

12.6.2 VECTOR SIGNAL SPECTRUM ANALYZER

12.6.3 REAL-TIME SPECTRUM ANALYZER

12.7 INDUSTRIAL & ENERGY

12.7.1 SWEPT-TUNED SPECTRUM ANALYZER

12.7.2 VECTOR SIGNAL SPECTRUM ANALYZER

12.7.3 REAL-TIME SPECTRUM ANALYZER

12.8 EDUCATIONAL INSTITUTES

12.8.1 SWEPT-TUNED SPECTRUM ANALYZER

12.8.2 VECTOR SIGNAL SPECTRUM ANALYZER

12.8.3 REAL-TIME SPECTRUM ANALYZER

12.9 GOVERNMENT SECTOR

12.9.1 SWEPT-TUNED SPECTRUM ANALYZER

12.9.2 VECTOR SIGNAL SPECTRUM ANALYZER

12.9.3 REAL-TIME SPECTRUM ANALYZER

12.1 OTHERS

12.10.1 SWEPT-TUNED SPECTRUM ANALYZER

12.10.2 VECTOR SIGNAL SPECTRUM ANALYZER

12.10.3 REAL-TIME SPECTRUM ANALYZER

13 NORTH AMERICA HANDHELD SPECTRUM ANALYZER MARKET, BY REGION

13.1 NORTH AMERICA

13.1.1 U.S.

13.1.2 CANADA

13.1.3 MEXICO

14 NORTH AMERICA HANDHELD SPECTRUM ANALYZER MARKET: COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

15 SWOT ANALYSIS

16 COMPANY PROFILE

16.1 KEYSIGHT TECHNOLOGIES

16.1.1 COMPANY SNAPSHOT

16.1.2 REVENUE ANALYSIS

16.1.3 COMPANY SHARE ANASLAYSIS

16.1.4 PRODUCT & SERVICE PORTFOLIO

16.1.5 RECENT DEVELOPMENTS

16.2 ADVANTEST CORPORATION

16.2.1 COMPANY SNAPSHOT

16.2.2 REVENUE ANALYSIS

16.2.3 COMPANY SHARE ANASLAYSIS

16.2.4 PRODUCT PORTFOLIO

16.2.5 RECENT DEVELOPMENT

16.3 VIAVI SOLUTIONS INC.

16.3.1 COMPANY SNAPSHOT

16.3.2 REVENUE ANALYSIS

16.3.3 COMPANY SHARE ANASLAYSIS

16.3.4 PRODUCT PORTFOLIO

16.3.5 RECENT DEVELOPMENTS

16.4 ROHDE & SCHWARZ

16.4.1 COMPANY SNAPSHOT

16.4.2 COMPANY SHARE ANASLAYSIS

16.4.3 PRODUCT PORTFOLIO

16.4.4 RECENT DEVELOPMENTS

16.5 ANRITSU

16.5.1 COMPANY SNAPSHOT

16.5.2 REVENUE ANALYSIS

16.5.3 COMPANY SHARE ANASLAYSIS

16.5.4 PRODUCT PORTFOLIO

16.5.5 RECENT DEVELOPMENTS

16.6 AARONIA AG

16.6.1 COMPANY SNAPSHOT

16.6.2 PRODUCT PORTFOLIO

16.6.3 RECENT DEVELOPMENT

16.7 AIM AND THURLBY THANDAR INSTRUMENTS

16.7.1 COMPANY SNAPSHOT

16.7.2 PRODUCT PORTFOLIO

16.7.3 RECENT DEVELOPMENT

16.8 AVCOM

16.8.1 COMPANY SNAPSHOT

16.8.2 PRODUCT PORTFOLIO

16.8.3 RECENT DEVELOPMENT

16.9 B&K PRECISION CORPORATION

16.9.1 COMPANY SNAPSHOT

16.9.2 PRODUCT PORTFOLIO

16.9.3 RECENT DEVELOPMENT

16.1 BIRD

16.10.1 COMPANY SNAPSHOT

16.10.2 PRODUCT PORTFOLIO

16.10.3 RECENT DEVELOPMENT

16.11 CEYEAR TECHNOLOGIES CO.,LTD

16.11.1 COMPANY SNAPSHOT

16.11.2 PRODUCT PORTFOLIO

16.11.3 RECENT DEVELOPMENTS

16.12 CRYSTAL INSTRUMENTS

16.12.1 COMPANY SNAPSHOT

16.12.2 PRODUCT PORTFOLIO

16.12.3 RECENT DEVELOPMENT

16.13 DEVISER INSTRUMENTS, INCORPORATED

16.13.1 COMPANY SNAPSHOT

16.13.2 PRODUCT PORTFOLIO

16.13.3 RECENT DEVELOPMENT

16.14 EXFO INC.

16.14.1 COMPANY SNAPSHOT

16.14.2 REVENUE ANALYSIS

16.14.3 PRODUCT PORTFOLIO

16.14.4 RECENT DEVELOPMENTS

16.15 GAO TEK & GAO GROUP INC.

16.15.1 COMPANY SNAPSHOT

16.15.2 PRODUCT PORTFOLIO

16.15.3 RECENT DEVELOPMENT

16.16 GSAS MICRO SYSTEMS PRIVATE LIMITED

16.16.1 COMPANY SNAPSHOT

16.16.2 PRODUCT PORTFOLIO

16.16.3 RECENT DEVELOPMENT

16.17 LP TECHNOLOGIES

16.17.1 COMPANY SNAPSHOT

16.17.2 PRODUCT PORTFOLIO

16.17.3 RECENT DEVELOPMENTS

16.18 MERATRONIK

16.18.1 COMPANY SNAPSHOT

16.18.2 PRODUCT PORTFOLIO

16.18.3 RECENT DEVELOPMENT

16.19 MICRONIX

16.19.1 COMPANY SNAPSHOT

16.19.2 PRODUCT PORTFOLIO

16.19.3 RECENT DEVELOPMENT

16.2 NARDA SAFETY TEST SOLUTIONS GMBH (A SUBSIDIARY OF L3HARRIS TECHNOLOGIES, INC.)

16.20.1 COMPANY SNAPSHOT

16.20.2 REVENUE ANALYSIS

16.20.3 PRODUCT PORTFOLIO

16.20.4 RECENT DEVELOPMENTS

16.21 NEW RIDGE TECHNOLOGIES, LLC (A SUBSIDIARY OF LUNA INNOVATIONS INCORPORATED)

16.21.1 COMPANY SNAPSHOT

16.21.2 REVENUE ANALYSIS

16.21.3 PRODUCT PORTFOLIO

16.21.4 RECENT DEVELOPMENT

16.22 OWON TECHNOLOGY INC.

16.22.1 COMPANY SNAPSHOT

16.22.2 PRODUCT PORTFOLIO

16.22.3 RECENT DEVELOPMENTS

16.23 PCTEL, INC.

16.23.1 COMPANY SNAPSHOT

16.23.2 REVENUE ANALYSIS

16.23.3 PRODUCT PORTFOLIO

16.23.4 RECENT DEVELOPMENTS

16.24 RESEARCH ELECTRONICS INTERNATIONAL (A SUBSIDIARY OF HEICO CORPORATION)

16.24.1 COMPANY SNAPSHOT

16.24.2 REVENUE ANALYSIS

16.24.3 PRODUCT PORTFOLIO

16.24.4 RECENT DEVELOPMENT

16.25 SAF TEHNIKA

16.25.1 COMPANY SNAPSHOT

16.25.2 PRODUCT PORTFOLIO

16.25.3 RECENT DEVELOPMENTS

16.26 SALUKI TECHNOLOGY

16.26.1 COMPANY SNAPSHOT

16.26.2 PRODUCT PORTFOLIO

16.26.3 RECENT DEVELOPMENT

16.27 SIGNAL HOUND

16.27.1 COMPANY SNAPSHOT

16.27.2 PRODUCT PORTFOLIO

16.27.3 RECENT DEVELOPMENTS

16.28 TEKTRONIX, INC. (A SUBSIDIARY OF FORTIVE)

16.28.1 COMPANY SNAPSHOT

16.28.2 REVENUE ANALYSIS

16.28.3 PRODUCT PORTFOLIO

16.28.4 RECENT DEVELOPMENTS

16.29 TRANSCOM INSTRUMENTS CO., LTD.

16.29.1 COMPANY SNAPSHOT

16.29.2 PRODUCT PORTFOLIO

16.29.3 RECENT DEVELOPMENT

16.3 VEEX INC.

16.30.1 COMPANY SNAPSHOT

16.30.2 PRODUCT PORTFOLIO

16.30.3 RECENT DEVELOPMENT

17 QUESTIONNAIRE

18 RELATED REPORTS

표 목록

LIST OF TABLES

TABLE 1 NORTH AMERICA HANDHELD SPECTRUM ANALYZER MARKET, BY PRODUCT TYPE, 2019-2028 (USD MILLION)

TABLE 2 NORTH AMERICA SWEPT-TUNED SPECTRUM ANALYZER IN HANDHELD SPECTRUM ANALYZER MARKET, BY REGION, 2019-2028(USD MILLION)

TABLE 3 NORTH AMERICA SWEPT-TUNED SPECTRUM ANALYZER IN HANDHELD SPECTRUM ANALYZER MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 4 NORTH AMERICA VECTOR SIGNAL SPECTRUM ANALYZER IN HANDHELD SPECTRUM ANALYZER MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 5 NORTH AMERICA REAL-TIME SPECTRUM ANALYZER IN HANDHELD SPECTRUM ANALYZER MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 6 NORTH AMERICA REAL-TIME SPECTRUM ANALYZER IN HANDHELD SPECTRUM ANALYZER MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 7 NORTH AMERICA HANDHELD SPECTRUM ANALYZER MARKET, BY FREQUENCY TYPE, 2019-2028 (USD MILLION)

TABLE 8 NORTH AMERICA 6 GHZ – 18 GHZ IN HANDHELD SPECTRUM ANALYZER MARKET, BY REGION ,2019-2028(USD MILLION)

TABLE 9 NORTH AMERICA LESS THAN 6 GHZ IN HANDHELD SPECTRUM ANALYZER MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 10 NORTH AMERICA MORE THAN 18 GHZ IN HANDHELD SPECTRUM ANALYZER MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 11 NORTH AMERICA HANDHELD SPECTRUM ANALYZER MARKET, BY SIZE, 2019-2028 (USD MILLION)

TABLE 12 NORTH AMERICA LESS THAN 1 KG IN HANDHELD SPECTRUM ANALYZER MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 13 NORTH AMERICA MORE THAN 1 KG IN HANDHELD SPECTRUM ANALYZER MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 14 NORTH AMERICA HANDHELD SPECTRUM ANALYZER MARKET, BY POWER SOURCE, 2019-2028 (USD MILLION)

TABLE 15 NORTH AMERICA BATTERY IN HANDHELD SPECTRUM ANALYZER MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 16 NORTH AMERICA LINE IN HANDHELD SPECTRUM ANALYZER MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 17 NORTH AMERICA OTHERS IN HANDHELD SPECTRUM ANALYZER MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 18 NORTH AMERICA HANDHELD SPECTRUM ANALYZER MARKET, BY NETWORK TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 19 NORTH AMERICA WIRED IN HANDHELD SPECTRUM ANALYZER MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 20 NORTH AMERICA WIRELESS IN HANDHELD SPECTRUM ANALYZER MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 21 NORTH AMERICA HANDHELD SPECTRUM ANALYZER MARKET, BY END USE, 2019-2028 (USD MILLION)

TABLE 22 NORTH AMERICA SEMICONDUCTORS & ELECTRONICS IN HANDHELD SPECTRUM ANALYZER MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 23 NORTH AMERICA SEMICONDUCTORS & ELECTRONICS IN HANDHELD SPECTRUM ANALYZER MARKET, BY PRODUCT TYPE, 2019-2028 (USD MILLION)

TABLE 24 NORTH AMERICA AUTOMOTIVE & TRANSPORTATION IN HANDHELD SPECTRUM ANALYZER MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 25 NORTH AMERICA AUTOMOTIVE & TRANSPORTATION IN HANDHELD SPECTRUM ANALYZER MARKET, BY PRODUCT TYPE, 2019-2028 (USD MILLION)

TABLE 26 NORTH AMERICA AEROSPACE & DEFENSE IN HANDHELD SPECTRUM ANALYZER MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 27 NORTH AMERICA AEROSPACE & DEFENSE IN HANDHELD SPECTRUM ANALYZER MARKET, BY PRODUCT TYPE, 2019-2028 (USD MILLION)

TABLE 28 NORTH AMERICA IT & TELECOMMUNICATION IN HANDHELD SPECTRUM ANALYZER MARKET, BY REGION, 2019-2028(USD MILLION)

TABLE 29 NORTH AMERICA IT & TELECOMMUNICATION IN HANDHELD SPECTRUM ANALYZER MARKET, BY PRODUCT TYPE, 2019-2028 (USD MILLION)

TABLE 30 NORTH AMERICA MEDICAL & HEALTHCARE IN HANDHELD SPECTRUM ANALYZER MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 31 NORTH AMERICA MEDICAL & HEALTHCARE IN HANDHELD SPECTRUM ANALYZER MARKET, BY PRODUCT TYPE, 2019-2028 (USD MILLION)

TABLE 32 NORTH AMERICA INDUSTRIAL & ENERGY IN HANDHELD SPECTRUM ANALYZER MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 33 NORTH AMERICA INDUSTRIAL & ENERGY IN HANDHELD SPECTRUM ANALYZER MARKET, BY PRODUCT TYPE, 2019-2028 (USD MILLION)

TABLE 34 NORTH AMERICA EDUCATIONAL INSTITUTES IN HANDHELD SPECTRUM ANALYZER MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 35 NORTH AMERICA EDUCATIONAL INSTITUTES IN HANDHELD SPECTRUM ANALYZER MARKET, BY PRODUCT TYPE, 2019-2028 (USD MILLION)

TABLE 36 NORTH AMERICA GOVERNMENT SECTOR IN HANDHELD SPECTRUM ANALYZER MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 37 NORTH AMERICA GOVERNMENT SECTOR IN HANDHELD SPECTRUM ANALYZER MARKET, BY PRODUCT TYPE, 2019-2028 (USD MILLION)

TABLE 38 NORTH AMERICA OTHERS IN HANDHELD SPECTRUM ANALYZER MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 39 NORTH AMERICA OTHERS IN HANDHELD SPECTRUM ANALYZER MARKET, BY PRODUCT TYPE, 2019-2028 (USD MILLION)

TABLE 40 NORTH AMERICA HANDHELD SPECTRUM ANALYZER MARKET, BY COUNTRY, 2019-2028 (USD MILLION)

TABLE 41 NORTH AMERICA HANDHELD SPECTRUM ANALYZER MARKET, BY PRODUCT TYPE, 2019-2028 (USD MILLION)

TABLE 42 NORTH AMERICA SWEPT-TUNED SPECTRUM ANALYZER IN HANDHELD SPECTRUM ANALYZER MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 43 NORTH AMERICA REAL-TIME SPECTRUM ANALYZER IN HANDHELD SPECTRUM ANALYZER MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 44 NORTH AMERICA HANDHELD SPECTRUM ANALYZER MARKET, BY FREQUENCY TYPE, 2019-2028 (USD MILLION)

TABLE 45 NORTH AMERICA HANDHELD SPECTRUM ANALYZER MARKET, BY SIZE, 2019-2028 (USD MILLION)

TABLE 46 NORTH AMERICA HANDHELD SPECTRUM ANALYZER MARKET, BY POWER SOURCE, 2019-2028 (USD MILLION)

TABLE 47 NORTH AMERICA HANDHELD SPECTRUM ANALYZER MARKET, BY NETWORK TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 48 NORTH AMERICA HANDHELD SPECTRUM ANALYZER MARKET, BY END USE, 2019-2028 (USD MILLION)

TABLE 49 NORTH AMERICA SEMICONDUCTORS AND ELECTRONICS IN HANDHELD SPECTRUM ANALYZER MARKET, BY PRODUCT TYPE, 2019-2028 (USD MILLION)

TABLE 50 NORTH AMERICA AEROSPACE AND DEFENSE IN HANDHELD SPECTRUM ANALYZER MARKET, BY PRODUCT TYPE, 2019-2028 (USD MILLION)

TABLE 51 NORTH AMERICA INDUSTRIAL AND ENERGY IN HANDHELD SPECTRUM ANALYZER MARKET, BY PRODUCT TYPE, 2019-2028 (USD MILLION)

TABLE 52 NORTH AMERICA IT AND TELECOMMUNICATION IN HANDHELD SPECTRUM ANALYZER MARKET, BY PRODUCT TYPE, 2019-2028 (USD MILLION)

TABLE 53 NORTH AMERICA AUTOMOTIVE AND TRANSPORTATION IN HANDHELD SPECTRUM ANALYZER MARKET, BY PRODUCT TYPE, 2019-2028 (USD MILLION)

TABLE 54 NORTH AMERICA MEDICAL AND HEALTHCARE IN HANDHELD SPECTRUM ANALYZER MARKET, BY PRODUCT TYPE, 2019-2028 (USD MILLION)

TABLE 55 NORTH AMERICA GOVERNMENT SECTOR IN HANDHELD SPECTRUM ANALYZER MARKET, BY PRODUCT TYPE, 2019-2028 (USD MILLION)

TABLE 56 NORTH AMERICA EDUCATIONAL INSTITUTIONS IN HANDHELD SPECTRUM ANALYZER MARKET, BY PRODUCT TYPE, 2019-2028 (USD MILLION)

TABLE 57 NORTH AMERICA OTHERS IN HANDHELD SPECTRUM ANALYZER MARKET, BY PRODUCT TYPE, 2019-2028 (USD MILLION)

TABLE 58 U.S. HANDHELD SPECTRUM ANALYZER MARKET, BY PRODUCT TYPE, 2019-2028 (USD MILLION)

TABLE 59 U.S. SWEPT-TUNED SPECTRUM ANALYZER IN HANDHELD SPECTRUM ANALYZER MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 60 U.S. REAL-TIME SPECTRUM ANALYZER IN HANDHELD SPECTRUM ANALYZER MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 61 U.S. HANDHELD SPECTRUM ANALYZER MARKET, BY FREQUENCY TYPE, 2019-2028 (USD MILLION)

TABLE 62 U.S. HANDHELD SPECTRUM ANALYZER MARKET, BY SIZE, 2019-2028 (USD MILLION)

TABLE 63 U.S. HANDHELD SPECTRUM ANALYZER MARKET, BY POWER SOURCE, 2019-2028 (USD MILLION)

TABLE 64 U.S. HANDHELD SPECTRUM ANALYZER MARKET, BY NETWORK TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 65 U.S. HANDHELD SPECTRUM ANALYZER MARKET, BY END USE, 2019-2028 (USD MILLION)

TABLE 66 U.S. SEMICONDUCTORS AND ELECTRONICS IN HANDHELD SPECTRUM ANALYZER MARKET, BY PRODUCT TYPE, 2019-2028 (USD MILLION)

TABLE 67 U.S. AEROSPACE AND DEFENSE IN HANDHELD SPECTRUM ANALYZER MARKET, BY PRODUCT TYPE, 2019-2028 (USD MILLION)

TABLE 68 U.S. INDUSTRIAL AND ENERGY IN HANDHELD SPECTRUM ANALYZER MARKET, BY PRODUCT TYPE, 2019-2028 (USD MILLION)

TABLE 69 U.S. IT AND TELECOMMUNICATION IN HANDHELD SPECTRUM ANALYZER MARKET, BY PRODUCT TYPE, 2019-2028 (USD MILLION)

TABLE 70 U.S. AUTOMOTIVE AND TRANSPORTATION IN HANDHELD SPECTRUM ANALYZER MARKET, BY PRODUCT TYPE, 2019-2028 (USD MILLION)

TABLE 71 U.S. MEDICAL AND HEALTHCARE IN HANDHELD SPECTRUM ANALYZER MARKET, BY PRODUCT TYPE, 2019-2028 (USD MILLION)

TABLE 72 U.S. GOVERNMENT SECTOR IN HANDHELD SPECTRUM ANALYZER MARKET, BY PRODUCT TYPE, 2019-2028 (USD MILLION)

TABLE 73 U.S. EDUCATIONAL INSTITUTIONS IN HANDHELD SPECTRUM ANALYZER MARKET, BY PRODUCT TYPE, 2019-2028 (USD MILLION)

TABLE 74 U.S. OTHERS IN HANDHELD SPECTRUM ANALYZER MARKET, BY PRODUCT TYPE, 2019-2028 (USD MILLION)

TABLE 75 CANADA HANDHELD SPECTRUM ANALYZER MARKET, BY PRODUCT TYPE, 2019-2028 (USD MILLION)

TABLE 76 CANADA SWEPT-TUNED SPECTRUM ANALYZER IN HANDHELD SPECTRUM ANALYZER MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 77 CANADA REAL-TIME SPECTRUM ANALYZER IN HANDHELD SPECTRUM ANALYZER MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 78 CANADA HANDHELD SPECTRUM ANALYZER MARKET, BY FREQUENCY TYPE, 2019-2028 (USD MILLION)

TABLE 79 CANADA HANDHELD SPECTRUM ANALYZER MARKET, BY SIZE, 2019-2028 (USD MILLION)

TABLE 80 CANADA HANDHELD SPECTRUM ANALYZER MARKET, BY POWER SOURCE, 2019-2028 (USD MILLION)

TABLE 81 CANADA HANDHELD SPECTRUM ANALYZER MARKET, BY NETWORK TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 82 CANADA HANDHELD SPECTRUM ANALYZER MARKET, BY END USE, 2019-2028 (USD MILLION)

TABLE 83 CANADA SEMICONDUCTORS AND ELECTRONICS IN HANDHELD SPECTRUM ANALYZER MARKET, BY PRODUCT TYPE, 2019-2028 (USD MILLION)

TABLE 84 CANADA AEROSPACE AND DEFENSE IN HANDHELD SPECTRUM ANALYZER MARKET, BY PRODUCT TYPE, 2019-2028 (USD MILLION)

TABLE 85 CANADA INDUSTRIAL AND ENERGY IN HANDHELD SPECTRUM ANALYZER MARKET, BY PRODUCT TYPE, 2019-2028 (USD MILLION)

TABLE 86 CANADA IT AND TELECOMMUNICATION IN HANDHELD SPECTRUM ANALYZER MARKET, BY PRODUCT TYPE, 2019-2028 (USD MILLION)

TABLE 87 CANADA AUTOMOTIVE AND TRANSPORTATION IN HANDHELD SPECTRUM ANALYZER MARKET, BY PRODUCT TYPE, 2019-2028 (USD MILLION)

TABLE 88 CANADA MEDICAL AND HEALTHCARE IN HANDHELD SPECTRUM ANALYZER MARKET, BY PRODUCT TYPE, 2019-2028 (USD MILLION)

TABLE 89 CANADA GOVERNMENT SECTOR IN HANDHELD SPECTRUM ANALYZER MARKET, BY PRODUCT TYPE, 2019-2028 (USD MILLION)

TABLE 90 CANADA EDUCATIONAL INSTITUTIONS IN HANDHELD SPECTRUM ANALYZER MARKET, BY PRODUCT TYPE, 2019-2028 (USD MILLION)

TABLE 91 CANADA OTHERS IN HANDHELD SPECTRUM ANALYZER MARKET, BY PRODUCT TYPE, 2019-2028 (USD MILLION)

TABLE 92 MEXICO HANDHELD SPECTRUM ANALYZER MARKET, BY PRODUCT TYPE, 2019-2028 (USD MILLION)

TABLE 93 MEXICO SWEPT-TUNED SPECTRUM ANALYZER IN HANDHELD SPECTRUM ANALYZER MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 94 MEXICO REAL-TIME SPECTRUM ANALYZER IN HANDHELD SPECTRUM ANALYZER MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 95 MEXICO HANDHELD SPECTRUM ANALYZER MARKET, BY FREQUENCY TYPE, 2019-2028 (USD MILLION)

TABLE 96 MEXICO HANDHELD SPECTRUM ANALYZER MARKET, BY SIZE, 2019-2028 (USD MILLION)

TABLE 97 MEXICO HANDHELD SPECTRUM ANALYZER MARKET, BY POWER SOURCE, 2019-2028 (USD MILLION)

TABLE 98 MEXICO HANDHELD SPECTRUM ANALYZER MARKET, BY NETWORK TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 99 MEXICO HANDHELD SPECTRUM ANALYZER MARKET, BY END USE, 2019-2028 (USD MILLION)

TABLE 100 MEXICO SEMICONDUCTORS AND ELECTRONICS IN HANDHELD SPECTRUM ANALYZER MARKET, BY PRODUCT TYPE, 2019-2028 (USD MILLION)

TABLE 101 MEXICO AEROSPACE AND DEFENSE IN HANDHELD SPECTRUM ANALYZER MARKET, BY PRODUCT TYPE, 2019-2028 (USD MILLION)

TABLE 102 MEXICO INDUSTRIAL AND ENERGY IN HANDHELD SPECTRUM ANALYZER MARKET, BY PRODUCT TYPE, 2019-2028 (USD MILLION)

TABLE 103 MEXICO IT AND TELECOMMUNICATION IN HANDHELD SPECTRUM ANALYZER MARKET, BY PRODUCT TYPE, 2019-2028 (USD MILLION)

TABLE 104 MEXICO AUTOMOTIVE AND TRANSPORTATION IN HANDHELD SPECTRUM ANALYZER MARKET, BY PRODUCT TYPE, 2019-2028 (USD MILLION)

TABLE 105 MEXICO MEDICAL AND HEALTHCARE IN HANDHELD SPECTRUM ANALYZER MARKET, BY PRODUCT TYPE, 2019-2028 (USD MILLION)

TABLE 106 MEXICO GOVERNMENT SECTOR IN HANDHELD SPECTRUM ANALYZER MARKET, BY PRODUCT TYPE, 2019-2028 (USD MILLION)

TABLE 107 MEXICO EDUCATIONAL INSTITUTIONS IN HANDHELD SPECTRUM ANALYZER MARKET, BY PRODUCT TYPE, 2019-2028 (USD MILLION)

TABLE 108 MEXICO OTHERS IN HANDHELD SPECTRUM ANALYZER MARKET, BY PRODUCT TYPE, 2019-2028 (USD MILLION)

그림 목록

LIST OF FIGURES

FIGURE 1 NORTH AMERICA HANDHELD SPECTRUM ANALYZER MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA HANDHELD SPECTRUM ANALYZER MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA HANDHELD SPECTRUM ANALYZER MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA HANDHELD SPECTRUM ANALYZER MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA HANDHELD SPECTRUM ANALYZER MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA HANDHELD SPECTRUM ANALYZER MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA HANDHELD SPECTRUM ANALYZER MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA HANDHELD SPECTRUM ANALYZER MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 NORTH AMERICA HANDHELD SPECTRUM ANALYZER MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 10 NORTH AMERICA HANDHELD SPECTRUM ANALYZER MARKET: SEGMENTATION

FIGURE 11 INCREASING ADOPTION OF PORTABLE AND HANDHELD SPECTRUM ANALYZERS FOR MEASUREMENT ACROSS VARIOUS SECTORS IS EXPECTED TO DRIVE THE NORTH AMERICA HANDHELD SPECTRUM ANALYZER MARKET IN THE FORECAST PERIOD OF 2021 TO 2028

FIGURE 12 SWEPT-TUNED SPECTRUM ANALYZER SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF NORTH AMERICA HANDHELD SPECTRUM ANALYZER MARKET IN 2021 & 2028

FIGURE 13 ASIA PACIFIC IS EXPECTED TO DOMINATE AND IT IS THE FASTEST GROWING REGION IN THE NORTH AMERICA HANDHELD SPECTRUM ANALYZER MARKET IN THE FORECAST PERIOD OF 2021 TO 2028

FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF HANDHELD SPECTRUM ANALYZER MARKET

FIGURE 15 NORTH AMERICA HANDHELD SPECTRUM ANALYZER MARKET, BY PRODUCT TYPE, 2020

FIGURE 16 NORTH AMERICA HANDHELD SPECTRUM ANALYZER MARKET, BY FREQUENCY TYPE, 2020

FIGURE 17 NORTH AMERICA HANDHELD SPECTRUM ANALYZER MARKET, BY SIZE, 2020

FIGURE 18 NORTH AMERICA HANDHELD SPECTRUM ANALYZER MARKET, BY POWER SOURCE, 2020

FIGURE 19 NORTH AMERICA HANDHELD SPECTRUM ANALYZER MARKET, BY NETWORK TECHNOLOGY, 2020

FIGURE 20 NORTH AMERICA HANDHELD SPECTRUM ANALYZER MARKET, BY END USE, 2020

FIGURE 21 NORTH AMERICA HANDHELD SPECTRUM ANALYZER MARKET: SNAPSHOT (2020)

FIGURE 22 NORTH AMERICA HANDHELD SPECTRUM ANALYZER MARKET: BY COUNTRY (2020)

FIGURE 23 NORTH AMERICA HANDHELD SPECTRUM ANALYZER MARKET: BY COUNTRY (2021 & 2028)

FIGURE 24 NORTH AMERICA HANDHELD SPECTRUM ANALYZER MARKET: BY COUNTRY (2020 & 2028)

FIGURE 25 NORTH AMERICA HANDHELD SPECTRUM ANALYZER MARKET: BY PRODUCT TYPE (2021-2028)

FIGURE 26 NORTH AMERICA HANDHELD SPECTRUM ANALYZER MARKET: COMPANY SHARE 2020 (%)

연구 방법론

데이터 수집 및 기준 연도 분석은 대규모 샘플 크기의 데이터 수집 모듈을 사용하여 수행됩니다. 이 단계에는 다양한 소스와 전략을 통해 시장 정보 또는 관련 데이터를 얻는 것이 포함됩니다. 여기에는 과거에 수집한 모든 데이터를 미리 검토하고 계획하는 것이 포함됩니다. 또한 다양한 정보 소스에서 발견되는 정보 불일치를 검토하는 것도 포함됩니다. 시장 데이터는 시장 통계 및 일관된 모델을 사용하여 분석하고 추정합니다. 또한 시장 점유율 분석 및 주요 추세 분석은 시장 보고서의 주요 성공 요인입니다. 자세한 내용은 분석가에게 전화를 요청하거나 문의 사항을 드롭하세요.

DBMR 연구팀에서 사용하는 주요 연구 방법론은 데이터 마이닝, 시장에 대한 데이터 변수의 영향 분석 및 주요(산업 전문가) 검증을 포함하는 데이터 삼각 측량입니다. 데이터 모델에는 공급업체 포지셔닝 그리드, 시장 타임라인 분석, 시장 개요 및 가이드, 회사 포지셔닝 그리드, 특허 분석, 가격 분석, 회사 시장 점유율 분석, 측정 기준, 글로벌 대 지역 및 공급업체 점유율 분석이 포함됩니다. 연구 방법론에 대해 자세히 알아보려면 문의를 통해 업계 전문가에게 문의하세요.

사용자 정의 가능

Data Bridge Market Research는 고급 형성 연구 분야의 선두 주자입니다. 저희는 기존 및 신규 고객에게 목표에 맞는 데이터와 분석을 제공하는 데 자부심을 느낍니다. 보고서는 추가 국가에 대한 시장 이해(국가 목록 요청), 임상 시험 결과 데이터, 문헌 검토, 재생 시장 및 제품 기반 분석을 포함하도록 사용자 정의할 수 있습니다. 기술 기반 분석에서 시장 포트폴리오 전략에 이르기까지 타겟 경쟁업체의 시장 분석을 분석할 수 있습니다. 귀하가 원하는 형식과 데이터 스타일로 필요한 만큼 많은 경쟁자를 추가할 수 있습니다. 저희 분석가 팀은 또한 원시 엑셀 파일 피벗 테이블(팩트북)로 데이터를 제공하거나 보고서에서 사용 가능한 데이터 세트에서 프레젠테이션을 만드는 데 도움을 줄 수 있습니다.