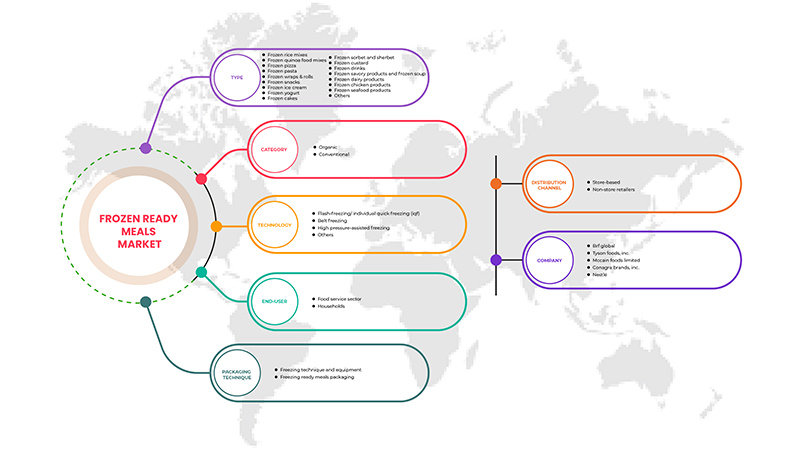

Europe Frozen Ready Meals Market, By Type (Frozen Rice Mixes, Frozen Quinoa Food Mixes, Frozen Pizza, Frozen Pasta, Frozen Wraps & Rolls, Frozen SnacksFrozen Ice CreamFrozen Yogurt, Frozen Cakes, Frozen Sorbet And Sherbet, Frozen Custard, Frozen Drinks, Frozen Savory Products And Frozen Soup, Frozen Dairy Products, Frozen Chicken Products, Frozen Seafood Products, And Others), Category(Organic And Conventional) Technology (Flash-Freezing/ Individual Quick Freezing (IQF), Belt Freezing, High Pressure-Assisted Freezing, And Others), End User (Food Service Sector And Households), Packaging Technique (Freezing Technique And Equipment And Freezing Ready Meals Packaging And Distribution Channel (Store-Based And Non-Store Retailers) - Industry Trends and Forecast to 2029.

Europe Frozen Ready Meals Market Analysis and Insights

Europe frozen ready meals market is growing faster, owing to the busy lifestyles of consumers. The growing number of individuals altering their eating habits and embracing a balanced nutritional diet and active lifestyle is a major element driving the growth of the frozen-ready meals industry. People worldwide have hectic lifestyles and thus prefer ready meals to save energy and time, which benefits the market's growth. However, high prices of frozen ready meals may hamper the market's growth.

Various companies are making strategic decisions, such as launching innovative frozen-ready meal foods and acquiring other companies to improve their market share. As a result, the global frozen-ready meals market is growing rapidly. The rising consumption of frozen chicken, beef, and seafood will open new opportunities for the global market. In contrast, competition among market players may challenge the market's growth.

Various companies are making strategic decisions, such as launching innovative frozen-ready meal foods and acquiring other companies to improve their market share. As a result, the global frozen-ready meals market is growing rapidly. The rising consumption of frozen chicken, beef, and seafood will open new opportunities for the global market. In contrast, competition among market players may challenge the market's growth.

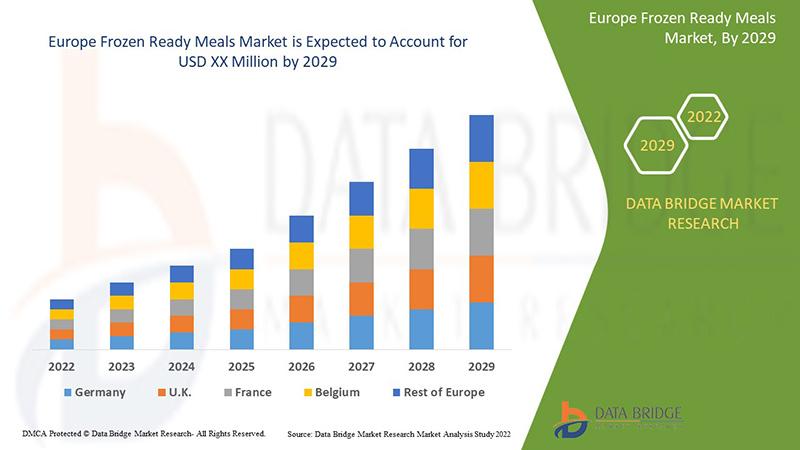

Data Bridge Market Research analyses that the Europe frozen ready meals market will grow at a CAGR of 5.6% during the forecast period of 2022 to 2029.

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Years |

2020 (Customizable to 2019- 2015) |

|

Quantitative Units |

Revenue in USD Million |

|

Segments Covered |

유형별(냉동쌀 믹스, 냉동퀴노아 식품 믹스, 냉동피자, 냉동파스타, 냉동랩 및 롤, 냉동 스낵 , 냉동아이스크림 , 냉동요거트 , 냉동케이크, 냉동샤베트 및 셔벗, 냉동커스타드, 냉동음료, 냉동짭짤한 음식 및 냉동수프, 냉동유제품, 냉동닭고기 제품 , 냉동해산물 제품 및 기타), 범주별(유기농 및 재래식) 기술(플래시 냉동/ 개별 급속 냉동(IQF) , 벨트 냉동, 고압 보조 냉동 및 기타), 최종 사용자(식품 서비스 부문 및 가정), 포장 기술(냉동 기술 및 장비 및 냉동 레디밀 포장 및 유통 채널(매장형 및 비매장형 소매업체)) |

|

적용 지역 |

독일, 영국, 프랑스, 이탈리아, 스페인, 스웨덴, 벨기에, 네덜란드, 덴마크, 스위스, 러시아, 폴란드, 터키, 유럽의 나머지 지역 |

|

시장 참여자 포함 |

McCain Foods Limited, Nestlé, Tyson Foods, Inc., BRF Global, General Mills Inc., JBS S/A, Nomad Foods, The Kraft Heinz Company, Dr. Oetker, Kellogg Co., Ajinomoto Co., Inc., McCain Foods Limited, Virto Group |

시장 정의

냉동식품은 일반적으로 공장에서 조리하고 포장합니다. 이 과정에는 재료를 가열하여 용기에 포장하는 과정이 포함됩니다. 식사를 준비하고 냉동고에 넣어 식힌 후 다양한 메뉴를 제공하고 준비하기 편리하기 때문에 소비자에게 인기가 있습니다. 냉동식품에는 육류 메인 요리, 야채, 파스타와 소스와 같은 전분 기반 식품이 포함될 수 있습니다. 일부 냉동식품은 채식주의자나 특정 식단이 필요한 개인을 위해 특별히 준비됩니다. 이러한 제품을 제조하려면 식품 가공업체의 세심한 주의가 필요합니다.

유럽 냉동 인스턴트 밀 시장 동향

운전자

- 바로 먹을 수 있는 유기농 식품에 대한 선호도 증가

최근 몇 년 동안, 즉석식품은 글로벌 즉석식품 사업에서 가장 다양한 부문 중 하나로 발전했습니다. 편의성 패턴의 성장과 유기농 식사에 대한 수요 증가로 인해 유기농 냉동 포장 식사에 대한 수요가 증가했습니다. 유기농 냉동 식품 및 음료 부문은 이동 중인 소비자를 위한 또 다른 중간 기착지로, 냉동 과자에서 애피타이저와 식사에 이르기까지 모든 것을 제공합니다. 유기농 냉동 즉석식품은 미생물 및 곰팡이 오염이 없기 때문에 소비자에게 인기가 있습니다. 또한 유기농 냉동 즉석식품이 제공하는 영양 및 건강상의 이점으로 인해 시장 수요가 증가했습니다. 따라서 건강과 맛을 추구하는 더 많은 소비자에게 어필하기 위해 냉동 포장 식품 제조업체도 영양상의 이점을 맛과 통합하여 글로벌 냉동 즉석식품 시장이 성장하고 있습니다. 식물성, 비건 제품에 대한 소비자 선호도가 변화함에 따라 유기농, 편리한 식품에 대한 길이 열리고 있으며, 그 결과 글로벌 시장에서 냉동 즉석식품에 대한 수요가 증가하고 있습니다.

따라서 영양상의 이점이 있는 유기농 냉동식품과 편리하게 구할 수 있는 바로 조리하거나 바로 먹을 수 있는 냉동식품에 대한 수요가 증가하면서 예상 기간 동안 냉동 즉석식품 시장이 성장할 것입니다.

- 소비자들의 생활양식과 식습관의 변화

빠르게 움직이는 이동 세계에서 인구의 절반은 소비자가 식사 준비에 시간과 노력을 절약하는 데 도움이 되는 편의 식품을 선호합니다. 빠르고 바쁜 삶으로 인해 소비자의 소비 패턴이 생식품에서 편의 식품으로 전환되고 있습니다. 또한 급속한 도시화와 사람들의 라이프스타일 변화로 인해 냉동 인스턴트 푸드에 대한 수요가 증가하고 있습니다. 소비자의 소비 패턴이 끊임없이 진화함에 따라 소비자의 건강 의식이 확대되고 도시 라이프스타일이 증가함에 따라 편의 식품이 전 세계적으로 상당히 성장했습니다. 그와 함께 소비자는 시간이 부족하고 업무량이 늘어나 식사 패턴을 다양화하는 빠르게 움직이는 기업 설정으로 이동하고 있습니다. 냉동 인스턴트 푸드는 요리하기 쉽고 쉽게 구할 수 있으며 저렴하고 접근성이 뛰어나 소비자의 일상적인 영양 요구를 충족시키는 스마트 솔루션입니다. 소비자의 건강과 웰빙에 대한 인식이 높아짐에 따라 건강한 라이프스타일 채택이 가속화되고 긍정적인 라이프스타일에 대한 수용이 증가하고 영양소가 보존된 건강한 냉동식품을 섭취하면서 유럽 냉동 인스턴트 푸드 시장이 발전하고 있습니다.

또한 가처분 소득의 증가는 가정의 편의 식품 수요에도 영향을 미치고 있습니다. 전 세계적으로 패스트푸드 레스토랑의 수가 빠르게 증가하면서 편의 식품에 대한 수요가 증가하고 있습니다. 결과적으로 편의 식품의 소비가 증가함에 따라 냉동 식품 제품에 대한 수요가 증가합니다. 결과적으로 냉동 식품의 성장이 개선되고 유럽의 냉동 즉석식품 시장이 주도되고 있습니다.

기회

-

아미노산 제조업체가 취하는 이니셔티브의 증가

제품 출시, 확장, 자금 조달 등과 같은 제조업체가 냉동 인스턴트 푸드를 위해 취하는 이니셔티브의 수가 증가하면 글로벌 냉동 인스턴트 푸드 시장 성장에 큰 기회가 생길 것입니다. 바쁜 일정, 가처분 소득 증가, 요리 시간을 절약하기 위한 인스턴트 푸드 제품에 대한 수요 증가로 인해 소비자 사이에서 냉동 인스턴트 푸드에 대한 수요가 증가하고 있습니다. 소비자의 냉동 인스턴트 푸드에 대한 수요 증가로 제조업체는 시장에 신제품을 출시하고, 제조 시설을 확장하고, 다양한 최종 사용자를 위한 다양한 냉동 인스턴트 푸드 제품을 제조하기 위한 투자를 늘릴 수 있습니다.

예를 들어,

-

2022년 4월, Nomad Foods는 파트너가 혁신적인 솔루션을 공유하도록 초대하는 오픈 혁신 포털을 출시했습니다. 새로운 포털 출시를 통해 회사는 냉동 홍합 및 기타 이매패류 제품의 확장성을 높이는 데 도움이 되었습니다.

따라서 냉동 인스턴트 식품 출시 수의 증가, 냉동 식품 사업을 확대하기 위한 확장 및 투자와 제조업체의 기타 이니셔티브와 더불어 소비자와 식품 서비스 부문에서 냉동 인스턴트 식품에 대한 수요 증가는 전 세계 시장에서 냉동 인스턴트 식품 제조업체에게 엄청난 기회를 창출할 것으로 예상됩니다.

제약/도전

- 시장 참여자들 간의 치열한 경쟁

기존 시장 참여자들 간의 치열한 경쟁은 시장에 진출하고자 하는 신규 참여자들에게 상당한 도전이 되고 있는데, 여러 참여자들이 최종 사용자의 수요를 충족시키기 위해 고품질의 다양한 냉동 인스턴트 푸드 제품을 제공하고 있기 때문이다. Nestlé, General Mills Inc., Conagra Brands, Inc., The Kraft Heinz Company, Nomad Foods, JBS S/A 등과 같은 시장의 기존 참여자들은 다양한 냉동 인스턴트 푸드 제품을 제공하고 있으며, 끊임없이 고품질의 신제품을 출시하고 있기 때문에 시장에서 큰 경쟁이 벌어지고 있다. 게다가, 지역 참여자들과 소규모 제조업체들은 낮은 가격으로 품질이 낮은 제품을 제공하고 있어, 글로벌 냉동 인스턴트 푸드 시장에 영향을 미치고 있다. 게다가, 광범위한 냉동 인스턴트 푸드를 제공하는 제조업체들이 늘어나면서 시장의 다른 참여자들과의 치열한 경쟁이 벌어질 것이다.

고품질 냉동 인스턴트 푸드를 제공하는 업체가 늘어나는 것은 글로벌 냉동 인스턴트 푸드 시장의 신규 업체에게 큰 과제입니다. 게다가 냉동 파스타, 피자, 닭고기 제품, 해산물 제품 등 광범위한 제품을 제공하는 주요 업체가 다수 존재하여 소비자의 수요에 부응하면 소규모 제조업체나 지역 업체 또는 신규 진입업체가 시장에서 성장하기 어려울 것입니다.

- 냉동 인스턴트 식품에 지방이 존재함

심장병과 동맥 막힘과 관련이 있는 트랜스 지방은 포장 또는 냉동 식품에서 발견됩니다. 이 지질은 나쁜 콜레스테롤(LDL)을 높이는 반면 좋은 콜레스테롤(HDL)을 낮춥니다. 이 모든 것이 심장병을 악화시킵니다. 이러한 식품은 또한 나트륨이 많아 신체의 콜레스테롤 수치를 높일 수 있습니다. 또한 냉동 식품은 지방이 엄청나게 많습니다. 이러한 식품은 지방 대 탄수화물 대 단백질 비율이 거의 두 배나 되므로 건강을 의식하는 소비자 사이에서 냉동 식품에 대한 수요가 제한되는 칼로리가 높은 이유를 설명합니다.

게다가 냉동식품은 소금 수치가 높기 때문에 혈압을 높일 수 있습니다. 과도한 소금 섭취는 뇌졸중과 심장병과 같은 다양한 의학적 장애의 위험도 높입니다. 점점 더 많은 사람들이 냉동식품의 이러한 효과에 대해 알게 되면서 냉동식품보다 신선한 음식을 선호하게 되어 냉동 인스턴트 식품 시장 성장을 방해하고 있습니다.

따라서 앞서 언급한 대로 대부분의 냉동 인스턴트 푸드에 함유된 과도하고 건강에 해로운 지방은 글로벌 냉동 인스턴트 푸드 시장 성장을 저해하는 요인으로 작용할 수 있습니다.

코로나19 이후 유럽 냉동 인스턴트 밀 시장에 미치는 영향

팬데믹 이후, 이동에 제한이 없기 때문에 냉동 식품에 대한 수요가 증가했습니다. 따라서 제품 공급이 쉬울 것입니다. COVID-19가 장기간 지속되면서 공급망이 중단되면서 영향을 받았고, 소비자에게 식품을 공급하기 어려워져 처음에는 제품 수요가 증가했습니다. 그러나 COVID 이후, 냉동 식품의 유통기한이 길어져 냉동 식품에 대한 수요가 크게 증가하여 편의 식품에 대한 수요가 증가했습니다.

최근 개발 사항

- 2022년 4월, Nomad Foods는 파트너가 혁신적인 솔루션을 공유하도록 초대하는 오픈 혁신 포털을 출시했습니다. 새로운 포털 출시를 통해 회사는 냉동 홍합 및 기타 이매패류 제품의 확장성을 높이는 데 도움이 되었습니다.

- 2020년 7월, 타이슨푸드는 유럽 푸드서비스 산업에 타이슨 브랜드로 새로운 닭고기 제품 라인을 출시했습니다. 여기에는 레스토랑, 카페테리아, 케이터링이 포함됩니다. 이를 통해 회사는 푸드서비스 산업에서 수익을 늘리는 데 도움이 되었습니다.

유럽 냉동 인스턴트 밀 시장 범위

유럽 냉동 인스턴트 식품 시장은 유형, 범주, 기술, 최종 사용자, 포장 기술 및 유통 채널을 기준으로 6개 부문으로 구분됩니다.

이들 세그먼트의 성장은 업계의 주요 성장 세그먼트를 분석하고 사용자에게 귀중한 시장 개요와 시장 통찰력을 제공하여 핵심 시장 애플리케이션을 식별하기 위한 전략적 의사 결정을 내리는 데 도움이 됩니다.

유형

- 냉동 스낵

- 냉동 피자

- 냉동 아이스크림

- 냉동 해산물 제품

- 냉동 닭고기 제품

- 프로즌 요거트

- 냉동 유제품

- 냉동 파스타

- 냉동 음료

- 냉동 채식 식사

- 냉동 샤베트와 셔벗

- 냉동 케이크

- 냉동 랩 & 롤

- 냉동 커스타드

- 냉동 수프

- 냉동 퀴노아 식품 믹스

- 냉동 쌀 믹스

- 기타

글로벌 냉동 인스턴트 식품 시장은 유형을 기준으로 냉동 쌀 믹스, 냉동 퀴노아 식품 믹스, 냉동 피자, 냉동 파스타, 냉동 랩 및 롤, 냉동 스낵, 냉동 아이스크림, 냉동 요거트, 냉동 케이크, 냉동 샤르베트 및 셔벗, 냉동 커스타드, 냉동 음료, 냉동 짭짤한 음식 및 냉동 수프, 냉동 유제품, 냉동 닭고기 제품, 냉동 해산물 제품 등으로 구분됩니다.

범주

- 본질적인

- 전통적인

글로벌 냉동 인스턴트 식품 시장은 종류별로 유기농과 일반 식품으로 구분됩니다.

기술

- 급속냉동/ 개별 급속냉동(IQF)

- 벨트 동결

- 고압 지원 냉동

- 기타

기술을 기준으로 볼 때, 글로벌 냉동 인스턴트 푸드 시장은 급속 냉동/개별 급속 냉동(IQF), 벨트 냉동, 고압 보조 냉동 및 기타로 구분됩니다.

최종 사용자

- 가정/소매 부문

- 음식 서비스 부문

최종 사용자를 기준으로 볼 때, 글로벌 냉동 인스턴트 식품 시장은 식품 서비스 부문과 가정 부문으로 구분됩니다.

포장 기술

- 냉동 인스턴트 밀 포장

- 동결 기술 및 장비

포장 기술을 기준으로 볼 때, 글로벌 냉동 인스턴트 식품 시장은 냉동 기술 및 장비와 냉동 인스턴트 식품 포장으로 구분됩니다.

유통 채널

- 매장 기반 소매업체

- 비매장 소매업체

유통 채널을 기준으로 볼 때, 글로벌 냉동 인스턴트 식품 시장은 매장형 소매업체와 무매장 소매업체로 구분됩니다.

유럽 냉동 인스턴트 밀 시장 지역 분석/통찰력

유럽 냉동 인스턴트 식품 시장을 분석하고, 위에 참조된 내용을 바탕으로 시장 규모에 대한 통찰력과 추세를 제공합니다.

유럽 냉동 인스턴트 식품 시장 보고서에서 다루는 국가는 독일, 영국, 프랑스, 이탈리아, 스페인, 스웨덴, 벨기에, 네덜란드, 덴마크, 스위스, 러시아, 폴란드, 터키, 기타 유럽 국가입니다.

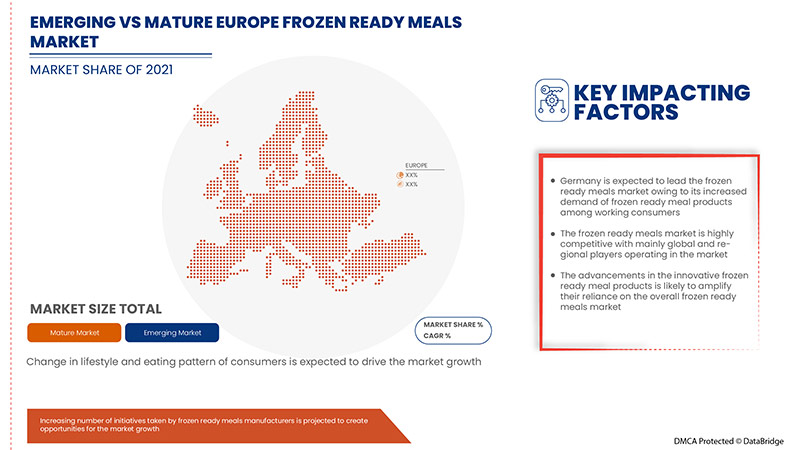

독일은 시장 점유율과 시장 수익 측면에서 유럽 냉동 즉석식품 시장을 지배하고 있습니다. 그러나 영국은 예측 기간 동안 가장 높은 성장률을 기록할 것입니다. 이는 식품 서비스 산업의 산업화와 국가의 경제 성장 때문입니다. 유럽 지역의 편의성과 즉석식품에 대한 수요가 증가하면서 이 지역의 냉동 즉석식품 시장이 활성화되고 있습니다.

보고서의 국가 섹션은 또한 현재 및 미래 시장 추세에 영향을 미치는 개별 시장 영향 요인과 시장 규정의 변화를 제공합니다. 신규 및 교체 판매, 국가 인구 통계, 질병 역학 및 수출입 관세와 같은 데이터 포인트는 개별 국가의 시장 시나리오를 예측하는 데 사용되는 주요 포인터 중 일부입니다. 또한 유럽 브랜드의 존재 및 가용성, 국내 및 국내 브랜드와의 치열한 경쟁으로 인해 직면한 과제, 판매 채널의 영향이 국가 데이터에 대한 예측 분석을 제공하는 동안 고려됩니다.

경쟁 환경 및 유럽 냉동 인스턴트 밀 시장 점유율 분석

경쟁적인 유럽 냉동 인스턴트 푸드 시장은 경쟁자들을 자세히 설명합니다. 포함된 세부 정보는 회사 개요, 회사 재무, 창출된 수익, 시장 잠재력, 연구 개발 투자, 새로운 시장 이니셔티브, 유럽의 입지, 생산 현장 및 시설, 생산 용량, 회사의 강점과 약점, 제품 출시, 제품 폭과 범위, 그리고 응용 프로그램 우세입니다. 위의 데이터 포인트는 유럽 냉동 인스턴트 푸드 시장에 대한 회사의 초점에만 관련이 있습니다.

유럽 냉동 인스턴트 식품 시장의 주요 기업으로는 McCain Foods Limited, Nestlé, Tyson Foods, Inc., BRF Global, General Mills Inc., JBS S/A, Nomad Foods, The Kraft Heinz Company, Dr. Oetker, Kellogg Co., Ajinomoto Co., Inc., McCain Foods Limited, Virto Group 등이 있습니다.

연구 방법론

Data collection and base year analysis are done using data collection modules with large sample sizes. The market data is analyzed and estimated using market statistical and coherent models. In addition, market share analysis and key trend analysis are the major success factors in the market report. The key research methodology used by the DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market, and primary (industry expert) validation. Apart from this, data models include Vendor Positioning grids, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Company Market Share Analysis, Standards of Measurement, Global Vs Regional, and Vendor Share Analysis. Please request an analyst call in case of further inquiry.

SKU-

세계 최초의 시장 정보 클라우드 보고서에 온라인으로 접속하세요

- 대화형 데이터 분석 대시보드

- 높은 성장 잠재력 기회를 위한 회사 분석 대시보드

- 사용자 정의 및 질의를 위한 리서치 분석가 액세스

- 대화형 대시보드를 통한 경쟁자 분석

- 최신 뉴스, 업데이트 및 추세 분석

- 포괄적인 경쟁자 추적을 위한 벤치마크 분석의 힘 활용

목차

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF EUROPE FROZEN READY MEALS MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 TYPE LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 BRAND COMPARATIVE ANALYSIS

4.2 CONSUMER DISPOSABLE INCOME DYNAMICS/SPEND DYNAMICS

4.2.1 OVERVIEW

4.2.2 SOCIAL FACTORS

4.2.3 CULTURAL FACTORS

4.2.4 PSYCHOLOGICAL FACTORS

4.2.5 PERSONAL FACTORS

4.2.6 ECONOMIC FACTORS

4.2.7 PRODUCT TRAITS

4.2.8 MARKET ATTRIBUTES

4.2.9 CONSUMERS DISPOSABLE INCOME/SPEND DYNAMICS

4.2.10 CONCLUSION

4.3 CONSUMER TYPE AND THEIR BUYING PERCEPTIONS

4.3.1 OVERVIEW

4.3.2 MILLENNIALS

4.3.3 GEN X

4.3.4 BABY BOOMERS

4.4 FACTORS INFLUENCING PURCHASE DECISION

4.4.1 PRICING OF FROZEN READY MEALS PRODUCTS

4.4.2 CERTIFIED FROZEN READY MEALS PRODUCTS

4.4.3 QUALITY OF READY MEAL PRODUCTS

4.5 PRICING ANALYSIS FOR FROZEN READY MEALS MARKET

4.6 EXPORT & IMPORT ANALYSIS

4.7 LABELING AND CLAIMS

4.7.1 UNITED NATIONS ENVIRONMENT PROGRAMME SALE OF FROZEN FOODS REGULATIONS

4.7.2 DIRECTIVE 89/108/EEC ON QUICK-FROZEN FOODSTUFFS FOR HUMAN CONSUMPTION

4.7.3 FOOD CLAIMS ON LABELS – THE EUROPEAN PERSPECTIVE

4.8 LIST OF TOP EXPORTING COMPANIES OF EUROPE FROZEN READY MEALS MARKET

4.9 LIST OF TOP IMPORTING COMPANIES FOR FROZEN READY MEALS MARKET

4.1 MARKET TRENDS

4.11 NEW PRODUCT LAUNCH STRATEGY

4.11.1 OVERVIEW

4.11.2 NUMBER OF PRODUCT LAUNCHES

4.11.2.1 LINE EXTENSION

4.11.2.2 NEW PACKAGING

4.11.2.3 RELAUNCHED

4.11.2.4 NEW FORMULATION

4.11.3 DIFFERENTIAL PRODUCT OFFERING

4.11.4 MEETING CONSUMER REQUIREMENT

4.11.5 PACKAGE DESIGNING

4.11.6 PRICING ANALYSIS

4.11.7 PRODUCT POSITIONING

4.11.8 CONCLUSION

4.12 BRAND LABEL

4.13 PROMOTIONAL ACTIVITIES

4.14 SHOPPING BEHAVIOUR AND DYNAMICS

4.14.1 RECOMMENDATIONS FROM FAMILY & FRIENDS-

4.14.2 RESEARCH

4.14.3 IMPULSIVE

4.14.4 ADVERTISEMENT

4.14.5 TELEVISION ADVERTISEMENT

4.14.6 ONLINE ADVERTISEMENT

4.14.7 IN-STORE ADVERTISEMENT

4.14.8 OUTDOOR ADVERTISEMENT

4.15 SUPPLY CHAIN ANALYSIS

4.15.1 RAW MATERIAL PROCUREMENT

4.15.2 MANUFACTURING PROCESS

4.15.3 INDIVIDUAL QUICK FREEZER

4.15.4 INSPECTION OF FROZEN FOOD

4.15.5 PACKING OF FROZEN FOOD

4.15.6 AUTOMATIC PACKAGING UNIT

4.15.7 MARKETING AND DISTRIBUTION

4.15.8 END-USERS

5 REGULATORY FRAMEWORK

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 INCREASED USE OF FROZEN FOOD IN THE FOOD SERVICE INDUSTRY

6.1.2 RISING PREFERENCE FOR READY-TO-EAT ORGANIC FOODS

6.1.3 EXPANSIONS OF CONVENIENCE STORES

6.1.4 CHANGE IN LIFESTYLE AND EATING PATTERN OF CONSUMERS

6.2 RESTRAINTS

6.2.1 PRESENCE OF FATS IN FROZEN READY MEALS

6.2.2 LACK OF COLD CHAIN INFRASTRUCTURE

6.2.3 LIMITED SELF-LIFE OF FROZEN FOOD

6.3 OPPORTUNITIES

6.3.1 DIGITALIZATION OF THE RETAIL INDUSTRY

6.3.2 INCREASING NUMBER OF INITIATIVES TAKEN BY FROZEN READY MEALS MANUFACTURERS

6.4 CHALLENGES

6.4.1 HIGH COMPETITION AMONG THE MARKET PLAYERS

6.4.2 RISING PREFERENCE FOR FRESH AND NATURAL FOOD PRODUCTS

7 EUROPE FROZEN READY MEALS MARKET, BY TYPE

7.1 OVERVIEW

7.2 FROZEN SNACKS

7.2.1 FRENCH FRIES

7.2.2 NUGGETS

7.2.3 BITES

7.2.4 WEDGES

7.2.5 OTHERS

7.3 FROZEN PIZZA

7.3.1 FROZEN VEG PIZZA

7.3.1.1 WITH CHEESE

7.3.1.2 WITHOUT CHEESE

7.3.2 FROZEN NON-VEG PIZZA

7.3.2.1 FROZEN NON-VEG PIZZA, BY MEAT TYPE

7.3.2.1.1 PEPPERONI PIZZA

7.3.2.1.2 CHICKEN PIZZA

7.3.2.1.3 BEEF PIZZA

7.3.2.1.4 OTHERS

7.3.2.2 FROZEN NON-VEG PIZZA, BY BASE TYPE

7.3.2.2.1 WITH CHEESE

7.3.2.2.2 WITHOUT CHEESE

7.4 FROZEN ICE CREAM

7.4.1 FROZEN SOFT SERVE

7.4.2 FROZEN GELATO

7.4.3 OTHERS

7.5 FROZEN SEAFOOD PRODUCTS

7.5.1 FROZEN FISH FILLETS

7.5.2 FROZEN SHRIMP POPCORN

7.5.3 FROZEN FISH NUGGETS

7.5.4 FROZEN FISH BITES

7.5.5 OTHERS

7.6 FROZEN CHICKEN PRODUCTS

7.6.1 FROZEN CHICKEN NUGGETS

7.6.2 FROZEN CHICKEN STRIPS

7.6.3 FROZEN CHICKEN BITES

7.6.4 FROZEN CHICKEN WINGS

7.6.5 FROZEN CHICKEN POPCORN

7.6.6 OTHERS

7.7 FROZEN YOGHURT

7.7.1 LOW FAT

7.7.2 FAT FREE

7.7.3 FULL FAT

7.8 FROZEN DAIRY PRODUCTS

7.8.1 FROZEN DAIRY PRODUCTS, BY SOURCE

7.8.1.1 ANIMAL-BASED DAIRY

7.8.1.2 PLANT-BASED DAIRY

7.8.1.2.1 ALMOND MILK

7.8.1.2.2 SOY MILK

7.8.1.2.3 COCONUT MILK

7.8.1.2.4 OAT MILK

7.8.1.2.5 OTHERS

7.8.2 FROZEN DAIRY PRODUCTS, BY FLAVOR

7.8.2.1 REGULAR

7.8.2.2 FLAVOR

7.8.2.2.1 CHOCOLATES

7.8.2.2.2 VANILLA

7.8.2.2.3 STRAWBERRY

7.8.2.2.4 CARAMEL

7.8.2.2.5 BLACKBERRY

7.8.2.2.6 NUTS

7.8.2.2.7 BUTTERSCOTCH

7.8.2.2.8 PEPPERMINT

7.8.2.2.9 MOCHA

7.8.2.2.10 BLUEBERRY

7.8.2.2.11 BANANA

7.8.2.2.12 CHERRY

7.8.2.2.13 PEACH

7.8.2.2.14 AMARETTO

7.8.2.2.15 POMEGRANATE

7.8.2.2.16 PUMPKIN

7.8.2.2.17 COTTON CANDY

7.8.2.2.18 ORCHARD CHERRY

7.8.2.2.19 COCONUT

7.8.2.2.20 HONEY

7.8.2.2.21 HERBAL

7.8.2.2.22 OTHERS

7.9 FROZEN PASTA

7.9.1 SPAGHETTI

7.9.2 PENNE

7.9.3 RAVIOLI

7.9.4 MACARONI / MACCHERONI / ELBOW

7.9.5 LASAGNA

7.9.6 FETTUCCINE

7.9.7 GNOCCHI

7.9.8 OTHERS

7.1 FROZEN DRINKS

7.11 FROZEN VEGETARIAN MEALS

7.11.1 POWER BOWL

7.11.2 BUDDHA BOWL

7.11.3 SOUP BOWL

7.11.4 CURRY BOWL

7.12 FROZEN SORBET AND SHERBET

7.13 FROZEN CAKES

7.13.1 FLAVORED CAKES

7.13.2 PLUM CAKES

7.13.3 SPONGE CAKES

7.13.4 CHEESE CAKES

7.13.5 CUP CAKES

7.13.6 OTHERS

7.14 FROZEN WRAPS & ROLLS

7.14.1 FROZEN VEG WRAPS & ROLLS

7.14.2 FROZEN NON-VEG WRAPS & ROLLS

7.15 FROZEN CUSTARD

7.16 FROZEN SOUP

7.17 FROZEN QUINOA FOOD MIXES

7.17.1 QUINOA WITH VEGETABLES

7.17.2 QUINOA WITH CHICKEN

7.17.3 QUINOA WITH PORK

7.17.4 QUINOA WITH SEAFOOD

7.17.5 OTHERS

7.18 FROZEN RICE MIXES

7.18.1 FROZEN RICE MIXES, BY TYPE

7.18.1.1 WHITE RICE

7.18.1.2 BROWN RICE

7.18.1.3 BLACK RICE

7.18.1.4 WILD RICE

7.18.1.5 OTHERS

7.18.2 FROZEN RICE MIXES, BY RICE MIX CATEGORY

7.18.2.1 RICE WITH CHICKEN

7.18.2.1.1 WHITE RICE

7.18.2.1.2 BROWN RICE

7.18.2.1.3 BLACK RICE

7.18.2.1.4 WILD RICE

7.18.2.1.5 OTHERS

7.18.2.2 RICE WITH BEEF

7.18.2.2.1 WHITE RICE

7.18.2.2.2 BROWN RICE

7.18.2.2.3 BLACK RICE

7.18.2.2.4 WILD RICE

7.18.2.2.5 OTHERS

7.18.2.3 RICE WITH PORK

7.18.2.3.1 WHITE RICE

7.18.2.3.2 BROWN RICE

7.18.2.3.3 BLACK RICE

7.18.2.3.4 WILD RICE

7.18.2.3.5 OTHERS

7.18.2.4 RICE WITH SEAFOOD

7.18.2.4.1 WHITE RICE

7.18.2.4.2 BROWN RICE

7.18.2.4.3 BLACK RICE

7.18.2.4.4 WILD RICE

7.18.2.4.5 OTHERS

7.18.2.5 RICE WITH VEGETABLES

7.18.2.5.1 WHITE RICE

7.18.2.5.2 BROWN RICE

7.18.2.5.3 BLACK RICE

7.18.2.5.4 WILD RICE

7.18.2.5.5 OTHERS

7.18.2.6 OTHERS

7.19 OTHERS

8 EUROPE FROZEN READY MEALS MARKET, BY CATEGORY

8.1 OVERVIEW

8.2 ORGANIC

8.3 CONVENTIONAL

9 EUROPE FROZEN READY MEALS MARKET, BY PACKAGING TECHNIQUE

9.1 OVERVIEW

9.2 FROZEN READY MEALS PACKAGING

9.2.1 FROZEN READY MEALS PACKAGING, BY TYPE

9.2.1.1 OXYGEN SCAVENGERS

9.2.1.2 MOISTURE CONTROL

9.2.1.3 ANTIMICROBIALS

9.2.1.4 TIME TEMPERATURE INDICATORS

9.2.1.5 EDIBLE FILMS

9.3 FREEZING TECHNIQUE & EQUIPMENT

9.3.1 FREEZING TECHNIQUE & EQUIPMENT, BY TYPE

9.3.1.1 AIR BLAST FREEZERS

9.3.1.2 TUNNEL FREEZERS

9.3.1.3 BELT FREEZERS

9.3.1.4 CONTACT FREEZERS

10 EUROPE FROZEN READY MEALS MARKET, BY TECHNOLOGY

10.1 OVERVIEW

10.2 FLASH-FREEZING/ INDIVIDUAL QUICK FREEZING (IQF)

10.3 BELT FREEZING

10.4 HIGH PRESSURE-ASSISTED FREEZING

10.5 OTHERS

11 EUROPE FROZEN READY MEALS MARKET, BY END-USER

11.1 OVERVIEW

11.2 HOUSEHOLD/RETAIL SECTOR

11.3 FOOD SERVICE SECTOR

11.3.1 RESTAURANTS

11.3.2 QUICK SERVICE RESTAURANTS

11.3.3 DINING RESTAURANTS

11.3.4 GHOST RESTAURANTS (DELIVERY ONLY RESTAURANTS)

11.3.5 OTHERS

11.3.6 CAFES

11.3.7 HOTEL

11.3.8 OTHERS

12 EUROPE FROZEN READY MEALS MARKET, BY DISTRIBUTION CHANNEL

12.1 OVERVIEW

12.2 STORE BASED RETAILERS

12.2.1 GROCERY RETAILERS

12.2.2 SUPERMARKETS/HYPERMARKETS

12.2.3 FROZEN DAIRY PRODUCTS SHOPS/PARLORS

12.2.4 CONVENIENCE STORES

12.2.5 SPECIALTY STORES

12.2.6 WHOLESALERS

12.2.7 OTHERS

12.3 NON- STORE BASED RETAILERS

12.3.1 ONLINE RETAILERS

12.3.2 COMPANY WEBSITE

13 EUROPE FROZEN READY MEALS MARKET BY GEOGRAPHY

13.1 EUROPE

13.1.1 GERMANY

13.1.2 U.K

13.1.3 FRANCE

13.1.4 ITALY

13.1.5 SPAIN

13.1.6 SWEDEN

13.1.7 BELGIUM

13.1.8 NETHERLANDS

13.1.9 DENMARK

13.1.10 SWITZERLAND

13.1.11 RUSSIA

13.1.12 POLAND

13.1.13 TURKEY

13.1.14 REST OF EUROPE

14 COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: EUROPE

15 SWOT ANALYSIS

16 COMPANY PROFILE

16.1 BRF EUROPE

16.1.1 COMPANY SNAPSHOT

16.1.2 REVENUE ANALYSIS

16.1.3 COMPANY SHARE ANALYSIS

16.1.4 PRODUCT PORTFOLIO

16.1.5 RECENT DEVELOPMENTS

16.2 TYSON FOODS, INC.

16.2.1 COMPANY SNAPSHOT

16.2.2 REVENUE ANALYSIS

16.2.3 COMPANY SHARE ANALYSIS

16.2.4 PRODUCT PORTFOLIO

16.2.5 RECENT DEVELOPMENT

16.3 MCCAIN FOODS LIMITED

16.3.1 COMPANY SNAPSHOT

16.3.2 COMPANY SHARE ANALYSIS

16.3.3 PRODUCT PORTFOLIO

16.3.4 RECENT DEVELOPMENT

16.4 CONAGRA BRANDS, INC.

16.4.1 COMPANY SNAPSHOT

16.4.2 REVENUE ANALYSIS

16.4.3 COMPANY SHARE ANALYSIS

16.4.4 PRODUCT PORTFOLIO

16.4.5 RECENT DEVELOPMENTS

16.5 NESTLÉ

16.5.1 COMPANY SNAPSHOT

16.5.2 REVENUE ANALYSIS

16.5.3 COMPANY SHARE ANALYSIS

16.5.4 PRODUCT PORTFOLIO

16.5.5 RECENT DEVELOPMENT

16.6 ADVANCE PIERRE

16.6.1 COMPANY SNAPSHOT

16.6.2 PRODUCT PORTFOLIO

16.6.3 RECENT DEVELOPMENT

16.7 AJINOMOTO CO., INC.

16.7.1 COMPANY SNAPSHOT

16.7.2 REVENUE ANALYSIS

16.7.3 PRODUCT PORTFOLIO

16.7.4 RECENT DEVELOPMENTS

16.8 AL KABEER GROUP ME

16.8.1 COMPANY SNAPSHOT

16.8.2 PRODUCT PORTFOLIO

16.8.3 RECENT DEVELOPMENT

16.9 AMY’S KITCHEN

16.9.1 COMPANY SNAPSHOT

16.9.2 PRODUCT PORTFOLIO

16.9.3 RECENT DEVELOPMENT

16.1 DR. OETKER

16.10.1 COMPANY SNAPSHOT

16.10.2 PRODUCT PORTFOLIO

16.10.3 RECENT DEVELOPMENTS

16.11 GENERAL MILLS INC.

16.11.1 COMPANY SNAPSHOT

16.11.2 REVENUE ANALYSIS

16.11.3 PRODUCT PORTFOLIO

16.11.4 RECENT DEVELOPMENT

16.12 EUROPE FOOD INDUSTRIES LLC

16.12.1 COMPANY SNAPSHOT

16.12.2 PRODUCT PORTFOLIO

16.12.3 RECENT DEVELOPMENT

16.13 VIRTO GROUP

16.13.1 COMPANY SNAPSHOT

16.13.2 PRODUCT PORTFOLIO

16.13.3 RECENT DEVELOPMENT

16.14 GULF WEST COMPANY

16.14.1 COMPANY SNAPSHOT

16.14.2 PRODUCT PORTFOLIO

16.14.3 RECENT DEVELOPMENT

16.15 HAKAN AGRO DMCC

16.15.1 COMPANY SNAPSHOT

16.15.2 PRODUCT PORTFOLIO

16.15.3 RECENT DEVELOPMENT

16.16 JBS S/A

16.16.1 COMPANY SNAPSHOT

16.16.2 REVENUE ANALYSIS

16.16.3 PRODUCT PORTFOLIO

16.16.4 RECENT DEVELOPMENTS

16.17 KELLOGG CO. (2021)

16.17.1 COMPANY SNAPSHOT

16.17.2 REVENUE ANALYSIS

16.17.3 PRODUCT PORTFOLIO

16.17.4 RECENT DEVELOPMENT

16.18 MOSAIC FOODS

16.18.1 COMPANY SNAPSHOT

16.18.2 PRODUCT PORTFOLIO

16.18.3 RECENT DEVELOPMENT

16.19 NOMAD FOODS

16.19.1 COMPANY SNAPSHOT

16.19.2 REVENUE ANALYSIS

16.19.3 PRODUCT PORTFOLIO

16.19.4 RECENT DEVELOPMENTS

16.2 SAFCO INTERNATIONAL GEN. TRADING CO. L.L.C.

16.20.1 COMPANY SNAPSHOT

16.20.2 PRODUCT PORTFOLIO

16.20.3 RECENT DEVELOPMENT

16.21 SCHWAN'S HOME DELIVERY

16.21.1 COMPANY SNAPSHOT

16.21.2 PRODUCT PORTFOLIO

16.21.3 RECENT DEVELOPMENTS

16.22 SIDCO FOODS TRADING L.L.C.

16.22.1 COMPANY SNAPSHOT

16.22.2 PRODUCT PORTFOLIO

16.22.3 RECENT DEVELOPMENT

16.23 THE KRAFT HEINZ COMPANY

16.23.1 COMPANY SNAPSHOT

16.23.2 REVENUE ANALYSIS

16.23.3 PRODUCT PORTFOLIO

16.23.4 RECENT DEVELOPMENTS

16.24 WAWONA

16.24.1 COMPANY SNAPSHOT

16.24.2 PRODUCT PORTFOLIO

16.24.3 RECENT DEVELOPMENT

17 QUESTIONNAIRE:

18 RELATED REPORTS

표 목록

TABLE 1 EUROPE AVERAGE SELLING PRICES OF FROZEN READY MEALS:

TABLE 2 IMPORT OF FROZEN MEAT OF BOVINE ANIMALS (USD THOUSANDS)

TABLE 3 EXPORT OF FROZEN MEAT OF BOVINE ANIMALS (USD THOUSANDS)

TABLE 4 IMPORT OF CHILLED OR FROZEN MEAT OF SWINE (USD THOUSANDS)

TABLE 5 EXPORT OF FRESH, CHILLED OR FROZEN MEAT OF SWINE (USD THOUSANDS)

TABLE 6 IMPORT OF FRESH, CHILLED OR FROZEN MEAT OF SHEEP OR GOATS (USD THOUSANDS)

TABLE 7 EXPORT OF FRESH, CHILLED OR FROZEN MEAT OF SHEEP OR GOATS (USD THOUSANDS)

TABLE 8 IMPORT OF FROZEN CRABS (2020)

TABLE 9 EXPORT OF FROZEN CRABS (2020)

TABLE 10 IMPORT OF FROZEN VEGETABLES (2020)

TABLE 11 EXPORT OF FROZEN VEGETABLES (2020)

TABLE 12 IMPORT OF FROZEN EELS, WHOLE (2020)

TABLE 13 EXPORT OF FROZEN EELS, WHOLE (2020)

TABLE 14 IMPORT OF FROZEN FISH FILLETS (2020)

TABLE 15 EXPORT OF FROZEN FISH FILLETS (2020)

그림 목록

FIGURE 1 EUROPE FROZEN READY MEALS MARKET: SEGMENTATION

FIGURE 2 EUROPE FROZEN READY MEALS MARKET: DATA TRIANGULATION

FIGURE 3 EUROPE FROZEN READY MEALS MARKET: DROC ANALYSIS

FIGURE 4 EUROPE FROZEN READY MEALS MARKET: EUROPE VS REGIONAL MARKET ANALYSIS

FIGURE 5 EUROPE FROZEN READY MEALS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 EUROPE FROZEN READY MEALS FOOD MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 EUROPE FROZEN READY MEALS MARKET: DBMR MARKET POSITION GRID

FIGURE 8 EUROPE FROZEN READY MEALS MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 EUROPE FROZEN READY MEALS MARKET: SEGMENTATION

FIGURE 10 EUROPE IS EXPECTED TO DOMINATE THE EUROPE FROZEN READY MEALS MARKET AND GROW WITH THE HIGHEST CAGR IN THE FORECAST PERIOD

FIGURE 11 INCREASED USE OF FROZEN FOOD IN THE FOOD SERVICE INDUSTRY IS EXPECTED TO DRIVE THE EUROPE FROZEN READY MEALS MARKET IN THE FORECAST PERIOD

FIGURE 12 TYPE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE EUROPE FROZEN READY MEALS MARKET IN 2022 & 2029

FIGURE 13 EUROPE FROZEN READY MEALS MARKET: FACTORS AFFECTING DISPOSABLE INCOME OR SPEND DYNAMICS OF THE CONSUMERS

FIGURE 14 EUROPE FROZEN READY MEALS MARKET: FACTORS AFFECTING NEW PRODUCT LAUNCHES STRATEGY

FIGURE 15 SUPPLY CHAIN ANALYSIS

FIGURE 16 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE EUROPE FROZEN READY MEALS MARKET

FIGURE 17 EUROPE FROZEN READY MEALS MARKET, BY TYPE

FIGURE 18 EUROPE FROZEN READY MEALS MARKET, BY CATEGORY

FIGURE 19 EUROPE FROZEN READY MEALS MARKET, BY PACKAGING TECHNIQUE

FIGURE 20 EUROPE FROZEN READY MEALS MARKET, BY TECHNOLOGY

FIGURE 21 EUROPE FROZEN READY MEALS MARKET, BY END USER

FIGURE 22 EUROPE FROZEN READY MEALS MARKET, BY DISTRIBUTION CHANNEL

FIGURE 23 EUROPE FROZEN READY MEALS MARKET: SNAPSHOT (2021)

FIGURE 24 EUROPE FROZEN READY MEALS MARKET: BY COUNTRY (2021)

FIGURE 25 EUROPE FROZEN READY MEALS MARKET: BY COUNTRY (2022 & 2029)

FIGURE 26 EUROPE FROZEN READY MEALS MARKET: BY COUNTRY (2021 & 2029)

FIGURE 27 EUROPE FROZEN READY MEALS MARKET: BY TYPE (2022 & 2029)

FIGURE 28 EUROPE FROZEN READY MEALS MARKET: COMPANY SHARE 2021 (%)

연구 방법론

데이터 수집 및 기준 연도 분석은 대규모 샘플 크기의 데이터 수집 모듈을 사용하여 수행됩니다. 이 단계에는 다양한 소스와 전략을 통해 시장 정보 또는 관련 데이터를 얻는 것이 포함됩니다. 여기에는 과거에 수집한 모든 데이터를 미리 검토하고 계획하는 것이 포함됩니다. 또한 다양한 정보 소스에서 발견되는 정보 불일치를 검토하는 것도 포함됩니다. 시장 데이터는 시장 통계 및 일관된 모델을 사용하여 분석하고 추정합니다. 또한 시장 점유율 분석 및 주요 추세 분석은 시장 보고서의 주요 성공 요인입니다. 자세한 내용은 분석가에게 전화를 요청하거나 문의 사항을 드롭하세요.

DBMR 연구팀에서 사용하는 주요 연구 방법론은 데이터 마이닝, 시장에 대한 데이터 변수의 영향 분석 및 주요(산업 전문가) 검증을 포함하는 데이터 삼각 측량입니다. 데이터 모델에는 공급업체 포지셔닝 그리드, 시장 타임라인 분석, 시장 개요 및 가이드, 회사 포지셔닝 그리드, 특허 분석, 가격 분석, 회사 시장 점유율 분석, 측정 기준, 글로벌 대 지역 및 공급업체 점유율 분석이 포함됩니다. 연구 방법론에 대해 자세히 알아보려면 문의를 통해 업계 전문가에게 문의하세요.

사용자 정의 가능

Data Bridge Market Research는 고급 형성 연구 분야의 선두 주자입니다. 저희는 기존 및 신규 고객에게 목표에 맞는 데이터와 분석을 제공하는 데 자부심을 느낍니다. 보고서는 추가 국가에 대한 시장 이해(국가 목록 요청), 임상 시험 결과 데이터, 문헌 검토, 재생 시장 및 제품 기반 분석을 포함하도록 사용자 정의할 수 있습니다. 기술 기반 분석에서 시장 포트폴리오 전략에 이르기까지 타겟 경쟁업체의 시장 분석을 분석할 수 있습니다. 귀하가 원하는 형식과 데이터 스타일로 필요한 만큼 많은 경쟁자를 추가할 수 있습니다. 저희 분석가 팀은 또한 원시 엑셀 파일 피벗 테이블(팩트북)로 데이터를 제공하거나 보고서에서 사용 가능한 데이터 세트에서 프레젠테이션을 만드는 데 도움을 줄 수 있습니다.