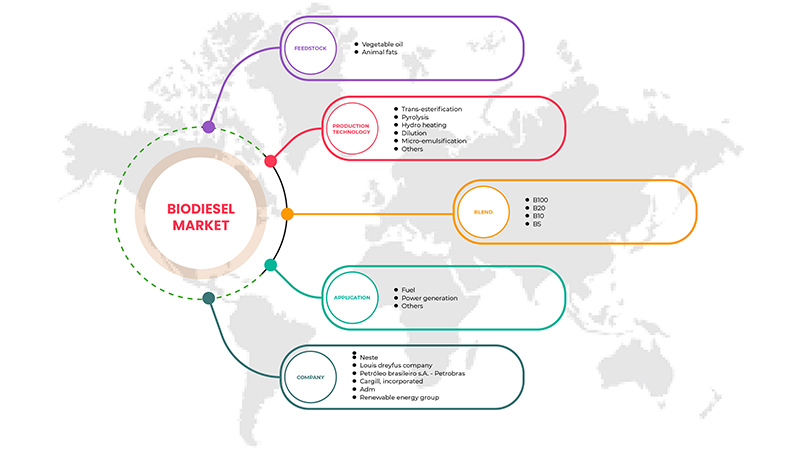

Europe Biodiesel Market, By Feedstock (Vegetable Oil and Animal Fats), Blend (B100, B20, B10, and B5), Production Technology (Trans-Esterification, Pyrolysis, Hydro Heating, Dilution, Micro-Emulsification, and Others), Application (Fuel, Power Generation, and Others) Industry Trends and Forecast to 2029.

Europe Biodiesel Market Analysis and Insights

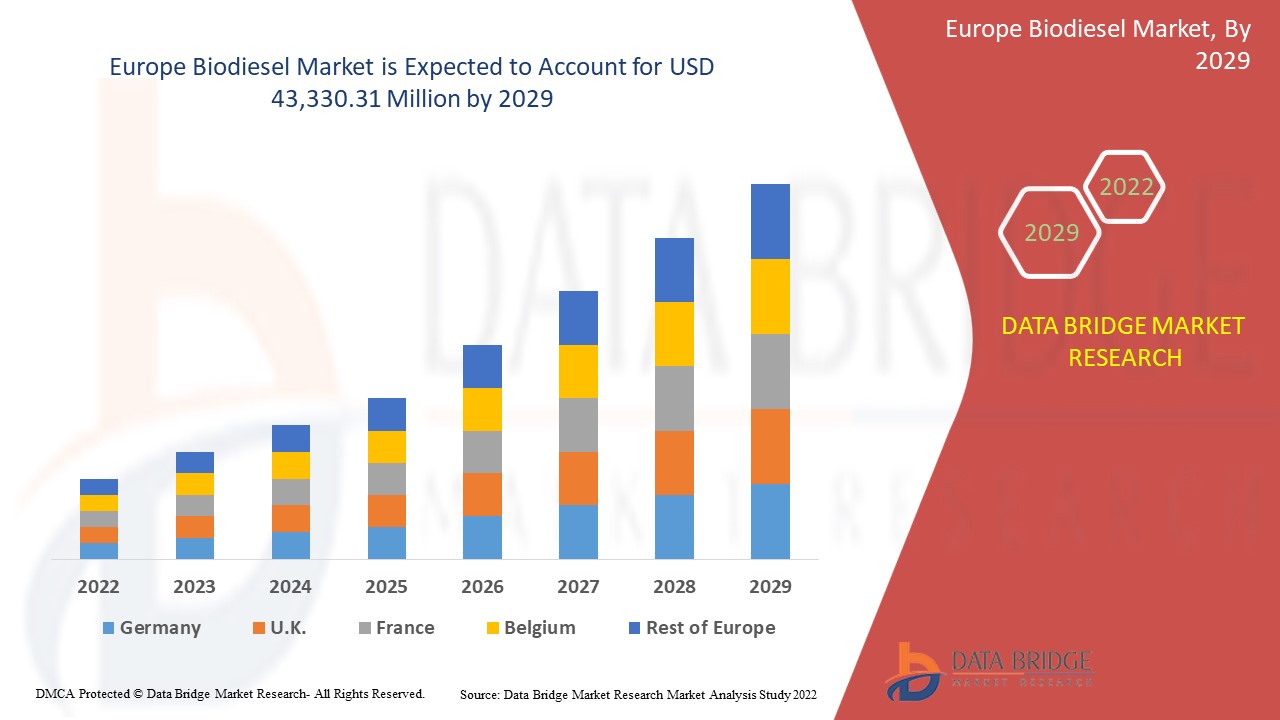

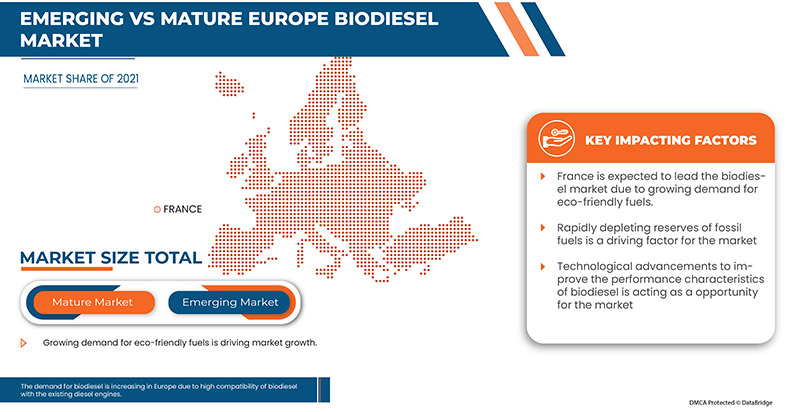

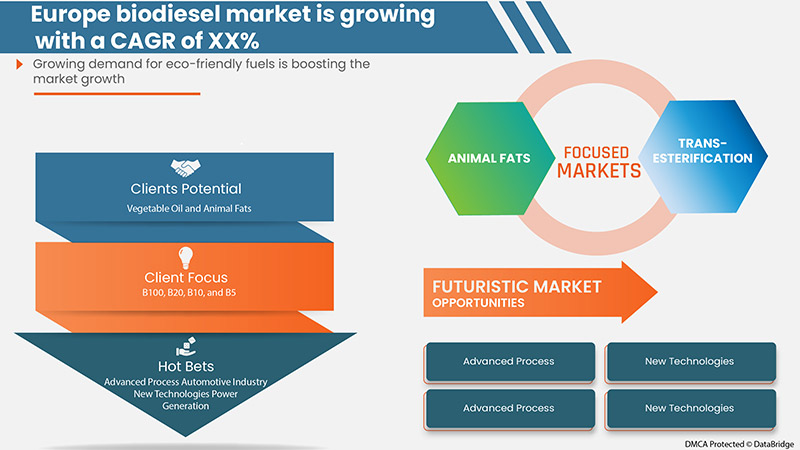

Europe biodiesel market is expected to gain significant growth in the forecast period of 2022 to 2029. Data Bridge Market Research analyzes that the market is growing with a CAGR of 4.7% in the forecast period of 2022 to 2029 and is expected to reach USD 43,330.31 million by 2029. Some of the major factors driving the market growth are growing demand for eco-friendly fuels, high compatibility of biodiesel with existing diesel engines, and rapidly depleting reserves of fossil fuels.

Biodiesel is becoming a more affordable option due to the unstable prices of petroleum-based products. The biodiesel market is developing in response to public pressure to reduce emissions and replace fossil fuels due to environmental concerns and concerns over rapidly depleting crude oil reserves across the globe. Moreover, the use of biodiesel boosts the fuel's cetane number and improves its lubricity.

Europe biodiesel market report provides details of market share, new developments, impact of domestic and localized market players, analyzes opportunities in terms of emerging revenue pockets, changes in market regulations, product approvals, strategic decisions, product launches, geographic expansions, and technological innovations in the market. To understand the analysis and the market scenario contact us for an analyst brief, our team will help you create a revenue impact solution to achieve your desired goal.

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Year |

2020 (Customizable to 2019 - 2014) |

|

Quantitative Units |

Revenue in USD Million |

|

Segments Covered |

By Feedstock (Vegetable Oil and Animal Fats), Blend (B100, B20, B10, and B5), Production Technology (Trans-Esterification, Pyrolysis, Hydro Heating, Dilution, Micro-Emulsification, and Others), Application (Fuel, Power Generation, and Others) |

|

Countries Covered |

U.K., Russia, France, Spain, Italy, Germany, Turkey, Netherlands, Switzerland, Belgium, Luxembourg, and rest of Europe |

|

Market Players Covered |

Louis Dreyfus Company, Münzer Bioindustrie GmbH, Bio-Oils Energy, Argent Energy, Eco Fox Srl, ecomotion.de, ECODIESEL COLOMBIA S.A., ADM, Neste, Renewable Energy Group, VERBIO Vereinigte BioEnergie AG, Petróleo Brasileiro S.A. – Petrobras, and Cargill, Incorporated. |

Market Definition

Biodiesel is obtained from renewable feedstock such as vegetable oil and animal fats by utilizing a chemical procedure called trans-esterification which converts oil and fats into fatty acids methyl esters. It is employed as a substitute for petroleum diesel fuel and is often combined with petroleum diesel fuel for other parts. It is efficient to decrease exhaust release when compared to petroleum diesel fuel. It has applications in automotive, marine, aviation, industrial, and other industries. In marine industry, it is used as an excellent material as shipping fuel, being biodegradable and non-toxic in nature.

Europe Biodiesel Market Dynamics

DRIVERS

- Growing demand for environment-friendly fuels

Biodiesel fuel is similar to diesel fuel but is much more eco-friendly. Biodiesel is a clean, non-polluting energy source. This green transition is seen as a catalyst for the biodiesel market, paving the way for biodiesel suppliers. The need to integrate renewable energy sources is driving the demand for biodiesel. Biodiesel is expected to grow fast in popularity as a replacement for conventional fossil fuels in various applications. Biodiesel is helping several countries across Europe to decrease their reliance on foreign oil reserves and imports, since it is manufactured domestically and deployed in a diesel engine with minor or near modifications. Moreover, second-generation and third-generation biofuels, such as those produced using algae, have a greater potential to reduce emissions. Therefore, the growing demand for eco-friendly and sustainable fuels and energy sources across various industries is expected to drive the demand for biodiesel, which in turn is expected to drive market growth.

- High compatibility of biodiesel with the existing diesel engines

The industry is expected to benefit from increased demand for fuel in commercial vehicles as a replacement for crude oil as it emits fewer Volatile Organic Compounds (VOCs) than traditional fuels, such as diesel. The main target for biodiesel consumption is fuel and power generation applications. Today, automotive and marine industries are using a majority of the fuel produced, which uses components of crude oil in heavy quantities. These conventional fuels release toxicants into the environment. Also, in power generation, biodiesel can be used in generators where only a few changes or no changes are needed to be done to the structure of machine.

- Rapidly depleting reserves of fossil fuels

The limited availability and surging prices of non-renewable energy sources, such as petrol, diesel, and Liquefied Petroleum Gas (LPG) are favoring the utilization of biodiesel in various industries. Biofuel production and its uses in industries and transportation considerably minimize fossil fuel dependence. Furthermore, a growing preference for replacing fossil fuels, which are associated with higher Greenhouse Gas (GHG) emissions, with biofuel such as biodiesel, which is renewable and biodegradable, is influencing the demand in various European countries.

OPPORTUNITIES

- Rise in government initiatives to adopt renewable energy sources

Governments of many countries are supporting eco-friendly alternatives such as biodiesel. Government aid like subsidies and imposing mandates indicates and helps in continued market growth. Governments in the European region are constantly attempting to adopt renewable energy sources to generate power and as a fuel to reduce GHG emissions. As a result, the demand for the product in fuel applications and power generation applications is expected to grow in the near future.

- Technological advancements to improve the performance characteristics of biodiesel

The transportation sector is mainly responsible for adding GHGs to the environment. These pollutants are produced by burning petrol and diesel which are used in different locomotives. Though biodiesel has proved to be a promising and best resource for alternative fuel, its exhaust emissions and especially Nitrous Oxide (NOx) is harmful. Nanoparticles added to emulsions have the potential to reduce exhaust emissions without compromising engine performances. The addition of nano additives to biodiesel aids in increasing fuel properties. Nanoparticles increase the surface-to-volume ratio and oxidation rate of fuel. It decreases ignition delay and improves the ignition temperature of combustion zone.

RESTRAINTS/CHALLENGES

- Insufficient production capacity

Europe biodiesel market is largely affected by lack of efficiency in the production of biodiesel in desired quantities and this is due to several factors. At present, there is no policy mechanism incentivizing farmers to collect and deliver biomass residues to a next-generation biodiesel plant. Therefore, it is important to establish a reliable supply chain for biomass covering collection, transportation, and handling of biomass feedstock. If the policymakers seek to foster an industry for long term, they could create a mechanism whereby cooperatives or farming communities could be involved in the process of collection, storage, and delivery of residues for the adequate use of feedstock for the production of biodiesel.

- Emissions and pollution caused during production of biodiesel

Substituting conventional fuels with biodiesel blends is considered to be extremely vital for social and environmental reasons; however, there are potential problems associated with its use. Despite the favorable environmental impacts in terms of overall reduced GHG emissions, biodiesel has the potential to increase NOx emissions. Approximately 3% to 4%, 4% to 6%, and 6% to 9% of petroleum diesel are emitted from B20, B40, and B100 respectively.

- High feedstock costs for biodiesel production

Demand for biodiesel and clean-burning fuels over traditional petroleum-based fuels is also linked to the agricultural commodity market. Vegetable oils, such as soybean oil, canola oil, and palm oil, are the most common feedstocks for biodiesel production. Feedstock costs account for approximately 80% to 85% of total biodiesel production costs. Therefore, high price volatility of the feedstock on which biodiesel producers rely threatens their long-term financial stability. Feedstock prices will rise in tandem with biodiesel prices, resulting in lower profit margins.

Recent Development

- In September 2022, Neste launched a strategic study on transitioning its refinery in Porvoo, Finland, to non-crude oil refining and into a globally leading renewable and circular solutions site. Through co-processing and retrofitting units, and benefiting from available refining assets, experience, and know-how Neste targets to significantly grow its renewables and circular production in Porvoo in long term.

Europe Biodiesel Market Scope

Europe biodiesel market is segmented into four notable segments based on feedstock, blend, production technology, and application. The growth amongst these segments will help you analyze major growth segments in the industries and provide the users with a valuable market overview and market insights to make strategic decisions to identify core market applications.

Feedstock

- Vegetable Oil

- Animal Fats

Based on feedstock, the market is segmented into vegetable oil and animal fats.

Blend

- B20

- B10

- B5

- B100

Based on a blend, the market is segmented into B100, B20, B10, and B5.

Production Technology

- Trans-Esterification

- Pyrolysis

- Hydro Heating

- Dilution

- Micro-Emulsification

- Others

Based on production technology, the market is segmented into trans-esterification, pyrolysis, hydro heating, dilution, micro-emulsification, and others.

Application

- Fuel

- Power Generation

- Others

Based on application, the market is segmented into fuel, power generation, and others.

Europe Biodiesel Market Regional Analysis/Insights

Europe biodiesel market is segmented based on feedstock, blend, production technology, and application.

The countries covered in the market are U.K., Russia, France, Spain, Italy, Germany, Turkey, Netherlands, Switzerland, Belgium, Luxembourg, and rest of Europe. France is dominating the market in terms of market share and market revenue due to the growing demand for commercial vehicles in the region.

The country section of the report also provides individual market-impacting factors and changes in market regulation that impact the current and future trends of the market. Data point downstream and upstream value chain analysis, technical trends porter's five forces analysis, and case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of Europe brands and their challenges faced due to large or scarce competition from local and domestic brands, and the impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Europe Biodiesel Market Share Analysis

Europe biodiesel market competitive landscape provides details by competitors. Details included are company overview, company financials, revenue generated, market potential, investment in R&D, new market initiatives, production sites and facilities, company strengths and weaknesses, product launch, product trials pipelines, product approvals, patents, product width and breadth, application dominance, technology lifeline curve. The above data points provided are only related to the companies’ focus related to the market.

Some of the prominent participants operating in the Europe biodiesel market are Louis Dreyfus Company, Münzer Bioindustrie GmbH, Bio-Oils Energy, Argent Energy, Eco Fox Srl, ecomotion.de, ECODIESEL COLOMBIA S.A., ADM, Neste, Renewable Energy Group, VERBIO Vereinigte BioEnergie AG, Petróleo Brasileiro S.A. – Petrobras, and Cargill, Incorporated.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The market data is analyzed and estimated using market statistical and coherent models. In addition, market share analysis and key trend analysis are the major success factors in the market report. The key research methodology used by the DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market, and primary (industry expert) validation. Apart from this, data models include Vendor Positioning grids, Market Time Line Analysis, Market Overview and Guide, Company Positioning grids, Company Market Share Analysis, Standards of Measurement, Europe Vs Regional, and Vendor Share Analysis. Please request an analyst call in case of further inquiry.

SKU-

세계 최초의 시장 정보 클라우드 보고서에 온라인으로 접속하세요

- 대화형 데이터 분석 대시보드

- 높은 성장 잠재력 기회를 위한 회사 분석 대시보드

- 사용자 정의 및 질의를 위한 리서치 분석가 액세스

- 대화형 대시보드를 통한 경쟁자 분석

- 최신 뉴스, 업데이트 및 추세 분석

- 포괄적인 경쟁자 추적을 위한 벤치마크 분석의 힘 활용

목차

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF EUROPE BIODIESEL MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 BMR TRIPOD DATA VALIDATION MODEL

2.6 FEEDSTOCK LIFE LINE CURVE

2.7 MULTIVARIATE MODELING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 DBMR MARKET CHALLENGE MATRIX

2.12 BMR VENDOR SHARE ANALYSIS

2.13 IMPORT-EXPORT DATA

2.14 SECONDARY SOURCES

2.15 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 BIODIESEL BY-PRODUCTS SCENARIO

4.2 IMPORT EXPORT ANALYSIS

4.3 INDUSTRIAL INSIGHTS

4.4 PRODUCTION CONSUMPTION ANALYSIS

4.5 CERTIFIED STANDARDS

4.5.1 EUROPEAN UNION

4.5.2 EUROPEAN COMMISSION SUSTAINABILITY CRITERIA

4.5.3 RENEWABLE ENERGY DIRECTIVE (RED II)

4.5.4 EUROPEAN DIESEL FUEL SPECIFICATION

4.6 VALUE CHAIN ANALYSIS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 GROWING DEMAND FOR ENVIRONMENT-FRIENDLY FUELS

5.1.2 HIGH COMPATIBILITY OF BIODIESEL WITH THE EXISTING DIESEL ENGINES

5.1.3 RAPIDLY DEPLETING RESERVES OF FOSSIL FUELS

5.2 RESTRAINTS

5.2.1 INSUFFICIENT PRODUCTION CAPACITY

5.2.2 EMISSIONS AND POLLUTION CAUSED DURING PRODUCTION OF BIODIESEL

5.3 OPPORTUNITIES

5.3.1 RISE IN GOVERNMENT INITIATIVES TO ADOPT TO RENEWABLE ENERGY SOURCES

5.3.2 TECHNOLOGICAL ADVANCEMENTS TO IMPROVE THE PERFORMANCE CHARACTERISTICS OF BIODIESEL

5.4 CHALLENGE

5.4.1 HIGH FEEDSTOCK COSTS FOR BIODIESEL PRODUCTION

6 EUROPE BIODIESEL MARKET, BY FEEDSTOCK

6.1 OVERVIEW

6.2 VEGETABLE OIL

6.2.1 EDIBLE OILS

6.2.1.1 RAPESEED OIL

6.2.1.2 SOYA BEAN OIL

6.2.1.3 PALM OIL

6.2.1.4 CORN OIL

6.2.1.5 CANOLAOIL

6.2.1.6 OTHERS

6.2.2 NON-EDIBLE OILS

6.2.2.1 JATROPHA

6.2.2.2 KARANJA

6.2.2.3 MAHUJA

6.2.2.4 RUBBER SEED

6.2.2.5 MICROALGAE

6.2.2.6 SILK COTTON TREE

6.2.2.7 OTHERS

6.2.2.7.1 FUEL

6.2.2.7.2 POWER GENERATION

6.2.2.7.3 OTHERS

6.3 ANIMAL FATS

6.3.1 WHITE GREASE

6.3.2 TALLOW

6.3.3 POULTRY

6.3.4 OTHERS

6.3.4.1 FUEL

6.3.4.2 POWER GENERATION

6.3.4.3 OTHERS

7 EUROPE BIODIESEL MARKET, BY BLEND

7.1 OVERVIEW

7.2 B20

7.3 B10

7.4 B5

7.5 B100

8 EUROPE BIODIESEL MARKET, BY PRODUCTION TECHNOLOGY

8.1 OVERVIEW

8.2 TRANS-ESTERIFICATION

8.3 PYROLYSIS

8.4 HYDRO HEATING

8.5 DILUTION

8.6 MICRO-EMULSIFICATION

8.7 OTHERS

9 EUROPE BIODIESEL MARKET, BY APPLICATION

9.1 OVERVIEW

9.2 FUEL

9.2.1 AUTOMOTIVE

9.2.1.1 ON-ROAD VEHICLES

9.2.1.1.1 LIGHT DUTY

9.2.1.1.2 MEDIUM DUTY

9.2.1.1.3 HEAVY DUTY

9.2.1.2 OFF-ROAD VEHICLES

9.2.1.2.1 CONSTRUCTION MACHINERY

9.2.1.2.2 MINING EQUIPMENTS

9.2.1.2.3 LOCOMOTIVES

9.2.1.2.4 OTHERS

9.2.1.1 MARINE

9.2.1.2 AGRICULTURE

9.2.1.3 OTHERS

9.3 POWER GENERATION

9.4 OTHERS

10 EUROPE BIODIESEL MARKET, BY COUNTRY

10.1 EUROPE

10.1.1 FRANCE

10.1.2 GERMANY

10.1.3 SPAIN

10.1.4 U.K.

10.1.5 ITALY

10.1.6 BELGIUM

10.1.7 RUSSIA

10.1.8 SWITZERLAND

10.1.9 NETHRLANDS

10.1.10 TURKEY

10.1.11 LUXEMBURG

10.1.12 REST OF EUROPE

11 EUROPE BIODIESEL MARKET, COMPANY LANDSCAPE

11.1 COMPANY SHARE ANALYSIS: EUROPE

11.2 COLLABORATION

11.3 FACILITY EXPANSIONS

11.4 PRODUCT LAUNCH

11.5 ACQUISITION

12 SWOT ANALYSIS

13 COMPANY PROFILES

13.1 NESTE

13.1.1 COMPANY SNAPSHOT

13.1.2 REVENUE ANALYSIS

13.1.3 PRODUCT PORTFOLIO

13.1.4 RECENT DEVELOPMENTS

13.2 LOUIS DREYFUS COMPANY

13.2.1 COMPANY SNAPSHOT

13.2.2 PRODUCT PORTFOLIO

13.2.3 RECENT DEVELOPMENT

13.3 PETRÓLEO BRASILEIRO S.A. – PETROBRAS

13.3.1 COMPANY SNAPSHOT

13.3.2 REVENUE ANALYSIS

13.3.3 PRODUCT PORTFOLIO

13.3.4 RECENT DEVELOPMENT

13.4 CARGILL, INCORPORATED

13.4.1 COMPANY SNAPSHOT

13.4.2 PRODUCT PORTFOLIO

13.4.3 RECENT DEVELOPMENTS

13.5 ADM

13.5.1 COMPANY SNAPSHOT

13.5.2 REVENUE ANALYSIS

13.5.3 PRODUCT PORTFOLIO

13.5.4 RECENT DEVELOPMENTS

13.6 ARGENT ENERGY

13.6.1 COMPANY SNAPSHOT

13.6.2 PRODUCT PORTFOLIO

13.6.3 RECENT DEVELOPMENT

13.7 BIO-OILS ENERGY

13.7.1 COMPANY SNAPSHOT

13.7.2 PRODUCT PORTFOLIO

13.7.3 RECENT DEVELOPMENT

13.8 ECOMOTION.DE

13.8.1 COMPANY SNAPSHOT

13.8.2 PRODUCT PORTFOLIO

13.8.3 RECENT DEVELOPMENT

13.9 ECODIESEL COLOMBIA S.A.

13.9.1 COMPANY SNAPSHOT

13.9.2 PRODUCT PORTFOLIO

13.9.3 RECENT DEVELOPMENT

13.1 ECO FOX SRL

13.10.1 COMPANY SNAPSHOT

13.10.2 PRODUCT PORTFOLIO

13.10.3 RECENT DEVELOPMENT

13.11 MÜNZER BIOINDUSTRIE GMBH

13.11.1 COMPANY SNAPSHOT

13.11.2 PRODUCT PORTFOLIO

13.11.3 RECENT DEVELOPMENT

13.12 RENEWABLE ENERGY GROUP

13.12.1 COMPANY SNAPSHOT

13.12.2 PRODUCT PORTFOLIO

13.12.3 RECENT DEVELOPMENTS

13.13 VERBIO UNITED BIOENERGY AG

13.13.1 COMPANY SNAPSHOT

13.13.2 PRODUCT PORTFOLIO

13.13.3 RECENT DEVELOPMENT

14 QUESTIONNAIRE

15 RELATED REPORTS

표 목록

TABLE 1 IMPORT DATA OF BIODIESEL AND MIXTURES THEREOF, NOT CONTAINING OR CONTAINING < 70 % BY WEIGHT OF PETROLEUM; HS CODE – 3826 (USD THOUSAND)

TABLE 2 EXPORT DATA OF BIODIESEL AND MIXTURES THEREOF, NOT CONTAINING OR CONTAINING < 70 % BY WEIGHT OF PETROLEUM; HS CODE – 3826 (USD THOUSAND)

TABLE 3 EUROPE BIODIESEL MARKET, BY FEEDSTOCK, 2020-2029 (USD MILLION)

TABLE 4 EUROPE VEGETABLE OIL IN BIODIESEL MARKET, BY SEGMENT, 2020-2029 (USD MILLION)

TABLE 5 EUROPE EDIBLE OIL IN BIODIESEL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 6 EUROPE NON-EDIBLE OIL IN BIODIESEL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 7 EUROPE VEGETABLE OIL IN BIODIESEL MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 8 EUROPE ANIMAL FATS IN BIODIESEL MARKET, BY SEGMENT, 2020-2029 (USD MILLION)

TABLE 9 EUROPE ANIMAL FATS IN BIODIESEL MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 10 EUROPE BIODIESEL MARKET, BY BLEND, 2020-2029 (USD MILLION)

TABLE 11 EUROPE BIODIESEL MARKET, BY PRODUCTION TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 12 EUROPE BIODIESEL MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 13 EUROPE FUEL IN BIODIESEL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 14 EUROPE AUTOMOTIVE IN BIODIESEL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 15 EUROPE ON-ROAD VEHICLE IN BIODIESEL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 16 EUROPE OFF-ROAD VEHICLE IN BIODIESEL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 17 EUROPE BIODIESEL MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 18 EUROPE BIODIESEL MARKET, BY COUNTRY, 2020-2029 (MILLION LITERS)

TABLE 19 FRANCE BIODIESEL MARKET, BY FEEDSTOCK, 2020-2029 (USD MILLION)

TABLE 20 FRANCE VEGETABLE OIL IN BIODIESEL MARKET, BY SEGMENT, 2020-2029 (USD MILLION)

TABLE 21 FRANCE EDIBLE OILS IN BIODIESEL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 22 FRANCE NON-EDIBLE OILS IN BIODIESEL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 23 FRANCE VEGETABLE OIL IN BIODIESEL MARKET, BY APPLICATION, 2020-2029 (USD MILLION))

TABLE 24 FRANCE ANIMAL FATS IN BIODIESEL MARKET, BY SEGMENT, 2020-2029 (USD MILLION)

TABLE 25 FRANCE ANIMAL FATS IN BIODIESEL MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 26 FRANCE BIODIESEL MARKET, BY BLEND, 2020-2029 (USD MILLION)

TABLE 27 FRANCE BIODIESEL MARKET, BY PRODUCTION TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 28 FRANCE BIODIESEL MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 29 FRANCE FUEL IN BIODIESEL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 30 FRANCE AUTOMOTIVE IN BIODIESEL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 31 FRANCE ON-ROAD VEHICLES IN BIODIESEL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 32 FRANCE OFF-ROAD VEHICLES IN BIODIESEL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 33 GERMANY BIODIESEL MARKET, BY FEEDSTOCK, 2020-2029 (USD MILLION)

TABLE 34 GERMANY VEGETABLE OIL IN BIODIESEL MARKET, BY SEGMENT, 2020-2029 (USD MILLION)

TABLE 35 GERMANY EDIBLE OILS IN BIODIESEL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 36 GERMANY NON-EDIBLE OILS IN BIODIESEL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 37 GERMANY VEGETABLE OIL IN BIODIESEL MARKET, BY APPLICATION, 2020-2029 (USD MILLION))

TABLE 38 GERMANY ANIMAL FATS IN BIODIESEL MARKET, BY SEGMENT, 2020-2029 (USD MILLION)

TABLE 39 GERMANY ANIMAL FATS IN BIODIESEL MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 40 GERMANY BIODIESEL MARKET, BY BLEND, 2020-2029 (USD MILLION)

TABLE 41 GERMANY BIODIESEL MARKET, BY PRODUCTION TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 42 GERMANY BIODIESEL MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 43 GERMANY FUEL IN BIODIESEL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 44 GERMANY AUTOMOTIVE IN BIODIESEL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 45 GERMANY ON-ROAD VEHICLES IN BIODIESEL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 46 GERMANY OFF-ROAD VEHICLES IN BIODIESEL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 47 SPAIN BIODIESEL MARKET, BY FEEDSTOCK, 2020-2029 (USD MILLION)

TABLE 48 SPAIN VEGETABLE OIL IN BIODIESEL MARKET, BY SEGMENT, 2020-2029 (USD MILLION)

TABLE 49 SPAIN EDIBLE OILS IN BIODIESEL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 50 SPAIN NON-EDIBLE OILS IN BIODIESEL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 51 SPAIN VEGETABLE OIL IN BIODIESEL MARKET, BY APPLICATION, 2020-2029 (USD MILLION))

TABLE 52 SPAIN ANIMAL FATS IN BIODIESEL MARKET, BY SEGMENT, 2020-2029 (USD MILLION)

TABLE 53 SPAIN ANIMAL FATS IN BIODIESEL MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 54 SPAIN BIODIESEL MARKET, BY BLEND, 2020-2029 (USD MILLION)

TABLE 55 SPAIN BIODIESEL MARKET, BY PRODUCTION TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 56 SPAIN BIODIESEL MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 57 SPAIN FUEL IN BIODIESEL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 58 SPAIN AUTOMOTIVE IN BIODIESEL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 59 SPAIN ON-ROAD VEHICLES IN BIODIESEL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 60 SPAIN OFF-ROAD VEHICLES IN BIODIESEL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 61 U.K BIODIESEL MARKET, BY FEEDSTOCK, 2020-2029 (USD MILLION)

TABLE 62 U.K VEGETABLE OIL IN BIODIESEL MARKET, BY SEGMENT, 2020-2029 (USD MILLION)

TABLE 63 U.K EDIBLE OILS IN BIODIESEL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 64 U.K NON-EDIBLE OILS IN BIODIESEL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 65 U.K VEGETABLE OIL IN BIODIESEL MARKET, BY APPLICATION, 2020-2029 (USD MILLION))

TABLE 66 U.K ANIMAL FATS IN BIODIESEL MARKET, BY SEGMENT, 2020-2029 (USD MILLION)

TABLE 67 U.K ANIMAL FATS IN BIODIESEL MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 68 U.K BIODIESEL MARKET, BY BLEND, 2020-2029 (USD MILLION)

TABLE 69 U.K BIODIESEL MARKET, BY PRODUCTION TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 70 U.K BIODIESEL MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 71 U.K FUEL IN BIODIESEL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 72 U.K AUTOMOTIVE IN BIODIESEL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 73 U.K ON-ROAD VEHICLES IN BIODIESEL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 74 U.K OFF-ROAD VEHICLES IN BIODIESEL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 75 ITALY BIODIESEL MARKET, BY FEEDSTOCK, 2020-2029 (USD MILLION)

TABLE 76 ITALY VEGETABLE OIL IN BIODIESEL MARKET, BY SEGMENT, 2020-2029 (USD MILLION)

TABLE 77 ITALY EDIBLE OILS IN BIODIESEL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 78 ITALY NON-EDIBLE OILS IN BIODIESEL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 79 ITALY VEGETABLE OIL IN BIODIESEL MARKET, BY APPLICATION, 2020-2029 (USD MILLION))

TABLE 80 ITALY ANIMAL FATS IN BIODIESEL MARKET, BY SEGMENT, 2020-2029 (USD MILLION)

TABLE 81 ITALY ANIMAL FATS IN BIODIESEL MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 82 ITALY BIODIESEL MARKET, BY BLEND, 2020-2029 (USD MILLION)

TABLE 83 ITALY BIODIESEL MARKET, BY PRODUCTION TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 84 ITALY BIODIESEL MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 85 ITALY FUEL IN BIODIESEL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 86 ITALY AUTOMOTIVE IN BIODIESEL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 87 ITALY ON-ROAD VEHICLES IN BIODIESEL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 88 ITALY OFF-ROAD VEHICLES IN BIODIESEL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 89 BELGIUM BIODIESEL MARKET, BY FEEDSTOCK, 2020-2029 (USD MILLION)

TABLE 90 BELGIUM VEGETABLE OIL IN BIODIESEL MARKET, BY SEGMENT, 2020-2029 (USD MILLION)

TABLE 91 BELGIUM EDIBLE OILS IN BIODIESEL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 92 BELGIUM NON-EDIBLE OILS IN BIODIESEL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 93 BELGIUM VEGETABLE OIL IN BIODIESEL MARKET, BY APPLICATION, 2020-2029 (USD MILLION))

TABLE 94 BELGIUM ANIMAL FATS IN BIODIESEL MARKET, BY SEGMENT, 2020-2029 (USD MILLION)

TABLE 95 BELGIUM ANIMAL FATS IN BIODIESEL MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 96 BELGIUM BIODIESEL MARKET, BY BLEND, 2020-2029 (USD MILLION)

TABLE 97 BELGIUM BIODIESEL MARKET, BY PRODUCTION TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 98 BELGIUM BIODIESEL MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 99 BELGIUM FUEL IN BIODIESEL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 100 BELGIUM AUTOMOTIVE IN BIODIESEL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 101 BELGIUM ON-ROAD VEHICLES IN BIODIESEL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 102 BELGIUM OFF-ROAD VEHICLES IN BIODIESEL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 103 RUSSIA BIODIESEL MARKET, BY FEEDSTOCK, 2020-2029 (USD MILLION)

TABLE 104 RUSSIA VEGETABLE OIL IN BIODIESEL MARKET, BY SEGMENT, 2020-2029 (USD MILLION)

TABLE 105 RUSSIA EDIBLE OILS IN BIODIESEL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 106 RUSSIA NON-EDIBLE OILS IN BIODIESEL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 107 RUSSIA VEGETABLE OIL IN BIODIESEL MARKET, BY APPLICATION, 2020-2029 (USD MILLION))

TABLE 108 RUSSIA ANIMAL FATS IN BIODIESEL MARKET, BY SEGMENT, 2020-2029 (USD MILLION)

TABLE 109 RUSSIA ANIMAL FATS IN BIODIESEL MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 110 RUSSIA BIODIESEL MARKET, BY BLEND, 2020-2029 (USD MILLION)

TABLE 111 RUSSIA BIODIESEL MARKET, BY PRODUCTION TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 112 RUSSIA BIODIESEL MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 113 RUSSIA FUEL IN BIODIESEL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 114 RUSSIA AUTOMOTIVE IN BIODIESEL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 115 RUSSIA ON-ROAD VEHICLES IN BIODIESEL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 116 RUSSIA OFF-ROAD VEHICLES IN BIODIESEL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 117 SWITZERLAND BIODIESEL MARKET, BY FEEDSTOCK, 2020-2029 (USD MILLION)

TABLE 118 SWITZERLAND VEGETABLE OIL IN BIODIESEL MARKET, BY SEGMENT, 2020-2029 (USD MILLION)

TABLE 119 SWITZERLAND EDIBLE OILS IN BIODIESEL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 120 SWITZERLAND NON-EDIBLE OILS IN BIODIESEL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 121 SWITZERLAND VEGETABLE OIL IN BIODIESEL MARKET, BY APPLICATION, 2020-2029 (USD MILLION))

TABLE 122 SWITZERLAND ANIMAL FATS IN BIODIESEL MARKET, BY SEGMENT, 2020-2029 (USD MILLION)

TABLE 123 SWITZERLAND ANIMAL FATS IN BIODIESEL MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 124 SWITZERLAND BIODIESEL MARKET, BY BLEND, 2020-2029 (USD MILLION)

TABLE 125 SWITZERLAND BIODIESEL MARKET, BY PRODUCTION TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 126 SWITZERLAND BIODIESEL MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 127 SWITZERLAND FUEL IN BIODIESEL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 128 SWITZERLAND AUTOMOTIVE IN BIODIESEL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 129 SWITZERLAND ON-ROAD VEHICLES IN BIODIESEL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 130 SWITZERLAND OFF-ROAD VEHICLES IN BIODIESEL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 131 NETHERLANDS BIODIESEL MARKET, BY FEEDSTOCK, 2020-2029 (USD MILLION)

TABLE 132 NETHERLANDS VEGETABLE OIL IN BIODIESEL MARKET, BY SEGMENT, 2020-2029 (USD MILLION)

TABLE 133 NETHERLANDS EDIBLE OILS IN BIODIESEL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 134 NETHERLANDS NON-EDIBLE OILS IN BIODIESEL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 135 NETHERLANDS VEGETABLE OIL IN BIODIESEL MARKET, BY APPLICATION, 2020-2029 (USD MILLION))

TABLE 136 NETHERLANDS ANIMAL FATS IN BIODIESEL MARKET, BY SEGMENT, 2020-2029 (USD MILLION)

TABLE 137 NETHERLANDS ANIMAL FATS IN BIODIESEL MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 138 NETHERLANDS BIODIESEL MARKET, BY BLEND, 2020-2029 (USD MILLION)

TABLE 139 NETHERLANDS BIODIESEL MARKET, BY PRODUCTION TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 140 NETHERLANDS BIODIESEL MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 141 NETHERLANDS FUEL IN BIODIESEL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 142 NETHERLANDS AUTOMOTIVE IN BIODIESEL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 143 NETHERLANDS ON-ROAD VEHICLES IN BIODIESEL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 144 NETHERLANDS OFF-ROAD VEHICLES IN BIODIESEL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 145 TURKEY BIODIESEL MARKET, BY FEEDSTOCK, 2020-2029 (USD MILLION)

TABLE 146 TURKEY VEGETABLE OIL IN BIODIESEL MARKET, BY SEGMENT, 2020-2029 (USD MILLION)

TABLE 147 TURKEY EDIBLE OILS IN BIODIESEL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 148 TURKEY NON-EDIBLE OILS IN BIODIESEL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 149 TURKEY VEGETABLE OIL IN BIODIESEL MARKET, BY APPLICATION, 2020-2029 (USD MILLION))

TABLE 150 TURKEY ANIMAL FATS IN BIODIESEL MARKET, BY SEGMENT, 2020-2029 (USD MILLION)

TABLE 151 TURKEY ANIMAL FATS IN BIODIESEL MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 152 TURKEY BIODIESEL MARKET, BY BLEND, 2020-2029 (USD MILLION)

TABLE 153 TURKEY BIODIESEL MARKET, BY PRODUCTION TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 154 TURKEY BIODIESEL MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 155 TURKEY FUEL IN BIODIESEL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 156 TURKEY AUTOMOTIVE IN BIODIESEL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 157 TURKEY ON-ROAD VEHICLES IN BIODIESEL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 158 TURKEY OFF-ROAD VEHICLES IN BIODIESEL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 159 LUXEMBURG BIODIESEL MARKET, BY FEEDSTOCK, 2020-2029 (USD MILLION)

TABLE 160 LUXEMBURG VEGETABLE OIL IN BIODIESEL MARKET, BY SEGMENT, 2020-2029 (USD MILLION)

TABLE 161 LUXEMBURG EDIBLE OILS IN BIODIESEL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 162 LUXEMBURG NON-EDIBLE OILS IN BIODIESEL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 163 LUXEMBURG VEGETABLE OIL IN BIODIESEL MARKET, BY APPLICATION, 2020-2029 (USD MILLION))

TABLE 164 LUXEMBURG ANIMAL FATS IN BIODIESEL MARKET, BY SEGMENT, 2020-2029 (USD MILLION)

TABLE 165 LUXEMBURG ANIMAL FATS IN BIODIESEL MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 166 LUXEMBURG BIODIESEL MARKET, BY BLEND, 2020-2029 (USD MILLION)

TABLE 167 LUXEMBURG BIODIESEL MARKET, BY PRODUCTION TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 168 LUXEMBURG BIODIESEL MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 169 LUXEMBURG FUEL IN BIODIESEL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 170 LUXEMBURG AUTOMOTIVE IN BIODIESEL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 171 LUXEMBURG ON-ROAD VEHICLES IN BIODIESEL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 172 LUXEMBURG OFF-ROAD VEHICLES IN BIODIESEL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 173 REST OF EUROPE BIODIESEL MARKET, BY FEEDSTOCK, 2020-2029 (USD MILLION)

그림 목록

FIGURE 1 EUROPE BIODIESEL MARKET

FIGURE 2 EUROPE BIODIESEL MARKET: DATA TRIANGULATION

FIGURE 3 EUROPE BIODIESEL MARKET: DROC ANALYSIS

FIGURE 4 EUROPE BIODIESEL MARKET: REGIONAL MARKET ANALYSIS

FIGURE 5 EUROPE BIODIESEL MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 EUROPE BIODIESEL MARKET: THE FEEDSTOCKLIFE LINE CURVE

FIGURE 7 EUROPE BIODIESEL MARKET: MULTIVARIATE MODELLING

FIGURE 8 EUROPE BIODIESEL MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 EUROPE BIODIESEL MARKET: DBMR MARKET POSITION GRID

FIGURE 10 EUROPE BIODIESEL MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 11 EUROPE BIODIESEL MARKET: THE MARKET CHALLENGE MATRIX

FIGURE 12 EUROPE BIODIESEL MARKET: VENDOR SHARE ANALYSIS

FIGURE 13 EUROPE BIODIESEL MARKET: SEGMENTATION

FIGURE 14 GROWING DEMAND FOR ENVIRONMENT FRIENDLY FUELS IS EXPECTED TO DRIVE EUROPE BIODIESEL MARKET IN THE FORECAST PERIOD

FIGURE 15 VEGETABLE OIL SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE EUROPE BIODIESEL MARKET IN 2022 & 2029

FIGURE 16 IMPORT EXPORT SCENARIO (USD THOUSAND)

FIGURE 17 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF EUROPE BIODIESEL MARKET

FIGURE 18 EUROPE BIODIESEL MARKET: BY FEEDSTOCK, 2021

FIGURE 19 EUROPE BIODIESEL MARKET: BY BLEND, 2021

FIGURE 20 EUROPE BIODIESEL MARKET: BY PRODUCTION TECHNOLOGY, 2021

FIGURE 21 EUROPE BIODIESEL MARKET: BY APPLICATION, 2021

FIGURE 22 EUROPE BIODIESEL MARKET: SNAPSHOT (2021)

FIGURE 23 EUROPE BIODIESEL MARKET: BY COUNTRY (2021)

FIGURE 24 EUROPE BIODIESEL MARKET: BY COUNTRY (2022 & 2029)

FIGURE 25 EUROPE BIODIESEL MARKET: BY COUNTRY (2021 & 2029)

FIGURE 26 EUROPE BIODIESEL MARKET: BY BLEND (2022-2029)

FIGURE 27 EUROPE BIODIESEL MARKET: COMPANY SHARE 2021 (%)

연구 방법론

데이터 수집 및 기준 연도 분석은 대규모 샘플 크기의 데이터 수집 모듈을 사용하여 수행됩니다. 이 단계에는 다양한 소스와 전략을 통해 시장 정보 또는 관련 데이터를 얻는 것이 포함됩니다. 여기에는 과거에 수집한 모든 데이터를 미리 검토하고 계획하는 것이 포함됩니다. 또한 다양한 정보 소스에서 발견되는 정보 불일치를 검토하는 것도 포함됩니다. 시장 데이터는 시장 통계 및 일관된 모델을 사용하여 분석하고 추정합니다. 또한 시장 점유율 분석 및 주요 추세 분석은 시장 보고서의 주요 성공 요인입니다. 자세한 내용은 분석가에게 전화를 요청하거나 문의 사항을 드롭하세요.

DBMR 연구팀에서 사용하는 주요 연구 방법론은 데이터 마이닝, 시장에 대한 데이터 변수의 영향 분석 및 주요(산업 전문가) 검증을 포함하는 데이터 삼각 측량입니다. 데이터 모델에는 공급업체 포지셔닝 그리드, 시장 타임라인 분석, 시장 개요 및 가이드, 회사 포지셔닝 그리드, 특허 분석, 가격 분석, 회사 시장 점유율 분석, 측정 기준, 글로벌 대 지역 및 공급업체 점유율 분석이 포함됩니다. 연구 방법론에 대해 자세히 알아보려면 문의를 통해 업계 전문가에게 문의하세요.

사용자 정의 가능

Data Bridge Market Research는 고급 형성 연구 분야의 선두 주자입니다. 저희는 기존 및 신규 고객에게 목표에 맞는 데이터와 분석을 제공하는 데 자부심을 느낍니다. 보고서는 추가 국가에 대한 시장 이해(국가 목록 요청), 임상 시험 결과 데이터, 문헌 검토, 재생 시장 및 제품 기반 분석을 포함하도록 사용자 정의할 수 있습니다. 기술 기반 분석에서 시장 포트폴리오 전략에 이르기까지 타겟 경쟁업체의 시장 분석을 분석할 수 있습니다. 귀하가 원하는 형식과 데이터 스타일로 필요한 만큼 많은 경쟁자를 추가할 수 있습니다. 저희 분석가 팀은 또한 원시 엑셀 파일 피벗 테이블(팩트북)로 데이터를 제공하거나 보고서에서 사용 가능한 데이터 세트에서 프레젠테이션을 만드는 데 도움을 줄 수 있습니다.