Asia Pacific Unmanned Ground Vehicle Market

시장 규모 (USD 10억)

연평균 성장률 :

%

USD

1.82 Billion

USD

3.44 Billion

2025

2033

USD

1.82 Billion

USD

3.44 Billion

2025

2033

| 2026 –2033 | |

| USD 1.82 Billion | |

| USD 3.44 Billion | |

|

|

|

|

아시아 태평양 무인 지상 차량 시장 세분화, 응용 분야별(군사, 상업 및 연방 법 집행), 크기(대형(500~1,000파운드), 중형(200~500파운드), 초대형(1,000~2,000파운드), 초대형(2,000파운드) 및 소형(10~200파운드)), 시스템(탑재체, 제어 장치, 커넥터, 전선, 액추에이터 및 기계), 이동성(추적식, 바퀴식, 다리식 및 기타), 작동 모드(원격 조작, 자율식 및 테더링) - 산업 동향 및 2032년까지의 예측

아시아 태평양 무인 지상 차량 시장 규모와 성장률은 어느 정도입니까?

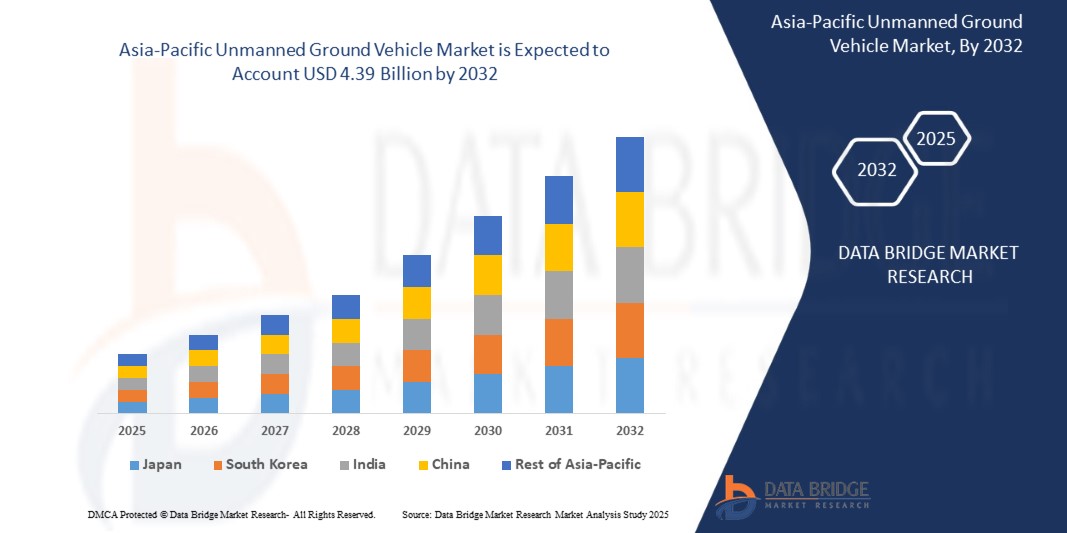

- 아시아 태평양 무인 지상 차량 시장 규모는 2024년에 15억 달러 로 평가되었으며 예측 기간 동안 14.30%의 CAGR 로 2032년까지 43억 9천만 달러 에 도달할 것으로 예상됩니다 .

- 농업 부문 무인 지상 차량에 대한 수요 증가는 시장 성장을 견인하는 주요 요인 중 하나입니다. 업계에서는 차량 및 로봇 플랫폼의 네트워크 연결성을 개선하기 위한 신제품을 출시하고 있으며, 이는 시장 성장을 견인하고 있습니다.

- 국방 및 상업 부문에서 자율 시스템에 대한 수요가 증가함에 따라 시장 성장이 확대되고 있습니다.

무인 지상 차량 시장의 주요 결과는 무엇입니까?

- 방위 현대화 프로그램 확대, 사상자 감소에 대한 집중적인 관심, 그리고 물류 및 광산 부문의 자동화 가속화는 해결 가능한 수요를 동시에 확대합니다. 무인 지상 차량 시장은 또한 센서 및 컴퓨팅 비용 하락으로 인해 가격 상승 없이 정교한 자율 주행이 가능해져 수혜를 입을 것입니다.

- 중국 무인 지상 차량 시장은 국가의 군산복합체 확장, AI 및 로봇 공학에 대한 막대한 투자, 물류 및 감시를 위한 무인 시스템에 대한 강조 증가에 힘입어 2024년 아시아 태평양 지역에서 가장 큰 점유율을 차지했습니다.

- 인도 무인 지상 차량 시장은 Make in India 이니셔티브, 국방비 지출 증가, 국경 감시 및 반란 진압 역량에 대한 긴급한 요구로 인해 2032년까지 강력한 CAGR로 성장할 것으로 예상됩니다.

- 군사 부문은 감시, 전투 지원, 물류 및 폭발물 처리를 위한 무인 지상 차량 배치 증가에 힘입어 2024년 61.5%의 가장 큰 수익 점유율로 시장을 장악했습니다.

보고서 범위 및 무인 지상 차량 시장 세분화

|

속성 |

무인 지상 차량 주요 시장 통찰력 |

|

다루는 세그먼트 |

|

|

포함 국가 |

아시아 태평양

|

|

주요 시장 참여자 |

|

|

시장 기회 |

|

|

부가가치 데이터 정보 세트 |

Data Bridge Market Research에서 큐레이팅한 시장 보고서에는 시장 가치, 성장률, 세분화, 지리적 범위, 주요 업체 등 시장 시나리오에 대한 통찰력 외에도 심층적인 전문가 분석, 가격 분석, 브랜드 점유율 분석, 소비자 설문 조사, 인구 통계 분석, 공급망 분석, 가치 사슬 분석, 원자재/소모품 개요, 공급업체 선택 기준, PESTLE 분석, Porter 분석 및 규제 프레임워크가 포함되어 있습니다. |

무인 지상 차량 시장의 주요 동향은 무엇인가?

“ 자율 기능과 AI 통합으로 지상 작전 재정의 ”

- 무인 지상 차량(UGV) 시장을 형성하는 주요 추세는 AI , 머신 러닝 및 자율 항법 기술의 빠른 통합으로, 임무 수행에 중요한 시나리오에서 고급 지형 매핑, 장애물 회피 및 실시간 의사 결정이 가능해집니다.

- 예를 들어, 2024년 2월 Rheinmetall AG는 AI 기반 목표 인식 및 지형 적응 기능을 갖춘 최신 자율 무인 지상 차량 모델을 공개했습니다. 이 모델은 갈등 지역의 물류 및 감시 임무를 위해 설계되었습니다.

- UGV에는 LiDAR , 레이더, GPS 및 열화상을 결합한 센서 융합 시스템이 점점 더 많이 장착되어 특히 GPS가 없는 환경과 복잡한 지형에서 상황 인식을 개선합니다.

- 국방 기관과 민간 부문 참여자들은 무기, 센서 또는 물류 모듈 과 같은 교체 가능한 탑재물을 다양한 임무 요구 사항에 적응시킬 수 있는 모듈식 무인 지상 차량 플랫폼에 집중하고 있습니다.

- 또한 V2X(차량-사물 간) 통신의 발전으로 무인 지상 차량과 지휘 센터 간의 실시간 데이터 공유가 가능해져 조정과 다중 부대 작전 효율성이 향상되고 있습니다.

- 더욱 스마트하고 자율적인 무인 지상 차량으로의 이러한 전환은 인적 위험을 줄이고 효율성을 개선하며 임무 성공률을 높여 군사, 광산 및 농업 운영을 혁신하고 있습니다.

무인 지상 차량 시장의 주요 동인은 무엇입니까?

- 적대적인 환경에서 군인의 노출을 줄여야 한다는 필요성과 더불어 자동화된 방어 및 감시 시스템에 대한 수요 증가는 군사 및 국토 안보 부문 전반에 걸쳐 무인 지상 차량 도입을 촉진하는 주요 요인입니다.

- 2023년 10월, Northrop Grumman Corporation은 경계 감시 및 자율 재공급 작업을 위한 반자율 무인 지상 차량 시스템의 성공적인 현장 시험을 발표했으며, 이는 로봇 시스템에 대한 방위 투자가 증가하고 있음을 보여줍니다.

- 농업, 광업, 석유 및 가스와 같은 상업 부문에서 무인 지상 차량의 활용이 증가함에 따라 무인 지상 차량은 작물 모니터링, 지형 매핑 및 위험 물질 처리에 도움이 되면서 시장 성장도 촉진되고 있습니다.

- NATO 및 아시아 태평양 국가 전역의 정부 이니셔티브와 방위 현대화 프로그램은 물류, 정찰 및 전투 지원 역할을 수행할 수 있는 무인 시스템에 대한 수요를 촉진하고 있습니다.

- 국경 보안, 테러 방지 작전 및 재난 대응 응용 프로그램에 대한 강조가 커지면서 고급 이동성 및 감지 기능을 갖춘 무인 지상 차량 조달이 더욱 촉진되고 있습니다.

- 이들 드라이버는 함께 다중 도메인 작업에 UGV를 통합하는 것을 가속화하고 지상 기반 자동화 및 방어 전략의 환경을 변화시키고 있습니다.

무인 지상 차량 시장 성장을 저해하는 요인은 무엇인가?

- 무인 지상 차량(UAV)의 광범위한 도입을 저해하는 주요 과제 중 하나는 충전 인프라가 부족하며, 특히 농촌이나 저개발 지역에서 그렇습니다. 모든 곳에 주유소가 있는 것에 익숙한 소비자들에게 주행 거리 불안은 여전히 큰 걱정거리입니다.

- 예를 들어, 발전에도 불구하고 많은 국가에서는 여전히 대규모 도입을 지원하는 데 필요한 고속 충전 네트워크가 부족하여 장거리 여행의 실행 가능성과 차량 사용에 영향을 미칩니다.

- 또한 고급 배터리 팩과 모터 시스템을 사용하기 때문에 프리미엄 무인 지상 차량의 초기 비용이 높기 때문에 인도와 동남아시아와 같이 가격에 민감한 시장에서 특히 장벽이 될 수 있습니다.

- 배터리 수명, 교체 비용 및 배터리 폐기에 따른 환경 영향에 대한 우려도 지속 가능성과 관련된 장애물로 작용합니다.

- 또한 일부 소비자들은 특히 스포츠 및 투어링 카테고리에서 기존 오토바이에 비해 제한된 모델 종류와 가용성에 대해 주저하고 있습니다.

- 이러한 과제를 극복하려면 정부, 제조업체 및 에너지 공급업체 간의 협력적 노력이 필요합니다. 이를 통해 인프라를 개선하고 혁신을 통해 비용을 절감하며 무인 지상 차량의 이점과 사용성에 대한 소비자 교육을 확대해야 합니다.

무인 지상 차량 시장은 어떻게 세분화되어 있나요?

시장은 구동 유형, 배터리 유형, 최종 용도를 기준으로 세분화됩니다.

• 응용 프로그램별

무인 지상 차량 시장은 적용 분야별로 군용, 상업용, 그리고 연방 법 집행용으로 구분됩니다. 군용 부문은 감시, 전투 지원, 군수, 폭발물 처리 등을 위한 무인 지상 차량 배치 증가에 힘입어 2024년 61.5%의 매출 점유율로 시장을 장악했습니다. 전 세계 군대는 임무 수행 능력을 향상시키고 적대적인 환경에서의 인명 위험을 줄이기 위해 로봇 시스템에 투자하고 있습니다.

상업 부문은 광업, 농업, 인프라 검사 등의 산업 분야에서 도입이 증가함에 따라 2025년부터 2032년까지 가장 빠른 연평균 성장률(CAGR)을 기록할 것으로 예상됩니다. 자율 주행 기술이 발전함에 따라 UGV는 상업 부문 전반에서 노동 집약적이거나 위험한 작업에 점점 더 많이 사용되고 있습니다.

• 크기별

시장은 규모에 따라 소형(10~200파운드), 중형(200~500파운드), 대형(500~1,000파운드), 초대형(1,000~2,000파운드), 그리고 초대형(2,000파운드 이상)으로 구분됩니다. 소형 UGV 부문은 다재다능함, 경제성, 그리고 군 및 민간 환경 모두에서 정찰, 감시 및 전술적 활용에 대한 적합성 덕분에 2024년에 38.2%의 가장 큰 시장 점유율을 차지할 것으로 예상됩니다.

매우 큰(>2,000파운드) 세그먼트는 물류, 재공급 임무 및 건설 작업에 사용되는 대형 자율 주행차에 대한 수요가 증가함에 따라 예측 기간 동안 가장 빠른 성장률을 기록할 것으로 예상됩니다.

• 시스템별

UGV 시장은 시스템 기준으로 페이로드, 제어 장치, 커넥터, 전선, 액추에이터, 기계 장치로 구분됩니다. 페이로드 부문은 2024년 매출 점유율 33.7%로 가장 큰 비중을 차지했으며, 다양한 작전 임무를 위해 무인 지상 차량에 통합된 첨단 센서, 카메라, 무기 시스템 및 통신 도구에 대한 수요 증가로 인해 성장세가 두드러졌습니다.

제어 장치 부문은 AI 기반 탐색 및 실시간 명령 인터페이스를 포함한 원격 및 자율 제어 기술의 혁신에 힘입어 2025년부터 2032년까지 가장 빠른 CAGR로 성장할 것으로 예상됩니다.

• 이동성별

이동성을 기준으로 시장은 궤도형, 바퀴형, 다리형, 기타형으로 구분됩니다. 궤도형 무인 지상 차량 부문은 2024년 시장 점유율 45.1%로 가장 큰 비중을 차지했으며, 국방 및 광산 작업에서 탁월한 오프로드 성능, 안정성, 그리고 하중 지지 성능으로 선호되었습니다.

다리 달린 무인 지상 차량 부문은 생체 모방 로봇 공학의 발전과 바퀴 달린 또는 추적 시스템이 덜 효과적인 복잡한 지형을 탐색할 수 있는 시스템에 대한 수요로 인해 예측 기간 동안 가장 빠른 성장을 경험할 것으로 예상됩니다.

• 작동 모드별

무인 지상 차량 시장은 운영 방식에 따라 원격 조종, 자율 주행, 그리고 테더링으로 구분됩니다. 원격 조종 부문은 2024년 52.6%의 가장 큰 매출 점유율을 기록하며 시장을 장악했습니다. 이는 군사 및 산업 분야에서 임무 유연성과 상황 대응력을 위해 인간의 통제가 여전히 중요하기 때문입니다.

자율주행 부문은 AI, 머신 비전, 자율주행 시스템의 급속한 발전에 힘입어 2025년부터 2032년까지 가장 빠른 연평균 성장률(CAGR)을 기록할 것으로 예상됩니다. 무인 시스템에 대한 신뢰도 향상과 물류, 농업, 국방 분야에서의 활용 증가가 성장을 촉진하는 핵심 요인입니다.

무인 지상 차량 시장에서 가장 큰 점유율을 차지하는 나라는 어디인가요?

- 중국 무인 지상 차량 시장은 국가의 군산복합체 확장, AI 및 로봇 공학에 대한 막대한 투자, 물류 및 감시를 위한 무인 시스템에 대한 강조 증가에 힘입어 2024년 아시아 태평양 지역에서 가장 큰 점유율을 차지했습니다.

- 중국 인민해방군(PLA)은 국경 순찰 및 도시전 훈련을 위해 무인 지상 차량을 적극적으로 시험하고 배치하고 있습니다.

- 또한 중국의 상업 부문에서는 무인 지상 차량을 스마트 농업 및 산업 검사에 통합하여 부문 간 도입을 촉진하고 있습니다.

인도 무인 지상 차량 시장 통찰력

인도 무인 지상 차량 시장은 '메이크 인 인디아(Make in India)' 이니셔티브, 국방비 지출 증가, 그리고 국경 감시 및 반군 진압 능력에 대한 긴급한 수요에 힘입어 2032년까지 견고한 연평균 성장률(CAGR)로 성장할 것으로 예상됩니다. 인도 국방 기관들은 스타트업 및 공공 부문과 협력하여 험준한 지형과 적대적인 환경에 최적화된 자체 무인 지상 차량 기술을 개발하고 있습니다. 또한, 광산 회사들은 외딴 지역에서 자재 운반을 위한 반자율 주행 무인 차량(UGV)을 시험하고 있습니다.

일본 무인 지상 차량 시장 통찰력

일본의 무인 지상 차량 시장은 첨단 로봇 기술, 재난 복구 역량 강화, 그리고 진화하는 국방 전략에 힘입어 꾸준히 성장하고 있습니다. 일본 자위대는 수색 및 구조, 폭발물 처리(EOD), 그리고 경계 경비를 위한 무인 지상 차량 도입을 검토하고 있습니다. 민간 부문에서는 인프라 점검 및 농업 자동화에 소형 모바일 로봇을 활용하면서 시장 침투를 더욱 가속화하고 있습니다.

한국 무인 지상 차량 시장 분석

한국의 무인 지상 차량 시장은 국방 혁신, 국경 감시 수요 증가, 그리고 국내 방산 기업과 연구 기관 간의 협력에 힘입어 빠르게 성장하고 있습니다. 한국은 물류, 감시, 전투 지원을 위해 AI 기반 UGV에 투자하고 있습니다. 건설 및 경비 순찰 등 민간 분야에서도 UGV가 시험 운용되고 있으며, 민간 활용 분야도 확대되고 있습니다. 정부의 국방 수출 확대 정책은 한국을 지역 내 주요 무인 지상 차량 생산국으로 자리매김할 것으로 예상됩니다.

무인 지상 차량 시장의 최고 기업은 어디인가요?

무인 지상 차량 산업은 주로 다음을 포함한 기존 기업들이 주도하고 있습니다.

- 혼다 자동차 주식회사(일본)

- Harley-Davidson, Inc. (미국)

- 제로 모터사이클 주식회사(미국)

- KTM AG(오스트리아)

- BMW 모토라드(독일)

- 메이빙(영국)

- Energica Motor Company SpA(이탈리아)

- 케이크(스웨덴)

- SUR-RON USA(미국)

- 일렉트릭 모션(프랑스)

- Fonz Moto Pty Limited(호주)

- 아크 벡터(영국)

- Emflux Motors(인도)

- 에보크 모터사이클(중국)

- 퓨얼 플로우(미국)

- 가와사키 중공업 주식회사(일본)

- Savic Motorcycles(호주)

- 스즈키 자동차 주식회사(일본)

- 타시타 모터사이클(이탈리아)

- 타르폼 루나(미국)

아시아 태평양 무인 지상 차량 시장의 최근 동향은 무엇인가?

- 2025년 6월, 스웨덴 국방물자청(FMV)은 라인메탈(Rheinmetall)과 DAMM 프로그램에 따라 미션 마스터(Mission Master) 무인 지상 차량(UGV)을 평가하기 위한 56만 3천 달러 규모의 계약을 체결했습니다. 이 사업은 스웨덴이 미래 국방 작전에 자율 시스템을 통합하려는 지속적인 의지를 반영합니다.

- 2025년 5월, 화웨이는 중국 이민(Yimin) 탄광에 5G-A 기반 자율 주행 전기 채굴 트럭 100대를 배치하여 기존 수동 차량 대비 120%의 운영 효율성을 달성했습니다. 이번 배치는 산업 현장에서 무인 차량 기술의 상업적 실현 가능성과 생산성 향상 효과를 보여줍니다.

- 2025년 3월, 우크라이나는 UGV와 FPV 드론만을 사용하여 최초의 본격적인 전투 강습을 성공적으로 수행하며 자율 합동 제병 전술의 전장 효율성을 입증했습니다. 이는 현대전에서 중요한 이정표로, 완전 무인 지상 전투 시나리오의 작전적 잠재력을 강조합니다.

- 2025년 1월, 프랑스 군수국(DGA)은 KNDS 및 Safran과 협력하여 DROIDE 프로그램을 시작하여 2035년까지 배치할 수 있는 다중 임무 지상 로봇을 개발하는 것을 목표로 합니다. 이 프로그램은 국가 방위 계획 내에서 로봇 공학 및 자율성에 대한 프랑스의 장기 전략적 초점을 강조합니다.

SKU-

세계 최초의 시장 정보 클라우드 보고서에 온라인으로 접속하세요

- 대화형 데이터 분석 대시보드

- 높은 성장 잠재력 기회를 위한 회사 분석 대시보드

- 사용자 정의 및 질의를 위한 리서치 분석가 액세스

- 대화형 대시보드를 통한 경쟁자 분석

- 최신 뉴스, 업데이트 및 추세 분석

- 포괄적인 경쟁자 추적을 위한 벤치마크 분석의 힘 활용

목차

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELING

2.7 SIZE TIMELINE CURVE

2.8 MARKET APPLICATION COVERAGE GRID

2.9 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.1 DBMR MARKET POSITION GRID

2.11 DBMR VENDOR SHARE ANALYSIS

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHT

4.1 PESTEL ANALYSIS

4.2 CASE STUDY ANALYSIS

4.2.1 CASE STUDY: DEPLOYMENT OF THEMIS UNMANNED GROUND VEHICLE AND ITS IMPACT ON MILITARY LOGISTICS AND COMBAT SUPPORT OPERATIONS

4.2.1.1 BACKGROUND AND STRATEGIC CONTEXT

4.2.1.2 OPERATIONAL CHALLENGES PRIOR TO UGV INTEGRATION

4.2.1.2.1 HIGH PERSONNEL RISK IN FRONTLINE AND SUPPORT MISSIONS

4.2.1.2.2 LOGISTICAL CONSTRAINTS IN CONTESTED AND REMOTE TERRAIN

4.2.1.2.3 DEMAND FOR ENHANCED SITUATIONAL AWARENESS

4.2.1.3 TECHNOLOGICAL AND OPERATIONAL MEASURES INTRODUCED

4.2.1.3.1 MODULAR UGV ARCHITECTURE

4.2.1.3.2 REMOTE AND SEMI-AUTONOMOUS OPERATION

4.2.1.3.3 INTEGRATION WITH EXISTING FORCE STRUCTURES

4.2.1.4 IMPACT ON MILITARY OPERATIONS AND LOGISTICS EFFICIENCY

4.2.1.4.1 IMPROVED LOGISTICS CONTINUITY

4.2.1.4.2 REDUCED EXPOSURE OF HUMAN PERSONNEL

4.2.1.4.3 ENHANCED OPERATIONAL FLEXIBILITY

4.2.1.4.4 SUPPORT FOR MULTI-DOMAIN OPERATIONS

4.2.1.5 LIMITATIONS AND LESSONS LEARNED

4.2.1.5.1 DEPENDENCE ON COMMUNICATIONS AND CONTROL SYSTEMS

4.2.1.5.2 CONSTRAINTS ON FULL AUTONOMY IN COMPLEX ENVIRONMENTS

4.2.2 CASE STUDY: MULTIFUNCTIONAL UNMANNED GROUND VEHICLES IN EMERGENCY RESPONSE AND PUBLIC SAFETY OPERATIONS

4.2.2.1 BACKGROUND AND STRATEGIC CONTEXT

4.2.2.2 OPERATIONAL CHALLENGES BEFORE UGV DEPLOYMENT

4.2.2.2.1 HIGH RISK TO FIRST RESPONDERS

4.2.2.2.2 DELAYS IN INCIDENT ASSESSMENT

4.2.2.3 TECHNOLOGICAL MEASURES INTRODUCED

4.2.2.3.1 INTEGRATED SENSORS AND MANIPULATION TOOLS

4.2.2.3.2 REMOTE COMMAND AND CONTROL OPERATIONS

4.2.2.4 IMPACT ON EMERGENCY RESPONSE EFFECTIVENESS

4.2.2.4.1 IMPROVED RESPONDER SAFETY

4.2.2.4.2 FASTER AND MORE INFORMED DECISION-MAKING

4.3 CONSUMER BUYING BEHAVIOUR

4.4 CONSUMER PURCHASE DECISION PROCESS

4.4.1 PROBLEM RECOGNITION

4.4.2 INFORMATION SEARCH

4.4.3 ALTERNATIVE EVALUATION

4.4.4 PURCHASE DECISION

4.4.5 POST-PURCHASE BEHAVIOR

4.4.6 INFLUENCING FACTORS

4.5 KEY STRATEGIC INITIATIVES

4.5.1 INTEGRATION OF UGVS INTO MULTI-DOMAIN DEFENCE AND SECURITY ARCHITECTURES

4.5.1.1 CONVERGENCE OF LAND, AIR, AND COMMAND-AND-CONTROL SYSTEMS

4.5.1.2 INTEROPERABILITY WITH EXISTING MILITARY AND HOMELAND SECURITY ASSETS

4.5.1.3 Coordination of Multimodal Transport Networks

4.5.2 EMPHASIS ON AUTONOMY, ARTIFICIAL INTELLIGENCE AND ADVANCED SENSING

4.5.2.1 ADVANCEMENT OF SEMI-AUTONOMOUS AND AUTONOMOUS NAVIGATION

4.5.2.2 INTEGRATION OF MULTI-SENSOR AND PERCEPTION SYSTEMS

4.5.3 PLATFORM MODULARITY AND MISSION-SPECIFIC CONFIGURABILITY

4.5.3.1 DEVELOPMENT OF MODULAR PAYLOAD AND CHASSIS DESIGNS

4.5.3.2 SUPPORT FOR DUAL-USE AND CIVIL–MILITARY APPLICATIONS

4.5.4 LOCALISATION, DOMESTIC MANUFACTURING AND SUPPLY CHAIN RESILIENCE

4.5.4.1 ALIGNMENT WITH NATIONAL DEFENCE INDUSTRIAL POLICIES

4.5.4.2 STRENGTHENING OF REGIONAL SUPPLY AND MAINTENANCE ECOSYSTEMS

4.5.5 CYBERSECURITY, RELIABILITY AND OPERATIONAL RESILIENCE

4.5.5.1 INTEGRATION OF SECURE COMMUNICATION AND CYBER HARDENING

4.5.5.2 DESIGN FOR HARSH AND CONTESTED ENVIRONMENTS

4.5.6 EXPANSION OF INTERNATIONAL COLLABORATIONS AND DEFENCE PARTNERSHIPS

4.5.6.1 CROSS-BORDER TECHNOLOGY COLLABORATION AND JOINT PROGRAMS

4.5.6.2 PARTICIPATION IN ASIA-PACIFIC DEFENCE MODERNISATION PROGRAMS

4.6 REGIONAL GROWTH OPPORTUNITIES

4.6.1 NORTH AMERICA — ADVANCED DEFENCE DOCTRINE AND TECHNOLOGY LEADERSHIP

4.6.1.1 INSTITUTIONALISATION OF ROBOTIC AND AUTONOMOUS GROUND SYSTEMS

4.6.1.2 BORDER SECURITY, BASE PROTECTION AND HOMELAND APPLICATIONS

4.6.2 EUROPE — MULTINATIONAL COOPERATION AND TERRITORIAL SECURITY

4.6.2.1 COLLECTIVE DEFENCE AND INTEROPERABILITY-DRIVEN DEMAND

4.6.2.2 HEIGHTENED FOCUS ON BORDER SURVEILLANCE AND INFRASTRUCTURE PROTECTION

4.6.3 ASIA–PACIFIC — STRATEGIC TENSIONS AND DUAL-USE EXPANSION

4.6.3.1 BORDER MANAGEMENT AND TERRAIN-INTENSIVE OPERATIONS

4.6.3.2 DISASTER RESPONSE, URBAN SAFETY AND CIVIL APPLICATIONS

4.6.4 MIDDLE EAST — BORDER CONTROL AND CRITICAL ASSET SECURITY

4.6.4.1 PROTECTION OF ENERGY AND STRATEGIC INFRASTRUCTURE

4.6.4.2 LOCAL DEFENCE INDUSTRIAL DEVELOPMENT

4.6.5 CONCLUSION

4.7 TECHNOLOGICAL ADVANCEMENTS

4.7.1 OVERVIEW

4.7.2 AUTONOMOUS NAVIGATION AND ADVANCED SLAM CAPABILITIES

4.7.3 ARTIFICIAL INTELLIGENCE–DRIVEN PERCEPTION AND SENSOR FUSION

4.7.4 EDGE COMPUTING AND ON-BOARD AUTONOMY

4.7.5 SWARMING TECHNOLOGIES AND MULTI-VEHICLE COORDINATION

4.7.6 MODULAR DESIGN AND OPEN-SYSTEM ARCHITECTURES

4.7.7 DIGITAL TWINS, SIMULATION, AND SYNTHETIC TRAINING ENVIRONMENTS

4.7.8 CONCLUSION

4.8 PRICING ANALYSIS

4.9 COMPANY COMPARATIVE ANALYSIS: TOP SELLING MODEL VS PRICE RANGE

4.1 IMPORT EXPORT SCENARIO

4.10.1 COUNTRY-LEVEL PATTERNS

4.10.2 COMPANY-LEVEL TRADE BEHAVIOR

4.11 SUSTAINABILITY INITIATIVES

4.11.1 SUSTAINABILITY DRIVERS IN THE UGV MARKET:

4.11.2 REAL-TIME EXAMPLES: SUSTAINABILITY IN PRACTICE

4.11.2.1 Defense Sector: Hybridization and Fuel Reduction

4.11.2.2 Active Combat Logistics: Resource Optimization

4.11.2.3 Agriculture: Direct Environmental Sustainability Impact

4.11.2.4 Disaster Response & Hazard Mitigation

4.11.3 CROSS-CUTTING SUSTAINABILITY THEMES

4.11.4 STRATEGIC IMPLICATIONS FOR THE UGV MARKET

4.12 TECHNOLOGICAL TRENDS

4.13 SUPPLY CHAIN ANALYSIS

4.13.1 RAW MATERIALS AND FOUNDATIONAL INPUTS

4.13.2 CORE COMPONENT MANUFACTURING

4.13.3 SENSORS, ELECTRONICS, AND SUBSYSTEMS

4.13.4 SOFTWARE, AUTONOMY, AND CONTROL SYSTEMS

4.13.5 SYSTEM INTEGRATION AND FINAL ASSEMBLY

4.13.6 DISTRIBUTION, DEPLOYMENT, AND LIFECYCLE SUPPORT

5 REGULATORY STANDARDS

5.1 DEFENSE AND MILITARY PROCUREMENT FRAMEWORKS

5.1.1 NATIONAL DEFENSE ACQUISITION SYSTEMS

5.1.2 REGULATIONS ON WEAPONIZATION AND AUTONOMOUS ENGAGEMENT

5.2 SAFETY AND OPERATIONAL COMPLIANCE STANDARDS

5.2.1 INTERNATIONAL ROBOTICS AND FUNCTIONAL SAFETY STANDARDS

5.2.2 SECTOR-SPECIFIC OPERATIONAL SAFETY REQUIREMENTS

5.3 COMMUNICATION, SPECTRUM, AND CYBERSECURITY REGULATIONS

5.3.1 RADIOFREQUENCY SPECTRUM GOVERNANCE

5.3.2 CYBERSECURITY AND ENCRYPTION COMPLIANCE

5.4 ARTIFICIAL INTELLIGENCE, AUTONOMY AND ETHICAL GOVERNANCE

5.4.1 INTERNATIONAL AI PRINCIPLES AND HUMAN-CONTROL REQUIREMENTS

5.4.2 NATIONAL AND REGIONAL AI REGULATORY POLICIES

5.5 EXPORT CONTROL AND CROSS-BORDER TRADE REGULATIONS

5.5.1 CONTROL OF DUAL-USE TECHNOLOGIES

5.5.2 SANCTIONS AND MARKET ACCESS LIMITATIONS

5.6 CERTIFICATION, TESTING, AND FIELD DEPLOYMENT STANDARDS

5.6.1 DEFENSE OPERATIONAL TESTING AND EVALUATION

5.6.2 INDUSTRIAL AND COMMERCIAL COMPLIANCE PATHWAYS

5.7 CONCLUSION

6 MARKET OVERVIEW

6.1 DRIVER

6.1.1 DEFENCE MODERNIZATION PROGRAMS ACCELERATING ASIA-PACIFIC UGV PROCUREMENT MOMENTUM

6.1.2 ADVANCEMENTS IN AI AND SENSORS ENABLING HIGHER-AUTONOMY CAPABILITIES

6.1.3 EXPANDING COMMERCIAL ADOPTION ACROSS MINING, AGRICULTURE, AND LOGISTICS

6.1.4 GROWING USAGE OF UNMANNED GROUND VEHICLES IN AREAS AFFECTED BY CBRN ATTACKS

6.2 RESTRAINT

6.2.1 HIGH DEVELOPMENT AND INTEGRATION COSTS LIMITING WIDER DEPLOYMENT

6.2.2 EXPORT CONTROLS AND POLICY RESTRICTIONS CONSTRAINING ASIA-PACIFIC SALES

6.3 OPPORTUNITIES

6.3.1 MODULAR MISSION-PAYLOAD DESIGNS UNLOCKING DIVERSIFIED APPLICATION SEGMENTS OF UGV

6.3.2 EXPANDING ROLE OF UNMANNED SYSTEMS IN MULTI-DOMAIN OPERATIONS

6.3.3 AFTERMARKET SERVICE AND SOFTWARE EXPANDING UGV PROFITABILITY POTENTIAL

6.4 CHALLENGES

6.4.1 CYBERSECURITY VULNERABILITIES CREATING OPERATIONAL AND SAFETY RISKS

6.4.2 RELIABILITY ISSUES IN HARSH, CONTESTED, AND REMOTE ENVIRONMENTS

7 ASIA-PACIFIC UNMANNED GROUND VEHICLE MARKET, BY SIZE

7.1 OVERVIEW

7.2 MICRO UGVS (<10 LBS)

7.3 SMALL (10 - 200 LBS)

7.4 MEDIUM (200 - 500 LBS)

7.5 LARGE (500 – 1,000 LBS)

7.6 VERY LARGE (1,000 – 2,000 LBS)

7.7 EXTREMELY LARGE (>2,000 LBS)

7.8 ASIA-PACIFIC MICRO UGVS IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

7.8.1 ASIA-PACIFIC

7.8.2 EUROPE

7.8.3 NORTH AMERICA

7.8.4 SOUTH AMERICA

7.8.5 MIDDLE EAST & AFRICA

7.9 ASIA-PACIFIC SMALL IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

7.9.1 ASIA-PACIFIC

7.9.2 EUROPE

7.9.3 NORTH AMERICA

7.9.4 SOUTH AMERICA

7.9.5 MIDDLE EAST & AFRICA

7.1 ASIA-PACIFIC MEDIUM IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

7.10.1 ASIA-PACIFIC

7.10.2 EUROPE

7.10.3 NORTH AMERICA

7.10.4 SOUTH AMERICA

7.10.5 MIDDLE EAST & AFRICA

7.11 ASIA-PACIFIC LARGE IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

7.11.1 ASIA-PACIFIC

7.11.2 EUROPE

7.11.3 NORTH AMERICA

7.11.4 SOUTH AMERICA

7.11.5 MIDDLE EAST & AFRICA

7.12 ASIA-PACIFIC VERY LARGE IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

7.12.1 ASIA-PACIFIC

7.12.2 EUROPE

7.12.3 NORTH AMERICA

7.12.4 SOUTH AMERICA

7.12.5 MIDDLE EAST & AFRICA

7.13 ASIA-PACIFIC EXTREMELY LARGE IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

7.13.1 ASIA-PACIFIC

7.13.2 EUROPE

7.13.3 NORTH AMERICA

7.13.4 SOUTH AMERICA

7.13.5 MIDDLE EAST & AFRICA

8 ASIA-PACIFIC UNMANNED GROUND VEHICLE MARKET, BY SYSTEM

8.1 OVERVIEW

8.2 ASIA-PACIFIC UNMANNED GROUND VEHICLE MARKET, BY SYSTEM, 2019-2033 (USD THOUSAND)

8.2.1 PAYLOADS

8.2.2 CONTROLLER UNITS

8.2.3 POWER SYSTEM

8.2.4 NAVIGATION SYSTEM

8.2.5 CHASSIS SYSTEM

8.2.6 COMMUNICATION SYSTEM

8.2.7 OTHERS

8.3 ASIA-PACIFIC PAYLOAD IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

8.3.1 CAMERAS

8.3.2 SENSORS

8.3.3 GPS ANTENNAS

8.3.4 LASERS

8.3.5 RADARS

8.3.6 MOTOR ENCODERS

8.3.7 ARTICULATED ARMS

8.3.8 OTHERS

8.4 ASIA-PACIFIC PAYLOAD IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

8.4.1 ASIA-PACIFIC

8.4.2 EUROPE

8.4.3 NORTH AMERICA

8.4.4 SOUTH AMERICA

8.4.5 MIDDLE EAST & AFRICA

8.5 ASIA-PACIFIC CONTROLLER IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

8.5.1 ASIA-PACIFIC

8.5.2 EUROPE

8.5.3 NORTH AMERICA

8.5.4 SOUTH AMERICA

8.5.5 MIDDLE EAST & AFRICA

8.6 ASIA-PACIFIC POWER SYSTEM IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

8.6.1 ELECTRIC NON SOLAR RECHARGEABLE BATTERY

8.6.2 SOLAR RECHARGEABLE BATTERY

8.7 ASIA-PACIFIC ELECTRIC NON SOLAR RECHARGABLE IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

8.7.1 LITHIUM ION

8.7.2 LEAD ACID

8.7.3 NICKEL METAL HYDRIDE

8.7.4 NICKEL CADMIUM

8.8 ASIA-PACIFIC POWER SYSTEM IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

8.8.1 ASIA-PACIFIC

8.8.2 EUROPE

8.8.3 NORTH AMERICA

8.8.4 SOUTH AMERICA

8.8.5 MIDDLE EAST & AFRICA

8.9 ASIA-PACIFIC NAVIGATION SYSTEM IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

8.9.1 ASIA-PACIFIC

8.9.2 EUROPE

8.9.3 NORTH AMERICA

8.9.4 SOUTH AMERICA

8.9.5 MIDDLE EAST & AFRICA

8.1 ASIA-PACIFIC CHASSIS SYSTEM IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

8.10.1 MOTOR

8.10.2 ACTUATOR

8.11 ASIA-PACIFIC CHASSIS SYSTEM IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

8.11.1 ASIA-PACIFIC

8.11.2 EUROPE

8.11.3 NORTH AMERICA

8.11.4 SOUTH AMERICA

8.11.5 MIDDLE EAST & AFRICA

8.12 ASIA-PACIFIC COMMUNICATION SYSTEM IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

8.12.1 RF COMMUNICATION

8.12.2 SATELLITE COMMUNICATION

8.12.3 4G/5G COMMUNICATION

8.13 ASIA-PACIFIC COMMUNICATION SYSTEM IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

8.13.1 ASIA-PACIFIC

8.13.2 EUROPE

8.13.3 NORTH AMERICA

8.13.4 SOUTH AMERICA

8.13.5 MIDDLE EAST & AFRICA

8.14 ASIA-PACIFIC OTHERS IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

8.14.1 ASIA-PACIFIC

8.14.2 EUROPE

8.14.3 NORTH AMERICA

8.14.4 SOUTH AMERICA

8.14.5 MIDDLE EAST & AFRICA

9 ASIA-PACIFIC UNMANNED GROUND VEHICLE MARKET, BY MOBILITY

9.1 OVERVIEW

9.2 ASIA-PACIFIC UNMANNED GROUND VEHICLE MARKET, BY MOBILITY, 2019-2033 (USD THOUSAND)

9.2.1 WHEELED

9.2.2 TRACKED

9.2.3 LEGGED

9.2.4 HYBRID

9.2.5 SNAKE/ARTICULATED MOBILITY

9.3 ASIA-PACIFIC WHEELED IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

9.3.1 ASIA-PACIFIC

9.3.2 EUROPE

9.3.3 NORTH AMERICA

9.3.4 SOUTH AMERICA

9.3.5 MIDDLE EAST & AFRICA

9.4 ASIA-PACIFIC TRACKED IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

9.4.1 ASIA-PACIFIC

9.4.2 EUROPE

9.4.3 NORTH AMERICA

9.4.4 SOUTH AMERICA

9.4.5 MIDDLE EAST & AFRICA

9.5 ASIA-PACIFIC LEGGED IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

9.5.1 ASIA-PACIFIC

9.5.2 EUROPE

9.5.3 NORTH AMERICA

9.5.4 SOUTH AMERICA

9.5.5 MIDDLE EAST & AFRICA

9.6 ASIA-PACIFIC HYBRID IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

9.6.1 ASIA-PACIFIC

9.6.2 EUROPE

9.6.3 NORTH AMERICA

9.6.4 SOUTH AMERICA

9.6.5 MIDDLE EAST & AFRICA

9.7 ASIA-PACIFIC SNAKE/ARTICULATED MOBILITY IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

9.7.1 ASIA-PACIFIC

9.7.2 EUROPE

9.7.3 NORTH AMERICA

9.7.4 SOUTH AMERICA

9.7.5 MIDDLE EAST & AFRICA

10 ASIA-PACIFIC UNMANNED GROUND VEHICLE MARKET, BY MODE OF OPERATION

10.1 OVERVIEW

10.2 ASIA-PACIFIC UNMANNED GROUND VEHICLE MARKET, BY MODE OF OPERATION, 2019-2033 (USD THOUSAND)

10.2.1 TELEOPERATED

10.2.2 TETHERED

10.2.3 AUTONOMOUS

10.3 ASIA-PACIFIC TELEOPERATED IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

10.3.1 ASIA-PACIFIC

10.3.2 EUROPE

10.3.3 NORTH AMERICA

10.3.4 SOUTH AMERICA

10.3.5 MIDDLE EAST & AFRICA

10.4 ASIA-PACIFIC TETHERED IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

10.4.1 ASIA-PACIFIC

10.4.2 EUROPE

10.4.3 NORTH AMERICA

10.4.4 SOUTH AMERICA

10.4.5 MIDDLE EAST & AFRICA

10.5 ASIA-PACIFIC AUTONOMOUS IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

10.5.1 SEMI-AUTONOMOUS

10.5.2 FULLY AUTONOMOUS

10.6 ASIA-PACIFIC AUTONOMOUS IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

10.6.1 ASIA-PACIFIC

10.6.2 EUROPE

10.6.3 NORTH AMERICA

10.6.4 SOUTH AMERICA

10.6.5 MIDDLE EAST & AFRICA

11 ASIA-PACIFIC UNMANNED GROUND VEHICLE MARKET, BY PAYLOAD

11.1 OVERVIEW

11.2 ASIA-PACIFIC UNMANNED GROUND VEHICLE MARKET, BY PAYLOAD, 2019-2033 (USD THOUSAND)

11.2.1 LIGHT DUTY (LESS THAN 50 KG

11.2.2 MEDIUM DUTY (50–200 KG)

11.2.3 HEAVY DUTY (200–1,000 KG)

11.2.4 ULTRA-HEAVY DUTY (>1,000 KG)

11.3 ASIA-PACIFIC LIGHT DUTY IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

11.3.1 ASIA-PACIFIC

11.3.2 EUROPE

11.3.3 NORTH AMERICA

11.3.4 SOUTH AMERICA

11.3.5 MIDDLE EAST & AFRICA

11.4 ASIA-PACIFIC MEDIUM DUTY IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

11.4.1 ASIA-PACIFIC

11.4.2 EUROPE

11.4.3 NORTH AMERICA

11.4.4 SOUTH AMERICA

11.4.5 MIDDLE EAST & AFRICA

11.5 ASIA-PACIFIC HEAVY DUTY IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

11.5.1 ASIA-PACIFIC

11.5.2 EUROPE

11.5.3 NORTH AMERICA

11.5.4 SOUTH AMERICA

11.5.5 MIDDLE EAST & AFRICA

11.6 ASIA-PACIFIC ULTRA HEAVY DUTY IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

11.6.1 ASIA-PACIFIC

11.6.2 EUROPE

11.6.3 NORTH AMERICA

11.6.4 SOUTH AMERICA

11.6.5 MIDDLE EAST & AFRICA

12 ASIA-PACIFIC UNMANNED GROUND VEHICLE MARKET, BY PROPULSION

12.1 OVERVIEW

12.2 ASIA-PACIFIC UNMANNED GROUND VEHICLE MARKET, BY PROPULSION, 2019-2033 (USD THOUSAND)

12.2.1 ELECTRIC

12.2.2 HYBRID

12.2.3 DIESEL/GASOLINE POWERED

12.2.4 HYDROGEN FUEL CELL UGVS

12.2.5 SOLAR-ASSISTED UGVS

12.3 ASIA-PACIFIC ELECTRIC IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

12.3.1 ASIA-PACIFIC

12.3.2 EUROPE

12.3.3 NORTH AMERICA

12.3.4 SOUTH AMERICA

12.3.5 MIDDLE EAST & AFRICA

12.4 ASIA-PACIFIC HYBRID IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

12.4.1 ASIA-PACIFIC

12.4.2 EUROPE

12.4.3 NORTH AMERICA

12.4.4 SOUTH AMERICA

12.4.5 MIDDLE EAST & AFRICA

12.5 ASIA-PACIFIC DIESEL/GASOLINE POWERED IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

12.5.1 ASIA-PACIFIC

12.5.2 EUROPE

12.5.3 NORTH AMERICA

12.5.4 SOUTH AMERICA

12.5.5 MIDDLE EAST & AFRICA

12.6 ASIA-PACIFIC HYDROGEN FUEL CELL UGVS IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

12.6.1 ASIA-PACIFIC

12.6.2 EUROPE

12.6.3 NORTH AMERICA

12.6.4 SOUTH AMERICA

12.6.5 MIDDLE EAST & AFRICA

12.7 ASIA-PACIFIC SOLAR ASSISTED UGVS IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

12.7.1 ASIA-PACIFIC

12.7.2 EUROPE

12.7.3 NORTH AMERICA

12.7.4 SOUTH AMERICA

12.7.5 MIDDLE EAST & AFRICA

13 ASIA-PACIFIC UNMANNED GROUND VEHICLE MARKET, BY APPLICATION

13.1 OVERVIEW

13.2 ASIA-PACIFIC UNMANNED GROUND VEHICLE MARKET, BY APPLICATION, 2019-2033 (USD THOUSAND)

13.2.1 COMMERCIAL

13.2.2 MILITARY

13.2.3 FEDERAL LAW ENFORCEMENT

13.2.4 LAW ENFORCEMENT

13.3 ASIA-PACIFIC COMMERCIAL IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

13.3.1 FIREFIGHTING

13.3.2 AUTONOMOUS DELIVERY

13.3.3 CBRN

13.3.4 PHYSICAL SECURITY

13.3.5 AGRICULTURE

13.3.6 DOMESTIC

13.3.7 OIL & GAS

13.3.8 WAREHOUSE & LOGISTICS

13.3.9 OTHERS

13.4 ASIA-PACIFIC AGRICULTURE IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

13.4.1 SPRAYING

13.4.2 MOWING

13.4.3 TILLING

13.5 ASIA-PACIFIC OIL & GAS IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

13.5.1 INSPECTION

13.5.2 HAULAGE

13.6 ASIA-PACIFIC WAREHOUSE & LOGISTICS IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

13.6.1 SORTING ROBOTS

13.6.2 PALLET MOVERS

13.7 ASIA-PACIFIC COMMERCIAL IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

13.7.1 ASIA-PACIFIC

13.7.2 EUROPE

13.7.3 NORTH AMERICA

13.7.4 SOUTH AMERICA

13.7.5 MIDDLE EAST & AFRICA

13.8 ASIA-PACIFIC MILITARY IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

13.8.1 TRANSPORTATION

13.8.2 INTELLIGENCE, SURVEILLANCE, AND RECONNAISSANCE (ISR)

13.8.3 EXPLOSIVE ORDNANCE DISPOSAL

13.8.4 SEARCH & RESCUE

13.8.5 FIREFIGHTING

13.8.6 COMBAT SUPPORT

13.8.7 MINE CLEARANCE

13.8.8 OTHERS

13.9 ASIA-PACIFIC MILITARY IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

13.9.1 ASIA-PACIFIC

13.9.2 EUROPE

13.9.3 NORTH AMERICA

13.9.4 SOUTH AMERICA

13.9.5 MIDDLE EAST & AFRICA

13.1 ASIA-PACIFIC FEDERAL LAW ENFORCEMENT IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

13.10.1 ASIA-PACIFIC

13.10.2 EUROPE

13.10.3 NORTH AMERICA

13.10.4 SOUTH AMERICA

13.10.5 MIDDLE EAST & AFRICA

13.11 ASIA-PACIFIC LAW ENFORCEMENT IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

13.11.1 BOMB DISPOSAL UNITS

13.11.2 RIOT CONTROL ROBOTS

13.11.3 URBAN SURVEILLANCE ROBOTS

13.12 ASIA-PACIFIC LAW ENFORCEMENT IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

13.12.1 ASIA-PACIFIC

13.12.2 EUROPE

13.12.3 NORTH AMERICA

13.12.4 SOUTH AMERICA

13.12.5 MIDDLE EAST & AFRICA

14 ASIA-PACIFIC UNMANNED GROUND VEHICLE MARKET, BY REGION

14.1 ASIA-PACIFIC

14.1.1 JAPAN

14.1.2 CHINA

14.1.3 SOUTH KOREA

14.1.4 INDIA

14.1.5 AUSTRALIA

14.1.6 SINGAPORE

14.1.7 THAILAND

14.1.8 MALAYSIA

14.1.9 INDONESIA

14.1.10 PHILIPPINES

14.1.11 NEW ZEALAND

14.1.12 VIETNAM

14.1.13 TAIWAN

14.1.14 REST OF ASIA-PACIFIC

15 ASIA-PACIFIC UNMANNED GROUND VEHICLE MARKET

15.1 COMPANY SHARE ANALYSIS: GLOBAL

16 SWOT ANALYSIS

17 COMPANY PROFILE

17.1 GENERAL DYNAMICS LAND SYSTEMS

17.1.1 COMPANY SNAPSHOT

17.1.2 COMPANY SHARE ANALYSIS

17.1.3 PRODUCT PORTFOLIO

17.1.4 RECENT DEVELOPMENT

17.2 RHEINMETALL AG

17.2.1 COMPANY SNAPSHOT

17.2.2 REVENUE ANALYSIS

17.2.3 COMPANY SHARE ANALYSIS

17.2.4 PRODUCT PORTFOLIO

17.2.5 RECENT DEVELOPMENT

17.3 ELBIT SYSTEMS LTD.

17.3.1 COMPANY SNAPSHOT

17.3.2 REVENUE ANALYSIS

17.3.3 COMPANY SHARE ANALYSIS

17.3.4 PRODUCT PORTFOLIO

17.3.5 RECENT DEVELOPMENT

17.4 TEXTRON SYSTEMS

17.4.1 COMPANY SNAPSHOT

17.4.2 COMPANY SHARE ANALYSIS

17.4.3 PRODUCT PORTFOLIO

17.4.4 RECENT DEVELOPMENT

17.5 THALES

17.5.1 COMPANY SNAPSHOT

17.5.2 REVENUE ANALYSIS

17.5.3 COMPANY SHARE ANALYSIS

17.5.4 PRODUCT PORTFOLIO

17.5.5 RECENT DEVELOPMENT

17.6 AEROVIRONMENT, INC

17.6.1 COMPANY SNAPSHOT

17.6.2 REVENUE ANALYSIS

17.6.3 PRODUCT PORTFOLIO

17.6.4 RECENT DEVELOPMENT

17.7 ASELSAN A.Ş.

17.7.1 COMPANY SNAPSHOT

17.7.2 REVENUE ANALYSIS

17.7.3 PRODUCT PORTFOLIO

17.7.4 RECENT DEVELOPMENT

17.8 DOK-ING

17.8.1 COMPANY SNAPSHOT

17.8.2 PRODUCT PORTFOLIO

17.8.3 RECENT DEVELOPMENT

17.9 EDGEFORCE

17.9.1 COMPANY SNAPSHOT

17.9.2 PRODUCT PORTFOLIO

17.9.3 RECENT DEVELOPMENT

17.1 GHOSTROBOTICS.

17.10.1 COMPANY SNAPSHOT

17.10.2 PRODUCT PORTFOLIO

17.10.3 RECENT DEVELOPMENT

17.11 HANWHA AEROSPACE

17.11.1 COMPANY SNAPSHOT

17.11.2 REVENUE ANALYSIS

17.11.3 PRODUCT PORTFOLIO

17.11.4 RECENT DEVELOPMENT

17.12 HYUNDAI ROTEM COMPANY.

17.12.1 COMPANY SNAPSHOT

17.12.2 REVENUE ANALYSIS

17.12.3 PRODUCT PORTFOLIO

17.12.4 RECENT DEVELOPMENT

17.13 IAI

17.13.1 COMPANY SNAPSHOT

17.13.2 PRODUCT PORTFOLIO

17.13.3 RECENT DEVELOPMENT

17.14 LEONARDO S.P.A.

17.14.1 COMPANY SNAPSHOT

17.14.2 REVENUE ANALYSIS

17.14.3 PRODUCT PORTFOLIO

17.14.4 RECENT DEVELOPMENT

17.15 MILREM AS

17.15.1 COMPANY SNAPSHOT

17.15.2 PRODUCT PORTFOLIO

17.15.3 RECENT DEVELOPMENT

17.16 PERATON

17.16.1 COMPANY SNAPSHOT

17.16.2 PRODUCT PORTFOLIO

17.16.3 RECENT DEVELOPMENT

17.17 QINETIQ

17.17.1 COMPANY SNAPSHOT

17.17.2 REVENUE ANALYSIS

17.17.3 PRODUCT PORTFOLIO

17.17.4 RECENT DEVELOPMENT

17.18 ROBOTEAM

17.18.1 COMPANY SNAPSHOT

17.18.2 PRODUCT PORTFOLIO

17.18.3 RECENT DEVELOPMENT

17.19 ST ENGINEERING

17.19.1 COMPANY SNAPSHOT

17.19.2 REVENUE ANALYSIS

17.19.3 PRODUCT PORTFOLIO

17.19.4 RECENT DEVELOPMENT

17.2 TELEDYNE FLIR DEFENSE INC.

17.20.1 COMPANY SNAPSHOT

17.20.2 REVENUE ANALYSIS

17.20.3 PRODUCT PORTFOLIO

17.20.4 RECENT DEVELOPMENT

18 QUESTIONNAIRE

19 RELATED REPORTS

표 목록

TABLE 1 COMPANY COMPARATIVE ANALYSIS

TABLE 2 TECHNOLOGICAL DEVELOPMENT

TABLE 3 ASIA-PACIFIC UNMANNED GROUND VEHICLE MARKET, BY SIZE, 2019-2033 (USD THOUSAND)

TABLE 4 ASIA-PACIFIC MICRO UGVS IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

TABLE 5 ASIA-PACIFIC SMALL IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

TABLE 6 ASIA-PACIFIC MEDIUM IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

TABLE 7 ASIA-PACIFIC LARGE IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

TABLE 8 ASIA-PACIFIC VERY LARGE IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

TABLE 9 ASIA-PACIFIC EXTREMELY LARGE IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

TABLE 10 ASIA-PACIFIC UNMANNED GROUND VEHICLE MARKET, BY SYSTEM, 2019-2033 (USD THOUSAND)

TABLE 11 ASIA-PACIFIC PAYLOAD IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 12 ASIA-PACIFIC PAYLOAD IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

TABLE 13 ASIA-PACIFIC CONTROLLER IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

TABLE 14 ASIA-PACIFIC POWER SYSTEM IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 15 ASIA-PACIFIC ELECTRIC NON SOLAR RECHARGABLE IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 16 ASIA-PACIFIC POWER SYSTEM IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

TABLE 17 ASIA-PACIFIC NAVIGATION SYSTEM IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

TABLE 18 ASIA-PACIFIC CHASSIS SYSTEM IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 19 ASIA-PACIFIC CHASSIS SYSTEM IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

TABLE 20 ASIA-PACIFIC COMMUNICATION SYSTEM IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 21 ASIA-PACIFIC COMMUNICATION SYSTEM IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

TABLE 22 ASIA-PACIFIC OTHERS IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

TABLE 23 ASIA-PACIFIC UNMANNED GROUND VEHICLE MARKET, BY MOBILITY, 2019-2033 (USD THOUSAND)

TABLE 24 ASIA-PACIFIC WHEELED IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

TABLE 25 ASIA-PACIFIC TRACKED IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

TABLE 26 ASIA-PACIFIC LEGGED IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

TABLE 27 ASIA-PACIFIC HYBRID IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

TABLE 28 ASIA-PACIFIC SNAKE/ARTICULATED MOBILITY IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

TABLE 29 ASIA-PACIFIC UNMANNED GROUND VEHICLE MARKET, BY MODE OF OPERATION, 2019-2033 (USD THOUSAND)

TABLE 30 ASIA-PACIFIC TELEOPERATED IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

TABLE 31 ASIA-PACIFIC TETHERED IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

TABLE 32 ASIA-PACIFIC AUTONOMOUS IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 33 ASIA-PACIFIC AUTONOMOUS IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

TABLE 34 ASIA-PACIFIC UNMANNED GROUND VEHICLE MARKET, BY PAYLOAD, 2019-2033 (USD THOUSAND)

TABLE 35 ASIA-PACIFIC LIGHT DUTY IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

TABLE 36 ASIA-PACIFIC MEDIUM DUTY IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

TABLE 37 ASIA-PACIFIC HEAVY DUTY IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

TABLE 38 ASIA-PACIFIC ULTRA HEAVY DUTY IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

TABLE 39 ASIA-PACIFIC UNMANNED GROUND VEHICLE MARKET, BY PROPULSION, 2019-2033 (USD THOUSAND)

TABLE 40 ASIA-PACIFIC ELECTRIC IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

TABLE 41 ASIA-PACIFIC HYBRID IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

TABLE 42 ASIA-PACIFIC DIESEL/GASOLINE POWERED IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

TABLE 43 ASIA-PACIFIC HYDROGEN FUEL CELL UGVS IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

TABLE 44 ASIA-PACIFIC SOLAR ASSISTED UGVS IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

TABLE 45 ASIA-PACIFIC UNMANNED GROUND VEHICLE MARKET, BY APPLICATION, 2019-2033 (USD THOUSAND)

TABLE 46 ASIA-PACIFIC COMMERCIAL IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 47 ASIA-PACIFIC AGRICULTURE IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 48 ASIA-PACIFIC OIL & GAS IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 49 ASIA-PACIFIC WAREHOUSE & LOGISTICS IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 50 ASIA-PACIFIC COMMERCIAL IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

TABLE 51 ASIA-PACIFIC MILITARY IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 52 ASIA-PACIFIC MILITARY IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

TABLE 53 ASIA-PACIFIC FEDERAL LAW ENFORCEMENT IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

TABLE 54 ASIA-PACIFIC LAW ENFORCEMENT IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 55 ASIA-PACIFIC LAW ENFORCEMENT IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

TABLE 56 ASIA-PACIFIC

TABLE 57 ASIA-PACIFIC UNMANNED GROUND VEHICLE MARKET, BY COUNTRY, 2019-2033 (USD THOUSAND)

TABLE 58 ASIA-PACIFIC

TABLE 59 ASIA-PACIFIC UNMANNED GROUND VEHICLE MARKET, BY SIZE, 2019-2033 (USD THOUSAND)

TABLE 60 ASIA-PACIFIC UNMANNED GROUND VEHICLE MARKET, BY SYSTEM, 2019-2033 (USD THOUSAND)

TABLE 61 ASIA-PACIFIC PAYLOAD IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 62 ASIA-PACIFIC POWER SYSTEM IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 63 ASIA-PACIFIC ELECTRIC NON SOLAR RECHARGABLE IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 64 ASIA-PACIFIC CHASSIS SYSTEM IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 65 ASIA-PACIFIC COMMUNICATION SYSTEM IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 66 ASIA-PACIFIC UNMANNED GROUND VEHICLE MARKET, BY MOBILITY, 2019-2033 (USD THOUSAND)

TABLE 67 ASIA-PACIFIC UNMANNED GROUND VEHICLE MARKET, BY MODE OF OPERATION, 2019-2033 (USD THOUSAND)

TABLE 68 ASIA-PACIFIC AUTONOMOUS IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 69 ASIA-PACIFIC UNMANNED GROUND VEHICLE MARKET, BY PAYLOAD, 2019-2033 (USD THOUSAND)

TABLE 70 ASIA-PACIFIC UNMANNED GROUND VEHICLE MARKET, BY PROPULSION, 2019-2033 (USD THOUSAND)

TABLE 71 ASIA-PACIFIC UNMANNED GROUND VEHICLE MARKET, BY APPLICATION, 2019-2033 (USD THOUSAND)

TABLE 72 ASIA-PACIFIC COMMERCIAL IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 73 ASIA-PACIFIC AGRICULTURE IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 74 ASIA-PACIFIC OIL & GAS IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 75 ASIA-PACIFIC WAREHOUSE & LOGISTICS IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 76 ASIA-PACIFIC MILITARY IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 77 ASIA-PACIFIC LAW ENFORCEMENT IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 78 JAPAN UNMANNED GROUND VEHICLE MARKET, BY SIZE, 2019-2033 (USD THOUSAND)

TABLE 79 JAPAN UNMANNED GROUND VEHICLE MARKET, BY SYSTEM, 2019-2033 (USD THOUSAND)

TABLE 80 JAPAN PAYLOAD IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 81 JAPAN POWER SYSTEM IN UNMANNED GROUND VEHICLE MARKET, BY POWER SYSTEM, 2019-2033 (USD THOUSAND)

TABLE 82 JAPAN ELECTRIC NON SOLAR RECHARGABLE BATTERY IN UNMANNED GROUND VEHICLE MARKET, BY POWER SYSTEM, 2019-2033 (USD THOUSAND)

TABLE 83 JAPAN CHASSIS IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 84 JAPAN COMMUNICATION SYSTEM IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 85 JAPAN UNMANNED GROUND VEHICLE MARKET, BY MOBILITY, 2019-2033 (USD THOUSAND)

TABLE 86 JAPAN UNMANNED GROUND VEHICLE MARKET, BY MODE OF OPERATION, 2019-2033 (USD THOUSAND)

TABLE 87 JAPAN AUTONOMOUS IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 88 JAPAN UNMANNED GROUND VEHICLE MARKET, BY PAYLOAD, 2019-2033 (USD THOUSAND)

TABLE 89 JAPAN UNMANNED GROUND VEHICLE MARKET, BY PROPULSION, 2019-2033 (USD THOUSAND)

TABLE 90 JAPAN UNMANNED GROUND VEHICLE MARKET, BY APPLICATION, 2019-2033 (USD THOUSAND)

TABLE 91 JAPAN COMMERCIAL IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 92 JAPAN AGRICULTURE IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 93 JAPAN OIL & GAS IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 94 JAPAN WAREHOUSE & LOGISTICS IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 95 JAPAN MILITARY IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 96 JAPAN LAW ENFORCEMENT IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 97 CHINA UNMANNED GROUND VEHICLE MARKET, BY SIZE, 2019-2033 (USD THOUSAND)

TABLE 98 CHINA UNMANNED GROUND VEHICLE MARKET, BY SYSTEM, 2019-2033 (USD THOUSAND)

TABLE 99 CHINA PAYLOAD IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 100 CHINA POWER SYSTEM IN UNMANNED GROUND VEHICLE MARKET, BY POWER SYSTEM, 2019-2033 (USD THOUSAND)

TABLE 101 CHINA ELECTRIC NON SOLAR RECHARGABLE BATTERY IN UNMANNED GROUND VEHICLE MARKET, BY POWER SYSTEM, 2019-2033 (USD THOUSAND)

TABLE 102 CHINA CHASSIS IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 103 CHINA COMMUNICATION SYSTEM IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 104 CHINA UNMANNED GROUND VEHICLE MARKET, BY MOBILITY, 2019-2033 (USD THOUSAND)

TABLE 105 CHINA UNMANNED GROUND VEHICLE MARKET, BY MODE OF OPERATION, 2019-2033 (USD THOUSAND)

TABLE 106 CHINA AUTONOMOUS IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 107 CHINA UNMANNED GROUND VEHICLE MARKET, BY PAYLOAD, 2019-2033 (USD THOUSAND)

TABLE 108 CHINA UNMANNED GROUND VEHICLE MARKET, BY PROPULSION, 2019-2033 (USD THOUSAND)

TABLE 109 CHINA UNMANNED GROUND VEHICLE MARKET, BY APPLICATION, 2019-2033 (USD THOUSAND)

TABLE 110 CHINA COMMERCIAL IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 111 CHINA AGRICULTURE IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 112 CHINA OIL & GAS IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 113 CHINA WAREHOUSE & LOGISTICS IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 114 CHINA MILITARY IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 115 CHINA LAW ENFORCEMENT IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 116 SOUTH KOREAUNMANNED GROUND VEHICLE MARKET, BY SIZE, 2019-2033 (USD THOUSAND)

TABLE 117 SOUTH KOREAUNMANNED GROUND VEHICLE MARKET, BY SYSTEM, 2019-2033 (USD THOUSAND)

TABLE 118 SOUTH KOREAPAYLOAD IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 119 SOUTH KOREAPOWER SYSTEM IN UNMANNED GROUND VEHICLE MARKET, BY POWER SYSTEM, 2019-2033 (USD THOUSAND)

TABLE 120 SOUTH KOREAELECTRIC NON SOLAR RECHARGABLE BATTERY IN UNMANNED GROUND VEHICLE MARKET, BY POWER SYSTEM, 2019-2033 (USD THOUSAND)

TABLE 121 SOUTH KOREA CASSIS IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 122 SOUTH KOREACOMMUNICATION SYSTEM IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 123 SOUTH KOREAUNMANNED GROUND VEHICLE MARKET, BY MOBILITY, 2019-2033 (USD THOUSAND)

TABLE 124 SOUTH KOREAUNMANNED GROUND VEHICLE MARKET, BY MODE OF OPERATION, 2019-2033 (USD THOUSAND)

TABLE 125 SOUTH KOREA AUTONOMOUS IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 126 SOUTH KOREAUNMANNED GROUND VEHICLE MARKET, BY PAYLOAD, 2019-2033 (USD THOUSAND)

TABLE 127 SOUTH KOREAUNMANNED GROUND VEHICLE MARKET, BY PROPULSION, 2019-2033 (USD THOUSAND)

TABLE 128 SOUTH KOREAUNMANNED GROUND VEHICLE MARKET, BY APPLICATION, 2019-2033 (USD THOUSAND)

TABLE 129 SOUTH KOREACOMMERCIAL IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 130 SOUTH KOREAAGRICULTURE IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 131 SOUTH KOREAOIL & GAS IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 132 SOUTH KOREAWAREHOUSE & LOGISTICS IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 133 SOUTH KOREA MILITARY IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 134 SOUTH KOREALAW ENFORCEMENT IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 135 INDIA UNMANNED GROUND VEHICLE MARKET, BY SIZE, 2019-2033 (USD THOUSAND)

TABLE 136 INDIA UNMANNED GROUND VEHICLE MARKET, BY SYSTEM, 2019-2033 (USD THOUSAND)

TABLE 137 INDIA PAYLOAD IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 138 INDIA POWER SYSTEM IN UNMANNED GROUND VEHICLE MARKET, BY POWER SYSTEM, 2019-2033 (USD THOUSAND)

TABLE 139 INDIA ELECTRIC NON SOLAR RECHARGABLE BATTERY IN UNMANNED GROUND VEHICLE MARKET, BY POWER SYSTEM, 2019-2033 (USD THOUSAND)

TABLE 140 INDIA CHASSIS IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 141 INDIA COMMUNICATION SYSTEM IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 142 INDIA UNMANNED GROUND VEHICLE MARKET, BY MOBILITY, 2019-2033 (USD THOUSAND)

TABLE 143 INDIA UNMANNED GROUND VEHICLE MARKET, BY MODE OF OPERATION, 2019-2033 (USD THOUSAND)

TABLE 144 INDIA AUTONOMOUS IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 145 INDIA UNMANNED GROUND VEHICLE MARKET, BY PAYLOAD, 2019-2033 (USD THOUSAND)

TABLE 146 INDIA UNMANNED GROUND VEHICLE MARKET, BY PROPULSION, 2019-2033 (USD THOUSAND)

TABLE 147 INDIA UNMANNED GROUND VEHICLE MARKET, BY APPLICATION, 2019-2033 (USD THOUSAND)

TABLE 148 INDIA COMMERCIAL IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 149 INDIA AGRICULTURE IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 150 INDIA OIL & GAS IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 151 INDIA WAREHOUSE & LOGISTICS IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 152 INDIA MILITARY IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 153 INDIA LAW ENFORCEMENT IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 154 AUSTRALIA UNMANNED GROUND VEHICLE MARKET, BY SIZE, 2019-2033 (USD THOUSAND)

TABLE 155 AUSTRALIA UNMANNED GROUND VEHICLE MARKET, BY SYSTEM, 2019-2033 (USD THOUSAND)

TABLE 156 AUSTRALIA PAYLOAD IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 157 AUSTRALIA POWER SYSTEM IN UNMANNED GROUND VEHICLE MARKET, BY POWER SYSTEM, 2019-2033 (USD THOUSAND)

TABLE 158 AUSTRALIA ELECTRIC NON SOLAR RECHARGABLE BATTERY IN UNMANNED GROUND VEHICLE MARKET, BY POWER SYSTEM, 2019-2033 (USD THOUSAND)

TABLE 159 AUSTRALIA CHASSIS IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 160 AUSTRALIA COMMUNICATION SYSTEM IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 161 AUSTRALIA UNMANNED GROUND VEHICLE MARKET, BY MOBILITY, 2019-2033 (USD THOUSAND)

TABLE 162 AUSTRALIA UNMANNED GROUND VEHICLE MARKET, BY MODE OF OPERATION, 2019-2033 (USD THOUSAND)

TABLE 163 AUSTRALIA AUTONOMOUS IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 164 AUSTRALIA UNMANNED GROUND VEHICLE MARKET, BY PAYLOAD, 2019-2033 (USD THOUSAND)

TABLE 165 AUSTRALIA UNMANNED GROUND VEHICLE MARKET, BY PROPULSION, 2019-2033 (USD THOUSAND)

TABLE 166 AUSTRALIA UNMANNED GROUND VEHICLE MARKET, BY APPLICATION, 2019-2033 (USD THOUSAND)

TABLE 167 AUSTRALIA COMMERCIAL IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 168 AUSTRALIA AGRICULTURE IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 169 AUSTRALIA OIL & GAS IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 170 AUSTRALIA WAREHOUSE & LOGISTICS IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 171 AUSTRALIA MILITARY IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 172 AUSTRALIA LAW ENFORCEMENT IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 173 SINGAPORE UNMANNED GROUND VEHICLE MARKET, BY SIZE, 2019-2033 (USD THOUSAND)

TABLE 174 SINGAPORE UNMANNED GROUND VEHICLE MARKET, BY SYSTEM, 2019-2033 (USD THOUSAND)

TABLE 175 SINGAPORE PAYLOAD IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 176 SINGAPORE POWER SYSTEM IN UNMANNED GROUND VEHICLE MARKET, BY POWER SYSTEM, 2019-2033 (USD THOUSAND)

TABLE 177 SINGAPORE ELECTRIC NON SOLAR RECHARGABLE BATTERY IN UNMANNED GROUND VEHICLE MARKET, BY POWER SYSTEM, 2019-2033 (USD THOUSAND)

TABLE 178 SINGAPORE CHASSIS IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 179 SINGAPORE COMMUNICATION SYSTEM IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 180 SINGAPORE UNMANNED GROUND VEHICLE MARKET, BY MOBILITY, 2019-2033 (USD THOUSAND)

TABLE 181 SINGAPORE UNMANNED GROUND VEHICLE MARKET, BY MODE OF OPERATION, 2019-2033 (USD THOUSAND)

TABLE 182 SINGAPORE AUTONOMOUS IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 183 SINGAPORE UNMANNED GROUND VEHICLE MARKET, BY PAYLOAD, 2019-2033 (USD THOUSAND)

TABLE 184 SINGAPORE UNMANNED GROUND VEHICLE MARKET, BY PROPULSION, 2019-2033 (USD THOUSAND)

TABLE 185 SINGAPORE UNMANNED GROUND VEHICLE MARKET, BY APPLICATION, 2019-2033 (USD THOUSAND)

TABLE 186 SINGAPORE COMMERCIAL IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 187 SINGAPORE AGRICULTURE IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 188 SINGAPORE OIL & GAS IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 189 SINGAPORE WAREHOUSE & LOGISTICS IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 190 SINGAPORE MILITARY IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 191 SINGAPORE LAW ENFORCEMENT IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 192 THAILAND UNMANNED GROUND VEHICLE MARKET, BY SIZE, 2019-2033 (USD THOUSAND)

TABLE 193 THAILAND UNMANNED GROUND VEHICLE MARKET, BY SYSTEM, 2019-2033 (USD THOUSAND)

TABLE 194 THAILAND PAYLOAD IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 195 THAILAND POWER SYSTEM IN UNMANNED GROUND VEHICLE MARKET, BY POWER SYSTEM, 2019-2033 (USD THOUSAND)

TABLE 196 THAILAND ELECTRIC NON SOLAR RECHARGABLE BATTERY IN UNMANNED GROUND VEHICLE MARKET, BY POWER SYSTEM, 2019-2033 (USD THOUSAND)

TABLE 197 THAILAND CHASSIS IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 198 THAILAND COMMUNICATION SYSTEM IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 199 THAILAND UNMANNED GROUND VEHICLE MARKET, BY MOBILITY, 2019-2033 (USD THOUSAND)

TABLE 200 THAILAND UNMANNED GROUND VEHICLE MARKET, BY MODE OF OPERATION, 2019-2033 (USD THOUSAND)

TABLE 201 THAILAND AUTONOMOUS IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 202 THAILAND UNMANNED GROUND VEHICLE MARKET, BY PAYLOAD, 2019-2033 (USD THOUSAND)

TABLE 203 THAILAND UNMANNED GROUND VEHICLE MARKET, BY PROPULSION, 2019-2033 (USD THOUSAND)

TABLE 204 THAILAND UNMANNED GROUND VEHICLE MARKET, BY APPLICATION, 2019-2033 (USD THOUSAND)

TABLE 205 THAILAND COMMERCIAL IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 206 THAILAND AGRICULTURE IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 207 THAILAND OIL & GAS IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 208 THAILAND WAREHOUSE & LOGISTICS IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 209 THAILAND MILITARY IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 210 THAILAND LAW ENFORCEMENT IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 211 MALAYSIA UNMANNED GROUND VEHICLE MARKET, BY SIZE, 2019-2033 (USD THOUSAND)

TABLE 212 MALAYSIA UNMANNED GROUND VEHICLE MARKET, BY SYSTEM, 2019-2033 (USD THOUSAND)

TABLE 213 MALAYSIA PAYLOAD IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 214 MALAYSIA POWER SYSTEM IN UNMANNED GROUND VEHICLE MARKET, BY POWER SYSTEM, 2019-2033 (USD THOUSAND)

TABLE 215 MALAYSIA ELECTRIC NON SOLAR RECHARGABLE BATTERY IN UNMANNED GROUND VEHICLE MARKET, BY POWER SYSTEM, 2019-2033 (USD THOUSAND)

TABLE 216 MALAYSIA CHASSIS IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 217 MALAYSIA COMMUNICATION SYSTEM IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 218 MALAYSIA UNMANNED GROUND VEHICLE MARKET, BY MOBILITY, 2019-2033 (USD THOUSAND)

TABLE 219 MALAYSIA UNMANNED GROUND VEHICLE MARKET, BY MODE OF OPERATION, 2019-2033 (USD THOUSAND)

TABLE 220 MALAYSIA AUTONOMOUS IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 221 MALAYSIA UNMANNED GROUND VEHICLE MARKET, BY PAYLOAD, 2019-2033 (USD THOUSAND)

TABLE 222 MALAYSIA UNMANNED GROUND VEHICLE MARKET, BY PROPULSION, 2019-2033 (USD THOUSAND)

TABLE 223 MALAYSIA UNMANNED GROUND VEHICLE MARKET, BY APPLICATION, 2019-2033 (USD THOUSAND)

TABLE 224 MALAYSIA COMMERCIAL IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 225 MALAYSIA AGRICULTURE IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 226 MALAYSIA OIL & GAS IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 227 MALAYSIA WAREHOUSE & LOGISTICS IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 228 MALAYSIA MILITARY IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 229 MALAYSIA LAW ENFORCEMENT IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 230 INDONESIA UNMANNED GROUND VEHICLE MARKET, BY SIZE, 2019-2033 (USD THOUSAND)

TABLE 231 INDONESIA UNMANNED GROUND VEHICLE MARKET, BY SYSTEM, 2019-2033 (USD THOUSAND)

TABLE 232 INDONESIA PAYLOAD IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 233 INDONESIA POWER SYSTEM IN UNMANNED GROUND VEHICLE MARKET, BY POWER SYSTEM, 2019-2033 (USD THOUSAND)

TABLE 234 INDONESIA ELECTRIC NON SOLAR RECHARGABLE BATTERY IN UNMANNED GROUND VEHICLE MARKET, BY POWER SYSTEM, 2019-2033 (USD THOUSAND)

TABLE 235 INDONESIA CHASSIS IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 236 INDONESIA COMMUNICATION SYSTEM IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 237 INDONESIA UNMANNED GROUND VEHICLE MARKET, BY MOBILITY, 2019-2033 (USD THOUSAND)

TABLE 238 INDONESIA UNMANNED GROUND VEHICLE MARKET, BY MODE OF OPERATION, 2019-2033 (USD THOUSAND)

TABLE 239 INDONESIA AUTONOMOUS IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 240 INDONESIA UNMANNED GROUND VEHICLE MARKET, BY PAYLOAD, 2019-2033 (USD THOUSAND)

TABLE 241 INDONESIA UNMANNED GROUND VEHICLE MARKET, BY PROPULSION, 2019-2033 (USD THOUSAND)

TABLE 242 INDONESIA UNMANNED GROUND VEHICLE MARKET, BY APPLICATION, 2019-2033 (USD THOUSAND)

TABLE 243 INDONESIA COMMERCIAL IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 244 INDONESIA AGRICULTURE IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 245 INDONESIA OIL & GAS IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 246 INDONESIA WAREHOUSE & LOGISTICS IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 247 INDONESIA MILITARY IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 248 INDONESIA LAW ENFORCEMENT IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 249 PHILIPPINES UNMANNED GROUND VEHICLE MARKET, BY SIZE, 2019-2033 (USD THOUSAND)

TABLE 250 PHILIPPINES UNMANNED GROUND VEHICLE MARKET, BY SYSTEM, 2019-2033 (USD THOUSAND)

TABLE 251 PHILIPPINES PAYLOAD IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 252 PHILIPPINES POWER SYSTEM IN UNMANNED GROUND VEHICLE MARKET, BY POWER SYSTEM, 2019-2033 (USD THOUSAND)

TABLE 253 PHILIPPINES ELECTRIC NON SOLAR RECHARGABLE BATTERY IN UNMANNED GROUND VEHICLE MARKET, BY POWER SYSTEM, 2019-2033 (USD THOUSAND)

TABLE 254 PHILIPPINES CHASSIS IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 255 PHILIPPINES COMMUNICATION SYSTEM IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 256 PHILIPPINES UNMANNED GROUND VEHICLE MARKET, BY MOBILITY, 2019-2033 (USD THOUSAND)

TABLE 257 PHILIPPINES UNMANNED GROUND VEHICLE MARKET, BY MODE OF OPERATION, 2019-2033 (USD THOUSAND)

TABLE 258 PHILIPPINES AUTONOMOUS IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 259 PHILIPPINES UNMANNED GROUND VEHICLE MARKET, BY PAYLOAD, 2019-2033 (USD THOUSAND)

TABLE 260 PHILIPPINES UNMANNED GROUND VEHICLE MARKET, BY PROPULSION, 2019-2033 (USD THOUSAND)

TABLE 261 PHILIPPINES UNMANNED GROUND VEHICLE MARKET, BY APPLICATION, 2019-2033 (USD THOUSAND)

TABLE 262 PHILIPPINES COMMERCIAL IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 263 PHILIPPINES AGRICULTURE IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 264 PHILIPPINES OIL & GAS IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 265 PHILIPPINES WAREHOUSE & LOGISTICS IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 266 PHILIPPINES MILITARY IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 267 PHILIPPINES LAW ENFORCEMENT IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 268 NEW ZEALAND UNMANNED GROUND VEHICLE MARKET, BY SIZE, 2019-2033 (USD THOUSAND)

TABLE 269 NEW ZEALAND UNMANNED GROUND VEHICLE MARKET, BY SYSTEM, 2019-2033 (USD THOUSAND)

TABLE 270 NEW ZEALAND PAYLOAD IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 271 NEW ZEALAND POWER SYSTEM IN UNMANNED GROUND VEHICLE MARKET, BY POWER SYSTEM, 2019-2033 (USD THOUSAND)

TABLE 272 NEW ZEALAND ELECTRIC NON SOLAR RECHARGABLE BATTERY IN UNMANNED GROUND VEHICLE MARKET, BY POWER SYSTEM, 2019-2033 (USD THOUSAND)

TABLE 273 NEW ZEALAND CHASSIS IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 274 NEW ZEALAND COMMUNICATION SYSTEM IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 275 NEW ZEALAND UNMANNED GROUND VEHICLE MARKET, BY MOBILITY, 2019-2033 (USD THOUSAND)

TABLE 276 NEW ZEALAND UNMANNED GROUND VEHICLE MARKET, BY MODE OF OPERATION, 2019-2033 (USD THOUSAND)

TABLE 277 NEW ZEALAND AUTONOMOUS IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 278 NEW ZEALAND UNMANNED GROUND VEHICLE MARKET, BY PAYLOAD, 2019-2033 (USD THOUSAND)

TABLE 279 NEW ZEALAND UNMANNED GROUND VEHICLE MARKET, BY PROPULSION, 2019-2033 (USD THOUSAND)

TABLE 280 NEW ZEALAND UNMANNED GROUND VEHICLE MARKET, BY APPLICATION, 2019-2033 (USD THOUSAND)

TABLE 281 NEW ZEALAND COMMERCIAL IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 282 NEW ZEALAND AGRICULTURE IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 283 NEW ZEALAND OIL & GAS IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 284 NEW ZEALAND WAREHOUSE & LOGISTICS IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 285 NEW ZEALAND MILITARY IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 286 NEW ZEALAND LAW ENFORCEMENT IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 287 VIETNAM UNMANNED GROUND VEHICLE MARKET, BY SIZE, 2019-2033 (USD THOUSAND)

TABLE 288 VIETNAM UNMANNED GROUND VEHICLE MARKET, BY SYSTEM, 2019-2033 (USD THOUSAND)

TABLE 289 VIETNAM PAYLOAD IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 290 VIETNAM POWER SYSTEM IN UNMANNED GROUND VEHICLE MARKET, BY POWER SYSTEM, 2019-2033 (USD THOUSAND)

TABLE 291 VIETNAM ELECTRIC NON SOLAR RECHARGABLE BATTERY IN UNMANNED GROUND VEHICLE MARKET, BY POWER SYSTEM, 2019-2033 (USD THOUSAND)

TABLE 292 VIETNAM CHASSIS IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 293 VIETNAM COMMUNICATION SYSTEM IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 294 VIETNAM UNMANNED GROUND VEHICLE MARKET, BY MOBILITY, 2019-2033 (USD THOUSAND)

TABLE 295 VIETNAM UNMANNED GROUND VEHICLE MARKET, BY MODE OF OPERATION, 2019-2033 (USD THOUSAND)

TABLE 296 VIETNAM AUTONOMOUS IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 297 VIETNAM UNMANNED GROUND VEHICLE MARKET, BY PAYLOAD, 2019-2033 (USD THOUSAND)

TABLE 298 VIETNAM UNMANNED GROUND VEHICLE MARKET, BY PROPULSION, 2019-2033 (USD THOUSAND)

TABLE 299 VIETNAM UNMANNED GROUND VEHICLE MARKET, BY APPLICATION, 2019-2033 (USD THOUSAND)

TABLE 300 VIETNAM COMMERCIAL IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 301 VIETNAM AGRICULTURE IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 302 VIETNAM OIL & GAS IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 303 VIETNAM WAREHOUSE & LOGISTICS IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 304 VIETNAM MILITARY IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 305 VIETNAM LAW ENFORCEMENT IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 306 TAIWAN UNMANNED GROUND VEHICLE MARKET, BY SIZE, 2019-2033 (USD THOUSAND)

TABLE 307 TAIWAN UNMANNED GROUND VEHICLE MARKET, BY SYSTEM, 2019-2033 (USD THOUSAND)

TABLE 308 TAIWAN PAYLOAD IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 309 TAIWAN POWER SYSTEM IN UNMANNED GROUND VEHICLE MARKET, BY POWER SYSTEM, 2019-2033 (USD THOUSAND)

TABLE 310 TAIWAN ELECTRIC NON SOLAR RECHARGABLE BATTERY IN UNMANNED GROUND VEHICLE MARKET, BY POWER SYSTEM, 2019-2033 (USD THOUSAND)

TABLE 311 TAIWAN CHASSIS IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 312 TAIWAN COMMUNICATION SYSTEM IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 313 TAIWAN UNMANNED GROUND VEHICLE MARKET, BY MOBILITY, 2019-2033 (USD THOUSAND)

TABLE 314 TAIWAN UNMANNED GROUND VEHICLE MARKET, BY MODE OF OPERATION, 2019-2033 (USD THOUSAND)

TABLE 315 TAIWAN AUTONOMOUS IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 316 TAIWAN UNMANNED GROUND VEHICLE MARKET, BY PAYLOAD, 2019-2033 (USD THOUSAND)

TABLE 317 TAIWAN UNMANNED GROUND VEHICLE MARKET, BY PROPULSION, 2019-2033 (USD THOUSAND)

TABLE 318 TAIWAN UNMANNED GROUND VEHICLE MARKET, BY APPLICATION, 2019-2033 (USD THOUSAND)

TABLE 319 TAIWAN COMMERCIAL IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 320 TAIWAN AGRICULTURE IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 321 TAIWAN OIL & GAS IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 322 TAIWAN WAREHOUSE & LOGISTICS IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 323 TAIWAN MILITARY IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 324 TAIWAN LAW ENFORCEMENT IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 325 REST OF ASIA-PACIFIC UNMANNED GROUND VEHICLE MARKET, BY SIZE, 2019-2033 (USD THOUSAND)

TABLE 326 REST OF ASIA-PACIFIC UNMANNED GROUND VEHICLE MARKET, BY SYSTEM, 2019-2033 (USD THOUSAND)

TABLE 327 REST OF ASIA-PACIFIC PAYLOAD IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 328 REST OF ASIA-PACIFIC POWER SYSTEM IN UNMANNED GROUND VEHICLE MARKET, BY POWER SYSTEM, 2019-2033 (USD THOUSAND)

TABLE 329 REST OF ASIA-PACIFIC ELECTRIC NON SOLAR RECHARGABLE BATTERY IN UNMANNED GROUND VEHICLE MARKET, BY POWER SYSTEM, 2019-2033 (USD THOUSAND)

TABLE 330 REST OF ASIA-PACIFIC CHASSIS IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 331 REST OF ASIA-PACIFIC COMMUNICATION SYSTEM IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 332 REST OF ASIA-PACIFIC UNMANNED GROUND VEHICLE MARKET, BY MOBILITY, 2019-2033 (USD THOUSAND)

TABLE 333 REST OF ASIA-PACIFIC UNMANNED GROUND VEHICLE MARKET, BY MODE OF OPERATION, 2019-2033 (USD THOUSAND)

TABLE 334 REST OF ASIA-PACIFIC AUTONOMOUS IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 335 REST OF ASIA-PACIFIC UNMANNED GROUND VEHICLE MARKET, BY PAYLOAD, 2019-2033 (USD THOUSAND)

TABLE 336 REST OF ASIA-PACIFIC UNMANNED GROUND VEHICLE MARKET, BY PROPULSION, 2019-2033 (USD THOUSAND)

TABLE 337 REST OF ASIA-PACIFIC UNMANNED GROUND VEHICLE MARKET, BY APPLICATION, 2019-2033 (USD THOUSAND)

TABLE 338 REST OF ASIA-PACIFIC COMMERCIAL IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 339 REST OF ASIA-PACIFIC AGRICULTURE IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 340 REST OF ASIA-PACIFIC OIL & GAS IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 341 REST OF ASIA-PACIFIC WAREHOUSE & LOGISTICS IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 342 REST OF ASIA-PACIFIC MILITARY IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 343 REST OF ASIA-PACIFIC LAW ENFORCEMENT IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

그림 목록

FIGURE 1 ASIA-PACIFIC UNMANNED GROUND VEHICLE MARKET

FIGURE 2 ASIA-PACIFIC UNMANNED GROUND VEHICLE MARKET: DATA TRIANGULATION

FIGURE 3 ASIA-PACIFIC UNMANNED GROUND VEHICLE MARKET: DROC ANALYSIS

FIGURE 4 ASIA-PACIFIC UNMANNED GROUND VEHICLE MARKET: ASIA-PACIFIC VS REGIONAL MARKET ANALYSIS

FIGURE 5 ASIA-PACIFIC UNMANNED GROUND VEHICLE MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 ASIA-PACIFIC UNMANNED GROUND VEHICLE MARKET: MULTIVARIATE MODELLING

FIGURE 7 UNMANNED GROUND VEHICLE MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 8 ASIA-PACIFIC UNMANNED GROUND VEHICLE MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 ASIA-PACIFIC UNMANNED GROUND VEHICLE MARKET: DBMR MARKET POSITION GRID

FIGURE 10 ASIA-PACIFIC UNMANNED GROUND VEHICLE MARKET: VENDOR SHARE ANALYSIS

FIGURE 11 EXECUTIVE SUMMARY

FIGURE 12 ASIA-PACIFIC UNMANNED GROUND VEHICLE MARKET: SEGMENTATION

FIGURE 13 STRATEGIC DECISIONS

FIGURE 14 SIX SEGMENTS COMPRISE THE ASIA-PACIFIC UNMANNED GROUND VEHICLE MARKET, BY SIZE

FIGURE 15 ASIA-PACIFIC IS EXPECTED TO BE THE DOMINANT AND FASTEST GROWING REGION IN THE ASIA-PACIFIC UNMANNED GROUND VEHICLE MARKET IN THE FORECAST PERIOD OF 2026 TO 2033

FIGURE 16 DEFENSE MODERNIZATION PROGRAMS ACCELERATING ASIA-PACIFIC UGV PROCUREMENT MOMENTUM IS EXPECTED TO DRIVE THE ASIA-PACIFIC UNMANNED GROUND VEHICLE MARKET DURING THE FORECAST PERIOD OF 2026 TO 2033

FIGURE 17 SMALL (10 - 200 LBS) SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE ASIA-PACIFIC UNMANNED GROUND VEHICLE MARKET IN 2026 & 2033

FIGURE 18 ASIA-PACIFIC IS THE FASTEST-GROWING REGION FOR THE ASIA-PACIFIC UNMANNED GROUND VEHICLE MARKET IN THE FORECAST PERIOD OF 2026 TO 2033

FIGURE 19 ASIA-PACIFIC UNMANNED GROUND VEHICLE MARKET, 2025-2033, AVERAGE SELLING PRICE (USD PER UNIT)

FIGURE 20 SWOT ANALYSIS

FIGURE 21 ASIA-PACIFIC UNMANNED GROUND VEHICLE MARKET, BY SIZE, 2025

FIGURE 22 ASIA-PACIFIC UNMANNED GROUND VEHICLE MARKET, BY SYSTEM, 2025

FIGURE 23 ASIA-PACIFIC UNMANNED GROUND VEHICLE MARKET, BY MOBILITY, 2025

FIGURE 24 ASIA-PACIFIC UNMANNED GROUND VEHICLE MARKET, BY MODE OF OPERATION, 2025

FIGURE 25 ASIA-PACIFIC UNMANNED GROUND VEHICLE MARKET, BY SIZE, 2025

FIGURE 26 ASIA-PACIFIC UNMANNED GROUND VEHICLE MARKET, BY PROPULSION, 2025

FIGURE 27 ASIA-PACIFIC UNMANNED GROUND VEHICLE MARKET, BY APPLICATION, 2025

FIGURE 28 ASIA-PACIFIC UNMANNED GROUND VEHICLE MARKET, SNAPSHOT (2025)

FIGURE 29 ASIA-PACIFIC UNMANNED GROUND VEHICLE MARKET: COMPANY SHARE 2025 (%)

연구 방법론

데이터 수집 및 기준 연도 분석은 대규모 샘플 크기의 데이터 수집 모듈을 사용하여 수행됩니다. 이 단계에는 다양한 소스와 전략을 통해 시장 정보 또는 관련 데이터를 얻는 것이 포함됩니다. 여기에는 과거에 수집한 모든 데이터를 미리 검토하고 계획하는 것이 포함됩니다. 또한 다양한 정보 소스에서 발견되는 정보 불일치를 검토하는 것도 포함됩니다. 시장 데이터는 시장 통계 및 일관된 모델을 사용하여 분석하고 추정합니다. 또한 시장 점유율 분석 및 주요 추세 분석은 시장 보고서의 주요 성공 요인입니다. 자세한 내용은 분석가에게 전화를 요청하거나 문의 사항을 드롭하세요.

DBMR 연구팀에서 사용하는 주요 연구 방법론은 데이터 마이닝, 시장에 대한 데이터 변수의 영향 분석 및 주요(산업 전문가) 검증을 포함하는 데이터 삼각 측량입니다. 데이터 모델에는 공급업체 포지셔닝 그리드, 시장 타임라인 분석, 시장 개요 및 가이드, 회사 포지셔닝 그리드, 특허 분석, 가격 분석, 회사 시장 점유율 분석, 측정 기준, 글로벌 대 지역 및 공급업체 점유율 분석이 포함됩니다. 연구 방법론에 대해 자세히 알아보려면 문의를 통해 업계 전문가에게 문의하세요.

사용자 정의 가능

Data Bridge Market Research는 고급 형성 연구 분야의 선두 주자입니다. 저희는 기존 및 신규 고객에게 목표에 맞는 데이터와 분석을 제공하는 데 자부심을 느낍니다. 보고서는 추가 국가에 대한 시장 이해(국가 목록 요청), 임상 시험 결과 데이터, 문헌 검토, 재생 시장 및 제품 기반 분석을 포함하도록 사용자 정의할 수 있습니다. 기술 기반 분석에서 시장 포트폴리오 전략에 이르기까지 타겟 경쟁업체의 시장 분석을 분석할 수 있습니다. 귀하가 원하는 형식과 데이터 스타일로 필요한 만큼 많은 경쟁자를 추가할 수 있습니다. 저희 분석가 팀은 또한 원시 엑셀 파일 피벗 테이블(팩트북)로 데이터를 제공하거나 보고서에서 사용 가능한 데이터 세트에서 프레젠테이션을 만드는 데 도움을 줄 수 있습니다.