Asia Pacific Leak Detection Market

시장 규모 (USD 10억)

연평균 성장률 :

%

USD

437.46 Million

USD

757.27 Million

2025

2033

USD

437.46 Million

USD

757.27 Million

2025

2033

| 2026 –2033 | |

| USD 437.46 Million | |

| USD 757.27 Million | |

|

|

|

|

Asia-Pacific Leak Detection Market, By Type (Upstream, Midstream and Downstream), Product Type (Handheld Gas Detectors, UAV-Based Detectors, Manned Aircraft Detectors and Vehicle-Based Detectors), Technology (Acoustic / Ultrasound, Fiber Optic, Pressure-Flow Deviation Methods, Extended Real-Time Transient Model (E-RTTM), Thermal Imaging, Mass/Volume Balance, Vapor Sensing, Laser Absorption and Lidar, Hydraulic Leak Detection, Negative Pressure Valves and Others), End User (Oil and Gas, Chemical Plant, Water Treatment Plants, Thermal Power Plant, Mining and Slurry and Others), Country (China, South Korea, Japan, India, Australia, Singapore, Malaysia, Indonesia, Thailand, Philippines, Rest of Asia-Pacific) Industry Trends and Forecast to 2028

Market Analysis and Insights: Asia-Pacific Leak Detection Market

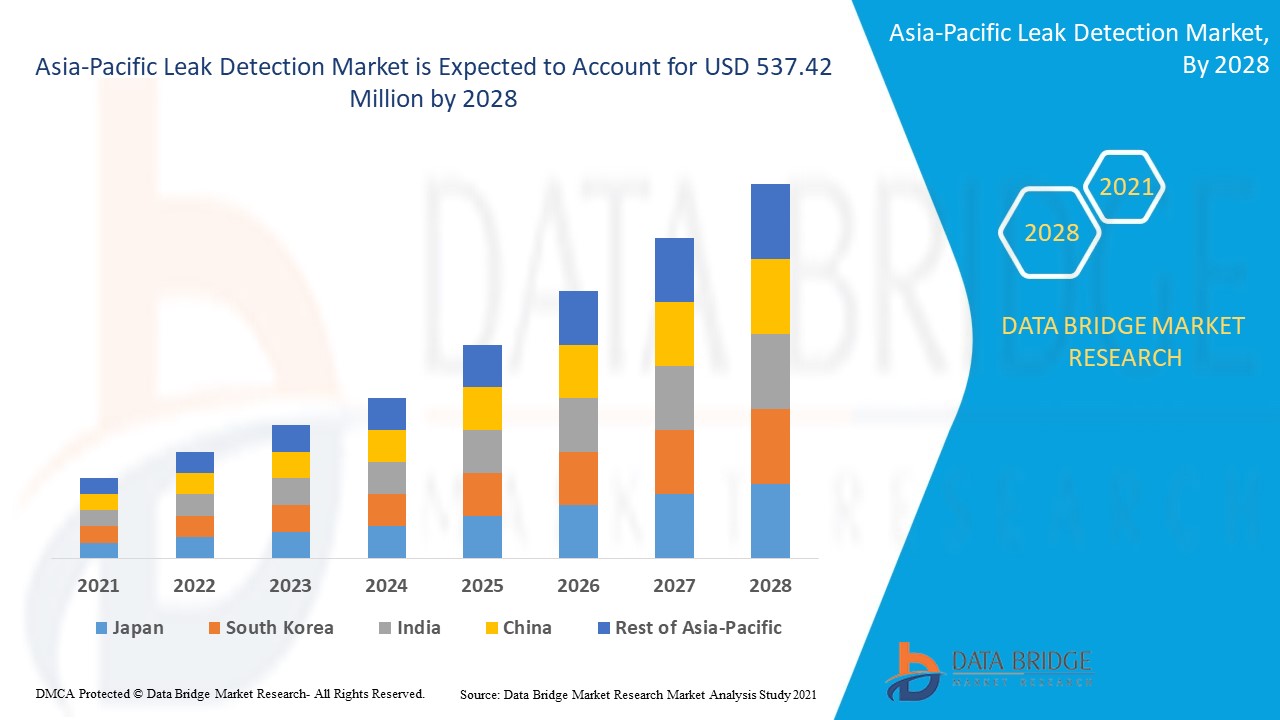

The leak detection market is expected to gain market growth in the forecast period of 2021 to 2028. Data Bridge Market Research analyses that the market is growing with the CAGR of 7.1% in the forecast period of 2021 to 2028 and expected to reach USD 537.42 million by 2028. Increasing growth in oil and gas pipeline and storage plant infrastructure is acting as major growth factor for global leak detection market

The term leak or leakage means an unintended crack, hole or porosity in an enveloping wall or joint of the pipes, batteries, sealed products, chambers or storage containers that must contain/transfer different fluids and gases. These cracks or holes allow the escape of fluids and gases from a closed medium.

High number of pipeline leakages incidents acts as a major factor for the growth of the leak detection market. Technical complications with leak detectors act as a major restraint for the leak detection market. Rising oil and gas production globally is acting as major window of opportunity for the leak detection market. Challenge associated with large diameter pipelines for effective leak detection is acting as a major challenge for the growth of the leak detection market.

This leak detection market report provides details of market share, new developments, and product pipeline analysis, impact of domestic and localised market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, product approvals, strategic decisions, product launches, geographical expansions, and technological innovations in the market. To understand the analysis and the market scenario contact us for an Analyst Brief, our team will help you create a revenue impact solution to achieve your desired goal.

Asia-Pacific Leak Detection Market Scope and Market Size

The leak detection market is segmented on the basis of type, product type, technology and end user. The growth among segments helps you analyse niche pockets of growth and strategies to approach the market and determine your core application areas and the difference in your target markets.

- On the basis of type, the leak detection market is segmented into upstream, midstream and downstream. In 2021, the midstream segment has been accounted the largest market share as midstream segment basically deals with the transportation of crude oil and natural gas through various modes of transportation such as pipeline.

- On the basis of product type, the leak detection market is segmented into handheld gas detectors, UAV-based detectors, manned aircraft detectors and vehicle-based detectors. In 2021, vehicle-based detectors segment has been accounted the largest market share as it can be easily mounted on a vehicle and used for monitoring the pipelines through the moving vehicle.

- On the basis of technology, the leak detection market is segmented into acoustic / ultrasound, fiber optic, pressure-flow deviation methods, extended real-time transient model (E-RTTM), thermal imaging, mass/volume balance, vapor sensing, laser absorption and lidar, hydraulic leak detection, negative pressure waves and others. In 2021, acoustic / ultrasound segment has been accounted the largest market share as it offers faster detection of leakage and is low cost solution, moreover, it provides early detection and the loss can be prevented at an early stage.

- On the basis of end user, the leak detection market is segmented into oil and gas, chemical plant, water treatment plants, thermal power plant, mining and slurry and others. In 2021, oil and gas segment has been accounted the largest market share as this industry is a major user of leak detection system in order to prevent leakage of crude oil and gas and methane emission.

Asia-Pacific Leak Detection Market Country Level Analysis

Asia-Pacific leak detection market is analysed and market size information is provided by the country, type, product type, technology and end user as referenced above.

The countries covered in the Asia-Pacific leak detection market report are the China, South Korea, Japan, India, Australia, Singapore, Malaysia, Indonesia, Thailand, Philippines, rest of Asia-Pacific.

China accounted for maximum share in the Asia-Pacific leak detection market, due to presence of large number of oil and gas refineries and technical advancement in leak detection products and smart homes.

The country section of the Leak Detection market report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points such as new sales, replacement sales, country demographics, regulatory acts and import-export analysis are some of the major pointers used to forecast the market scenario for individual countries. Also, presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of sales channels are considered while providing forecast analysis of the country data.

New Product Launches by Manufacturers is Creating New Opportunities for Players in the Leak Detection Market

The leak detection market also provides you with detailed market analysis for every country growth in installed base of different kind of products, impact of technology using life line curves and changes regulatory scenarios and their impact on the leak detection market. The data is available for historic year 2011 to 2019.

Competitive Landscape and Leak Detection Market Share Analysis

Leak detection market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, company strengths and weaknesses, product launch, clinical trials pipelines, brand analysis, product approvals, patents, product width and breadth, application dominance, technology lifeline curve. The above data points provided are only related to the companies’ focus related to leak detection market.

Some of the major players operating in the leak detection market are FLIR SYSTEMS, Inc., ABB, Honeywell International Inc., Siemens Energy, Pentair, ClampOn AS, Schneider Electric, Atmos International, Xylem, Emerson Electric Co., KROHNE Messtechnik GmbH, PERMA-PIPE International Holdings, Inc., TTK, PSI Software AG, MSA, HIMA, AVEVA Group plc, Yokogawa Electric Corporation, INFICON, Fotech Group Ltd. And Hawk Measurement Systems among others. Many product developments are also initiated by the companies worldwide which are also accelerating the growth of leak detection market.

Many product launches and agreements are also initiated by the companies’ worldwide which are also accelerating the leak detection market.

For instance,

- In January 2020, FLIR Systems, Inc. has launched FLIR GF77a, its first uncooled, fixed-mount, connected thermal camera for detecting methane and other industrial gases. With this new launch of optical gas imaging (OGI) series product, the company has extended their product portfolio and will increase their customer base.

Partnership, joint ventures and other strategies enhances the company market share with increased coverage and presence. It also provides the benefit for organisation to improve their offering for leak detection market through expanded product range.

SKU-

세계 최초의 시장 정보 클라우드 보고서에 온라인으로 접속하세요

- 대화형 데이터 분석 대시보드

- 높은 성장 잠재력 기회를 위한 회사 분석 대시보드

- 사용자 정의 및 질의를 위한 리서치 분석가 액세스

- 대화형 대시보드를 통한 경쟁자 분석

- 최신 뉴스, 업데이트 및 추세 분석

- 포괄적인 경쟁자 추적을 위한 벤치마크 분석의 힘 활용

연구 방법론

데이터 수집 및 기준 연도 분석은 대규모 샘플 크기의 데이터 수집 모듈을 사용하여 수행됩니다. 이 단계에는 다양한 소스와 전략을 통해 시장 정보 또는 관련 데이터를 얻는 것이 포함됩니다. 여기에는 과거에 수집한 모든 데이터를 미리 검토하고 계획하는 것이 포함됩니다. 또한 다양한 정보 소스에서 발견되는 정보 불일치를 검토하는 것도 포함됩니다. 시장 데이터는 시장 통계 및 일관된 모델을 사용하여 분석하고 추정합니다. 또한 시장 점유율 분석 및 주요 추세 분석은 시장 보고서의 주요 성공 요인입니다. 자세한 내용은 분석가에게 전화를 요청하거나 문의 사항을 드롭하세요.

DBMR 연구팀에서 사용하는 주요 연구 방법론은 데이터 마이닝, 시장에 대한 데이터 변수의 영향 분석 및 주요(산업 전문가) 검증을 포함하는 데이터 삼각 측량입니다. 데이터 모델에는 공급업체 포지셔닝 그리드, 시장 타임라인 분석, 시장 개요 및 가이드, 회사 포지셔닝 그리드, 특허 분석, 가격 분석, 회사 시장 점유율 분석, 측정 기준, 글로벌 대 지역 및 공급업체 점유율 분석이 포함됩니다. 연구 방법론에 대해 자세히 알아보려면 문의를 통해 업계 전문가에게 문의하세요.

사용자 정의 가능

Data Bridge Market Research는 고급 형성 연구 분야의 선두 주자입니다. 저희는 기존 및 신규 고객에게 목표에 맞는 데이터와 분석을 제공하는 데 자부심을 느낍니다. 보고서는 추가 국가에 대한 시장 이해(국가 목록 요청), 임상 시험 결과 데이터, 문헌 검토, 재생 시장 및 제품 기반 분석을 포함하도록 사용자 정의할 수 있습니다. 기술 기반 분석에서 시장 포트폴리오 전략에 이르기까지 타겟 경쟁업체의 시장 분석을 분석할 수 있습니다. 귀하가 원하는 형식과 데이터 스타일로 필요한 만큼 많은 경쟁자를 추가할 수 있습니다. 저희 분석가 팀은 또한 원시 엑셀 파일 피벗 테이블(팩트북)로 데이터를 제공하거나 보고서에서 사용 가능한 데이터 세트에서 프레젠테이션을 만드는 데 도움을 줄 수 있습니다.