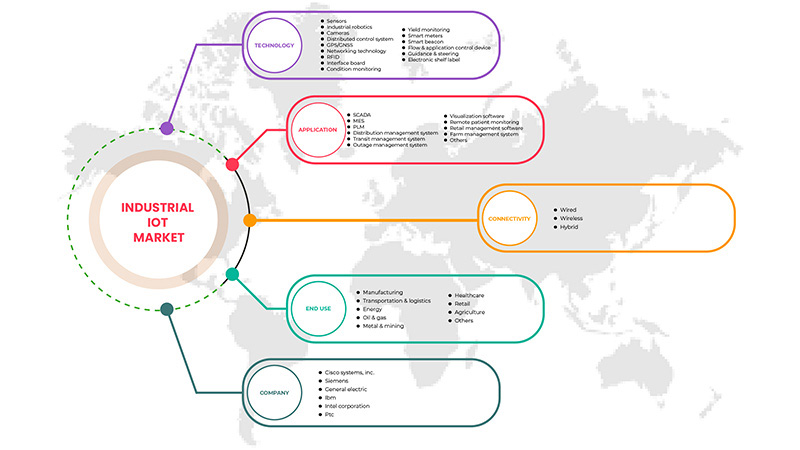

Asia-Pacific Industrial IoT Market, By Technology (Sensors, Industrial Robotics, Cameras, Distributed Control System, GPS/GNSS, Networking Technology, RFID, Interface Board, Condition Monitoring, Yield Monitoring, Smart Meters, Smart Beacon, Flow & Application Control Device, Guidance & Steering, and Electronic Shelf Label), Application (SCADA, MES, PLM, Distribution Management System, Transit Management System, Outage Management System, Visualization Software, Remote Patient Monitoring, Retail Management Software, Farm Management System And Others), Connectivity (Wired, Wireless And Hybrid), End Use (Manufacturing, Transportation & Logistics, Energy, Oil & Gas, Metal & Mining, Healthcare, Retail, Agriculture, and Others) Industry Trends and Forecast to 2029

Asia-Pacific Industrial IoT Market Analysis and Size

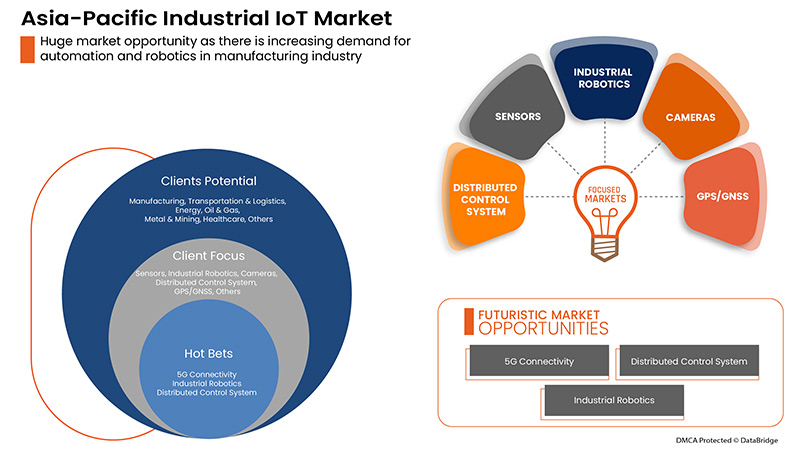

Increased use of the industrial IoT market due to the adoption of Artificial Intelligence (AI) and Machine Learning (ML) in the end user industry is also driving the market's growth. The higher probability of device theft and data breaches is expected to restrain the industrial IoT market. Growing internet penetration and digitalization across the globe are an opportunity for the industrial IoT market. High installation costs and difficulties in integrating IoT devices are challenging the Asia-Pacific industrial IoT market.

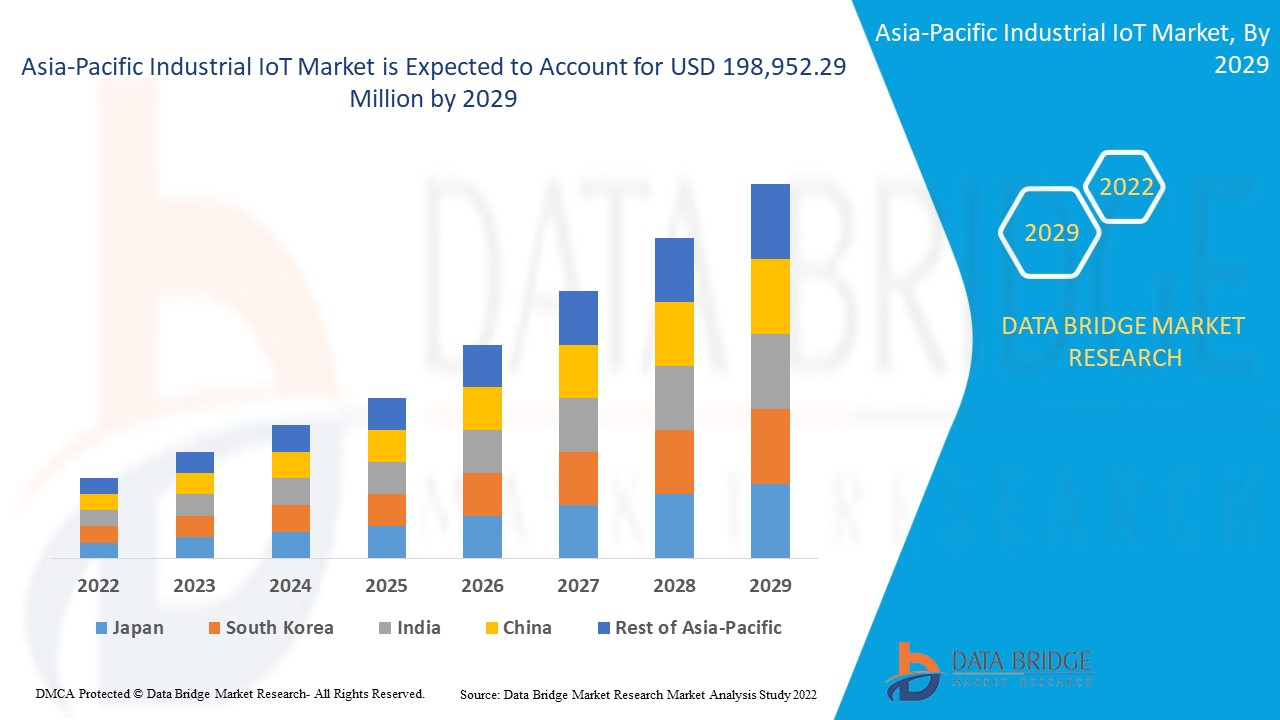

Data Bridge Market Research analyses that the Asia-Pacific industrial IoT market is expected to reach USD 198,952.29 million by 2029, at a CAGR of 10.6% during the forecast period. "Sensors" accounts for the most prominent technology segment as this type of technology is in demand and is the best option to extract information from industrial components. The industrial IoT market report also covers pricing analysis, patent analysis, and technological advancements in depth.

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Years |

2020 (Customizable to 2019-2014) |

|

Quantitative Units |

Revenue in USD Million, Volumes in Units, Pricing in USD |

|

Segments Covered |

By Technology (Sensors, Industrial Robotics, Cameras, Distributed Control System, GPS/GNSS, Networking Technology, RFID, Interface Board, Condition Monitoring, Yield Monitoring, Smart Meters, Smart Beacon, Flow & Application Control Device, Guidance & Steering, and Electronic Shelf Label), Application (SCADA, MES, PLM, Distribution Management System, Transit Management System, Outage Management System, Visualization Software, Remote Patient Monitoring, Retail Management Software, Farm Management System, and Others), Connectivity (Wired, Wireless, and Hybrid), End Use (Manufacturing, Transportation & Logistics, Energy, Oil & Gas, Metal & Mining, Healthcare, Retail, Agriculture, and Others)– Industry Trends and Forecast to 2029 |

|

Countries Covered |

China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, and Rest of Asia-Pacific |

|

Market Players Covered |

Cisco Systems, Inc., Siemens. General Electric, IBM Corporation, Intel Corporation, PTC, Honeywell International Inc., NEC Corporation, Rockwell Automation, ABB, SAP SE, Texas Instruments Incorporated, Robert Bosch GmbH, Emerson Electric Co., Microsoft, KUKA AG, Sigfox Network Limited (a subsidiary of UnaBiz), Wipro, Arm Limited (a subsidiary of Softbank Group Corp.) and Huawei Technologies Co., Ltd., among others |

Market Definition

The extension and application of the internet of things (IoT) in industrial sectors and applications are referred to as the industrial internet of things (IIoT). The Machine-to-Machine (M2M) Internet of Things (IIoT) enables businesses and industries to operate more efficiently and reliably because of its strong emphasis on M2M connectivity, big data, and machine learning. Industrial applications such as robotics, medical technology, and software-defined production processes are all included in the IIoT.

Industrial IoT Market Dynamics

This section deals with understanding the market drivers, advantages, opportunities, restraints, and challenges. All of this is discussed in detail below:

Drivers

- Increase in adoption of artificial intelligence (AI) and machine learning (ML) in end user industry

The popularity of AI and ML is increasing year over year in various industries such as manufacturing, healthcare, energy, oil & gas, and many others. Most of these industries adopt the technology to increase working efficiency, automate the service delivery process, and modernize the offerings which has gained an important role in competing with competitors in the market. Thus, the rising trend of AI & ML adoption is a major driver of the growth of the Asia-Pacific industrial IoT market.

- Surge in implementation of sensors and distributed control systems in business operations

The adoption of sensors and distributed control system will help control and manage the work process and automate the management process for all industrial processes. Thus, the demand for implementing sensors and DCS in various business operations will increase yearly. Thus, across the globe, the need for sensors and DCS is growing due to various advantages associated with the implementation, which promotes the growth of the Asia-Pacific industrial IoT market and acts as a driver for the development of the market.

- Increase in the need for real-time data solutions and services

the real-time data solutions require a wide range of electronic devices, and majorly the demand for IoT devices is expected to increase because to support the real-time data analysis in business operations to support the quick understanding of data and guide the decisions to deliver products or services to customers. Thus, there is high demand for the adoption of real-time solutions, which directly involve the usage of IoT devices for industries. Therefore, it is expected to be a major driver of market growth.

Restraints/ Challenges

- Lack of skilled labor and training sessions

Adopting IoT solutions for industries is not quick and easy; it involves detailed visualization and an adequate method of automating the sector. Therefore, end users need more time and labor to adopt the solutions and train the employees to understand the process and maintenance.

- Higher probability of device theft and data breaches

The dependability of the IT climate suggests getting the plant's resources, organization, and information created by these associated gadgets. The reliability responsibility is higher in adopting digitalization in business operations; however, there is a high probability of a safety disadvantage.

- Rise in the technical complexities due to day-by-day technological advancement

Flexible security is one thought for giving medical care, instruction, and lodging help, whether somebody is officially utilized. Furthermore, action records can back deep-rooted training and laborer retraining. Regardless of how individuals decide to invest energy, there should be ways for individuals to live satisfying lives irrespective of whether society needs fewer specialists. Thus, continuous technological advancement will lead to constant employee training and hinder the market growth.

Post COVID-19 Impact on Industrial IoT Market

COVID-19 significantly impacted the industrial IoT market as almost every country has opted for the shutdown for every production facility except those producing essential goods. The government has taken strict actions, such as shutting down production and sale of non-essential goods, blocking international trade, and many more, to prevent the spread of COVID-19. The only business dealing in this pandemic situation is the essential services allowed to open and run the processes.

The growth of the industrial IoT market is rising due to the digitalization in the production process and supply chains across agriculture, electrical utilities, mining, oil and gas, and transportation. Moreover, the IoT adoption in industries had huge progress from 2020 to 2021 as the pandemic demonstrated the importance of IoT in all types of businesses. The surge in demand for automation to avoid the involvement of a maximum workforce has driven the adoption of IoT in industries. This replicates the positive impact of COVID-19 on the IIoT market, which has further catalyzed the business through adopting industry 4.0 technologies.

Manufacturers are making various strategic decisions to bounce back post-COVID-19. The players are conducting multiple research and development activities to improve the technology in the industrial IoT market. The companies will bring advanced and accurate solutions to the market.

Recent Development

- In March 2022, Cisco Systems, Inc. developed an advanced IoT Control Center platform to help improve service reliability and reduce operational costs. This development will help the company diversify its solution portfolio and offers better quality solutions

- In April 2022, Arm Limited introduced two new solutions, Arm Cortex-M85 and Cortex-A. These new products and solutions will help the company offer better solutions to customers, attracting new customers and accelerating revenue growth

Asia-Pacific Industrial IoT Market Scope

The industrial IoT market is segmented based on technology, application, connectivity, and end use. The growth amongst these segments will help you analyze meager growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

By Technology

- Sensors

- Industrial Robotics

- Cameras

- Distributed Control System

- GPS/GNSS

- Networking Technology

- RFID

- Interface Board

- Condition Monitoring

- Yield Monitoring

- Smart Meters

- Smart Beacon

- Flow & Application Control Device

- Guidance & Steering

- Electronic Shelf Label

On the basis of technology, the Asia-Pacific industrial IoT market is segmented into sensors, industrial robotics, cameras, distributed control system, GPS/GNSS, networking technology, RFID, interface board, condition monitoring, yield monitoring, smart meters, smart beacon, flow & application control device, guidance & steering, and electronic shelf label.

By Application

- SCADA

- MES

- PLM

- Distribution Management System

- Transit Management System

- Outage Management System

- Visualization Software

- Remote Patient Monitoring

- Retail Management Software

- Farm Management System

- Others

On the basis of application, the Asia-Pacific industrial IoT market has been segmented into SCADA, MES, PLM, distribution management system, transit management system, outage management system, visualization software, remote patient monitoring, retail management software, farm management system, and others.

By Connectivity

- Wired

- Wireless

- Hybrid

On the basis of connectivity, the Asia-Pacific industrial IoT market has been segmented into wired, wireless, and hybrid.

By End Use

- Manufacturing

- Transportation & Logistics

- Energy

- Oil & Gas

- Metal & Mining

- Healthcare

- Retail

- Agriculture

- Others

On the basis of end use, the Asia-Pacific industrial IoT market has been segmented into manufacturing, transportation & logistics, energy, oil & gas, metal & mining, healthcare, retail, agriculture, and others

Industrial IoT Market Regional Analysis/Insights

The industrial IoT market is analyzed, and market size insights and trends are provided by technology, application, connectivity, and end-use, as referenced above.

The countries covered in the Industrial IoT market report are China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, and the rest of Asia-Pacific.

China dominates the industrial IoT market. China is likely to be the fastest-growing Asia-Pacific industrial IoT market. The rising infrastructure, commercial, and industrial developments in emerging countries such as China, Japan, India, and South Korea are credited with the market's dominance. The increasing growth in the countries towards digitalization and automation will boost the Industrial IoT demand for industrial IoT products in the Asia-Pacific region.

The country section of the report also provides individual market-impacting factors and market regulation changes that impact the market's current and future trends. Data points like downstream and upstream value chain analysis, technical trends, porter's five forces analysis, and case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of Asia-Pacific brands and their challenges faced due to large or scarce competition from local and domestic brands, the impact of domestic tariffs, and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Industrial IoT Market Share Analysis

The Industrial IoT market competitive landscape provides details about the competitor. Components included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, Asia-Pacific presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, and application dominance. The above data points provided are only related to the companies focus on the industrial IoT market.

Some of the major players operating in the industrial IoT market are:

- Cisco Systems, Inc.

- NEC Corporation

- Intel Corporation

- General Electric

- Texas Instruments Incorporated

- IBM

- Siemens

- PTC

- ABB

- Emerson Electric Co.

- Bosch.IO GmbH

- Microsoft

- Honeywell International Inc.

- SAP SE

- Rockwell Automation, Inc.

- KUKA AG

- Huawei Technologies Co., Ltd.

- Arm Limited (a subsidiary of Softbank Group Corp.)

- Sigfox Network Limited (a subsidiary of UnaBiz)

- Wipro

SKU-

세계 최초의 시장 정보 클라우드 보고서에 온라인으로 접속하세요

- 대화형 데이터 분석 대시보드

- 높은 성장 잠재력 기회를 위한 회사 분석 대시보드

- 사용자 정의 및 질의를 위한 리서치 분석가 액세스

- 대화형 대시보드를 통한 경쟁자 분석

- 최신 뉴스, 업데이트 및 추세 분석

- 포괄적인 경쟁자 추적을 위한 벤치마크 분석의 힘 활용

목차

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF ASIA PACIFIC INDUSTRIAL IOT MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELING

2.9 TECHNOLOGY TIMELINE CURVE

2.1 MARKET END USE COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 USE CASE ANALYSIS

4.1.1 OVERVIEW

4.1.2 PREDICTIVE MAINTENANCE

4.1.3 LOCATION TRACKING

4.1.4 WORKPLACE ANALYTICS

4.1.5 REMOTE QUALITY MONITORING

4.1.6 ENERGY OPTIMIZATION

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 INCREASE IN ADOPTION OF ARTIFICIAL INTELLIGENCE (AI) AND MACHINE LEARNING (ML) IN END USER INDUSTRY

5.1.2 SURGE IN IMPLEMENTATION OF SENSORS AND DISTRIBUTED CONTROL SYSTEMS IN BUSINESS OPERATIONS

5.1.3 INCREASE IN THE NEED FOR REAL-TIME DATA SOLUTIONS AND SERVICES

5.1.4 INCREASE IN THE PENETRATION OF INDUSTRY 4.0 IN AUTOMOTIVE AND MANUFACTURING INDUSTRIES

5.2 RESTRAINTS

5.2.1 LACK OF SKILLED LABOR AND TRAINING SESSIONS

5.2.2 HIGHER PROBABILITY OF DEVICE THEFT AND DATA BREACHES

5.2.3 RISE IN THE TECHNICAL COMPLEXITIES DUE TO DAY-BY-DAY TECHNOLOGICAL ADVANCEMENT

5.3 OPPORTUNITIES

5.3.1 RISE IN INTERNET PENETRATION ACROSS THE GLOBE

5.3.2 RISE IN THE DIGITALIZATION TREND

5.3.3 PROGRESSION IN SMART TECHNOLOGIES

5.3.4 HIGH ADOPTION OF CLOUD-BASED DEPLOYMENT MODEL

5.4 CHALLENGES

5.4.1 HIGH INSTALLATION COST

5.4.2 DIFFICULTIES IN INTEGRATION OF IOT DEVICES

6 ASIA PACIFIC INDUSTRIAL IOT MARKET, BY TECHNOLOGY

6.1 OVERVIEW

6.2 SENSORS

6.3 INDUSTRIAL ROBOTICS

6.4 CAMERAS

6.5 DISTRIBUTED CONTROL SYSTEM

6.6 GPS/GNSS

6.7 NETWORKING TECHNOLOGY

6.8 RFID

6.9 INTERFACE BOARD

6.1 CONDITION MONITORING

6.11 YIELD MONITORING

6.12 SMART METERS

6.13 SMART BEACON

6.14 FLOW & APPLICATION CONTROL DEVICE

6.15 GUIDANCE & STEERING

6.16 ELECTRONIC SHELF LABEL

7 ASIA PACIFIC INDUSTRIAL IOT MARKET, BY APPLICATION

7.1 OVERVIEW

7.2 SCADA

7.3 MES

7.4 PLM

7.5 DISTRIBUTED CONTROL SYSTEM

7.6 TRANSIT MANAGEMENT SYSTEM

7.7 OUTAGE MANAGEMENT SYSTEM

7.8 VISUALIZATION SOFTWARE

7.9 REMOTE PATIENT MONITORING

7.1 RETAIL MANAGEMENT SOFTWARE

7.11 FARM MANAGEMENT SYSTEM

7.12 OTHERS

8 ASIA PACIFIC INDUSTRIAL IOT MARKET, BY CONNECTIVITY

8.1 OVERVIEW

8.2 WIRED

8.3 WIRELESS

8.4 HYBRID

9 ASIA PACIFIC INDUSTRIAL IOT MARKET, BY END USE

9.1 OVERVIEW

9.2 MANUFACTURING

9.3 TRANSPORTATION & LOGISTICS

9.4 ENERGY

9.5 OIL & GAS

9.6 METAL & MINING

9.7 HEALTHCARE

9.8 RETAIL

9.9 AGRICULTURE

9.1 OTHERS

10 ASIA PACIFIC INDUSTRIAL IOT MARKET, BY REGION

10.1 ASIA-PACIFIC

10.1.1 CHINA

10.1.2 JAPAN

10.1.3 SOUTH KOREA

10.1.4 INDIA

10.1.5 AUSTRALIA

10.1.6 INDONESIA

10.1.7 THAILAND

10.1.8 SINGAPORE

10.1.9 MALAYSIA

10.1.10 PHILIPPINES

10.1.11 REST OF ASIA-PACIFIC

11 ASIA PACIFIC INDUSTRIAL IOT MARKET, COMPANY LANDSCAPE

11.1 COMPANY SHARE ANALYSIS: ASIA PACIFIC

12 SWOT ANALYSIS

13 COMPANY PROFILE

13.1 CISCO SYSTEMS, INC.

13.1.1 COMPANY SNAPSHOT

13.1.2 REVENUE ANALYSIS

13.1.3 COMPANY SHARE ANALYSIS

13.1.4 PRODUCT PORTFOLIO

13.1.5 RECENT DEVELOPMENTS

13.2 SIEMENS

13.2.1 COMPANY SNAPSHOT

13.2.2 REVENUE ANALYSIS

13.2.3 COMPANY SHARE ANALYSIS

13.2.4 PRODUCT PORTFOLIO

13.2.5 RECENT DEVELOPMENTS

13.3 GENERAL ELECTRIC

13.3.1 COMPANY SNAPSHOT

13.3.2 REVENUE ANALYSIS

13.3.3 COMPANY SHARE ANALYSIS

13.3.4 PRODUCT PORTFOLIO

13.3.5 RECENT DEVELOPMENTS

13.4 IBM CORPORATION

13.4.1 COMPANY SNAPSHOT

13.4.2 REVENUE ANALYSIS

13.4.3 COMPANY SHARE ANALYSIS

13.4.4 PRODUCT PORTFOLIO

13.4.5 RECENT DEVELOPMENTS

13.5 INTEL CORPORATION

13.5.1 COMPANY SNAPSHOT

13.5.2 REVENUE ANALYSIS

13.5.3 COMPANY SHARE ANALYSIS

13.5.4 PRODUCT PORTFOLIO

13.5.5 RECENT DEVELOPMENTS

13.6 ABB

13.6.1 COMPANY SNAPSHOT

13.6.2 REVENUE ANALYSIS

13.6.3 PRODUCT PORTFOLIO

13.6.4 RECENT DEVELOPMENT

13.7 ARM LIMITED (A SUBSIDIAIRY OF SOFTBANK GROUP)

13.7.1 COMPANY SNAPSHOT

13.7.2 REVENUE ANALYSIS

13.7.3 PRODUCT PORTFOLIO

13.7.4 RECENT DEVELOPMENTS

13.8 EMERSON ELECTRIC CO.

13.8.1 COMPANY SNAPSHOT

13.8.2 REVENUE ANALYSIS

13.8.3 PRODUCT PORTFOLIO

13.8.4 RECENT DEVELOPMENTS

13.9 HONEYWELL INTERNATIONAL INC.

13.9.1 COMPANY SNAPSHOT

13.9.2 REVENUE ANALYSIS

13.9.3 PRODUCT PORTFOLIO

13.9.4 RECENT DEVELOPMENTS

13.1 HUAWEI TECHNOLOGIES CO., LTD.

13.10.1 COMPANY SNAPSHOT

13.10.2 PRODUCT PORTFOLIO

13.10.3 RECENT DEVELOPMENTS

13.11 KUKA AG

13.11.1 COMPANY SNAPSHOT

13.11.2 REVENUE ANALYSIS

13.11.3 PRODUCT PORTFOLIO

13.11.4 RECENT DEVELOPMENTS

13.12 MICROSOFT

13.12.1 COMPANY SNAPSHOT

13.12.2 REVENUE ANALYSIS

13.12.3 PRODUCT PORTFOLIO

13.12.4 RECENT DEVELOPMENTS

13.13 NEC CORPORATION

13.13.1 COMPANY SNAPSHOT

13.13.2 REVENUE ANALYSIS

13.13.3 PRODUCT PORTFOLIO

13.13.4 RECENT DEVELOPMENTS

13.14 PTC

13.14.1 COMPANY SNAPSHOT

13.14.2 REVENUE ANALYSIS

13.14.3 PRODUCT PORTFOLIO

13.14.4 RECENT DEVELOPMENTS

13.15 ROBERT BOSCH GMBH

13.15.1 COMPANY SNAPSHOT

13.15.2 REVENUE ANALYSIS

13.15.3 PRODUCT PORTFOLIO

13.15.4 RECENT DEVELOPMENTS

13.16 ROCKWELL AUTOMATION, INC.

13.16.1 COMPANY SNAPSHOT

13.16.2 REVENUE ANALYSIS

13.16.3 PRODUCT PORTFOLIO

13.16.4 RECENT DEVELOPMENTS

13.17 SAP SE

13.17.1 COMPANY SNAPSHOT

13.17.2 REVENUE ANALYSIS

13.17.3 PRODUCT PORTFOLIO

13.17.4 RECENT DEVELOPMENTS

13.18 SIGFOX PARTNER NETWORK

13.18.1 COMPANY SNAPSHOT

13.18.2 PRODUCT PORTFOLIO

13.18.3 RECENT DEVELOPMENTS

13.19 TEXAS INSTRUMENTS INCORPORATED

13.19.1 COMPANY SNAPSHOT

13.19.2 REVENUE ANALYSIS

13.19.3 PRODUCT PORTFOLIO

13.19.4 RECENT DEVELOPMENTS

13.2 WIPRO

13.20.1 COMPANY SNAPSHOT

13.20.2 REVENUE ANALYSIS

13.20.3 PRODUCT PORTFOLIO

13.20.4 RECENT DEVELOPMENTS

14 QUESTIONNAIRE

15 RELATED REPORTS

표 목록

TABLE 1 ASIA PACIFIC INDUSTRIAL IOT MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 2 ASIA PACIFIC SENSORS IN INDUSTRIAL IOT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 3 ASIA PACIFIC INDUSTRIAL ROBOTICS IN INDUSTRIAL IOT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 4 ASIA PACIFIC CAMERAS IN INDUSTRIAL IOT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 5 ASIA PACIFIC DISTRIBUTED CONTROL SYSTEM IN INDUSTRIAL IOT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 6 ASIA PACIFIC GPS/GNSS IN INDUSTRIAL IOT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 7 ASIA PACIFIC NETWORKING TECHNOLOGY IN INDUSTRIAL IOT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 8 ASIA PACIFIC RFID IN INDUSTRIAL IOT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 9 ASIA PACIFIC INTERFACE BOARD IN INDUSTRIAL IOT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 10 ASIA PACIFIC CONDITION MONITORING IN INDUSTRIAL IOT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 11 ASIA PACIFIC YIELD MONITORING IN INDUSTRIAL IOT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 12 ASIA PACIFIC SMART METERS IN INDUSTRIAL IOT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 13 ASIA PACIFIC SMART BEACON IN INDUSTRIAL IOT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 14 ASIA PACIFIC FLOW & APPLICATION CONTROL DEVICE IN INDUSTRIAL IOT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 15 ASIA PACIFIC GUIDANCE & STEERING IN INDUSTRIAL IOT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 16 ASIA PACIFIC ELECTRONIC SHELF LABEL IN INDUSTRIAL IOT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 17 ASIA PACIFIC INDUSTRIAL IOT MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 18 ASIA PACIFIC SCADA IN INDUSTRIAL IOT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 19 ASIA PACIFIC MES IN INDUSTRIAL IOT MARKET, BY REGION, 2020-2029, (USD MILLION)

TABLE 20 ASIA PACIFIC PLM IN INDUSTRIAL IOT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 21 ASIA PACIFIC DISTRIBUTED CONTROL SYSTEM IN INDUSTRIAL IOT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 22 ASIA PACIFIC TRANSIT MANAGEMENT SYSTEM IN INDUSTRIAL IOT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 23 ASIA PACIFIC OUTAGE MANAGEMENT SYSTEM IN INDUSTRIAL IOT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 24 ASIA PACIFIC VISUALIZATION SOFTWARE IN INDUSTRIAL IOT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 25 ASIA PACIFIC REMOTE PATIENT MONITORING IN INDUSTRIAL IOT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 26 ASIA PACIFIC RETAIL MANAGEMENT SOFTWARE IN INDUSTRIAL IOT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 27 ASIA PACIFIC FARM MANAGEMENT SYSTEM IN INDUSTRIAL IOT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 28 ASIA PACIFIC OTHERS IN INDUSTRIAL IOT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 29 ASIA PACIFIC INDUSTRIAL IOT MARKET, BY CONNECTIVITY, 2020-2029 (USD MILLION)

TABLE 30 ASIA PACIFIC WIRED IN INDUSTRIAL IOT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 31 ASIA PACIFIC WIRELESS IN INDUSTRIAL IOT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 32 ASIA PACIFIC HYBRID IN INDUSTRIAL IOT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 33 ASIA PACIFIC INDUSTRIAL IOT MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 34 ASIA PACIFIC MANUFACTURING IN INDUSTRIAL IOT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 35 ASIA PACIFIC TRANSPORTATION & LOGISTICS IN INDUSTRIAL IOT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 36 ASIA PACIFIC ENERGY IN INDUSTRIAL IOT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 37 ASIA PACIFIC OIL & GAS IN INDUSTRIAL IOT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 38 ASIA PACIFIC METAL & MINING IN INDUSTRIAL IOT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 39 ASIA PACIFIC HEALTHCARE IN INDUSTRIAL IOT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 40 ASIA PACIFIC RETAIL IN INDUSTRIAL IOT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 41 ASIA PACIFIC AGRICULTURE IN INDUSTRIAL IOT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 42 ASIA PACIFIC OTHERS IN INDUSTRIAL IOT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 43 ASIA-PACIFIC INDUSTRIAL IOT MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 44 ASIA-PACIFIC INDUSTRIAL IOT MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 45 ASIA-PACIFIC INDUSTRIAL IOT MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 46 ASIA-PACIFIC INDUSTRIAL IOT MARKET, BY CONNECTIVITY, 2020-2029 (USD MILLION)

TABLE 47 ASIA-PACIFIC INDUSTRIAL IOT MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 48 CHINA INDUSTRIAL IOT MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 49 CHINA INDUSTRIAL IOT MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 50 CHINA INDUSTRIAL IOT MARKET, BY CONNECTIVITY, 2020-2029 (USD MILLION)

TABLE 51 CHINA INDUSTRIAL IOT MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 52 JAPAN INDUSTRIAL IOT MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 53 JAPAN INDUSTRIAL IOT MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 54 JAPAN INDUSTRIAL IOT MARKET, BY CONNECTIVITY, 2020-2029 (USD MILLION)

TABLE 55 JAPAN INDUSTRIAL IOT MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 56 SOUTH KOREA INDUSTRIAL IOT MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 57 SOUTH KOREA INDUSTRIAL IOT MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 58 SOUTH KOREA INDUSTRIAL IOT MARKET, BY CONNECTIVITY, 2020-2029 (USD MILLION)

TABLE 59 SOUTH KOREA INDUSTRIAL IOT MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 60 INDIA INDUSTRIAL IOT MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 61 INDIA INDUSTRIAL IOT MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 62 INDIA INDUSTRIAL IOT MARKET, BY CONNECTIVITY, 2020-2029 (USD MILLION)

TABLE 63 INDIA INDUSTRIAL IOT MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 64 AUSTRALIA INDUSTRIAL IOT MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 65 AUSTRALIA INDUSTRIAL IOT MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 66 AUSTRALIA INDUSTRIAL IOT MARKET, BY CONNECTIVITY, 2020-2029 (USD MILLION)

TABLE 67 AUSTRALIA INDUSTRIAL IOT MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 68 INDONESIA INDUSTRIAL IOT MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 69 INDONESIA INDUSTRIAL IOT MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 70 INDONESIA INDUSTRIAL IOT MARKET, BY CONNECTIVITY, 2020-2029 (USD MILLION)

TABLE 71 INDONESIA INDUSTRIAL IOT MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 72 THAILAND INDUSTRIAL IOT MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 73 THAILAND INDUSTRIAL IOT MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 74 THAILAND INDUSTRIAL IOT MARKET, BY CONNECTIVITY, 2020-2029 (USD MILLION)

TABLE 75 THAILAND INDUSTRIAL IOT MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 76 SINGAPORE INDUSTRIAL IOT MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 77 SINGAPORE INDUSTRIAL IOT MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 78 SINGAPORE INDUSTRIAL IOT MARKET, BY CONNECTIVITY, 2020-2029 (USD MILLION)

TABLE 79 SINGAPORE INDUSTRIAL IOT MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 80 MALAYSIA INDUSTRIAL IOT MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 81 MALAYSIA INDUSTRIAL IOT MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 82 MALAYSIA INDUSTRIAL IOT MARKET, BY CONNECTIVITY, 2020-2029 (USD MILLION)

TABLE 83 MALAYSIA INDUSTRIAL IOT MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 84 PHILIPPINES INDUSTRIAL IOT MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 85 PHILIPPINES INDUSTRIAL IOT MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 86 PHILIPPINES INDUSTRIAL IOT MARKET, BY CONNECTIVITY, 2020-2029 (USD MILLION)

TABLE 87 PHILIPPINES INDUSTRIAL IOT MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 88 REST OF ASIA-PACIFIC INDUSTRIAL IOT MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

그림 목록

FIGURE 1 ASIA PACIFIC INDUSTRIAL IOT MARKET: SEGMENTATION

FIGURE 2 ASIA PACIFIC INDUSTRIAL IOT MARKET: DATA TRIANGULATION

FIGURE 3 ASIA PACIFIC INDUSTRIAL IOT MARKET: DROC ANALYSIS

FIGURE 4 ASIA PACIFIC INDUSTRIAL IOT MARKET: ASIA PACIFIC VS REGIONAL MARKET ANALYSIS

FIGURE 5 ASIA PACIFIC INDUSTRIAL IOT MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 ASIA PACIFIC INDUSTRIAL IOT MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 ASIA PACIFIC INDUSTRIAL IOT MARKET: DBMR MARKET POSITION GRID

FIGURE 8 ASIA PACIFIC INDUSTRIAL IOT MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 ASIA PACIFIC INDUSTRIAL IOT MARKET: MARKET END USE COVERAGE GRID

FIGURE 10 ASIA PACIFIC INDUSTRIAL IOT MARKET: SEGMENTATION

FIGURE 11 INCREASE IN ADOPTION OF ARTIFICIAL INTELLIGENCE (AI) AND MACHINE LEARNING (ML) IN END USER INDUSTRY IS EXPECTED TO DRIVE THE ASIA PACIFIC INDUSTRIAL IOT MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 SCADA SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE ASIA PACIFIC INDUSTRIAL IOT MARKET IN 2022 AND 2029

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE ASIA PACIFIC INDUSTRIAL IOT MARKET

FIGURE 14 AI ADOPTION RATES AROUND THE GLOBE

FIGURE 15 COMPANIES GETTING BENEFITS FROM ANALYTICAL SOLUTIONS

FIGURE 16 GROWING INTERNET USERS WORLDWIDE

FIGURE 17 UNEMPLOYMENT RATE IN THE MIDDLE EAST AND NORTH AFRICA REGION

FIGURE 18 RESEARCH AND DEVELOPMENT EXPENDITURE (% OF GDP)

FIGURE 19 WORLDWIDE CLOUD INVESTMENT, 2019 – 2025

FIGURE 20 ASIA PACIFIC INDUSTRIAL IOT MARKET, BY TECHNOLOGY, 2021

FIGURE 21 ASIA PACIFIC INDUSTRIAL IOT MARKET, BY APPLICATION, 2021

FIGURE 22 ASIA PACIFIC INDUSTRIAL IOT MARKET, BY CONNECTIVITY, 2021

FIGURE 23 ASIA PACIFIC INDUSTRIAL IOT MARKET, BY END USE, 2021

FIGURE 24 ASIA-PACIFIC INDUSTRIAL IOT MARKET: SNAPSHOT (2021)

FIGURE 25 ASIA-PACIFIC INDUSTRIAL IOT MARKET: BY COUNTRY (2021)

FIGURE 26 ASIA-PACIFIC INDUSTRIAL IOT MARKET: BY COUNTRY (2022 & 2029)

FIGURE 27 ASIA-PACIFIC INDUSTRIAL IOT MARKET: BY COUNTRY (2021 & 2029)

FIGURE 28 ASIA-PACIFIC INDUSTRIAL IOT MARKET: BY TECHNOLOGY (2022 & 2029)

FIGURE 29 ASIA PACIFIC INDUSTRIAL IOT MARKET: COMPANY SHARE 2021 (%)

연구 방법론

데이터 수집 및 기준 연도 분석은 대규모 샘플 크기의 데이터 수집 모듈을 사용하여 수행됩니다. 이 단계에는 다양한 소스와 전략을 통해 시장 정보 또는 관련 데이터를 얻는 것이 포함됩니다. 여기에는 과거에 수집한 모든 데이터를 미리 검토하고 계획하는 것이 포함됩니다. 또한 다양한 정보 소스에서 발견되는 정보 불일치를 검토하는 것도 포함됩니다. 시장 데이터는 시장 통계 및 일관된 모델을 사용하여 분석하고 추정합니다. 또한 시장 점유율 분석 및 주요 추세 분석은 시장 보고서의 주요 성공 요인입니다. 자세한 내용은 분석가에게 전화를 요청하거나 문의 사항을 드롭하세요.

DBMR 연구팀에서 사용하는 주요 연구 방법론은 데이터 마이닝, 시장에 대한 데이터 변수의 영향 분석 및 주요(산업 전문가) 검증을 포함하는 데이터 삼각 측량입니다. 데이터 모델에는 공급업체 포지셔닝 그리드, 시장 타임라인 분석, 시장 개요 및 가이드, 회사 포지셔닝 그리드, 특허 분석, 가격 분석, 회사 시장 점유율 분석, 측정 기준, 글로벌 대 지역 및 공급업체 점유율 분석이 포함됩니다. 연구 방법론에 대해 자세히 알아보려면 문의를 통해 업계 전문가에게 문의하세요.

사용자 정의 가능

Data Bridge Market Research는 고급 형성 연구 분야의 선두 주자입니다. 저희는 기존 및 신규 고객에게 목표에 맞는 데이터와 분석을 제공하는 데 자부심을 느낍니다. 보고서는 추가 국가에 대한 시장 이해(국가 목록 요청), 임상 시험 결과 데이터, 문헌 검토, 재생 시장 및 제품 기반 분석을 포함하도록 사용자 정의할 수 있습니다. 기술 기반 분석에서 시장 포트폴리오 전략에 이르기까지 타겟 경쟁업체의 시장 분석을 분석할 수 있습니다. 귀하가 원하는 형식과 데이터 스타일로 필요한 만큼 많은 경쟁자를 추가할 수 있습니다. 저희 분석가 팀은 또한 원시 엑셀 파일 피벗 테이블(팩트북)로 데이터를 제공하거나 보고서에서 사용 가능한 데이터 세트에서 프레젠테이션을 만드는 데 도움을 줄 수 있습니다.