아시아 태평양 건강 및 웰빙 식품 시장, 유형별(기능성 식품, 강화 및 건강한 제빵 제품, 건강한 간식, BFY 식품, 음료, 초콜릿 및 기타), 칼로리 함량(무칼로리, 저칼로리 및 감소 칼로리), 본질(비GMO 및 GMO), 지방 함량(무지방, 저지방 및 감소 지방), 범주(일반 및 유기농), 무첨가 범주(글루텐 무첨가, 유제품 무첨가, 대두 무첨가, 견과류 무첨가, 락토오스 무첨가, 인공 향료 무첨가, 인공 색소 무첨가 및 기타) 및 유통 채널(매장형 소매업체 및 비매장형 소매업체) 산업 동향 및 2029년까지의 예측

시장 분석 및 통찰력

아시아 태평양 건강 및 웰빙 식품 시장은 성장하는 식품 및 음료 산업과 건강하고 영양가 있는 식품에 대한 수요 증가로 인해 상당한 성장을 이루고 있습니다. 건강을 의식하는 사람들의 수가 증가함에 따라 아시아 태평양 건강 및 웰빙 식품 시장도 성장하고 있습니다. 그러나 식품과 관련된 엄격한 정부 규제로 인해 예측 기간 동안 바닐라 시장의 시장 성장이 제한될 것으로 예상됩니다.

예를 들어,

- Economics Times에 따르면 2019년 8월, 유럽의 두 식품 거물인 다논과 네슬레는 건강 및 영양 산업에서 새로운 경쟁자를 물리치기 위한 공식인 신제품 출시와 개발을 앞당겼습니다. 네슬레는 세계 최대의 맥아 음료 브랜드인 Milo를 재런칭하는 반면, 다논은 저당 제품, 바, 건강 브랜드 Protinex의 레디투드링크 버전을 포함한 12개 이상의 신제품을 개발 중이라고 밝혔습니다.

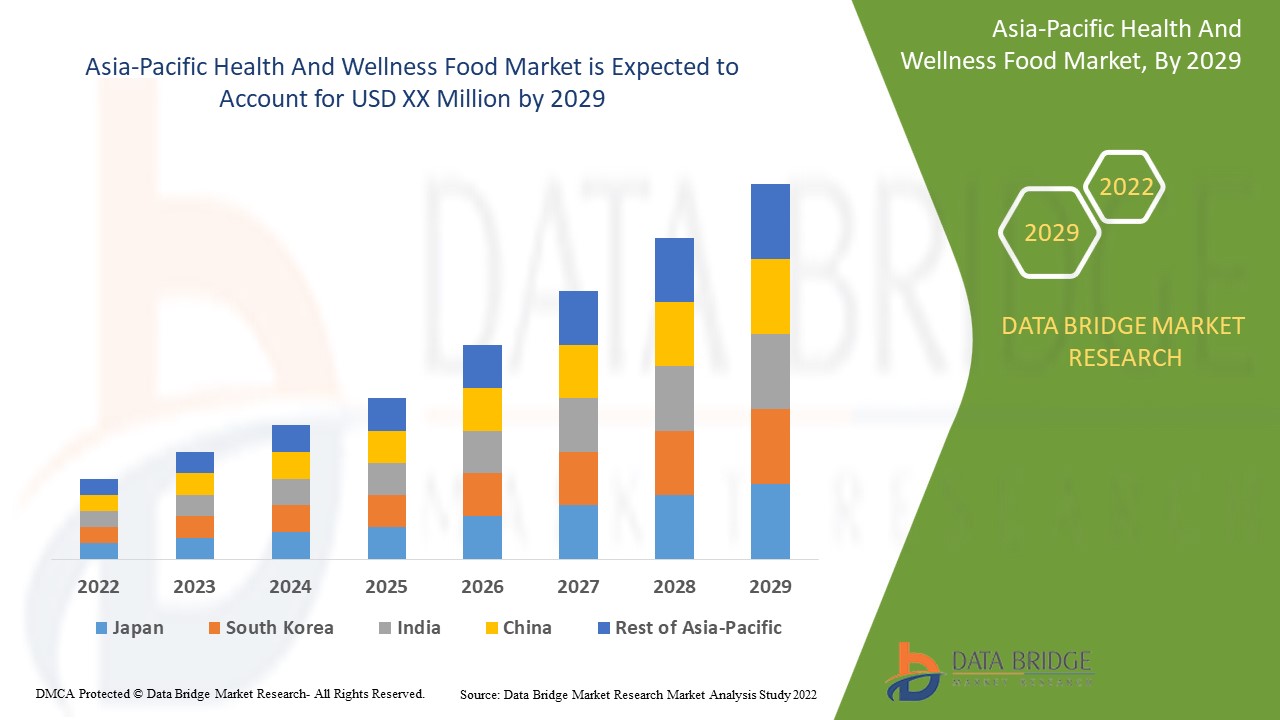

Data Bridge Market Research에 따르면 아시아 태평양 건강 및 웰빙 식품 시장은 2022년부터 2029년까지의 예측 기간 동안 9.9%의 CAGR로 성장할 것으로 분석됩니다.

|

보고서 메트릭 |

세부 |

|

예측 기간 |

2022년부터 2029년까지 |

|

기준 연도 |

2021 |

|

역사적 해 |

2020 (2019-2015까지 사용자 정의 가능) |

|

양적 단위 |

수익 (USD) 10억 |

|

다루는 세그먼트 |

유형별(기능성 식품, 강화 및 건강 베이커리 제품, 건강 간식, BFY 식품, 음료, 초콜릿 및 기타), 칼로리 함량(무칼로리, 저칼로리 및 감소 칼로리), 자연별(비GMO 및 GMO), 지방 함량(무지방, 저지방 및 감소 지방), 범주별(일반 및 유기농), 무첨가 범주별(글루텐 무첨가, 유제품 무첨가, 대두 무첨가, 견과류 무첨가, 락토오스 무첨가, 인공 향료 무첨가, 인공 색소 무첨가 및 기타) 및 유통 채널별(매장형 소매업체 및 비매장형 소매업체) |

|

적용 지역 |

중국, 일본, 호주, 인도, 필리핀, 인도네시아, 싱가포르, 한국, 말레이시아, 태국 및 기타 아시아 태평양 지역 |

|

시장 참여자 포함 |

앨터 에코, 마스펙스, 펩시코, 제너럴 밀스 주식회사, 마스 인코퍼레이티드, 네슬레, 다논, 애보트, 휴엘 주식회사, GSK 그룹, 클리프 바 앤 컴퍼니, 그린 밸리 데어리즈, 초바니, LLC., SO DELICIOUS DAIRY FREE, 엔조이 라이프, 더 심플리 굿 푸드 컴퍼니, 몬델레즈 인터내셔널, 켈로그, 더 퀘이커 오츠 컴퍼니, 야쿠르트 혼샤 주식회사 |

시장 정의

음식, 건강, 웰빙은 모두 서로 연결되어 있습니다. 우리가 섭취하는 음식과 그 출처는 우리의 건강과 체력에 영향을 미칩니다. 웰빙은 우리가 일상 생활에 통합하는 균형 잡힌 음식에서 비롯됩니다. 건강은 더 나은 음식을 먹는 것뿐만 아니라 긴장과 스트레스를 줄이고 규칙적으로 운동하는 것입니다. 음식, 건강, 웰빙 음식은 기능적 요소나 가공 과정을 수정하여 질병의 위험이나 치료를 줄이고 신체적 또는 정신적 성과를 개선하는 데 도움이 될 수 있습니다.

아시아 태평양 건강 및 웰빙 식품 시장 역학

운전자

- 단백질 기반 영양 및 건강 식품 및 음료에 대한 수요 증가

소비자들이 건강을 더 의식하고 건강한 식단을 유지하는 데 도움이 되는 영양가와 건강상의 이점이 더 높은 음식을 선호함에 따라 단백질 기반의 건강 식품과 음료에 대한 수요가 급증하고 있습니다.

견과류, 시리얼, 곡물, 과일, 채소는 단백질 기반 식품을 생산하는 데 사용되는 중요한 단백질 공급원입니다. 따라서 제조업체는 소비자 기반을 유치하기 위해 다양한 견과류, 과일, 곡물, 시리얼 기반 간식, 바, 음료 및 기타 단백질이 풍부한 블렌드를 제공하여 새로운 제품 개발에 집중합니다.

게다가 단백질은 우리 몸이 제대로 기능하기 위해 대량으로 필요로 하는 주요 거대 영양소 중 하나입니다. 단백질은 모든 신체 세포에 필요한 중요한 물질입니다. 단백질은 손톱과 머리카락의 주요 요소이며 피부와 신체에도 중요한 역할을 합니다. 조직을 만들고 복구하기 때문입니다. 또한 뼈, 근육, 혈액에도 필수적입니다. 따라서 제조업체는 단백질이 풍부한 식품을 시장에 출시하기 위해 노력하고 있습니다.

또한 단백질 기반 음료는 단백질과 기타 유익한 영양소를 다량 함유하고 있어 더 나은 영양을 제공합니다. 따라서 단백질이 풍부한 공급원이므로 에너지를 높이고 신체에 더 많은 영양을 공급합니다. 더욱이 단백질 기반 음료는 더 강한 건강, 뛰어난 맛, 더 많은 상쾌함을 제공합니다. 더욱이 단백질은 신체에 근육, 장기, 머리카락, 조직 및 피부를 제공합니다. 단백질 기반 영양 음료는 또한 신진대사, 체중 감량 및 체중 관리에 역할을 하여 지방 방출을 촉진하고 지방 저장을 줄이며 신체의 신진대사 속도를 증가시킵니다. 소비자는 이 사실을 알고 있으므로 전 세계적으로 더 많은 단백질 기반 식품 및 음료 제품을 요구하고 있습니다.

- 가처분 소득 증가와 건강식품에 대한 지출 증가

전 세계적으로 가처분소득이 늘어나거나 가처분소득이 높아지면서 소비자들은 더 많은 음식과 음료를 구매할 수 있게 됐습니다.

게다가 가처분 소득이 증가하면 가계는 저축하거나 음식에 쓸 돈이 더 많아지고, 이는 자연스럽게 건강한 식품 소비 증가로 이어지며, 글로벌 건강 및 웰빙 식품 시장에 대한 수요를 창출합니다. 따라서 소비자의 가처분 소득이 증가하면 건강한 삶을 살기 위해 더 많은 영양 음료를 구매할 수 있어 시장 성장이 촉진됩니다.

게다가 건강하고 영양가 있는 음식에 대한 지출이 증가하면서 사람들의 건강을 유지하는 데 도움이 되는 식품에 대한 수요도 늘어났습니다.

따라서 가처분소득의 증가로 인해 소비자들은 건강을 유지하기 위해 영양 음료 와 같은 건강식품에 더 많은 돈을 지출하는 것으로 보이며 , 이는 글로벌 건강과 웰빙 식품 시장의 성장을 촉진할 것으로 예상됩니다.

기회

-

건강 및 웰빙 식품 및 음료 제품 출시 수 증가

건강에 대한 인식이 높아지고 건강하고 영양가 있는 제품에 대한 수요가 증가함에 따라 건강과 웰빙 시장이 전 세계적으로 빠르게 성장하고 있습니다.

출시 계획의 중요한 부분은 제품과 그 이점을 빠르게 검증하는 것입니다. 이는 순추천점수(NPS)를 사용하여 수행되며, 제품이나 기능의 첫 번째 버전을 테스트할 의도가 없는 사용자로부터 부정적인 피드백을 받으면 고객 만족 점수(CSAT)가 손상될 수 있습니다. 이런 방식으로 건강 및 웰빙 식품 제조업체는 지속적으로 새로운 출시 전략을 만들어 회사의 성장에 도움이 됩니다.

예를 들어,

-

PR News Wire에 따르면, 2021년 7월, 미국 브랜드 Health-Ade가 설탕 함량이 낮고 장 건강에 실제로 이로운 프리바이오틱 소다 "Pop"을 출시하여 장 건강에 좋은 음료 포트폴리오를 완성했습니다. 건강에 더 좋은 이 소다는 새로운 포장, 맛, 제형으로 출시되어 총 6가지 맛있는 옵션이 제공됩니다. 석류 베리, 레몬 라임, 생강 피즈, 딸기 바닐라, 애플 스냅, 쥬시 그레이프가 출시된 맛 중 일부입니다.

따라서 새로운 출시 전략은 시장을 주도하는 데 적용됩니다. 이는 제조업체에게 탁월한 기회인데, 이러한 출시는 제품의 내용과 품질을 설명하여 소비자가 더 건강한 제품을 구매할 수 있게 하기 때문입니다.

제약/도전

- 건강한 음식과 음료에 대한 사람들의 인식 부족과 회의적 태도

영양 식품 및 음료의 건강상의 이점과 영양가에 대한 인식이 제한적이거나 부족하면 제품에 대한 회의주의가 생깁니다. 소비자는 식품 및 음료의 오염과 변질 증가로 인해 영양 음료를 섭취하는 데 주저합니다. 따라서 궁극적으로 이는 부작용을 피하기 위해 식품이나 음료를 구매하기 전에 두 번 생각하는 소비자 사이에 회의주의를 불러일으킵니다. 이는 시장 성장에 있어 핵심적인 도전 요소입니다. 식품 및 음료의 영양 라벨에 대한 이해 부족은 소비자 사이에 혼란을 일으킵니다. 영양 라벨은 오해의 소지가 있을 수 있으며, 어떤 경우에는 거짓 주장이어서 소비자가 적절한 건강한 식품 및 음료를 선택하는 데 주저하게 만듭니다.

- 건강하고 영양이 풍부한 음식과 음료의 가격이 상승

원자재 가격 변동과 더 나은 품질의 영양소에 대한 가격 상승으로 인해 영양 식품 및 음료 비용이 증가했습니다. 또한 식품 세금이 인상되고 영양 식품 및 음료에 대한 수요가 증가하여 가격이 높아졌습니다.

이러한 제품의 높은 가격은 소비자의 구매 패턴을 바꿀 수 있는데, 여기에는 중간 당 음료, 영양 쉐이크, 스포츠 음료, 에너지 음료 등이 포함되며, 이는 가격에 민감한 소비자가 해당 제품을 구매하지 못하도록 제한합니다.

예를 들어,

- Altrajuice Apple의 평균 가격은 200ml당 $4.75입니다. 그러나 Coke/Pepsi의 평균 가격은 330ml당 US$2.50입니다.

따라서 건강하고 영양가 있는 음식과 음료의 가격이 높기 때문에 소비자들은 중산층과 하위 중산층을 위한 더 저렴한 대체 식품으로 전환할 수 있으며, 이는 글로벌 건강과 웰빙 식품 시장의 성장을 억제할 수 있습니다.

COVID-19 이후 아시아 태평양 건강 및 웰빙 식품 시장에 미치는 영향

팬데믹 이후, 이동에 제한이 없기 때문에 건강 및 식품 제품에 대한 수요가 증가했습니다. 따라서 제품 공급이 쉬울 것입니다. 또한, 코로나바이러스 발병 이후 건강한 식단의 증가 추세와 전 세계적으로 건강을 의식하는 사람들의 증가가 시장 성장을 견인할 것으로 예상됩니다.

강화되고 건강하며 단백질이 풍부하고 영양가 있는 식품과 음료에 대한 수요가 증가함에 따라 제조업체는 혁신적이고 새로운 건강한 간식 옵션을 출시할 수 있었고, 궁극적으로 건강과 웰빙 식품에 대한 수요가 증가하여 시장 성장에 도움이 되었습니다.

예를 들어,

- 2020년 12월, 듀폰은 '바람직한 질감'과 '깨끗한 맛'을 지닌 가공 보조제인 Virslik이라는 새로운 성분 라인을 개발했다고 발표했습니다. 이 성분은 새로운 맛과 질감을 지닌 요거트를 만드는 데 도움이 될 것입니다.

최근 개발 사항

- Food Business에 따르면 2020년 10월, KIND Healthy Snacks는 통곡물에서 지속적인 에너지를 제공하는 바인 KIND Energy bar를 출시하여 에너지 바 카테고리를 높였습니다. 이 바는 귀리로 만들어졌으며 설탕 함량이 35% 적습니다.

- Food Business에 따르면, 2022년 5월 Oreo는 미국에서 글루텐 없는 새로운 오레오 제품군을 출시하고, 중국에서는 Oreo Zero를, 브라질에서는 Lacta Intense를, 호주에서는 초콜릿 제품인 Caramilk를 출시할 예정입니다. 이러한 제품은 건강과 웰빙이 회사의 혁신의 초점이 되고 있기 때문에 건강을 의식하는 소비자를 위한 새로운 제형에서 비롯됩니다.

아시아 태평양 건강 및 웰빙 식품 시장 범위

아시아 태평양 건강 및 웰빙 식품 시장은 유형, 칼로리 함량, 특성, 지방 함량, 범주, 자유형 범주 및 유통 채널을 기준으로 7개의 주요 세그먼트로 구분됩니다.

이들 세그먼트의 성장은 업계의 주요 성장 세그먼트를 분석하고 사용자에게 귀중한 시장 개요와 시장 통찰력을 제공하여 핵심 시장 애플리케이션을 식별하기 위한 전략적 의사 결정을 내리는 데 도움이 됩니다.

유형

- 기능성 식품

- 건강한 간식

- 음료수

- 강화되고 건강한 베이커리 제품

- BFY푸드

- 초콜릿

- 기타

아시아 태평양 건강 및 웰빙 식품 시장은 유형을 기준으로 기능성 식품, 건강 간식, 음료, 강화 및 건강 베이커리 제품, BFY 식품, 초콜릿 및 기타로 구분됩니다.

칼로리 함량

- 낮은 칼로리

- 칼로리 감소

- 칼로리 없음

칼로리 함량을 기준으로 아시아 태평양 건강 및 웰빙 식품 시장은 저칼로리, 칼로리 감소, 무칼로리로 구분됩니다.

자연

- 비GMO

- 유전자 변형

아시아 태평양 건강 및 웰빙 식품 시장은 자연에 따라 비GMO와 GMO로 구분됩니다.

지방 함량

- 지방 없음

- 저지방

- 저지방

아시아 태평양 건강 및 웰빙 식품 시장은 지방 함량을 기준으로 무지방, 저지방, 감소지방으로 구분됩니다.

범주

- 전통적인

- 본질적인

아시아 태평양 건강 및 웰빙 식품 시장은 범주별로 기존 건강 및 웰빙 식품과 유기농 건강 및 웰빙 식품으로 구분됩니다.

카테고리에서 무료

- 글루텐 프리

- 유제품 불포함

- 대두 무첨가

- 견과류 없음

- 락토오스 무첨가

- 인공 향료 없음

- 인공색소 무첨가

- 기타

아시아 태평양 건강 및 웰빙 식품 시장은 무첨가 항목을 기준으로 글루텐 무첨가, 유제품 무첨가, 대두 무첨가, 견과류 무첨가, 락토오스 무첨가, 인공 향료 무첨가, 인공 색소 무첨가 등으로 구분됩니다.

유통 채널

- 매장형 소매업체

- 비매장 소매업체

아시아 태평양 건강 및 웰빙 식품 시장은 유통 채널을 기준으로 매장 기반 소매업체와 무매장 소매업체로 구분됩니다.

아시아 태평양 건강 및 웰빙 식품 시장 지역 분석/통찰력

아시아 태평양 건강 및 웰빙 식품 시장을 분석하였고, 위에 참조된 내용을 바탕으로 시장 규모에 대한 통찰력과 추세를 제공했습니다.

아시아 태평양 건강 및 웰빙 식품 시장 보고서에서 다루는 국가는 중국, 일본, 호주, 인도, 필리핀, 인도네시아, 싱가포르, 한국, 말레이시아, 태국 및 기타 아시아 태평양 지역입니다.

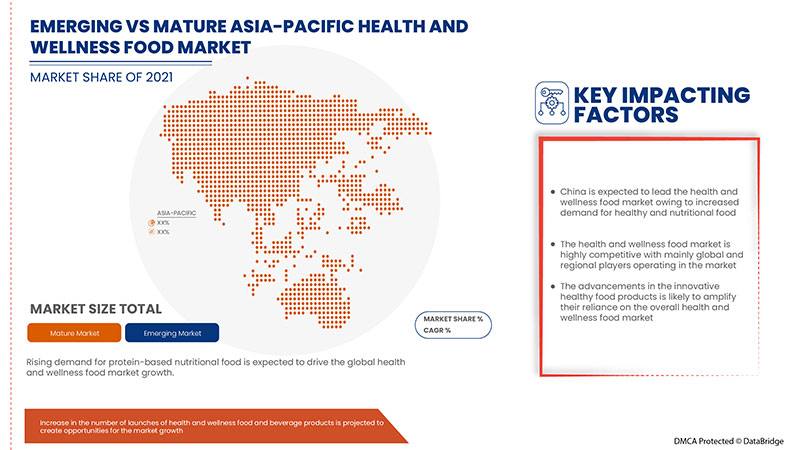

China dominates the Asia-Pacific health and wellness food marketing in terms of market share and revenue and will continue to flourish its dominance during the forecast period. This is due to the growing demand for healthy and nutrition-rich food. In addition, a rise in the number of health-conscious people in Asia-Pacific will add to the market's growth.

The country section of the report also provides individual market impacting factors and changes in regulations in the market that impact the current and future trends of the market. Data points, such as new and replacement sales, country demographics, disease epidemiology, and import-export tariffs, are some of the major pointers used to forecast the market scenario for individual countries. In addition, the presence and availability of Europe brands and their challenges faced due to high competition from local and domestic brands and the impact of sales channels are considered while providing a forecast analysis of the country data.

Competitive Landscape and Asia-Pacific Health and Wellness Food Market Share Analysis

Asia-Pacific health and wellness food market competitive landscape provides details about the competitors. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, Asia-Pacific presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width, and breadth, and application dominance. The above data points only relate to the companies' focus on the Asia-Pacific health and wellness food market.

The major players operating in the market are Alter Eco, Maspex, PepsiCo, General Mills Inc., Mars, Incorporated, Nestlé, Danone, Abbott, Huel Inc., GSK Group of Companies, Clif Bar & Company, Green Valley Dairies, Chobani, LLC., SO DELICIOUS DAIRY FREE, Enjoy Life, The Simply Good Foods Company, Mondelez International., Kellogg Co., The Quaker Oats Company and Yakult Honsha Co., Ltd.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The market data is analyzed and estimated using market statistical and coherent models. In addition, market share analysis and key trend analysis are the major success factors in the market report. The key research methodology used by the DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market, and primary (industry expert) validation. Apart from this, data models include Vendor Positioning grids, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Company Market Share Analysis, Standards of Measurement, Asia-Pacific Vs Regional, and Vendor Share Analysis. Please request an analyst call in case of further inquiry.

SKU-

세계 최초의 시장 정보 클라우드 보고서에 온라인으로 접속하세요

- 대화형 데이터 분석 대시보드

- 높은 성장 잠재력 기회를 위한 회사 분석 대시보드

- 사용자 정의 및 질의를 위한 리서치 분석가 액세스

- 대화형 대시보드를 통한 경쟁자 분석

- 최신 뉴스, 업데이트 및 추세 분석

- 포괄적인 경쟁자 추적을 위한 벤치마크 분석의 힘 활용

목차

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF ASIA PACIFIC HEALTH AND WELLNESS FOOD MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 TYPE LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 BRAND COMPARATIVE ANALYSIS

4.2 CONSUMER DISPOSABLE INCOME DYNAMICS

4.3 CONSUMER LEVEL TRENDS OF ASIA PACIFIC HEALTH AND WELLNESS FOOD MARKET

4.3.1 OVERVIEW

4.3.2 HIGH NUTRITIONAL VALUE

4.3.3 PLANT-BASED AND ORGANIC PRODUCTS

4.3.4 ON-THE-GO FOOD PRODUCTS

4.3.5 HEALTHY SNACKING

4.4 FACTORS INFLUENCING PURCHASE DECISION

4.4.1 GROWING CONSUMERS' INTEREST IN PLANT-BASED DIETS

4.4.2 DEMAND FOR FREE-FROM FOODS PRODUCTS

4.4.3 HEALTHY AND SUSTAINABLE FOOD AVAILABILITY

4.4.4 PRICING OF HEALTH AND WELLNESS FOOD

4.5 INDUSTRY TRENDS AND FUTURE PERSPECTIVE OF ASIA PACIFIC HEALTH AND WELLNESS FOOD MARKET

4.5.1 MANUFACTURERS LAUNCHING NATURAL INGREDIENT-BASED FOOD PRODUCTS

4.5.2 GROWING PRODUCTION OF A WIDE RANGE OF HEALTH AND WELLNESS FOOD BY MANUFACTURERS

4.5.3 MANUFACTURERS FOCUSING ON THE DEVELOPMENT OF NUTRACEUTICAL FOOD PRODUCTS

4.6 LIST OF KEY SOURCES OF MARKET INSIGHTS

4.7 MEETING CONSUMER REQUIREMENTS

4.8 NEW PRODUCT LAUNCH STRATEGY

4.8.1 NUMBER OF PRODUCT LAUNCHES

4.8.1.1 LINE EXTENSION

4.8.1.2 NEW PACKAGING

4.8.1.3 RELAUNCHED

4.8.1.4 NEW FORMULATION

4.9 PRIVATE LABEL VS BRAND LABEL

4.1 PROMOTIONAL ACTIVITIES

4.11 REGULATIONS, CERTIFICATION, AND LABELLING CLAIMS

4.11.1 REGULATIONS

4.11.2 LABELING AND CLAIM

4.11.3 CERTIFICATIONS

4.11.3.1 BRC FOOD SAFETY CERTIFICATION

4.11.3.2 AGMARK CERTIFICATION

4.11.3.3 PLANT AND PLANT PRODUCTS

4.12 SHOPPING BEHAVIOR AND DYNAMICS

4.12.1 RECOMMENDATIONS FROM FAMILY AND FRIENDS-

4.12.2 RESEARCH

4.12.3 IMPULSIVE

4.12.4 ADVERTISEMENT:

4.12.4.1 TELEVISION ADVERTISEMENT

4.12.4.2 ONLINE ADVERTISEMENT

4.12.4.3 IN-STORE ADVERTISEMENT

4.12.4.4 OUTDOOR ADVERTISEMENT

4.12.5 CONCLUSION

4.13 SUPPLY CHAIN ANALYSIS

4.13.1 RAW MATERIAL PROCUREMENT

4.13.2 MANUFACTURING PROCESS

4.13.3 MARKETING AND DISTRIBUTION

4.13.4 END USERS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 RISING DEMAND FOR PROTEIN-BASED NUTRITIONAL AND HEALTHY FOOD & BEVERAGES

5.1.2 INCREASING DISPOSABLE INCOME AND GROWING EXPENDITURE ON HEALTHY FOOD PRODUCTS

5.1.3 INCREASING DEMAND FOR VEGAN/PLANT-BASED HEALTHY FOOD

5.1.4 GROWING DEMAND FOR CLEAN LABEL FOOD

5.2 RESTRAINTS

5.2.1 INCREASING REGULATION ON FORTIFIED FOOD & BEVERAGES

5.2.2 HIGHER PRICES OF HEALTHY NUTRITIONAL FOOD & BEVERAGES

5.3 OPPORTUNITIES

5.3.1 INCREASE IN NUMBER OF LAUNCHES OF HEALTH AND WELLNESS FOOD & BEVERAGE PRODUCTS

5.3.2 CHANGE IN EATING HABITS AND LIFESTYLE OF MILLENNIALS

5.3.3 GROWING DEMAND FOR NON-ALCOHOLIC DRINKS THAT PROVIDE HEALTH BENEFITS

5.4 CHALLENGES

5.4.1 DISRUPTED SUPPLY CHAIN DUE TO COVID-19

5.4.2 LACK OF AWARENESS AMONG PEOPLE AND SKEPTICISM TOWARDS HEALTHY FOOD & BEVERAGES

6 POST-COVID IMPACT ON THE ASIA PACIFIC HEALTH AND WELLNESS FOOD MARKET

6.1 AFTERMATH OF COVID-19

6.2 IMPACT ON DEMAND AND SUPPLY CHAIN

6.3 IMPACT ON PRICE

6.4 CONCLUSION

7 ASIA PACIFIC HEALTH AND WELLNESS FOOD MARKET, BY TYPE

7.1 OVERVIEW

7.2 FUNCTIONAL FOOD

7.2.1 FUNCTIONAL FOOD, BY TYPE

7.2.1.1 BREAKFAST CEREAL PRODUCTS

7.2.1.1.1 BREAKFAST CEREAL FLAKES

7.2.1.1.2 BREAKFAST OATMEAL

7.2.1.1.3 BREAKFAST CEREAL PORRIDGE

7.2.1.1.4 BREAKFAST COOKIES

7.2.1.1.5 OTHERS

7.2.1.2 YOGURTS

7.2.1.2.1 YOGURT, BY TYPE

7.2.1.2.1.1 REGULAR YOGURTS

7.2.1.2.1.2 CONCENTRATED YOGURT

7.2.1.2.1.3 PROBIOTIC YOGURT

7.2.1.2.1.4 SET YOGURT

7.2.1.2.1.5 BIO LIVE YOGURT

7.2.1.2.1.6 STIRRED YOGURT

7.2.1.2.1.7 OTHERS

7.2.1.2.2 YOGURT, BY CATEGORY

7.2.1.2.2.1 FROZEN YOGURT

7.2.1.2.2.2 DRINKABLE YOGURT

7.2.1.2.2.3 SPOONABLE YOGURT

7.2.1.2.2.4 OTHERS

7.2.1.2.3 YOGURT, BY FLAVOR

7.2.1.2.3.1 PLAIN

7.2.1.2.3.2 FLAVORED

7.2.1.2.3.2.1 STRAWBERRY

7.2.1.2.3.2.2 VANILLA

7.2.1.2.3.2.3 BLUEBERRY

7.2.1.2.3.2.4 PEACH

7.2.1.2.3.2.5 BANANA

7.2.1.2.3.2.6 BLACKBERRY

7.2.1.2.3.2.7 CHERRY

7.2.1.2.3.2.8 BUTTERSCOTCH

7.2.1.2.3.2.9 CARAMEL

7.2.1.2.3.2.10 POMEGRANATE

7.2.1.2.3.2.11 CHOCOLATES

7.2.1.2.3.2.12 NUTS

7.2.1.2.3.2.13 COCONUT

7.2.1.2.3.2.14 ORCHARD CHERRY

7.2.1.2.3.2.15 COTTON CANDY

7.2.1.2.3.2.16 HONEY

7.2.1.2.3.2.17 MOCHA

7.2.1.2.3.2.18 AMARETTO

7.2.1.2.3.2.19 PUMPKIN

7.2.1.2.3.2.20 PEPPERMINT

7.2.1.2.3.2.21 OTHERS

7.2.1.3 NUTRITION BARS

7.2.1.3.1 NUTRITION BARS, BY TYPE

7.2.1.3.1.1 CEREALS BARS

7.2.1.3.1.1.1 GRANOLA BARS

7.2.1.3.1.1.2 OAT BARS

7.2.1.3.1.1.3 RICE BARS

7.2.1.3.1.1.4 MIXED CEREAL BARS

7.2.1.3.1.1.5 OTHERS

7.2.1.3.1.2 ENERGY BARS

7.2.1.3.1.2.1 PLANT-BASED PROTEIN BARS

7.2.1.3.1.2.2 ANIMAL-BASED PROTEIN BARS

7.2.1.3.1.2.2.1 WHEY PROTEIN BARS

7.2.1.3.1.2.2.2 CASEIN PROTEIN BARS

7.2.1.3.1.2.2.2.1 FIBER BARS

7.2.1.3.1.2.2.2.2 PROBIOTIC BARS

7.2.1.3.1.2.2.2.3 OMEGA-3 BARS

7.2.1.3.1.2.2.2.4 AMINO ACID BARS

7.2.1.3.1.2.2.2.5 OTHERS

7.2.1.3.1.3 FRUIT BARS

7.2.1.3.1.3.1 BANANA

7.2.1.3.1.3.2 APPLES

7.2.1.3.1.3.3 ORANGES

7.2.1.3.1.3.4 BERRIES

7.2.1.3.1.3.5 CHERRY

7.2.1.3.1.3.6 AVOCADO

7.2.1.3.1.3.7 OTHERS

7.2.1.3.1.4 NUT BARS

7.2.1.3.1.4.1 ALMOND

7.2.1.3.1.4.2 PEANUT

7.2.1.3.1.4.3 HAZELNUTS

7.2.1.3.1.4.4 CASHEW

7.2.1.3.1.4.5 DATES

7.2.1.3.1.4.6 OTHERS

7.2.1.3.1.5 OTHERS

7.2.1.3.2 NUTRITION BARS, BY CATEGORY

7.2.1.3.3 REGULAR

7.2.1.3.4 PRE WORK OUT BARS

7.2.1.3.5 MEAL REPLACEMENT BAR

7.2.1.3.6 POST WORK OUT BARS

7.2.1.3.7 YOGA BARS

7.2.1.3.8 OTHERS

7.2.2 FUNCTIONAL FOODS, BY CATEGORY

7.2.2.1 CONVENTIONAL

7.2.2.2 ORGANIC

7.2.3 FUNCTIONAL FOODS, BY CALORIE CONTENT

7.2.3.1 LOW CALORIES

7.2.3.2 REDUCED CALORIE

7.2.3.3 NO CALORIES

7.3 HEALTHY SNACKS

7.3.1 HEALTHY SNACKS, BY PRODUCT TYPE

7.3.1.1 VEGGIE SNACKS

7.3.1.2 MULTIGRAIN WAFERS, CRACKERS & CHIPS

7.3.1.3 TRAIL MIXES

7.3.1.4 DRY BERRIES SNACKS

7.3.1.5 OTHERS

7.3.2 HEALTHY SNACKS, BY CATEGORY

7.3.2.1 CONVENTIONAL

7.3.2.2 ORGANIC

7.3.3 HEALTHY SNACKS, BY CALORIE CONTENT

7.3.3.1 LOW CALORIES

7.3.3.2 REDUCED CALORIE

7.3.3.3 NO CALORIES

7.4 BEVERAGES

7.4.1 BEVERAGES, BY TYPE

7.4.1.1 FORTIFIED COFFEE

7.4.1.2 BFY BEVERAGES

7.4.1.2.1 HEALTHY SMOOTHIES

7.4.1.2.2 DIET SODA

7.4.1.2.3 PLANT-BASED MILK

7.4.1.2.3.1 PLANT-BASED MILK, BY TYPE

7.4.1.2.3.1.1 ALMOND MILK

7.4.1.2.3.1.2 SOY MILK

7.4.1.2.3.1.3 COCONUT MILK

7.4.1.2.3.1.4 OAT MILK

7.4.1.2.3.1.5 CASHEW MILK

7.4.1.2.3.1.6 OTHERS

7.4.1.2.4 PLANT-BASED MILK, BY FORMULATION

7.4.1.2.4.1.1 SWEETENED

7.4.1.2.4.1.2 UNSWEETENED

7.4.1.2.5 FLAVORED WATER

7.4.1.3 ENERGY DRINKS

7.4.1.4 KOMBUCHA DRINKS

7.4.1.5 HERBAL TEA

7.4.1.5.1 MIXED HERB

7.4.1.5.2 YERBA MATE

7.4.1.5.3 OOLONG

7.4.1.5.4 CHAMOMILE

7.4.1.5.5 MATCHA

7.4.1.5.6 MINT

7.4.1.5.7 ROSEMARY

7.4.1.5.8 PEPPERMINT

7.4.1.5.9 CONVENTIONAL TEA LEAVES

7.4.1.5.10 SINGLE HERB

7.4.1.5.11 CINNAMON

7.4.1.5.12 THYME

7.4.1.5.13 ROSE HIP

7.4.1.5.14 ECHINACEA

7.4.1.5.15 BUBBLE

7.4.1.5.16 OTHERS

7.4.1.6 FRUIT TEA

7.4.1.6.1 SINGLE FRUIT TEA

7.4.1.6.2 PEACH

7.4.1.6.3 ORANGE

7.4.1.6.4 POMEGRANATE

7.4.1.6.5 MANGO

7.4.1.6.6 STRAWBERRY

7.4.1.6.7 APPLE TEA

7.4.1.6.8 PINEAPPLE

7.4.1.6.9 KIWI

7.4.1.6.10 RASPBERRY

7.4.1.6.11 CRANBERRY

7.4.1.6.12 BLUEBERRY

7.4.1.6.13 GOJI BERRY

7.4.1.6.14 PASSION FRUIT

7.4.1.6.15 OTHERS

7.4.1.6.16 MIX FRUIT TEA

7.4.2 BEVERAGES, BY CATEGORY

7.4.2.1 CONVENTIONAL

7.4.2.2 ORGANIC

7.4.3 BEVERAGES, BY CALORIE CONTENT

7.4.3.1 LOW CALORIES

7.4.3.2 REDUCED CALORIES

7.4.3.3 NO CALORIES

7.5 FORTIFIED & HEALTHY BAKERY PRODUCTS

7.5.1 FORTIFIED & HEALTHY BAKERY PRODUCTS, BY TYPE

7.5.1.1 BREAD & ROLLS

7.5.1.2 BISCUIT & COOKIES

7.5.1.3 PANCAKES & OTHER BAKERY MIXES

7.5.1.4 CAKES & PASTRIES

7.5.1.5 TORTILLA

7.5.1.6 CUPCAKES & MUFFINS

7.5.2 FORTIFIED & HEALTHY BAKERY PRODUCTS, BY CATEGORY

7.5.2.1 CONVENTIONAL

7.5.2.2 ORGANIC

7.5.3 FORTIFIED & HEALTHY BAKERY PRODUCTS, BY CALORIE CONTENT

7.5.3.1 LOW CALORIES

7.5.3.2 REDUCED CALORIE

7.5.3.3 NO CALORIES

7.6 BFY FOODS

7.6.1 BFY FOODS, BY TYPE

7.6.1.1 HEALTHY PIZZA & PASTA

7.6.1.2 HEALTHY CRISPS

7.6.1.3 HEALTHY CRISPS, BY TYPE

7.6.1.3.1 PROTEIN CRISPS

7.6.1.3.2 VEGGIES CRISPS

7.6.1.3.3 GREEN BEANS CRISPS

7.6.1.3.4 MIX VEGGIE CRISPS

7.6.1.3.5 BEETS CRISPS

7.6.1.3.6 CAULIFLOWER CRISPS

7.6.1.3.7 OTHERS

7.6.1.3.8 HEALTHY CRISPS, BY FLAVOR

7.6.1.3.9 BARBECUE

7.6.1.3.10 CHEESE

7.6.1.3.11 SEA SALT

7.6.1.3.12 SWEET CHILLI

7.6.1.3.13 BUFFALO WING

7.6.1.3.14 SWEET & SALT

7.6.1.3.15 OTHERS

7.6.1.4 SOUPS

7.6.1.5 SPREADS

7.6.1.6 SAUCES, MAYONNAISE & DRESSINGS

7.6.1.7 OTHERS

7.6.2 BFY FOODS, BY CATEGORY

7.6.2.1 CONVENTIONAL

7.6.2.2 ORGANIC

7.6.3 BFY FOODS, BY CALORIE CONTENT

7.6.3.1 LOW CALORIES

7.6.3.2 REDUCED CALORIES

7.6.3.3 NO CALORIES

7.7 CHOCOLATE

7.7.1 CHOCOLATES, BY TYPE

7.7.1.1 DARK CHOCOLATE BARS

7.7.1.2 NUT INFUSED CHOCOLATES

7.7.1.3 FRUIT & NUT INFUSED CHOCOLATE BRITTLES

7.7.1.4 FORTIFIED CHOCOLATE BARS

7.7.1.5 OTHERS

7.7.2 CHOCOLATES, BY FORMULATION

7.7.2.1 SWEET

7.7.2.2 SEMI-SWEET

7.7.2.3 SUGAR FREE

7.7.3 CHOCOLATES, BY CATEGORY

7.7.3.1 CONVENTIONAL

7.7.3.2 ORGANIC

7.7.4 CHOCOLATES, BY CALORIE CONTENT

7.7.4.1 LOW CALORIES

7.7.4.2 REDUCED CALORIE

7.7.4.3 NO CALORIES

7.8 OTHERS

8 ASIA PACIFIC HEALTH AND WELLNESS FOOD MARKET, BY CALORIE CONTENT

8.1 OVERVIEW

8.2 LOW CALORIES

8.3 REDUCED CALORIES

8.4 NO CALORIES

9 ASIA PACIFIC HEALTH AND WELLNESS FOOD MARKET, BY NATURE

9.1 OVERVIEW

9.2 NON-GMO

9.3 GMO

10 ASIA PACIFIC HEALTH AND WELLNESS FOOD MARKET, BY FAT CONTENT

10.1 OVERVIEW

10.2 NO FAT

10.3 LOW FAT

10.4 REDUCED FAT

11 ASIA PACIFIC HEALTH AND WELLNESS FOOD MARKET, BY CATEGORY

11.1 OVERVIEW

11.2 ORGANIC

11.3 CONVENTIONAL

12 ASIA PACIFIC HEALTH AND WELLNESS FOOD MARKET, BY FREE FROM CATEGORY

12.1 OVERVIEW

12.2 GLUTEN FREE

12.3 DAIRY FREE

12.4 SOY FREE

12.5 NUT FREE

12.6 LACTOSE FREE

12.7 ARTIFICIAL FLAVOR FREE

12.8 ARTIFICIAL COLOR FREE

12.9 OTHERS

13 ASIA PACIFIC HEALTH AND WELLNESS FOOD MARKET, BY DISTRIBUTION CHANNEL

13.1 OVERVIEW

13.2 STORE BASED RETAILERS

13.2.1 SUPERMARKET/HYPERMARKET

13.2.2 CONVENIENCE STORES

13.2.3 SPECIALTY STORES

13.2.4 GROCERY STORES

13.2.5 OTHERS

13.3 NON-STORE RETAILERS

13.3.1 COMPANY WEBSITES

13.3.2 ONLINE

14 ASIA PACIFIC HEALTH AND WELLNESS FOOD MARKET, BY REGION

14.1 ASIA-PACIFIC

14.1.1 CHINA

14.1.2 JAPAN

14.1.3 AUSTRALIA

14.1.4 INDIA

14.1.5 PHILIPPINES

14.1.6 INDONESIA

14.1.7 SINGAPORE

14.1.8 SOUTH KOREA

14.1.9 MALAYSIA

14.1.10 THAILAND

14.1.11 REST OF ASIA-PACIFIC

15 ASIA PACIFIC HEALTH AND WELLNESS FOOD MARKET: COMPANY LANDSCAPE

15.1 COMPANY SHARE ANALYSIS: ASIA PACIFIC

16 SWOT ANALYSIS

17 COMPANY PROFILE

17.1 PEPSICO

17.1.1 COMPANY SNAPSHOT

17.1.2 REVENUE ANALYSIS

17.1.3 COMPANY SHARE ANALYSIS

17.1.4 PRODUCT PORTFOLIO

17.1.5 RECENT DEVELOPMENTS

17.2 DANONE

17.2.1 COMPANY SNAPSHOT

17.2.2 REVENUE ANALYSIS

17.2.3 COMPANY SHARE ANALYSIS

17.2.4 PRODUCT PORTFOLIO

17.2.5 RECENT DEVELOPMENT

17.3 NESTLÉ

17.3.1 COMPANY SNAPSHOT

17.3.2 REVENUE ANALYSIS

17.3.3 COMPANY SHARE ANALYSIS

17.3.4 PRODUCT PORTFOLIO

17.3.5 RECENT DEVELOPMENT

17.4 ABBOTT

17.4.1 COMPANY SNAPSHOT

17.4.2 REVENUE ANALYSIS

17.4.3 COMPANY SHARE ANALYSIS

17.4.4 PRODUCT PORTFOLIO

17.4.5 RECENT DEVELOPMENTS

17.5 GENERAL MILLS INC.

17.5.1 COMPANY SNAPSHOT

17.5.2 REVENUE ANALYSIS

17.5.3 COMPANY SHARE ANALYSIS

17.5.4 PRODUCT PORTFOLIO

17.5.5 RECENT DEVELOPMENT

17.6 YAKULT HONSHA CO., LTD.

17.6.1 COMPANY SNAPSHOT

17.6.2 REVENUE ANALYSIS

17.6.3 PRODUCT PORTFOLIO

17.6.4 RECENT DEVELOPMENTS

17.7 GSK GROUP OF COMPANIES

17.7.1 COMPANY SNAPSHOT

17.7.2 REVENUE ANALYSIS

17.7.3 PRODUCT PORTFOLIO

17.7.4 RECENT DEVELOPMENT

17.8 SIMPLY GOOD FOODS USA, INC.

17.8.1 COMPANY SNAPSHOT

17.8.2 PRODUCT PORTFOLIO

17.8.3 RECENT DEVELOPMENTS

17.9 ALTER ECO

17.9.1 COMPANY SNAPSHOT

17.9.2 PRODUCT PORTFOLIO

17.9.3 RECENT DEVELOPMENTS

17.1 BARREL. SITE BY BARREL

17.10.1 COMPANY SNAPSHOT

17.10.2 PRODUCT PORTFOLIO

17.10.3 RECENT DEVELOPMENT

17.11 CHOBANI, LLC.

17.11.1 COMPANY SNAPSHOT

17.11.2 PRODUCT PORTFOLIO

17.11.3 RECENT DEVELOPMENT

17.12 CLIF BAR & COMPANY

17.12.1 COMPANY SNAPSHOT

17.12.2 PRODUCT PORTFOLIO

17.12.3 RECENT DEVELOPMENTS

17.13 ENJOY LIFE

17.13.1 COMPANY SNAPSHOT

17.13.2 PRODUCT PORTFOLIO

17.13.3 RECENT DEVELOPMENTS

17.14 FORAGER PROJECT

17.14.1 COMPANY SNAPSHOT

17.14.2 PRODUCT PORTFOLIO

17.14.3 RECENT DEVELOPMENTS

17.15 GREEN VALLEY DAIRIE

17.15.1 COMPANY SNAPSHOT

17.15.2 PRODUCT PORTFOLIO

17.15.3 RECENT DEVELOPMENTS

17.16 HUEL INC.

17.16.1 COMPANY SNAPSHOT

17.16.2 PRODUCT PORTFOLIO

17.16.3 RECENT DEVELOPMENT

17.17 KASHI

17.17.1 COMPANY SNAPSHOT

17.17.2 PRODUCT PORTFOLIO

17.17.3 RECENT DEVELOPMENTS

17.18 KELLOGG CO.

17.18.1 COMPANY SNAPSHOT

17.18.2 REVENUE ANALYSIS

17.18.3 PRODUCT PORTFOLIO

17.18.4 RECENT DEVELOPMENT

17.19 KITE HILL

17.19.1 COMPANY SNAPSHOT

17.19.2 PRODUCT PORTFOLIO

17.19.3 RECENT DEVELOPMENTS

17.2 LAKE CHAMPLAIN CHOCOLATES

17.20.1 COMPANY SNAPSHOT

17.20.2 PRODUCT PORTFOLIO

17.20.3 RECENT DEVELOPMENTS

17.21 LAVVA

17.21.1 COMPANY SNAPSHOT

17.21.2 PRODUCT PORTFOLIO

17.21.3 RECENT DEVELOPMENTS

17.22 LIBERTE

17.22.1 COMPANY SNAPSHOT

17.22.2 PRODUCT PORTFOLIO

17.22.3 RECENT DEVELOPMENTS

17.23 MARS, INCORPORATED

17.23.1 COMPANY SNAPSHOT

17.23.2 PRODUCT PORTFOLIO

17.23.3 RECENT DEVELOPMENT

17.24 MASPEX GROUP

17.24.1 COMPANY SNAPSHOT

17.24.2 PRODUCT PORTFOLIO

17.24.3 RECENT DEVELOPMENTS

17.25 MONDELĒZ INTERNATIONAL.

17.25.1 COMPANY SNAPSHOT

17.25.2 REVENUE ANALYSIS

17.25.3 PRODUCT PORTFOLIO

17.25.4 RECENT DEVELOPMENT

17.26 SO DELICIOUS DAIRY FREE

17.26.1 COMPANY SNAPSHOT

17.26.2 PRODUCT PORTFOLIO

17.26.3 RECENT DEVELOPMENTS

17.27 STONYFIELD FARM, INC.

17.27.1 COMPANY SNAPSHOT

17.27.2 PRODUCT PORTFOLIO

17.27.3 RECENT DEVELOPMENTS

17.28 THE QUAKER OATS COMPANY

17.28.1 COMPANY SNAPSHOT

17.28.2 PRODUCT PORTFOLIO

17.28.3 RECENT DEVELOPMENTS

17.29 THE SIMPLY GOOD FOODS COMPANY

17.29.1 COMPANY SNAPSHOT

17.29.2 REVENUE ANALYSIS

17.29.3 PRODUCT PORTFOLIO

17.29.4 RECENT DEVELOPMENTS

17.3 YOPLAIT USA, INC.

17.30.1 COMPANY SNAPSHOT

17.30.2 PRODUCT PORTFOLIO

17.30.3 RECENT DEVELOPMENTS

18 QUESTIONNAIRE:

19 RELATED REPORTS

그림 목록

FIGURE 1 ASIA PACIFIC HEALTH AND WELLNESS FOOD MARKET: SEGMENTATION

FIGURE 2 ASIA PACIFIC HEALTH AND WELLNESS FOOD MARKET: DATA TRIANGULATION

FIGURE 3 ASIA PACIFIC HEALTH AND WELLNESS FOOD MARKET: DROC ANALYSIS

FIGURE 4 ASIA PACIFIC HEALTH AND WELLNESS FOOD MARKET: ASIA PACIFIC VS REGIONAL MARKET ANALYSIS

FIGURE 5 ASIA PACIFIC HEALTH AND WELLNESS FOOD MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 ASIA PACIFIC HEALTH AND WELLNESS FOOD MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 ASIA PACIFIC HEALTH AND WELLNESS FOOD MARKET: DBMR MARKET POSITION GRID

FIGURE 8 ASIA PACIFIC HEALTH AND WELLNESS FOOD MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 ASIA PACIFIC HEALTH AND WELLNESS FOOD MARKET: SEGMENTATION

FIGURE 10 NORTH AMERICA IS EXPECTED TO DOMINATE THE ASIA PACIFIC HEALTH AND WELLNESS FOOD MARKET AND GROW WITH THE HIGHEST CAGR IN THE FORECAST PERIOD

FIGURE 11 RISING DEMAND FOR PROTEIN-BASED NUTRITIONAL AND HEALTHY FOOD & BEVERAGES IS EXPECTED TO DRIVE THE ASIA PACIFIC HEALTH AND WELLNESS FOOD MARKET IN THE FORECAST PERIOD 2022 TO 2029

FIGURE 12 TYPE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE ASIA PACIFIC HEALTH AND WELLNESS FOOD MARKET IN 2022 & 2029

FIGURE 13 SUPPLY CHAIN ANALYSIS

FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE ASIA PACIFIC HEALTH AND WELLNESS FOOD MARKET

FIGURE 15 ASIA PACIFIC HEALTH AND WELLNESS FOOD MARKET: BY TYPE, 2021

FIGURE 16 ASIA PACIFIC HEALTH AND WELLNESS FOOD MARKET: BY CALORIE CONTENT, 2021

FIGURE 17 ASIA PACIFIC HEALTH AND WELLNESS FOOD MARKET: BY NATURE, 2021

FIGURE 18 ASIA PACIFIC GMO CROP REVENUE (2018)

FIGURE 19 ASIA PACIFIC HEALTH AND WELLNESS FOOD MARKET: BY FAT CONTENT, 2021

FIGURE 20 ASIA PACIFIC HEALTH AND WELLNESS FOOD MARKET: BY CATEGORY, 2021

FIGURE 21 ASIA PACIFIC HEALTH AND WELLNESS FOOD MARKET: BY FREE FROM CATEGORY, 2021

FIGURE 22 ASIA PACIFIC HEALTH AND WELLNESS FOOD MARKET: BY DISTRIBUTION CHANNEL, 2021

FIGURE 23 ASIA-PACIFIC HEALTH AND WELLNESS FOOD MARKET: SNAPSHOT (2021)

FIGURE 24 ASIA-PACIFIC HEALTH AND WELLNESS FOOD MARKET: BY COUNTRY (2021)

FIGURE 25 ASIA-PACIFIC HEALTH AND WELLNESS FOOD MARKET: BY COUNTRY (2022 & 2029)

FIGURE 26 ASIA-PACIFIC HEALTH AND WELLNESS FOOD MARKET: BY COUNTRY (2021 & 2029)

FIGURE 27 ASIA-PACIFIC HEALTH AND WELLNESS FOOD MARKET: BY TYPE (2022 & 2029)

FIGURE 28 ASIA PACIFIC HEALTH AND WELLNESS FOOD MARKET: COMPANY SHARE 2021 (%)

연구 방법론

데이터 수집 및 기준 연도 분석은 대규모 샘플 크기의 데이터 수집 모듈을 사용하여 수행됩니다. 이 단계에는 다양한 소스와 전략을 통해 시장 정보 또는 관련 데이터를 얻는 것이 포함됩니다. 여기에는 과거에 수집한 모든 데이터를 미리 검토하고 계획하는 것이 포함됩니다. 또한 다양한 정보 소스에서 발견되는 정보 불일치를 검토하는 것도 포함됩니다. 시장 데이터는 시장 통계 및 일관된 모델을 사용하여 분석하고 추정합니다. 또한 시장 점유율 분석 및 주요 추세 분석은 시장 보고서의 주요 성공 요인입니다. 자세한 내용은 분석가에게 전화를 요청하거나 문의 사항을 드롭하세요.

DBMR 연구팀에서 사용하는 주요 연구 방법론은 데이터 마이닝, 시장에 대한 데이터 변수의 영향 분석 및 주요(산업 전문가) 검증을 포함하는 데이터 삼각 측량입니다. 데이터 모델에는 공급업체 포지셔닝 그리드, 시장 타임라인 분석, 시장 개요 및 가이드, 회사 포지셔닝 그리드, 특허 분석, 가격 분석, 회사 시장 점유율 분석, 측정 기준, 글로벌 대 지역 및 공급업체 점유율 분석이 포함됩니다. 연구 방법론에 대해 자세히 알아보려면 문의를 통해 업계 전문가에게 문의하세요.

사용자 정의 가능

Data Bridge Market Research는 고급 형성 연구 분야의 선두 주자입니다. 저희는 기존 및 신규 고객에게 목표에 맞는 데이터와 분석을 제공하는 데 자부심을 느낍니다. 보고서는 추가 국가에 대한 시장 이해(국가 목록 요청), 임상 시험 결과 데이터, 문헌 검토, 재생 시장 및 제품 기반 분석을 포함하도록 사용자 정의할 수 있습니다. 기술 기반 분석에서 시장 포트폴리오 전략에 이르기까지 타겟 경쟁업체의 시장 분석을 분석할 수 있습니다. 귀하가 원하는 형식과 데이터 스타일로 필요한 만큼 많은 경쟁자를 추가할 수 있습니다. 저희 분석가 팀은 또한 원시 엑셀 파일 피벗 테이블(팩트북)로 데이터를 제공하거나 보고서에서 사용 가능한 데이터 세트에서 프레젠테이션을 만드는 데 도움을 줄 수 있습니다.