아시아 태평양 유리 제품 시장, 소재(소다석회유리, 납유리, 내열유리 및 기타), 스타일(스템리스 유리, 스템웨어, 일상 사용 및 기타), 유통 채널(B2B, 전문 매장, 슈퍼마켓/하이퍼마켓, 전자 상거래 및 기타), 가격대(중간, 프리미엄 및 이코노미), 최종 용도(호텔 및 레스토랑, 바 및 카페, 가정, 회사 식당 및 기타)별 산업 동향 및 2029년까지의 전망.

시장 분석 및 규모

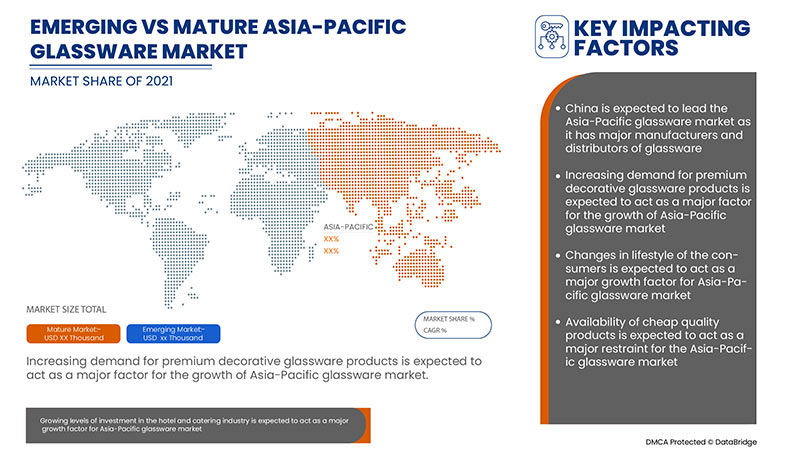

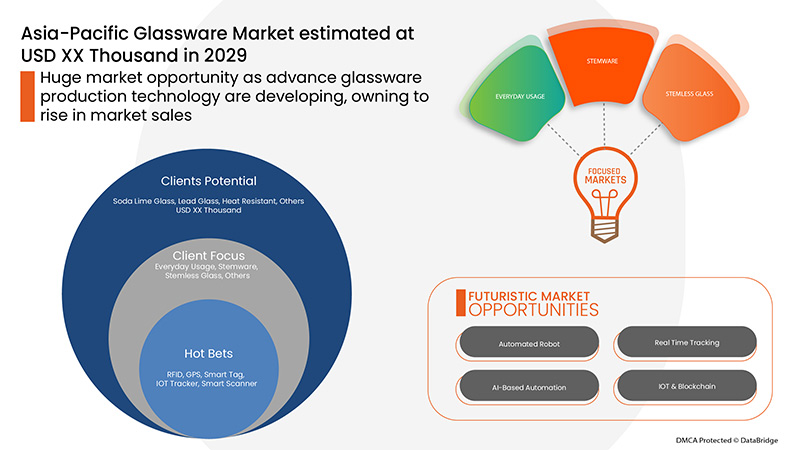

호텔 및 케이터링 산업에 대한 투자 수준이 증가함에 따라 예측 기간 동안 유리 제품 시장이 성장할 것으로 예상됩니다. 소비자의 라이프스타일 변화는 2022-2029년 예측 기간 동안 유리 제품 시장이 성장할 것으로 예상됩니다. 유리 제품 생산 기술의 발전은 앞으로 유리 제품 시장에 성장 기회를 가져올 것으로 예상됩니다.

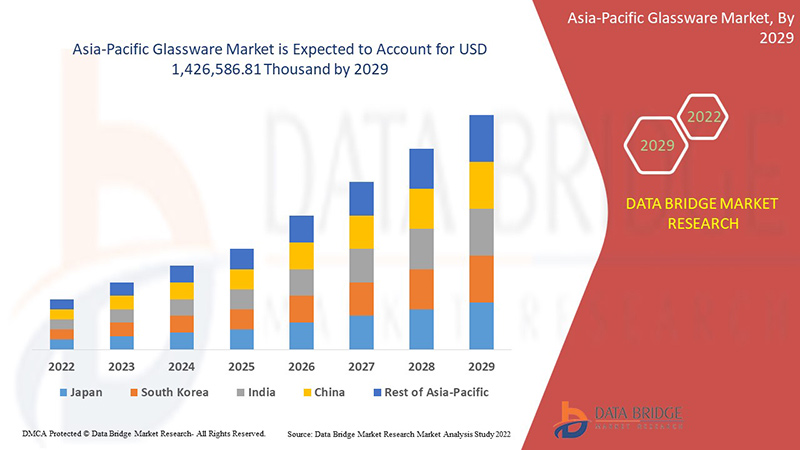

Data Bridge Market Research는 유리 제품 시장이 2029년까지 1,426,586.81천 달러에 도달할 것으로 예상하며, 예측 기간 동안 CAGR은 5.6%입니다. "소다석회"는 이 유형의 유리가 긁힘 방지 표면을 제공하기 때문에 가장 눈에 띄는 소재 세그먼트를 차지합니다. 유리 제품 시장 보고서는 또한 가격 분석, 특허 분석 및 심층적인 기술 발전을 다룹니다.

|

보고서 메트릭 |

세부 |

|

예측 기간 |

2022년부터 2029년까지 |

|

기준 연도 |

2021 |

|

역사적 연도 |

2020 |

|

양적 단위 |

매출은 천 달러, 볼륨은 단위, 가격은 달러로 표시 |

|

다루는 세그먼트 |

재료별(소다석회유리, 납유리, 내열유리, 기타), 스타일별(스템리스 유리, 스템웨어, 일상용, 기타), 유통채널별(B2B, 전문점, 슈퍼마켓/하이퍼마켓, 전자상거래, 기타), 가격대별(중간, 프리미엄, 이코노미), 최종 용도별(호텔 및 레스토랑, 바 및 카페, 가정, 회사 식당, 기타) |

|

적용 국가 |

중국, 일본, 인도, 한국, 싱가포르, 말레이시아, 호주 및 뉴질랜드, 태국, 인도네시아, 필리핀, 홍콩, 대만, 미얀마, 라오스, 캄보디아, 아시아 태평양(APAC)의 나머지(APAC) |

|

시장 참여자 포함 |

Hrastnik1860, Oneida, NoritakeChina, Ocean Glass Public Company Limited, Lenox Corporation, Treo.in, Libbey Inc, Fiskars Group, WMF(Groupe SEB의 자회사), Lifetime Brands, Inc, Villeroy & Boch, Bormioli Rocco SpA, Wonderchef Home Appliances Pvt. Ltd., The Zrike Company, Inc, Shandong Hikingpac Co., Ltd., Addresshome, Stölzle Lausitz GmbH, Eagle Glass Deco (P.) Ltd., Degrenne, Cello World, MYBOROSIL, Jiangsu Rongtai Glass Products Co., Ltd., Cumbria Crystal, Garbo Glassware 등 |

시장 정의

유리는 일반적으로 투명하거나 반투명한 취성적이고 단단한 재료입니다. 모래, 소다, 석회 또는 기타 미네랄의 혼합물로 만들어질 수 있습니다. 가장 일반적인 유리 형성 방법은 원료를 녹은 액체가 될 때까지 가열한 다음 혼합물을 빠르게 냉각하여 강화 유리를 만드는 것입니다. 유리 종류는 기계적 및 열적 품질에 따라 분류하여 가장 적합한 응용 분야를 식별할 수 있습니다.

소다석회 유리: 소다석회 유리는 창유리와 병, 음료, 음식, 특정 상품을 담는 항아리 등의 유리 용기에 사용되는 가장 일반적인 유리 형태입니다.

납 유리: 납 유리는 뛰어난 투명도와 밝기를 가진, 산화납의 함량이 높은 유리입니다.

내열성: 내열 유리는 열 스트레스를 견디도록 만들어졌으며 일반적으로 주방과 산업용 분야에서 사용됩니다.

유리제품 시장 동향

이 섹션에서는 시장 동인, 이점, 기회, 제약 및 과제를 이해하는 것을 다룹니다. 이 모든 내용은 아래에서 자세히 설명합니다.

- 호텔 및 케이터링 산업에 대한 투자 수준 증가

관광은 전 세계의 호텔 및 레스토랑 부문의 사업을 강화했으며 호텔 산업에 큰 범위를 제공했습니다. 이 산업은 주로 관광을 통해 번창했으며, 다양한 지역의 관광객에게 큰 매력을 제공한 다양한 풍경, 신념 및 사회로 인해 각 국가의 호텔 및 케이터링 부문이 지난 20년 동안 점진적으로 확장되었으며, 향후 몇 년 동안 다양한 유형의 유리 제품에 대한 수요 증가와 함께 개발이 예상됩니다.

- 소비자들의 라이프스타일 변화

소비자의 삶은 끊임없이 진화하고 있습니다. 소비자의 습관과 가치는 기존 및 새로운 트렌드, 끊임없이 변화하는 인구 구성, 전 세계적인 문화적 격변, 기술의 빠른 발전에 영향을 받습니다. 기업은 변화하는 행동과 신념에 따라 고객 선호도에 대한 심층적인 이해를 얻음으로써 새로운 가능성을 활용할 수 있습니다. 최근에는 모든 세대의 소비자가 일상 생활의 여러 영역에서 브랜드 제품에 더 집중하고 있습니다.

- 전 세계적으로 고급 레스토랑의 인기 상승

고급 레스토랑은 고품질 재료, 프레젠테이션, 흠잡을 데 없는 서비스를 중시하는 특선 요리 또는 다양한 요리를 제공하는 식당입니다. 이 범주는 15%라는 존경할 만한 속도로 증가하고 있으며, 이는 프리미엄 미슐랭 스타 레스토랑과 다른 지역 경쟁업체의 등장을 촉진했습니다. 따라서 고급 섬세한 식사에 대한 수요 증가는 주로 호텔과 레스토랑에서 다양한 유형의 유리 제품 브랜드의 성공적인 운영을 통해 달성됩니다.

- 저렴한 품질의 제품 공급

유리는 가장 복잡하고 적응력이 뛰어난 재료 중 하나이며 거의 모든 산업에서 사용됩니다. 유리의 광범위한 사용은 주거 및 상업 건물 모두에서 매우 하이테크하고 현대적인 외관을 만드는 데 기여합니다. 유리는 다양한 응용 분야에 맞게 다양한 모양과 크기로 제공되며 문, 창 및 칸막이와 같은 다양한 건축 응용 분야에 사용됩니다. 유리는 창유리로서의 겸손한 시작에서 오늘날 정교한 구조적 구성 요소가 되기까지 먼 길을 왔습니다.

- 스틸 및 종이 기반 식기에 대한 수요 증가

종이와 플라스틱은 환경적 성과가 뛰어나고 전자상거래와 배달 서비스에 대한 수요가 증가함에 따라 일회용 접시와 유리잔을 만드는 데 점점 더 많이 사용되고 있습니다. 소비자, 브랜드, 리테일러는 모두 재활용 가능한 종이 기반 제품에 대한 기대치가 높습니다. 종이 기반 소재의 재활용률은 약 85%이며 종이 가치 사슬은 날로 개선되고 있습니다. 종이 기반 포장의 유용성을 확장하는 동시에 더 높은 재활용 목표를 달성하려면 의도된 용도와 수명 종료를 모두 고려하는 설계 단계부터 시작하는 것이 중요합니다.

COVID-19 이후 유리 제품 시장에 미치는 영향

COVID-19는 거의 모든 국가가 필수품을 생산하는 곳을 제외한 모든 생산 시설을 폐쇄하기로 결정하면서 유리 제품 시장에 큰 영향을 미쳤습니다. 정부는 COVID-19의 확산을 막기 위해 비필수품의 생산 및 판매 중단, 국제 무역 차단 등 몇 가지 엄격한 조치를 취했습니다. 이 팬데믹 상황을 다루는 유일한 사업은 프로세스를 열고 운영할 수 있는 필수 서비스입니다.

유리 제품 시장의 성장은 COVID-19 이후 국제 무역을 촉진하기 위한 정부 정책으로 인해 상승하고 있습니다. 또한 봉쇄 해제로 인해 호텔 산업이 활성화되어 시장에서 유리 제품에 대한 수요가 증가하고 있습니다. 그러나 무역 경로와 관련된 혼잡 및 일부 국가 간의 무역 제한과 같은 요인이 시장 성장을 제한하고 있습니다. 팬데믹 상황에서 생산 시설이 폐쇄되면서 시장에 상당한 영향을 미쳤습니다.

제조업체는 COVID-19 이후 회복하기 위해 다양한 전략적 결정을 내리고 있습니다. 업체는 Glassware에 관련된 기술을 개선하기 위해 여러 연구 개발 활동을 수행하고 있습니다. 이를 통해 회사는 시장에 고급적이고 정확한 솔루션을 제공할 것입니다. 또한 국제 무역을 촉진하기 위한 정부 이니셔티브가 시장 성장으로 이어졌습니다.

최근 개발 사항

- 2020년 10월, Libbey Inc.는 재편 계획의 확정을 발표했으며, 법원 감독 하의 구조 조정을 완료하고 향후 몇 주 안에 더 강력한 대차대조표를 갖게 될 것으로 예상했습니다. 이 회사는 현재의 사업 운영 환경에서 성공하기 위해 이 발표를 했습니다.

- 2021년 10월, Lenox Corporation은 식기, 식기, 칼을 포함한 테이블탑 제품 브랜드인 Oneida Consumer LLC를 인수했습니다. 이 협업은 광범위한 소매 채널에서 타의 추종을 불허하는 고객 인지도를 가진 선도적인 브랜드와 혁신적 제품 포트폴리오를 마케팅하기 위해 이루어졌습니다.

아시아 태평양 유리 제품 시장 범위

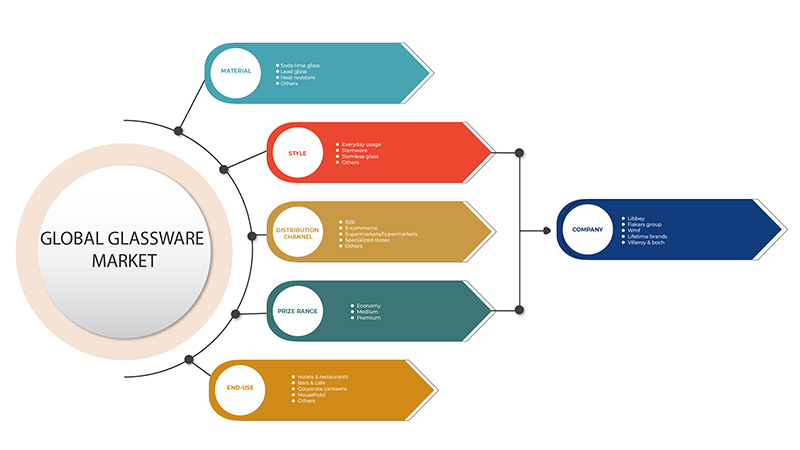

유리 제품 시장은 소재, 스타일, 유통 채널, 가격 범위, 최종 용도에 따라 세분화됩니다. 이러한 세그먼트 간의 성장은 산업의 빈약한 성장 세그먼트를 분석하고 사용자에게 핵심 시장 응용 프로그램을 식별하기 위한 전략적 결정을 내리는 데 도움이 되는 귀중한 시장 개요와 시장 통찰력을 제공하는 데 도움이 됩니다.

재료별로

- 소다 석회 유리

- 납유리

- 내열성

- 기타

유리 제품 시장은 재료에 따라 소다석회 유리, 납유리, 내열유리 등으로 구분됩니다.

스타일별로

- 스템리스 유리

- 스템웨어

- 일상 사용

- 기타

유리 제품 시장은 스타일을 기준으로 스템리스 유리, 스템웨어, 일상용 유리 제품 및 기타 제품으로 구분됩니다.

유통 채널별

- B2B

- 전문 매장

- 슈퍼마켓/하이퍼마켓

- 전자상거래

- 기타

유리제품 시장은 유통 채널을 기준으로 B2B, 전문점, 슈퍼마켓/하이퍼마켓, 전자상거래 및 기타로 구분됩니다.

가격대별

- 중간

- 프리미엄

- 경제

유리 제품 시장은 가격대에 따라 중간, 고급, 경제형으로 구분됩니다.

최종 사용별

- 호텔 & 레스토랑

- 바 & 카페

- 가정

- 회사 식당

- 기타

최종 용도를 기준으로 유리 제품 시장은 호텔 및 레스토랑, 바 및 카페, 가정, 회사 식당 및 기타로 구분됩니다.

유리 제품 시장 지역 분석/통찰력

유리 제품 시장을 분석하고, 위에 언급된 대로 국가, 소재, 스타일, 유통 채널, 가격대, 최종 용도별로 시장 규모에 대한 통찰력과 추세를 제공합니다.

유리 제품 시장 보고서에서 다루는 국가는 중국, 일본, 인도, 한국, 싱가포르, 말레이시아, 호주, 태국, 인도네시아, 필리핀, 홍콩, 대만, 미얀마, 라오스, 캄보디아입니다. 아시아 태평양(APAC)의 나머지 아시아 태평양(APAC).

중국은 아시아 태평양 유리 제품 시장을 지배하고 있습니다. 중국은 아시아 태평양 유리 제품 시장에서 가장 빠르게 성장할 가능성이 높습니다. 중국, 일본, 인도, 한국과 같은 신흥국에서 인프라, 상업 및 산업 개발이 증가하고 있어 시장이 우세합니다. 국가의 발전이 증가함에 따라 레스토랑과 바의 수가 늘어나고 있으며, 이는 아시아 태평양 지역에서 유리 제품 수요를 증가시킬 것입니다.

보고서의 국가 섹션은 또한 현재 및 미래 시장 추세에 영향을 미치는 개별 시장 영향 요인과 시장 규제의 변화를 제공합니다. 하류 및 상류 가치 사슬 분석, 기술 추세 및 포터의 5가지 힘 분석, 사례 연구와 같은 데이터 포인트는 개별 국가의 시장 시나리오를 예측하는 데 사용되는 몇 가지 포인터입니다. 또한 아시아 태평양 브랜드의 존재 및 가용성과 지역 및 국내 브랜드와의 대규모 또는 희소한 경쟁으로 인해 직면한 과제, 국내 관세 및 무역 경로의 영향이 국가 데이터에 대한 예측 분석을 제공하는 동안 고려됩니다.

경쟁 환경 및 유리 제품 시장 점유율 분석

유리 제품 시장 경쟁 구도는 경쟁자별 세부 정보를 제공합니다. 포함된 세부 정보는 회사 개요, 회사 재무, 창출된 수익, 시장 잠재력, 연구 개발 투자, 새로운 시장 이니셔티브, 아시아 태평양 지역 입지, 생산 현장 및 시설, 생산 용량, 회사의 강점과 약점, 제품 출시, 제품 폭과 범위, 응용 분야 우세입니다. 위에 제공된 데이터 포인트는 유리 제품 시장과 관련된 회사의 초점에만 관련이 있습니다.

유리 제품 시장에서 활동하는 주요 기업으로는 Hrastnik1860, Oneida, Noritake China, Ocean Glass Public Company Limited, Lenox Corporatio, Treo.in, Libbey Inc, Fiskars Group, WMF(Groupe SEB의 자회사), Lifetime Brands, Inc, Villeroy & Boch, Bormioli Rocco SpA, Wonderchef Home Appliances Pvt. Ltd., The Zrike Company, Inc, Shandong Hikingpac Co., Ltd., Addresshome, Stölzle Lausitz GmbH, Eagle Glass Deco (P.) Ltd., Degrenne, Cello World, MYBOROSIL, Jiangsu Rongtai Glass Products Co., Ltd., Cumbria Crystal, Garbo Glassware가 있습니다.

SKU-

세계 최초의 시장 정보 클라우드 보고서에 온라인으로 접속하세요

- 대화형 데이터 분석 대시보드

- 높은 성장 잠재력 기회를 위한 회사 분석 대시보드

- 사용자 정의 및 질의를 위한 리서치 분석가 액세스

- 대화형 대시보드를 통한 경쟁자 분석

- 최신 뉴스, 업데이트 및 추세 분석

- 포괄적인 경쟁자 추적을 위한 벤치마크 분석의 힘 활용

목차

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF ASIA PACIFIC GLASSWARE MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MATERIAL TIME LINE CURVE

2.7 MULTIVARIATE MODELING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 DBMR MARKET CHALLENGE MATRIX

2.12 VENDOR SHARE ANALYSIS

2.13 SECONDARY SOURCES

2.14 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER'S MODEL

4.2 CONSUMER BEHAVIOUR PATTERN

4.3 FACTORS INFLUENCING BUYING DECISION

4.3.1 PSYCHOLOGICAL FACTORS

4.3.2 SOCIAL FACTORS

4.3.3 CULTURAL FACTORS

4.3.4 PERSONAL FACTORS

4.3.5 ECONOMIC FACTORS

4.4 KEY TRENDS

4.4.1 BOROSILICATE GLASSWARE IS A GAME-CHANGER

4.4.2 OMNI-CHANNEL STRATEGY USAGE IS ENCOURAGING THE GROWTH OF THE GLASSWARE MARKET

4.4.3 BEVERAGE INDUSTRY TO REGISTER SIGNIFICANT GROWTH

4.4.4 INCREASE IN TABLEWARE PRODUCTS

4.5 PRICING ANALYSIS

4.6 PRODUCT ADOPTION SCENARIO

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 GROWING LEVELS OF INVESTMENT IN THE HOTEL AND CATERING INDUSTRY

5.1.2 CHANGES IN LIFESTYLE OF THE CONSUMERS

5.1.3 RISING POPULARITY OF FINE DINING ACROSS THE GLOBE

5.1.4 INCREASING DEMAND FOR PREMIUM DECORATIVE GLASSWARE PRODUCTS

5.2 RESTRAINTS

5.2.1 AVAILABILITY OF CHEAP QUALITY PRODUCTS

5.2.2 RISING DEMAND FOR STEEL AND PAPER BASE DRINKWARE

5.2.3 DIFFICULTY IN MAINTAINING THE GLASSWARE PRODUCTS

5.3 OPPORTUNITIES

5.3.1 ADVANCEMENTS IN GLASSWARE PRODUCTION TECHNOLOGIES

5.3.2 RISING DEMAND FOR GLASSWARE PRODUCTS FOR CLINICAL USE IN HOSPITALS AND FORENSIC LABORATORIES

5.4 CHALLENGES

5.4.1 COMPLEXITY IN MANUFACTURING GLASSWARE PRODUCTS

5.4.2 RISING DIFFICULTY IN RECYCLING GLASSWARE PRODUCTS

6 ASIA PACIFIC GLASSWARE MARKET, BY MATERIAL

6.1 OVERVIEW

6.2 SODA LIME GLASS

6.3 LEAD GLASS

6.4 HEAT RESISTANT

6.5 OTHERS

7 ASIA PACIFIC GLASSWARE MARKET, BY STYLE

7.1 OVERVIEW

7.2 STEMWARE

7.2.1 RED WINE GLASS

7.2.1.1 BORDEAUX

7.2.1.2 CABERNET

7.2.1.3 ZINFANDEL

7.2.1.4 BURGUNDY

7.2.1.5 PINOT NOIR

7.2.1.6 ROSE

7.2.2 WHITE WINE GLASS

7.2.2.1 SPARKLING

7.2.2.2 CHARDONNAY

7.2.2.3 VIOGNIER

7.2.2.4 SWEET WINE

7.2.2.5 VINTAGE

7.3 STEMLESS GLASS

7.3.1 LIQUOR GLASS

7.3.2 BEER GLASS

7.4 EVERYDAY USAGE

7.5 OTHERS

8 ASIA PACIFIC GLASSWARE MARKET, BY DISTRIBUTION CHANNEL

8.1 OVERVIEW

8.2 B2B

8.3 SPECIALIZED STORES

8.4 SUPERMARKETS/HYPERMARKETS

8.5 E-COMMERCE

8.6 OTHERS

9 ASIA PACIFIC GLASSWARE MARKET, BY PRICE RANGE

9.1 OVERVIEW

9.2 MEDIUM

9.3 PREMIUM

9.4 ECONOMY

10 ASIA PACIFIC GLASSWARE MARKET, BY END-USE

10.1 OVERVIEW

10.2 HOTELS & RESTAURANTS

10.3 BARS & CAFE

10.4 HOUSEHOLD

10.5 CORPORATE CANTEENS

10.6 OTHERS

11 ASIA PACIFIC GLASSWARE MARKET, BY GEOGRAPHY

11.1 ASIA-PACIFIC

11.1.1 CHINA

11.1.2 INDIA

11.1.3 JAPAN

11.1.4 SOUTH KOREA

11.1.5 SINGAPORE

11.1.6 MALAYSIA

11.1.7 THAILAND

11.1.8 AUSTRALIA AND NEW ZEALAND

11.1.9 INDONESIA

11.1.10 PHILIPPINES

11.1.11 HONG KONG

11.1.12 TAIWAN

11.1.13 MYANMAR

11.1.14 LAOS

11.1.15 CAMBODIA

11.1.16 REST OF ASIA-PACIFIC

12 ASIA PACIFIC GLASSWARE MARKET: COMPANY LANDSCAPE

12.1 COMPANY SHARE ANALYSIS: ASIA PACIFIC

13 SWOT ANALYSIS

14 COMPANY PROFILES

14.1 LIBBEY, INC.

14.1.1 COMPANY SNAPSHOT

14.1.2 COMPANY SHARE ANALYSIS

14.1.3 PRODUCT PORTFOLIO

14.1.4 RECENT UPDATE

14.2 FISKARS GROUP

14.2.1 COMPANY SNAPSHOT

14.2.2 REVENUE ANALYSIS

14.2.3 COMPANY SHARE ANALYSIS

14.2.4 PRODUCT PORTFOLIO

14.2.5 RECENT UPDATE

14.3 WMF (A SUBSIDIARY OF GROUPE SEB)

14.3.1 COMPANY SNAPSHOT

14.3.2 REVENUE ANALYSIS

14.3.3 PRODUCT PORTFOLIO

14.3.4 RECENT UPDATE

14.4 LIFETIME BRANDS, INC.

14.4.1 COMPANY SNAPSHOT

14.4.2 REVENUE ANALYSIS

14.4.3 COMPANY SHARE ANALYSIS

14.4.4 PRODUCT PORTFOLIO

14.4.5 RECENT UPDATE

14.5 VILLEROY & BOCH

14.5.1 COMPANY SNAPSHOT

14.5.2 REVENUE ANALYSIS

14.5.3 COMPANY SHARE ANALYSIS

14.5.4 PRODUCT PORTFOLIO

14.5.5 RECENT UPDATES

14.6 ADDRESSHOME

14.6.1 COMPANY SNAPSHOT

14.6.2 PRODUCT PORTFOLIO

14.6.3 RECENT UPDATE

14.7 BORMIOLI ROCCO S.P.A.

14.7.1 COMPANY SNAPSHOT

14.7.2 PRODUCT PORTFOLIO

14.7.3 RECENT UPDATE

14.8 CELLO WORLD

14.8.1 COMPANY SNAPSHOT

14.8.2 PRODUCT PORTFOLIO

14.8.3 RECENT UPDATE

14.9 CUMBRIA CRYSTAL

14.9.1 COMPANY SNAPSHOT

14.9.2 PRODUCT PORTFOLIO

14.9.3 RECENT UPDATE

14.1 DEGRENNE

14.10.1 COMPANY SNAPSHOT

14.10.2 PRODUCT PORTFOLIO

14.10.3 RECENT UPDATE

14.11 EAGLE GLASS DECO (P.) LTD.

14.11.1 COMPANY SNAPSHOT

14.11.2 PRODUCT PORTFOLIO

14.11.3 RECENT UPDATE

14.12 GARBO GLASSWARE

14.12.1 COMPANY SNAPSHOT

14.12.2 PRODUCT PORTFOLIO

14.12.3 RECENT UPDATES

14.13 HRASTNIK1860

14.13.1 COMPANY SNAPSHOT

14.13.2 PRODUCT PORTFOLIO

14.13.3 RECENT UPDATES

14.14 JIANGSU RONGTAI GLASS PRODUCTS CO., LTD.

14.14.1 COMPANY SNAPSHOT

14.14.2 PRODUCT PORTFOLIO

14.14.3 RECENT UPDATES

14.15 LENOX CORPORATION

14.15.1 COMPANY SNAPSHOT

14.15.2 PRODUCT PORTFOLIO

14.15.3 RECENT UPDATE

14.16 MYBOROSIL

14.16.1 COMPANY SNAPSHOT

14.16.2 REVENUE ANALYSIS

14.16.3 PRODUCT PORTFOLIO

14.16.4 RECENT UPDATE

14.17 NORITAKECHINA

14.17.1 COMPANY SNAPSHOT

14.17.2 REVENUE ANALYSIS

14.17.3 PRODUCT PORTFOLIO

14.17.4 RECENT UPDATE

14.18 OCEAN GLASS PUBLIC COMPANY LIMITED

14.18.1 COMPANY SNAPSHOT

14.18.2 REVENUE ANALYSIS

14.18.3 PRODUCT PORTFOLIO

14.18.4 RECENT UPDATE

14.19 ONEIDA

14.19.1 COMPANY SNAPSHOT

14.19.2 PRODUCT PORTFOLIO

14.19.3 RECENT UPDATE

14.2 SHANDONG HIKINGPAC CO., LTD.

14.20.1 COMPANY SNAPSHOT

14.20.2 PRODUCT PORTFOLIO

14.20.3 RECENT UPDATE

14.21 STÖLZLE LAUSITZ GMBH

14.21.1 COMPANY SNAPSHOT

14.21.2 PRODUCT PORTFOLIO

14.21.3 RECENT UPDATES

14.22 TREO.IN

14.22.1 COMPANY SNAPSHOT

14.22.2 PRODUCT PORTFOLIO

14.22.3 RECENT UPDATE

14.23 THE ZRIKE COMPANY, INC.

14.23.1 COMPANY SNAPSHOT

14.23.2 PRODUCT PORTFOLIO

14.23.3 RECENT UPDATE

14.24 WONDERCHEF HOME APPLIANCES PVT. LTD

14.24.1 COMPANY SNAPSHOT

14.24.2 PRODUCT PORTFOLIO

14.24.3 RECENT UPDATES

15 QUESTIONNAIRE

16 RELATED REPORTS

표 목록

TABLE 1 TYPE OF REUSABLE CUPS CONSUMERS WOULD PREFER FOR DRINKWARE IN U.S, 2015

TABLE 2 ASIA PACIFIC GLASSWARE MARKET, BY MATERIAL, 2016-2029 (USD THOUSAND)

TABLE 3 ASIA PACIFIC GLASSWARE MARKET, BY MATERIAL, 2016-2029 (THOUSAND UNITS)

TABLE 4 ASIA PACIFIC SODA LIME GLASS IN GLASSWARE MARKET, BY REGION, 2016-2029 (USD THOUSAND)

TABLE 5 ASIA PACIFIC SODA LIME GLASS IN GLASSWARE MARKET, BY REGION, 2016-2029 (THOUSAND UNITS)

TABLE 6 ASIA PACIFIC LEAD GLASS IN GLASSWARE MARKET, BY REGION, 2016-2029 (USD THOUSAND)

TABLE 7 ASIA PACIFIC LEAD GLASS IN GLASSWARE MARKET, BY REGION, 2016-2029 (THOUSAND UNITS)

TABLE 8 ASIA PACIFIC HEAT RESISTANT IN GLASSWARE MARKET, BY REGION, 2016-2029 (USD THOUSAND)

TABLE 9 ASIA PACIFIC HEAT RESISTANT IN GLASSWARE MARKET, BY REGION, 2016-2029 (THOUSAND UNITS)

TABLE 10 ASIA PACIFIC OTHERS IN GLASSWARE MARKET, BY REGION, 2016-2029 (USD THOUSAND)

TABLE 11 ASIA PACIFIC OTHERS IN GLASSWARE MARKET, BY REGION, 2016-2029 (THOUSAND UNITS)

TABLE 12 ASIA PACIFIC GLASSWARE MARKET, BY STYLE, 2016-2029 (USD THOUSAND)

TABLE 13 ASIA PACIFIC STEMWARE IN GLASSWARE MARKET, BY REGION, 2016-2029 (USD THOUSAND)

TABLE 14 ASIA PACIFIC STEMWARE IN GLASSWARE MARKET, BY TYPE, 2016-2029 (USD THOUSAND)

TABLE 15 ASIA PACIFIC RED WINE GLASS IN GLASSWARE MARKET, BY TYPE, 2016-2029 (USD THOUSAND)

TABLE 16 ASIA PACIFIC WHITE WINE GLASS IN GLASSWARE MARKET, BY TYPE, 2016-2029 (USD THOUSAND)

TABLE 17 ASIA PACIFIC STEMLESS GLASS IN GLASSWARE MARKET, BY REGION, 2016-2029 (USD THOUSAND)

TABLE 18 ASIA PACIFIC STEMLESS GLASS IN GLASSWARE MARKET, BY TYPE, 2016-2029 (USD THOUSAND)

TABLE 19 ASIA PACIFIC EVERYDAY USAGE IN GLASSWARE MARKET, BY REGION, 2016-2029 (USD THOUSAND)

TABLE 20 ASIA PACIFIC OTHERS IN GLASSWARE MARKET, BY REGION, 2016-2029 (USD THOUSAND)

TABLE 21 ASIA PACIFIC GLASSWARE MARKET, BY DISTRIBUTION CHANNEL, 2016-2029 (USD THOUSAND)

TABLE 22 ASIA PACIFIC B2B IN GLASSWARE MARKET, BY REGION, 2016-2029 (USD THOUSAND)

TABLE 23 ASIA PACIFIC SPECIALIZED STORES IN GLASSWARE MARKET, BY REGION, 2016-2029 (USD THOUSAND)

TABLE 24 ASIA PACIFIC SUPERMARKETS/HYPERMARKETS IN GLASSWARE MARKET, BY REGION, 2016-2029 (USD THOUSAND)

TABLE 25 ASIA PACIFIC E-COMMERCE IN GLASSWARE MARKET, BY REGION, 2016-2029 (USD THOUSAND)

TABLE 26 ASIA PACIFIC OTHERS IN GLASSWARE MARKET, BY REGION, 2016-2029 (USD THOUSAND)

TABLE 27 ASIA PACIFIC GLASSWARE MARKET, BY PRICE RANGE, 2016-2029 (USD THOUSAND)

TABLE 28 ASIA PACIFIC MEDIUM IN GLASSWARE MARKET, BY REGION, 2016-2029 (USD THOUSAND)

TABLE 29 ASIA PACIFIC PREMIUM IN GLASSWARE MARKET, BY REGION, 2016-2029 (USD THOUSAND)

TABLE 30 ASIA PACIFIC ECONOMY IN GLASSWARE MARKET, BY REGION, 2016-2029 (USD THOUSAND)

TABLE 31 ASIA PACIFIC GLASSWARE MARKET, BY END-USE, 2016-2029 (USD THOUSAND)

TABLE 32 ASIA PACIFIC HOTELS & RESTAURANTS IN GLASSWARE MARKET, BY REGION, 2016-2029 (USD THOUSAND)

TABLE 33 ASIA PACIFIC BARS & CAFÉ IN GLASSWARE MARKET, BY REGION, 2016-2029 (USD THOUSAND)

TABLE 34 ASIA PACIFIC HOUSEHOLD IN GLASSWARE MARKET, BY REGION, 2016-2029 (USD THOUSAND)

TABLE 35 ASIA PACIFIC CORPORATE CANTEENS IN GLASSWARE MARKET, BY REGION, 2016-2029 (USD THOUSAND)

TABLE 36 ASIA PACIFIC OTHERS IN GLASSWARE MARKET, BY REGION, 2016-2029 (USD THOUSAND)

TABLE 37 ASIA-PACIFIC GLASSWARE MARKET, BY COUNTRY, 2020-2029 (USD THOUSAND)

TABLE 38 ASIA-PACIFIC GLASSWARE MARKET, BY COUNTRY, 2020-2029 (THOUSAND UNITS)

TABLE 39 ASIA-PACIFIC GLASSWARE MARKET, BY MATERIAL, 2020-2029 (USD THOUSAND)

TABLE 40 ASIA-PACIFIC GLASSWARE MARKET, BY MATERIAL, 2020-2029 (THOUSAND UNITS)

TABLE 41 ASIA-PACIFIC GLASSWARE MARKET, BY STYLE, 2020-2029 (USD THOUSAND)

TABLE 42 ASIA-PACIFIC STEMWARE IN GLASSWARE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 43 ASIA-PACIFIC RED WINE GLASS IN GLASSWARE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 44 ASIA-PACIFIC WHITE WINE GLASS IN GLASSWARE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 45 ASIA-PACIFIC STEMLESS GLASS IN GLASSWARE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 46 ASIA-PACIFIC GLASSWARE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 47 ASIA-PACIFIC GLASSWARE MARKET, BY PRICE RANGE, 2020-2029 (USD THOUSAND)

TABLE 48 ASIA-PACIFIC GLASSWARE MARKET, BY END-USE, 2020-2029 (USD THOUSAND)

TABLE 49 CHINA GLASSWARE MARKET, BY MATERIAL, 2020-2029 (USD THOUSAND)

TABLE 50 CHINA GLASSWARE MARKET, BY MATERIAL, 2020-2029 (THOUSAND UNITS)

TABLE 51 CHINA GLASSWARE MARKET, BY STYLE, 2020-2029 (USD THOUSAND)

TABLE 52 CHINA STEMWARE IN GLASSWARE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 53 CHINA RED WINE GLASS IN GLASSWARE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 54 CHINA WHITE WINE GLASS IN GLASSWARE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 55 CHINA STEMLESS GLASS IN GLASSWARE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 56 CHINA GLASSWARE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 57 CHINA GLASSWARE MARKET, BY PRICE RANGE, 2020-2029 (USD THOUSAND)

TABLE 58 CHINA GLASSWARE MARKET, BY END-USE, 2020-2029 (USD THOUSAND)

TABLE 59 INDIA GLASSWARE MARKET, BY MATERIAL, 2020-2029 (USD THOUSAND)

TABLE 60 INDIA GLASSWARE MARKET, BY MATERIAL, 2020-2029 (THOUSAND UNITS)

TABLE 61 INDIA GLASSWARE MARKET, BY STYLE, 2020-2029 (USD THOUSAND)

TABLE 62 INDIA STEMWARE IN GLASSWARE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 63 INDIA RED WINE GLASS IN GLASSWARE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 64 INDIA WHITE WINE GLASS IN GLASSWARE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 65 INDIA STEMLESS GLASS IN GLASSWARE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 66 INDIA GLASSWARE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 67 INDIA GLASSWARE MARKET, BY PRICE RANGE, 2020-2029 (USD THOUSAND)

TABLE 68 INDIA GLASSWARE MARKET, BY END-USE, 2020-2029 (USD THOUSAND)

TABLE 69 JAPAN GLASSWARE MARKET, BY MATERIAL, 2020-2029 (USD THOUSAND)

TABLE 70 JAPAN GLASSWARE MARKET, BY MATERIAL, 2020-2029 (THOUSAND UNITS)

TABLE 71 JAPAN GLASSWARE MARKET, BY STYLE, 2020-2029 (USD THOUSAND)

TABLE 72 JAPAN STEMWARE IN GLASSWARE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 73 JAPAN RED WINE GLASS IN GLASSWARE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 74 JAPAN WHITE WINE GLASS IN GLASSWARE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 75 JAPAN STEMLESS GLASS IN GLASSWARE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 76 JAPAN GLASSWARE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 77 JAPAN GLASSWARE MARKET, BY PRICE RANGE, 2020-2029 (USD THOUSAND)

TABLE 78 JAPAN GLASSWARE MARKET, BY END-USE, 2020-2029 (USD THOUSAND)

TABLE 79 SOUTH KOREA GLASSWARE MARKET, BY MATERIAL, 2020-2029 (USD THOUSAND)

TABLE 80 SOUTH KOREA GLASSWARE MARKET, BY MATERIAL, 2020-2029 (THOUSAND UNITS)

TABLE 81 SOUTH KOREA GLASSWARE MARKET, BY STYLE, 2020-2029 (USD THOUSAND)

TABLE 82 SOUTH KOREA STEMWARE IN GLASSWARE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 83 SOUTH KOREA RED WINE GLASS IN GLASSWARE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 84 SOUTH KOREA WHITE WINE GLASS IN GLASSWARE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 85 SOUTH KOREA STEMLESS GLASS IN GLASSWARE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 86 SOUTH KOREA GLASSWARE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 87 SOUTH KOREA GLASSWARE MARKET, BY PRICE RANGE, 2020-2029 (USD THOUSAND)

TABLE 88 SOUTH KOREA GLASSWARE MARKET, BY END-USE, 2020-2029 (USD THOUSAND)

TABLE 89 SINGAPORE GLASSWARE MARKET, BY MATERIAL, 2020-2029 (USD THOUSAND)

TABLE 90 SINGAPORE GLASSWARE MARKET, BY MATERIAL, 2020-2029 (THOUSAND UNITS)

TABLE 91 SINGAPORE GLASSWARE MARKET, BY STYLE, 2020-2029 (USD THOUSAND)

TABLE 92 SINGAPORE STEMWARE IN GLASSWARE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 93 SINGAPORE RED WINE GLASS IN GLASSWARE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 94 SINGAPORE WHITE WINE GLASS IN GLASSWARE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 95 SINGAPORE STEMLESS GLASS IN GLASSWARE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 96 SINGAPORE GLASSWARE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 97 SINGAPORE GLASSWARE MARKET, BY PRICE RANGE, 2020-2029 (USD THOUSAND)

TABLE 98 SINGAPORE GLASSWARE MARKET, BY END-USE, 2020-2029 (USD THOUSAND)

TABLE 99 MALAYSIA GLASSWARE MARKET, BY MATERIAL, 2020-2029 (USD THOUSAND)

TABLE 100 MALAYSIA GLASSWARE MARKET, BY MATERIAL, 2020-2029 (THOUSAND UNITS)

TABLE 101 MALAYSIA GLASSWARE MARKET, BY STYLE, 2020-2029 (USD THOUSAND)

TABLE 102 MALAYSIA STEMWARE IN GLASSWARE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 103 MALAYSIA RED WINE GLASS IN GLASSWARE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 104 MALAYSIA WHITE WINE GLASS IN GLASSWARE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 105 MALAYSIA STEMLESS GLASS IN GLASSWARE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 106 MALAYSIA GLASSWARE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 107 MALAYSIA GLASSWARE MARKET, BY PRICE RANGE, 2020-2029 (USD THOUSAND)

TABLE 108 MALAYSIA GLASSWARE MARKET, BY END-USE, 2020-2029 (USD THOUSAND)

TABLE 109 THAILAND GLASSWARE MARKET, BY MATERIAL, 2020-2029 (USD THOUSAND)

TABLE 110 THAILAND GLASSWARE MARKET, BY MATERIAL, 2020-2029 (THOUSAND UNITS)

TABLE 111 THAILAND GLASSWARE MARKET, BY STYLE, 2020-2029 (USD THOUSAND)

TABLE 112 THAILAND STEMWARE IN GLASSWARE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 113 THAILAND RED WINE GLASS IN GLASSWARE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 114 THAILAND WHITE WINE GLASS IN GLASSWARE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 115 THAILAND STEMLESS GLASS IN GLASSWARE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 116 THAILAND GLASSWARE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 117 THAILAND GLASSWARE MARKET, BY PRICE RANGE, 2020-2029 (USD THOUSAND)

TABLE 118 THAILAND GLASSWARE MARKET, BY END-USE, 2020-2029 (USD THOUSAND)

TABLE 119 AUSTRALIA AND NEW ZEALAND GLASSWARE MARKET, BY MATERIAL, 2020-2029 (USD THOUSAND)

TABLE 120 AUSTRALIA AND NEW ZEALAND GLASSWARE MARKET, BY MATERIAL, 2020-2029 (THOUSAND UNITS)

TABLE 121 AUSTRALIA AND NEW ZEALAND GLASSWARE MARKET, BY STYLE, 2020-2029 (USD THOUSAND)

TABLE 122 AUSTRALIA AND NEW ZEALAND STEMWARE IN GLASSWARE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 123 AUSTRALIA AND NEW ZEALAND RED WINE GLASS IN GLASSWARE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 124 AUSTRALIA AND NEW ZEALAND WHITE WINE GLASS IN GLASSWARE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 125 AUSTRALIA AND NEW ZEALAND STEMLESS GLASS IN GLASSWARE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 126 AUSTRALIA AND NEW ZEALAND GLASSWARE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 127 AUSTRALIA AND NEW ZEALAND GLASSWARE MARKET, BY PRICE RANGE, 2020-2029 (USD THOUSAND)

TABLE 128 AUSTRALIA AND NEW ZEALAND GLASSWARE MARKET, BY END-USE, 2020-2029 (USD THOUSAND)

TABLE 129 INDONESIA GLASSWARE MARKET, BY MATERIAL, 2020-2029 (USD THOUSAND)

TABLE 130 INDONESIA GLASSWARE MARKET, BY MATERIAL, 2020-2029 (THOUSAND UNITS)

TABLE 131 INDONESIA GLASSWARE MARKET, BY STYLE, 2020-2029 (USD THOUSAND)

TABLE 132 INDONESIA STEMWARE IN GLASSWARE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 133 INDONESIA RED WINE GLASS IN GLASSWARE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 134 INDONESIA WHITE WINE GLASS IN GLASSWARE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 135 INDONESIA STEMLESS GLASS IN GLASSWARE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 136 INDONESIA GLASSWARE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 137 INDONESIA GLASSWARE MARKET, BY PRICE RANGE, 2020-2029 (USD THOUSAND)

TABLE 138 INDONESIA GLASSWARE MARKET, BY END-USE, 2020-2029 (USD THOUSAND)

TABLE 139 PHILIPPINES GLASSWARE MARKET, BY MATERIAL, 2020-2029 (USD THOUSAND)

TABLE 140 PHILIPPINES GLASSWARE MARKET, BY MATERIAL, 2020-2029 (THOUSAND UNITS)

TABLE 141 PHILIPPINES GLASSWARE MARKET, BY STYLE, 2020-2029 (USD THOUSAND)

TABLE 142 PHILIPPINES STEMWARE IN GLASSWARE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 143 PHILIPPINES RED WINE GLASS IN GLASSWARE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 144 PHILIPPINES WHITE WINE GLASS IN GLASSWARE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 145 PHILIPPINES STEMLESS GLASS IN GLASSWARE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 146 PHILIPPINES GLASSWARE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 147 PHILIPPINES GLASSWARE MARKET, BY PRICE RANGE, 2020-2029 (USD THOUSAND)

TABLE 148 PHILIPPINES GLASSWARE MARKET, BY END-USE, 2020-2029 (USD THOUSAND)

TABLE 149 HONG KONG GLASSWARE MARKET, BY MATERIAL, 2020-2029 (USD THOUSAND)

TABLE 150 HONG KONG GLASSWARE MARKET, BY MATERIAL, 2020-2029 (THOUSAND UNITS)

TABLE 151 HONG KONG GLASSWARE MARKET, BY STYLE, 2020-2029 (USD THOUSAND)

TABLE 152 HONG KONG STEMWARE IN GLASSWARE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 153 HONG KONG RED WINE GLASS IN GLASSWARE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 154 HONG KONG WHITE WINE GLASS IN GLASSWARE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 155 HONG KONG STEMLESS GLASS IN GLASSWARE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 156 HONG KONG GLASSWARE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 157 HONG KONG GLASSWARE MARKET, BY PRICE RANGE, 2020-2029 (USD THOUSAND)

TABLE 158 HONG KONG GLASSWARE MARKET, BY END-USE, 2020-2029 (USD THOUSAND)

TABLE 159 TAIWAN GLASSWARE MARKET, BY MATERIAL, 2020-2029 (USD THOUSAND)

TABLE 160 TAIWAN GLASSWARE MARKET, BY MATERIAL, 2020-2029 (THOUSAND UNITS)

TABLE 161 TAIWAN GLASSWARE MARKET, BY STYLE, 2020-2029 (USD THOUSAND)

TABLE 162 TAIWAN STEMWARE IN GLASSWARE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 163 TAIWAN RED WINE GLASS IN GLASSWARE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 164 TAIWAN WHITE WINE GLASS IN GLASSWARE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 165 TAIWAN STEMLESS GLASS IN GLASSWARE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 166 TAIWAN GLASSWARE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 167 TAIWAN GLASSWARE MARKET, BY PRICE RANGE, 2020-2029 (USD THOUSAND)

TABLE 168 TAIWAN GLASSWARE MARKET, BY END-USE, 2020-2029 (USD THOUSAND)

TABLE 169 MYANMAR GLASSWARE MARKET, BY MATERIAL, 2020-2029 (USD THOUSAND)

TABLE 170 MYANMAR GLASSWARE MARKET, BY MATERIAL, 2020-2029 (THOUSAND UNITS)

TABLE 171 MYANMAR GLASSWARE MARKET, BY STYLE, 2020-2029 (USD THOUSAND)

TABLE 172 MYANMAR STEMWARE IN GLASSWARE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 173 MYANMAR RED WINE GLASS IN GLASSWARE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 174 MYANMAR WHITE WINE GLASS IN GLASSWARE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 175 MYANMAR STEMLESS GLASS IN GLASSWARE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 176 MYANMAR GLASSWARE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 177 MYANMAR GLASSWARE MARKET, BY PRICE RANGE, 2020-2029 (USD THOUSAND)

TABLE 178 MYANMAR GLASSWARE MARKET, BY END-USE, 2020-2029 (USD THOUSAND)

TABLE 179 LAOS GLASSWARE MARKET, BY MATERIAL, 2020-2029 (USD THOUSAND)

TABLE 180 LAOS GLASSWARE MARKET, BY MATERIAL, 2020-2029 (THOUSAND UNITS)

TABLE 181 LAOS GLASSWARE MARKET, BY STYLE, 2020-2029 (USD THOUSAND)

TABLE 182 LAOS STEMWARE IN GLASSWARE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 183 LAOS RED WINE GLASS IN GLASSWARE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 184 LAOS WHITE WINE GLASS IN GLASSWARE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 185 LAOS STEMLESS GLASS IN GLASSWARE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 186 LAOS GLASSWARE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 187 LAOS GLASSWARE MARKET, BY PRICE RANGE, 2020-2029 (USD THOUSAND)

TABLE 188 LAOS GLASSWARE MARKET, BY END-USE, 2020-2029 (USD THOUSAND)

TABLE 189 CAMBODIA GLASSWARE MARKET, BY MATERIAL, 2020-2029 (USD THOUSAND)

TABLE 190 CAMBODIA GLASSWARE MARKET, BY MATERIAL, 2020-2029 (THOUSAND UNITS)

TABLE 191 CAMBODIA GLASSWARE MARKET, BY STYLE, 2020-2029 (USD THOUSAND)

TABLE 192 CAMBODIA STEMWARE IN GLASSWARE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 193 CAMBODIA RED WINE GLASS IN GLASSWARE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 194 CAMBODIA WHITE WINE GLASS IN GLASSWARE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 195 CAMBODIA STEMLESS GLASS IN GLASSWARE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 196 CAMBODIA GLASSWARE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 197 CAMBODIA GLASSWARE MARKET, BY PRICE RANGE, 2020-2029 (USD THOUSAND)

TABLE 198 CAMBODIA GLASSWARE MARKET, BY END-USE, 2020-2029 (USD THOUSAND)

TABLE 199 REST OF ASIA-PACIFIC GLASSWARE MARKET, BY MATERIAL, 2020-2029 (USD THOUSAND)

TABLE 200 REST OF ASIA-PACIFIC GLASSWARE MARKET, BY MATERIAL, 2020-2029 (THOUSAND UNITS)

그림 목록

FIGURE 1 ASIA PACIFIC GLASSWARE MARKET: SEGMENTATION

FIGURE 2 ASIA PACIFIC GLASSWARE MARKET: DATA TRIANGULATION

FIGURE 3 ASIA PACIFIC GLASSWARE MARKET: DROC ANALYSIS

FIGURE 4 ASIA PACIFIC GLASSWARE MARKET: ASIA PACIFIC VS REGIONAL MARKET ANALYSIS

FIGURE 5 ASIA PACIFIC GLASSWARE MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 ASIA PACIFIC GLASSWARE MARKET: MATERIAL TIME LINE CURVE

FIGURE 7 ASIA PACIFIC GLASSWARE MARKET: MULTIVARIATE MODELLING

FIGURE 8 ASIA PACIFIC GLASSWARE MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 ASIA PACIFIC GLASSWARE MARKET: DBMR MARKET POSITION GRID

FIGURE 10 ASIA PACIFIC GLASSWARE MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 11 ASIA PACIFIC GLASSWARE MARKET: THE MARKET CHALLENGE MATRIX

FIGURE 12 ASIA PACIFIC GLASSWARE MARKET: VENDOR SHARE ANALYSIS

FIGURE 13 ASIA PACIFIC GLASSWARE MARKET: SEGMENTATION

FIGURE 14 ASIA-PACIFIC IS EXPECTED TO DOMINATE THE ASIA PACIFIC GLASSWARE MARKET AND IS EXPECTED TO GROW WITH THE HIGHEST CAGR IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 15 RISING POPULARITY OF FINE DINING ACROSS THE GLOBE IS DRIVING THE ASIA PACIFIC GLASSWARE MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 16 SODA LIME GLASS SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE ASIA PACIFIC GLASSWARE MARKET IN 2022 & 2029

FIGURE 17 FACTOR INFLUENCING PURCHASE OF PRODUCT

FIGURE 18 PRICE RANGE COMPARISON OF KEY PLAYERS BY STEMLESS GLASSES

FIGURE 19 PRICE RANGE COMPARISON OF KEY PLAYERS BY STEMWARE GLASSES

FIGURE 20 PRICE RANGE COMPARISON OF KEY PLAYERS BY EVERYDAY USAGE GLASSES

FIGURE 21 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF ASIA PACIFIC GLASSWARE MARKET

FIGURE 22 ASIA PACIFIC LUXURY HOTEL COUNT, IN LUXURY CLASS, 2002-2018 (APPROXIMATE)

FIGURE 23 ASIA PACIFIC GLASSWARE MARKET, BY MATERIAL, 2021

FIGURE 24 ASIA PACIFIC GLASSWARE MARKET, BY STYLE, 2021

FIGURE 25 ASIA PACIFIC GLASSWARE MARKET, BY DISTRIBUTION CHANNEL, 2021

FIGURE 26 ASIA PACIFIC GLASSWARE MARKET, BY PRICE RANGE, 2021

FIGURE 27 ASIA PACIFIC GLASSWARE MARKET, BY END-USE, 2021

FIGURE 28 ASIA-PACIFIC GLASSWARE MARKET: SNAPSHOT (2021)

FIGURE 29 ASIA-PACIFIC GLASSWARE MARKET: BY COUNTRY (2021)

FIGURE 30 ASIA-PACIFIC GLASSWARE MARKET: BY COUNTRY (2022 & 2029)

FIGURE 31 ASIA-PACIFIC GLASSWARE MARKET: BY COUNTRY (2021 & 2029)

FIGURE 32 ASIA-PACIFIC GLASSWARE MARKET: BY MATERIAL (2022-2029)

FIGURE 33 ASIA PACIFIC GLASSWARE MARKET: COMPANY SHARE 2021 (%)

연구 방법론

데이터 수집 및 기준 연도 분석은 대규모 샘플 크기의 데이터 수집 모듈을 사용하여 수행됩니다. 이 단계에는 다양한 소스와 전략을 통해 시장 정보 또는 관련 데이터를 얻는 것이 포함됩니다. 여기에는 과거에 수집한 모든 데이터를 미리 검토하고 계획하는 것이 포함됩니다. 또한 다양한 정보 소스에서 발견되는 정보 불일치를 검토하는 것도 포함됩니다. 시장 데이터는 시장 통계 및 일관된 모델을 사용하여 분석하고 추정합니다. 또한 시장 점유율 분석 및 주요 추세 분석은 시장 보고서의 주요 성공 요인입니다. 자세한 내용은 분석가에게 전화를 요청하거나 문의 사항을 드롭하세요.

DBMR 연구팀에서 사용하는 주요 연구 방법론은 데이터 마이닝, 시장에 대한 데이터 변수의 영향 분석 및 주요(산업 전문가) 검증을 포함하는 데이터 삼각 측량입니다. 데이터 모델에는 공급업체 포지셔닝 그리드, 시장 타임라인 분석, 시장 개요 및 가이드, 회사 포지셔닝 그리드, 특허 분석, 가격 분석, 회사 시장 점유율 분석, 측정 기준, 글로벌 대 지역 및 공급업체 점유율 분석이 포함됩니다. 연구 방법론에 대해 자세히 알아보려면 문의를 통해 업계 전문가에게 문의하세요.

사용자 정의 가능

Data Bridge Market Research는 고급 형성 연구 분야의 선두 주자입니다. 저희는 기존 및 신규 고객에게 목표에 맞는 데이터와 분석을 제공하는 데 자부심을 느낍니다. 보고서는 추가 국가에 대한 시장 이해(국가 목록 요청), 임상 시험 결과 데이터, 문헌 검토, 재생 시장 및 제품 기반 분석을 포함하도록 사용자 정의할 수 있습니다. 기술 기반 분석에서 시장 포트폴리오 전략에 이르기까지 타겟 경쟁업체의 시장 분석을 분석할 수 있습니다. 귀하가 원하는 형식과 데이터 스타일로 필요한 만큼 많은 경쟁자를 추가할 수 있습니다. 저희 분석가 팀은 또한 원시 엑셀 파일 피벗 테이블(팩트북)로 데이터를 제공하거나 보고서에서 사용 가능한 데이터 세트에서 프레젠테이션을 만드는 데 도움을 줄 수 있습니다.