아시아 태평양 냉동 어선 시장, 시스템별(에어 블라스트 냉동, 플레이트 냉동, 염수, IQF(개별 급속 냉동)), 유형( 상업용 어선, 전통 어선 및 레크리에이션용 어선), 선박 길이(20M 미만, 21M-30M, 40M 초과 및 31M-40M), 냉동 용량(50톤~150톤, 150톤~300톤, 50톤 미만 및 300톤 초과) - 2029년까지의 산업 동향 및 예측

시장 분석 및 규모

어선은 바다나 호수 또는 개울에서 물고기를 잡는 데 사용되는 폰툰 또는 선박입니다. 다양한 종류의 어선이 상업적, 레크리에이션적 어업 및 수공예적으로 활용됩니다. 농업 자원과 생산은 야생에서 또는 양식업에서 통제된 상황에서 수집됩니다. 해산물 제품에 대한 수요가 증가함에 따라 시장에서 냉동 어선 솔루션에 대한 필요성이 증가합니다. 아시아 태평양 냉동 어선 시장은 해산물의 건강상의 이점과 더 높은 생산성에 대한 수요로 인해 빠르게 성장하고 있습니다. 이 회사들은 더 큰 시장 점유율을 얻기 위해 신제품을 출시하고 있습니다.

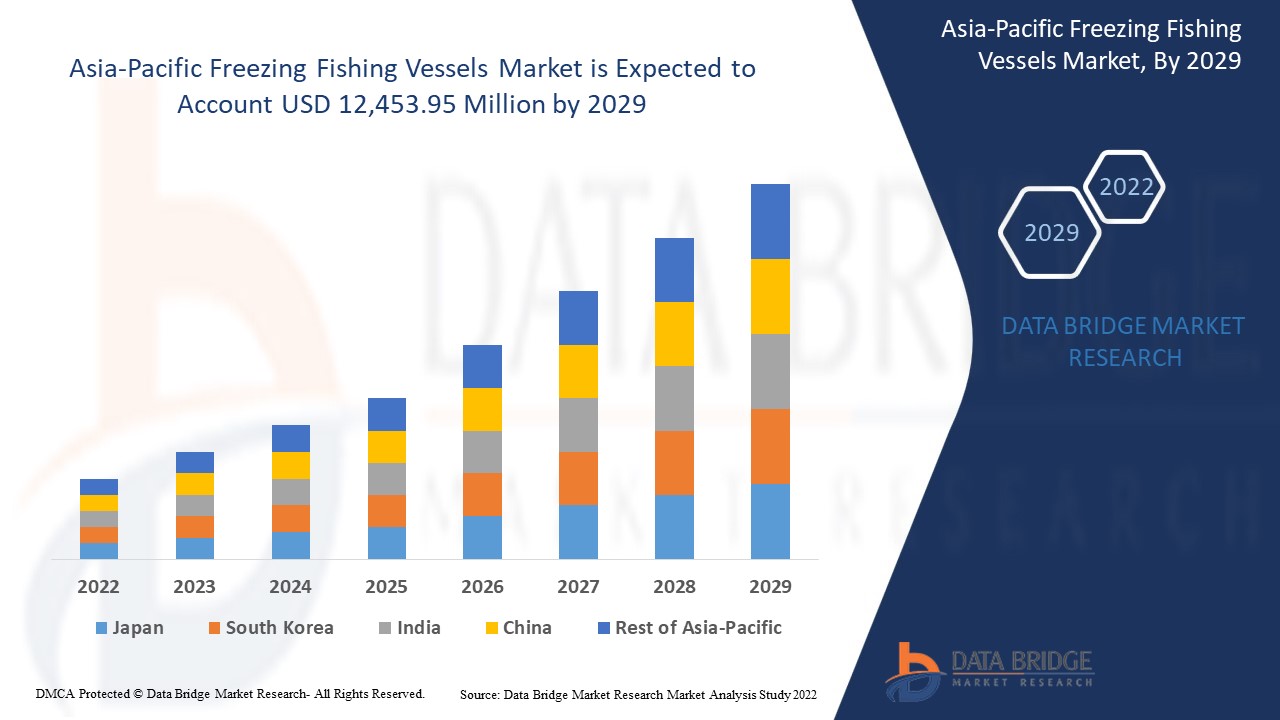

Data Bridge Market Research는 아시아 태평양 냉동 어선 시장이 2029년까지 12,453.95백만 달러에 도달할 것으로 예상하며, 예측 기간 동안 CAGR은 5.1%입니다. "공기 분사 냉동"이 가장 두드러진 모듈 모드 세그먼트를 차지합니다. 냉동 어선 시장 보고서는 또한 가격 분석, 특허 분석 및 심층적인 기술 발전을 다룹니다.

|

보고서 메트릭 |

세부 |

|

예측 기간 |

2022년부터 2029년까지 |

|

기준 연도 |

2021 |

|

역사적 연도 |

2020 |

|

양적 단위 |

미국 달러 백만 |

|

다루는 세그먼트 |

시스템별(에어 블라스트 냉동, 플레이트 냉동, 염수, IQF(개별 급속 냉동)), 유형별(상업용 어선, 전통 어선 및 레크리에이션용 어선), 선박 길이별(20M 미만, 21M-30M, 40M 초과 및 31M-40M), 냉동 용량별(50톤~150톤, 150톤~300톤, 50톤 미만 및 300톤 초과) |

|

적용 국가 |

중국, 일본, 뉴질랜드 및 아시아 태평양의 나머지 지역 |

|

시장 참여자 포함 |

Nordic Wildfish, Lerøy Havfisk, Nichols Bros Boat Builders, Master Boat Builders, Inc., Chantier de constructions navales Martinez, Astilleros Armon, Karstensens Skibsværft A/S, Green Yard Kleven, Ulstein Group ASA, HEINEN & HOPMAN, Marefsol BV, Integrated Marine Systems, Inc., MMC FIRST PROCESS AS., Teknotherm, Damen Shipyards Group, Damen Shipyards Group, Wärtsilä, Kongsberg Gruppen ASA, Thoma-Sea Ship Builders, LLC, Rolls-Royce plc, MAURICE, ELLIOTT BAY DESIGN GROUP, Aresa Shipyard 등 |

시장 정의

어선은 바다나 호수 또는 개울에서 물고기를 잡는 데 사용되는 폰툰 또는 선박입니다. 다양한 종류의 어선이 상업적, 레크리에이션적 어업 및 수공예적으로 활용됩니다. 농업 자원과 생산물은 야생에서 또는 양식업에서 통제된 상황에서 수집됩니다. 둘 다 선박 및 장비, 어업 장비 및 방법을 통합하는 독특하고 고도로 산업적인 혁신의 엄청난 조합을 사용합니다. 어업 및 양식업을 위해 어선 및 엔지니어링 필라멘트, 유압 장비 및 어류 취급과 같은 혁신적인 기술을 활용하는 것이 어선 시장의 현재 추세입니다. 게다가 어선에서 물고기를 잡는 데는 어류 발견을 위한 장치, 경로 및 통신을 위한 위성 기반 혁신, 설치된 보존 및 분리형 모터의 확대된 활용도 통합됩니다. 어업 기술 분야에서 어업 장비에 대한 수요가 증가함에 따라 글로벌 어선 시장이 활성화될 것으로 추산됩니다.

아시아 태평양 냉동 어선 시장 동향

이 섹션에서는 시장 동인, 이점, 기회, 제약 및 과제를 이해하는 것을 다룹니다. 이 모든 내용은 아래에서 자세히 설명합니다.

- 여가 활동의 인기 상승

전 세계적으로 낚시와 보트 타기와 같은 레크리에이션 활동이 증가하면서 낚시 보트에 대한 수요가 급증했습니다. 긴 보관 수명, 내구성, 사용자 정의 및 환경 친화성과 같은 낚시 보트의 고급 기능은 더 많은 고객을 유치합니다. 따라서 예측 기간 동안 낚시 보트에 대한 수요가 더욱 증가할 것으로 예상됩니다.

- 해산물과 관련된 건강상의 이점에 대한 인식 증가

전 세계적으로 낚시에 대한 수요가 증가하고 참치, 대구, 연어와 같은 해산물의 건강상의 이점에 대한 인식이 높아짐에 따라 이 제품에 대한 수요가 더 커졌습니다. 해산물에 대한 필요성과 함께 야외 활동 참여가 어선 시장을 엄청나게 촉진했으며, 예측 기간 동안 더욱 확대될 것으로 예상됩니다.

- 지속 가능한 개발에 대한 요구

이 시장의 성장을 방해하는 요인은 지속 가능한 개발에 대한 수요 증가일 수 있습니다. 어선은 종종 단시간에 보충할 수 있는 것보다 수역에서 더 많은 것을 추출하여 물고기 저장고를 빠르게 없앱니다. 하지만 이러한 효과는 물고기의 안정적인 공급을 보장하는 엄격한 어업 및 해상 규정을 전 세계적으로 도입함으로써 완충될 수 있습니다.

- 초기 투자 비용이 높음

냉동 어선 시장은 건강상의 이점과 용량 증가와 같은 여러 가지 유익한 요소를 제공하며, 투자 비용이 높습니다. 조선 산업은 비용이 많이 드는 일이며, 프로젝트는 수년에 걸쳐 진행될 수 있습니다. 이는 냉동 어선 시장의 성장을 제한할 수 있습니다.

COVID-19 이후 냉동 어선 시장에 미치는 영향

COVID-19는 냉동 어선 시장에 큰 영향을 미쳤습니다. 거의 모든 국가가 필수품을 생산하는 곳을 제외한 모든 생산 시설을 폐쇄하기로 했습니다. 정부는 COVID-19의 확산을 막기 위해 비필수품의 생산 및 판매 중단, 국제 무역 차단 등 엄격한 조치를 취했습니다. 이 팬데믹 상황을 다루는 유일한 사업은 프로세스를 열고 운영할 수 있는 필수 서비스입니다.

냉동 어선 시장의 성장은 코로나 이후 국제 무역을 촉진하기 위한 정부 정책으로 인해 상승하고 있습니다. 또한, 냉동 어선 시장이 어시장과 해산물 수요에 제공하는 혜택으로 인해 시장에서 냉동 어선 시장 수요가 증가하고 있습니다. 그러나 무역로와 관련된 혼잡 및 일부 국가 간의 무역 제한과 같은 요인이 시장 성장을 제한하고 있습니다. 팬데믹 동안 생산 시설이 폐쇄되면서 시장에 상당한 영향을 미쳤습니다.

제조업체는 COVID-19 이후 회복하기 위해 다양한 전략적 결정을 내리고 있습니다. 업체는 냉동 어선 시장에 관련된 기술을 개선하기 위해 여러 연구 개발 활동을 수행하고 있습니다. 이를 통해 회사는 시장에 고급적이고 정확한 솔루션을 제공할 것입니다. 또한 국제 무역을 촉진하기 위한 정부 이니셔티브가 시장 성장으로 이어졌습니다.

최근 개발

- 2021년 8월, Wärtsilä는 조선업체 Karstensens Shipyard에 어선용 추진 솔루션을 제공했습니다. 이 추진 시스템의 주요 특징은 NOx Reducer 배출 감소 시스템, 감속 기어, 가변 피치 프로펠러, ProTouch 추진 원격 제어 시스템이었습니다. 이 솔루션 출시는 회사가 시장을 확장하는 데 도움이 되었습니다.

- 2019년 6월, Rolls-Royce plc는 Engenes fiskeriselskap AS를 위해 70m 길이의 선미 트롤러를 건조하는 계약을 체결했습니다. 이 회사는 선박 설계와 전력 및 추진, 갑판 기계, 전기 및 자동화 시스템과 같은 광범위한 장비를 제공했습니다. 이를 통해 회사는 시장과 글로벌 입지를 확대했습니다.

아시아 태평양 냉동 어선 시장 범위

냉동 어선 시장은 시스템, 유형, 선박 길이 및 냉동 용량을 기준으로 세분화됩니다. 이러한 세그먼트 간의 성장은 산업의 빈약한 성장 세그먼트를 분석하고 사용자에게 핵심 시장 응용 프로그램을 식별하기 위한 전략적 결정을 내리는 데 도움이 되는 귀중한 시장 개요와 시장 통찰력을 제공하는 데 도움이 됩니다.

시스템별로

- 에어 블라스트 동결

- 플레이트 동결

- 소금물

- IQF (개별 급속 냉동)

이 시스템을 기준으로 북미, 유럽, 아시아 태평양, 남미 지역의 냉동 어선 시장은 공기 분사 냉동, 플레이트 냉동, 염수 냉동, IQF(개별 급속 냉동)로 구분됩니다.

유형별로

- 상업용 어선

- 수공예 어선

- 레크리에이션 낚시 선박

냉동 어선 시장은 유형에 따라 북미, 유럽, 아시아 태평양 및 남미 지역에서 상업용 어선, 소규모 어선 및 레크리에이션용 어선으로 구분됩니다.

선박 길이에 따라

- 20M 미만

- 21M-30M

- 40M 이상

- 31M-40M

북미, 유럽, 아시아 태평양, 남미 지역의 냉동 어선 시장은 선박 길이에 따라 20M 미만, 21M~30M, 40M 초과, 31M~40M로 구분됩니다.

냉동 용량에 따라

- 50톤 ~ 150톤

- 150톤 ~ 300톤

- 50톤 미만

- 300톤 이상

냉동 용량을 기준으로 북미, 유럽, 아시아 태평양, 남미 지역의 냉동 어선 시장은 50톤~150톤, 150톤~300톤, 50톤 미만, 300톤 초과로 구분됩니다.

냉동 어선 시장 지역 분석/통찰력

냉동 어선 시장을 분석하고, 위에 언급된 대로 국가, 시스템, 유형, 선박 길이 및 냉동 용량별로 시장 규모에 대한 통찰력과 추세를 제공합니다.

냉동어선 시장 보고서에서 다루는 국가는 중국, 일본, 뉴질랜드, 아시아 태평양 지역입니다.

중국은 아시아 태평양 냉동 어선 시장을 지배하고 있습니다. 중국은 아시아 태평양 냉동 어선 시장에서 가장 빠르게 성장할 가능성이 높습니다. 중국과 일본과 같은 신흥국의 인프라, 상업 및 산업 개발이 시장 지배력의 원천입니다. 중국은 주요 기업의 높은 제조 및 아웃소싱 제조 용량으로 인해 아시아 태평양 지역을 지배하고 있으며, 이는 이 지역에서 수출로 이어집니다.

보고서의 국가 섹션은 또한 현재 및 미래 시장 추세에 영향을 미치는 개별 시장 영향 요인과 시장 규제의 변화를 제공합니다. 하류 및 상류 가치 사슬 분석, 기술 추세, 포터의 5가지 힘 분석 및 사례 연구와 같은 데이터 포인트는 개별 국가의 시장 시나리오를 예측하는 데 사용되는 몇 가지 포인터입니다. 또한 아시아 태평양 브랜드의 존재 및 가용성과 지역 및 국내 브랜드와의 대규모 또는 희소한 경쟁으로 인해 직면한 과제, 국내 관세 및 무역 경로의 영향이 국가 데이터에 대한 예측 분석을 제공하는 동안 고려됩니다.

경쟁 환경 및 냉동 어선 시장 점유율 분석

냉동 어선 시장 경쟁 구도는 경쟁자에 대한 세부 정보를 제공합니다. 포함된 세부 정보는 회사 개요, 회사 재무, 창출된 수익, 시장 잠재력, 연구 개발 투자, 새로운 시장 이니셔티브, 아시아 태평양 지역 입지, 생산 현장 및 시설, 생산 용량, 회사의 강점과 약점, 제품 출시, 제품 폭과 범위, 응용 분야 우세입니다. 위의 데이터 포인트는 냉동 어선 시장에 대한 회사의 초점과만 관련이 있습니다.

냉동 어선 시장의 주요 기업으로는 Nordic Wildfish, Lerøy Havfisk, Nichols Bros Boat Builders, Master Boat Builders, Inc., Chantier de constructions navales Martinez, Astilleros Armon, Karstensens Skibsværft A/S, Green Yard Kleven, Ulstein Group ASA, HEINEN & HOPMAN, Marefsol BV, Integrated Marine Systems, Inc., MMC FIRST PROCESS AS., Teknotherm, Damen Shipyards Group, Damen Shipyards Group, Wärtsilä, Kongsberg Gruppen ASA, Thoma-Sea Ship Builders, LLC, Rolls-Royce plc, MAURICE, ELLIOTT BAY DESIGN GROUP, Aresa Shipyard 등이 있습니다.

SKU-

세계 최초의 시장 정보 클라우드 보고서에 온라인으로 접속하세요

- 대화형 데이터 분석 대시보드

- 높은 성장 잠재력 기회를 위한 회사 분석 대시보드

- 사용자 정의 및 질의를 위한 리서치 분석가 액세스

- 대화형 대시보드를 통한 경쟁자 분석

- 최신 뉴스, 업데이트 및 추세 분석

- 포괄적인 경쟁자 추적을 위한 벤치마크 분석의 힘 활용

목차

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF ASIA PACIFIC FREEZING FISHING VESSELS MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 PREMIUM INSIGHTS:

2.1 FISHING VESSEL CONSTRUCTION

2.2 OTHER DETAILS REGARDING FISHING VESSEL

2.2.1 FISHING VESSEL AVERAGE OPERATIONAL YEARS

2.2.2 TOTAL NUMBER OF FISHING VESSEL

3 ASIA PACIFIC FREEZING FISHING VESSELS MARKET, BY SYSTEM

3.1 OVERVIEW

3.2 AIR BLAST FREEZING

3.3 PLATE FREEZING

3.3.1 VERTICAL PLATE FREEZING

3.3.2 HORIZONTAL PLATE FREEZING

3.4 BRINE

3.5 IQF (INDIVIDUAL QUICK FROZEN)

4 ASIA PACIFIC FREEZING FISHING VESSELS MARKET, BY TYPE

4.1 OVERVIEW

4.2 COMMERCIAL FISHING VESSELS

4.3 ARTISANAL FISHING VESSELS

4.4 RECREATIONAL FISHING VESSELS

5 ASIA PACIFIC FREEZING FISHING VESSELS MARKET, BY VESSEL LENGTH

5.1 OVERVIEW

5.2 LESS THAN 20 M

5.3 21 M-30 M

5.4 ABOVE 40 M

5.5 31 M-40 M

6 ASIA PACIFIC FREEZING FISHING VESSELS MARKET, BY FREEZING CAPACITY

6.1 OVERVIEW

6.2 50 TONS TO 150 TONS

6.3 150 TONS TO 300 TONS

6.4 LESS THAN 50 TONS

6.5 MORE THAN 300 TONS

7 ASIA PACIFIC FREEZING FISHING VESSELS MARKET, BY REGION

7.1 ASIA-PACIFIC

7.1.1 CHINA

7.1.2 JAPAN

7.1.3 NEW ZEALAND

7.1.4 REST OF ASIA-PACIFIC

8 ASIA PACIFIC FREEZING FISHING VESSELS MARKET, COMPANY LANDSCAPE

8.1 COMPANY SHARE ANALYSIS: ASIA PACIFIC

9 SWOT ANALYSIS

10 COMPANY PROFILE

10.1 ROLLS-ROYCE PLC

10.1.1 COMPANY SNAPSHOT

10.1.2 REVENUE ANALYSIS

10.1.3 COMPANY SHARE ANALYSIS

10.1.4 PRODUCTS PORTFOLIO

10.1.5 RECENT DEVELOPMENTS

10.2 WÄRTSILÄ

10.2.1 COMPANY SNAPSHOT

10.2.2 REVENUE ANALYSIS

10.2.3 COMPANY SAHRE ANALYSIS

10.2.4 PRODUCTS PORTFOLIO

10.2.5 RECENT DEVELOPMENTS

10.3 DAMEN SHIPYARDS GROUP

10.3.1 COMPANY SNAPSHOT

10.3.2 COMPANY SHARE ANALYSIS

10.3.3 PRODUCTS PORTFOLIO

10.3.4 RECENT DEVELOPMENT

10.4 ULSTEIN GROUP ASA

10.4.1 COMPANY SNAPSHOT

10.4.2 COMPANY SHARE ANALYSIS

10.4.3 PRODUCTS PORTFOLIO

10.4.4 RECENT DEVELOPMENTS

10.5 KONGSBERG GRUPPEN ASA

10.5.1 COMPANY SNAPSHOT

10.5.2 REVENUE ANALYSIS

10.5.3 COMPANY SHARE ANALYSIS

10.5.4 PRODUCTS PORTFOLIO

10.5.5 RECENT DEVELOPMENTS

10.6 ARESA SHIPYARD

10.6.1 COMPANY SNAPSHOT

10.6.2 PRODUCTS PORTFOLIO

10.6.3 RECENT DEVELOPMENTS

10.7 ASTILLEROS ARMON

10.7.1 COMPANY SNAPSHOT

10.7.2 PRODUCTS PORTFOLIO

10.7.3 RECENT DEVELOPMENTS

10.8 CHANTIER DE CONSTRUCTIONS NAVALES MARTINEZ

10.8.1 COMPANY SNAPSHOT

10.8.2 PRODUCTS PORTFOLIO

10.8.3 RECENT DEVELOPMENTS

10.9 ELLIOTT BAY DESIGN GROUP

10.9.1 COMPANY SNAPSHOT

10.9.2 PRODUCTS PORTFOLIO

10.9.3 RECENT DEVELOPMENTS

10.1 GREEN YARD KLEVEN

10.10.1 COMPANY SNAPSHOT

10.10.2 SERVICES PORTFOLIO

10.10.3 RECENT DEVELOPMENTS

10.11 HEINEN & HOPMAN

10.11.1 COMPANY SNAPSHOT

10.11.2 PRODUCTS PORTFOLIO

10.11.3 RECENT DEVELOPMENTS

10.12 INTEGRATED MARINE SYSTEMS, INC.

10.12.1 COMPANY SNAPSHOT

10.12.2 PRODUCTS PORTFOLIO

10.12.3 RECENT DEVELOPMENTS

10.13 KARSTENSENS SKIBSVÆRFT A/S

10.13.1 COMPANY SNAPSHOT

10.13.2 PRODUCTS PORTFOLIO

10.13.3 RECENT DEVELOPMENTS

10.14 LERØY HAVFISK

10.14.1 COMPANY SNAPSHOT

10.14.2 PRODUCTS PORTFOLIO

10.14.3 RECENT DEVELOPMENTS

10.15 MAREFSOL B.V.

10.15.1 COMPANY SNAPSHOT

10.15.2 PRODUCTS PORTFOLIO

10.15.3 RECENT DEVELOPMENTS

10.16 MASTER BOAT BUILDERS, INC.

10.16.1 COMPANY SNAPSHOT

10.16.2 PRODUCTS PORTFOLIO

10.16.3 RECENT DEVELOPMENTS

10.17 MAURICE

10.17.1 COMPANY SNAPSHOT

10.17.2 PRODUCTS PORTFOLIO

10.17.3 RECENT DEVELOPMENTS

10.18 MMC FIRST PROCESS AS.

10.18.1 COMPANY SNAPSHOT

10.18.2 PRODUCTS PORTFOLIO

10.18.3 RECENT DEVELOPMENT

10.19 NICHOLS BROS BOAT BUILDERS

10.19.1 COMPANY SNAPSHOT

10.19.2 PRODUCTS PORTFOLIO

10.19.3 RECENT DEVELOPMENTS

10.2 NORDIC WILDFISH

10.20.1 COMPANY SNAPSHOT

10.20.2 PRODUCTS PORTFOLIO

10.20.3 RECENT DEVELOPMENTS

10.21 TEKNOTHERM

10.21.1 COMPANY SNAPSHOT

10.21.2 PRODUCTS PORTFOLIO

10.21.3 RECENT DEVELOPMENTS

10.22 THOMA-SEA SHIP BUILDERS, LLC

10.22.1 COMPANY SNAPSHOT

10.22.2 PRODUCTS PORTFOLIO

10.22.3 RECENT DEVELOPMENTS

11 QUESTIONNAIRE

12 RELATED REPORTS

표 목록

TABLE 1 FISHING VESSEL CONSTRUCTION DETAILS

TABLE 2 FISHING VESSEL AVERAGE OPERATIONAL YEARS WITH RESPECT TO THE TYPE

TABLE 3 FISHING VESSEL OWNERS REQUIRING FREEZING SYSTEMS

TABLE 4 ASIA PACIFIC FREEZING FISHING VESSELS MARKET, BY SYSTEM, 2020-2029 (USD MILLION)

TABLE 5 ASIA PACIFIC AIR BLAST FREEZING IN FREEZING FISHING VESSELS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 6 ASIA PACIFIC PLATE FREEZING IN FREEZING FISHING VESSELS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 7 ASIA PACIFIC PLATE FREEZING IN FREEZING FISHING VESSELS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 8 ASIA PACIFIC BRINE IN FREEZING FISHING VESSELS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 9 ASIA PACIFIC IQF (INDIVIDUAL QUICK FROZEN) IN FREEZING FISHING VESSELS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 10 ASIA PACIFIC FREEZING FISHING VESSELS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 11 ASIA PACIFIC COMMERCIAL FISHING VESSELS IN FREEZING FISHING VESSELS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 12 ASIA PACIFIC ARTISANAL FISHING VESSELS IN FREEZING FISHING VESSELS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 13 ASIA PACIFIC RECREATIONAL FISHING VESSELS IN FREEZING FISHING VESSELS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 14 ASIA PACIFIC FREEZING FISHING VESSELS MARKET, BY VESSEL LENGTH, 2020-2029 (USD MILLION)

TABLE 15 ASIA PACIFIC LESS THAN 20 M IN FREEZING FISHING VESSELS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 16 ASIA PACIFIC 21 M-30 M IN FREEZING FISHING VESSELS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 17 ASIA PACIFIC ABOVE 40 M IN FREEZING FISHING VESSELS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 18 ASIA PACIFIC 31 M-40 M IN FREEZING FISHING VESSELS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 19 ASIA PACIFIC FREEZING FISHING VESSELS MARKET, BY FREEZING CAPACITY, 2020-2029 (USD MILLION)

TABLE 20 ASIA PACIFIC 50 TONS TO 150 TONS IN FREEZING FISHING VESSELS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 21 ASIA PACIFIC 150 TONS TO 300 TONS IN FREEZING FISHING VESSELS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 22 ASIA PACIFIC LESS THAN 50 TONS IN FREEZING FISHING VESSELS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 23 ASIA PACIFIC MORE THAN 300 TONS IN FREEZING FISHING VESSELS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 24 ASIA-PACIFIC FREEZING FISHING VESSELS MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 25 ASIA-PACIFIC FREEZING FISHING VESSELS MARKET, BY SYSTEM, 2020-2029 (USD MILLION)

TABLE 26 ASIA-PACIFIC PLATE FREEZING IN FREEZING FISHING VESSELS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 27 ASIA-PACIFIC FREEZING FISHING VESSELS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 28 ASIA-PACIFIC FREEZING FISHING VESSELS MARKET, BY VESSEL LENGTH, 2020-2029 (USD MILLION)

TABLE 29 ASIA-PACIFIC FREEZING FISHING VESSELS MARKET, BY FREEZING CAPACITY, 2020-2029 (USD MILLION)

TABLE 30 CHINA FREEZING FISHING VESSELS MARKET, BY SYSTEM, 2020-2029 (USD MILLION)

TABLE 31 CHINA PLATE FREEZING IN FREEZING FISHING VESSELS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 32 CHINA FREEZING FISHING VESSELS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 33 CHINA FREEZING FISHING VESSELS MARKET, BY VESSEL LENGTH, 2020-2029 (USD MILLION)

TABLE 34 CHINA FREEZING FISHING VESSELS MARKET, BY FREEZING CAPACITY, 2020-2029 (USD MILLION)

TABLE 35 JAPAN FREEZING FISHING VESSELS MARKET, BY SYSTEM, 2020-2029 (USD MILLION)

TABLE 36 JAPAN PLATE FREEZING IN FREEZING FISHING VESSELS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 37 JAPAN FREEZING FISHING VESSELS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 38 JAPAN FREEZING FISHING VESSELS MARKET, BY VESSEL LENGTH, 2020-2029 (USD MILLION)

TABLE 39 JAPAN FREEZING FISHING VESSELS MARKET, BY FREEZING CAPACITY, 2020-2029 (USD MILLION)

TABLE 40 NEW ZEALAND FREEZING FISHING VESSELS MARKET, BY SYSTEM, 2020-2029 (USD MILLION)

TABLE 41 NEW ZEALAND PLATE FREEZING IN FREEZING FISHING VESSELS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 42 NEW ZEALAND FREEZING FISHING VESSELS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 43 NEW ZEALAND FREEZING FISHING VESSELS MARKET, BY VESSEL LENGTH, 2020-2029 (USD MILLION)

TABLE 44 NEW ZEALAND FREEZING FISHING VESSELS MARKET, BY FREEZING CAPACITY, 2020-2029 (USD MILLION)

TABLE 45 REST OF ASIA-PACIFIC FREEZING FISHING VESSELS MARKET, BY SYSTEM, 2020-2029 (USD MILLION)

그림 목록

FIGURE 1 ASIA PACIFIC FREEZING FISHING VESSELS MARKET: BY SYSTEM, 2021

FIGURE 2 ASIA PACIFIC FREEZING FISHING VESSELS MARKET: BY TYPE, 2021

FIGURE 3 ASIA PACIFIC FREEZING FISHING VESSELS MARKET: BY VESSEL LENGTH, 2021

FIGURE 4 ASIA PACIFIC FREEZING FISHING VESSELS MARKET: BY FREEZING CAPACITY, 2021

FIGURE 5 ASIA-PACIFIC FREEZING FISHING VESSELS MARKET: SNAPSHOT (2021)

FIGURE 6 ASIA-PACIFIC FREEZING FISHING VESSELS MARKET: BY COUNTRY (2021)

FIGURE 7 ASIA-PACIFIC FREEZING FISHING VESSELS MARKET: BY COUNTRY (2022 & 2029)

FIGURE 8 ASIA-PACIFIC FREEZING FISHING VESSELS MARKET: BY COUNTRY (2021 & 2029)

FIGURE 9 ASIA-PACIFIC FREEZING FISHING VESSELS MARKET: BY SYSTEM (2022-2029)

FIGURE 10 ASIA PACIFIC FREEZING FISHING VESSELS MARKET: COMPANY SHARE 2021 (%)

연구 방법론

데이터 수집 및 기준 연도 분석은 대규모 샘플 크기의 데이터 수집 모듈을 사용하여 수행됩니다. 이 단계에는 다양한 소스와 전략을 통해 시장 정보 또는 관련 데이터를 얻는 것이 포함됩니다. 여기에는 과거에 수집한 모든 데이터를 미리 검토하고 계획하는 것이 포함됩니다. 또한 다양한 정보 소스에서 발견되는 정보 불일치를 검토하는 것도 포함됩니다. 시장 데이터는 시장 통계 및 일관된 모델을 사용하여 분석하고 추정합니다. 또한 시장 점유율 분석 및 주요 추세 분석은 시장 보고서의 주요 성공 요인입니다. 자세한 내용은 분석가에게 전화를 요청하거나 문의 사항을 드롭하세요.

DBMR 연구팀에서 사용하는 주요 연구 방법론은 데이터 마이닝, 시장에 대한 데이터 변수의 영향 분석 및 주요(산업 전문가) 검증을 포함하는 데이터 삼각 측량입니다. 데이터 모델에는 공급업체 포지셔닝 그리드, 시장 타임라인 분석, 시장 개요 및 가이드, 회사 포지셔닝 그리드, 특허 분석, 가격 분석, 회사 시장 점유율 분석, 측정 기준, 글로벌 대 지역 및 공급업체 점유율 분석이 포함됩니다. 연구 방법론에 대해 자세히 알아보려면 문의를 통해 업계 전문가에게 문의하세요.

사용자 정의 가능

Data Bridge Market Research는 고급 형성 연구 분야의 선두 주자입니다. 저희는 기존 및 신규 고객에게 목표에 맞는 데이터와 분석을 제공하는 데 자부심을 느낍니다. 보고서는 추가 국가에 대한 시장 이해(국가 목록 요청), 임상 시험 결과 데이터, 문헌 검토, 재생 시장 및 제품 기반 분석을 포함하도록 사용자 정의할 수 있습니다. 기술 기반 분석에서 시장 포트폴리오 전략에 이르기까지 타겟 경쟁업체의 시장 분석을 분석할 수 있습니다. 귀하가 원하는 형식과 데이터 스타일로 필요한 만큼 많은 경쟁자를 추가할 수 있습니다. 저희 분석가 팀은 또한 원시 엑셀 파일 피벗 테이블(팩트북)로 데이터를 제공하거나 보고서에서 사용 가능한 데이터 세트에서 프레젠테이션을 만드는 데 도움을 줄 수 있습니다.