아시아 태평양 식품 알레르겐 및 불내성 테스트 시장, 테스트 유형( 알레르겐 테스트 , 불내성 테스트), 방법(체외, 체내), 최종 사용자(알레르겐 테스트 최종 사용자, 불내성 테스트 최종 사용자)별 - 업계 동향 및 2029년 예측.

시장 분석 및 통찰력

식품 안전과 품질은 식품 제조 및 소매 및 호텔 산업의 주요 관심사입니다. 생산성에 영향을 미칩니다. 식품 알레르기는 알레르겐 수, 감작률, 유병률을 포함하여 전 세계적으로 증가하고 있습니다. 지역 사회에서 식품 알레르기가 있는 개인을 보호하기 위해 식품 알레르기는 적절하게 관리되고 가공 식품에서 테스트되고 적절하게 표시되어야 합니다. 알레르겐 테스트의 존재는 최근 증가했으며 테스트 실험실은 이러한 알레르겐을 감지하는 데 도움이 될 수 있습니다. 식품 알레르겐 실험실의 가장 중요한 기능은 콩, 유제품, 땅콩, 견과류 등과 같은 알레르겐의 존재 여부를 테스트하는 것입니다.

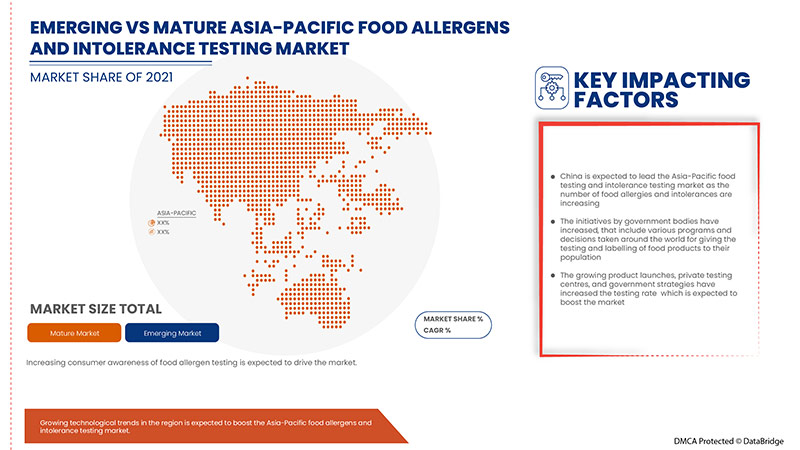

식품 테스트에 대한 수요가 증가하고 있으며, 제조업체는 시장에서 신제품 출시, 프로모션, 시상, 인증 및 이벤트 참여에 참여하고 있습니다. 이러한 결정은 궁극적으로 시장 성장을 강화하고 있습니다.

식품 알레르겐 및 불내증 검사 시장 보고서는 시장 점유율, 새로운 개발 및 국내 및 지역 시장 참여자의 영향에 대한 세부 정보를 제공하고, 새로운 수익 주머니, 시장 규정의 변화, 제품 승인, 전략적 의사 결정, 제품 출시, 지리적 확장 및 시장의 기술 혁신 측면에서 기회를 분석합니다. 분석 및 시장 시나리오를 이해하려면 분석가 브리핑을 위해 저희에게 연락하세요. 저희 팀은 원하는 목표를 달성하기 위한 수익 영향 솔루션을 만드는 데 도움을 드릴 것입니다. 약리학적 치료법을 발명하고 혁신하기 위한 협력, 계약 및 판매 계약 체결과 같은 전략적 이니셔티브는 예측 기간 동안 시장 수요를 촉진한 주요 원동력입니다.

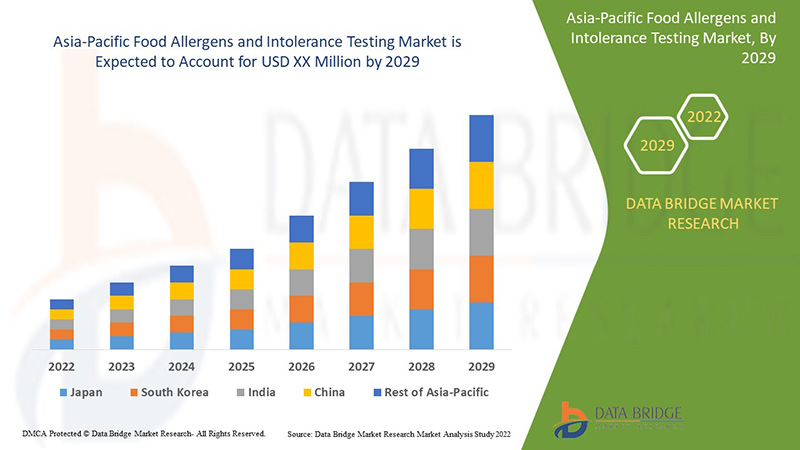

식품 알레르겐 및 불내증 검사 시장은 지지적이며 질병의 진행을 줄이는 것을 목표로 합니다. Data Bridge Market Research는 식품 알레르겐 및 불내증 검사 시장이 2022년에서 2029년까지의 예측 기간 동안 7.1%의 CAGR로 성장할 것이라고 분석합니다.

|

보고서 메트릭 |

세부 |

|

예측 기간 |

2022년부터 2029년까지 |

|

기준 연도 |

2021 |

|

역사적 연도 |

2020 (2019-2014까지 사용자 정의 가능) |

|

양적 단위 |

수익은 백만 달러, 가격은 미화로 표시됨 |

|

다루는 세그먼트 |

테스트 유형별(알레르겐 테스트, 불내성 테스트), 방법별(체외, 체내), 최종 사용자별(알레르겐 테스트 최종 사용자, 불내성 테스트 최종 사용자) |

|

적용 국가 |

일본, 중국, 인도, 한국, 호주, 싱가포르, 말레이시아, 태국, 인도네시아, 필리핀, 베트남, 뉴질랜드, 기타 아시아 태평양 지역 |

|

시장 참여자 포함 |

SGS SA, Agilent Technologies, Inc., NEOGEN Corporation, ALS Limited, Mérieux NutriSciences, Eurofins Scientific, Intertek Group plc, TÜV SÜD, Bureau Veritas, Symbio Laboratories, RJ Hill Laboratories Limited, NSF International, Healthy Stuff Online Limited, QIMA, IFP INSTITUT FÜR PRODUKTQUALITÄT GMBH, ADPEN LABORATORIES, INC., AsureQuality, Microbac Laboratories, Inc, Romer Labs Division Holding GmbH, FOOD SAFETY NET SERVICES, PCAS Labs, Element Materials Technology, OMIC USA Inc. 등이 있습니다. |

시장 정의

식품 알레르기는 특정 음식을 먹은 직후에 발생하는 면역 체계 반응입니다. 알레르기를 유발하는 음식의 아주 작은 양만으로도 소화 문제, 두드러기 또는 기도 부기와 같은 징후와 증상이 유발될 수 있습니다. 어떤 사람들에게는 식품 알레르기가 심각한 증상이나 아나필락시스라고 알려진 생명을 위협하는 반응을 일으킬 수도 있습니다. 반면에 식품 불내증은 사람이 특정 음식을 소화하는 데 어려움이 있을 때 발생합니다. 이는 장내 가스, 복통 또는 설사와 같은 증상으로 이어질 수 있습니다. 식품 알레르겐 및 불내증 검사는 알레르겐을 감지하기 위한 식품 및 식품 내용물의 과학적 분석입니다. 이는 식품의 구조, 구성 및 물리화학적 특성을 포함하여 식품의 다양한 알레르기 성분에 대한 정보를 제공하기 위해 수행됩니다. 식품 제품 검사는 식품의 영양가와 안전성에 대한 정확한 정보를 제공하기 위해 여러 가지 매우 진보된 방법을 사용하여 수행할 수 있습니다.

식품 검사 및 분석은 식품이 소비하기에 안전한지 확인하기 위해 식품 안전에 필수적입니다. 여기에는 식품 검사 실험실 네트워크를 육성하고, 식품 검사의 품질을 보장하고, 인적 자원에 투자하고 감시 활동을 수행하고, 소비자를 교육하는 것이 포함됩니다.

식품 알레르겐 및 불내증 테스트 시장 동향

운전자

- 식품 알레르기 및 불내증의 증가 추세

세계보건기구에 따르면 알레르기는 전 세계 인구의 최대 40%에 영향을 미치며 대도시와 선진국에서 알레르기를 앓는 사람의 비율이 증가하고 있습니다. 만성 질환을 일으킬 수 있으며 일부 식품 알레르기의 경우 치명적일 수 있습니다. 식품 알레르기는 심각한 공중 보건 문제로 떠올랐습니다. 식품 알레르기의 유병률은 성인의 경우 약 2-4%, 어린이의 경우 6-8%로 추산됩니다. 서구 국가에서 도전 진단 식품 알레르기는 최대 10%로 보고되었으며 어린 어린이에게 가장 큰 유병률이 나타났습니다. 개발도상국에서도 유병률이 증가하고 있다는 증거가 늘어나고 있으며 중국과 아프리카에서 도전 진단 식품 알레르기 비율이 서구 국가와 비슷한 것으로 보고되었습니다. 흥미로운 관찰 결과는 서구 환경에서 태어난 동아시아 또는 아프리카계 어린이가 백인 어린이에 비해 식품 알레르기 위험이 더 높다는 것입니다. 이 흥미로운 발견은 게놈-환경 상호작용의 중요성을 강조하고, 이 지역에서 경제 성장이 계속됨에 따라 아시아와 아프리카에서 식품 알레르기가 앞으로 증가할 것으로 예측합니다. 소의 우유와 계란 알레르기는 대부분 국가에서 가장 흔한 식품 알레르기 중 두 가지이지만, 각 국가의 수유 패턴에 따라 결정되는 개별 지리적 지역에서 다양한 식품 알레르기 패턴을 관찰할 수 있습니다. 게다가, 유해한 비독성 반응(과민증)으로 인해 식품 알레르기 유병률이 기하급수적으로 증가하고 있습니다. 식품 알레르기 사례가 증가함에 따라 전 세계 공중 보건 당국은 알레르기 반응과 그에 따른 결과를 억제하기 위한 상당한 조치를 취하게 되었습니다.

- 알레르기 유발 물질에 취약한 다양한 식품으로 인해 테스트가 필요합니다.

유아식품부터 제과 및 제과 , 유제품, 음료, 편의용품, 육류 제품에 이르기까지 모든 식품은 알레르기를 일으킬 수 있으며, 이로 인해 식품 알레르기 검사 시장이 크게 확대되고 있습니다. 게다가 가축 사료의 품질이 좋지 않기 때문에 고기가 사람에게 알레르기를 일으킬 가능성이 항상 있습니다. 식품 및 음료 산업에서 사료의 품질을 개선할 수 있는 가축 사료 첨가제에 대한 수요가 증가하고 있지만, 식품 불내증 검사 시장은 여전히 고기로 인한 알레르기를 개선하는 데 중요한 역할을 합니다.

민감한 소비자에게 식품 알레르기를 일으키는 것으로 확인된 식품은 170종 이상이지만, USDA와 FDA는 2004년 FALCPA(식품 알레르기 표시 및 소비자 보호법)에 따라 8가지 주요 알레르기 식품을 지정했습니다.

기회

- 신흥시장에서의 식품 알레르기 테스트

세계 알레르기 기구(WAO)에 따르면 응급실에서의 아나필락시스는 헝가리, 일본, 중국에서 연간 222건, 300~350건, 3,000건에 달했습니다. 또한 이 기구는 미국, 한국, 호주에서 아나필락시스 유병률을 인구의 2%, 0.1%, 0.6~1%로 추정합니다. 식품의약품안전청(FDA)은 식품 안전을 식품 산업의 필수적인 측면으로 삼았으며, 이는 시장의 원동력으로 작용하고 있습니다. 또한 1990년대 이후 식품 알레르기를 겪는 사람의 수가 눈에 띄게 증가했으며, 이로 인해 유럽, 미국 등의 국가에서 식품 알레르겐 테스트 시장이 더욱 중요한 부문이 되고 있습니다.

제약/도전

개발도상국에서 식품 알레르기(FA)를 적절히 진단하는 데는 많은 장애물이 있습니다. 부모와 의료 종사자가 식품 알레르기에 대한 지식이 부족하다는 증거가 있고, 체외 진단 검사를 쉽게 이용할 수 없기 때문입니다. FA를 조기에 진단하는 것은 예후와 적절한 영양 관리에 중요합니다. 그러나 선진국에서도 비 IgE 매개 우유 알레르기의 증상이 덜 심한 영아의 경우 특히 4개월 진단 지연이 보고되었습니다. 이 상황은 개발도상국에서 더 심할 가능성이 있습니다. Aguilar-Jasso 등은 멕시코 북서부에서 FA 진단이 38개월 지연되는 것을 발견했습니다.

개발도상국의 식품 관리 인프라 및 자원 부족과 샘플링, 테스트, 단백질 식별 중 기술적 어려움이 시장 성장을 방해할 것으로 예상됩니다. 중동 및 아프리카 국가와 기타 저소득 국가는 현재 식품 알레르기 및 불내성 테스트에 대한 인식이 낮아 제한을 받고 있습니다. 정부의 주도권 부족, 경제 침체, 무엇보다도 식품과 관련된 알레르기에 대한 개인의 인식 부족이 시장을 방해할 것입니다.

그러나 각 국가는 다양한 기관에서 규제하는 지침의 제약을 받고 있으며, 이는 식품 알레르기 및 불내증 검사 시장의 성장에 어려움을 겪을 것으로 예상됩니다.

최근 개발 사항

- 2020년 12월, Eurofins Scientific은 포장 식품에서 식품 알레르겐을 감지하는 SENSI Strip Allergen 제품군을 출시했습니다. 이 신제품 출시는 회사가 제품 포트폴리오를 강화하는 데 도움이 되었습니다.

- 2020년 10월, NEOGEN Corporation은 식품 제품을 직접 테스트하기 위한 Reveal 3-D 식품 알레르기 검사의 기능을 확장하기 위해 새로운 식품 추출 방법을 출시했습니다. 새로운 Reveal 3-D 제품은 식품 및 재료 샘플을 빠르게 스크리닝할 수 있습니다. 버퍼는 계란, 코코넛, 헤이즐넛, 콩, 땅콩 및 아몬드 테스트에 사용할 수 있습니다. 이 새로운 제품 출시는 회사가 식품 안전 제품 포트폴리오를 확장하는 데 도움이 되었습니다.

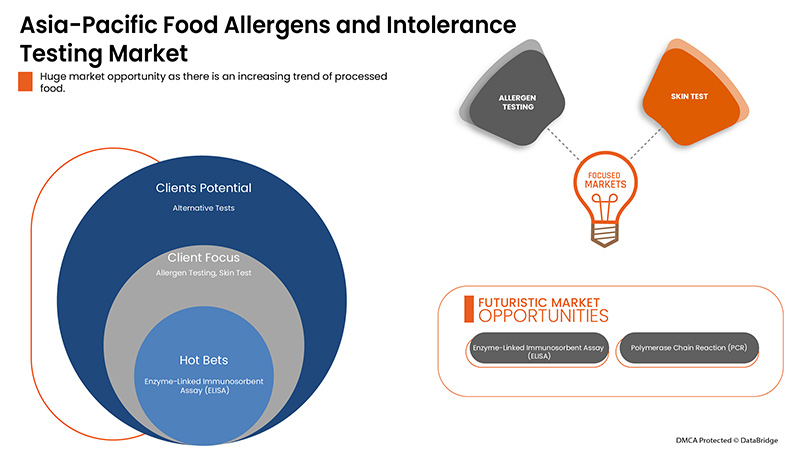

식품 알레르겐 및 불내증 테스트 시장 분열

식품 알레르겐 및 불내증 검사 시장은 검사 유형, 방법 및 최종 사용자를 기준으로 하는 세 가지 주요 세그먼트로 분류됩니다. 세그먼트 간의 성장은 틈새 성장 포켓과 시장에 접근하고 핵심 응용 분야와 타겟 시장의 차이점을 파악하기 위한 전략을 분석하는 데 도움이 됩니다.

알레르겐 유형

- 알레르겐 테스트

- 불내성 테스트

테스트 유형을 기준으로, 식품 알레르기 및 불내성 테스트 시장은 알레르기 테스트와 불내성 테스트로 구분됩니다.

방법

- 시험관내

- 생체 내

방법에 따라 식품 알레르기 및 불내증 테스트 시장은 시험관 내 테스트와 생체 내 테스트로 구분됩니다.

최종 사용자

- 알레르겐 테스트 최종 사용자

- 불내성 테스트 최종 사용자

최종 사용자를 기준으로 식품 알레르기 및 불내증 테스트 시장은 알레르기 테스트 최종 사용자와 불내증 테스트 최종 사용자로 구분됩니다.

식품 알레르겐 및 불내증 테스트 시장 지역 분석/통찰력

식품 알레르기 및 불내증 테스트 시장을 분석하고, 위에 언급된 대로 테스트 유형, 방법 및 최종 사용자별로 시장 규모에 대한 통찰력과 추세를 제공합니다.

식품 알레르기 및 불내증 테스트 시장 보고서에서 다루는 지역은 중국, 일본, 인도, 한국, 싱가포르, 말레이시아, 호주, 태국, 인도네시아, 필리핀, 기타 아시아 태평양 지역입니다.

가공식품 소비 증가 추세로 인해 중국이 아시아 태평양 시장을 장악할 것으로 예상됩니다.

보고서의 국가 섹션은 또한 현재 및 미래 시장 추세에 영향을 미치는 개별 시장 영향 요인과 시장 규제의 변화를 제공합니다. 다운스트림 및 업스트림 가치 사슬 분석, 기술 추세 및 포터의 5가지 힘 분석, 사례 연구와 같은 데이터 포인트는 개별 국가의 시장 시나리오를 예측하는 데 사용되는 몇 가지 포인터입니다. 또한 글로벌 브랜드의 존재 및 가용성과 지역 및 국내 브랜드와의 대규모 또는 희소한 경쟁으로 인해 직면한 과제, 국내 관세 및 무역 경로의 영향은 국가 데이터에 대한 예측 분석을 제공하는 동안 고려됩니다.

경쟁 환경 및 식품 알레르겐 및 불내증 테스트 시장 점유율 분석

식품 알레르겐 및 불내증 검사 시장 경쟁 구도는 경쟁업체의 세부 정보를 제공합니다. 포함된 세부 정보는 회사 개요, 회사 재무, 창출된 수익, 시장 잠재력, 연구 개발 투자, 새로운 시장 이니셔티브, 글로벌 입지, 생산 현장 및 시설, 생산 용량, 회사의 강점과 약점, 제품 출시, 제품 폭과 범위, 응용 분야 우세입니다. 위에 제공된 데이터 포인트는 식품 알레르겐 및 불내증 검사 시장에 대한 회사의 초점과만 관련이 있습니다.

식품 알레르기 및 불내증 검사 시장의 주요 기업으로는 SGS SA, Agilent Technologies, Inc., NEOGEN Corporation, ALS Limited, Mérieux NutriSciences, Eurofins Scientific, Intertek Group plc, TÜV SÜD, Bureau Veritas, Symbio Laboratories, RJ Hill Laboratories Limited, NSF International, Healthy Stuff Online Limited, QIMA, IFP INSTITUT FÜR PRODUKTQUALITÄT GMBH, ADPEN LABORATORIES, INC., AsureQuality, Microbac Laboratories, Inc, Romer Labs Division Holding GmbH, FOOD SAFETY NET SERVICES, PCAS Labs, Element Materials Technology, OMIC USA Inc. 등이 있습니다.

연구 방법론

데이터 수집 및 기준 연도 분석은 대규모 샘플 크기의 데이터 수집 모듈을 사용하여 수행됩니다. 시장 데이터는 시장 통계 및 일관된 모델을 사용하여 분석 및 추정됩니다. 또한 시장 점유율 분석 및 주요 추세 분석은 시장 보고서의 주요 성공 요인입니다. DBMR 연구팀에서 사용하는 주요 연구 방법론은 데이터 마이닝, 시장에 대한 데이터 변수의 영향 분석 및 기본(산업 전문가) 검증을 포함하는 데이터 삼각 측량입니다. 이 외에도 데이터 모델에는 공급업체 포지셔닝 그리드, 시장 타임라인 분석, 시장 개요 및 가이드, 회사 포지셔닝 그리드, 회사 시장 점유율 분석, 측정 표준, 아시아 태평양 대 지역 및 공급업체 점유율 분석이 포함됩니다. 추가 문의 사항이 있는 경우 분석가에게 전화해 달라고 요청하세요.

SKU-

세계 최초의 시장 정보 클라우드 보고서에 온라인으로 접속하세요

- 대화형 데이터 분석 대시보드

- 높은 성장 잠재력 기회를 위한 회사 분석 대시보드

- 사용자 정의 및 질의를 위한 리서치 분석가 액세스

- 대화형 대시보드를 통한 경쟁자 분석

- 최신 뉴스, 업데이트 및 추세 분석

- 포괄적인 경쟁자 추적을 위한 벤치마크 분석의 힘 활용

목차

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF ASIA PACIFIC FOOD ALLERGENS AND INTOLERANCE TESTING MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 TESTING TYPE LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 VENDOR SHARE ANALYSIS

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER’S FIVE FORCES ANALYSIS-

4.1.1 BARGAINING POWER OF CUSTOMERS

4.1.2 BARGAINING POWER OF SUPPLIERS

4.1.3 THE THREAT OF NEW ENTRANTS

4.1.4 THREAT OF SUBSTITUTES

4.1.5 RIVALRY AMONG EXISTING COMPETITORS

4.2 VALUE CHAIN ANALYSIS

4.3 GROWTH STRATEGIES ADOPTED BY KEY MARKET PLAYERS

4.4 TECHNOLOGY INNOVATIONS

4.5 INDUSTRY TRENDS AND FUTURE PERSPECTIVE

4.6 FACTOR INFLUENCING PURCHASING DECISION OF END-USERS

4.6.1 QUALITY OF THE PRODUCTS:

4.6.2 AVAILABILITY OF A VARIETY OF TESTING TYPES:

4.6.3 WIDE USE IN VARIOUS INDUSTRIES:

4.7 UPCOMING TESTING TECHNOLOGIES

5 REGULATORY FRAMEWORK

5.1 ASIA PACIFIC FOOD SAFETY INITIATIVE

5.2 INTERNATIONAL BODY FOR FOOD SAFETY STANDARDS AND REGULATIONS

5.3 FEDERAL LEGISLATION

5.3.1 EUROPEAN UNION

5.3.2 THE U.S.

5.3.3 CANADA

5.3.4 AUSTRALIA

5.4 FDA FOOD SAFETY MODERNIZATION ACT

5.5 FOOD SAFETY ON TRACEABILITY SYSTEMS AND FOOD DIAGNOSTICS

5.6 THE TOXIC SUBSTANCES CONTROL ACT OF 1976

5.7 REGULATORY IMPOSITIONS ON GM LABELING

5.8 RAPID ALERT SYSTEM FOR FOOD AND FEED (RASFF) TO REPORT FOOD SAFETY ISSUES

5.9 OTHERS

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 INCREASING PREVALENCE OF FOOD ALLERGIES AND INTOLERANCE

6.1.2 INCREASED HEALTH CARE EXPENDITURE WORLDWIDE

6.1.3 A VARIETY OF FOODS SUSCEPTIBLE TO ALLERGENS CREATES A NEED FOR TESTING

6.1.4 GROWING AWARENESS OF FOOD ALLERGENS

6.1.5 LABELING COMPLIANCE IN SEVERAL FOOD INDUSTRIES

6.2 RESTRAINTS

6.2.1 UNAVAILABILITY OF FOOD CONTROL INFRASTRUCTURE & RESOURCES

6.2.2 LACK OF AWARENESS ABOUT LABELLING REGULATION

6.2.3 HIGH COST OF TREATMENT

6.3 OPPORTUNITIES

6.3.1 FOOD ALLERGEN TESTING IN EMERGING MARKETS

6.3.2 USE OF HEALTH IN ALLERGY DIAGNOSIS

6.4 CHALLENGES

6.4.1 DIAGNOSTIC CHALLENGES IN DEVELOPING WORLD

6.4.2 LACK OF STANDARDIZATION IN ALLERGEN TESTING PRACTICES

7 POST COVID-19 IMPACT ON FOOD ALLERGENS AND INTOLERANCE TESTING MARKET

8 ASIA PACIFIC FOOD ALLERGEN AND INTOLERANCE TESTING MARKET, BY TESTING TYPE

8.1 OVERVIEW

8.2 ALLERGEN TESTING

8.3 INTOLERANCE TESTING

9 ASIA PACIFIC FOOD ALLERGEN AND INTOLERANCE TESTING MARKET, BY METHOD

9.1 OVERVIEW

9.2 IN-VITRO

9.3 IN-VIVO

10 ASIA PACIFIC FOOD ALLERGEN AND INTOLERANCE TESTING MARKET, BY END USER

10.1 OVERVIEW

10.2 ALLERGEN TESTING END USER

10.3 INTOLERANCE TESTING END USER

11 ASIA PACIFIC FOOD ALLERGENS AND INTOLERANCE TESTING MARKET, BY REGION

11.1 ASIA-PACIFIC

11.1.1 CHINA

11.1.2 JAPAN

11.1.3 AUSTRALIA

11.1.4 INDIA

11.1.5 SOUTH KOREA

11.1.6 MALAYSIA

11.1.7 SINGAPORE

11.1.8 INDONESIA

11.1.9 THAILAND

11.1.10 NEW ZEALAND

11.1.11 PHILIPPINES

11.1.12 VIETNAM

11.1.13 REST OF ASIA-PACIFIC

12 ASIA PACIFIC INHERITED RETINAL DISEASES MARKET: COMPANY LANDSCAPE

12.1 COMPANY SHARE ANALYSIS: ASIA PACIFIC

13 SWOT

14 COMPANY PROFILE

14.1 EUROFINS SCIENTIFIC

14.1.1 COMPANY SNAPSHOT

14.1.2 REVENUE ANALYSIS

14.1.3 COMPANY SHARE ANALYSIS

14.1.4 SERVICE PORTFOLIO

14.1.5 RECENT DEVELOPMENTS

14.1.5.1 ACQUISITION

14.1.5.2 LAUNCH

14.2 SGS SA

14.2.1 COMPANY SNAPSHOT

14.2.2 REVENUE ANALYSIS

14.2.3 COMPANY SHARE ANALYSIS

14.2.4 SERVICES PORTFOLIO

14.2.5 RECENT DEVELOPMENTS

14.2.5.1 BUISNESS EXPANSION

14.2.5.2 ACQUISITION

14.3 BUREAU VERITAS

14.3.1 COMPANY SNAPSHOT

14.3.2 REVENUE ANALYSIS

14.3.3 COMPANY SHARE ANALYSIS

14.3.4 SERVICE PORTFOLIO

14.3.5 RECENT DEVELOPMENTS

14.3.5.1 AGREEMENTS

14.3.5.2 AWARD

14.4 TÜV SÜD

14.4.1 COMPANY SNAPSHOT

14.4.2 COMPANY SHARE ANALYSIS

14.4.3 SERVICE PORTFOLIO

14.4.4 RECENT DEVELOPMENTS

14.4.4.1 EVENT

14.4.4.2 PATNERSHIP

14.5 ALS LIMITED

14.5.1 COMPANY SNAPSHOT

14.5.2 REVENUE ANALYSIS

14.5.3 COMPANY SHARE ANALYSIS

14.5.4 SERVICE PORTFOLIO

14.5.5 RECENT DEVELOPMENTS

14.5.5.1 ACQUISITION

14.5.5.2 AWARDS

14.6 NEOGEN CORPORATION

14.6.1 COMPANY SNAPSHOT

14.6.2 REVENUE ANALYSIS

14.6.3 SERVICE PORTFOLIO

14.6.4 RECENT DEVELOPMENS

14.6.4.1 PRODUCT DEVELOPMENTS

14.6.4.2 AGREEMENT

14.7 INTERTEK GROUP PLC

14.7.1 COMPANY SNAPSHOT

14.7.2 REVENUE ANALYSIS

14.7.3 SERVICE PORTFOLIO

14.7.4 RECENT DEVELOPMENTS

14.7.4.1 AWARD

14.7.5 ACQUISITION

14.8 ROMER LABS DIVISION HOLDING GMBH

14.8.1 COMPANY SNAPSHOT

14.8.2 PRODUCT PORTFOLIO

14.8.3 RECENT DEVELOPMENT

14.9 QIMA

14.9.1 COMPANY SNAPSHOT

14.9.2 SERVICES PORTFOLIO

14.9.3 RECENT DEVELOPMENTS

14.1 MÉRIEUX NUTRISCIENCES

14.10.1 COMPANY SNAPSHOT

14.10.2 SERVICES PORTFOLIO

14.10.3 RECENT DEVELOPMENTS

14.11 MICROBAC LABORATORIES, INC.

14.11.1 COMPANY SNAPSHOT

14.11.2 PRODUCT PORTFOLIO

14.11.3 RECENT DEVELOPMENT

14.12 FOOD SAFETY NET SERVICES

14.12.1 COMPANY SNAPSHOT

14.12.2 SERVICES PORTFOLIO

14.12.3 RECENT DEVELOPMENTS

14.13 ADPEN LABORATORIES, INC.

14.13.1 COMPANY SNAPSHOT

14.13.2 SERVICES PORTFOLIO

14.13.3 RECENT DEVELOPMENT

14.14 ASUREQUALITY

14.14.1 COMPANY SNAPSHOT

14.14.2 SERVICES PORTFOLIO

14.14.3 RECENT DEVELOPMENT

14.15 ELEMENT MATERIALS TECHNOLOGY

14.15.1 COMPANY SNAPSHOT

14.15.2 PRODUCT PORTFOLIO

14.15.3 RECENT DEVELOPMENT

14.16 HEALTHY STUFF ONLINE LIMITED

14.16.1 COMPANY SNAPSHOT

14.16.2 SERVICE PORTFOLIO

14.16.3 RECENT DEVELOPMENTS

14.17 IFP INSTITUT FÜR PRODUKTQUALITÄT GMBH

14.17.1 COMPANY SNAPSHOT

14.17.2 SERVICES PORTFOLIO

14.17.3 RECENT DEVELOPMENTS

14.18 NSF INTERNATIONAL

14.18.1 COMPANY SNAPSHOT

14.18.2 SERVICE PORTFOLIO

14.18.3 RECENT DEVELOPMENT

14.18.3.1 RELOCATION

14.19 OMIC USA INC.

14.19.1 COMPANY SNAPSHOT

14.19.2 SERVICE PORTFOLIO

14.19.3 RECENT DEVELOPMENT

14.2 PCAS LABS

14.20.1 COMPANY SNAPSHOT

14.20.2 SERVICES PORTFOLIO

14.20.3 RECENT DEVELOPMENT

14.21 R J HILL LABORATORIES LIMITED

14.21.1 COMPANY SNAPSHOT

14.21.2 SERVICE PORTFOLIO

14.21.3 RECENT DEVELOPMENTS

14.21.3.1 LAUNCH

14.22 SYMBIO LABORATORIES

14.22.1 COMPANY SNAPSHOT

14.22.2 PRODUCT PORTFOLIO

14.22.3 RECENT DEVELOPMENTS

14.22.3.1 EXPANSION

14.22.3.2 ACQUISITION

15 QUESTIONNAIRE

16 RELATED REPORTS

그림 목록

FIGURE 1 ASIA PACIFIC FOOD ALLERGENS AND INTOLERANCE TESTING MARKET: SEGMENTATION

FIGURE 2 ASIA PACIFIC FOOD ALLERGENS AND INTOLERANCE TESTING MARKET: DATA TRIANGULATION

FIGURE 3 ASIA PACIFIC FOOD ALLERGENS AND INTOLERANCE TESTING MARKET: DROC ANALYSIS

FIGURE 4 ASIA PACIFIC FOOD ALLERGENS AND INTOLERANCE TESTING MARKET: REGIONAL VS COUNTRY MARKET ANALYSIS

FIGURE 5 ASIA PACIFIC FOOD ALLERGENS AND INTOLERANCE TESTING MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 ASIA PACIFIC FOOD ALLERGENS AND INTOLERANCE TESTING MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 ASIA PACIFIC FOOD ALLERGENS AND INTOLERANCE TESTING MARKET: DBMR MARKET POSITION GRID

FIGURE 8 ASIA PACIFIC FOOD ALLERGENS AND INTOLERANCE TESTING MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 9 ASIA PACIFIC FOOD ALLERGENS AND INTOLERANCE TESTING MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 ASIA PACIFIC FOOD ALLERGENS AND INTOLERANCE TESTING MARKET: SEGMENTATION

FIGURE 11 EUROPE IS EXPECTED TO DOMINATE THE ASIA PACIFIC FOOD ALLERGENS AND INTOLERANCE TESTING MARKET AND IS GROWING WITH THE HIGHEST CAGR IN THE FORECAST PERIOD

FIGURE 12 INCREASING CASES OF FOOD ALLERGIES ARE EXPECTED TO DRIVE THE ASIA PACIFIC FOOD ALLERGENS AND INTOLERANCE TESTING MARKET IN THE FORECAST PERIOD

FIGURE 13 ALLERGEN TESTING IN TESTING TYPE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE ASIA PACIFIC FOOD ALLERGENS AND INTOLERANCE TESTING MARKET IN 2022 & 2029

FIGURE 14 VALUE CHAIN OF ASIA PACIFIC FOOD ALLERGENS AND INTOLERANCE TESTING MARKET

FIGURE 15 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF ASIA PACIFIC FOOD ALLERGENS AND INTOLERANCE TESTING MARKET

FIGURE 16 SELF-REPORTED PREVALENCE OF FOOD ALLERGY IN THE UNITED STATES

FIGURE 17 ASIA PACIFIC FOOD ALLERGEN AND INTOLERANCE TESTING MARKET: BY TESTING TYPE, 2021

FIGURE 18 ASIA PACIFIC FOOD ALLERGEN AND INTOLERANCE TESTING MARKET: BY TESTING TYPE, 2022-2029 (USD MILLION)

FIGURE 19 ASIA PACIFIC FOOD ALLERGEN AND INTOLERANCE TESTING MARKET: BY TESTING TYPE, CAGR (2022-2029)

FIGURE 20 ASIA PACIFIC FOOD ALLERGEN AND INTOLERANCE TESTING MARKET: BY TESTING TYPE, LIFELINE CURVE

FIGURE 21 ASIA PACIFIC FOOD ALLERGEN AND INTOLERANCE TESTING MARKET: BY METHOD, 2021

FIGURE 22 ASIA PACIFIC FOOD ALLERGEN AND INTOLERANCE TESTING MARKET: BY METHOD, 2022-2029 (USD MILLION)

FIGURE 23 ASIA PACIFIC FOOD ALLERGEN AND INTOLERANCE TESTING MARKET: BY METHOD, CAGR (2022-2029)

FIGURE 24 ASIA PACIFIC FOOD ALLERGEN AND INTOLERANCE TESTING MARKET: BY METHOD, LIFELINE CURVE

FIGURE 25 ASIA PACIFIC FOOD ALLERGEN AND INTOLERANCE TESTING MARKET: BY END USER, 2021

FIGURE 26 ASIA PACIFIC FOOD ALLERGEN AND INTOLERANCE TESTING MARKET: BY END USER, 2022-2029 (USD MILLION)

FIGURE 27 ASIA PACIFIC FOOD ALLERGEN AND INTOLERANCE TESTING MARKET: BY END USER, CAGR (2022-2029)

FIGURE 28 ASIA PACIFIC FOOD ALLERGEN AND INTOLERANCE TESTING MARKET: BY END USER, LIFELINE CURVE

FIGURE 29 ASIA-PACIFIC FOOD ALLERGENS AND INTOLERANCE TESTING MARKET: SNAPSHOT (2021)

FIGURE 30 ASIA-PACIFIC FOOD ALLERGENS AND INTOLERANCE TESTING MARKET: BY COUNTRY (2021)

FIGURE 31 ASIA-PACIFIC FOOD ALLERGENS AND INTOLERANCE TESTING MARKET: BY COUNTRY (2022 & 2029)

FIGURE 32 ASIA-PACIFIC FOOD ALLERGENS AND INTOLERANCE TESTING MARKET: BY COUNTRY (2021 & 2029)

FIGURE 33 ASIA-PACIFIC FOOD ALLERGENS AND INTOLERANCE TESTING MARKET: BY TESTING TYPE (2022-2029)

FIGURE 34 ASIA PACIFIC FOOD ALLERGENS AND INTOLERANCE TESTING MARKET: COMPANY SHARE 2021 (%)

연구 방법론

데이터 수집 및 기준 연도 분석은 대규모 샘플 크기의 데이터 수집 모듈을 사용하여 수행됩니다. 이 단계에는 다양한 소스와 전략을 통해 시장 정보 또는 관련 데이터를 얻는 것이 포함됩니다. 여기에는 과거에 수집한 모든 데이터를 미리 검토하고 계획하는 것이 포함됩니다. 또한 다양한 정보 소스에서 발견되는 정보 불일치를 검토하는 것도 포함됩니다. 시장 데이터는 시장 통계 및 일관된 모델을 사용하여 분석하고 추정합니다. 또한 시장 점유율 분석 및 주요 추세 분석은 시장 보고서의 주요 성공 요인입니다. 자세한 내용은 분석가에게 전화를 요청하거나 문의 사항을 드롭하세요.

DBMR 연구팀에서 사용하는 주요 연구 방법론은 데이터 마이닝, 시장에 대한 데이터 변수의 영향 분석 및 주요(산업 전문가) 검증을 포함하는 데이터 삼각 측량입니다. 데이터 모델에는 공급업체 포지셔닝 그리드, 시장 타임라인 분석, 시장 개요 및 가이드, 회사 포지셔닝 그리드, 특허 분석, 가격 분석, 회사 시장 점유율 분석, 측정 기준, 글로벌 대 지역 및 공급업체 점유율 분석이 포함됩니다. 연구 방법론에 대해 자세히 알아보려면 문의를 통해 업계 전문가에게 문의하세요.

사용자 정의 가능

Data Bridge Market Research는 고급 형성 연구 분야의 선두 주자입니다. 저희는 기존 및 신규 고객에게 목표에 맞는 데이터와 분석을 제공하는 데 자부심을 느낍니다. 보고서는 추가 국가에 대한 시장 이해(국가 목록 요청), 임상 시험 결과 데이터, 문헌 검토, 재생 시장 및 제품 기반 분석을 포함하도록 사용자 정의할 수 있습니다. 기술 기반 분석에서 시장 포트폴리오 전략에 이르기까지 타겟 경쟁업체의 시장 분석을 분석할 수 있습니다. 귀하가 원하는 형식과 데이터 스타일로 필요한 만큼 많은 경쟁자를 추가할 수 있습니다. 저희 분석가 팀은 또한 원시 엑셀 파일 피벗 테이블(팩트북)로 데이터를 제공하거나 보고서에서 사용 가능한 데이터 세트에서 프레젠테이션을 만드는 데 도움을 줄 수 있습니다.