Asia Pacific Food Acidulants Market

시장 규모 (USD 10억)

연평균 성장률 :

%

USD

17,583.40 Million

USD

28,133.40 Million

2021

2029

USD

17,583.40 Million

USD

28,133.40 Million

2021

2029

| 2022 –2029 | |

| USD 17,583.40 Million | |

| USD 28,133.40 Million | |

|

|

|

아시아 태평양 식품 성분(산미제) 시장, 유형별( 구연산 , 젖산, 아세트산, 푸마르산, 타르타르산, 사과산, 글루콘산, 인산 및 염, 석신산, 구연산나트륨, 구연산칼륨, 타닌산, 개미산 및 기타), 형태(건조 및 액상), 기능(pH 조절, 산성 풍미 향상제, 방부제 및 기타), 유통 채널(B2B 및 B2C), 최종 사용자(식품 가공 부문, 식품 서비스 부문, 가정/소매) 산업 동향 및 2029년까지의 예측.

시장 분석 및 통찰력

아시아 태평양 식품 성분 (산미제) 시장은 성장하는 식품 및 음료 산업과 풍미 음료 및 식품에 대한 수요 증가로 인해 상당한 성장을 이루고 있습니다. 와인과 같은 알코올 음료의 산미제에 대한 수요 증가는 아시아 태평양 식품 성분(산미제) 시장의 성장을 촉진합니다. 그러나 산미제와 관련된 엄격한 정부 규제 및 인산과 같은 일부 산미제와 관련된 건강 위험은 예측 기간 동안 산미제 시장의 시장 성장을 제한할 것으로 예상됩니다.

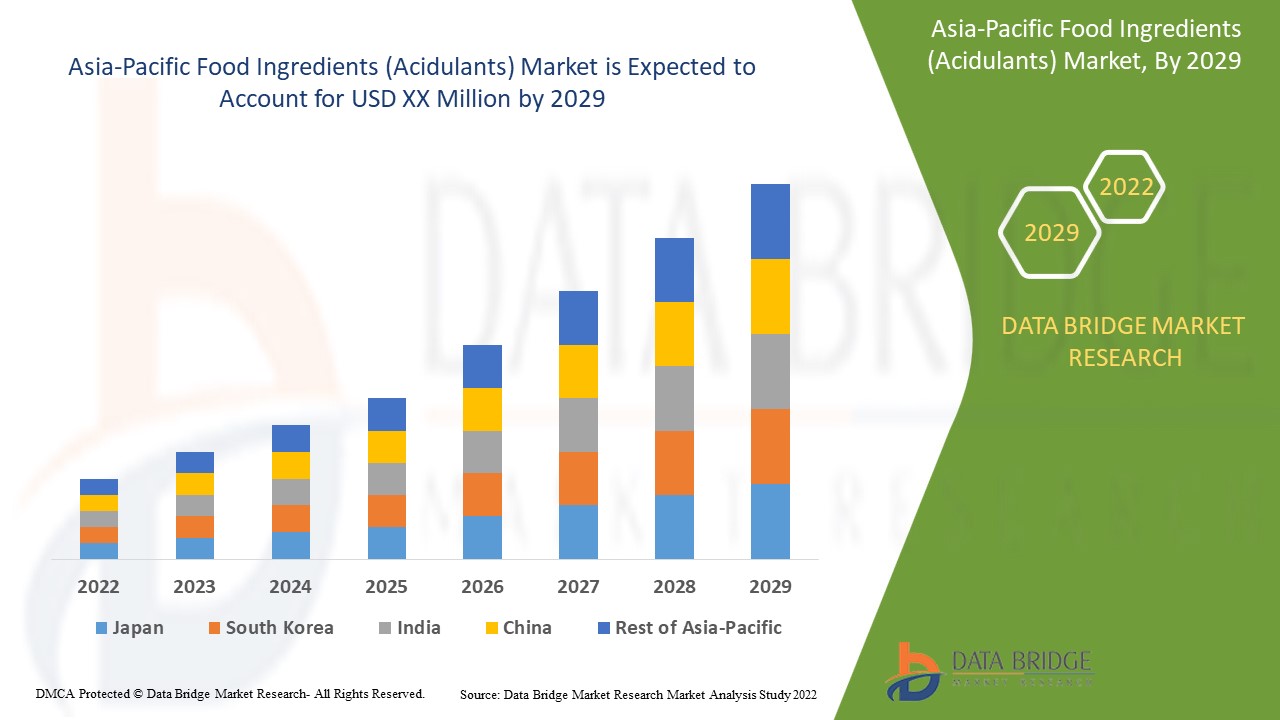

Data Bridge Market Research에 따르면 아시아 태평양 식품 성분(산미제) 시장은 2022년부터 2029년까지의 예측 기간 동안 연평균 성장률 6.1%로 성장할 것으로 예상됩니다.

|

보고서 메트릭 |

세부 |

|

예측 기간 |

2022년부터 2029년까지 |

|

기준 연도 |

2021 |

|

역사적 연도 |

2020 (2019-2014까지 사용자 정의 가능) |

|

양적 단위 |

수익은 백만 달러, 가격은 미화로 표시됨 |

|

다루는 세그먼트 |

유형별(구연산, 젖산, 초산, 푸마르산, 타르타르산, 사과산, 글루콘산, 인산 및 염, 석신산, 구연산나트륨, 구연산칼륨, 탄닌산, 개미산 및 기타), 형태별(건조 및 액상), 기능별(pH 조절, 산성 풍미 증강제, 방부제 및 기타), 유통 채널별(B2B 및 B2C), 최종 사용자별(식품 가공 부문, 식품 서비스 부문 및 가정/소매) |

|

적용 국가 |

중국, 일본, 인도, 한국, 태국, 필리핀, 인도네시아, 싱가포르, 베트남, 말레이시아, 호주, 뉴질랜드 및 기타 아시아 태평양 지역 |

|

시장 참여자 포함 |

Cargill, Incorporated, Brenntag SE, Tate & Lyle, ADM, Foodchem International Corporation, Corbion, Bartek Ingredients Inc., Weifang Ensign Industry Co., Ltd, Chemvera Specialty Chemicals Pvt. Ltd., Hawkins Watts Limited, Richest Group, Suntran.cn, Arshine Pharmaceutical Co., INDUSTRIAL TECNICA PECUARIA, SA, Arihant Chemicals 등 |

시장 정의

산미제는 음식에 신맛, 신맛 또는 산성 맛을 주거나 음식의 단맛을 강화하는 화학 화합물입니다. 산미제는 일부 가공 식품에서 팽창제 및 유화제로도 작용할 수 있습니다. 산미제는 pH를 낮출 수 있지만, 식품 안정성이나 효소를 수정하기 위해 특별히 고안된 식품 첨가물인 산도 조절제와는 다릅니다. 일반적인 산미제는 아세트산(예: 피클)과 구연산입니다. 콜라와 같은 많은 음료에는 인산이 들어 있습니다. 신맛이 나는 사탕은 종종 사과산으로 제조됩니다. 식품 생산에 사용되는 다른 산미제로는 푸마르산, 타르타르산, 젖산 및 글루콘산이 있습니다.

아시아 태평양 식품 성분(산성제) 시장 동향

운전자

- 편의식품에 대한 수요 증가로 인해 식품 산미제 산업 성장이 촉진될 가능성이 높습니다.

산미제는 편의식품 제조에 사용되는 핵심 성분으로 상쾌한 풍미, 향상된 질감과 신맛, 제품의 맛을 강화합니다. 바쁜 라이프스타일과 소비자의 빵 선호도 변화로 인해 향상된 편의/바로 먹을 수 있는 식품에 대한 수요가 증가함에 따라 식품 가공 제조업체는 수요를 충족하기 위해 식품에 더 많은 산미제를 추가해야 한다고 요구하고 있습니다.

- 신흥 알코올 음료 및 비알코올 음료 응용 분야에서 구연산 및 사과산의 광범위한 사용

대부분의 음료에서 구연산은 산미료로 사용되는 첫 번째 선택입니다. 이것은 특정하고 비교적 온화하거나 약간 날카로운 신맛이며 대부분의 과일 맛에 상쾌한 효과를 줍니다. 또한 사과산은 강한 풍미 향상이 예상되는 경우 주로 구연산과 함께 사용됩니다. 이러한 산미료 외에도 인산과 석신산도 음료 응용 분야에 사용됩니다. 인산은 주로 콜라와 같은 탄산 음료에 사용되어 특정 맛 프로필과 pH에 대한 강력한 효과를 제공합니다. 이러한 모든 요소가 아시아 태평양 식품 성분(산미료) 시장의 성장을 촉진할 것으로 예상됩니다.

기회

- 인도, 중국 등 신흥 경제권의 식품 가공 산업이 성장함에 따라 산미제에 대한 수요 증가

식품 가공 산업은 편의식품, 즉석식품, 인스턴트 음료, 가공육 제품, 과자 등에 대한 수요가 증가함에 따라 인도와 중국에서 꾸준히 성장하고 있습니다. 소비자의 바쁜 라이프스타일은 가처분 소득을 늘려 소비자는 더 많은 돈을 쓰고 다양한 풍미의 새롭고 더 나은 식품을 맛보고 싶어합니다.

산미제는 스포츠 음료의 상쾌한 맛, 치즈의 크림 녹는 맛, 젤리와 기타 식품의 젤 같은 질감을 만드는 데 도움이 됩니다. 이로 인해 식품 가공 산업에서 산미제에 대한 수요가 증가하고 산미제 시장에 기회가 생깁니다.

예를 들어,

- Investor Portal에 따르면 2021년 인도 식품 가공 산업의 총 부가가치는 2016~2021년 5년 동안 17,583.40백만 달러에서 28,133.40백만 달러로 증가했습니다.

제약/도전

- 인산염 기반 제품의 과도한 사용으로 인해 발생하는 문제

인은 많은 식품에서 자연적으로 발견되며, 인산은 산미제로 사용됩니다. 따라서 대부분의 사람들은 식단에서 충분한 인을 섭취합니다. 정상적인 신체 기능에 필요한 인의 권장 일일 섭취량(RDA)은 700mg입니다. 천연 식품 공급원에서 쉽게 얻을 수 있습니다. 단백질이 풍부한 식품(예: 고기, 콩, 계란, 닭고기, 생선)은 일반적으로 인이 높습니다. 즉, 가공 식품과 소다에서 나오는 추가 인산은 신체에 필요한 것보다 많다는 것을 의미합니다.

그러나 사람들이 건강에 해롭고 보존식 식품을 더 많이 섭취함에 따라 정상 수준보다 인산 섭취량이 늘어나고 있습니다.

예를 들어,

소다 한 잔에는 최대 500mg의 인산이 들어있을 수 있습니다.

하루에 4,000mg의 인을 섭취하는 사람들은 인과 관련된 부정적인 건강 영향에 대한 위험이 높은 것으로 간주됩니다.

이 아시아 태평양 식품 성분(산미제) 시장 보고서는 최근의 새로운 개발, 무역 규정, 수출입 분석, 생산 분석, 가치 사슬 최적화, 시장 점유율, 국내 및 지역 시장 참여자의 영향, 새로운 수익 창출처, 시장 규정의 변화, 전략적 시장 성장 분석, 시장 규모, 범주 시장 성장, 응용 분야 틈새 시장 및 지배력, 제품 승인, 제품 출시, 지리적 확장, 시장의 기술 혁신에 대한 분석 기회를 제공합니다. 아시아 태평양 식품 성분(산미제) 시장에 대한 자세한 정보를 얻으려면 Data Bridge Market Research에 연락하여 분석가 브리핑을 받으세요. 저희 팀은 시장 성장을 달성하기 위한 정보에 입각한 시장 결정을 내리는 데 도움을 드릴 것입니다.

COVID-19 이후 아시아 태평양 식품 성분(산미제) 시장 에 미치는 영향

팬데믹 이후, 이동에 대한 제한이 더 이상 없기 때문에 산미제에 대한 수요가 증가했고, 따라서 제품 공급이 쉬울 것입니다. 또한, 특히 젊은 세대 사이에서 새로운 요리와 청량 음료, 콤부차, 케피어, 워터 케피어, 테파체, 보자와 같은 발효 음료를 시도하는 추세가 커지면서 시장 성장이 촉진될 것입니다.

발효 음료에 대한 수요가 증가함에 따라 제조업체는 혁신적이고 풍미가 있는 발효 음료를 출시할 수 있게 되었고, 그에 따라 궁극적으로 산미제에 대한 수요가 늘어나 시장이 성장하는 데 도움이 되었습니다.

최근 개발

- 2022년 3월, Brenntag SE는 자회사인 Biochem Trading과 함께 이스라엘 특수 화학 제품 유통업체 YS Ashkenazi Agencies Ltd를 인수했습니다. 이 인수는 Brenntag가 이스라엘 시장에 진출하는 것을 의미합니다. 이 인수는 회사의 호의도를 높일 것입니다.

아시아 태평양 식품 성분(산성제) 시장 범위

아시아 태평양 식품 성분(산미제) 시장은 유형, 형태, 기능, 유통 채널 및 최종 사용자로 세분화됩니다. 이러한 세그먼트 간의 성장은 산업의 빈약한 성장 세그먼트를 분석하고 사용자에게 핵심 시장 응용 프로그램을 식별하기 위한 전략적 결정을 내릴 수 있는 귀중한 시장 개요와 시장 통찰력을 제공하는 데 도움이 됩니다.

유형

- 구연산

- 구연산나트륨

- 칼륨 시트르산

- 아세트산

- 개미산

- 글루콘산

- 푸마르산

- 능금산

- 인산과 염

- 타르타르산

- 유산

- 타닌산

- 석신산

- 기타

아시아 태평양 식품 성분(산미제) 시장은 유형을 기준으로 구연산, 구연산나트륨, 구연산칼륨, 아세트산, 개미산, 글루콘산, 사과산, 인산 및 염, 타르타르산, 젖산, 타닌산, 푸마르산, 석신산 등으로 구분됩니다.

형태

- 마른

- 액체

아시아 태평양 식품 성분(산미제) 시장은 형태에 따라 건조형과 액상으로 구분됩니다.

기능

- pH 조절

- 산성 풍미 강화제

- 방부제

- 기타

기능을 기준으로 볼 때, 아시아 태평양 식품 성분(산미제) 시장은 pH 조절제, 산성 풍미 향상제, 방부제 및 기타로 구분됩니다.

유통 채널

- B2B

- B2C

아시아 태평양 식품 성분(산미제) 시장은 유통 채널을 기준으로 B2B와 B2C로 구분됩니다.

최종 사용자

- 가정/소매

- 식품 가공 부문

- 음식 서비스 부문

최종 사용자를 기준으로 아시아 태평양 식품 성분(산미제) 시장은 가정/소매, 식품 가공 부문, 식품 서비스 부문으로 구분됩니다.

아시아 태평양 식품 성분(산성제) 시장 지역 분석/통찰력

위에 언급된 대로, 아시아 태평양 식품 성분(산미제) 시장을 분석하고, 국가, 유형, 형태, 기능, 최종 사용자 및 유통 채널별로 시장 규모에 대한 통찰력과 추세를 제공합니다.

아시아 태평양 식품 성분(산미제) 시장 보고서에서 다루는 국가로는 중국, 일본, 인도, 한국, 태국, 필리핀, 인도네시아, 싱가포르, 베트남, 말레이시아, 호주, 뉴질랜드, 그리고 나머지 아시아 태평양 지역 국가들이 있습니다.

중국은 시장 점유율과 수익 면에서 아시아 태평양 식품 성분(산미제) 시장을 지배할 것으로 예상되며 예측 기간 동안 지배력을 계속 확대할 것입니다. 이는 라이프스타일의 변화와 시간적 제약으로 인해 특히 가공 식품을 중심으로 식품 및 음료 제품 수요가 급증하고 있기 때문입니다.

보고서의 국가 섹션은 또한 현재 및 미래 시장 추세에 영향을 미치는 개별 시장 영향 요인과 시장 규정의 변화를 제공합니다. 신규 및 교체 판매, 국가 인구 통계, 질병 역학 및 수출입 관세와 같은 데이터 포인트는 개별 국가의 시장 시나리오를 예측하는 데 사용되는 주요 포인터 중 일부입니다. 또한 아시아 태평양 브랜드의 존재 및 가용성과 국내 및 국내 브랜드와의 치열한 경쟁으로 인해 직면한 과제, 판매 채널의 영향이 국가 데이터에 대한 예측 분석을 제공하는 동안 고려됩니다.

경쟁 환경 및 아시아 태평양 식품 성분(산성제) 시장 점유율 분석

아시아 태평양 식품 성분(산미제) 시장 경쟁 구도는 경쟁자에 대한 세부 정보를 제공합니다. 포함된 세부 정보는 회사 개요, 회사 재무, 창출된 수익, 시장 잠재력, 연구 개발 투자, 새로운 시장 이니셔티브, 아시아 태평양 지역 입지, 생산 현장 및 시설, 생산 용량, 회사의 강점과 약점, 제품 출시, 제품 폭과 범위, 응용 분야 우세입니다. 위에 제공된 데이터 포인트는 아시아 태평양 식품 성분(산미제) 시장에 대한 회사의 초점과만 관련이 있습니다.

아시아 태평양 식품 성분(산미제) 시장의 주요 기업으로는 Cargill, Incorporated, Brenntag SE, Tate & Lyle, ADM, Foodchem International Corporation, Corbion, Bartek Ingredients Inc., Weifang Ensign Industry Co., Ltd, Chemvera Specialty Chemicals Pvt. Ltd., Hawkins Watts Limited, Richest Group, Suntran.cn, Arshine Pharmaceutical Co., INDUSTRIAL TECNICA PECUARIA, SA, Arihant Chemicals 등이 있습니다.

연구 방법론

데이터 수집 및 기준 연도 분석은 대규모 샘플 크기의 데이터 수집 모듈을 사용하여 수행됩니다. 시장 데이터는 시장 통계 및 일관된 모델을 사용하여 분석 및 추정됩니다. 또한 시장 점유율 분석 및 주요 추세 분석은 시장 보고서의 주요 성공 요인입니다. DBMR 연구팀에서 사용하는 주요 연구 방법론은 데이터 마이닝, 시장에 대한 데이터 변수의 영향 분석 및 기본(산업 전문가) 검증을 포함하는 데이터 삼각 측량입니다. 이 외에도 데이터 모델에는 공급업체 포지셔닝 그리드, 시장 타임라인 분석, 시장 개요 및 가이드, 회사 포지셔닝 그리드, 회사 시장 점유율 분석, 측정 표준, 아시아 태평양 대 지역 및 공급업체 점유율 분석이 포함됩니다. 추가 문의 사항이 있는 경우 분석가에게 전화를 요청하십시오.

SKU-

세계 최초의 시장 정보 클라우드 보고서에 온라인으로 접속하세요

- 대화형 데이터 분석 대시보드

- 높은 성장 잠재력 기회를 위한 회사 분석 대시보드

- 사용자 정의 및 질의를 위한 리서치 분석가 액세스

- 대화형 대시보드를 통한 경쟁자 분석

- 최신 뉴스, 업데이트 및 추세 분석

- 포괄적인 경쟁자 추적을 위한 벤치마크 분석의 힘 활용

목차

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE ASIA PACIFIC FOOD INGREDIENTS (ACIDULANTS) MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 TYPE LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET END-USER COVERAGE GRID

2.11 VENDOR SHARE ANALYSIS

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 BRAND ANALYSIS

4.2 FACTORS INFLUENCING PURCHASING DECISION

4.2.1 PRICING OF FOOD INGREDIENTS (ACIDULANTS)

4.2.2 QUALITY AND PURITY OF ACIDULANTS

4.2.3 CERTIFIED FOOD INGREDIENTS (ACIDULANTS)

4.3 REGULATORY OR LEGAL RISK COVERAGE

4.4 NEW PRODUCT LAUNCH STRATEGIES

4.5 PATENT ANALYSIS

4.6 RAW MATERIAL ANALYSIS – TOP 10 ACIDULANTS

4.6.1 CITRIC ACID

4.6.2 ACETIC ACID

4.6.3 SODIUM CITRATE

4.6.4 LACTIC ACID

4.6.5 FUMARIC ACID

4.6.6 TARTARIC ACID

4.6.7 MALIC ACID

4.6.8 GLUCONIC ACID

4.6.9 PHOSPHORIC ACID AND SALT

4.7 RISK ANALYSIS (LIQUIDITY) – MAJOR PLAYERS

4.8 RISK ANALYSIS OF ACIDULANTS

4.8.1 CITRIC ACID

4.8.2 SODIUM CITRATE

4.8.3 ACETIC ACID

4.8.4 SUCCINIC ACID

4.8.5 MALIC ACID

4.8.6 TARTARIC ACID

4.8.7 POTASSIUM CITRATE

4.8.8 GLUCONIC ACID

4.8.9 FUMARIC ACID

4.8.10 LACTIC ACID

4.8.11 TANNIC ACID

4.8.12 FORMIC ACID

4.8.13 PHOSPHORIC ACID AND SALTS

4.9 RUSSIA AND UKRAINE WAR IMPACT

4.9.1 COUNTRIES THAT ARE LIKELY TO BE IMPACTED THE MOST –

4.9.2 RISK OF CIVIL UNREST

4.1 SUPPLY CHAIN OF ASIA PACIFIC FOOD INGREDIENTS (ACIDULANTS) MARKET

4.10.1 RAW MATERIAL PROCUREMENT

4.10.2 FOOD INGREDIENT (ACIDULANTS) PRODUCTION/PROCESSING

4.10.3 DISTRIBUTION

4.10.4 END-USERS

4.11 SUPPLIER DEEP DIVE – PART 1

4.12 PORTER'S FIVE FORCES ANALYSIS FOR CITRIC ACID-

4.13 PORTER'S FIVE FORCES ANALYSIS FOR LACTIC ACID-

4.14 PORTER'S FIVE FORCES ANALYSIS FOR ACETIC ACID-

4.15 PORTER'S FIVE FORCES ANALYSIS FOR FUMARIC ACID-

4.16 PORTER'S FIVE FORCES ANALYSIS FOR TARTARIC ACID-

4.17 PORTER'S FIVE FORCES ANALYSIS FOR MALIC ACID-

4.18 PORTER'S FIVE FORCES ANALYSIS FOR GLUCONIC ACID-

4.19 PORTER'S FIVE FORCES ANALYSIS FOR PHOSPHORIC ACID AND SALT-

4.2 PORTER'S FIVE FORCES ANALYSIS FOR SUCCINIC ACID-

4.21 PORTER'S FIVE FORCES ANALYSIS FOR SODIUM CITRATE –

4.22 SUPPLIERS DEEP DIVE – PART 2

4.22.1 PRODUCTION LOCATIONS

4.22.2 SUPPLIER SPECIFIC RISKS/OPPORTUNITIES

4.22.3 MARKETS THEY SELL TO

4.22.4 SUPPLIER SPECIFIC RISKS/OPPORTUNITIES

4.22.5 MARKETS THEY SELL TO

4.22.6 PRODUCTION LOCATIONS

4.23 ADM

4.23.1 PRODUCTION LOCATIONS

4.23.2 SUPPLIER SPECIFIC RISKS/OPPORTUNITIES

4.23.3 MARKETS THEY SELL TO

4.24 CORBION N.V

4.24.1 PRODUCTION LOCATIONS

4.24.2 SUPPLIER SPECIFIC RISKS/OPPORTUNITIES

4.24.3 MARKETS THEY SELL TO

4.25 TATE & LYLE

4.25.1 PRODUCTION LOCATIONS

4.25.2 SUPPLIER SPECIFIC RISKS/OPPORTUNITIES

4.25.3 MARKETS THEY SELL TO

4.26 JUNGBUNZLAUER SUISSE AG

4.26.1 PRODUCTION LOCATIONS

4.26.2 SUPPLIER SPECIFIC RISKS/OPPORTUNITIES

4.26.3 MARKETS THEY SELL TO

4.27 BARTEK INGREDIENTS INC.

4.27.1 PRODUCTION LOCATIONS

4.27.2 SUPPLIER SPECIFIC RISKS/OPPORTUNITIES

4.27.3 MARKETS THEY SELL TO

4.28 DAIRYCHEM

4.28.1 PRODUCTION LOCATIONS

4.28.2 SUPPLIER SPECIFIC RISKS/OPPORTUNITIES

4.28.3 MARKETS THEY SELL TO

4.29 WEIANG ENSIGN INDUSTRY CO.,LTD.

4.29.1 PRODUCTION LOCATIONS

4.29.2 SUPPLIER SPECIFIC RISKS/OPPORTUNITIES

4.29.3 MARKETS THEY SELL TO

4.3 INDUSTRIAL TECNICA PECUARIA, S.A.

4.30.1 PRODUCTION LOCATIONS

4.30.2 SUPPLIER SPECIFIC RISKS/OPPORTUNITIES

4.30.3 MARKETS THEY SELL TO

4.31 PRODUCTION CAPACITY – TOP FIVE PLAYERS

4.32 PRICING ANALYSIS FOR FOOD INGREDIENTS (ACIDULANTS)

4.33 SWOT ANALYSIS – TOP 10 ACIDULANTS

4.33.1 CITRIC ACID –

4.33.2 ACETIC ACID –

4.33.3 SODIUM CITRATE –

4.33.4 SUCCINIC ACID –

4.33.5 LACTIC ACID –

4.33.6 FUMARIC ACID –

4.33.7 TARTARIC ACID –

4.33.8 MALIC ACID –

4.33.9 GLUCONIC ACID –

4.33.10 PHOSPHORIC ACID AND SALTS -

5 REGULATIONS:

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 GROWING DEMAND FOR CONVENIENCE FOOD PRODUCTS IS LIKELY TO FAVOR FOOD ACIDULANTS INDUSTRY GROWTH

6.1.2 WIDE USE OF CITRIC ACID AND MALIC ACID IN EMERGING ALCOHOLIC AS WELL AS NON-ALCOHOLIC BEVERAGE APPLICATIONS

6.1.3 RISE IN DEMAND FOR ACIDULANTS SUCH AS MALIC ACID, LACTIC ACID, AND SODIUM LACTATE IN THE CONFECTIONERY INDUSTRY

6.1.4 GROWING DEMAND FOR INSTANT BEVERAGES, CARBONATED DRINKS, AND FERMENTED DRINKS IS LIKELY TO FAVOR ACIDULANTS MARKET GROWTH

6.2 RESTRAINTS:

6.2.1 RULES AND REGULATION OF FOOD REGULATORY BODIES ON ACIDULANTS PRODUCTS

6.2.2 ISSUES ARISING DUE TO OVER USAGE OF PHOSPHATE-BASED PRODUCTS

6.3 OPPORTUNITIES

6.3.1 INCREASING DEMAND FOR ACIDULANTS FROM THE RISING FOOD PROCESSING INDUSTRY IN EMERGING ECONOMIES SUCH AS INDIA AND CHINA

6.3.2 BIOLOGICAL PRODUCTION OF CITRIC ACID AND ACETIC ACID

6.4 CHALLENGES

6.4.1 GROWING HEALTH CONCERNS REGARDING ACIDULANTS

6.4.2 HIGH PRICES OF ACIDULANTS

7 IMPACT OF COVID-19 ON THE ASIA PACIFIC FOOD INGREDIENTS (ACIDULANTS) MARKET

7.1 IMPACT ON DEMAND AND SUPPLY CHAIN

7.2 IMPACT ON PRICE

7.3 CONCLUSION

8 ASIA PACIFIC FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE

8.1 OVERVIEW

8.2 CITRIC ACID

8.3 LACTIC ACID

8.4 ACETIC ACID

8.5 FUMARIC ACID

8.6 TARTARIC ACID

8.7 MALLIC ACID

8.8 GLUCONIC ACID

8.9 PHOSPHORIC ACID

8.1 SUCCINIC ACID

8.11 SODIUM CITRATE AND SALT

8.12 POTASSIUM CITRATE AND SALT

8.13 TANNIC ACID AND SALT

8.14 FORMIC ACID AND SALT

8.15 OTHERS

9 ASIA PACIFIC FOOD INGREDIENTS (ACIDULANTS) MARKET, BY FORM

9.1 OVERVIEW

9.2 DRY

9.3 LIQUID

10 ASIA PACIFIC FOOD INGREDIENTS (ACIDULANTS) MARKET, BY FUNCTION

10.1 OVERVIEW

10.2 PH CONTROL

10.3 ACIDIC FLAVOR ENHANCER

10.4 PRESERVATIVES

10.5 OTHERS

11 ASIA PACIFIC FOOD INGREDIENTS (ACIDULANTS) MARKET, BY DISTRIBUTION CHANNEL

11.1 OVERVIEW

11.2 B2B

11.2.1 WHOLESALERS

11.2.2 ONLINE

11.3 B2C

11.3.1 SUPERMARKET

11.3.2 ONLINE

11.3.3 HYPERMARKET

11.3.4 DEPARTMENTAL STORES

11.3.5 SPECIALTY STORES

11.3.6 OTHERS

12 ASIA PACIFIC FOOD INGREDIENTS (ACIDULANTS) MARKET, BY END-USER

12.1 OVERVIEW

12.2 FOOD PROCESSING SECTOR

12.2.1 FOOD

12.2.1.1 PROCESSED MEAT PRODUCTS

12.2.1.1.1 POULTRY

12.2.1.1.2 PORK

12.2.1.1.3 BEEF

12.2.1.1.4 OTHERS

12.2.1.2 DAIRY PRODUCTS

12.2.1.2.1 CHEESE

12.2.1.2.2 MILK-POWDER

12.2.1.2.3 ICE CREAM

12.2.1.2.4 SPREADS

12.2.1.2.5 OTHERS

12.2.1.3 CONVENIENCE FOOD

12.2.1.3.1 READY TO EAT PRODUCTS

12.2.1.3.2 SOUPS & SAUCES

12.2.1.3.3 SEASONING & DRESSING

12.2.1.3.4 NOODLES & PASTA

12.2.1.3.5 OTHERS

12.2.1.4 BAKERY

12.2.1.4.1 CAKES & PASTRIES

12.2.1.4.2 BREAD

12.2.1.4.3 BISCUITS & COOKIES

12.2.1.4.4 MUFFINS

12.2.1.4.5 OTHERS

12.2.1.5 CONFECTIONERY

12.2.1.5.1 CHOCOLATE

12.2.1.5.2 GUMS & JELLY

12.2.1.5.3 HARD & SOFT CANDY

12.2.1.5.4 CREAM FILLINGS

12.2.1.5.5 OTHERS

12.2.1.5.6 SEAFOOD PRODUCTS

12.2.1.5.7 PROCESSED FOOD

12.2.1.5.8 SPORTS NUTRITION

12.2.1.5.9 DIETARY SUPPLEMENTS

12.2.1.5.10 INFANT FORMULA

12.2.1.6 BEVERAGES

12.2.1.6.1 NON-ALCOHOLIC BEVERAGES

12.2.1.6.1.1 RTD

12.2.1.6.1.2 FRUIT JUICES

12.2.1.6.1.3 SOFT DRINKS

12.2.1.6.1.4 DAIRY DRINKS

12.2.1.6.1.5 FLAVORED DRINKS

12.2.1.6.1.6 OTHERS

12.2.1.6.1.7 ALCOHOLIC BEVERAGES

12.3 FOOD SERVICE SECTOR

12.3.1 RESTAURANTS

12.3.2 CAFÉS

12.3.3 HOTELS

12.3.4 CANTEEN/CAFETERIA

12.3.5 CLOUD KITCHEN

12.4 HOUSEHOLD/RETAIL

13 ASIA PACIFIC FOOD INGREDIENTS (ACIDULANTS) MARKET, BY REGION

13.1 ASIA-PACIFIC

13.1.1 CHINA

13.1.2 INDIA

13.1.3 JAPAN

13.1.4 SOUTH KOREA

13.1.5 THAILAND

13.1.6 PHILIPPINES

13.1.7 INDONESIA

13.1.8 SINGAPORE

13.1.9 VIETNAM

13.1.10 MALAYSIA

13.1.11 NEW ZEALAND

13.1.12 AUSTRALIA

13.1.13 REST OF ASIA-PACIFIC

14 ASIA PACIFIC FOOD INGREDIENT (ACIDULANTS) MARKET, COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: ASIA PACIFIC

15 COMPANY PROFILE

15.1 CARGILL, INCORPORATED

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 COMPANY SHARE ANALYSIS

15.1.4 PRODUCT PORTFOLIO

15.1.5 RECENT DEVELOPMENTS

15.2 TATE & LYLE

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 COMPANY SHARE ANALYSIS

15.2.4 PRODUCT PORTFOLIO

15.2.5 RECENT DEVELOPMENTS

15.3 ADM

15.3.1 COMPANY SNAPSHOT

15.3.2 REVENUE ANALYSIS

15.3.3 COMPANY SHARE ANALYSIS

15.3.4 PRODUCT PORTFOLIO

15.3.5 RECENT DEVELOPMENTS

15.4 JUNGBUNZLAUER SUISSE AG

15.4.1 COMPANY SNAPSHOT

15.4.2 COMPANY SHARE ANALYSIS

15.4.3 PRODUCT PORTFOLIO

15.4.4 RECENT DEVELOPMENTS

15.5 BRENNTAG SE

15.5.1 COMPANY SNAPSHOT

15.5.2 REVENUE ANALYSIS

15.5.3 COMPANY SHARE ANALYSIS

15.5.4 PRODUCT PORTFOLIO

15.5.5 RECENT DEVELOPMENTS

15.6 ARIHANT CHEMICALS

15.6.1 COMPANY SNAPSHOT

15.6.2 PRODUCT PORTFOLIO

15.6.3 RECENT DEVELOPMENTS

15.7 ARSHINE PHARMACEUTICAL CO.

15.7.1 COMPANY SNAPSHOT

15.7.2 PRODUCT PORTFOLIO

15.7.3 RECENT DEVELOPMENT

15.8 BARTEK INGREDIENTS INC.

15.8.1 COMPANY SNAPSHOT

15.8.2 PRODUCT PORTFOLIO

15.8.3 RECENT DEVELOPMENTS

15.9 CHEMVERA SPECIALTY CHEMICALS PVT. LTD.

15.9.1 COMPANY SNAPSHOT

15.9.2 PRODUCT PORTFOLIO

15.9.3 RECENT DEVELOPMENT

15.1 CORBION

15.10.1 COMPANY SNAPSHOT

15.10.2 REVENUE ANALYSIS

15.10.3 PRODUCT PORTFOLIO

15.10.4 RECENT DEVELOPMENTS

15.11 DAIRYCHEM

15.11.1 COMPANY SNAPSHOT

15.11.2 PRODUCT PORTFOLIO

15.11.3 RECENT DEVELOPMENTS

15.12 DIRECT FOOD INGREDIENTS LTD

15.12.1 COMPANY SNAPSHOT

15.12.2 PRODUCT PORTFOLIO

15.12.3 RECENT DEVELOPMENT

15.13 FBC INDUSTRIES

15.13.1 COMPANY SNAPSHOT

15.13.2 PRODUCT PORTFOLIO

1.13.3 RECENT DEVELOPMENTS 343

15.14 FOODCHEM INTERNATIONAL CORPORATION

15.14.1 COMPANY SNAPSHOT

15.14.2 PRODUCT PORTFOLIO

15.14.3 RECENT DEVELOPMENT

15.15 HAWKINS WATTS LIMITED

15.15.1 COMPANY SNAPSHOT

15.15.2 PRODUCT PORTFOLIO

15.15.3 RECENT DEVELOPMENTS

15.16 INDUSTRIAL TECNICA PECUARIA, S.A.

15.16.1 COMPANY SNAPSHOT

15.16.2 PRODUCT PORTFOLIO

15.16.3 RECENT DEVELOPMENT

15.17 INNOVA CORPORATE

15.17.1 COMPANY SNAPSHOT

15.17.2 PRODUCT PORTFOLIO

15.17.3 RECENT DEVELOPMENTS

15.18 RICHEST GROUP

15.18.1 COMPANY SNAPSHOT

15.18.2 PRODUCT PORTFOLIO

15.18.3 RECENT DEVELOPMENT

15.19 SUNTRAN.CN

15.19.1 COMPANY SNAPSHOT

15.19.2 PRODUCT PORTFOLIO

15.19.3 RECENT DEVELOPMENTS

15.2 WEIFANG ENSIGN INDUSTRY CO.,LTD

15.20.1 COMPANY SNAPSHOT

15.20.2 PRODUCT PORTFOLIO

15.20.3 RECENT DEVELOPMENT

16 QUESTIONNAIRE

17 RELATED REPORTS

표 목록

TABLE 1 REGULATORY OR LEGAL RISK COVERAGE FRAMEWORK

TABLE 2 MICROORGANISMS USED FOR THE PRODUCTION OF CITRIC ACID

TABLE 3 COMPARISON OF CITRIC ACID PRODUCTION FROM THE VARIOUS SUBSTRATES USING Y. LIPOLYTICA STRAINS

TABLE 4 CITRIC ACID APPLICATION IN DIFFERENT FOOD AND BEVERAGES INDUSTRY

TABLE 5 MICROORGANISMS USED TO PRODUCE ACETIC ACID

TABLE 6 ACETIC ACID APPLICATION IN DIFFERENT FOOD AND BEVERAGES INDUSTRY

TABLE 7 MICROORGANISMS USED FOR PRODUCING SODIUM CITRATE

TABLE 8 SODIUM CITRATE APPLICATION IN DIFFERENT FOOD AND BEVERAGES INDUSTRY

TABLE 9 MICROORGANISMS USED FOR BIO-SUCCINIC ACID PRODUCTION

TABLE 10 SUCCINIC ACID APPLICATION IN THE FOOD AND BEVERAGES INDUSTRY

TABLE 11 MICROORGANISMS USED TO PRODUCE LACTIC ACID-

TABLE 12 COMPARISON OF DIFFERENT STRAINS AND SUBSTRATES FOR LACTIC ACID PRODUCTION

TABLE 13 LACTIC ACID APPLICATION IN DIFFERENT FOOD AND BEVERAGES INDUSTRY-

TABLE 14 MICROORGANISMS USED IN THE PRODUCTION OF FUMARIC ACID

TABLE 15 FUMARIC ACID APPLICATION IN DIFFERENT FOOD AND BEVERAGES INDUSTRY-

TABLE 16 TARTARIC ACID APPLICATION IN DIFFERENT FOOD AND BEVERAGES INDUSTRY

TABLE 17 MALIC ACID APPLICATION IN DIFFERENT FOOD AND BEVERAGES INDUSTRY

TABLE 18 APPLICATIONS OF GLUCONIC ACID IN DIFFERENT FOOD AND BEVERAGES INDUSTRY-

TABLE 19 PHOSPHORIC ACID AND SALTS APPLICATION IN DIFFERENT FOOD AND BEVERAGES INDUSTRY

TABLE 20 RAW MATERIAL FOR DIFFERENT FOOD INGREDIENTS (ACIDULANTS)-

TABLE 21 MARKET SHARE OF CITRIC ACID

TABLE 22 MARKET SHARE OF LACTIC ACID

TABLE 23 MARKET SHARE OF FUMARIC ACID

TABLE 24 MARKET SHARE OF TARTARIC ACID

TABLE 25 MARKET SHARE OF MALIC ACID

TABLE 26 CATEGORY AND THEIR FUNCTIONALITY

TABLE 27 ACIDULANTS IN VARIOUS FOOD FUNCTIONALITY

TABLE 28 ACIDULANTS PRODUCTS AND THEIR APPLICATIONS

TABLE 29 ASIA PACIFIC AVERAGE SELLING PRICES OF ACIDULANTS

TABLE 30 THE BELOW TABLE SHOWS THE ACIDULANTS AND THEIR APPLICATIONS IN BEVERAGES

TABLE 31 THE RECOMMENDED DIETARY ALLOWANCE (RDA) FOR PHOSPHORUS IS THE FOLLOWING:

TABLE 32 THE TABLE BELOW SHOWS CITRIC ACID-PRODUCING MICROORGANISMS AND THEIR SPECIES:

TABLE 33 BELOW TABLE SHOWS THE SIDE EFFECTS OF ACIDULANTS:

TABLE 34 ASIA PACIFIC FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 35 ASIA PACIFIC FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (MILLION TONS)

TABLE 36 ASIA PACIFIC CITRIC ACID IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 37 ASIA PACIFIC LACTIC ACID IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 38 ASIA PACIFIC ACETIC ACID IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 39 ASIA PACIFIC FUMARIC ACID IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 40 ASIA PACIFIC TARTARIC ACID IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 41 ASIA PACIFIC MALLIC ACID IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 42 ASIA PACIFIC GLUCONIC ACID IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 43 ASIA PACIFIC PHOSPHORIC ACID IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 44 ASIA PACIFIC SUCCINIC ACID IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 45 ASIA PACIFIC SODIUM CITRATE AND SALT IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 46 ASIA PACIFIC POTASSIUM CITRATE AND SALT IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 47 ASIA PACIFIC TANNIC ACID AND SALT IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 48 ASIA PACIFIC FORMIC ACID AND SALT IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 49 ASIA PACIFIC OTHERS IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 50 ASIA PACIFIC FOOD INGREDIENTS (ACIDULANTS) MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 51 THE TABLE BELOW SHOWS THE FUNCTIONS OF DIFFERENT ACIDULANTS IN SOLID FORM:

TABLE 52 ASIA PACIFIC DRY IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 53 THE BELOW TABLE SHOWS THE FUNCTIONS OF LIQUID ACIDULANTS IN THE FOOD PROCESSING INDUSTRY:

TABLE 54 ASIA PACIFIC LIQUID IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 55 ASIA PACIFIC FOOD INGREDIENTS (ACIDULANTS) MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 56 ASIA PACIFIC PH CONTROL IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 57 ASIA PACIFIC ACIDIC FLAVOR ENHANCER IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 58 ASIA PACIFIC PRESERVATIVES IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 59 ASIA PACIFIC OTHERS IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 60 ASIA PACIFIC FOOD INGREDIENTS (ACIDULANTS) MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 61 ASIA PACIFIC B2B IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 62 ASIA PACIFIC B2B IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 63 ASIA PACIFIC B2C IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 64 ASIA PACIFIC B2C IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 65 ASIA PACIFIC FOOD INGREDIENTS (ACIDULANTS) MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 66 ASIA PACIFIC FOOD PROCESSING SECTOR IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 67 ASIA PACIFIC FOOD PROCESSING SECTOR IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 68 ASIA PACIFIC FOOD IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 69 ASIA PACIFIC PROCESSED MEAT PRODUCTS IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 70 ASIA PACIFIC DAIRY PRODUCTS IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 71 ASIA PACIFIC CONVENIENCE FOOD IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 72 ASIA PACIFIC BAKERY IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 73 ASIA PACIFIC CONFECTIONERY IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 74 ASIA PACIFIC BEVERAGES IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 75 ASIA PACIFIC NON-ALCOHOLIC BEVERAGES IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 76 ASIA PACIFIC FOOD SERVICE SECTOR IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 77 ASIA PACIFIC FOOD SERVICE SECTOR IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 78 ASIA PACIFIC HOUSEHOLD/RETAIL IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 79 ASIA-PACIFIC FOOD INGREDIENTS (ACIDULANTS) MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 80 ASIA-PACIFIC FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 81 ASIA-PACIFIC FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (MILLION TONS)

TABLE 82 ASIA-PACIFIC FOOD INGREDIENTS (ACIDULANTS) MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 83 ASIA-PACIFIC FOOD INGREDIENTS (ACIDULANTS) MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 84 ASIA-PACIFIC FOOD INGREDIENTS (ACIDULANTS) MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 85 ASIA-PACIFIC B2B IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 86 ASIA-PACIFIC B2C IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 87 ASIA-PACIFIC FOOD INGREDIENTS (ACIDULANTS) MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 88 ASIA-PACIFIC FOOD SERVICE SECTOR IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 89 ASIA-PACIFIC FOOD PROCESSING SECTOR IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 90 ASIA-PACIFIC FOOD IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 91 ASIA-PACIFIC DAIRY PRODUCTS IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 92 ASIA-PACIFIC BAKERY IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 93 ASIA-PACIFIC CONVENIENCE FOOD IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 94 ASIA-PACIFIC PROCESSED MEAT PRODUCTS IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 95 ASIA-PACIFIC CONFECTIONERY IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 96 ASIA-PACIFIC BEVERAGES IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 97 ASIA-PACIFIC NON-ALCOHOLIC BEVERAGES IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 98 CHINA FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 99 CHINA FOOD INGREDIENTS (ACIDULANTS) MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 100 CHINA FOOD INGREDIENTS (ACIDULANTS) MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 101 CHINA FOOD INGREDIENTS (ACIDULANTS) MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 102 CHINA B2B IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 103 CHINA B2C IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 104 CHINA FOOD INGREDIENTS (ACIDULANTS) MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 105 CHINA FOOD SERVICE SECTOR IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 106 CHINA FOOD PROCESSING SECTOR IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 107 CHINA FOOD IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 108 CHINA DAIRY PRODUCTS IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 109 CHINA BAKERY IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 110 CHINA CONVENIENCE FOOD IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 111 CHINA PROCESSED MEAT PRODUCTS IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 112 CHINA CONFECTIONERY IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 113 CHINA BEVERAGES IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 114 CHINA NON-ALCOHOLIC BEVERAGES IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 115 INDIA FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 116 INDIA FOOD INGREDIENTS (ACIDULANTS) MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 117 INDIA FOOD INGREDIENTS (ACIDULANTS) MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 118 INDIA FOOD INGREDIENTS (ACIDULANTS) MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 119 INDIA B2B IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 120 INDIA B2C IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 121 INDIA FOOD INGREDIENTS (ACIDULANTS) MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 122 INDIA FOOD SERVICE SECTOR IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 123 INDIA FOOD PROCESSING SECTOR IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 124 INDIA FOOD IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 125 INDIA DAIRY PRODUCTS IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 126 INDIA BAKERY IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 127 INDIA CONVENIENCE FOOD IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 128 INDIA PROCESSED MEAT PRODUCTS IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 129 INDIA CONFECTIONERY IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 130 INDIA BEVERAGES IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 131 INDIA NON-ALCOHOLIC BEVERAGES IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 132 JAPAN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 133 JAPAN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 134 JAPAN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 135 JAPAN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 136 JAPAN B2B IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 137 JAPAN B2C IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 138 JAPAN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 139 JAPAN FOOD SERVICE SECTOR IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 140 JAPAN FOOD PROCESSING SECTOR IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 141 JAPAN FOOD IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 142 JAPAN DAIRY PRODUCTS IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 143 JAPAN BAKERY IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 144 JAPAN CONVENIENCE FOOD IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 145 JAPAN PROCESSED MEAT PRODUCTS IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 146 JAPAN CONFECTIONERY IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 147 JAPAN BEVERAGES IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 148 JAPAN NON-ALCOHOLIC BEVERAGES IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 149 SOUTH KOREA FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 150 SOUTH KOREA FOOD INGREDIENTS (ACIDULANTS) MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 151 SOUTH KOREA FOOD INGREDIENTS (ACIDULANTS) MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 152 SOUTH KOREA FOOD INGREDIENTS (ACIDULANTS) MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 153 SOUTH KOREA B2B IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 154 SOUTH KOREA B2C IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 155 SOUTH KOREA FOOD INGREDIENTS (ACIDULANTS) MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 156 SOUTH KOREA FOOD SERVICE SECTOR IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 157 SOUTH KOREA FOOD PROCESSING SECTOR IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 158 SOUTH KOREA FOOD IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 159 SOUTH KOREA DAIRY PRODUCTS IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 160 SOUTH KOREA BAKERY IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 161 SOUTH KOREA CONVENIENCE FOOD IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 162 SOUTH KOREA PROCESSED MEAT PRODUCTS IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 163 SOUTH KOREA CONFECTIONERY IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 164 SOUTH KOREA BEVERAGES IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 165 SOUTH KOREA NON-ALCOHOLIC BEVERAGES IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 166 THAILAND FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 167 THAILAND FOOD INGREDIENTS (ACIDULANTS) MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 168 THAILAND FOOD INGREDIENTS (ACIDULANTS) MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 169 THAILAND FOOD INGREDIENTS (ACIDULANTS) MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 170 THAILAND B2B IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 171 THAILAND B2C IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 172 THAILAND FOOD INGREDIENTS (ACIDULANTS) MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 173 THAILAND FOOD SERVICE SECTOR IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 174 THAILAND FOOD PROCESSING SECTOR IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 175 THAILAND FOOD IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 176 THAILAND DAIRY PRODUCTS IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 177 THAILAND BAKERY IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 178 THAILAND CONVENIENCE FOOD IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 179 THAILAND PROCESSED MEAT PRODUCTS IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 180 THAILAND CONFECTIONERY IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 181 THAILAND BEVERAGES IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 182 THAILAND NON-ALCOHOLIC BEVERAGES IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 183 PHILIPPINES FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 184 PHILIPPINES FOOD INGREDIENTS (ACIDULANTS) MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 185 PHILIPPINES FOOD INGREDIENTS (ACIDULANTS) MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 186 PHILIPPINES FOOD INGREDIENTS (ACIDULANTS) MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 187 PHILIPPINES B2B IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 188 PHILIPPINES B2C IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 189 PHILIPPINES FOOD INGREDIENTS (ACIDULANTS) MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 190 PHILIPPINES FOOD SERVICE SECTOR IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 191 PHILIPPINES FOOD PROCESSING SECTOR IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 192 PHILIPPINES FOOD IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 193 PHILIPPINES DAIRY PRODUCTS IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 194 PHILIPPINES BAKERY IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 195 PHILIPPINES CONVENIENCE FOOD IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 196 PHILIPPINES PROCESSED MEAT PRODUCTS IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 197 PHILIPPINES CONFECTIONERY IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 198 PHILIPPINES BEVERAGES IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 199 PHILIPPINES NON-ALCOHOLIC BEVERAGES IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 200 INDONESIA FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 201 INDONESIA FOOD INGREDIENTS (ACIDULANTS) MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 202 INDONESIA FOOD INGREDIENTS (ACIDULANTS) MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 203 INDONESIA FOOD INGREDIENTS (ACIDULANTS) MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 204 INDONESIA B2B IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 205 INDONESIA B2C IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 206 INDONESIA FOOD INGREDIENTS (ACIDULANTS) MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 207 INDONESIA FOOD SERVICE SECTOR IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 208 INDONESIA FOOD PROCESSING SECTOR IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 209 INDONESIA FOOD IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 210 INDONESIA DAIRY PRODUCTS IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 211 INDONESIA BAKERY IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 212 INDONESIA CONVENIENCE FOOD IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 213 INDONESIA PROCESSED MEAT PRODUCTS IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 214 INDONESIA CONFECTIONERY IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 215 INDONESIA BEVERAGES IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 216 INDONESIA NON-ALCOHOLIC BEVERAGES IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 217 SINGAPORE FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 218 SINGAPORE FOOD INGREDIENTS (ACIDULANTS) MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 219 SINGAPORE FOOD INGREDIENTS (ACIDULANTS) MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 220 SINGAPORE FOOD INGREDIENTS (ACIDULANTS) MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 221 SINGAPORE B2B IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 222 SINGAPORE B2C IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 223 SINGAPORE FOOD INGREDIENTS (ACIDULANTS) MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 224 SINGAPORE FOOD SERVICE SECTOR IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 225 SINGAPORE FOOD PROCESSING SECTOR IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 226 SINGAPORE FOOD IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 227 SINGAPORE DAIRY PRODUCTS IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 228 SINGAPORE BAKERY IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 229 SINGAPORE CONVENIENCE FOOD IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 230 SINGAPORE PROCESSED MEAT PRODUCTS IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 231 SINGAPORE CONFECTIONERY IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 232 SINGAPORE BEVERAGES IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 233 SINGAPORE NON-ALCOHOLIC BEVERAGES IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 234 VIETNAM FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 235 VIETNAM FOOD INGREDIENTS (ACIDULANTS) MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 236 VIETNAM FOOD INGREDIENTS (ACIDULANTS) MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 237 VIETNAM FOOD INGREDIENTS (ACIDULANTS) MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 238 VIETNAM B2B IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 239 VIETNAM B2C IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 240 VIETNAM FOOD INGREDIENTS (ACIDULANTS) MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 241 VIETNAM FOOD SERVICE SECTOR IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 242 VIETNAM FOOD PROCESSING SECTOR IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 243 VIETNAM FOOD IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 244 VIETNAM DAIRY PRODUCTS IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 245 VIETNAM BAKERY IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 246 VIETNAM CONVENIENCE FOOD IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 247 VIETNAM PROCESSED MEAT PRODUCTS IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 248 VIETNAM CONFECTIONERY IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 249 VIETNAM BEVERAGES IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 250 VIETNAM NON-ALCOHOLIC BEVERAGES IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 251 MALAYSIA FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 252 MALAYSIA FOOD INGREDIENTS (ACIDULANTS) MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 253 MALAYSIA FOOD INGREDIENTS (ACIDULANTS) MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 254 MALAYSIA FOOD INGREDIENTS (ACIDULANTS) MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 255 MALAYSIA B2B IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 256 MALAYSIA B2C IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 257 MALAYSIA FOOD INGREDIENTS (ACIDULANTS) MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 258 MALAYSIA FOOD SERVICE SECTOR IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 259 MALAYSIA FOOD PROCESSING SECTOR IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 260 MALAYSIA FOOD IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 261 MALAYSIA DAIRY PRODUCTS IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 262 MALAYSIA BAKERY IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 263 MALAYSIA CONVENIENCE FOOD IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 264 MALAYSIA PROCESSED MEAT PRODUCTS IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 265 MALAYSIA CONFECTIONERY IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 266 MALAYSIA BEVERAGES IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 267 MALAYSIA NON-ALCOHOLIC BEVERAGES IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 268 NEW ZEALAND FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 269 NEW ZEALAND FOOD INGREDIENTS (ACIDULANTS) MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 270 NEW ZEALAND FOOD INGREDIENTS (ACIDULANTS) MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 271 NEW ZEALAND FOOD INGREDIENTS (ACIDULANTS) MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 272 NEW ZEALAND B2B IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 273 NEW ZEALAND B2C IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 274 NEW ZEALAND FOOD INGREDIENTS (ACIDULANTS) MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 275 NEW ZEALAND FOOD SERVICE SECTOR IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 276 NEW ZEALAND FOOD PROCESSING SECTOR IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 277 NEW ZEALAND FOOD IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 278 NEW ZEALAND DAIRY PRODUCTS IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 279 NEW ZEALAND BAKERY IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 280 NEW ZEALAND CONVENIENCE FOOD IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 281 NEW ZEALAND PROCESSED MEAT PRODUCTS IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 282 NEW ZEALAND CONFECTIONERY IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 283 NEW ZEALAND BEVERAGES IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 284 NEW ZEALAND NON-ALCOHOLIC BEVERAGES IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 285 AUSTRALIA FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 286 AUSTRALIA FOOD INGREDIENTS (ACIDULANTS) MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 287 AUSTRALIA FOOD INGREDIENTS (ACIDULANTS) MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 288 AUSTRALIA FOOD INGREDIENTS (ACIDULANTS) MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 289 AUSTRALIA B2B IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 290 AUSTRALIA B2C IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 291 AUSTRALIA FOOD INGREDIENTS (ACIDULANTS) MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 292 AUSTRALIA FOOD SERVICE SECTOR IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 293 AUSTRALIA FOOD PROCESSING SECTOR IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 294 AUSTRALIA FOOD IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 295 AUSTRALIA DAIRY PRODUCTS IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 296 AUSTRALIA BAKERY IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 297 AUSTRALIA CONVENIENCE FOOD IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 298 AUSTRALIA PROCESSED MEAT PRODUCTS IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 299 AUSTRALIA CONFECTIONERY IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 300 AUSTRALIA BEVERAGES IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 301 AUSTRALIA NON-ALCOHOLIC BEVERAGES IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 302 REST OF ASIA-PACIFIC FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

그림 목록

FIGURE 1 ASIA PACIFIC FOOD INGREDIENTS (ACIDULANTS) MARKET: SEGMENTATION

FIGURE 2 ASIA PACIFIC FOOD INGREDIENTS (ACIDULANTS) MARKET: DATA TRIANGULATION

FIGURE 3 ASIA PACIFIC FOOD INGREDIENTS (ACIDULANTS) MARKET: DROC ANALYSIS

FIGURE 4 ASIA PACIFIC FOOD INGREDIENTS (ACIDULANTS) MARKET: ASIA PACIFIC VS REGIONAL MARKET ANALYSIS

FIGURE 5 ASIA PACIFIC FOOD INGREDIENTS (ACIDULANTS) MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 ASIA PACIFIC FOOD INGREDIENTS (ACIDULANTS) MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 ASIA PACIFIC FOOD INGREDIENTS (ACIDULANTS) MARKET: DBMR MARKET POSITION GRID

FIGURE 8 ASIA PACIFIC FOOD INGREDIENTS (ACIDULANTS) MARKET: MARKET END-USER COVERAGE GRID

FIGURE 9 ASIA PACIFIC FOOD INGREDIENTS (ACIDULANTS) MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 ASIA PACIFIC FOOD INGREDIENTS (ACIDULANTS) MARKET: SEGMENTATION

FIGURE 11 NORTH AMERICA IS EXPECTED TO DOMINATE THE ASIA PACIFIC FOOD INGREDIENTS (ACIDULANTS) MARKET AND IS GROWING WITH THE HIGHEST CAGR IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 GROWING DEMAND FOR CONVENIENCE FOOD PRODUCTS IS LIKELY TO FAVOR FOOD ACIDULANTS INDUSTRY GROWTH WHICH IS DRIVING THE ASIA PACIFIC FOOD INGREDIENTS (ACIDULANTS) MARKET IN THE FORECAST PERIOD

FIGURE 13 CITRIC ACID SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE ASIA PACIFIC FOOD INGREDIENTS (ACIDULANTS) MARKET IN 2022 & 2029

FIGURE 14 UKRAINE AND RUSSIA’S SHARE OF ASIA PACIFIC TRADE (2018-2020)-

FIGURE 15 SUPPLY CHAIN OF ASIA PACIFIC FOOD INGREDIENTS (ACIDULANTS) MARKET

FIGURE 16 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE ASIA PACIFIC FOOD INGREDIENTS (ACIDULANTS) MARKET

FIGURE 17 THE BELOW GRAPH SHOWS THE ASIA PACIFIC MARKET SIZE FOR BEVERAGES

FIGURE 18 THE BELOW GRAPH SHOWS THE SALES OF ASIA PACIFIC NON-ALCOHOLIC BEVERAGES FROM 2018 TO 2022:

FIGURE 19 THE BELOW GRAPH SHOWS THE SALES OF NON-ALCOHOLIC BEVERAGES IN U.S. FROM 2019 TO 2021-

FIGURE 20 ASIA PACIFIC FOOD INGREDIENTS (ACIDULANTS) MARKET: BY TYPE, 2021

FIGURE 21 ASIA PACIFIC FOOD INGREDIENTS (ACIDULANTS) MARKET: BY FORM, 2021

FIGURE 22 ASIA PACIFIC FOOD INGREDIENTS (ACIDULANTS) MARKET: BY FUNCTION, 2021

FIGURE 23 ASIA PACIFIC FOOD INGREDIENTS (ACIDULANTS) MARKET, BY DISTRIBUTION CHANNEL, 2021

FIGURE 24 ASIA PACIFIC FOOD INGREDIENTS (ACIDULANTS) MARKET: BY END-USER, 2021

FIGURE 25 ASIA-PACIFIC FOOD INGREDIENTS (ACIDULANTS) MARKET: SNAPSHOT (2021)

FIGURE 26 ASIA-PACIFIC FOOD INGREDIENTS (ACIDULANTS) MARKET: BY COUNTRY (2021)

FIGURE 27 ASIA-PACIFIC FOOD INGREDIENTS (ACIDULANTS) MARKET: BY COUNTRY (2022 & 2029)

FIGURE 28 ASIA-PACIFIC FOOD INGREDIENTS (ACIDULANTS) MARKET: BY COUNTRY (2021 & 2029)

FIGURE 29 ASIA-PACIFIC FOOD INGREDIENTS (ACIDULANTS) MARKET: BY TYPE (2022 & 2029)

FIGURE 30 ASIA PACIFIC FOOD INGREDIENT (ACIDULANTS) MARKET: COMPANY SHARE 2021 (%)

연구 방법론

데이터 수집 및 기준 연도 분석은 대규모 샘플 크기의 데이터 수집 모듈을 사용하여 수행됩니다. 이 단계에는 다양한 소스와 전략을 통해 시장 정보 또는 관련 데이터를 얻는 것이 포함됩니다. 여기에는 과거에 수집한 모든 데이터를 미리 검토하고 계획하는 것이 포함됩니다. 또한 다양한 정보 소스에서 발견되는 정보 불일치를 검토하는 것도 포함됩니다. 시장 데이터는 시장 통계 및 일관된 모델을 사용하여 분석하고 추정합니다. 또한 시장 점유율 분석 및 주요 추세 분석은 시장 보고서의 주요 성공 요인입니다. 자세한 내용은 분석가에게 전화를 요청하거나 문의 사항을 드롭하세요.

DBMR 연구팀에서 사용하는 주요 연구 방법론은 데이터 마이닝, 시장에 대한 데이터 변수의 영향 분석 및 주요(산업 전문가) 검증을 포함하는 데이터 삼각 측량입니다. 데이터 모델에는 공급업체 포지셔닝 그리드, 시장 타임라인 분석, 시장 개요 및 가이드, 회사 포지셔닝 그리드, 특허 분석, 가격 분석, 회사 시장 점유율 분석, 측정 기준, 글로벌 대 지역 및 공급업체 점유율 분석이 포함됩니다. 연구 방법론에 대해 자세히 알아보려면 문의를 통해 업계 전문가에게 문의하세요.

사용자 정의 가능

Data Bridge Market Research는 고급 형성 연구 분야의 선두 주자입니다. 저희는 기존 및 신규 고객에게 목표에 맞는 데이터와 분석을 제공하는 데 자부심을 느낍니다. 보고서는 추가 국가에 대한 시장 이해(국가 목록 요청), 임상 시험 결과 데이터, 문헌 검토, 재생 시장 및 제품 기반 분석을 포함하도록 사용자 정의할 수 있습니다. 기술 기반 분석에서 시장 포트폴리오 전략에 이르기까지 타겟 경쟁업체의 시장 분석을 분석할 수 있습니다. 귀하가 원하는 형식과 데이터 스타일로 필요한 만큼 많은 경쟁자를 추가할 수 있습니다. 저희 분석가 팀은 또한 원시 엑셀 파일 피벗 테이블(팩트북)로 데이터를 제공하거나 보고서에서 사용 가능한 데이터 세트에서 프레젠테이션을 만드는 데 도움을 줄 수 있습니다.