Asia Pacific Anti Friction Coating Market

시장 규모 (USD 10억)

연평균 성장률 :

%

USD

466.95 Million

USD

890.24 Million

2025

2033

USD

466.95 Million

USD

890.24 Million

2025

2033

| 2026 –2033 | |

| USD 466.95 Million | |

| USD 890.24 Million | |

|

|

|

|

Asia-Pacific anti-friction coatings market are By product (MOS2, PTFE, Graphite, FEP, PFA, and Tungsten Disulfide) nature (solvent based and water based) application (automotive parts, power transmission items, bearings, ammunition components, valve components & actuators, and others) end use (automotive, aerospace, marine, construction, healthcare, and others). Country (Japan, China, South Korea, India, Singapore, Thailand, Indonesia, Malaysia, Philippines, Australia and New Zealand and Rest of Asia-Pacific) industry Trends and Forecast to 2028

Market Analysis and Insights: Asia-Pacific Anti-Friction Coatings Market

Market Analysis and Insights: Asia-Pacific Anti-Friction Coatings Market

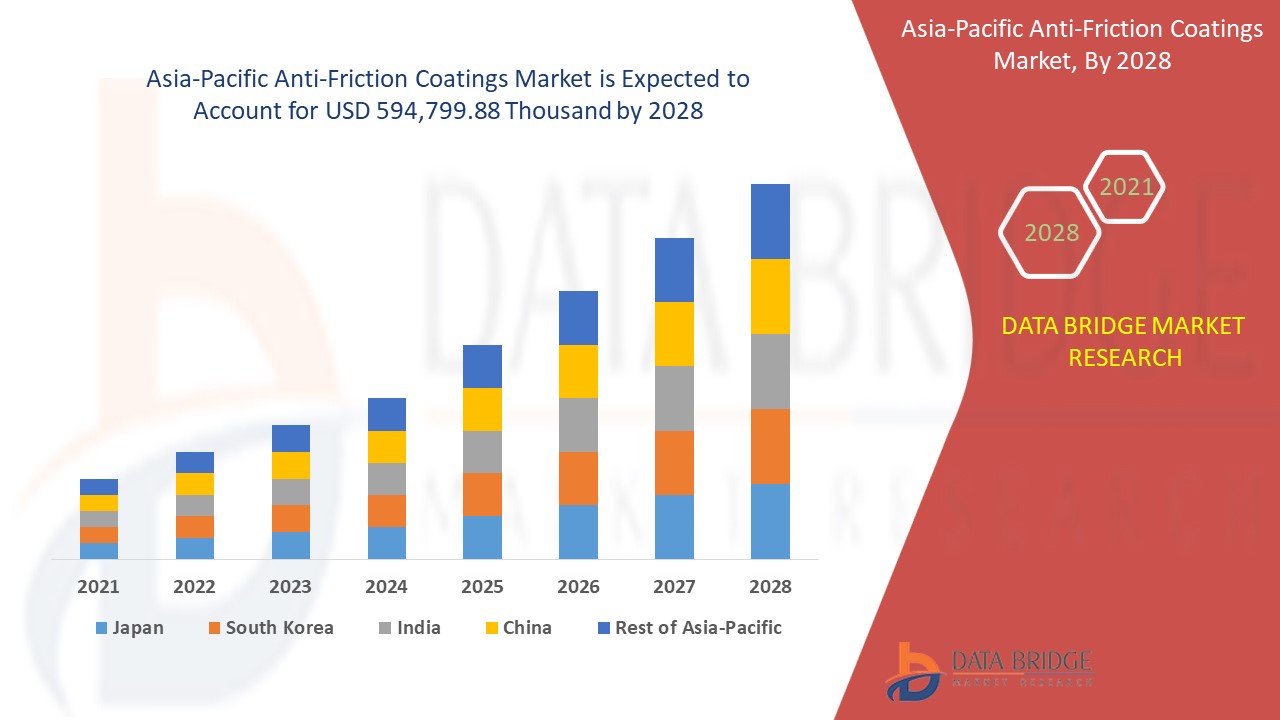

Anti-Friction coatings market is expected to gain market growth in the forecast period of 2021 to 2028. Data Bridge Market Research analyses that the market is growing at a CAGR of 8.4% in the forecast period of 2021 to 2028 and expected to reach USD 594,799.88 thousand by 2028.

Anti-Friction Coatings are a type of lubricant solutions that are similar in formulation to common industrial paints. They comprise solid lubricants and resins as solvents. The main components of solid lubricants are molybdenum disulphide, Polytetrafluoroethylene (PTFE), and graphite. Anti-friction coatings are used as dry lubricants in the automotive industry.

Anti-Friction Coatings Market have wide applications. These are mostly used in automotive, aerospace, health care, construction, and marine sectors. Among all the industries, the demand for anti-friction coatings is higher in the automotive industry. Many problems encountered within the automotive industry including corrosion, noise, dry lubrication, and abrasion can be solved by the usage of anti-friction coatings. Some of the major applications include door/window seals, solenoid components, suspension components, piston skirts, connecting rods, fuel system components, assembly aids, connectors, and glue jigs.

The raw materials which are majorly used by companies to produce anti-frictional coating materials include polytetrafluoro ethylene, molybdenum disulfide, fluoroethyl propylene, Perfluoroalkoxy alkane, tungsten disulfide. Anti-friction coatings are highly resistant to wear and abrasion, which leads to their long-lasting durability. Anti-friction coatings are applied to objects that are subjected to constant friction such as boat hulls to always maintain high degree of performance by reducing friction levels

Anti-Friction Coating Market report provides details of market share, new developments, and product pipeline analysis, impact of domestic and localised market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, product approvals, strategic decisions, product launches, geographic expansions, and technological innovations in the market. To understand the analysis and the market scenario contact us for an Analyst Brief, our team will help you create a revenue impact solution to achieve your desired goal.

Asia-Pacific Anti-friction coatings Market Scope and Market Size

Asia-Pacific Anti-friction coatings Market Scope and Market Size

Asia-Pacific Anti-Friction coatings market is segmented into four notable segments, which are based on product, nature, application, and end use in the market

- On the basis of product, Anti-Friction coatings market is segmented into MOS2, PTFE, Graphite, FEP, PFA, and Tungsten Disulfide.

- On the basis of nature of coatings, Anti-Friction coatings market is segmented into solvent based and water based.

- On the basis of application, Anti-Friction coatings market is segmented into automotive parts, power transmission items, bearings, ammunition components, valve components & actuators, and others.

- On the basis of end use, Anti-Friction coatings market can be segmented into automotive, aerospace, marine, construction, healthcare, and others.

Anti-friction coatings Market Country Level Analysis

Asia-Pacific Anti Friction coatings market is analysed and market size information is provided by country, product, nature, application, and end use in the market as referenced above.

The countries covered in Asia-Pacific Anti-Friction coatings market report are Japan, China, South Korea, India, Singapore, Thailand, Indonesia, Malaysia, Philippines, Australia and New Zealand and Rest of Asia-Pacific.

- In Asia-Pacific anti-friction coatings, China , India and japan country market is dominating the market due to high demand of muti-layer coated products in the country and also export the products to other country..

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points such as new sales, replacement sales, country demographics, regulatory acts and import-export tariffs are some of the major pointers used to forecast the market scenario for individual countries. Also, presence and availability of brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of sales channels are considered while providing forecast analysis of the country data.

Growths in the anti-friction coatings Industry

Asia-Pacific Anti-Friction Coatings market also provides you with detailed market analysis for every country growth in installed base of different kind of products for anti-friction coatings market, impact of technology using life line curves and changes in infant formula regulatory scenarios and their impact on the Anti-friction coatings market. The data is available for historic period 2010 to 2019

Competitive Landscape and anti-friction coatings Market Share Analysis

Asia-Pacific Anti-Friction Coatings market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, company strengths and weaknesses, product launch, clinical trials pipelines, brand analysis, product approvals, patents, product width and breath, application dominance, technology lifeline curve. The above data points provided are only related to the company’s focus related to Asia-Pacific Anti-friction coatings market.

Major market players engaged in theAsia –Pacific Anti-Friction coatings market are Parker Hannifin Corp, DuPont, CARL BECHEM GMBH, ASV Mutichemie Private Limited, Whitmore Manufacturing LLC., and others. DBMR analysts understand competitive strengths and provide competitive analysis for each competitor separately.

For instance,

- In May 2021, DuPont announced the introduction of MOLYKOTE G-1079 grease, a noise-reducing grease specially formulated for sliding-contact applications with fast movement and high loads or slow movement and low loads particularly actuators. MOLYKOTE G-1079 anti-friction coating is used in next generation electric vehicles. Thus, it will help raise the company’s market sales.

- In April, 2021, Whitmore Manufacturing, LLC introduced a scalable solution to lubrication storage and dispensing systems, namely Lustor. The new Lustor line helps companies extend .DBMR analysts understand competitive strengths and provide competitive analysis for each competitor separately.

SKU-

세계 최초의 시장 정보 클라우드 보고서에 온라인으로 접속하세요

- 대화형 데이터 분석 대시보드

- 높은 성장 잠재력 기회를 위한 회사 분석 대시보드

- 사용자 정의 및 질의를 위한 리서치 분석가 액세스

- 대화형 대시보드를 통한 경쟁자 분석

- 최신 뉴스, 업데이트 및 추세 분석

- 포괄적인 경쟁자 추적을 위한 벤치마크 분석의 힘 활용

연구 방법론

데이터 수집 및 기준 연도 분석은 대규모 샘플 크기의 데이터 수집 모듈을 사용하여 수행됩니다. 이 단계에는 다양한 소스와 전략을 통해 시장 정보 또는 관련 데이터를 얻는 것이 포함됩니다. 여기에는 과거에 수집한 모든 데이터를 미리 검토하고 계획하는 것이 포함됩니다. 또한 다양한 정보 소스에서 발견되는 정보 불일치를 검토하는 것도 포함됩니다. 시장 데이터는 시장 통계 및 일관된 모델을 사용하여 분석하고 추정합니다. 또한 시장 점유율 분석 및 주요 추세 분석은 시장 보고서의 주요 성공 요인입니다. 자세한 내용은 분석가에게 전화를 요청하거나 문의 사항을 드롭하세요.

DBMR 연구팀에서 사용하는 주요 연구 방법론은 데이터 마이닝, 시장에 대한 데이터 변수의 영향 분석 및 주요(산업 전문가) 검증을 포함하는 데이터 삼각 측량입니다. 데이터 모델에는 공급업체 포지셔닝 그리드, 시장 타임라인 분석, 시장 개요 및 가이드, 회사 포지셔닝 그리드, 특허 분석, 가격 분석, 회사 시장 점유율 분석, 측정 기준, 글로벌 대 지역 및 공급업체 점유율 분석이 포함됩니다. 연구 방법론에 대해 자세히 알아보려면 문의를 통해 업계 전문가에게 문의하세요.

사용자 정의 가능

Data Bridge Market Research는 고급 형성 연구 분야의 선두 주자입니다. 저희는 기존 및 신규 고객에게 목표에 맞는 데이터와 분석을 제공하는 데 자부심을 느낍니다. 보고서는 추가 국가에 대한 시장 이해(국가 목록 요청), 임상 시험 결과 데이터, 문헌 검토, 재생 시장 및 제품 기반 분석을 포함하도록 사용자 정의할 수 있습니다. 기술 기반 분석에서 시장 포트폴리오 전략에 이르기까지 타겟 경쟁업체의 시장 분석을 분석할 수 있습니다. 귀하가 원하는 형식과 데이터 스타일로 필요한 만큼 많은 경쟁자를 추가할 수 있습니다. 저희 분석가 팀은 또한 원시 엑셀 파일 피벗 테이블(팩트북)로 데이터를 제공하거나 보고서에서 사용 가능한 데이터 세트에서 프레젠테이션을 만드는 데 도움을 줄 수 있습니다.