북미 트랜스펙션 시약 및 장비 시장, 부산물(시약 및 키트 및 기기), 단계(연구, 전임상, 임상 단계 및 상업), 유형(일시적 트랜스펙션 시약 및 장비, 안정적 트랜스펙션 시약 및 장비), 방법(비바이러스 방법 및 바이러스 방법), 분자 유형(플라스미드 DNA, 소간섭 RNA(siRNA), 단백질, DNA 올리고뉴클레오티드, 리보핵산단백질 복합체(RNP) 및 기타), 유기체(포유류 세포, 식물, 진균, 바이러스 및 박테리아), 응용 분야(시험관 내 응용 분야, 생체 내 응용 분야, 생물 생산 및 기타), 최종 사용자(바이오파마, CRO(CMO/CDMO), 학계, 병원, 임상 실험실 및 기타), 유통 채널(직접 입찰, 소매 판매 및 기타), 산업 동향 및 2030년까지의 예측

북미 트랜스펙션 시약 및 장비 시장 분석 및 통찰력

형질감염은 바이러스 및 비바이러스 방법을 통해 진핵 세포에 핵산을 도입하는 것을 포함합니다. 형질감염 방법은 음전하를 띤 막을 전달하는 과제를 극복할 수 있습니다. 인산 칼슘 및 디에틸아미노에틸(DEAE)-덱스트란 또는 양이온성 지질 기반 시약 과 같은 화학 물질은 외부 DNA 코팅과 반응합니다. 전체 음전하를 중화하고 분자에 양전하를 부여하여 DNA 전달을 허용합니다. 전기천공과 같은 물리적 방법은 전압을 적용하여 세포막에 미세한 기공을 만들어 DNA가 세포질로 직접 유입되도록 합니다. DEAE-덱스트란은 일시적 형질감염에 사용되지만 리포펙션은 안정적인 형질감염을 달성할 수 있으므로 장기적인 단백질 발현에 사용할 수 있습니다. 인산칼슘 매개 형질감염도 안정적인 형질감염에 사용할 수 있습니다. 바이러스 형질감염 방법은 높은 효율성을 달성하며 제약 제품 개발의 여러 단계에 사용됩니다.

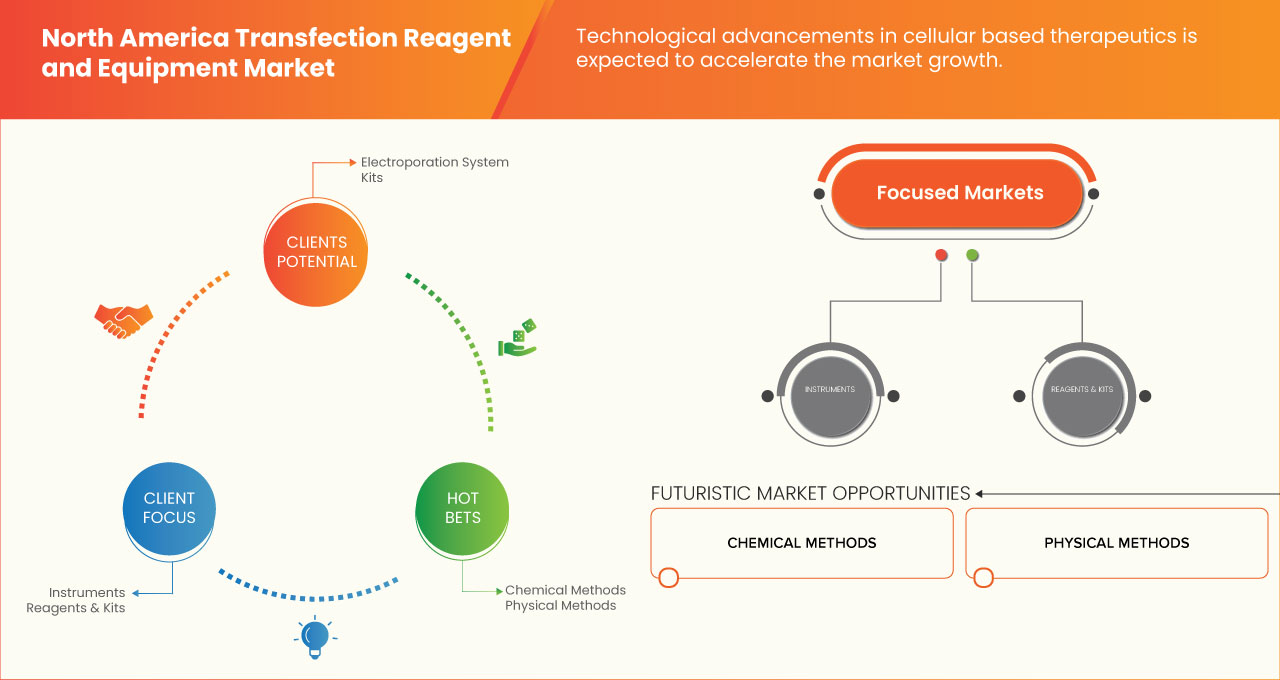

형질감염 방법은 작물 보호 및 수확량 증가를 위한 농업, 풍미와 향을 강화하기 위한 합성 생물학 제품 생산, 단세포 단백질 강화 등 여러 가지 용도로 사용됩니다. 선진국과 개발도상국 모두에서 형질감염에 대한 수요가 증가했으며, 그 이유는 만성 질환의 증가 때문입니다. 형질감염 시장은 키메라 유전자에 대한 수요 증가와 단백질 생산에 생물제약품 활용으로 인해 성장하고 있습니다 . 이 시장은 신흥 시장 탐색, 시장 참여자의 전략적 이니셔티브, 정부 지원 증가로 인해 예측 기간 동안 성장할 것입니다.

장비 비용이 높고, 형질감염 시약의 선택적 효과와 형질감염 방법으로 인한 세포 손상이 북미 형질감염 시약 및 장비 시장 성장을 제한할 것으로 예상됩니다.

시장 참여자들이 인수, 협력, 파트너십을 포함한 여러 전략적 이니셔티브를 채택하면서 시장이 성장하고 있습니다.

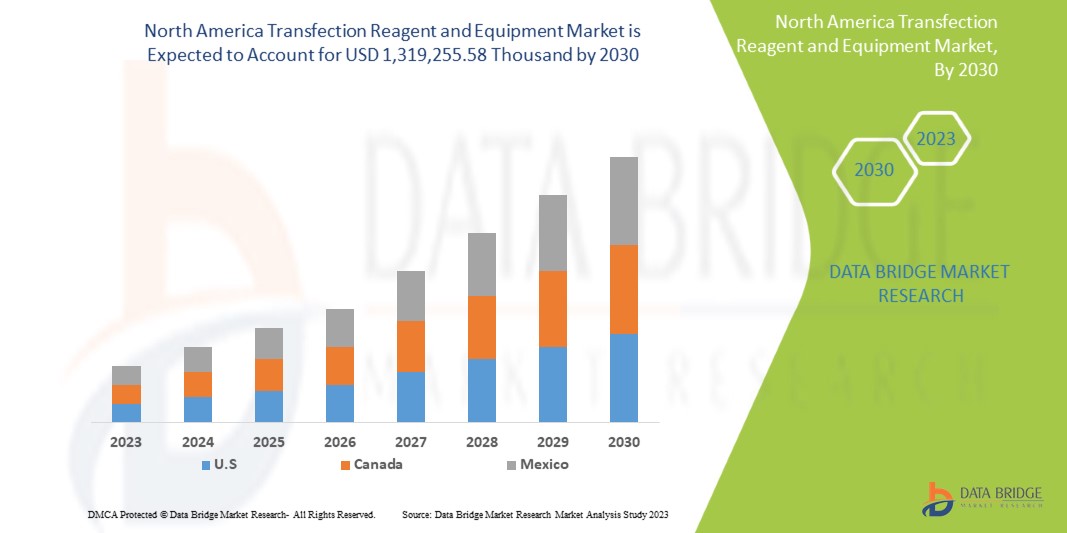

Data Bridge Market Research에 따르면, 북미 형질감염 시약 및 장비 시장은 2030년까지 1,319,255.58만 달러 규모에 도달할 것으로 예상되며, 이는 예측 기간 동안 연평균 성장률 9.9%를 기록할 것으로 예상됩니다.

|

보고서 메트릭 |

세부 |

|

예측 기간 |

2023년부터 2030년까지 |

|

기준 연도 |

2022 |

|

역사적 연도 |

2021 (2020-2016까지 사용자 정의 가능) |

|

양적 단위 |

매출은 천 단위, 볼륨은 단위, 가격은 USD로 표시 |

|

다루는 세그먼트 |

제품별(시약 및 키트와 기기), 단계(연구, 전임상, 임상 단계 및 상업적), 유형(일시적 형질감염 시약 및 장비, 안정적 형질감염 시약 및 장비), 방법(비바이러스 방법 및 바이러스 방법), 분자 유형(플라스미드 DNA, 소형 간섭 RNA(siRNA), 단백질, DNA 올리고뉴클레오티드, 리보핵산단백질 복합체(RNP) 및 기타), 생물체(포유류 세포, 식물, 균류, 바이러스 및 박테리아), 응용 분야(체외 응용 분야, 체내 응용 분야, 생물 생산 및 기타), 최종 사용자(바이오파마, CRO(CMO/CDMO), 학계, 병원, 임상 실험실 및 기타), 유통 채널(직접 입찰, 소매 판매 및 기타). |

|

적용 국가 |

미국, 캐나다, 멕시코. |

|

시장 참여자 포함 |

이 시장에서 운영되는 주요 기업 중 일부는 Mirus Bio LLC., Promega Corporation, Polyplus Transfection, Bio-Rad Laboratories, Inc., Merck KGaA, Lonza, MaxCyte, Inc., Altogen Biosystems, SBS Genetech, FUJIFILM Irvine Scientific(FUJIFILM Holdings Corporation의 자회사), Avanti Polar Lipids(Croda International Plc의 자회사), PerkinElmer chemagen Technologie GmbH(PerkinElmer Inc.의 자회사), Cytiva, Geno Technology Inc., USA, R&D Systems, Inc., Takara Bio Inc., Thermofisher Scientific Inc., Roche Molecular Systems, Inc.(F. Hoffmann-La Roche Ltd의 자회사), QIAGEN, OriGene Technologies, Inc., Applied Biological Materials Inc.(abm), Beckman Coulter, Inc.(Danaher의 자회사)입니다. Amyris, Codexis, Autolus, SignaGen Laboratories, Impossible Foods Inc., Genlantis Inc., Ginkgo Bioworks, Verve Therapeutics, Inc., Conagen, Inc., Poseida Therapeutics, Inc., Twist Bioscience 등이 있습니다. |

시장 정의

형질감염 방법은 세포에 RNA, DNA 또는 단백질 생성물을 도입하여 생물체의 표현형과 유전형을 변경하는 데 사용됩니다. 형질감염 방법은 새로운 유전자 전이 또는 게놈 편집을 위한 클러스터링된 규칙적으로 간격이 있는 짧은 팔린드롬 반복(CRISPR)과 같은 유전자 구조를 전이하는 것을 포함합니다. 형질감염은 면역 요법, 유전자 치료 및 세포 치료 분야에서 광범위하게 사용됩니다. 형질감염에는 비바이러스 및 바이러스 매개 형질감염이 모두 포함됩니다. 화학적 및 물리적 방법은 비바이러스 형질감염을 달성할 수 있습니다. 형질감염에 사용되는 가장 일반적인 화학적 방법은 인산칼슘 형질감염 및 리포좀 형질감염 등입니다. 바이러스 형질감염은 높은 형질감염 효율을 제공하며 형질감염에 사용되는 다양한 유형의 물리적 방법에는 미세주입, 생물학적 입자 전달 및 전기천공이 포함되며 그 중 전기천공은 높은 형질감염 효율을 제공합니다. 형질감염에는 일시적 또는 안정적인 형질감염의 두 가지 유형이 있습니다. 유전자 녹아웃 연구와 같은 단기 유전자 발현 연구의 경우, 소규모 생산 일시적 형질감염 방법이 선호됩니다. 그러나 장기 연구 및 대규모 단백질 생산을 위한 안정적 형질감염 방법이 널리 채택됩니다.

북미 트랜스펙션 시약 및 장비 시장 동향

이 섹션에서는 시장 동인, 이점, 기회, 제약 및 과제를 이해하는 것을 다룹니다. 이 모든 내용은 아래에서 자세히 설명합니다.

운전자

- 만성 질환 유병률 증가

만성 질환의 유병률은 전 세계적으로 증가하고 있으며, 효과적이고 정확한 치료에 대한 수요가 증가하고 있습니다. 형질감염은 여러 유전 질환을 치료하기 위해 표적 변형 유전자를 전달하는 데 사용됩니다. 형질감염 방법은 또한 적응 면역을 강화하고 개인을 다양한 질병으로부터 예방할 수 있는 CRISPR 유전자를 전달하는 데 사용됩니다.

COVID-19 및 기타 감염성 질환과 같은 만성 질환의 증가로 인해 결함이 있는 유전자를 올바른 유전자로 대체할 수 있는 효과적인 유전자 치료 제품이 발견되었습니다. 형질감염 방법은 유전자 치료 등에 널리 사용됩니다. 전 세계적으로 효과적이고 정확한 치료에 대한 수요가 증가함에 따라 유전자 치료 및 형질감염 방법에 대한 수요도 증가하고 있습니다. 게다가 유전자 치료가 만성 질환 치료에 잠재력이 있다는 것을 증명하는 여러 연구가 진행 중이며 의사와 환자 사이에서 수요가 증가하고 있습니다. 따라서 만성 질환 유병률의 증가가 북미 형질감염 시약 및 장비 시장 성장의 원동력으로 작용하고 있음을 의미합니다.

- 합성생물학제품 개발

합성생물학은 공학 원리를 생물학에 통합한 새로운 시대의 생물학입니다. 합성생물학은 유전체학 지식을 결합하여 DNA 게놈을 재조립하여 DNA의 화학적 합성을 포함합니다. 새로운 유전자로 시퀀싱하는 합성생물학은 유전공학을 포함하며, 여기에는 형질감염 방법 등이 포함됩니다. 전 세계적으로 합성생물학 제품에 대한 수요가 증가함에 따라 형질감염 제품의 사용도 증가하고 있습니다.

효과적이고 혁신적인 제품에 대한 수요가 증가함에 따라 합성 생물학 제품에 대한 수요가 증가하고 있습니다. 합성 제품의 제조는 유전자 전달이 다른 것들 중에서도 형질 전환 방법과 함께 수행될 수 있기 때문에 형질 전환 제품에 대한 수요를 증가시킵니다. 따라서 이는 합성 제품 개발이 북미 형질 전환 시약 및 장비 시장 성장을 주도한다는 것을 의미합니다.

제지

- 형질감염 과정으로 인한 세포 손상

일부 형질감염 방법은 세포 손상을 유발하여 전체 방법의 재현성을 감소시키는 것으로 보고되었습니다. 여러 종류의 형질감염 절차 중에서 전기천공은 전압 증가에 따라 최대 세포 손상을 유발하는 것으로 보고되었습니다. 이 세포 손상은 효율성을 낮추고 진행 중인 프로젝트에 영향을 미칩니다.

트랜스펙션 과정의 가장 흔한 부작용 중 하나는 세포 손상으로, 이는 세포의 대사 사건을 낮추고 세포 사멸로 이어진다. 이 손상된 세포는 배지 독성을 증가시켜 부적절한 결과를 초래할 수 있다. 따라서 이는 트랜스펙션 과정에 의해 유발된 세포 손상이 북미 트랜스펙션 시약 및 장비 시장 성장에 제약으로 작용한다는 것을 시사한다.

기회

-

신흥시장 탐색

형질전환 제품은 유전공학 및 프로테오믹스 산업에 유망한 도구로 나타났습니다. 형질전환 제품의 주요 시장은 유럽과 북미입니다. 이러한 제품의 긍정적인 결과를 살펴보면, 많은 시장 참여자가 중국과 인도를 포함한 성장하는 경제에 뿌리를 내리고 있습니다. 신흥 시장은 이러한 시장 참여자가 잘 확립된 시장에서 발생하는 손실을 극복할 수 있게 해줍니다.

신흥 시장은 시장 참여자들이 특정 기존 시장에 지정된 경기 침체를 극복할 수 있게 하므로, 신흥 시장에 대한 투자와 탐색을 통해 시장 참여자들은 수익성 있는 성장을 달성하기 위해 형질 전환 제품의 개발 및 제조에 참여할 수 있습니다. 따라서 이는 신흥 시장을 탐색하는 것이 북미 형질 전환 시약 및 장비 시장을 성장시킬 수 있는 기회임을 의미합니다.

도전

- 장기 승인 절차

트랜스펙션 시약 및 기구에 대한 긴 승인 절차는 트랜스펙션 시장 성장을 방해하는 요인입니다. 트랜스펙션 제품은 광범위한 규제를 받고 매번 모니터링해야 합니다. 트랜스펙션 제품은 특정 세포주에 원하는 유전자 분자를 삽입하여 단백질 및 기타 생물학적 화합물을 얻는 데 널리 사용됩니다. 따라서 이 과정은 길고 엄격한 규제 절차에 의해 조사되고 승인됩니다. 모든 임상 시험에서 긍정적인 결과를 얻는 데 필요한 긴 절차는 더 많은 시간 소모와 시장 참여자의 많은 자금 투자로 이어졌습니다.

트랜스펙션 시약은 대부분 21CFR 210 및 211 US FDA 가이드라인을 따르며, 이에 따라 제조업체는 제조된 시약이 규제 기관에서 제안한 안전, 포장 및 처리 특성을 충족하는지 확인해야 합니다. 소유자 또는 제조업체는 PHS(공중 보건 서비스)법 351조에 따라 라이센스를 제출해야 하는데, 이는 매우 지루한 절차입니다. 따라서 이는 긴 승인 절차가 북미 트랜스펙션 시약 및 장비 시장 성장에 도전한다는 것을 의미합니다.

최근 개발 사항

- 2021년 8월, Mirus Bio는 세포 및 유전자 치료 개발, 공정 운영 및 상업적 생산을 지원하기 위해 GMP(Good Manufacturing Practice) 바이러스 벡터 생산을 위한 TransIT VirusGen 플랫폼을 확장했습니다. TransIT VirusGen GMP Transfection Reagent라고 하는 이 확장은 재조합 아데노 연관 바이러스 및 렌티바이러스 벡터의 생산을 개선하기 위해 현탁 및 부착 HEK 293 세포 유형에 대한 벡터 DNA의 패키징 및 전달을 개선하도록 설계되었습니다.

- 2021년 4월, BOC Sciences는 siRNA 생체 내 형질감염 키트와 mRNA 생체 내 형질감염 키트 등 두 가지 생체 내 RNA 형질감염 키트 출시를 발표했습니다. 각각 siRNA와 mRNA의 생체 내 형질감염에 적합합니다.

북미 트랜스펙션 시약 및 장비 시장 범위

북미 트랜스펙션 시약 및 장비 시장은 제품, 단계, 방법, 유형, 분자 유형, 응용 프로그램, 최종 사용자, 유기체 및 유통 채널과 같은 9가지 주요 세그먼트로 세분화됩니다. 세그먼트 간의 성장은 틈새 성장 포켓과 시장에 접근하고 핵심 응용 분야와 타겟 시장의 차이점을 파악하기 위한 전략을 분석하는 데 도움이 됩니다.

제품

- 악기

- 시약 및 키트

제품을 기준으로 북미 형질감염 시약 및 장비 시장은 장비와 시약 및 키트로 구분됩니다.

단계

- 연구

- 전임상

- 임상 단계

- 광고

북미 형질감염 시약 및 장비 시장은 단계를 기준으로 연구 단계, 전임상 단계, 임상 단계, 상업 단계로 구분됩니다.

유형

- 일시적 형질감염 시약 및 장비

- 안정된 형질전환 시약 및 장비

On the basis of type, the North America transfection reagent and equipment market is segmented into transient transfection reagent and equipment and stable transfection reagent and equipment.

METHODS

- NON-VIRAL METHODS

- VIRAL METHODS

On the basis of methods, the North America transfection reagent and equipment market is segmented into non-viral methods and viral methods.

TYPES OF MOLECULE

- PLASMID DNA

- DNA OLIGONUCLEOTIDES

- SMALL INTERFERING RNA (SIRNA)

- PROTEINS

- RIBONUCLEOPROTEIN COMPLEXES (RNPS)

- OTHERS

On the basis of types of molecule, the North America transfection reagent and equipment market is segmented into plasmid DNA, DNA oligonucleotides, small interfering RNA (siRNA), proteins, ribonucleoprotein complexes (RNPs) and others.

ORGANISM

- BACTERIA

- MAMMALIAN CELLS

- FUNGI

- PLANTS

- VIRUS

On the basis of organism, the North America transfection reagent and equipment market is segmented into bacteria, mammalian cells, fungi, plants and virus.

APPLICATION

- BY TYPE

- IN VITRO APPLICATION

- IN VIVO APPLICATION

- BIOPRODUCTION

- OTHERS

- BY INDUSTRY

- AGRICULTURE

- SYNTHETIC BIOLOGY

- OTHERS

On the basis of application, the North America transfection reagent and equipment market is segmented by type into in vitro application, in vivo application, bioproduction, others and by industry into agriculture, synthetic biology, others.

END USER

- BIOPHARMA

- CROS

- CMOS/CDMOS

- ACADEMIA

- HOSPITALS

- CLINICAL LABS

- OTHERS

On the basis of end user, the North America transfection reagent and equipment market is segmented into biopharma, CROs, CMOs/ CDMOs, academia, hospitals, clinical labs and others.

DISTRIBUTION CHANNEL

- DIRECT TENDER

- RETAIL SALES

- OTHERS

On the basis of distribution channel, the North America transfection Reagent and equipment market is segmented into direct tender, retail sales and others.

North America Transfection Reagent and Equipment Market Regional Analysis/Insights

The North America transfection reagent and equipment market is categorized into many notable segments such as geography, products, stages, methods, type, types of molecule, application, end user, organism, and distribution channel.

The countries covered in this market report are U.S., Canada, and Mexico.

In 2023, North America is dominating due to the presence of key market players in the largest consumer market with high GDP. U.S is expected to grow due to rise in the prevalence of chronic and rare diseases leading to increase in the use of transfection reagent and equipment.

North America is dominating the market due to the increasing investment in healthcare is expected to boost the market growth. The U.S. dominates North America region due to strong presence of key players.

보고서의 국가 섹션은 또한 개별 시장 영향 요인과 국내 시장의 현재 및 미래 트렌드에 영향을 미치는 규제 변화를 제공합니다. 신규 판매, 교체 판매, 국가 인구 통계, 규제 조치 및 수출입 관세와 같은 데이터 포인트는 개별 국가의 시장 시나리오를 예측하는 데 사용되는 주요 포인터 중 일부입니다. 또한 북미 브랜드의 존재 및 가용성과 지역 및 국내 브랜드와의 대규모 또는 희소한 경쟁으로 인해 직면한 과제, 판매 채널의 영향이 국가 데이터에 대한 예측 분석을 제공하는 동안 고려됩니다.

경쟁 환경 및 북미 트랜스펙션 시약 및 장비 시장 점유율 분석

북미 트랜스펙션 시약 및 장비 시장 경쟁 구도는 경쟁자별 세부 정보를 제공합니다. 포함된 세부 정보는 회사 개요, 회사 재무, 창출된 수익, 시장 잠재력, R&D 투자, 새로운 시장 이니셔티브, 생산 현장 및 시설, 회사의 강점과 약점, 제품 출시, 제품 승인, 제품 폭 및 호흡, 응용 분야 우세, 제품 유형 수명선 곡선입니다. 위에 제공된 데이터 포인트는 회사의 북미 트랜스펙션 시약 및 장비 시장에 대한 집중과만 관련이 있습니다.

이 시장에서 운영되는 주요 기업 중 일부는 Mirus Bio LLC., Promega Corporation, Polyplus Transfection, Bio-Rad Laboratories, Inc., Merck KGaA, Lonza, MaxCyte, Inc., Altogen Biosystems, SBS Genetech, FUJIFILM Irvine Scientific(FUJIFILM Holdings Corporation의 자회사), Avanti Polar Lipids(Croda International Plc의 자회사), PerkinElmer chemagen Technologie GmbH(PerkinElmer Inc.의 자회사), Cytiva, Geno Technology Inc., USA, R&D Systems, Inc., Takara Bio Inc., Thermofisher Scientific Inc., Roche Molecular Systems, Inc.(F. Hoffmann-La Roche Ltd의 자회사), QIAGEN, OriGene Technologies, Inc., Applied Biological Materials Inc.(abm), Beckman Coulter, Inc.(Danaher의 자회사)입니다. Amyris, Codexis, Autolus, SignaGen Laboratories, Impossible Foods Inc., Genlantis Inc., Ginkgo Bioworks, Verve Therapeutics, Inc., Conagen, Inc., Poseida Therapeutics, Inc., Twist Bioscience 등이 있습니다.

SKU-

세계 최초의 시장 정보 클라우드 보고서에 온라인으로 접속하세요

- 대화형 데이터 분석 대시보드

- 높은 성장 잠재력 기회를 위한 회사 분석 대시보드

- 사용자 정의 및 질의를 위한 리서치 분석가 액세스

- 대화형 대시보드를 통한 경쟁자 분석

- 최신 뉴스, 업데이트 및 추세 분석

- 포괄적인 경쟁자 추적을 위한 벤치마크 분석의 힘 활용

목차

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE NORTH AMERICA TRANSFECTION REAGENTS AND EQUIPMENT MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 TRANSIENT TRANSFECTION OF TRANSFECTION LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 VENDOR SHARE ANALYSIS

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHT

4.1 PESTEL

4.2 PORTER'S FIVE FORCES MODEL

5 INDUSTRY INSIGHTS:

6 NORTH AMERICA TRANSFECTION REAGENTS AND EQUIPMENT MARKET, REGULATIONS

6.1 EUROPEAN UNION REGULATORY SCENARIO

6.2 U.S. REGULATORY SCENARIO

6.3 JAPAN REGULATORY SCENARIO

6.4 CHINA REGULATORY SCENARIO

7 MARKET OVERVIEW

7.1 DRIVERS

7.1.1 RISE IN THE PREVALENCE OF CHRONIC DISEASES

7.1.2 DEVELOPMENT OF SYNTHETIC BIOLOGY PRODUCTS

7.1.3 GROWING DEMAND FOR CHIMERIC GENES

7.1.4 LARGE-SCALE TRANSFECTIONS USED IN CLINICAL RESEARCH

7.1.5 UTILIZATION OF BIOPHARMACEUTICALS IN THE PRODUCTION OF PROTEINS

7.2 RESTRAINTS

7.2.1 HIGH COST OF TRANSFECTION PRODUCTS

7.2.2 SELECTIVE EFFECTIVENESS OF TRANSFECTION REAGENTS

7.2.3 CELL DAMAGE INDUCED BY TRANSFECTION PROCEDURE

7.3 OPPORTUNITIES

7.3.1 EXPLORATION OF EMERGING MARKET

7.3.2 STRATEGIC INITIATIVES BY MARKET PLAYERS

7.3.3 SURGING LEVEL OF INVESTMENT

7.4 CHALLENGES

7.4.1 LONG APPROVAL PROCEDURE

7.4.2 LACK OF SAFETY LEVEL LAB FOR VIRUS-ASSOCIATED TRANSFECTION

7.4.3 LACK OF TRAINED PROFESSIONALS

8 NORTH AMERICA TRANSFECTION REAGENT AND EQUIPMENT MARKET, BY PRODUCTS

8.1 OVERVIEW

8.2 REAGENTS & KITS

8.3 INSTRUMENTS

9 NORTH AMERICA TRANSFECTION REAGENT AND EQUIPMENT MARKET, BY STAGE

9.1 OVERVIEW

9.2 RESEARCH

9.3 PRECLINICAL

9.4 CLINICAL PHASES

9.5 COMMERCIAL

10 NORTH AMERICA TRANSFECTION REAGENT AND EQUIPMENT MARKET, BY TYPE

10.1 OVERVIEW

10.2 TRANSIENT TRANSFECTION REAGENTS AND EQUIPMENT

10.3 STABLE TRANSECTION REAGENTS AND EQUIPMENT

11 NORTH AMERICA TRANSFECTION REAGENT AND EQUIPMENT MARKET, BY METHODS

11.1 OVERVIEW

11.2 NON-VIRAL METHODS

11.3 VIRAL METHODS

12 NORTH AMERICA TRANSFECTION REAGENT AND EQUIPMENT MARKET, BY TYPES OF MOLECULE

12.1 OVERVIEW

12.2 PLASMID DNA

12.3 SMALL INTERFERING RNA (SIRNA)

12.4 PROTEINS

12.5 DNA OLIGONUCLEOTIDES

12.6 RIBONUCLEOPROTEIN COMPLEXES (RNPS)

12.7 OTHERS

13 NORTH AMERICA TRANSFECTION REAGENT AND EQUIPMENT MARKET, BY ORGANISM

13.1 OVERVIEW

13.2 MAMMALIAN CELLS

13.3 PLANTS

13.4 FUNGI

13.5 VIRUS

13.6 BACTERIA

14 NORTH AMERICA TRANSFECTION REAGENT AND EQUIPMENT MARKET, BY APPLICATION

14.1 OVERVIEW

14.2 IN VITRO APPLICATION

14.2.1 IN VIVO APPLICATION

14.2.2 BIOPRODUCTION

14.2.3 OTHERS

14.2.4 SYNTHETIC BIOLOGY

14.2.5 AGRICULTURE

14.2.6 OTHERS

15 NORTH AMERICA TRANSFECTION REAGENT AND EQUIPMENT MARKET, BY END USER

15.1 OVERVIEW

15.2 BIOPHARMA

15.3 CROS

15.4 CMOS/CDMOS

15.5 ACADEMIA

15.6 HOSPITALS

15.7 CLINICAL LABS

15.8 OTHERS

16 NORTH AMERICA TRANSFECTION REAGENT AND EQUIPMENT MARKET, BY DISTRIBUTION CHANNEL

16.1 OVERVIEW

16.2 DIRECT TENDER

16.3 RETAIL SALES

16.4 OTHERS

17 NORTH AMERICA TRANSFECTION REAGENT AND EQUIPMENT MARKET, BY REGION

17.1 NORTH AMERICA

17.1.1 U.S.

17.1.2 CANADA

17.1.3 MEXICO

18 NORTH AMERICA TRANSFECTION REAGENTS AND EQUIPMENT MARKET, COMPANY LANDSCAPE

18.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

19 SWOT ANALYSIS

20 COMPANY PROFILE

20.1 THERMO FISHER SCIENTIFIC INC.

20.1.1 COMPANY SNAPSHOT

20.1.2 REVENUE ANALYSIS

20.1.3 COMPANY SHARE ANALYSIS

20.1.4 PRODUCT PORTFOLIO

20.1.5 RECENT DEVELOPMENT

20.2 ROCHE MOLECULAR SYSTEMS, INC. (A SUBSIDIARY OF F. HOFFMANN-LA ROCHE LTD)

20.2.1 COMPANY SNAPSHOT

20.2.2 REVENUE ANALYSIS

20.2.3 COMPANY SHARE ANALYSIS

20.2.4 PRODUCT PORTFOLIO

20.2.5 RECENT DEVELOPMENT

20.3 PROMEGA CORPORATION

20.3.1 COMPANY SNAPSHOT

20.3.2 COMPANY SHARE ANALYSIS

20.3.3 PRODUCT PORTFOLIO

20.3.4 RECENT DEVELOPMENT

20.4 TAKARA BIO INC.

20.4.1 COMPANY SNAPSHOT

20.4.2 REVENUE ANALYSIS

20.4.3 COMPANY SHARE ANALYSIS

20.4.4 PRODUCT PORTFOLIO

20.4.5 RECENT DEVELOPMENT

20.5 BIO-RAD LABORATORIES, INC.

20.5.1 COMPANY SNAPSHOT

20.5.2 REVENUE ANANLYSIS

20.5.3 COMPANY SHARE ANALYSIS

20.5.4 PRODUCT PORTFOLIO

20.5.5 RECENT DEVELOPMENT

20.6 ALTOGEN BIOSYSTEMS

20.6.1 COMPANY SNAPSHOT

20.6.2 PRODUCT PORTFOLIO

20.6.3 RECENT DEVELOPMENT

20.7 APPLIED BIOLOGICAL MATERIALS INC. (ABM)

20.7.1 COMPANY SNAPSHOT

20.7.2 PRODUCT PORTFOLIO

20.7.3 RECENT DEVELOPMENT

20.8 AVANTI POLAR LIPIDS (A SUBSIDIARY OF CRODA INTERNATIONAL PLC)

20.8.1 COMPANY SNAPSHOT

20.8.2 REVENUE ANALYSIS

20.8.3 PRODUCT PORTFOLIO

20.8.4 RECENT DEVELOPMENT

20.9 BECKMAN COULTER, INC. (A SUBSIDIARY OF DANAHER)

20.9.1 COMPANY SNAPSHOT

20.9.2 PRODUCT PORTFOLIO

20.9.3 RECENT DEVELOPMENT

20.1 CYTIVA

20.10.1 COMPANY SNAPSHOT

20.10.2 PRODUCT PORTFOLIO

20.10.3 RECENT DEVELOPMENT

20.11 FUJIFILM IRVINE SCIENTIFIC (A SUBSIDIARY OF FUJIFILM HOLDINGS CORPORATION)

20.11.1 COMPANY SNAPSHOT

20.11.2 REVENUE ANANLYSIS

20.11.3 PRODUCT PORTFOLIO

20.11.4 RECENT DEVELOPMENT

20.12 GENLANTIS INC.

20.12.1 COMPANY SNAPSHOT

20.12.2 PRODUCT PORTFOLIO

20.12.3 RECENT DEVELOPMENT

20.13 GENO TECHNOLOGY INC., USA

20.13.1 COMPANY SNAPSHOT

20.13.2 PRODUCT PORTFOLIO

20.13.3 RECENT DEVELOPMENT

20.14 GINKGO BIOWORKS

20.14.1 COMPANY SNAPSHOT

20.14.2 PRODUCT PORTFOLIO

20.14.3 RECENT DEVELOPMENTS

20.15 LONZA

20.15.1 COMPANY SNAPSHOT

20.15.2 REVENUE ANANLYSIS

20.15.3 PRODUCT PORTFOLIO

20.15.4 RECENT DEVELOPMENT

20.16 MAXCYTE, INC.

20.16.1 COMPANY SNAPSHOT

20.16.2 REVENUE ANALYSIS

20.16.3 PRODUCT PORTFOLIO

20.16.4 RECENT DEVELOPMENT

20.17 MERCK KGAA

20.17.1 COMPANY SNAPSHOT

20.17.2 REVENUE ANALYSIS

20.17.3 PRODUCT PORTFOLIO

20.17.4 RECENT DEVELOPMENT

20.18 MIRUS BIO LLC.

20.18.1 COMPANY SNAPSHOT

20.18.2 PRODUCT PORTFOLIO

20.18.3 RECENT DEVELOPMENT

20.19 ORIGENE TECHNOLOGIES, INC.

20.19.1 COMPANY SNAPSHOT

20.19.2 PRODUCT PORTFOLIO

20.19.3 RECENT DEVELOPMENT

20.2 PERKINELMER CHEMAGEN TECHNOLOGIE GMBH (A SUBSIDIARY OF PERKINELMER INC.)

20.20.1 COMPANY SNAPSHOT

20.20.2 REVENUE ANALYSIS

20.20.3 PRODUCT PORTFOLIO

20.20.4 RECENT DEVELOPMENT

20.21 POLYPLUS TRANSFECTION

20.21.1 COMPANY SNAPSHOT

20.21.2 PRODUCT PORTFOLIO

20.21.3 RECENT DEVELOPMENT

20.22 R&D SYSTEMS, INC.

20.22.1 COMPANY SNAPSHOT

20.22.2 PRODUCT PORTFOLIO

20.22.3 RECENT DEVELOPMENT

20.23 SBS GENETECH

20.23.1 COMPANY SNAPSHOT

20.23.2 PRODUCT PORTFOLIO

20.23.3 RECENT DEVELOPMENT

20.24 SIGNAGEN LABORATORIES

20.24.1 COMPANY SNAPSHOT

20.24.2 PRODUCT PORTFOLIO

20.24.3 RECENT DEVELOPMENT

21 QUESTIONNAIRE

22 RELATED REPORTS

표 목록

TABLE 1 NORTH AMERICA TRANSFECTION REAGENT AND EQUIPMENT MARKET, BY PRODUCTS, 2021-2030 (USD THOUSAND)

TABLE 2 NORTH AMERICA REAGENT AND KITS IN TRANSFECTION REAGENT AND EQUIPMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 3 NORTH AMERICA INSTRUMENTS IN TRANSFECTION REAGENT AND EQUIPMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 4 NORTH AMERICA TRANSFECTION REAGENT AND EQUIPMENT MARKET, BY STAGE, 2021-2030 (USD THOUSAND)

TABLE 5 NORTH AMERICA RESEARCH IN TRANSFECTION REAGENT AND EQUIPMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 6 NORTH AMERICA PRECLINICAL IN TRANSFECTION REAGENT AND EQUIPMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 7 NORTH AMERICA CLINICAL PHASES IN TRANSFECTION REAGENT AND EQUIPMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 8 NORTH AMERICA COMMERCIAL IN TRANSFECTION REAGENT AND EQUIPMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 9 NORTH AMERICA TRANSFECTION REAGENT AND EQUIPMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 10 NORTH AMERICA TRANSIENT TRANSFECTION REAGENTS AND EQUIPMENT IN TRANSFECTION REAGENT AND EQUIPMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 11 NORTH AMERICA STABLE TRANSFECTION REAGENTS AND EQUIPMENT IN TRANSFECTION REAGENT AND EQUIPMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 12 NORTH AMERICA TRANSFECTION REAGENTS AND EQUIPMENT MARKET, BY METHODS, 2021-2030 (USD THOUSAND)

TABLE 13 NORTH AMERICA NON-VIRAL METHODS IN TRANSFECTION REAGENT AND EQUIPMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 14 NORTH AMERICA VIRAL METHODS IN TRANSFECTION REAGENT AND EQUIPMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 15 NORTH AMERICA TRANSFECTION REAGENT AND EQUIPMENT MARKET, BY TYPES OF MOLECULE, 2021-2030 (USD THOUSAND)

TABLE 16 NORTH AMERICA PLASMID DNA IN TRANSFECTION REAGENT AND EQUIPMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 17 NORTH AMERICA SMALL INTERFERING RNA (SIRNA) IN TRANSFECTION REAGENT AND EQUIPMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 18 NORTH AMERICA PROTEINS IN TRANSFECTION REAGENT AND EQUIPMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 19 NORTH AMERICA DNA OLIGONUCLEOTIDES IN TRANSFECTION REAGENT AND EQUIPMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 20 NORTH AMERICA RIBONUCLEOPROTEIN COMPLEXES (RNPS) IN TRANSFECTION REAGENT AND EQUIPMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 21 NORTH AMERICA OTHERS IN TRANSFECTION REAGENT AND EQUIPMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 22 NORTH AMERICA TRANSFECTION REAGENT AND EQUIPMENT MARKET, BY ORGANISM, 2021-2030 (USD THOUSAND)

TABLE 23 NORTH AMERICA MAMMALIAN CELLS IN TRANSFECTION REAGENT AND EQUIPMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 24 NORTH AMERICA PLANTS IN TRANSFECTION REAGENT AND EQUIPMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 25 NORTH AMERICA FUNGI IN TRANSFECTION REAGENT AND EQUIPMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 26 NORTH AMERICA VIRUS IN TRANSFECTION REAGENT AND EQUIPMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 27 NORTH AMERICA BACTERIA IN TRANSFECTION REAGENT AND EQUIPMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 28 NORTH AMERICA TRANSFECTION REAGENT AND EQUIPMENT MARKET , BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 29 NORTH AMERICA IN VITRO APPLICATION IN TRANSFECTION REAGENT AND EQUIPMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 30 NORTH AMERICA IN VIVO APPLICATION IN TRANSFECTION REAGENT AND EQUIPMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 31 NORTH AMERICA BIOPRODUCTION IN TRANSFECTION REAGENT AND EQUIPMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 32 NORTH AMERICA OTHERS IN TRANSFECTION REAGENT AND EQUIPMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 33 NORTH AMERICA APPLICATION IN TRANSFECTION REAGENT AND EQUIPMENT MARKET, BY INDUSTRY, 2021-2030 (USD THOUSAND)

TABLE 34 NORTH AMERICA TRANSFECTION REAGENT AND EQUIPMENT MARKET, BY END USER, 2021-2030 (USD THOUSAND)

TABLE 35 NORTH AMERICA BIOPHARMA IN TRANSFECTION REAGENT AND EQUIPMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 36 NORTH AMERICA CROS IN TRANSFECTION REAGENT AND EQUIPMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 37 NORTH AMERICA CMOS/CDMOS IN TRANSFECTION REAGENT AND EQUIPMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 38 NORTH AMERICA ACADEMIA IN TRANSFECTION REAGENT AND EQUIPMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 39 NORTH AMERICA HOSPITALS IN TRANSFECTION REAGENT AND EQUIPMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 40 NORTH AMERICA CLINICAL LABS IN TRANSFECTION REAGENT AND EQUIPMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 41 NORTH AMERICA OTHERS IN TRANSFECTION REAGENT AND EQUIPMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 42 NORTH AMERICA TRANSFECTION REAGENT AND EQUIPMENT MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 43 NORTH AMERICA DIRECT TENDER IN TRANSFECTION REAGENT AND EQUIPMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 44 NORTH AMERICA RETAIL SALES IN TRANSFECTION REAGENT AND EQUIPMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 45 NORTH AMERICA OTHERS IN TRANSFECTION REAGENT AND EQUIPMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

그림 목록

FIGURE 1 NORTH AMERICA TRANSFECTION REAGENTS AND EQUIPMENT MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA TRANSFECTION REAGENTS AND EQUIPMENT MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA TRANSFECTION REAGENTS AND EQUIPMENT MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA TRANSFECTION REAGENTS AND EQUIPMENT MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA TRANSFECTION REAGENTS AND EQUIPMENT MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA TRANSFECTION REAGENTS AND EQUIPMENT MARKET: MULTIVARIATE MODELLING

FIGURE 7 NORTH AMERICA TRANSFECTION MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 8 NORTH AMERICA TRANSFECTION REAGENTS AND EQUIPMENT MARKET: DBMR MARKET POSITION GRID

FIGURE 9 NORTH AMERICA TRANSFECTION REAGENTS AND EQUIPMENT MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 10 NORTH AMERICA TRANSFECTION REAGENTS AND EQUIPMENT MARKET: VENDOR SHARE ANALYSIS

FIGURE 11 NORTH AMERICA TRANSFECTION REAGENTS AND EQUIPMENT MARKET: SEGMENTATION

FIGURE 12 INCREASING OCCURENCE OF CHRONIC DISEASES AND DEVELOPMENT OF SYNTHETIC BIOLOGY PRODUCTS IS DRIVING THE NORTH AMERICA TRANSFECTION REAGENTS AND EQUIPMENT MARKET IN THE FORECAST PERIOD OF 2022 TO 2030

FIGURE 13 THE TRANSIENT TRANSFECTION SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA TRANSFECTION REAGENTS AND EQUIPMENT MARKET IN 2022 & 2030

FIGURE 14 APPROVAL PROCESS FOR GENE THERAPY IN CHINA

FIGURE 15 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE NORTH AMERICA TRANSFECTION REAGENTS AND EQUIPMENT MARKET

FIGURE 16 NORTH AMERICA TRANSFECTION REAGENT AND EQUIPMENT MARKET: BY PRODUCTS, 2023

FIGURE 17 NORTH AMERICA TRANSFECTION REAGENT AND EQUIPMENT MARKET: BY PRODUCTS, 2023-2030 (USD THOUSAND)

FIGURE 18 NORTH AMERICA TRANSFECTION REAGENT AND EQUIPMENT MARKET: BY PRODUCTS, CAGR (2023-2030)

FIGURE 19 NORTH AMERICA TRANSFECTION REAGENT AND EQUIPMENT MARKET: BY PRODUCTS, LIFELINE CURVE

FIGURE 20 NORTH AMERICA TRANSFECTION REAGENT AND EQUIPMENT MARKET: BY STAGE, 2023

FIGURE 21 NORTH AMERICA TRANSFECTION REAGENT AND EQUIPMENT MARKET: BY STAGE, 2023-2030 (USD THOUSAND)

FIGURE 22 NORTH AMERICA TRANSFECTION REAGENT AND EQUIPMENT MARKET: BY STAGE, CAGR (2023-2030)

FIGURE 23 NORTH AMERICA TRANSFECTION REAGENT AND EQUIPMENT MARKET: BY STAGE, LIFELINE CURVE

FIGURE 24 NORTH AMERICA TRANSFECTION REAGENT AND EQUIPMENT MARKET: BY TYPE, 2023

FIGURE 25 NORTH AMERICA TRANSFECTION REAGENT AND EQUIPMENT MARKET: BY TYPE, 2023-2030 (USD THOUSAND)

FIGURE 26 NORTH AMERICA TRANSFECTION REAGENT AND EQUIPMENT MARKET: BY TYPE, CAGR (2023-2030)

FIGURE 27 NORTH AMERICA TRANSFECTION REAGENT AND EQUIPMENT MARKET: BY TYPE, LIFELINE CURVE

FIGURE 28 NORTH AMERICA TRANSFECTION REAGENTS AND EQUIPMENT MARKET: BY METHODS, 2022

FIGURE 29 NORTH AMERICA TRANSFECTION REAGENTS AND EQUIPMENT MARKET: BY METHODS, 2023-2030 (USD THOUSAND)

FIGURE 30 NORTH AMERICA TRANSFECTION REAGENTS AND EQUIPMENT MARKET: BY METHODS, CAGR (2023-2030)

FIGURE 31 NORTH AMERICA TRANSFECTION REAGENTS AND EQUIPMENT MARKET: BY METHODS, LIFELINE CURVE

FIGURE 32 NORTH AMERICA TRANSFECTION REAGENT AND EQUIPMENT MARKET: BY TYPES OF MOLECULE, 2022

FIGURE 33 NORTH AMERICA TRANSFECTION REAGENT AND EQUIPMENT MARKET: BY TYPES OF MOLECULE, 2023-2030 (USD THOUSAND)

FIGURE 34 NORTH AMERICA TRANSFECTION REAGENT AND EQUIPMENT MARKET: BY TYPES OF MOLECULE, CAGR (2023-2030)

FIGURE 35 NORTH AMERICA TRANSFECTION REAGENT AND EQUIPMENT MARKET: BY TYPES OF MOLECULE, LIFELINE CURVE

FIGURE 36 NORTH AMERICA TRANSFECTION REAGENT AND EQUIPMENT MARKET: BY ORGANISM, 2022

FIGURE 37 NORTH AMERICA TRANSFECTION REAGENT AND EQUIPMENT MARKET: BY ORGANISM, 2023-2030 (USD THOUSAND)

FIGURE 38 NORTH AMERICA TRANSFECTION REAGENT AND EQUIPMENT MARKET: BY ORGANISM, CAGR (2023-2030)

FIGURE 39 NORTH AMERICA TRANSFECTION REAGENT AND EQUIPMENT MARKET: BY ORGANISM, LIFELINE CURVE

FIGURE 40 NORTH AMERICA TRANSFECTION REAGENT AND EQUIPMENT MARKET BY APPLICATION, 2022

FIGURE 41 NORTH AMERICA TRANSFECTION REAGENT AND EQUIPMENT MARKET BY APPLICATION, 2023-2030 (USD THOUSAND)

FIGURE 42 NORTH AMERICA TRANSFECTION REAGENT AND EQUIPMENT MARKET BY APPLICATION, CAGR (2023-2030)

FIGURE 43 NORTH AMERICA TRANSFECTION REAGENT AND EQUIPMENT MARKET BY APPLICATION, LIFELINE CURVE

FIGURE 44 NORTH AMERICA TRANSFECTION REAGENT AND EQUIPMENT MARKET: BY END USER, 2022

FIGURE 45 NORTH AMERICA TRANSFECTION REAGENT AND EQUIPMENT MARKET : BY END USER, 2023-2030 (USD THOUSAND)

FIGURE 46 NORTH AMERICA TRANSFECTION REAGENT AND EQUIPMENT MARKET : BY END USER, CAGR (2023-2030)

FIGURE 47 NORTH AMERICA TRANSFECTION REAGENT AND EQUIPMENT MARKET : BY END USER, LIFELINE CURVE

FIGURE 48 NORTH AMERICA TRANSFECTION REAGENT AND EQUIPMENT MARKET: BY DISTRIBUTION CHANNEL, 2022

FIGURE 49 NORTH AMERICA TRANSFECTION REAGENT AND EQUIPMENT MARKET: BY DISTRIBUTION CHANNEL, 2023-2030 (USD THOUSAND)

FIGURE 50 NORTH AMERICA TRANSFECTION REAGENT AND EQUIPMENT MARKET: BY DISTRIBUTION CHANNEL, CAGR (2023-2030)

FIGURE 51 NORTH AMERICA TRANSFECTION REAGENT AND EQUIPMENT MARKET: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 52 NORTH AMERICA TRANSFECTION REAGENT AND EQUIPMENT MARKET: SNAPSHOT (2022)

FIGURE 53 NORTH AMERICA TRANSFECTION REAGENT AND EQUIPMENT MARKET: BY COUNTRY (2022)

FIGURE 54 NORTH AMERICA TRANSFECTION REAGENT AND EQUIPMENT MARKET: BY COUNTRY (2023 & 2030)

FIGURE 55 NORTH AMERICA TRANSFECTION REAGENT AND EQUIPMENT MARKET: BY COUNTRY (2022 & 2030)

FIGURE 56 NORTH AMERICA TRANSFECTION REAGENT AND EQUIPMENT MARKET: BY PRODUCTS (2023-2030)

FIGURE 57 NORTH AMERICA TRANSFECTION REAGENTS AND EQUIPMENT MARKET: COMPANY SHARE 2022 (%)

연구 방법론

데이터 수집 및 기준 연도 분석은 대규모 샘플 크기의 데이터 수집 모듈을 사용하여 수행됩니다. 이 단계에는 다양한 소스와 전략을 통해 시장 정보 또는 관련 데이터를 얻는 것이 포함됩니다. 여기에는 과거에 수집한 모든 데이터를 미리 검토하고 계획하는 것이 포함됩니다. 또한 다양한 정보 소스에서 발견되는 정보 불일치를 검토하는 것도 포함됩니다. 시장 데이터는 시장 통계 및 일관된 모델을 사용하여 분석하고 추정합니다. 또한 시장 점유율 분석 및 주요 추세 분석은 시장 보고서의 주요 성공 요인입니다. 자세한 내용은 분석가에게 전화를 요청하거나 문의 사항을 드롭하세요.

DBMR 연구팀에서 사용하는 주요 연구 방법론은 데이터 마이닝, 시장에 대한 데이터 변수의 영향 분석 및 주요(산업 전문가) 검증을 포함하는 데이터 삼각 측량입니다. 데이터 모델에는 공급업체 포지셔닝 그리드, 시장 타임라인 분석, 시장 개요 및 가이드, 회사 포지셔닝 그리드, 특허 분석, 가격 분석, 회사 시장 점유율 분석, 측정 기준, 글로벌 대 지역 및 공급업체 점유율 분석이 포함됩니다. 연구 방법론에 대해 자세히 알아보려면 문의를 통해 업계 전문가에게 문의하세요.

사용자 정의 가능

Data Bridge Market Research는 고급 형성 연구 분야의 선두 주자입니다. 저희는 기존 및 신규 고객에게 목표에 맞는 데이터와 분석을 제공하는 데 자부심을 느낍니다. 보고서는 추가 국가에 대한 시장 이해(국가 목록 요청), 임상 시험 결과 데이터, 문헌 검토, 재생 시장 및 제품 기반 분석을 포함하도록 사용자 정의할 수 있습니다. 기술 기반 분석에서 시장 포트폴리오 전략에 이르기까지 타겟 경쟁업체의 시장 분석을 분석할 수 있습니다. 귀하가 원하는 형식과 데이터 스타일로 필요한 만큼 많은 경쟁자를 추가할 수 있습니다. 저희 분석가 팀은 또한 원시 엑셀 파일 피벗 테이블(팩트북)로 데이터를 제공하거나 보고서에서 사용 가능한 데이터 세트에서 프레젠테이션을 만드는 데 도움을 줄 수 있습니다.