중동 및 아프리카 견고한 산업용 디스플레이 시장, 기술별(LCD, LED, OLED, E-Paper 디스플레이), 디스플레이 크기(8"-11", 11"-12", 13"-18", 19"-25", 40" 이상), 해상도(1920x1200, 1920x1080, 1280x1024, 1024x768, 800x600, 1366x768), 장착(패널 장착, 랙 장착, 벽면 장착, 암 장착, 오픈 프레임, 기타), 터치 스크린 유형(저항성, PCAP, IR 터치, 정전식), 응용 분야(의료, HMI, 산업 자동화, 키오스크/POS, 디지털 사이니지, 이미징, 게임/복권), 수직(석유 및 가스, 제조, 화학, 에너지 및 전력, 광산 및 금속, 운송, 군사 및 방위, 기타), 국가(남아프리카, 사우디 아라비아, 아랍에미리트, 이집트, 이스라엘, 중동 및 아프리카의 나머지 지역) 산업 동향 및 2028년까지의 예측

시장 분석 및 통찰력: 중동 및 아프리카 견고한 산업용 디스플레이 시장

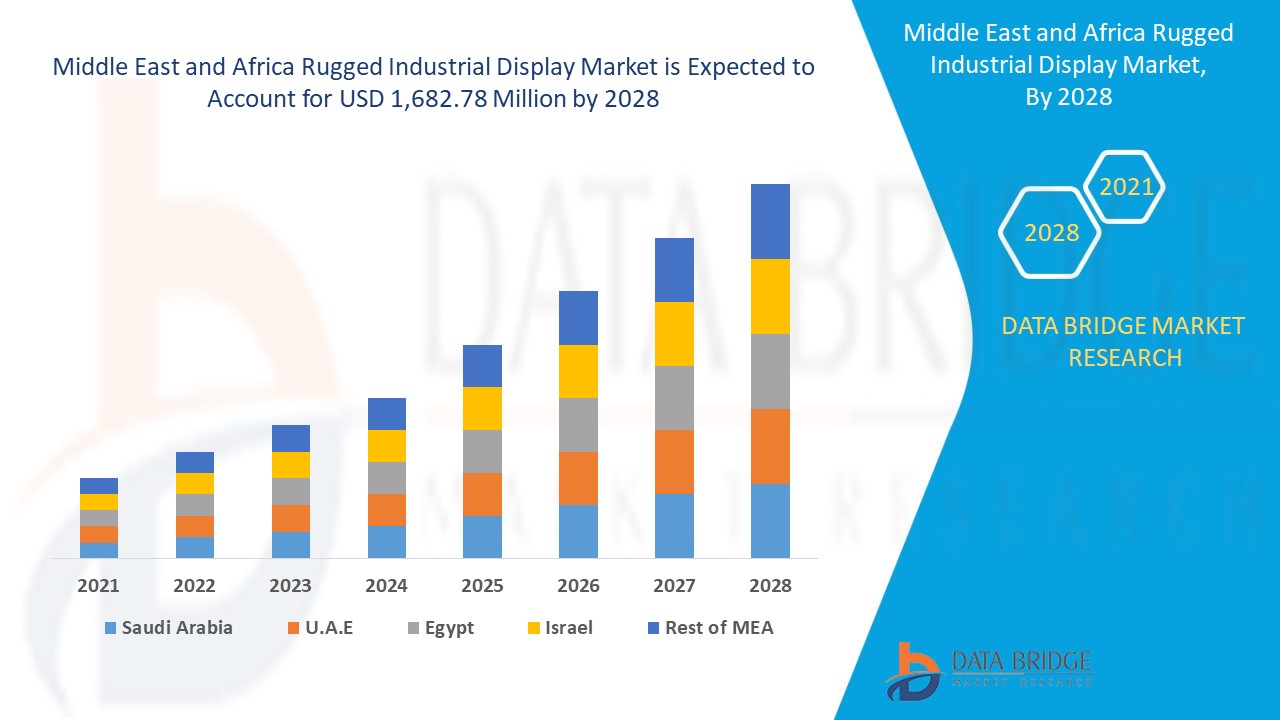

견고한 산업용 디스플레이 시장은 2021년에서 2028년까지의 예측 기간 동안 시장 성장을 이룰 것으로 예상됩니다. Data Bridge Market Research는 시장이 2021년에서 2028년까지의 예측 기간 동안 7.9%의 CAGR로 성장하고 있으며 2028년까지 1,682.78백만 달러에 도달할 것으로 예상된다고 분석합니다. 산업 4.0에 따른 자동화 및 IoT의 증가와 의료, 제조, 군사 및 방위 분야의 디지털 데이터의 증가는 각 부문의 혹독한 환경에 더 적합한 상호 작용을 위한 화면을 필요로 하며, 이는 견고한 산업용 디스플레이 시장 성장을 촉진하는 요인으로 작용합니다.

견고한 산업용 디스플레이는 고성능과 견고성이 중요한 해양, 군사 및 산업 분야에서 직면한 혹독한 환경을 위해 설계된 특수한 종류의 디스플레이입니다. 이는 사용 사례에 따라 단단한 충격 방지 셸, 긁힘 방지 스크린, 내식성 및 특수 코팅과 같은 기능을 제공합니다.

산업에서 떠오르는 기술 개발과 자동화된 프로세스는 중동과 아프리카의 견고한 산업용 디스플레이 시장을 이끄는 주요 원동력으로 입증되고 있습니다. 최근 몇 년 동안 인간-기계 상호작용이 증가하면서 최근 몇 년 동안 HMI 디스플레이 시장이 성장했고 제조 부문에서 자동화 도입이 증가하면서 시장이 주도되고 있습니다. 견고한 디스플레이 도입 비용이 높고 까다로운 조건에 대한 높은 개발 비용은 제약이 될 수 있지만 많은 산업이 산업 4.0과 빠른 디지털화 및 자동화로 전환하는 것은 시장에 더 큰 기회입니다. 전천후 디스플레이 개발은 도전이 될 수 있으며, 특히 국제적으로 전자 제품의 주요 공급업체인 중국에서의 수입을 포함한 원자재 공급망에 대한 COVID-19의 영향으로 인해 직면한 도전이 있습니다.

견고한 산업용 디스플레이 시장 보고서는 시장 점유율, 새로운 개발 및 제품 파이프라인 분석, 국내 및 현지 시장 참여자의 영향, 새로운 수익 창출, 시장 규정의 변화, 제품 승인, 전략적 의사 결정, 제품 출시, 지리적 확장 및 시장의 기술 혁신 측면에서의 분석 기회에 대한 세부 정보를 제공합니다. 분석 및 견고한 산업용 디스플레이 시장 시나리오를 이해하려면 Data Bridge Market Research에 연락하여 분석가 브리핑을 요청하세요. 당사 팀은 원하는 목표를 달성하기 위한 수익 영향 솔루션을 만드는 데 도움을 드립니다.

견고한 산업용 디스플레이 시장 범위 및 시장 규모

견고한 산업용 디스플레이 시장은 기술, 디스플레이 크기, 해상도, 장착, 터치 스크린 유형, 애플리케이션 및 수직을 기준으로 세분화됩니다. 세그먼트 간 성장은 틈새 성장 포켓과 시장에 접근하고 핵심 애플리케이션 영역과 타겟 시장의 차이점을 파악하기 위한 전략을 분석하는 데 도움이 됩니다.

- 기술에 따라 견고한 산업용 디스플레이 시장은 LCD, LED, OLED, E-Paper 디스플레이로 세분화됩니다. 2021년에는 LCD 세그먼트가 모든 부문 중에서 채택 비용이 가장 저렴하기 때문에 견고한 산업용 디스플레이 시장을 지배하고 있습니다.

- 디스플레이 크기에 따라 견고한 산업용 디스플레이 시장은 8"-11", 11"-12", 13"-18", 19"-25", 40"-이상 등으로 세분화됩니다. 2021년에는 13"-18" 세그먼트가 모든 종류의 애플리케이션과 장착 유형에 최적의 디스플레이 크기이기 때문에 시장을 지배하고 있습니다.

- 해상도를 기준으로 견고한 산업용 디스플레이 시장은 1920x1200, 1920x1080, 1280x1024, 1024x768, 800x600, 1366x768로 세분화됩니다. 2021년에는 1024x768 세그먼트가 시장을 지배하고 있는데, 그 이유는 4:3 종횡비가 HMI 디스플레이에서 일반적이며 레거시 소프트웨어도 지원하기 때문입니다.

- 견고한 산업용 디스플레이 시장은 장착을 기준으로 패널 장착, 랙 장착, 벽면 장착, 암 장착, 오픈 프레임 및 기타로 세분화됩니다. 2021년에는 다양한 어댑터에 대한 채택의 다재다능한 특성과 제조 부문에서의 광범위한 채택으로 인해 패널 장착 세그먼트가 시장을 지배하고 있습니다.

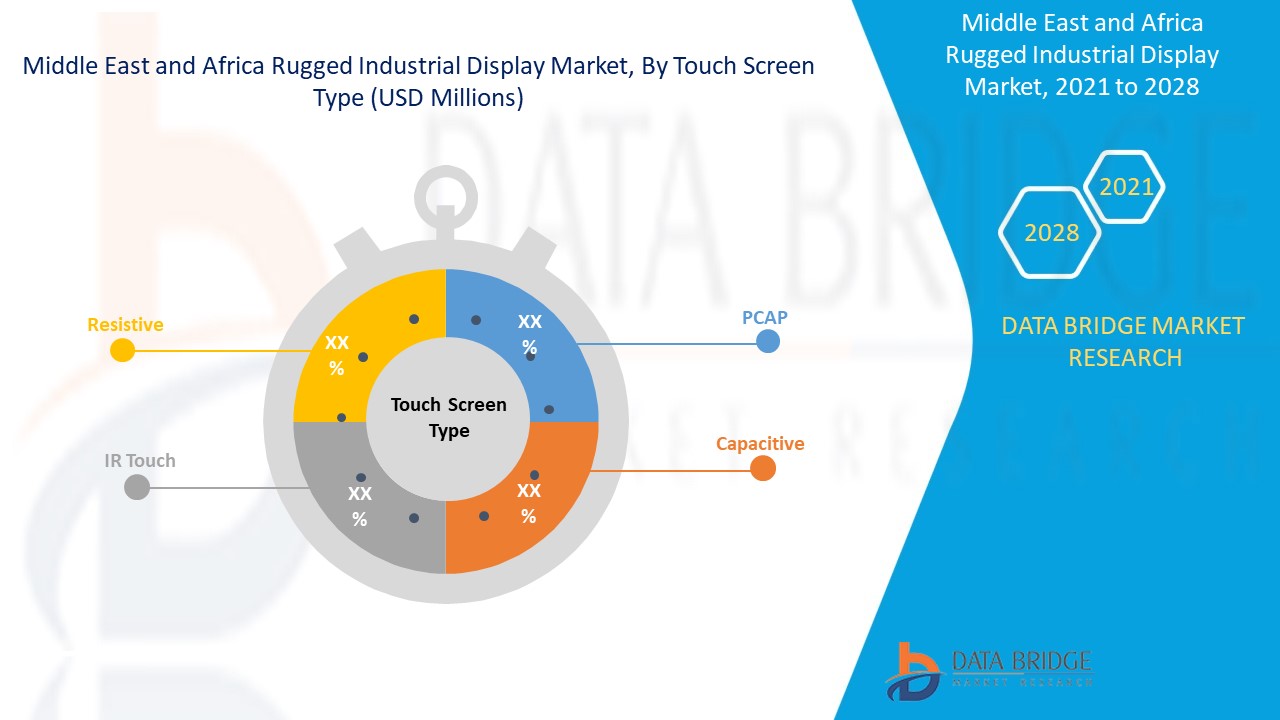

- 터치 스크린 유형을 기준으로 견고한 산업용 디스플레이 시장은 저항식, PCAP, IR 터치, 정전식으로 세분화됩니다. 2021년에는 저항식 세그먼트가 채택 비용이 낮고 장갑과 수동 스타일러스로 사용하기 쉽기 때문에 시장을 지배하고 있습니다.

- 응용 프로그램을 기준으로 견고한 산업용 디스플레이 시장은 의료, HMI, 산업 자동화, 키오스크/POS, 디지털 사이니지 , 이미징, 게임/복권으로 세분화됩니다. 2021년에는 HMI 부문이 빠른 산업화와 자동화 사용으로 시장을 지배하고 있습니다.

- 수직 기준으로 견고한 산업용 디스플레이 시장은 석유 및 가스, 제조, 화학 , 에너지 및 전력, 광업 및 금속, 운송, 군사 및 방위 및 기타로 세분화됩니다. 2021년에는 아시아 태평양 전역에서 자동화 증가와 제조 시설 확대로 인해 수요가 증가하여 제조 부문이 시장을 지배하고 있습니다.

견고한 산업용 디스플레이 시장 국가 수준 분석

견고한 산업용 디스플레이 시장을 분석하고, 위에 언급된 대로 국가, 기술, 디스플레이 크기, 해상도, 장착, 터치 스크린 유형, 응용 분야 및 수직 분야별로 시장 규모 정보를 제공합니다.

견고한 산업용 디스플레이 시장 보고서에서 다루는 국가는 남아프리카공화국, 사우디아라비아, 아랍에미리트, 이집트, 이스라엘, 기타 중동 및 아프리카입니다.

사우디아라비아는 산업의 급속한 성장과 제조업에서의 HMI 활용으로 인해 중동과 아프리카 지역을 선도하고 있습니다.

보고서의 국가 섹션은 또한 개별 시장 영향 요인과 국내 시장의 현재 및 미래 트렌드에 영향을 미치는 규제 변화를 제공합니다. 신규 판매, 교체 판매, 국가 인구 통계, 규제 조치 및 수출입 관세와 같은 데이터 포인트는 개별 국가의 시장 시나리오를 예측하는 데 사용되는 주요 포인터 중 일부입니다. 또한 아시아 태평양 브랜드의 존재 및 가용성과 지역 및 국내 브랜드와의 대규모 또는 희소한 경쟁으로 인해 직면한 과제, 판매 채널의 영향이 국가 데이터에 대한 예측 분석을 제공하는 동안 고려됩니다.

주요 시장 참여자들이 견고한 산업용 디스플레이에 대한 인지도를 높이기 위해 전략적 활동을 확대함에 따라 견고한 산업용 디스플레이 시장 성장이 촉진되고 있습니다.

견고한 산업용 디스플레이 시장은 또한 특정 시장에서 모든 국가의 성장에 대한 자세한 시장 분석을 제공합니다. 또한 시장 참여자의 전략과 지리적 입지에 대한 자세한 정보를 제공합니다. 이 데이터는 2010년부터 2019년까지의 과거 기간에 대해 제공됩니다.

경쟁 환경 및 견고한 산업용 디스플레이 시장 점유율 분석

견고한 산업용 디스플레이 시장 경쟁 구도는 경쟁자별 세부 정보를 제공합니다. 포함된 세부 정보에는 회사 개요, 회사 재무, 창출된 수익, 시장 잠재력, 연구 개발 투자, 새로운 시장 이니셔티브, 생산 현장 및 시설, 회사의 강점과 약점, 제품 출시, 제품 시험 파이프라인, 제품 승인, 특허, 제품 폭과 폭, 응용 분야 우세, 기술 수명선 곡선이 있습니다. 위에 제공된 데이터 포인트는 견고한 산업용 디스플레이 시장과 관련된 회사의 초점에만 관련이 있습니다.

견고한 산업용 디스플레이를 취급하는 주요 기업으로는 Bit Tradition GmbH, SAMSUNG ELECTRONICS AMERICA, Advantech Co., Ltd., GETAC, Kyocera, Pepperl+Fuchs SE, Rockwell Automation, Inc., Siemens 등이 있습니다. DBMR 분석가는 경쟁 우위를 이해하고 각 경쟁사에 대한 경쟁 분석을 별도로 제공합니다.

또한 전 세계 여러 회사에서 많은 계약과 협정을 체결하면서 견고한 산업용 디스플레이 시장이 가속화되고 있습니다.

예를 들어,

- 2021년 4월, Curtiss-Wright 방위 솔루션 사업부는 Scientific Research Corporation(SRC)에서 미국이 사용하는 T-6 Texan II 훈련기를 업그레이드하기 위해 업계를 선도하는 Fortress 비행 기록 시스템 버전을 제공하도록 선정되었습니다. 이 회사는 SRC에 군용 고정익 및 회전익 항공기 공중 플랫폼에서 사용하도록 개발된 Fortress CVR25의 새로운 변형을 제공했습니다. 이를 통해 이 회사는 방위 사업부에서 DoD 내의 다른 비행 기록 애플리케이션을 추가로 탐색할 수 있습니다.

- 2021년 3월 IoT 기술 분야의 아시아 태평양 리더인 Advantech Co. Ltd는 세계 최대 규모의 온라인 파트너 컨퍼런스 시리즈를 시작한다고 발표했습니다. 이 시리즈의 주제는 "Edge+ to the future of AIoT"입니다. 이 시리즈는 60명 이상의 산업 전문가와 생태계 협력자를 모아 새로운 Edge+ 솔루션과 기술을 공유했습니다. 이 회사는 또한 이러한 협력자들과 장기적으로 협력하여 지속 가능한 환경을 공동으로 만들고 IoT 사업 기회를 개선할 계획입니다.

협력, 제품 출시, 사업 확장, 수상 및 인정, 합작 투자 및 시장 참여자의 기타 전략을 통해 견고한 산업용 디스플레이 시장에서 회사의 입지를 강화하고 조직의 수익 성장에도 도움이 됩니다.

SKU-

세계 최초의 시장 정보 클라우드 보고서에 온라인으로 접속하세요

- 대화형 데이터 분석 대시보드

- 높은 성장 잠재력 기회를 위한 회사 분석 대시보드

- 사용자 정의 및 질의를 위한 리서치 분석가 액세스

- 대화형 대시보드를 통한 경쟁자 분석

- 최신 뉴스, 업데이트 및 추세 분석

- 포괄적인 경쟁자 추적을 위한 벤치마크 분석의 힘 활용

목차

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF MIDDLE EAST AND AFRICA RUGGED INDUSTRIAL DISPLAY MARKET

1.4 CURRENCY & PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELING

2.9 TECHNOLOGY TIMELINE CURVE

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 INDUSTRIAL DISPLAY TYPES

4.2 STANDARD RATINGS FOR INDUSTRIAL DISPLAYS

4.2.1 INGRESS PROTECTION (IP) RATING:

4.2.2 NATIONAL ELECTRIC MANUFACTURERS ASSOCIATION (NEMA) RATINGS

4.3 KEY CUSTOMERS BY INDUSTRY

4.3.1 MILITARY & DEFENSE INDUSTRY

4.3.2 INDUSTRIAL AUTOMATION & MANUFACTURING

4.3.3 OIL & GAS INDUSTRY

4.3.4 CHEMICAL INDUSTRY

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 EMERGENCE OF VARIOUS TECHNOLOGICAL DEVELOPMENTS AND AUTOMATED PROCESSES IN INDUSTRIES

5.1.2 LED AND LCD BASED DISPLAY PRODUCTS REDUCES RISK OF EYE DAMAGE

5.1.3 RISE IN DEMAND FOR HUMAN MACHINE INTERFACE (HMI) APPLICATION IN VARIOUS INDUSTRIES

5.1.4 INCREASE IN MANUFACTURING FACILITIES WORLDWIDE ENHANCES ADOPTION OF INDUSTRIAL DISPLAYS

5.1.5 AVAILABILITY OF ROBUST DISPLAY SCREEN AND WIRELESS CONNECTION

5.1.6 RISE IN DEMAND FOR COST-EFFECTIVE KIOSKS FOR INDUSTRIAL APPLICATIONS

5.2 RESTRAINTS

5.2.1 HIGH INVESTMENTS REQUIRED FOR INSTALLING OF INDUSTRIAL DISPLAYS/PANELS

5.2.2 DEVELOPING & DESIGNING OF DISPLAY EQUIPMENT FOR ALL WEATHER CONDITIONS

5.3 OPPORTUNITIES

5.3.1 GROWING DEMAND FOR DIGITAL SIGNAGE APPLICATIONS IN INDUSTRIES FOR DISPLAYING NECESSARY INFORMATION

5.3.2 INCREASE IN DIGITALIZATION OF FACILITIES WITH INDUSTRY 4.0

5.3.3 RISE IN ADOPTION OF OLED DISPLAYS IN VARIOUS APPLICATIONS

5.3.4 TRANSFORMATION OF MANUAL PROCESS INTO DIGITAL PROCESS BY COMPANIES

5.3.5 INCREASE IN PARTNERSHIPS AND ACQUISITIONS AMONGST DIFFERENT MARKET PLAYERS

5.4 CHALLENGES

5.4.1 SUITABILITY OF INDUSTRIAL DISPLAY FOR ALL WEATHER CONDITIONS

5.4.2 DEPENDENCY OF MANUFACTURERS ON VARIOUS SUPPLIERS TO PROVIDE EQUIPMENT AND COMPONENTS

5.4.3 ECONOMIC CRISIS OCCURRED DUE TO VARIOUS FACTORS

6 IMPACT OF COVID-19 ON THE MIDDLE EAST AND AFRICA RUGGED INDUSTRIAL DISPLAY MARKET

6.1 AFTERMATH OF COVID-19 AND GOVERNMENT INITIATIVE TO BOOST THE MARKET

6.2 STRATEGIC DECISIONS FOR MANUFACTURERS AFTER COVID-19 TO GAIN COMPETITIVE MARKET SHARE

6.3 IMPACT ON PRICE

6.4 IMPACT ON DEMAND

6.5 CONCLUSION

7 MIDDLE EAST AND AFRICA RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY

7.1 OVERVIEW

7.2 LCD

7.3 LED

7.3.1 FULL ARRAY

7.3.2 EDGE LIT

7.3.3 DIRECT LIT

7.4 OLED

7.4.1 AMOLED DISPLAY

7.4.2 PMOLED DISPLAY

7.5 E-PAPER DISPLAY

8 MIDDLE EAST AND AFRICA RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE

8.1 OVERVIEW

8.2” – 18”

8.3 8” – 11”

8.4” – 12”

8.5” – 25”

8.6 ABOVE 40"

9 MIDDLE EAST AND AFRICA RUGGED INDUSTRIAL DISPLAY MARKET, BY RESOLUTION

9.1 OVERVIEW

9.24X768

9.36X768

9.40X1080

9.5X600

9.60X1024

9.70X1200

10 MIDDLE EAST AND AFRICA RUGGED INDUSTRIAL DISPLAY MARKET, BY MOUNTING

10.1 OVERVIEW

10.2 PANEL MOUNTING

10.3 OPEN-FRAME

10.4 RACK MOUNTING

10.5 WALL MOUNTING

10.6 ARM-MOUNTED

10.7 OTHERS

11 MIDDLE EAST AND AFRICA RUGGED INDUSTRIAL DISPLAY MARKET, BY TOUCH SCREEN TYPE

11.1 OVERVIEW

11.2 RESISTIVE

11.3 P CAP

11.4 CAPACITIVE

11.5 IR TOUCH

12 MIDDLE EAST AND AFRICA RUGGED INDUSTRIAL DISPLAY MARKET, BY APPLICATION

12.1 OVERVIEW

12.2 HMI

12.2.1” – 18”

12.2.2 8” – 11”

12.2.3” – 25”

12.2.4” – 12”

12.2.5 ABOVE 40"

12.3 MEDICAL

12.3.1” – 18”

12.3.2” – 25”

12.3.3” – 12”

12.3.4 8” – 11”

12.3.5 ABOVE 40"

12.4 INDUSTRIAL AUTOMATION

12.4.1 ABOVE 40"

12.4.2” – 25”

12.4.3” – 18”

12.4.4” – 12”

12.4.5 8” – 11”

12.5 DIGITAL SIGNAGE

12.5.1 ABOVE 40"

12.5.2” – 25”

12.5.3” – 18”

12.5.4” – 12”

12.5.5 8” – 11”

12.6 KIOSK/ POS

12.6.1 8” – 11”

12.6.2” – 12”

12.6.3” – 18”

12.6.4” – 25”

12.6.5 ABOVE 40"

12.7 GAMING/ LOTTERY

12.7.1” – 18”

12.7.2” – 25”

12.7.3” – 12”

12.7.4 8” – 11”

12.7.5 ABOVE 40"

12.8 IMAGING

12.8.1” – 18”

12.8.2” – 25”

12.8.3 ABOVE 40"

12.8.4” – 12”

12.8.5 ABOVE 40"

13 MIDDLE EAST AND AFRICA RUGGED INDUSTRIAL DISPLAY MARKET, BY VERTICAL

13.1 OVERVIEW

13.2 MANUFACTURING

13.2.1 LCD

13.2.2 LED

13.2.3 OLED

13.3 MILITARY & DEFENCE

13.3.1 LCD

13.3.2 LED

13.3.3 OLED

13.4 ENERGY & POWER

13.4.1 LCD

13.4.2 LED

13.4.3 OLED

13.5 OIL & GAS

13.5.1 LCD

13.5.2 LED

13.5.3 OLED

13.6 CHEMICAL

13.6.1 LCD

13.6.2 LED

13.6.3 OLED

13.7 TRANSPORTATION

13.7.1 LCD

13.7.2 LED

13.7.3 OLED

13.8 METAL & MINING

13.8.1 LCD

13.8.2 LED

13.8.3 OLED

13.9 OTHERS

14 MIDDLE EAST AND AFRICA RUGGED INDUSTRIAL DISPLAY MARKET, BY GEOGRAPHY

14.1 MIDDLE EAST AND AFRICA

14.1.1 SAUDI ARABIA

14.1.2 SOUTH AFRICA

14.1.3 UAE

14.1.4 EGYPT

14.1.5 ISRAEL

14.1.6 REST OF MIDDLE EAST AND AFRICA

15 MIDDLE EAST AND AFRICA RUGGED INDUSTRIAL DISPLAY MARKET: COMPANY LANDSCAPE

15.1 COMPANY SHARE ANALYSIS: MIDDLE EAST AND AFRICA

16 SWOT ANALYSIS

17 COMPANY PROFILE

17.1 SAMSUNG ELECTRONICS AMERICA

17.1.1 COMPANY SNAPSHOT

17.1.2 COMPANY SHARE ANALYSIS

17.1.3 PRODUCT PORTFOLIO

17.1.4 RECENT DEVELOPMENTS

17.2 AU OPTRONICS CORP.

17.2.1 COMPANY SNAPSHOT

17.2.2 REVENUE ANALSYSIS

17.2.3 COMPANY SHARE ANALYSIS

17.2.4 PRODUCT PORTFOLIO

17.2.5 RECENT DEVELOPMENTS

17.3 KYOCERA

17.3.1 COMPANY SNAPSHOT

17.3.2 REVENUE ANALYSIS

17.3.3 COMPANY SHARE ANALYSIS

17.3.4 PRODUCT PORTFOLIO

17.3.5 RECENT DEVELOPMENTS

17.4 CURTISS-WRIGHT CORPORATION

17.4.1 COMPANY SNAPSHOT

17.4.2 REVENUE ANALYSIS

17.4.3 COMPANY SHARE ANALYSIS

17.4.4 PRODUCT PORTFOLIO

17.4.5 RECENT DEVELOPMENTS

17.5 ROCKWELL AUTOMATION INC.

17.5.1 COMPANY SNAPSHOT

17.5.2 COMPANY SHARE ANALYSIS

17.5.3 PRODUCT PORTFOLIO

17.5.4 RECENT DEVELOPMENTS

17.6 GETAC

17.6.1 COMPANY SNAPSHOT

17.6.2 REVENUE ANALYSIS

17.6.3 PRODUCT PORTFOLIO

17.6.4 RECENT DEVELOPMENTS

17.7 ADVANCED EMBEDDED SOLUTIONS

17.7.1 COMPANY SNAPSHOT

17.7.2 PRODUCT PORTFOLIO

17.7.3 RECENT DEVELOPMENTS

17.8 ADVANTECH CO., LTD.

17.8.1 COMPANY SNAPSHOT

17.8.2 REVENUE ANALYSIS

17.8.3 PRODUCT PORTFOLIO

17.8.4 RECENT DEVELOPMENTS

17.9 BIT TRADITION GMBH

17.9.1 COMPANY SNAPSHOT

17.9.2 PRODUCT PORTFOLIO

17.9.3 RECENT DEVELOPMENTS

17.1 BLUESTONE TECHNOLOGY LTD

17.10.1 COMPANY SNAPSHOT

17.10.2 PRODUCT PORTFOLIO

17.10.3 RECENT DEVELOPMENTS

17.11 BOE TECHNOLOGY UK LIMITED

17.11.1 COMPANY SNAPSHOT

17.11.2 PRODUCT PORTFOLIO

17.11.3 RECENT DEVELOPMENTS

17.12 BRESSNER TECHNOLOGY GMBH

17.12.1 COMPANY SNAPSHOT

17.12.2 PRODUCT PORTFOLIO

17.12.3 RECENT DEVELOPMENTS

17.13 CRYSTAL GROUP INC.

17.13.1 COMPANY SNAPSHOT

17.13.2 PRODUCT PORTFOLIO

17.13.3 RECENT DEVELOPMENTS

17.14 GENERAL DIGITAL CORPORATION

17.14.1 COMPANY SNAPSHOT

17.14.2 PRODUCT PORTFOLIO

17.14.3 RECENT DEVELOPMENTS

17.15 HEMATEC GMBH

17.15.1 COMPANY SNAPSHOT

17.15.2 PRODUCT PORTFOLIO

17.15.3 RECENT DEVELOPMENTS

17.16 HOPE INDUSTRIAL SYSTEMS, INC.

17.16.1 COMPANY SNAPSHOT

17.16.2 PRODUCT PORTFOLIO

17.16.3 RECENT DEVELOPMENTS

17.17 NOAX TECHNOLOGIES AG

17.17.1 COMPANY SNAPSHOT

17.17.2 PRODUCT PORTFOLIO

17.17.3 RECENT DEVELOPMENTS

17.18 PEPPERL+FUCHS SE

17.18.1 COMPANY SNAPSHOT

17.18.2 PRODUCT PORTFOLIO

17.18.3 RECENT DEVELOPMENTS

17.19 SIEMENS

17.19.1 COMPANY SNAPSHOT

17.19.2 REVENUE ANALYSIS

17.19.3 PRODUCT PORTFOLIO

17.19.4 RECENT DEVELOPMENTS

17.2 TCI GMBH

17.20.1 COMPANY SNAPSHOT

17.20.2 PRODUCT PORTFOLIO

17.20.3 RECENT DEVELOPMENTS

18 QUESTIONNAIRE

19 RELATED REPORTS

표 목록

TABLE 1 DESCRIPTION OF VARIOUS IP RATING NUMBERS

TABLE 2 SIGNIFICANCE OF NEMA RATING

TABLE 3 MIDDLE EAST AND AFRICA RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 4 MIDDLE EAST AND AFRICA LCD IN RUGGED INDUSTRIAL DISPLAY MARKET, BY REGION, 2019-2028, (USD MILLION)

TABLE 5 MIDDLE EAST AND AFRICA LED IN RUGGED INDUSTRIAL DISPLAY MARKET, BY REGION, 2019-2028, (USD MILLION)

TABLE 6 MIDDLE EAST AND AFRICA LED IN RUGGED INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 7 MIDDLE EAST AND AFRICA OLED IN RUGGED INDUSTRIAL DISPLAY MARKET, BY REGION, 2019-2028, (USD MILLION)

TABLE 8 MIDDLE EAST AND AFRICA OLED IN RUGGED INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 9 MIDDLE EAST AND AFRICA E-PAPER DISPLAY IN RUGGED INDUSTRIAL DISPLAY MARKET, BY REGION, 2019-2028, (USD MILLION)

TABLE 10 MIDDLE EAST AND AFRICA RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 11 MIDDLE EAST AND AFRICA 13” – 18” IN RUGGED INDUSTRIAL DISPLAY MARKET, BY REGION, 2019-2028, (USD MILLION)

TABLE 12 MIDDLE EAST AND AFRICA 8” – 11” IN RUGGED INDUSTRIAL DISPLAY MARKET, BY REGION, 2019-2028, (USD MILLION)

TABLE 13 MIDDLE EAST AND AFRICA 11” – 12” IN RUGGED INDUSTRIAL DISPLAY MARKET, BY REGION, 2019-2028, (USD MILLION)

TABLE 14 MIDDLE EAST AND AFRICA 19” – 25” IN RUGGED INDUSTRIAL DISPLAY MARKET, BY REGION, 2019-2028, (USD MILLION)

TABLE 15 MIDDLE EAST AND AFRICA ABOVE 40" IN RUGGED INDUSTRIAL DISPLAY MARKET, BY REGION, 2019-2028, (USD MILLION)

TABLE 16 MIDDLE EAST AND AFRICA RUGGED INDUSTRIAL DISPLAY MARKET, BY RESOLUTION, 2019-2028 (USD MILLION)

TABLE 17 MIDDLE EAST AND AFRICA 1024X768 IN RUGGED INDUSTRIAL DISPLAY MARKET, BY REGION, 2019-2028, (USD MILLION)

TABLE 18 MIDDLE EAST AND AFRICA 1366X768 IN RUGGED INDUSTRIAL DISPLAY MARKET, BY REGION, 2019-2028, (USD MILLION)

TABLE 19 MIDDLE EAST AND AFRICA 1920X1080 IN RUGGED INDUSTRIAL DISPLAY MARKET, BY REGION, 2019-2028, (USD MILLION)

TABLE 20 MIDDLE EAST AND AFRICA 800X600 IN RUGGED INDUSTRIAL DISPLAY MARKET, BY REGION, 2019-2028, (USD MILLION)

TABLE 21 MIDDLE EAST AND AFRICA 1280X1024 IN RUGGED INDUSTRIAL DISPLAY MARKET, BY REGION, 2019-2028, (USD MILLION)

TABLE 22 MIDDLE EAST AND AFRICA 1920X1200 IN RUGGED INDUSTRIAL DISPLAY MARKET, BY REGION, 2019-2028, (USD MILLION)

TABLE 23 MIDDLE EAST AND AFRICA RUGGED INDUSTRIAL DISPLAY MARKET, BY MOUNTING, 2019-2028 (USD MILLION)

TABLE 24 MIDDLE EAST AND AFRICA PANEL MOUNTING IN RUGGED INDUSTRIAL DISPLAY MARKET, BY REGION, 2019-2028, (USD MILLION)

TABLE 25 MIDDLE EAST AND AFRICA OPEN-FRAME IN RUGGED INDUSTRIAL DISPLAY MARKET, BY REGION, 2019-2028, (USD MILLION)

TABLE 26 MIDDLE EAST AND AFRICA RACK MOUNTING IN RUGGED INDUSTRIAL DISPLAY MARKET, BY REGION, 2019-2028, (USD MILLION)

TABLE 27 MIDDLE EAST AND AFRICA WALL MOUNTING IN RUGGED INDUSTRIAL DISPLAY MARKET, BY REGION, 2019-2028, (USD MILLION)

TABLE 28 MIDDLE EAST AND AFRICA ARM-MOUNTED IN RUGGED INDUSTRIAL DISPLAY MARKET, BY REGION, 2019-2028, (USD MILLION)

TABLE 29 MIDDLE EAST AND AFRICA OTHERS IN RUGGED INDUSTRIAL DISPLAY MARKET, BY REGION, 2019-2028, (USD MILLION)

TABLE 30 MIDDLE EAST AND AFRICA RUGGED INDUSTRIAL DISPLAY MARKET, BY TOUCH SCREEN TYPE, 2019-2028 (USD MILLION)

TABLE 31 MIDDLE EAST AND AFRICA RESISTIVE IN RUGGED INDUSTRIAL DISPLAY MARKET, BY REGION, 2019-2028, (USD MILLION)

TABLE 32 MIDDLE EAST AND AFRICA P CAP IN RUGGED INDUSTRIAL DISPLAY MARKET, BY REGION, 2019-2028, (USD MILLION)

TABLE 33 MIDDLE EAST AND AFRICA CAPACITIVE IN RUGGED INDUSTRIAL DISPLAY MARKET, BY REGION, 2019-2028, (USD MILLION)

TABLE 34 MIDDLE EAST AND AFRICA IR TOUCH IN RUGGED INDUSTRIAL DISPLAY MARKET, BY REGION, 2019-2028, (USD MILLION)

TABLE 35 MIDDLE EAST AND AFRICA RUGGED INDUSTRIAL DISPLAY MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 36 MIDDLE EAST AND AFRICA HMI IN RUGGED INDUSTRIAL DISPLAY MARKET, BY REGION, 2019-2028, (USD MILLION)

TABLE 37 MIDDLE EAST AND AFRICA HMI IN RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 38 MIDDLE EAST AND AFRICA MEDICAL IN RUGGED INDUSTRIAL DISPLAY MARKET, BY REGION, 2019-2028, (USD MILLION)

TABLE 39 MIDDLE EAST AND AFRICA MEDICAL IN RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 40 MIDDLE EAST AND AFRICA INDUSTRIAL AUTOMATION IN RUGGED INDUSTRIAL DISPLAY MARKET, BY REGION, 2019-2028, (USD MILLION)

TABLE 41 MIDDLE EAST AND AFRICA INDUSTRIAL AUTOMATION IN RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 42 MIDDLE EAST AND AFRICA DIGITAL SIGNAGE IN RUGGED INDUSTRIAL DISPLAY MARKET, BY REGION, 2019-2028, (USD MILLION)

TABLE 43 MIDDLE EAST AND AFRICA DIGITAL SIGNAGE IN RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 44 MIDDLE EAST AND AFRICA KIOSK/POS IN RUGGED INDUSTRIAL DISPLAY MARKET, BY REGION, 2019-2028, (USD MILLION)

TABLE 45 MIDDLE EAST AND AFRICA KIOSK/ POS IN RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 46 MIDDLE EAST AND AFRICA GAMING/ LOTTERY IN RUGGED INDUSTRIAL DISPLAY MARKET, BY REGION, 2019-2028, (USD MILLION)

TABLE 47 MIDDLE EAST AND AFRICA GAMING/ LOTTERY IN RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 48 MIDDLE EAST AND AFRICA IMAGING IN RUGGED INDUSTRIAL DISPLAY MARKET, BY REGION, 2019-2028, (USD MILLION)

TABLE 49 MIDDLE EAST AND AFRICA IMAGING IN RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 50 MIDDLE EAST AND AFRICA RUGGED INDUSTRIAL DISPLAY MARKET, BY VERTICAL, 2019-2028 (USD MILLION)

TABLE 51 MIDDLE EAST AND AFRICA MANUFACTURING IN RUGGED INDUSTRIAL DISPLAY MARKET, BY REGION, 2019-2028, (USD MILLION)

TABLE 52 MIDDLE EAST AND AFRICA MANUFACTURING IN RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 53 MIDDLE EAST AND AFRICA MILITARY & DEFENCE IN RUGGED INDUSTRIAL DISPLAY MARKET, BY REGION, 2019-2028, (USD MILLION)

TABLE 54 MIDDLE EAST AND AFRICA MILITARY & DEFENCE IN RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 55 MIDDLE EAST AND AFRICA ENERGY AND POWER IN RUGGED INDUSTRIAL DISPLAY MARKET, BY REGION, 2019-2028, (USD MILLION)

TABLE 56 MIDDLE EAST AND AFRICA ENERGY & POWER IN RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 57 MIDDLE EAST AND AFRICA OIL & GAS IN RUGGED INDUSTRIAL DISPLAY MARKET, BY REGION, 2019-2028, (USD MILLION)

TABLE 58 MIDDLE EAST AND AFRICA OIL & GAS IN RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 59 MIDDLE EAST AND AFRICA CHEMICAL IN RUGGED INDUSTRIAL DISPLAY MARKET, BY REGION, 2019-2028, (USD MILLION)

TABLE 60 MIDDLE EAST AND AFRICA CHEMICAL IN RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 61 MIDDLE EAST AND AFRICA TRANSPORTATION IN RUGGED INDUSTRIAL DISPLAY MARKET, BY REGION, 2019-2028, (USD MILLION)

TABLE 62 MIDDLE EAST AND AFRICA TRANSPORTATION IN RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 63 MIDDLE EAST AND AFRICA METAL & MINING IN RUGGED INDUSTRIAL DISPLAY MARKET, BY REGION, 2019-2028, (USD MILLION)

TABLE 64 MIDDLE EAST AND AFRICA METAL & MINING IN RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 65 MIDDLE EAST AND AFRICA OTHERS IN RUGGED INDUSTRIAL DISPLAY MARKET, BY REGION, 2019-2028, (USD MILLION)

TABLE 66 MIDDLE EAST AND AFRICA RUGGED INDUSTRIAL DISPLAY MARKET, BY COUNTRY, 2018-2027 (USD MILLION)

TABLE 67 MIDDLE EAST AND AFRICA RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 68 MIDDLE EAST AND AFRICA LED IN RUGGED INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 69 MIDDLE EAST AND AFRICA OLED IN RUGGED INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 70 MIDDLE EAST AND AFRICA RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 71 MIDDLE EAST AND AFRICA RUGGED INDUSTRIAL DISPLAY MARKET, BY RESOLUTION, 2019-2028 (USD MILLION)

TABLE 72 MIDDLE EAST AND AFRICA RUGGED INDUSTRIAL DISPLAY MARKET, BY MOUNTING, 2019-2028 (USD MILLION)

TABLE 73 MIDDLE EAST AND AFRICA RUGGED INDUSTRIAL DISPLAY MARKET, BY TOUCH SCREEN TYPE, 2019-2028 (USD MILLION)

TABLE 74 MIDDLE EAST AND AFRICA RUGGED INDUSTRIAL DISPLAY MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 75 MIDDLE EAST AND AFRICA RUGGED INDUSTRIAL DISPLAY MARKET, BY APPLICATION, 2019-2028 (THOUSAND UNITS)

TABLE 76 MIDDLE EAST AND AFRICA HMI RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 77 MIDDLE EAST AND AFRICA MEDICAL RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 78 MIDDLE EAST AND AFRICA INDUSTRIAL AUTOMATION RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 79 MIDDLE EAST AND AFRICA DIGITAL SIGNAGE INDUSTRIAL DISPLAY MARKET, BY DIGITAL SIGNAGE, 2019-2028 (USD MILLION)

TABLE 80 MIDDLE EAST AND AFRICA KIOSK/POS RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 81 MIDDLE EAST AND AFRICA GAMING/LOTTERY RUGGED INDUSTRIAL DISPLAY MARKET, BY DIGITAL SIGNAGE, 2019-2028 (USD MILLION)

TABLE 82 MIDDLE EAST AND AFRICA IMAGING RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 83 MIDDLE EAST AND AFRICA RUGGED INDUSTRIAL DISPLAY MARKET, BY VERTICAL, 2019-2028 (USD MILLION)

TABLE 84 MIDDLE EAST AND AFRICA MANUFACTURING RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 85 MIDDLE EAST AND AFRICA MILITARY & DEFENCE RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 86 MIDDLE EAST AND AFRICA ENERGY & POWER RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 87 MIDDLE EAST AND AFRICA OIL & GAS RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 88 MIDDLE EAST AND AFRICA CHEMICAL RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 89 MIDDLE EAST AND AFRICA TRANSPORTATION RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 90 MIDDLE EAST AND AFRICA METAL & MINING RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 91 SAUDI ARABIA RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 92 SAUDI ARABIA LED TECHNOLOGY RUGGED INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 93 SAUDI ARABIA OLED RUGGED INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 94 SAUDI ARABIA RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 95 SAUDI ARABIA RUGGED INDUSTRIAL DISPLAY MARKET, BY RESOLUTION, 2019-2028 (USD MILLION)

TABLE 96 SAUDI ARABIA RUGGED INDUSTRIAL DISPLAY MARKET, BY MOUNTING, 2019-2028 (USD MILLION)

TABLE 97 SAUDI ARABIA RUGGED INDUSTRIAL DISPLAY MARKET, BY TOUCH SCREEN TYPE, 2019-2028 (USD MILLION)

TABLE 98 SAUDI ARABIA RUGGED INDUSTRIAL DISPLAY MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 99 SAUDI ARABIA HMI RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 100 SAUDI ARABIA MEDICAL RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 101 SAUDI ARABIA INDUSTRIAL AUTOMATION RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 102 SAUDI ARABIA DIGITAL SIGNAGE RUGGED INDUSTRIAL DISPLAY MARKET, BY DIGITAL SIGNAGE, 2019-2028 (USD MILLION)

TABLE 103 SAUDI ARABIA KIOSK/POS RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 104 SAUDI ARABIA GAMING/LOTTERY RUGGED INDUSTRIAL DISPLAY MARKET, BY DIGITAL SIGNAGE, 2019-2028 (USD MILLION)

TABLE 105 SAUDI ARABIA IMAGING RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 106 SAUDI ARABIA RUGGED INDUSTRIAL DISPLAY MARKET, BY VERTICAL, 2019-2028 (USD MILLION)

TABLE 107 SAUDI ARABIA MANUFACTURING RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 108 SAUDI ARABIA OIL & GAS RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 109 SAUDI ARABIA MILITARY & DEFENCE RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 110 SAUDI ARABIA ENERGY & POWER RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 111 SAUDI ARABIA CHEMICAL RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 112 SAUDI ARABIA TRANSPORTATION RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 113 SAUDI ARABIA METAL & MINING RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 114 SOUTH AFRICA RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 115 SOUTH AFRICA LED TECHNOLOGY RUGGED INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 116 SOUTH AFRICA OLED RUGGED INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 117 SOUTH AFRICA RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 118 SOUTH AFRICA RUGGED INDUSTRIAL DISPLAY MARKET, BY RESOLUTION, 2019-2028 (USD MILLION)

TABLE 119 SOUTH AFRICA RUGGED INDUSTRIAL DISPLAY MARKET, BY MOUNTING, 2019-2028 (USD MILLION)

TABLE 120 SOUTH AFRICA RUGGED INDUSTRIAL DISPLAY MARKET, BY TOUCH SCREEN TYPE, 2019-2028 (USD MILLION)

TABLE 121 SOUTH AFRICA RUGGED INDUSTRIAL DISPLAY MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 122 SOUTH AFRICA HMI RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 123 SOUTH AFRICA MEDICAL RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 124 SOUTH AFRICA INDUSTRIAL AUTOMATION RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 125 SOUTH AFRICA MEDICAL RUGGED INDUSTRIAL DISPLAY MARKET, BY DIGITAL SIGNAGE, 2019-2028 (USD MILLION)

TABLE 126 SOUTH AFRICA KIOSK/POS RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 127 SOUTH AFRICA GAMING/LOTTERY RUGGED INDUSTRIAL DISPLAY MARKET, BY DIGITAL SIGNAGE, 2019-2028 (USD MILLION)

TABLE 128 SOUTH AFRICA IMAGING RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 129 SOUTH AFRICA RUGGED INDUSTRIAL DISPLAY MARKET, BY VERTICAL, 2019-2028 (USD MILLION)

TABLE 130 SOUTH AFRICA MANUFACTURING RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 131 SOUTH AFRICA MILITARY & DEFENCE RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 132 SOUTH AFRICA ENERGY & POWER RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 133 SOUTH AFRICA OIL & GAS RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 134 SOUTH AFRICA CHEMICAL RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 135 SOUTH AFRICA TRANSPORTATION RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 136 SOUTH AFRICA METAL & MINING RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 137 UAE RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 138 UAE LED TECHNOLOGY RUGGED INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 139 UAE OLED RUGGED INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 140 UAE RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 141 UAE RUGGED INDUSTRIAL DISPLAY MARKET, BY RESOLUTION, 2019-2028 (USD MILLION)

TABLE 142 UAE RUGGED INDUSTRIAL DISPLAY MARKET, BY MOUNTING, 2019-2028 (USD MILLION)

TABLE 143 UAE RUGGED INDUSTRIAL DISPLAY MARKET, BY TOUCH SCREEN TYPE, 2019-2028 (USD MILLION)

TABLE 144 UAE RUGGED INDUSTRIAL DISPLAY MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 145 UAE HMI RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 146 UAE MEDICAL RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 147 UAE INDUSTRIAL AUTOMATION RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 148 UAE DIGITAL SIGNAGE RUGGED INDUSTRIAL DISPLAY MARKET, BY DIGITAL SIGNAGE, 2019-2028 (USD MILLION)

TABLE 149 UAE KIOSK/POS RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 150 UAE GAMING/LOTTERY RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 151 UAE IMAGING RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 152 UAE RUGGED INDUSTRIAL DISPLAY MARKET, BY VERTICAL, 2019-2028 (USD MILLION)

TABLE 153 UAE MANUFACTURING RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 154 UAE OIL & GAS RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 155 UAE MILITARY & DEFENCE RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 156 UAE ENERGY & POWER RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 157 UAE CHEMICAL RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 158 UAE TRANSPORTATION RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 159 UAE METAL & MINING RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 160 EGYPT RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 161 EGYPT LED TECHNOLOGY RUGGED INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 162 EGYPT OLED RUGGED INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 163 EGYPT RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 164 EGYPT RUGGED INDUSTRIAL DISPLAY MARKET, BY RESOLUTION, 2019-2028 (USD MILLION)

TABLE 165 EGYPT RUGGED INDUSTRIAL DISPLAY MARKET, BY MOUNTING, 2019-2028 (USD MILLION)

TABLE 166 EGYPT RUGGED INDUSTRIAL DISPLAY MARKET, BY TOUCH SCREEN TYPE, 2019-2028 (USD MILLION)

TABLE 167 EGYPT RUGGED INDUSTRIAL DISPLAY MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 168 EGYPT HMI RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 169 EGYPT MEDICAL RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 170 EGYPT INDUSTRIAL AUTOMATION RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 171 EGYPT DIGITAL SIGNAGE RUGGED INDUSTRIAL DISPLAY MARKET, BY DIGITAL SIGNAGE, 2019-2028 (USD MILLION)

TABLE 172 EGYPT KIOSK/POS RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 173 EGYPT GAMING/LOTTERY RUGGED INDUSTRIAL DISPLAY MARKET, BY DIGITAL SIGNAGE, 2019-2028 (USD MILLION)

TABLE 174 EGYPT IMAGING RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 175 EGYPT RUGGED INDUSTRIAL DISPLAY MARKET, BY VERTICAL, 2019-2028 (USD MILLION)

TABLE 176 EGYPT MANUFACTURING RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 177 EGYPT MILITARY & DEFENCE RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 178 EGYPT ENERGY & POWER RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 179 EGYPT OIL & GAS RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 180 EGYPT CHEMICAL RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 181 EGYPT TRANSPORTATION RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 182 EGYPT METAL & MINING RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 183 ISRAEL RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 184 ISRAEL LED TECHNOLOGY RUGGED INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 185 ISRAEL OLED RUGGED INDUSTRIAL DISPLAY MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 186 ISRAEL RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 187 ISRAEL RUGGED INDUSTRIAL DISPLAY MARKET, BY RESOLUTION, 2019-2028 (USD MILLION)

TABLE 188 ISRAEL RUGGED INDUSTRIAL DISPLAY MARKET, BY MOUNTING, 2019-2028 (USD MILLION)

TABLE 189 ISRAEL RUGGED INDUSTRIAL DISPLAY MARKET, BY TOUCH SCREEN TYPE, 2019-2028 (USD MILLION)

TABLE 190 ISRAEL RUGGED INDUSTRIAL DISPLAY MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 191 ISRAEL HMI RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 192 ISRAEL MEDICAL RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 193 ISRAEL INDUSTRIAL AUTOMATION RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 194 ISRAEL DIGITAL SIGNAGE RUGGED INDUSTRIAL DISPLAY MARKET, BY DIGITAL SIGNAGE, 2019-2028 (USD MILLION)

TABLE 195 ISRAEL KIOSK/POS RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 196 ISRAEL GAMING/LOTTERY RUGGED INDUSTRIAL DISPLAY MARKET, BY DIGITAL SIGNAGE, 2019-2028 (USD MILLION)

TABLE 197 ISRAEL IMAGING RUGGED INDUSTRIAL DISPLAY MARKET, BY DISPLAY SIZE, 2019-2028 (USD MILLION)

TABLE 198 ISRAEL RUGGED INDUSTRIAL DISPLAY MARKET, BY VERTICAL, 2019-2028 (USD MILLION)

TABLE 199 ISRAEL MANUFACTURING RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 200 ISRAEL MILITARY & DEFENCE RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 201 ISRAEL ENERGY & POWER RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 202 ISRAEL OIL & GAS RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 203 ISRAEL CHEMICAL RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 204 ISRAEL TRANSPORTATION RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 205 ISRAEL METAL & MINING RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 206 REST OF MIDDLE EAST AND AFRICA RUGGED INDUSTRIAL DISPLAY MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

그림 목록

FIGURE 1 MIDDLE EAST AND AFRICA RUGGED INDUSTRIAL DISPLAY MARKET: SEGMENTATION

FIGURE 2 MIDDLE EAST AND AFRICA RUGGED INDUSTRIAL DISPLAY MARKET: DATA TRIANGULATION

FIGURE 3 MIDDLE EAST AND AFRICA RUGGED INDUSTRIAL DISPLAY MARKET: DROC ANALYSIS

FIGURE 4 MIDDLE EAST AND AFRICA RUGGED INDUSTRIAL DISPLAY MARKET: MIDDLE EAST AND AFRICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 MIDDLE EAST AND AFRICA RUGGED INDUSTRIAL DISPLAY MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 MIDDLE EAST AND AFRICA RUGGED INDUSTRIAL DISPLAY MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 MIDDLE EAST AND AFRICA RUGGED INDUSTRIAL DISPLAY MARKET: DBMR MARKET POSITION GRID

FIGURE 8 MIDDLE EAST AND AFRICA RUGGED INDUSTRIAL DISPLAY MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 MIDDLE EAST AND AFRICA RUGGED INDUSTRIAL DISPLAY MARKET: SEGMENTATION

FIGURE 10 RISE IN DEMAND FOR HUMAN MACHINE INTERFACE (HMI) APPLICATION IN VARIOUS INDUSTRIES IS EXPECTED TO DRIVE TH MIDDLE EAST AND AFRICA RUGGED INDUSTRIAL DISPLAY MARKET IN THE FORECAST PERIOD OF 2021 TO 2028

FIGURE 11 LCD SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF MIDDLE EAST AND AFRICA RUGGED INDUSTRIAL DISPLAY MARKET IN 2021 & 2028

FIGURE 12 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF MIDDLE EAST AND AFRICA RUGGED INDUSTRIAL DISPLAY MARKET

FIGURE 13 MIDDLE EAST AND AFRICA RUGGED INDUSTRIAL DISPLAY MARKET: BY TECHNOLOGY, 2020

FIGURE 14 MIDDLE EAST AND AFRICA RUGGED INDUSTRIAL DISPLAY MARKET: BY DISPLAY SIZE, 2020

FIGURE 15 MIDDLE EAST AND AFRICA RUGGED INDUSTRIAL DISPLAY MARKET: BY RESOLUTION, 2020

FIGURE 16 MIDDLE EAST AND AFRICA RUGGED INDUSTRIAL DISPLAY MARKET: BY MOUNTING, 2020

FIGURE 17 MIDDLE EAST AND AFRICA RUGGED INDUSTRIAL DISPLAY MARKET: BY TOUCH SCREEN TYPE, 2020

FIGURE 18 MIDDLE EAST AND AFRICA RUGGED INDUSTRIAL DISPLAY MARKET: BY APPLICATION, 2020

FIGURE 19 MIDDLE EAST AND AFRICA RUGGED INDUSTRIAL DISPLAY MARKET: BY VERTICAL, 2020

FIGURE 20 MIDDLE EAST AND AFRICA RUGGED INDUSTRIAL DISPLAY MARKET: SNAPSHOT (2020)

FIGURE 21 MIDDLE EAST AND AFRICA RUGGED INDUSTRIAL DISPLAY MARKET: BY COUNTRY (2020)

FIGURE 22 MIDDLE EAST AND AFRICA RUGGED INDUSTRIAL DISPLAY MARKET: BY COUNTRY (2021 & 2028)

FIGURE 23 MIDDLE EAST AND AFRICA RUGGED INDUSTRIAL DISPLAY MARKET: BY COUNTRY (2020 & 2028)

FIGURE 24 MIDDLE EAST AND AFRICA RUGGED INDUSTRIAL DISPLAY MARKET: BY TECHNOLOGY (2019-2028)

FIGURE 25 MIDDLE EAST AND AFRICA RUGGED INDUSTRIAL DISPLAY MARKET: COMPANY SHARE 2020 (%)

연구 방법론

데이터 수집 및 기준 연도 분석은 대규모 샘플 크기의 데이터 수집 모듈을 사용하여 수행됩니다. 이 단계에는 다양한 소스와 전략을 통해 시장 정보 또는 관련 데이터를 얻는 것이 포함됩니다. 여기에는 과거에 수집한 모든 데이터를 미리 검토하고 계획하는 것이 포함됩니다. 또한 다양한 정보 소스에서 발견되는 정보 불일치를 검토하는 것도 포함됩니다. 시장 데이터는 시장 통계 및 일관된 모델을 사용하여 분석하고 추정합니다. 또한 시장 점유율 분석 및 주요 추세 분석은 시장 보고서의 주요 성공 요인입니다. 자세한 내용은 분석가에게 전화를 요청하거나 문의 사항을 드롭하세요.

DBMR 연구팀에서 사용하는 주요 연구 방법론은 데이터 마이닝, 시장에 대한 데이터 변수의 영향 분석 및 주요(산업 전문가) 검증을 포함하는 데이터 삼각 측량입니다. 데이터 모델에는 공급업체 포지셔닝 그리드, 시장 타임라인 분석, 시장 개요 및 가이드, 회사 포지셔닝 그리드, 특허 분석, 가격 분석, 회사 시장 점유율 분석, 측정 기준, 글로벌 대 지역 및 공급업체 점유율 분석이 포함됩니다. 연구 방법론에 대해 자세히 알아보려면 문의를 통해 업계 전문가에게 문의하세요.

사용자 정의 가능

Data Bridge Market Research는 고급 형성 연구 분야의 선두 주자입니다. 저희는 기존 및 신규 고객에게 목표에 맞는 데이터와 분석을 제공하는 데 자부심을 느낍니다. 보고서는 추가 국가에 대한 시장 이해(국가 목록 요청), 임상 시험 결과 데이터, 문헌 검토, 재생 시장 및 제품 기반 분석을 포함하도록 사용자 정의할 수 있습니다. 기술 기반 분석에서 시장 포트폴리오 전략에 이르기까지 타겟 경쟁업체의 시장 분석을 분석할 수 있습니다. 귀하가 원하는 형식과 데이터 스타일로 필요한 만큼 많은 경쟁자를 추가할 수 있습니다. 저희 분석가 팀은 또한 원시 엑셀 파일 피벗 테이블(팩트북)로 데이터를 제공하거나 보고서에서 사용 가능한 데이터 세트에서 프레젠테이션을 만드는 데 도움을 줄 수 있습니다.