North America Cleanroom Technology Market

시장 규모 (USD 10억)

연평균 성장률 :

%

USD

116.27 Million

USD

178.44 Million

2024

2032

USD

116.27 Million

USD

178.44 Million

2024

2032

| 2025 –2032 | |

| USD 116.27 Million | |

| USD 178.44 Million | |

|

|

|

|

북미 클린룸 기술 시장 세분화, 제품별(휘발성 부식 방지 필름, 클린 백, 라미네이션 실란트 필름, 클린 용기 및 초청정 포장), 구성 요소별(장비 및 소모품), 구매자 범주별(반도체 관련 회사, 제약 회사, 화학 회사 및 분석 장비 공급업체), 최종 사용자별(제약, 생명공학 , 의료 기기, 병원 반도체 제조 및 기타) - 산업 동향 및 2032년까지의 전망

북미 클린룸 기술 시장 규모

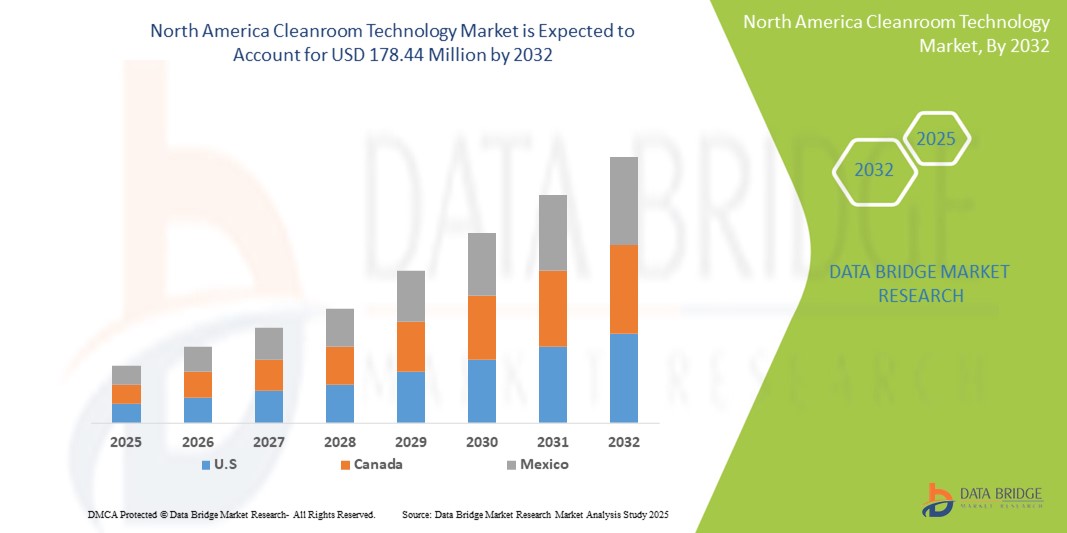

- 북미 클린룸 기술 시장 규모는 2024년에 1억 1,627만 달러 로 평가되었으며 예측 기간 동안 5.50%의 CAGR 로 2032년까지 1억 7,844만 달러에 도달할 것으로 예상됩니다 .

- 시장 성장은 제약, 생명공학, 의료기기, 전자 제조 등 산업 전반에서 오염 없는 환경에 대한 수요 증가에 크게 힘입어 북미 지역에서 첨단 클린룸 기술 솔루션의 도입이 확대되고 있습니다. 모듈형 클린룸, HEPA 여과 시스템, 자동화 도구의 기술 발전은 운영 효율성과 청결 기준을 더욱 향상시키고 있습니다.

- 더욱이, 규제 준수 요건 강화와 고정밀 제조 분야에서 제품 품질 보증에 대한 요구 증가로 인해 북미 지역의 클린룸 기술 시스템은 현대 산업 및 의료 환경에서 필수적인 인프라로 자리매김하고 있습니다. 이러한 요소들이 융합되면서 북미 지역 전체에서 클린룸 솔루션 도입이 가속화되고 있으며, 이는 업계 성장을 크게 촉진하고 있습니다.

북미 클린룸 기술 시장 분석

- 모듈형 클린룸, HVAC 시스템, 클린룸 소모품 및 공기 여과 장치를 포함한 북미 클린룸 기술은 규제 표준 및 오염 제어 요구 사항의 증가로 인해 제약, 생명공학, 반도체 및 의료 기기 제조 전반에 걸쳐 점점 더 중요한 구성 요소가 되고 있습니다.

- 이 지역의 클린룸 기술에 대한 수요 증가는 주로 생물학 및 제약 제조 기반 확대, 엄격한 FDA 지침, 무균 약물 생산 환경이 필요한 만성 질환의 유병률 증가에 의해 주도됩니다.

- 미국은 2024년 77.8%의 시장 점유율로 북미 클린룸 기술 시장을 장악했으며, 이는 강력한 제약 파이프라인, 개인 맞춤 의료 도입 증가, 생명 과학 및 생명 기술 시설의 상당한 확장에 힘입은 것입니다.

- 캐나다는 북미에서 가장 빠르게 성장하는 국가로 예상되며, 청정실 기술 시장은 생명공학의 발전과 연방 자금 지원 프로그램의 지원에 힘입어 2025년부터 2032년까지 연평균 성장률 10.5%로 성장할 것으로 예상됩니다.

- 휘발성 부식 방지 필름 부문은 전자 및 의약품 포장재의 민감한 부품을 보호하는 데 필수적인 역할을 하며, 2024년 북미 클린룸 기술 시장에서 32.6%의 가장 큰 매출 점유율을 차지했습니다. 이 부문의 성장은 특히 반도체 및 바이오 의약품과 같은 고부가가치 산업에서 보관 및 운송 중 제품의 무결성을 보장하는 부식 방지 솔루션에 대한 수요 증가에 힘입어 견인되고 있습니다.

보고서 범위 및 북미 클린룸 기술 시장 세분화

|

속성 |

북미 클린룸 기술 주요 시장 통찰력 |

|

다루는 세그먼트 |

|

|

포함 국가 |

북아메리카

|

|

주요 시장 참여자 |

|

|

시장 기회 |

|

|

부가가치 데이터 정보 세트 |

Data Bridge Market Research에서 큐레이팅한 시장 보고서에는 시장 가치, 성장률, 세분화, 지리적 적용 범위, 주요 기업 등 시장 시나리오에 대한 통찰력 외에도 심층적인 전문가 분석, 가격 분석, 브랜드 점유율 분석, 소비자 설문 조사, 인구 통계 분석, 공급망 분석, 가치 사슬 분석, 원자재/소모품 개요, 공급업체 선택 기준, PESTLE 분석, Porter 분석 및 규제 프레임워크가 포함되어 있습니다. |

북미 클린룸 기술 시장 동향

“ 규제 준수 및 멸균 표준에 대한 집중 강화 ”

- 북미 클린룸 기술 시장에서 중요하고 빠르게 성장하는 추세는 cGMP, ISO 클린룸 등급, FDA 지침 등 엄격한 규제 프레임워크 준수에 대한 중요성이 커지고 있다는 점입니다. 이러한 추세는 제약, 생명공학, 의료기기 제조업체들이 입자 제어, 무균성, 운영 효율성을 보장하는 첨단 클린룸 기술을 도입하도록 유도하고 있습니다.

- 예를 들어 DuPont 및 Clean Air Products와 같은 주요 업체가 모듈식 클린룸 시스템을 도입함으로써 회사는 시설 확장 또는 재구성의 유연성을 유지하면서 특정 살균 수준을 충족하도록 클린룸 환경을 사용자 지정할 수 있습니다.

- 클래스 100 또는 ISO 5 청정도 기준을 충족하기 위해 클린룸 환경에 HEPA 및 ULPA 필터 시스템을 통합하는 것이 점점 더 보편화되고 있습니다. 또한, 오염 위험을 최소화하고 지속적인 환경 무결성을 보장하기 위해 자동 공기 흐름 제어 및 압력 밸런싱 시스템이 점차 인기를 얻고 있습니다.

- 멸균 보증이 제약 제조 및 임상 연구 전반에서 협상할 수 없는 우선순위가 됨에 따라 클린룸 공급업체는 진화하는 표준을 충족하기 위해 항균 표면, 핸즈프리 진입 시스템 및 통합 공기 모니터링 기술로 서비스를 강화하고 있습니다.

- 이러한 성장 추세는 북미 지역의 시설 설계 및 운영 전략을 근본적으로 변화시키고 있습니다. 따라서 Terra Universal과 Labconco와 같은 기업들은 긴급한 시장 수요에 대응하기 위해 내장형 환경 모니터링 및 신속한 구축 기능을 갖춘 새로운 모듈식 클린룸 솔루션을 혁신하고 있습니다.

- 이러한 규정을 준수하고 사용자 정의 가능하며 확장 가능한 클린룸 기술의 채택이 증가함에 따라 특히 의료, 반도체 및 R&D 부문에서 북미 클린룸 기술 시장 성장에 크게 기여하고 있습니다.

북미 클린룸 기술 시장 동향

운전사

“오염 관리 및 규정 준수 증가로 인한 수요 증가”

- FDA, ISO 14644, cGMP와 같은 엄격한 규제 프레임워크와 더불어 제약, 생명공학 및 반도체 산업에서 오염 위험이 점점 더 만연해지면서 북미 클린룸 기술 솔루션에 대한 수요가 크게 증가하고 있습니다.

- 예를 들어, 2024년 4월, 듀폰은 미국과 캐나다 전역의 제약 제조업체들의 증가하는 수요를 충족하기 위해 클린룸 의류 제품 라인 확장을 발표했습니다. 이러한 계획은 특히 첨단 제조 환경에서 무균 및 통제된 환경 유지에 중점을 둔 이 지역의 노력을 반영합니다.

- 기업들이 더 높은 제품 무결성을 위해 노력함에 따라 모듈식 클린룸 시스템, HEPA 여과, 자동 모니터링을 포함한 고급 클린룸 기술을 도입함으로써 기존 HVAC 및 격리 방법에 비해 매력적인 업그레이드가 제공됩니다.

- 더욱이, 생물학, 개인 맞춤형 의료, 그리고 마이크로일렉트로닉스 생산에 대한 투자가 증가함에 따라 클린룸은 북미 전역의 시설 계획 및 운영에 필수적인 요소가 되고 있습니다. 이러한 솔루션은 최적의 공기질, 차압, 그리고 미립자 제어를 보장하여 공정 효율성과 규정 준수에 기여합니다.

- 클린룸 시스템과 환경 모니터링, 에너지 효율적인 HVAC 장치, 그리고 확장성과 빠른 설치 시간을 제공하는 사용자 친화적인 모듈형 설계의 통합으로 수요가 더욱 증가하고 있습니다. 기업들이 유연하면서도 규정을 준수하는 인프라를 점점 더 많이 추구함에 따라, 북미는 클린룸 기술 도입의 주요 허브로 부상하고 있습니다.

제지/도전

“ 높은 자본 투자와 운영 복잡성 ”

- 북미 클린룸 기술 시장은 높은 초기 설치 비용과 운영상의 어려움으로 인해 상당한 제약에 직면해 있으며, 특히 중소기업의 경우 더욱 그렇습니다. HVAC 시스템, 여과 장치, 모니터링 소프트웨어, 그리고 모듈식 구조를 통합하는 과정은 복잡하여 상당한 자본 투자와 전문 지식이 필요한 경우가 많습니다.

- 예를 들어, ISO 5등급 클린룸을 구축하는 데는 유지 관리 및 검증 절차를 포함하여 기존 작업 공간 환경보다 최대 5배 더 많은 비용이 소요될 수 있습니다. 이러한 비용은 스타트업이나 예산이 부족한 의료 서비스 제공업체가 고급 클린룸 시스템에 투자하는 것을 꺼리게 할 수 있습니다.

- 또한, 규정 기준에 맞춰 청정실을 유지하려면 지속적인 환경 모니터링, 잦은 청소, 직원 교육이 필요하며 이는 모두 운영 비용 증가에 기여합니다.

- 또한 기존 시설을 규정에 맞는 클린룸 환경으로 개조하는 것은 설계 제한, 오래된 인프라 또는 공간적 제약으로 인해 복잡할 수 있습니다. 특히 기존 제약 공장 및 병원에서는 더욱 그렇습니다.

- 이러한 장벽을 극복하기 위해서는 제조업체가 비용 효율적이고 확장 가능한 솔루션과 설치 시간, 교육 및 유지 보수 필요성을 줄여주는 모듈형 장치를 제공해야 합니다. 지속적인 혁신과 정부 지원책은 생명 과학 및 전자 분야의 소규모 업체들의 도입을 촉진할 수 있습니다.

북미 클린룸 기술 시장 범위

시장은 제품, 구성 요소, 구매자 범주, 최종 사용자를 기준으로 세분화됩니다.

• 제품별

북미 클린룸 기술 시장은 제품 기준으로 휘발성 부식 방지 필름, 클린 백, 라미네이션 실란트 필름, 클린 용기, 그리고 초청정 포장재로 구분됩니다. 휘발성 부식 방지 필름 부문은 전자 및 의약품 포장재의 민감한 부품을 보호하는 데 필수적인 역할을 하기 때문에 2024년 매출 점유율 32.6%로 가장 큰 비중을 차지했습니다.

초고순도 포장 부문은 생명공학 및 반도체 제조와 같은 고순도 응용 분야의 수요 증가에 힘입어 2025년부터 2032년까지 10.9%의 가장 빠른 CAGR로 성장할 것으로 예상됩니다.

• 구성 요소별

북미 클린룸 기술 시장은 구성 요소를 기준으로 장비와 소모품으로 구분됩니다. 소모품은 2024년 매출 점유율 61.3%로 시장을 장악했으며, 이는 무균 환경에서의 빈번한 사용과 지속적인 보충이 주요 원인으로 작용했습니다.

장비는 제약 및 전자 산업 전반에 걸쳐 클린룸 건설 및 업그레이드에 대한 투자 증가에 힘입어 2025년부터 2032년까지 연평균 성장률 9.5%로 확대될 것으로 예상됩니다.

• 구매자 카테고리별

북미 클린룸 기술 시장은 구매자 범주를 기준으로 반도체 관련 기업, 제약 회사, 화학 회사, 그리고 분석 장비 공급업체로 구분됩니다. 반도체 관련 기업은 칩 제조 활동 증가와 오염 없는 제조 환경에 대한 투자에 힘입어 2024년에 34.2%로 가장 큰 점유율을 차지할 것으로 예상됩니다.

제약 회사는 약물 개발 파이프라인 확대, 규제 엄격화, 팬데믹으로 인한 클린룸 확장에 힘입어 2025년부터 2032년까지 11.4%의 가장 빠른 CAGR로 성장할 것으로 예상됩니다.

• 최종 사용자별

북미 클린룸 기술 시장은 최종 사용자 기준으로 제약, 생명공학, 의료기기, 병원, 반도체 제조 등으로 세분화됩니다. 반도체 제조는 2024년 매출 점유율 29.8%로 가장 큰 비중을 차지했는데, 이는 이 지역이 초고청정 설비를 필요로 하는 첨단 마이크로일렉트로닉스 생산의 핵심 분야로 남아 있기 때문입니다.

세포 치료, 생물학 제제, 백신 생산 분야의 연구 활동 증가에 힘입어 생명공학 분야는 2025년부터 2032년까지 12.1%의 가장 높은 CAGR로 성장할 것으로 예상됩니다.

북미 클린룸 기술 시장 지역 분석

- 북미는 2024년 40.01%의 가장 큰 매출 점유율로 글로벌 클린룸 기술 시장을 장악했으며, 이는 제약, 반도체 및 생명공학 분야의 첨단 제조 역량에 힘입은 것입니다.

- 특히 미국에서 엄격한 규제 환경과 생명 과학 및 전자 분야 전반에 걸친 R&D 투자 증가로 인해 해당 지역 전체에서 클린룸 기술 도입이 촉진되고 있습니다.

- 이 지역은 탄탄한 산업 기반, 강력한 연구 개발 역량, 그리고 특히 제약 및 생명 과학 분야에서 우수 의약품 제조 기준(GMP)의 광범위한 시행이라는 이점을 누리고 있습니다. 이러한 요소들이 북미 전역의 클린룸 기술 확장을 뒷받침하고 있습니다.

미국 북미 클린룸 기술 시장 통찰력

미국 클린룸 기술 시장은 탄탄한 제약, 의료기기, 반도체 제조 기반을 바탕으로 2024년 77.8%의 시장 점유율을 기록하며 가장 큰 비중을 차지했습니다. 주요 클린룸 솔루션 공급업체의 존재, 엄격한 FDA 및 GMP 규정 준수, 그리고 생물학적 제제 및 백신 생산 증가가 주요 성장 동력입니다. 미국 시장은 생명공학 연구 확대와 첨단 치료법 투자에 힘입어 2025년부터 2032년까지 연평균 9.8% 성장할 것으로 예상됩니다.

캐나다 북미 클린룸 기술 시장 통찰력

캐나다 클린룸 기술 시장은 2024년 북미 클린룸 기술 시장의 11.3%를 차지했으며, 이는 제약 생산 및 생명 과학 R&D 투자 증가에 힘입은 것입니다. 캐나다가 회복력 있는 의약품 공급망 구축에 중점을 두고 있으며, 학술 연구 기관의 모듈식 클린룸 설비 수요 증가가 주요 성장 동력입니다. 캐나다 시장은 생명공학의 발전과 연방 기금 지원 프로그램에 힘입어 2025년부터 2032년까지 연평균 10.5% 성장할 것으로 예상됩니다.

멕시코 북미 클린룸 기술 시장 통찰력

멕시코 클린룸 기술 시장은 2024년 북미 클린룸 기술 시장의 7.7% 매출 점유율을 차지했으며, 이는 제약 및 의료기기 제조의 급속한 성장과 외국인 직접 투자 증가에 힘입은 것입니다. 미국과의 근접성, 비용 효율적인 노동력, 그리고 계약 생산 및 포장 분야에서 클린룸 도입 증가는 시장 매력도를 높이고 있습니다.

북미 클린룸 기술 시장 점유율

북미 청정실 기술 산업은 주로 다음을 포함한 잘 확립된 회사들이 주도하고 있습니다.

- 듀폰(미국)

- 클린 에어 프로덕츠(미국)

- 클린룸 디포(미국)

- 콜란디스(독일)

- 니코스 그룹(Nicos Group, Inc.) (미국)

- 아드맥(아일랜드)

- 아즈빌 주식회사(일본)

- KCWW(미국)

- 캄필(스웨덴)

- 랩콘코(미국)

- 타이키샤 주식회사(일본)

- 테라 유니버설 주식회사(미국)

북미 클린룸 기술 시장의 최신 동향

- 2024년 12월, 모듈식 및 모바일 클린룸 인프라 및 솔루션 분야의 선도적인 혁신 기업인 Germfree는 세계 최초의 소프트웨어 독립적인 완전 통합 IV 워크플로 하드웨어 플랫폼인 Smarthood를 출시했습니다. 무균 조제 분야의 지속적인 과제를 해결하기 위해 설계된 Smarthood는 첨단 기술을 통합된 시스템으로 결합하여 오염 제어를 강화하고, 워크플로 오류를 최소화하며, 약사와 기술자의 운영 효율성을 최적화합니다.

- 2024년 4월, 모듈식 클린룸 인프라 및 서비스 분야의 선도적인 혁신 기업인 Germfree는 분산형 세포 및 유전자 치료(CGT) 분야의 글로벌 선두 기업인 Orgenesis Inc.와 자산 인수 계약 및 전략적 파트너십을 체결했습니다. 이번 협력은 Orgenesis의 치료 프로그램 발전을 가속화하고 제품 개발 및 GMP 세포 처리 서비스 포트폴리오를 강화하는 것을 목표로 합니다.

- 2023년 8월, Labconco Corporation은 완벽하게 통합된 온보드 인텔리전스를 갖춘 최초의 층류 후드인 Nexus 수평 클린 벤치(Nexus Horizontal Clean Bench) 출시를 발표했습니다. 이 획기적인 워크스테이션은 비위험 샘플 및 절차에 탁월한 오염 제어 기능을 제공하여 업계 표준을 새롭게 정의합니다.

SKU-

세계 최초의 시장 정보 클라우드 보고서에 온라인으로 접속하세요

- 대화형 데이터 분석 대시보드

- 높은 성장 잠재력 기회를 위한 회사 분석 대시보드

- 사용자 정의 및 질의를 위한 리서치 분석가 액세스

- 대화형 대시보드를 통한 경쟁자 분석

- 최신 뉴스, 업데이트 및 추세 분석

- 포괄적인 경쟁자 추적을 위한 벤치마크 분석의 힘 활용

목차

- introduction

- OBJECTIVES OF THE STUDY

- MARKET DEFINITION

- OVERVIEW OF NORTH AMERICA CLEANROOM TECHNOLOGY MARKET

- CURRENCY AND PRICING

- LIMITATIONS

- MARKETS COVERED

- MARKET SEGMENTATION

- MARKETS COVERED

- GEOGRAPHICAL SCOPE

- YEARS CONSIDERED FOR THE STUDY

- DBMR TRIPOD DATA VALIDATION MODEL

- PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

- MULTIVARIATE MODELLING

- TYPE LIFELINE CURVE

- DBMR MARKET POSITION GRID

- MARKET APPLICATION COVERAGE GRID

- VENDOR SHARE ANALYSIS

- SECONDARY SOURCES

- ASSUMPTIONS

- EXECUTIVE SUMMARY

- Market Overview

- drIvErs

- Introduction of Technological advanced products

- Stringent REGULATORY standards OF FDA & WHO

- High adoption of cleanroom technology in manufacturing units

- rising demand for sterilized pharmaceutical formulations

- Upsurge in development and use of new biologics

- Restraints

- high installation and maintenance cost associated with modular cleanroom technology

- Lack of experienced professionals

- OPPORTUNITIES

- Increasing preference toward safety and quality of products

- Extensive R&D activities in the healthcare industry

- Emergence of COVID-19

- CHALLENGES

- Customized design of cleanrooms as per facility requirements

- Financial inputs required for the establishment with constant pressure on manufacturers to reduce costs

- IMPACT OF COVID-19 ON NORTH AMERICA CLEANROOM TECHNOLOGY MARKET

- IMPACT ON DEMAND

- IMPACT ON PRICE

- IMPACT ON SUPPLY CHAIN

- STRATEGIC INITIATIVES BY KEY PLAYERS

- CONCLUSION

- NORTH AMERICA CLEANROOM TECHNOLOGY market, BY PRODUCT

- overview

- volatile corrosion inhibiting film

- CLEAN BAGS

- LAMINATION SEALANT FILMS

- ULTRA CLEAN PACKAGING

- CLEAN CONTAINERS

- NORTH AMERICA CLEANROOM TECHNOLOGY market, BY BUYER CATEGORY

- overview

- semiconductor related companies

- pharmaceutical companies

- chemical companies

- analytical equipment provider companies

- NORTH AMERICA cleanroom technology market, BY Country

- North America

- U.S.

- CANADA

- MEXICO

- North America Cleanroom Technology Market: COMPANY landscape

- company share analysis: North America

- SWOT

- company profiles

- CORTEC CORPORATION

- COMPANY SNAPSHOT

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENTS

- AICELLO CORPORATION

- COMPANY SNAPSHOT

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENTS

- northern technologies international corporation

- COMPANY SNAPSHOT

- 3.2 REVENUE ANALYSIS

- SERVICE PORTFOLIO

- RECENT DEVELOPMENTs

- AERO PACKAGING, INC.

- COMPANY SNAPSHOT

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENT

- branopac

- COMPANY SNAPSHOT

- SERVICE PORTFOLIO

- RECENT DEVELOPMENTs

- ARMOR PROTECTIVE PACKAGING

- COMPANY SNAPSHOT

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENTS

- BRENTWOOD PLASTICS, INC.

- COMPANY SNAPSHOT

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENT

- DAUBERT CROMWELL, INC.

- COMPANY SNAPSHOT

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENTS

- Edco supply corporation

- COMPANY SNAPSHOT

- SERVICE PORTFOLIO

- RECENT DEVELOPMENT

- PROTECTIVE PACKAGING CORPORATION

- COMPANY SNAPSHOT

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENT

- questionnaire

- related reports

표 목록

TABLE 1 COMPARISON OF COST OF SMALL & LARGE CLEANROOM SETUPS

TABLE 2 NORTH AMERICA CLEANROOM TECHNOLOGY market, By PRODUCT, 2019-2028 (USD Million)

TABLE 3 NORTH AMERICA CLEANROOM TECHNOLOGY market, BY BUYER CATEGORY, 2019-2028 (USD Million)

TABLE 4 North America CLEANROOM TECHNOLOGY Market, By COUNTRY, 2019-2028 (USD million)

TABLE 5 U.S. CLEANROOM TECHNOLOGY Market, By PRODUCT, 2019-2028 (USD million)

TABLE 6 U.S. CLEANROOM TECHNOLOGY Market, By BUYER CATEGORY, 2019-2028 (USD million)

TABLE 7 CANADA cleanroom technology Market, By product, 2019-2028 (USD million)

TABLE 8 CANADA CLEANROOM TECHNOLOGY Market, By BUYER CATEGORY, 2019-2028 (USD million)

TABLE 9 MEXICO cleanroom technology Market, By product, 2019-2028 (USD million)

TABLE 10 MEXICO cleanroom technology Market, By buyer category, 2019-2028 (USD million)

그림 목록

FIGURE 1 NORTH AMERICA CLEANROOM TECHNOLOGY MARKET: segmentation

FIGURE 2 NoRTH AMERICA CLEANROOM TECHNOLOGY MARKET: data triangulation

FIGURE 3 NORTH AMERICA CLEANROOM TECHNOLOGY MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA CLEANROOM TECHNOLOGY MARKET: REGIONAL VS Country MARKET ANALYSIS

FIGURE 5 NORTH AMERICA CLEANROOM TECHNOLOGY MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA CLEANROOM TECHNOLOGY MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA CLEANROOM TECHNOLOGY MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA CLEANROOM TECHNOLOGY Market: MARKET APPLICATION COVERAGE GRID

FIGURE 9 NORTH AMERICA cleanroom technology Market: vendor share analysis

FIGURE 10 north america CLEANROOM TECHNOLOGY MARKET: SEGMENTATION

FIGURE 11 Stringent regulatory standards are expected to drive Growth of the NORTH AMERICA CLEANROOM TECHNOLOGY MARKET in the forecast period of 2021 to 2028

FIGURE 12 volatile corrosion INHIBITING FILM is expected to account for the largest share of the NORTH AMERICA CLEANROOM TECHNOLOGY MARKET in 2021 & 2028

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF North America Cleanroom Technology Market

FIGURE 14 NORTH AMERICA CLEANROOM TECHNOLOGY market : BY PRODUCT, 2020

FIGURE 15 NORTH AMERICA CLEANROOM TECHNOLOGY market : BY PRODUCT, 2021-2028 (USD Million)

FIGURE 16 NORTH AMERICA CLEANROOM TECHNOLOGY market : BY PRODUCT, CAGR (2021-2028)

FIGURE 17 NORTH AMERICA CLEANROOM TECHNOLOGY market : BY PRODUCT, LIFELINE CURVE

FIGURE 18 NORTH AMERICA CLEANROOM TECHNOLOGY market : BY BUYER CATEGORY, 2020

FIGURE 19 NORTH AMERICA CLEANROOM TECHNOLOGY market : BY BUYER CATEGORY, 2021-2028 (USD Million)

FIGURE 20 NORTH AMERICA CLEANROOM TECHNOLOGY market : BY BUYER CATEGORY, CAGR (2021-2028)

FIGURE 21 NORTH AMERICA CLEANROOM TECHNOLOGY market : BY BUYER CATEGORY, LIFELINE CURVE

FIGURE 22 NORTH AMERICA CLEANROOM TECHNOLOGY market: SNAPSHOT (2020)

FIGURE 23 NORTH AMERICA CLEANROOM TECHNOLOGY market: BY COUNTRY (2020)

FIGURE 24 NORTH AMERICA CLEANROOM TECHNOLOGY market: BY COUNTRY (2021 & 2028)

FIGURE 25 NORTH AMERICA CLEANROOM TECHNOLOGY market: BY COUNTRY (2020 & 2028)

FIGURE 26 NORTH AMERICA CLEANROOM TECHNOLOGY market: BY Product (2021-2028)

FIGURE 27 North America cleanroom technology market: company share 2020 (%)

연구 방법론

데이터 수집 및 기준 연도 분석은 대규모 샘플 크기의 데이터 수집 모듈을 사용하여 수행됩니다. 이 단계에는 다양한 소스와 전략을 통해 시장 정보 또는 관련 데이터를 얻는 것이 포함됩니다. 여기에는 과거에 수집한 모든 데이터를 미리 검토하고 계획하는 것이 포함됩니다. 또한 다양한 정보 소스에서 발견되는 정보 불일치를 검토하는 것도 포함됩니다. 시장 데이터는 시장 통계 및 일관된 모델을 사용하여 분석하고 추정합니다. 또한 시장 점유율 분석 및 주요 추세 분석은 시장 보고서의 주요 성공 요인입니다. 자세한 내용은 분석가에게 전화를 요청하거나 문의 사항을 드롭하세요.

DBMR 연구팀에서 사용하는 주요 연구 방법론은 데이터 마이닝, 시장에 대한 데이터 변수의 영향 분석 및 주요(산업 전문가) 검증을 포함하는 데이터 삼각 측량입니다. 데이터 모델에는 공급업체 포지셔닝 그리드, 시장 타임라인 분석, 시장 개요 및 가이드, 회사 포지셔닝 그리드, 특허 분석, 가격 분석, 회사 시장 점유율 분석, 측정 기준, 글로벌 대 지역 및 공급업체 점유율 분석이 포함됩니다. 연구 방법론에 대해 자세히 알아보려면 문의를 통해 업계 전문가에게 문의하세요.

사용자 정의 가능

Data Bridge Market Research는 고급 형성 연구 분야의 선두 주자입니다. 저희는 기존 및 신규 고객에게 목표에 맞는 데이터와 분석을 제공하는 데 자부심을 느낍니다. 보고서는 추가 국가에 대한 시장 이해(국가 목록 요청), 임상 시험 결과 데이터, 문헌 검토, 재생 시장 및 제품 기반 분석을 포함하도록 사용자 정의할 수 있습니다. 기술 기반 분석에서 시장 포트폴리오 전략에 이르기까지 타겟 경쟁업체의 시장 분석을 분석할 수 있습니다. 귀하가 원하는 형식과 데이터 스타일로 필요한 만큼 많은 경쟁자를 추가할 수 있습니다. 저희 분석가 팀은 또한 원시 엑셀 파일 피벗 테이블(팩트북)로 데이터를 제공하거나 보고서에서 사용 가능한 데이터 세트에서 프레젠테이션을 만드는 데 도움을 줄 수 있습니다.