북미 자율 지게차 시장, 판매 채널(리스, 자체 구매), 응용 분야(자재 취급, 창고, 물류 및 운송, 제조 및 기타), 산업(3PL, 전자 상거래, 자동차, 금속 및 중장비, 식품 및 음료, 반도체 및 전자, 제지 및 펄프 산업 , 항공, 의료 및 기타), 내비게이션 기술(레이저 유도, 자기 유도, 유도 유도, 비전 유도, 광학 테이프 유도 및 기타) - 산업 동향 및 2030년까지의 예측.

북미 자율 지게차 시장 분석 및 규모

자율 지게차는 인간의 도움 없이 상품을 들어올리는 자체 추진식 지게차라고도 합니다. 모든 보관 서비스는 개별적으로 처리할 수 있습니다. 이를 통해 창고 운영에 대한 인간 노동의 필요성이 없어집니다. 창고 운영에서 인간의 개입으로 인해 발생한 결함은 자동 지게차의 출현으로 편리하게 관리할 수 있습니다. 물류 및 건설 산업의 급속한 성장으로 자율 장치에 대한 수요가 증가했습니다. 자재 취급 및 공급망에서 무거운 하중을 처리해야 하는 필요성으로 인해 자동 지게차에 대한 수요가 증가하고 있습니다. 기술의 발전으로 산업용 트럭의 효율성도 높아졌습니다. 자동 지게차는 물류 프로세스를 최적화하는 데 크게 기여합니다. 이를 통해 적절한 부품이 항상 적절한 시기에 적절한 위치에 있도록 합니다. 이 기술은 운전자가 어려운 상황에서 가장 안전한 기동을 계산하여 잠재적 위험을 피하는 데 도움이 되므로 사고가 크게 줄어듭니다.

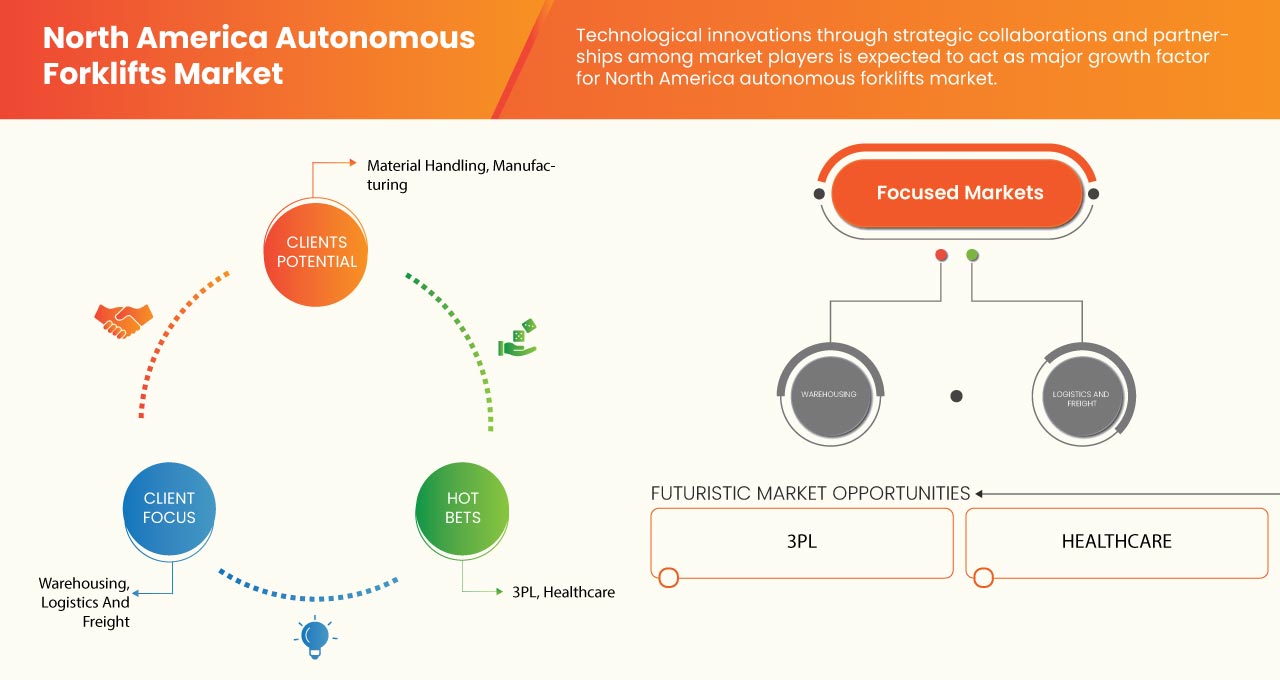

이를 위해 다양한 시장 참여자들이 새로운 제품을 출시하고 파트너십을 형성하여 자율 주행 지게차 시장에서 사업을 확장하고 있습니다.

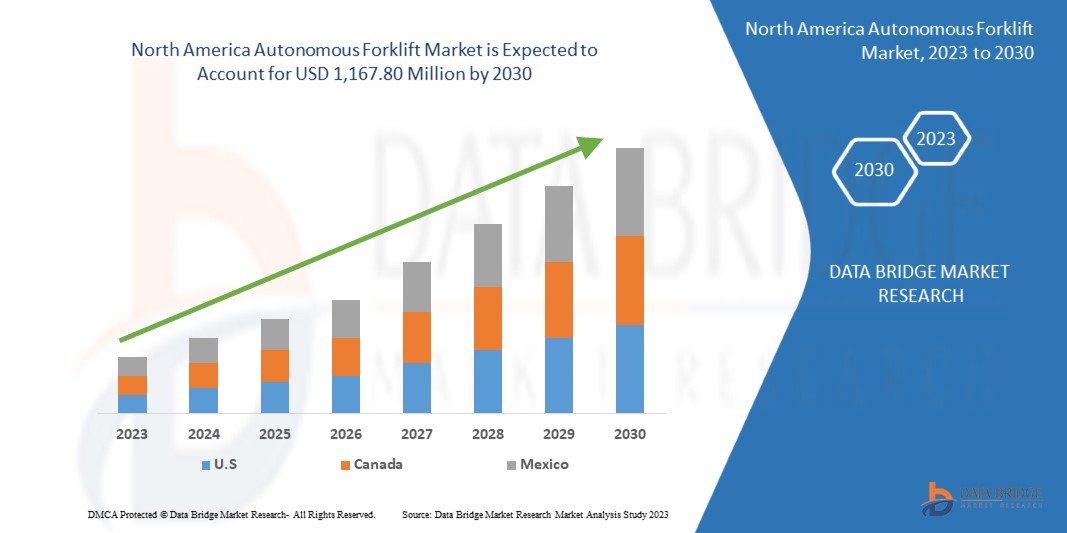

Data Bridge Market Research에 따르면, 북미 자율 주행 지게차 시장은 2030년까지 1,167.80백만 달러 규모에 도달할 것으로 예상되며, 이는 예측 기간 동안 연평균 성장률 7.2%를 기록할 것으로 예상됩니다.

|

보고서 메트릭 |

세부 |

|

예측 기간 |

2023년부터 2030년까지 |

|

기준 연도 |

2022 |

|

역사적 연도 |

2021 (2015-2020으로 사용자 정의 가능) |

|

양적 단위 |

매출은 백만 달러, 볼륨은 단위, 가격은 달러로 표시 |

|

다루는 세그먼트 |

판매 채널별(리스, 사내 구매), 응용 분야별(자재 취급, 창고, 물류 및 운송, 제조 및 기타), 산업별(3PL, 전자 상거래 , 자동차, 금속 및 중장비, 식품 및 음료, 반도체 및 전자, 제지 및 펄프 산업, 항공, 의료 및 기타), 내비게이션 기술별(레이저 유도, 자기 유도, 유도 유도, 비전 유도, 광학 테이프 유도 및 기타) |

|

국가 커버 |

미국, 캐나다, 멕시코 |

|

시장 참여자 포함 |

Oceaneering International, Inc 및 Seegrid Corporation |

시장 정의

자율 지게차는 한 장소에서 다른 장소로 무거운 짐을 운반할 수 있는 동력 기계입니다. 이 기계는 창고에서 최대 무게의 짐을 실을 수 있도록 설계되었습니다. 이 기계는 인간의 개입 없이도 적재 및 하역이 가능합니다. 따라서 자율 지게차는 인적 오류를 최소화하고 산업 사고 가능성을 줄이는 데 도움이 됩니다.

급속한 산업화와 건설 산업의 성장과 확장은 자율 지게차 수요 증가를 촉진하는 두 가지 주요 요인입니다. 창고에서 무거운 무게를 적재 및 하역할 수 있는 기계에 대한 수요가 증가함에 따라 자율 지게차의 성장이 더욱 촉진되고 있습니다. 창고 사고와 인적 오류 사례가 증가함에 따라 시장 성장도 촉진되고 있습니다 .

북미 자율 지게차 시장 동향

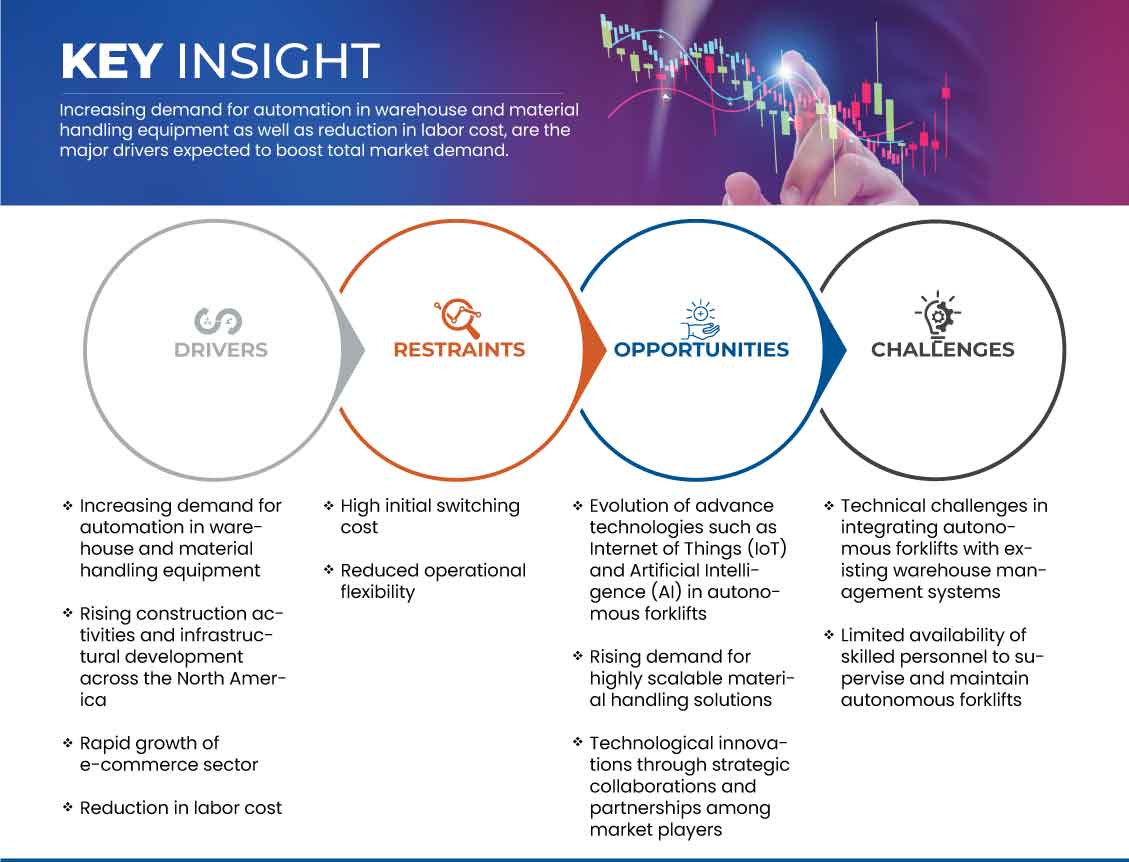

이 섹션에서는 시장 동인, 이점, 기회, 제약 및 과제를 이해하는 것을 다룹니다. 이 모든 내용은 아래와 같이 자세히 논의됩니다.

운전자

- 창고 및 물류 장비 자동화에 대한 수요 증가

창고 및 물류 처리 장비의 자동화 지게차는 시간이 지남에 따라 수요가 증가함에 따라 이러한 작업을 수행하는 방식에 혁명을 일으켰습니다. 자동화 지게차는 기술 발전의 결과로 현대 물류 및 물류 작업의 필수 구성 요소가 되었습니다. 이를 통해 기업은 다음을 수행할 수 있습니다.

- 효율성과 생산성 향상: 자동화 지게차는 인간 운전자보다 더 빠르고 정밀하게 자재를 이동하고 보관할 수 있어 시간과 노동력을 절약할 수 있습니다. 이로 인해 창고 및 자재 취급 작업이 더 생산적이고 효율적이 됩니다.

- 향상된 안전성: 지게차 사고는 직장 부상 및 사망의 중요한 원인이며, 컴퓨터화된 지게차는 인간 운전자의 필요성을 없애 사고 위험을 줄이는 데 도움이 될 수 있습니다. 또한 엄격한 안전 절차를 준수하여 항상 안전하게 작동하도록 프로그래밍할 수도 있습니다.

- 유연성 증가: 프로그래밍 가능한 자동화 포크리프트는 자재 운반, 재고 적재 및 정리, 제품 픽업 및 배치, 상품 운반을 위해 설정할 수 있습니다. 적응성 덕분에 다양한 창고에서 사용하기에 이상적입니다.

- 향상된 정확도: 자동화 지게차는 극도로 정밀하게 작동하도록 프로그래밍할 수 있어 자재가 적절하게 이동되고 보관되도록 할 수 있습니다. 이를 통해 오류를 줄이고 재고 관리의 정확도를 개선하는 데 도움이 될 수 있습니다.

북미 전역에서 증가하는 건설 활동 및 인프라 개발

자율 주행 지게차의 사용은 북미에서 건설 및 물류 부문이 크게 확장되는 주요 요인 중 하나입니다. 자율 주행 지게차의 고급 센서와 카메라는 인간의 개입 없이 작동할 수 있게 하여 생산성이 증가하고, 안전성이 높아지고, 노동 비용이 감소합니다. 자율 주행 지게차가 북미에서 건설 및 물류를 어떻게 변화시키고 있는가:-

- 생산성 향상: 자율 지게차가 휴식을 취하지 않고 24시간 연중무휴로 작동할 수 있는 능력은 주요 장점 중 하나입니다. 이는 확장된 효율성과 개발 프로젝트의 더 빠른 완료를 촉진합니다. 자율 지게차는 자재를 적재 및 하역하고, 다양한 위치로 자재를 운송하고, 자재를 쌓을 수 있기 때문에 건설 및 물류 작업에 다재다능한 도구입니다. 독립형 지게차를 사용하면 개발 조직은 다른 어느 때보다 더 빠르고 효과적으로 프로젝트를 완료할 수 있습니다.

- 안전성 향상: 자율 주행 지게차에는 첨단 카메라와 센서가 포함되어 있어 충돌을 피하고 장애물을 감지할 수 있습니다. 이로 인해 장애물을 피하기 위해 인간 운전자가 필요한 기존 지게차보다 작동이 더 안전합니다. 자율 주행 지게차의 센서 와 카메라는 실시간으로 장애물을 감지하고 충돌을 피하기 위해 경로를 조정할 수 있습니다. 이를 통해 건설 현장에서 사고와 부상의 위험이 줄어들어 근로자에게 더 안전합니다.

기회

- 확장성이 뛰어난 물류 처리 솔루션에 대한 수요 증가

더 큰 상품 이동 효율성, 속도 및 정확성에 대한 필요성으로 인해 최근 몇 년 동안 물류 및 자재 취급 산업에 상당한 변화가 발생했습니다. 변화하는 비즈니스 요구 사항에 적응하고 증가하는 전자 상거래 수요를 따라갈 수 있는 확장성이 뛰어난 자재 취급 솔루션에 대한 수요가 증가하는 것은 이 산업에서 가장 중요한 추세 중 하나입니다.

전자상거래의 증가로 인해 전 세계로 배송되는 패키지와 소포의 수가 증가했습니다. 그 결과, 창고 운영자와 물류 회사는 운영을 보다 효율적으로 만들고 그 어느 때보다 빠르게 상품을 배송해야 하는 엄청난 압박을 받고 있습니다. 그 결과 확장성, 적응성, 유연성이 뛰어난 자재 취급 솔루션에 대한 수요가 점점 더 커지고 있습니다. 확장성은 기업이 수요 변화에 대응하여 운영을 빠르고 효율적으로 조정할 수 있기 때문에 자재 취급 시스템에서 중요한 요소입니다. 예를 들어, 성수기나 세일 이벤트 기간에는 조직이 예상보다 훨씬 많은 양의 패키지를 처리해야 할 수 있습니다. 이러한 수요 급증은 기본 인프라를 크게 변경하지 않고도 확장성이 뛰어난 자재 취급 솔루션으로 수용할 수 있습니다.

제지/도전

- 초기 전환 비용이 높음

물류 산업은 자율 지게차로 인해 변혁될 가능성이 있지만, 높은 초기 전환 비용으로 인해 광범위한 채택이 방해받을 수 있습니다. 자율 주행에는 특수 센서, 카메라 및 기타 장비가 필요하기 때문에 기술 자체가 비쌀 수 있습니다. 기술의 독점적 특성으로 인해 비용이 더 증가할 수도 있습니다.

또한 자율 지게차 구현을 위해서는 기존 창고 관리 시스템(WMS), ERP 시스템 및 기타 물류 소프트웨어와의 상당한 통합이 필요합니다. 이러한 통합은 어렵고 비용이 많이 들 수 있으며, 전문적인 리소스와 전문성이 필요합니다. 전문적인 교육과 지원이 필요할 때에도 상당한 비용이 발생할 수 있습니다. 자율 지게차의 지속적인 작동에는 지속적인 지원과 유지 관리가 필요하며, 이는 비용을 더욱 증가시킬 수 있습니다.

COVID-19 이후 북미 자율 지게차 시장에 미치는 영향

자율 지게차 시장은 봉쇄와 COVID-19 정부 법률로 인해 수요가 점진적으로 감소했습니다. 제조 시설과 서비스가 폐쇄되었습니다. 민간 및 공공 개발조차 중단되었습니다. 게다가 이 산업은 특히 자율 지게차 제조 공정에 사용되는 원자재의 공급망 중단으로 영향을 받았습니다. 다양한 산업에 대한 엄격한 정부 규제, 무역 및 운송 제한은 2020년과 2021년 상반기에 전 세계 자율 지게차 시장 성장에 영향을 미친 주요 요인 중 일부였습니다. 전 세계 정부의 제한으로 자율 지게차 생산이 둔화되면서 2020년 1~3분기에 생산이 수요를 충족하지 못했습니다. 따라서 이는 수요 증가로 이어질 뿐만 아니라 제품 비용도 증가했습니다.

최근 개발 사항

- 2023년 4월, Oceaneering International, Inc는 Mobile Robotics 사업부에서 자율 주행 모바일 로봇 함대를 위한 새로운 감독 소프트웨어를 출시한다고 발표했습니다. 이 소프트웨어 플랫폼은 조립 라인부터 여러 건물의 여러 층에 걸쳐 있는 복잡한 물류 흐름에 이르기까지 광범위한 용도로 사용할 수 있습니다.

- 2022년 10월, Seegrid Corporation은 조립 조건을 위한 현대 기계화에서 실질적인 경험을 얻는 주요 프레임워크 통합자인 Koops Automation Systems와 전략적 파트너십을 발표했습니다. Koops는 협력 계약으로 인해 Seegrid Palion 및 Fleet Central 엔터프라이즈 소프트웨어 솔루션으로 알려진 자율 주행 모바일 로봇의 전체 라인을 고객에게 소개함으로써 제품 제공을 확장할 수 있습니다. 이러한 파트너십은 회사가 고객 요구 사항에 따라 개발하는 데 도움이 됩니다.

북미 자율 지게차 시장 범위

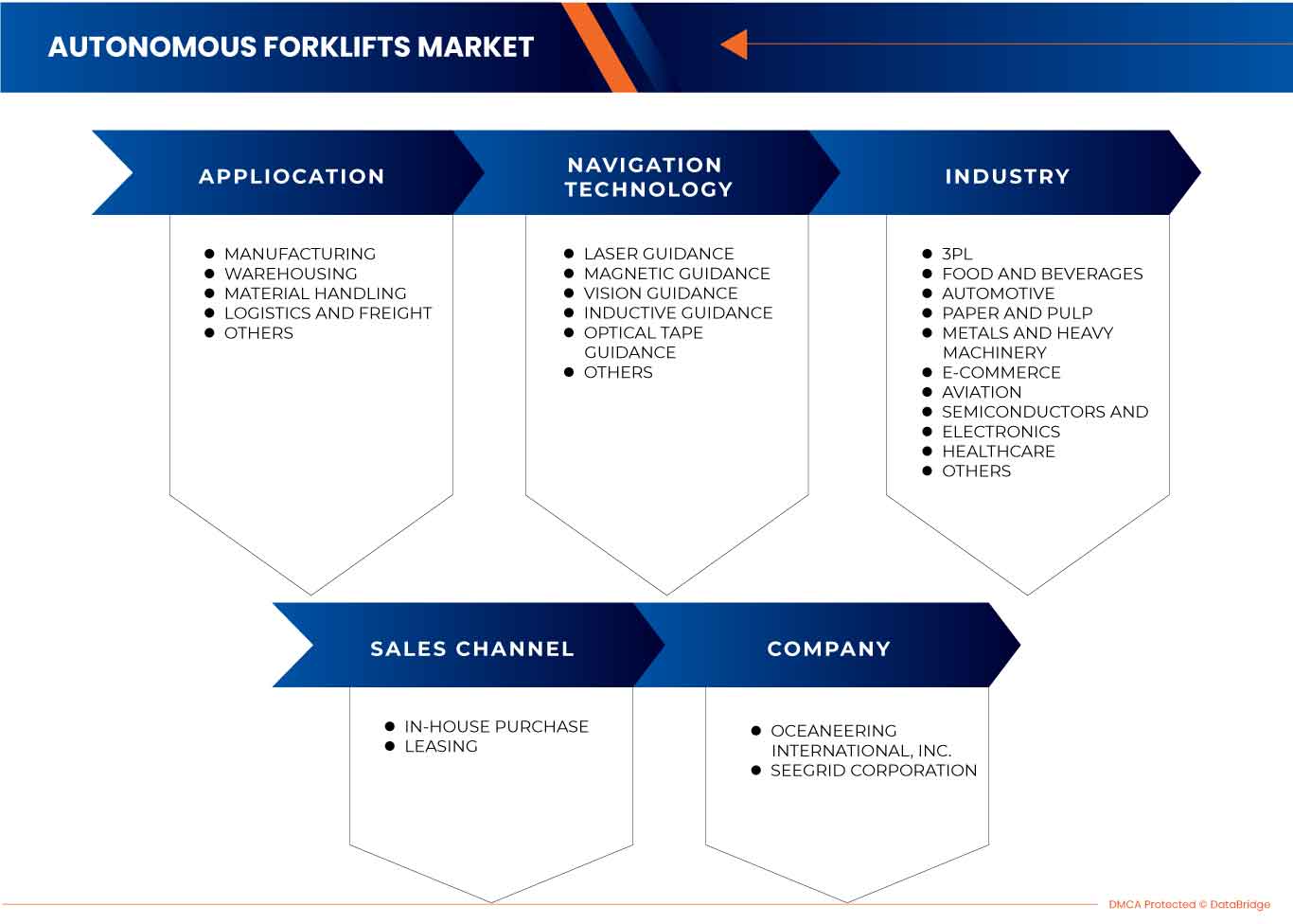

북미 자율 지게차 시장을 분석하고, 산업, 내비게이션 기술, 애플리케이션 및 판매 채널별로 시장 규모에 대한 통찰력과 추세를 제공합니다. 이러한 세그먼트 간의 성장은 산업의 빈약한 성장 세그먼트를 분석하고 사용자에게 핵심 시장 애플리케이션을 식별하기 위한 전략적 결정을 내리는 데 도움이 되는 귀중한 시장 개요와 시장 통찰력을 제공하는 데 도움이 됩니다.

북미 자율 지게차 시장, 판매 채널별

- 리스

- 사내 구매

판매 채널을 기준으로 볼 때 북미 자율 지게차 시장은 임대와 자체 구매로 구분됩니다.

북미 자율 지게차 시장, 응용 분야별

- 자재 취급

- 창고

- 물류 및 운송

- 조작

- 기타

북미 자율 지게차 시장은 응용 분야를 기준으로 자재 취급, 창고, 물류 및 운송, 제조 및 기타로 구분됩니다.

북미 자율 지게차 시장, 산업별

- 3PL

- 전자상거래

- 자동차

- 금속 및 중장비

- 음식과 음료

- 반도체 및 전자

- 제지 및 펄프 산업

- 비행

- 헬스케어

- 기타

산업별로 보면 북미 자율 지게차 시장은 3PL, 전자 상거래, 자동차, 금속 및 중장비, 식품 및 음료, 반도체 및 전자, 제지 및 펄프 산업, 항공, 의료 등으로 구분됩니다.

북미 자율 지게차 시장, 내비게이션 기술별

- 레이저 유도

- 자기 유도

- 귀납적 안내

- 비전 가이드

- 광 테이프 가이드

- 기타

북미 자율 지게차 시장은 내비게이션 기술을 기반으로 레이저 유도, 자기 유도, 유도 유도, 비전 유도, 광학 테이프 유도 및 기타로 구분됩니다.

북미 자율 지게차 시장 지역 분석/통찰력

북미 자율 지게차 시장을 분석하고, 위에 언급된 대로 지역, 산업, 내비게이션 기술, 응용 프로그램 및 판매 채널별로 시장 규모에 대한 통찰력과 추세를 제공합니다.

북미 자율 지게차 시장 보고서에서 다루는 국가는 미국, 캐나다, 멕시코입니다. 미국은 물류 산업 전반에 걸쳐 지게차에 대한 수요가 높아 이 지역에서 우위를 점하고 있습니다.

보고서의 지역 섹션은 또한 현재 및 미래 시장 추세에 영향을 미치는 개별 시장 영향 요인과 시장 규제의 변화를 제공합니다. 하류 및 상류 가치 사슬 분석, 기술 추세, 포터의 5가지 힘 분석, 사례 연구와 같은 데이터 포인트는 개별 국가의 시장 시나리오를 예측하는 데 사용되는 몇 가지 포인터입니다. 또한 지역 데이터에 대한 예측 분석을 제공하는 동안 브랜드의 존재 및 가용성과 지역 및 국내 브랜드와의 대규모 또는 희소한 경쟁으로 인해 직면한 과제, 국내 관세의 영향 및 무역 경로가 고려됩니다.

경쟁 환경 및 북미 자율 지게차 시장 점유율 분석

북미 자율 지게차 시장 경쟁 구도는 경쟁자에 대한 세부 정보를 제공합니다. 포함된 세부 정보는 회사 개요, 회사 재무, 창출된 수익, 시장 잠재력, 연구 개발 투자, 새로운 시장 이니셔티브, 유럽의 입지, 생산 현장 및 시설, 생산 용량, 회사의 강점과 약점, 제품 출시, 제품 폭과 범위, 애플리케이션 우세입니다. 제공된 위의 데이터 포인트는 자율 지게차 시장과 관련된 회사의 초점에만 관련이 있습니다.

북미 자율 지게차 시장의 주요 업체로는 Oceaneering International, Inc와 Seegrid Corporation이 있습니다.

SKU-

세계 최초의 시장 정보 클라우드 보고서에 온라인으로 접속하세요

- 대화형 데이터 분석 대시보드

- 높은 성장 잠재력 기회를 위한 회사 분석 대시보드

- 사용자 정의 및 질의를 위한 리서치 분석가 액세스

- 대화형 대시보드를 통한 경쟁자 분석

- 최신 뉴스, 업데이트 및 추세 분석

- 포괄적인 경쟁자 추적을 위한 벤치마크 분석의 힘 활용

목차

1 PREMIUM INSIGHTS

1.1 MARKET DEFINATION

1.2 VALUE CHAIN ANALYSIS

1.3 CASE STUDY

1.3.1 AUTONOMOUS FORKLIFTS STACK CHEESE BOXES USING 3D TIME-OF-FLIGHT

1.3.2 HOBURNE HOLIDAYS CASE STUDY

1.3.3 MILTON CAT ACHIEVES UP TO 50% IMPROVED ORDER FULFILLMENT

1.4 REGULATORY FRAMEWORK

1.4.1 ANSI/ITSDF

1.4.2 ISO STANDARDS

1.5 TECHNOLOGICAL TRENDS

1.6 PRICING ANALYSIS

1.7 SUPPLY CHAIN ANALYSIS

2 MARKET OVERVIEW

2.1 DRIVERS

2.1.1 INCREASING DEMAND FOR AUTONOMOUS IN WAREHOUSE AND MATERIAL HANDLING EQUIPMENT

2.1.2 RISING CONSTRUCTION ACTIVITIES AND INFRASTRUCTURAL DEVELOPMENT ACROSS NORTH AMERICA

2.1.3 RAPID GROWTH OF THE E-COMMERCE SECTOR

2.1.4 REDUCTION IN LABOR COST

2.2 RESTRAINTS

2.2.1 HIGH INITIAL SWITCHING COST

2.2.2 REDUCED OPERATIONAL FLEXIBILITY

2.3 OPPORTUNITIES

2.3.1 EVOLUTION OF ADVANCED TECHNOLOGIES SUCH AS THE INTERNET OF THINGS (IOT) AND ARTIFICIAL INTELLIGENCE (AI) IN AUTONOMOUS FORKLIFTS

2.3.2 RISING DEMAND FOR HIGHLY SCALABLE MATERIAL HANDLING SOLUTIONS

2.3.3 TECHNOLOGICAL INNOVATIONS THROUGH STRATEGIC COLLABORATIONS AND PARTNERSHIPS AMONG MARKET PLAYERS

2.4 CHALLENGES

2.4.1 TECHNICAL CHALLENGES IN INTEGRATING AUTONOMOUS FORKLIFTS WITH EXISTING WAREHOUSE MANAGEMENT SYSTEMS

2.4.2 LIMITED AVAILABILITY OF SKILLED PERSONNEL TO SUPERVISE AND MAINTAIN AUTONOMOUS FORKLIFTS

3 NORTH AMERICA AUTONOMOUS FORKLIFTS MARKET, BY SALES CHANNEL

3.1 OVERVIEW

3.2 LEASING

3.3 IN-HOUSE PURCHASE

4 NORTH AMERICA AUTONOMOUS FORKLIFTS MARKET, BY APPLICATION

4.1 OVERVIEW

4.2 MATERIAL HANDLING

4.3 WAREHOUSING

4.4 LOGISTICS & FREIGHT

4.5 MANUFACTURING

4.6 OTHERS

5 NORTH AMERICA AUTONOMOUS FORKLIFTS MARKET, BY INDUSTRY

5.1 OVERVIEW

5.2 3PL

5.3 E-COMMERCE

5.4 AUTOMOTIVE

5.5 METAL & HEAVY MACHINERY

5.6 FOOD AND BEVERAGES

5.7 SEMICONDUCTOR & ELECTRONICS

5.8 PAPER & PULP INDUSTRY

5.9 AVIATION

5.1 HEALTHCARE

5.11 OTHERS

6 NORTH AMERICA AUTONOMOUS FORKLIFTS MARKET, BY NAVIGATION TECHNOLOGY

6.1 OVERVIEW

6.2 LASER GUIDANCE

6.3 MAGNETIC GUIDANCE

6.4 INDUCTIVE GUIDANCE

6.5 VISION GUIDANCE

6.6 OPTICAL TAPE GUIDANCE

6.7 OTHERS

7 NORTH AMERICA AUTONOMOUS FORKLIFTS MARKET:BY COUNTRIES

7.1 U.S.

7.2 CANADA

7.3 MEXICO

8 NORTH AMERICA AUTONOMOUS FORKLIFTS MARKET: COMPANY LANDSCAPE

8.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

9 COMPANY PROFILE

9.1 OCEANEERING INTERNATIONAL, INC

9.1.1 COMPANY SNAPSHOT

9.1.2 REVENUE ANALYSIS

9.1.3 PRODUCT PORTFOLIO

9.1.4 RECENT DEVELOPMENTS

9.2 SEEGRID CORPORATION

9.2.1 COMPANY SNAPSHOT

9.2.2 PRODUCT PORTFOLIO

9.2.3 RECENT DEVELOPMENTS

표 목록

TABLE 1 NORTH AMERICA AUTONOMOUS FORKLIFTS MARKET, BY SALES CHANNEL, 2021-2030 (USD MILLION)

TABLE 2 NORTH AMERICA AUTONOMOUS FORKLIFTS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 3 NORTH AMERICA AUTONOMOUS FORKLIFTS MARKET, BY INDUSTRY, 2021-2030 (USD MILLION)

TABLE 4 NORTH AMERICA AUTONOMOUS FORKLIFTS MARKET, BY NAVIGATION TECHNOLOGY, 2021-2030 (USD MILLION)

TABLE 5 NORTH AMERICA AUTONOMOUS FORKLIFTS MARKET, BY COUNTRY, 2021-2030 (USD MILLION)

TABLE 6 U.S. AUTONOMOUS FORKLIFTS MARKET, BY SALES CHANNEL, 2021-2030 (USD MILLION)

TABLE 7 U.S. AUTONOMOUS FORKLIFTS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 8 U.S. AUTONOMOUS FORKLIFTS MARKET, BY INDUSTRY, 2021-2030 (USD MILLION)

TABLE 9 U.S. AUTONOMOUS FORKLIFTS MARKET, BY NAVIGATION TECHNOLOGY, 2021-2030 (USD MILLION)

TABLE 10 CANADA AUTONOMOUS FORKLIFTS MARKET, BY SALES CHANNEL, 2021-2030 (USD MILLION)

TABLE 11 CANADA AUTONOMOUS FORKLIFTS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 12 CANADA AUTONOMOUS FORKLIFTS MARKET, BY INDUSTRY, 2021-2030 (USD MILLION)

TABLE 13 CANADA AUTONOMOUS FORKLIFTS MARKET, BY NAVIGATION TECHNOLOGY, 2021-2030 (USD MILLION)

TABLE 14 MEXICO AUTONOMOUS FORKLIFTS MARKET, BY SALES CHANNEL, 2021-2030 (USD MILLION)

TABLE 15 MEXICO AUTONOMOUS FORKLIFTS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 16 MEXICO AUTONOMOUS FORKLIFTS MARKET, BY INDUSTRY, 2021-2030 (USD MILLION)

TABLE 17 MEXICO AUTONOMOUS FORKLIFTS MARKET, BY NAVIGATION TECHNOLOGY, 2021-2030 (USD MILLION)

그림 목록

FIGURE 1 TOTAL CONSTRUCTION IN THE UNITED STATES

FIGURE 2 E-COMMERCE RETAIL SALES IN UNITED STATES

FIGURE 3 EMPLOYMENT COST INDEX IN UNITED STATES

FIGURE 4 NEW ORDERS OF MATERIAL HANDLING EQUIPMENT IN THE UNITED STATES

FIGURE 5 NORTH AMERICA AUTONOMOUS FORKLIFTS MARKET: SNAPSHOT (2022)

FIGURE 6 NORTH AMERICA AUTONOMOUS FORKLIFTS MARKET: BY COUNTRY (2022)

FIGURE 7 NORTH AMERICA AUTONOMOUS FORKLIFTS MARKET: BY COUNTRY (2023 & 2030)

FIGURE 8 NORTH AMERICA AUTONOMOUS FORKLIFTS MARKET: BY COUNTRY (2022 & 2030)

FIGURE 9 NORTH AMERICA AUTONOMOUS FORKLIFTS MARKET: BY SALES CHANNEL (2023-2030)

FIGURE 10 NORTH AMERICA AUTONOMOUS FORKLIFTS MARKET: 2022 (%)

연구 방법론

데이터 수집 및 기준 연도 분석은 대규모 샘플 크기의 데이터 수집 모듈을 사용하여 수행됩니다. 이 단계에는 다양한 소스와 전략을 통해 시장 정보 또는 관련 데이터를 얻는 것이 포함됩니다. 여기에는 과거에 수집한 모든 데이터를 미리 검토하고 계획하는 것이 포함됩니다. 또한 다양한 정보 소스에서 발견되는 정보 불일치를 검토하는 것도 포함됩니다. 시장 데이터는 시장 통계 및 일관된 모델을 사용하여 분석하고 추정합니다. 또한 시장 점유율 분석 및 주요 추세 분석은 시장 보고서의 주요 성공 요인입니다. 자세한 내용은 분석가에게 전화를 요청하거나 문의 사항을 드롭하세요.

DBMR 연구팀에서 사용하는 주요 연구 방법론은 데이터 마이닝, 시장에 대한 데이터 변수의 영향 분석 및 주요(산업 전문가) 검증을 포함하는 데이터 삼각 측량입니다. 데이터 모델에는 공급업체 포지셔닝 그리드, 시장 타임라인 분석, 시장 개요 및 가이드, 회사 포지셔닝 그리드, 특허 분석, 가격 분석, 회사 시장 점유율 분석, 측정 기준, 글로벌 대 지역 및 공급업체 점유율 분석이 포함됩니다. 연구 방법론에 대해 자세히 알아보려면 문의를 통해 업계 전문가에게 문의하세요.

사용자 정의 가능

Data Bridge Market Research는 고급 형성 연구 분야의 선두 주자입니다. 저희는 기존 및 신규 고객에게 목표에 맞는 데이터와 분석을 제공하는 데 자부심을 느낍니다. 보고서는 추가 국가에 대한 시장 이해(국가 목록 요청), 임상 시험 결과 데이터, 문헌 검토, 재생 시장 및 제품 기반 분석을 포함하도록 사용자 정의할 수 있습니다. 기술 기반 분석에서 시장 포트폴리오 전략에 이르기까지 타겟 경쟁업체의 시장 분석을 분석할 수 있습니다. 귀하가 원하는 형식과 데이터 스타일로 필요한 만큼 많은 경쟁자를 추가할 수 있습니다. 저희 분석가 팀은 또한 원시 엑셀 파일 피벗 테이블(팩트북)로 데이터를 제공하거나 보고서에서 사용 가능한 데이터 세트에서 프레젠테이션을 만드는 데 도움을 줄 수 있습니다.