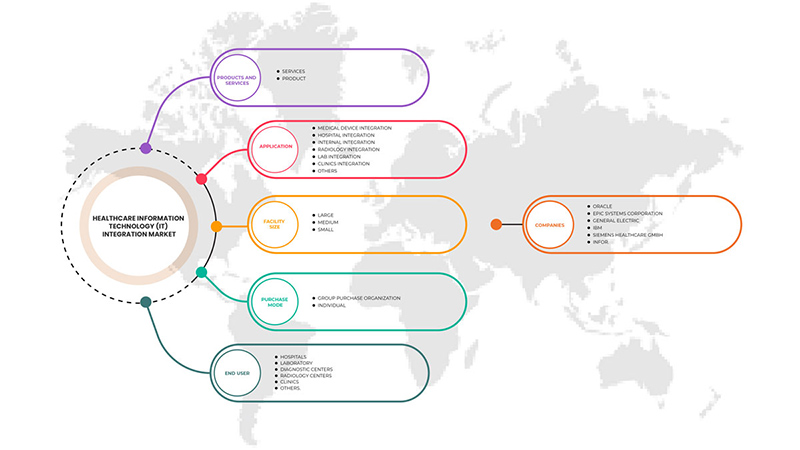

U.S. Healthcare Information Technology (IT) Integration Market, By Product and Services (Product and Services), Application (Medical Device Integration, Internal Integration, Hospital Integration, Lab Integration, Clinics Integration and Radiology Integration), Facility Size (Large, Medium and Small), Purchase Mode (Group Purchase Organization and Individual), End User (Hospitals, Laboratory, Diagnostic Centers, Radiology Centers and Clinics) - Industry Trends and Forecast to 2029.

U.S. Healthcare Information Technology (IT) Integration Market Analysis and Insights

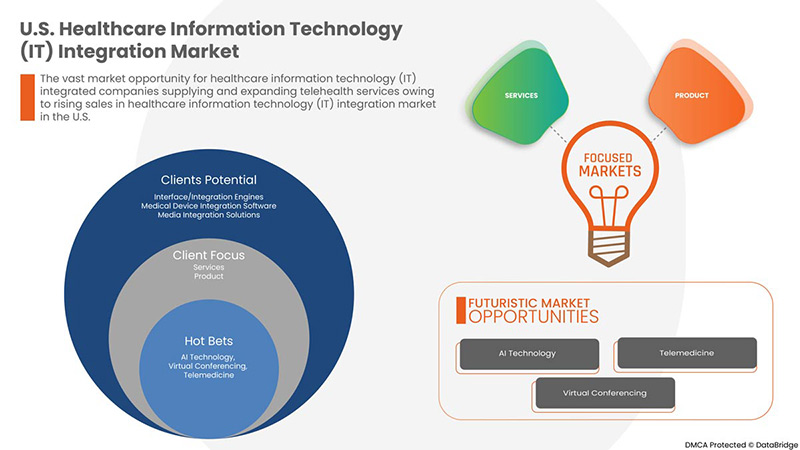

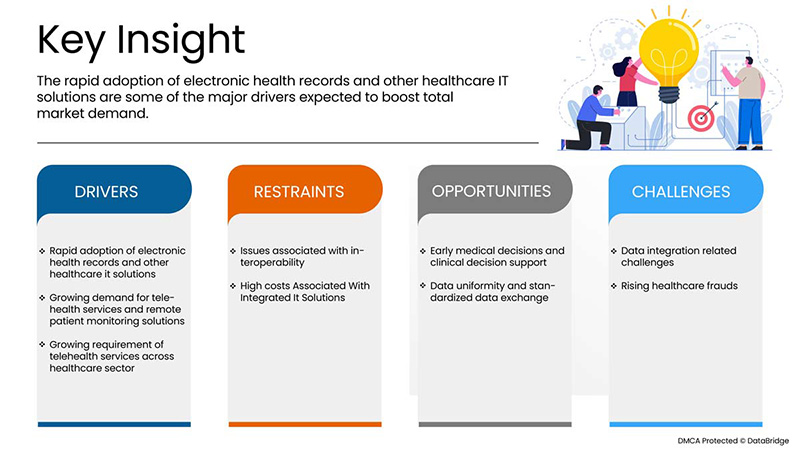

The increasing adoption of electronic health records and other healthcare it solutions, growing demand for telehealth services and remote patient monitoring solutions and growing requirement of telehealth services across healthcare sector are the factors that are expected to drive the market growth.

However, issues associated with interoperability, and high costs associated with integrated IT solutions are expected to restrain the market growth.

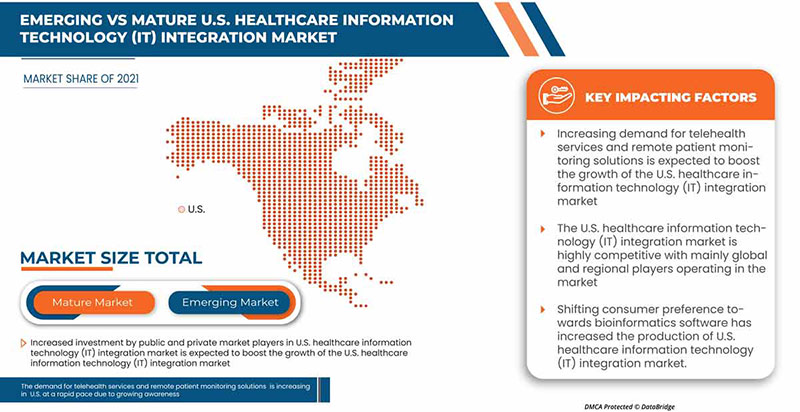

The rising technological progressions in clinical trial imaging for diagnosis and treatment of chronic diseases are expected to drive market growth. Data Bridge Market Research analyzes that the U.S. healthcare information technology (IT) integration market will grow at a CAGR of 13.7%, during the forecast period of 2022 to 2029.

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Years |

2020 (Customizable to 2019-2014) |

|

Quantitative Units |

Revenue in USD Million, and Pricing in USD |

|

Segments Covered |

By Product and Services (Product and Services), Application (Medical Device Integration, Internal Integration, Hospital Integration, Lab Integration, Clinics Integration and Radiology Integration), Facility Size (Large, Medium and Small), Purchase Mode (Group Purchase Organization and Individual), End User (Hospitals, Laboratory, Diagnostic Centers, Radiology Centers and Clinics) |

|

Countries Covered |

U.S. |

|

Market Players Covered |

Lyniate, Redox, Inc., carepoint health, Nextgen Healthcare Inc., Interfaceware, Inc. Koninklijke Philips, Oracle, AVI-SPL, INC., Allscripts Healthcare solutions, Inc, Epic systems corporation, Qualcomm life Inc., Capsule technologies Inc. Orion health, Quality syetems, Inc., Cerner corporation, Intersystems corporation, intersystem corporation, Infor Inc., GE Healthcare, MCKESSON Corporation, Meditech among others |

Market Definition

Healthcare IT integration is the area of IT involving the design, development, creation, use, and maintenance of information systems for the healthcare industry. Automated and interoperable healthcare information systems will continue to improve medical care and public health, lower costs, increase efficiency, reduce errors and improve patient satisfaction, while also optimizing reimbursement for ambulatory and inpatient healthcare providers. The importance of health IT results from the combination of evolving technology and changing government policies that influence the quality of patient care.

Some of the healthcare IT integration products are interface/integration engines, medical device integration software and media integration solutions and services, implementation & integration, support & maintenance, training and education, and consulting. Health IT makes it possible for health care providers to better manage patient care through the secure use and sharing of health information. By developing secure and private Electronic Health Records (EHRs) for most Americans and making health information available electronically, when and where it is needed, health IT can improve the quality of care, even as it makes health care more cost-effective. With the help of health IT, health care providers will have accurate and complete information about patient's health. That way, providers can give the best possible care, whether during a routine visit or a medical emergency. This is especially important if a patient has a serious medical condition and this is the way to securely share information with patients and their family members over the internet.

The patients and their families can fully take part in decisions about their healthcare and information to help diagnose health problems, reduce medical errors, and provide safer care at lower costs. During the forecast period, technological developments in healthcare IT integration are anticipated to drive market growth.

U.S. Healthcare Information Technology (IT) Integration Market Dynamics

Drivers

- Rapid adoption of electronic health records and other healthcare it solutions

Patient data is complex, confidential, and often unstructured. Incorporating this information into the healthcare delivery process is a challenge that must be met in order to realize the opportunity to improve patient care. Although Electronic Health Record (HER) has been in use for over a decade, the market has recently accelerated due to government initiatives in different countries to improve patient data security.

For instance,

- In June 2021, health funding agencies such as the National Institute of Health (NIH), in U.S., had funded for the digital healthcare IT solutions

- In March 2020, the Office of the National Coordinator for Health Information Technology (ONC) issued a report on the funding opportunity (NOFO), under the Leading Edge Acceleration Projects (LEAP) in Health Information Technology (Health IT)

IT services help to integrate various end-users throughout the healthcare system, including hospitals, nursing units, pharmacies, and health insurance companies. However, the integration of this data and its availability in real time are essential for healthcare professionals to ensure effective decision making. The rapid adoption of electronic health records and other healthcare it solutions, is expected to drive the market growth.

- Growing demand for telehealth services and remote patient monitoring solutions

Currently, telehealth services are being requested for monitoring and consulting purposes. Advances in healthcare solutions have helped to deliver educational content and ensure uninterrupted communication between patients and healthcare providers. The successful operation of remote patient monitoring solutions depends on the successful integration of medical and Information and Communications Technology (ICT) devices that enable the delivery of medical services over long distances.

For instance,

- In 2021, according to a report, by the U.S. Department of Health and Human Services found that Medicare telehealth utilization increased 63-fold between 2019 and 2020

- In July 2020, in Europe, a study conducted by HIMSS and Siemens Healthineers found that 93% of healthcare facilities had adopted at least one type of telemedicine service or solution just prior to the COVID-19 outbreak

With advancements in technology, these solutions play an important role in improving remote monitoring and patient compliance, and subsequently their quality of life. Therefore, the growing demand for remote monitoring solutions and remote devices is expected to drive the growth of the U.S. healthcare information technology (IT) integration solution providers in the coming years.

Opportunities

- Early medical decisions and clinical decision support

Technology has opened doors to improve and support healthcare that plays a major role to play in making medicine more precise and shaping care delivery. Innovative technologies, such as AI, robotics, and automation, are crucial enablers for expanding precision medicine, transforming care delivery, and improving patient experience.

For instance,

- In 2020, according to the National Centre for Biotech Information (NCBI), clinical decision support system (CDSS) is intended to improve healthcare delivery by enhancing medical decisions with targeted clinical knowledge, patient information, and other health information

The medical decisions taken are primarily fruitful as it significantly affects the development of better and advanced medical imaging products in the market. Therefore, the surge in early medical decisions and clinical decision support is expected to create a greater opportunity for the market.

- Increasing awareness among people

Healthcare IT Integration offers alternative options for receiving healthcare services U.S.ly, improving access and reducing costs associated with traveling for services. However, the full potential of healthcare IT has not been realized with slow and fragmented uptake.

For instance,

- In 2019, According to National Centre for Biotech Information (NCBI) the Software for the Evolution of Knowledge in Medicine (SEKMED) is an interactive and dynamic working Web platform employing a multidimensional approach to knowledge, which considers the various dimensions linked to clinical practice such as scientific, organizational, professional, and experiential. The solution also allows collaboration and interactions through an iterative and continuous process of knowledge generation supported by the involvement of CoP.

These awareness programs and events have raised the market growth and providing opportunities for the companies to grow as these awareness programs or publications helps people to get the needs or requirements of the healthcare IT integration.

Restraints/Challenges

- High costs associated with integrated IT solutions

High upfront acquisition costs, ongoing maintenance costs, and disruptions to workflows that contribute to temporary losses act as a restrain for the market growth.

For instance,

- According to ScienceSoft USA Corporation, cost of ultrasound software is USD 30,000 to integrate a healthcare solution with one EHR system is required and USD 150,000 is required to enable EHR integration capabilities of a software product.

Moreover, maintenance and support costs after the EHR integration implementation are expected to further hinder the market growth.

- Data integration related challenges

Information related to patients have created from different departments and at all points of treatment within the healthcare organization, making it more highly information-intensive industry and reliable patient records, However, it is essential to give reliable information by combining huge amounts of data in order to produce comprehensive and trustworthy patient records. Because a variety of medical equipment and diagnostic instruments are used in healthcare systems and is a growing need to connect all of these systems in to assist healthcare practitioners in responding quickly at various care delivery points.

For instance,

- In October 2016, According to the Published report in 2016 International Conference on Innovations in Science, Engineering and Technology (ICISET), they mentioned and analyzed different problems for healthcare data integration in Bangladesh to develop a national level health data warehouse for the citizen and Discovering the hidden knowledge from different health data repositories requires the integration of health data from widely diversified sources.

COVID-19 Impact on the U.S. Healthcare Information Technology (IT) Integration Market

Diagnostic imaging services have been time-consuming and complicated by the need for strict infection control and prevention practices developed to contain the risk of transmission and protect healthcare personnel. Hence, the decision to image suspected patients or COVID-19-positive patients is based on their impact on the improvement of patient status. The use of health information technology (HIT) during the coronavirus disease 2019 (COVID-19) pandemic has rapidly increased. During the pandemic, HIT has been used to provide telehealth services, education on the severe acute respiratory syndrome coronavirus 2 disease, updates on epidemiology and treatments, and most recently, access to scheduling systems for the COVID-19 vaccines.

Recent Developments

- In August 2022, Oracle announced the availability of Rapid direct connections to Oracle Cloud Infrastructure (OCI) that helps Internet2 member institutions make a move to the cloud. Through an Internet2 Cloud Connect dedicated network connection, institutions can utilize their existing Internet2 connections to extend their data center to OCI in a matter of days for no additional fee from Internet2 for up to 5Gbps. This makes it easy for organizations to access and use cloud resources to support research, collaboration, and the academic enterprise without significant new investments.

- In June 2022, Epic Systems Corporation has announced its plan to join a new health information exchange framework to improve health data interoperability across the country. The Trusted Exchange Framework and Common Agreement (TEFCA) have brought information networks together to help ensure that all people benefit from complete, longitudinal health records wherever they receive care. This has helped company to expand its business.

U.S. Healthcare Information Technology (IT) Integration Market Scope

The U.S. healthcare information technology (IT) integration market is segmented into five notable segments based on product and services, application, facility size, purchase mode, and end user. The growth amongst these segments will help you analyze meager growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Products and Services

- Services

- Product

Based on product and services, the market is segmented into services and product.

Application

- Medical Device Integration

- Internal Integration

- Hospital Integration

- Lab Integration

- Clinics Integration

- Radiology Integration

- Other Applications

Based on application, the market is segmented into medical device integration, internal integration, hospital integration, lab integration, clinics integration, radiology integration and other applications.

Facility Size

- Large

- Medium

- Small

Based on facility size, the market is segmented into large, medium and small.

Purchase Mode

- Group Purchase Organization

- Individual

Based on purchase mode, the market is segmented into group purchase organization and individual.

End user

- Hospitals

- Laboratory

- Diagnostic Centers

- Radiology Centers

- Clinics

- Others

Based on end user, the market is segmented into hospitals, laboratory, diagnostic centers, radiology centers, clinics and others.

U.S. Healthcare Information Technology (IT) Integration Market Regional Analysis/Insights

The U.S. healthcare information technology (IT) integration market is analyzed, and market size insights and trends are provided by regions, product and services, application, facility size, purchase mode, and end user as referenced above.

The country covered in this market report is the U.S.

U.S. is expected to dominate the market because of its latest advanced technology and inventions in healthcare IT integration.

The country section of the report also provides individual market-impacting factors and changes in regulations in the market domestically that impact the current and future trends of the market. Data points such as new sales, replacement sales, country demographics, disease epidemiology, and import-export tariffs are some of the major pointers used to forecast the market scenario for individual countries. Also, the presence and availability of North American brands and their challenges faced due to large or scarce competition from local and domestic brands impact on sales channels are considered while providing forecast analysis of the country data.

Competitive Landscape and U.S. Healthcare Information Technology (IT) Integration Market Share Analysis

The U.S. healthcare information technology (IT) integration market competitive landscape provides details on the competitor. Details included are company overview, company financials, revenue generated, market potential, investment in R&D, new market initiatives, the North America presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width, and breadth, and application dominance. The above data points provided are only related to the companies' focus related to the U.S. healthcare information technology (IT) integration market.

Some of the major players operating in the market are Lyniate, Redox, Inc., carepoint health, Nextgen Healthcare Inc., Interfaceware, Inc. Koninklijke Philips, Oracle, AVI-SPL, INC., Allscripts Healthcare solutions, Inc, Epic systems corporation, Qualcomm life Inc., Capsule technologies Inc. Orion health, Quality syetems, Inc., Cerner corporation, Intersystems corporation, intersystem corporation, Infor Inc., GE Healthcare, MCKESSON Corporation, Meditech among others.

SKU-

세계 최초의 시장 정보 클라우드 보고서에 온라인으로 접속하세요

- 대화형 데이터 분석 대시보드

- 높은 성장 잠재력 기회를 위한 회사 분석 대시보드

- 사용자 정의 및 질의를 위한 리서치 분석가 액세스

- 대화형 대시보드를 통한 경쟁자 분석

- 최신 뉴스, 업데이트 및 추세 분석

- 포괄적인 경쟁자 추적을 위한 벤치마크 분석의 힘 활용

목차

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF U.S. HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 MULTIVARIATE MODELLING

2.7 MARKET APPLICATION COVERAGE GRID

2.8 PRODUCT AND SERVICES LIFELINE CURVE

2.9 DBMR MARKET POSITION GRID

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHT

4.1 POTENTIAL HEALTHCARE IT TECHNOLOGIES

4.1.1 ELECTRONIC HEALTH RECORDS (EHRS)

4.1.2 ELECTRONIC MEDICAL RECORDS (EMRS)

4.1.3 ARTIFICIAL INTELLIGENCE (AI)

4.1.4 TELEMEDICINE

5 U.S. HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET SHARE ANALYSIS-

6 REGULATIONS

7 MARKET OVERVIEW

7.1 DRIVERS

7.1.1 RAPID ADOPTION OF ELECTRONIC HEALTH RECORDS AND OTHER HEALTHCARE IT SOLUTIONS

7.1.2 GROWING DEMAND FOR TELEHEALTH SERVICES AND REMOTE PATIENT MONITORING SOLUTIONS

7.1.3 GROWING REQUIREMENT OF TELEHEALTH SERVICES ACROSS HEALTHCARE SECTOR

7.2 RESTRAINTS

7.2.1 ISSUES ASSOCIATED WITH INTEROPERABILITY

7.2.2 HIGH COSTS ASSOCIATED WITH INTEGRATED IT SOLUTIONS

7.3 OPPORTUNITIES

7.3.1 EARLY MEDICAL DECISIONS AND CLINICAL DECISION SUPPORT

7.3.2 DATA UNIFORMITY AND STANDARDIZED DATA EXCHANGE

7.3.3 INCREASING AWARENESS AMONG PEOPLE

7.4 CHALLENGES

7.4.1 DATA INTEGRATION RELATED CHALLENGES

7.4.2 RISING HEALTHCARE FRAUDS

8 U.S. HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT AND SERVICES

8.1 OVERVIEW

8.2 SERVICES

8.2.1 SUPPORT & MAINTENANCE

8.2.2 IMPLEMENTATION & INTEGRATION

8.2.3 TRAINING & EDUCATION

8.2.4 CONSULTING

8.3 PRODUCT

8.3.1 INTERFACE/INTEGRATION ENGINES

8.3.1.1 Group Purchase Organization

8.3.1.2 Individual

8.3.2 MEDICAL DEVICE INTEGRATION SOFTWARE

8.3.2.1 Group Purchase Organization

8.3.2.2 Individual

8.3.3 MEDIA INTEGRATION SOLUTIONS

8.3.3.1 Group Purchase Organization

8.3.3.2 Individual

8.3.4 OTHER INTEGRATION TOOLS

9 U.S. HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY APPLICATION

9.1 OVERVIEW

9.2 MEDICAL DEVICE INTEGRATION

9.3 HOSPITAL INTEGRATION

9.4 INTERNAL INTEGRATION

9.5 RADIOLOGY INTEGRATION

9.6 LAB INTEGRATION

9.7 CLINICS INTEGRATION

9.8 OTHERS

10 U.S. HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY FACILITY SIZE

10.1 OVERVIEW

10.2 LARGE

10.3 MEDIUM

10.4 SMALL

11 U.S. HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PURCHASE MODE

11.1 OVERVIEW

11.2 GROUP PURCHASE ORGANIZATION

11.3 INDIVIDUAL

12 U.S. HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY END USER

12.1 OVERVIEW

12.2 HOSPITAL

12.3 DIAGNOSTIC CENTERS

12.4 RADIOLOGY CENTERS

12.5 LABORATORY

12.6 CLINICS

12.7 OTHERS

13 U.S. HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET: COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: U.S.

14 SWOT ANALYSIS

15 COMPANY PROFILE

15.1 ORACLE (BOTH PROVIDERS)

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 PRODUCT PORTFOLIO

15.1.4 RECENT DEVELOPMENTS

15.2 EPIC SYSTEMS CORPORATION (EMR PROVIDERS)

15.2.1 COMPANY SNAPSHOT

15.2.2 PRODUCT PORTFOLIO

15.2.3 RECENT DEVELOPMENT

15.3 GENERAL ELECTRIC

15.3.1 COMPANY SNAPSHOT

15.3.2 REVENUE ANALYSIS

15.3.3 PRODUCT PORTFOLIO

15.3.4 RECENT DEVELOPMENTS

15.4 IBM (INTEGRATION PROVIDERS)

15.4.1 COMPANY SNAPSHOT

15.4.2 REVENUE ANALYSIS

15.4.3 PRODUCT PORTFOLIO

15.4.4 RECENT DEVELOPMENTS

15.5 SIEMENS HEALTHCARE GMBH (INTEGRATION PROVIDERS)

15.5.1 COMPANY SNAPSHOT

15.5.2 REVENUE ANALYSIS

15.5.3 PRODUCT PORTFOLIO

15.5.4 RECENT DEVELOPMENTS

15.6 ALLSCRIPTS HEALTHCARE, LLC AND/OR ITS AFFILIATES. (EMR PROVIDERS)

15.6.1 COMPANY SNAPSHOT

15.6.2 REVENUE ANALYSIS

15.6.3 PRODUCT PORTFOLIO

15.6.4 RECENT DEVELOPMENTS

15.7 COGNIZANT (INTEGRATION PROVIDERS)

15.7.1 COMPANY SNAPSHOT

15.7.2 REVENUE ANALYSIS

15.7.3 PRODUCT PORTFOLIO

15.7.4 RECENT DEVELOPMENTS

1.5 INFOR.

15.7.5 COMPANY SNAPSHOT

15.7.6 PRODUCT PORTFOLIO

15.7.7 RECENT DEVELOPMENT

15.8 INTERSYSTEM CORPORATION (INTRGRATION PROVIDERS)

15.8.1 COMPANY SNAPSHOT

15.8.2 PRDUCT PORTFOLIO

15.8.3 RECENT DEVELOPMENTS

15.9 INTERFACEWARE INC.(INTEGRATION PROVIDERS)

15.9.1 COMPANY SNAPSHOT

15.9.2 PRODUCT PORTFOLIO

15.9.3 RECENT DEVELOPMENTS

15.1 KONNKLIJKE PHILIPS N.V. (2021) (BOTH PROVIDERS)

15.10.1 COMPANY SNAPSHOT

15.10.2 REVENUE ANALYSIS

15.10.3 PRODUCT PORTFOLIO

15.10.4 RECENT DEVELOPMENTS

15.11 LYNIATE

15.11.1 COMPANY SNAPSHOT

15.11.2 PRODUCT PORTFOLIO

15.11.3 RECENT DEVELOPMENTS

15.12 MASIMO (2021) (INTEGRATION PROVIDERS)

15.12.1 COMPANY SNAPSHOT

15.12.2 REVENUE ANALYSIS

15.12.3 PRODUCT PORTFOLIO

15.12.4 RECENT DEVELOPMENT

15.13 MDI SOLUTIONS (INTGRATION PROVIDERS)

15.13.1 COMPANY SNAPSHOT

15.13.2 PRODUCT PORTFOLIO

15.13.3 RECENT DEVELOPMENTS

15.14 MEDICAL INFORMATION TECHNOLOGY, INC. (EMR PROVIDERS)

15.14.1 COMPANY SNAPSHOT

15.14.2 PRODUCT PORTFOLIO

15.14.3 RECENT DEVELOPMENTS

15.15 NXGN MANAGEMENT, LLC (EMR PROVIDERS)

15.15.1 COMPANY SNAPSHOT

15.15.2 REVENUE ANALYSIS

15.15.3 PRODUCT PORTFOLIO

15.15.4 RECENT DEVELOPMENTS

15.16 ORION HEALTH GROUP (INTEGRATION PROVIDERS)

15.16.1 COMPANY SNAPSHOT

15.16.2 REVENUE ANALYSIS

1.11.3. PRODUCT PORTFOLIO 115

15.16.3 RECENT DEVELOPMENTS

15.17 REDOX, INC.(INTEGRATION PROVIDERS)

15.17.1 COMPANY SNAPSHOT

15.17.2 PRODUCT PORTFOLIO

15.17.3 RECENT DEVELOPMENTS

15.18 SUMMIT HEALTHCARE SERVICES, INC.(INTEGRATION PROVIDERS)

15.18.1 COMPANY SNAPSHOT

15.18.2 PRODUCT PORTFOLIO

15.18.3 RECENT DEVELOPMENTS

15.19 QVERA (INTEGRATION PROVIDERS)

15.19.1 COMPANY SNAPSHOT

15.19.2 PRODUCT PORTFOLIO

15.19.3 RECENT DEVELOPMENTS

16 QUESTIONNAIRE

17 RELATED REPORTS

표 목록

TABLE 1 U.S. HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 2 U.S. SERVICES IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 3 U.S. PRODUCT IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 4 U.S. INTERFACE/INTEGRATION ENGINES IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 5 U.S. MEDICAL DEVICE INTEGRATION SOFTWARE IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 6 U.S. MEDIA INTEGRATION SOLUTIONS IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 7 U.S. HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 8 U.S. HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY FACILITY SIZE, 2020-2029 (USD MILLION)

TABLE 9 U.S. HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PURCHASE MODE, 2020-2029 (USD MILLION)

TABLE 10 U.S. HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY END USER, 2020-2029 (USD MILLION)

그림 목록

FIGURE 1 U.S. HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET: SEGMENTATION

FIGURE 2 U.S. HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET: DATA TRIANGULATION

FIGURE 3 U.S. HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET: DROC ANALYSIS

FIGURE 4 U.S. HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET: REGIONAL VS COUNTRY MARKET ANALYSIS

FIGURE 5 U.S. HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 U.S. HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 U.S. HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 8 U.S. HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET: DBMR MARKET POSITION GRID

FIGURE 9 U.S. HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET: SEGMENTATION

FIGURE 10 GROWING DEMAND FOR HEALTHCARE IT SOLUTIONS, TELEHEALTH SERVICES, AND REMOTE PATIENT MONITORING SOLUTIONS ARE EXPECTED TO DRIVE THE U.S. HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 11 SERVICES SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE U.S. HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET FROM 2022 TO 2029

FIGURE 12 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF U.S. HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET

FIGURE 13 U.S. HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET: BY PRODUCT AND SERVICES, 2021

FIGURE 14 U.S. HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET: BY PRODUCT AND SERVICES, 2022-2029 (USD MILLION)

FIGURE 15 U.S. HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET: BY PRODUCT AND SERVICES, CAGR (2022-2029)

FIGURE 16 U.S. HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET: BY PRODUCT AND SERVICES, LIFELINE CURVE

FIGURE 17 U.S. HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET: BY APPLICATION, 2021

FIGURE 18 U.S. HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET: BY APPLICATION, 2022-2029 (USD MILLION)

FIGURE 19 U.S. HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET: BY APPLICATION, CAGR (2022-2029)

FIGURE 20 U.S. HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET: BY APPLICATION, LIFELINE CURVE

FIGURE 21 U.S. HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET: BY FACILITY SIZE, 2021

FIGURE 22 U.S. HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET: BY FACILITY SIZE, 2022-2029 (USD MILLION)

FIGURE 23 U.S. HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET: BY FACILITY SIZE, CAGR (2022-2029)

FIGURE 24 U.S. HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET: BY FACILITY SIZE, LIFELINE CURVE

FIGURE 25 U.S. HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET: BY PURCHASE MODE, 2021

FIGURE 26 U.S. HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET: BY PURCHASE MODE, 2022-2029 (USD MILLION)

FIGURE 27 U.S. HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET: BY PURCHASE MODE, CAGR (2022-2029)

FIGURE 28 U.S. HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET: BY PURCHASE MODE, LIFELINE CURVE

FIGURE 29 U.S. HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET: BY END USER, 2021

FIGURE 30 U.S. HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET: BY END USER, 2022-2029 (USD MILLION)

FIGURE 31 U.S. HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET: BY END USER, CAGR (2022-2029)

FIGURE 32 U.S. HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET: BY END USER, LIFELINE CURVE

FIGURE 33 U.S. HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET: COMPANY SHARE 2021 (%)

연구 방법론

데이터 수집 및 기준 연도 분석은 대규모 샘플 크기의 데이터 수집 모듈을 사용하여 수행됩니다. 이 단계에는 다양한 소스와 전략을 통해 시장 정보 또는 관련 데이터를 얻는 것이 포함됩니다. 여기에는 과거에 수집한 모든 데이터를 미리 검토하고 계획하는 것이 포함됩니다. 또한 다양한 정보 소스에서 발견되는 정보 불일치를 검토하는 것도 포함됩니다. 시장 데이터는 시장 통계 및 일관된 모델을 사용하여 분석하고 추정합니다. 또한 시장 점유율 분석 및 주요 추세 분석은 시장 보고서의 주요 성공 요인입니다. 자세한 내용은 분석가에게 전화를 요청하거나 문의 사항을 드롭하세요.

DBMR 연구팀에서 사용하는 주요 연구 방법론은 데이터 마이닝, 시장에 대한 데이터 변수의 영향 분석 및 주요(산업 전문가) 검증을 포함하는 데이터 삼각 측량입니다. 데이터 모델에는 공급업체 포지셔닝 그리드, 시장 타임라인 분석, 시장 개요 및 가이드, 회사 포지셔닝 그리드, 특허 분석, 가격 분석, 회사 시장 점유율 분석, 측정 기준, 글로벌 대 지역 및 공급업체 점유율 분석이 포함됩니다. 연구 방법론에 대해 자세히 알아보려면 문의를 통해 업계 전문가에게 문의하세요.

사용자 정의 가능

Data Bridge Market Research는 고급 형성 연구 분야의 선두 주자입니다. 저희는 기존 및 신규 고객에게 목표에 맞는 데이터와 분석을 제공하는 데 자부심을 느낍니다. 보고서는 추가 국가에 대한 시장 이해(국가 목록 요청), 임상 시험 결과 데이터, 문헌 검토, 재생 시장 및 제품 기반 분석을 포함하도록 사용자 정의할 수 있습니다. 기술 기반 분석에서 시장 포트폴리오 전략에 이르기까지 타겟 경쟁업체의 시장 분석을 분석할 수 있습니다. 귀하가 원하는 형식과 데이터 스타일로 필요한 만큼 많은 경쟁자를 추가할 수 있습니다. 저희 분석가 팀은 또한 원시 엑셀 파일 피벗 테이블(팩트북)로 데이터를 제공하거나 보고서에서 사용 가능한 데이터 세트에서 프레젠테이션을 만드는 데 도움을 줄 수 있습니다.