Global Gear Oils Market

시장 규모 (USD 10억)

연평균 성장률 :

%

USD

8.77 Billion

USD

10.69 Billion

2024

2032

USD

8.77 Billion

USD

10.69 Billion

2024

2032

| 2025 –2032 | |

| USD 8.77 Billion | |

| USD 10.69 Billion | |

|

|

|

|

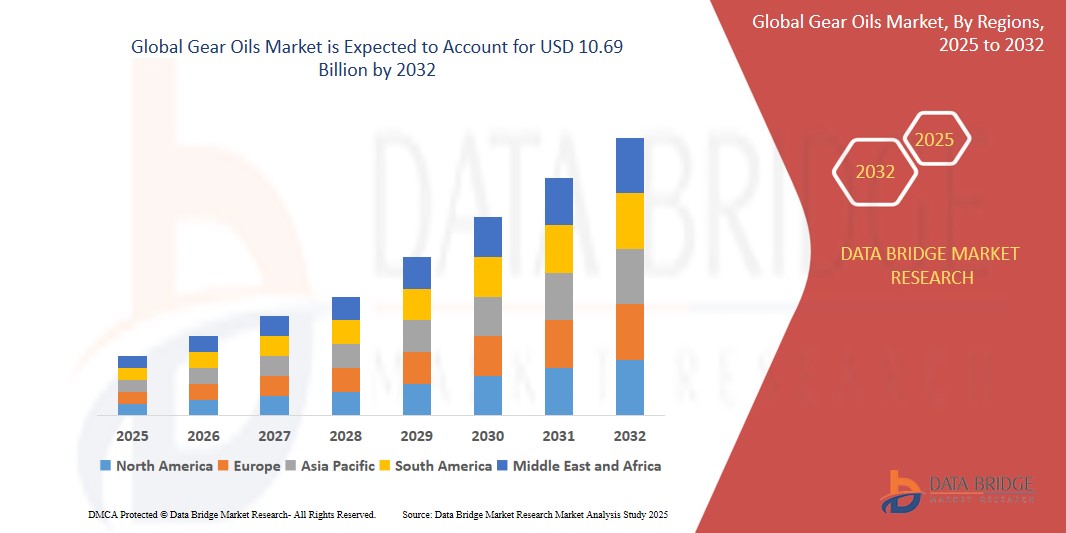

Global Gear Oils Market Segmentation, By Base Oil (Mineral Oil, Synthetic Oil, Semi-Synthetic Oil and Bio-Based Oil), Product Type (Transportation and Industrial), Application (Worm Gearboxes, Spur and Helical Gearboxes, Bevel and Hypoid Gearboxes, Planetary Gearboxes, Spiral Bevel Gearboxes, and Parallel Shaft Gearboxes) and End-use (Manufacturing, Mining, Construction and Heavy Equipment, Agriculture, Metallurgy and Metalworking, Oil and Gas, Power Generation, Transport and Others) - Industry Trends and Forecast to 2032

Gear Oils Market Size

- The global gear oils market was valued atUSD 8.77 billion in 2024 and is expected to reachUSD 10.69 billion by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at aCAGR of 2.5%, primarily driven by the rising industrialization and machinery usage

- This growth is driven by ongoing infrastructure projects demand construction equipment and machinery—another key user of industrial gear oils, reinforcing consistent market growth

Gear Oils Market Analysis

- Growing environmental concerns and stringent regulations are driving the development and adoption of biodegradable and non-toxic gear oils.

- These eco-friendly formulations offer reduced environmental impact while maintaining high performance, aligning with the industry's shift towards sustainability.

- Innovations in gear oil formulations, such as the incorporation of advanced additives and synthetic base oils, are enhancing lubrication efficiency.

- These advancements lead to improved wear protection, thermal stability, and extended service life of machinery, catering to the demands of modern industrial applications.

Report Scope and Gear Oils Market Segmentation

|

Attributes |

Gear Oils Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Gear Oils Market Trends

“Shift Toward Bio-Based and Environmentally Friendly Gear Oils”

- Governments and environmental bodies worldwide are enforcing stricter regulations on lubricant disposal and emissions, encouraging the use of biodegradable, non-toxic gear oils.

- Automotive, marine, and industrial sectors are aligning with sustainability targets by adopting bio-based gear oils that reduce carbon footprint and ecological impact.

- Innovations in ester-based and synthetic bio-lubricants are enhancing performance, oxidation stability, and lifespan—making them competitive with conventional mineral oils.

- Original Equipment Manufacturers (OEMs) are increasingly recommending or mandating eco-friendly lubricants, driving wider adoption across end-user industries.

- For instance, FUCHS offers a range of biodegradable lubricants called PLANTO that includes gear oils. These products are designed for environmentally sensitive applications, such as forestry and marine, where minimizing environmental impact is crucial.

- Increased awareness among consumers and industries about environmental protection is leading to higher demand for green alternatives in maintenance and operations.

Gear Oils Market Dynamics

Driver

“Rising Industrialization and Machinery Usage”

- As global industrialization accelerates—especially in emerging economies—there is a growing need for machinery that requires gear oils for smooth and efficient operation.

- Sectors like mining, steel, cement, and power generation extensively use heavy-duty gearboxes and require high-performance gear oils to minimize wear and downtime.

- Rising vehicle production globally boosts the use of gear oils in transmissions and differentials, particularly in commercial and off-road vehicles.

- Industries are increasingly investing in high-quality gear oils to reduce maintenance costs, extend machinery life, and improve energy efficiency.

- Ongoing infrastructure projects demand construction equipment and machinery—another key user of industrial gear oils, reinforcing consistent market growth.

- For instance, According to an article by JUSDA Supply Chain Management International Co., Ltd., the shift of manufacturing bases to Southeast Asia has led to greater use of industrial machinery, increasing the need for reliable gear oils to support continuous operations.

- The rising pace of industrialization and expanding machinery usage continue to be primary catalysts for gear oil demand across multiple sectors. This trend is expected to sustain market growth as industries prioritize operational efficiency and equipment longevity.

Opportunity

“Growth in Wind Energy Installations”

- The global push for renewable energy is driving rapid expansion of wind farms, particularly in Asia-Pacific, Europe, and North America.

- Wind turbine gearboxes require high-performance gear oils to handle extreme pressures and temperature variations, ensuring operational reliability.

- Wind gearboxes need synthetic gear oils with extended service life, presenting opportunities for manufacturers offering premium, long-lasting lubricants.

- Partnerships with turbine manufacturers (e.g., Siemens Gamesa, Vestas) open doors for long-term supply contracts and co-development of application-specific oils.

- For instance, Shell developed its Omala S5 Wind 320 synthetic gear oil specifically for wind turbines, offering extended oil drain intervals and superior protection. Shell has partnerships with major turbine OEMs and operates in over 30,000 wind turbines globally.

- Growing installed base of turbines increases demand for maintenance, offering recurring revenue through oil changes, condition monitoring, and technical support, making it a key growth opportunity in the Gear Oils market.

Restraint/Challenge

“Fluctuating Raw Material Prices”

- Gear oils are primarily derived from base oils (mineral, synthetic), which are directly linked to crude oil prices. Volatility in crude oil markets significantly impacts production costs.

- Frequent price changes make it difficult for manufacturers to maintain stable profit margins, especially when cost increases cannot be fully passed on to customers.

- Unpredictable prices often lead to disruptions in the procurement and inventory planning of raw materials, affecting consistent product availability.

- In price-sensitive markets, companies may hesitate to adjust product prices in response to cost increases, leading to intense price competition and reduced profitability.

- Unstable input costs can divert funds away from research and development, slowing innovation in high-performance or eco-friendly gear oil formulations.

Gear Oils Market Scope

The market is segmented on the basis of base oil, product type, and application.

|

Segmentation |

Sub-Segmentation |

|

By Base Oil |

|

|

By Product Type |

|

|

By Application |

|

|

By End-use |

|

Gear Oils Market Regional Analysis

“Asia-Pacific is the Dominant Region in the Gear Oils Market”

- Asia-Pacific dominates the Gear Oils market, driven its large automotive and industrial sectors, rapid urbanization, and growing manufacturing industries

- China holds a significant share due to contribute significantly to demand, driven by expanding automotive production, industrial machinery usage, and increasing infrastructure development in the region

“India is Projected To Register the Highest Growth Rate as a country”

- India is growing with highest CAGR in the region due to increasing adoption of automation and advanced manufacturing technologies further fuels the demand for high-performance lubricants in the region.

- Government initiatives to promote industrial growth and sustainable development are expected to create new opportunities for market players

Gear Oils Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Global Gear Oil Market Are:

- Shell group of companies (Netherlands)

- China Petrochemical Corporation (China)

- Exxon Mobil Corporation (U.S.)

- Chevron Corporation (U.S.)

- bp p.l.c. (U.K.)

- FUCHS (Germany)

- Total (France)

- Phillips 66 Company (U.S.)

- Saudi Arabian Oil Co. (Saudi Arabia)

- LUKOIL (Russia)

- Idemitsu Kosan Co., Ltd. (Japan)

- CASTROL LIMITED (U.K.)

- LIQUI MOLY GmbH (Germany)

- Calumet Specialty Products Partners, L.P. (U.S.)

- Morris Lubricants (U.K.)

- Penrite Oil (Australia)

- Carl Bechem GmbH (Germany)

- Valvoline Inc. (U.S.)

- Peak Lubricants Pty Ltd (Australia)

- Indian Oil Corporation (India)

Latest Developments in Global Gear Oils Market

- In January 2023, Goodyear Lubricants introduced new BS-6-compliant lubricants in Haryana for the Indian market. The company launched a new line of car lubricant oils for distribution in South and Southeast Asia, as well as New Zealand. The goal of the new product line was to reduce carbon footprint while complying with current EURO 6 and BS-6 regulations. Goodyear worked with Assurance International Limited to develop a range of environmentally friendly and sustainable products.

- In October 2023, HPCL and Chevron Brands International LLC, a division of Chevron Corporation, reached a long-term agreement in which Chevron's lubricant products, including its exclusive Havoline and Delo brands, were licensed, produced, distributed, and marketed under the Caltex brand.

- In August 2022, Exol unveiled Optifarm HP, a high-performance gear oil specifically designed for JCB use. This product launch demonstrated Exol's commitment to offering a wide range of performance oil solutions to meet the market's evolving demands. Made with premium quality, thermally stable base oils and advanced additive chemistry, Optifarm HP was a specialized, high-performance gear oil. It helped reduce chatter and squawk in oil-immersed braking systems while offering exceptional component protection to extend equipment life. Other benefits of Optifarm HP included reduced foaming, outstanding anti-wear properties, superior oxidation stability, and enhanced anti-squawk performance in brake systems.

- In May 2022, German lubricant specialist LIQUI MOLY launched Top Tec Gear EV 510 gear oil, designed specifically for high-torque electric motors and meeting the strict manufacturer requirements of Tesla. LIQUI MOLY's research and development team also worked on low-conductivity coolants for electric vehicle batteries. As e-mobility became more prevalent in Europe, the US, and Asia, LIQUI MOLY prepared for the future by offering specialized lubricants for all types of vehicles.

SKU-

세계 최초의 시장 정보 클라우드 보고서에 온라인으로 접속하세요

- 대화형 데이터 분석 대시보드

- 높은 성장 잠재력 기회를 위한 회사 분석 대시보드

- 사용자 정의 및 질의를 위한 리서치 분석가 액세스

- 대화형 대시보드를 통한 경쟁자 분석

- 최신 뉴스, 업데이트 및 추세 분석

- 포괄적인 경쟁자 추적을 위한 벤치마크 분석의 힘 활용

연구 방법론

데이터 수집 및 기준 연도 분석은 대규모 샘플 크기의 데이터 수집 모듈을 사용하여 수행됩니다. 이 단계에는 다양한 소스와 전략을 통해 시장 정보 또는 관련 데이터를 얻는 것이 포함됩니다. 여기에는 과거에 수집한 모든 데이터를 미리 검토하고 계획하는 것이 포함됩니다. 또한 다양한 정보 소스에서 발견되는 정보 불일치를 검토하는 것도 포함됩니다. 시장 데이터는 시장 통계 및 일관된 모델을 사용하여 분석하고 추정합니다. 또한 시장 점유율 분석 및 주요 추세 분석은 시장 보고서의 주요 성공 요인입니다. 자세한 내용은 분석가에게 전화를 요청하거나 문의 사항을 드롭하세요.

DBMR 연구팀에서 사용하는 주요 연구 방법론은 데이터 마이닝, 시장에 대한 데이터 변수의 영향 분석 및 주요(산업 전문가) 검증을 포함하는 데이터 삼각 측량입니다. 데이터 모델에는 공급업체 포지셔닝 그리드, 시장 타임라인 분석, 시장 개요 및 가이드, 회사 포지셔닝 그리드, 특허 분석, 가격 분석, 회사 시장 점유율 분석, 측정 기준, 글로벌 대 지역 및 공급업체 점유율 분석이 포함됩니다. 연구 방법론에 대해 자세히 알아보려면 문의를 통해 업계 전문가에게 문의하세요.

사용자 정의 가능

Data Bridge Market Research는 고급 형성 연구 분야의 선두 주자입니다. 저희는 기존 및 신규 고객에게 목표에 맞는 데이터와 분석을 제공하는 데 자부심을 느낍니다. 보고서는 추가 국가에 대한 시장 이해(국가 목록 요청), 임상 시험 결과 데이터, 문헌 검토, 재생 시장 및 제품 기반 분석을 포함하도록 사용자 정의할 수 있습니다. 기술 기반 분석에서 시장 포트폴리오 전략에 이르기까지 타겟 경쟁업체의 시장 분석을 분석할 수 있습니다. 귀하가 원하는 형식과 데이터 스타일로 필요한 만큼 많은 경쟁자를 추가할 수 있습니다. 저희 분석가 팀은 또한 원시 엑셀 파일 피벗 테이블(팩트북)로 데이터를 제공하거나 보고서에서 사용 가능한 데이터 세트에서 프레젠테이션을 만드는 데 도움을 줄 수 있습니다.