미국 저속차량 시장은 2021년부터 2028년까지의 예측 기간 동안 6.4%의 CAGR로 성장할 것으로 예상됩니다. 연구에 고려된 연도는 아래와 같습니다.

전체 보고서는 https://www.databridgemarketresearch.com/reports/us-low-speed-vehicle-market 에서 확인하세요.

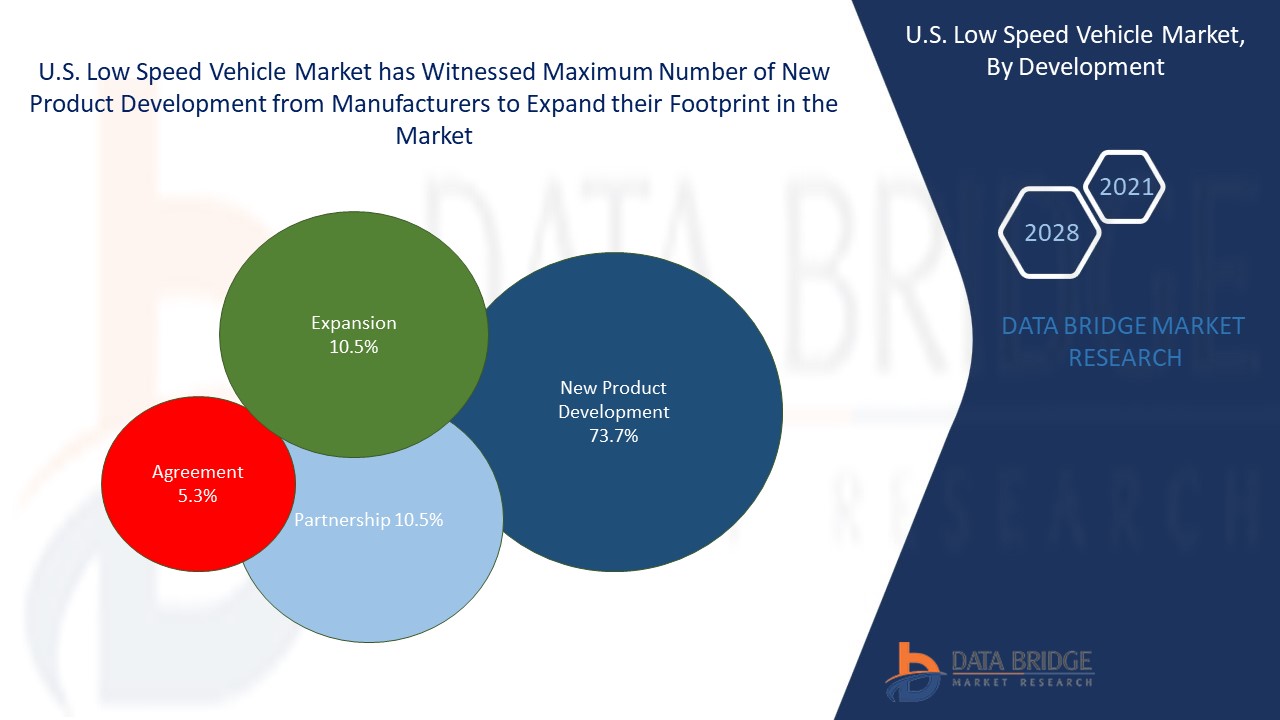

미국 저속 차량 시장은 주요 업체뿐만 아니라 지역 업체들도 다수 포함된 고도로 통합된 시장입니다. 호조세에 힘입어 전략적 개발이 활발하게 진행되고 있습니다.

미국 저속 차량 시장을 선도하는 주요 업체들은 탄탄한 제품 포트폴리오를 선보이고 있습니다. 이를 통해 기업들은 향상된 제품 포트폴리오를 통해 매출을 극대화할 수 있었습니다. 예를 들어,

- 2019년 1월, 야마하 모터(Yamaha Motor Co., Ltd.)는 UMAX RALLY 2+2 경유차(Light Utility Vehicle)를 출시했습니다. 이 신형 차량은 컨버터블 뒷좌석, 리프트 서스펜션, 화물칸 측면 분체 도장 마감, 전면 브러시 가드, 넓은 펜더 플레어, 그리고 질감이 있는 바닥을 특징으로 합니다. 이 신형 차량은 회사의 제품 포트폴리오를 더욱 확대했습니다.

텍스트론(Textron Inc.)은 미국 저속 차량 시장을 장악하고 있습니다. 이 시장의 다른 주요 기업으로는 야마하 모터(Yamaha Motor Co., Ltd.), 폴라리스(Polaris Inc.), 구보타(KUBOTA Corporation), 아메리칸 랜드마스터(American LandMaster), 잉거솔 랜드(Ingersoll Rand), 컬럼비아 비클 그룹(Columbia Vehicle Group Inc.), 디어앤컴퍼니(Deere & Company), 토로(Toro Company), 그리고 전기 자동차(Electric Vehicles) 등이 있습니다.

텍스트론(Textron Inc.)은 미국 로드아일랜드에 본사를 두고 있으며 1923년에 설립되었습니다. 이 회사는 항공기, 방위, 산업 및 금융 등 다양한 산업 분야에 제품과 서비스를 제공합니다. 텍스트론 항공, 벨, 텍스트론 시스템, 산업, 금융 부문에서 사업을 운영하고 있으며, 그중 산업 분야는 시장 집중형입니다. 텍스트론 항공, 벨, 텍스트론 시스템, 산업, 금융 부문 등 다양한 솔루션 범주를 제공하며, 그중 산업 분야는 시장 집중형입니다. 예를 들어,

- 2019년 1월, 텍스트론(Textron Inc.)은 Hauler 800 ELiTE 전기 유틸리티 차량 출시를 발표했습니다. 삼성SDI의 리튬 기술이 적용된 이 신차는 높은 에너지 효율과 함께 유지보수가 필요 없는 배터리를 탑재했습니다. 이 신제품은 텍스트론의 ELiTE 시리즈를 확장했습니다.

이 회사는 유럽, 아시아 태평양, 북미, 남미, 중동 및 아프리카에 걸쳐 글로벌한 입지를 확보하고 있으며 Arctic Cat(미국), Cessna(미국), Textron Aviation(미국), Bell Textron(미국), Cushman(미국) 등의 자회사에서 수익을 창출합니다.

디어앤컴퍼니

디어앤컴퍼니(Deere & Company)는 미국 일리노이주에 본사를 두고 있으며 1837년에 설립되었습니다. 이 회사는 농업 및 건설 산업에 첨단 기술, 제품 및 서비스를 제공하는 데 특화되어 있습니다. 농업 및 잔디, 건설 및 임업, 금융 서비스 부문에서 사업을 운영하고 있으며, 그중 농업 및 잔디는 시장 집중 부문입니다. 또한, 장비, 금융, 부품 및 서비스 부문을 제공하며, 그중 장비는 시장 집중 부문입니다. 예를 들어,

- 2020년 9월, 디어앤컴퍼니(Deere & Company)는 2021년형 게이터(Gator) 유틸리티 차량을 새롭게 업그레이드하여 출시했습니다. 새롭게 업그레이드된 존 디어 게이터 유틸리티 차량은 더욱 향상된 파워 스티어링, 더욱 편리한 기어 변속, 향상된 디지털 디스플레이, 그리고 향상된 변속기 제어 기능을 제공합니다. 이 새로운 차량은 회사의 제품 포트폴리오를 더욱 확장할 것입니다.

이 회사는 유럽, 아시아 태평양, 북미, 남미, 중동 및 아프리카 전역에 걸쳐 글로벌한 입지를 확보하고 있으며 John Deere Financial Services, Inc.(미국), A and I Products, Inc(캐나다), Blue River Technology Inc(미국), Nortrax(미국), The Vapormatic Company(영국) 등의 자회사에서 수익을 창출합니다.

토로 회사

미국 미네소타주에 본사를 둔 토로 컴퍼니(Toro Company)는 1914년에 설립되었습니다. 토로는 잔디 및 조경 관리, 임대 및 특수 건설, 지하 시설 건설, 제설 및 결빙 관리, 관개 및 옥외 조명 솔루션 등 옥외 환경 솔루션을 제공합니다. 토로는 전문 및 주거용 제품을 취급하며, 그중 전문 분야는 시장 집중형입니다. 토로는 토로, 디치 위치(Ditch Witch), 엑스마크(Exmark), 보스(BOSS), 아메리칸 오거스(American Augers), 벤트랙(Ventrac), 서브사이트 일렉트로닉스(Subsite Electronics), 해머헤드(HammerHead), 트렌코(Trencor), 유니크 라이팅 시스템(Unique Lighting Systems), 이리트롤(Irritrol), 헤이터(Hayter), 포프(Pope), 론보이(Lawn-Boy), 래디우스(Radius) 등의 제품을 제공하며, 토로는 시장 집중형 제품 카테고리입니다. 예를 들어,

- 2016년 6월, 토로 컴퍼니(Toro Company)는 토로 워크맨 GTX 유틸리티 차량(Toro Workman GTX Utility Vehicle) 출시를 발표했습니다. 이 신형 차량은 피니언 스티어링 시스템을 통해 더욱 편리한 조향과 자동차급 랙을 통해 향상된 제어력을 제공합니다. 가솔린 및 전기 모델로 출시되며, 폭 119cm(47인치)의 프레임으로 구성됩니다. 이 신제품으로 토로의 제품 포트폴리오가 더욱 확대되었습니다.

이 회사는 유럽, 북미, 아시아, 라틴 아메리카, 중동 및 아프리카 등 전 세계에 지사를 두고 있습니다. 이 외에도 itch Witch(미국), Hayter(영국), Exmark Manufacturing Company Incorporated(미국), MTI Distributing Inc(미국), Toro France(프랑스) 등 다양한 자회사를 통해 수익을 창출합니다.