자동심장충격기(AED)에 대한 수요는 급성심장마비(SCA) 환자의 생존율 향상에 중요한 요인인 신속한 제세동 시행 효과로 인해 급증했습니다. 최신 AED는 휴대성과 사용자 편의성 덕분에 전문 의료 교육을 받지 않은 사람들을 포함하여 더 폭넓은 계층의 사람들이 사용할 수 있게 되었습니다. 이로 인해 다양한 공공장소, 직장, 심지어 가정까지 AED가 더 광범위하게 보급되면서 AED 시장 성장에 기여했습니다.

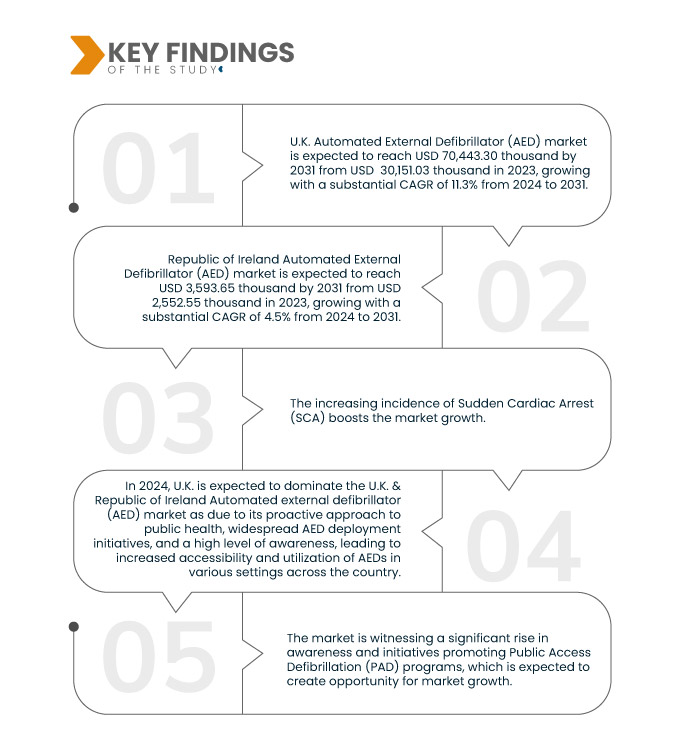

Data Bridge Market Research에 따르면 영국 자동 체외 제세동기(AED) 시장은 2023년 30,151,030달러에서 2031년 70,443,300달러로 성장할 것으로 예상되며, 2024년부터 2031년까지의 예측 기간 동안 11.3%의 상당한 CAGR로 성장할 것으로 보입니다. 아일랜드 자동 체외 제세동기(AED) 시장은 2023년 2,552,550달러에서 2031년 3,593,650달러로 성장할 것으로 예상되며, 2024년부터 2031년까지의 예측 기간 동안 4.5%의 상당한 CAGR로 성장할 것으로 보입니다.

연구의 주요 결과

- 급성 심장마비(SCA) 발생률 증가

급성 심정지(SCA)는 예고 없이 발생할 수 있는 생명을 위협하는 질환으로, 심장 기능의 빠르고 예상치 못한 상실을 초래합니다. 심혈관 질환 유병률 증가와 인구 고령화로 인해 SCA 위험 또한 증가하고 있습니다. 이로 인해 효과적이고 신속한 중재가 절실히 필요하며, 자동 제세동기는 즉각적인 치료를 제공하는 데 필수적입니다.

자동심장충격기(AED)에 대한 수요는 급성심장마비(SCA) 환자의 생존율 향상에 중요한 요인인 신속한 제세동 시행 효과로 인해 급증했습니다. 최신 AED는 휴대성과 사용자 편의성 덕분에 전문 의료 교육을 받지 않은 사람들을 포함하여 더 폭넓은 계층의 사람들이 사용할 수 있게 되었습니다. 이로 인해 다양한 공공장소, 직장, 심지어 가정까지 AED의 사용이 확대되어 AED 시장 성장에 기여했습니다.

보고서 범위 및 시장 세분화

보고서 메트릭

|

세부

|

예측 기간

|

2024년부터 2031년까지

|

기준 연도

|

2023

|

역사적인 해

|

2022 (2016-2021년까지 맞춤 설정 가능)

|

양적 단위

|

매출(USD 천), 볼륨(단위), 가격(USD)

|

다루는 세그먼트

|

제품 유형(자동 체외 제세동기(AED) 장치, 자동 체외 제세동기(AED) 부속품), 적용 분야(심실 세동, 무맥성 심실 빈맥 및 기타), 최종 사용자(병원 전 치료 및 응급 의료 서비스(EMS) 제공자, 병원, 외래 수술 센터 (ASC), 심장 센터, 공공 접근, 군대 및 국방, 재택 치료 시설, 외래 치료 센터, 전문 클리닉 및 기타), 유통 채널(직접 입찰, 온라인 판매, 소매 판매 및 기타)

|

국가 커버

|

영국과 아일랜드 공화국

|

시장 참여자 포함

|

Koninklijke Philips NV(네덜란드), NIHON KOHDEN CORPORATION(일본), Stryker(미국), Asahi Kasei Corporation(일본), Shenzhen Mindray Bio-Medical Electronics Co., Ltd.(중국), corpuls(독일), CU Medical Germany GmbH(독일), Amiitalia(이탈리아), Cardia International A/S(덴마크), SCHILLER AG(스위스), Metrax GmbH(독일), WEINMANN Emergency Medical Technology GmbH + Co. KG(독일), MEDIANA Co., Ltd.(한국), Progetti srl(이탈리아), HEARTHERO(미국) 등

|

보고서에서 다루는 데이터 포인트

|

Data Bridge Market Research에서 큐레이팅한 시장 보고서에는 시장 가치, 성장률, 세분화, 지리적 범위 및 주요 업체와 같은 시장 시나리오에 대한 통찰력 외에도 심층적인 전문가 분석, 지리적으로 대표되는 회사별 생산 및 용량, 유통업체 및 파트너의 네트워크 레이아웃, 상세하고 업데이트된 가격 추세 분석 및 공급망 및 수요의 적자 분석이 포함됩니다.

|

세그먼트 분석

영국 및 아일랜드 공화국의 자동심장충격기(AED) 시장은 제품 유형, 용도, 최종 사용자 및 유통 채널을 기준으로 네 가지 주요 세그먼트로 구분됩니다. 세그먼트별 성장은 틈새 시장의 성장 요인과 시장 접근 전략을 분석하고 핵심 적용 분야와 목표 시장의 차이점을 파악하는 데 도움이 됩니다.

- 제품 유형을 기준으로 시장은 자동 외부 제세동기(AED) 장치와 자동 외부 제세동기(AED) 액세서리로 세분화됩니다.

2024년에는 자동 체외 제세동기(AED) 장치 부문이 영국 및 아일랜드 공화국 자동 체외 제세동기(AED) 시장을 지배할 것으로 예상됩니다.

2024년에는 자동 체외 제세동기(AED) 장치 부문이 사용자 친화적인 디자인, 휴대성, 자동화된 기능 덕분에 72.35%의 시장 점유율로 영국 자동 체외 제세동기(AED) 시장을 장악할 것으로 예상됩니다.

2024년에는 자동 체외 제세동기(AED) 장치 부문이 사용자 친화적인 디자인, 휴대성, 자동화된 기능 덕분에 72.84%의 시장 점유율로 아일랜드 공화국 자동 체외 제세동기(AED) 시장을 장악할 것으로 예상됩니다.

- 응용 프로그램을 기준으로 시장은 심실세동, 무맥성 심실빈맥 및 기타로 세분화됩니다.

2024년에는 심실세동 부문이 영국 및 아일랜드 공화국 자동 체외 제세동기(AED) 시장을 장악할 것으로 예상됩니다.

2024년에는 심실세동 부문이 갑작스러운 심장마비와의 연관성으로 인해 영국 자동 체외 제세동기(AED) 시장을 장악할 것으로 예상되며, AED는 56.73%의 시장 점유율로 이러한 생명을 위협하는 상태를 해결하기 위해 특별히 설계되었습니다.

2024년에는 심실세동 분야가 갑작스러운 심장마비와 관련이 있어 아일랜드 공화국 자동 체외 제세동기(AED) 시장을 장악할 것으로 예상되며, AED는 57.73%의 시장 점유율로 이러한 생명을 위협하는 상태를 해결하기 위해 특별히 설계되었습니다.

- 최종 사용자 기준으로 시장은 병원 전 진료 및 응급 의료 서비스(EMS) 제공업체, 병원, 외래 수술 센터(ASC), 심장 센터, 공공 시설, 군 및 국방 시설, 가정 간호 시설, 외래 진료 센터, 전문 클리닉 등으로 세분화됩니다. 2024년에는 병원 전 진료 및 응급 의료 서비스(EMS) 제공업체 부문이 영국 자동심장충격기(AED) 시장에서 24.55%의 시장 점유율을 기록하며 시장을 주도할 것으로 예상됩니다. 2024년에는 병원 전 진료 및 응급 의료 서비스(EMS) 제공업체 부문이 아일랜드 자동심장충격기(AED) 시장에서 26.94%의 시장 점유율을 기록하며 시장을 주도할 것으로 예상됩니다.

- 영국 자동심장충격기(AED) 시장은 유통 채널을 기준으로 직접 입찰, 온라인 판매, 소매 판매 등으로 세분화됩니다. 2024년에는 직접 입찰 부문이 영국 자동심장충격기(AED) 시장을 51.36%의 시장 점유율로 주도할 것으로 예상됩니다. 2024년에는 직접 입찰 부문이 아일랜드 자동심장충격기(AED) 시장을 52.87%의 시장 점유율로 주도할 것으로 예상됩니다.

주요 플레이어

Data Bridge Market Research는 Koninklijke Philips NV(네덜란드), NIHON KOHDEN CORPORATION(일본), Stryker(미국), Asahi Kasei Corporation(일본), Shenzhen Mindray Bio-Medical Electronics Co., Ltd.(중국)를 영국 및 아일랜드 공화국 자동 체외 제세동기(AED) 시장의 주요 회사로 분석했습니다.

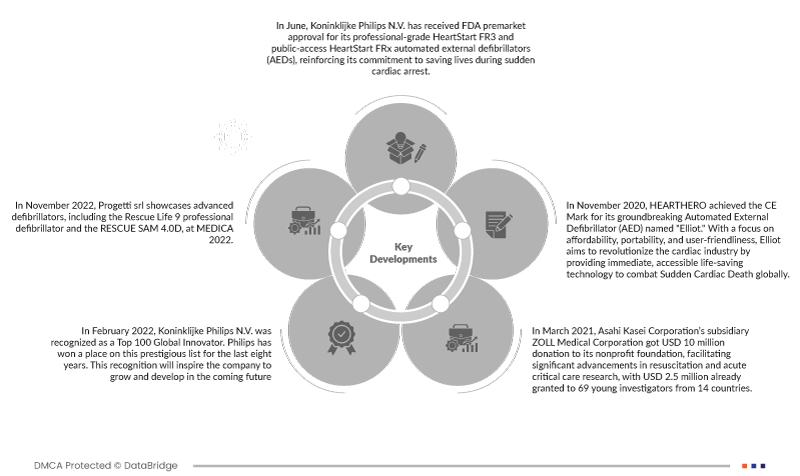

시장 개발

- 2022년 11월, Progetti srl은 MEDICA 2022에서 Rescue Life 9 전문 제세동기와 RESCUE SAM 4.0D를 포함한 첨단 제세동기를 선보입니다. Rescue Life 9는 견고한 TFT LCD 디스플레이, 긴 배터리 수명, 그리고 다양한 구성을 제공하며, RESCUE SAM 4.0D는 효율적인 제세동을 위한 신속한 분석 시스템을 갖추고 있습니다. 이러한 전시를 통해 Progetti srl은 전 세계 고객의 관심을 사로잡을 수 있습니다.

- 6월, Koninklijke Philips NV는 전문가급 HeartStart FR3와 일반인이 사용할 수 있는 HeartStart FRx 자동심장충격기(AED)에 대한 FDA 시판 전 승인을 획득했습니다. 이는 급성 심정지 발생 시 생명을 구하겠다는 필립스의 의지를 더욱 강화하는 것입니다. 이번 승인은 필립스의 업계 선도적인 AED 포트폴리오를 확장하여 의료 전문가와 일반 대중을 위한 응급 대응에서 필립스가 차지하는 중요한 역할을 강조합니다.

- 2022년 2월, Koninklijke Philips NV는 세계 100대 혁신 기업으로 선정되었습니다. 필립스는 지난 8년간 이 명망 높은 명단에 이름을 올려왔습니다. 이번 수상은 필립스가 앞으로 성장하고 발전하는 데 큰 힘이 될 것입니다.

- 2021년 3월, 아사히카세이(Asahi Kasei Corporation)의 자회사인 졸 메디컬(ZOLL Medical Corporation)은 비영리 재단에 1천만 달러를 기부하여 소생술 및 급성 중환자 치료 연구 분야의 괄목할 만한 발전을 촉진했습니다. 이미 14개국 출신의 젊은 연구자 69명에게 250만 달러가 지원되었습니다. 이 재단의 영향력 있는 지원은 차세대 연구자들을 육성하고, 이 중요한 분야의 과학적 발전을 촉진하며, 미래 연구자들을 위한 멘토링을 통해 연구의 지속성을 보장하고 있습니다.

- 2020년 11월, HEARTHERO는 획기적인 자동심장충격기(AED) "엘리엇(Elliot)"에 대한 CE 마크를 획득했습니다. 합리적인 가격, 휴대성, 그리고 사용자 친화성에 중점을 둔 엘리엇은 전 세계적으로 급성 심장사(SCC)에 대처할 수 있는 즉각적이고 접근성 높은 생명 구명 기술을 제공함으로써 심장 산업에 혁신을 가져오는 것을 목표로 합니다.

Data Bridge 시장 조사 분석에 따르면

이 시장 보고서에서 다루는 국가는 영국과 아일랜드 공화국입니다.

2024년 영국은 영국 및 아일랜드 공화국 자동 체외 제세동기(AED) 시장에서 주도권을 잡고 가장 빠르게 성장하는 국가가 될 것으로 예상됩니다.

영국은 공중 보건에 대한 적극적인 접근, 광범위한 AED 배포 이니셔티브, 높은 수준의 인지 덕분에 2024년에 영국 및 아일랜드 공화국 자동 체외 제세동기(AED) 시장에서 우위를 점하고 가장 빠르게 성장하는 국가가 될 것으로 예상됩니다. 이로 인해 전국의 다양한 환경에서 AED의 접근성과 활용이 증가했습니다.

보고서의 국가별 섹션은 개별 시장 영향 요인과 국내 시장의 현재 및 미래 동향에 영향을 미치는 규제 변화도 제공합니다. 신규 매출, 교체 매출, 국가별 인구 통계, 규제 조치, 수출입 관세와 같은 데이터는 개별 국가의 시장 시나리오를 예측하는 데 사용되는 주요 지표입니다. 또한, 글로벌 브랜드의 존재 및 가용성, 그리고 국내 및 국내 브랜드와의 경쟁이 심화되거나 부족하여 직면하는 과제, 그리고 판매 채널의 영향도 국가별 데이터 예측 분석에 고려됩니다.

영국 및 아일랜드 공화국 자동 외부 제세동기(AED) 시장 보고서에 대한 자세한 내용은 여기를 클릭하세요. - https://www.databridgemarketresearch.com/reports/uk-and-republic-of-ireland-automated-external-defibrillator-aed-market