증가하는 인프라 투자와 급속한 도시화는 싱가포르의 지질 공학 계측 및 모니터링에 대한 수요를 이끄는 주요 요인입니다. 도시 국가가 증가하는 인구와 경제 활동을 수용하기 위해 인프라를 지속적으로 개발함에 따라 건설 프로젝트의 안정성을 보장하는 것이 더욱 중요해졌습니다. 지반 공학 계측은 위험을 완화하고 인프라 자산의 수명을 보장하기 위해 지반 이동, 기초 안정성, 지하수 수위 등 토양 및 구조물 거동의 다양한 측면을 모니터링하는 데 중요한 역할을 합니다.

전체 보고서에 액세스 @https://www.databridgemarketresearch.com/reports/singapore-geotechnical-instrumentation-monitoring-market

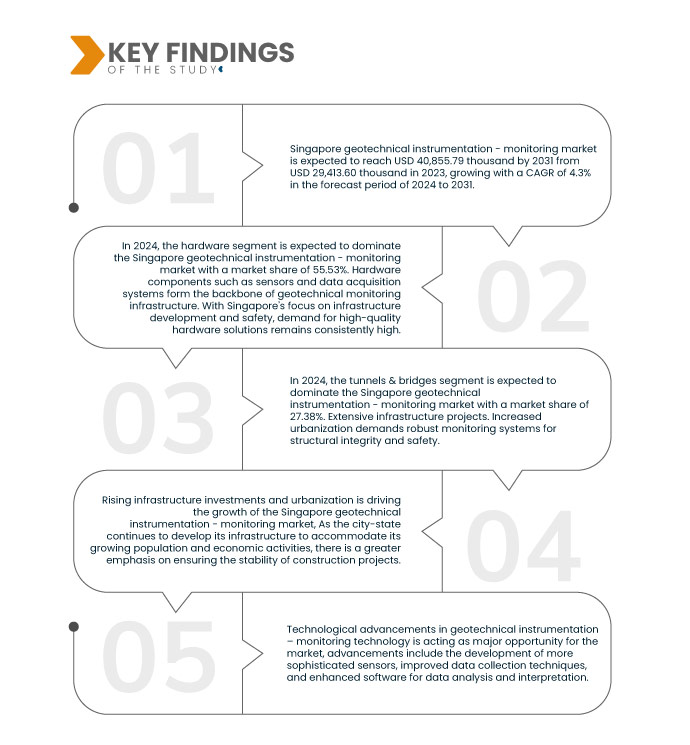

Data Bridge Market Research에서는 다음과 같이 분석합니다. 싱가포르 지질공학 계측 - 모니터링 시장 2024~2031년 예측 기간 동안 CAGR 4.3% 성장해 2023년 USD 29,413.60천에서 2031년에는 USD 40,855.79천에 도달할 것으로 예상됩니다.

연구의 주요 결과

실시간 모니터링 수요 증가

실시간 모니터링에 대한 수요 증가는 싱가포르 지질 공학 계측 및 모니터링 시장을 크게 주도했습니다. 지반공학 계측은 건설 프로젝트, 인프라 개발, 환경 모니터링과 관련된 위험을 평가하고 관리하는 데 중요한 역할을 합니다. 실시간 모니터링을 통해 지속적인 데이터 수집 및 분석이 가능해지면 이동, 토양 불안정, 구조적 변형과 같은 잠재적인 위험을 조기에 감지할 수 있습니다. 이러한 사전 예방적 접근 방식은 시기적절한 개입과 조정을 촉진하여 안전성을 강화하고, 프로젝트 지연을 최소화하며, 전체 비용을 절감합니다.

보고서 범위 및 시장 세분화

|

보고서 지표

|

세부

|

|

예측기간

|

2024년부터 2031년까지

|

|

기준 연도

|

2023년

|

|

역사적인 연도

|

2022년(2016~2021년까지 맞춤 설정 가능)

|

|

양적 단위

|

수익(단위: 천 달러)

|

|

해당 세그먼트

|

오퍼링(하드웨어, 소프트웨어, 서비스), 구조(터널 및 교량, 건물 및 유틸리티, 댐, 도로/철도, 지하철, 원자력 발전소 및 기타), 네트워킹 기술(유선, 무선), 기술(지반 및 구조물의 변형) 관측, 데이터 관리 및 모니터링 시스템, 건설 모니터링 서비스, 수질 관측, 경사 및 표면 정착), 최종 사용자(빌딩 및 인프라, 광업, 석유 및 가스, 에너지 및 전력, 제조, 정부, 항공 우주, 농업 및 기타) )

|

|

해당 국가

|

싱가포르

|

|

해당 시장 참여자

|

센싱테크 PTE. LTD. (싱가포르), Applus+(스페인), Expont, Inc.(미국), GEO-Instruments(미국), Fugro(네덜란드), GEOKON(미국), Monitoring Solution Providers Pte Ltd.(싱가포르), GeoSIG, Ltd(스위스) , RST Instruments Ltd.(캐나다), SERCEL(프랑스), TRITECH ENGINEERING and TESTING(싱가포르) PTE LTD(싱가포르), Worldsensing(스페인), Encardio Rite(인도), CSC Holdings Limited(싱가포르) 등

|

|

보고서에서 다루는 데이터 포인트

|

Data Bridge 시장 조사팀이 큐레이팅한 시장 보고서에는 시장 가치, 성장률, 시장 부문, 지리적 범위, 시장 플레이어 및 시장 시나리오와 같은 시장 통찰력 외에도 심층적인 전문가 분석, 수입/수출 분석, 가격분석, 생산소비분석, 유봉분석

|

세그먼트 분석

싱가포르 지질 공학 계측 - 모니터링 시장은 제품, 구조, 네트워킹 기술, 기술 및 최종 사용자를 기반으로 5개의 주목할만한 부문으로 분류됩니다.

- 제공을 기반으로 시장은 하드웨어, 소프트웨어 및 서비스로 분류됩니다.

2024년에는 하드웨어 부문이 싱가포르 지질 공학 계측 - 모니터링을 지배할 것으로 예상됩니다. 시장

2024년에는 하드웨어 부문이 싱가포르 지질 공학 계측 - 모니터링 시장을 55.53%의 시장 점유율로 지배할 것으로 예상됩니다. 센서 데이터 수집 시스템은 지질 공학 모니터링 인프라의 중추를 형성합니다.

- 구조를 기준으로 시장은 터널 및 교량, 건물 및 유틸리티, 댐, 도로/철도, 지하철, 원자력 발전소 등으로 분류됩니다. 2024년에는 터널 및 교량 부문이 27.38%의 시장 점유율로 싱가포르 지질 공학 계측-모니터링 시장을 지배할 것으로 예상됩니다.

- 네트워킹 기술을 기반으로 시장은 유선과 무선으로 구분됩니다. 2024년에는 유선 부문이 78.46%의 시장 점유율로 싱가포르 지질 공학 계측 - 모니터링 시장을 지배할 것으로 예상됩니다.

- 기술을 기반으로 시장은 지반 및 구조물의 변형 관찰, 데이터 관리 및 모니터링 시스템, 건설 모니터링 서비스, 수역 관찰, 경사 및 표면 침하로 분류됩니다.

2024년에는 지반 및 구조물 관측 부문의 변형이 싱가포르 지질 공학 계측-모니터링 시장을 지배할 것으로 예상됩니다.

2024년에는 건설 프로젝트 증가와 인프라 개발로 인해 지상 및 구조물 관측 부문의 변형이 싱가포르 지질 공학 계측-모니터링 시장을 34.90%의 시장 점유율로 지배할 것으로 예상됩니다.

- 최종 사용자를 기준으로 시장은 건물 및 인프라, 광업, 석유 및 가스, 에너지 및 전력, 제조, 정부, 항공 우주, 농업 등으로 분류됩니다. 2024년에는 건물 및 인프라 부문이 21.46%의 시장 점유율로 싱가포르 지질 공학 계측-모니터링 시장을 지배할 것으로 예상됩니다.

주요 플레이어

Data Bridge 시장 조사에서는 Soil Investigation Pte Ltd.(CSC Holdings Limited의 일부)(싱가포르), CAST Laboratories Pte Ltd.(싱가포르), Geoscan Pte Ltd.(싱가포르), Fugro(네덜란드), Geocomp, Inc.(A)를 분석합니다. SERCEL)(미국)의 일부로서 이 시장의 주요 시장 참여자입니다.

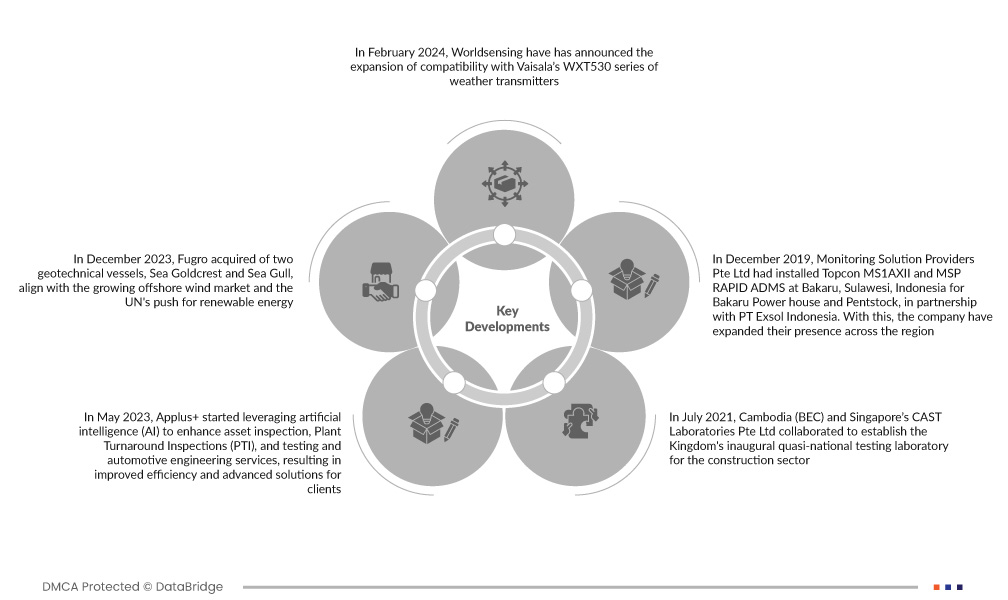

시장 개척

- 2024년 2월, Worldsensing은 Vaisala의 WXT530 시리즈 기상 송신기와의 호환성 확장을 발표했습니다. 이번 개발은 2020년 8월 WXT536 모델에 대한 호환성 도입으로 시작된 파트너십의 정점을 의미합니다.

- 2023년 12월 Fugro는 성장하는 해상 풍력 시장과 UN의 재생 에너지 추진에 맞춰 지질 공학 선박인 Sea Goldcrest와 Sea Gull을 인수했습니다. 장기적인 선박 용량 확보를 위해 Fugro는 해상 풍력 산업의 요구 사항을 충족하고 향후 프로젝트를 위한 시장 선도적 위치와 유연성을 강화하는 것을 목표로 하고 있습니다. 이러한 전략적 움직임은 지속 가능한 해양 개발에 필수적인 포괄적인 지질 공학 솔루션을 제공하려는 Fugro의 노력을 강조합니다.

- 2023년 5월, Applus+는 인공 지능(AI)을 활용하여 자산 검사, 공장 턴어라운드 검사(PTI), 테스트 및 자동차 엔지니어링 서비스를 향상시키기 시작했으며, 그 결과 고객을 위한 향상된 효율성과 고급 솔루션을 제공했습니다. AI는 파이프라인 벽 두께 평가, 검사관에게 기술 지원 제공 등 비파괴 테스트 데이터 및 이미지의 자동 분석을 가능하게 했으며, 학습 기반 솔루션은 자율 주행 적응 및 충돌 테스트 신호 검증과 같은 영역에 적용됩니다. 이러한 서비스는 회사가 포트폴리오를 강화하고 고객을 늘리는 데 도움이 됩니다.

- 2021년 7월, 캄보디아(BEC)와 싱가포르의 CAST Laboratories Pte Ltd가 협력하여 건설 부문을 위한 왕국 최초의 준국가 테스트 연구소를 설립했습니다. 7월에 출범한 BECL(Board of Engineers, 캄보디아 연구소)은 새로운 표준과 업계 모범 사례를 성공적으로 도입했습니다. 이번 협력을 통해 BECL은 건축 부문에 대한 포괄적인 제품 테스트, 검증, 검사 및 인증 서비스를 제공하여 역량을 강화하고 산업 발전에 기여할 수 있게 되었습니다.

- 2019년 12월, 모니터링 솔루션 제공업체 Pte Ltd는 PT Exsol Indonesia와 협력하여 Bakaru Power house 및 Pentstock을 위해 인도네시아 술라웨시 바카루에 Topcon MS1AXII 및 MSP RAPID ADMS를 설치했습니다. 이를 통해 회사는 지역 전반에 걸쳐 입지를 확대했습니다.

Data Bridge 시장 조사 분석에 따르면:

싱가포르 지질 공학 계측 - 모니터링 시장에 대한 자세한 정보 신고하려면 여기를 클릭하세요 –https://www.databridgemarketresearch.com/reports/singapore-geotechnical-instrumentation-monitoring-market