파이프는 다양한 산업 분야에서 유체, 기체, 그리고 때로는 고체를 운반하는 데 사용되는 속이 빈 원통형 구조물입니다. 일반적으로 강철, 구리 , PVC, 폴리에틸렌 과 같은 재질로 제작되는 파이프는 석유 및 가스, 상수도, 건설, 화학 처리, 제조 등의 분야에서 필수적입니다. 파이프는 복잡한 시스템을 통해 장거리 물질을 안전하고 효율적으로 운반하는 수단을 제공합니다. 산업 및 용도에 따라 파이프는 다양한 압력, 온도 및 부식성 환경을 견딜 수 있도록 크기, 두께, 재질 구성이 다양하므로 산업 기반 시설의 필수 구성 요소입니다.

전체 보고서는 https://www.databridgemarketresearch.com/reports/north-america-pipe-market 에서 확인하세요.

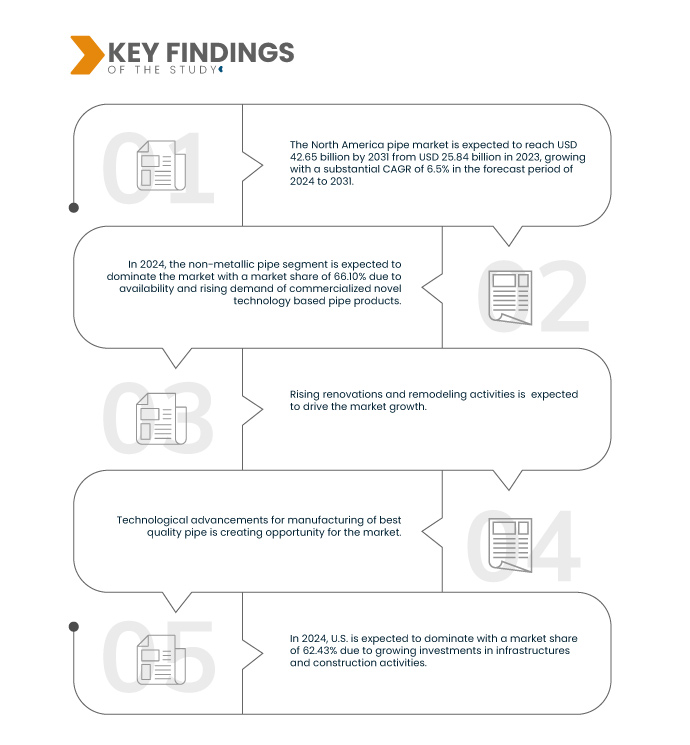

Data Bridge Market Research에 따르면 북미 파이프 시장은 2023년 258억 4천만 달러에서 2031년 426억 5천만 달러로 성장할 것으로 예상되며, 2024년부터 2031년까지 예측 기간 동안 6.5%의 높은 CAGR로 성장할 것으로 전망됩니다. 상용화된 신기술 기반 파이프 제품이 시장 성장을 견인할 것입니다.

연구의 주요 결과

국내 및 상업용 파이프 사용 증가

북미 파이프 시장은 가정 및 상업 분야 전반의 수요 증가에 힘입어 성장하고 있습니다. 도시화와 인구 밀도 증가는 주거, 상업 및 산업 환경에서 안정적인 배관 시스템에 대한 수요를 증가시키고 있습니다. 가정 부문에서는 주택 개발 및 개보수 증가로 PVC, PEX, 구리 파이프와 같은 고급 배관 솔루션에 대한 수요가 증가하고 있습니다. 상업 부문에서는 의료, 호텔, 제조업 분야의 신축 공사로 인해 상수도, 폐기물 관리, HVAC(난방 및 환기 시스템), 산업 공정에 필요한 내구성 있는 파이프 수요가 증가하고 있습니다. 건설 및 인프라 개발이 확대됨에 따라 효율적인 배관 시스템에 대한 수요는 시장 규모를 더욱 확대할 것으로 예상됩니다.

보고서 범위 및 시장 세분화

보고서 메트릭

|

세부

|

예측 기간

|

2024년부터 2031년까지

|

기준 연도

|

2023

|

역사적인 해

|

2022 (2016-2021년까지 맞춤 설정 가능)

|

양적 단위

|

매출(10억 달러), 양(킬로톤), 가격(톤당 USD)

|

다루는 세그먼트

|

재료별(비금속 파이프 및 금속 파이프), 제조 공정별(이음매 없는 파이프 제조, 전기 저항 용접(ERW) 파이프 제조, 잠수 아크 용접(SAW) 파이프 제조, 이중 잠수 아크 용접(DSAW) 파이프 제조, 이음매 없는 용접 파이프 제조 공정), 범주별(압력 파이프 및 비압력 파이프), 크기별(최대 1/2인치, 1/2-1인치, 1-2인치, 2-5인치, 5-10인치, 10-20인치, 20인치 이상), 산업별(수자원 인프라, 석유 및 가스 인프라, 건물 인프라, 산업 인프라)

|

포함 국가

|

미국, 캐나다, 멕시코

|

시장 참여자 포함

|

JM EAGLE, INC.(미국), Advanced Drainage Systems(미국), Chevron Phillips Chemical Company LLC.(미국), Charlotte Pipe, Foundry(미국), Aliaxis Holdings SA(벨기에), Orbia(멕시코), Atkore(미국), Nucor Tubular Products(미국), Uponor North America(미국), Contech Engineered Solutions LLC(미국), WL Plastics(미국), Prinsco, Inc.(미국), Pestan North America(미국), Furukawa Electric Co.Ltd.(일본), Lane Enterprises, Inc.(미국), Westlake Pipe & Fittings(미국).

|

보고서에서 다루는 데이터 포인트

|

Data Bridge Market Research에서 큐레이팅한 시장 보고서에는 시장 가치, 성장률, 세분화, 지리적 범위 및 주요 업체와 같은 시장 시나리오에 대한 통찰력 외에도 수입 수출 분석, 생산 능력 개요, 생산 소비 분석, 가격 추세 분석, 기후 변화 시나리오, 공급망 분석, 가치 사슬 분석, 원자재/소모품 개요, 공급업체 선택 기준, PESTLE 분석, Porter 분석 및 규제 프레임워크가 포함됩니다.

|

세그먼트 분석:

북미 파이프 시장은 재료, 제조 공정, 범주, 규모 및 산업을 기준으로 5개의 주요 부문으로 구분됩니다.

- 재료에 따라 시장은 비금속 파이프와 금속 파이프로 구분됩니다.

2024년에는 비금속 파이프 부문이 북미 파이프 시장을 지배할 것으로 예상됩니다.

2024년에는 비금속 파이프 부문이 비용 효율성, 내식성, 설치 용이성 등의 장점으로 인해 시장 점유율 66.10%를 기록하며 시장을 지배할 것으로 예상됩니다.

- 제조 공정을 기준으로 시장은 이음매 없는 파이프 제조, 전기 저항 용접(ERW) 파이프 제조, 잠수 아크 용접(SAW) 파이프 제조, 이중 잠수 아크 용접(DSAW) 파이프 제조, 이음매 없는 용접 파이프 제조 공정으로 세분화됩니다.

2024년에는 원활한 파이프 제조가 북미 파이프 시장을 지배할 것으로 예상됩니다.

2024년에는 원활한 파이프 제조 부문이 37.36%의 시장 점유율로 시장을 장악할 것으로 예상됩니다. 이는 뛰어난 강도, 내구성, 고압 및 온도 조건을 견뎌낼 수 있는 능력 덕분 입니다 .

- 시장은 범주별로 압력 파이프와 비압력 파이프로 구분됩니다. 2024년에는 압력 파이프 부문이 63.97%의 시장 점유율로 시장을 주도할 것으로 예상됩니다.

- 크기는 1/2인치 이하, 1/2인치~1인치, 1~2인치, 2~5인치, 5~10인치, 10~20인치, 그리고 20인치 이상으로 세분화됩니다. 2024년에는 1/2인치 이하 세그먼트가 22.44%의 시장 점유율로 시장을 장악할 것으로 예상됩니다.

- 산업별로 시장은 수자원 인프라, 석유 및 가스 인프라, 건물 인프라, 산업 인프라로 구분됩니다. 2024년에는 수자원 인프라 부문이 38.86%의 시장 점유율로 시장을 주도할 것으로 예상됩니다.

주요 플레이어

Data Bridge Market Research는 JM EAGLE, INC.(미국), Advanced Drainage Systems(미국), Chevron Phillips Chemical Company LLC.(미국), Charlotte Pipe and Foundry(미국), Aliaxis Holdings SA(벨기에) 등을 분석합니다.

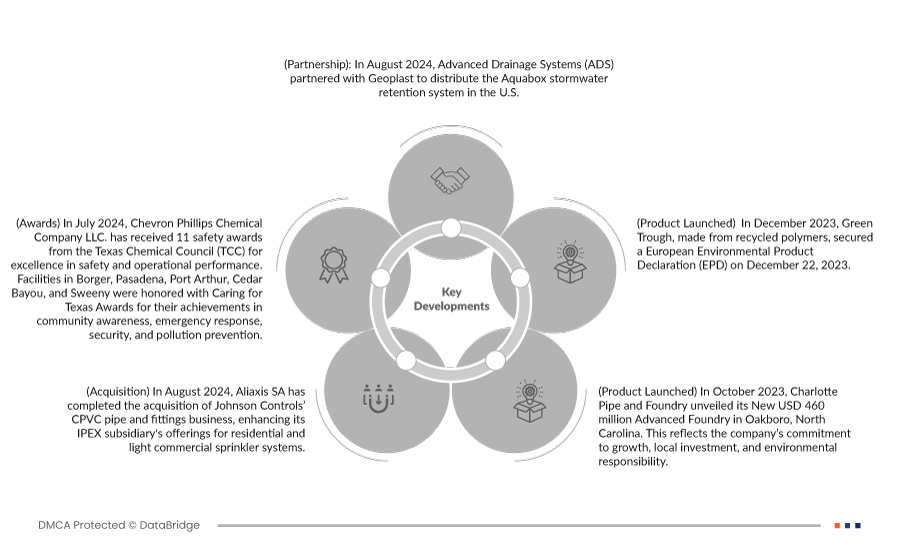

시장 개발

- 2024년 8월, Advanced Drainage Systems(ADS)는 Geoplast와 협력하여 미국에서 Aquabox 우수유출 방지 시스템을 배포했습니다. 이 협업을 통해 ADS의 우수유출 관리 포트폴리오가 확장되어 도시 홍수 조절 및 지속 가능한 수자원 관리를 위한 혁신적이고 대용량 솔루션을 제공하고 시장 리더십을 강화합니다.

- 2024년 7월, 쉐브론 필립스 케미컬 컴퍼니(Chevron Phillips Chemical Company LLC.)는 텍사스 화학 협회(TCC)로부터 안전 및 운영 성과 우수성을 인정받아 11개의 안전 상을 수상했습니다. 보거(Borger), 패서디나(Pasadena), 포트 아서(Port Arthur), 시더 바이유(Cedar Bayou), 스위니(Sweeny) 소재 시설은 지역 사회 인식 제고, 비상 대응, 보안 및 오염 방지 분야에서의 성과를 인정받아 케어링 포 텍사스 어워드(Caring for Texas Awards)를 수상했습니다. 콘로(Conroe)와 오렌지(Orange) 시설은 OSHA 기록상 무사고(Zero Incident Award)와 샘 만난 박사상(Dr. Sam Mannan Award)을 수상했습니다.

- 2024년 8월, Aliaxis SA는 Johnson Controls의 CPVC 파이프 및 피팅 사업 인수를 완료하여 IPEX 자회사의 주거용 및 상업용 스프링클러 시스템 제품군을 강화했습니다. 이번 인수를 통해 Aliaxis는 북미 지역에서 화재 진압 솔루션을 강화하고, 제조 역량을 확대하며, 성장과 고객 서비스 향상에 대한 의지를 입증할 수 있게 되었습니다.

- 2023년 10월, 샬럿 파이프 앤 파운드리는 노스캐롤라이나주 오크보로에 4억 6천만 달러 규모의 새로운 첨단 주조 공장을 공개했습니다. 이는 회사의 성장, 지역 투자, 그리고 환경적 책임에 대한 의지를 보여줍니다.

- 2023년 12월, 재활용 폴리머로 제작된 Green Trough는 2023년 12월 22일 유럽 환경 제품 선언(EPD)을 획득했습니다. 이 성과는 EU Green Deal에 따른 환경 목표 및 모달 전환을 지원하는 유럽 내 일본 트로프 제조업체의 첫 번째 EPD 획득을 의미합니다.

지역 분석

시장은 지리적 위치에 따라 미국, 캐나다, 멕시코로 구분됩니다.

Data Bridge Market Research 분석에 따르면 :

미국은 북미 파이프 시장에서 가장 지배적이고 가장 빠르게 성장하는 국가가 될 것으로 예상됩니다.

미국은 정부의 현대화 및 도시화 사업 투자를 통해 건설 및 인프라 개발이 활발하게 이루어지고 있어 북미 파이프 시장을 주도할 것으로 예상됩니다. 미국은 또한 제조업이 탄탄하고 석유 및 가스, 상수도, 에너지 등 산업 분야에서 파이프 수요가 높습니다. 또한, 노후화된 인프라 개선과 주택 및 상업용 건설 활동 확대에 대한 미국의 집중적인 노력은 파이프 수요를 더욱 증가시키고 있습니다. 미국 시장은 첨단 기술, 다양한 자재 공급, 그리고 엄격한 규제 기준을 갖추고 있어 북미 지역의 선두 주자입니다.

북미 파이프 시장에 대한 자세한 내용은 여기를 클릭하세요 - https://www.databridgemarketresearch.com/reports/north-america-pipe-market