건강보험은 질병이나 부상으로 인해 발생하는 모든 종류의 수술비와 치료비를 보장하는 보험의 일종입니다. 이는 특정 서비스의 전체 또는 부분 비용을 보장하는 포괄적이거나 제한된 범위의 의료 서비스에 적용됩니다. 보험 가입자가 치료를 위해 입원할 경우 모든 의료비를 보장해 가입자에게 재정적 지원을 제공합니다. 입원 전 비용과 입원 후 비용도 포함됩니다.

전체 보고서에 액세스 @ https://www.databridgemarketresearch.com/reports/indonesia-private-health-insurance-market

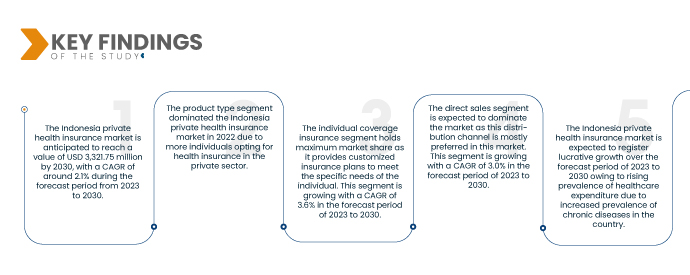

Data Bridge Market Research는 다음과 같이 분석합니다. 인도네시아 민간 건강 보험 시장 2023년부터 2030년까지 예측 기간 동안 연평균 성장률(CAGR) 2.1%로 성장할 것으로 예상되며, 2030년에는 33억 2,175만 달러에 이를 것으로 예상됩니다. 2023년에는 제품 유형 부문이 시장을 지배할 것으로 예상됩니다. 건강보험 혜택.

연구의 주요 결과

인도네시아 의료관광의 성장

인도네시아 의료관광의 성장

의료 관광은 사람들이 치료, 시술, 수술을 위해 여러 나라를 여행하는 점점 인기가 높아지고 있는 추세입니다. 인도네시아는 의료 인프라 개선, 저렴한 비용, 잘 훈련된 의료 전문가 덕분에 최근 몇 년 동안 의료 관광이 꾸준히 성장해 왔습니다. 인도네시아의 의료 관광 산업은 치과 치료, 미용 수술, 심장 수술, 정형외과 수술 등 다양한 서비스를 제공합니다. 이 나라는 또한 대체 치유 방법을 찾는 관광객들에게 인기가 있는 자무(jamu)와 침술과 같은 전통 의학 요법을 제공합니다.

결론적으로, 인도네시아의 의료 관광 산업 성장은 국가의 의료 인프라 개선, 저렴한 비용 및 독특한 문화 제공의 결과입니다. 정부의 지속적인 의료 및 관광 투자로 인도네시아는 동남아시아 최고의 의료 관광 목적지가 될 준비가 되어 있습니다. 따라서 인도네시아의 민간 건강보험 수요 증가는 시장 성장의 주요 기회로 작용할 것으로 예상됩니다.

보고서 범위 및 시장 세분화

|

보고서 지표

|

세부

|

|

예측기간

|

2023년부터 2030년까지

|

|

기준 연도

|

2022년

|

|

역사적 연도

|

2021(2015~2020으로 맞춤 설정 가능)

|

|

양적 단위

|

백만 단위의 수익 및 USD 단위의 가격

|

|

해당 세그먼트

|

상품 유형별(메디클레임 보험, 입원 보장 보험, 중증 질병 보험, 개인 보장 보험, 가족 유동 보장 보험, 노인 보장 보험, 단위 연계 건강 보험, 영구 민간 건강 보험 등), 비즈니스 솔루션(리드 생성 솔루션) , 로봇 프로세스 자동화, 인공 지능 및 블록체인 솔루션, 수익 관리 및 청구 솔루션, 청구 관리 클라우드 솔루션, 가치 기반 결제 솔루션, 지능형 사례 관리 솔루션, 보험 클라우드 솔루션 등), 지원/서비스 유형(입원환자/어린이집, 병원 숙박, 사고사 혜택, 완화 치료, 출산, 의료 후송, 송환 계획, 외래 환자, 치과, 종양학, 레이저 눈 치료, 정신과 및 심리 치료, 장기 이식, 재활 치료 및 기타), 보장 수준(청동, 실버, 골드, 플래티넘), 보험 플랜 유형(건강 유지 관리 기관(HMO), 우선 제공 기관(PPO), 독점 의료 서비스 제공 기관(EPO), POS(Point-Of-Service) 플랜, 면책 민간 건강 보험, 건강 저축 계좌(HSA), 적격 소규모 고용주 건강 상환 약정(QSEHRA) 및 기타), 인구통계(성인, 노인 및 미성년자), 보장 유형(평생 보장 및 기간 보장), 최종 사용자(개인, 커플, 가족 및 기타) 기업), 유통채널(직판, 금융기관, 병원, 진료소, 전자상거래 등)

|

|

해당 국가

|

인도네시아

|

|

해당 시장 참여자

|

Pacific Cross(필리핀), Allianz Indonesia(독일), Etiqa(말레이시아), PT FWD Insurance Indonesia(중국), Aetna Inc.(CVS health 자회사)(미국), BUPA Global(영국), Manulife(캐나다), PT BANK MANDIRI (PERSERO) TBK(인도네시아), AXA(프랑스), AIA Group Limited(중국), PRUDENTIAL INDONESIA(인도네시아), Medibank Private Limited. (호주), BNI Life(Bank Negara Indonesia 자회사)(인도네시아), Sun Life Financial(캐나다), PT AVRIST ASSURANCE(인도네시아), Great Eastern Holdings Limited(싱가포르), Now Health International(중국), PT Tokio Marine Life Insurance Indonesia(Tokoi Marine Holdings의 자회사)(인도네시아), Cigna(미국) 및 ALLIANZ WORLDWIDE CARE LIMITED(아일랜드) 등이 있습니다.

|

|

보고서에서 다루는 데이터 포인트

|

시장 가치, 성장률, 세분화, 지리적 범위 및 주요 플레이어와 같은 시장 시나리오에 대한 통찰력 외에도 Data Bridge Market Research에서 선별한 시장 보고서에는 심층 전문가 분석, 환자 역학, 파이프라인 분석, 가격 분석, 규제 프레임워크.

|

세그먼트 분석

인도네시아 민간 건강보험 시장은 제품 유형, 비즈니스 솔루션, 지원/서비스 유형, 보장 수준, 보험 계획 유형, 인구 통계, 보장 유형, 최종 사용자 및 유통 채널을 기준으로 9개의 주목할만한 부문으로 분류됩니다.

- 상품 유형에 따라 시장은 입원 보장 보험, 의료 보험, 중병 보험, 개인 보장 보험, 가족 유동자 보장 보험, 노인 보장 보험 단위 연계 건강 계획, 영구 민간 건강 보험 등으로 분류됩니다. 2023년에는 개인 보장 보험 부문이 21.68%의 시장 점유율로 시장을 장악하고 2030년까지 7억 9,867만 달러에 도달하여 2023~2030년 예측 기간 동안 연평균 성장률(CAGR) 3.6%로 성장할 것으로 예상됩니다.

- 비즈니스 솔루션을 기반으로 시장은 리드 생성 솔루션, 로봇 프로세스 자동화, 인공 지능 및 블록체인 솔루션, 수익 관리 및 청구 솔루션, 청구 관리 클라우드 솔루션, 가치 기반 결제 솔루션, 지능형 사례 관리 솔루션, 보험 클라우드 솔루션, 다른 사람. 2023년 리드 생성 솔루션 부문은 30.94%의 시장 점유율로 시장을 장악하고 2030년까지 11억 2,529만 달러에 도달하여 2023~2030년 예측 기간 동안 연평균 성장률(CAGR) 3.4%로 성장할 것으로 예상됩니다.

- 지원/서비스 유형에 따라 시장은 입원환자/어린이집, 병원 숙박, 사고사 혜택, 완화 치료, 출산, 의료 후송, 송환 계획, 외래 환자, 치과, 종양학, 레이저 안구 치료, 정신과 및 심리 치료로 분류됩니다. 장기 이식, 재활 치료 등. 2023년에는 입원 환자/어린이집 부문이 25.07%의 시장 점유율로 시장을 장악하고 2030년까지 8억 7,765만 달러에 도달하여 2023~2030년 예측 기간 동안 연평균 성장률(CAGR) 2.9%로 성장할 것으로 예상됩니다.

- 적용 범위 수준에 따라 시장은 브론즈, 실버, 골드 및 플래티넘으로 분류됩니다. 2023년에는 청동 부문이 42.91%의 시장 점유율로 시장을 지배할 것으로 예상되며, 2030년까지 14억 9981만 달러에 도달하여 2023~2030년 예측 기간 동안 연평균 성장률(CAGR) 2.8%로 성장할 것으로 예상됩니다.

- 보험 계획 유형에 따라 시장은 건강 유지 관리 조직(HMO), 선호 공급자 조직(PPO), 독점 공급자 조직(EPO), 서비스 시점(POS) 계획, 손해 민간 건강 보험, 건강 저축으로 분류됩니다. 계정(HSA), 자격을 갖춘 소규모 고용주, 건강상환제도(QSEHRA) 등이 있습니다. 2023년에는 건강 관리 조직(HMO) 부문이 37.94%의 시장 점유율로 시장을 지배할 것으로 예상되며, 2030년까지 13억 979만 달러에 도달하여 2023~2030년 예측 기간 동안 연평균 성장률(CAGR) 2.7%로 성장할 것으로 예상됩니다. .

- 인구 통계에 따라 시장은 성인, 노인 및 미성년자로 분류됩니다. 2023년에는 성인 부문이 53.44%의 시장 점유율로 시장을 장악하고 2030년까지 18억 5,397만 달러에 도달하여 2023~2030년 예측 기간 동안 연평균 성장률(CAGR) 2.7%로 성장할 것으로 예상됩니다.

- 보장 유형에 따라 시장은 평생 보장과 기간 보장으로 분류됩니다. 2023년에는 평생 보장 부문이 62.58%의 시장 점유율로 시장을 장악하고 2030년까지 21억 3,851만 달러에 도달하여 2023~2030년 예측 기간 동안 연평균 성장률(CAGR) 2.5%로 성장할 것으로 예상됩니다.

- 최종 사용자를 기준으로 시장은 개인, 커플, 가족 및 기업으로 분류됩니다. 2023년에는 개별 부문이 52.39%의 시장 점유율로 시장을 장악하고 2030년까지 18억 1,294만 달러에 도달하여 2023~2030년 예측 기간 동안 연평균 성장률(CAGR) 2.7%로 성장할 것으로 예상됩니다.

- 유통채널을 기준으로 시장은 직접판매, 금융기관, 병원, 진료소, 전자상거래 등으로 분류됩니다. 2023년에는 직접 판매 부문이 36.48%의 시장 점유율로 시장을 장악하고 2030년까지 12억 9,278만 달러에 도달하여 2023~2030년 예측 기간 동안 연평균 성장률(CAGR) 3.0%로 성장할 것으로 예상됩니다.

주요 플레이어

Data Bridge Market Research는 Pacific Cross(필리핀), Allianz Indonesia(독일), Etiqa(말레이시아), PT FWD Insurance Indonesia(중국), Aetna를 포함하여 다음 회사를 인도네시아 민간 건강 보험 시장의 주요 민간 건강 보험 시장 참가자로 인식합니다. Inc.(CVS health 자회사)(미국), BUPA Global(영국), Manulife(캐나다), PT BANK MANDIRI(PERSERO) TBK(인도네시아), AXA(프랑스), AIA Group Limited(중국), PRUDENTIAL INDONESIA(인도네시아) ), 메디뱅크 프라이빗 리미티드(Medibank Private Limited). (호주), BNI Life(Bank Negara Indonesia 자회사)(인도네시아), Sun Life Financial(캐나다), PT AVRIST ASSURANCE(인도네시아), Great Eastern Holdings Limited(싱가포르), Now Health International(중국), PT Tokio Marine Life Insurance Indonesia(Tokoi Marine Holdings의 자회사)(인도네시아), Cigna(미국) 및 ALLIANZ WORLDWIDE CARE LIMITED(아일랜드) 등이 있습니다.

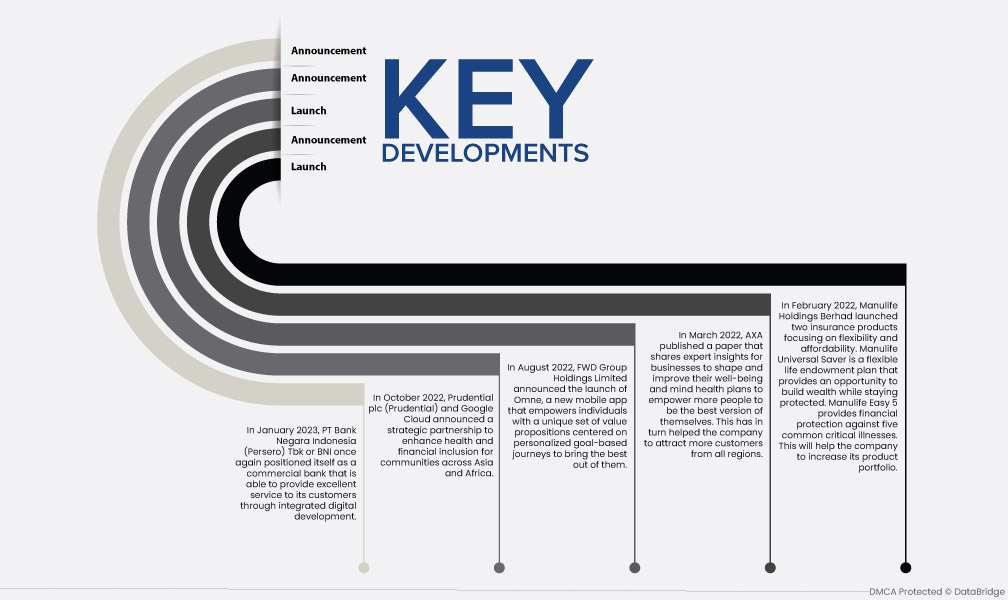

시장 개척

- 2023년 1월, PT Bank Negara Indonesia (Persero) Tbk 또는 BNI는 통합 디지털 개발을 통해 고객에게 탁월한 서비스를 제공할 수 있는 상업 은행으로 다시 한번 자리매김했습니다.

- 2022년 10월 Prudential plc(Prudential)와 Google Cloud는 아시아와 아프리카 지역 사회의 건강 및 금융 포용성을 향상하기 위한 전략적 파트너십을 발표했습니다.

- 2022년 8월, FWD Group Holdings Limited는 개인화된 목표 기반 여정을 중심으로 개인에게 최고의 가치를 제공하는 고유한 가치 제안 세트를 제공하는 새로운 모바일 앱인 Omne의 출시를 발표했습니다.

- 2022년 3월, AXA는 기업이 웰빙과 정신 건강 계획을 수립하고 개선하여 더 많은 사람들이 최고의 모습을 보일 수 있도록 역량을 강화할 수 있도록 전문가의 통찰력을 공유하는 논문을 발표했습니다. 이는 결과적으로 회사가 모든 지역에서 더 많은 고객을 유치하는 데 도움이 되었습니다.

- 2022년 2월 Manulife Holdings Berhad는 유연성과 경제성에 초점을 맞춘 두 가지 보험 상품을 출시했습니다. Manulife Universal Saver는 보호를 유지하면서 부를 쌓을 수 있는 기회를 제공하는 유연한 생명 기부 계획입니다. Manulife Easy 5는 5가지 일반적인 중병에 대한 재정적 보호를 제공합니다. 이는 회사가 제품 포트폴리오를 늘리는 데 도움이 될 것입니다.

지역분석

지리적으로 인도네시아 민간 건강 보험 시장 보고서에서 다루는 국가는 인도네시아입니다.

인도네시아 민간 건강보험 시장 보고서에 대한 자세한 내용을 보려면 여기를 클릭하세요.https://www.databridgemarketresearch.com/reports/indonesia-private-health-insurance-market