"제네릭 주사제"라는 용어는 제네릭 의약품을 이용한 약물 주사 투여를 의미합니다. 이 약물 투여 방식은 정확한 용량 관리를 제공하고 경구 투여가 불가능하거나 효과적이지 않을 때 대체 약물로 사용할 수 있다는 점에서 선호됩니다. 제네릭 주사제는 치료적 필요성을 희생하지 않으면서도 합리적인 가격으로 대체 약물을 제공하기 때문에 의료 서비스에 필수적입니다.

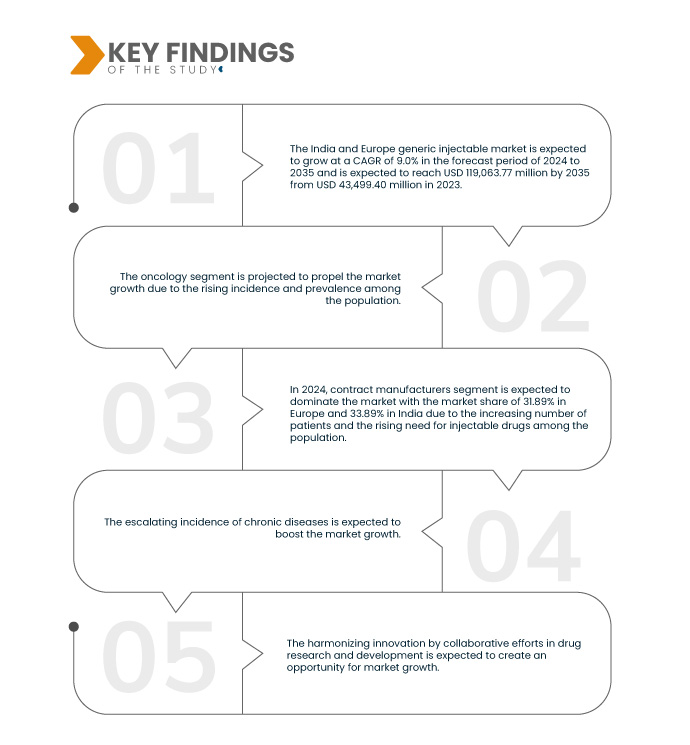

Data Bridge Market Research에 따르면, 인도 및 유럽의 제네릭 주사제 시장은 2024년부터 2035년까지 연평균 성장률 9.0%로 성장할 것으로 예상되며, 2023년 434억 9,940만 달러에서 2031년에는 1,190억 6,377만 달러에 이를 것으로 전망됩니다. 만성 질환 발병률 증가와 제네릭 주사제 개발 및 생산 급증이 시장 확대를 촉진할 것으로 예상됩니다.

연구의 주요 결과

다양한 유통채널의 가용성

소매 약국, 병원 약국, 온라인 플랫폼, 정부 의료 시설을 포함한 유통 채널의 다양성은 다양한 인구 집단에서 제네릭 주사제의 접근성과 가용성을 높이는 데 기여합니다. 이러한 광범위한 유통 채널은 이러한 약물이 도시와 농촌 지역에 도달할 수 있도록 보장하여 의료 서비스 접근성의 지역적 격차를 해소합니다. 또한, 다양한 유통 옵션은 건전한 경쟁을 촉진하여 시장의 효율성과 경제성을 향상시킵니다. 다양한 유통 채널이 제공하는 편의성과 유연성은 소비자에게 다양한 접근 지점을 제공하고 제조업체의 효율적인 시장 침투를 촉진하여 이익을 제공합니다. 이러한 역동적인 환경은 인도 시장의 의료 서비스와 치료 결과의 전반적인 개선에 기여하며, 제네릭 주사제를 위한 광범위하고 경쟁적인 유통 네트워크의 긍정적인 영향을 반영하여 시장 성장을 촉진합니다.

보고서 범위 및 시장 세분화

보고서 메트릭

|

세부

|

예측 기간

|

2024년부터 2035년까지

|

기준 연도

|

2023

|

역사적인 해

|

2022 (2016~2021년까지 맞춤 설정 가능)

|

양적 단위

|

매출 (백만 달러)

|

다루는 세그먼트

|

치료적 적용(종양학, 심혈관 질환, 감염성 질환, 통증 관리, 대사 장애(당뇨병), 면역 질환), 바이오시밀러 약물(세마글루타이드, 이부티딜리드 푸마르산염, 에볼로쿠맙, 알리로쿠맙, 아니둘라푼긴, 둘라글루타이드, 릭시세나타이드, 엑세나타이드, 리라글루타이드, 아달리무맙), 최종 사용자(직접 판매 유통업체, 제약 도매업체, 약국, 약국, 단체 구매 조직(GPO) 및 기타), 유통 채널(제약 도매업체, 계약 제조업체, 약국 체인, 단체 구매 조직(GPO) 및 기타)

|

시장 참여자 포함

|

Cipla Inc.(인도), Concord Biotech(인도) Reddy's Laboratories Ltd(인도), Sanofi(미국), Viatris Inc., Fresenius Kabi AG(독일), Sandoz Group AG(스위스), GLENMARK PHARMACEUTICALS LTD(인도), Gland Pharma Limited(인도), Par Pharmaceutical(인도), Aurobindo Pharma(인도). Pharmaceuticals Ltd.(인도), Sun Pharmaceutical Industries Ltd(인도), Amneal Pharmaceuticals LLC(미국), Viatris Inc(미국), Zydus Group(인도), Lupine(인도) 등

|

적용 국가/지역

|

인도와 유럽

|

보고서에서 다루는 데이터 포인트

|

Data Bridge Market Research에서 큐레이팅한 시장 보고서에는 시장 가치, 성장률, 세분화, 지리적 적용 범위, 주요 기업 등 시장 시나리오에 대한 통찰력 외에도 심층적인 전문가 분석, 환자 역학, 파이프라인 분석, 가격 분석, 규제 프레임워크가 포함됩니다.

|

세그먼트 분석

인도와 유럽의 제네릭 주사제 시장은 치료적 적용, 바이오시밀러 약물, 최종 사용자, 유통 채널을 기준으로 4개의 주요 부문으로 분류됩니다.

- 치료적 적용을 기준으로 인도와 유럽의 제네릭 주사제 시장은 종양학, 심혈관 질환, 감염성 질환 , 통증 관리, 대사 장애(당뇨병), 면역 장애 로 세분화됩니다.

2024년에는 종양학 부문이 인도와 유럽의 제네릭 주사제 시장을 지배할 것으로 예상됩니다.

2024년에는 종양학 분야가 유럽의 제네릭 주사제 시장에서 44.42%, 인도의 제네릭 주사제 시장에서 39.65%의 점유율을 기록하며 인도와 유럽의 제네릭 주사제 시장을 장악할 것으로 예상됩니다. 제네릭 주사제 개발 및 생산이 급증할 전망입니다.

- 바이오시밀러 약물을 기준으로 인도와 유럽의 제네릭 주사제 시장은 세마글루타이드, 이부틸리드 푸마르산염, 에볼로쿠맙, 알리로쿠맙, 아니둘라푼긴, 엑세나타이드, 릭시세나타이드, 둘라글루타이드, 아달리무맙으로 세분화됩니다.

2024년에는 바이오시밀러 약물 부문의 이부틸리드 푸마르산염 부문이 인도와 유럽 제네릭 주사제 시장을 장악할 것으로 예상됩니다.

2024년에는 이부틸리드 푸마르산염 부문이 제네릭 주사제 개발 및 생산 급증으로 인해 유럽 40.33%, 인도 43.50%의 시장 점유율로 인도 및 유럽 제네릭 주사제 시장을 지배할 것으로 예상됩니다.

- 최종 사용자 기준으로 시장은 직접 판매 유통업체, 의약품 도매업체, 약국, 약국, 단체 구매 기관(GPO) 등으로 세분화됩니다. 2024년에는 직접 판매 유통업체 부문이 유럽 26.04%, 인도 24.41%의 시장 점유율로 인도와 유럽 제네릭 주사제 시장을 장악할 것으로 예상됩니다.

- 유통 채널을 기준으로 시장은 의약품 도매업체, 계약 제조업체, 약국 체인, 공동 구매 기관(GPO) 등으로 세분화됩니다. 2024년에는 계약 제조업체 부문이 유럽 31.89%, 인도 33.89%의 시장 점유율로 인도와 유럽 제네릭 주사제 시장을 장악할 것으로 예상됩니다.

주요 플레이어

Data Bridge Market Research는 Fresenius SE & Co. KGaA(독일), Sun Pharmaceutical Industries Ltd.(인도), Amneal Pharmaceuticals LLC.(미국), Zydus Group(인도), Lupin(인도)을 인도와 유럽 제네릭 주사제 시장의 주요 시장 주체로 분석합니다.

시장 개발

- 2024년 1월, Sun Pharmaceutical Industries Limited와 Taro Pharmaceutical Industries Ltd.는 최종 합병 계약을 공식 체결했습니다. 이 계약에 따라, Taro의 지배 주주인 Sun Pharma는 Sun Pharma 또는 그 계열사가 이미 보유하고 있는 Taro의 모든 발행 보통주를 인수하게 됩니다. 인수 가격은 주당 미화 43.00달러이며, 무이자입니다. 이번 합병을 통해 더욱 강력하고 경쟁력 있는 기업이 탄생할 것으로 예상되며, Sun Pharma와 Taro Pharmaceutical Industries Ltd.의 시장 입지 확대, 운영 효율성 향상, 그리고 역량 강화와 같은 잠재적 이점을 가져올 것입니다.

- 2023년 11월, 프레제니우스 카비는 유럽 연합에서 로악템라(토실리주맙)의 바이오시밀러인 타이엔(Tyenne)을 출시했습니다. 타이엔은 다양한 염증성 및 면역 질환 치료를 위한 유럽 최초의 토실리주맙 바이오시밀러입니다. 타이엔은 제품 범위를 확장할 예정입니다.

- 2023년 8월, 오로빈도 파마(Aurobindo Pharma)는 미국 식품의약국(USFDA)으로부터 1.25g/바이알 및 1.5g/바이알 용량의 단회투여용 반코마이신 염산염 USP의 생산 및 시판 허가를 최종 획득했습니다. 이 제형은 마일란 래버러토리스(Mylan Laboratories Ltd)에서 제조한 대조약(RLD)인 반코마이신 염산염 USP와 생물학적 동등성 및 치료학적 동등성을 갖습니다.

- 2023년 6월, Dr. Reddy's Laboratories Ltd.는 인도 상업용 제네릭 의약품 시장 진출을 알리는 새로운 전담 부서 "RGenX"의 설립을 발표했습니다. Dr. Reddy는 이를 통해 환자들이 더 저렴한 가격으로 더 다양한 제품을 이용할 수 있게 될 것이라고 믿습니다. 이 새로운 사업은 2030년까지 15억 명 이상의 환자에게 서비스를 제공하겠다는 회사의 목표를 달성하는 데 기여할 것입니다. 이를 통해 회사는 제품 공급을 확대하여 사업을 확장할 수 있었습니다.

- 2023년 12월, 히크마 파마슈티컬스(Hikma Pharmaceuticals PLC)는 500mcg/5mL 및 1,000mcg/10mL 용량의 페닐에프린 염산염 주사제 USP를 출시했습니다. 이 제품은 현재 미국에서 즉시 사용 가능한 바이알 형태로 판매되고 있습니다. 이 제품의 용도는 주로 마취 중 혈관 확장으로 인해 임상적으로 유의미한 저혈압을 경험하는 성인 환자의 혈압을 높이는 것입니다. 이를 통해 회사는 시장 확대에 기여했습니다.

지리적 분석

지리적으로, 시장 보고서에서 다루는 국가/지역은 인도와 유럽입니다.

Data Bridge Market Research 분석에 따르면:

유럽은 인도와 유럽 제네릭 주사제 시장 에서 가장 우세하고 가장 빠르게 성장하는 지역이 될 것으로 예상됩니다.

유럽은 다양한 유통 채널을 갖추고 있어 시장을 주도할 것으로 예상됩니다. 또한, 이 지역의 만성 질환 발생률 증가로 인해 시장 성장이 예상됩니다.

인도 및 유럽 제네릭 주사제 시장 보고서에 대한 자세한 내용은 여기를 클릭하세요. - https://www.databridgemarketresearch.com/reports/india-and-europe-generic-injectable-market