글로벌 산업용 X선 시장은 중요하고 역동적인 자동차 산업입니다. 비파괴 검사(NDT)는 산업계에서 재료, 부품, 구조 또는 시스템의 특성을 평가하여 원부품을 손상시키지 않고 특성 차이, 용접 결함 및 불연속성을 평가하는 데 사용되는 검사 및 분석 기법입니다. X선 검사 시스템은 제품 품질과 안전을 저해할 수 있는 결함과 오염 물질을 정확하고 신뢰할 수 있게 감지하기 때문에 NDT의 핵심 요소입니다. 최신 비파괴 검사는 제조, 제작 및 가동 중 검사에 사용되어 제품의 무결성과 신뢰성을 보장하고, 제조 공정을 제어하고, 생산 비용을 절감하고, 균일한 품질 수준을 유지합니다.

전체 보고서는 https://www.databridgemarketresearch.com/reports/global-industrial-x-ray-market 에서 확인하세요.

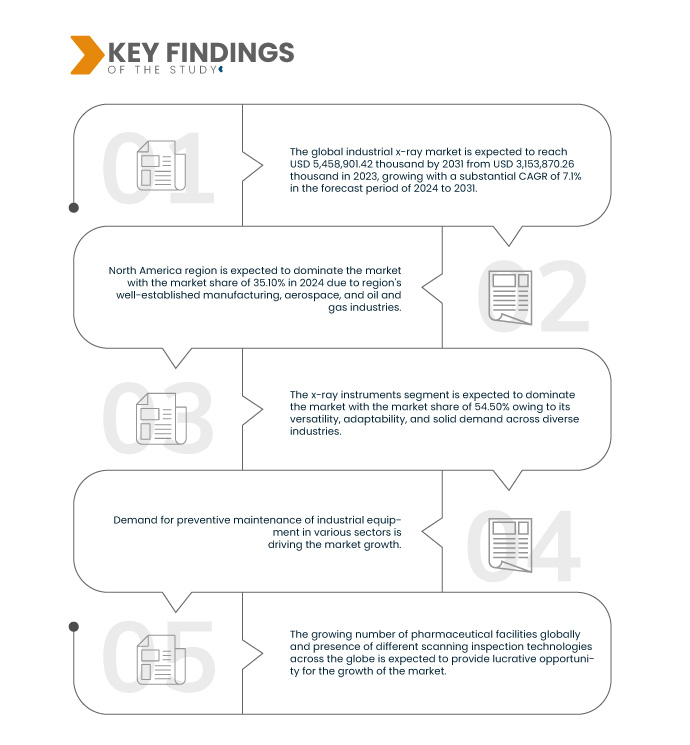

Data Bridge Market Research에 따르면 글로벌 산업용 X선 시장은 2023년 3,153,870.26달러에서 2031년 5,458,901.42달러로 성장할 것으로 예상되며, 2024년에서 2031년까지의 예측 기간 동안 연평균 성장률 7.1%로 성장할 것으로 전망됩니다.

연구의 주요 결과

휴대용 및 모바일 검사 시스템 개발

휴대용 및 모바일 X선 검사 시스템은 소형, 경량, 운반 용이성 등 여러 가지 장점을 제공하여 원격지 또는 접근하기 어려운 위치에서 사용하기에 이상적입니다.따라서 휴대용 및 모바일 X선 검사 시스템은 원격지 또는 접근하기 어려운 위치에서 NDT를 수행할 수 있으며 필요에 따라 시스템을 신속하게 설치 및 해체할 수 있습니다.이러한 시스템에 대한 수요는 석유 및 가스, 자동차, 항공우주 및 건설을 포함하여 제품 안전과 신뢰성을 보장하는 데 NDT가 중요한 다양한 산업에서 증가하고 있습니다.휴대용 및 모바일 X선 검사 시스템은 파이프라인 검사, 항공우주 및 석유화학과 같은 다양한 산업 분야에서 사용하도록 설계되었습니다 .회사는 제품과 시스템 제공을 확장하여 휴대용 및 모바일 시스템에 대한 수요 증가에 대응하고 있습니다.이로 인해 다양한 산업에서 휴대용 및 모바일 X선 검사 시스템 도입이 증가할 것으로 예상됩니다.따라서 새로운 휴대용 및 모바일 X선 검사 시스템 개발이 시장 성장을 촉진하고 있습니다.

보고서 범위 및 시장 세분화

보고서 메트릭

|

세부

|

예측 기간

|

2024년부터 2031년까지

|

기준 연도

|

2023

|

역사적인 해

|

2022 (2016~2021년까지 맞춤 설정 가능)

|

양적 단위

|

매출 (USD 천)

|

다루는 세그먼트

|

영상 기술(디지털 방사선 촬영 및 필름 기반 방사선 촬영), 응용 분야(항공우주 산업, 방위 및 군사, 발전 산업, 자동차 산업, 제조 산업, 식음료 산업 및 기타), 모달리티(2D, 3D 및 하이브리드), 범위(미세 초점 X선, 고에너지 X선 및 기타), 소스(코발트-59, 이리듐-192 및 기타), 유통 채널(간접 채널 및 직접 채널), 제품 유형(X선 소모품, X선 장비 및 X선 서비스)

|

포함 국가

|

미국, 캐나다, 멕시코, 독일, 영국, 이탈리아, 프랑스, 스페인, 스위스, 네덜란드, 벨기에, 러시아, 터키, 노르웨이, 핀란드, 덴마크, 스웨덴, 폴란드, 유럽 기타 지역, 일본, 중국, 한국, 인도, 호주 및 뉴질랜드, 싱가포르, 태국, 인도네시아, 말레이시아, 대만, 베트남, 필리핀, 아시아 태평양 기타 지역, 브라질, 아르헨티나, 남미 기타 지역, 남아프리카 공화국, UAE, 사우디 아라비아, 쿠웨이트, 이집트, 카타르, 바레인, 이스라엘, 오만, 중동 및 아프리카 기타 지역

|

시장 참여자 포함

|

Teledyne Digital Imaging Inc.(캐나다), Hamamatsu Photonics KK(일본), GENERAL ELECTRIC(미국), Comet Group(스위스), Varex Imaging(미국), Carestream Health(미국), Carl Zeiss Group(독일), Eastman Kodak Company(미국), North Star Imaging Inc.(미국), Ixar(인도), VJ X-Ray(미국), Rigaku Corporation(일본), Minebea Intec GmbH(독일), Lohmann X-Ray GmbH(독일), PROTEC GmbH & Co. KG(독일), OR Technology(독일), FUJIFILM Corporation(일본), Shimadzu Corporation(일본), Krystalvision Image Systems Pvt. (인도), Lucky Healthcare Co., Ltd.(중국), Canon Electron Tubes & Devices Co., Ltd.(일본), Applus+(스페인), Hitachi High-Tech Analytical Science(일본), Avonix Imaging(미국), Nordson Corporation(미국) 등이 있습니다.

|

보고서에서 다루는 데이터 포인트

|

Data Bridge Market Research 팀이 큐레이팅한 시장 보고서에는 시장 가치, 성장률, 시장 부문, 지리적 범위, 시장 참여자 및 시장 시나리오와 같은 시장 통찰력 외에도 심층적인 전문가 분석, 수입/수출 분석, 가격 분석, 생산 소비 분석 및 막자 분석이 포함되어 있습니다.

|

세그먼트 분석

글로벌 산업용 엑스선 시장은 제품 유형, 영상 기술, 모달리티, 범위, 출처, 응용 분야 및 유통 채널을 기준으로 7개의 주요 부문으로 구분됩니다.

- 제품 유형을 기준으로 글로벌 산업용 X선 시장은 X선 장비, X선 소모품 및 X선 서비스로 구분됩니다.

2024년에는 X선 장비 부문이 글로벌 산업용 X선 시장을 장악할 것으로 예상된다.

2024년에는 X선 장비 부문이 다재다능하고, 비용 효율성이 뛰어나며, 인명 위험을 줄이면서 중요한 임무를 수행할 수 있는 능력 덕분에 시장 점유율이 54.50%로 시장을 장악할 것으로 예상됩니다.

- 영상 기술을 기준으로 글로벌 산업용 X선 시장은 디지털 방사선 촬영과 필름 기반 방사선 촬영으로 구분됩니다.

2024년에는 디지털 방사선 촬영 부문이 글로벌 산업용 엑스레이 시장을 장악할 것으로 예상된다.

2024년에는 디지털 방사선 촬영 분야가 보안, 감시, 산업, 의료, 자동차, 항공우주 등 광범위한 산업에 적용되어 시장 점유율 66.00%를 기록하며 시장을 장악할 것으로 예상됩니다.

- 전 세계 산업용 엑스레이 시장은 방식을 기준으로 2D, 3D, 하이브리드 방식으로 구분됩니다. 2024년에는 2D 방식이 59.58%의 시장 점유율로 시장을 장악할 것으로 예상됩니다.

- 전 세계 산업용 엑스선 시장은 범위 기준으로 미소초점 엑스선, 고에너지 엑스선, 기타 엑스선 등으로 구분됩니다. 2024년에는 미소초점 엑스선 부문이 65.39%의 시장 점유율로 시장을 주도할 것으로 예상됩니다.

- 글로벌 산업용 X선 시장은 원료를 기준으로 코발트-59, 이리듐-192 등으로 구분됩니다. 2024년에는 코발트-59가 3.60%의 시장 점유율로 시장을 장악할 것으로 예상됩니다.

- 글로벌 산업용 엑스레이 시장은 응용 분야별로 항공우주 산업, 방위 및 군사, 발전 산업, 자동차 산업, 제조업, 식음료 산업 등으로 세분화됩니다. 2024년에는 항공우주 산업 부문이 33.21%의 시장 점유율로 시장을 주도할 것으로 예상됩니다.

- 글로벌 산업용 엑스레이 시장은 유통 채널을 기준으로 간접 채널과 직접 채널로 구분됩니다. 2024년에는 간접 채널 부문이 66.09%의 시장 점유율로 시장을 주도할 것으로 예상됩니다.

주요 플레이어

Data Bridge Market Research는 Teledyne Digital Imaging Inc.(캐나다), Hamamatsu Photonics KK(일본), Carl Zeiss Group(독일), Comet Group(스위스), Applus+(스페인)를 글로벌 산업용 X선 시장의 주요 시장 주체로 분석했습니다.

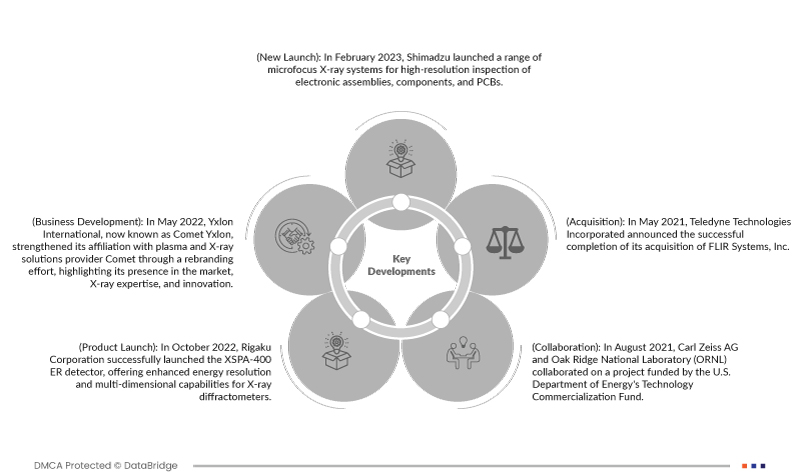

시장 개발

- 2022년 10월, 리가쿠(Rigaku Corporation)는 X선 회절 분석기에 향상된 에너지 분해능과 다차원 기능을 제공하는 XSPA-400 ER 검출기를 성공적으로 출시했습니다. 이 혁신적인 기술은 배터리, 강철, 세라믹과 같은 까다로운 산업 분야에 적용되어 전이 금속 함유 시료의 정밀 측정을 가능하게 하고, 응용 분야 확장을 촉진하며, 고급 XRD 솔루션 분야에서 리가쿠의 입지를 더욱 공고히 했습니다.

- 2021년 8월, 칼 자이스 AG와 오크리지 국립연구소(ORNL)는 미국 에너지부 기술상업화 기금의 지원을 받는 프로젝트에 협력했습니다. 이 프로젝트는 인공지능 (AI)과 X선 CT 기술을 활용하여 적층 제조(AM) 부품의 신뢰할 수 있는 비파괴 특성 분석을 가능하게 하는 것을 목표로 했습니다. 적층 제조(AM)는 재료를 축적하여 3D 형상을 생성하는 제조 방식입니다. 이번 파트너십은 적층 제조를 위한 포괄적인 분말-부품 특성 분석 방법론을 개발하여 측정의 품질과 정확도를 향상시키고, 적층 제조(AM) 산업을 넘어 비파괴 검사 및 계측학에 잠재적 변화를 가져올 것입니다.

- 2023년 2월, 시마즈는 전자 어셈블리, 부품 및 PCB의 고해상도 검사를 위한 다양한 마이크로포커스 X선 시스템을 출시했습니다. 향상된 이미지 품질과 워크플로우를 갖춘 Xslicer SMX-1010/1020과 내부 구조 및 결함을 자세히 관찰할 수 있는 넓은 다이내믹 레인지의 고정밀 이미지를 제공하는 Xslicer SMX-6010이 라인업에 포함됩니다.

- 2022년 5월, Yxlon International(현 Comet Yxlon)은 플라즈마 및 X선 솔루션 제공업체 Comet과의 제휴를 강화하여 시장 입지, X선 전문성, 그리고 혁신을 더욱 강화했습니다. Yxlon은 Comet Group 산하에서 인공지능과 데이터 분석을 활용한 통합 서비스를 통해 산업 환경을 위한 고급 X선 및 CT 시스템 솔루션을 제공합니다. Yxlon International의 Comet Yxlon으로의 리브랜딩은 모회사인 Comet Group과의 제휴를 강화하고, 플라즈마 및 X선 솔루션 제공업체로서의 Comet Group의 입지를 더욱 공고히 합니다.

- 2021년 5월, Teledyne Technologies Incorporated는 FLIR Systems, Inc. 인수를 성공적으로 완료했다고 발표했습니다. 이 인수를 통해 Teledyne FLIR이 설립되었으며, 다양한 이미징 기술과 제품을 제공하는 합병 법인으로, 무인 시스템과 이미징 탑재 장비의 범위를 확장하게 되었습니다. 이러한 전략적 움직임은 Teledyne의 업계 입지를 강화하고 다양한 분야에 걸쳐 혁신적인 솔루션을 제공하기 위한 것입니다.

지역 분석

지리적으로, 글로벌 산업용 X선 시장 보고서에서 다루는 국가는 미국, 캐나다, 멕시코, 독일, 영국, 이탈리아, 프랑스, 스페인, 스위스, 네덜란드, 벨기에, 러시아, 터키, 노르웨이, 핀란드, 덴마크, 스웨덴, 폴란드, 유럽의 다른 지역, 일본, 중국, 한국, 인도, 호주 및 뉴질랜드, 싱가포르, 태국, 인도네시아, 말레이시아, 대만, 베트남, 필리핀, 아시아 태평양의 다른 지역, 브라질, 아르헨티나, 남미의 다른 지역, 남아프리카 공화국, UAE, 사우디 아라비아, 쿠웨이트, 이집트, 카타르, 바레인, 이스라엘, 오만, 중동 및 아프리카의 다른 지역입니다.

Data Bridge Market Research 분석에 따르면:

북미는 글로벌 산업용 X선 시장에서 가장 지배적이고 가장 빠르게 성장하는 지역입니다.

북미 지역은 강력한 기술 리더십, 상당한 국방 예산, 탄탄한 방위 산업, 그리고 유리한 규제 여건을 바탕으로 시장을 선도할 것으로 예상됩니다. 이러한 요소들이 북미가 이 산업에서 주도적인 역할을 하는 데 기여하고 있습니다. 북미는 X선 제품에 대한 수요가 높고 다양한 기업들이 신제품을 출시하고 있어 가장 빠르게 성장할 것으로 예상됩니다. 또한, 첨단 X선 기술 개발 및 도입에 집중하며 기술 혁신에 있어 상당한 진전을 이루어 왔습니다.

글로벌 산업용 X선 시장 보고서에 대한 자세한 내용은 여기를 클릭하세요 - https://www.databridgemarketresearch.com/reports/global-industrial-x-ray-market