아세안(ASEAN) 지역의 만성 질환 유병률 증가는 건강 검진 시장의 주요 성장 동력입니다. 생활 습관의 변화와 인구 고령화로 심혈관 질환, 당뇨병, 암과 같은 만성 질환이 더욱 흔해지고 있습니다. 이러한 추세는 정기적인 건강 검진, 조기 발견 서비스, 그리고 예방적 의료 조치에 대한 수요를 촉진했습니다. 정부와 의료 서비스 제공업체는 이러한 건강 문제를 효과적으로 해결하기 위해 검진 프로그램을 확대하고 첨단 진단 기술에 투자하고 있습니다. 만성 질환의 부담이 지속적으로 증가함에 따라 아세안 건강 검진 시장은 증가하는 인구의 의료 수요를 충족하기 위해 더욱 확대될 것으로 예상됩니다. 예를 들어, 2022년 9월 WHO에서 발표한 "WHO 동남아시아 지역, 비전염성 질환 예방 및 관리 진전 가속화" 보고서는 구강 및 안과 관리를 포함한 비전염성 질환의 예방 및 관리 진전을 보여줍니다. 심혈관 질환, 암, 만성 호흡기 질환, 당뇨병을 포함한 비전염성 질환은 WHO 동남아시아 지역 전체 사망 원인의 거의 3분의 2를 차지합니다. 2021년 기준으로 이러한 사망의 절반 가까이가 30~69세 사이의 조기 사망이었습니다.

당뇨병, 심혈관 질환, 암 등의 유병률이 지속적으로 증가함에 따라, 이러한 건강 문제를 효과적으로 관리하기 위해서는 종합 건강 검진 접근성 확대가 필수적입니다. 첨단 진단 기술에 대한 투자, 공중 보건 인식 제고, 그리고 의료 인프라 강화는 이 지역의 만성 질환 부담 증가에 대처하고 전반적인 건강 결과를 개선하는 데 필수적입니다.

전체 보고서는 https://www.databridgemarketresearch.com/reports/asean-health-screening-market 에서 확인하세요.

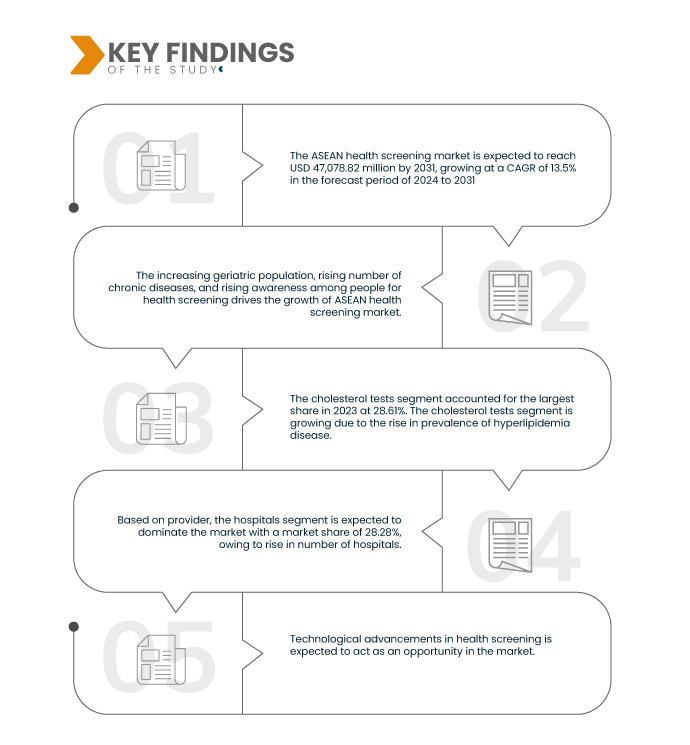

Data Bridge Market Research에 따르면 ASEAN 건강 검진 시장은 2024년부터 2031년까지 예측 기간 동안 연평균 성장률 13.5%로 성장할 것으로 예상되며, 2023년 176억 9,722만 달러에서 2031년에는 470억 7,882만 달러에 이를 것으로 예상됩니다. 콜레스테롤 검사 분야는 콜레스테롤 검사 도입이 증가함에 따라 시장 성장을 촉진할 것으로 예상됩니다.

연구의 주요 결과

핵심 뱅킹 솔루션을 위한 만성 질환 증가

보고서 범위 및 시장 세분화

보고서 메트릭

|

세부

|

예측 기간

|

2024년부터 2031년까지

|

기준 연도

|

2023

|

역사적인 해

|

2022 (2016~2021년까지 맞춤 설정 가능)

|

양적 단위

|

매출 (백만 달러)

|

다루는 세그먼트

|

검사 유형(콜레스테롤 검사, 당뇨병 검사 , 암 검사, 일반 건강 검진, 성병, 혈압 검사 등), 적용 분야(심혈관 질환, 대사 장애, 종양학, 염증성 질환, 근골격계 질환, 신경계 질환, C형 간염 합병증, 면역 관련 질환 등), 패널 유형(다중 검사 패널, 단일 검사 패널), 요양 시설(통합형, 단독형), 사용자(국내 사용자, 의료 관광객), 고객 소득(상류층, 중류층, 하류층), 제공자(병원, 진료소, 요양 시설, 재활 센터, 진단 검사실 등)

|

포함 국가

|

인도, 싱가포르, 태국, 말레이시아, 인도네시아, 필리핀, 베트남, 캄보디아, 브루나이, 미얀마, 라오스

|

시장 참여자 포함

|

Fullerton Health Corporation Limited(싱가포르), Mount Alvernia Hospital(싱가포르), PT Prodia Widyahusada Tbk(인도네시아), Raffles Medical Group(싱가포르), Icon Group(호주), The Farrer Park Company(싱가포르), Parkway Holdings Limited(싱가포르), PT Siloam International Hospitals Tbk(인도네시아), Mount Elizabeth Hospital(싱가포르), SingHealth Group(싱가포르) 등이 있습니다.

|

보고서에서 다루는 데이터 포인트

|

Data Bridge Market Research에서 큐레이팅한 시장 보고서에는 시장 가치, 성장률, 세분화, 지리적 범위 및 주요 업체와 같은 시장 시나리오에 대한 통찰력 외에도 심층적인 전문가 분석, 지리적으로 대표되는 회사별 생산 및 용량, 유통업체 및 파트너의 네트워크 레이아웃, 상세하고 업데이트된 가격 추세 분석 및 공급망 및 수요의 적자 분석이 포함됩니다.

|

세그먼트 분석

ASEAN 건강 검진 시장은 검사 유형, 응용 프로그램, 패널 유형, 치료/시설, 사용자, 고객 소득 및 제공자를 기준으로 7개의 주요 세그먼트로 구분됩니다.

- 검사 유형에 따라 시장은 콜레스테롤 검사, 당뇨병 검사, 암 검사, 일반 검진 검사, 성병, 혈압 검사 등으로 세분화됩니다.

2024년에는 검사유형 부문 중 콜레스테롤 검사 부문이 시장을 주도할 것으로 예상된다.

2024년에는 콜레스테롤 검사 수요가 증가함에 따라 콜레스테롤 검사 부문이 시장점유율 28.61%로 시장을 지배할 것으로 예상됩니다.

2024년에는 심혈관 질환 분야가 시장을 주도할 것으로 예상됩니다.

2024년에는 심장질환의 유병률이 높아 심혈관질환 부문이 시장점유율 33.50%로 시장을 지배할 것으로 예상됩니다.

- 패널 유형에 따라 시장은 다중 테스트 패널과 단일 테스트 패널로 구분됩니다. 2024년에는 다중 테스트 패널 부문이 78.65%의 시장 점유율로 시장을 주도할 것으로 예상됩니다.

- 요양/시설을 기준으로 시장은 통합형과 독립형으로 구분됩니다. 2024년에는 통합형 부문이 60.85%의 시장 점유율로 시장을 주도할 것으로 예상됩니다.

- 사용자 기준으로 시장은 국내 사용자와 의료 관광객으로 구분됩니다. 2024년에는 통합 부문이 87.87%의 시장 점유율로 시장을 장악할 것으로 예상됩니다.

- 고객 소득을 기준으로 시장은 상류층, 중류층, 하류층으로 세분화됩니다. 2024년에는 상류층이 59.11%의 시장 점유율로 시장을 장악할 것으로 예상됩니다.

- 시장은 제공업체 기준으로 병원, 진료소, 요양 시설, 재활 센터, 진단 검사실 등으로 세분화됩니다. 2024년에는 병원 부문이 28.28%의 시장 점유율로 시장을 장악할 것으로 예상됩니다.

주요 플레이어

Data Bridge Market Research에서는 Fullerton Health Corporation Limited(싱가포르), Mount Alvernia Hospital(싱가포르), PT Prodia Widyahusada Tbk(인도네시아), Raffles Medical Group(싱가포르), Icon Group(호주), The Farrer Park Company(싱가포르), Parkway Holdings Limited(싱가포르), PT Siloam International Hospitals Tbk(인도네시아), Mount Elizabeth Hospital(싱가포르), SingHealth Group(싱가포르) 등을 포함한 주요 ASEAN 건강 검진 시장 참여자로 인식하고 있습니다.

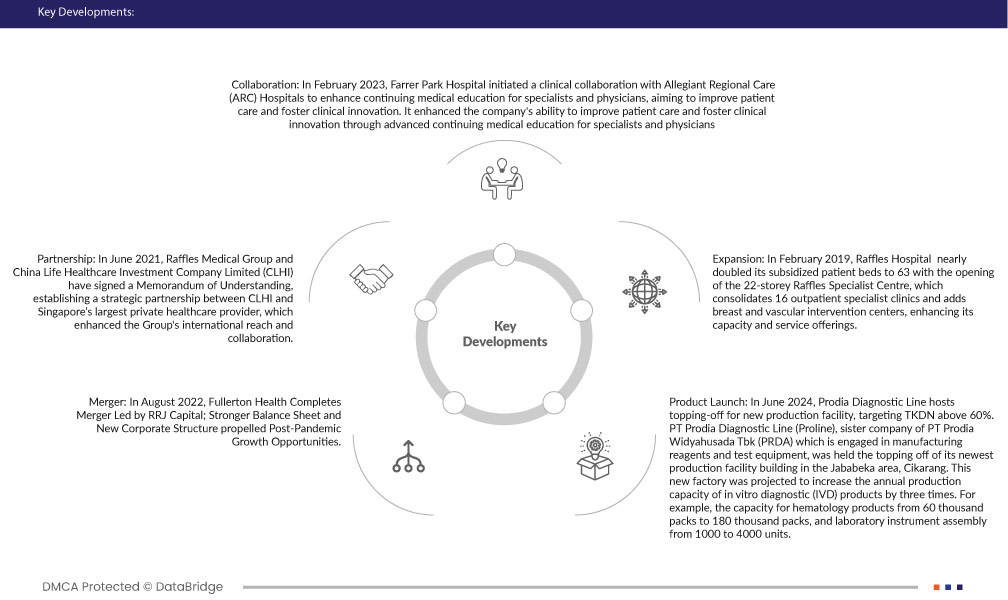

시장 개발

- 2024년 6월, Prodia Diagnostic Line은 TKDN(전장핵심진단) 60% 이상을 목표로 신규 생산 시설 준공식을 가졌습니다. 시약 및 검사 장비 제조 업체인 PT Prodia Widyahusada Tbk(PRDA)의 자매 회사인 PT Prodia Diagnostic Line(Proline)은 치카랑 자바베카 지역에 위치한 최신 생산 시설의 준공식을 가졌습니다. 이 신규 공장은 체외진단(IVD) 제품의 연간 생산 능력을 3배 증가시킬 것으로 예상됩니다. 예를 들어, 혈액학 제품의 생산 능력은 6만 팩에서 18만 팩으로, 실험실 장비 조립 용량은 1,000대에서 4,000대로 증가할 것입니다.

- 2023년 2월, 패러 파크 병원(Farrer Park Hospital)은 전문의와 의사를 위한 지속적인 의료 교육을 강화하기 위해 얼리전트 리저널 케어(Allegiant Regional Care, ARC) 병원과 임상 협력을 시작했습니다. 이를 통해 전문의와 의사를 위한 고급 지속적인 의료 교육을 통해 환자 치료를 개선하고 임상 혁신을 촉진하는 회사의 역량을 강화했습니다.

- 2022년 8월, 풀러턴 헬스(Fullerton Health)는 RRJ 캐피털(RRJ Capital) 주도로 합병을 완료했습니다. 더욱 강화된 재무구조와 새로운 기업 구조는 팬데믹 이후 성장 기회를 촉진했습니다. 풀러턴 헬스 코퍼레이션 리미티드(이하 "풀러턴 헬스" 또는 "회사")는 사모펀드의 지분 투자와 총 3억 9천만 달러 규모의 선순위 대출을 통해 RRJ 캐피털(이하 "RRJ") 주도로 합병을 완료했다고 발표했습니다. 이 합병을 통해 더욱 강화된 재무구조와 새로운 자본 구조가 구축되어 팬데믹 이후 성장 기회가 더욱 확대되었습니다.

- 2022년 6월, Farrer Park Hospital은 대장직장 용종 및 암의 탐지, 분류 및 감시를 강화하여 환자 치료 및 진단 정확도를 향상시키는 것을 목표로 AI 지원 대장직장 검진 서비스를 시작했습니다.

- 2021년 6월, Raffles Medical Group과 China Life Healthcare Investment Company Limited(CLHI)는 양해각서에 서명하여 CLHI와 싱가포르 최대 민간 의료 서비스 제공업체 간의 전략적 파트너십을 구축했으며, 이를 통해 그룹의 국제적 영향력과 협력이 강화되었습니다.

- 2020년 9월, Farrer Park Company Pte Ltd는 싱가포르 의료 시설 최초로 유나이티드 오버시즈 뱅크(UOB)로부터 1억 2천만 달러 규모의 친환경 대출을 확보하여 지속가능성 증진을 위한 노력을 뒷받침했습니다. 이 자금은 싱가포르의 선구적인 통합 의료 및 호스피탈리티 단지인 커넥션(Connexion)의 재융자에 사용될 예정이며, 운영 효율성과 지속가능성 이니셔티브를 강화할 것으로 예상됩니다.

지역 분석

지리적으로 ASEAN 건강검진 시장 보고서에서 다루는 국가는 인도, 싱가포르, 태국, 말레이시아, 인도네시아, 필리핀, 베트남, 캄보디아, 브루나이, 미얀마, 라오스입니다.

Data Bridge Market Research 분석에 따르면:

ASEAN 건강 검진 시장 보고서에 대한 자세한 내용은 여기를 클릭하세요 - https://www.databridgemarketresearch.com/reports/asean-health-screening-market