Global Project Portfolio Management Market Size, Share and Trends Analysis Report

Market Size in USD Billion

CAGR :

%

USD

5.55 Billion

USD

8.79 Billion

2025

2033

USD

5.55 Billion

USD

8.79 Billion

2025

2033

| 2026 –2033 | |

| USD 5.55 Billion | |

| USD 8.79 Billion | |

|

|

|

|

Global Project Portfolio Management Market Segmentation, By Component (Solution and Services), Deployment Mode (On-Premises and Cloud), Organization Size (Small and Medium-Sized Enterprises (SMEs) and Large Enterprises), Industry Vertical (Banking, Financial Services and Insurance (BFSI), IT and Telecom, Consumer Goods and Retail, Healthcare and Life Sciences, Manufacturing, Government and Defense, Energy and Utilities, and Others) - Industry Trends and Forecast to 2033

What is the Global Project Portfolio Management Market Size and Growth Rate?

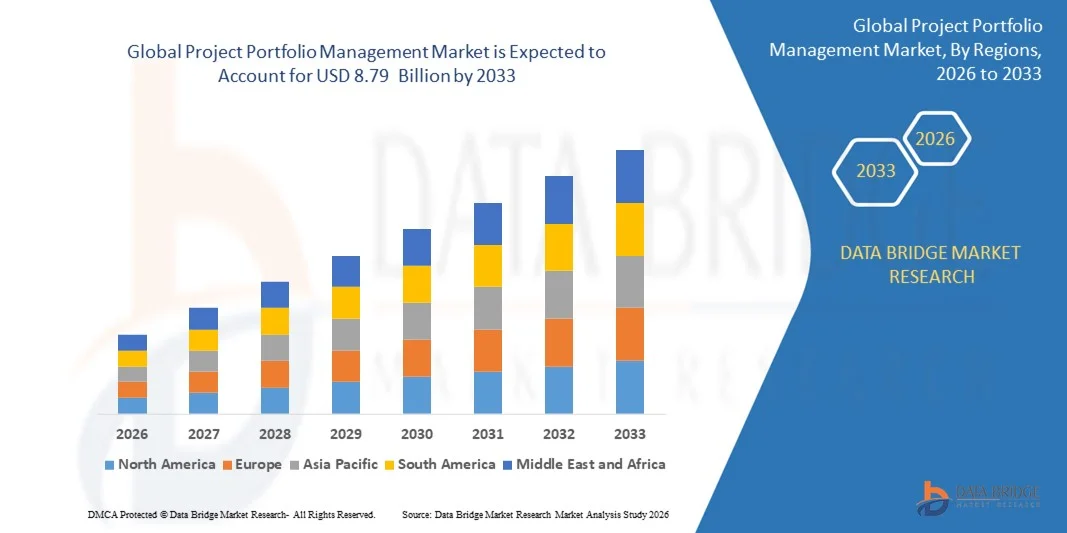

- The global project portfolio management market size was valued at USD 5.55 Billion in 2025 and is expected to reach USD 8.79 Billion by 2033, at a CAGR of5.90% during the forecast period

- The rise in the adoption of cloud-based services for the remote monitoring of assignments, acts as one of the major factors driving the growth of project portfolio management market

- The increase in the number of activities such as automation and digitalization across industries including healthcare, government, engineering and construction, BFSI and telecom raising the need for monitoring and analytical solutions with the purpose of enhancing productivity and business efficiency accelerate the project portfolio management market growth

What are the Major Takeaways of Project Portfolio Management Market?

- The growing need for a 360-degree view of project operations and resource management as it assists in collaborative scheduling, planning, and faster and efficient decision-making and rising trend of bring your own device (BYOD) along with the growing focus of organizations on attaining faster Return on Investment (ROI) further influence the project portfolio management market

- In addition, rapid urbanization and digitization, increasing investments in research and development activities and growth in competition worldwide positively affect the project portfolio management market

- North America dominated the project portfolio management market with a 42.65% revenue share in 2025, driven by early adoption of enterprise software, strong presence of global PPM vendors, and widespread implementation of digital transformation initiatives across the U.S. and Canada

- Asia-Pacific is projected to register the fastest CAGR of 9.12% from 2026 to 2033, driven by rapid enterprise digitalization, expanding IT services sector, and rising adoption of cloud-based PPM platforms across China, Japan, India, South Korea, and Southeast Asia

- The Solutions segment dominated the market, accounting for around 68.5% share in 2025, as enterprises increasingly adopted integrated PPM platforms for project planning, portfolio optimization, financial management, and resource allocation

Report Scope and Project Portfolio Management Market Segmentation

|

Attributes |

Project Portfolio Management Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Project Portfolio Management Market?

Increasing Shift Toward Cloud-Based, AI-Driven, and Integrated Project Portfolio Management Platforms

- The project portfolio management market is witnessing a strong shift toward cloud-native, scalable, and subscription-based PPM solutions that enable centralized visibility, real-time collaboration, and remote portfolio governance

- Vendors are integrating AI, machine learning, and advanced analytics to support predictive project planning, risk identification, resource optimization, and data-driven investment decisions

- Growing demand for integrated platforms that combine project management, financial planning, resource management, and enterprise reporting is accelerating adoption across large enterprises and SMEs

- For instance, companies such as Microsoft, SAP, Oracle, ServiceNow, and Planview are enhancing their PPM offerings with AI-powered insights, automation, and seamless integration with ERP, CRM, and DevOps tools

- Rising adoption of hybrid work models, agile frameworks, and digital transformation initiatives is increasing reliance on cloud-based PPM platforms for cross-functional alignment

- As organizations manage increasingly complex project portfolios, PPM solutions will remain critical for strategic alignment, governance, and value realization

What are the Key Drivers of Project Portfolio Management Market?

- Rising demand for enterprise-wide visibility, cost control, and strategic alignment across multiple projects and programs is driving adoption of PPM solutions

- For instance, in 2024–2025, vendors such as SAP, Microsoft, and Oracle expanded AI-enabled portfolio analytics, financial forecasting, and automated reporting capabilities

- Growing adoption of digital transformation, agile project management, and hybrid IT environments across the U.S., Europe, and Asia-Pacific is boosting market growth

- Advancements in cloud computing, data analytics, API-based integrations, and low-code platforms have enhanced scalability, usability, and deployment flexibility

- Increasing focus on resource optimization, capital efficiency, and ROI-driven decision-making is strengthening demand among IT, BFSI, healthcare, and manufacturing sectors

- Supported by rising enterprise IT spending and focus on operational efficiency, the Project Portfolio Management market is expected to witness steady long-term growth

Which Factor is Challenging the Growth of the Project Portfolio Management Market?

- High implementation costs and complex deployment requirements of advanced PPM platforms limit adoption among small enterprises and cost-sensitive organizations

- For instance, during 2024–2025, enterprises reported challenges related to integration complexity, customization costs, and longer deployment cycles for large-scale PPM systems

- Complexity in managing organizational change, user adoption, and data migration increases reliance on skilled professionals and training

- Limited awareness among mid-sized firms regarding strategic benefits of portfolio-level governance slows penetration in emerging markets

- Competition from standalone project management tools, ERP modules, and agile planning software creates pricing pressure and differentiation challenges

- To overcome these barriers, vendors are focusing on modular pricing, simplified UX, cloud deployment, and AI-driven automation to expand global adoption of PPM solutions

How is the Project Portfolio Management Market Segmented?

The market is segmented on the basis of component, deployment mode, organization size, and industry vertical.

- By Component

On the basis of component, the Project Portfolio Management market is segmented into Solutions and Services. The Solutions segment dominated the market, accounting for around 68.5% share in 2025, as enterprises increasingly adopted integrated PPM platforms for project planning, portfolio optimization, financial management, and resource allocation. PPM solutions enable real-time visibility, strategic alignment, automated reporting, and governance across multiple projects, making them essential for large-scale digital transformation initiatives. Organizations prefer scalable, configurable platforms that integrate with ERP, CRM, and DevOps tools to improve decision-making and ROI tracking.

The Services segment is expected to grow at the fastest CAGR from 2026 to 2033, driven by rising demand for implementation, customization, training, and consulting services. Increasing complexity of enterprise PPM deployments, data migration needs, and user adoption challenges are pushing organizations to rely on professional and managed services for long-term optimization and performance improvement.

- By Deployment Mode

Based on deployment mode, the Project Portfolio Management market is segmented into On-Premises and Cloud. The Cloud segment dominated the market with an estimated 62.7% share in 2025, owing to its scalability, lower upfront costs, faster deployment, and support for remote and hybrid work environments. Cloud-based PPM platforms enable real-time collaboration, centralized portfolio visibility, and seamless integration with enterprise applications, making them highly attractive to global organizations managing distributed teams. Subscription-based pricing models further accelerate adoption among SMEs and large enterprises asuch as.

The Cloud segment is also projected to be the fastest-growing from 2026 to 2033, supported by increasing adoption of SaaS models, AI-driven analytics, and continuous feature updates. Meanwhile, on-premises deployment continues to see demand in highly regulated industries requiring strict data control and security compliance.

- By Organization Size

On the basis of organization size, the Project Portfolio Management market is segmented into Small and Medium-Sized Enterprises (SMEs) and Large Enterprises. The Large Enterprises segment dominated the market with a 59.3% share in 2025, driven by the need to manage complex, multi-project portfolios across departments, regions, and business units. Large organizations rely on PPM solutions for capital planning, strategic prioritization, governance, and compliance, particularly in IT, manufacturing, and BFSI sectors. Advanced analytics, resource optimization, and financial tracking capabilities are key adoption drivers in this segment.

The SMEs segment is expected to grow at the fastest CAGR from 2026 to 2033, fueled by rising availability of cloud-based, cost-effective, and modular PPM solutions. Growing digitalization, agile adoption, and focus on operational efficiency are encouraging SMEs to invest in scalable portfolio management tools.

- By Industry Vertical

Based on industry vertical, the Project Portfolio Management market is segmented into BFSI, IT & Telecom, Consumer Goods & Retail, Healthcare & Life Sciences, Manufacturing, Government & Defense, Energy & Utilities, and Others. The IT & Telecom segment dominated the market with a 34.6% share in 2025, supported by large-scale IT transformation programs, agile and DevOps adoption, and continuous demand for project prioritization and resource optimization. PPM platforms play a critical role in managing application development, infrastructure upgrades, and digital services portfolios in this sector.

The Healthcare & Life Sciences segment is expected to register the fastest CAGR from 2026 to 2033, driven by increasing investments in digital health, regulatory compliance, R&D projects, and clinical program management. Growing complexity of healthcare projects and need for transparency and governance are accelerating PPM adoption across this vertical.

Which Region Holds the Largest Share of the Project Portfolio Management Market?

- North America dominated the project portfolio management market with a 42.65% revenue share in 2025, driven by early adoption of enterprise software, strong presence of global PPM vendors, and widespread implementation of digital transformation initiatives across the U.S. and Canada. Large enterprises across BFSI, IT & telecom, manufacturing, and government sectors increasingly rely on PPM platforms to manage complex project portfolios, optimize capital allocation, and ensure strategic alignment

- Leading vendors in North America continue to enhance PPM platforms with AI-driven analytics, cloud deployment, automation, and deep integration with ERP and DevOps ecosystems, strengthening regional leadership

- High concentration of skilled professionals, mature IT infrastructure, and strong focus on governance, compliance, and ROI-based project execution further reinforce market dominance

U.S. Project Portfolio Management Market Insight

The U.S. is the largest contributor to the North American market, supported by widespread adoption of enterprise PPM solutions across IT services, financial institutions, healthcare systems, defense programs, and large-scale infrastructure projects. Organizations increasingly use PPM platforms for agile portfolio management, financial forecasting, and enterprise-wide resource optimization. Strong presence of global software providers, high cloud adoption, and continuous investments in AI-enabled enterprise solutions continue to drive market growth.

Canada Project Portfolio Management Market Insight

Canada contributes steadily to regional growth, driven by increasing digitalization across public sector projects, financial services, telecom, and healthcare organizations. Enterprises and government agencies are adopting PPM solutions to improve transparency, compliance, and program governance. Growing cloud adoption, skilled workforce availability, and government-backed digital initiatives support expanding PPM deployment across the country.

Asia-Pacific Project Portfolio Management Market

Asia-Pacific is projected to register the fastest CAGR of 9.12% from 2026 to 2033, driven by rapid enterprise digitalization, expanding IT services sector, and rising adoption of cloud-based PPM platforms across China, Japan, India, South Korea, and Southeast Asia. Growing focus on operational efficiency, portfolio-level governance, and strategic investment planning across enterprises is accelerating adoption. Expansion of multinational operations and large-scale infrastructure and IT programs further boosts demand.

China Project Portfolio Management Market Insight

China leads the Asia-Pacific market due to large-scale enterprise modernization, strong adoption of cloud platforms, and growing demand for centralized project and investment governance. Increasing complexity of IT, infrastructure, and industrial transformation programs is driving adoption of PPM solutions with advanced analytics and reporting capabilities.

Japan Project Portfolio Management Market Insight

Japan shows stable growth supported by mature enterprise environments, strong focus on operational efficiency, and increasing adoption of portfolio governance tools across manufacturing, automotive, and telecom sectors. Demand for structured project prioritization and risk management supports steady PPM adoption.

India Project Portfolio Management Market Insight

India is emerging as a high-growth market, driven by expanding IT services, startup ecosystems, and government-led digital initiatives. Growing adoption of cloud-based and cost-effective PPM solutions among enterprises and SMEs is accelerating market penetration.

South Korea Project Portfolio Management Market Insight

South Korea contributes significantly due to strong enterprise IT investments, growing adoption of agile frameworks, and increasing demand for portfolio-level visibility across technology, manufacturing, and telecom sectors. Continuous digital innovation supports sustained market growth.

Which are the Top Companies in Project Portfolio Management Market?

The project portfolio management industry is primarily led by well-established companies, including:

- Oracle (U.S.)

- Planview, Inc. (U.S.)

- Broadcom (U.S.)

- SAP SE (Germany)

- Microsoft (U.S.)

- Workfront, Inc. (U.S.)

- HEXAGON (Sweden)

- ServiceNow (U.S.)

- Upland Software, Inc. (U.S.)

- Micro Focus (U.K.)

- Planisware (France)

- Sciforma (U.S.)

- Clarizen (Israel)

- Sopheon (U.K.)

- Cerri.com AG (Germany)

- Changepoint Corporation (U.S.)

- Keyedin, Inc. (U.S.)

- One2Team (France)

- ONEPOINT Projects GmbH (Germany)

- Meisterplan (Germany)

- Bestoutcome (U.K.)

- Project Objects (Netherlands)

- WorkOtter (U.S.)

What are the Recent Developments in Global Project Portfolio Management Market?

- In March 2023, Cora Systems announced a collaboration agreement with Aer Soléir, under which the renewable energy company adopted the Cora platform as its Project Portfolio Management solution to manage its multi-gigawatt renewable energy pipeline across Europe, strengthening portfolio governance and project execution capabilities

- In March 2023, SAP announced updates to the compatibility range for project management and enterprise portfolio solutions, with the SAP S/4HANA 2023 release modernizing key elements of Portfolio and Project Management and Project System modules, enhancing system integration and long-term platform efficiency

- In March 2023, OnePlan, a leading provider of strategic portfolio management software, launched a new agile portfolio management solution with enhanced support for Jira, enabling organizations to improve portfolio visibility, align initiatives with strategic objectives, and make data-driven decisions, reinforcing agile portfolio adoption

- In February 2023, Synami introduced PPM Core, a cloud-driven platform designed to unify project and portfolio management by connecting teams, data, and workflows across organizations, improving collaboration, transparency, and overall project delivery outcomes

- In January 2023, Hexagon AB acquired Projectmates, a SaaS-based project management software provider for capital construction projects, integrating it into Hexagon’s Geosystems division to support over 100,000 active projects across North America, expanding Hexagon’s PPM software portfolio and market reach

SKU-

世界初のマーケットインテリジェンスクラウドに関するレポートにオンラインでアクセスする

- インタラクティブなデータ分析ダッシュボード

- 成長の可能性が高い機会のための企業分析ダッシュボード

- カスタマイズとクエリのためのリサーチアナリストアクセス

- インタラクティブなダッシュボードによる競合分析

- 最新ニュース、更新情報、トレンド分析

- 包括的な競合追跡のためのベンチマーク分析のパワーを活用

調査方法

データ収集と基準年分析は、大規模なサンプル サイズのデータ収集モジュールを使用して行われます。この段階では、さまざまなソースと戦略を通じて市場情報または関連データを取得します。過去に取得したすべてのデータを事前に調査および計画することも含まれます。また、さまざまな情報ソース間で見られる情報の不一致の調査も含まれます。市場データは、市場統計モデルと一貫性モデルを使用して分析および推定されます。また、市場シェア分析と主要トレンド分析は、市場レポートの主要な成功要因です。詳細については、アナリストへの電話をリクエストするか、お問い合わせをドロップダウンしてください。

DBMR 調査チームが使用する主要な調査方法は、データ マイニング、データ変数が市場に与える影響の分析、および一次 (業界の専門家) 検証を含むデータ三角測量です。データ モデルには、ベンダー ポジショニング グリッド、市場タイムライン分析、市場概要とガイド、企業ポジショニング グリッド、特許分析、価格分析、企業市場シェア分析、測定基準、グローバルと地域、ベンダー シェア分析が含まれます。調査方法について詳しくは、お問い合わせフォームから当社の業界専門家にご相談ください。

カスタマイズ可能

Data Bridge Market Research は、高度な形成的調査のリーダーです。当社は、既存および新規のお客様に、お客様の目標に合致し、それに適したデータと分析を提供することに誇りを持っています。レポートは、対象ブランドの価格動向分析、追加国の市場理解 (国のリストをお問い合わせください)、臨床試験結果データ、文献レビュー、リファービッシュ市場および製品ベース分析を含めるようにカスタマイズできます。対象競合他社の市場分析は、技術ベースの分析から市場ポートフォリオ戦略まで分析できます。必要な競合他社のデータを、必要な形式とデータ スタイルでいくつでも追加できます。当社のアナリスト チームは、粗い生の Excel ファイル ピボット テーブル (ファクト ブック) でデータを提供したり、レポートで利用可能なデータ セットからプレゼンテーションを作成するお手伝いをしたりすることもできます。