B2B 企業支出による米国のホテル市場、チェーン別 (高級、上級高級、高級、上級中級、中級、エコノミー)、ドメイン別 (国際および国内)、セクター別 (BFSI、製造、ヘルスケア、IT サービス、政府およびその他)、予約チャネル別 (直接予約、オンライン旅行代理店 (OTAS)、旅行管理会社 (TMC)) - 2029 年までの業界動向および予測。

B2B 企業支出分析と洞察による米国のホテル市場

B2B企業支出による米国のホテル市場は、2022年から2029年の予測期間に大幅な成長が見込まれています。データブリッジマーケットリサーチは、市場は2022年から2029年の予測期間に3.7%のCAGRで成長し、2029年までに226億4,046万米ドルに達すると分析しています。市場の成長を牽引する主な要因は、予測期間中にホスピタリティ業界で革新的なマーケティング戦略と実践が採用されたことです。企業のオンラインイベントとデジタル化への好みの変化は、市場の成長を抑制すると予想されます。

ホテルの予約のためのさまざまな種類のプラットフォームの増加は、市場に大きなチャンスをもたらすと予想されます。しかし、COVID-19パンデミックの発生により、さまざまな企業イベントがキャンセルされ、B2B支出が市場の成長に課題をもたらすと予測されています。

B2B 企業支出レポートの米国ホテル市場は、市場シェア、新しい開発、国内および現地の市場プレーヤーの影響、新たな収益源の観点から見た機会の分析、市場規制の変更、製品承認、戦略的決定、製品発売、地理的拡大、市場における技術革新の詳細を提供します。分析と市場シナリオを理解するには、アナリスト概要についてお問い合わせください。当社のチームが、希望する目標を達成するための収益影響ソリューションの作成をお手伝いします。

|

レポートメトリック |

詳細 |

|

予測期間 |

2022年から2029年 |

|

基準年 |

2021 |

|

歴史的な年 |

2020 (2019 - 2014 にカスタマイズ可能) |

|

定量単位 |

収益(百万米ドル) |

|

対象セグメント |

チェーン別(高級、アッパーアップスケール、アップスケール、アッパーミッドスケール、ミッドスケール、エコノミー)、ドメイン別(国際および国内)、セクター別(BFSI、製造、ヘルスケア、ITサービス、政府およびその他)、予約チャネル別(直接予約、オンライン旅行代理店(OTAS)、旅行管理会社(TMC)) |

|

対象国 |

私たち |

|

対象となる市場プレーヤー |

マリオット・インターナショナル、ハイアット・ホテル・コーポレーション、ヒルトン・ワールドワイド・ホールディングス、ウィンダム・ホテルズ&リゾーツ、ラディソン・ホテル・グループ・マリオット、ローズウッド・ホテル・グループ |

市場の定義

B2B 企業のホテル支出は、従業員や顧客に焦点を当てて顧客基盤をさらに強化するために経営者がホテルで開催する集会などのイベントへの支出、およびさまざまなイベントでの従業員の宿泊と定義できます。さまざまな企業や法人がさまざまな理由でイベントを開催しています。教育、報酬、動機付け、祝賀、重要な節目の記念、組織変更の管理、コラボレーションの促進などを目的としている場合があります。

B2B企業支出市場の動向から見た米国のホテル市場

ドライバー

- ホスピタリティ業界における革新的なマーケティング戦略と実践の採用

バーチャルリアリティ(VR)は、最近のホスピタリティ技術およびマーケティングの最も大きなトレンドの1つになっています。空間やホテルのVRツアーは、遠くから場所を体験するための究極の手段を提供し、ある程度の探索と没入を可能にする方法で環境を再現します。企業イベントの顧客にとって、それは物理的にそこへ行かなくてもイベント会場を探索する機会を意味します。これは、旅行が制限されている時期には特に価値があります。さらに、さまざまなホテルグループやブランドが、ソーシャルメディアプラットフォーム上の動画を通じて自社のブランドやホテルチェーンを宣伝しており、デジタルプラットフォームで実施されるハッシュタグやブランドエンゲージメントキャンペーンは、ホスピタリティセクターのベストプラクティスと見なされています。したがって、ホスピタリティセクターによるこのような革新的な実践により、企業のB2B支出が増加し、市場の成長を促進することが期待されます。

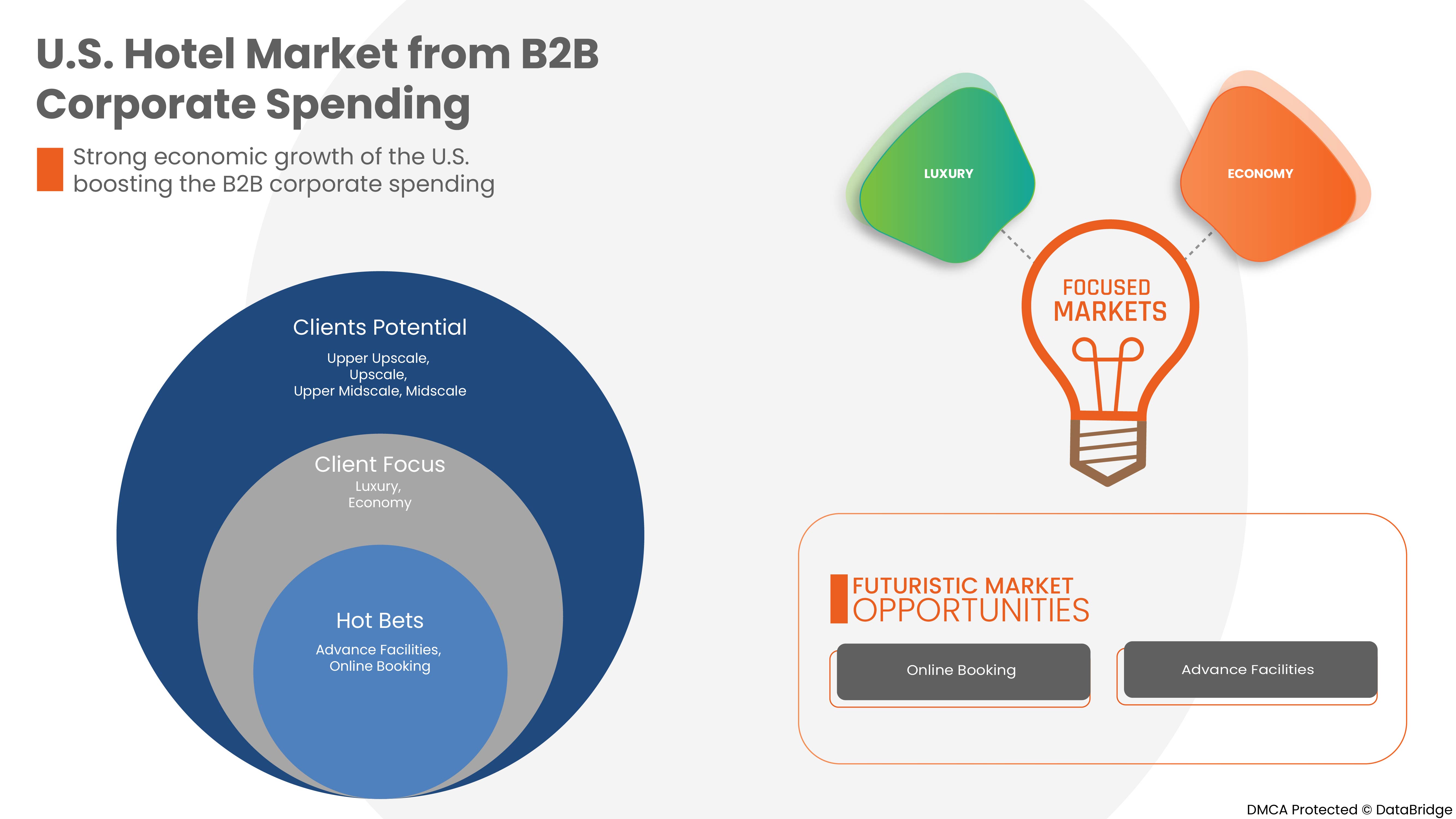

- 米国の力強い経済成長がB2B企業の支出を押し上げる

国の経済成長に伴い、すべての企業やスタートアップはブランディングとプロモーションを必要としています。したがって、イベントの面でのホテルへのB2B企業支出は、ライブ音楽イベント、スポーツイベントなどのエンターテイメントイベントショーをスポンサーすることでビジネスを宣伝するための最良のプラットフォームです。この地域の企業は、より高い競争力を得るために、市場に新しい製品や技術を導入することを望んでいます。その結果、潜在的な顧客と投資家の交流を促進するために、さまざまな見本市、新製品発表イベント、製品展示会などが大規模に開催されています。このため、ホテル業界におけるB2B企業支出は急成長を遂げています。

これに加えて、ヘルスケアや IT 分野の企業数の増加や、企業による展示会、会議、セミナーへの支出の増加が市場の成長を後押ししています。

機会

- ホテルの予約のためのさまざまなタイプのプラットフォームの増加

旅行代理店は、ホスピタリティ マーケティングにおいて最も重要な流通チャネルの 1 つです。近年、旅行代理店の数は飛躍的に増加しています。これにより、顧客は個々の会社の Web サイトにアクセスする代わりに、旅行商品やサービスをオンラインで検索できます。したがって、旅行代理店と提携することは非常に重要です。ホスピタリティ業界では、予約のための多種多様な予約チャネルが存在するため、市場の成長と発展にとって有利な機会が生まれます。

抑制/挑戦

- 企業のオンラインイベントやデジタル化への志向の変化

Hopin は現在、イベントや会議を開催するための人気のプラットフォームとなっています。こうした企業の多くは、ライブイベントとオンラインイベントのギャップを埋めることに重点を置いています。こうした取り組みはすべて、イベント業界に大きな成長の可能性を生み出すと見込まれています。しかし、こうした取り組みは B2B 企業のホテル支出を制限し、市場の成長に悪影響を及ぼすと見込まれています。COVID-19 による制限により、企業はセミナーや企業イベントを開催するために人々とつながるためにテクノロジーに頼らざるを得なくなったためです。これを実現するのに、コミュニケーション プラットフォームの Zoom がかなり人気を博しています。

- COVID-19パンデミックの発生により、さまざまな企業イベントやB2B支出がキャンセルされました。

米国全土で企業やビジネス グループの支出が広範囲に減少していることから、ホテル業界は COVID-19 パンデミックによる打撃を最も受けたセクターの 1 つとなっています。さらに、フランチャイズや独立系ホテルと比較して、チェーン経営のホテルは COVID-19 パンデミックの影響を最も受けています。COVID-19 によって生じた課題は、客室稼働率やスタッフ計画から食品や飲料の提供まで、ホテル運営のほぼすべての部分に影響を及ぼしました。パンデミックは業界に広範囲にわたる影響を及ぼす可能性があり、市場の成長に課題をもたらします。

COVID-19後のB2B企業支出による米国ホテル市場への影響

COVID-19パンデミックは、コミュニティのロックダウン、社会的距離の確保、自宅待機命令、旅行および移動の制限により、ホスピタリティ業界に大きな打撃を与え、多くのホスピタリティ企業が一時的に閉鎖され、閉鎖が許可された企業の需要が大幅に減少しました。当局が発令した旅行制限と自宅待機命令により、ホテルの稼働率と収益が急激に低下しましたが、ホスピタリティ業界はゆっくりと回復しており、市場の成長が加速するでしょう。

最近の開発

- 2022年9月、ハイアット ホテルズ コーポレーションの社長兼最高経営責任者であるマーク ホプラマジアンは、2022年9月8日木曜日にニューヨークで開催されたバンク オブ アメリカ セキュリティーズ 2022 ゲーミング & ロッジング カンファレンスで講演しました。

B2B企業支出市場スコープから見た米国のホテル市場

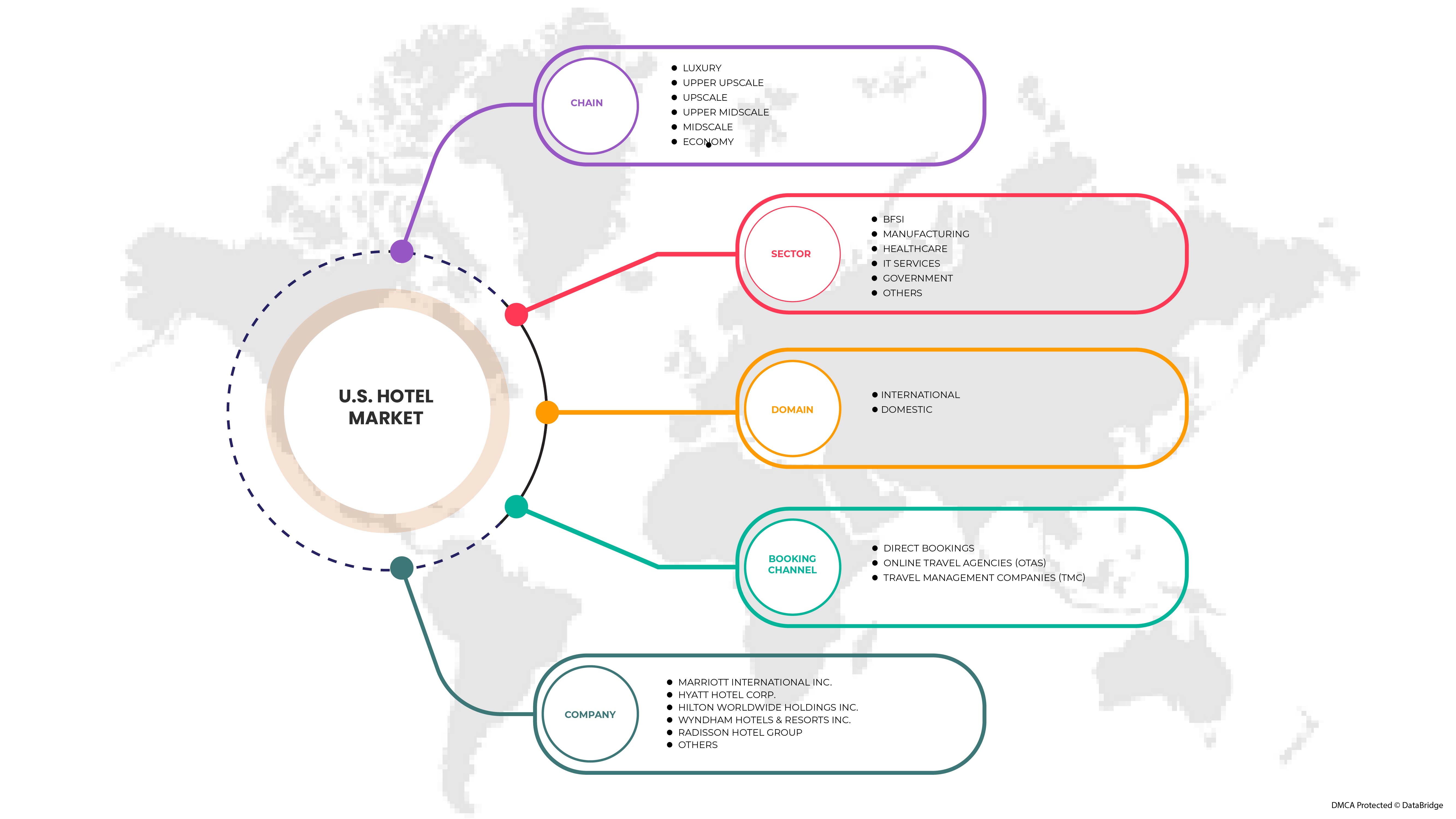

B2B 企業支出による米国のホテル市場は、チェーン、ドメイン、セクター、予約チャネルに基づいて 4 つの主要なセグメントに分類されます。

The growth amongst these segments will help you analyze major growth segments in the industries and provide the users with a valuable market overview and market insights to make strategic decisions to identify core market applications.

Chain

- Luxury

- Upper Upscale

- Upscale

- Upper Midscale

- Midscale

- Economy

Based on chain, the market is segmented into luxury, upper upscale, upscale, upper midscale, midscale and economy

Domain

- International

- Domestic

Based on domain, the market is segmented into international and domestic

Sector

- BFSI

- Manufacturing

- Healthcare

- ITServices

- Government

- Others

Based on sector, the market is segmented into BFSI, manufacturing, healthcare, IT services, government and others

Booking Channel

- Direct Bookings

- Online Travel Agencies (OTAS)

- Travel Management Companies (TMC)

Based on booking channel, the market is segmented into direct bookings, Online Travel Agencies (OTAS) and Travel Management Companies (TMC)

U.S. Hotel Market from B2B Corporate Spending Country Regional Analysis/Insights

The U.S. hotel market from B2B corporate spending is analyzed and market size insights and trends are provided based on chain, domain, sector and booking channel.

The states covered in this market report are California, Florida, New York, Texas, Illinois, Georgia, Pennsylvania, Ohio and rest of U.S. In 2022, California State is expected to dominate the U.S. hotel market from B2B corporate spending.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data point’s downstream and upstream value chain analysis, technical trends and porter's five forces analysis and case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of U.S. brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and U.S. Hotel Market from B2B Corporate Spending Share Analysis

U.S. hotel market from B2B corporate spending competitive landscape provides details by competitors. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, production sites and facilities, company strengths and weaknesses, product launch, product trials pipelines, product approvals, patents, product width and breadth, application dominance, technology lifeline curve. The above data points provided are only related to the companies’ focus related to the market.

Some of the prominent participants operating in the market are Marriott International Inc., Hyatt Hotel Corp., Hilton Worldwide Holdings Inc., Wyndham Hotels & Resorts Inc., Radisson Hotel Group MARRIOTT and Rosewood Hotel Group.

Research Methodology

データ収集と基準年分析は、大規模なサンプル サイズのデータ収集モジュールを使用して行われます。市場データは、市場統計モデルとコヒーレント モデルを使用して分析および推定されます。さらに、市場シェア分析と主要トレンド分析は、市場レポートの主要な成功要因です。DBMR 調査チームが使用する主要な調査方法は、データ マイニング、データ変数の市場への影響の分析、および一次 (業界の専門家) 検証を含むデータ三角測量です。これとは別に、データ モデルには、ベンダー ポジショニング グリッド、市場タイムライン分析、市場概要とガイド、企業ポジショニング グリッド、企業市場シェア分析、測定基準、米国対地域、ベンダー シェア分析が含まれます。さらに質問がある場合は、アナリストへの電話をリクエストしてください。

SKU-

世界初のマーケットインテリジェンスクラウドに関するレポートにオンラインでアクセスする

- インタラクティブなデータ分析ダッシュボード

- 成長の可能性が高い機会のための企業分析ダッシュボード

- カスタマイズとクエリのためのリサーチアナリストアクセス

- インタラクティブなダッシュボードによる競合分析

- 最新ニュース、更新情報、トレンド分析

- 包括的な競合追跡のためのベンチマーク分析のパワーを活用

目次

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF U.S. HOTEL MARKET FROM B2B CORPORATE SPENDING

1.4 LIMITATION

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 CHAIN LIFE LINE CURVE

2.7 MULTIVARIATE MODELING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET CHALLENGE MATRIX

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 OVERVIEW: U.S. LEISURE SPENDING BY THE CONSUMERS

4.2 REGULATORY COVERAGE

4.3 U.S. HOTEL MARKET FROM B2B CORPORATE SPENDING: COMPANY LANDSCAPE

4.3.1 COMPANY SHARE ANALYSIS: U.S.

4.4 U.S. HOTEL MARKET, BRAND SHARE ANALYSIS, 2021, (%)

4.4.1 MARRIOTT

4.4.2 HYATT

4.4.3 HILTON

4.4.4 WYNDHAM

4.4.5 RADISSON

4.4.6 ROSEWOOD

4.5 RECENT DEVELOPMENT AND BRAND STRATEGIES

4.5.1 HYATT

4.5.2 RADDISON

4.5.3 MARRIOTT

4.5.4 FOUR SEASONS HOTELS AND RESORTS

4.5.5 HILTON

4.5.6 WYNDHAM HOTELS

4.6 CONSUMERS’ TRENDS/ RESPONSE

4.7 U.S. HOTEL MARKET, MARKET ANALYSIS

5 U.S. HOTEL MARKET: LUXURY SEGMENT, BRAND SHARE ANALYSIS, 2021, (%)

6 U.S. HOTEL MARKET FROM B2B CORPORATE SPENDING, BY CHAIN

6.1 OVERVIEW

6.2 UPSCALE

6.3 UPPER UPSCALE

6.4 UPPER MIDSCALE

6.5 MIDSCALE

6.6 ECONOMY

6.7 LUXURY

6.7.1 INTERNATIONAL

6.7.2 DOMESTIC

6.7.2.1 IT SERVICES

6.7.2.2 BFSI

6.7.2.3 MANUFACTURING

6.7.2.4 HEALTHCARE

6.7.2.5 GOVERNMENT

6.7.2.6 OTHERS

6.7.2.6.1 DIRECT BOOKINGS

6.7.2.6.2 ONLINE TRAVEL AGENCIES (OTAS)

6.7.2.6.3 TRAVEL MANAGEMENT COMPANIES (TMC)

7 U.S. HOTEL MARKET FROM B2B CORPORATE SPENDING, BY DOMAIN

7.1 OVERVIEW

7.2 INTERNATIONAL

7.3 DOMESTIC

8 U.S. HOTEL MARKET FROM B2B CORPORATE SPENDING, BY SECTOR

8.1 OVERVIEW

8.2 IT SERVICES

8.3 BFSI

8.4 MANUFACTURING

8.5 HEALTHCARE

8.6 GOVERNMENT

8.7 OTHERS

9 U.S. HOTEL MARKET FROM B2B CORPORATE SPENDING, BY BOOKING CHANNEL

9.1 OVERVIEW

9.2 DIRECT BOOKINGS

9.3 ONLINE TRAVEL AGENCIES (OTAS)

9.4 TRAVEL MANAGEMENT COMPANIES (TMC)

10 U.S. HOTEL MARKET FROM B2B CORPORATE SPENDING, BY STATE

10.1 CALIFORNIA

10.2 FLORIDA

10.3 NEW YORK

10.4 TEXAS

10.5 ILLINOIS

10.6 GEORGIA

10.7 PENNSYLVANIA

10.8 OHIO

10.9 REST OF U.S.

11 SWOT

12 QUESTIONNAIRE

13 RELATED REPORTS

表のリスト

TABLE 1 REGULATORY FRAMEWORK

TABLE 2 U.S. HOTEL MARKET FROM B2B CORPORATE SPENDING, BY CHAIN, 2018-2029 (USD MILLION)

TABLE 3 U.S. HOTEL MARKET FROM B2B CORPORATE SPENDING, BY DOMAIN, 2018-2029 (USD MILLION)

TABLE 4 U.S. HOTEL MARKET FROM B2B CORPORATE SPENDING, BY SECTOR, 2018-2029 (USD MILLION)

TABLE 5 U.S. HOTEL MARKET FROM B2B CORPORATE SPENDING, BY BOOKING CHANNEL, 2018-2029 (USD MILLION)

TABLE 6 U.S. HOTEL MARKET FROM B2B CORPORATE SPENDING, BY DOMAIN, 2018-2029 (USD MILLION)

TABLE 7 U.S. HOTEL MARKET FROM B2B CORPORATE SPENDING, BY SECTOR, 2018-2029 (USD MILLION)

TABLE 8 U.S. HOTEL MARKET FROM B2B CORPORATE SPENDING, BY BOOKING CHANNEL, 2018-2029 (USD MILLION)

TABLE 9 U.S. HOTEL MARKET FROM B2B CORPORATE SPENDING, BY STATE, 2018-2029 (USD MILLION)

TABLE 10 CALIFORNIA HOTEL MARKET FROM B2B CORPORATE SPENDING, BY CHAIN, 2018-2029 (USD MILLION)

TABLE 11 CALIFORNIA LUXURY IN HOTEL MARKET FROM B2B CORPORATE SPENDING, BY DOMAIN, 2018-2029 (USD MILLION)

TABLE 12 CALIFORNIA LUXURY IN HOTEL MARKET FROM B2B CORPORATE SPENDING, BY SECTOR, 2018-2029 (USD MILLION)

TABLE 13 CALIFORNIA LUXURY IN HOTEL MARKET FROM B2B CORPORATE SPENDING, BY BOOKING CHANNEL, 2018-2029 (USD MILLION)

TABLE 14 CALIFORNIA HOTEL MARKET FROM B2B CORPORATE SPENDING, BY DOMAIN, 2018-2029 (USD MILLION)

TABLE 15 CALIFORNIA HOTEL MARKET FROM B2B CORPORATE SPENDING, BY SECTOR, 2018-2029 (USD MILLION)

TABLE 16 CALIFORNIA HOTEL MARKET FROM B2B CORPORATE SPENDING, BY BOOKING CHANNEL, 2018-2029 (USD MILLION)

TABLE 17 FLORIDA HOTEL MARKET FROM B2B CORPORATE SPENDING, BY CHAIN, 2018-2029 (USD MILLION)

TABLE 18 FLORIDA LUXURY IN HOTEL MARKET FROM B2B CORPORATE SPENDING, BY DOMAIN, 2018-2029 (USD MILLION)

TABLE 19 FLORIDA LUXURY IN HOTEL MARKET FROM B2B CORPORATE SPENDING, BY SECTOR, 2018-2029 (USD MILLION)

TABLE 20 FLORIDA LUXURY IN HOTEL MARKET FROM B2B CORPORATE SPENDING, BY BOOKING CHANNEL, 2018-2029 (USD MILLION)

TABLE 21 FLORIDA HOTEL MARKET FROM B2B CORPORATE SPENDING, BY DOMAIN, 2018-2029 (USD MILLION)

TABLE 22 FLORIDA HOTEL MARKET FROM B2B CORPORATE SPENDING, BY SECTOR, 2018-2029 (USD MILLION)

TABLE 23 FLORIDA HOTEL MARKET FROM B2B CORPORATE SPENDING, BY BOOKING CHANNEL, 2018-2029 (USD MILLION)

TABLE 24 NEW YORK HOTEL MARKET FROM B2B CORPORATE SPENDING, BY CHAIN, 2018-2029 (USD MILLION)

TABLE 25 NEW YORK LUXURY IN HOTEL MARKET FROM B2B CORPORATE SPENDING, BY DOMAIN, 2018-2029 (USD MILLION)

TABLE 26 NEW YORK LUXURY IN HOTEL MARKET FROM B2B CORPORATE SPENDING, BY SECTOR, 2018-2029 (USD MILLION)

TABLE 27 NEW YORK LUXURY IN HOTEL MARKET FROM B2B CORPORATE SPENDING, BY BOOKING CHANNEL, 2018-2029 (USD MILLION)

TABLE 28 NEW YORK HOTEL MARKET FROM B2B CORPORATE SPENDING, BY DOMAIN, 2018-2029 (USD MILLION)

TABLE 29 NEW YORK HOTEL MARKET FROM B2B CORPORATE SPENDING, BY SECTOR, 2018-2029 (USD MILLION)

TABLE 30 NEW YORK HOTEL MARKET FROM B2B CORPORATE SPENDING, BY BOOKING CHANNEL, 2018-2029 (USD MILLION)

TABLE 31 TEXAS HOTEL MARKET FROM B2B CORPORATE SPENDING, BY CHAIN, 2018-2029 (USD MILLION)

TABLE 32 TEXAS LUXURY IN HOTEL MARKET FROM B2B CORPORATE SPENDING, BY DOMAIN, 2018-2029 (USD MILLION)

TABLE 33 TEXAS LUXURY IN HOTEL MARKET FROM B2B CORPORATE SPENDING, BY SECTOR, 2018-2029 (USD MILLION)

TABLE 34 TEXAS LUXURY IN HOTEL MARKET FROM B2B CORPORATE SPENDING, BY BOOKING CHANNEL, 2018-2029 (USD MILLION)

TABLE 35 TEXAS HOTEL MARKET FROM B2B CORPORATE SPENDING, BY DOMAIN, 2018-2029 (USD MILLION)

TABLE 36 TEXAS HOTEL MARKET FROM B2B CORPORATE SPENDING, BY SECTOR, 2018-2029 (USD MILLION)

TABLE 37 TEXAS HOTEL MARKET FROM B2B CORPORATE SPENDING, BY BOOKING CHANNEL, 2018-2029 (USD MILLION)

TABLE 38 ILLINOIS HOTEL MARKET FROM B2B CORPORATE SPENDING, BY CHAIN, 2018-2029 (USD MILLION)

TABLE 39 ILLINOIS LUXURY IN HOTEL MARKET FROM B2B CORPORATE SPENDING, BY DOMAIN, 2018-2029 (USD MILLION)

TABLE 40 ILLINOIS LUXURY IN HOTEL MARKET FROM B2B CORPORATE SPENDING, BY SECTOR, 2018-2029 (USD MILLION)

TABLE 41 ILLINOIS LUXURY IN HOTEL MARKET FROM B2B CORPORATE SPENDING, BY BOOKING CHANNEL, 2018-2029 (USD MILLION)

TABLE 42 ILLINOIS HOTEL MARKET FROM B2B CORPORATE SPENDING, BY DOMAIN, 2018-2029 (USD MILLION)

TABLE 43 ILLINOIS HOTEL MARKET FROM B2B CORPORATE SPENDING, BY SECTOR, 2018-2029 (USD MILLION)

TABLE 44 ILLINOIS HOTEL MARKET FROM B2B CORPORATE SPENDING, BY BOOKING CHANNEL, 2018-2029 (USD MILLION)

TABLE 45 GEORGIA HOTEL MARKET FROM B2B CORPORATE SPENDING, BY CHAIN, 2018-2029 (USD MILLION)

TABLE 46 GEORGIA LUXURY IN HOTEL MARKET FROM B2B CORPORATE SPENDING, BY DOMAIN, 2018-2029 (USD MILLION)

TABLE 47 GEORGIA LUXURY IN HOTEL MARKET FROM B2B CORPORATE SPENDING, BY SECTOR, 2018-2029 (USD MILLION)

TABLE 48 GEORGIA LUXURY IN HOTEL MARKET FROM B2B CORPORATE SPENDING, BY BOOKING CHANNEL, 2018-2029 (USD MILLION)

TABLE 49 GEORGIA HOTEL MARKET FROM B2B CORPORATE SPENDING, BY DOMAIN, 2018-2029 (USD MILLION)

TABLE 50 GEORGIA HOTEL MARKET FROM B2B CORPORATE SPENDING, BY SECTOR, 2018-2029 (USD MILLION)

TABLE 51 GEORGIA HOTEL MARKET FROM B2B CORPORATE SPENDING, BY BOOKING CHANNEL, 2018-2029 (USD MILLION)

TABLE 52 PENNSYLVANIA HOTEL MARKET FROM B2B CORPORATE SPENDING, BY CHAIN, 2018-2029 (USD MILLION)

TABLE 53 PENNSYLVANIA LUXURY IN HOTEL MARKET FROM B2B CORPORATE SPENDING, BY DOMAIN, 2018-2029 (USD MILLION)

TABLE 54 PENNSYLVANIA LUXURY IN HOTEL MARKET FROM B2B CORPORATE SPENDING, BY SECTOR, 2018-2029 (USD MILLION)

TABLE 55 PENNSYLVANIA LUXURY IN HOTEL MARKET FROM B2B CORPORATE SPENDING, BY BOOKING CHANNEL, 2018-2029 (USD MILLION)

TABLE 56 PENNSYLVANIA HOTEL MARKET FROM B2B CORPORATE SPENDING, BY DOMAIN, 2018-2029 (USD MILLION)

TABLE 57 PENNSYLVANIA HOTEL MARKET FROM B2B CORPORATE SPENDING, BY SECTOR, 2018-2029 (USD MILLION)

TABLE 58 PENNSYLVANIA HOTEL MARKET FROM B2B CORPORATE SPENDING, BY BOOKING CHANNEL, 2018-2029 (USD MILLION)

TABLE 59 OHIO HOTEL MARKET FROM B2B CORPORATE SPENDING, BY CHAIN, 2018-2029 (USD MILLION)

TABLE 60 OHIO LUXURY IN HOTEL MARKET FROM B2B CORPORATE SPENDING, BY DOMAIN, 2018-2029 (USD MILLION)

TABLE 61 OHIO LUXURY IN HOTEL MARKET FROM B2B CORPORATE SPENDING, BY SECTOR, 2018-2029 (USD MILLION)

TABLE 62 OHIO LUXURY IN HOTEL MARKET FROM B2B CORPORATE SPENDING, BY BOOKING CHANNEL, 2018-2029 (USD MILLION)

TABLE 63 OHIO HOTEL MARKET FROM B2B CORPORATE SPENDING, BY DOMAIN, 2018-2029 (USD MILLION)

TABLE 64 OHIO HOTEL MARKET FROM B2B CORPORATE SPENDING, BY SECTOR, 2018-2029 (USD MILLION)

TABLE 65 OHIO HOTEL MARKET FROM B2B CORPORATE SPENDING, BY BOOKING CHANNEL, 2018-2029 (USD MILLION)

TABLE 66 REST OF U.S. HOTEL MARKET FROM B2B CORPORATE SPENDING, BY CHAIN, 2018-2029 (USD MILLION)

図表一覧

FIGURE 1 U.S. HOTEL MARKET FROM B2B CORPORATE SPENDING: SEGMENTATION

FIGURE 2 U.S. HOTEL MARKET FROM B2B CORPORATE SPENDING: DATA TRIANGULATION

FIGURE 3 U.S. HOTEL MARKET FROM B2B CORPORATE SPENDING: DROC ANALYSIS

FIGURE 4 U.S. HOTEL MARKET FROM B2B CORPORATE SPENDING: U.S. MARKET ANALYSIS

FIGURE 5 U.S. HOTEL MARKET FROM B2B CORPORATE SPENDING: COMPANY RESEARCH ANALYSIS

FIGURE 6 U.S. HOTEL MARKET FROM B2B CORPORATE SPENDING: THE CHAIN LIFE LINE CURVE

FIGURE 7 U.S. HOTEL MARKET FROM B2B CORPORATE SPENDING: MULTIVARIATE MODELLING

FIGURE 8 U.S. HOTEL MARKET FROM B2B CORPORATE SPENDING: INTERVIEW DEMOGRAPHICS

FIGURE 9 U.S. HOTEL MARKET FROM B2B CORPORATE SPENDING: THE MARKET CHALLENGE MATRIX

FIGURE 10 U.S. HOTEL MARKET FROM B2B CORPORATE SPENDING: SEGMENTATION

FIGURE 11 STRONG ECONOMIC GROWTH OF THE U.S. BOOSTING THE B2B CORPORATE SPENDING IS EXPECTED TO DRIVE U.S. HOTEL MARKET FROM B2B CORPORATE SPENDING IN THE FORECAST PERIOD

FIGURE 12 UPSCALE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE U.S. HOTEL MARKET FROM B2B CORPORATE SPENDING IN 2022 & 2029

FIGURE 13 U.S. HOTEL MARKET FROM B2B CORPORATE SPENDING: COMPANY SHARE 2021 (%)

FIGURE 14 MARRIOTT: BRAND ANALYSIS

FIGURE 15 MARRIOTT: SELECT SEGMENT

FIGURE 16 MARRIOTT: PREMIUM SEGMENT

FIGURE 17 MARRIOTT: LUXURY SEGMENT

FIGURE 18 HYATT: BRAND ANALYSIS

FIGURE 19 HYATT: UPPER-UPSCALE

FIGURE 20 HYATT: UPSCALE

FIGURE 21 HYATT: LUXURY

FIGURE 22 HILTON: BRAND ANALYSIS

FIGURE 23 HILTON: UPPER-UPSCALE

FIGURE 24 HILTON: UPSCALE

FIGURE 25 HILTON: LUXURY

FIGURE 26 WYNDHAM: BRAND ANALYSIS

FIGURE 27 WYNDHAM: ECONOMY

FIGURE 28 WYNDHAM: MID-SCALE

FIGURE 29 WYNDHAM: UPSCALE

FIGURE 30 WYNDHAM: LIFESTYLE

FIGURE 31 WYNDHAM: EXTENDED STAY

FIGURE 32 RADISSON: BRAND ANALYSIS

FIGURE 33 RADISSON: UPPER UPSCALE

FIGURE 34 RADISSON: UPSCALE

FIGURE 35 RADISSON: MID-SCALE

FIGURE 36 RADISSON: LUXURY

FIGURE 37 ROSEWOOD: BRAND ANALYSIS

FIGURE 38 U.S. HOTEL MARKET, (USD BILLION)

FIGURE 39 LUXURY HOTELS: BRAND ANALYSIS

FIGURE 40 U.S. HOTEL MARKET FROM B2B CORPORATE SPENDING: BY CHAIN, 2021

FIGURE 41 U.S. HOTEL MARKET FROM B2B CORPORATE SPENDING: BY DOMAIN, 2021

FIGURE 42 U.S. HOTEL MARKET FROM B2B CORPORATE SPENDING: BY SECTOR, 2021

FIGURE 43 U.S. HOTEL MARKET FROM B2B CORPORATE SPENDING: BY BOOKING CHANNEL, 2021

FIGURE 44 U.S. HOTEL MARKET FROM B2B CORPORATE SPENDING: SNAPSHOT (2021)

FIGURE 45 U.S. HOTEL MARKET FROM B2B CORPORATE SPENDING: BY STATE (2021)

FIGURE 46 U.S. HOTEL MARKET FROM B2B CORPORATE SPENDING: BY STATE (2022 & 2029)

FIGURE 47 U.S. HOTEL MARKET FROM B2B CORPORATE SPENDING: BY STATE (2021 & 2029)

FIGURE 48 U.S. HOTEL MARKET FROM B2B CORPORATE SPENDING: BY CHAIN (2022-2029)

調査方法

データ収集と基準年分析は、大規模なサンプル サイズのデータ収集モジュールを使用して行われます。この段階では、さまざまなソースと戦略を通じて市場情報または関連データを取得します。過去に取得したすべてのデータを事前に調査および計画することも含まれます。また、さまざまな情報ソース間で見られる情報の不一致の調査も含まれます。市場データは、市場統計モデルと一貫性モデルを使用して分析および推定されます。また、市場シェア分析と主要トレンド分析は、市場レポートの主要な成功要因です。詳細については、アナリストへの電話をリクエストするか、お問い合わせをドロップダウンしてください。

DBMR 調査チームが使用する主要な調査方法は、データ マイニング、データ変数が市場に与える影響の分析、および一次 (業界の専門家) 検証を含むデータ三角測量です。データ モデルには、ベンダー ポジショニング グリッド、市場タイムライン分析、市場概要とガイド、企業ポジショニング グリッド、特許分析、価格分析、企業市場シェア分析、測定基準、グローバルと地域、ベンダー シェア分析が含まれます。調査方法について詳しくは、お問い合わせフォームから当社の業界専門家にご相談ください。

カスタマイズ可能

Data Bridge Market Research は、高度な形成的調査のリーダーです。当社は、既存および新規のお客様に、お客様の目標に合致し、それに適したデータと分析を提供することに誇りを持っています。レポートは、対象ブランドの価格動向分析、追加国の市場理解 (国のリストをお問い合わせください)、臨床試験結果データ、文献レビュー、リファービッシュ市場および製品ベース分析を含めるようにカスタマイズできます。対象競合他社の市場分析は、技術ベースの分析から市場ポートフォリオ戦略まで分析できます。必要な競合他社のデータを、必要な形式とデータ スタイルでいくつでも追加できます。当社のアナリスト チームは、粗い生の Excel ファイル ピボット テーブル (ファクト ブック) でデータを提供したり、レポートで利用可能なデータ セットからプレゼンテーションを作成するお手伝いをしたりすることもできます。