米国のヘルスケア情報技術 (IT) 統合市場、製品およびサービス別 (製品およびサービス)、アプリケーション別 (医療機器統合、社内統合、病院統合、研究室統合、診療所統合、放射線科統合)、施設規模別 (大規模、中規模、小規模)、購入モード別 (グループ購入組織および個人)、エンドユーザー別 (病院、研究室、診断センター、放射線科センター、診療所) - 2029 年までの業界動向および予測。

米国のヘルスケア情報技術 (IT) 統合市場の分析と洞察

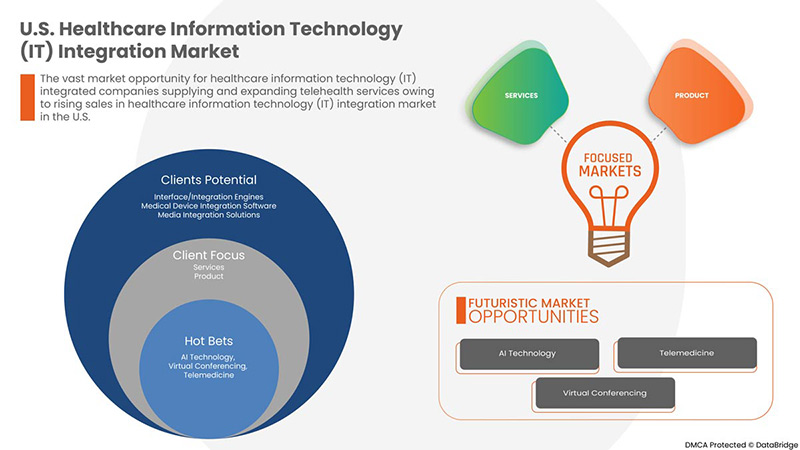

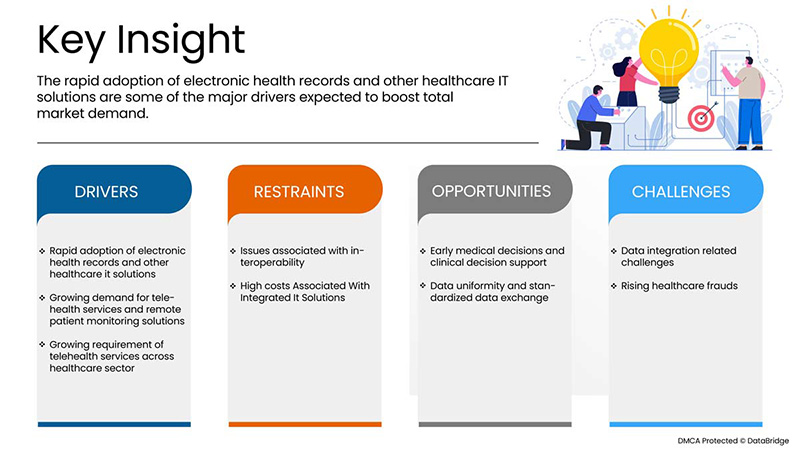

電子健康記録やその他のヘルスケア IT ソリューションの採用の増加、遠隔医療サービスや遠隔患者モニタリング ソリューションの需要の増加、ヘルスケア分野全体での遠隔医療サービスの要件の増加は、市場の成長を促進すると予想される要因です。

ただし、相互運用性に関連する問題や、統合 IT ソリューションに関連する高コストにより、市場の成長が抑制されると予想されます。

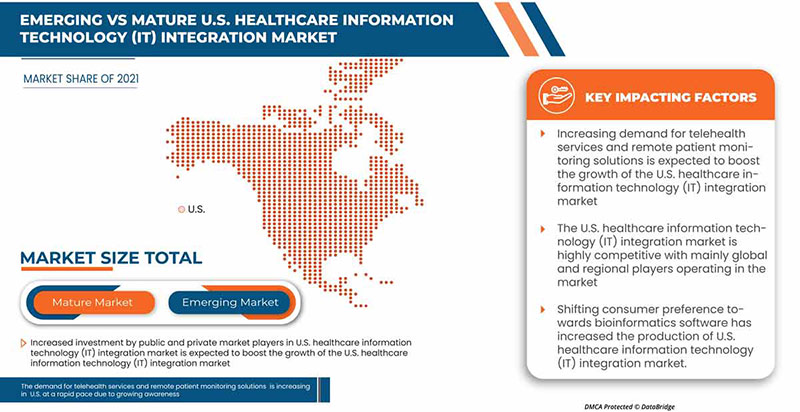

慢性疾患の診断と治療のための臨床試験画像診断における技術の進歩が市場の成長を牽引すると予想されています。Data Bridge Market Research は、米国のヘルスケア情報技術 (IT) 統合市場は、2022 年から 2029 年の予測期間中に 13.7% の CAGR で成長すると分析しています。

|

レポートメトリック |

詳細 |

|

予測期間 |

2022年から2029年 |

|

基準年 |

2021 |

|

歴史的な年 |

2020 (2019~2014 にカスタマイズ可能) |

|

定量単位 |

収益は百万米ドル、価格は米ドル |

|

対象セグメント |

製品とサービス別(製品とサービス)、アプリケーション別(医療機器統合、社内統合、病院統合、研究室統合、診療所統合、放射線科統合)、施設規模別(大規模、中規模、小規模)、購入形態別(グループ購入組織および個人)、エンドユーザー別(病院、研究室、診断センター、放射線科センター、診療所) |

|

対象国 |

私たち |

|

対象となる市場プレーヤー |

Lyniate、Redox, Inc.、carepoint health、Nextgen Healthcare Inc.、Interfaceware, Inc.、Koninklijke Philips、Oracle、AVI-SPL, INC.、Allscripts Healthcare solutions, Inc、Epic systems corporation、Qualcomm life Inc.、Capsule technologies Inc.、Orion health、Quality syetems, Inc.、Cerner corporation、Intersystems corporation、intersystem corporation、Infor Inc.、GE Healthcare、MCKESSON Corporation、Meditech など |

市場の定義

ヘルスケア IT 統合は、ヘルスケア業界向けの情報システムの設計、開発、作成、使用、保守に関わる IT の領域です。自動化され相互運用可能なヘルスケア情報システムは、医療と公衆衛生の向上、コストの削減、効率の向上、エラーの削減、患者満足度の向上に引き続き貢献するとともに、外来および入院医療提供者への診療報酬の最適化も実現します。ヘルスケア IT の重要性は、患者ケアの質に影響を与える進化するテクノロジーと変化する政府政策の組み合わせから生まれます。

医療 IT 統合製品には、インターフェイス/統合エンジン、医療機器統合ソフトウェア、メディア統合ソリューションとサービス、実装と統合、サポートとメンテナンス、トレーニングと教育、コンサルティングなどがあります。医療 IT により、医療提供者は医療情報を安全に使用および共有することで、患者のケアをより適切に管理できるようになります。ほとんどのアメリカ人向けに安全でプライベートな電子医療記録 (EHR) を開発し、必要なときに必要な場所で電子的に医療情報を利用できるようにすることで、医療 IT は医療の質を向上させると同時に、医療のコスト効率を高めることができます。医療 IT の助けにより、医療提供者は患者の健康に関する正確で完全な情報を得ることができます。こうすることで、医療提供者は定期診察でも医療上の緊急事態でも、可能な限り最高のケアを提供できます。患者が深刻な病状を抱えている場合、これは特に重要であり、インターネットを介して患者とその家族と情報を安全に共有する方法です。

患者とその家族は、健康上の問題の診断、医療ミスの削減、より低コストでより安全なケアの提供に役立つ医療情報に関する決定に全面的に参加することができます。予測期間中、医療 IT 統合における技術開発が市場の成長を牽引すると予想されます。

米国のヘルスケア情報技術 (IT) 統合市場の動向

ドライバー

- 電子健康記録やその他の医療ITソリューションの急速な導入

患者データは複雑で機密性が高く、構造化されていないことがよくあります。この情報を医療提供プロセスに組み込むことは、患者ケアを改善する機会を実現するために解決しなければならない課題です。電子健康記録 (HER) は 10 年以上使用されていますが、患者データのセキュリティを向上させるための各国政府の取り組みにより、市場は最近加速しています。

例えば、

- 2021年6月、米国の国立衛生研究所(NIH)などの保健資金提供機関は、デジタルヘルスケアITソリューションに資金を提供した。

- 2020年3月、国立医療情報技術調整官室(ONC)は、医療情報技術(Health IT)における最先端加速プロジェクト(LEAP)の下での資金提供機会(NOFO)に関する報告書を発行しました。

IT サービスは、病院、看護部門、薬局、健康保険会社など、医療システム全体のさまざまなエンドユーザーを統合するのに役立ちます。ただし、このデータの統合とリアルタイムでの利用は、医療専門家が効果的な意思決定を行うために不可欠です。電子健康記録やその他の医療 IT ソリューションの急速な導入により、市場の成長が促進されると予想されます。

- 遠隔医療サービスと遠隔患者モニタリングソリューションの需要増加

現在、遠隔医療サービスはモニタリングとコンサルティングの目的で求められています。ヘルスケア ソリューションの進歩により、教育コンテンツの提供や患者と医療提供者間の途切れないコミュニケーションの確保が可能になりました。遠隔患者モニタリング ソリューションの運用が成功するかどうかは、医療機器と情報通信技術 (ICT) 機器の統合が成功し、遠距離での医療サービスの提供が可能になるかどうかにかかっています。

例えば、

- 2021年、米国保健福祉省の報告書によると、メディケアの遠隔医療の利用は2019年から2020年の間に63倍に増加したことが判明した。

- 2020年7月、ヨーロッパではHIMSSとシーメンス・ヘルスシナーズが実施した調査で、COVID-19の発生直前に医療施設の93%が少なくとも1種類の遠隔医療サービスまたはソリューションを導入していたことが判明した。

技術の進歩により、これらのソリューションは遠隔モニタリングと患者のコンプライアンス、ひいては生活の質の向上に重要な役割を果たしています。したがって、遠隔モニタリング ソリューションと遠隔デバイスに対する需要の高まりは、今後数年間で米国の医療情報技術 (IT) 統合ソリューション プロバイダーの成長を促進すると予想されます。

機会

- 早期の医療決定と臨床意思決定支援

テクノロジーは、医療をより正確にし、ケアの提供方法を形作る上で重要な役割を果たすヘルスケアを改善しサポートするための扉を開きました。AI、ロボット工学、自動化などの革新的なテクノロジーは、精密医療の拡大、ケアの提供方法の変革、患者体験の向上に不可欠な要素です。

例えば、

- 2020年、国立バイオテクノロジー情報センター(NCBI)によると、臨床意思決定支援システム(CDSS)は、対象を絞った臨床知識、患者情報、その他の健康情報を使用して医療上の意思決定を強化することで、医療サービスを改善することを目的としています。

医療上の決定は、市場におけるより優れた高度な医療用画像製品の開発に大きく影響するため、主に有益です。したがって、早期の医療上の決定と臨床上の意思決定サポートの急増により、市場に大きなチャンスが生まれることが期待されます。

- Increasing awareness among people

Healthcare IT Integration offers alternative options for receiving healthcare services U.S.ly, improving access and reducing costs associated with traveling for services. However, the full potential of healthcare IT has not been realized with slow and fragmented uptake.

For instance,

- In 2019, According to National Centre for Biotech Information (NCBI) the Software for the Evolution of Knowledge in Medicine (SEKMED) is an interactive and dynamic working Web platform employing a multidimensional approach to knowledge, which considers the various dimensions linked to clinical practice such as scientific, organizational, professional, and experiential. The solution also allows collaboration and interactions through an iterative and continuous process of knowledge generation supported by the involvement of CoP.

These awareness programs and events have raised the market growth and providing opportunities for the companies to grow as these awareness programs or publications helps people to get the needs or requirements of the healthcare IT integration.

Restraints/Challenges

- High costs associated with integrated IT solutions

High upfront acquisition costs, ongoing maintenance costs, and disruptions to workflows that contribute to temporary losses act as a restrain for the market growth.

For instance,

- According to ScienceSoft USA Corporation, cost of ultrasound software is USD 30,000 to integrate a healthcare solution with one EHR system is required and USD 150,000 is required to enable EHR integration capabilities of a software product.

Moreover, maintenance and support costs after the EHR integration implementation are expected to further hinder the market growth.

- Data integration related challenges

Information related to patients have created from different departments and at all points of treatment within the healthcare organization, making it more highly information-intensive industry and reliable patient records, However, it is essential to give reliable information by combining huge amounts of data in order to produce comprehensive and trustworthy patient records. Because a variety of medical equipment and diagnostic instruments are used in healthcare systems and is a growing need to connect all of these systems in to assist healthcare practitioners in responding quickly at various care delivery points.

For instance,

- In October 2016, According to the Published report in 2016 International Conference on Innovations in Science, Engineering and Technology (ICISET), they mentioned and analyzed different problems for healthcare data integration in Bangladesh to develop a national level health data warehouse for the citizen and Discovering the hidden knowledge from different health data repositories requires the integration of health data from widely diversified sources.

COVID-19 Impact on the U.S. Healthcare Information Technology (IT) Integration Market

Diagnostic imaging services have been time-consuming and complicated by the need for strict infection control and prevention practices developed to contain the risk of transmission and protect healthcare personnel. Hence, the decision to image suspected patients or COVID-19-positive patients is based on their impact on the improvement of patient status. The use of health information technology (HIT) during the coronavirus disease 2019 (COVID-19) pandemic has rapidly increased. During the pandemic, HIT has been used to provide telehealth services, education on the severe acute respiratory syndrome coronavirus 2 disease, updates on epidemiology and treatments, and most recently, access to scheduling systems for the COVID-19 vaccines.

Recent Developments

- In August 2022, Oracle announced the availability of Rapid direct connections to Oracle Cloud Infrastructure (OCI) that helps Internet2 member institutions make a move to the cloud. Through an Internet2 Cloud Connect dedicated network connection, institutions can utilize their existing Internet2 connections to extend their data center to OCI in a matter of days for no additional fee from Internet2 for up to 5Gbps. This makes it easy for organizations to access and use cloud resources to support research, collaboration, and the academic enterprise without significant new investments.

- In June 2022, Epic Systems Corporation has announced its plan to join a new health information exchange framework to improve health data interoperability across the country. The Trusted Exchange Framework and Common Agreement (TEFCA) have brought information networks together to help ensure that all people benefit from complete, longitudinal health records wherever they receive care. This has helped company to expand its business.

U.S. Healthcare Information Technology (IT) Integration Market Scope

The U.S. healthcare information technology (IT) integration market is segmented into five notable segments based on product and services, application, facility size, purchase mode, and end user. The growth amongst these segments will help you analyze meager growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Products and Services

- Services

- Product

Based on product and services, the market is segmented into services and product.

Application

- Medical Device Integration

- Internal Integration

- Hospital Integration

- Lab Integration

- Clinics Integration

- Radiology Integration

- Other Applications

Based on application, the market is segmented into medical device integration, internal integration, hospital integration, lab integration, clinics integration, radiology integration and other applications.

Facility Size

- Large

- Medium

- Small

Based on facility size, the market is segmented into large, medium and small.

Purchase Mode

- グループ購入組織

- 個人

購入モードに基づいて、市場はグループ購入組織と個人に分類されます。

エンドユーザー

- 病院

- 研究室

- 診断センター

- 放射線科センター

- クリニック

- その他

エンドユーザーに基づいて、市場は病院、研究所、診断センター、放射線センター、診療所、その他に分類されます。

米国ヘルスケア情報技術 (IT) 統合市場の地域分析/洞察

米国のヘルスケア情報技術 (IT) 統合市場が分析され、上記のように地域、製品とサービス、アプリケーション、施設の規模、購入モード、エンドユーザー別に市場規模の洞察と傾向が提供されます。

この市場レポートで取り上げられている国は米国です

米国は、ヘルスケア IT 統合における最新の高度なテクノロジーと発明により、市場を支配すると予想されています。

レポートの国別セクションでは、市場の現在および将来の傾向に影響を与える国内市場における個別の市場影響要因と規制の変更も提供しています。新規販売、交換販売、国の人口統計、疾病疫学、輸出入関税などのデータ ポイントは、各国の市場シナリオを予測するために使用される主要な指標の一部です。また、国別データの予測分析を提供する際には、北米ブランドの存在と可用性、および販売チャネルに影響を与える地元および国内ブランドとの競争が激しいか少ないために直面する課題も考慮されます。

競争環境と米国の医療情報技術 (IT) 統合市場シェア分析

米国のヘルスケア情報技術 (IT) 統合市場の競争状況は、競合他社の詳細を提供します。詳細には、企業概要、企業の財務状況、収益、市場の可能性、研究開発への投資、新しい市場への取り組み、北米でのプレゼンス、生産拠点と施設、生産能力、企業の強みと弱み、製品の発売、製品の幅と広さ、アプリケーションの優位性などが含まれます。上記のデータ ポイントは、米国のヘルスケア情報技術 (IT) 統合市場に関連する企業の重点にのみ関連しています。

この市場で活動している主要企業には、Lyniate、Redox, Inc.、carepoint health、Nextgen Healthcare Inc.、Interfaceware, Inc.、Koninklijke Philips、Oracle、AVI-SPL, INC.、Allscripts Healthcare solutions, Inc、Epic systems corporation、Qualcomm life Inc.、Capsule technologies Inc.、Orion health、Quality syetems, Inc.、Cerner corporation、Intersystems corporation、intersystem corporation、Infor Inc.、GE Healthcare、MCKESSON Corporation、Meditech などがあります。

SKU-

世界初のマーケットインテリジェンスクラウドに関するレポートにオンラインでアクセスする

- インタラクティブなデータ分析ダッシュボード

- 成長の可能性が高い機会のための企業分析ダッシュボード

- カスタマイズとクエリのためのリサーチアナリストアクセス

- インタラクティブなダッシュボードによる競合分析

- 最新ニュース、更新情報、トレンド分析

- 包括的な競合追跡のためのベンチマーク分析のパワーを活用

目次

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF U.S. HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 MULTIVARIATE MODELLING

2.7 MARKET APPLICATION COVERAGE GRID

2.8 PRODUCT AND SERVICES LIFELINE CURVE

2.9 DBMR MARKET POSITION GRID

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHT

4.1 POTENTIAL HEALTHCARE IT TECHNOLOGIES

4.1.1 ELECTRONIC HEALTH RECORDS (EHRS)

4.1.2 ELECTRONIC MEDICAL RECORDS (EMRS)

4.1.3 ARTIFICIAL INTELLIGENCE (AI)

4.1.4 TELEMEDICINE

5 U.S. HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET SHARE ANALYSIS-

6 REGULATIONS

7 MARKET OVERVIEW

7.1 DRIVERS

7.1.1 RAPID ADOPTION OF ELECTRONIC HEALTH RECORDS AND OTHER HEALTHCARE IT SOLUTIONS

7.1.2 GROWING DEMAND FOR TELEHEALTH SERVICES AND REMOTE PATIENT MONITORING SOLUTIONS

7.1.3 GROWING REQUIREMENT OF TELEHEALTH SERVICES ACROSS HEALTHCARE SECTOR

7.2 RESTRAINTS

7.2.1 ISSUES ASSOCIATED WITH INTEROPERABILITY

7.2.2 HIGH COSTS ASSOCIATED WITH INTEGRATED IT SOLUTIONS

7.3 OPPORTUNITIES

7.3.1 EARLY MEDICAL DECISIONS AND CLINICAL DECISION SUPPORT

7.3.2 DATA UNIFORMITY AND STANDARDIZED DATA EXCHANGE

7.3.3 INCREASING AWARENESS AMONG PEOPLE

7.4 CHALLENGES

7.4.1 DATA INTEGRATION RELATED CHALLENGES

7.4.2 RISING HEALTHCARE FRAUDS

8 U.S. HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT AND SERVICES

8.1 OVERVIEW

8.2 SERVICES

8.2.1 SUPPORT & MAINTENANCE

8.2.2 IMPLEMENTATION & INTEGRATION

8.2.3 TRAINING & EDUCATION

8.2.4 CONSULTING

8.3 PRODUCT

8.3.1 INTERFACE/INTEGRATION ENGINES

8.3.1.1 Group Purchase Organization

8.3.1.2 Individual

8.3.2 MEDICAL DEVICE INTEGRATION SOFTWARE

8.3.2.1 Group Purchase Organization

8.3.2.2 Individual

8.3.3 MEDIA INTEGRATION SOLUTIONS

8.3.3.1 Group Purchase Organization

8.3.3.2 Individual

8.3.4 OTHER INTEGRATION TOOLS

9 U.S. HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY APPLICATION

9.1 OVERVIEW

9.2 MEDICAL DEVICE INTEGRATION

9.3 HOSPITAL INTEGRATION

9.4 INTERNAL INTEGRATION

9.5 RADIOLOGY INTEGRATION

9.6 LAB INTEGRATION

9.7 CLINICS INTEGRATION

9.8 OTHERS

10 U.S. HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY FACILITY SIZE

10.1 OVERVIEW

10.2 LARGE

10.3 MEDIUM

10.4 SMALL

11 U.S. HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PURCHASE MODE

11.1 OVERVIEW

11.2 GROUP PURCHASE ORGANIZATION

11.3 INDIVIDUAL

12 U.S. HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY END USER

12.1 OVERVIEW

12.2 HOSPITAL

12.3 DIAGNOSTIC CENTERS

12.4 RADIOLOGY CENTERS

12.5 LABORATORY

12.6 CLINICS

12.7 OTHERS

13 U.S. HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET: COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: U.S.

14 SWOT ANALYSIS

15 COMPANY PROFILE

15.1 ORACLE (BOTH PROVIDERS)

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 PRODUCT PORTFOLIO

15.1.4 RECENT DEVELOPMENTS

15.2 EPIC SYSTEMS CORPORATION (EMR PROVIDERS)

15.2.1 COMPANY SNAPSHOT

15.2.2 PRODUCT PORTFOLIO

15.2.3 RECENT DEVELOPMENT

15.3 GENERAL ELECTRIC

15.3.1 COMPANY SNAPSHOT

15.3.2 REVENUE ANALYSIS

15.3.3 PRODUCT PORTFOLIO

15.3.4 RECENT DEVELOPMENTS

15.4 IBM (INTEGRATION PROVIDERS)

15.4.1 COMPANY SNAPSHOT

15.4.2 REVENUE ANALYSIS

15.4.3 PRODUCT PORTFOLIO

15.4.4 RECENT DEVELOPMENTS

15.5 SIEMENS HEALTHCARE GMBH (INTEGRATION PROVIDERS)

15.5.1 COMPANY SNAPSHOT

15.5.2 REVENUE ANALYSIS

15.5.3 PRODUCT PORTFOLIO

15.5.4 RECENT DEVELOPMENTS

15.6 ALLSCRIPTS HEALTHCARE, LLC AND/OR ITS AFFILIATES. (EMR PROVIDERS)

15.6.1 COMPANY SNAPSHOT

15.6.2 REVENUE ANALYSIS

15.6.3 PRODUCT PORTFOLIO

15.6.4 RECENT DEVELOPMENTS

15.7 COGNIZANT (INTEGRATION PROVIDERS)

15.7.1 COMPANY SNAPSHOT

15.7.2 REVENUE ANALYSIS

15.7.3 PRODUCT PORTFOLIO

15.7.4 RECENT DEVELOPMENTS

1.5 INFOR.

15.7.5 COMPANY SNAPSHOT

15.7.6 PRODUCT PORTFOLIO

15.7.7 RECENT DEVELOPMENT

15.8 INTERSYSTEM CORPORATION (INTRGRATION PROVIDERS)

15.8.1 COMPANY SNAPSHOT

15.8.2 PRDUCT PORTFOLIO

15.8.3 RECENT DEVELOPMENTS

15.9 INTERFACEWARE INC.(INTEGRATION PROVIDERS)

15.9.1 COMPANY SNAPSHOT

15.9.2 PRODUCT PORTFOLIO

15.9.3 RECENT DEVELOPMENTS

15.1 KONNKLIJKE PHILIPS N.V. (2021) (BOTH PROVIDERS)

15.10.1 COMPANY SNAPSHOT

15.10.2 REVENUE ANALYSIS

15.10.3 PRODUCT PORTFOLIO

15.10.4 RECENT DEVELOPMENTS

15.11 LYNIATE

15.11.1 COMPANY SNAPSHOT

15.11.2 PRODUCT PORTFOLIO

15.11.3 RECENT DEVELOPMENTS

15.12 MASIMO (2021) (INTEGRATION PROVIDERS)

15.12.1 COMPANY SNAPSHOT

15.12.2 REVENUE ANALYSIS

15.12.3 PRODUCT PORTFOLIO

15.12.4 RECENT DEVELOPMENT

15.13 MDI SOLUTIONS (INTGRATION PROVIDERS)

15.13.1 COMPANY SNAPSHOT

15.13.2 PRODUCT PORTFOLIO

15.13.3 RECENT DEVELOPMENTS

15.14 MEDICAL INFORMATION TECHNOLOGY, INC. (EMR PROVIDERS)

15.14.1 COMPANY SNAPSHOT

15.14.2 PRODUCT PORTFOLIO

15.14.3 RECENT DEVELOPMENTS

15.15 NXGN MANAGEMENT, LLC (EMR PROVIDERS)

15.15.1 COMPANY SNAPSHOT

15.15.2 REVENUE ANALYSIS

15.15.3 PRODUCT PORTFOLIO

15.15.4 RECENT DEVELOPMENTS

15.16 ORION HEALTH GROUP (INTEGRATION PROVIDERS)

15.16.1 COMPANY SNAPSHOT

15.16.2 REVENUE ANALYSIS

1.11.3. PRODUCT PORTFOLIO 115

15.16.3 RECENT DEVELOPMENTS

15.17 REDOX, INC.(INTEGRATION PROVIDERS)

15.17.1 COMPANY SNAPSHOT

15.17.2 PRODUCT PORTFOLIO

15.17.3 RECENT DEVELOPMENTS

15.18 SUMMIT HEALTHCARE SERVICES, INC.(INTEGRATION PROVIDERS)

15.18.1 COMPANY SNAPSHOT

15.18.2 PRODUCT PORTFOLIO

15.18.3 RECENT DEVELOPMENTS

15.19 QVERA (INTEGRATION PROVIDERS)

15.19.1 COMPANY SNAPSHOT

15.19.2 PRODUCT PORTFOLIO

15.19.3 RECENT DEVELOPMENTS

16 QUESTIONNAIRE

17 RELATED REPORTS

表のリスト

TABLE 1 U.S. HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 2 U.S. SERVICES IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 3 U.S. PRODUCT IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 4 U.S. INTERFACE/INTEGRATION ENGINES IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 5 U.S. MEDICAL DEVICE INTEGRATION SOFTWARE IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 6 U.S. MEDIA INTEGRATION SOLUTIONS IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 7 U.S. HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 8 U.S. HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY FACILITY SIZE, 2020-2029 (USD MILLION)

TABLE 9 U.S. HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PURCHASE MODE, 2020-2029 (USD MILLION)

TABLE 10 U.S. HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY END USER, 2020-2029 (USD MILLION)

図表一覧

FIGURE 1 U.S. HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET: SEGMENTATION

FIGURE 2 U.S. HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET: DATA TRIANGULATION

FIGURE 3 U.S. HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET: DROC ANALYSIS

FIGURE 4 U.S. HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET: REGIONAL VS COUNTRY MARKET ANALYSIS

FIGURE 5 U.S. HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 U.S. HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 U.S. HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 8 U.S. HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET: DBMR MARKET POSITION GRID

FIGURE 9 U.S. HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET: SEGMENTATION

FIGURE 10 GROWING DEMAND FOR HEALTHCARE IT SOLUTIONS, TELEHEALTH SERVICES, AND REMOTE PATIENT MONITORING SOLUTIONS ARE EXPECTED TO DRIVE THE U.S. HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 11 SERVICES SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE U.S. HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET FROM 2022 TO 2029

FIGURE 12 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF U.S. HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET

FIGURE 13 U.S. HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET: BY PRODUCT AND SERVICES, 2021

FIGURE 14 U.S. HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET: BY PRODUCT AND SERVICES, 2022-2029 (USD MILLION)

FIGURE 15 U.S. HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET: BY PRODUCT AND SERVICES, CAGR (2022-2029)

FIGURE 16 U.S. HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET: BY PRODUCT AND SERVICES, LIFELINE CURVE

FIGURE 17 U.S. HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET: BY APPLICATION, 2021

FIGURE 18 U.S. HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET: BY APPLICATION, 2022-2029 (USD MILLION)

FIGURE 19 U.S. HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET: BY APPLICATION, CAGR (2022-2029)

FIGURE 20 U.S. HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET: BY APPLICATION, LIFELINE CURVE

FIGURE 21 U.S. HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET: BY FACILITY SIZE, 2021

FIGURE 22 U.S. HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET: BY FACILITY SIZE, 2022-2029 (USD MILLION)

FIGURE 23 U.S. HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET: BY FACILITY SIZE, CAGR (2022-2029)

FIGURE 24 U.S. HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET: BY FACILITY SIZE, LIFELINE CURVE

FIGURE 25 U.S. HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET: BY PURCHASE MODE, 2021

FIGURE 26 U.S. HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET: BY PURCHASE MODE, 2022-2029 (USD MILLION)

FIGURE 27 U.S. HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET: BY PURCHASE MODE, CAGR (2022-2029)

FIGURE 28 U.S. HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET: BY PURCHASE MODE, LIFELINE CURVE

FIGURE 29 U.S. HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET: BY END USER, 2021

FIGURE 30 U.S. HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET: BY END USER, 2022-2029 (USD MILLION)

FIGURE 31 U.S. HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET: BY END USER, CAGR (2022-2029)

FIGURE 32 U.S. HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET: BY END USER, LIFELINE CURVE

FIGURE 33 U.S. HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET: COMPANY SHARE 2021 (%)

調査方法

データ収集と基準年分析は、大規模なサンプル サイズのデータ収集モジュールを使用して行われます。この段階では、さまざまなソースと戦略を通じて市場情報または関連データを取得します。過去に取得したすべてのデータを事前に調査および計画することも含まれます。また、さまざまな情報ソース間で見られる情報の不一致の調査も含まれます。市場データは、市場統計モデルと一貫性モデルを使用して分析および推定されます。また、市場シェア分析と主要トレンド分析は、市場レポートの主要な成功要因です。詳細については、アナリストへの電話をリクエストするか、お問い合わせをドロップダウンしてください。

DBMR 調査チームが使用する主要な調査方法は、データ マイニング、データ変数が市場に与える影響の分析、および一次 (業界の専門家) 検証を含むデータ三角測量です。データ モデルには、ベンダー ポジショニング グリッド、市場タイムライン分析、市場概要とガイド、企業ポジショニング グリッド、特許分析、価格分析、企業市場シェア分析、測定基準、グローバルと地域、ベンダー シェア分析が含まれます。調査方法について詳しくは、お問い合わせフォームから当社の業界専門家にご相談ください。

カスタマイズ可能

Data Bridge Market Research は、高度な形成的調査のリーダーです。当社は、既存および新規のお客様に、お客様の目標に合致し、それに適したデータと分析を提供することに誇りを持っています。レポートは、対象ブランドの価格動向分析、追加国の市場理解 (国のリストをお問い合わせください)、臨床試験結果データ、文献レビュー、リファービッシュ市場および製品ベース分析を含めるようにカスタマイズできます。対象競合他社の市場分析は、技術ベースの分析から市場ポートフォリオ戦略まで分析できます。必要な競合他社のデータを、必要な形式とデータ スタイルでいくつでも追加できます。当社のアナリスト チームは、粗い生の Excel ファイル ピボット テーブル (ファクト ブック) でデータを提供したり、レポートで利用可能なデータ セットからプレゼンテーションを作成するお手伝いをしたりすることもできます。