米国袋入り馬用飼料市場の規模、シェア、トレンド分析レポート

Market Size in USD Billion

CAGR :

%

USD

8.46 Billion

USD

12.93 Billion

2024

2032

USD

8.46 Billion

USD

12.93 Billion

2024

2032

| 2025 –2032 | |

| USD 8.46 Billion | |

| USD 12.93 Billion | |

|

|

|

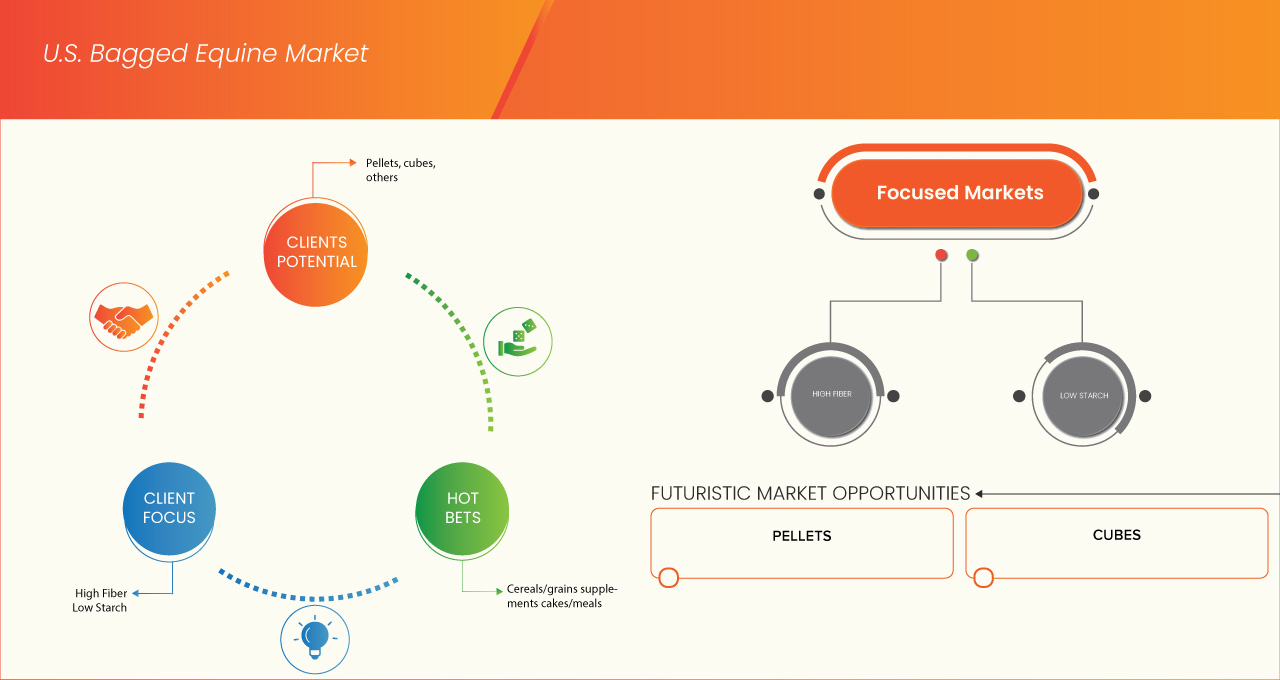

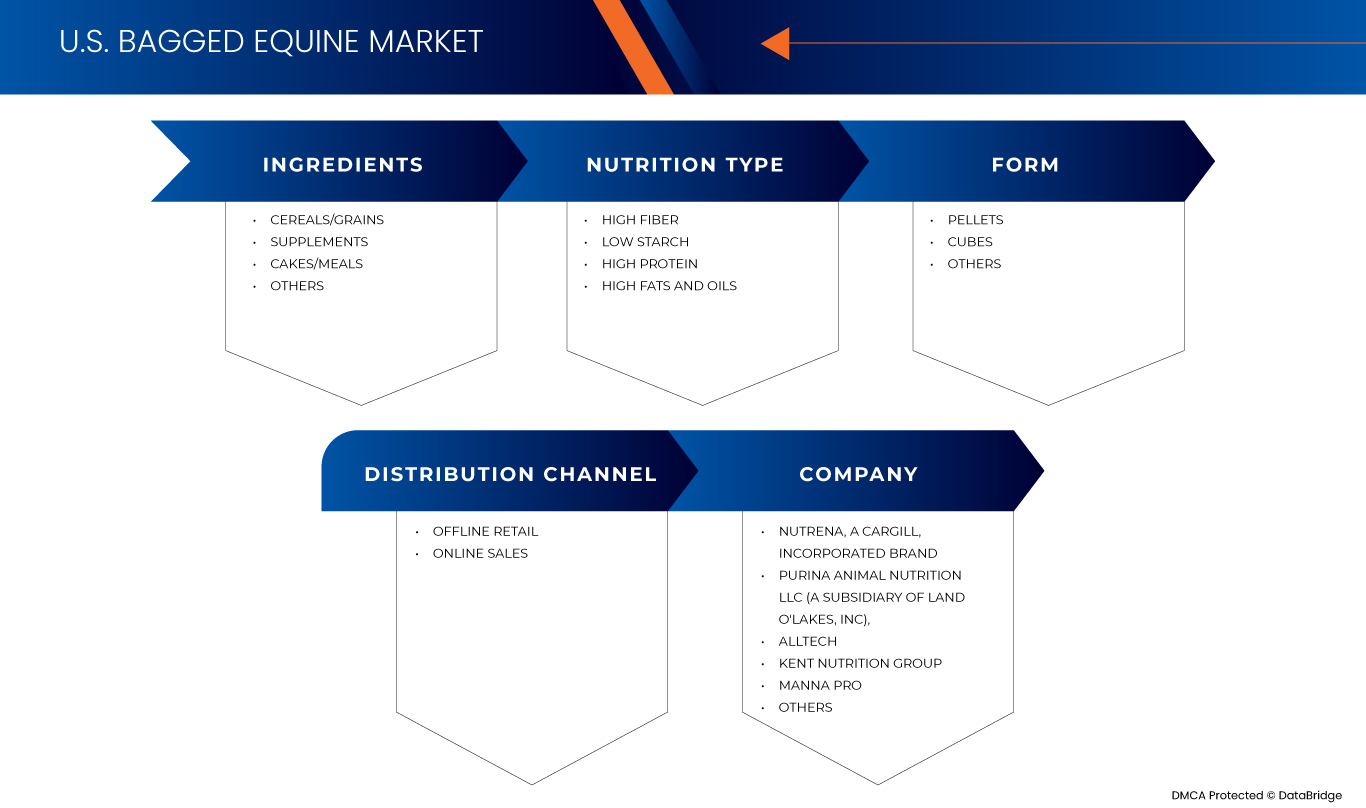

米国の袋入り馬用飼料市場のセグメンテーション、製品別(原材料別(穀物、サプリメント、ケーキ/ミール、その他)、栄養タイプ別(高繊維、低デンプン、高タンパク質、高脂肪・油)、形態別(ペレット、キューブ、その他)、流通チャネル別(オフライン小売およびオンライン販売) - 業界動向と2032年までの予測

米国の袋入り馬用飼料市場分析

米国の袋入り馬用飼料市場は、馬主、ブリーダー、そして乗馬のプロを顧客とし、幅広い動物飼料業界の重要なセグメントを占めています。馬用飼料とは、馬やその他の馬の食事ニーズ、健康、そしてパフォーマンスをサポートするために特別に配合された栄養製品を指します。穀物、粗飼料、サプリメント、ビタミン、ミネラルなど、様々な原料から構成される馬用飼料は、馬の自然な食事では不足しがちな必須栄養素を補うように設計されています。ペレット状、テクスチャード加工、キューブ状など、様々な形態で提供されており、馬の様々な活動、ライフステージ、そして健康状態のニーズに合わせて調整されています。馬主は、寿命、コンディション、そしてパフォーマンスのために栄養を重視しており、オーガニック、非遺伝子組み換え、そしてカスタマイズされた飼料への需要が市場の成長を後押ししています。詳細な分析は以下の通りです。

米国の袋入り馬用飼料市場規模

米国の袋入り馬用飼料市場規模は、2024年に84億6,000万米ドルと評価され、2032年には129億3,000万米ドルに達すると予測されており、2024年から2032年の予測期間中に5.5%のCAGRで成長します。市場価値、成長率、セグメンテーション、地理的範囲、主要プレーヤーなどの市場シナリオに関する洞察に加えて、データブリッジ市場調査がまとめた市場レポートには、輸出入分析、生産能力概要、生産消費分析、価格動向分析、気候変動シナリオ、サプライチェーン分析、バリューチェーン分析、原材料/消耗品概要、ベンダー選択基準、PESTLE分析、ポーター分析、規制枠組みも含まれています。

米国の袋入り馬用飼料市場の動向

「馬のライフステージや活動に応じた高品質で特殊な飼料の需要の高まり」

高品質で特殊な馬用飼料への需要の高まりは、馬の飼育と管理における大きな変化を反映しており、馬主が最適な健康状態、パフォーマンス、そして長寿を重視する傾向が見られます。馬は骨の成長と筋肉の発達を促すため、高タンパク質でカルシウムを豊富に含む飼料を必要とします。適度なエネルギーレベル、食物繊維、そして維持と作業効率を高める必須栄養素を含むバランスの取れた食事が求められます。この傾向は、馬のライフステージ、活動、そして個々のニーズに合わせた栄養管理を重視しており、馬用飼料業界にとって成長の機会を示唆しています。

レポートの範囲と米国の袋入り馬用飼料 市場のセグメンテーション

|

属性 |

米国の袋入り馬用飼料 市場の洞察 |

|

対象セグメント |

|

|

主要な市場プレーヤー |

Nutrena(Cargill, Incorporatedブランド、米国)、Purina Animal Nutrition LLC(Land O'Lakes, Inc.の子会社)(米国)、Alltech(米国)、Kent Nutrition Group(米国)、Manna Pro(米国)、Wallnut Hill Feeds, Inc.(米国)、Seminole Feed(米国)、Hi-Pro Feeds(米国)、Midway Co-Op(米国)、Star Milling CO(米国)、Gain Animal Nutrition(米国) |

|

市場機会 |

|

|

付加価値データ情報セット |

データブリッジマーケットリサーチがまとめた市場レポートには、市場価値、成長率、セグメンテーション、地理的範囲、主要プレーヤーなどの市場シナリオに関する洞察に加えて、輸出入分析、生産能力概要、生産消費分析、価格動向分析、気候変動シナリオ、サプライチェーン分析、バリューチェーン分析、原材料/消耗品概要、ベンダー選択基準、PESTLE分析、ポーター分析、規制枠組みも含まれています。 |

米国の袋入り馬用飼料市場の定義

馬飼料とは、馬やその他の馬類の食事ニーズ、健康、そしてパフォーマンスをサポートするために特別に配合された栄養製品を指します。穀物、粗飼料、サプリメント、ビタミン、ミネラルなど、様々な原料から構成される馬飼料は、馬の自然な食事では不足しがちな必須栄養素を補給するように設計されています。ペレット状、テクスチャード加工、キューブ状など、様々な形状で提供されており、馬の様々な活動、ライフステージ、そして健康状態のニーズに合わせて調整されています。適切にバランスの取れた馬飼料は、馬の成長、活力、そして全体的な健康状態を最適に促進するため、馬の管理とケアにおいて不可欠な要素となっています。

米国の袋入り馬用飼料市場の動向

ドライバー

- ペットの人間化トレンドの高まり

ペットの人間化トレンドの高まりは、馬の飼い主が馬を家族の一員として扱うことが増えていることから、米国の袋入り馬用飼料市場を大きく牽引しています。こうした考え方の変化は、愛馬の健康と幸福を最優先する、高品質で栄養価の高い飼料配合への投資意欲の高まりにつながっています。消費者は馬用飼料の原料についてより厳しい目を持つようになり、天然、オーガニック、そして高品質な原料を使用した製品を求めています。その結果、年齢、品種、活動レベルなど、個々の馬のニーズに合わせた特別な栄養ソリューションへの需要が高まり、馬の健康とパフォーマンス全体への配慮が高まっています。

例えば、

- 2024年4月、米国疾病予防管理センター(CDC)が発表した記事によると、米国では約200万世帯が馬を所有していると報告されています。さらに、乗馬や馬と触れ合うことは、バランス感覚、自信、そして自尊心を高める効果があることが示されています。

さらに、人間化のトレンドは、馬主と馬の間に強い感情的な絆を育むことで、消費者の購買決定とブランドロイヤルティに影響を与えます。馬主は馬の生活の質をますます重視するようになり、倫理的な調達、持続可能性、そして動物福祉を重視するブランドに惹かれる傾向があります。ソーシャルメディアやオンラインコミュニティの存在はこのトレンドを加速させ、馬主は栄養に関する洞察や推奨事項を共有できるようになり、プレミアムな袋入り馬用飼料製品の需要をさらに押し上げています。結果として、質の高いケア、個々のニーズに合わせた栄養、そして倫理的な慣行への重点が市場の成長につながっています。

- 馬の個体数増加

米国における馬の頭数増加は重要な役割を果たしています。馬の頭数増加は、専門的な栄養製品への需要の増加に直接つながるからです。馬の健康、パフォーマンス、そして寿命を支えるために高品質の飼料の重要性を認識するオーナーが増えるにつれ、袋入り馬用飼料市場は拡大を続けています。乗馬、競技馬術、馬の飼育といった趣味の人気が高まり、馬のライフステージにおける栄養ニーズへの意識が高まるにつれ、多様でカスタマイズされた飼料製品の消費が進んでいます。さらに、この馬の頭数増加は、メーカーによる革新と製品の多様化を促し、競争をさらに激化させ、市場における製品の入手可能性を高めています。

例えば、

- 2023年1月、The Pharma Innovation Journalに掲載された記事によると、競走馬は、よく訓練されたアスリートの身体を発達させるために必要なタンパク質、エネルギー、ビタミンなどの栄養素を摂取しています。さらに、激しい運動をする馬、成長期の馬、妊娠中の馬、授乳中の馬は、食事により多くのエネルギーとタンパク質を必要とします。

さらに、馬の飼育頭数の増加は馬のケアへの関心の高まりと相関関係にあり、関連製品やサービスの市場拡大につながっています。飼育される馬が増えるにつれて、専用の袋入り飼料の需要が高まり、特定の健康状態やパフォーマンスニーズを満たす飼料配合の革新が促進されます。小売業者やメーカーは、オーガニック、非遺伝子組み換え、パフォーマンスに特化した飼料など、多様な製品ラインを開発することで、この成長市場に対応する機会を認識しています。その結果、馬の飼育頭数の増加は、袋入り馬用飼料セクターの売上を押し上げるだけでなく、製品開発の進歩を促し、全国の馬主の変化するニーズに合わせた活気に満ちた競争の激しい市場を創出しています。

機会

- Eコマースの拡大

Eコマースの拡大は、米国の袋入り馬用飼料市場にとって大きなチャンスをもたらします。メーカーと小売業者は、地理的な制約を超えてより幅広い顧客層にリーチできるようになるからです。オンラインショッピングの普及に伴い、馬の飼い主は自宅にいながらにして、手軽に馬用飼料を閲覧・購入できるようになりました。こうした消費者行動の変化は、アクセス性を高め、ニッチブランドが大規模な実店舗を持たずに市場に参入する可能性を広げています。ユーザーフレンドリーなウェブサイトと効果的なオンラインマーケティング戦略に投資する企業は、より幅広い顧客基盤を獲得し、競争の激しい市場において売上成長を促進することができます。

さらに、eコマースプラットフォームは、ターゲットマーケティングやカスタマイズされたレコメンデーションを通じて、ブランドがよりパーソナライズされたショッピング体験を提供することを可能にします。データ分析と顧客インサイトを活用することで、企業は消費者の嗜好をより深く理解し、馬のオーナー特有のニーズに合わせて設計されたサブスクリプションサービスやまとめ買いオプションなどのカスタマイズされたサービスを導入できます。さらに、eコマースは、ブランドがソーシャルメディア、コンテンツマーケティング、教育リソースを通じて顧客と関わり、製品を中心とするコミュニティを構築する機会を提供します。こうしたエンゲージメントはブランドロイヤルティを高め、馬の栄養に関する信頼できる権威としてのブランドを確立し、消費者との長期的な関係を育み、リピート購入や市場シェアの拡大につながります。

- 動物飼料の生産および製造に関わる技術研究

動物飼料における技術研究は、馬の特定の栄養ニーズを満たす革新的で科学的に配合された製品の開発を可能にすることで、米国の袋入り馬用飼料市場に魅力的な機会をもたらします。栄養科学、バイオテクノロジー、そして飼料配合技術の進歩により、メーカーは馬の健康、パフォーマンス、そして全体的なウェルビーイングを最適化する飼料を開発することが可能になります。例えば、様々な原料の消化率を研究することで、栄養吸収を改善し、馬のパフォーマンスと健康状態を向上させる飼料の開発につながります。科学的イノベーションへの注力は、効果が実証されたプレミアム製品を提供することで、競争の激しい市場においてブランドが差別化を図ることを可能にし、ひいては愛馬のための質の高い栄養に投資する目の肥えた消費者の獲得につながります。

さらに、技術の進歩により、飼料生産のカスタマイズと精度が向上し、ペットおよび動物ケア業界ではパーソナライズされた栄養管理がますます重要になっています。データ分析、機械学習、人工知能を活用することで、企業は個々の馬のプロフィール、年齢、活動レベルに基づいた特定の食事ニーズに関する洞察を得ることができ、オーダーメイドの飼料ソリューションの開発が可能になります。このレベルのパーソナライズは飼料の有効性を高めるだけでなく、馬の飼い主が自分の馬のために特別に設計された製品を評価するため、ブランドと消費者の関係強化にもつながります。さらに、研究と技術への投資は、馬の健康に尽力する業界リーダーとしてのブランドの信頼性とポジショニングを高め、進化する袋入り馬用飼料市場における競争優位性を生み出すことにもつながります。

制約/課題

- 原材料費の上昇

馬のケア需要が高まるにつれ、手頃な価格の飼料を提供する新規参入企業が、コスト意識の高い馬主の注目を集めています。こうした低価格の代替品は、多くの場合、大手サプライヤーや国際的な生産者から供給されているため、既存の米国ブランドが市場シェアを維持するのは困難です。高級ブランドは品質、栄養価、安全性を重視していますが、特に経済が不安定な時期には、予算が厳しい馬主にとって、低価格の魅力は特に魅力的です。

さらに、低価格の代替品の急増は、消費者の購買行動の変化をもたらしています。多くの馬主は、高品質の飼料に伴う長期的なメリットよりも、短期的な節約を優先し、こうした手頃な価格の選択肢を選ぶ可能性があります。この傾向は、プレミアムな袋入り馬用飼料の売上に影響を与えるだけでなく、メーカーに価格戦略と製品ラインナップの見直しを迫っています。既存ブランドは、低価格の選択肢との競争に苦戦する中で、品質を妥協したり、マーケティングキャンペーンに投資したりせざるを得なくなる可能性があり、これは利益率をさらに低下させ、既に競争の激しい市場における成長を阻害する可能性があります。

- あらゆる種類の馬に適さないバッグ式馬具

袋入り馬用飼料は、馬の種類、年齢、活動レベルによって食事ニーズや栄養要件が異なるため、あらゆる馬に適さないという特性があり、米国の袋入り馬用飼料市場にとって大きな課題となっています。馬は、健康状態、トレーニングの強度、運動量に応じて、代謝率が異なり、特定の食事ニーズも異なります。例えば、競技馬、妊娠中の牝馬、高齢馬には、標準的な袋入り飼料とは異なる、特別に配合された飼料が必要になる場合があります。個々の馬に合わせた栄養供給ができないと、最適な健康状態が得られず、パフォーマンスが低下し、獣医費用が増加し、最終的には顧客満足度とブランドロイヤルティが低下する可能性があります。

したがって、この課題は市場の成長を阻害し、袋入り馬用飼料がすべての馬主にとって適切なソリューションであるという消費者の信頼を損ないます。さらに、この変化は袋入り製品の市場シェアを全体的に低下させ、企業はより専門的な配合の研究開発に投資せざるを得なくなり、そうでなければ特定の栄養ニーズに対応する競合他社に顧客を奪われるリスクを負うことになります。

米国の袋入り馬用飼料市場の展望

市場は、原材料、栄養タイプ、形態、流通チャネルに基づいてセグメント化されています 。これらのセグメント間の成長は、業界における成長の少ないセグメントの分析に役立ち、ユーザーに貴重な市場概要と市場洞察を提供し、コア市場アプリケーションを特定するための戦略的意思決定を支援します。

材料

- 穀物

- サプリメント

- ケーキ/食事

- その他

栄養タイプ

- 高繊維

- 低デンプン

- 高タンパク

- 高脂肪・高油脂

形状

- ペレット

- キューブ

- その他

流通チャネル

- オフライン小売

- オンライン販売

米国の袋入り馬用飼料市場シェア

市場競争環境は、競合他社ごとに詳細な情報を提供します。企業概要、財務状況、収益、市場ポテンシャル、研究開発投資、新規市場への取り組み、アジア太平洋地域におけるプレゼンス、生産拠点・設備、生産能力、強みと弱み、製品投入、製品群の幅広さ、アプリケーションにおける優位性などの詳細が含まれます。上記のデータは、各社の市場への注力分野にのみ関連しています。

米国の袋入り馬用飼料市場のリーダー企業は次のとおりです。

- Nutrena(カーギル社ブランド、米国)

- Purina Animal Nutrition LLC(Land O'Lakes, Inc.の子会社)(米国)

- オルテック(米国)

- ケントニュートリショングループ(米国)

- マナプロ(米国)

- ウォールナットヒルフィード社(米国)

- セミノールフィード(米国)

- Hi-Pro Feeds(米国)

- ミッドウェイ・コープ(米国)

- スターミリングCO(米国)

- ゲイン・アニマル・ニュートリション(米国)

米国の袋入り馬用飼料市場の最新動向

- 2024年9月、オールテックとエンバイロエクワインは、オールテックの技術をエンバイロエクワインのサプリメントに組み込むための戦略的ライセンス契約を発表しました。この契約により、製品の品質が向上し、北米とヨーロッパにおけるブランドプレゼンスの拡大につながりました。

- 2024年8月、オールテック傘下のハバード・フィードは、肉牛の飼料摂取量を最適化し、生産性と収益性を向上させる製品ライン「リチャージ」を発表しました。リチャージは、特にストレス下における牛の健康をサポートし、飼料効率と成長の改善が実証されています。

- 9月、Equine NetworkはAbsorbineおよびSentinelと提携し、「My New Horse」というブランドを立ち上げました。これは、馬のオーナーや騎手向けのリソースとコミュニティを提供するものです。このプラットフォームは、専門家のアドバイス、ハウツー動画、予算管理のヒント、そしてソーシャルなつながりを提供することで、初心者が自信を持って馬の所有という旅路を歩めるよう支援します。

- 2019年9月、ピュリナ・オモレン・ホースフィードは、ラインナップにアウトラスト・ガストリック・サポート・サプリメントを追加するという画期的なアップデートを発表しました。このサプリメントは、毎日の食事で胃腸をサポートし、馬の胃の不快感を軽減します。胃腸の不快感は、活動的な馬の最大90%に影響を与えます。改良されたパッケージを備えたこのアップデートされたオモレンフィードは、アクティブな楽しみを求める馬からトップクラスの競技馬まで、あらゆるタイプの馬に、パフォーマンス向上のための栄養を提供し、最適な健康とサポートを保証します。

SKU-

世界初のマーケットインテリジェンスクラウドに関するレポートにオンラインでアクセスする

- インタラクティブなデータ分析ダッシュボード

- 成長の可能性が高い機会のための企業分析ダッシュボード

- カスタマイズとクエリのためのリサーチアナリストアクセス

- インタラクティブなダッシュボードによる競合分析

- 最新ニュース、更新情報、トレンド分析

- 包括的な競合追跡のためのベンチマーク分析のパワーを活用

目次

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE U.S. BAGGED EQUINE FEED MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 YEARS CONSIDERED FOR THE STUDY

2.3 DBMR TRIPOD DATA VALIDATION MODEL

2.4 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.5 MULTIVARIATE MODELLING

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 SECONDARY SOURCES

2.9 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER’S FIVE FORCES

4.2 PESTEL ANALYSIS

4.3 BRAND ANALYSIS

4.3.1 OVERVIEW

4.3.1.1 NUTRENA, A CARGILL, INCORPORATED BRAND

4.3.1.2 PURINA ANIMAL NUTRITION LLC (A SUBSIDIARY OF LAND O'LAKES, INC)

4.3.1.3 ALTECH

4.3.1.4 KENT NUTRITION GROUP

4.3.1.5 MANA PRO

4.3.2 SUMMARY

4.4 FACTORS INFLUENCING BUYING BEHAVIOR IN THE U.S. BAGGED EQUINE FEED MARKET

4.4.1 CONCLUSION

4.5 PRODUCTION CAPACITY OUTLOOK

4.6 SUPPLY CHAIN ANALYSIS

4.6.1 OVERVIEW

4.6.2 LOGISTIC COST SCENARIO

4.6.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

4.7 TECHNOLOGICAL ADVANCEMENTS BY MANUFACTURERS

4.7.1 PRECISION NUTRITION AND CUSTOMIZED FORMULATIONS

4.7.2 ENHANCED INGREDIENT PROCESSING TECHNIQUES

4.7.3 ADVANCED QUALITY CONTROL AND SAFETY MONITORING

4.7.4 SUSTAINABLE MANUFACTURING PRACTICES

4.7.5 INCORPORATION OF FUNCTIONAL INGREDIENTS AND ADDITIVES

4.7.6 AUTOMATED PRODUCTION AND PACKAGING PROCESSES

4.7.7 USE OF DIGITAL SOLUTIONS FOR CUSTOMER ENGAGEMENT AND EDUCATION

4.7.8 RESEARCH AND DEVELOPMENT IN FEED INNOVATION

4.7.9 CONCLUSION

4.8 VALUE CHAIN ANALYSIS: U.S. BAGGED EQUINE FEED MARKET

4.8.1 PROCUREMENT:

4.8.2 MANUFACTURING:

4.8.3 MARKETING & DISTRIBUTION:

4.9 VENDOR SELECTION CRITERIA

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 RISE IN THE PET HUMANIZATION TREND

5.1.2 INCREASE IN THE EQUINE POPULATION

5.1.3 CONVENIENCE INVOLVED IN THE USAGE OF BAGGED FEED

5.2 RESTRAINTS

5.2.1 RISE IN RAW MATERIAL COSTS

5.2.2 RISING CONCERNS REGARDING SUSTAINABILITY DURING THE MANUFACTURING OF THE FEED

5.3 OPPORTUNITIES

5.3.1 E-COMMERCE EXPANSION

5.3.2 TECHNOLOGICAL RESEARCH INVOLVED IN PRODUCTION AND THE MANUFACTURING OF ANIMAL FEED

5.4 CHALLENGES

5.4.1 COMPETITION FROM LOW-COST ALTERNATIVES

5.4.2 UNSUITABILITY OF BAGGED EQUINE FOR ALL KINDS OF HORSES

6 U.S. BAGGED EQUINE FEED MARKET, BY FORM

6.1 OVERVIEW

6.2 PELLETS

6.3 CUBES

6.4 OTHERS

7 U.S. BAGGED EQUINE FEED MARKET, BY NUTRITION TYPE

7.1 OVERVIEW

7.2 HIGH FIBER

7.3 LOW STARCH

7.4 HIGH PROTEIN

7.5 HIGH FATS AND OILS

8 U.S. BAGGED EQUINE FEED MARKET, BY INGREDIENTS

8.1 OVERVIEW

8.2 CEREALS/GRAINS

8.3 SUPPLEMENTS

8.4 CAKES/MEALS

8.5 OTHERS

9 U.S. BAGGED EQUINE FEED MARKET, BY DISTRIBUTION CHANNEL

9.1 OVERVIEW

9.2 OFFLINE RETAIL

9.3 ONLINE SALES

10 U.S. BAGGED EQUINE FEED MARKET, COMPANY LANDSCAPE

10.1 COMPANY SHARE ANALYSIS: U.S.

11 SWOT ANALYSIS

12 COMPANY PROFILES

12.1 NUTRENA, A CARGILL, INCORPORATED BRAND

12.1.1 COMPANY SNAPSHOT

12.1.2 PRODUCT PORTFOLIO

12.1.3 RECENT DEVELOPMENT

12.2 PURINA ANIMAL NUTRITION LLC(A SUBSIDIARY OF LAND O’LAKES, INC)

12.2.1 COMPANY SNAPSHOT

12.2.2 PRODUCT PORTFOLIO

12.2.3 RECENT DEVELOPMENT

12.3 ALLTECH

12.3.1 COMPANY SNAPSHOT

12.3.2 PRODUCT PORTFOLIO

12.3.3 RECENT DEVELOPMENT

12.4 KENT NUTRITION GROUP

12.4.1 COMPANY SNAPSHOT

12.4.2 PRODUCT PORTFOLIO

12.4.3 RECENT DEVELOPMENT

12.5 MANNA PRO

12.5.1 COMPANY SNAPSHOT

12.5.2 PRODUCT PORTFOLIO

12.5.3 RECENT DEVELOPMENT

12.6 GAIN ANIMAL NUTRITION

12.6.1 COMPANY SNAPSHOT

12.6.2 PRODUCT PORTFOLIO

12.6.3 RECENT DEVELOPMENT

12.7 HI-PRO FEEDS

12.7.1 COMPANY SNAPSHOT

12.7.2 PRODUCT PORTFOLIO

12.7.3 RECENT DEVELOPMENT

12.8 MIDWAY CO-OP

12.8.1 COMPANY SNAPSHOT

12.8.2 PRODUCT PORTFOLIO

12.8.3 RECENT DEVELOPMENT

12.9 SEMINOLE FEED

12.9.1 COMPANY SNAPSHOT

12.9.2 PRODUCT PORTFOLIO

12.9.3 RECENT DEVELOPMENT

12.1 STAR MILLING CO

12.10.1 COMPANY SNAPSHOT

12.10.2 PRODUCT PORTFOLIO

12.10.3 RECENT DEVELOPMENT

12.11 WALNUT HILL FEEDS, INC.

12.11.1 COMPANY SNAPSHOT

12.11.2 PRODUCT PORTFOLIO

12.11.3 RECENT DEVELOPMENT

13 QUESTIONNAIRE

14 RELATED REPORTS

図表一覧

FIGURE 1 U.S. BAGGED EQUINE FEED MARKET: SEGMENTATION

FIGURE 2 U.S. BAGGED EQUINE FEED MARKET: DATA TRIANGULATION

FIGURE 3 U.S. BAGGED EQUINE FEED MARKET: DROC ANALYSIS

FIGURE 4 U.S. BAGGED EQUINE FEED MARKET: COUNTRY-WISE MARKET ANALYSIS

FIGURE 5 U.S. BAGGED EQUINE FEED MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 U.S. BAGGED EQUINE FEED MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 U.S. BAGGED EQUINE FEED MARKET: DBMR MARKET POSITION GRID

FIGURE 8 U.S. BAGGED EQUINE FEED MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 U.S. BAGGED EQUINE FEED MARKET: SEGMENTATION

FIGURE 10 EXECUTIVE SUMMARY

FIGURE 11 FOUR SEGMENTS COMPRISE U.S. BAGGED EQUINE FEED MARKET, BY INGREDIENTS 2024, (%)

FIGURE 12 STRATEGIC DECISIONS

FIGURE 13 RISE IN PET HUMANIZATION TREND IS DRIVING THE GROWTH OF THE U.S. BAGGED EQUINE FEED MARKET FROM 2025 TO 2032

FIGURE 14 THE CEREALS/GRAINS SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE U.S. BAGGED EQUINE FEED MARKET IN 2025 AND 2032

FIGURE 15 ESTIMATED PRODUCTION CAPACITY OUTLOOK, 2018–2032 (KILO TONS)

FIGURE 16 VALUE CHAIN ANALYSIS OF THE U.S. BAGGED EQUINE FEED MARKET

FIGURE 17 VENDOR SELECTION CRITERIA

FIGURE 18 DROC ANALYSIS

FIGURE 19 U.S. BAGGED EQUINE FEED MARKET: BY FORM, 2024

FIGURE 20 U.S. BAGGED EQUINE FEED MARKET: BY NUTRITION TYPE, 2024

FIGURE 21 U.S. BAGGED EQUINE FEED MARKET: BY INGREDIENTS, 2024

FIGURE 22 U.S. BAGGED EQUINE FEED MARKET: BY DISTRIBUTION CHANNEL, 2024

FIGURE 23 U.S. BAGGED EQUINE FEED MARKET: COMPANY SHARE 2024 (%)

調査方法

データ収集と基準年分析は、大規模なサンプル サイズのデータ収集モジュールを使用して行われます。この段階では、さまざまなソースと戦略を通じて市場情報または関連データを取得します。過去に取得したすべてのデータを事前に調査および計画することも含まれます。また、さまざまな情報ソース間で見られる情報の不一致の調査も含まれます。市場データは、市場統計モデルと一貫性モデルを使用して分析および推定されます。また、市場シェア分析と主要トレンド分析は、市場レポートの主要な成功要因です。詳細については、アナリストへの電話をリクエストするか、お問い合わせをドロップダウンしてください。

DBMR 調査チームが使用する主要な調査方法は、データ マイニング、データ変数が市場に与える影響の分析、および一次 (業界の専門家) 検証を含むデータ三角測量です。データ モデルには、ベンダー ポジショニング グリッド、市場タイムライン分析、市場概要とガイド、企業ポジショニング グリッド、特許分析、価格分析、企業市場シェア分析、測定基準、グローバルと地域、ベンダー シェア分析が含まれます。調査方法について詳しくは、お問い合わせフォームから当社の業界専門家にご相談ください。

カスタマイズ可能

Data Bridge Market Research は、高度な形成的調査のリーダーです。当社は、既存および新規のお客様に、お客様の目標に合致し、それに適したデータと分析を提供することに誇りを持っています。レポートは、対象ブランドの価格動向分析、追加国の市場理解 (国のリストをお問い合わせください)、臨床試験結果データ、文献レビュー、リファービッシュ市場および製品ベース分析を含めるようにカスタマイズできます。対象競合他社の市場分析は、技術ベースの分析から市場ポートフォリオ戦略まで分析できます。必要な競合他社のデータを、必要な形式とデータ スタイルでいくつでも追加できます。当社のアナリスト チームは、粗い生の Excel ファイル ピボット テーブル (ファクト ブック) でデータを提供したり、レポートで利用可能なデータ セットからプレゼンテーションを作成するお手伝いをしたりすることもできます。