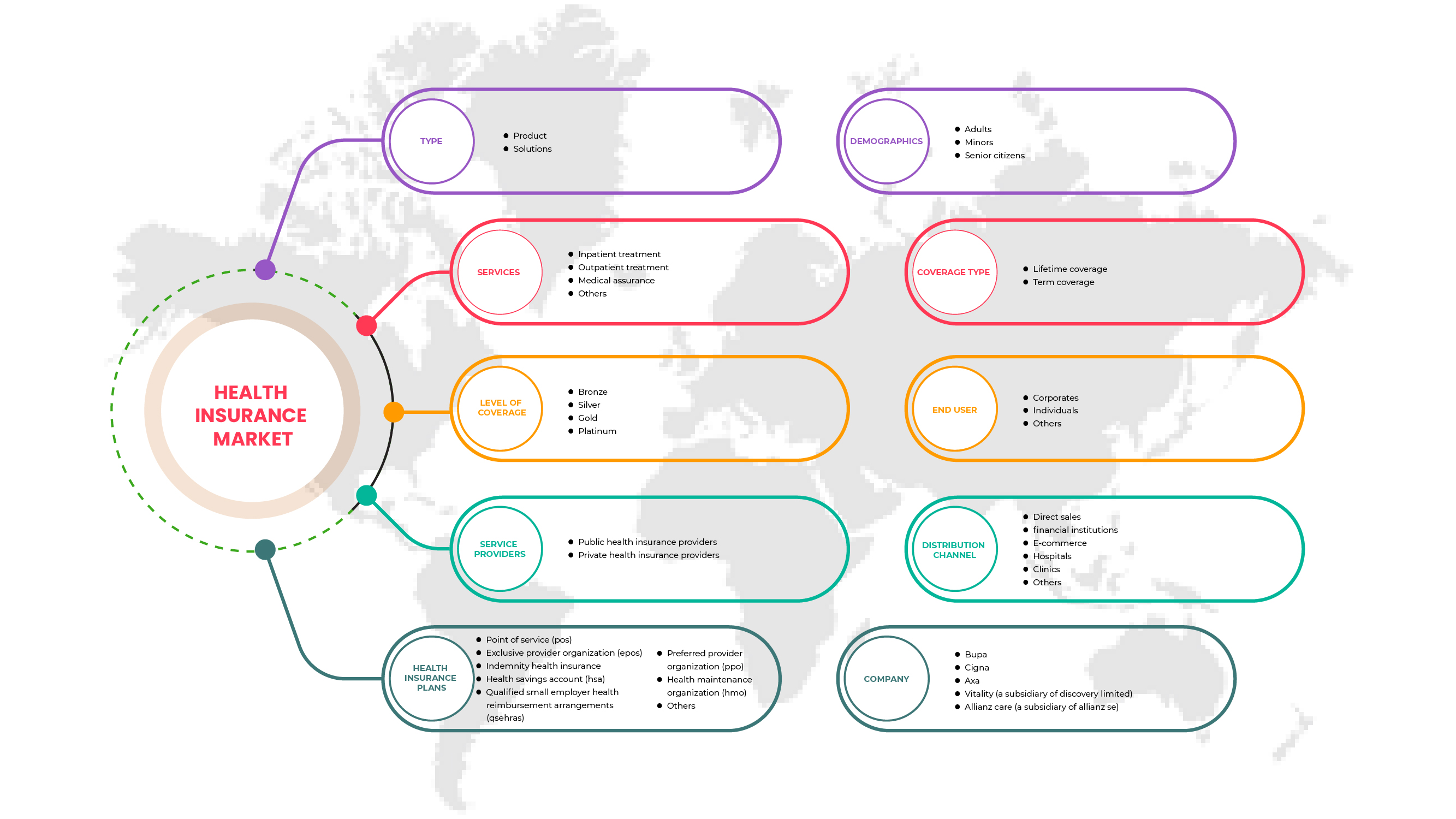

英国の健康保険市場、タイプ別(製品およびソリューション)、サービス別(入院治療、外来治療、医療保証、その他)、補償レベル別(ブロンズ、シルバー、ゴールド、プラチナ)、サービスプロバイダー別(公的医療保険会社、民間医療保険会社)、医療保険プラン別(ポイントオブサービス(POS)、独占提供者組織(EPOS)、損害賠償医療保険、健康貯蓄口座(HSA)、適格小規模雇用者医療償還協定(QSEHRAS)、優先提供者組織(PPO)、健康維持組織(HMO)、その他)、人口統計別(成人、未成年者、高齢者)、補償タイプ別(生涯補償、定期補償)、エンドユーザー別(企業、個人、その他)、流通チャネル別(直接販売、金融機関、電子商取引、病院、診療所、その他)、業界動向および2029年までの予測。

英国の健康保険市場の分析と規模

健康保険は、いくつかの種類の機能と利点から構成されています。保険契約者に特定の治療に対する経済的補償を提供します。健康保険には、キャッシュレス入院、入院前および入院後の補償、払い戻し、さまざまな追加オプションなどの利点があります。英国の健康保険市場レポートでは、市場シェア、新しい開発、製品パイプライン分析、国内およびローカル市場プレーヤーの影響の詳細を提供し、新たな収益源、市場規制の変更、製品承認、戦略的決定、製品の発売、地理的拡大、市場における技術革新の観点からの機会を分析します。

Data Bridge Market Research の分析によると、英国の健康保険市場は、予測期間中に 4.7% の CAGR で成長し、2029 年までに 1,343 億 7,664 万ドルに達すると予想されています。製品セグメントは、英国の健康保険市場で最大の提供セグメントを占めています。英国の健康保険市場レポートでは、価格分析、特許分析、技術進歩についても詳細に取り上げています。

|

レポートメトリック |

詳細 |

|

予測期間 |

2022年から2029年 |

|

基準年 |

2021 |

|

歴史的な年 |

2020 (2019 - 2014 にカスタマイズ可能) |

|

定量単位 |

売上高(百万米ドル)、販売数量(個数)、価格(米ドル) |

|

対象セグメント |

タイプ別 (製品およびソリューション)、サービス別 (入院治療、外来治療、医療保証、その他)、補償レベル別 (ブロンズ、シルバー、ゴールド、プラチナ)、サービス プロバイダー別 (公的医療保険会社、民間医療保険会社)、医療保険プラン別 (ポイント オブ サービス (POS)、専属プロバイダー組織 (EPOS)、損害賠償医療保険、健康貯蓄口座 (HSA)、適格小規模雇用者医療償還協定 (QSEHRAS)、優先プロバイダー組織 (PPO)、健康維持組織 (HMO)、その他)、人口統計別 (成人、未成年者、高齢者)、補償タイプ別 (生涯補償、定期補償)、エンド ユーザー別 (企業、個人、その他)、流通チャネル別 (直接販売、金融機関、電子商取引、病院、診療所、その他)。 |

|

対象国 |

英国 |

|

対象となる市場プレーヤー |

Bupa、Cigna、AXA、Vitality(Discovery Limited の子会社)、Allianz Care(Allianz SE の子会社)、Aviva、AIA Group Limited、Saga、Exeter Friendly Society Limited、Pru Life UK、Freedom Health Insurance、General and Medical Finance Ltd、American International Group, Inc. |

市場の定義

健康保険は、病気や怪我による治療だけでなく、あらゆる種類の手術費用をカバーする保険の一種です。包括的または限定された範囲の医療サービスに適用され、特定のサービスの費用の全額または一部をカバーします。保険契約者が治療のために入院した場合、すべての医療費をカバーするため、保険契約者に経済的支援を提供します。また、入院前および入院後の費用もカバーされます。

健康保険プランでは、キャッシュレスまたは払い戻し請求のいくつかの種類の補償が利用可能です。キャッシュレスの特典は、保険契約者が保険会社のネットワーク病院で治療を受けた場合に利用できます。保険契約者がリストネットワークにない病院で治療を受けた場合、その場合、保険契約者はすべての医療費を負担し、その後、すべての医療費請求書を提出して保険会社に払い戻しを請求します。

英国の健康保険市場の動向

このセクションでは、市場の推進要因、利点、機会、制約、課題について理解します。これらはすべて、以下のように詳細に説明されます。

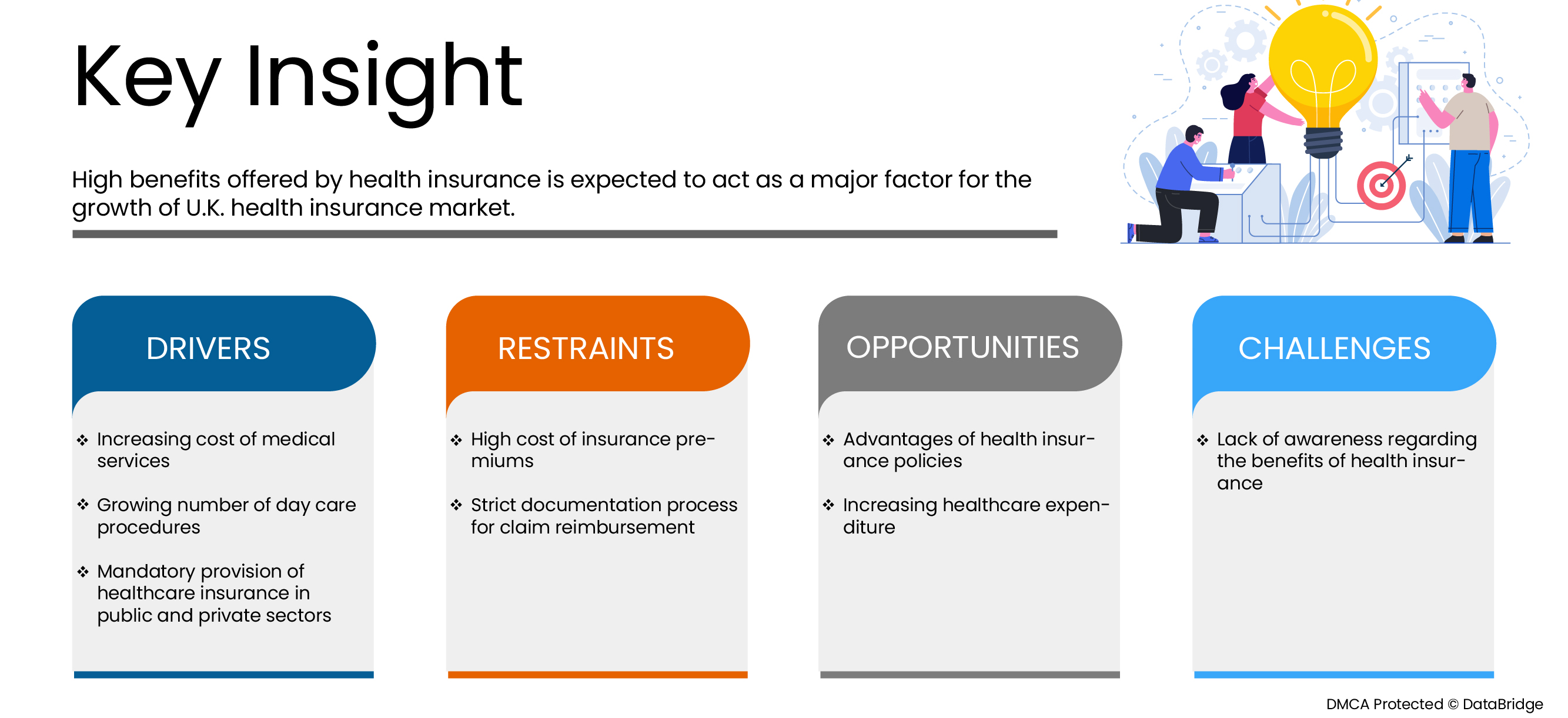

ドライバー

-

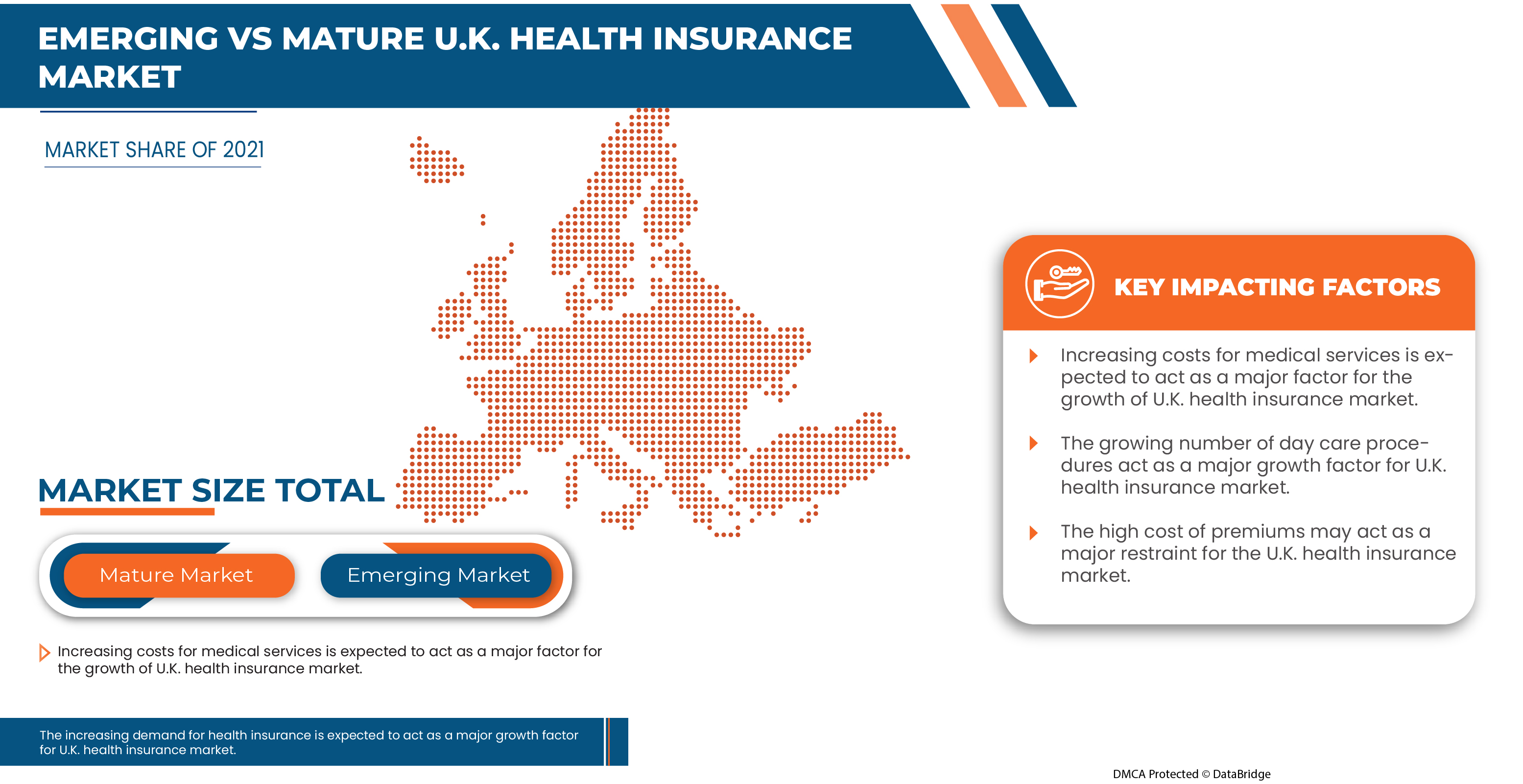

医療サービスコストの上昇

世界中で、そして英国でも医療サービス費用が上昇しており、これが英国の健康保険市場の牽引役となることが予想されます。これにより、多くの消費者が、消費者自身や家族の健康上の医療ニーズが発生した場合に医療費を賄う生命保険に加入できるようになります。

-

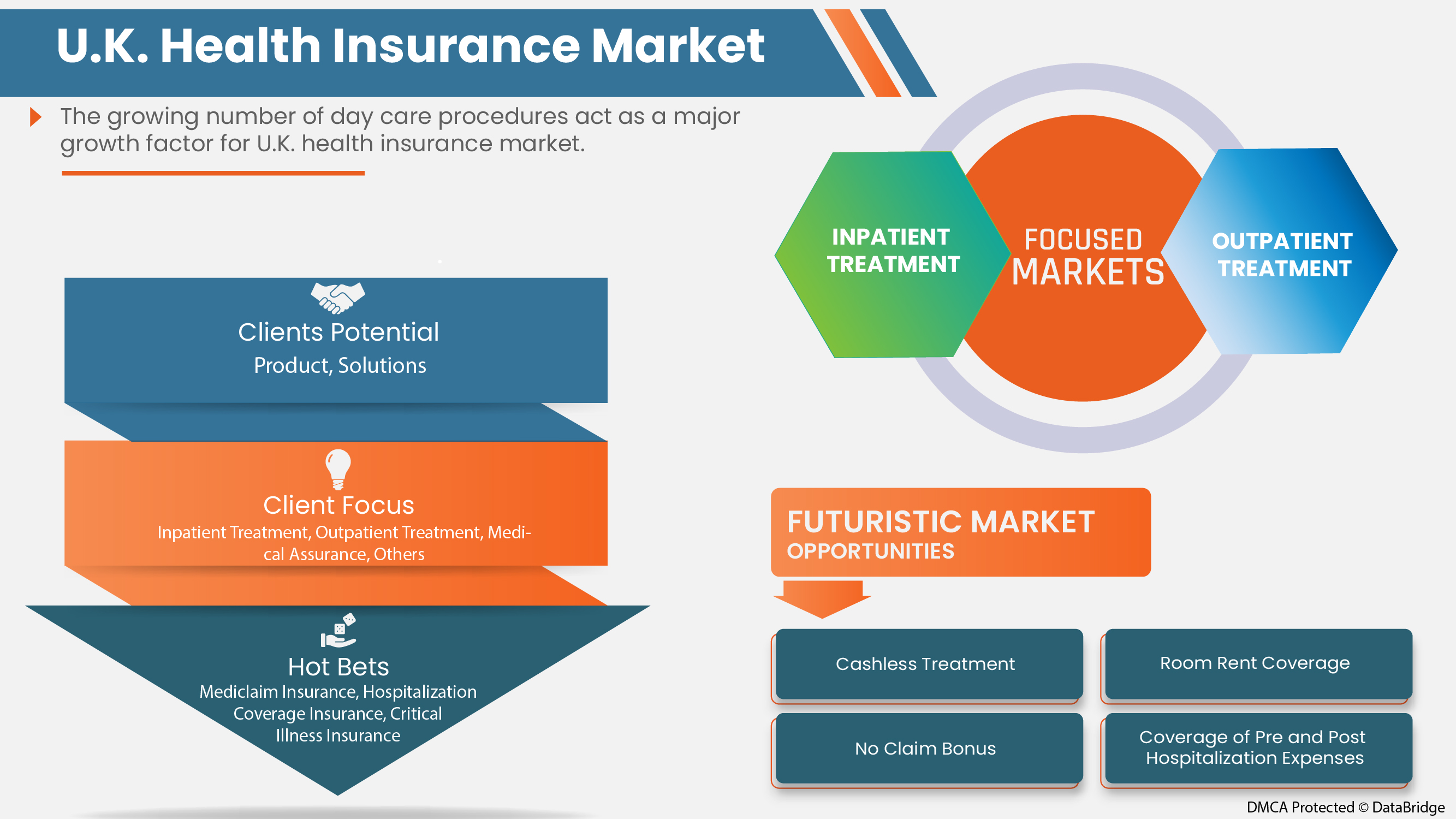

保育サービスの増加

現在、ほとんどの健康保険会社は、保険プランでデイケアの処置をカバーしています。このようなタイプの手術の請求には、保険請求に必要な最低入院期間である 24 時間の入院は義務付けられていません。これにより、デイケア処置の増加が英国の健康保険市場の成長を後押ししています。

機会

-

健康保険のメリット

健康保険プランでは、保険加入者は入院、手術、怪我による治療などの医療費の払い戻しを受けられます。健康保険契約は、保険加入者と保険会社の間の一種の契約であり、保険会社は将来の医療問題が発生した場合に治療費の支払いを保証することに同意し、保険加入者は保険プランに従って保険料の金額を支払うことに同意します。したがって、健康保険契約のメリットの増大は、市場成長の機会として機能することが期待されています。

抑制/挑戦

- 保険料の高騰

健康保険は、あらゆるタイプの医療費をカバーします。保険契約者が治療のために入院した場合、すべての医療費をカバーできるため、保険契約者に経済的支援を提供します。健康保険は、入院前および入院後の費用もカバーします。健康保険を購入するには、保険契約者は健康保険契約を有効に保つために定期的に保険料を支払う必要があります。保険プランによっては保険料のコストが高額になる場合がほとんどで、これが市場の成長を妨げる可能性があります。

COVID-19による英国医療保険市場への影響

COVID-19は、ほぼすべての国が必需品を扱う施設を除くすべての施設の閉鎖を選択したため、さまざまな業界に大きな影響を与えました。政府は、施設の閉鎖、必需品以外の商品の販売、国際貿易のブロックなど、COVID-19の拡散を防ぐためにいくつかの厳格な措置を講じました。これにより、消費者が医療ニーズが発生した場合に備えて病院での巨額の資本支払いを避けるために保険を利用していたため、英国の健康保険市場が活性化しました。したがって、COVID-19は英国の健康保険市場にプラスの影響を与えました。

最近の動向

- 2020 年 8 月、International Medical Group, Inc. (IMG) は、安全な海外旅行に必要な計画と調査を行う組織をサポートするために、製品ラインナップを強化しました。同社の独自の新しい支援サービスは、2020 年以降の計画を立てるクライアントをサポートするために設計されました。この開発により、同社はパンデミックの中でも存続し、繁栄することができました。

- In February 2019, Now Health International announced that they had launched their SimpleCare plans in the international market. The new plans of SimpleCare are designed to provide affordable international health insurance for the cost-conscious person. By launching a new product, the company enhanced its business in the international market, such as the U.K. market, and generated more revenue.

U.K. Health Insurance Market Scope

The U.K. health insurance market is segmented on the basis of type, services, level of coverage, service providers, health insurance plans, demographics, coverage type, end user, and distribution channel. The growth amongst these segments will help you analyze meager growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

U.K. Health Insurance Market, By Type

- Product

- Solutions

On the basis of type, the market is segmented into product and solutions.

U.K. Health Insurance Market, By Services

- Inpatient treatment

- Outpatient treatment

- Medical Assurance

- Others

On the basis of services, the market is segmented into inpatient treatment, outpatient treatment, medical assurance, and others.

U.K. Health Insurance Market, By Level of Coverage

- Bronze

- Silver

- Gold

- Platinum

On the basis of the level of coverage, the market is segmented into bronze, silver, gold, and platinum.

U.K. Health Insurance Market, By Service Providers

- Private health insurance providers

- Public health insurance providers

On the basis of service providers, the market is segmented into private health insurance providers and public health insurance providers.

U.K. Health Insurance Market, By Health Insurance Plans

- Point of service (POS)

- Exclusive provider organization (EPOS)

- Indemnity health insurance

- Health savings account (HSA)

- Qualified small employer health reimbursement arrangements (QSEHRAS)

- Preferred provider organization (PPO)

- Health maintenance organization (HMO)

- Others

On the basis of health insurance plans, the market is segmented into point of service (POS), exclusive provider organization (EPOS), indemnity health insurance, health savings account (HSA), qualified small employer health reimbursement arrangements (QSEHRAS), preferred provider organization (PPO), health maintenance organization (HMO), and others.

By Demographics

- Adults

- Minors

- Senior citizens

On the basis of demographics, the U.K. health insurance market is segmented into adults, minors, and senior citizens.

By Coverage Type

- Lifetime Coverage

- Term Coverage

On the basis of coverage type, the U.K. health insurance market is segmented into lifetime coverage and term coverage.

By End User

- Corporates

- Individuals

- Others

On the basis of end user, the U.K. health insurance market is segmented into corporates, individuals, and others.

By Distribution Channel

- Direct Sales

- Financial Institutions

- E-Commerce

- Hospitals

- Clinics

- Others

流通チャネルに基づいて、英国の健康保険市場は、直接販売、金融機関、電子商取引、病院、診療所、その他に分類されます。

英国健康保険市場の地域分析/洞察

上記のように、タイプ、サービス、補償レベル、サービスプロバイダー、健康保険プラン、人口統計、補償タイプ、エンドユーザー、および流通チャネルに基づいた英国の健康保険市場。

2022年には、健康保険の利点や医療費の増加などの要因により、英国の健康保険市場は成長すると予想されています。

レポートの国別セクションでは、市場の現在および将来の傾向に影響を与える個別の市場影響要因と市場規制の変更も提供しています。下流および上流のバリュー チェーン分析、技術動向、ポーターの 5 つの力の分析、ケース スタディなどのデータ ポイントは、個々の国の市場シナリオを予測するために使用される指標の一部です。また、国別データの予測分析を提供する際には、英国ブランドの存在と可用性、および地元および国内ブランドとの競争が激しいか少ないために直面する課題、国内関税の影響、貿易ルートも考慮されます。

競争環境と英国の健康保険市場シェア分析

分析ラボ サービス市場の競争状況では、競合他社ごとに詳細が提供されます。含まれる詳細には、会社概要、会社の財務状況、収益、市場の可能性、研究開発への投資、新しい市場への取り組み、英国でのプレゼンス、生産拠点と施設、生産能力、会社の強みと弱み、製品の発売、製品の幅と広さ、アプリケーションの優位性などがあります。提供されている上記のデータ ポイントは、英国の健康保険市場に関連する会社の焦点にのみ関連しています。

英国の健康保険市場で保険サービスを提供している大手企業には、Bupa、Cigna、AXA、Vitality(Discovery Limited の子会社)、Allianz Care(Allianz SE の子会社)、Aviva、AIA Group Limited、Saga、Exeter Friendly Society Limited、Pru Life UK、Freedom Health Insurance、general and medical finance ltd、American International Group, Inc. などがあります。

SKU-

世界初のマーケットインテリジェンスクラウドに関するレポートにオンラインでアクセスする

- インタラクティブなデータ分析ダッシュボード

- 成長の可能性が高い機会のための企業分析ダッシュボード

- カスタマイズとクエリのためのリサーチアナリストアクセス

- インタラクティブなダッシュボードによる競合分析

- 最新ニュース、更新情報、トレンド分析

- 包括的な競合追跡のためのベンチマーク分析のパワーを活用

目次

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF U.K. HEALTH INSURANCE MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.7 DBMR MARKET POSITION GRID

2.8 MARKET END-USER COVERAGE GRID

2.9 DBMR MARKET CHALLENGE MATRIX

2.1 TYPE LIFE LINE CURVE

2.11 MULTIVARIATE MODELING

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 INCREASING COST OF MEDICAL SERVICES

5.1.2 GROWING NUMBER OF DAYCARE PROCEDURES

5.1.3 MANDATORY PROVISION OF HEALTHCARE INSURANCE IN PUBLIC AND PRIVATE SECTORS

5.2 RESTRAINTS

5.2.1 HIGH COST OF INSURANCE PREMIUMS

5.2.2 STRICT DOCUMENTATION PROCESS FOR CLAIM REIMBURSEMENT

5.3 OPPORTUNITIES

5.3.1 ADVANTAGES OF HEALTH INSURANCE POLICIES

5.3.2 INCREASING HEALTHCARE EXPENDITURE

5.4 CHALLENGE

5.4.1 LACK OF AWARENESS REGARDING THE BENEFITS OF HEALTH INSURANCE

6 U.K. HEALTH INSURANCE MARKET, BY TYPE

6.1 OVERVIEW

6.2 PRODUCT

6.2.1 MEDICLAIM INSURANCE

6.2.2 INDIVIDUAL COVERAGE INSURANCE

6.2.3 FAMILY FLOATER COVERAGE INSURANCE

6.2.4 HOSPITALIZATION COVERAGE INSURANCE

6.2.5 SENIOR CITIZEN COVERAGE INSURANCE

6.2.6 CRITICAL ILLNESS INSURANCE

6.2.7 UNIT LINKED HEALTH PLANS

6.2.8 PERMANENT HEALTH INSURANCE

6.3 SOLUTIONS

6.3.1 LEAD GENERATIONS SOLUTIONS

6.3.2 REVENUE MANAGEMENT & BILLING SOLUTIONS

6.3.3 ROBOTIC PROCESS AUTOMATION

6.3.4 INSURANCE CLOUD SOLUTIONS

6.3.5 CLAIMS ADMINISTRATION CLOUD SOLUTIONS

6.3.6 VALUE-BASED PAYMENTS SOLUTIONS

6.3.7 ARTIFICIAL INTELLIGENCE & BLOCK CHAIN SOLUTIONS

6.3.8 INTELLIGENT CASE MANAGEMENT SOLUTIONS

6.3.9 OTHERS

7 U.K. HEALTH INSURANCE MARKET, BY SERVICES

7.1 OVERVIEW

7.2 INPATIENT TREATMENT

7.3 OUTPATIENT TREATMENT

7.4 MEDICAL ASSURANCE

7.5 OTHERS

8 U.K. HEALTH INSURANCE MARKET, BY LEVEL OF COVERAGE

8.1 OVERVIEW

8.2 BRONZE

8.3 SILVER

8.4 GOLD

8.5 PLATINUM

9 U.K. HEALTH INSURANCE MARKET, BY SERVICE PROVIDERS

9.1 OVERVIEW

9.2 PUBLIC HEALTH INSURANCE PROVIDERS

9.3 PRIVATE HEALTH INSURANCE PROVIDERS

10 U.K. HEALTH INSURANCE MARKET, BY HEALTH INSURANCE PLANS

10.1 OVERVIEW

10.2 POINT OF SERVICE (POS)

10.3 EXCLUSIVE PROVIDER ORGANIZATION (EPOS)

10.4 PREFERRED PROVIDER ORGANIZATION (PPO)

10.5 INDEMNITY HEALTH INSURANCE

10.6 HEALTH MAINTENANCE ORGANIZATION (HMO)

10.7 HEALTH SAVINGS ACCOUNT (HSA)

10.8 QUALIFIED SMALL EMPLOYER HEALTH REIMBURSEMENT ARRANGEMENTS (QSEHRAS)

10.9 OTHERS

11 U.K. HEALTH INSURANCE MARKET, BY DEMOGRAPHICS

11.1 OVERVIEW

11.2 ADULTS

11.3 MINORS

11.4 SENIOR CITIZENS

12 U.K. HEALTH INSURANCE MARKET, BY COVERAGE TYPE

12.1 OVERVIEW

12.2 LIFETIME COVERAGE

12.3 TERM COVERAGE

13 U.K. HEALTH INSURANCE MARKET, BY END-USER

13.1 OVERVIEW

13.2 CORPORATES

13.3 INDIVIDUALS

13.4 OTHERS

14 U.K. HEALTH INSURANCE MARKET, BY DISTRIBUTION CHANNEL

14.1 OVERVIEW

14.2 DIRECT SALES

14.3 FINANCIAL INSTITUTIONS

14.4 E-COMMERCE

14.5 HOSPITALS

14.6 CLINICS

14.7 OTHERS

15 U.K. HEALTH INSURANCE MARKET, COMPANY LANDSCAPE

15.1 COMPANY SHARE ANALYSIS: U.K.

16 SWOT ANALYSIS

17 COMPANY PROFILE

17.1 CIGNA

17.1.1 COMPANY SNAPSHOT

17.1.2 REVENUE ANALYSIS

17.1.3 PRODUCT PORTFOLIO

17.1.4 RECENT UPDATE

17.2 AVIVA

17.2.1 COMPANY SNAPSHOT

17.2.2 REVENUE ANALYSIS

17.2.3 PRODUCT PORTFOLIO

17.2.4 RECENT UPDATES

17.3 ALLIANZ CARE (A SUBSIDIARY OF ALLIANZ)

17.3.1 COMPANY SNAPSHOT

17.3.2 REVENUE ANALYSIS

17.3.3 PRODUCT PORTFOLIO

17.3.4 RECENT UPDATE

17.4 AXA

17.4.1 COMPANY SNAPSHOT

17.4.2 REVENUE ANALYSIS

17.4.3 PRODUCT PORTFOLIO

17.4.4 RECENT UPDATES

17.5 BUPA

17.5.1 COMPANY SNAPSHOT

17.5.2 REVENUE ANALYSIS

17.5.3 PRODUCT PORTFOLIO

17.5.4 RECENT UPDATES

17.6 AMERICAN INTERNATIONAL GROUP, INC. (2021)

17.6.1 COMPANY SNAPSHOT

17.6.2 REVENUE ANALYSIS

17.6.3 PRODUCT PORTFOLIO

17.6.4 RECENT DEVELOPMENTS

17.7 EXETER FRIENDLY SOCIETY LIMITED

17.7.1 COMPANY SNAPSHOT

17.7.2 PRODUCT PORTFOLIO

17.7.3 RECENT DEVELOPMENTS

17.8 FREEDOM HEALTH INSURANCE

17.8.1 COMPANY SNAPSHOT

17.8.2 PRODUCT PORTFOLIO

17.8.3 RECENT DEVELOPMENTS

17.9 GENERAL AND MEDICAL FINANCE LTD

17.9.1 COMPANY SNAPSHOT

17.9.2 PRODUCT PORTFOLIO

17.9.3 RECENT DEVELOPMENTS

17.1 PRU LIFE UK

17.10.1 COMPANY SNAPSHOT

17.10.2 PRODUCT PORTFOLIO

17.10.3 RECENT DEVELOPMENTS

17.11 SAGA (2021)

17.11.1 COMPANY SNAPSHOT

17.11.2 REVENUE ANALYSIS

17.11.3 PRODUCT PORTFOLIO

17.11.4 RECENT DEVELOPMENTS

17.12 VITALITY (A SUBSIDIARY OF DISCOVERY LTD)

17.12.1 COMPANY SNAPSHOT

17.12.2 REVENUE ANALYSIS

17.12.3 PRODUCT PORTFOLIO

17.12.4 RECENT UPDATES

18 QUESTIONNAIRE

19 RELATED REPORTS

表のリスト

TABLE 1 AVERAGE COSTS FOR COMMON SURGERIES

TABLE 2 LIST OF DAYCARE PROCEDURES

TABLE 3 AVERAGE EMPLOYEE PREMIUMS IN U.S. (2020)

TABLE 4 U.K. HEALTH INSURANCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 5 U.K. PRODUCT IN HEALTH INSURANCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 6 U.K. SOLUTIONS IN HEALTH INSURANCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 7 U.K. HEALTH INSURANCE MARKET, BY SERVICES, 2020-2029 (USD MILLION)

TABLE 8 U.K. HEALTH INSURANCE MARKET, BY LEVEL OF COVERAGE, 2020-2029 (USD MILLION)

TABLE 9 U.K. HEALTH INSURANCE MARKET, BY SERVICE PROVIDERS, 2020-2029 (USD MILLION)

TABLE 10 U.K. HEALTH INSURANCE MARKET, BY HEALTH INSURANCE PLANS, 2020-2029 (USD MILLION)

TABLE 11 U.K. HEALTH INSURANCE MARKET, BY DEMOGRAPHICS, 2020-2029 (USD MILLION)

TABLE 12 U.K. HEALTH INSURANCE MARKET, BY COVERAGE TYPE, 2020-2029 (USD MILLION)

TABLE 13 U.K. HEALTH INSURANCE MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 14 U.K. HEALTH INSURANCE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

図表一覧

FIGURE 1 U.K. HEALTH INSURANCE MARKET: SEGMENTATION

FIGURE 2 U.K. HEALTH INSURANCE MARKET: DATA TRIANGULATION

FIGURE 3 U.K. HEALTH INSURANCE MARKET: DROC ANALYSIS

FIGURE 4 U.K. HEALTH INSURANCE MARKET: REGIONAL VS COUNTRY MARKET ANALYSIS

FIGURE 5 U.K. HEALTH INSURANCE MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 U.K. HEALTH INSURANCE MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 U.K. HEALTH INSURANCE MARKET: DBMR MARKET POSITION GRID

FIGURE 8 U.K. HEALTH INSURANCE MARKET: END-USER COVERAGE GRID

FIGURE 9 U.K. HEALTH INSURANCE MARKET: CHALLENGE MATRIX

FIGURE 10 U.K. HEALTH INSURANCE MARKET: TYPE LIFE LINE CURVE

FIGURE 11 U.K. HEALTH INSURANCE MARKET: MULTIVARIATE MODELLING

FIGURE 12 U.K. HEALTH INSURANCE MARKET: SEGMENTATION

FIGURE 13 INCREASING COST OF MEDICAL SERVICES IS EXPECTED TO DRIVE THE U.K. HEALTH INSURANCE MARKET GROWTH IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 14 PRODUCT SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE U.K. HEALTH INSURANCE MARKET IN 2022 & 2029

FIGURE 15 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE U.K. HEALTH INSURANCE MARKET

FIGURE 16 HEALTH INSURANCE COVERAGE

FIGURE 17 U.K. HEALTH INSURANCE MARKET: BY TYPE, 2021

FIGURE 18 U.K. HEALTH INSURANCE MARKET: BY SERVICES, 2021

FIGURE 19 U.K. HEALTH INSURANCE MARKET: BY LEVEL OF COVERAGE, 2021

FIGURE 20 U.K. HEALTH INSURANCE MARKET: BY SERVICE PROVIDERS, 2021

FIGURE 21 U.K. HEALTH INSURANCE MARKET: BY HEALTH INSURANCE PLANS, 2021

FIGURE 22 U.K. HEALTH INSURANCE MARKET: BY DEMOGRAPHICS, 2021

FIGURE 23 U.K. HEALTH INSURANCE MARKET: BY COVERAGE TYPE, 2021

FIGURE 24 U.K. HEALTH INSURANCE MARKET: BY END-USER, 2021

FIGURE 25 U.K. HEALTH INSURANCE MARKET: BY DISTRIBUTION CHANNEL, 2021

FIGURE 26 U.K. HEALTH INSURANCE MARKET: COMPANY SHARE 2021 (%)

調査方法

データ収集と基準年分析は、大規模なサンプル サイズのデータ収集モジュールを使用して行われます。この段階では、さまざまなソースと戦略を通じて市場情報または関連データを取得します。過去に取得したすべてのデータを事前に調査および計画することも含まれます。また、さまざまな情報ソース間で見られる情報の不一致の調査も含まれます。市場データは、市場統計モデルと一貫性モデルを使用して分析および推定されます。また、市場シェア分析と主要トレンド分析は、市場レポートの主要な成功要因です。詳細については、アナリストへの電話をリクエストするか、お問い合わせをドロップダウンしてください。

DBMR 調査チームが使用する主要な調査方法は、データ マイニング、データ変数が市場に与える影響の分析、および一次 (業界の専門家) 検証を含むデータ三角測量です。データ モデルには、ベンダー ポジショニング グリッド、市場タイムライン分析、市場概要とガイド、企業ポジショニング グリッド、特許分析、価格分析、企業市場シェア分析、測定基準、グローバルと地域、ベンダー シェア分析が含まれます。調査方法について詳しくは、お問い合わせフォームから当社の業界専門家にご相談ください。

カスタマイズ可能

Data Bridge Market Research は、高度な形成的調査のリーダーです。当社は、既存および新規のお客様に、お客様の目標に合致し、それに適したデータと分析を提供することに誇りを持っています。レポートは、対象ブランドの価格動向分析、追加国の市場理解 (国のリストをお問い合わせください)、臨床試験結果データ、文献レビュー、リファービッシュ市場および製品ベース分析を含めるようにカスタマイズできます。対象競合他社の市場分析は、技術ベースの分析から市場ポートフォリオ戦略まで分析できます。必要な競合他社のデータを、必要な形式とデータ スタイルでいくつでも追加できます。当社のアナリスト チームは、粗い生の Excel ファイル ピボット テーブル (ファクト ブック) でデータを提供したり、レポートで利用可能なデータ セットからプレゼンテーションを作成するお手伝いをしたりすることもできます。