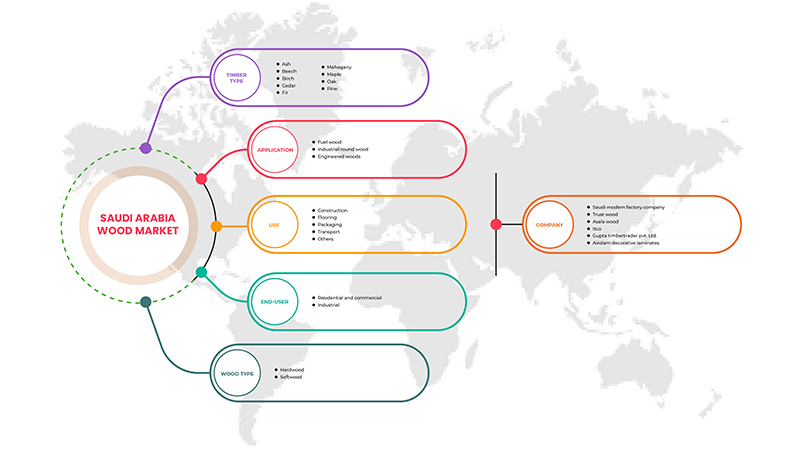

サウジアラビアの木材市場、木材の種類別(アッシュ、ブナ、バーチ、スギ、モミ、マホガニー、カエデ、オーク、マツ)、用途別(燃料用木材、工業用丸太、エンジニアードウッド)、使用目的別(建設、床材、梱包、輸送、その他)、エンドユーザー別(住宅、商業、工業)、木材の種類別(広葉樹、針葉樹)、業界動向および2029年までの予測。

サウジアラビアの木材市場の分析と規模

商業および住宅建築の需要の高まりは、サウジアラビアの木材市場の重要な推進力となっています。さらに、梱包および輸送用途での使用の増加が市場の成長を加速させています。

Data Bridge Market Research の分析によると、サウジアラビアの木材市場は、予測期間中に 2.2% の CAGR で成長し、2029 年までに 41 億 180 万米ドルに達すると予想されています。マホガニーは、最も顕著な木材セグメントを占めています。

|

レポートメトリック |

詳細 |

|

予測期間 |

2022年から2029年 |

|

基準年 |

2021 |

|

歴史的な年 |

2020 (2019 - 2014 にカスタマイズ可能) |

|

定量単位 |

収益(百万米ドル) |

|

対象セグメント |

木材の種類(トネリコ、ブナ、カバ、スギ、モミ、マホガニー、カエデ、オーク、マツ)、用途(燃料用木材、工業用丸太、エンジニアードウッド)、使用目的(建設、床材、梱包、輸送、その他)、最終使用者(住宅用、商業用、工業用)、木材の種類(広葉樹、針葉樹)別。 |

|

対象国 |

サウジアラビア |

|

対象となる市場プレーヤー |

Saudi Modern Factory Company、Trust Wood、Asala Wood、ITCO、Gupta Timbertrader Pvt. Ltd.、Airolam 装飾ラミネート。 |

市場の定義

木材産業は、林業、伐採、木材取引、および一次林産物と木材製品(家具など)およびパルプおよび製紙産業向けの木材パルプなどの二次製品の生産に関わる産業です。最大手の生産者の中には、森林地の最大の所有者もいます。木材産業は歴史的に多くの経済において重要な部門であり続けてきました。木材は比較的軽量で強度が高く、構造目的における効率性は鋼鉄に似た性質を持っています。木材は通常、ブナやオークなどの広葉樹からの硬材、またはマツやモミなどの針葉樹からの軟材に分類されます。マツのような成長の早い樹種は、オークのような成長の遅い樹木よりも交換可能であるため、持続可能である傾向があります。オークの森は、持続可能にするために注意深く管理し、適切に栽培および収穫する必要がありますが、それは可能です。

エンジニアードウッドは、一般的に木材の製造に使われるのと同じ広葉樹と針葉樹から作られていますが、接着剤などの添加物が混ぜられています。このタイプの木材は、製材所から出る廃材を利用することが多く、化学処理または熱処理によって、自然界では見つけるのが難しいサイズ要件を満たす木材が生産されます。エンジニアードウッドは、住宅建設から商業ビル、工業製品まで、さまざまな用途に使用されています。サウジアラビアは森林地帯と森林を保護するための法的措置を導入しており、最近では伐採される木よりも植えられる木の方が多いです。サウジアラビアの森林は減少するどころか、実際に成長しており、これは将来にとって素晴らしいニュースです。

サウジアラビアの木材市場の市場動向は次のとおりです。

ドライバー

- 商業・住宅建築部門における需要の増加

木材は現在、建築材料として一般的に使用されており、炭素排出量が少ないことから、コンクリートや鋼鉄に代わって急速に選ばれる材料になりつつあります。現在、建築部門はサウジアラビアの温室効果ガス排出量の 25% を占めており、業界ではグリーン ビルディング建設が CO2 排出量の削減と炭素の貯蔵に役立つと考えています。木材は、商業、住宅、産業構造において、鋼鉄やコンクリートよりも明確な利点を提供しながら、必要な弾力性、硬度、耐久性、強度を備えていることが証明されています。木材により、建築家や建設業者は持続可能で経済的、かつ環境に優しい構造物を作り上げることができます。より野心的なプロジェクトでは、木材が建築材料として使用されます。木材は、ドア、窓、キャビネット、食器棚、棚、テーブルなど、建築や家具製造に高価な材料です。木材は、合板 (合板ブロックおよび合板ボード) や原木としても広く使用されています。重厚な模様のドアや窓は、強度、靭性、耐久性のために無垢材/木材で作られています。これらの特性と用途の結果として、木材と木材は主要な建築材料になりました。

- 包装および輸送用途での使用が増加

木材は梱包と輸送において重要な役割を果たします。木製梱包材は、その優れた強度と安価なコストから、古代から利用されてきました。過去、梱包に関して木材を上回る素材はほとんどありませんでした。しかし、持続可能な成長と環境保護への意識の高まりにより、木材が主要な梱包材として再導入されました。他の素材と比較して、木製梱包材はより安定しており、環境に優しいと言われています。これらの素材は長持ちし、再生可能で、環境に優しく、重い物に適しており、積み重ね可能です。木製梱包材は、重量物を扱う分野に最適です。その優れた強度と安価なコストにより、最も費用対効果の高い梱包ソリューションと見なされています。

- 軽量木材の重要性の高まり

持続可能な木材として、ライトウッドは住宅、装飾品、家具、外装デザイン、紙、額縁、棚、キャビネット、ワードローブ、庭のフェンス、プランターボックスなどの製品の建設に潜在的な代替品です。広葉樹に対するライトウッドの主な利点は、軽量で密度が低いことです。同様に、ライトウッド種は高品質の木材を生産しながら急速に成長する可能性があります。ライトウッドは、建築部門でゲームチェンジャーになる可能性があります。これらの種は成長が早いため、高品質で持続可能な木材やその他の木製品を迅速に入手できます。高品質の木材建築材料として、ライトウッドは木材ビジネスとして戦略的優位性を与える可能性があり、技術的な木製品や現代の大量木造建築で際立った地位を築いています。木材の可能性を最大限に活用することで、CO2隔離(森林の炭素貯蔵)、CO2貯蔵(材料内の炭素)、高排出製品の代替、リサイクル(ライフサイクルの終了)などの気候上の利点の影響を高めることができます。

機会

- 活気ある商業部門が木材プラスチック複合材(WPC)への道を切り開いている

近年、サウジアラビアでは、オフィス、小売、工業、医療、レジャーなどの商業分野が飛躍的に拡大しています。まず、本物の木材を使用するには、CO2排出量の削減に重要な役割を果たす樹木の伐採が必要です。また、木材はプラスチックよりも重いため、本物の木材の配送と輸送にはコストがかかり、より多くの燃料が必要になり、炭素の影響が大きくなります。木材には多くの利点があるにもかかわらず、環境に悪影響を与えるものもあります。人々が環境への関心を高め、木の価値を認識するにつれて、木材に代わるものを好むようになりました。ここで、同様の品質と強力な環境上の利点を備えた木材の優れた代替品である木材プラスチック複合材 (WPC) が登場します。

- 研究開発や各種プロジェクトへの投資増加

サウジアラビアは経済の多様化を図るため、研究開発に投資している。研究、開発、イノベーション部門は、王国の競争力を高めることを目指している。RDI計画は、オープンイノベーションと科学に大きく依存しており、特別居住者センターを通じて特別プログラムを設立し、世界中から専門家を集め、王国への移住を容易にする。王国の長期計画の変更は、特にデジタル経済に慣れた人口の増加に伴い、サウジアラビア経済を牽引している。最も重要なのは、国内消費を増やし民間部門の発展を支援することで、国の石油収入への依存を減らすために2016年に最初に発表された戦略枠組みであるサウジビジョン2030が提供する前向きな雰囲気である。政府は、収入源を石油から多様化することに尽力している。その結果、プラスチックから木材や木材材料への移行が促進されている。

制約/課題

- Availability of substitutes such as plastics and metal products

Engineers have long used wood, metal, and concrete to construct numerous constructions. Timber walks were employed in forest preserves, and park authorities frequently acquired metal seating. Wood was also employed by manufacturers for cribbing. Engineers developed recycled plastic lumber, which is more environmentally friendly, more durable, and less expensive than wood. Although metal, concrete, and wood have several advantages, many people are moving away from wood in a variety of building projects in order to aid the earth's earth and preserve our natural resources. Steel construction is out of reach for clients on a limited budget due to the high costs of manufacture, shipment, and installation. While concrete is a long-lasting and low-maintenance material, there are alternative materials on the market, such as plastic lumber, that fit the bill and the project better. Metal (expense, fire danger, corrosion), concrete (time, contraction), and lumber all have drawbacks (shrinking, swelling, deterioration, health hazard).

- Potential direct and indirect impact of climate change on the timber industry

Forest wood has been a vital necessity for humanity since the dawn of civilization and remains the primary supply for many applications in our daily lives. Trees serve to sustain the water cycle and provide habitat for species. The Saudi Arabia’s impact of both direct and indirect climate change has hampered the expansion of wood production. The largest loss of forest related to climate is forest fire, which kills many trees each year. This is caused by severe summer and winter temperatures. Nature sparked the fire, which resulted in a massive loss of forest cover.

- Stringent rules and regulations regarding the timber

Saudi Arabia's forests are threatened by a harsh environment characterized by low fluctuating rainfall, severe drought, high temperatures, and human effects such as urban and agricultural development, as well as fuel wood harvesting. A scarcity of competent forestry professionals in comparison to what is necessary to carry out the activities required to sustainably manage the resources exacerbates the mix of natural and manmade causes. In response to these causes, the Saudi government has undertaken and/or supported a number of institutional and/or legislative efforts, as well as a number of programs, to reduce forest degradation and maintain, extend, and develop existing forests.

- Shrinking of the forests causes wide-reaching problems

森林破壊とは、森林、荒れ地、または毎日学校に通う途中で通る木など、かなりの量の木を切り倒すことを言います。土地を耕作したり、家や産業を作ったり、伐採したり、家畜の放牧地を開拓したり、石油を抽出したり、採掘したり、ダムを建設したり、家具や燃料用の木材を入手したりするために、自然林が破壊されています。森林被覆の喪失は生物多様性に影響を与え、人々の生活を脅かします。森林の縮小は、土壌浸食、作物の減少、洪水、水循環の乱れ、温室効果ガスの排出、気候変動、生物多様性の喪失など、広範囲にわたる問題を引き起こします。

例えば、

- ティンバー・エクスチェンジによると、2021年には、リヤド、ジェッダ、ダンマン、コバールでの需要増加により、サウジアラビアでは今後10年間で100万戸の追加住宅が必要になる。この需要により62万8000戸が建設され、そのうち48パーセントがリヤドで占められる。

サウジアラビアの木材市場の概要

サウジアラビアの木材市場は、木材の種類、用途、使用法、エンドユーザー、木材の種類に基づいてセグメント化されています。これらのセグメントの成長は、業界のわずかな成長セグメントを分析するのに役立ち、ユーザーに貴重な市場の概要と市場の洞察を提供し、コア市場の用途を特定するための戦略的決定を下すのに役立ちます。

木材の種類別

- 灰

- ブナ

- バーチ

- 杉

- モミ

- マホガニー

- メープル

- オーク

- 松

木材の種類に基づいて、サウジアラビアの木材市場は、トネリコ、ブナ、カバ、スギ、モミ、マホガニー、カエデ、オーク、マツに分類されます。

応用

- 燃料用木材

- 工業用丸太

- エンジニアードウッド

用途に基づいて、サウジアラビアの木材市場は、燃料用木材、産業用丸太、およびエンジニアリング木材に分類されます。

使用

- 工事

- フローリング

- パッケージ

- 輸送

- その他

用途に基づいて、サウジアラビアの木材市場は、建設、床材、梱包、輸送、その他に分類されます。

最終用途

- 住宅および商業

- 産業

最終用途に基づいて、サウジアラビアの木材市場は住宅用、商業用、および工業用に分類されます。

木材の種類

- ハードウッド

- 針葉樹

木材の種類に基づいて、サウジアラビアの木材市場は広葉樹と針葉樹に分類されます。

競争環境とサウジアラビアの木材シェア分析

サウジアラビアの木材市場の競争状況は、競合他社ごとに詳細を提供します。含まれる詳細には、会社概要、会社の財務状況、収益、市場の可能性、研究開発への投資、新しい市場への取り組み、サウジアラビアでのプレゼンス、生産拠点と施設、生産能力、会社の強みと弱み、製品の発売、製品の幅と広さ、アプリケーションの優位性などがあります。提供されている上記のデータ ポイントは、サウジアラビアの木材市場に関連する会社の焦点にのみ関連しています。

サウジアラビアの木材市場に参入している主要な市場プレーヤーとしては、Saudi Modern Factory Company、Trust Wood、Asala Wood、ITCO、Gupta Timbertrader Pvt. Ltd.、Airolam decorating latins などがあります。

SKU-

世界初のマーケットインテリジェンスクラウドに関するレポートにオンラインでアクセスする

- インタラクティブなデータ分析ダッシュボード

- 成長の可能性が高い機会のための企業分析ダッシュボード

- カスタマイズとクエリのためのリサーチアナリストアクセス

- インタラクティブなダッシュボードによる競合分析

- 最新ニュース、更新情報、トレンド分析

- 包括的な競合追跡のためのベンチマーク分析のパワーを活用

目次

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF SAUDI ARABIA WOOD MARKET

1.4 LIMITATION

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 WOOD TYPE LINE CURVE

2.7 MULTIVARIATE MODELING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 DBMR MARKET CHALLENGE MATRIX

2.12 DBMR VENDOR SHARE ANALYSIS

2.13 IMPORT-EXPORT DATA

2.14 SECONDARY SOURCES

2.15 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 SAUDI ARABIA WOOD AND TIMBER MARKET, PESTEL ANALYSIS

4.1.1 OVERVIEW

4.1.2 POLITICAL FACTORS

4.1.3 ENVIRONMENTAL FACTORS

4.1.4 SOCIAL FACTORS

4.1.5 TECHNOLOGICAL FACTORS

4.1.6 ECONOMICAL FACTORS

4.1.7 LEGAL FACTORS

4.1.8 CONCLUSION

4.2 ILLEGAL WOOD IMPORTS FROM INDONESIA

4.3 CERTIFICATION

4.4 COMPLETE LIFE CYCLE OF WOOD AND TIMBER

4.5 LEGAL AND ILLEGAL IMPORT OF WOOD AND TIMBER INTO SAUDI ARABIA MARKET

4.6 SUSTAINABILITY FOR WOOD AND TIMBER

4.7 SUSTAINABILITY OF WOOD

4.8 TRANSPORT AND CUSTOM DETAILS OF TIMBER AND WOOD

4.9 REGULATION AND STANDARDS FOR WOOD AND TIMBER

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 RISING DEMAND IN COMMERCIAL AND RESIDENTIAL BUILDING SECTORS

5.1.2 GROWING USES IN PACKAGING AND TRANSPORTATION APPLICATIONS

5.1.3 RISING IMPORTANCE OF LIGHT WOOD MATERIAL

5.2 RESTRAINTS

5.2.1 AVAILABILITY OF SUBSTITUTES SUCH AS PLASTICS AND METAL PRODUCTS

5.2.2 POTENTIAL DIRECT AND INDIRECT IMPACT OF CLIMATE CHANGE ON THE TIMBER INDUSTRY

5.3 OPPORTUNITIES

5.3.1 THE THRIVING COMMERCIAL SECTORS ARE PAVING THE PATH FOR WOOD PLASTIC COMPOSITES (WPC)

5.3.2 RISING INVESTMENT IN R&D AND VARIOUS PROJECTS

5.4 CHALLENGES

5.4.1 STRINGENT RULES AND REGULATIONS REGARDING THE TIMBER

5.4.2 SHRINKING OF THE FORESTS CAUSES WIDE-REACHING PROBLEMS

6 SAUDI ARABIA WOOD MARKET, BY TIMBER TYPE

6.1 OVERVIEW

6.2 MAHOGANY

6.3 OAK

6.4 ASH

6.5 BEECH

6.6 BIRCH

6.7 CEDAR

6.8 FIR

6.9 MAPLE

6.1 PINE

7 SAUDI ARABIA WOOD MARKET, BY APPLICATION

7.1 OVERVIEW

7.2 INDUSTRIAL ROUND WOOD

7.3 ENGINEERED WOODS

7.3.1 CROSS-LAMINATED TIMBER (CLT)

7.3.2 ORIENTED STRAND BOARDS (OSB)

7.3.3 GLULAM (GLUED LAMINATED TIMBER)

7.3.4 LAMINATED VENEER LUMBER (LVL)

7.3.5 I-BEAMS, PLYWOOD

7.3.6 OTHERS

7.4 FUEL WOOD

8 SAUDI ARABIA WOOD MARKET, BY USE

8.1 OVERVIEW

8.2 CONSTRUCTION

8.3 FLOORING

8.4 PACKAGING

8.5 TRANSPORT

8.6 OTHERS

9 SAUDI ARABIA WOOD MARKET, BY END USER

9.1 OVERVIEW

9.2 RESIDENTIAL AND COMMERCIAL

9.3 INDUSTRIAL

10 SAUDI ARABIA WOOD MARKET, BY WOOD TYPE

10.1 OVERVIEW

10.2 HARDWOOD

10.3 SOFTWOOD

11 SAUDI ARABIA WOOD MARKET, COMPANY LANDSCAPE

11.1 COMPANY SHARE ANALYSIS: SAUDI ARABIA

11.2 CERTIFICATION

12 SWOT ANALYSIS

13 COMPANY PROFILES

13.1 ITCO

13.1.1 COMPANY SNAPSHOT

13.1.2 PRODUCT PORTFOLIO

13.1.3 RECENT DEVELOPMENT

13.2 GUPTA TIMBERTRADER PVT. LTD.

13.2.1 COMPANY SNAPSHOT

13.2.2 PRODUCT PORTFOLIO

13.2.3 RECENT DEVELOPMENT

13.3 ASALA WOOD

13.3.1 COMPANY SNAPSHOT

13.3.2 PRODUCT PORTFOLIO

13.3.3 RECENT DEVELOPMENT

13.4 SAUDI MODERN FACTORY COMPANY

13.4.1 COMPANY SNAPSHOT

13.4.2 PRODUCT PORTFOLIO

13.4.3 RECENT DEVELOPMENT

13.5 TRUST WOOD

13.5.1 COMPANY SNAPSHOT

13.5.2 PRODUCT PORTFOLIO

13.5.3 RECENT DEVELOPMENT

13.6 AIROLAM DECORATIVE LAMINATES

13.6.1 COMPANY SNAPSHOT

13.6.2 REVENUE ANALYSIS

13.6.3 PRODUCT PORTFOLIO

13.6.4 RECENT DEVELOPMENT

14 QUESTIONNAIRE

15 RELATED REPORTS

表のリスト

TABLE 1 IMPORT DATA OF BITUMEN AND WOOD, NATURAL; BITUMINOUS OR OIL-SHALE AND TAR SANDS; WOODITES AND WOODIC; HS CODE – 2714 (USD MILLION)

TABLE 2 EXPORT DATA OF BITUMEN AND WOOD, NATURAL; BITUMINOUS OR OIL-SHALE AND TAR SANDS; WOODITES AND WOODIC; HS CODE – 2714 (USD MILLION)

TABLE 3 SAUDI ARABIA WOOD MARKET, BY TIMBER TYPE, 2020-2029 (USD MILLION)

TABLE 4 SAUDI ARABIA WOOD MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 5 SAUDI ARABIA ENGINEERED WOODS IN WOOD MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 6 SAUDI ARABIA WOOD MARKET, BY USE, 2020-2029 (USD MILLION)

TABLE 7 SAUDI ARABIA WOOD MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 8 SAUDI ARABIA WOOD MARKET, BY WOOD TYPE, 2020-2029 (USD MILLION)

図表一覧

FIGURE 1 SAUDI ARABIA WOOD MARKET: SEGMENTATION

FIGURE 2 SAUDI ARABIA WOOD MARKET: DATA TRIANGULATION

FIGURE 3 SAUDI ARABIA WOOD MARKET: DROC ANALYSIS

FIGURE 4 SAUDI ARABIA WOOD MARKET: SAUDI ARABIA MARKET ANALYSIS

FIGURE 5 SAUDI ARABIA WOOD MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 SAUDI ARABIA WOOD MARKET: THE WOOD TYPE LIFE LINE CURVE

FIGURE 7 SAUDI ARABIA WOOD MARKET: MULTIVARIATE MODELLING

FIGURE 8 SAUDI ARABIA WOOD MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 SAUDI ARABIA WOOD MARKET: DBMR MARKET POSITION GRID

FIGURE 10 SAUDI ARABIA WOOD MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 11 SAUDI ARABIA WOOD MARKET: THE MARKET CHALLENGE MATRIX

FIGURE 12 SAUDI ARABIA WOOD MARKET: VENDOR SHARE ANALYSIS

FIGURE 13 SAUDI ARABIA WOOD MARKET: SEGMENTATION

FIGURE 14 RISING DEMAND IN COMMERCIAL AND RESIDENTIAL BUILDING SECTORS IS EXPECTED TO DRIVE SAUDI ARABIA WOOD MARKET IN THE FORECAST PERIOD

FIGURE 15 INDUSTRIAL ROUND WOOD SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE SAUDI ARABIA WOOD MARKET IN 2022 & 2029

FIGURE 16 SAUDI ARABIA WOOD AND TIMBER MARKET: PESTEL ANALYSIS

FIGURE 17 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF SAUDI ARABIA WOOD MARKET

FIGURE 18 SAUDI ARABIA WOOD MARKET: BY TIMBER TYPE, 2021

FIGURE 19 SAUDI ARABIA WOOD MARKET: BY APPLICATION, 2021

FIGURE 20 SAUDI ARABIA WOOD MARKET: BY USE, 2021

FIGURE 21 SAUDI ARABIA WOOD MARKET: BY END USER, 2021

FIGURE 22 SAUDI ARABIA WOOD MARKET: BY WOOD TYPE, 2021

FIGURE 23 SAUDI ARABIA WOOD MARKET: COMPANY SHARE 2021 (%)

調査方法

データ収集と基準年分析は、大規模なサンプル サイズのデータ収集モジュールを使用して行われます。この段階では、さまざまなソースと戦略を通じて市場情報または関連データを取得します。過去に取得したすべてのデータを事前に調査および計画することも含まれます。また、さまざまな情報ソース間で見られる情報の不一致の調査も含まれます。市場データは、市場統計モデルと一貫性モデルを使用して分析および推定されます。また、市場シェア分析と主要トレンド分析は、市場レポートの主要な成功要因です。詳細については、アナリストへの電話をリクエストするか、お問い合わせをドロップダウンしてください。

DBMR 調査チームが使用する主要な調査方法は、データ マイニング、データ変数が市場に与える影響の分析、および一次 (業界の専門家) 検証を含むデータ三角測量です。データ モデルには、ベンダー ポジショニング グリッド、市場タイムライン分析、市場概要とガイド、企業ポジショニング グリッド、特許分析、価格分析、企業市場シェア分析、測定基準、グローバルと地域、ベンダー シェア分析が含まれます。調査方法について詳しくは、お問い合わせフォームから当社の業界専門家にご相談ください。

カスタマイズ可能

Data Bridge Market Research は、高度な形成的調査のリーダーです。当社は、既存および新規のお客様に、お客様の目標に合致し、それに適したデータと分析を提供することに誇りを持っています。レポートは、対象ブランドの価格動向分析、追加国の市場理解 (国のリストをお問い合わせください)、臨床試験結果データ、文献レビュー、リファービッシュ市場および製品ベース分析を含めるようにカスタマイズできます。対象競合他社の市場分析は、技術ベースの分析から市場ポートフォリオ戦略まで分析できます。必要な競合他社のデータを、必要な形式とデータ スタイルでいくつでも追加できます。当社のアナリスト チームは、粗い生の Excel ファイル ピボット テーブル (ファクト ブック) でデータを提供したり、レポートで利用可能なデータ セットからプレゼンテーションを作成するお手伝いをしたりすることもできます。